Data Center Networking Market

Equinix to deploy Nokia’s IP/MPLS network infrastructure for its global data center interconnection services

Today, Nokia announced that Equinix will deploy a new Nokia IP/MPLS network infrastructure to support its global interconnection services. As one of the largest data center and colocation providers, Equinix currently runs services on multiple networks from multiple vendors. With the new network, Equinix will be able to consolidate into one, efficient web-scale infrastructure to provide FP4-powered connectivity to all data centers – laying the groundwork for customers to deploy 5G networks and services.

Muhammad Durrani, Director of IP Architecture for Equinix, said, “We see tremendous opportunity in providing our customers with 5G services, but this poses special demands for our network, from ultra-low latency to ultra broadband performance, all with business- and mission-critical reliability. Nokia’s end-to-end router portfolio will provide us with the highly dynamic and programmable network fabric we need, and we are pleased to have the support of the Nokia team every step of the way.”

“We’re pleased to see Nokia getting into the data center networking space and applying the same rigor to developing a next-generation open and easily extendible data center network operating system while leveraging its IP routing stack that has been proven in networks globally. It provides a platform that network operations teams can easily adapt and build applications on, giving them the control they need to move fast.”

Sri Reddy, Co-President of IP/Optical Networks, Nokia, said, “We are working closely with Equinix to help advance its network and facilitate the transformation and delivery of 5G services. Our end-to-end portfolio was designed precisely to support this industrial transformation with a highly flexible, scalable and programmable network fabric that will be the ideal platform for 5G in the future. It is exciting to work with Equinix to help deliver this to its customers around the world.”

With an end-to-end portfolio, including the Nokia FP4-powered routing family, Nokia is working in partnership with operators to deliver real 5G. The FP4 chipset is the industry’s leading network processor for high-performance routing, setting the bar for density and scale. Paired with Nokia’s Service Router Operating System (SR OS) software, it will enable Equinix to offer additional capabilities driven by routing technologies such as Ethernet VPNs (EVPNs) and segment routing (SR).

Image Credit: Nokia

……………………………………………………………………………………………………………………………………………………………………………….

This latest deal comes just two weeks after Equinix said it will host Nokia’s Worldwide IoT Network Grid (WING) service on its data centers. WING is an Infrastructure-as-a-Service offering that provides low-latency and global reach to businesses, hastening their deployment of IoT and utilizing solutions offered by the Edge and cloud.

Equinix operates more than 210 data centers across 55 markets. It is unclear which of these data centers will first offer Nokia’s services and when WING will be available to customers.

“Nokia needed access to multiple markets and ecosystems to connect to NSPs and enterprises who want a play in the IoT space,” said Jim Poole, VP at Equinix. “By directly connecting to Nokia WING, mobile network operators can capture business value across IoT, AI, and security, with a connectivity strategy to support business transformation.”

References:

…………………………………………………………………………………………………………………………………………………………..

About Nokia:

We create the technology to connect the world. Only Nokia offers a comprehensive portfolio of network equipment, software, services and licensing opportunities across the globe. With our commitment to innovation, driven by the award-winning Nokia Bell Labs, we are a leader in the development and deployment of 5G networks.

Our communications service provider customers support more than 6.4 billion subscriptions with our radio networks, and our enterprise customers have deployed over 1,300 industrial networks worldwide. Adhering to the highest ethical standards, we transform how people live, work and communicate. For our latest updates, please visit us online www.nokia.com and follow us on Twitter @nokia.

Resources:

- Webpage: Nokia 7750 SR-s

- Webpage: Nokia FP4 silicon

- Webpage: Nokia Service Router Operating System (SR OS)

- Webpage: Nokia Network Services Platform

Synergy Research: Strong demand for Colocation with Equinix, Digital Realty and NTT top providers

New data from Synergy Research Group shows that just 25 metro areas account for 65% of worldwide retail and wholesale colocation revenues. Ranked by revenue generated in Q2 2020, the top five metros are Washington, Tokyo, London, New York and Shanghai, which in aggregate account for 27% of the worldwide market. The next 20 largest metro markets account for another 38% of the market.

