Uncategorized

ETTelecom survey: Challenges to 5G adoption in India

Availability of an inadequate ecosystem — spectrum and handsets – along with the financial burden on Indian telecom operators will prove to be the major challenges to adoption of 5G technology in the country, an ETTelecom 5G survey findings revealed.

A large portion of respondents believes that India will be ready to launch the technology commercially before 2022. However, 50% of the respondents who work at a telecom equipment vendor firms such as Nokia, Ericsson believe that 5G will be deployed during 2020.

About 80% executives from the industry further hold the view that 5G could account for more than 10% of operator revenues by 2023.

A large proportion of the respondents believe that an inadequate ecosystem in terms of spectrum and handsets (69%) and the financial burden on MNOs (68%) are the major challenges to 5G adoption in India. Moreover, 89% of the respondents working at C-level roles believe the financial burden on telcos be a major challenge.

Some respondents mentioned that lack of fiber for backhaul, and passive infrastructure such as towers and optical fiber cable will be some major challenges for telcos in India.

ETTelecom published a report on 5G evolution and roadmap in India in collaboration with Analysys Mason which showed that smart cities (70%) and high-speed broadband at home (69%) are the most relevant use cases of 5G in India.

Respondents working at telecom equipment vendors believed high-speed broadband at home to be the most relevant use case with 85% responding positively. Smart cities are the most relevant use case according to respondents currently working at telcos such as Airtel, Vodafone, Idea, Reliance Jio etc. with 78% mentioning it as a relevant use case.

The respondents also believe that smart manufacturing, smart home and cloud, AR/VR are also relevant to the Indian market.

Media and Entertainment driven by higher throughput on mobile broadband is believed to be the industry that will benefit the most from 5G and drive adoption with a large majority of the respondents (83%) believing so. Healthcare (64%) and automotive (60%) are other industries which the respondents feel will benefit from 5G and drive its adoption.

When it comes to industry’s expectations on the key spectrum bands for 5G, there is a mixed sentiment with no clear spectrum band getting more than 50% positive response. However, 67% of the respondents working at C-level positions expect the sub-1GHz band to be the preferred for 5G deployment.

68% of the respondents feel that fibre backhaul is the most important technology, which could be crucial towards deployment of 5G. Ultra-dense network of small cells (50%) and massive MIMO (48%) are other technologies that respondents believe could be crucial.

Also, 82% of the respondents working with Indian telcos believe fibre backhaul to be a crucial technology and 85% of those working at telecom equipment vendors believe the same.

53% of the respondents suggested that legacy technologies such as 2G and 3G could still co-exist with 4G and 5G by 2025, while 40% believe they will be replaced. However, 67% of the C-level respondents believe legacy technologies will be replaced and, on the other hand several users also point out that while 3G will be replaced, 2G will continue to co-exist.

A clear majority with 73% responses suggested that the initial rollout of 5G would be limited to urban pockets. Additionally, 59% of the respondents believe that 5G could cannibalize fixed broadband in India if it can offer high-speed broadband.

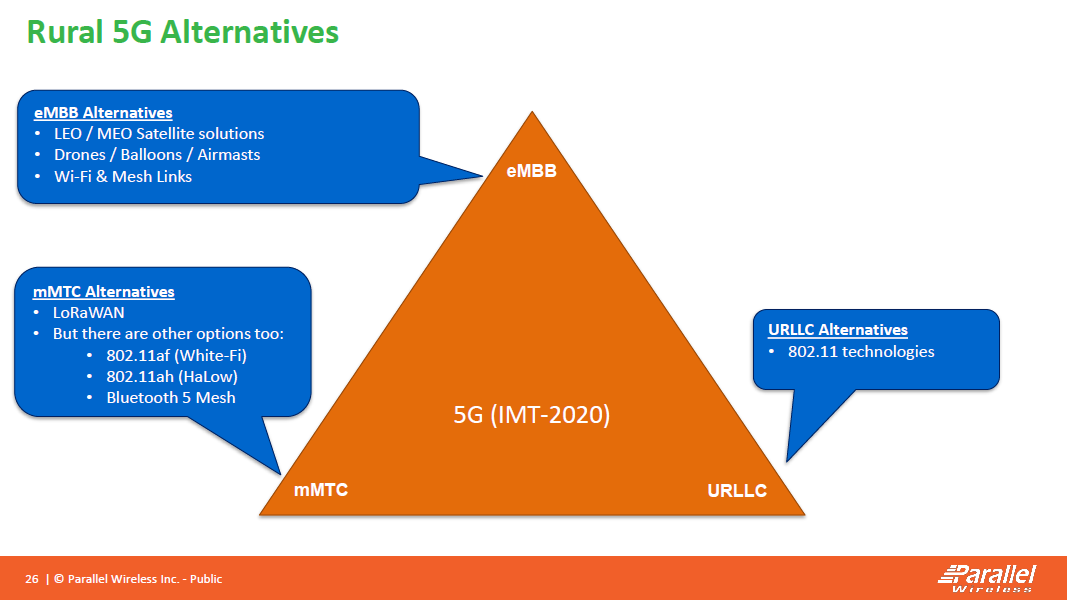

What about rural 5G which is needed in India?

For more insights, download ETTelecom-Analysys Mason’s 5G readiness in India report.

5G Network and Smartphone Update: AT&T Verizon and Qualcomm

AT&T is sticking to its “end of the year” 5G commercial deployment schedule, but no smartphones or tablets will be available at that time. AT&T plans to have 5G available in parts of 12 markets up by the end of the year. AT&T Communications CEO John Donovan. said AT&T’s 5G is expected to move into 19 cities (so far) in 2019. AT&T has told Light Reading that it has 5G sites live in Dallas and Waco, Texas now. But the operator has not yet launched its commercial 5G service.

