HPE Aruba

Analysis: Ethernet gains on InfiniBand in data center connectivity market; White Box/ODM vendors top choice for AI hyperscalers

Disclaimer: The author used Perplexity.ai for the research in this article.

……………………………………………………………………………………………………………..

Introduction:

Ethernet is now the leader in “scale-out” AI networking. In 2023, InfiniBand held an ~80% share of the data center switch market. A little over two years later, Ethernet has overtaken it in data center switch and server port counts. Indeed, the demand for Ethernet-based interconnect technologies continues to strengthen, reflecting the market’s broader shift toward scalable, open, and cost-efficient data center fabrics. According to Dell’Oro Group research published in July 2025, Ethernet was on track to overtake InfiniBand and establish itself as the primary fabric technology for large-scale data centers. The report projects cumulative data center switch revenue approaching $80 billion over the next five years, driven largely by AI infrastructure investments. Other analysts say Ethernet now represents a majority of AI‑back‑end switch ports, likely well above 50% and trending toward 70–80% as Ultra Ethernet / RoCE‑based fabrics (Remote Direct Memory Access/RDMA over Converged Ethernet) scale.

With Nvidia’s expanding influence across the data center ecosystem (via its Mellanox acquisition), Ethernet-based switching platforms are expected to maintain strong growth momentum through 2026 and the next investment cycle.

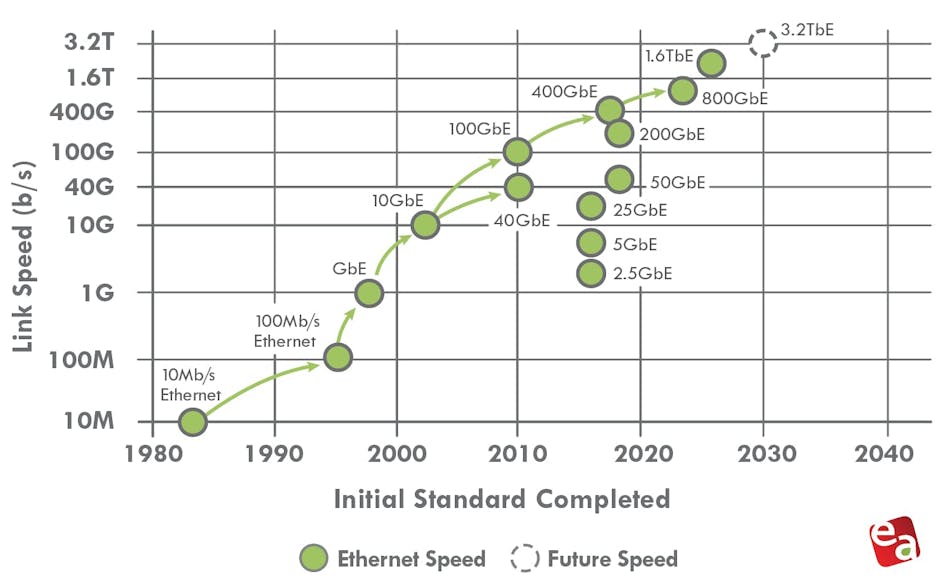

The past, present, and future of Ethernet speeds depicted in the Ethernet Alliance’s 2026 Ethernet Roadmap:

- IEEE 802.3 expects to complete IEEE 802.3dj, which supports 200 Gb/s, 400 Gb/s, 800 Gb/s, and 1.6 Tb/s, by late 2026.

- A 400-Gb/s/lane Signaling Call For Interest (CFI) is already scheduled for March.

- PAM-6 is an emerging, high-order modulation format for short-reach, high-speed optical fiber links (e.g., 100G/400G+ data center interconnects). It encodes 2.585 bits per symbol using 6 distinct amplitude levels, offering a 25% higher bitrate than PAM-4 within the same bandwidth.

………………………………………………………………………………………………………………………………………………………………………………………………………..

Dominant Ethernet speeds and PHY/PMD trends:

In 2026, the Ethernet portfolio spans multiple tiers of performance, with 100G, 200G, 400G, and 800G serving as the dominant server‑ and fabric‑facing speeds, while 1.6T begins to appear in early AI‑scale spine and inter‑cluster links.

