IHS Markit: Enterprises Evaluating SD-WAN; Ethernet Access Device Market up 8% YoY

Companies Evaluating SD-WAN As Enterprises Embrace the Cloud, IHS Markit Survey Says

LONDON (April 25, 2018) – IHS Markit (Nasdaq: INFO), a world leader in critical information, analytics and solutions, today released findings from its WAN Strategies North American enterprise survey, which reviews the evolving requirements for wide-area networks (WANs) of medium-to-large companies, including the adoption of software-defined WAN (SD-WAN). Nearly three-quarters (74 percent) of respondents conducted SD-WAN lab trials in 2017; by 2018, many will move into production trials and then to live production.

The latest annual survey of network managers from IHS Markit shows that investments in WANs continue unabated, driven by traffic growth, company expansion, adoption of the Internet of things (IoT), the need for greater control over the WAN, and the need to put WAN costs on a sustainable path. Security in particular is the number one network change by a wide margin, and the top reason to invest in new infrastructure, as companies must fend off the constant threat of cyber attacks.

“As companies shift a greater portion of their IT infrastructure into the cloud, and expand their physical presence to go after new markets or be closer to customers and partners, the need for reliable, secure and high-performance WAN and internet connectivity has never been greater,” saidMatthias Machowinski, senior research director for enterprise networks at IHS Markit. “However, companies don’t have unlimited budgets to fund growing WAN bandwidth consumption, which is why a majority are planning to deploy software-defined WAN in the next three years, to better control how their WANs are used.”

Following are some additional data points from the survey:

- Respondents expect their WAN bandwidth usage to grow over 20 percent annually — data center usage is the highest, while branch offices are experiencing the highest growth, at nearly 30 percent per year.

- Reflecting the significant demands placed on WANs, total WAN expenditures rose nearly 20 percent annually, to reach $300,000 per respondent in 2017.

- 71 percent of respondents will use off-premises cloud service providers by 2018, which will become the top application strategy in 2018.

………………………………………………………………………………………………………………

Ethernet access device market up 8 percent year over year in 2017

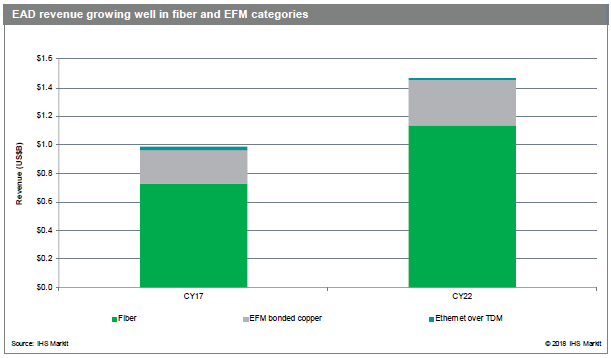

Worldwide Ethernet access device (EAD) revenue totaled $987 million in 2017, increasing 8 percent over 2016. The market is forecast to reach $1.47 billion in 2021, achieving a 2017–2022 compound annual growth rate (CAGR) of 8 percent.

“The EAD market is growing as a direct reflection of the continuous, steady demand from operators for mobile backhaul and wholesale services — and from business, broadband and building applications,” said Richard Webb, associate director, mobile backhaul and small cells research at IHS Markit.

“A new sub-segment is beginning to make an impact in the EAD market: the universal CPE, or ‘uCPE’ — a device that provides a ‘pico cloud’ of computing, storage and switching capable of executing virtualized functions,” Webb said. “Still, there will be an ongoing role for EADs even as virtual CPE takes off.”

Additional EAD market highlights

- Increasing demand for fiber-connected EADs will be the main driver of the market though at least 2022; in 2017, there was a 6 percent increase in the fiber segment

- Ciena was number one in EAD revenue market share for 2017, followed by ADVA, RAD, Actelis and MRV

- North America remained the largest market for EADs in 2017, with 50 percent of EAD revenue; Europe, the Middle East and Africa (EMEA) had 24 percent, Asia Pacific held 20 percent and the Caribbean and Latin America (CALA) had 6 percent

- For now and in the foreseeable future, North America maintains its lead through the early adoption of higher-capacity ports over fiber

Ethernet Access Devices Market Tracker

The biannual EAD report from IHS Markit tracks fiber and copper (EFM bonded and EoTDM bonded) Ethernet access devices by port speed, form factor and application. It also tracks uCPE. The report provides worldwide and regional market size, vendor market share, forecasts through 2022, analysis and trends.

FCM9003: Ethernet Access Device solution

Image courtesy of Metrodata in the U.K.

……………………………………………………………………………………………………….

About IHS Markit (www.ihsmarkit.com)

IHS Markit (Nasdaq: INFO) is a world leader in critical information, analytics and solutions for the major industries and markets that drive economies worldwide. The company delivers next-generation information, analytics and solutions to customers in business, finance and government, improving their operational efficiency and providing deep insights that lead to well-informed, confident decisions. IHS Markit has more than 50,000 business and government customers, including 80 percent of the Fortune Global 500 and the world’s leading financial institutions.

Taiwan Regulator: Price Wars Negative for 5G Development & Deployments

Taiwan’s National Communications Commission (NCC) regulator said that an ongoing price war in the Taiwanese mobile industry could hamper the development and deployment of 5G, according to an article in the Taipei Times.

The warning came after Chunghwa Telecom introduced a fourth-generation (4G) service plan earlier this month that targets government workers, teachers, school staff and military personnel, charging users NT$499 per month for unlimited access to mobile Internet and unlimited phone calls between subscribers of the same network. Taiwan Mobile, Far EasTone Telecommunications and Asia-Pacific Telecom quickly followed suit, introducing the same plan to attract subscribers.

NCC spokesperson Wong Po-tsung (翁柏宗) said that the commission respects a free market system, but added: “If telecoms simply want to boost their market shares and revenue by luring subscribers from competitors, rather than with innovative business models, it would not be positive for the development of 5G in the nation.”