The only confirmed 5G device announced for AT&T’s mobile 5G network is the Netgear Nighthawk 5G Mobile Hotspot, which AT&T calls a “puck.”

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/13592246/Nighthawk_5G_Hotspot_crop.jpg)

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/11914977/IMG_20180802_150637.jpg)

…………………………………………………………………………………………………………………………………………………………………………

“We believe the early 5G opportunities are going to be in enterprise,” Donovan said. He noted that AT&T’s work with Samsung Corp. on“robotic manufacturing” and augmented reality with Magic Leap Inc. will be future 5G enterprise offerings. 5G smartphones will be available in 2019, according to Donovan.

According to The Verge, Verizon will technically have a phone when it launches its mobile 5G offering in early 2019. If you buy the existing, Verizon-exclusive Moto Z3 which is advertised as “5G ready.” Verizon says its first 5G device will be a magnetic, modular 5G Moto Mod attachment you can snap onto that phone to add speedy 5G NR (3GPP Release 15) connectivity.

AT&T and Verizon both say they’re exclusively rolling out millimeter wave (mmWave) radios, which inherently provide far more bandwidth and capacity than today’s networks. But at 39GHz and 28GHz, those millimeter wave signals also don’t travel as far or penetrate buildings as easily as conventional cellular. That means you’ll probably drop down to LTE speeds when you transition indoors, and in order to cover the same area as today’s LTE cell towers, carriers will need to provide many more smaller cell sites. AT&T says it’s focusing on outdoor cells first, but is also looking at indoor ones for public venues like stadiums and concert halls.

……………………………………………………………………………………………………………………………………………………………………………

Qualcomm president Cristiano Amon expects the first real wave of 5G smartphones to arrive in Q2 2019 at the earliest. ”We are working, so as early as the second quarter of 2019, you’ll have smartphones being launched across the United States, across Europe, across South Korea, Australia. Some early in the quarter, some later in the quarter… they’re all going to be Android flagship devices,” says Amon. “You go to CES [in January], you’ll start to see a lot of phone announcements; you go to MWC [in February], you’ll see a lot of actual phone launches.”

Author’s Note: Don’t expect a 5G smartphone from Apple till 2020 at the earliest. The company is closely tracking the REAL 5G standard- ITU-R IMT 2020 which won’t be completed till year end 2020. Companion IMT 2020 standards from ITU-T won’t be finalized till 2021 or later.

………………………………………………………………………………………………………………………………………………………………………………………………

“We need to build a crescendo,” says Amon. “You’re not going to change your phone unless the battery life is higher, the form factor is attractive, and you need companies that can actually deliver the performance,” he added.

“Today you stream music everywhere. You don’t download music anymore; even if you have low coverage, you have enough quality to stream music. 5G will do that for video,” Amon says, before moving on to fancier, further-out predictions like unlimited storage and on-demand processing power from the cloud that can, he imagines, virtually cram the power of a Magic Leap-like augmented reality headset into a normal pair of glasses.”

The Verge says that Qualcomm will announce a new Snapdragon processor at its third annual Snapdragon Technology Summit next week in Maui. It is targeted at 5G NR smartphones. A “Snapdragon 1000” processor for a new wave of always-connected Windows laptops will also be introduced at the summit.

5G Network and Smartphone Update: AT&T Verizon and Qualcomm

AT&T is sticking to its “end of the year” 5G commercial deployment schedule, but no smartphones or tablets will be available at that time. AT&T plans to have 5G available in parts of 12 markets up by the end of the year. AT&T Communications CEO John Donovan. said AT&T’s 5G is expected to move into 19 cities (so far) in 2019. AT&T has told Light Reading that it has 5G sites live in Dallas and Waco, Texas now. But the operator has not yet launched its commercial 5G service.

The only confirmed 5G device announced for AT&T’s mobile 5G network is the Netgear Nighthawk 5G Mobile Hotspot, which AT&T calls a “puck.”

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/13592246/Nighthawk_5G_Hotspot_crop.jpg)

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/11914977/IMG_20180802_150637.jpg)

…………………………………………………………………………………………………………………………………………………………………………

“We believe the early 5G opportunities are going to be in enterprise,” Donovan said. He noted that AT&T’s work with Samsung Corp. on“robotic manufacturing” and augmented reality with Magic Leap Inc. will be future 5G enterprise offerings. 5G smartphones will be available in 2019, according to Donovan.

According to The Verge, Verizon will technically have a phone when it launches its mobile 5G offering in early 2019. If you buy the existing, Verizon-exclusive Moto Z3 which is advertised as “5G ready.” Verizon says its first 5G device will be a magnetic, modular 5G Moto Mod attachment you can snap onto that phone to add speedy 5G NR (3GPP Release 15) connectivity.

AT&T and Verizon both say they’re exclusively rolling out millimeter wave (mmWave) radios, which inherently provide far more bandwidth and capacity than today’s networks. But at 39GHz and 28GHz, those millimeter wave signals also don’t travel as far or penetrate buildings as easily as conventional cellular. That means you’ll probably drop down to LTE speeds when you transition indoors, and in order to cover the same area as today’s LTE cell towers, carriers will need to provide many more smaller cell sites. AT&T says it’s focusing on outdoor cells first, but is also looking at indoor ones for public venues like stadiums and concert halls.