-

Server‑to‑leaf topology:

-

100G and 200G remain prevalent for general‑purpose and mid‑tier AI inference workloads, often implemented over 100GBASE‑CR4 / 100GBASE‑FR / 100GBASE‑LR and their 200G counterparts (e.g., 200GBASE‑CR4 / 200GBASE‑FR4 / 200GBASE‑LR4) using 4‑lane PAM4 modulation.

-

Many AI‑optimized racks are migrating to 400G server interfaces, typically using 400GBASE‑CR8 / 400GBASE‑FR8 / 400GBASE‑LR8 with 8‑lane 50 Gb/s PAM4 lanes, often via QSFP‑DD or OSFP form‑factors.

-

-

Leaf‑to‑spine and spine‑to‑spine topology:

-

400G continues as the workhorse for many brownfield and cost‑sensitive fabrics, while 800G is increasingly targeted for new AI and high‑growth pods, typically deployed as 800GBASE‑DR8 / 800GBASE‑FR8 / 800GBASE‑LR8 over 8‑lane 100 Gb/s PAM4 links.

-

IEEE 802.3dj is progressing toward completion in 2026, standardizing 200 Gb/s per lane operation a

-

For cloud‑resident (hyperscale) data centers, the Ethernet‑switch leadership is concentrated among a handful of vendors that supply high‑speed, high‑density leaf‑spine fabrics and AI‑optimized fabrics.

Core Ethernet‑switch leaders:

-

NVIDIA (Spectrum‑X / Spectrum‑4)

NVIDIA has become a dominant force in cloud‑resident Ethernet, largely by bundling its Spectrum‑4 and Spectrum‑X Ethernet switches with H100/H200/Blackwell‑class GPU clusters. Spectrum‑X is specifically tuned for AI workloads, integrating with BlueField DPUs and offering congestion‑aware transport and in‑network collectives, which has helped NVIDIA surpass both Cisco and Arista in data‑center Ethernet revenue in 2025. -

Arista Networks

Arista remains a leading supplier of cloud‑native, high‑speed Ethernet to hyperscalers, with strong positions in 100G–800G leaf‑spine fabrics and its EOS‑based software stack. Arista has overtaken Cisco in high‑speed data‑center‑switch market share and continues to grow via AI‑cluster‑oriented features such as cluster‑load‑balancing and observability suites. -

Cisco Systems

Cisco maintains broad presence in cloud‑scale environments via Nexus 9000 / 7000 platforms and Silicon One‑based designs, particularly where customers want deep integration with routing, security, and multi‑cloud tooling. While its share in pure high‑speed data‑center switching has eroded versus Arista and NVIDIA, Cisco remains a major supplier to many large cloud providers and hybrid‑cloud operators.

Other notable players:

-

HPE (including Aruba and Juniper post‑acquisition)

HPE and its Aruba‑branded switches are widely deployed in cloud‑adjacent and hybrid‑cloud environments, while the HPE‑Juniper combination (via the 2025 acquisition) strengthens its cloud‑native switching and security‑fabric portfolio. -

Huawei

Huawei supplies CloudEngine Ethernet switches into large‑scale cloud and telecom‑owned data centers, especially in regions where its end‑to‑end ecosystem (switching, optics, and management) is preferred. -

White‑box / ODM‑based vendors

Most hyperscalers also source Ethernet switches from ODMs (e.g., Quanta, Celestica, Inspur) running open‑source or custom NOS’ (SONiC, Cumulus‑style stacks), which can collectively represent a large share of cloud‑resident ports even if they are not branded like Cisco or Arista. White‑box / ODM‑based Ethernet switches hold a meaningful and growing share of the data‑center Ethernet market, though they still trail branded vendors in overall revenue. Estimates vary by source and definition. - ODM / white‑box share of the global data‑center Ethernet switch market is commonly estimated in the low‑ to mid‑20% range by revenue in 2024–2025, with some market trackers putting it around 20–25% of the data‑center Ethernet segment. Within hyperscale cloud‑provider data centers specifically, the share of white‑box / ODM‑sourced Ethernet switches is higher, often cited in the 30–40% range by port volume or deployment count, because large cloud operators heavily disaggregate hardware and run open‑source NOSes (e.g., SONiC‑style stacks).

