Telecom and ICT

Enterprise IoT and the Transformation of UK Telecom Business Models – Part 1

By Afnan Khan (ML Engineer) and Raabia Riaz (Data Scientist)

Introduction:

This is the first of two articles on the impact of the Internet of Things (IoT) on the UK Telecom industry. The second is at

From LPWAN to Hybrid Networks: Satellite and NTN as Enablers of Enterprise IoT – Part 2

Executive Summary:

In 2026, the Internet of Things (IoT) is fundamentally changing the UK telecom sector by enabling new business models rather than simply driving incremental network upgrades.

As consumer mobile markets show limited YoY growth between 2025 and 2026, telecom operators have prioritised IoT-led enterprise services as a source of new revenue (as per Ofcom-2025; GSMA-2024). Investment has shifted away from consumer facing upgrades towards private networks, managed connectivity and long-term service contracts for industry and infrastructure. This change reflects a broader move from usage-based connectivity towards service-based delivery.

IoT and Enterprise Connectivity through Private 5G:

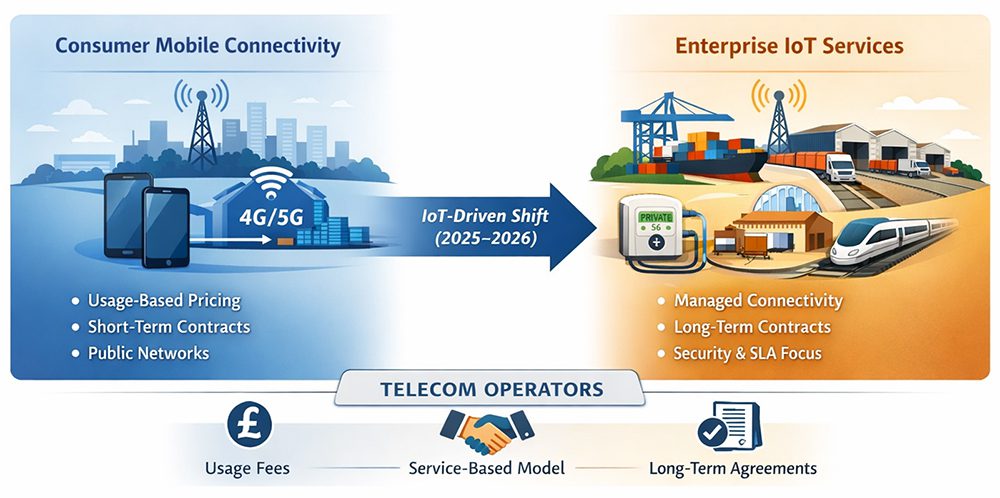

Figure 1: Transition from consumer mobile connectivity to enterprise IoT services in the UK telecom sector, highlighting the shift towards managed connectivity and long-term service contracts.

The growth of private 5G and managed enterprise networks represents one of the clearest IoT driven business shifts. Industrial customers increasingly require predictable performance, low latency and enhanced security, which are not consistently available through public mobile networks. 5G Standalone architecture enables features such as network slicing and low latency communication, allowing operators to sell connectivity as a managed service rather than a commodity product (Mobile UK, 2024).

In the UK, this model is visible in projects such as the Port of Felixstowe private 5G trials supporting automated port operations and asset tracking (BT Group, 2023), the Liverpool City Region 5G programme focused on connected logistics (DCMS, 2022), the West Midlands 5G transport and connected vehicle projects (WM5G, 2023) and Network Rail 5G rail monitoring trials supporting safety and asset management (Network Rail, 2024). These deployments are typically delivered through long term enterprise contracts.

Together, these projects illustrate how connectivity is increasingly sold as a managed operational capability embedded within enterprise workflows rather than them being priced through consumer-style data usage as illustrated in figure 1.

