2019 IoT World: Verizon’s Narrowband IoT (NB-IoT) Network now covers 92% of U.S.

Verizon announced yesterday that its NB-IoT network is now available coast-to-coast covering more than 92% of the U.S. population. NB-IoT focuses on applications needing data rates below 100K bits/sec which makes it ideal for solutions that aren’t designed to be always mobile such as alarm panels, environmental sensors, industrial appliances, factory equipment and parking meters.

NB-IoT is specifically designed for IoT applications that could benefit from access to lower cost chipsets, superior coverage and significantly prolonged battery life. The NB-IoT Network provides the ability to manage both IP and non-IP data traffic. This ability to handle non-IP data traffic allows for the creation of much simpler and more cost-effective IoT devices which are ideal for solutions that aren’t designed to be always mobile such as alarm panels, environmental sensors, industrial appliances, factory equipment and parking meters.

Other viable use cases for NB-IoT include:

- Smart cities – improve citizen experience and municipal operations through parking sensors, waste management and smart lighting.

- Smart buildings – enhance building safety and incident response times through connected smoke detectors including regular auto-test, battery check and real-time alerts to the relevant parties in case of fire.

- Industrial – improved machinery maintenance cycles and factory safety through machinery control such as equipment status, factory control, and process and safety monitoring.

- Environment monitoring – increase focus on environmental responsibility through status reporting of manhole covers, fire hydrants and chemical emission levels.

- Agricultural – improve efficiency in the agricultural industry with livestock tracker, connected greenhouse, stationary tracking and monitoring of air quality, humidity, moisture, temperature, and weather conditions of air and soil.

- Asset Tracking – improve efficiency and decrease costs by using pallet tracking and geo-fencing.

- Utilities – improve efficiency and decrease waste by using gas and water metering, including smart meter consumption tracking and pipeline monitoring.

Verizon has partnered with chipset and module manufacturers for its NB-IoT network. The carrier said three module makers – Telit, SIM-COM and Quectel, are in the final stages of testing modules, and will be available for use in IoT development on the new network.

NB-IoT adds another connection option for businesses:

Verizon maintains a strong leadership position in IoT technology and solutions with a history of providing customers with many options to meet their needs including nationwide deployment of 4G LTE, LTE Cat 1, and LTE Cat M1 networks. While CAT-M1 targets a wide range of applications for business customers such as wearables, fleet and asset management, NB-IoT focuses on applications needing data rates below 100 kbps. NB-IoT technology occupies a dedicated frequency of 180 kHz bandwidth designated for IoT applications which does not share spectrum resources with commercial smartphone traffic.

“We have engineered our NB-IoT network in the Guard Band of our spectrum. By using the more complex Guard Band solution for our Narrow Band IoT Network, we are demonstrating very efficient use of spectrum assets while giving customers the breadth of options they need to best meet their needs. This strategic use of spectrum is one of the many variables that has resulted in Verizon’s continued performance superiority and strong capital management over the years,” said Bill Stone, Vice President of Technology Development and Planning at Verizon.

During his IoT World Tuesday keynote speech, Shamik Basu, Director of IoT Products at Verizon, said that massive IoT sensor networks could be deployed today using Verizon’s NB-IoT or LTE-M networks. “They make critical infrastructure intelligent….NB-IoT and LTE-M will co-exist in some networks (i.e. the IoT device module supports both as does the wireless base station). You don’t need gateways to deploy massive sensor networks today.”

Verizon is ready to support developers and manage commercial traffic:

Verizon continues to expand its already robust ecosystem of partners to help develop, bring to market, connect and manage IoT solutions. Verizon has partnered with leading chipset and module manufacturers so that IoT makers can immediately start working towards building their devices for the Verizon NB-IoT network. Three module manufacturers in final stages of testing – Telit, SIM-COM and Quectel – have modules on Verizon’s Network which are ready to be used in development efforts. Additionally, customers will be able to manage their connections securely using the integrated ThingSpace platform that supports connectivity management, location and device security.

Verizon has announced an initial NB-IoT Standard Price Plan, offering 50 KB of data with a $1.00 monthly access fee per device. The data allowance can be shared with other NB-IoT devices on the same price plan and on the same account.

…………………………………………………………………………………………………………………………………………

Verizon at IoT World 2019, Santa Clara, CA: Booth 510

Verizon’s NB IoT demo, permits conference attendees to experience Verizon’s NB IoT network in action.

At Verizon’s 5G for enterprise demo, conference attendees will explore the possibilities that will result from the ultra-low latency and massively scalable characteristics of the Verizon’s 5G technology.

Mixed reality developer Arvizio will be on hand demonstrating their MR Studio mixed reality platform for XR experiences on Microsoft HoloLens. Arvizio has converged Verizon’s ThingSpace IoT platform and augmented/mixed reality technologies to transform how businesses connect and use the data flow from IoT devices.

At the ThingSpace Ready demo, conference attendees will learn about ThingSpace Ready, Verizon’s IoT Accelerator program, which enables easier IoT onboarding with Verizon. We curated partnerships with design houses, system integrators, module/modem providers, and SIM manufacturers, so OEMs (device makers) get easy access to the hardware and solutions needed to create the next generation of IoT devices, all with upfront and transparent pricing.

At the ThingSpace Manage demo, conference attendees will learn how Verizon’s ThingSpace Manage platform will enable customers to provision, monitor, diagnose and control their IoT devices using connectivity APIs, as well as value-added microservices. The exhibit will demonstrate key capabilities on the ThingSpace Manage Portal such as device activation, network diagnostics, and coarse location. A demonstration of SIM-secure will also showcase how Verizon can help protect devices if the SIM are removed.

At the Critical Asset Sensor demo, conference attendees will experience how Verizon made it simple for customers using public clouds to get the data they need to drive their businesses. Critical Asset Sensor is an Edge to Enterprise solution with 7 sensors, GPS, LTE-M connectivity, and the ThingSpace platform with APIs to consume data into Amazon Web Services or any other cloud platform that drives your business.

