Spectrum Sharing

European Commission’s Digital Networks Act to restructure European telecom regulations with indefinite duration spectrum licenses

The European Commission’s forthcoming Digital Networks Act (DNA) aims to restructure the regulatory framework for the telecommunications sector in Europe to stimulate investment. The act indicates the European Commission is avoiding a mandatory levy system or new enforceable duties specifically targeting major tech firms. Instead, the proposal advocates for a voluntary cooperation framework where the largest online providers would engage in discussions moderated by the Body of European Regulators for Electronic Communications (BEREC), which comprises national telecom regulators.

A key component of this revamp, outlined in a draft document reviewed by Reuters, includes the potential allocation of lucrative radio spectrum licenses to telecom providers for an indefinite duration. The proposed legislation, scheduled for presentation by EU tech chief Henna Virkkunen on January 20th, suggests that licenses without time limits could foster a more functional secondary market for spectrum trading and leasing.

To prevent spectrum hoarding, EU regulators have suggested implementing “use-it-or-share-it or lose-it” conditions and specific roll-out obligations, ensuring the resource remains actively utilized and accessible to efficient competitors. The document said: “Spectrum usage rights shall be in principle granted for an unlimited duration….Sufficiently long duration of rights of use of radio spectrum should increase investment predictability to contribute to faster network roll-out and better services, as well as stability to support radio spectrum trading and leasing.”

The draft Digital Networks Act also addresses market dominance by suggesting that companies identified as having significant market power in one specific market could also be designated as such in closely related markets. This designation would subject them to stringent obligations, including enhanced transparency, non-discrimination requirements, and potentially price controls, cost accounting, or accounting separation.

This cooperative approach aligns with the Commission’s prior stance on “network fees.” A July 2025 policy analysis concluded that mandating large online platforms to pay network fees was not a viable mechanism for financing 5G and broadband infrastructure deployment. Nonetheless, the reported DNA draft introduces measures that could significantly impact telecom operators and national regulators. These include addressing spectrum license durations, sales conditions, and a proposed pricing methodology intended to guide national regulators during spectrum auctions—a sensitive area for member states given the substantial revenues generated by these auctions. Furthermore, the text is expected to provide EU-level guidance on fiber infrastructure rollout. A noted element is flexibility regarding the 2030 objective for replacing legacy copper networks; governments may be granted deadline extensions if they can demonstrate a lack of readiness.

Advocates for stronger EU harmonization argue that a unified market is essential for creating viable pan-European investment models, particularly for high-capacity fixed networks and future mobile technologies. Industry groups have consistently called for longer, more predictable spectrum licensing and consistent award conditions across the EU, arguing that national divergences impede deployment and escalate costs.

Critics of increased centralization caution that the DNA could facilitate a transfer of powers away from national regulators and governments.

The Reuters reporting suggests some national regulators may perceive the Commission’s planned interventions in spectrum policy and rollout guidance as a “power grab,” as spectrum management has traditionally remained a core national competence within the existing EU framework. Civil society organizations have raised concerns that attempts to restructure telecom market rules might compromise net neutrality principles or encourage commercial agreements that influence traffic management practices.

The DNA proposal is set against the backdrop of recent major EU digital legislation, including the Digital Services Act (DSA) and Digital Markets Act (DMA). To avoid repeating US criticism that EU rules disproportionately target US-based tech companies, the DNA appears designed to place the largest platforms within a cooperative, rather than compulsory, regime, while focusing binding measures on the connectivity sector’s regulatory architecture.

For large online services, the voluntary framework presents questions regarding incentives and enforcement. While a “best practices” code moderated by regulators can facilitate technical dialogue on issues like network resilience and traffic management, it inherently lacks hard obligations or penalties for non-compliance. Upon official publication, the Commission’s proposal will enter the EU’s ordinary legislative procedure. Core points of contention—including the balance between EU coordination and national discretion on spectrum, and the scope of any obligations placed on large digital firms—will be negotiated by member states in the Council and the European Parliament in the coming months.

If the reported draft details are confirmed, the Digital Networks Act signifies a strategic pivot: moving away from compelling Big Tech to directly finance networks and towards reshaping the existing telecom rulebook, spectrum practices, and infrastructure targets to unlock investment. The legislative negotiations will determine whether this combination is sufficient to accelerate infrastructure deployment without reigniting net neutrality disputes or national sovereignty arguments.

A July 2025 joint statement by consumer and civil society groups urged the Commission to preserve robust net neutrality within the DNA and voiced concerns regarding proposals linked to the “fair share” debate, including ideas for dispute-resolution systems between telecom operators and online services. Hence, Europe’s commitment to the principle of net neutrality is reaffirmed, mandating equal treatment for all Internet traffic by operators, a stance maintained despite industry calls for a less restrictive regulatory environment.

References:

https://eutoday.net/digital-networks-act-draft/

StrandConsult Analysis: European Commission second 5G Cybersecurity Toolbox report

European Commission DESI report reveals broadband network status is lagging

EU Commissioner outlines strategic direction for European Satellite Communications System

European Union plan for LEO satellite internet system

India’s COAI joins 4 European telcos in demanding OTT players pay to use their networks

57% of European homes can now get FTTH/B internet access; >50% growth forecast over next 5 years

GSMA Vision 2040 study identifies spectrum needs during the peak 6G era of 2035–2040