-

ODM‑direct sales into data centers grew over 150% year‑on‑year in 3Q25, according to IDC, signaling that white‑box share is expanding faster than the overall data‑center Ethernet switch market.

-

Separate white‑box‑switch market studies project the global data‑center white‑box Ethernet switch market to reach roughly $3.2–3.5 billion in 2025, growing at a ~12–13% CAGR through 2030, which implies an increasing percentage of the broader Ethernet‑switch pie over time.

Ethernet vendor positioning table:

| Vendor | Key Ethernet positioning in cloud‑resident DCs | Typical speed range (cloud‑scale) |

|---|---|---|

| NVIDIA | AI‑optimized Spectrum‑X fabrics tightly coupled to GPU clusters | 200G/400G/800G, moving toward 1.6T |

| Arista | Cloud‑native, high‑density leaf‑spine with EOS | 100G–800G, strong 400G/800G share |

| Cisco | Broad Nexus/Silicon One portfolio, multi‑cloud integration | 100G–400G, some 800G |

| HPE / Juniper | Cloud‑native switching and security fabrics | 100G–400G, growing 800G |

| Huawei | Cost‑effective high‑throughput CloudEngine switches | 100G–400G, some 800G |

| White‑box ODMs | Disaggregated switches running SONiC‑style NOSes | 100G–400G, increasingly 800G |

Supercomputers and modern HPC clusters increasingly use high‑speed, low‑latency Ethernet as the primary interconnect, often replacing or coexisting with InfiniBand. The “type” of Ethernet used is defined by three layers: speed/lane rate, PHY/PMD/optics, and protocol enhancements tuned for HPC and AI. Slingshot, the proprietary Ethernet-based solution from HPE, commanded 48.1% of performance for the Top500 list in June 2025 and 46.3% in November 2025. On both of the lists, it provided interconnectivity for six of the top 10 – including the top three: El Capitan, Frontier, and Aurora.

HPC Speed and lane‑rate tiers:

-

Mid‑tier HPC / legacy supercomputers:

-

100G Ethernet (e.g., 100GBASE‑CR4/FR4/LR4) remains common for mid‑tier clusters and some scientific workloads, especially where cost and power are constrained.

-

-

AI‑scale and next‑gen HPC:

-

400G and 800G Ethernet (400GBASE‑DR4/FR4/LR4, 800GBASE‑DR8/FR8/LR8) are now the workhorses for GPU‑based supercomputers and large‑scale HPC fabrics.

-

1.6T Ethernet (IEEE 802.3dj, 200 Gb/s per lane) is entering early deployment for spine‑to‑spine and inter‑cluster links in the largest AI‑scale “super‑factories.”

-

In summary, NVIDIA and Arista are the most prominent Ethernet‑switch leaders specifically for AI‑driven, cloud‑resident data centers, with Cisco, HPE/Juniper, Huawei, and white‑box ODMs rounding out the ecosystem depending on region, workload, and procurement model. In hyperscale cloud‑provider data centers, ODMs hold a 30%-to-40% market share.

References:

Will AI clusters be interconnected via Infiniband or Ethernet: NVIDIA doesn’t care, but Broadcom sure does!

Big tech spending on AI data centers and infrastructure vs the fiber optic buildout during the dot-com boom (& bust)

Fiber Optic Boost: Corning and Meta in multiyear $6 billion deal to accelerate U.S data center buildout

AI Data Center Boom Carries Huge Default and Demand Risks

Markets and Markets: Global AI in Networks market worth $10.9 billion in 2024; projected to reach $46.8 billion by 2029

Using a distributed synchronized fabric for parallel computing workloads- Part I

Using a distributed synchronized fabric for parallel computing workloads- Part II

HPE cost reduction campaign with more layoffs; 250 AI PoC trials or deployments

Hewlett Packward Enterprise (HPE) is going through yet another restructuring to reduce costs and to capitalize on the AI use cases it’s been developing. HPE’s workforce reduction program announced in March 2025 was to reduce its headcount of around 61,000 by 2,500 and to have another reduction of 500 people by attrition, over a period of 12 to 18 months, eliminating about $350 million in annual costs when it is said and done. The plan is to have this restructuring done by the end of this fiscal year, which comes to a close at the end of October. The headcount at the end of Q2 Fiscal Year 2025 was 59,000, so the restructuring is proceeding apace and this is, by the way, the lowest employee count that HPE’s enterprise business has had since absorbing Compaq in the wake of the Dot Com Bust in 2001.