Those top 25 metros include eleven in North America, nine in the APAC region, four in EMEA and one in Latin America. The world’s three largest colocation providers are Equinix, Digital Realty and NTT. One of those three is the market leader in 17 of the top 25 metros. The global footprint of Equinix is particularly notable and it is the retail colocation leader in 16 of the top 25 metros. In the wholesale segment Digital Realty is leader in seven of the metros, with NTT, Global Switch and GDS each leading in at least two metros. Other colocation operators that feature heavily in the top 25 metros include 21Vianet, @Tokyo, China Telecom, China Unicom, CoreSite, CyrusOne, Cyxtera, KDDI and QTS.

Over the last twenty quarters the top 25 metro share of the worldwide retail colocation market has been relatively constant at around the 63-65% mark, despite a push to expand data center footprints and to build out more edge locations.

->That seems to indicate that edge computing hasn’t made a wider impact beyond the 25 largest colo metro areas.

Among the top 25 metros, those with the highest colocation growth rates (measured in local currencies) are Sao Paulo, Beijing, Shanghai and Seoul, all of which grew by well over 20% in the last year. Other metros with growth rates well above the worldwide average include Phoenix, Frankfurt, Mumbai and Osaka. While not in the group of highest growth metros overall, growth in wholesale revenues was particularly strong in Washington DC/Northern Virginia and London.

“We continue to see strong demand for colocation, with the standout regional growth numbers coming from APAC. Revenue growth from hyperscale operator customers remains particularly strong, demonstrating the symbiotic nature of the relationship between cloud and colocation,” said John Dinsdale, a Chief Analyst at Synergy Research Group. “The major economic hubs around the world are naturally the most important colocation markets, while hyperscale operators tend to focus their own data center operations in more remote areas with much lower real estate and operating costs. These cloud providers will continue to rely on colocation firms to help better serve major clients in key cities, ensuring the large metros will maintain their share of the colocation market over the coming years.”

About Synergy Research Group

Synergy provides quarterly market tracking and segmentation data on IT and Cloud related markets, including vendor revenues by segment and by region. Market shares and forecasts are provided via Synergy’s uniquely designed online database tool, which enables easy access to complex data sets. Synergy’s CustomView ™ takes this research capability one step further, enabling our clients to receive ongoing quantitative market research that matches their internal, executive view of the market segments they compete in.

References:

https://www.srgresearch.com/articles/top-25-metros-generate-65-worldwide-colocation-revenues

Dell’Oro: Data Center Switch market declined 9% YoY; SD-WAN market increased at slower rate than in 2019

Market research firm Dell’Oro Group reported today that the worldwide Data Center Switch market recorded its first decline in nine years, dropping 9 percent year-over-year in the first quarter. 1Q 2020 revenue level was also the lowest in three years. The softness was broad-based across all major branded vendors, except Juniper Networks and white box vendors. Revenue from white box vendors was propelled mainly by strong demand from Google and Amazon.

“The COVID-19 pandemic has created some positive impact on the market as some customers pulled in orders in anticipation of supply shortage and elongated lead times,” said Sameh Boujelbene, Senior Director at Dell’Oro Group. “Yet this upside dynamic was more than offset by the pandemic’s more pronounced negative impact on customer demand as they paused purchases due to macro-economic uncertainties. Supply constraints were not major headwinds during the first quarter but expected to become more apparent in the next quarter,” added Boujelbene.

Additional highlights from the 1Q 2020 Ethernet Switch – Data Center Report:

- The revenue decline was broad-based across all regions but was less pronounced in North America.

- We expect revenue in the market to decline high single-digit in 2020, despite some pockets of strength from certain segments.

The Dell’Oro Group Ethernet Switch – Data Center Quarterly Report offers a detailed view of the market, including Ethernet switches for server access, server aggregation, and data center core. (Software is addressed separately.) The report contains in-depth market and vendor-level information on manufacturers’ revenue; ports shipped; average selling prices for both Modular and Fixed Managed and Unmanaged Ethernet Switches (1000 Mbps,10, 25, 40, 50, 100, 200, and 400 GE); and regional breakouts. To purchase these reports, please contact us by email at [email protected].