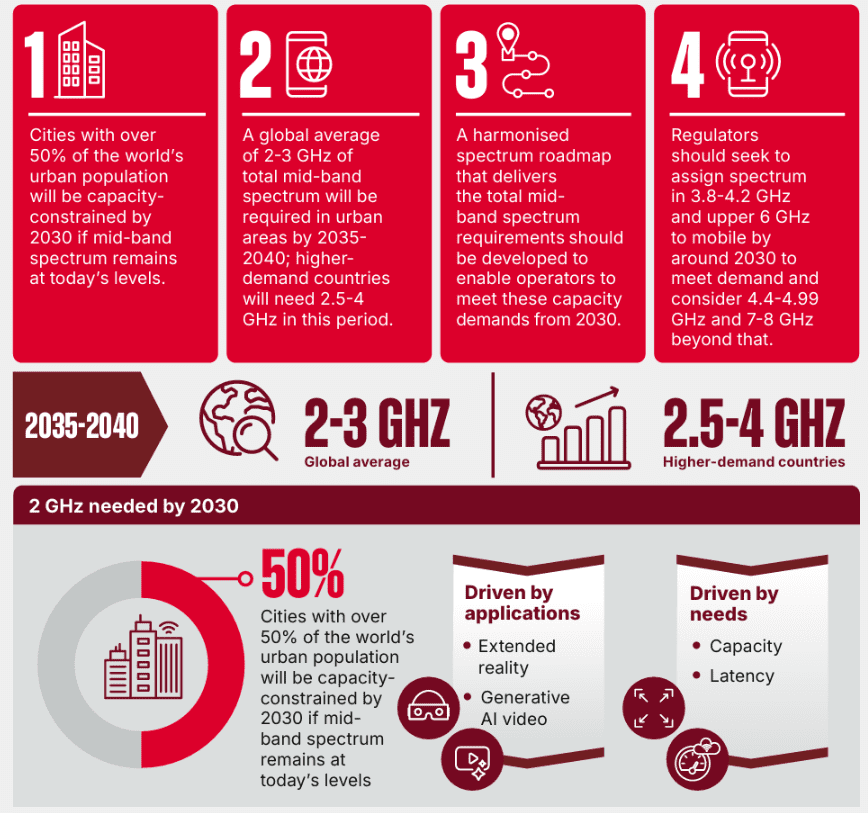

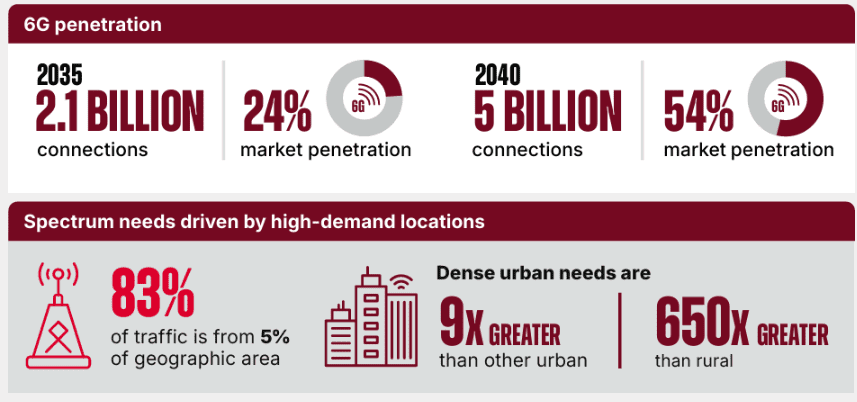

According to a recent GSMA Vision 2040 study, many cities worldwide could face capacity limitations by 2030 if mid-band spectrum availability does not increase, impacting over half of the global urban population. Strategic long-term planning for future wireless generations like 6G is necessary, as device and equipment development can take over a decade, with 6G expected to account for roughly 5 billion connections by 2040 while 4G and 5G remain prevalent. The GSMA’s modeling forecasts a significant rise in traffic, potentially reaching 4,000 EB/month by 2040 in a high-growth scenario driven by AI-enabled applications. The report’s analysis shows that countries must act now to secure enough spectrum for 6G, or risk slower speeds, rising congestion and lost economic opportunity in the 2030s.The GSMA cautions that without early government planning, consumers could face poorer connectivity, businesses may struggle to adopt new technologies, and national digital economies could lose competitiveness in the global transition to 6G.

“Next-generation 6G networks will require up to three times more mid-band spectrum than is typically available today to keep pace with surging demand for data, AI-powered services and advanced digital applications, according to new analysis published today by the GSMA, which represents the mobile ecosystem worldwide.”

John Giusti, Chief Regulatory Officer, GSMA:

“This study shows that the 6G era will require three times more mid-band spectrum than is available today. Satisfying these spectrum requirements will support robust and sustainable connectivity, deliver digital ambitions and help economies grow. I hope this report provides useful insights to governments as they strive to meet the connectivity needs of their citizens in the coming decade.”

Long-Term Spectrum Planning Underpins Enterprise Strategy:

Planning for 6G requires a substantial lead time; the report highlights that device ecosystem readiness and equipment development cycles often span a decade or more. Telecom operators must finalize decisions regarding fiber backhaul, Radio Access Network (RAN) upgrades, and site acquisitions years before new services go live. Enterprises developing AI-driven products or advanced mobility services rely heavily on this network predictability.

The report’s modeling suggests 6G will account for roughly 5 billion connections by 2040—approximately half of all global mobile connections. However, 4G and 5G will remain heavily utilized, particularly in emerging markets, making immediate spectrum re-farming impractical. Operators will increasingly rely on multi-RAT spectrum sharing (MRSS) to manage parallel generations of mobile technology. While MRSS offers improved efficiency over current dynamic spectrum sharing methods, coexistence introduces inherent operational complexity.

AI, Sensing, and the Power User Dynamic:

Demand is shifting toward intelligence-driven workloads, resulting in projected traffic growth across all GSMA scenarios. Even the most conservative projection forecasts 10% annual growth between 2030 and 2040, reaching 1,700 EB/month. The high-growth scenario predicts 4,000 EB/month, driven largely by AI-enabled applications.

The report identifies four primary channels through which Artificial Intelligence will impact traffic:

- New applications: including multimodal assistants.

- Performance demands: higher requirements for existing experiences like personalized video.

- Increased time online.

- Efficiency gains: some optimization through compression.

Enterprises implementing AI assistants, high-definition video, or hybrid cloud-edge processing will contribute significantly to this shift, requiring a focus on increased uplink demand.

A key behavioral finding is that 10% of users currently generate 60-70% of mobile traffic. As digitally-native generations mature, these usage patterns will become mainstream. Enterprise solutions for mobility, frontline workers, and customer engagement must be architected to handle these higher sustained uplink and downlink loads.

Geospatial analysis shows that 83% of traffic is concentrated in 5% of geographic areas. Dense-urban traffic can be nearly 700x higher per square kilometer than in rural areas. For enterprises operating in high-demand zones (e.g., logistics hubs, retail corridors, public venues), the localized performance of RAN deployments will determine service reliability and efficacy.

Mid-Band Spectrum as 6G’s Anchor Capability:

The GSMA study asserts that dense-urban areas will require 2-3 GHz of mid-band spectrum globally by 2035-2040, increasing to 2.5-4 GHz in higher-demand markets. Many regions currently provide only around 1 GHz, necessitating an additional 1-3 GHz allocation. The report stresses that at least 2 GHz must be operational by 2030 to prevent early 6G rollouts from facing immediate congestion.

This additional spectrum capacity enables several critical 6G capabilities:

- Low latency: Wide channels required for sub-10 ms latency supporting digital twins and real-time sensors.

- Balanced performance: Symmetrical uplink/downlink performance for real-time bi-directionality.

- Efficiency: Efficient reuse of existing bands via MRSS.

- Optimized deployment: Reduced reliance on mmWave, which is not economical for wide-area traffic coverage.

Operational Constraints to Manage:

- Densification Limits: Most urban networks operate optimally within inter-site distances of 200-800m. Further densification introduces rapidly escalating costs, making spectrum acquisition a more scalable solution.

- mmWave Role: Millimeter wave (mmWave) remains a supplementary technology, suitable for localized capacity but limited to carrying 5-10% of dense-urban traffic; it does not replace mid-band for wide-area coverage.