The company, which sells IT servers, network communications equipment and cloud services, employed about 66,000 people in 2017, not long after it was created by the bi-section of Hewlett-Packard (with the PC- and printer-making part now called HP Inc). By the end of April this year, the number of employees had dropped to 59,000 – “the lowest we have seen as an independent company,” said HPE chief financial officer of Marie Myers, on the company’s Wednesday earnings call (according to this Motley Fool transcript)– after 2,000 job cuts in the last six months. By the end of October, under the latest plans, HPE expects to have shed another 1,050 employees.

Weak profitability of its server and cloud units is why HPE now attaches such importance to intelligent edge. HPE’s networking division today encompasses the Aruba enterprise Wi-Fi business along with more recent acquisitions such as Athonet, an Italian developer of core network software for private 5G. It accounts for only 15% of sales but a huge 41% of earnings, which makes it HPE’s most profitable division by far, with a margin of 24%.

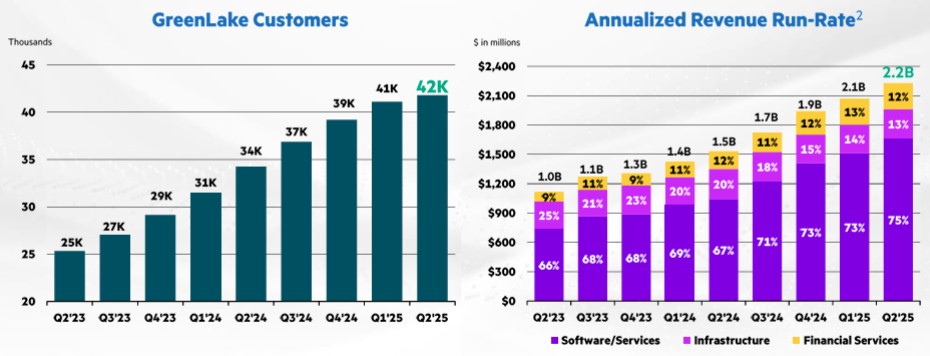

Customer growth is slowing at HPE’s GreenLake cloud services division. Only 1,000 customers added in the quarter, bringing to total to 42,000 worldwide. The annualized run rate for the GreenLake business inched up to $2.2 billion, compared to $2.1 billion in Q1 F2025 and from $1.5 billion a year ago. It is in this area that HPE plans to accelerate it’s AI growth, via Nvidia’s AI/GPU chips.

Source: HPE

With respect to the Juniper Networks acquisition, there is a possibility that the $14 billion deal may collapse. A legal battle in court is due to begin on July 9th, but Neri talked on the analyst call about exploring “a number of other options if the Juniper deal doesn’t happen.”

Photo Credit: HPE

Apparently, artificial intelligence (AI) is allowing HPE to eject staff it once needed. It has apparently worked with Deloitte, a management consultancy, to create AI “agents” based on Nvidia’s technology and its own cloud. Let loose in finance, those agents already seem to be taking over some jobs. “This strategic move will transform our executive reporting,” said Myers. “We’re turning data into actionable intelligence, accelerating our reporting cycles by approximately 50% and reducing processing costs by an estimated 25%. Our ambition is clear: a leaner, faster and more competitive organization. Nothing is off limits.”

HPE CEO Anthony Neris AI comments on yesterday’s earnings call:

Ultimately, it comes down to the mix of the business with AI. And that’s why we take a very disciplined approach across the AI ecosystem, if you will. And what I’m really pleased in AI is that this quarter, one-third of our orders came from enterprise, which tend to come with higher margin because there is more software and services attached to that enterprise market. Then you have to pay attention also to working capital. Working capital is very important because in some of these deals, you are deploying a significant amount of capital and there is a time between the capital deployment and the revenue profit recognition. So that’s why, it is a technology transition, there is a business transition, and then there’s a working capital transition. But I’m pleased with the progress we made in Q2.