……………………………………………………………………………………………………………………………………………………………………………

Qualcomm president Cristiano Amon expects the first real wave of 5G smartphones to arrive in Q2 2019 at the earliest. ”We are working, so as early as the second quarter of 2019, you’ll have smartphones being launched across the United States, across Europe, across South Korea, Australia. Some early in the quarter, some later in the quarter… they’re all going to be Android flagship devices,” says Amon. “You go to CES [in January], you’ll start to see a lot of phone announcements; you go to MWC [in February], you’ll see a lot of actual phone launches.”

Author’s Note: Don’t expect a 5G smartphone from Apple till 2020 at the earliest. The company is closely tracking the REAL 5G standard- ITU-R IMT 2020 which won’t be completed till year end 2020. Companion IMT 2020 standards from ITU-T won’t be finalized till 2021 or later.

………………………………………………………………………………………………………………………………………………………………………………………………

“We need to build a crescendo,” says Amon. “You’re not going to change your phone unless the battery life is higher, the form factor is attractive, and you need companies that can actually deliver the performance,” he added.

“Today you stream music everywhere. You don’t download music anymore; even if you have low coverage, you have enough quality to stream music. 5G will do that for video,” Amon says, before moving on to fancier, further-out predictions like unlimited storage and on-demand processing power from the cloud that can, he imagines, virtually cram the power of a Magic Leap-like augmented reality headset into a normal pair of glasses.”

The Verge says that Qualcomm will announce a new Snapdragon processor at its third annual Snapdragon Technology Summit next week in Maui. It is targeted at 5G NR smartphones. A “Snapdragon 1000” processor for a new wave of always-connected Windows laptops will also be introduced at the summit.

Oracle Confirms Research: China Telecom Misdirected U.S. Internet traffic thru China

China Telecom is the largest fixed line operator in China, state owned, and bidding to become the third telecommunications network operator in the Philippines. Two weeks ago, researchers found that the company has been hacking into internet networks in the United States and hijacking data from countless users, a study has found.

The research, conducted jointly by scholars from the US Naval War College and Tel Aviv University, discovered that the China government, acting through China Telecom, has been engaged in data hacking even though it had entered into a pact with the U.S. in 2015 to stop cyber operations aimed at intellectual property theft.

Oracle’s Internet Intelligence division has just confirmed the findings of the academic paper published two weeks ago that accused China of “hijacking the vital internet backbone of western countries.”

Doug Madory, Director of Oracle’s Internet Analysis division (formerly Dyn), confirmed that China Telecom has, indeed, engaged in internet traffic “misdirection.” “I don’t intend to address the paper’s claims around the motivations of these actions,” said Madori. “However, there is truth to the assertion that China Telecom (whether intentionally or not) has misdirected internet traffic (including out of the United States) in recent years. I know because I expended a great deal of effort to stop it in 2017,” Madori said.

Image Courtesy of Oracle

……………………………………………………………………………………………………………….

Madori then goes on to detail several of China Telecom’s BGP (Border Gateway Protocol) route “misdirections,” most of which have involved hijacking US-to-US traffic and sending it via mainland China before returning it to the U.S.

Verizon APAC errors had a knock-on effect, Madori explained: “Verizon APAC … were announcing [routes] to the internet on behalf of their customers. A couple of AS hops away, China Telecom was mishandling them – announcing them in a manner that would cause internet traffic destined for those IP address ranges to flow back through China Telecom’s network.”

………………………………………………………………………………………………………………………………..

Indeed, the researchers found that China Telecom uses BGPs in order to carry out their data intrusions. Created in the early 1980s, BGP protocols do not feature any security controls, often resulting in misdirected traffic through “bad BGPs”. The majority of these cases are attributed to configuration mistakes.

However, researchers found that China Telecom has been deliberately hijacking BGP routes to send legitimate traffic through malicious servers.

They described the state-owned telco as “one of the most determined BGP hijackers in the international community.”

In order to validate their findings, the researchers built a route tracing system to monitor BGP announcements, allowing them to distinguish between normal, accidental patterns and deliberate ones.

They concluded that China Telecom was responsible for patterns of BGP behavior that “suggest malicious intent, precisely because of their unusual transit characteristics -namely the lengthened routes and the abnormal durations.”

“[China Telecom] has already relatively seamlessly hijacked the domestic US and cross-US traffic and redirected it to China over days, weeks, and months,” the researchers said.

“The prevalence of and demonstrated ease with which one can simply redirect and copy data by controlling key transit nodes buried in a nation’s infrastructure requires an urgent policy response,” they warned.

………………………………………………………………………………………………………………………………………….

The routing snafu involving domestic US Internet traffic coincided with a larger misdirection that started in late 2015 and lasted for about two and a half years, Oracle’s Madory said in a blog post published Monday. The misdirection was the result of AS4134, the autonomous system belonging to China Telecom, incorrectly handling the routing announcements of AS703, Verizon’s Asia-Pacific AS. The mishandled routing announcements caused several international carriers—including Telia’s AS1299, Tata’s AS6453, GTT’s AS3257, and Vodafone’s AS1273—to send data destined for Verizon Asia-Pacific through China Telecom, rather than using the normal multinational telecoms.

………………………………………………………………………………………………………………………………………….

Ahead of the third telco player’s selection Wednesday (November 7), Senators Grace Poe and Francis Escudero already voiced concerns about the possible threats to national security and data privacy in case China Telecom becomes the winner of the bidding.

………………………………………………………………………………………………………………………………………….