- Wi-Fi Offload: Due to its unmanaged nature, Wi-Fi offload cannot deliver the predictable performance guarantees required for mission-critical 6G-era applications.

- Gradual Re-farming: With 4G and 5G still prevalent through 2040, MRSS is essential for balancing capacity across generations of radio technology.

Recommendations for Telecoms Companies:

Telecom operators should develop a long-term spectrum roadmap informed by these findings, prioritizing 2-3 GHz globally, with targets up to 4 GHz in high-demand markets. Key actions include:

- Prioritize 6 GHz: Focus on the upper 6 GHz band, which offers approximately 700 MHz of new capacity between 6.425-7.125 GHz.

- Integrate MRSS: Build multi-RAT spectrum sharing into core network design to balance 4G, 5G, and 6G operations.

- Model Uplink Demands: Plan for greater asymmetric demands driven by future uplink-heavy workloads (e.g., enterprise AI, sensing).

- Address Vertical Needs: Prepare specific service level agreements (SLAs) for verticals such as manufacturing, transport, and retail that require guaranteed latency and reliability.

- Evaluate Densification: Utilize densification strategically in high-value, targeted areas rather than as a broad replacement for acquiring additional spectrum.

Conclusions:

Spectrum policy directly translates to concrete operational outcomes. A city or nation’s ability to deliver reliable 6G performance will be a key determinant of future economic growth and service innovation. For both telecom operators and enterprise technology leaders, aligning current investment strategies with critical spectrum decisions is essential for defining next-generation connectivity infrastructure. The full study is available on the GSMA Intelligence website.

Editor’s Note:

ITU-R is the SDO (Standards Development Organization) that defines the framework, requirements, and evaluation criteria for IMT-2030 (6G) systems, which includes identifying the necessary spectrum. The WRC-23 identified key frequency ranges (e.g., 4400-4800 MHz, 7125-8400 MHz, and 14.8-15.35 GHz) for further study for IMT-2030 under a WRC-27 agenda item.

After WRC determines the IMT 2030 frequencies, ITU-R WP 5D will develop a recommendation for IMT 2030 Frequency Arrangements, just as it did for IMT 2020, but it was delayed due to bickering and only was finalized after the ITU-R M.2150 recommendation (IMT 2020 RIT/SRITs) was approved. Specifically, ITU-R M.1036-7 provides harmonized frequency bands to facilitate global roaming and economies of scale, while acknowledging that specific national band plans may vary due to existing services.

References:

https://www.telecomstechnews.com/news/the-spectrum-decisions-shaping-gsma-6g-era-report/

Big 5G Conference: 6G spectrum sharing should learn from CBRS experiences

India’s TRAI releases Recommendations on use of Tera Hertz Spectrum for 6G

WRC-23 concludes with decisions on low-band/mid-band spectrum and 6G (?)

https://www.itu.int/en/ITU-R/study-groups/rsg5/rwp5d/imt-2030/pages/default.aspx

Do ITU Radio Regulations Matter? China allocates 6 GHz spectrum for 5G and 6G services prior to WRC 23; CTIA objects!

Gartner: Gen AI nearing trough of disillusionment; GSMA survey of network operator use of AI

GSMA: China’s 5G market set to top 1 billion this year

Highlights of GSMA study: Mobile Net Zero 2024, State of the Industry on Climate Action

GSMA- ESA to collaborate on on new satellite and terrestrial network technologies

GSMA: Closing the digital divide in Central Asia and the South Caucasus

InterDigital led consortium to advance wireless spectrum coexistence & sharing

InterDigital, Inc, a mobile, video and AI technology research and development company, was awarded a contract by the U.S. Department of War (DoW) to lead research and conduct demonstrations of advanced spectrum coexistence for civil and military applications. Spectrum sharing optimizes the use of the airwaves, or wireless communications channels, by enabling multiple categories of users to safely share the same frequency bands.

A consortium led by InterDigital, including DeepSig, Skylark Wireless, Virginia Tech, and Radisys, will endeavor to advance spectrum coexistence. The collaboration will focus on developing and testing new technologies that leverage artificial intelligence, advanced sensing, and commercial 5G systems. The need for this work stems from the high demand for mid-band frequencies, which are essential for both defense radar and commercial wireless applications due to their balance of coverage and capacity. The goal is to enhance dynamic spectrum sharing performance, ensuring national security radar systems can function without interference while enabling commercial 5G to operate in the same frequency bands.

The consortium plans to develop new technologies that will enable government and industry systems to “more seamlessly coexist.” Examples are given as low-latency AI-based distributed spectrum sensing and interference mitigation operations performed locally at cellular base stations and user equipment.

“InterDigital’s heritage of research has produced innovations that make it possible for radar and communications to coexist in ways that were not feasible,” said InterDigital CTO Rajesh Pankaj. “Building on our groundbreaking work in sensing and AI integration, we can foster greater collaboration between government and industry to achieve more efficient sharing of one of our most valuable resources. We look forward to working with the DoW and alongside these esteemed partners and suppliers.”

“DeepSig is proud to support the DoW and InterDigital in advancing dynamic spectrum sharing technologies,” said DeepSig CEO Jim Shea. “Our AI-native spectrum sensing and communications software was developed to help meet this need and brings the speed, accuracy and adaptability needed to ensure that critical defense systems and commercial 5G networks can safely and efficiently coexist. This project represents an important step toward unlocking the full potential of mid-band spectrum for both national security and next-generation connectivity, and offers to help unlock future band-sharing for 6G and beyond.”

Skylark Director of Business Development & Product Samir Rahi added: “Skylark is pleased to have been selected as a collaborator for the DoW and InterDigital’s coalition of US-based partners to support dynamic spectrum-sharing solutions. This activity builds upon Skylark’s prior success in related DoW programs. Specifically, our flexible architecture for last-mile connectivity is designed to integrate best-of-breed technologies in real-time, from partners such as InterDigital and DeepSig, at the pace of innovation required to support national interests. Skylark believes the DoW’s initiatives such as this represent the United States’ emerging capabilities in deploying dynamic spectrum-sharing at scale, providing dual use benefits for the commercial sector while simultaneously advancing national security objectives.”

…………………………………………………………………………………………………………………………………………………………………………

This project will leverage InterDigital’s proven foundational dynamic spectrum sharing technologies, which have been successfully demonstrated in commercial deployments and validated through prior government initiatives. The team will build upon this baseline with new and innovative technologies, including low-latency AI-based distributed spectrum sensing and interference mitigation operations performed locally at cellular base stations and user equipment. These new technologies will enable government and industry systems to more seamlessly coexist.

Image Credit: Blue Planet Studio SHUTTERSTOCK

……………………………………………………………………………………………………………………………………………………………..