IoT and Long-Term Infrastructure Revenue:

IoT enables telecom operators to participate in long-term infrastructure-based revenue models. The UK national smart meter programme illustrates this shift. By the third quarter of 2025, more than 40 million smart and advanced meters had been installed across Great Britain, with around 70% operating in smart mode (Department for Energy Security and Net Zero, 2025).

These systems rely on continuous, secure connectivity over long lifecycles. The Data Communications Company network processes billions of encrypted messages each month, creating sustained demand for resilient connectivity (DCC, 2024). Ofcom has linked the growth of such systems to increased regulatory focus on network resilience where connectivity underpins critical national infrastructure, while the National Cyber Security Centre has highlighted security risks associated with large IoT deployments (Ofcom, 2025; NCSC, 2024).

For telecom operators, these deployments favour long-term service contracts and regulated infrastructure partnerships over short-term retail revenue models.

Conclusions:

In 2026, IoT is transforming the UK telecom sector primarily by reshaping how connectivity is monetised rather than by driving incremental network upgrades. As consumer mobile markets show limited growth, telecom operators have increasingly aligned investment with enterprise IoT demand through private 5G deployments and long-term infrastructure connectivity. These models prioritise predictable performance, security and service continuity over mass-market scale. Private 5G projects across ports, transport networks and logistics hubs demonstrate how IoT demand has accelerated the commercial adoption of 5G Standalone capabilities, allowing operators to sell connectivity as a managed operational service embedded within enterprise workflows (Mobile UK, 2024). At the same time, national smart infrastructure programmes such as smart metering illustrate how IoT supports long-duration connectivity contracts that favour regulated partnerships and resilient network design over short-term retail revenue (Department for Energy Security and Net Zero, 2025; DCC, 2024). Taken together, these developments indicate that IoT is no longer an adjunct to UK telecom networks. Instead, it has become a central driver of enterprise-led, service-based business models that align network investment with stable, long-term revenue streams and critical infrastructure requirements.

…………………………………………………………………………………………………………………………………………………………..

References:

BT Group. (2023). BT and Hutchison Ports trial private 5G at the Port of Felixstowe.

https://www.bt.com/about/news/2023/bt-hutchison-ports-5g-felixstowe

Data Communications Company. (2024). Annual report and accounts 2023–24.

https://www.smartdcc.co.uk/our-company/our-performance/annual-reports/

Department for Digital, Culture, Media and Sport. (2022). Liverpool City Region 5G Testbeds and Trials Programme.

https://www.gov.uk/government/publications/5g-testbeds-and-trials-programme

Department for Energy Security and Net Zero. (2025). Smart meter statistics in Great Britain Q3 2025.

https://www.gov.uk/government/collections/smart-meters-statistics

GSMA. (2024). The Mobile Economy Europe.

https://www.gsma.com/mobileeconomy/europe/

Mobile UK. (2024). Unleashing the power of 5G Standalone.

https://www.mobileuk.org

National Cyber Security Centre. (2024). Cyber security principles for connected places.

https://www.ncsc.gov.uk

Network Rail. (2024). 5G on the railway connectivity trials.

https://www.networkrail.co.uk

Ofcom. (2025). Connected Nations UK report.

https://www.ofcom.org.uk

MTN Consulting: Satellite network operators to focus on Direct-to-device (D2D), Internet of Things (IoT), and cloud-based services

IoT Market Research: Internet Of Things Eclipses The Internet Of People

Artificial Intelligence (AI) and Internet of Things (IoT): Huge Impact on Tech Industry

ITU-R M.2150-1 (5G RAN standard) will include 3GPP Release 17 enhancements; future revisions by 2025

5G Americas: LTE & LPWANs leading to ‘Massive Internet of Things’ + IDC’s IoT Forecast

GSA: 102 Network Operators in 52 Countries have Deployed NB-IoT and LTE-M LPWANs for IoT

LoRaWAN and Sigfox lead LPWANs; Interoperability via Compression

IEEE/SCU SoE Virtual Event: May 26, 2022- Critical Cybersecurity Issues for Cellular Networks (3G/4G, 5G), IoT, and Cloud Resident Data Centers

2025 Year End Review: Integration of Telecom and ICT; What to Expect in 2026

Disclosure:

Perplexity.ai was used as a resource to generate this article rather than use Google search engine results.