The fact is that we have more than 250 use cases where we are doing PoCs (Proof of Concepts) or already deploying AI. In fact, more than 40 are already in production. And we see the benefits of that across finance, global operations, marketing, as well as services. So that’s why we believe there is an opportunity to accelerate that improvement, not just by reducing the workforce, but really becoming nimbler and better at everything we do.

- About Hewlett Packard Enterprise (HPE):

HP Enterprise (HPE) is a large US based business and technology services company. HPE was founded on 1 November 2015 as part of splitting of the Hewlett-Packard company. The company has over 240,000 employees and the headquarters are based in Palo Alto, CA (as of 2016).

HPE operates in 60 countries, centered in the metropolitan areas of Dallas-Fort Worth; Detroit; Des Moines and Clarion, Iowa; Salt Lake City; Indianapolis; Winchester, Kentucky; Tulsa, Oklahoma; Boise, Idaho; and Northern Virginia in the United States. Other major locations are as follows: Argentina, Colombia, Costa Rica, India, Brazil, Mexico, the United Kingdom, Australia, Canada, Egypt, Germany, New Zealand, Hungary, Spain, Slovakia, Israel, South Africa, Italy, Malaysia and the Philippines.

HPE has four major operating divisions: Enterprise Group, which works in servers, storage, networking, consulting and support; Services; Software; and Financial Services. In May 2016, HPE announced it would sell its Enterprise Services division to one of its competitors, Computer Sciences Corporation (CSC).

References:

HPE-Juniper combo + Cisco restructuring create enterprise network uncertainty

Hewlett Packard Enterprise’s (HPE) pending acquisition of Juniper Networks and Cisco’s recent corporate restructuring (which de-emphasizes legacy networking products like access/core routers and Ethernet switches) is putting enterprise networking customers in a holding pattern. They are pausing investments in network equipment as they wait out the uncertainty.

“I’ve had customers put things on hold right now, and not just the Juniper side but both sides,” Andre Kindness, principal analyst at Forrester Research, said in an interview with SDxCentral about how Juniper and HPE customers are reacting to uncertainty around the deal. “Typically, if customers are strong enough to look outside of Cisco and they’re not a Cisco shop, then HPE, Aruba, Juniper are the primary ones that they’re looking at. I’ve had customers put some of that on hold at this point.”

That holding pattern is tied to uncertainty over what systems and platforms will emerge from a combined HPE-Juniper. Mr. Kindness noted in a blog post when the deal was announced that “the journey ahead will be rife with obstacles for Juniper and HPE/Aruba customers alike.” Kindness explained that one important move for HPE would be to “rationalize/optimize the portfolio, the products and the solutions.”

“HPE will try to reassure you that nothing will change; it doesn’t make sense to keep everything, especially the multiple AP [access point] product lines (Instant On, Mist, and Aruba Aps), all the routing and switching operating systems (Juno, AOS-CX, and ArubaOS) and both management systems (Central and Mist),” Kindness wrote.

“Though not immediately, products will need to go and the hardware that stays will need to be changed to accommodate cloud-based management, monitoring, and AI.” HPE CEO Antonio Neri and his management team has attempted to temper these concerns by stating there is virtually no overlap between HPE and Juniper’s product lines, which Kindness said, “just boggles my mind,” he added.

Juniper’s AI product, called Marvis (part of the Mist acquisition in 2019), is by far the most advanced AI solution in the networking market. That’s not a profound statement; no vendor has anything close to it. The quick history: Juniper’s acquisition of Mist brought the company a cloud-based Wi-Fi solution with a leading AI capability, Marvis. Juniper quickly started integrating its switching and routing portfolio into Marvis. Walmart, Amazon, and others took notice. Fast-forward to today: This gives HPE Aruba a two-year lead against its competitors by bringing Juniper into the fold.