References:

https://internetintel.oracle.com/blog-single.html?id=China+Telecom%27s+Internet+Traffic+Misdirection

https://www.zdnet.com/article/oracle-confirms-china-telecom-internet-traffic-misdirections/

AT&T exec: SD-WAN is “killer app” after MEF says they will define SD-WAN service

AT&T’s Josh Goodell at MEF 18 conference in LA: “SD-WAN is the killer app — we’re deploying 28,000 end points, it has really exploded.” Really? We’re from Missouri= show me

Meanwhile, the MEF has definesd an SD-WAN service and its various attributes. With strong support from service provider and technology provider members, MEF currently is on track to ratify and publicly release its MEF 3.0 SD-WAN Service Attributes and Service Definition standard in 1Q 2019. SD-WAN service standardization will enable a wide range of ecosystem stakeholders to use the same terminology when buying, selling, assessing, deploying, and delivering SD-WAN services. The SD-WAN service definition is a foundational step for accelerating sales, market adoption, and certification of MEF 3.0 SD-WAN services orchestrated across a global ecosystem of automated networks.

SD-WAN Service Standardization

SD-WAN service standardization is being conducted within the context of the MEF 3.0 Global Services Framework. It is part of a transformational initiative to standardize a complete family of dynamic Carrier Ethernet (CE), IP, Optical Transport, SD-WAN, security, and other virtualized services that will be orchestrated over programmable networks using LSO (Lifecycle Service Orchestration) APIs.

MEF’s SD-WAN service definition specification describes requirements for an application-aware, over-the-top WAN connectivity service that uses policies to determine how application flows are forwarded over multiple underlay networks irrespective of the underlying technologies.

“MEF’s groundbreaking work in standardizing an SD-WAN service addresses one of the biggest obstacles impacting SD-WAN service market growth,” said Nan Chen, President, MEF. “In a recent joint MEF and Vertical Systems Group survey of service providers worldwide, nearly 80% of respondents identified the lack of an industry-standard service definition as a significant challenge for service providers to offer or migrate to SD-WAN services. MEF’s SD-WAN service standardization will undoubtedly accelerate sales of SD-WAN products and services like MEF accomplished with Carrier Ethernet service standardization.”

Just as the industry has benefited from MEF standardization of CE services – which now exceed an estimated $50 billion in annual revenues globally – there are numerous potential benefits associated with a common SD-WAN service definition. These include, among other things:

- Reducing market confusion about service components, core capabilities, and related concepts, thus saving valuable time given the scarce availability of skilled personnel.

- Enabling service providers and technology providers to focus on providing a core set of common capabilities and then building on that core resulting in differentiated offerings.

- Facilitating inclusion of SD-WAN services in standardized LSO architectures, thereby advancing efforts to orchestrate MEF 3.0 SD-WAN services across multiple providers.

- Paving the way for creation and implementation of SD-WAN services certification, which will give users confidence that a service meets a fundamental set of requirements.

SD-WAN Implementation

MEF member companies are involved in multiple SD-WAN implementation-related initiatives that can be leveraged to provide feedback on standardization requirements and create software-oriented artifacts that can be used to accelerate efforts to orchestrate standardized SD-WAN services. These initiatives include the MEF 3.0 Multi-Vendor SD-WAN Implementation project, the MEF18 LSO Hackathon, and several SD-WAN Proof of Concept (PoC) demonstrations at MEF18.

The MEF18 LSO Hackathon is focused on developing and validating data models for SD-WAN services. This presents a unique opportunity for those involved in technical aspects of SD-WAN services and products to learn in a hands-on way about the latest SD-WAN service and LSO standardization work at MEF as well as the related API and YANG work at ONF and IETF.

Three MEF18 PoC demonstrations directly related to LSO-enabled orchestration of SD-WAN services include:

- Zero Touch Services with Secure SD-WAN

- Towards a Multi-Vendor Orchestrated SD-WAN – LSO-enabled Solution with Open Source Orchestrator and Container-based uCPEs

- Instantiation and Delivery of SD-WAN over a Virtualized and Orchestrated Wholesale Carrier Ethernet Access Service.

MEF 3.0 SD-WAN Service Certification

MEF currently plans to introduce a pilot version of certification for MEF 3.0 SD-WAN services in the first half of 2019. This certification will test a set of service attributes and their behaviors defined in the upcoming SD-WAN standard and described in detail in the MEF 3.0 SD-WAN Service Certification Blueprint.

…………………………………………………………………………………………..

References:

…………………………………………………………………………………

Cisco Virtual Networking Index report: Enterprise SD-WAN growth will increase five-fold by 2022:

Should Web Giants Partner with Telcos to bring Broadband to 3rd World?

Facebook along with Indian telecom giant Bharti Airtel Ltd.’s Ugandan unit and Mauritius-based Bandwidth & Cloud Services Group, has deployed nearly 500 miles of fiber-optic cable across the isolated northwest of Uganda. The project, begun in early 2017 and completed at the end of last year, has expanded the region’s network capacity, providing faster internet access to an area with some three million people, many of whom live in towns still haunted by memories of the three-decade insurgency led by Joseph Kony’s Lord’s Resistance Army.

The Ugandan cable is the largest terrestrial network Facebook has helped construct in Africa and part of what the company describes as a broader push to connect the approximately 3.8 billion people who are still without internet around the world.

The move comes as Facebook’s user growth slows in developed markets like the U.S. and Europe. The social media giant’s presence on the continent remains small compared with other regions, but the Menlo Park, Calif.–based company said its strategy to get more people onto a faster and more robust internet will plug more of sub-Saharan Africa into the global economy.

Indeed, the summer of 2018 brought different fortunes to attempts by Facebook and Google to offer broadband services using high-flying drones and balloons (atmospheric satellites) to the unserved in remote rural areas.

GlobalData, a data and analytics company, feels that webscale giants need to partner with telcos globally to address the affordability challenge of reaching out to the unconnected in rural markets with atmospheric satellites.