About InterDigital®

InterDigital is a global research and development company focused primarily on wireless, video, artificial intelligence (“AI”), and related technologies. We design and develop foundational technologies that enable connected, immersive experiences in a broad range of communications and entertainment products and services. We license our innovations worldwide to companies providing such products and services, including makers of wireless communications devices, consumer electronics, IoT devices, cars and other motor vehicles, and providers of cloud-based services such as video streaming. As a leader in wireless technology, our engineers have designed and developed a wide range of innovations that are used in wireless products and networks, from the earliest digital cellular systems to 5G and today’s most advanced Wi-Fi technologies. We are also a leader in video processing and video encoding/decoding technology, with a significant AI research effort that intersects with both wireless and video technologies. Founded in 1972, InterDigital is listed on Nasdaq.

InterDigital is a registered trademark of InterDigital, Inc.

For more information, visit: www.interdigital.com.

InterDigital Contact:Roya StephensEmail: [email protected] +1 (202) 349-1714

About DeepSig, Inc.DeepSig is a pioneer in AI native wireless communications which are helping to shape 6G. Its transformative technology pushes the boundaries of spectrum sensing, wireless performance and network capabilities. Drawing on its expertise in deep learning, wireless systems and signal processing, DeepSig’s AI/ML-powered software enhances security, efficiency and capacity for tactical and commercial wireless communications in licensed or shared radio spectrum and in existing 5G Open RAN or AI native next generation 6G networks.

For more information, visit: https://www.deepsig.ai/

DeepSig Contact: [email protected]

About Skylark Wireless

Skylark Wireless is building the interface between the physical and digital worlds by connecting industrial, enterprise, and public sector customers through a dynamic, converged communications platform. The company designs and manufactures US-assembled critical infrastructure for last-mile connectivity that combines patented techniques to improve range, performance, and interference mitigation with a fully software-defined radio architecture. This fusion of efficiency and flexibility uniquely supports an ever-growing collection of value-add use cases as networks evolve from 5G to 6G and beyond. To learn more about Skylark’s connectivity solution, please contact [email protected]

………………………………………………………………………………………………………………………………………………………

Other Spectrum Activities:

- Earlier in 2025, the GSMA’s global 5G spectrum landscape stated mid-band remains the backbone of 5G deployments, while interest in both low-band and mmWave “continues to evolve in line with network strategies and future 6G planning.”

- ITU-R WP 5D develops the methodologies for carrying out sharing and coexistence studies between IMT and other radio services, such as broadcasting and satellite services. These studies address issues like potential interference and define separation criteria and technical conditions for coexistence.

- WP 5D’s work also addresses the evolution of spectrum management to incorporate more efficient techniques like dynamic spectrum access (DSA).

- As part of its process, WP 5D collaborates with and receives input from various external organizations, research communities, and other ITU-R Working Parties. This collaborative approach ensures that the spectrum management and coexistence frameworks for IMT systems are robust and informed by diverse perspectives.

References:

InterDigital to Lead Research and Demonstrate Advanced Spectrum Coexistence; DeepSig to Partner

https://www.nist.gov/spectrum-sharing

Why Spectrum Sharing is Critical for the Future of Connectivity

mmWave Coalition on the need for very high frequency spectrum; DSA on dynamic spectrum sharing in response to NSF RFI

Big 5G Conference: 6G spectrum sharing should learn from CBRS experiences

NTIA and DoD report: Spectrum Sharing strategy for users of lower 37 GHz band

In a new 31-page report, the U.S. NTIA and the DoD offered spectrum sharing recommendations for federal and non-federal users in the lower 37GHz band. The NTIA is the government agency that handles federal usage of spectrum. The FCC handles commercial spectrum usage.

“The FCC, NTIA and DoD began discussions in 2020 on the details of a coordination mechanism. These discussions resulted in a draft sharing framework, based on first-in user rights,” the NTIA wrote in a press release. Here’s the backgrounder from NTIA:

- Building on prior collaborative efforts of NTIA, DoD, and the FCC, the findings reflect coordination across a range of government and industry stakeholders.

- The recommendations for a sharing framework take advantage of the physical characteristics of this band, which is well-suited for short-range and line-of-sight wireless applications.

- The report recognizes the need for flexible access tailored to both Federal and non-Federal user requirements to foster technological advances and policy innovation.

With limited incumbent uses, the band presents a “clean slate” for developing a new model for co-primary Federal and non-Federal access. Specifically, this spectrum supports the creation of very narrow, directed beams and limited propagation for ground communications, making robust forms of sharing possible.

- U.S. policymakers have long recognized the unique sharing opportunities of the Lower 37 GHz band, as well as the need to protect Federal sites, including 15 military sites, five National Aeronautics and Space Administration receiving earth station operations and two National Science Foundation sites.

- In coordination with NTIA, the FCC in 2016 adopted an Order that concluded that non-Federal fixed and mobile applications can share 37-38.6 GHz with DoD operations. The Order made the Lower 37 GHz band available for co-primary sharing, with both Federal and non-Federal users accessing the band by registering sites through a coordination mechanism.

- In 2019, the FCC established service rules addressing Federal sites for a 2020 auction in the 37 GHz band, with sharing rules for 37.0-37.6 GHz to be addressed at a later date. Among other things, the decision added one Federal site to the list of protected Federal sites in the 37 GHz band and limited future DoD access to the 37.6-38.6 GHz (Upper 37 GHz) band unless the Department could demonstrate that its operations cannot be accommodated in the Lower 37 GHz band.

- To enable an innovative sharing approach for the Lower 37 GHz band, the FCC, NTIA and DoD began discussions in 2020 on the details of a coordination mechanism. These discussions resulted in a draft sharing framework, based on first-in user rights.

- Following the release of the NSS Implementation Plan, the FCC released a 2024 Public Notice, that sought information on sharing issues in the Lower 37 GHz band, including how to accommodate various use cases through a coordination mechanism between Federal and non-Federal operators.

Image Credit: Dmytro Razinkov/Alamy Stock Photo

The NTIA outlined a detailed, two-phase sharing process for the 37GHz band: “The first phase would use simple propagation models to determine whether there are overlapping contours and permit operations to proceed in the absence of any overlap,” the NTIA wrote. “The second phase would apply in the event of overlap between a proposed site registration and an existing site already registered in the database and would require the parties to exchange more detailed data and attempt to coordinate their operations.” Next the FCC would have to implement the NTIA’s sharing recommendations.

Expected uses of the Lower 37 GHz band include data-intensive applications, such as high speed, low latency 5G services. Wireless operators view this spectrum as well-suited for providing additional bandwidth, for example during large events through indoor distributed antenna deployments. Industry also sees value in the band for addressing increased demand for mobile network capacity by offloading traffic from other bands.

- Potential use cases include fixed wireless access; high-capacity backhaul; cable supplement for Internet of things (IoT) networks and augmented reality applications; and mobile or private networks that support industrial IoT, smart factories and other high-bandwidth indoor communications applications.

- Federal users, including DoD, may leverage some of this same technology, including as part of potential additional adaptations to meet mission requirements (e.g., hardening).