…………………………………………………………………………………………………………………………………………………

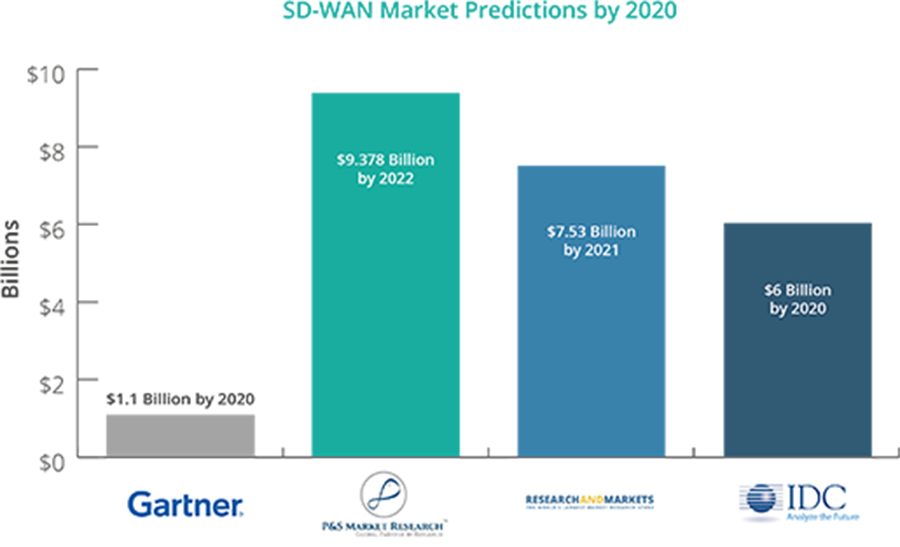

Separately, Dell’Oro Group reported that the market for software-defined (SD)-WAN equipment increased by 24% in the first quarter (year-to-year), which was significantly below the 64% growth seen in 2019. Citing supply chain issues created by the coronavirus pandemic, the market research firm’s Shin Umeda predicted the market will post double-digit growth in 2020 despite “macroeconomic uncertainty.”

- Supply chain disruptions accounted for the majority of the Service Provider (SP) Router and CES Switch market decline in 1Q 2020.

- The SP Router and CES market in China showed a modest decline in 1Q 2020, but upgrades for 5G infrastructure are expected to drive strong demand over the rest of 2020.

Omdia: High-speed data-center Ethernet adapter market at $1.7 billion in 2019

Executive Summary:

The market for Ethernet adapters with speeds of 25 gigabits (25GE) and faster deployed by enterprises, cloud service providers and telecommunication network providers at data centers topped $1 billion for the first time in 2019, according to Omdia.

The total Ethernet adapter market size stood at $1.7 billion for the year. This result was in line with Omdia’s long term server and storage connectivity forecast. Factors driving that forecast include the growth in data sets, such as those computed by analytics algorithms looking for patterns, and the adoption of new software technologies like AI and ML which must examine large data sets to be effective, driving larger movement of data.

“Server virtualization and containerization reached new highs in 2019 and drove up server utilization. This increased server connectivity bandwidth requirements, and the need for higher speed Ethernet adapters” said Vlad Galabov, principal analyst for data center IT, at Omdia. “The popularization of data-intensive workloads, like analytics and AI, were also strong drivers for higher speed adapters in 2019”

25GE Ethernet adapters represented more than 25 percent of total data-center Ethernet adapter ports and revenue in 2019, as reported by Omdia’s Ethernet Network Adapter Equipment Market Tracker. Omdia also found that the price per each 25GE port is continued to decline. A single 25GE port cost an average of $81 in 2019, a decrease of $9 from 2018.

Despite representing a small portion of the market, 100GE Ethernet adapters are increasingly deployed by cloud service providers and enterprises running high-performance computing clusters. Shipments and revenue for 100GE Ethernet adapter ports both grew by more than 60 percent in 2019. Each 100GE adapter port is also becoming more affordable. In 2019, an individual 100GE Ethernet adapter port cost $321 on average, a decrease of $34 from 2018.

“Cloud service providers (CSPs) are leading the transition to faster networks as they run multi-tenant servers with a large number of virtual machines and/or containers per server. This is driving high traffic and bandwidth needs,” Galabov said. “Omdia expects telcos to invest more in higher speeds going forward—including 100GE—driven by network function virtualization (NFV) and increased bandwidth requirements from HD video, social media, AR/VR and expanded IoT use cases.”

The Ethernet outlook:

Omdia expects Ethernet adapter revenue to grow 21 percent on average each year through 2024. Despite the COVID-19 lockdown, the Ethernet adapter market is set to remain close to this growth curve in 2020.