Atmospheric satellites fit in the space between true satellites commonly used for communications and ground-based networks. Their theoretical advantage over satellites is much lower cost. Launching a balloon or a drone and equipping it with a radio base station represents a much cheaper way of covering large swaths of land. Considering one-third of the world population remains unconnected, the lower costs associated with balloon- or drone-based coverage is compelling.

However in June 2018, following several setbacks over a period of four years, Facebook abandoned developing its own high-flying solar-powered drones (Aquila project) for delivering Internet. However, the California-based social media giant said that it will focus on working with partners like Airbus on high altitude platform station (HAPS) system, which is capable of beaming down high-speed Internet to the unserved in 3rd world countries.

On the other hand Alphabet, the parent company of Google, turned its Loon balloon project into an independent company and announced its first commercial project with partly-state owned Telkom Kenya in July 2018. The partners plan to launch balloon-based 4G/LTE services commercially to parts of central Kenya, starting from 2019.

Alphabet’s Project Loon uses helium balloons to bring internet access to remote locations

…………………………………………………………………………………………………………………………………………….

Google used Project Loon in Puerto Rico last year after two hurricanes destroyed much of the telecom infrastructure on the island. Project Loon’s pilot deployment with Telkom Kenya may provide the clearest test of whether atmospheric satellites can really work. This puts pressure on Loon to demonstrate it has a viable technology.

Emir Halilovic, Telecom Technology and Software Analyst at GlobalData, said:

“Things get more complicated when the practical challenges of covering the unconnected masses with drone- or balloon-based mobile signals are considered. For starters, the potential customers for services provided from atmospheric satellites are not concentrated in one part of the world; rather, they are spread across remote, rural, or tribal areas, in many different countries and continents.”

Truly addressing this group would require the participation of multiple operators in dozens of countries. Moreover, most of the unconnected usually do not live outside areas where they can get mobile service; they just cannot afford a mobile plan. Drones and balloons do little to address the ’affordability’ challenge.

Halilovic concludes:

“Still, there are reasons to continue to pursue atmospheric satellites to provide coverage to the underserved rural communities, which could use internet connection to improve access to medical services in isolated locations, for example. Another use case for atmospheric satellites is quick restoration of communication services in natural disasters. Telcos should therefore continue to test atmospheric satellites to support development of such services.”

Critics say Facebook’s ventures into less-developed markets could undermine net neutrality by channeling traffic to its own platform and away from competitors. An earlier effort by Facebook to expand internet access in the developing world faltered in 2016, when India’s telecommunications regulator effectively banned the company from offering free access to a low-data version of Facebook and selected websites and apps. Governments across Africa—including in Uganda—are rolling back internet freedoms and cracking down on social media.

Facebook, which declined to comment on the cost of the Ugandan cable, says its Africa strategy is a long-term effort. Analysts say the lack of connectivity on the continent is a central impediment to increasing economic growth: Removing barriers to commerce and trade should create more opportunities for consumers to spend.

“It’s not a philanthropic venture. It’s a strategic investment with a long-term goal,” said Ebele Okobi, Facebook’s director of Africa public policy. “We see this as an enabler of our business, not as a way to gain advantages.”

Dexter Thillien, a London-based analyst with Fitch Solutions, said Facebook, conscious of the risks, is still testing the waters in Africa. “It’s where they can make the least money, at least right now,” he said.

The word “Africa” appears just once in Facebook’s 2017 annual report, to inform readers that the continent is included, along with the Middle East and Latin America, under its “Rest of World” designation.

Since the fiber rollout, Airtel Uganda has installed 33 new telecom towers in northern Uganda, while 71 towers have been upgraded to 3G and another 43 towers now beam 4G, which improves users’ ability to download and stream quickly, the company said. Previously, most places in the region had 2G or no service at all—a far cry from developed economies, which are racing to roll out 5G networks. More than half of Africa’s mobile broadband connections remain 2G (which AT&T has discontinued in the U.S.).

“That cable is fast for internet. That means communications will be much easier,” said Patricia Akello, project manager for Youth Alive, a Gulu-based provider of youth HIV counseling and testing. “Internet has become a necessity: Allowing young people access will educate them. They’ll be better able to prevent HIV…and they can be educators to others in the community.”

Meanwhile, telcos like AT&T are testing drones to act as temporary cell sites after a disaster, Inside Towers reported. BAE Systems’ PHASA-35 could bring internet access to the most remote corners of the world, Martin Topping, delivery director at BAE Systems said: “Essentially any payload that can fit within the capacity can be put inside it. That could be 5G and 6G communications, border surveillance, agriculture and forestry, famine relief – it’s infinite. The vehicle is the carrier – the transit van. Spying is quite a niche usage.”

References:

https://www.wsj.com/articles/facebook-pushes-into-africa-1539000000

Huawei launches “5G Power Solution” for global wireless telcos

Huawei has launched what it says is the industry’s first full-range 5G power solutions for wireless network operators which will address an expected 100% increase in 5G energy consumption when compared to 4G power dissipation.

The 5G Power series of products are designed to deliver an end-to-end, scalable energy solution for both newly built and upgradeable cell sites.

It has been designed utilizing technology including peak shaving, linked voltage boosting and energy slicing to provide a ‘one site one cabinet’ design.

Huawei said its research suggests that more than 70% of cell sites will face challenges such as insufficient power, battery and distribution capacity, and more than 30% of sites need grid modernization to match the power demands of 5G. Its solution has been designed to help network operators reduce capex and opex while improving energy reliability to meet the high reliability and low latency requirements of future mobile applications.

Huawei launched 5G Power series solutions to ensure that energy evolution is simpler, more reliable and more efficient in the 5G network process. Huawei believes that site synergy, network synergy, business synergy will be the direction for telecom energy in the future.