- Although not being proposed for any specific frequency allocation at this time, DoD is evaluating additional use cases to meet military missions, including: (1) Unmanned Systems to provide terrestrial or maritime to aeronautical mobile and potentially space to aeronautical mobile (maritime, terrestrial) unmanned systems; and (2) Wireless Power Transfer to provide a variety of capabilities currently in development by military research labs to deliver power to wireless communication systems, mobile vehicles, surface and subsurface vehicles, and other potential uses cases.

References:

https://www.lightreading.com/5g/dod-agrees-to-spectrum-sharing-paradigm-in-37ghz

T-Mobile and Charter propose 5G spectrum sharing in 42GHz band

Big 5G Conference: 6G spectrum sharing should learn from CBRS experiences

mmWave Coalition on the need for very high frequency spectrum; DSA on dynamic spectrum sharing in response to NSF RFI

Sharing of lower 3 GHz band in U.S. is unclear after DoD redacted report

The U.S. wireless industry would like to use the lower 3 GHz band, but it’s currently occupied by the military. The DoD says sharing between federal and commercial systems is not feasible unless certain conditions are met. Sharing between federal radar and mobile systems presents unique challenges, especially for airborne operations.

The DoD acknowledges the potential of freeing up some of the spectrum for 5G use, emphasizing that in order to make the lower 3 GHz band available for commercial use a “coordination framework must facilitate spectrum sharing in the time, frequency, and geography domains,” notes Broadband Breakfast.

5G already coexists with U.S. military systems in the lower 3 GHz band in more than 30 countries, said Umair Javed, CTIA senior vice president-spectrum. However, the future of the lower 3 GHz band in the U.S. is unsettled following DoD’s public release last week of a redacted version of its Emerging Mid-Band Radar Spectrum Sharing Feasibility Assessment [1.].

Note 1. Emerging Mid-Band Radar Spectrum Sharing Feasibility Assessment report

This redacted DoD report examines military systems located in lower 3 GHz spectrum, with an eye on potential sharing but not on clearing as sought by CTIA and carriers. It concludes that sharing the 3.1-3.45 GHz band between federal and commercial systems is not currently feasible “unless certain regulatory, technological, and resourcing conditions are proven and implemented.” The report originally came out in September 2023.

…………………………………………………………………………………………………………………..

DoD Chief Information Officer John Sherman said in February the department is willing to consider clearing part of the band “perhaps for future airborne radars,” which wasn’t part of EMBRSS. The spectrum is home to the Airborne Warning and Control System (AWACS), which DOD is upgrading. Airborne radars are considered the most difficult to address in a sharing regime because they are so mobile.

The lower 3 GHz is one of a few bands allowing for military radars “with small enough antenna apertures” to be mobile, with “sufficient range capabilities to serve as medium and long-range radars,” the study says. It notes the propagation characteristics of mid-band spectrum, which also make it a top target of carriers. “A complicating factor … has been the increased packing of federal systems relocated from other bands, including those as a result of repurposing from previous auctions,” the study says.

DoD found that more than 120 different ground-based, ship-borne and airborne radars use the band. While details are redacted, the report offers basic information on how the bands are used, for everything from land-based radar for tracking threats to Coast Guard and Navy search and rescue missions to air-traffic control to tracking bird migrations with an eye toward avoiding collisions. It also discusses the Department of Homeland Security’s uses.

But EMBRSS says sharing is possible using a dynamic spectrum management system (DSMS). It cites sharing in the citizens broadband radio service band. A DSMS, which “evolves the CBRS framework … with advanced interference mitigation features” addressing the unique needs of airborne systems, “provides a feasible path forward for spectrum sharing between the Federal and commercial systems,” EMBRSS said.

Blair Levin wrote Wednesday in a note to New Street clients.:

“The report’s most significant implications for investors involve what the DOD report did not do. It did not resolve any issues or provide a timetable for doing so. Thus, we remain far from resolving the question of where the spectrum that the wireless carriers argue they will need by 2027 will come from. While some advocate exclusive licensing of the band, and others sharing, DOD “almost certainly retains a veto power over any potential outcome,” he said.

DoD leaders, including John Sherman, the Pentagon’s top IT official, met Monday with the National Spectrum Consortium, a group of more than 350 members of academia and industry who work with the electromagnetic spectrum, to take the first steps to outline a framework to share the bandwidth with industry and to kickstart a discussion on a spectrum management program.

“No surprise. We know that spectrum will be challenging,” said Kevin Mulvihill, the Pentagon’s deputy chief information officer for command, control and communications. “But we need to work together across industry, government and academia to explore potential ways to achieve spectrum coexistence for the benefit of the entire nation while ensuring that the spectrum sharing that we choose does not negatively affect the primary mission of the Department of Defense.”

References:

https://dodcio.defense.gov/Portals/0/Documents/Library/DoD-EMBRSS-FeasabilityAssessmentRedacted.pdf

https://www.fierce-network.com/5g/dod-releases-long-awaited-report-lower-3-ghz

If the Pentagon has to share 5G spectrum, it wants some new ground rules – Breaking Defense

Could Transpositional Modulation be used to solve the “spectrum crunch” problem

Transpositional Modulation (TM) permits a single carrier wave to simultaneously transmit two or more signals, unlike other modulation methods. It does this without destroying the integrity of the individual bit streams.

TM Technologies (TMT) is a wireless technology company offering dramatic data throughput increases for existing wireless and wired networks, using TM.

TMT’s In Band Full Duplex (IBFD) is a MIMO-compatible antenna and software technology providing signal interference cancellation via its Adaptive-Array Antenna which allows simultaneous transmit and Receive = Doubling Data Rates. TM-IBFD development has shown a combined 120 db noise reduction in two-way communications, which provides up to a 100% gain in wireless data transport efficiency.

TMT believes that the use of its patented methods can prevent or delay the onset of a wireless “bandwidth crunch” and focuses on developing products for a range of applications. These products will use core technology to provide solutions and create value for customers, the economy, and the global wireless infrastructure. The company says that the TM-IBFD is backwards compatible and complimentary with existing beam forming or beam shaping installations.

Image Courtesy of TM Technologies (TMT)

……………………………………………………………………………………………………………………………………..

Using the latest Xilinx RFSoC devices, TMT has produced a Software Defined Radio (SDR) format with OFDM as primary modulation with multiple TM channel overlays. This is applicable to nearly any access or backhaul radio device with adequate head-space and operating within the 3GPP Rel 16 specifications.

Industry analyst Jeff Kagan wrote: “Spectrum shortage remains a problem that is not going to solve itself. That’s why new solutions like this are necessary….In the case of solving this spectrum crisis, there are two different groups to focus on. One, is the wireless carriers. Two, are wireless network builders. Either, the customer, which is the wireless network needs to demand this from their network builders. Or the network builders need to embrace this as a competitive advantage and as a solution to their customers.”