Ethernet adapters that can provide complete on-card processing of network, storage or memory protocols, data-plane offload or that can offload server memory access will account for half of the total market revenue in 2020, or $1.1 billion. Ethernet adapters that have an onboard field customizable processor such as a field-programmable gate array (FPGA) or system on chip (SoC), will account for slightly more than than a quarter of 2020 adapter revenue, totaling $557 million. Adapters that only provide Ethernet connectivity will make up a minority share of the market, at just $475 million.

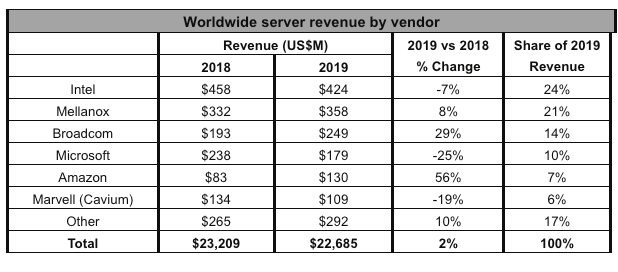

Intel maintains lead:

Looking at semiconductor vendor market share, Intel held 24 percent of the 2019 Ethernet adapter market, shipping adapters worth $424 million in 2019. This represents a 2.5-point decrease from 2018 that Omdia attributes to the aging Intel Ethernet adapter portfolio which consists primarily of 1GE and 10GE adapters with Ethernet connectivity only. Intel indicated it will introduce adapters with offload functionality in 2020 that will help it remain competitive in the market.

Mellanox (now part of NVIDIA) captured 21 percent of the 2019 Ethernet adapter market, a 1-point increase compared to 2018. The vendor reported strong growth of its 25GE and 100GE offload adapters driven by strong cloud service provider demand and growing demand among enterprises for 25GE networking.

Broadcom was the third largest Ethernet adapter vendor in 2019, commanding a 14 percent share of the market, an increase of 3 points from 2018. Broadcom’s revenue growth was driven by strong demand for high-speed offload and programmable adapters at hyperscale CSPs.

In 2019, Microsoft and Amazon continued to adopt in-house-developed Ethernet adapters. Given their large scale and the high value of their high-speed offload and programmable adapters, the companies cumulatively deployed Ethernet adapters worth over $300 million. This made them the fourth and fifth largest makers of Ethernet adapters in 2019. As both service providers deploy 100GE adapters in larger numbers in 2020, they’re set to remain key trendsetters in the market.

Amazon AWS and Microsoft Azure continued to use in-house-developed Ethernet adapters. Given their large scale and the high value of their high-speed offload and programmable adapters, the companies cumulatively deployed Ethernet adapters worth over $300 million, according to Omdia. This made Microsoft and Amazon, respectively, the fourth and fifth largest makers of Ethernet adapters in 2019. As both service providers deploy 100GE adapters in larger numbers in 2020, Omdia expects them to continue to be key trendsetters in the market going forward.

About Omdia:

Omdia is a global technology research powerhouse, established following the merger of the research division of Informa Tech (Ovum, Heavy Reading and Tractica) and the acquired IHS Markit technology research portfolio*.

We combine the expertise of over 400 analysts across the entire technology spectrum, analyzing 150 markets publishing 3,000 research solutions, reaching over 14,000 subscribers, and covering thousands of technology, media & telecommunications companies.

Our exhaustive intelligence and deep technology expertise allow us to uncover actionable insights that help our customers connect the dots in today’s constantly evolving technology environment and empower them to improve their businesses – today and tomorrow.

………………………………………………………………………………………………………………………………………………..

Omdia is a registered trademark of Informa PLC and/or its affiliates. All other company and product names may be trademarks of their respective owners. Informa PLC registered in England & Wales with number 8860726, registered office and head office 5 Howick Place, London, SW1P 1WG, UK. Copyright © 2020 Omdia. All rights reserved.

*The majority of IHS Markit technology research products and solutions were acquired by Informa in August 2019 and are now part of Omdia.

TMR: Data Center Networking Market sees shift to user-centric & data-oriented business + CoreSite DC Tour

TMR Press Release edited by Alan J Weissberger followed by Coresite Data Center Talk & Tour for IEEE ComSocSCV and Power Electronics members

TMR Executive Summary and Forecast:

The global data center networking market is expected to emerge as highly competitive due to rising demand for networking components.