From its press release (reference below):

With the design concept of ‘one site, one cabinet’ and ‘one band, one blade power,’ Huawei’s new Power Solution adopts innovative technology of peak shaving, linked voltage boosting and energy slicing, and fully considers the capacity expansion of cooling and battery backup. Facing the capacity expansion requirement in the future, Huawei Power Solution enables carriers to avoid energy modernization and get 5G network overlaid quickly.

“Based on our deep understanding of pain points carriers are facing in the progress of network evolving, Huawei 5G Power Solution achieve end-to-end synergy from wireless network to telecom energy, which will further enable carriers to build networks quickly, reduce site energy consumption, and maximize their investment value,” Huawei president of telecom energy Tao Hongming said.

“As a telecom energy supplier who is able to provide end-to-end ICT solutions, Huawei is willing to work with carriers and industry partners on continuous innovation and exploration, and jointly solve the energy challenges in 5G era,” Tao added.

https://www.huawei.com/en/press-events/news/2018/10/huawei-first-5g-power-solution

3 Network Equipment Vendors Spin Off Video Units

Decisions by Cisco, Ericsson and Nokia to spin off video technology units represent an attempt to better compete with nimble startups, analysts say.

It’s indicative of transition in a competitive, confusing sector that provides myriad services to the consumer video market – from encryption to caching to streaming to storage.

“There are so many companies out there chasing too few dollars,” said London-based media and technology analyst Paolo Pescatore, noting “hundreds” of them at the latest NAB (National Association of Broadcasters) meeting occupying the entire upper South Hall. Many are small. To stand out, they advertise, but don’t always deliver on the hottest trends, from Artificial Intelligence to Blockchain.

“Now, everyone does Blockchain. But are they genuinely doing it? Are they genuinely doing Big Data? For many [customers], trying to work with them is tough,” he said. “There needs to be a reality check across the board.”

There is, and it started at the top for three big players whose corporate parents have not seen adequate returns. Executives at the new standalone companies—Synamedia (spun up from Cisco’s Service Provider Video Solutions business), Mediakind (the new Ericsson media solutions) and Velocix (the result of Nokia selling off its IP Video business)—insist that operating independently is key to performing better.

“As a private, independent company, Synamedia will live and breathe video and that single focus will benefit us and our customers,” said Yves Padrines, incoming CEO of Synamedia.

Cisco agreed to sell its Service Provider Video Software Solutions unit to U.K. private equity firm Permira in May for a reported $1 billion in a deal expected to close by early next year. Rebranded as Synamedia, it includes Cisco’s Infinite Video Platform, cloud digital video recording, video processing, video security, video middleware and other services. Many of the businesses were originally part of NDS, a video and security specialist Cisco acquired in 2012 for $5 billion.

Cisco will retain some video technology for networking like WebEx, which facilitates video and web conferencing, webinars, and screen sharing.

Padrines has three priorities: integrating broadband and broadcast so pay-TV operators can embrace IP and OTT; helping customers secure revenue through piracy prevention, rapid detection and response; and using data on viewer behavior and content to help clients generate fresh revenue through targeted advertising.

He said Synamedia’s “thousands” of employees worldwide will prioritize R&D and developing local solutions for local markets. London is the headquarters with staff in the U.S., Canada, the U.K., Belgium, Israel, India and China.

Cisco’s move followed Ericsson’s decision last January to sell a majority stake in its Media Solutions division to private equity firm One Equity Partners. The unit also got a snappier name, MediaKind, in July and a coming-out party at IBC last month. The deal hasn’t closed yet either as MediaKind carefully decouples from its parent company, market by market, said Arun Bhikshesvaran, chief marketing officer.

He said MediaKind staffers were in 120 of the 140 countries where Ericsson has “legal entities,” which the spinoff couldn’t replicate. In a complex process, the group narrowed the number of its legal entities to about 30 worldwide, with staffers reporting in from other areas.

“We had to figure out how to work in an agile manner, like a startup, but not [being] a startup,” Bhikshesvaran said. “What we consciously decided to do is to do this right from the beginning instead of creating an entity and fixing it later.” MediaKind will launch with 1,700 employees.

Bhikshesvaran said the relationship with Ericsson—which is retaining a hefty 49% interest in the business—will preserve the companies’ “combined heritage of video and mobility.”

Nokia is keeping an unspecified but smaller minority stake in Velocix. Cisco is selling Synamedia outright.

MediaKind, based in Plano, Texas, will be melding its businesses and focusing on R&D to address shifts in the media sector. Over the years, it has invested heavily in a collection of media properties, including Apex, Azuki Systems, Envivio, Fabrix, HyCGroup, Microsoft Mediaroom and Tandberg Television, but has acknowledged it did a poor job integrating them.

Bhikshesvaran described the current transition in the industry in part as moving to standalone software that can run on different kinds of commercial hardware, and helping clients migrate to the Cloud. MediaKind recently unveiled MediaKind Universe and announced a handful of global contracts with CogecoConnexion, Digicel, TotalPlay and TangerineGlobal.

Nokia’s IP video business, Velocix, the smallest of the three with about 300 employees, was sold in September to Volaris in a deal that will close by year end. It was the first media acquisition by the Toronto-based software company.

Nokia remains a Global Channel Partner for Velocix, which is focused on video and IP delivery and on storage technology. Velocix chief, Paul Larbey, said a core mission is to continue its work to make streaming video as smooth as broadcast.

He’s upbeat about shifts in the media industry, which he said have boosted business over the past six months. The group has added 12 new customers and increased traffic.

“Operators are starting to invest in new services—moving from analysis into the implementation phase,” he said. “There’s a nice head of steam in the development of product devices and services.”

