Uncategorized

Analysys Mason: Public WiFi to add $20B to India’s GDP

Public Wi-Fi can play a key role in driving ubiquitous connectivity and digital inclusion in India, as explored in an Analysys Mason report – ‘Accelerating connectivity through public Wi-Fi: Early lessons from the railway Wi-Fi project.’

Despite fast increases in number of people connected (316 million at the end of 2017, compared to 200 million the previous year), mobile broadband penetration in India stood at only 31% at the end of 2017, still significantly behind many of India’s peers. The report, prepared through the lens of Google and Railtel Public Wi-Fi project, support the Government’s ambition under the draft NDCP to reach 5 million access points in 2020 and 10 million in 2022, to provide an all-pervasive coverage and internet connectivity, for 600 million Indians.

David Abecassis, partner at Analysys Mason, said: “In the last few years, India has made significant progress in driving mobile data usage, thanks to improved networks, and low cost data. But to really achieve the connected India vision, India will need to further invest in developing public Wi-Fi as a complement to mobile and fiber broadband.”

According to Abecassis, the Google and RailWire project to deploy high speed Wi-Fi across 400 stations has shown that there was a technical and operational solution to providing high-quality public Wi-Fi to millions of Indians nationwide, on affordable terms.

“The success of this rollout and Reliance Jio’s 80,000 public Wi-Fi access points as of mid-2017 provided valuable insights in further developing public Wi-Fi as a service that can truly achieve the Digital India vision,” he added.

The report further outlines an opportunity to develop a wider connectivity ecosystem with Public Wi-Fi as a key component, which can not only benefit users and wireless ISPs, but also telecom service providers, handset manufacturers and venue owners. ISPs can benefit by monetizing demand for faster mobile broadband and higher data volumes on their networks, as people get used to fast speeds and ubiquitous connectivity.

Analysis Mason found that around 100 million people would be willing to spend an additional USD 2 to 3 billion per year on handsets and cellular mobile broadband services, as a result of experiencing fast broadband on public Wi-Fi. In addition to driving productivity improvements from high speed Wi-Fi for the overall economy, public Wi-Fi can also translate into tangible benefits to GDP, by around USD 20 billion between 2017-19 and at least billion per annum thereafter.

References:

Google’s Internet Access for Emerging Markets – Managed WiFi Network for India Railways

4G Speeds Increase in the U.S. and Asia: Seoul, Korea and Singapore fastest 4G cities

4G (LTE and LTE Advanced) speeds have increased all over the world in the last year. In the U.S., PC Mag wrote:

Peak speeds have jumped from the 200Mbps range to the 300Mbps range, average download speeds have bumped up by 10Mbps or more, and latency has dropped by 10ms. That’s an impressive change in one year, and it continues the trend of improvement that we’ve seen over the past several years of testing.

As we get to a world where we can assume 20Mbps or higher download speeds on 4G in most cities, other questions arise: Where are those speeds most consistent? Where is the network most responsive, especially when you’re downloading pages made of many small files?

Our tests cover data speeds and reliability; we don’t make voice calls. But our awards for data service apply more and more to voice, too. All of the carriers other than Sprint now use voice-over-LTE, piping their voice calls through their data networks. So the reliability of those LTE data networks translates into the reliability of your HD voice calls, as well.

………………………………………………………………………………………………………………………………………………………………..

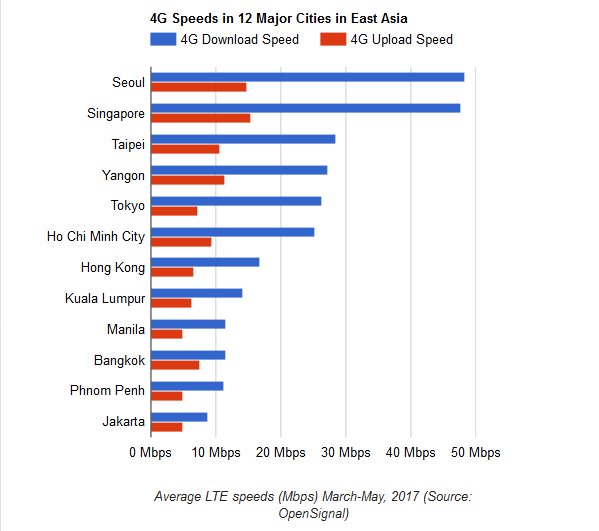

In Southeast Asia (including Japan, but not China except for Hong Kong), Seoul and Singapore are the fastest 4G cities, according to a regional ranking of major cities from OpenSignal. An analysis of 12 cities in the region shows that Seoul recorded an average 4G speed of nearly 50Mbps, with Singapore close behind.

Four cities demonstrated 4G speeds of over 25Mbps – Taipei, Tokyo, Yangon and Ho Chi Minh. The latter cities have benefited from having launched 4G just two years ago, which OpenSignal said suggests that they have not yet filled their networks to the extent that speeds have started to decline.

The final six cities examined all had speeds at or below the global average of 16.9Mbps. Hong Kong was highest among this grouping, followed by Kuala Lumpur, Manila, Bangkok, Phnom Penh and Jakarta.

OpenSignal noted that Southeast Asian operators are focusing on improving coverage over speed. Singapore topped the list for average 4G upload speed at 15.4Mbps, followed by Seoul and Yangon. But the gap between the fastest and slowest upload speed was only around 10Mbps, with even the slowest cities in the region, Phnom Penh and Jakarta, averaging 4G upload speeds of 4.9 Mbps.

As 4G connections are far superior to 3G connections, Southeast Asia’s wireless network operators seem intent on making LTE services accessible to the vast majority of their customers before they turn their attention to raw speed.

Nokia, Tencent working together on 5G applications

Nokia and Tencent will collaborate on 5G applications, testing and rolling out offerings to WeChat and QQ users, the companies announced. Under the partnership, the two will focus on products for the transportation, finance, energy, intelligent manufacturing and entertainment sectors, including edge computing, “Cellular Vehicle-to-Everything” and cloud-based entertainment.

Nokia to build and test 5G apps in China with Tencent, leveraging 1B+ WeChat and QQ users

Comcast Blames Widespread Service Outage on Cut Fiber Lines Owned by CenturyLink & Zayo

Comcast Corp, which has more than 29 million business and residential customers, today blamed cuts in two fiber lines for a widespread system failure that knocked out cable, internet and phone services around the country.

It was unclear how many customers were affected as the system failure, which appeared contained to Comcast’s network, also disrupted connectivity services like Netflix Inc. and Okta Inc. as other internet service providers routed internet traffic through Comcast’s network, according to network research firm ThousandEyes.

Comcast service problems today (June 29, 2018):

https://outage.report/us/xfinity

………………………………………………………………………………………………………………………………………………………

Comcast, one of the dominant cablecom companies in the U.S., said most service had been restored by late Friday. The Philadelphia-based company said in a statement that “one of Comcast’s large backbone network partners had a fiber cut that we believe is also impacting other providers.” Later, Comcast said the damaged fiber optic lines are owned by CenturyLink Inc. and Zayo Group Holdings Inc.

A spokeswoman for CenturyLink issued a statement saying CenturyLink’s network was working normally, though the company had “experienced two isolated fiber cuts in North Carolina affecting some customers that in and of itself did not cause the issues experienced by other providers.” The spokeswoman, Francie Dudrey, didn’t comment further. Attempts to reach Zayo were unsuccessful. Fiber networks, which make up the backbone of the internet, transmit vast amounts of internet traffic, processing everything from online purchases to 911 calls.

Down Detector and Outage.Report, two websites that monitor the running of consumer-technology services, ranked the system failure as extreme and posted maps indicating large numbers of customers affected in the New York, Philadelphia and Washington, D.C., metro areas as well as San Francisco, Chicago and Denver.

Reports of outages, according to the websites, spiked early Friday afternoon. Some customers took to social media to discuss the outages, saying they were having trouble getting through the company’s phones and online chats. Comcast, on Twitter, directed customers to an internal website that was at one point down as well, eliciting a second round of customer complaints.

https://www.wsj.com/articles/comcast-blames-widespread-service-outage-on-cut-fiber-line-1530308633

Write to Maria Armental at [email protected]

IHS Markit: Ethernet switching market +12% YoY; data center and campus upgrades

By Matthias Machowinski, senior research director, enterprise networks and video, IHS Markit

Highlights:

- Worldwide Ethernet switch revenue totaled $6.1 billion in the first quarter of 2018 (Q1 2018), growing 12 percent on a year-over-year basis

- 100GE continued to ramp, increasing more than twofold year over year and reaching 1.7 million ports in the quarter; 40GE ports were flat year over year

- Power-over-Ethernet (PoE) port shipments grew 11 percent in Q1 2018

- Number-one Cisco grew 7 percent year over year, number-two Huawei rose 43 percent, number-three HPE (Aruba) was up 2 percent and number-four Arista grew 40 percent

IHS Markit analysis:

Ethernet switch revenue declined 10 percent sequentially in Q1 2018 due to a seasonal slowdown in demand, but the longer-term growth outlook remains positive and strengthened further during the quarter, with year-over-year growth hitting 12 percent, up from 7 percent the previous quarter.

The market enjoyed its strongest growth in seven years in 2017, and the momentum continued into 2018, fueled by continuing data center upgrades and expansion, as well as growing demand for campus gear due to improving economic conditions. The transition to 25/100GE architectures in the data center is in full swing, driving strong gains in 25GE, 100GE and white box shipments. And power over Ethernet is growing once again, a sign of strengthening campus switching demand.

Growth is well balanced around the globe and not driven by any single geography. In Q1 2018, Europe, the Middle East and Africa (EMEA) and Asia Pacific were the top growth markets, increasing 15 and 16 percent, respectively, year over year, while growth in North America remained solid at 8 percent.

IHS Markit forecasts low- to mid-single-digit growth for the Ethernet switching market from 2019 to 2022. The bright spots will be the 10GE, 25GE, 100GE, 200GE and 400GE segments, where significant growth is expected over the next few years.

Ethernet switch report synopsis

The IHS Markit quarterly Ethernet switch report provides worldwide and regional market size, vendor market share, forecasts through 2022, analysis and trends for unmanaged, web-managed and fully managed fixed and chassis switches by port speed (100ME, 1GE, 2.5GE, 10GE, 25GE, 40GE, 50GE, 100GE, 200GE, 400GE) and revenue.

…………………………………………………………………………………………………………………………………………………………………………………………………

Related articles on Ethernet Switch Market:

IDC’s Worldwide Quarterly Ethernet Switch and Router Trackers Show Marked Improvement for Q1 2018

IDC: Global IT, telecom spending=$4T in 2018; Economic risks loom for 2019

Global IT and telecom spending will grow 3.7 percent to $4 trillion in 2018, but economic concerns could derail growth in 2019, according to IDC.

In 2017, IT and telecom spending grew at a 4.2 percent clip. IDC said economic issues like tariffs, rising interest rates and growth in China could cut IT spending to less than 3 percent.

Indeed, Daimler issued a profit warning based on Chinese tariffs on its U.S. made cars.

By 2022, annual IT spending should hit $4.5 trillion with software and services, cloud, and digital transformation seeing the most demand. Infrastructure spending has stabilized largely due to cloud spending.

IDC said there’s a likelihood for a mild U.S. recession by 2020, but spending on cost saving software and cloud should provide a buffer for IT spending.

Last year saw a significant rebound in spending on devices, driven by the improving economy and pent-up demand for PC upgrades. The smartphone market performed better than forecast in terms of value, with price increases making up for slowing shipments in many countries. Tablets continued to struggle but will return to modest growth in some countries over the next few years as premium and commercial devices begin to account for an increasing proportion of shipments. Meanwhile, server/storage spending is increasingly driven by cloud hyperscale datacenter buildout but is also benefiting from a significant enterprise upgrade cycle related to product refreshes. IT infrastructure spending, including network equipment, increased by 11% in 2017 and will continue to post annual growth in the range of 8-12% over the next five years even while spending on devices slows again.

“The infrastructure market is increasingly stable because a large proportion is now tied to the service provider model and overall demand for cloud services, which shows no sign of slowing down even in the event of a weakening economy,” said Stephen Minton, vice president, Customer Insights & Analysis. “To some extent, this spending will be more insulated against economic downturns than end-user capital spending, and therefore the IT market will be less vulnerable than it was in the past when any kind of GDP slowdown would translate into big declines for hardware spending. Nevertheless, economic risks are now higher than three months ago.”

US Demand is Stable, but China Facing Slowdown

All regions saw strong demand for technology in 2017, thanks to the broad-based strength of economic performance. The U.S. rebounded from 1.9% growth in 2016 to 4.5% in 2017. Tax cuts will help to ensure another strong year for the U.S. market in 2018, before overall growth is expected to slow. Many economists now expect a mild recession in the U.S. by 2020 at the latest, but the impact on ICT spending will be less than previous downturns due the growth of the service provider model and the increasing adoption of cost-saving software. Meanwhile overall growth in China slowed from 9% in 2016 to 8% last year and will drop to 6% in 2018.

“The economy is gradually slowing in China, but the real reason for slowing ICT growth is because the market is still heavily reliant on mobile devices, which are now seeing higher penetration rates,” said Minton. “Software and services are growing strongly, but still represent a very small proportion of average ICT budgets in China compared to other countries.”

Economy, Cloud, and Mobile Driving Growth

Other regions which posted improving growth in 2017 included Japan (+3%), Western Europe (+2%), Central & Eastern Europe (+3%), Canada (+5%), Asia/Pacific (excluding Japan) (+5%) and the Middle East/Africa (+2%). All of these regions benefited from improving business and consumer confidence, which enabled ICT buyers to work off the pent-up demand that had swelled during the prior years of subdued growth.

“Cloud and mobile are still the big drivers for traditional ICT spending, as legacy products and services like desktop PCs and fixed-line networks either stagnate or begin to decline,” added Minton. “This means what while the overall market is broadly tracking GDP, there is a lot of variation by product category. cloud-related hardware, software, and services are posting strong rates of growth. For example, Infrastructure as a Service (IaaS) is expected to grow by another 37% this year and will continue to grow by around 30% per year over the forecast. This in turn will ensure that cloud service providers continue to invest in server/storage and network infrastructure.”

https://www.idc.com/getdoc.jsp?containerId=prUS44021718

Point Topic: 931.6M Fixed Broadband Connections at end of Q4-2017; VDSL Growth but Copper Connections Continue Decline

|

|

|

IHS Markit: Optical Network Equipment Market off to slow start in 2018

By Heidi Adams, senior research director, IP and optical networks, IHS Markit

Highlights

- Global optical network hardware revenue totaled $3.1 billion in the first quarter of 2018 (Q1 2018), declining 25 percent sequentially and remaining flat on a year-over-year basis.

- The global Q1 2018 optical equipment market net of China was down 2 percent year over year. China itself was up 7 percent year over year, and continues to be a key market for optical transport equipment.

- Huawei remained the overall optical equipment market leader in Q1 2018, with 26 percent market share.

Our analysis

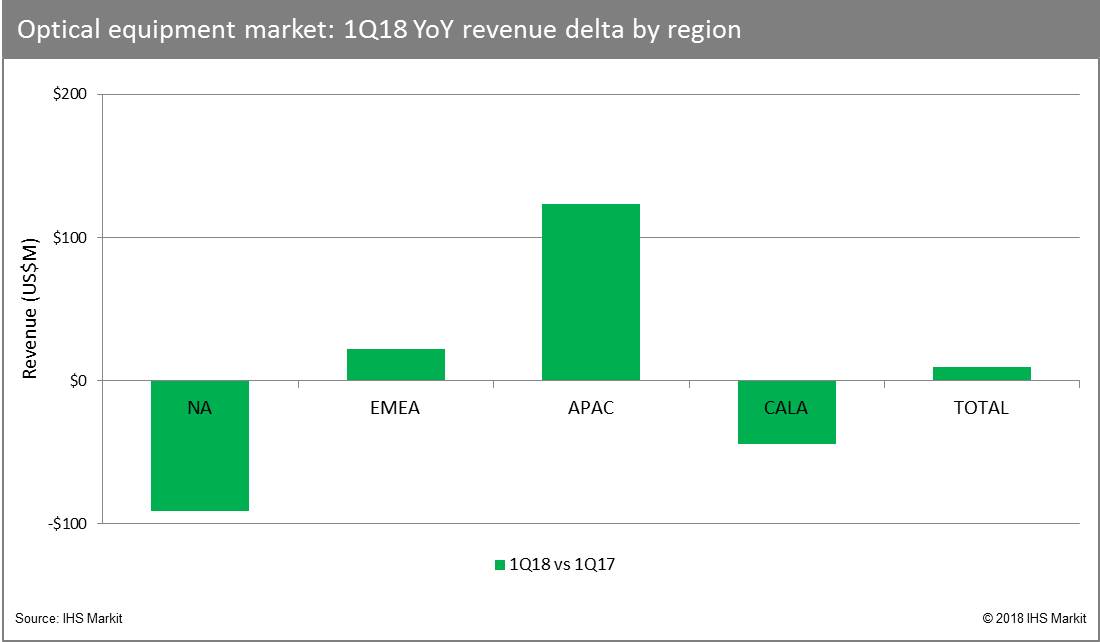

After a strong close to 2017, the optical equipment market got off to a lackluster start in 2018. Modest year-over-year growth in Europe, the Middle East and Africa (EMEA) and Asia Pacific was not sufficient to overcome year-over-year spending declines in North America and the Caribbean and Latin America (CALA) regions in the quarter. Total optical equipment market spending was down 25 percent on a sequential basis, with all regions seeing quarter-over-quarter declines.

Wavelength-division multiplexing (WDM) continues to be the growth engine for the market. In Q1 2018, the WDM segment totaled $2.9 billion, up 3 percent year-over-year, thanks to gains in EMEA and Asia Pacific. Both the metro and long haul segments experienced low single-digit year-over-year growth in Q1 2018.

Synchronous optical networking (SONET)/synchronous digital hierarchy (SDH) continued its overall decline. Global revenue came to $206 million in Q1 2018, down over 25 percent year over year. This segment represented less than 10 percent of the total optical network equipment market in the quarter.

Huawei continued to lead the total optical equipment market by a wide margin in Q1 2018. Nokia secured second place based on continuing strength in EMEA and increasing business in Asia Pacific. Ciena maintained its leadership position in North America and remained number three overall in the global market. ZTE rounded out the top four, but faces a difficult journey ahead with the impact of US sanctions and a subsequent halt in major operations.

Unstoppable bandwidth demand drives long-term growth

IHS Markit anticipates a continuing ramp in network capacity to address growing bandwidth demand. In the metro, the primary driver is burgeoning bandwidth demand—to, from and between data centers.

Not to be ignored is the coming broader introduction and adoption of consumer 4K and higher video content and services on a variety of devices. The shift from data to video to virtual reality (VR)/augmented reality (AR) will add yet another set of bandwidth-intensive and latency-sensitive services to the mix toward 2022.

Finally, a further evolutionary shift in mobile network architectures in preparation for 5G and a range of new fixed and mobile machine-to-machine (M2M) and Internet of Things (IoT) applications will set the stage for an investment cycle at the farthest reaches of the optical access network.

Based on these industry trends, the optical equipment market will grow at a compound annual growth rate (CAGR) of 4.5 percent from 2017 to 2022, according to IHS Markit forecasts.

……………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………

Editor’s Note:

We believe much of the anticipated fiber optic network growth will come from a variety of factors in the metro, including data center interconnect demands, higher-bandwidth video transmission (with the advent of 4K video) and eventually virtual and augmented reality. We think 5G mobile backhaul support is questionable in the next few years considering all the “5G” hype and lack of standards till IMT 2020 (5G radio aspects ONLY) recommendations are finalized in late 2020.

……………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………

Optical Network Hardware Market Tracker – Q1 2018

This report tracks the global market for metro and long-haul WDM and SONET/SDH equipment and SONET/SDH and WDM ports. It provides market size, market share, forecasts through 2022, analysis and trends.