Jeff Kagan

References:

Kagan: Could TM Technologies help solve wireless spectrum shortage?

U.S. Launches National Spectrum Strategy and Industry Reacts

The U.S. Dept of Commerce has finally published a National Spectrum Strategy that could pave the way for 2,786MHz of frequencies to be repurposed for new use. That is nearly double NTIA’s initial target of 1,500 megahertz.

The frequencies in question, across five bands, will be studied for potential new uses, and the study could go either way. The next step will see the Biden-Harris administration develop and publish an Implementation Plan.

The spectrum target includes more than 1,600 megahertz of midband spectrum – a frequency range in high demand by the wireless industry for next-generation services.

As required by the Presidential Memorandum titled Modernizing United States Spectrum Policy and Establishing a National Spectrum Strategy, the Secretary of Commerce, through the National Telecommunications and Information Administration (NTIA), prepared this National Spectrum Strategy to both promote private-sector innovation and further the missions of federal departments and agencies, submitting it to the President through the Assistant to the President for National Security Affairs, the Assistant to the President for Economic Policy, and the Director of the Office of Science and Technology Policy.

The Strategy reflects collaboration with the Federal Communications Commission (FCC), recognizing the FCC’s unique responsibilities with respect to non-Federal uses of spectrum, and coordination with other Federal departments and agencies (referred to collectively here as “agencies”).

The NTIA will study the following bands in the next two years, noting that the spectrum could support a range of uses, including mobile broadband (IMT), drones and satellite operations:

- 3.1 GHz-3.45 GHz

- 5.03 GHz-5.091 GHz

- 7.125 GHz-8.4 GHz

- 18.1 GHz-18.6 GHz

- 37.0 GHz-37.6 GHz

Note that for terrestrial IMT (3G, 4G, 5G), the only one of the above frequencies approved by ITU-R Radio Regulations in ITU-R M.1036 is 3.3 GHz-to-3.7 GHz frequency range. Please refer to my Comment in the box below this post.

………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………

The goals of the Spectrum Strategy are to: drive technological innovation (including innovative spectrum sharing technologies); boost U.S. industrial competitiveness; protect the security of the American people; foster scientific advancements; promote digital equity and inclusion; and maintain U.S. leadership in global markets for wireless equipment and services, as well as innovative spectrum-sharing technologies. Dynamic spectrum sharing will be part of the plan.

…………………………………………………………………………………………………………….

Industry Reactions to the Strategy:

“It is a critical first step, and we fully support their goal of making the 7/8 GHz band available for 5G wireless broadband and their decision to re-study all options for future full-power commercial access to the lower 3 GHz band,” said Meredith Attwell Baker, president and CEO of industry body the CTIA. “In order to meet growing consumer demand for 5G, close America’s widening 5G spectrum deficit and counter China’s global ambitions, America’s wireless networks need 1500 MHz of additional full power, licensed spectrum within the next ten years. Failure to make this spectrum available risks America’s economic competitiveness and national security,” Attwell Baker added.

“The plan released today will secure our digital future by eliminating the structural problems that hold back U.S. wireless innovation,” added Harold Feld, senior vice president of consumer advocacy group Public Knowledge.

“For six years, the United States has lacked a comprehensive spectrum strategy,” he said. “This lack of a national plan has created increasing tensions between the FCC’s efforts to meet our ever-expanding need for wireless capacity and federal agencies trying to carry out vital missions from weather forecasting to national security. These tensions, in turn, have compromised our ability to develop new wireless technologies and undermined our ability to maintain global leadership.”

“We hope this reallocation will help correct the midband spectrum imbalance that currently prioritizes unlicensed and federal uses – a disparity that fails to meet Americans’ ever-accelerating demand for mobile connectivity and neglects licensed spectrum’s place as the foundation of our wireless ecosystem,” AT&T’s Rhonda Johnson, EVP of federal regulatory relations, said.

“We don’t think the events of today should be thought of as anyone scoring a touchdown, but rather, moving the ball from one’s own 20-yard line to the opponents’ 40,” summarized the financial analysts at New Street Research in a note to investors Monday.

…………………………………………………………………………………………………………………………..

Light Reading’s Mike Dano had 5 takeaways from NTIA’s Spectrum plan:

1. It’s evolutionary, not revolutionary.

2. It’s pretty boring.

3. It makes no clear decision on the lower 3GHz band.

4. Sharing, and other spectrum management technologies, are encouraged.

5. 6G is mentioned, but only obliquely.

References:

https://www.ntia.gov/issues/national-spectrum-strategy

https://telecoms.com/524821/us-spectrum-plan-eases-frequency-frustrations-to-an-extent/

https://www.lightreading.com/5g/five-takeaways-from-biden-s-new-national-spectrum-strategy

https://www.itu.int/en/ITU-R/information/Pages/emergency-bands.aspx

Highlights of FCC Notice of Inquiry (NOI) on radio spectrum usage & how AI might be used

The U.S. Federal Communications Commission (FCC) is requesting input from the public on new technological approaches to assessing “real-time, non-Federal (government) spectrum usage, so that it has better insights into current technologies that might help the agency to manage spectrum and identify opportunities for spectrum sharing—including how artificial intelligence (AI) might be used.

This FCC Notice of Inquiry (NOI) was approved by all four members of the Commission. It states:

“Spectrum usage information is generally non-public and made available infrequently. As the radiofrequency (RF) environment grows more congested, however, we anticipate a greater need to consider such data to improve spectrum management. That is especially true as the burgeoning growth of machine learning (ML) and artificial intelligence (AI) offer revolutionary insights into large and complex datasets. Leveraging today’s tools to understand tomorrow’s commercial spectrum usage can help identify new opportunities to facilitate more efficient spectrum use, including

new spectrum sharing techniques and approaches to enable co-existence among users and services.”

Spectrum usage has been defined in various ways. In one technical paper, for instance, NTIA and NIST defined “band occupancy” as “the percentage of frequencies or channels in the band with a detected signal level that exceeds a default or user-defined threshold.”

“Right now, so many of our commercial spectrum bands are growing crowded,” said FCC Chairwoman Jessica Rosenworcel. “Hundreds of millions of wireless connections—from smartphones to medical sensors—are using this invisible infrastructure. And that number is growing fast. But congestion can make it harder to make room in our skies for new technologies and new services. Yet we have to find a way, because no one wants innovation to grind to a halt. To do this we need smarter policies, like efforts that facilitate more efficient use of this scarce resource. … Now enter AI. A large wireless provider’s network can generate several million performance measurements every minute. Using those measurements, machine learning can provide insights that help better understand network usage, support greater spectrum efficiency, and improve resiliency by making it possible to heal networks on their own.”

“[This] inquiry is a way to understand this kind of potential and help ensure it develops here in the United States first. “I believe we can do more to increase our understanding of spectrum utilization and support the development of AI tools in wireless networks,” she added.