As a standalone entity, Velocix can better hone its operations and sales. “Video is very specialized. It has a very technically oriented sales cycle. So being part of a big company” is not ideal, he said.

Larbey called Volaris “a nice, stable home,” noting that private equity firms like the ones that acquired Velocix’ larger rivals generally seek an exit in 3 to 5 years through an IPO or sale. Volaris is looking to expand and will be a buyer of assets, he predicted. The industry is still in flux, said Pescatore, but it could be worse.

“You would be worried if they [parent companies] had written them off and closed these businesses. But private investors have come in and believe they can make a success where the giants have failed,” he said.

https://www.fiercevideo.com/video/big-spinoffs-by-cisco-ericsson-and-nokia-redraw-media-tech-sector

Superb Article on What’s Wrong with Communications Industry by Steve Saunders, co-founder of Light Reading

Here’s the url for Steve Saunder’s spot on the money article: https://www.linkedin.com/pulse/future-communications-steve-saunders/

The only add on I have to Steve’s exquisite post is that the lack of standards is pervasive throughout the WAN space:

- SD WANs are a single vendor solution – no UNI or NNI specified or being worked on by an accredited standards body.

- NFV: No standards for exposed interfaces, APIs (NFV orchestrator (NFVO) to/from virtual appliances), no backward compatibility between virtual appliances and physical appliances, no standard for network management or fault isolation/repair, etc.

- Every major Cloud Service Provider (CSP) has their own defacto standards/specs and APIs, e.g. Amazon, Google, MSFT, etc

- Every major CSP has their own connectivity solution(s) from customer premises network to their point of presence (PoP); and their own method for realizing a virtual private cloud (VPC)

- Every CSP and network service provider has their own definition and implementation of SDN, including one or more southbound API (s) to/from Control Plane to data plane. That southbound API was supposed to be ONLY OpenFlow according to the ONF. The Northbound API was never standardized and there are many options. Many SDNs use an overlay network and virtualization of network functions while others do not. Equipment and software built for one provider’s SDN won’t operate on another’s as the specs are different and usually proprietary.

- Far too many LPWANs for IoT: Sigfox (by company with same name), LoRa WAN, Weightless SIG (unidirectional Weightless-N, bidirectional Weightless-P and Weightless-W), NB-IoT, LTE Cat M1, many other proprietary versions like RPMA (from Ingenu).

- The message sets between “things”/IoT devices and the cloud controller have not been standardized. Neither is the functions of an “IoT Platform” which has become a wild west menagerie of incompatible platforms from hundreds of vendors.

- Every so called “5G” deployment planned before IMT 2020 has been completed (end of 2020) is proprietary. The only thing in common seems to be use of 3GPP release 15 “5G New Radio” which is not a standard. That implies mobile 5G will have severe roaming problems when moving from one 5G carrier to another.

And the list goes on and on and on……………………………………….

Without agreed upon standards, the upshot is that the big cloud players (Google, Amazon, FB, Microsoft, Tencent, Alibaba, Baidu, etc) will dominate communications in the future (I think they already dominate all of IT!!)

Also, the rise of open source hardware organizations (OCP, TIP, ONF, etc) along with Taiwan/China ODMs have profoundly changed the communications industry. With so many open source white boxes and bare metal switches available, there is little or no value add for vendor specific network equipment other than possibly higher performance (e.g. throughput).

Reliance Jio Blankets India with Inexpensive 4G Service; Where are the Profits?

India has the second largest number of Internet users in the world- second only to China. But only in the last two years has India moved to true broadband wireless service. Mukesh Ambani, head of Reliance Industries, one of India’s largest conglomerates, has shelled out $35 billion of the company’s money to blanket the South Asian nation with its first all-4G network. By offering free calls and data for pennies, the telecom latecomer has upended the industry, setting off a cheap internet tsunami that is opening the market of 1.3 billion people to global tech and retailing titans.

The unknown factor: Can Reliance reap profits itself after unleashing a cutthroat price war? Analysts say the company’s ultimate plan, after connecting the masses, is to use the platform to sell content, financial services and advertising. It could also recoup its massive investment in the years to come by charging for high-speed broadband to consumers’ homes and connections for various businesses, according to a person familiar with the matter.

Sidebar: Reliance Jio gaining ground on incumbents via price war

Business Standard says that according to revenue figures of the industry for the April-June quarter, Jio has become the second biggest wireless network operator by revenues, overtaking Vodafone.

In fact, both Vodafone and Idea reported a revenue decline of 7 per cent and 5.2 per cent respectively in the reported quarter. Airtel though managed to increase its adjusted gross revenue (AGR) by 1 per cent, thanks to income from national long distance (NLD) services.

According to a report by JP Morgan, Reliance Jio keeps flourishing in a continually stressed industry, which is why the industry may continue to be in stress.

Meanwhile, zeebiz.com reports “Reliance Jio impact: 15,000 people lost jobs, just 3 companies left in 2 years.” Apart from declining financial health of incumbents, there have been massive job losses owing to mergers and sector consolidation. Experts estimate the number of job losses to be around 12,000-15,000 in the last two years, with a major shedding from Vodafone and Idea Cellular duo.

Reliance Jio has been gaining subscribers and revenue market share at a rapid pace. But for the incumbents, including Bharti Airtel, Vodafone India, Idea Cellular, there has been declining average revenue per user (Arpu) and margins with high debt levels. Together, the telecom industry has a cumulative debt of Rs 3.6 lakh crore.

Analysts from Jefferies say that the competitive intensity will remain high as Jio and Bharti focus on subscriber additions. “We expect increased competitive intensity in the postpaid and feature phone segments. The market share is expected to stabilise in the next 12 months. Post that, there will be a gradual Arpu recovery due to customer willingness to pay higher.”