“I think [Neri’s] got to worry about the financial analyst out there in the stock market or the shareholders to pacify them, and then at the same time you don’t want to scare the bejesus out of your customer base, or Juniper customer base, so you’re going to say that there’s going to be either no overlap or no changes, everything will coexist,” Kindness said.

While overlap and other concerns could alter what a potential Juniper HPE combo looks like, Kindness said he expects the result to lean heavily on Juniper’s telecom and networking assets. That includes HPE products like Aruba networking gear being replaced by Juniper’s artificial intelligence (AI)-focused Mist and Marvis platforms.

“Mist has been really a game changer for the company and just really opened a lot of doors,” Kindness explained. “[Juniper] really did a 180 degree turn when they bought [Mist], and just the revenue that’s brought in and the expansion of the product line itself, and the capabilities of Mist and actually Marvis in the background would be hard for [HPE] to replicate at this point. My perception was HPE looked at it and said, Marvis and Mist is just something that would take too long to get to.” Kindness added that he does not expect significant platform thinning to happen for a couple of years after a potential closing of the deal, but the interim could be filled with challenges tied to channel partners and go-to-market strategies that could chip away at market opportunities similar to what is happening at VMware following the Broadcom acquisition. “Broadcom is ruthless, right or wrong, it’s its business model,” Kindness said. “HPE is not quite that dynamic.”

……………………………………………………………………………………………………………………………………….

Cisco CFO Scott Herren told the audience at a recent investor conference that HPE’s pending Juniper acquisition is causing “uncertainty” in the enterprise WLAN market that could be benefit Cisco. “I think for sure that’s created just a degree of uncertainty and a question of, hey, should I consider if I was previously a vendor or a customer of either of those, now is the time to kind of open up and look at other opportunities,” Herren said. “And we’ve seen our wireless business, our orders greater than $1 million grew more than 20% in the fourth quarter.”

Cisco is also working through its own networking drama as part of the vendor’s recently announced restructuring process. Those moves will see Cisco focus more on high-growth areas like AI, security, and cloud at the expense of its legacy operations, including the pairing down of its networking product lines.

“It looks like Cisco’s realizing that all the complexity of customer choice and all these variations and offering a zillion features is probably not the way to go. I think Chuck realized it,” Kindness said of Cisco’s efforts. “If you look at the ACI [Application Centric Infrastructure] and Cloud Dashboard for Nexus starting to consolidate, and then the Catalyst line and the Aironet line and the Meraki line are consolidating, it’s just the right move. The market has told them that for the last 10 years, it just took them a while to recognize it.”

References:

https://www.juniper.net/us/en.html

Cisco to lay off more than 4,000 as it shifts focus to AI and Cybersecurity

Cisco restructuring plan will result in ~4100 layoffs; focus on security and cloud based products

HPE acquires private cellular network provider Athonet (Italy) to strengthen HPE Aruba’s networking portfolio

Hewlett Packard Enterprise (HPE) today announced the expansion of its connected edge-to-cloud offering with the acquisition of Athonet, a private cellular network technology provider that delivers mobile core networks to enterprises and communication service providers. Combined with the HPE telco and Aruba networking portfolios, Athonet will put HPE at the forefront of a growing market that is predicted by IDC to increase to more than $1.6 billion1 by 2026.

Based in Vicenza, Italy, Athonet has more than 15 years of experience delivering 4G and 5G mobile core solutions to customers and partners globally. Athonet is an award-winning technology pioneer with more than 450 successful customer deployments in various industries, including leading mobile operators, hospitals, airports, transportation ports, utilities, government and public safety organizations.

With enterprises facing complex connectivity challenges across large and remote sites, private 5G offers high levels of coverage, reliability and mobility across campus and industrial environments. It also augments the cost-effective, high-capacity connectivity provided by Wi-Fi. The incorporation of Athonet’s technology will allow HPE to deliver private networking capabilities directly to enterprises as part of HPE’s Aruba networking portfolio, while also enabling communications service providers (CSPs) to quickly deploy private 5G networks for their customers.

“Telco customers are looking for simpler ways to deploy private 5G networks to meet growing customer expectations at the connected edge,” said Tom Craig, global vice president and general manager, Communications Technology Group at HPE. “At the same time, enterprise customers are demanding a customized 5G experience with low-latency, segregated resources, extended range and security across campus and industrial environments that complement their existing wireless networks. With the acquisition of Athonet, HPE now has one of the most complete private 5G and Wi-Fi portfolios for CSP and enterprise customers – and we will offer it as a service through HPE GreenLake.”

HPE expands private 5G solutions for both telcos and the enterprise:

HPE will integrate Athonet’s technology into its existing CSP and Aruba networking enterprise offerings to create a private networking portfolio that accelerates digital transformation from edge-to-cloud. The networking portfolio will provide the following benefits:

- Enhanced private networks that combine the high capacity of Wi-Fi with the coverage and mobility of 5G

- Accelerated private 5G deployments that improve agility and innovation to help telco B2B teams and enterprise customers

- New enterprise revenue streams for telcos with differentiated services leveraging 5G and Wi-Fi

- Alignment of costs to revenues with consumption-based models for enterprises and telcos through HPE GreenLake, reducing the risk of entering new markets

- Management of operational complexity and cost efficiency with 5G orchestration and zero-touch automation to deliver new workloads from edge-to-cloud

With 5G investments running into the billions of dollars, CSPs are looking for simple ways to meet customer needs and drive new B2B revenue by deploying both edge compute and private 5G networks. The addition of Athonet’s software to HPE’s telco portfolio enhances one of the broadest communications portfolios in the market, which serves a base of more than 300 customers across 160 countries and connects more than one billion mobile devices worldwide. Building on its existing private 5G solutions, HPE’s enhanced offering for CSPs will support private 4G and 5G networks and include telco-grade orchestration and automation capabilities. These capabilities will help launch new B2B services that meet growing customer expectations for the connected edge.

“Athonet was founded to provide customers with private 4G and 5G solutions that deliver carrier-grade reliability and performance to suit their increasing and more challenging connectivity needs,” said Gianluca Verin, CEO and co-founder of Athonet. “We are excited to join HPE and combine our highly skilled teams as we expand our joint service provider offerings for the rapidly growing private 5G market and build on HPE’s strategy to be the leading edge-to-cloud solutions provider.”

Private 5G offers enterprises new capabilities that are ultra-secure, easy to deploy and manage, ready for highly specialized applications such as robotics and industrial IoT, data networks and pipelines, and security systems facilitation. The acquisition of Athonet strengthens Aruba’s connected edge portfolio, providing the unique and highly sought-after ability to deliver fully integrated Wi-Fi and private 5G networks. Integration with Aruba Central will enable network managers to administer Wi-Fi and private 5G through a single pane of glass and bring to bear the power of AI-powered insights, workflow automation, and robust security.

HPE GreenLake, HPE’s edge-to-cloud platform, will offer Athonet private 5G offerings, combining all costs for Wi-Fi and private 5G into one single monthly subscription with no capital expenditure. Flexible consumption options, including HPE’s networking as a service, mean private 5G networks can be deployed with reduced risk, little upfront investment and scaled according to demand.

HPE portfolio integration and availability:

HPE will integrate Athonet’s solutions with its existing telco software assets and plans to make them available to customers some time following the close of the transaction. HPE will also integrate the solutions with the Aruba networking portfolio in the near future. The transaction is expected to close at the beginning of the third quarter of HPE’s 2023 fiscal year, subject to regulatory approvals and other customary closing conditions.

About Hewlett Packard Enterprise:

Hewlett Packard Enterprise is the global edge-to-cloud company that helps organizations accelerate outcomes by unlocking value from all of their data, everywhere. Built on decades of reimagining the future and innovating to advance the way people live and work, HPE delivers unique, open and intelligent technology solutions as a service. With offerings spanning Cloud Services, Compute, High Performance Computing & AI, Intelligent Edge, Software, and Storage, HPE provides a consistent experience across all clouds and edges, helping customers develop new business models, engage in new ways, and increase operational performance. For more information, visit: www.hpe.com

Media Contacts for U.S. & Canada:

Ben Stricker [email protected]

…………………………………………………………………………………………………………………………………………

Analysis from Channel Futures:

While HPE already offers a 5G cloud-native software core, Athonet gives deeper in-house capabilities to more quickly and directly deploy private 5G networks.