NFIC Conference at SCU May 30, 2018 3PM-10PM: Accelerating Smart and Connected Communities

The joint IEEE-NATEA conference on an emerging technology is aimed to provide IEEE and NATEA members with an inexpensive solid overview of a technology that may affect their work and careers in the near future.

Co-organized initially by IEEE Computer Society Silicon Valley Chapter and NATEA in 1999, the New Frontiers in Computing Conference aims to provide computer and engineering professionals with enough technical information on a developing field to make informed decisions as to its role in their professional careers. NFIC strives to make all this accessible through an inexpensive one-day conference on emerging technologies such as Cloud Computing, Nanotechnology, Multi Core Processors and RFID.

Innovation in edge cloud and increased automation of technologies drive urban agglomeration to meet our lifestyle demands. Through keynotes, panelists, and presentations, this conference provides a means to enhance your understanding of the problems and solutions that are at trial in communities and the workplace.

The conference will address the innovation in edge cloud and the increased automation of associated technologies that are driving urban agglomeration to meet our lifestyle demands. In addition, we will explore how these technologies are being used in:

-Mobile Edge Computing with Distributed Cloud

-Smart Devices and Gateways

-Location-Based Applications

At the end of this conference, we hope you are equipped with the knowledge and tools to collaborate with your communities. Most importantly, we hope that you will carry forth the vision of bringing cutting-edge technologies and innovations to ensure that all benefit from the improved standards of living that smart and connected communities offer.

More info at:

https://ieee-nfic.org/program/

https://ieee-nfic.org

Dell’Oro: Market for disaggregated WDM systems increased 142% YoY in 1Q-2018

A new report from market research firm Dell’Oro Group states the market for disaggregated WDM platforms increased at a 142% year-over-year (YoY) growth in sales in the first quarter of this year. This high growth was driven by the adoption of disaggregated WDM systems expanding beyond web-scale companies and data center interconnect (DCI).

“Small form factor, disaggregated WDM systems were developed for the hyperscalers,” said Jimmy Yu, Vice President at Dell’Oro Group. “And for a long period of time, they were the only large purchasers. However, now we see a growing number of buyers that include cable operators and wholesale carriers. We think this is just the start of a good thing, and expect demand for these disaggregated systems will continue to grow at a hyper-scale rate,” added Yu.

Disaggregated WDM systems reached an annualized revenue run-rate of $800 million in the first three months of this year and Dell’Oro projects the run rate will exceed $925 million for full-year 2018. Ciena and Infinera currently have enjoyed the most success in this niche, with a combined market share of approximately 60% for the trailing four quarters ending in 1Q-2018.

………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

Author’s Note: The move towards disaggregated network equipment started in the Open Compute Project (OCP) Networking and Telco groups. It’s now being propelled forward by the the Telecom Infra Project (TIP) which aims to create greater innovation and flexibility through disaggregation of traditional (vendor specific/proprietary) network equipment. TIP is also attempting to disaggregate optical line terminal equipment (e.g. OLT) and transmission systems such as those that use mmWave frequencies. We first wrote about this disaggregation mega-trend almost three years ago in this article.

Here’s a schematic of an open line system (OLS), which allow transponders from many different suppliers to share a single line system:

………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

Dell’Oro Group’s “Optical Transport Quarterly Report” provides tables stating manufacturers’ revenue, average selling prices, and unit shipments (by speed, including 40 Gbps, 100 Gbps, 200 Gbps, and 400 Gbps). The report tracks DWDM long-haul terrestrial, WDM metro, multiservice multiplexers (SONET/SDH), optical switches, optical packet platforms, and data center interconnect (metro and long haul).

To purchase this report, call Daisy Kwok at +1.650.622.9400 x227 or email [email protected].

About Dell’Oro Group

Dell’Oro Group is a market research firm that specializes in strategic competitive analysis in the telecommunications, networks, and data center IT markets. Our firm provides in-depth quantitative data and qualitative analysis to facilitate critical, fact-based business decisions. For more information, contact Dell’Oro Group at +1.650.622.9400 or visit www.delloro.com.