“The next battleground is the 500 million non-LTE subscriber base, which would include 400 million 2G subscribers. Half of the 2G subscribers are low-value subscribers with monthly spend of Rs 50-80. Content and advertising will emerge as key pillars to increase average revenue per user and profitability for the sector in the medium term,” according to Deutsche Bank Research.

…………………………………………………………………………………………………………………………………………………………………………………………………….

Mr. Ambani’s project has the potential to give India the largest—and most diverse—connected population in the world, with low-cost access to data helping to level the playing field between rich and poor.

It also could revolutionize retail. Mr. Ambani’s success or failure could affect Alphabet Inc.’s Google and Facebook Inc.’s WhatsApp, which have poured resources into developing products for the Indian market, and Walmart Inc. and Amazon.com Inc., which have invested billions here on logistics for online shoppers. To profit, they all need people connected to the internet.

Underserved Population

India has more internet users than the U.S., but a low percentage of the country is online. Slow download speeds are a drag on building subscribers.

………………………………………………………………………………………………………………………………………………………

Mr. Ambani wasn’t available to comment, according to a Reliance spokesman. The company “has unleashed huge data potential in the country,” the spokesman said. “Digital life will no longer be the privilege of the affluent few.”

There are 390 million internet users in India, according to Bain & Co., but the penetration rate is still only 28%, compared with 88% in the U.S. The country’s e-commerce market is expected to be worth $33 billion this year, three times what it was in 2015, but less than 3% of India’s overall retail market, according to research firm eMarketer.

Companies are after customers like 59-year-old potato farmer Govind Singh Panwar. His home in the Himalayan foothills is built of mud and stone, and his village has no paved roads or indoor plumbing. Still, broadband internet has arrived.

“I bought our first fridge” online, Mr. Panwar said. “It’s a rare thing in a village.” He got online last year with Reliance Jio Infocomm Ltd., Mr. Ambani’s telecom company, which built a tower nearby that beams his phone nearly unlimited 4G data for about $2.10 a month.

Jio, which means “to live” in Hindi, has signed up 215 million subscribers since it went live in 2016, making it India’s No. 4 mobile provider, after Bharti Airtel Ltd., with 345 million, Vodafone Group PLC and Idea Cellular Ltd.

Mr. Ambani’s foray started in 2010, when he bought a company that had just acquired a pan-India 4G license. That was a risky move at a time when fewer than one in 10 Indians were online. Airtel and Vodafone were still focused on rolling out 3G services, and few Indians owned 4G-capable smartphones.

Fourth generation, or 4G-LTE networks provide significantly faster speeds than 3G, enabling more content like streaming video and music. They also provide the steadier connections important for online shopping, which can be difficult on patchy networks. 4G networks are common in the U.S., Europe and East Asia.

Mr. Ambani, now 61 and worth more than $48 billion, had just finished building what some have dubbed the world’s most expensive home, a 27-story mansion on a hill with views of the Arabian Sea. It was packed with bling—helipad, home theater, gym, garden, pool—but the internet connection was bad.

When his daughter came home from Yale University during a break, she struggled to submit her course work online. “Dad, the internet in our house sucks,” she complained, according to a story Mr. Ambani later recounted at an event.

At the time, India’s telecom industry executives and analysts agreed there was need for more speed, but they doubted enough people would be willing to pay for it. Indians then were spending only about $2 a month on their cellphones, the vast majority of that on voice calls.

Subscribers in India typically use prepaid plans without contracts, making it easy to switch carriers by swapping in a new SIM card from a competitor. One adversary that has thrown in the towel: Reliance Communications Ltd., formerly part of the Reliance empire but taken separate by Mr. Ambani’s brother, Anil Ambani, after a family dispute. The company, under pricing pressure from Jio, closed its mobile business in late 2017.

The price war has cut industry wide revenue per user—now averaging $1.53 a month, compared with about $2.50 in 2016. Jio beats the average, at $1.89 a month, but the number has been falling since its launch.

The result has been a data binge. Jio transmitted more data in the first year of its operation than any carrier ever world-wide, according to research firm Strategy Analytics. India last year surpassed the U.S. in the number of apps downloaded from the Google Play store, according to mobile-app analytics firm App Annie. Monthly data traffic in India per user has jumped 570% in the two years since Jio launched, according to Morgan Stanley .

When Jio realized it was reaching the consumers who could afford the data but not the 4G-enabled smartphones, it built a new type of “smart” feature phone that worked on 4G and had some smartphone features. Consumers could own a JioPhone for a $23 security deposit—refundable if they return the phone. It launched in September 2017 and has overtaken Samsung Electronics Co. to capture 47% of the feature phone market, according to research firm Counterpoint.

Companies such as Amazon.com are depending on the new pool of users. Amazon has tweaked its model in India by introducing services like cash on delivery, in which customers can pay with cash when items arrive at their door, since few people have credit cards. The retailer has also deployed swarms of delivery men on motorbikes, so they can negotiate chaotic city traffic.

Google, which has been effectively shut out of China since 2010, has been rolling out new features to cater to users in India, testing products that might also work in other emerging markets, such as Indonesia. It launched a version of its YouTube app, called YouTube Go, designed to work on inexpensive smartphones. It created a mobile payment app for India, called Tez, that works without a credit or debit card. It is also working to make many of its services work with local languages.

At a July investors’ meeting, Mr. Ambani made his ambitions clear. “Even after serving the needs of our 215 plus million customers, the capacity utilization of the Jio network is less than 20%,” he said. “We are determined to connect everyone and everything, everywhere.”