Deploying IoT Massive Sensor Networks:

In his IoT World keynote, Mr. Basu suggested that companies deploying IoT massive sensor networks match the technology to their needs. Those needs might include: long battery life (10+ years), long range (network) coverage, ubiquitous, low improvement cost, security, reliability/availability, and longevity. Putting a NB-IoT interface in a sensor module facilitates data collection in real time which can then be tabulated and analyzed at the edge or in the cloud.

Shamik recommended Verizon’s ThingSpace to manage a rich suite of services for IoT. Companies can then monetize their IoT solutions and use public clouds, like Amazon Web Services (AWS). By pre-integrating software on development kits pre-approved by Verizon and Amazon, developers have all the key building blocks to create an IoT solution out of the box. AWS’s reliability and scalability make it an ideal foundation for your solution.

The ThingSpace Cloud Connectors program allows you to build a powerful IoT solution by combining your AWS solution, the Verizon network and ThingSpace device lifecycle management tools.

Conclusions:

In summary, NB-IoT combined with Verizon’s ThingSpace IoT accelerator/ management platform, new pricing and rich ecosystem of partners who have modules ready for development, enterprise customers have the ability to bring unique NB-IoT solutions to market quickly.

References:

https://www.verizon.com/about/news/verizon-extends-iot-leadership

https://thingspace.verizon.com/partners/aws/

DriveNets Network Cloud: Fully disaggregated software solution that runs on white boxes

by Ofer Weill, Director of Product Marketing at DriveNets; edited and augmented by Alan J Weissberger

Introduction:

Networking software startup DriveNets announced in February that it had raised $110 million in first round (Series A) of venture capital funding. With headquarters in Ra’anana, Israel, DriveNets’ cloud-based service, called Network Cloud, simplifies the deployment of new services for carriers at a time when many telcos are facing declining profit margins. Bessemer Venture Partners and Pitango Growth are the lead VC investors in the round, which also includes money from an undisclosed number of private angel investors.

DriveNets was founded in 2015 by telco experts Ido Susan and Hillel Kobrinsky who are committed to creating the best performing CSP Networks and improving its economics. Network Cloud was designed and built for CSPs (Communications Service Providers), addressing their strict resilience, security and QoS requirements, with zero compromise.

“We believe Network Cloud will become the networking model of the future,” said DriveNets co-founder and CEO Ido Susan, in a statement. “We’ve challenged many of the assumptions behind traditional routing infrastructures and created a technology that will allow service providers to address their biggest challenges like the exponential capacity growth, 5G deployments and low-latency AI applications.”’

The Solution:

Network Cloud does not use open-source code. It’s an “unbundled” networking software solution, which runs over a cluster of low-cost white box routers and white box x86 based compute servers. DriveNets has developed its own Network Operating System (NOS) rather than use open source or Cumulus’ NOS as several other open networking software companies have done.

Fully disaggregated, its shared data plane scales-out linearly with capacity demand. A single Network Cloud can encompass up to 7,600 100Gb ports in its largest configuration. Its control plane scales up separately, consolidating any service and routing protocol.

Network Cloud data-plane is created from just two building blocks white boxes – NCP for packet forwarding and NCF for fabric, shrinking operational expenses by reducing the number of hardware devices, software versions and change procedures associated with building and managing the network. The two white-boxes (NCP and NCF) are based on Broadcom’s Jericho2 chipset which has high-speed, high-density port interfaces of 100G and 400G bits/sec. A single virtual chassis for max ports might have this configuration: 30720 x 10G/25G / 7680 x 100G / 1920 x 400G bits/sec.

Last month, DriveNets disaggregated router added 400G-port routing support (via whitebox routers using the aforementioned Broadcom chipset). The latest Network Cloud hardware and software is now being tested and certified by an undisclosed tier-1 Telco customer.

“Just like hyper-scale cloud providers have disaggregated hardware and software for maximum agility, DriveNets is bringing a similar approach to the service provider router market. It is impressive to see it coming to life, taking full advantage of the strength and scale of our Jericho2 device,” said Ram Velaga, Senior Vice President and General Manager of the Switch Products Division at Broadcom.

Network Cloud control-plane runs on a separate compute server and is based on containerized microservices that run different routing services for different network functions (Core, Edge, Aggregation, etc.). Where they are co-located, service-chaining allows sharing of the same infrastructure for all router services.

Multi-layer resiliency, with auto failure recovery, is a key feature of Network Cloud. There is inter-router redundancy and geo-redundancy of control to select a new end to end path by routing around points of failure.

Network Cloud’s orchestration capabilities include Zero Touch Provisioning, full life cycle management and automation, as well as superior diagnostics with unmatched transparency. These are illustrated in the figures below:

Image Courtesy of DriveNets

Future New Services:

Network Cloud is a platform for new revenue generation. For example, adding 3rd party services as separate micro-services, such as DDoS Protection, Managed LAN to WAN, Network Analytics, Core network and Edge network.

“Unlike existing offerings, Network Cloud has built a disaggregated router from scratch. We adapted the data-center switching model behind the world’s largest clouds to routing, at a carrier-grade level, to build the world’s largest Service Providers’ networks. We are proud to show how DriveNets can rapidly and reliably deploy technological innovations at that scale,” said Ido Susan CEO and Co-Founder of DriveNets in a press release.

………………………………………………………………………………………………

References:

https://www.drivenets.com/about-us

https://www.drivenets.com/uploads/Press/201904_dn_400g.pdf

Mukesh Ambani of Reliance Jio wants to connect next billion in India

Infrastructure and affordability barriers are being broken in India by Reliance Industries Chairman and Managing Director Mukesh Ambani and his initiatives, a new survey said on Friday. According to the survey by Booking Holdings, a growing affluence has lifted over a billion people out of poverty, creating a new middle class — in many countries for the first time — and driving a growth in consumer demand. Asked which factors were driving, or were likely to drive, increased internet adoption, the respondents highlighted pull factors like the increased availability of high-quality infrastructure, improved affordability and better public understanding of the internet as factors that would drive increased uptake.

Asked which factors were driving, or were likely to drive, increased internet adoption, the respondents highlighted pull factors like the increased availability of high-quality infrastructure, improved affordability and better public understanding of the internet as factors that would drive increased uptake.

“This ties in neatly with the infrastructure — as opposed to the human — barriers, the removal of which our respondents identified as being key to unleashing the potential of the Next Billion.

“With projects such as the $35 billion investment in 4G by Indian billionaire Mukesh Ambani, these barriers are quickly coming down in India,” the report emphasised.

As on March 31, the subscriber base of Reliance Jio stood at 306.7 million. The average data consumption per user per month was 10.9 GB and average voice consumption 823 minutes per user per month.

“We at Jio are truly overwhelmed and proud to now serve over 300 million subscribers. The growth in data and voice traffic at this scale has been unparalleled,” Mukesh Ambani said.

The average Jio customer data consumption per user per month was 10.9 GB and average voice consumption 823 minutes per user per month.

……………………………………………………………………………………………………………………………………………………………………………………

For the survey, Booking Holdings surveyed tech experts and tech leaders in three markets — China, India and Indonesia. Nearly 74 per cent respondents in India said internet access is a basic necessity.

One of the most heartening and economically significant impacts of the expansion of connectivity in Asia was the corresponding improvement in the lives of women and girls.

Nearly 79 per cent of respondents said gender was not a barrier to internet adoption in their country.

“Nearly 86 per cent said that increased gender equality would drive adoption and 91 per cent said greater digital participation would also improve gender equality in their country,” the findings showed.

By large majorities, the respondents expected their countrymen and women to benefit from digital inclusion in ways that would help them become more educated and more prosperous — allowing the connected to rise up the social ladder.

“This aspirational edge to gathering digital transformation of all three countries reveals a growing individualistic and entrepreneurial culture that would not be out of place in Silicon Valley,” the survey noted.

According to Glenn Fogel, CEO, Booking Holdings, much of this explosion of commerce and entrepreneurship is due to the growing availability and ease of internet connectivity in Asia.

“In India, the e-commerce market is expected to quadruple in size between 2017 and 2022 to a value of $150 billion… Asians are going online to sell and to shop,” he said.

FCC to open up more spectrum for terrestrial fixed and mobile 5G

The FCC voted to propose opening up even more spectrum for 5G, allowing sharing of spectrum now used for weather forecasting by the National Oceanic and Atmospheric Administration. It was a unanimous decision to take the first step toward reallocating spectrum for shared use between those federal users and non-federal flexible-use wireless.

The Notice of Proposed Rulemaking (NPRM) approved at Thursday’s (May 9, 2019) FCC open meeting proposes to reallocate that spectrum (1675-1680 MHz) on a co-primary basis, meaning both weather forecasting and wireless will have equal stature. The band can be used for terrestrial fixed and mobile (except aeronautical mobile) on a shared basis, with appropriate technical rules to protect each.

The FCC is also seeking comment on other ways the NOAA weather data can be delivered to those now receiving it via earth stations using the 1675-1680 MHz band. In particular, the Commission seeks comment on how to implement a sharing framework that would create opportunities for commercial operations in this band while also protecting incumbent federal users. Finally, the Commission asks about possible alternative methods of providing access to National Oceanic and Atmospheric Administration weather data to other non-federal users that currently receive such data via earth stations they operate in this band.

Wireless broadband is a critical component of economic growth, job creation, public safety, and global competitiveness, and the demand for spectrum continues to increase. As shown by today’s action, the Commission is continuing to work to identify and make available additional spectrum to meet the growing demand.

“Today, the FCC joined together to take an important step to free up vital mid-band spectrum and help secure American digital superiority in 5G,” said Doug Smith, CEO of Ligado Networks, which had sought the move as part of its mid-band 5G strategy, which will require 40 MHz of spectrum. “Under chairman Pai’s leadership, this FCC is working hard to identify opportunities to make mid-band spectrum available, and the NPRM on 1675–1680 MHz will help deliver on the promise of developing and deploying 5G in the U.S. as soon as possible. We applaud the Commissioners’ commitment to make our nation first in next-generation technologies through a free market approach that encourages private sector investment and innovation.”

“The FCC’s action today proposing to reallocate the 1675–1680 MHz band for shared federal and non-federal commercial use is another positive step in the effort to make available more mid-band spectrum for private sector use,” said Free State Foundation president Randolph May. “It should not go unremarked that the FCC’s action today is an important ‘infrastructure’ measure — just as much as a federal grant to build a highway or road — because the availability of spectrum, especially mid-band spectrum, is necessary to support the investment in transmitters, small antennas, tower structures, terrestrial links, and so forth that will comprise the guts of 5G network infrastructure.”

Public Knowledge also praised the move: “Consumer demand for wireless services continues to grow, and spectrum that can easily be cleared and used for mobile use has been exhausted,” said PK senior policy counsel Phillip Berenbroick. “Today’s proposal to permit sharing of the 1675-1680 MHz band correctly recognizes the need to more efficiently use scarce spectrum resources to meet this consumer demand, while also ensuring federal users can accomplish their missions. Public Knowledge supports the NPRM and looks forward to weighing in on the details of the 1675-1680 MHz band plan.”

References:

https://www.multichannel.com/news/fcc-forecasts-more-spectrum-for-5g

Indian telcos propose year-long 5G field trials which begin this June!

India’s major mobile operators have both submitted proposals to conduct year-long field trials of 5G services. Bharti Airtel, Vodafone Idea and Reliance Jio Infocomm – along with technology partners including Cisco, Samsung, Ericsson and Nokia – have submitted detailed proposals to the Department of Telecom, the Economic Times reported.

The Indian mobile network operators are now awaiting approvals, and it is expected to take an additional initial three months to complete preparations and clearances, the Cellular Operators’ Association of India (COAI) told the publication. COAI is the industry body that represents Vodafone Idea, Airtel and Jio.

But the Department of Telecom has previously expressed a reluctance to allocate airwaves for 5G trials beyond a 90 day window, which the industry believes would be way too short of a time to conduct the required trials. The India government has not taken any decision yet on the duration, a contentious issue for airwaves allocation.

According to COAI, the industry is expected to finally reach an agreement with the DoT on the duration of the proposed allocations, as well as other issues. The Telecommunications Regulator of India has recommended the 3.5-GHz frequency range be used for 5G, and aims to complete an initial 5G auction early next year.

The much-awaited network trial for 5G services in India is scheduled to start this June, with a Telecom Ministry panel recommending spectrum for the test run to the incumbent telcos for a three-month period. The panel which deliberated on the quantum and duration of the spectrum trial has recommended 5G spectrum to Airtel, Vodafone Idea and Reliance Jio initially for three months, which can be scaled up to one year in case they need more time for network stabilisation.

The three equipment vendors who have got the green signal from the panel are Samsung, Nokia and Ericsson, sources said.

The allocation will take place in the next 15 days and telcos could start intial 5G run in June itself. The network trial licenses will be issued in a few days’ time.

References:

Will Reliance Jio overtake Bharti Airtel today to become India’s 2nd largest telecom operator?

By: Prachi Gupta– Published: May 6, 2019. Edited for clarity by Alan J Weissberger, IEEE Techblog Content Manager

The race to become India’s second largest telecom operator between Bharti Airtel and Reliance Jio is still on. With Airtel’s Q4 results due on Monday, it will soon become clear if Mukesh Ambani’s Jio will actually climb the ladder and outshine Sunil Bharti Mittal’s company.

With 29 crore wireless subscribers towards the end of February 2019, Reliance Jio has emerged as a tough competitor to many telecom operators in India. Considering Jio’s growth trend in the previous few quarters, it may even leave behind Vodafone-Idea, dethroning it as the current largest telecom firm in India.

While other telecom operators have mostly maintained a ‘lose’ or ‘barely growing’ trend on the subscriber base, Reliance Jio has been the only telecom which maintained a ‘gain’ streak throughout the year 2018. For the QE Sep-Dec 18, Reliance Jio was the only private telco (along with PSU BSNL) to gain subscribers while both small and large players, including Vodafone-Idea, registered mostly negative growth. Jio had added close to 3 crore subscribers in that quarter, according to TRAI’s Indian Telecom Services Performance Report. In the year 2018, Reliance Jio has continued to add more than 2.5 crore subscribers every quarter.

Reliance Jio’s own reported user base tells a similar story. In its Jan-Mar 2019 quarterly results details, Reliance Jio reported over 30 crore subscribers at the end of March. Bharti Airtel is due to report its March-end user base today, along with its quarterly results.

NOTE: Crore is an Indian term that =ten million; or = 100 lakhs, especially of rupees, units of measurement, or people.

Reliance Jio vs Airtel vs Vodafone Idea: Who will emerge as India’s largest telecom operator?

………………………………………………………………………………………………………………………………………………………………………………

As of February 2019:

- Vodafone-Idea had over 40 crore users (wireline and wireless combined),

- Bharti Airtel had over 34 crore users.

- Reliance Jio was strong with a little less than 30 crore subscribers (TRAI figures). Vodafone-Idea leads in terms of market share for wireless subscribers with 34.58% share.

- Bharti Airtel’s market share is 28.75%, while Reliance Jio is inching closer with 25.11%.

In terms of wireline market share, BSNL leads with more than half the subscription hold, followed by Bharti Airtel at 18.95%. For broadband services, Reliance Jio topples all other telecom operators with a 54% share in the market.

…………………………………………………………………………………………………………

Update- May 21, 2019: Jio adds 9.4 million customers in March, Airtel, Vodafone-Idea lose

: Reliance Jio has added 9.4 million customers while India’s teledensity has declined 1.82% to 90.11%, from 91.86% in March 2019 with active wireless subscribers reaching 1,021.75 million, the sector regulator in a finding Tuesday said.

Jio has added 9.4 million users in March to take its user base to 307.7 million, while Vodafone Idea and Bharti Airtel lost 14.5 million and 15.1 million customers, respectively, to take their subscriber bases to 394.8 million and 325.2 million during the same period, the Telecom Regulatory Authority of India (Trai) said.

Bharti Airtel had 27.99% subscriber market share, Vodafone Idea 33.98% and Jio had 26.40% market share as of March 2019.

Vodafone Idea’s active use base, or VLR, was 93.27% of its overall subscribers, while Reliance Jio was at 84.04%. The finding revealed that Bharti Airtel has the maximum proportion – of 100.82% – of active wireless subscribers in the month of March 2019.

In the broadband segment, Vodafone Idea had 19.57%, Bharti Airtel 20.35% and Reliance Jio had 54.45% market share as of March this year.

The monthly decline rates of urban and rural subscription stood at 0.90% and 2.98% respectively in March 2019, according to Trai.

The regulator added that in March, 5.30 million subscribers submitted their requests for Mobile Number Portability (MNP), and the cumulative porting requests have increased from 423.11 million in February to 428.40 million at the end of March 2019.

…………………………………………………………………………………………………………

References:

Reliance Jio Blankets India with Inexpensive 4G Service; Where are the Profits?

Samsung deploying small cells in large volumes for Reliance Jio in India

Analysts say monetizing 5G deployments will be very difficult in next few years

Several Wall Street and Market analysts weigh in with opinions on Monetizing 5G Technology (UPDATED November 1, 2019):

Many believe that if 5G is just “faster and more reliable service,” many consumers will wait to adopt. They need to see and understand the other products and benefits, like longer battery life or portability of a fast home broadband connection. Here’s a sample of recent opinions:

Investor interest in 5G remains high and there is general understanding that 5G can offer higher throughput and lower latency connections. However, Citi continues to receive questions on how carriers can monetize the new 5G platform given concerns regarding the current competitive landscape, limited evidence on the scalability of potential fixed wireless broadband services, and an absence of specific timing for new application development by enterprise firms.

Citigroup takes a relatively optimistic view of 5G and believes that carriers will first try to monetize new 5G deployments by charging more for greater speeds.

This author believes that Verizon is waiting for new 5G software releases and 3GPP Release 16 spec completion in the 2020 time frame to dynamically allocate 5G services to the spectrum it owns. Also, VZ is looking to differentiate with ultra-wideband mobile broadband using mmW spectrum in urban environments, but that requires many more small cells due to distance limitations of mmW spectrum. And that entails obtaining permits to mount the small cells in public structures (street lamps, traffic lights, buildings, etc).

Other U.S. carriers such as T-Mobile US, Sprint and AT&T may create marketing advantages if they can fill out their coverage maps with 5G before their competitors do. That will largely depend if the U.S. carriers use mmWave spectrum which is really on practicable for dense urban areas due to short range transmissions and need for many small cells. Some network experts remain enthusiastic that new antennas with beam forming can improve propagation for mid-band spectrum (2.0-6.0 GHz), similar to the PCS band (1.8 GHz).

In an earlier bearish report, S&P Global Ratings last year warned that AT&T, Verizon and other wireless firms planning 5G wireless services could wait five to 10 years for a payback on investments. Consumers may resist higher service fees on faster 5G wireless speeds for video streaming, S&P said.

Recent research on 5G consumer attitudes conducted by PwC shows that significant headwinds are ahead for 5G pricing. Indeed, fully two-thirds of consumers indicated that they would not be willing to pay anything additional for the increased speeds and capabilities delivered by 5G. When combined with those who would be willing to pay, the average premium barely approached $5 per month, less than half of the initial pricing recently announced.

“Based on recent checks, we believe this ‘5G hype’ may be a bit premature, and near-term fundamentals have been somewhat ‘so so’ at best in given some key (and somewhat unique) initiatives in our view going on at each of the respective US wireless carriers,” wrote the analysts at Wall Street research firm Wells Fargo Securities in a recent note to investors about the cell tower industry. “As a result, we believe the risk / reward for the sector at the present time is not an overly attractive one.”

“We tested Verizon’s newly launched 5G network in Chicago. If performance does not improve, investors will once again question whether Verizon will have to materially increase its capital investment in order to enable millimeter wave spectrum in more than just limited hotspot locations,” wrote Walter Piecyk, an analyst with Wall Street firm BTIG, in a recent blog post.

Warned BTIG’s Piecyk: “Verizon has insisted that it can use their existing cell site footprint to roll out 5G technology on millimeter-wave spectrum. That seems very hard to believe. In our limited testing, the 5G small cells provided coverage of just ~350 feet. In fact, 5G performance suffered from reduced reliability beyond 200 feet when faced with street obstructions. That’s not even close to the 800-2,000 feet radius that Verizon and their vendors have promised. Meanwhile, Verizon’s LTE network, using mid-band spectrum, was clocking speeds north of 250 Mbps, which is more than adequate for nearly all applications.”

…………………………………………………………………………………………………………………………………………………………………..

Layer 123 Network Transformation Congress: Unlocking 5G Growth Requires New Operating Model

by Johanne Mayer, Director MayerConsult and TM Forum Distinguished Fellow

At the Layer123 Network Transformation Congress in San Jose, CA this week, the discussions predominantly focused on the network technology changes and references to traditional network transformation such as 3G to 4G and the benefits that transforming to 5G would bring.

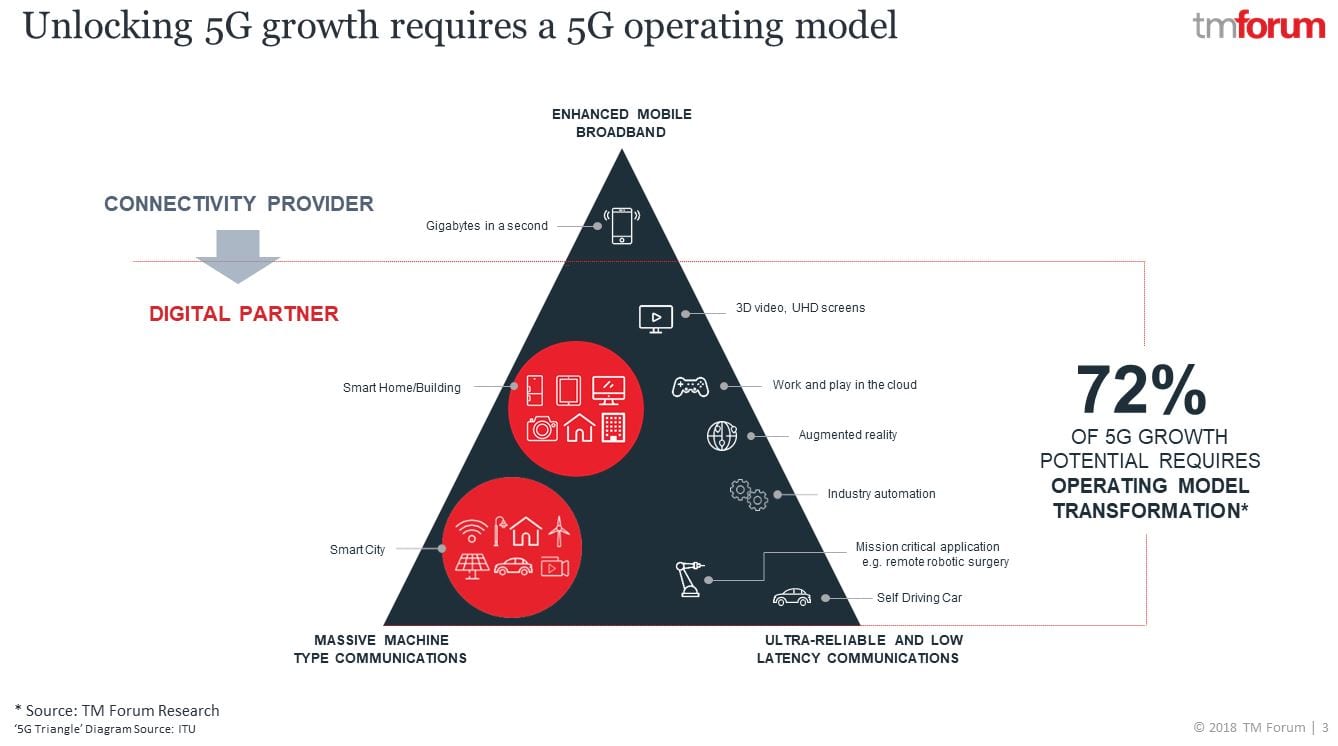

However I would contend that unlocking growth in 5G requires a new operating model with new processes, automation and actual supplier implementation of standard APIs for Communications Service Providers (CSPs) to achieve the agility and speedier time to market to remain relevant in the new ecosystem which has consequential impact on what they need from their vendors.

CSPs have predominantly packaged and sold products and services direct to customers with every technology, think 2G, 3G, 4G which have included connectivity and often a handset. Looking at 5G and IoT growth from the above figure, it’s highly unlikely that CSPs will package and resell connected cars, or robots for remote robotic surgery, or AR games with headsets, etc.

In addition, with today’s timeframes of 18 to 24 months to get new product to market due to the complexity and touch points between the network equipment and all of the operational and business support systems (OSS/BSS), we need to rethink how we do things for CSPs to stay relevant and profitable.

Traditional OSS and BSS have served us well but with newer cloud, SDN and NFV technologies, the relevance of understanding the relationships (think inventories) between products, services and resources is diminishing, and having to adapt to different APIs for each supplier is slowing CSP’s time to market and adding more cost pressure.

TM Forum has introduced its Open Digital Framework Concept to address CSP’s business challenges including business & IT agility, optimization, digital customer experience and both B2B and B2C growth through a set of core tools and standards along with support and guidance programs.

Of particular interest is the Open Digital Architecture (ODA) which focuses on seamless interactions between functional domains using a rich set of Open APIs which have been released and made available in Open Source (https://www.tmforum.org/open-apis/).

To achieve the seamless integration with 5G ecosystem partners and reduce costly time to market to stay competitive, the interaction and processes between the production and other functional areas need to change. The network needs to expose and fully manage the lifecycle of its set of capabilities as reusable services independent of products and resources.

The temptation today is for product and network engineers to translate the current product/network service into a monolithic network service model. Think NFV 5 years ago where we asked suppliers to place their code on white boxes. They abstracted the code from the current hardware and adapted the same thing on white boxes without taking advantage of micro-service architecture a la NFV2.

Since each product or network engineer selects their own suppliers for their products (e.g. internet security and managed firewall services) each used a firewall but likely from different suppliers. If each product engineering team were to expose their network service model, we would likely have exposure of “internet security” and “managed firewall service” as is (i.e. per early NFV) rather than “Firewall as a Service” micro-service that could be reused in both network services.

A TM Forum NaaS API Component Suite has been created in support of the complete lifecycle operations for each network as a service including service qualification, service configuration and activation, service test, service problem management and service usage. Also the more that product and network engineers can expose in relation to that reusable network service during the design time, the more automation can be developed reducing time to market to deliver products and offers to the market.

Is this too good to be true?

While the telecom industry keeps on saying that CSPs are too slow, it is rich in promoting proprietary APIs claiming that “my APIs are the best”, that standard APIs are not agile enough or that they can’t support “my differentiators” hence each of the OSS/BSS applications (think inventories, product catalogues, orchestrators, alarm management, performance management, SLA, etc.) has to use integration services to create adapters for each supplier, increasing time and costs and adding extra testing. The costs and delays in getting service up and running inherent in this business approach are simply not economically sustainable in the new business opportunities for CSPs.

The good news is that if suppliers don’t expose a service, for example it could be a core router supporting and routing several network services, but that device in itself does not expose a “reusable service” (think firewall or AAA or Eline, etc) then that supplier does not need to support the TM Forum NaaS (Network as a Service) APIs.

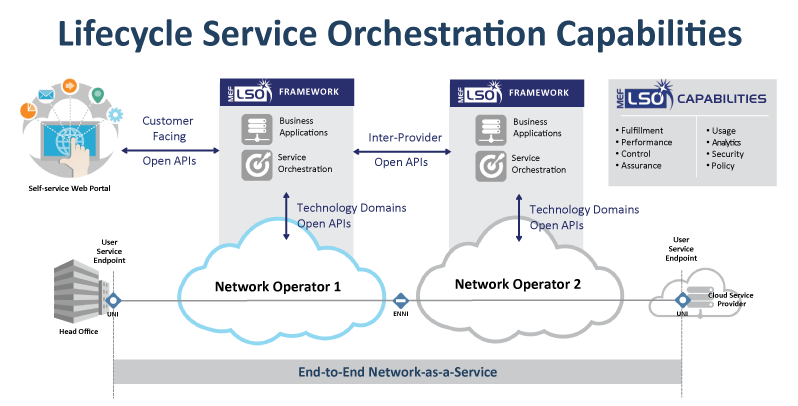

Using MEF LSO architecture, the NaaS component suite would fit the Legato interface point.

Conclusions:

As a supplier or CSP, it’s time to think where you want to fit in the new value chain.

I believe that more and more CSPs will start their transformation towards a NaaS architecture, allowing them to expose their network capabilities using standard and open APIs to be consumed seamlessly by their partners and customers.

For further information, the TM Forum is hosting a Network Transformation track at its Digital Transformation World event in Nice, May 14-16th, 2019. https://dtw.tmforum.org

………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

References:

IG1167 ODA Functional Architecture R18.5.1

Global Architecture Forum – Webinar 1 NaaS

From network spaghetti to hyperscale simplicity

http://www.mef.net/lso/lifecycle-service-orchestration

……………………………………………………………………………………

Kindly post comments in the box below this article.

Alan J Weissberger

……………………………………………………………………………………

Huawei to compete in global consumer electronics market with world’s first “5G” TV

Huawei is reportedly preparing to produce the world’s first 5G TV as a way to challenge Apple and Samsung in the global consumer electronics market. The TV would include a “5G” modem [1] and 8K display resolution, allowing users to download high-resolution programming over cellular connections. Huawei would then be able to use some type of non standard “fixed 5G” network to download data-heavy content, such as 360 degree videos in which viewers can watch in every direction, and virtual reality programs. There are questions, however, over how soon the wider ecosystem for such services will be available.

Note 1. This author has no idea what fixed broadband network or frequencies will be used for this version of so called “5G.” Can’t emphasize enough that residential broadband Internet access and/or TV are NOT IMT 2020 use cases and are not being standardized by any accredited standards body.

……………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………

Huawei’s first attempt to make TV sets is fueled by a desire to complete its “ecosystem” of consumer electronics — which already includes everything from smartphones to wearable devices — even as analysts voice doubts over the strength of its brand image. Among the potential benefits of a 5G TV is the fact it would not require the fiber optics or cable boxes that traditional cable or satellite broadcast services do. The TV could also act as a router hub for all other electronic devices in a home. The ultrahigh-definition 8K resolution, meanwhile, represents the most advanced TV screen on the market, with 16 times more pixels than the standard 1080 pixel high-definition. Indeed, 8K video is also shaping up as an important battlefield. Research company IHS Markit forecasts that shipments of 8K TVs will increase from less than 20,000 sets last year to 430,000 this year and to 2 million next year.

Huawei is the world’s biggest telecom equipment maker and in the first quarter of this year it overtook Apple to become the second-largest smartphone maker by shipments, just behind Samsung. It has signalled its determination to stay ahead in the 5G era. Besides 5G base stations, Huawei has already unveiled a 5G foldable smartphone and several home-use 5G routers that will be available later this year.

Samsung is currently the world’s biggest TV maker and just started shipping its own 8K TV without 5G capability starting at $4,999 this spring. Apple introduced the Macintosh TV in 1993, but it was not a hit, and the California tech giant has not released its own TV set since. It did, however, introduce a digital streaming box dubbed Apple TV in 2006 and has updated it several times to incorporate third-party applications, including Netflix. This March, the company unveiled Apple TV plus, a subscription service for original Apple content starring superstars such as Oprah Winfrey, Jennifer Aniston and Reese Witherspoon.

Many leading TV and camera makers are planning to roll out 8K products by 2020, as Japanese broadcaster NHK is set to broadcast the 2020 Tokyo Olympics in ultrahigh-definition. Samsung, LG Electronics, Sharp, China’s TCL, and Hisense all showcased 8K TVs at the Consumer Electronics Show earlier this year.

Huawei is not a total newcomer in the television business. The Chinese company’s chip arm Hisilicon Technologies is the world’s second-largest provider of TV chipsets after Taiwan’s MediaTek, and supplies to various local brands such as Hisense, Skyworth and Changhong, as well as Sharp. It also builds its own 5G modem chips in-house. Modem chips are a crucial component that help determine the speed of data transfers and the quality of phone calls. Although Huawei could secure large TV displays from local vendors BOE Technology Group and China Star Optoelectronics Technology, the supply of large, high-quality 8K displays is still dominated by Samsung Display, Samsung’s panel-making arm, analysts said.

“Compared with existing TV makers, Huawei likely has the most resources and knowledge related to 5G … so it’s very natural at the moment it would want to get into the sector,” said Eric Chiu, an analyst at WitsView. “It’s not yet known whether Huawei could quickly grab market share, but such a move could definitely help the Chinese company expand its brand into a new market and boost its ecosystem.”

C.Y. Yao, a tech analyst at the Taipei-based TrendForce, said there are still many challenges ahead for 5G-capable 8K TVs. “In addition to 5G base stations, you also need small-cell stations in the region, and there needs to be an ecosystem for 8K, including cameras, and 8K TV processors, encoders and decoders to broadcast 8K content, which are not yet mature.”

Cooperation with telecom operators to support the 5G service is also needed, which would disrupt current cable broadcasters, Yao added.

Huawei wants to complete is consumer electronics “ecosystem” and tie users more closely to its smartphones. © Reuters

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………

In addition to getting into TVs, Huawei has also set a goal of becoming a top five PC maker by 2021 and target to triple shipments in that segment for 2019, a source told Nikkei. Though Huawei relies heavily on Intel for processor chips for laptops, the Chinese company is developing its own central processing units, or CPUs, for its computer product line, the person said.

Huawei is a latecomer to this market, having introduced its first laptop computer in late 2017. It shipped some 1 million units last year in the overall PC market of about 259 million units, according to research company IDC. Apple — whose MacBook line of laptops served as the inspiration for Huawei’s MateBook and MagicBook — is the world’s No. 4 PC maker, shipping some 18 million units last year.

President Linford Wang of Tablet&PC Product Line of Huawei Consumer Business Group told Nikkei that his company is making computers in hopes of completing its consumer electronics ecosystem. “But if we are able to expand our market share, that’s very welcome too.”

Joey Yen, an analyst at IDC, said Huawei’s emerging PC business is doing well in China, its home market, grabbing a nearly 4% share last year despite its recent entry and could gradually put some pressure on smaller PC makers such as Acer and Asustek Computer. “It also has chances to expand in emerging markets first,” said Yen.

While she was less confident about Huawei’s ability to challenge Apple’s strong brand image, she noted the thinking behind the company’s strategy. “It will surely hope that building key consumer electronics products such as laptops, smart speakers, earphones, and TVs will help consumers stay inside its ecosystem and be more loyal to Huawei’s phones.”

Huawei’s consumer electronics unit has become the company’s biggest revenue contributor for the very first time in 2018, making up 48.4% of annual sales of 721.2 billion yuan ($105.2 billion).

Its flagship telecom equipment business, however, experienced headwinds in many markets since last year as the U.S. has been lobbying allies to ban the use of the Chinese company’s equipment in crucial network infrastructure, citing cyber espionage concerns.

Huawei has consistently denied all the allegations and sued the American government on March 7 over being blocked from the U.S. Huawei has already rolled out a wearable product line including smart watches and wristbands, similar to Apple Watch and Fitbit’s offering. It also makes wireless earphones FreeBuds and FlyPods from its diffusion line Honor, to compete against Apple’s AirPods. The company’s AI speaker unveiled last October as an answer to Apple’ voice-activated Homepod. For 2018, it shipped 206 million units of smartphone and ranked as the world’s third largest vendor, just behind Samsung and Apple.

References:

https://www.techradar.com/news/huawei-is-developing-a-5g-8k-tv-because-thats-apparently-a-thing-now

Layer 123 Network Transformation Congress: Status of Network Automation, Orchestration, Zero (or Low) Touch Provisioning, SDN & NFV

The REALITY:

Disappointingly small number of deployments, many open source software and open API organizations (ONF, Linux Foundation, MEF, TM Forum, OCP, etc), pop-up consortiums (Cloud RAN, Open RAN, other disaggregated hardware), defunct standards organizations (e.g. ETSI, ITU-T, IEEE) that only produce functional requirements, reference architectures, and white papers or none of the above. Nothing that can be actually implemented via standardized exposed interfaces or APIs.

Discussion:

Tuesday April 30th and Wednesday May 1st I spent the entire day and early evening at the Layer 1,2,3 Network Transformation Congress which assessed the state of SDN, NFV, Open Source MANO (OSM), Open APIs (TM Forum and MEF), other Open Source management software, and topics related to what network operators have been talking about for at least eight years- computer controlled network automation and orchestration of services (sometimes referred to as service chaining). Contrary to the rah, rah cheerleader talk from a few network operators (especially AT&T), telco deployment of this new age open source software for automation and control of networks has been very slow. NFV actual deployments are minimal (if not zero) and SDN has become a marketing term that can mean any software control of network functions. Every network operator and cloud service provider uses different protocols, many of which they invented (e.g. Google’s routing protocol for DCI) along with a sprinkling of open source code (such as a SDN Controller).

Decades of man years has been invested in network operator proprietary network management software, which is used to provision new services, keep track and maintain existing services, facilitate moves and changes. One speaker said that he’d like to see light touch provisioning rather than zero touch. Another said that they stack the new automation, provisioning and orchestration software on top of their legacy software

For the cloud giants (e.g. Amazon, Google, Tencent, etc), it has been done, but in almost a totally proprietary fashion with almost all the network automation, control and management done using in house generated code. Amazon spoke at the conference and, in response to this author’s question, suggested the different types of network access for AWS. Microsoft spoke, not about Azure but their private enterprise network which doesn’t use any open source code. Moreover, it took two years to get 22 new sites connected via direct internet connections (<600M bit/sec) that would normally be served by copper lines (bonded DSL or short reach fiber).

Selected Quotes from Conference Participants:

Long time colleague Craig Matsumoto (whom I met when he was EE Times, but now at 451 Research) coined a new term during his presentation – “software programmable interconnection” (SPI) for data centers. Craig said: “We talk a lot about telcos. The question is what does network transformation mean for the data center world? What are they doing about it? We came up with this new term, software programmable interconnection (SPI) . It’s basically about the idea that data centers connect with one another with a fabric.” In this author’s opinion the SPI term captures the wide variety of software being used within and between data centers!

“For me covering data centers after covering telcos for so long, they’ve (data center operators) talked to me about using the SDN for pretty much anything that involved automation and the network. Anything that has software is SDN to them. We came up with a different term as a good way to encapsulate that some kind of software is being used that might or might not be SDN,” Matsumoto added.

Tuesday’s keynote speaker and Wednesday moderator Roy Chua, Founder and Principal of AvidThink – a boutique market research firm:

“With regard to the key takeaways, I think you’ve captured them. I was very impressed at the level of candor in the discussions and presentations. I liked the concrete examples and quantification of NFV uptake challenges and the recognition that we need to solve constrained problems than try to boil the ocean. There was definitely good content…..Appreciate all the excellent questions and enjoyed the discussion at lunch. And I am most grateful for your endorsement of the analysis that I do.”

This author recommends only a select few (<5) networking market analysts that do primary market research. Roy is one of those select few!

From Kaustubha Parkhi, Principal Analyst at Insight Research (a well respected Indian market research firm):

“There is no doubt that LSO [2] is essential. Equally essential is the pruning of its objectives and scope, which becomes a bit overwhelming at times. The objectives, in the present form are so broad-based that they cover everything from billing functions to network equipment deployment.” –>More on LSO in a forthcoming IEEE Techblog article.

Note 2. LSO (Lifecycle Service Orchestration) is the set of MEF-defined specifications enabling standardized service orchestration based on standardized lifecycles of end-to-end connectivity services across one or more network service domains. A key contribution is open APIs – to automate the entire lifecycle for services orchestrated across multiple provider networks and multiple technology domains within a provider network. LSO enables service providers to transition from a silo-structured BSS/OSS approach towards flexible end-to-end orchestration that unleashes the value of SDN and NFV. Standardized LSO APIs are critical for enabling agile, assured, and orchestrated services over automated, virtualized, and interconnected networks worldwide.

Above illustration courtesy of MEF

…………………………………………………………………………………………………………………………………………………………………………………………………………………

Conclusions:

I was pleasantly surprised by the honesty (if not brutal frankness) of the speakers. What a refreshing change from the never ending hype, exaggeration and lies one hears at most networking conferences – including the IEEE 5G Summits :-((.

With over 20 pages of handwritten notes and so many important things revealed, I am not able to write a detailed conference summary report on this free website. Hence, I solicit readers to email me what they’d like me to cover in future posts, after reading the conference agenda for Tuesday- Day 1 and Wednesday -Day 2.

Please remember that the IEEE Techblog does not accept advertisements so we can tell the real truth. Also we don’t charge for viewing posts or comments (no pay wall). Finally, this author has managed and contributed to this and predecessor website (community.comsoc.org) for over 10 years without any pay.

You may contact this author at: [email protected]

…………………………………………………………………………………………………………………..

References:

PRESENTATIONS FROM:

– WORKSHOP DAY: https://www.layer123.com/downloadfiles/NTC19_Presentations_WorkshopDay.zip

– DAY 1: https://www.layer123.com/downloadfiles/NTC19_Presentations_Day1.zip

– DAY 2: https://www.layer123.com/downloadfiles/NTC19_Presentations_Day2.zip

– FINAL ALL: https://www.layer123.com/downloadfiles/NTC19_Presentations_Final.zip