“What they are doing does not help to make the pie bigger. They are not benefiting from innovative business models that could sustain them through the maintenance and operation of 4G services, the auctioning of the 5G service spectrum and finally commercial operation of 5G,” Wong said.

“That would hamper sustainable development of the nation’s telecommunications industry,” he added.

While carriers in other countries have sought to provide original content by buying content producers or have expanded their businesses overseas, Taiwanese telecoms are unlikely to do so, Wong said.

“Either none of them are big enough to develop their businesses overseas, or the acquisition of content providers is out of the question because of regulations that ban the government, political parties and the military from investing in media,” Wong said.

Carriers need to have courage and stop offering unlimited data and call service at unreasonably low prices, which would hurt their development in the long term, Wong said.

It is not the first time that telecoms have engaged in price competition to attract subscribers since 4G was launched in 2014. Average monthly fees dropped from about NT$1,300 to below NT$1,000 within one year of the service being launched, in a bid to motivate people to upgrade to 4G. The tactic was revived last year, with prices dropping further to NT$599 per month.

NCC statistics showed that mobile carriers’ revenue has declined from NT$53.2 billion (US$1.81 billion) in the second quarter of 2016 to NT$49.4 billion in the fourth quarter of last year.

Apart from a continued decrease in revenue from voice communication and a rapid increase in data transmission, industry experts have also attributed the decline in revenue to an ongoing price war. Offering unlimited data and call services at unreasonably low prices will hurt operators’ development in the long term, the regulator added. Operators are already grappling with declining revenue as a result of the price war, coupled with the continued decline in voice revenues.

As noted above, NCC does not believe that Taiwan’s operators will be able to follow the models their overseas counterparts have been pursuing to sustain growth – such as expanding overseas. pursuing acquisitions, or diversifying into original media content – due to Taiwanese operators’ relatively small size and regulatory restrictions.

“5G” terminals to be available 2nd half of 2019 in China; CCS Insight’s Mobile Phone Forecast

The first set of 5G end points, including data terminals, smartphones, tablets, and other products are expected to be released in China during the second half of 2019. That will lead to the commercialization of 5G technology in China, according to an official with the Ministry of Industry and Information Technology (MIIT), Xinhua news agency reported.

Wen Ku, director of the telecom development department at the Ministry of Industry and Information Technology, made the remarks as part of a timetable for 5G at the First Digital China Summit, which opened Sunday in Fuzhou, capital of Fujian province. “China started 5G research experiments in 2016, and entered the third stage of system verification this year,” Wen Ku said at the ongoing first Digital China Summit in Fuzhou, capital of east China’s Fujian Province. Wen noted that device manufacturers such as Huawei and Ericsson had participated in development of 5G products to help create a complete 5G industrial chain.

China has launched 5G cooperation mechanisms with Japan, South Korea, the European Union and the United States, with international companies joining the research and development, he noted.

Given the significantly greater speed — up to 10 gigabits per second — that 5G offers, the next-generation ultra-fast networks will see ways of life change more than in the 4G era, in virtually everything from how we “interact” with our cars to how we use the products in our homes.

In 2013, a working group focusing on 5G is established by the Ministry of Industry and Information Technology, the National Development and Reform Commission and the Ministry of Science and Technology.

At the beginning of 2016, China started its research on 5G technology. The country has finished two rounds of tests on 5G and is conducting a third round now. Initial 5G applications in China are set for 2019.

According to Beijing Youth Daily, China’s three major telecom operators including China Mobile, China Unicom and China Telecom have been approved to set up 5G networks in big cities.

- China Unicom will pilot 5G-technology in 16 cities including Beijing, Tianjin, Qingdao, Guiyang and Zhengzhou. China Unicom said it has started free chip upgrading for 2G users and cut 2G frequencies for the 5G network.

- China Mobile will launch offline testing in five cities in eastern and southern China, with each city installed with more than 100 5G stations as well as 5G application demonstrations in 12 cities.

- China Telecom has confirmed it will pilot 5G-technology in Xiong’an, Shanghai, Suzhou, Shenzhen, Chengdu and Lanzhou, and plans to expand the network to six more cities.

…………………………………………………………………………………………………………………………………………….

CCS Insight believes that manufacturers are increasingly looking to 5G technology to reignite growth in mature markets. Koytcheva comments, “The arrival of 5G handsets offers a glimmer of hope for embattled smartphone makers. They’re betting that this new, faster technology will give consumers a reason to upgrade their phones.”

However, Koytcheva cautions that phone-makers will have to be patient as they wait for this next wave of upgrade activity. “Although we expect the first 5G smartphones will hit the market in 2019, really significant demand won’t start until 2021, eventually having a positive impact in 2022, when we expect over 600 million 5G phones will be sold, accounting for 31 percent of the global market.”

CCS Insight also notes that while advanced markets are focused on the transition to 5G, consumers in emerging markets are taking up smartphones more slowly than previously expected. Koytcheva comments, “The rising cost of components for entry-level smartphones and the arrival of affordable feature phones that support 4G networks mean that many people who otherwise might have bought their first smartphone are sticking with a feature phone for now.”

The chart below provides a summary of CCS Insight’s mobile phone forecast.

Total shipments of mobile phones, 2013-2022

Source: CCS Insight Market Forecast: Mobile Phones Worldwide, 2018-2022

References:

Huawei Diminished Expectations for 5G; Struggles in U.S. vs Booming Business Elsewhere

He noted out that the full 3GPP Release 15 spec – which is expected in June this year – will only address part of future use cases for 5G, which is the enhanced mobile broadband for consumers.

[This author has repeatedly stated that 3GPP Release 16 and parts of Release 15 will be submitted to ITU-R WP5D as a candidate IMT 2020 RIT in July 2019 and NOT BEFORE THEN!]

Xu said the current 4G infrastructure is “pretty robust” and good enough to support most use cases and he doesn’t see many clear use cases or applications which can only be supported with 5G. Xu is not expecting 5G to be used for nationwide coverage in China (or any other country for that matter), at least to begin with. Instead, he expects 5G to be used for specific, more localized deployments where there is a need for increased speed and bandwidth.