Rosenworcel noted that some pioneering work on dynamic, cognitive radios was kick-started with the Defense Advanced Research Project’s three-year Spectrum Collaboration Challenge, which sought to develop software-defined radios’ capability to dynamically detect other spectrum users and work around them in a congested radio frequency environment.

The FCC pointed out in a statement that it generally doesn’t collect information on spectrum usage, and instead relies on intermittent data from third-party sources.

“As the radiofrequency environment becomes more congested, leveraging technologies such as artificial intelligence to understand spectrum usage and draw insights from large and complex datasets can help facilitate more efficient spectrum use, including new spectrum sharing techniques and approaches to enable co-existence among users and services,” the agency said, adding that the inquiry will explore the “feasibility, benefits, and limitations” of various ways to understand non-federal spectrum usage, as well as band- or service-specific considerations and various technical, practical or legal aspects that should be considered.

References:

https://www.fcc.gov/document/spectrum-usage-noi

https://docs.fcc.gov/public/attachments/FCC-23-63A1.pdf

Big 5G Conference: 6G spectrum sharing should learn from CBRS experiences

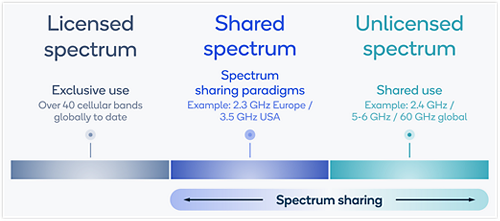

Spectrum sharing is a methodology that allows multiple wireless networks to access the same frequency band dynamically and efficiently. It can reduce the spectrum scarcity issue and enable more wireless applications and services, but also requires careful coordination and management to avoid interference and ensure fair access.

Examples of spectrum sharing techniques include Licensed Shared Access (LSA), which uses a regulatory framework to permit licensed users to share spectrum with incumbent users, Dynamic Spectrum Access (DSA), which enables wireless networks to sense and adapt to the spectrum environment, and Spectrum Aggregation, which combines multiple spectrum bands or channels into a larger bandwidth. LSA can be used by mobile operators to access spectrum that is not used by TV broadcasters, DSA can be employed by cognitive radio networks to detect and avoid channels occupied by primary users, Spectrum Aggregation can be used by 5G networks for coverage and speed.

The wireless telecom industry has to take a “concerted look at revolutionizing spectrum sharing” and to take a closer look at the lessons learned from CBRS spectrum sharing [1.], which took about a decade to be successfully implemented, according to Andrew Thiessen, chair of the spectrum working group at the Next G Alliance who was speaking at the Informa Big 5G conference panel session in Austin, TX. He opined that the industry needs to be pushing ahead with spectrum sharing technologies and techniques at speeds similar to the innovations that are being applied to smartphones.

Note 1. Citizens Broadband Radio Service (CBRS), which allows for dynamic spectrum sharing between the Department of Defense and commercial spectrum users. The DOD users have protected, prioritized use of the spectrum. When the government isn’t using the airwaves, companies and the public can gain access through a tiered licensing arrangement. This means the DOD can use the same spectrum for its critical missions while companies can use it for 5G and high-speed Internet deployment.

“Innovative spectrum sharing frameworks are key to unlocking additional bandwidth for wireless connectivity across the country,” Deputy Assistant Secretary of Commerce for Communications and Information April McClain-Delaney said. “The success and growth of the CBRS band shows the promise of dynamic spectrum sharing to make more efficient use of this finite resource.”

………………………………………………………………………………………………………………………………………………..

Joe Kochan, executive director of the National Spectrum Consortium, agreed that spectrum sharing for 6G does present challenges as it faces a wide range of commercial users, federal users and non-federal users, as well as different types of technologies, such as radar. That elicits a need for the industry to build new tools and to get more creative about how that spectrum can be shared.

The Biden administration’s National Spectrum Strategy will “lay the framework” to get everything moving, said Derek Khlopin, deputy associate administrator, spectrum planning policy, at the NTIA. “We’re tech and application-neutral. But the better we understand, the better we can plan.” he explained.

“We’ve started listening, to be frank,” Khlopin said. “But it’s not necessarily the role of the government to figure all of this out. We need help, so we’re working closely with industry, with academia and others. Spectrum sharing is here to stay between federal and non-federal users,” he added.

Khlopin was asked about NTIA’s exploration of the 7GHz band and its potential for 6G. “It’s a very complicated band,” he said. “There’s a lot there … We’re aware of the industry interest there.”

Thiessen said one challenge for 6G will be a lack of contiguous spectrum. He believes that 6G will likely be made up of a lot of pieces of spectrum, and those pieces will likely need to be targeted to specific use cases. However, that presumption is premature as neither 3GPP or ITU-R WP5D has started any serious work on defining 6G specifications. That is why all the buzz about 6G is irrelevant at this time.

References:

https://www.linkedin.com/advice/1/how-can-wireless-network-coexistence-interference

https://ntia.gov/blog/2023/innovative-spectrum-sharing-framework-connecting-americans-across-country

https://www.lightreading.com/6g/spectrum-sharing-will-be-key-to-unlocking-6g/d/d-id/784884?

Vodafone tests 5G Dynamic Spectrum Sharing (DSS) in its Dusseldorf lab

SNS Telecom & IT: Shared Spectrum to Boost 5G NR & LTE Small Cell RAN Market

SNS Telecom & IT‘s latest research report indicates that annual spending on (3GPP specified) 5G NR and LTE small cell RAN (Radio Access Network) infrastructure operating in shared spectrum [1.] will reach nearly $4 Billion by 2024 to support a variety of uses including private cellular networks for enterprises and vertical industries, densification of mobile operator networks, FWA (Fixed Wireless Access), and neutral host connectivity.

Note 1. Spectrum sharing is the simultaneous usage of a specific radio frequency band, in a specific geographical area, by a number of independent entities (usually wireless telcos). In other words, it is the “cooperative use of common spectrum” by multiple users. Spectrum sharing also can take many forms, coordinated and uncoordinated.

Release Date: January 2021 Number of Pages: 592 Number of Tables and Figures: 94

………………………………………………………………………………………………………………………………………………………………………………………………………….

As the 5G era advances, the cellular communications industry is undergoing a revolutionary paradigm shift, driven by technological innovations, liberal regulatory policies and disruptive business models. One important aspect of this radical transformation is the growing adoption of shared and unlicensed spectrum – frequencies that are not exclusively licensed to a single mobile operator.

Telecommunications regulatory authorities across the globe have launched innovative frameworks to facilitate the coordinated sharing of licensed spectrum, most notably the United States’ three-tiered CBRS scheme for dynamic sharing of 3.5 GHz spectrum, Germany’s 3.7-3.8 GHz licenses for private 5G networks, the United Kingdom’s shared and local access licensing model, France’s 2.6 GHz licenses for industrial LTE/5G networks, the Netherlands’ local mid-band spectrum permits, Japan’s local 5G network licenses, Hong Kong’s geographically-shared licenses, and Australia’s 26/28 GHz area-wide apparatus licenses. Collectively, these ground-breaking initiatives are catalyzing the rollout of shared spectrum LTE and 5G NR networks for a diverse array of use cases ranging from private cellular networks for enterprises and vertical industries to mobile network densification, FWA and neutral host infrastructure.

In addition, the 3GPP cellular wireless ecosystem is also accelerating its foray into vast swaths of globally and regionally harmonized unlicensed spectrum bands. Although existing commercial activity is largely centered around LTE-based LAA (Licensed Assisted Access) technology whereby license-exempt frequencies are used in tandem with licensed anchors to expand mobile network capacity and deliver higher data rates, the introduction of 5G NR-U in 3GPP’s Release 16 specifications paves the way for 5G NR deployments in unlicensed spectrum for both licensed assisted and standalone modes of operation.

Even with ongoing challenges such as the COVID-19 pandemic-induced economic slowdown, SNS Telecom & IT estimates that global investments in 5G NR and LTE small cell RAN infrastructure operating in shared and unlicensed spectrum will account for more than $1.3 Billion by the end of 2021. The market is expected to continue its upward trajectory beyond 2021, growing at CAGR of approximately 44% between 2021 and 2024 to reach nearly $4 Billion in annual spending by 2024.

The “Shared & Unlicensed Spectrum LTE/5G Network Ecosystem: 2021 – 2030 – Opportunities, Challenges, Strategies & Forecasts” report presents a detailed assessment of the shared and unlicensed spectrum LTE/5G network ecosystem including the value chain, market drivers, barriers to uptake, enabling technologies, key trends, future roadmap, business models, use cases, application scenarios, standardization, spectrum availability/allocation, regulatory landscape, case studies, ecosystem player profiles and strategies. The report also provides global and regional forecasts for shared and unlicensed spectrum LTE/5G RAN infrastructure from 2021 till 2030. The forecasts cover two air interface technologies, two cell type categories, two spectrum licensing models, 12 frequency band ranges, seven use cases and five regional markets.

Important research findings from the report include the following:

- Even with ongoing challenges such as the COVID-19 pandemic-induced economic slowdown, SNS Telecom & IT estimates that global investments in LTE and 5G NR RAN infrastructure operating in shared and unlicensed spectrum will account for more than $1.3 Billion by the end of 2021. The market is expected to continue its upward trajectory beyond 2021, growing at CAGR of approximately 44% between 2021 and 2024 to reach nearly $4 Billion in annual spending by 2024.

- Breaking away from traditional practices of spectrum assignment for mobile services that predominantly focused on exclusive-use national licenses, telecommunications regulatory authorities across the globe have launched innovative frameworks to facilitate the coordinated sharing of licensed spectrum.

- Notable examples include the United States’ three-tiered CBRS scheme for dynamic sharing of 3.5 GHz spectrum, Germany’s 3.7-3.8 GHz licenses for private 5G networks, the United Kingdom’s shared and local access licensing model, France’s 2.6 GHz licenses for industrial LTE/5G networks, the Netherlands’ local mid-band spectrum permits, Japan’s local 5G network licenses, Hong Kong’s geographically-shared licenses, and Australia’s 26/28 GHz area-wide apparatus licenses.

- Collectively, these ground-breaking initiatives are catalyzing the rollout of shared spectrum LTE and 5G NR networks for a diverse array of use cases ranging from private cellular networks for enterprises and vertical industries to mobile network densification, FWA and neutral host infrastructure.

- In particular, private LTE and 5G networks operating in shared spectrum are becoming an increasingly common theme. For example, Germany’s national telecommunications regulator BNetzA (Federal Network Agency) has received more than a hundred applications for private 5G licenses in 2020 alone. Dozens of purpose-built 5G networks are already in operational use by the likes of aircraft maintenance specialist Lufthansa Technik, industrial conglomerate Bosch, automakers and other manufacturing giants.

- Since the commencement of its local 5G spectrum licensing scheme, Japan has been showing a similar appetite for industrial-grade 5G networks, with initial field trials and deployments being spearheaded by many of the country’s largest industrial players including Fujitsu, Mitsubishi Electric, Sumitomo Corporation and Kawasaki Heavy Industries.

- Among other examples, the 3.5 GHz CBRS shared spectrum band is being utilized to set up private LTE networks across the United States for applications as diverse as remote learning and COVID-19 response efforts in healthcare facilities. 5G NR-based CBRS implementations are also expected to emerge between 2021 and 2022 to better support industrial IoT requirements. Multiple companies including agriculture and construction equipment manufacturer John Deere have already made commitments to deploy private 5G networks in CBRS spectrum.

- Mobile operators and other cellular ecosystem stakeholders are also seeking to tap into vast swaths of globally and regionally harmonized unlicensed spectrum bands for the operation of 3GPP technologies. Although existing deployments are largely based on LTE-LAA technology whereby license-exempt frequencies are used in tandem with licensed anchors to expand mobile network capacity and deliver higher data rates, standalone cellular networks that can operate solely in unlicensed spectrum – without requiring an anchor carrier in licensed spectrum – are beginning to emerge as well.

- In the coming years, with the commercial maturity of 5G NR-U technology, we also anticipate to see 5G NR deployments in unlicensed spectrum for both licensed assisted and standalone modes of operation using the 5 GHz and 6 GHz bands as well as higher frequencies in the millimeter wave range – for example, Australia’s 24.25-25.1 GHz band that is being made available for uncoordinated deployments of private 5G networks servicing locations such as factories, mining sites, hospitals and educational institutions.

The report will be of value to current and future potential investors into the shared and unlicensed spectrum LTE/5G network market, as well as LTE/5G equipment suppliers, mobile operators, MVNOs, fixed-line service providers, neutral hosts, private network operators, vertical domain specialists and other ecosystem players who wish to broaden their knowledge of the ecosystem.

For further information concerning the SNS Telecom & IT publication “The Shared & Unlicensed Spectrum LTE/5G Network Ecosystem: 2021 – 2030 – Opportunities, Challenges, Strategies & Forecasts” please visit: https://www.snstelecom.com/shared-spectrum

For a sample please contact: [email protected]

About SNS Telecom & IT:

Part of the SNS Worldwide group, SNS Telecom & IT is a global market intelligence and consulting firm with a primary focus on the telecommunications and information technology industries. Developed by in-house subject matter experts, our market intelligence and research reports provide unique insights on both established and emerging technologies. Our areas of coverage include but are not limited to wireless networks, 5G, LTE, SDN (Software Defined Networking), NFV (Network Functions Virtualization), IoT (Internet of Things), critical communications, big data, smart cities, smart homes, consumer electronics, wearable technologies, and vertical applications.

References: