SP Telecom deploys VeloCloud/VMware’s SD-WAN technology in Singapore

SP Telecom has launched Singapore’s first software-defined wide area network (SD-WAN). It’s based on VMware NSX SD-WAN by VeloCloud which VMware acquired last year. This will provide businesses with a low latency wide-area network that is automated and infrastructure-independent, to deliver robust and more secure networking services. Coupled with SP Telecom’s network management and consultancy services, this collaboration will expand SP Telecom offerings to meet growing customer demand to more securely run, manage, and connect any application from cloud to device.

The new SD-WAN services will provide businesses with the ability to automate and prioritize business-critical traffic to travel over faster, more secure connections, as well as set backup options for downed traffic links. This optimization of high traffic volume that enables near real-time access to rapidly changing data, is a key benefit crucial for mission-critical industries such as telecommunications, financial services, and the media and entertainment verticals.

In a multi-cloud era, where businesses operate in an increasingly complex environment, VMware NSX SD-WAN combined with SP Telecom’s diverse and utility-base data network provides simplicity, enabling greater flexibility to:

- support virtualized services from the cloud, connecting branch offices and mobile users to any type of data centers such as enterprise, cloud, or software-as-a-service;

- enable bandwidth expansion economically;

- provide optimal connectivity and access to the cloud and on-premises;

- accelerate new site deployments through zero-touch automated deployment.

SP Telecom’s data network is truly diverse, with network paths running along the Singapore power grid, enabling network resiliency for business-critical functions. Furthermore, this data network is enhanced with superior latency performance for more efficient processes. This reduces the risk of outage that could occur due to power or active equipment failure. Part of its network consultancy services, SP Telecom analyses and optimizes the network to deliver cost savings and efficiency. The connectivity and consultancy services, bundled with the new SD-WAN offering, will enable businesses to innovate fast and more securely by delivering robust performance for cloud applications, all through zero-touch deployment, the automation of network infrastructure implementation. Velocloud says their SD-WAN reduces the branch office footprint with a single click with seamless insertion and chaining of virtualized services on premise and in the cloud.

SP Telecom has more than 1M km of fiber connecting more than 100 sub-stations (data centers and commercial buildings) in Singapore as per this graphic:

Figure above courtesy of SP Telecom

……………………………………………………………………………………………………………………………………………………………………………………

“Smart and discerning businesses are competing to offer differentiated end-user experiences, and with advanced connectivity, they can go-to-market quickly and roll out new innovations to meet the changing demands of customers,” said Titus Yong, Chief Executive Officer of SP Telecom. “This is precisely why we are enhancing our portfolio with VMware’s NSX SD-WAN on VeloCloud, a game-changer that will provide our enterprise customers with the best-in-class network infrastructure that they need to sharpen their competitive edge and win in a digital era.”

NSX SD-WAN is touted by Velocloud as the industry-leading SD-WAN solution. One that enables customers to deliver better cloud and application performance with full visibility, metrics, control, and automation of all devices and user endpoints, and lower overall costs. VMware NSX SD-WAN provides an extensible platform for enterprises and telcos to integrate both on-premise and cloud services under the same consistent business policy framework. It’s said to eliminate data center backhaul penalties with a cloud-ready network to provide an optimized direct path to public and private enterprise clouds.

“We are shifting from a model of data centers to centers of data at the network’s edge. This new networking approach, virtual cloud networking, is required to manage the hyper-distribution of applications and data,” said Sanjay K. Deshmukh, vice president and managing director, Southeast Asia and Korea, VMware. “By deploying VMware SD-WAN by VeloCloud as part of a Virtual Cloud Network, SP Telecom can provide enterprise customers with consistent, pervasive connectivity and intrinsic security for applications, data, and users from the data centers to the cloud and the branch. VMware SD-WAN will enable their customers to streamline the digital transformation journey by providing superior application performance with significantly reduced network complexity,” he added.

References:

T-Mobile’s “Record Breaking” 4th Quarter, Prospects for Sprint Acquisition; 5G Bragging Rights?

Controlled by Deutsche Telekom, T-Mobile USA said it added 1 million postpaid phone customers in the December quarter, accelerating its holiday period gains from 891,000 new subscribers a year ago. For fiscal 2019, T-Mobile said it expects to add 2.6 million to 3.6 million subscribers.

T-Mobile CEO John Legere sounded very optimistic on Thursday’s earnings call:

“We had the highest total customer net additions ever in Q4 and we followed that up with record breaking financials, which is a winning formula for our shareholders. T-Mobile led the industry in postpaid phone net adds for the fifth year in a row and we posted a Q4 record low branded postpaid phone churn. Both service and total revenues hit record highs in this quarter while adjusted EBITDA was our best Q4 ever. Our 2019 guidance shows our confidence for the standalone outlook for T-Mobile. We continue to meet the needs of wireless customers and translate that into incredible results. I feel good about the state of our business going into 2019.

I want to reiterate unequivocally that prices will go down and customers will get more for less. We’re entering the final stages of our regulatory review process and it’s an important time to document the commitments that we’ve made from day one. This is another example of T-Mobile putting its money where its mouth is and backing up what we said in our public interest statement.

In summary, I am very, very pleased with the progress we’ve made on our merger and the process so far and I continue to expect regulatory approval in the first half of this year. Okay, to wrap it up I also couldn’t be more excited about the performance in 2018 and our guidance shows continued momentum in 2019. The combination with Sprint means that we will be able to create a future that is even more exciting for American consumers.”

Legere also said that he expects the acquisition of Sprint to be approved in the first half of this year.

“We continue to work through the regulatory review process with humility and respect for all parties involved. A number of major milestones have been completed and we remain optimistic and confident that once regulators review all the facts they will recognize the significant pro consumer and pro competitive benefits of this combination. We continue to have a productive dialogue with both federal and state regulatory authorities.”

On Monday, T-Mobile told U.S. Federal Communications Commission it would not increase prices for three years, with few exceptions, if it gets approval to buy Sprint for $26 billion.