Executive Summary:

The Telecom and Information and Communications Technology (ICT) landscape is entering 2026 shaped by a deep integration of artificial intelligence (AI), cloud-native architectures, next-generation connectivity, and security frameworks. What once operated as parallel technology domains (or silos) has evolved into a unified, software-defined infrastructure layer that powers both the digital and physical dimensions of the global economy. AI has become the organizing principle of this new fabric—infusing intelligence into every layer of network and service delivery, from RAN and transport orchestration to enterprise automation and edge computing.

In this environment, connectivity is no longer just about bandwidth or coverage. Instead, it represents a programmable, dynamic interface between data generation and AI-driven decision-making. Cloud hyperscalers, telecom operators, and infrastructure vendors are aligning around disaggregated, service-based models that enable on-demand scalability, distributed computing, and seamless workload mobility across networks. This architectural shift redefines how capacity, latency, and resilience are provisioned—transforming the network into a real-time, adaptive resource optimized for varied enterprise and consumer needs.

As the world’s digital infrastructure becomes more interdependent, cybersecurity and digital trust function as the new currency of global stability. Zero-trust frameworks, sovereign cloud strategies, and AI-enabled threat detection systems are foundational elements ensuring operational continuity and regulatory compliance in an increasingly data-sovereign and geopolitically complex world.

Global Connectivity Advances:

Global connectivity continues to strengthen, with rising fixed and mobile broadband performance underpinned by sustained FTTH and FWA rollouts, 5G private network expansion, and growing 5G-Advanced trials in both mature and emerging markets. These capabilities are increasingly engineered around quality of experience and deterministic performance rather than raw coverage, positioning networks as strategic enablers of industrial digitalization, not just consumer access.

According to Ookla, as of the end of 2025, median fixed broadband download speeds reached 115.43 Mbps and upload speeds reached 58.94 Mbps, reflecting sustained infrastructure investments and wider FTTH penetration worldwide.

At the national level, the United Arab Emirates (UAE) led global mobile speeds, with median download speeds of 672.68 Mbps, followed closely by its Gulf peers, Qatar (542.56 Mbps) and Kuwait (398.66 Mbps). On the fixed broadband side, Singapore (407.05 Mbps), Chile (357.25 Mbps), the UAE (356.24 Mbps), and France (346.04 Mbps) were among the fastest globally, while emerging markets such as Vietnam (273.64 Mbps) posted significant gains by entering the top fixed speed brackets.

Saudi Arabia mobile network operators offer stable, high-speed FWA connections, with minimum download speeds starting at 70 Mbps and reaching up to 500 Mbps, effectively meeting users’ demands for high-quality gaming experiences. For instance, there are three package tiers—Home Basic, Home, and Home Plus—priced at SAR 239, 299, and 529, respectively. Only the premium Home Plus package includes gaming privileges, such as access to over 1,000 games via GeForce NOW, weekly updates with new titles, and the ability to play games in the cloud across all devices. Saudi operators have successfully monetized the FWA service by enhancing user experiences through high-speed, reliable network connections, tailored gaming services, and a comprehensive range of benefits.

According to the ITU’s Global Connectivity Report, about 74% of the world’s population are now using the Internet. 5G coverage has reached approximately 55%, with the report emphasizing that closing these gaps requires strengthening the six pillars of Universal and Meaningful Connectivity (UMC)—quality, availability, affordability, devices, skills, and safety/security—supported by policy, data measurement, and institutional capacity to ensure that connectivity delivers equitable, secure, and sustainable digital participation for all.

Image Credit: Telecom Review

AI-Native, Network Automation, and Cloud-Centric Architectures:

AI has moved from experimentation into the network and cloud fabric, with operators and vendors embedding intelligence across RAN, core, edge, and OSS/BSS to enable intent-based operations and closed-loop automation. In parallel, cloud strategies are being redefined around AI acceleration, network automation, multi-cloud orchestration, and sovereignty, as governments and enterprises seek control of the “intelligence layer” while still leveraging hyperscale innovation.

By Q4 2025, over 60% of Tier-1 operators had implemented AI-based network management tools, reducing operational expenditure by 15–25% through predictive maintenance and closed-loop automation. As 5G-Advanced and early 6G pilots mature, AI-native RAN and intent-based networking are expected to emerge as standard across national networks, with over 70% of new deployments shifting toward cloud-native infrastructure. This transformation enables networks to function as dynamic computing fabrics that allocate resources based on real-time demand, latency profiles, and workload type—effectively turning connectivity into a programmable, data-centric utility.

- Huawei is at the forefront of moving AI-native networks from concept into large-scale, commercial deployment, with intelligence now systematically embedded across the full network lifecycle—from RAN and core to edge domains and OSS/BSS stacks. This evolution is driven by the tight convergence of 5G-Advanced and AI, which Alex Xu, President of Carrier Business at Huawei Middle East and Central Asia, describes as “the dual engine accelerating the industry’s evolution from telco to techco,” enabling networks to operate as intent-driven, self-optimizing, and commercially intelligent platforms.

- This paradigm is being validated in live environments by collaborations such as China Mobile and Huawei, which demonstrate how 5G-Advanced features—enhanced uplink, deterministic latency, and integrated sensing—when coupled with AI, are redefining performance benchmarks and enabling truly cognitive, intent-centric network behavior. China Mobile’s AI+NETWORK framework, as articulated by Li Huidi, positions AI as a native capability within the network fabric, powering a broader digital-intelligent future rather than functioning as a peripheral optimization tool.

- Nokia is reinforcing this industry shift by explicitly positioning AI as the foundational layer for next-generation architectures, integrating automation, advanced analytics, and cloud-native design patterns to support autonomous operations and scalable service innovation at carrier grade. At the ecosystem level, the 19th Telecom Review Leaders’ Summit highlighted ZTE’s focus on inclusive innovation and AI-driven infrastructure, emphasizing that intelligent connectivity is now a cornerstone of sustainable digital development, while ZTE Overseas President Xiao Ming underscored that connectivity has evolved from basic infrastructure to the digital foundation for intelligent living and long-term sustainability.

- Ericsson is similarly sharpening the conversation around value-centric AI adoption, with Alain Maupin, Vice President and Head of Ericsson East and North Africa, stressing that the “real bias” that matters in AI is the bias toward tangible value creation for people, enterprises, and society. In parallel, the industry consensus is that intelligence is no longer confined to offline analytics; it is becoming increasingly agentic, autonomous, and revenue-generating. AWTG’s agentic AI implementations and perspectives from Ishwar Parulkar, Chief Technologist for Telecom at AWS, show how AI agents are transforming telecom operations via closed-loop automation, real-time decision-making, and predictive assurance, a direction reinforced at the Telecom Review AI Roundtable in Saudi Arabia, which explicitly linked AI-driven network automation with monetization and growth agendas.

The boundary between cloud and network infrastructure continues to disappear. Edge compute nodes increased by nearly 40% year-over-year in 2025, driven by enterprise AI applications, autonomous systems, and industrial IoT workflows. Hyperscaler-operator collaborations—such as co-location at metro data centers and multi-cloud orchestration partnerships—are allowing workloads to move seamlessly between private, public, and sovereign clouds. These hybrid models are reshaping the economics of data gravity, with up to 65% of new enterprise AI deployments projected to rely on edge-to-cloud integrations by 2026.

Sovereignty, Security, and Quantum Readiness:

Security and data sovereignty have evolved from regulatory concerns to competitive differentiators. Spending on AI-enhanced cybersecurity surged 30% globally in 2025, reaching nearly $220 billion, as operators integrated machine learning into traffic inspection, anomaly detection, and threat prediction. At the same time, national governments have accelerated sovereign digital programs, investing in localization of data centers, spectrum governance frameworks, and domestic semiconductor supply chains. This push toward sovereignty reinforces the importance of telecom infrastructure in geopolitical and economic resilience.

Digital sovereignty is now a board- and cabinet-level theme, driving investment in sovereign clouds, data residency–compliant architectures, and jurisdiction-first AI platforms across regions including the Middle East, Europe, and Asia. At the same time, cybersecurity and post-quantum resilience are reshaping architectural blueprints, with zero-trust models, quantum-safe cryptography, and AI-secure data center designs becoming foundational requirements for long-lived critical infrastructure.

In 2025, governments and national operators asserted direct control over infrastructure, data, and intelligence layers. In the UAE, this philosophy was encapsulated by du’s Jasim Al Awadi, who framed the strategy succinctly, “We build, we own, we operate,” underscoring a move away from dependency toward sovereign-by-design networks and platforms. This approach was further reinforced by du CEO Fahad Al Hassawi’s focus on trust, talent, and technology as the foundational pillars for the UAE’s AI era, aligning with Abu Dhabi’s ambition to become the world’s first AI-native government. In an exclusive interview with Telecom Review, His Excellency Wesam Lootah, Director General of GovDigital, detailed how GovDigital is delivering integrated platforms and services that unify government operations, data exchange, and citizen engagement.

The international policy landscape is evolving in parallel, with the United Nations establishing a scientific panel for AI governance, signaling that sovereign AI will shape global regulatory norms. Commercial ecosystems are responding accordingly: SoftBank and Oracle’s partnership to deliver Japan’s sovereign AI cloud, Indosat’s launch of a sovereign SOC in Indonesia, and HCLSoftware’s sovereign AI platforms for governments and regulated sectors all reflect a decisive shift toward nationally anchored AI stacks. In Europe, this trend is mirrored by Cisco’s expanded data sovereignty portfolio and SAP joining the AWS Sovereign Cloud, demonstrating how hyperscalers and vendors are adapting to jurisdiction-first architectures.

5G-Advanced, Monetization, and New Revenue Streams:

5G-Advanced is emerging as the experience layer between 5G and 6G, combining advanced radio features, spectrum aggregation, and edge capabilities to support industrial IoT, XR, and latency-sensitive enterprise use cases. Monetization is shifting from connectivity volume to platforms, APIs, and autonomous operations, as operators pursue new revenue through network exposure, enterprise-grade SLAs, and ecosystem partnerships rather than traditional data plans alone.

Standards status: The current ITU-R M.2150-2 standard for 5G RIT/SRIT incorporates the 3GPP Release 17 enhancements to the 5G standards (IMT-2020). 5G Advanced corresponds to 3GPP Release 18 and Release 19 specifications which are expected to be part of a future revision of the M.2150 recommendation which are currently under development by ITU-R Working Party 5D.

In 2025, Kuwait’s three major operators—Zain, stc, and Ooredoo—launched the initial stage of pre-standard 5G-Advanced under the authorization of the Kuwait Communications and Information Technology Regulatory Authority (CITRA) to comprehensively enhance the user network experience, marking Kuwait’s first entry into a new stage of global experience operations. UAE operators du and e& introduced differentiated experience packages for high-end users, including gaming and video bundles. Saudi Arabian operators released cloud travel acceleration and fixed wireless access (FWA) high-speed packages to enter the experience operation market, continuing to explore new business models that shift the focus from traffic monetization to experience-centric services.

What to expect in 2026:

As the telecom/ICT industry approaches 2026, the nature of partnership and regulation is increasingly shaping the trajectory of next-generation networks, particularly the five year transition from 5G to 6G which we expect to be deployed in late 2030-early 2031.

- 6G research partnerships like Nokia and du’s in the UAE, together with strategic alliances among Europe’s leading CEOs on AI and advanced technologies, signals a clear industry-level recognition that scaling 6G and AI requires tightly coordinated execution across operators, vendors, hyperscalers, and policymakers. This emerging model treats 6G not as a standalone radio upgrade, but as an integrated socio-technical program spanning spectrum policy, industrial strategy, standards, security, and national digital agendas.

- The technical requirements for 6G are correspondingly demanding. Sustaining projected traffic and service growth is expected to require on the order of three times today’s mid-band spectrum allocations, placing spectrum efficiency, refarming sprectrum, and new band access at the center of regulatory and engineering roadmaps. At the same time, AI-native network management will drive new KPIs, operating models, and governance structures, shifting from legacy availability and throughput metrics toward intent-based, experience-centric, and energy-aware performance indicators.

- Standards bodies (ITU-R and 3GPP) and multilateral forums are already shaping these trajectories by explicitly linking the co-evolution of AI, connectivity, next-generation protocols, and national priorities. National strategies, such as India’s spectrum-focused 6G vision and associated domestic R&D programs, illustrate how spectrum policy, local innovation ecosystems, and global standards participation are being aligned to secure both technological capability and economic competitiveness.

- Operational milestones are beginning to validate these strategic directions. NTT DOCOMO’s outdoor trials of AI-powered wireless interfaces demonstrate how intelligence will be embedded directly into the air interface and RAN control loops, rather than remaining confined to centralized analytics layers. In parallel, SoftBank’s work with 7 GHz spectrum showcases early readiness for ultra-dense urban 6G deployments, where capacity, beamforming precision, and interference management will be critical design vectors.

- Danial Mausoof, Nokia’s VP of Technology, Product, & Services for Mobile Networks in the Middle East & Africa emphasizes that the next era of intelligent connectivity hinges on aligning advanced technology with robust governance frameworks, so that “no connection, no progress” evolves from a slogan into an operational principle for universal, inclusive access. Taken together, these policy initiatives, cross-industry partnerships, and AI-driven infrastructure advances are laying the groundwork for a highly orchestrated, globally coordinated 6G paradigm in which regulation does not merely constrain innovation, but actively catalyzes investment, ecosystem development, and sustainable digital growth.

- Throughout 2026, programmable and data-driven telecom platforms will serve as the foundation for three intertwined priorities shaping global digital progress:

-

Enterprise AI scaling: Telecommunications networks are optimizing to support exponentially growing AI workloads, especially at the edge, where data proximity and latency sensitivity are key. We can expect high-intensity AI workloads, particularly in industrial automation, health, and finance, driving demand for distributed compute and low-latency connectivity.

-

Sovereign digital agendas: Nations are aiming to secure domestic control over critical data flows and cloud platforms. They are promoting autonomy in data management, spectrum control, and cloud governance, driving demand for localized infrastructure ecosystems.

-

Universal broadband acceleration: The continued expansion of fiber, 5G-Advanced, and satellite connectivity aims to close the digital divide and unlock inclusive economic growth.

Together, these trends point toward an unprecedented level of convergence, where telecom and ICT no longer describe separate sectors but rather a single global nervous system—intelligent, distributed, and central to economic expansion. As AI amplifies every layer of this infrastructure, 2026 marks a decisive shift from digital transformation to digital orchestration, where intelligent connectivity defines competitiveness, productivity, and resilience on a planetary scale. This environment positions 2026 as a pivotal year: the moment when connectivity itself becomes intelligent utility, forming the operational bedrock for a data-centric, expansionary global economy.

-

……………………………………………………………………………………………………………………………………………………………………………………………………….