However, he noted, this doesn’t mean it’s not worth investing in 5G. “If you’re not investing in 5G, your customers won’t invest in your 4G,” Xu said.

“It’s the same case for telecoms operators. They are driven by competition, if one telco in the market says, ‘I have 5G-enabled services,’ the other service providers will have to launch 5G, for marketing and branding reasons.”

Xu said Huawei will continue to be committed in 5G investment and the company’s progress in this area is quite “encouraging.”

“By the second half of this year we will launch end to end 5G solution to cater our operators customers who do have requirements for 5G. And we are going to launch 5G-capable smartphones in the third quarter of next year.”

………………………………………………………………………………………………………………..

Huawei’s Struggles in the U.S. vs. Booming Business Elsewhere

Huawei has failed to find a U.S. carrier to partner with for its smartphones, and the Federal Communications Commission this Tuesday approved a draft order that could damage Huawei’s existing business in telecom/network equipment. The order cited Huawei and its Chinese rival ZTE by name.

Huawei’s struggles in the United States are in contrast to its booming business in developing countries and growing presence in Europe, where it has been working on next-generation, or “5G,” wireless standards. The company’s profits rose 28.1 percent in 2017, boosted by strong enterprise and consumer sales and booming business overseas.

The recent setbacks have left Huawei’s future in the U.S. uncertain. Huawei recently let go of several American employees in their Washington D.C. office, including William Plummer, who spearheaded efforts to convince the U.S. to allow Huawei in for nearly a decade. Though Huawei declined to comment on the layoffs, the news was first reported by the New York Times and independently confirmed by the Associated Press.

Huawei and ZTE’s burgeoning 5G research is seen as a particular threat, as its expanded transmitting capabilities are seen as crucial for a host of emerging technologies based on artificial intelligence – including self-driving vehicles, robots and other machines that transmit vast amounts of data in real time.

Apart from expanding its influence in the ITU-R WP 5D, which develops cellular technology standards, Huawei joined forces with European companies to develop pseudo “5G” standards. In February, it completed the world’s first “5G” test call in partnership with London-based Vodafone.

Still, while Chinese trade relations with Europe remain calm, Washington has been warning officials in Canada and Australia about Huawei, raising questions about the company’s long-term global prospects.

“Huawei is perceived differently in Europe but that’s definitely a risk for the company,” said Thomas Husson, principal analyst at technology research firm Forrester. “Let’s not forget Europeans can still try to push in favor of European-based solutions from Nokia or Ericsson.”

CTIA Commissioned Study Finds China Ahead of South Korea and U.S. in race to 5G

China has moved slightly ahead of both South Korea and the U.S. in the race to deploy 5G, according to a new report by Analysys Mason. The countries were ranked based on nations’ respective 5G spectrum and infrastructure policies as well as commercial plans by their respective wireless sectors.

China leads the world in 5G readiness, followed by South Korea, the U.S. and Japan in that order, according to the report, which was commissioned by CTIA-the U.S. based trade organization for the wireless industry.

Analysis Mason found that all three major Chinese wireless network operators (China Telecom, China Mobile, and China Unicom) have committed to specific 5G launch dates. The government has also committed to providing at least 100 MHz of mid-band spectrum and 2,000 MHz of high-band spectrum for each operator.

In South Korea, the government is soon expected to free up a combined 1300 MHz of both mid-band 3.5-GHz and high-band 28-GHz spectrum, with an additional 2 GHz of high-band spectrum capable of being utilized for 5G.

While all major US wireless providers are trialing 5G technologies and a number have committed to small-scale fixed wireless 5G launches by the end of the year, the country has yet to announce plan to allocate mid-band spectrum exclusively for mobile by the end of 2020.

“The United States will not get a second chance to win the global 5G race,” CTIA president and CEO Meredith Attwell Baker said.

“Today’s research highlights the importance of policymaker action in 2018 to reform local zoning rules and unlock access to mid-band spectrum as part of a broader spectrum pipeline plan. I’m optimistic we will leapfrog China because key leaders in the Administration, on Capitol Hill, and at the FCC are focused on the reforms needed to win the race.”

In Japan, wireless providers are investing in 5G testing and regulators have committed to releasing mid- and high-band spectrum by early 2019.

In evaluating the current status of the global race to 5G, Analysys Mason studied 5G spectrum and infrastructure policies as well the commercial industry plans of ten countries.

Key findings by Analysys Mason include:

- All major Chinese providers have committed to specific launch dates and the government has committed to at least 100 MHz of mid-band spectrum and 2,000 MHz of high-band spectrum for each wireless provider.

- Countries around the world are moving quickly to make spectrum available for 5G. This year alone, the U.K., Spain, and Italy are all holding 5G spectrum auctions.

- At the end of 2018, the U.S. will rank sixth out of the 10 countries in mid-band (3– 24GHz) spectrum availability, a critical band for 5G. The U.S. joins Russia and Canada as the only countries currently without announced plans to allocate mid-band spectrum on an exclusive basis to mobile by the end of 2020.

- Countries like the U.K. and regions like the European Union are taking significant steps to modernize infrastructure rules to facilitate the deployment of 5G networks.

To understand the potential impact the race to 5G may have on America’s economy, Recon Analytics conducted an historical analysis of how winning and losing wireless leadership effected the economies of the U.S. and other nations.

“When countries lose global leadership in a generation of wireless, jobs are shed and technology innovation gets exported overseas,” said Roger Entner, Founder, Recon Analytics. “Conversely, leading the world in wireless brings significant economic benefits, as the U.S. has seen with its 4G leadership. These are the serious stakes that face American policymakers in the escalating global race to 5G.”

Findings from Recon Analytics include:

- Winning the race to 4G boosted America’s GDP by nearly $100B and our 4G launch spurred an 84% increase in wireless-related jobs – benefits that could have gone to other countries had the U.S. not led the world in 4G.

- U.S. 4G leadership helped secure leading positions in key parts of the global wireless ecosystem, including the app economy.

- Losing wireless leadership had long-term negative effects on Japan and Europe, contributing to job losses and the contraction of their domestic wireless industries.

To highlight the implications of these reports, CTIA is hosting the Race to 5G Summit on Thursday, April 19 in Washington, D.C. The summit will bring together leading policymakers and technology and wireless industry executives involved in shaping America’s 5G future.

Additional resources:

- Race to 5G Report: www.ctia.org/news/race-to-5g-report

- Race to 5G Facts and Figures: www.ctia.org/the-wireless-industry/the-race-to-5g

- Analysys Mason: Global Race to 5G – Spectrum and Infrastructure Plans and Priorities: www.ctia.org/news/global-race-to-5g-spectrum-and-infrastructure-plans-and-priorities

- Recon Analytics: How America’s 4G Leadership Propelled the U.S. Economy: www.ctia.org/news/how-americas-4g-leadership-propelled-the-u-s-economy

About the Analysys Mason Research

This research was commissioned by CTIA. Analysys Mason compared 5G spectrum and infrastructure policies proposed in markets worldwide to advance 5G technology and facilitate successful network deployment, and to prepare a readiness comparison between markets.

About Analysys Mason

Analysys Mason is a global consultancy and research firm specialising in telecoms, media and technology for more than 30 years. Our consulting and research expertise in telecoms, media and technology underpins everything we do to help change our clients’ businesses for the better. Since 1985, Analysys Mason’s consulting and analyst teams have played an influential role in key industry milestones and helping clients around the world through major shifts in the market. Our consulting and research divisions continue to be at the forefront of developments in digital services and transformation are advising clients on new business strategies to address disruptive technologies. Our experts located in offices around the world provide local perspective on global issues.

About the Recon Analytics Research

This research was commissioned by CTIA. This is the fifth report over the last thirteen years that Recon Analytics has authored on the impact of the wireless industry on the U.S. economy. Building on the same consistent framework, these reports have documented how the U.S. wireless industry has revolutionized society and the U.S. economy, relying on extensive primary and secondary research for these studies.

About Recon Analytics: The mission of Recon Analytics is to clear the clutter, help focus executives and policymakers on what is actually happening in the marketplace and what really matters, and make a positive impact on business and policy decisions. Founded and led by leading telecom analyst Roger Entner, Recon Analytics’ approach is bolstered by its industry-first executive advisory board, which helps us hone our strategy, improve our research, and provide unparalleled insights into the matters most relevant to the business and the public policies impacting it. With this foundation, Recon Analytics focuses on three core areas: Syndicated research, custom consulting, policy related data analysis, as well as white papers.

About CTIA

CTIA® (www.ctia.org) represents the U.S. wireless communications industry and the companies throughout the mobile ecosystem that enable Americans to lead a 21st century connected life. The association’s members include wireless carriers, device manufacturers, suppliers as well as apps and content companies. CTIA vigorously advocates at all levels of government for policies that foster continued wireless innovation and investment. The association also coordinates the industry’s voluntary best practices, hosts educational events that promote the wireless industry and co-produces the industry’s leading wireless tradeshow. CTIA was founded in 1984 and is based in Washington, D.C.

Huawei’s growth due to increased smartphone sales (but not in U.S.); China to lead world in 5G handsets

In an annual business report meeting with journalists in late March at the company’s Shenzhen, China headquarters, Huawei reported that its total revenue grew 15.7%, to $92.5 billion, in 2017. More impressive, net profit grew 28.1%, to $7.3 billion, a huge improvement over 2016’s 0.4% rate. Privately owned Huawei gets most of its revenue now from selling telecom/network equipment, which generated roughly $47 billion over the past year. While that was only a 3% growth rate, the Chinese company enjoyed a 35.1% growth in its enterprise business unit, which includes cloud computing and big data, though the overall revenue of $8.7 billion is relatively small.

Until 2020 (or later), when”5G” is deployed by carriers using Huawei base stations, the company’s fastest growing and most visibly prominent area is and will be its smartphones.

Huawei’s Deputy Chairwoman and Chief Financial Officer Sabrina Meng, along with CEO Ken Hu, recently told reporters how the company managed to increase net profits and net profit margins at a rate higher than total revenue growth. The company became more efficient at growing smartphone sales. “In 2016, one of the biggest areas that dragged consumer business group profits down were the high cost of components,” said Meng. “So we developed a better supply management chain and improved our working relationships with vendors.” Hu added that whether it’s brand image with consumers or phone units sold, Huawei made significant improvements in 2017. According to data released to the media, Huawei and sub-brand Honor combined to sell 153 million handsets in 2017, generating $37.85 billion in sales. The smartphone market is arguably the most competitive industry in all of consumer business with many players jockeying for a small market share behind kingpins Samsung and Apple.

………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………….

Ben Sin of Forbes recently wrote, “the Huawei P20 Pro is the new low light photography king (of smartphones), and it’s not even close right now.” It’s even better than the Samsung Galaxy S9+ which received excellent reviews from journalists that tested it. The Huawei P20 Pro. Photo courtesy of Forbes.com:

The Huawei P20 Pro has a 6.1-inch display with an 18.7:9 aspect ratio. The screen’s unusually tall aspect ratio makes the phone very easy to hold and reach across, and the panel is an OLED from Samsung, so it’s very good. The resolution here is just 1080p so technically it isn’t as crisp as the Quad HD found on other Android flagships, but frankly it doesn’t matter. What does matter is that the OLED panel on the P20 Pro just doesn’t get as bright as the panel on the Galaxy S9. I suspect Huawei’s Samsung OLED panel is a generation behind the ones used on the S9. The back of the handset is crafted out of glass, and it attracts fingerprints just as much as Samsung or LG phones. The P20 Pro ships in colors that are a bit different from the norm, including an eye-catching Twilight color with a gradient finish. The phone also comes in black or this pinkish gold color.

The triple camera set-up includes: a 40-megapixel RGB lens, 20-megapixel monochrome lens, and an 8-megapixel telephoto lens. Huawei has used the RGB+monochrome combo for its phones since 2016, so the new addition here is the telephoto lens, which offer lossless optical zoom. The optical lens is a 3X zoom compared to the Apple iPhone X’s 2X zoom.

………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………….

U.S. Market Difficult to Enter for Huawei, ZTE and other China based Companies:

As the U.S. government, and more recently AT&T and Verizon, have taken numerous steps over the years to prevent Huawei from entering its market. Xiang Ligang, a telecom veteran and CEO of the industry website Cctime, said it has become increasingly challenging for Chinese telecom companies to do business in the U.S. amid heightened concerns over national security.

“The U.S. is a market Chinese companies must conquer if they want to become global players. But now politics rather than technology or products is playing a bigger role in their business prospects in the U.S.,” Xiang said. He also opined that China’s handset producers have an edge in developing 5G terminal devices compared with their U.S. competitors. “In terms of the research and innovation ability, the global top four telecom equipment suppliers are Huawei, Ericsson, ZTE and Nokia… two out of the four are Chinese technology giants and we could barely name a U.S. company,” he said. “Without 5G-capable terminal devices, you cannot access a 5G network.” Xiang believes this year will be a watershed for China’s 5G technology development. He thinks the final testing of “basic 5G” technologies will be completed (this author disagrees and things that won’t be before 2021), paving the way for the next phase of development – 5G products such as terminal devices (e.g. smartphones, other handsets, IoT devices, etc).

In addition to compatible terminal devices, China’s investment in 5G infrastructure also bodes well for its position in the intensifying global competition. Under the guidelines of the National Development and Reform Commission, the country’s three State-owned network operators – China Mobile, China Unicom and China Telecom – have each announced plans to begin building 5G networks this year in at least five cities. China Mobile said in February that it may be able to offer a full 5G service by the end of 2019, a year ahead of the 2020 goal, thanks to a technology known as “slicing packet networks,” which help operators to manage network architectures, bandwidth, traffic, latency and time synchronization, said another Xinhua report.

Huawei, failed to get its smartphones sold in the local carrier retailing channel, which accounts for a majority of smartphone sales in the US. Verizon Communications Inc has dropped all plans to sell Huawei’ s phones, while AT&T Inc also walked away from a similar deal at the last minute under pressure from the U.S. government, according to a Bloomberg report.

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

Sidebar: Top Smartphone Makers

Currently, Chinese companies account for 7 of the world’s top 10 smartphone vendors (see top 10 below), but in the U.S., only one Chinese brand stood out – ZTE Corp grabbing a market share of 12 percent. “Such contrast is a result of multiple factors, and political concern is certainly one of them,” Xiang said. As a result, Huawei will likely focus on increasing smartphone sales in Asia, Europe and Latin America.

According to marketing91, the top 10 smart phone makers in 2017 were: 1) Samsung 2) Apple 3) Huawei 4) Lenovo 5) Xiaomi 6) LG 7) ZTE 8) Oppo 9) Alcatel 10) Vivo

……………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………

Looking for Future Growth:

This year marks Huawei‘s 30th birthday. Following the general Chinese idea that age 30 is when a boy truly becomes a man, the company is looking for new growth opportunities.

“As we look to 2018, emerging technologies like the Internet of Things, cloud computing, artificial intelligence and 5G will soon see large-scale application,” said Hu. “Throughout this process, Huawei will . . . pay special attention to the practical challenges that our customers face as they go digital. Our job is to help them overcome these challenges and achieve business success. Ultimately, we aim to bring digital to every person, home and organization for a fully connected, intelligent world.”

xRAN Forum approves Fronthaul Interface Specification for NexGen Open RAN architecture

Executive Summary:

On April 12th, the xRAN Forum (xRAN.org) announced the public availability of the xRAN Fronthaul Specification Version 1.0 – the first specification made publicly available from xRAN since its launch in October 2016. The specification was said to permit “a wide range of vendors to develop innovative, best-of-breed RRUs (remote radio unit) and BBUs (base band units) for a wide range of deployment scenarios, which can be easily integrated with virtualized infrastructure and management systems using standardized data models.”

Why is a new RAN architecture needed?

Current RAN architectures result in sub-optimal use of scarce spectrum and radio resources as well as make it hard for operators to program them quickly to meet emerging customer needs. Amid exploding demand for bandwidth and intense demands from new services, carriers need an alternative approach to address the escalating capital and operational costs of the existing design as well as make the network more agile to deploy new services.

Why It’s Important:

The new specification was said to “deliver on important operator member requirements.” It defines open interfaces between the remote radio unit/head (RRU/RRH), the baseband unit (BBU) and the operation and management (OAM) interface to simplify interoperability between suppliers. It’s significant because traditionally, the RRU and BBU had to come from the same vendor. By complying with this spec, different vendors (best of breed?) could provide each of those pieces of equipment. The desired outcome is for a wireless network operator to buy an RRU from one vendor and a BBU from another vendor such that they’ll work together via a common interface. Some say it’s going to bust up the old “cartel” of RRU/BBU suppliers.

The xRAN Fronthaul spec was said to address several key operator-defined requirements, including:

• BBU – RU interoperability based on well specified control, user and management plane interfaces.

• Efficient bandwidth scaling as a function of user throughput and spatial layers to address

increasing bandwidth needs and Massive MIMO deployments.

• Support for LTE, NR, associated features, 2T – 8T RU products and Massive MIMO beamforming

antenna systems.

• Advanced receivers and co-ordination functions.

• Ethernet based transport layer solutions.

• Extensible data models for management functions to simplify integration.

The xRAN Forum Front Haul Working Group is chaired by Verizon. A spokeswoman for Verizon, told Lightreading in an email that the xRAN spec defines an “open Internet-based standard on which future RAN products will be built,” while ORAN is an effort to “ensure various proprietary CPRI-based systems can understand one another’s languages and operations.”

Note: CPRI (Common Public Radio Interface) defines the interface between Radio Equipment Controllers (REC) and Radio Equipment (RE) such that multiple vendors can provide different parts of a base station.

Selected Quotes:

“Our vision to develop, standardize and promote an open alternative to the traditionally closed, hardwarebased RAN architecture is becoming a reality,” said Dr. Sachin Katti, Professor at Stanford University and Director of the xRAN Forum. “Our operator members have been very focused and clear on requirements and our ecosystem of contributing members have risen to the challenge. The Fonthaul Specification is the first of several open interface specifications we expect to be released in 2018.”

“The release of the xRAN Fronthaul Specification is a groundbreaking advancement toward enabling an open RAN architecture to support next-generation products and services,” said Bill Stone, Vice President, Network Technology Development and Planning at Verizon. “xRAN compliant radios coupled with virtualized basebands provide much needed flexibility to support rapid development and deployment of RAN products. By adopting xRAN specifications, we will be able to speed innovation, increase collaboration, and be more agile to a quickly evolving market.”

“We are pleased to have worked with xRAN members in reaching the key milestone of delivering the first open xRAN fronthaul specification,” said Dr. Hiroshi Nakamura, EVP and CTO of NTT DOCOMO. “We believe that the completion and publication of this specification will contribute in further advancing the RAN and in expanding the ecosystem in the 5G era. DOCOMO will keep contributing to this activity with the experience we had in realizing multi-vendor interoperable RAN with our partners using common interfaces for our LTE network.”

“The xRAN Fronthaul Specification is a foundational component in the xRAN architectural vision and vital to accelerating the worldwide deployment of next-generation RAN infrastructure network operators demand,” said Alex Jinsung Choi, SVP Research & Technology Innovation, Deutsche Telekom. “Going forward, by connecting these specification activities to the broad architectural scope in ORAN, we can ensure the implementations across a wider community of suppliers to promote both innovation and open market competition.”

“xRAN’s release of this jointly-developed open specification creates the first wave of a positive sea change for our industry, transforming the way next-generation RAN infrastructure will be built, managed and optimized,” said Andre Fuetsch, CTO and President AT&T Labs. “Equipment that supports open specifications from xRAN (and ORAN in the future), combined with increasing RAN virtualization and data-driven intelligence, will allow carriers to reduce complexity, innovate more quickly and significantly reduce deployment and operational costs.”

The specification is designed to allow for a range of vendors to develop best-of-breed RRUs and BBUs for various deployment scenarios. (Pixabay)

About xRAN Forum:

The xRAN Forum was formed to develop, standardize and promote an open alternative to the traditionally closed, hardware-based RAN architecture. xRAN fundamentally advances RAN architecture in three areas – decouples the RAN control plane from the user plane, builds a modular eNB software stack that operates on common-off-the-shelf (COTS) hardware and publishes open north- and south-bound interfaces to the industry.

xRAN Forum operator members include: AT&T, Verizon and Deutsche Telekom, KDDI, NTT DoCoMo, SK Telecom and Telstra. The vendor and academic community is also represented in the xRAN Forum by AltioStar, Amdocs, Aricent, ASOCS, Blue Danube, Ciena, Cisco, CommScope, Fujitsu, Intel, Mavenir, NEC, Netsia, Nokia, Radisys, Samsung, Stanford University, Texas Instruments and University of Sydney.

References:

http://www.xran.org/resources/

Mozilla Foundation: Internet is NOT Healthy! FB Google, Amazon and Tencent Hold Too Much Power

The Mozilla Foundation has published its 2018 Internet Health Report, specifically citing consolidation of control as a concerning issue. Other areas of concern include web literacy, “digital inclusion,” openness, and personal privacy and security. “Fake news,” IoT security weakness and hacking are symptoms of larger problems.

Mozilla Foundation Executive Director Mark Surman explained the harm done by Facebook’s failure to enforce its privacy policy. In a blog post today, he described the process of creating the 2018 Internet Health Report. As Surman and foundation fellows were discussing how to examine the topic of “fake news,” he wrote, “I sketched out a list on a napkin to help order our thoughts:”

What the napkin said:

Collecting all our data

+ precision targeted ads

+ bots and fake accounts

+ FB dominates news distribution

+ not enough Web literacy

= fuel for fraud and abuse, and very bad real world outcomes

…………………………………………………………………………………………………….

Edited by Solana Larsen and written by Mozilla Foundation research fellows, the Internet Health report is an evaluation of “what’s helping and what’s hurting the Internet,” and it focuses on five broad areas of concern—personal privacy and security, decentralization, openness, “digital inclusion,” and general Web literacy. And Facebook’s part in the health of the Internet is writ large across the report.

Of particular concern were three issues:

- Consolidation of power over the Internet, particularly by Facebook, Google, Tencent, and Amazon.

- The spread of “fake news,” which the report attributes in part to the “broken online advertising economy” that provides financial incentive for fraud, misinformation, and abuse.

- The threat to privacy posed by the poor security of the Internet of Things.

The foundation’s report isn’t all bad news—it highlights progress in affordable access and the adoption of cryptography. But the cautionary notes outweigh the optimistic ones, especially on the topic of consolidation of control over Internet content and collection of personal data. While the data collected and transformed into intelligence by the big social media and e-commerce vendors is vast, the Mozilla Foundation report warns, “The network control of major Internet services is only part of the grip they hold on our lives. Through sheer size and diverse holdings, a few companies including Google, Facebook, and Amazon—or if you live in China, Baidu, Tencent and Alibaba—have become intertwined not only with our daily lives, but with all aspects of the global economy, civic discourse, and democracy itself… they are too big. Through monopolistic business practices that are specific to the digital age, they undermine privacy, openness, and competition on the Web.”

That impact extends into the realm of “fake news,” as the report points out, because “most people are getting at least some of their news from social media now.” This enabled the Russia-based Internet Research Agency’s efforts to distort reality by creating dozens of ‘fake’ Facebook pages, including “BlackMattersUS” and “Heart of Texas,” as the report cites—using the language of US political movements to attract followers and spread misinformation—as well as organizing actual protests, “and once even a protest and a counter protest at the same time,” the report notes.

At the same time, thousands of “fake news” stories were created entirely to generate revenue from advertising—many of them created by people in one town in Macedonia. Social media platforms allowed these fraudulent articles to generate hundreds of thousands of dollars in revenue for their creators.

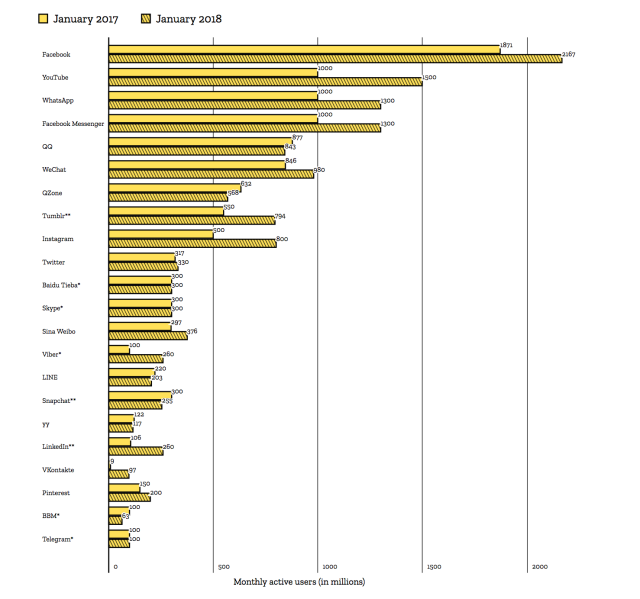

Social media sites are a natural platform for this sort of deception and fraud, because it’s where the eyeballs are. The reach of social media companies has continued to expand, as the report shows in this chart of monthly active users, in millions, for each social media platform. During 2017, Facebook managed to expand its monthly active user base from 1.87 billion to 2.17 billion, while expanding its reach into users’ lives as millions more adopted Facebook’s Messenger application and WhatsApp (each of which now has approximately 1.3 billion monthly active users).

The precision with which these platforms can be used to target particular types of users and to effectively distort their perception of the world around them makes the dominance of the Internet by Facebook and others even more dangerous, the researchers asserted.

The emerging Internet of Things poses its own sort of danger to the privacy and security of individuals. With 30 billion Internet-connected devices expected by 2020, the report’s authors expressed concern about both the privacy impact of those devices and the threat posed by malware like the Mirai botnet that struck the Internet last year. The report warns that “the risk of all these insecure ‘things’ still exists, and the scale grows bigger with every new connected device.”

………………………………………………………………………………………………………………………

Here’s the link to an excellent webinar that analyzes the crux of the Facebook/Cambridge Analytica fiasco. The bottom line is Facebook didn’t enforce its stated privacy policies and there was no regulatory oversight to hold them accountable. This author asked the first question towards the end of the webinar at 56:05. The presenter said “That’s a very weighty question but I’d appreciate it.”

Dell’Oro: Worldwide Capex Forecast to Rise 2017 – 2020 Despite Flat Carrier Revenues with only 2% from IoT

According to a recently published report from Dell’Oro Group, worldwide newtork operator capex is forecast to rise from 2017 through 2020 despite flat carrier revenues. The most notable increases come from AT&T, Sprint, Megafon, Orange, Etisalat, and Deutsche Telekom.

“We have adjusted our overall three-year CapEx expectations upward to reflect a more optimistic investment view than we had originally envisioned in both the US and Chinese markets,” Stefan Pongratz, a senior analyst at Delloro, said in a blog post online. The increase in global CapEx is being driven by increased spending in the US, as the country tries to position itself at the front of the queue for 5G deployment.

“After three consecutive years of declining capex, short-term and near-term market expectations have shifted up,” Pongratz said.

“Here in the US, we maintain the view that conditions are stabilizing and both capex and capital intensity will continue to trend upward. There are multiple factors that support our renewed optimism for capex in the US:

- We are seeing our first signs of US Federal tax reductions translating into increases in capex with a clear boost in AT&T’s 2018 capex projections.

- We see Sprint investing again

- FirstNet investments are set to commence in 2018

- Larger data plans are propelling capacity investments

And lastly, overall carrier revenue trends are stabilizing,” continued Pongratz.

However, total capex spending in China [Figure 1. below] is still expected to decline year-on-year in 2018 and stay flat in 2019 before returning to growth in 2020.

Currency adjusted operator revenues are projected to remain flat between 2017 and 2020, with operators expected to struggle to find new revenue streams to offset slower smartphone revenue growth.

While the IoT has long-term revenue generation possibilities, there is expected to be limited benefit over the next few years. Dell’Oro estimates that carrier IoT revenues will account for just 2% of total mobile revenues by 2020. Preliminary IoT connection pricing trends for 2017 are cause for concern, with downside risks to the IoT carrier revenue forecast, should price trends prevail. Please see Figure 2. below for Dell ‘Oro forecast of IoT Carrier revenue growth through 2020.

About the Report

The Dell’Oro Group Carrier Economics Report provides in-depth coverage of more than 50 carriers’ revenue, capital expenditure, and capital intensity trends. The report provides actual and forecast details by carrier, by region, by country (United States, Canada, China, India, Japan, and South Korea), and by technology (wireless/wireline). The report also discusses further capex accelerating factors such as preparation for 5G and inhibiting factors such as the flat revenue trend. The report assumes operators will struggle to identify new revenue streams.

To purchase this report, please contact Matt Dear at +1.650.622.9400 x223 or email [email protected].