The major players operating in the global data center networking market include Hewlett Packard Enterprise, Cisco Systems, Inc., Arista Networks, Microsoft Corporation, and Juniper Networks. The key players are also indulging into business strategies such as mergers and acquisitions to improve their existing technologies. Those vendors are investing heavily in the research and development activities to sustain their lead in the market. Besides, these firms aim to improve their product portfolio in order to expand their global reach and get an edge over their competitors globally.

The global data center networking market is likely to pick up a high momentum since the firms are rapidly shifting to a more user-centric and data-oriented business. According to a recent report by Transparency Market Research (TMR), the global data center networking market is expected to project a steady CAGR of 15.5% within the forecast period from 2017 to 2025. In 2016, the global market was valued around worth US$63.05 bn, which is projected to reach around a valuation of US$228.40 bn by 2025.

On the basis of component, the global data center networking market is segmented into services, software, and hardware. Among these, the hardware segment led the market in 2016 with around 52.0% of share of data center networking market, as per the revenue. Nevertheless, projecting a greater CAGR than other segments, software segment is as well foreseen to emerge as the key segment contributing to the market growth. Geographically, North America was estimated to lead the global market in 2016. Nevertheless, Asia Pacific is likely to register the leading CAGR of 17.3% within the forecast period from 2017 to 2025.

Rising Demand for Networking Solutions to Propel Growth in Market

Increased demand for networking solutions has initiated a need for firms to change data center as a collective automated resource centers, which provide better flexibility to shift workload from any cloud so as to improve the operational efficiency.

Rising number of internet users across the globe require high-speed interface. Companies are highly dependent on the data centers in terms of efficiency to decrease the operational cost and improve the productivity.

Nevertheless, virtualization and rising demand for end-use gadgets are the major restrictions likely to hamper growth in the data center networking market in the coming years. Rising usage of mobile devices and cloud services also is hindering the steady strides in the data center networking market.

Popularity of Big Data to Add to Market Development in Future:

Rising popularity of big data and cloud services from the industry as well as consumer is anticipated to fuel the development in the global data center networking market. Advantages such as low operational costs, flexibility, better security and safety, and improved performance are likely to proliferate the market growth.

Disaster recovery and business continuity has resulted in simplification of data center networking by saving both money and time for companies. Financial advantages along with technology is likely to augur the demand in data center networking and cloud computing.

Companies are highly focused on data center solution providers to perform efficiently and effectively, with better productivity, high profit, and decreased prices. These goals require high-end networking technologies and upgraded performance server. It also needs a proper integration between simplified networking framework and server to reach the optimum level of performance.

The study presented here is based on a report by Transparency Market Research (TMR) titled “Data Center Networking Market (Component Type – Hardware, Software, and Services; Industry Vertical – Telecommunications, Government, Retail, Media and Entertainment, BFSI, Healthcare, and Education) – Global Industry Analysis, Size, Share, Growth, Trends and Forecast 2017 – 2025.”

Get PDF Brochure at:

https://www.transparencymarketresearch.com/sample/sample.php?flag=B&rep_id=21257

Request PDF Sample of Data Center Networking Market:

https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=21257

About TMR:

Transparency Market Research is a next-generation market intelligence provider, offering fact-based solutions to business leaders, consultants, and strategy professionals.

Our reports are single-point solutions for businesses to grow, evolve, and mature. Our real-time data collection methods along with ability to track more than one million high growth niche products are aligned with your aims. The detailed and proprietary statistical models used by our analysts offer insights for making right decision in the shortest span of time. For organizations that require specific but comprehensive information we offer customized solutions through adhoc reports. These requests are delivered with the perfect combination of right sense of fact-oriented problem solving methodologies and leveraging existing data repositories.

TMR believes that unison of solutions for clients-specific problems with right methodology of research is the key to help enterprises reach right decision.”

Contact

Mr. Rohit Bhisey

Transparency Market Research

State Tower

90 State Street,

Suite 700,

Albany, NY – 12207

United States

Tel: +1-518-618-1030

USA – Canada Toll Free: 866-552-3453

Email: [email protected]

Website: https://www.transparencymarketresearch.com

Research Blog: http://www.europlat.org/

Press Release:

………………………………………………………………………………………………………..

Coresite Data Center Tour:

On May 23, 2019, IEEE ComSocSCV and IEEE Power Electronics members were treated to a superb talk and tour of the Coresite Multi-Tenant Data Center (MTDC) in Santa Clara, CA.