In sharp contrast, MoffettNathanson analyst Craig Moffett said in a report published on Thursday: “A series of developments over the past few weeks have forced investors to consider the possibility that T-Mobile’s merger with Sprint may be in more trouble than previously appreciated,”

……………………………………………………………………………………………………………………………………………………………………………………………………………….

T-Mobile has just a 10 percent market share of business customers, said Chief Operating Officer Mike Sievert during the call, giving the carrier opportunity for more growth. “Now that the network is there … we’re starting to see these kinds of customers come in, in historic numbers,” Sievert said. T-Mobile added network capacity in rural areas of the United States during the 4th quarter of 2018.

Legere summarized the wireless carrier’s progress and 5G and how the competition (mostly AT&T) responded:

“Our engineering team is hard at work furiously building out our 600 MHz and setting the stage for America’s first real nationwide 5G network next year. Our aggressive build out is on 5G ready equipment and we have made rapid progress in just one year since getting our hands on the spectrum. 2700 cities and towns in 43 states and Puerto Rico are live on 600 MHz and we already have 29 600 MHz capable devices in our lineup today including the new iPhones.

We have standards based 5G equipment deployed to six of the top 10 markets including New York and Los Angeles. We believe the 5G revolution should be for everyone, everywhere, and not just the few intense areas. While the other guys hyped 5G we continue to focus on real 5G using global standards based equipment, 5G NR that will light up and deliver for customers across the U.S.

How has the competition responded to our plans? Well, AT&T responded by trying to rebrand 4G as 5GE and we know the customers see right through their bullshit and Verizon by the way, their current standard pups, pre-standard 5G footprint covers what they even themselves call limited areas in four cities, while our 5G capable 600 MHz network already covers hundreds of thousands of square miles. Also we continue to expand our 4G LTE coverage and deliver industry leading network performance.

Our network now covers more than 325 million Americans with 4G LTE effectively matching Verizon’s population coverage. We now have 600 and 700 MHz low band spectrum deployed to 301 million people across the country and we continue to lead the industry in 4G LTE speeds. In Q4 our average download 4G LTE speed was 33.4 Mb per second once again ahead of all the competitors. We remain very confident in our outlook for 2019 and this is reflected in our guidance.”

T-Mo CTO Neville Ray, bragging about T-Mobile’s adding 600 MHz spectrum for both 5G NR and LTE, said that the uncarrier’s 600 MHz spectrum is deployed in more than 2,700 cities and is supported by 29 devices. It is “going to be the biggest and largest and most transformative piece as we move through ’19 and into ’20. We do not take our eye off the ball at all on capacity and performance…The 600 LTE rollout has been going incredibly strong. As we get our software matured and ready for primetime, we will light up 5G services on those same radios. The 5G story is coming on super strong.” If that wasn’t enough, Ray said:

“You can see an aggressive competitive response against 5G NR victory lap on the fastest LTE. AT&T especially trying to figure out how to not be second or third in that race for the coming couple of years. We’re going to be adding 600 MHz spectrum to the fight, both with LTE and with 5G NR and speeds and performance are going to continue to increase on this network into 2019 and materially more so in 2020 when we can reach our nationwide ambition on the 600 MHz 5G deployment……

Biggest focus right now is, as we’ve reference multiple times here is the 600 MHz build, that’s going to be the biggest and largest and most transformative piece as we move through ’19 and into ’20. I mean thousands upon thousands of new sites with 600 MHz capability coming on air, but we do not take our eye off the ball at all on capacity and performance. We’re at the best capacity performance in our company’s history right now, lowest congestion figures we’ve ever seen. We love to be that way.

The proxy for that in the marketplace is our fastest speed performance. And as I mentioned earlier, we continue to win on that front and look to maintain that lead. On the small cell piece, we are starting to see and introduce license assisted access, so LTE in the 5 gig space we’re seeing very positive results and returns from those investments and so a lot of opportunity to grow capacity in the urban calls. We’re not taking our eye off that ball, but big, big most major improvements coming on the 600 MHz side this year.”

On small cells: “(we have) just over 21,000 small cells in play today. We plan on continuing our march on small cells another 20,000 or so plan to come off as we exit ’19 and into ’20. And we continue to densify this network to prepare for obviously a tremendous capacity and performance future.”

T-Mo President Mike Sievert on incremental revenues and pricing:

“So, on pricing, the short answer would be, we have big aspirations for incremental revenues and growth from 5G, but not through pricing, through our current smartphone plans. So the incremental revenues come from more and more users picking wireless technologies instead of other technologies for their conductivity.

There is a big broadband business that we expect to build, there are big enterprise opportunities, there are IoT opportunities, there more devices per users, there are new capabilities being developed, all of which we can monetize with revenue growth. But we don’t have plans for the smartphone plans that you see today to charge differently for 5G enablement versus 4G LTE.”

Legere concluded his bragging about T-Mo’s (not yet deployed with paying customers) 5G network:

“Yes, so again, as I said from the very first day back in April going into the first week of May, I’ve been down here in Washington with the very same story that the 5G Network that’s going to be built with the $40 billion worth of investment and the breadth and the depth is going to be something that the country needs and has yet to see, it’s going to be super charging the uncarrier, capacity will go up precipitously and prices will go down and jobs will increase. And that’s been a dialogue that has gone from sound bite to tremendous modeling and conversation and depositions and hearings.”

References on T-Mo’s 5G at 600MHz:

https://www.t-mobile.com/news/first-600mhz-5g-test

https://www.digitaltrends.com/mobile/t-mobile-5g-rollout/

http://fortune.com/2019/02/07/t-mobile-5g-prices-sprint/

https://www.rcrwireless.com/20190207/carriers/t-mobile-us-600-mhz-update

………………………………………………………………………………………………………………………….

Related post:

The Future of 5G—and the Risks that Come With It

CoBank: Secular Tailwinds Support Current Fiber Optic Company Valuations

Fiber network consolidation has driven up the value of fiber optic networks for strategic buyers and infrastructure funds, says rural communications infrastructure financing company CoBank in a new report. As CoBank notes, the number of fiber networks available for acquisition has declined, causing the report authors to speculate that investors will turn their attention next to regional cable operators and potentially to rural local exchange carriers (RLECs).

Driving fiber consolidation and fiber network values is Americans’ growing demand for bandwidth, the report states. The authors cite research from Deloitte that forecasts the need for an estimated $130 billion to $150 billion in fiber infrastructure investment over the next five to seven years. Key demand drivers include broadband competition, rural coverage and wireless densification.

Building fiber networks takes a long time and as operators race to meet the expected surge in demand, a build/lease hybrid model will likely continue to play out over the next several years. Institutional investor interest in the fiber market should continue given the underlying demand drivers and predictable revenue streams these networks offer.

Given the relatively high entry barriers in the fiber market and consumers’ insatiable demand for data, there do not appear to be many glaring risks to fiber valuations. Oversupply is the most obvious one, but this is more region-specific than any kind of systemic risk, particularly given the proliferation of data usage.

Considering the amount of industry consolidation and scarcity of acquisition candidates, fiber-rich cable operators could become attractive assets for both institutional investors and strategic buyers. All of these factors paint a positive picture for future fiber valuations.

According to CoBank, fiber valuations have increased approximately 30% over the last 12 months, and some buyers have paid multiples above 20 times earnings before interest, taxes, depreciation and amortization (EBITDA).

The authors caution that “there is clearly a disconnect between public (e.g. fiber operator Zayo) and private fiber valuations.” The report attributes this disparity to “volatility in equity markets and waning investor confidence that have resulted in public valuations coming in much lower than private valuations.”

CoBank doesn’t see lower public company valuations negatively impacting those of private companies, however.

“Infrastructure funds have a much longer time horizon, and strategic buyers enjoy synergies that will allow them to pay a higher multiple versus myopically focused public equity investors,” the authors wrote.

Fiber Network Consolidation

The CoBank report references several key fiber network acquisitions by strategic buyers and foreign infrastructure funds, including:

- Macquarie Infrastructure’s plan to purchase Bluebird Network in conjunction with Uniti Group

- European-based EQT purchasing a majority stake in Spirit Communications and EQT’s plan to combine those operations with Lumos

- Antin Infrastructure Partners purchase of FirstLight Fiber

- Crown Castle’s purchase of Lightower, Wilcon Holdings and Fibernet Holdings

With so many deals in the rear-view mirror, CoBank noted that FiberLight, which has 14,000 route miles of fiber, is one of few remaining privately held fiber network operators that has yet to be acquired.

As a result, CoBank argues that strategic buyers and infrastructure funds are likely to begin taking a closer look at those regional cable operators that have been investing in fiber and at “progressive RLECs” that have been investing in fiber to offset their declining regulated revenues.

Although CoBank didn’t specifically identify the category, it would seem that statewide and regional fiber networks owned by RLEC consortia might be a particularly attractive category for such investors.

………………………………………………………………………………………………………………………………………………………..

References:

https://www.cobank.com/knowledge-exchange/communications/fiber-valuations

https://www.youtube.com/watch?v=GDqOw3jfsMshttps://www.youtube.com/watch?v=GDqOw3jfsMs

Synergy Research: Cloud Service Provider Rankings (See Comments for Details)

………………………………………………………………………………………………………………………………………………………………………

According to Larry Dignan of ZDNET, “the cloud computing market in 2019 will have a decidedly multi-cloud spin, as the hybrid shift by players such as IBM, which is acquiring Red Hat, could change the landscape. This year’s edition of the top cloud computing providers also features software-as-a-service giants that will increasingly run more of your enterprise’s operations via expansion.

One thing to note about the cloud in 2019 is that the market isn’t zero sum. Cloud computing is driving IT spending overall. For instance, Gartner predicts that 2019 global IT spending will increase 3.2 percent to $3.76 trillion with as-a-service models fueling everything from data center spending to enterprise software. In fact, it’s quite possible that a large enterprise will consume cloud computing services from every vendor in this guide. The real cloud innovation may be from customers that mix and match the following public cloud vendors in unique ways. ”

Key 2019 themes to watch among the top cloud providers include:

- Pricing power. Google recently raised prices of G Suite and the cloud space is a technology where add-ons exist for most new technologies. While compute and storage services are often a race to the bottom, tools for machine learning, artificial intelligence and serverless functions can add up. There’s a good reason that cost management is such a big theme for cloud computing customers–it’s arguably the biggest challenge. Look for cost management and concerns about lock-in to be big themes.

- Multi-cloud. A recent survey from Kentik highlights how public cloud customers are increasingly using more than one vendor. AWS and Microsoft Azure are most often paired up. Google Cloud Platform is also in the mix. And naturally these public cloud service providers are often tied into existing data center and private cloud assets. Add it up and there’s a healthy hybrid and private cloud race underway and that’s reordered the pecking order. The multi-cloud approach is being enabled by virtual machines and containers.

- Artificial intelligence, Internet of things and analytics are the upsell technologies for cloud vendors. Microsoft Azure, Amazon Web Services and Google Cloud Platform all have similar strategies to land customers with compute, cloud storage, serverless functions and then upsell you to the AI that’ll differentiate them. Companies like IBM are looking to manage AI and cloud services across multiple clouds.

- The cloud computing landscape is maturing rapidly yet financial transparency backslides. It’s telling when Gartner’s Magic Quadrant for cloud infrastructure goes to 6 players from more than a dozen. In addition, transparency has become worse among cloud computing providers. For instance, Oracle used to break out infrastructure-, platform- and software-as-a-service in its financial reports. Today, Oracle’s cloud business is lumped together. Microsoft has a “commercial cloud” that is very successful, but also hard to parse. IBM has cloud revenue and “as-a-service” revenue. Google doesn’t break out cloud revenue at all. Aside from AWS, parsing cloud sales has become more difficult.

IBM is more private cloud and hybrid with hooks into IBM Cloud as well as other cloud environments. Oracle Cloud is primarily a software- and database-as-a-service provider. Salesforce has become about way more than CRM.

………………………………………………………………………

Vietnamese Mobile Network Operators in 5G Trials

Vietnam Minister of Information & Communications Nguyen Manh Hung signed a decision to license the implementation of 5G for Viettel – a military-run telecommunications company. This licence was granted to test and evaluate technical features and the ability to deploy telecommunications infrastructure using (undisclosed spec for) 5G technology. Hanoi and Ho Chi Minh (HCM) City will be the first two cities to test Viettels 5G and the trial will last for 12 months. Users will not be charged during the test period.

The group must be responsible for investment efficiency and report results to the Ministry of Information and Communications. The ministry said that, together with the 5G trial, it would license the new 4G frequency and study the route to find the right time to turn off 2G or 3G waves.

Viettel engineers install telecom equipment. The company is ready to trial 5G technology. – VIET NAM NEWS/ANN

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………….

Meanwhile, MobiFone said they had sent a document to the Ministry of Information and Communications, asking for 5G testing in Hanoi and HCM City to evaluate technology and the marketplace before officially going live. MobiFone General Director Nguyen Dang Nguyen said they asked for permission to test 5G for the Ministry of Information and Communications from September last year. MobiFone is working with equipment suppliers to prepare for this test. It is expected that devices will come to Vietnam and will be installed in the second quarter of this year, he said.

Viet Nam Posts and Telecommunications Group (VNPT), is also planning to test 5G in the future. VNPT and Nokia signed a co-operation agreement to research, survey and test 5G technology and Internet of Things (IoT) during the working visit in Europe of Prime Minister Nguyen Xuan Phuc in October last year. The project is expected to be implemented within three years and worth around US $15 million. Chairman of VNPTs member council Tran Manh Hung said the group submitted documents to the Ministry of Information and Communications to ask for 5G testing. The purpose of the 5G testing is to enable VNPT to master the technology and plan the network in the future. VNPT had also tested to prepare for the production of 5G network devices, he said.

https://borneobulletin.com.bn/vietnamese-operators-speed-up-with-5g/

…………………………………………………………………………………………………………………………………………………………………………………………………………………

“Vietnam should be among the first nations to launch 5G services in order to move up in global telecom rankings,” said Nguyen Manh Hung, the country’s new minister of information and communications.

Four Vietnamese telecom companies — Vietnamobile, a joint venture of Hanoi Telecom and Hongkong based Hutchison Asia Telecommunications, and three state-owned entities, Viettel, Vietnam Posts and Telecommunications Group, MobiFone and Vietnamobile — are expected to receive 5G testing licenses this year.

https://asia.nikkei.com/Business/Technology/Vietnam-to-begin-testing-5G-networks-next-year

AT&T’s 5G Use Cases at NGNM Conference on Licensing Practices in 5G Industry Segments

Dawn Of The 5G World – AT&T Perspective

by Michael Robinson Director, Business Development AT&T Intellectual Property

Current “5G” Deployment:

• Live in 12 Cities: Atlanta, Charlotte & Raleigh, NC, Indianapolis, Jacksonville, FL, Louisville, KY, Oklahoma City, New Orleans, Dallas, Houston, San Antonio & Waco, TX

• Millimeter wave spectrum

2019-2020 “5G” Deployment:

• Live in 9+ additional cities: Austin TX, Las Vegas, Nashville, New York City, Orlando, Los Angeles, San Diego, San Francisco and San Jose, CA, (millimeter wave spectrum)

• Nationwide coverage available early 2020 (sub 6Ghz spectrum)

5G Use Cases:

1. Healthcare

• Provide more effective healthcare and improve revenue realization for providers

• Minimize need for annual exams or office visits

• Wearables/Home Sensors provide near constant monitoring

• Alert healthcare providers of potential ailments or abnormalities

• Preventative Care: wearables will calculate daily recommendations, provide prompting based on medical records, real-time vitals, projected needs

• Hospital of the Future: collaboration with Rush University Medical Center and the Rush System for Health

2. Retail

• Enable in-store 3D printers to create custom products

• AR/VR to try on clothing

• Home improvement stores use VR to create personalized demo of remodeling options

3. Finance

• Create highly customized financial/insurance experiences

• High resolution video enables customer interaction with in-person or AI representatives

• Security – AI cyber immune system to send threat intelligent defender cells from one edge of the network to the other

• Insurance companies

• Dispatch drones for claim investigations

• Holographic teleportation for adjusters – tour damaged property to provide benefits more rapidly

4. Manufacturing

• IoT neural network enables a ‘brain’ to react, calibrate and optimize end-to-end manufacturing process

• Robots mimicking human capabilities to carry out high-risk, dangerous tasks

• Network reliability and low latency enables manufacturing equipment to communicate wirelessly with back-end systems for time critical operations

• Samsung Austin Semiconductor “Innovation Zone”

• Test bed for the Smart Factory

• Location services to improve safety

• Industrial IoT sensors – environmental & equipment conditions

AT&T Foundry (Plano, TX) – Use Case Development:

• Plano Foundry prototypes innovative solutions for AT&T customers in manufacturing, retail, finance, public sector

• 5G functionality (2019) to co-create 5G solutions:

• Using 5G-enabled network slicing in a manufacturing shop floor to create a separate network for operational equipment efficiency,

• Transform the retail buying experience for consumers through innovative solutions like digital signage, IoT-enabled smart shelving and auto-inventory tracking,

• Enabling life-changing healthcare technologies, like Aira, that use our IoT connectivity to bridge the physical gap between caregiver and patient,

• Deploying drones to rethink the damage assessment process for insurance companies, and ………………

• Applying AI or machine learning techniques to enhance situational awareness for first responders

https://www.itu.int/en/ITU-T/Workshops-and-Seminars/itu-ngmn/Documents/2018/Michael_Robinson_Presentation.pdf

…………………………………………………………………………………………………………………………………………………………..

NGMN Alliance Backgrouner: by Peter Meissner, CEO NGMN

The NGMN Alliance was founded by leading international mobile network operators in 2006 with the “Objective to ensure that functionality and performance of next generation mobile network infrastructure, service platforms and devices will meet the requirements of operators and, ultimately, will satisfy end user demand and expectations.”

§ NGMN actively drives global alignment and convergence of technology standards and industry initiatives with the objective to avoid fragmentation and to guarantee industry scale.

§ A global presence has been established that comprises a leadership network of about 90 Partners: Operators, Vendors, Software Companies and Universities. These Partners are contributing to and delivering the results of the Work Programme with a focus on 5G. Several Cooperation Partners support the NGMN Alliance by two-way liaison statements.

§ The 5G Eco-System is different! New use cases beyond mobile broadband like massive IoT as well as highly demanding requirements from Vertical Industries on low latency, ultra-high reliability and security are causing substantial network transformation. Service Based Architecture, Network Slicing as well as Network Function Virtualisation are the solutions with major impact on network architecture and operations.

………………………………………………………………………………………………………………………………………………………………………………………

AT&T’s 5G Use Cases at NGNM Conference on Licensing Practices in 5G Industry Segments

Dawn Of The 5G World – AT&T Perspective

by Michael Robinson Director, Business Development AT&T Intellectual Property

Current “5G” Deployment:

• Live in 12 Cities: Atlanta, Charlotte & Raleigh, NC, Indianapolis, Jacksonville, FL, Louisville, KY, Oklahoma City, New Orleans, Dallas, Houston, San Antonio & Waco, TX

• Millimeter wave spectrum

2019-2020 “5G” Deployment:

• Live in 9+ additional cities: Austin TX, Las Vegas, Nashville, New York City, Orlando, Los Angeles, San Diego, San Francisco and San Jose, CA, (millimeter wave spectrum)

• Nationwide coverage available early 2020 (sub 6Ghz spectrum)

5G Use Cases:

1. Healthcare

• Provide more effective healthcare and improve revenue realization for providers

• Minimize need for annual exams or office visits

• Wearables/Home Sensors provide near constant monitoring

• Alert healthcare providers of potential ailments or abnormalities

• Preventative Care: wearables will calculate daily recommendations, provide prompting based on medical records, real-time vitals, projected needs

• Hospital of the Future: collaboration with Rush University Medical Center and the Rush System for Health

2. Retail

• Enable in-store 3D printers to create custom products

• AR/VR to try on clothing

• Home improvement stores use VR to create personalized demo of remodeling options

3. Finance

• Create highly customized financial/insurance experiences

• High resolution video enables customer interaction with in-person or AI representatives

• Security – AI cyber immune system to send threat intelligent defender cells from one edge of the network to the other

• Insurance companies

• Dispatch drones for claim investigations

• Holographic teleportation for adjusters – tour damaged property to provide benefits more rapidly

4. Manufacturing

• IoT neural network enables a ‘brain’ to react, calibrate and optimize end-to-end manufacturing process

• Robots mimicking human capabilities to carry out high-risk, dangerous tasks

• Network reliability and low latency enables manufacturing equipment to communicate wirelessly with back-end systems for time critical operations

• Samsung Austin Semiconductor “Innovation Zone”

• Test bed for the Smart Factory

• Location services to improve safety

• Industrial IoT sensors – environmental & equipment conditions

AT&T Foundry (Plano, TX) – Use Case Development:

• Plano Foundry prototypes innovative solutions for AT&T customers in manufacturing, retail, finance, public sector

• 5G functionality (2019) to co-create 5G solutions:

• Using 5G-enabled network slicing in a manufacturing shop floor to create a separate network for operational equipment efficiency,

• Transform the retail buying experience for consumers through innovative solutions like digital signage, IoT-enabled smart shelving and auto-inventory tracking,

• Enabling life-changing healthcare technologies, like Aira, that use our IoT connectivity to bridge the physical gap between caregiver and patient,

• Deploying drones to rethink the damage assessment process for insurance companies, and ………………

• Applying AI or machine learning techniques to enhance situational awareness for first responders

https://www.itu.int/en/ITU-T/Workshops-and-Seminars/itu-ngmn/Documents/2018/Michael_Robinson_Presentation.pdf

…………………………………………………………………………………………………………………………………………………………..

NGMN Alliance Backgrouner: by Peter Meissner, CEO NGMN

The NGMN Alliance was founded by leading international mobile network operators in 2006 with the “Objective to ensure that functionality and performance of next generation mobile network infrastructure, service platforms and devices will meet the requirements of operators and, ultimately, will satisfy end user demand and expectations.”

§ NGMN actively drives global alignment and convergence of technology standards and industry initiatives with the objective to avoid fragmentation and to guarantee industry scale.

§ A global presence has been established that comprises a leadership network of about 90 Partners: Operators, Vendors, Software Companies and Universities. These Partners are contributing to and delivering the results of the Work Programme with a focus on 5G. Several Cooperation Partners support the NGMN Alliance by two-way liaison statements.

§ The 5G Eco-System is different! New use cases beyond mobile broadband like massive IoT as well as highly demanding requirements from Vertical Industries on low latency, ultra-high reliability and security are causing substantial network transformation. Service Based Architecture, Network Slicing as well as Network Function Virtualisation are the solutions with major impact on network architecture and operations.

………………………………………………………………………………………………………………………………………………………………………………………

India’s 5G Conundrum: Mass Adoption not seen till 2023-2024!

by Hetal Gandhi (edited by Alan J Weissberger)

The writer is a Director at CRISIL Research

As the noise around India’s upcoming 5G spectrum auction rise, one must remember that ecosystem development is crucial to the success of next-generation technology. India is yet to complete the transition from 2G and 3G to 4G-LTE. But the march towards 5G is inexorable and necessitates giga-buck spending. Telcos have already invested more than Rs 3 lakh crore (India money) over the past three years, and a large portion of that money has been used to roll out 4G-LTE networks across the country, and we are still counting.

The implementation of any paradigm-shifting technology spawns manifold ecosystem changes such as spectrum usage, network infrastructure and devices. While newer bands will be made available for 5G services in India, the reserve price for the spectrum bands, recommended by the Telecom Regulatory Authority of India (TRAI) at around $0.23/MHz/pop (for metros), is almost twice compared to $0.12/MHz/pop auctioned in the UK in June 2018.

At TRAI’s pricing, owning a block of 20 MHz spectrum across circles in the 3.3-3.6 GHz band will cost a staggering Rs 98,000 crore or so. Also, high-frequency bands such as these will require more investments in cell sites because of their low-propagation characteristics. Even though a combination of sub-1 GHz and 3.3-3.6 GHz is ideal for the 5G rollout, prices in the 700 MHz band remain very high while the rest of the sub-1 GHz bands will be mostly utiliszd for 2G (voice) and 4G-LTE services.

The government seems ready to conduct the 5G auction towards the end of 2019, but it is imperative for telcos to check the readiness of their ecosystems before plonking down truckloads of money to buy spectrum. On the other hand, if the US and China successfully adopt 5G by 2020 as expected, subsequent adopters will have the benefit of lower network equipment and device costs, thus making the ecosystem transition smoother.

An important 5G ecosystem prerequisite, essential to building use cases, is optic fibre networks. But India lags far behind with lower than 30 per cent use of fibre as on date compared to more than 70 per cent in the US and China. CRISIL Research estimates that India needs to lay another 10 lakh fibre km to be 5G-ready. That will require an investment of over Rs 1 lakh crore.

Nearly three-fourths of this cost will occur to get right-of-way (RoW) approvals, which can be as high as Rs 1 crore per km in metros. We believe it will take three-four years for telcos to reach the required fibre levels, given delays in RoW and other permissions.

For telcos, getting RoW approvals has been as much an issue as making investments and RoW issues may delay fibre deployment. However, leasing of fibre can significantly reduce the investments required, depending on sharing modalities, and it will also make India 5G-ready sooner.

Furthermore, the Indian telecom industry is struggling under a massive debt load of Rs 4 lakh crore (as of March 31, 2018). In the recent past, a combination of asset and stake sales and sponsor support have helped telcos maintain their debt levels. But bundling of voice with data amid a price war, coupled with high investments, has resulted in low returns. We now see low single-digit returns on the capital employed in the industry compared to more than 15 per cent three-four years ago. So, telcos need to explore areas of revenue generation to make such investments viable.

While 5G-enabled devices are expected to enter India in late 2019 or early 2020, it may take another three-four years before mass adoption of affordable versions takes place. With the number of interconnected devices rising, the Internet of things will unfold newer revenue streams across domains such as healthcare, education and transportation. A lot is in store for Indian telcos, but things will not take a clear shape before fiscal 2023.

Copyright 2019. Living Media India Ltd

Sprint’s Earnings Report + Update on LTE Wireless Network and 5G Launch

Sprint Corp.’s third quarter earnings report showed the company’s effort to produce rapid growth and cut costs, while awaiting approval of its proposed $26.5 billion merger with T-Mobile US Inc.

On Thursday January 31th, the Overland Park-based wireless carrier reported its second consecutive quarter of year-over-year growth in wireless service revenue and its sixth consecutive quarter of postpaid net additions. The company also reported its 12th consecutive quarter of operating income.

Sprint reported 309,000 postpaid net additions in the quarter that ended Dec. 31, an improvement of 53,000 compared to the previous year, as the carrier focused on growing revenue per customer with wearables and other services.

“Sprint’s strategy of balancing growth and profitability while we work toward regulatory approval of our T-Mobile merger is reflected in our fiscal third-quarter results,” Sprint CEO Michel Combes said in a press release. “We delivered solid financials, increased network investments as we prepare for our mobile 5G launch, and continued the digital transformation of the company.”

For the full fiscal year, the company expects to cut costs by more than $1 billion for the fifth consecutive year, with net reductions of less than $500 million after reinvestments. Sprint more than doubled its quarterly network investments, or cash capital expenditures excluding leased devices, to $1.4 billion, and increased by approximately $150 million compared to the previous quarter as the company moved toward launching its 5G service. The company reports it now has 2.5 GHz spectrum deployed on approximately 75 percent of its macro sites, and has 27,000 small cells deployed — both key factors in deploying 5G service.

Sprint reported a net loss of $141 million in the quarter compared to a net income of $7.2 billion in the year-ago period.

https://www.bizjournals.com/kansascity/news/2019/01/31/sprint-third-quarter-earnings-report.html

…………………………………………………………………………………………………………………………………………………………………………………………………………….

Highlights of Sprint’s Earnings Call:

Sprint CEO Michel Combes:

Atlanta is one of our Massive MIMO markets preparing for 5G launch in the coming months. That means fans in town for the Superbowl will see exceptional network performance in the highest traffic locations, whether they are inside or outside the stadium, to a nearby museum or hotel, or traveling around the city to one of the many special events planned this weekend.

We’re also preparing to launch our mobile 5G network in the first half of 2019. Our Massive MIMO radio are software upgradable to 5G NR as you know, allowing us to fully utilize our spectrum for both LTE and 5G simultaneously while we enhance capacity even further with 5G and begin to support new 5G use cases.

We celebrated an important milestone earlier this month on our path towards launching mobile 5G service in the first half of this year, when we completed the world’s first over-the-air 5G data transition using 2.5 and Massive MIMO on Sprint’s live commercial network.

We’ve also announced three 5G devices including smartphones from both LG and Samsung as well as a feature-rich mobile hotspot from HTC. The other carriers are not standing still, but our significant work investments, spectrum resources and cutting-edge technologies will help us continue to improve our network and we expect to deliver robust 5G experience in major metro areas.

Nevertheless, we’re hopeful to complete our merger with T-Mobile which is the only path to deliverings of breadth and depth of spectrum which will allow us to provide a truly consistent national-wide 5G experience to Americans.

As a stand-alone company, we love to scale to keep pace with the bigger carriers, AT&T and Verizon, in sustained capital investments and without additional low-band spectrum we will face challenges to provide customers with coverage comparable to that of the big two carriers.

Sprint CTO John Saw:

We expect to be substantially done with adding 2.5 GHz to where we needed it in another quarter, towards spring this year. And like we have said, we have made significant progress. A year ago, we were only at 50% of our sites having 2.5 GHz.

Small cells, again, a lot of momentum recently, 27,000 small cells. A year ago, we only had 3,000. So the permits are starting to come in. Some of our infrastructure that we are leveraging, especially with the cable companies, is making it easier for us to deploy small cells faster.

LTE Advanced has rolled out in more than 270 cities, and this is why we’re starting to make an impression even in the big markets where our customer experience speeds have improved significantly because of LTE Advanced.

We expect the LTE Advanced upgrades to complete around spring this year as well. Small cells will continue to be a focus for us because we need to continue to densify our networks even with 5G. A network is never done, Brett, so we are also rapidly transitioning to focusing on 5G as well. As you know, a lot of our radios that we’re deploying today with Massive MIMO allows us to simultaneously support LTE and 5G, and that is going to be the main focus for the rest of this year for 5G.

Closing remarks by Michel Combes:

We are aggressively executing our Next-Gen Network deployment to deliver a network build for unlimited with building the foundation for our mobile 5G network that will launch commercially in the coming months. We continue to enhance our value proposition and continue to transform our cost structure and customer experience with digital, artificial intelligence, advanced analytics and automation.

References:

Sprint’s Next-Gen Network and Massive MIMO as “linchpin for 5G”

NGNM Alliance conference with ITU on 5G and IoT licensing; RAN/Core Network report with WBA

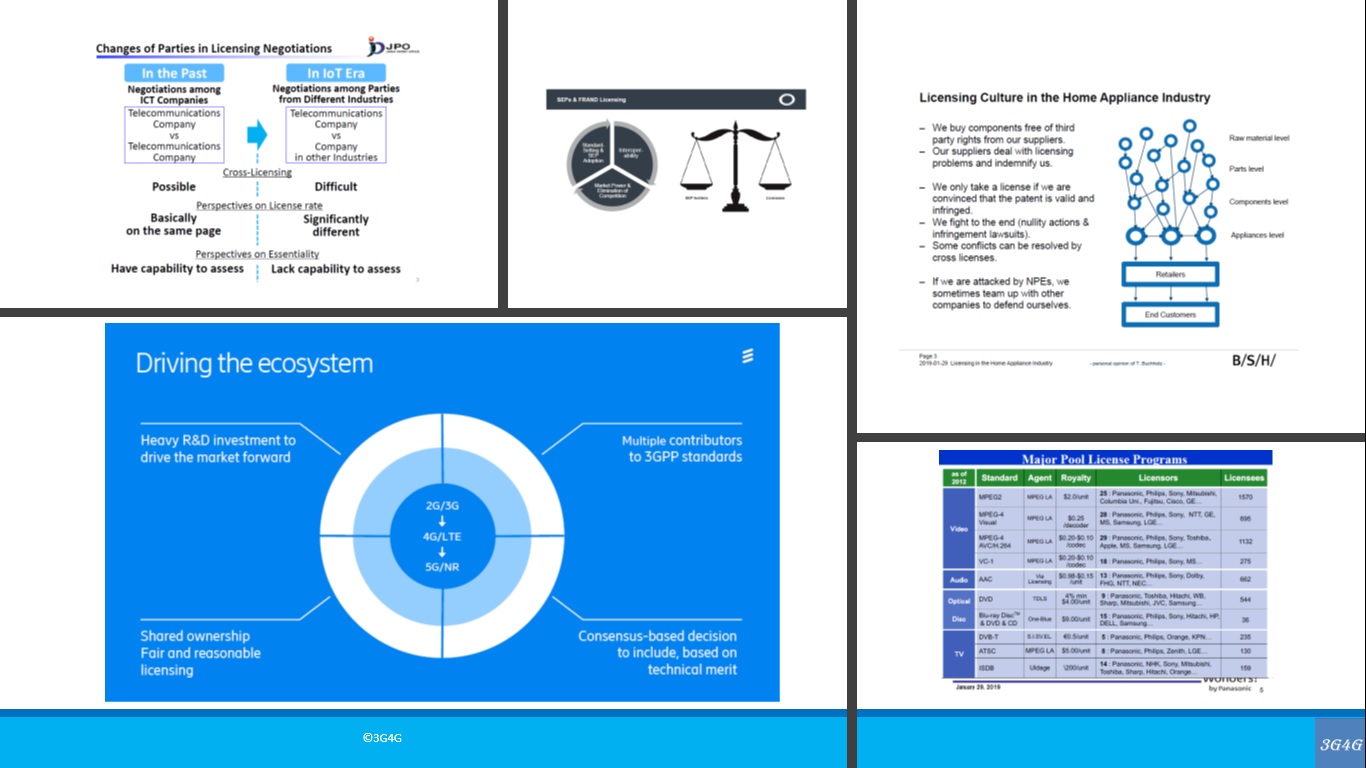

The Next Generation Mobile Networks (NGNM) Alliance and ITU organized and successfully held a multi-stakeholder conference on licensing practices in the emerging, pre-standard 5G industry and the Internet of Things (IoT). The conference, held in Geneva, Switzerland, attracted representatives from network operators including NTT Docomo, vendors including Ericsson, Nokia and Microsoft, and licensing and standards bodies such as ETSI and the Japanese and European Patent Offices.

Also participating were representatives from vertical industries set to benefit from the introduction of 5G – including automotive, consumer electronics and semiconductors – as well as patent tool administrators.

A host of insightful sessions took place igniting an inclusive exchange on:

- Patent licensing practices with interactive discussions that focused on issues stakeholders need to be aware of.

- Sharing licensors’, licensees’ and pool administrators’ requirements on patent pools/platforms.

- Identifying proposed practices and conducts for paent licensors and licensees.

- Listing requirements for increasing transparency and assessing essentiality of Standard Essential Patents declared to Standards Developing Organisations.

“It’s great to notice that our joint ITU-NGMN conference has been such a success. Obviously, the 5G ecosystem is different. New use cases beyond mobile broadband – like massive IoT as well as highly demanding requirements from vertical industries on low latency, ultra-high reliability and security – are causing substantial network transformation,” NGMN CEO Dr. Peter Meissner said. All these challenges have implications on the intellectual property of mobile network operators and across the different industry segments. Conferences like this are key in identifying IPR issues and exploring solutions for the enlarged ecosystem,” he added.

On a related matter, NGMN will be hosting a Press & Industry Briefing on 5G use cases beyond mobile broadband on 26thFebruary 2019, from 11am – noon at Mobile World Congressin Barcelona, Spain. If you are interested in attending or speaking to an NGMN representative, please contact: ngmn(at)proactive-pr.com.

AT&T’s 5G Use Cases at NGNM Conference on Licensing Practices in 5G Industry Segments

………………………………………………………………………………………………………………………………………………………

NGMN and Wireless Broadband Alliance (WBA) have published the first results of their collaboration to drive the convergence of multi-technology RANs and core networks. The joint report identifies a number of emerging opportunities and use cases that the industry can benefit from through the convergence of 3GPP’s 5G and Wi-Fi, driven by the ever-enhancing capabilities of licenced and unlicensed technologies. It also highlights the key challenges, which must first be addressed in order to realise convergence over 3GPP Access and Wi-Fi – including tighter integration of Wi-Fi access in 5G networks, network manageability and policy control, and the enablement of Wi-Fi-only devices.

The convergence opportunity

Wi-Fi and cellular ecosystems have traditionally followed their own development paths. The latest versions of each technology have greatly enhanced capability compared with early offerings, with Wi-Fi 6 and 3GPP’s 5G, encompassing New Radio (NR) and LTE from Release 15 onwards, as well as the 3GPP 5G Core. However, as society increasingly depends on fast reliable data connectivity, NGMN and WBA believe an important capability for the industry is the convergence at a network level between 5G and Wi-Fi, so that the unique and complementary capabilities of both RANs can be leveraged to provide seamless network services. Bearing in mind that a significant amount of data traffic from smartphones use a Wi-Fi access, this will lead to a better user experience and create new business opportunities for both Wi-Fi and cellular providers.

New resource requirements

The report identifies a number of use cases and verticals that may require combined resources from both 5G and Wi-Fi networks in providing cost effective solutions that meet diverse sets of requirements on throughput, latency, connection density, coverage, availability and reliability. For example, enterprise services on cellular networks, and in particular, those that the 5G Core enables, may require a new look at the use of an access neutral mechanism for a number of reasons. These include gaps in coverage, the proliferation of indoor and outdoor Wi-Fi deployments, and potential for multi-site enterprise environments.

“Convergence of 5G and Wi-Fi can potentially bring major benefits to cellular operators, enterprise Wi-Fi and public Wi-Fi solution providers, giving access to 5G and enterprise services from both Wi-Fi and 5G access networks.” said Dr. Peter Meissner, CEO of the NGMN Alliance. “However, in order to realise service and network convergence, we have worked with the WBA to identify a number of requirements that must first be satisfied. This is particularly true in the enterprise and Public Wi-Fi space, where there is a demand from cellular operators for a standardised solution for improved visibility and control in the configuration and management of Wi-Fi access networks.”

5G/Wi-Fi Interworking

A number of industry developments and specifications address the interworking of 5G and Wi-Fi from a technical standpoint:

- 3GPP has already developed specifications to ensure tight integration of 3GPP and non-3GPP radio technologies, such as Wi-Fi. In order to better serve customers and provide the full 5G experience the tight integration of non-3GPP technologies needs to be ensured also within the 5G Core Network. Solutions enabling some of these objectives have already been adopted by 3GPP and Wi-Fi 6, such as the EAP authentication framework similar to Wi-Fi, to accommodate different wireless service subscription-types (e.g. mobile, wireless or fixed broadband) and their native authentication methods.

- 3GPP Release 15 provides some support for interworking between 5G and Wi-Fi. In particular, 3GPP Release 15 provides support for untrusted non-3GPP access (such as Wi-Fi) to the 5G core via Non-3GPP Interworking Function (N3IWF), with secure transport of Control-Plane/User-Plane (CP/UP) messages over an IKEv2/IPSec tunnels between the terminal devices and the N3IWF

- 3GPP Release 16 is continuing the work by enhancing capabilities for Wi-Fi integration, including trusted Wi-Fi support and access traffic steering, switching and splitting.

However, challenges and needs remain – including the enablement of Wi-Fi only devices to connect to the 5G core, further study to ensure the tight integration between 5G and Wi-Fi networks, an interface to enable certain level of network manageability and policy control between 5G core and Wi-Fi networks, and the ability of a client to route traffic over one or more accesses, making optimal use of the available connectivity. As a next step, the WBA and NGMN are undergoing further study on these challenges in order to uncover potential solutions. This will culminate in the recommendation of a future strategy for Converged RAN deployment, ensuring the best user experience making use of both Wi-Fi and Cellular access.

Tiago Rodrigues, General Manager of WBA said: “Wi-Fi 6 introduces new capabilities for carriers, cities and enterprises to cost effectively provide additional coverage and capacity, mainly indoor, to address the 5G use case requirements. Now it’s time to fully capitalize on these capabilities by delivering a clear strategic path for converged RAN deployments. This is a priority. We will continue to work closely with NGMN and its members to review, develop and test potential solutions, as identified in our recent 5G White Paper.”

https://www.ngmn.org/fileadmin/ngmn/content/downloads/Technical/2019/RAN_Convergence_Paper_V2.pdf