About Dell’Oro Group

Dell’Oro Group is a market research firm that specializes in strategic competitive analysis in the telecommunications, networks, and data center IT markets. Our firm provides in-depth quantitative data and qualitative analysis to facilitate critical, fact-based business decisions. For more information, contact Dell’Oro Group at +1.650.622.9400 or visit www.delloro.com.

New FTTC technology to be deployed in Australia under NBN rollout

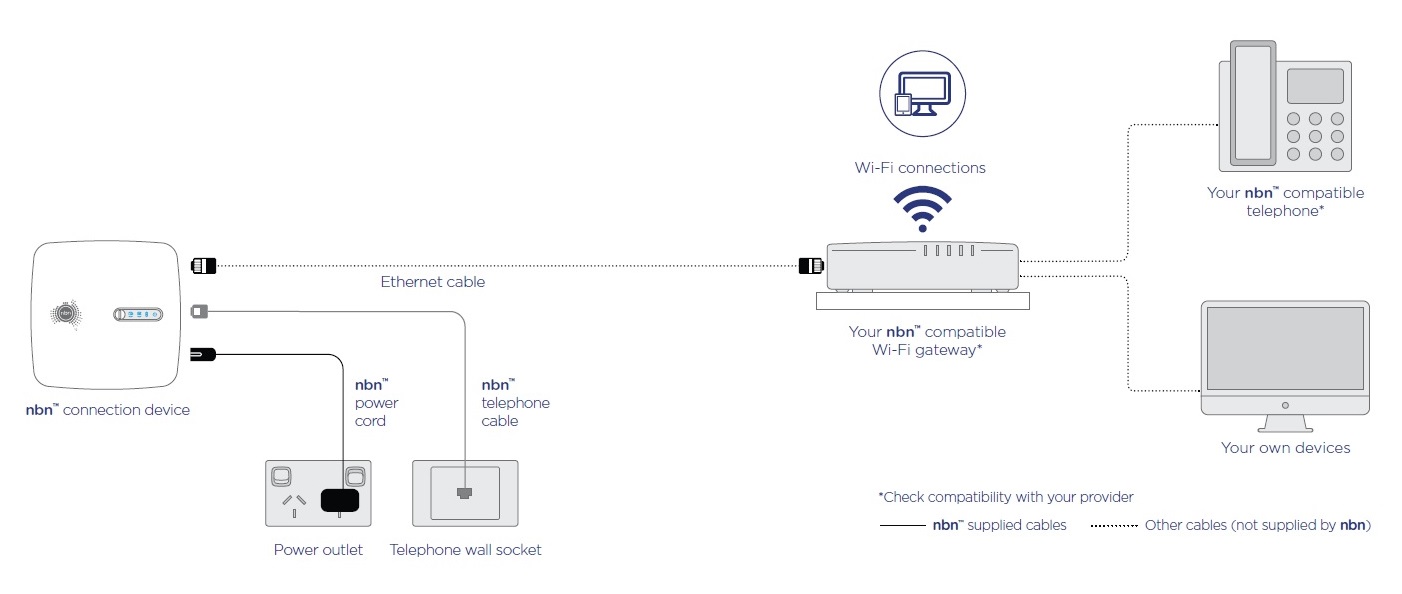

More than 1000 homes and businesses in North Melbourne and Sydney’s south will be the first to benefit from new technology under the NBN rollout that will deliver faster broadband speeds. NBN Co is providing a limited release of its fiber-to-the-curb (FTTC) technology that will connect to a telecom pit near a driveway outside a home or business rather than a junction box down the street, with a larger release due in the second half of this year. Fiber-optic cable is connected to the pit outside the home or business, with existing copper lines used to connect the Internet to the premise. [That’s the same topology used by AT&T’s U-verse in the U.S.]

NBN Co‘s chief network engineering officer Peter Ryan labelled the Australian-made technology a “breakthrough:”

“It allows us to deliver a lot of the benefits of fiber-to-the-premise (FTTP) without the inconvenience of digging front lawns of Australians,” he told reporters. “It allows us to deploy the NBN faster and at a lower cost and complete the network by 2020,” he added.

Testing has seen download speeds of over 100 Mbps and more than 40 Mbps uploads. That could reach a gigabit per second with the addition of new “copper acceleration technology”, which is planned in selected areas by the end of the year.

About one million premises are expected to be connected by 2020, Communications Minister Mitch Fifield said, although that could change. “This is really good news and a further development in the evolution of the NBN,” he told reporters alongside Treasurer Scott Morrison at the launch in Miranda, in Sydney’s south, on Sunday.

nbn™ Fibre to the Curb (FTTC) equipment

For more information, please visit: https://www.nbnco.com.au/learn-about-the-nbn/network-technology/fibre-to-the-curb-explained-fttc.html

………………………………………………………………………………………………………………………………………………………………………………………………………………………….

NBN Co will decide what other locations will get the FTTC broadband access, based on what technology “makes sense” in any given area, Mr. Fifield said. FTTC can deliver the same 100Mbps speeds as fiber-to-the-premise, but at a lower cost, in much less time and with far less disruption to people’s property, he added. Mr Fifield guaranteed all premises would get at least 25 Mbps, with 90 per cent above 50 and 72 per cent at 100 Mbps. “The Turnbull government is keeping broadband bills down and taxes lower by rollout the NBN sooner and more affordably,” he said.

NBN Co’s chief customer officer for residential, Brad Whitcomb, said new “copper acceleration technology” known as G.fast could deliver even faster speeds in selected areas by the end of the year.

Mr Whitcomb said NBN has been working closely with service providers to test the new FTTC over the past few months.

“As with the introduction of any new technology, we will continue to gain insights as we navigate the complexity of the build as well as potential issues which can arise when people connect to the network,” he said in a statement.

Mr. Fifield is confident the network will meet the speed needs of Australians once completed in 2020, but noted NBN Co would pursue upgrade options if needed. “I think the experience people are having today is, overwhelmingly, a good one,” he said.

https://thenewdaily.com.au/news/state/nsw/2018/04/08/nbn-fttc-sydney-melbourne/