CoreSite is a Multi-Tenant Data Center owner that competes with Equinix. CoreSite offers the following types of Network Access for their MTDC colocation customers:

•Direct Access to Tier-1 and Eyeball Networks

•Access to Broad Range of Network Services (Transit/Transport/Dark Fiber)

•Direct Access to Public Clouds (Amazon, Microsoft, Google, etc)

•Direct Access to Optical Ethernet Fabrics

………………………………………………………….

CoreSite also provides POWER distribution and backup on power failures:

•Standby Generators

•Large Scale UPS

•Resilient Design

•Power Quality

•A/B Power Delivery

•99.999% Uptime

….and PHYSICAL SECURITY:

•24/7 OnSite Security Personnel

•Dual-Authentication Access

•IP DVR for All Facility Areas

•Perimeter Security

•Equipment Check-In/Out Process

•Access-Control Policies (Badge Deactivation, etc)

……………………………………………………………………………………………………..

There are 28 network operators and cloud service providers that have brought fiber into the CoreSite Santa Clara MTDC campus. The purpose of that is to enable customers to share fiber network/cloud access at a much higher speed and lower cost than would otherwise be realized via premises-based network/cloud access.

While the names of the network and cloud service providers could not be disclosed, network providers included: Verizon, AT&T, Century Link, Zayo. In addition, AWS Direct Connect, Microsoft Azure ExpressRoute, Alibaba Cloud, Google Cloud interconnection and other unnamed cloud providers were said to have provided direct fiber to cloud connectivity for CoreSite’s Santa Clara MTDC customers.

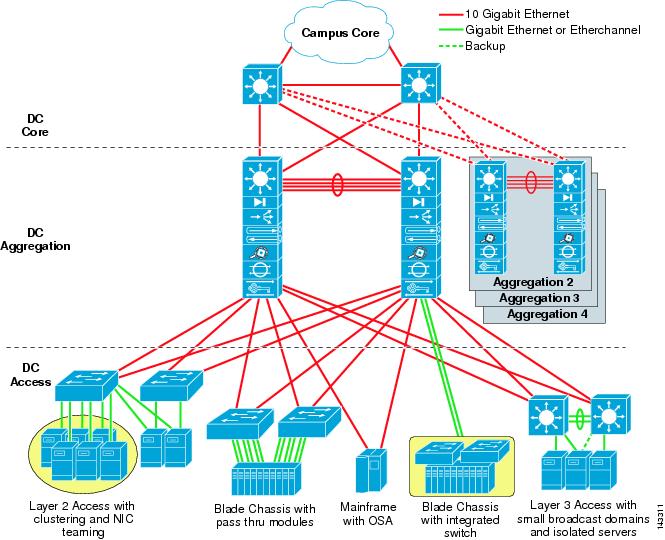

Here’s how network connectivity is achieved within and outside the CoreSite MTDC:

The SMF or MMF from each customer’s colocation cage is physically routed (under the floor) to a fiber wiring cross-connect/patch panel maintained by Coresite. The output fibers are then routed to a private room where the network/cloud providers maintain their own fiber optic gear (fiber optic multiplexers/switches, DWDM transponders and other fiber transmission equipment) which connect to the outside plant fiber optic cable(s) for each network/cloud services provider.

The outside plant fiber fault detection and restoration are done by each network/cloud provider- either via a mesh topology fiber optic network or 1:1 or N:1 hot standby. Coresite’s responsibility ends when it delivers the fiber to the provider cages. They do, however, have network engineers that are responsible for maintenance and trouble shooting in the DC when necessary.

Instead of using private lines or private IP connections, CoreSite offers an Interconnect Gateway-SM provides their enterprise customers a dedicated, high-performance interconnection solution between their cloud and network service providers, while establishing a flexible IT architecture that allows them to adapt to market demands and rapidly evolving technologies.

CoreSite’s gateway directly integrates enterprises’ WAN architecture into CoreSite’s native cloud and carrier ecosystem using high-speed fiber and virtual interconnections. This solution includes:

-Private network connectivity to the CoreSite data center

-Dedicated cabinets and network hardware for routing, switching, and security

-Direct fiber and virtual interconnections to cloud and network providers

-Technical integration, 24/7/365 monitoring and management from a certified CoreSite Solution Partner

-Industry-leading SLA