“Given HPE’s Wi-Fi and security assets – like Aruba – I’d say this makes a clear play to simplify management for key enterprise digital assets. And this is the kind of issue that enterprises are often bringing up to us,” Omdia chief analyst of enterprise services Camille Mendler told Channel Futures. (Omdia and Channel Futures share a parent company, Informa.)

Patrick Filkins, IDC‘s research manager for IoT and telecom network infrastructure, said Athonet can give HPE customers an improved option for deploying a private 5G network together with Wi-Fi. Filkins said that integrated portfolio could well serve an enterprise that has already done the heavy legwork of building a Wi-Fi network.

“This is a very complicated task, and one the enterprise itself controls. They don’t want to start from scratch or be forced to have someone else tinkering in their systems, so this acquisition will hopefully provide some assurance to enterprise customers that the vendors will help ensure their customers can repurpose work they’ve already done to integrate a new network technology, and hopefully new use cases,” Filkins said.

Filkins said the acquisition will immediately improve the HPE 5G core and gradually work its way into Aruba portfolio improvements. For example, HPE will integrate Athonet into the Aruba Central network management platform.

“Specifically, we expect HPE/Aruba to over time release follow-on solutions which help enterprises manage the two technologies seamlessly. Enterprises are not interested in deploying both 5G and Wi-Fi networks in a silo. They want a combined solution that can help tackle the integration and management issues from a single pane. This means you’ll see HPE’s telco and Aruba teams working together more closely over time,” Filkins said.

Mendler said one might see a U.S. equivalent in Celona, despite Athonet’s age (founded 2004) compared to that of Celona (founded in 2019). Filkins added that although many vendors provide private and public LTE/5G cores in the U.S., most run their headquarters abroad. He pointed to Cisco and Microsoft-acquired Mavenir, Affirmed Networks and MetaSwitch as 5G core providers in the U.S.

“However, from a competitive standpoint, Athonet competes globally against Nokia, Ericsson, Mavenir, Microsoft Azure, Cisco, etc., among others,” Filkins told Channel Futures. He described Athonet as “no slouch” in the wireless market. He calls the company’s customer base deep, though consisting of smaller customers. HPE said in an announcement that Athonet has performed 450 customer deployments in various verticals. Athonet’s customers include SpaceX, which uses a private cellular network in Antarctica.

Filkins called the Athonet technology offerings “relatively advanced for 5G.” For example, the cloud-native 5G core meets almost all of 3GPP‘s listed functions. He also said Athonet’s core augments HPE’s 5G core offerings.

“The cloud-native part means it can be deployed fully on-site, fully in the cloud, or in a hybrid format. This should cover any scenario the customer wants. [Athonet] has specialized in selling mobile core software to enterprises, and smaller, regional operations for years. It knows the needs of the enterprise well,” Filkins said.

Athonet CEO and co-founder Gianluca Verin said his team looks forward to joining HPE. Moreover, he said he wants to enhance HPE’s goal of being “the leading edge-to-cloud solutions provider.” Verin worked in support and solution engineer positions at Ericsson for eight years before starting Athonet.

HPE’s GreenLake edge-to-cloud services platform will host the private 5G service. HPE executives have said GreenLake as-a-service consumption model will “simplify” enterprises’ entrance into 5G and lower risk.

“I think this is an important step HPE is taking. For the most part, private 5G and Wi-Fi networks have been offered as point solutions, but HPE/Aruba intend to do the ‘under-the-hood’ work to make them as integrated as possible, which is what enterprise customers want,” Filkins said.

In December, HPE said 80% of its top 100 customers have adopted the GreenLake platform. The vendor is also equipping Aruba partners to deliver its network-as-a-service offering.

When HPE unveiled a private 5G offering one year ago, an executive said HPE preferred to go to market though system integrators, telcos and service providers rather than straight to the enterprise. HPE’s telco business serves 300 customers across the world, the company said.

……………………………………………………………………………………………………………………………………………….

References: