Optical network market poised for growth in 2013, especially in EMEA region

1. Market research firm Infonetics Research just released vendor market share and preliminary analysis from its 4th quarter 2012 (4Q12) and year-end Optical Network Hardware report. The full report will be published Feb. 27th.

OPTICAL NETWORK MARKET HIGHLIGHTS :

. The global optical network hardware market rose 2% in 4Q12 from 3Q12, but was down 13% from the year-ago 4thQ

. For the full year 2012, total optical equipment spending was down 10% worldwide

. The SONET/SDH optical segment fared much worse, essentially dealt a death blow in 2012 as global legacy capex fell 30%

. After posting its lowest-ever optical revenue results a quarter ago, Alcatel-Lucent bounced back in 4Q12, up 29% on the tide of the EMEA capex surge; still, ALU’s WDM revenue is down from a year ago

. Ciena’s optical revenue was down sequentially and year-over-year, but grew shipments of its 40G and 100G equipment and is ramping production of a new single-carrier 100G solution

. Infinera had another strong quarter, thanks to a surge in sales of its new DTN-X OTN switching platform

“After ending 2012 on a flat note, things are looking up for the optical market in 2013,” notes Andrew Schmitt, principal analyst for optical at Infonetics Research. “Our conversations with equipment providers continue to trend positive, particularly in North America where 100G spending is about to ramp. The general consensus remains that an optical cycle for equipment in the core is emerging, what we call the ‘optical reboot.'”

“Meanwhile, there are positive rumbles in the EMEA region, where 2012 ended with a spending flourish and carriers are cutting dividends to plow capital into general capex,” Schmitt adds. “And we are looking forward to our visits with carriers in Beijing this spring to get a good read on the year, but the preliminary indication is it will be a huge year for 100G. China is about half of the global 40G WDM market, and 2013 will be the peak year for 40G worldwide.”

In an earlier report, Mr Schmitt was quite positive about the OTN Switching market. Andrew wrote, “Though OTN switching currently makes up only a small portion of the overall OTN market and deployments have been centered mostly in China, we anticipate breakout growth for this segment as operators in EMEA and North America adopt integrated WDM+OTN switching as part of the roll out of 100G coherent technology in regional and core networks. We’re forecasting the OTN switching segment to grow at a 5-year compound annual growth rate of 28% from 2012 to 2016.”

OPTICAL HARDWARE REPORT SYNOPSIS:

Infonetics’ quarterly optical hardware report provides worldwide and regional market size, market share, analysis, forecasts, and trends for metro and long haul SONET/SDH and WDM equipment, Ethernet optical ports, SONET/SDH/ POS ports, and WDM ports. Companies tracked include Adtran, ADVA, Alcatel-Lucent, Ciena, Cisco, ECI Telecom, Ericsson, Fujitsu, Huawei, Infinera, NEC, Nokia Siemens Networks, Tellabs, Transmode, Tyco Telecom, ZTE, and others. To buy the report, contact Infonetics:

http://www.infonetics.com/contact.asp

2. TechNavio’s report, the Optical Network Hardware Market in the EMEA Region 2011-2015, has been prepared based on an in-depth market analysis with inputs from industry experts. The report focuses on the EMEA region; it also covers the Optical Network Hardware market landscape and its growth prospects in the coming years. The report also includes a discussion of the key vendors operating in this market.

TechNavio’s analysts forecast the Optical Network Hardware market in the EMEA region to grow at a CAGR of 2.93 percent over the period 2011-2015. One of the key factors contributing to this market growth is the increased bandwidth requirements. The Optical Network Hardware market in the EMEA region has also been witnessing strong growth prospects in Central and Eastern Europe. However, the high initial investment could pose a challenge to the growth of this market.

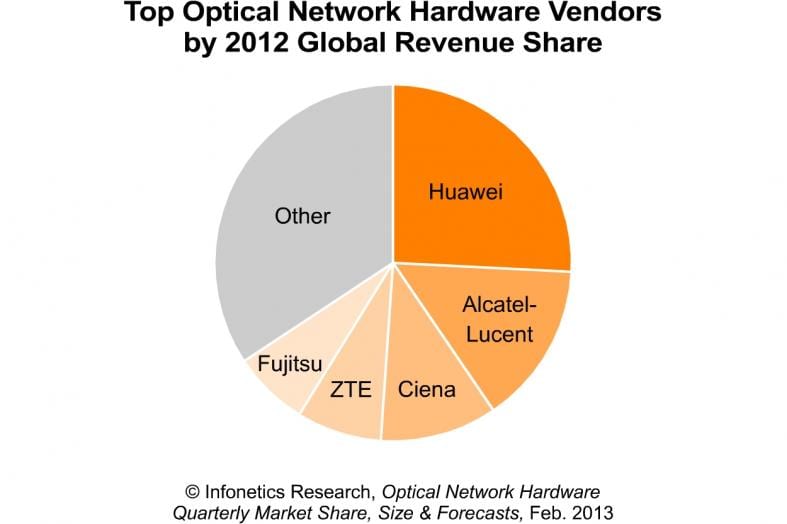

The key vendors dominating the optical network hardware space are Alcatel-Lucent, Ciena Corp., Huawei Technologies Co. Ltd., and ZTE Corp. The other vendors mentioned in the report are Fujitsu Ltd., Cisco Systems Inc., Ericsson Inc., NEC Corp., Nokia Siemens Networks, and Tellabs Inc.

To buy this report: http://www.researchmoz.us/optical-network-hardware-market-in-the-emea-region-2011-2015-report.html

3. 100G OPTICS WEBINAR:

Join Infonetics analyst Andrew Schmitt, Cisco, Cyan and Oclaro on March 5 for 100G Optics: Why Operators Are Upgrading Now, a free live webinar examining coherent 100G deployment activity to date and solutions for adding 100G to the network. Learn more or register at:

http://w.on24.com/r.htm?e=564650&s=1&k=D516668CBFFF7CD6D45545BA350F0373

Alcatel-Lucent Posts Q4 Loss; CEO Forced Out Under Pressure

Alcatel-Lucent reported Q4 loss of 1.37 billion Euros, or 60 Euro cents a share, reflecting a 1.41 billion Euro asset impairment charge. Operating income was 66 million Euros. Revenues were up 13.8% sequentially to 4.1 bilion Euros, but down 1.3% from the year ago quarter.

While North American sales improved to 1.6 billion Euros from 1.41 billion a year ago, European revenue fell to 1.1 billion Euros from 1.28 billion, and Asia-Pacific fell to 714 million Euros from 775 million.

Ben Verwaayen, CEO Alcatel-Lucent, commented: “Our fourth quarter reflects the early progress of The

Performance Program announced last July. We announced clear choices on where we would operate, how we

would operate and where we would differentiate.”

“We have seen progress on all these choices, and close 2012 ahead on our cost reduction plans. We have

addressed half of the previously margin-diluting Managed Services contracts, and show continued and strong

growth in IP and Next Generation Wireless. We can see a clear statement of customer confidence through

growth in both our order book and backlog.”

The WSJ reports: Alcatel Chief Is Out as Turnaround Stalls

“The CEO’s departure comes at a turbulent time for the equipment maker. More than six years after France’s Alcatel merged with U.S.-based Lucent Technologies to create a telecom-equipment giant, the company is discovering that it can’t keep up in the global tech race. It is smaller by revenue than most of its competitors. But it competes in more lines of business than almost all of them. It has racked up billions of euros of red ink for its efforts.

Under Mr. Verwaayen’s leadership, Alcatel-Lucent has pinned hopes on leading the market for next-generation networks. But when France’s two largest cellphone operators launched the first next-generation wireless networks in the Paris area last week, they weren’t using Alcatel-Lucent’s gear.

Instead, they went with competitors who had figured out how to bundle the new network alongside existing ones all in the same small transmitter—something Alcatel-Lucent couldn’t easily match. The Paris-based company was outflanked in its back yard.

On Thursday, Alcatel-Lucent posted a €1.37 billion ($1.85 billion) loss in the fourth quarter, dragged down by an impairment charge largely on the declining value of its businesses making wireless network equipment and optical-network gear. It had full-year cash burn of €679 million—its seventh consecutive year of negative free cash flow.

The company has responded to its losses with a €2 billion loan package to buy time for a restructuring that aims to shed unprofitable products and exit underperforming contracts, especially in the troubled European market. The result is that a company with century-old roots in Europe will be doing less business there.

Alcatel-Lucent’s strategy for years has been to be an end-to-end supplier for the biggest telecommunications companies in the world. It supplies everything from the submarine cables that wire together continents to the software that phone companies use to calculate and send out phone bills every month. It can plan new wireless networks, make the equipment and then be the outsourcing company to maintain the whole thing.

But Alcatel-Lucent has struggled to turn a consistent profit across its businesses. Europe has been a particular problem. Amid a struggling economy, phone companies have been slow to upgrade networks. Alcatel-Lucent revenue in Western Europe was down 19% through the third quarter of 2012, according to company filings, and its wireless division, where the company has been losing bidding for European contracts, was off 23%.

Few companies—apart from China’s massive Huawei Technologies, which had nearly 50% more revenue than Alcatel-Lucent in 2011—compete on such a wide playing field. Sweden’s even-larger Ericsson focuses more on networks, services and software for mobile operators. When it comes to Internet routing and switching, Alcatel-Lucent competes instead against Cisco Systems Inc. CSCO -0.67%and Juniper Networks Inc. JNPR -0.71%In next-generation optical networks dubbed 100G, its rivals include companies like Huawei and Ciena Corp. CIEN +0.41%

That breadth has stretched a research budget that is already trailing bigger competitors. Ericsson spent 47% more on research in the first nine months of 2012 than Alcatel-Lucent. Huawei began outpacing Alcatel-Lucent in absolute research spending in 2011, even though Huawei’s China-based engineers cost much less.

Alcatel-Lucent officials say their situation means they simply have to be smarter than competitors about where they place their technology bets. “It’s not a matter of size,” Alcatel-Lucent’s Mr. Verwaayen said in an interview in November. “It’s a matter of choices that we make.”

Alcatel-Lucent is the offspring of two giants. France’s Alcatel descends from a French industrial behemoth that developed bullet trains. Lucent was the equipment arm for the original AT&T T -0.68%and includes Bell Labs, which helped invent the laser and the idea of a cellular network. In 1986, the two units were Nos. 1 and 2 in the global telecommunications-equipment market, accounting for a 49% combined market share.”

http://online.wsj.com/article/SB10001424127887324906004578287852518071498.html?mod=djemalertTECH

Eric Beaudet, an analyst at Natixis, a bank in Paris, said that Mr. Verwaayen had lost credibility among investors after promising a succession of restructuring plans that had failed to bring it to sustainable profit. In 2010, Alcatel-Lucent posted a net loss of €292 million. The next year, the company had a €1.1 billion net profit. For 2012, the company reported a full-year loss of €1.1 billion.

“With the C.E.O. having lost credibility, we believe that this move will be appreciated, even though a replacement has not yet been named,” Mr. Beaudet wrote in a note to investors. “We believe that the market should react positively to this announcement with Mr. Verwaayen having lost some of his credibility with the numerous successive restructuring plans.”

In a statement, Mr. Verwaayen said the company needed new leadership.

“Alcatel-Lucent has been an enormous part of my life,” Mr. Verwaayen said. “It was therefore a difficult decision to not seek a further term, but it was clear to me that now is an appropriate moment for the board to seek fresh leadership to take the company forward.”

Under his tenure, Alcatel-Lucent developed a unified set of network products, eliminating redundant French and American gear, and focused efforts around wireless broadband technologies as it fought larger rivals like Ericsson of Sweden and Huawei of China.

“Mr. Verwaayen had done as much as he could with the assets he had,” said Martin Nilsson, an analyst at Handelsbanken in Stockholm. “But when he came in, things were pretty bad there, and a lot of ground had been lost.”

Lucent, Mr. Nilsson said, had been reduced to making “legacy” wireline products for AT&T and other American operators, a once-lucrative business whose profitability had diminished following deregulation of the U.S. telecommunications industry in the 1980’s.

Alcatel had a similar symbiotic relationship with the French government, supplying most of the core equipment and land lines to France Télécom, or to public entities like Thales.

But Mr. Verwaayen’s austerity cure, which he successfully applied as chief executive of the former British telecom monopoly BT from 2001 to 2008, has not brought the same results at Alcatel-Lucent.

Mr. Camus, the Alcatel-Lucent chairman, credited Mr. Verwaayen for leading the company out of a difficult transition following its merger.

http://www.nytimes.com/2013/02/08/technology/ben-verwaayen-alcatel-lucent-chief-resigns.html?_r=0

AT&T U-Verse Live TV now called Mobile TV & has Enhanced Picture Quality

AT&T has changed the name of its wireless video service from AT&T U-Verse Live TV to Mobile TV, saying in a blog post that it has also improved the picture quality of the $10 monthly service, introduced $5 add-on programming packages and made it available on most of its smartphones via 3G, 4G and Wi-Fi networks. Subscribers can view a number of live TV channels by downloading a streaming and on-demand TV application.

Rob Hyatt, AT&T’s Executive Director of Marketing Management, posted on the company’s Consumer blog page that the newly renamed service was intended to be your “on-the-go source for entertainment and information whether you’re traveling near or far and is accessible through Wi-Fi and AT&T’s 3G & 4G LTE networks.” It is available on most of the AT&T smartphones and will cost $9.99 per month.

http://blogs.att.net/consumerblog/blogger/a7787219

In addition to the accessibility on most of its smartphones, AT&T says it is now offering “enhanced picture quality” when viewed on its 4G LTE network. This implies that AT&T will broaden coverage of its 4G-LTE network as they promised last fall.

http://viodi.com/2012/11/08/at-bring-fiber-to-commercial-buildings-cover-99-of-us-with-lte/

Mobile TV subscribers will also have their Mobile TV subscription merged with their main account so it’s streamlined billing. The new Mobile TV service enables users to easily watch channels like ESPN Mobile, Disney, FOX News, ABC Mobile, and more right from their portable device using a streaming and on-demand television app.

AT&T is offering add-on packages for Mobile TV for $4.99. Its Urban Zone Pack features programming from BET while its Playground TV Pack is more for kids, and lastly Hispanics can get specialized programming with its Paquete en Espanol movil.

This isn’t the first time AT&T has offered a “mobile TV” service. The carrier, along with Verizon Wireless, offered Qualcomm’s MediaFLO broadcast mobile TV service until Qualcomm decided to shut the network down in 2011.

References:

http://www.engadget.com/2013/02/04/att-mobile-tv-10-per-month/

Oracle Buys Acme Packet for $2.1 Billion to Provide Converged Systems Solution

Oracle has agreed to acquire Acme Packet, a provider of Session Border Control technology, for $2.1 billion. Acme Packet allows service providers to deliver voice, data and unified communications services and applications across IP networks. More than 1,900 service providers and enterprises, including 89 of the world’s top 100 communications companies, are Acme Packet customers. The transaction is expected to close in the first half of this year.

Oracle President Mark Hurd called the proposed acquisition of Acme Packet another important piece in the company’s overall strategy to deliver integrated products that address critical customer requirements in key industries.

“The addition of Acme Packet to Oracle’s leading communications portfolio will enable service providers and enterprises to deliver innovative solutions that will change the way we interact, conduct commerce, deliver healthcare, secure our homes, and much more,” Hurd said.

By integrating Acme Packet technology, Oracle expects to accelerate the migration to all-IP networks by making it possible for service providers to offer secure, reliable communications from any device, across any network. With more high speed communications interfaces, companies are moving to deliver hardware stacks that consist of servers, storage and networking from a single vendor.

“The communications industry is undergoing a dramatic shift as users become more connected and dependent on mobile applications and devices,” said Bhaskar Gorti, senior vice president and general manager of Oracle Communications. “Service providers and enterprises need a comprehensive communications solution that will enable them to more effectively engage with their customers.”

Charles King, principal analyst at Pund-IT, said there were three issues to explore: how Acme Packet’s solutions stack up against Oracle’s competition; how the acquisition will affect Oracle’s longstanding relationships with Cisco and Juniper; and how customers will ultimately respond.

“In the past, we’ve seen some resistance, specifically among enterprises that have a fairly large investment in Cisco hardware. They want to stick with the hardware that they know and understand,” King said. “Adding yet one more network player to the mix may have questionable value for some of those customers.”

http://www.newsfactor.com/news/Oracle-Buys-Acme-Packet-for–2-1B/story.xhtml?story_id=010000R4XH36&full_skip=1

From Acme Packet CEO to Acme Packet Customers and Partners

On February 4, 2013, we announced that we have signed an agreement to be acquired by Oracle. The proposed transaction is subject to stockholder approval, certain regulatory approvals, and customary closing conditions and is expected to close in the first half of 2013. Until the deal closes, each company will continue to operate independently, and will operate its business as usual.

Today is a significant milestone for Acme Packet. We are excited to join forces with Oracle because we believe that together we can rapidly accelerate the transformation to all-IP communications networks across the globe. The combination of our session border control and other solutions with Oracle’s powerful Communications portfolio will enable service providers to uniquely differentiate and monetize next-generation services, and help enterprises benefit from more effective user engagement and improved employee productivity. This combination will also provide our partners with an expanded portfolio of world-class solutions to help them create even greater value for their customers.

Oracle plans to make Acme Packet a core offering in its Oracle Communications portfolio to enable customers to more rapidly innovate while simplifying their IT and network infrastructures. This means our customers can expect to continue to receive the expertise, vision and passion that they have come to expect from us today — and our efforts will be supported by the global reach, investment and infrastructure of Oracle.

Acme Packet’s management team and employees are expected to join Oracle’s Communications Global Business Unit, and continue their focus on building the industry’s best session delivery solutions. We expect that joining Oracle will provide significant benefits for both our customer and partner communities.

Thank you for your continued support and for being part of the Acme Packet community.

Best regards,

Andy Ory

CEO, Acme Packet

All IP-LTE Networks May Provide Opportunity for New Telecom Equipment Vendors; VZW Still #1 U.S. LTE Carrier

With an architecture based entirely on IP, the growth of LTE could result in a major shake up of the infrastructure vendor market. Data from the Telecoms.com Intelligence Industry Survey 2013, revealed that more than two-thirds of telecoms professionals (67.5 per cent) believe that the move to LTE will change the relative standings of equipment suppliers. Just 0.9 per cent strongly disagreed with this statement.

Network infrastructure vendors with a background in circuit switched deployments, such as NSN, Huawei and Ericsson, will need to expand their knowledge base. It has been noted however that NSN is still the market leader in terms of LTE contracts.

According to our survey of more than 2,000 industry professionals, 59.2 per cent of respondents believe that the market is ripe for new entrants, and relative newcomers such as Samsung, have a reasonable chance of success.

Ericsson is also a leading LTE equipment vendor. The world’s largest telecom vendor recently demonstrated LTE Advanced for TDD (Time Division Duplexing) to China Mobile, using carrier aggregation and reaching a peak downlink speed of over 220Mbps.

http://www.lte-tdd.org/newsdetail/754

Verizon Wireless Expands LTE Coverage; Still #1 LTE telco in US

On January 29, 2013, Verizon Wireless (VZW) rolled out its 4G LTE coverage to the Pennsylvania counties around Philadelphia; the New Jersey and Delaware shores; and the Lehigh Valley, among other places. Verizon Wireless said its 4G LTE network covers 94 percent of the population in what it calls its Philadelphia Tri-State Region and 89 percent of the population of the country. Verizon Wireless also activated new 4G LTE coverage on three sites in Sullivan County, expanding and filling in coverage on the high-speed data network it launched locally in November 2011. On January 28, 2013, Verizon Wireless reported to expand 4G LTE network in Schoharie County, Greene County, Utica-Rome Area, and Elmira Area. Verizon Wireless continues to be the operator of the nation’s largest 4G LTE network.

Editors Note: A lot of wireless carriers are calling their HSPDA+ networks 4G. They aren’t. Technically, LTE isn’t true 4G either. Only LTE Advanced qualifies for that distinction according to the ITU-R. However, the ITU has backed off their strict criteria for 4G so now any carrier can call their 3G+ network “4G.”

AT&T restores U-Verse service after sporadic outage hit thousands of customers!

AT&T Inc. says it has restored U-verse services following sporadic outages that hit multiple states starting Monday morning. All customers should be back online now or very soon.

To the frustration of the affected customers, AT&T didn’t disclose the cause of the outage or exactly how many of its U-Verse customers were out of service as a result. Based on customer accounts on outlets such as DSL Reports and the IEEE members discussion group, most of the problems were in the southern and eastern U.S., including parts of Texas, Louisiana, Kentucky, Georgia, Tennessee, Florida and Arkansas. Customers as far north as Detroit, MI also reported U-verse service problems this week.

AT&T said that less than 1 percent of U-verse customers were affected by the outage. The company’s statement said, that’s still “too many.” The cause of the outage was “related to a software upgrade.” Here’s the official AT&T report:

“AT&T customers in some of our markets are experiencing issues with U-verse service. This issue currently affects less than 1 percent of our U-verse subscribers, but that is too many and we are working hard to fix this. We are making progress in resolving the issue which is related to a server complex, and are working to determine when service will be completely restored. We apologize for this inconvenience.”

The Houston Chronicle reported, “Earlier statements by AT&T indicated “a server” was to blame, and now it’s a whole server complex, but again, there are no technical details being shared.”

“”U-verse service has been restored for all customers affected by the outage.,” AT&T spokeswoman Emily Edmonds told CNN on Thursday January 24th. “”We expect any remaining customer issues will be resolved this morning. We will provide a credit to customers who were affected. We know our customers count on their U-verse service and we apologize for the inconvenience.”

Ms. Edmonds said the outage hit “a limited number of customers” in the South, some of whom were without service since Monday. AT&Ts U-Verse service has roughly 7.4 million subscribers, including this author!

Also see:

http://www.cnn.com/2013/01/24/tech/web/uverse-outage-att/index.html

Personal Note: While this author and SF Bay area residents in the IEEE discussion group did NOT report any U-Verse outages or even service interruption, many of us have serious issues with AT&T’s sports programming. In particular,

1. Not offering NHL Network or Pac 12 Sports Network and

2. Blacking out of sports programs (which are NOT live pro games or replays) on regional sports networks in the U-Verse HD Premium Tier which costs $17 per month extra!

For more on this, please see the comments at

AT&T to buy Alltel Wireless network to boost spectrum in rural areas; VZW sells record number of LTE smart phones

AT&T still needs more spectrum, despite industry claims there’s enough to go around (please see this post: https://techblog.comsoc.org/2012/12/13/spectrum-crunch-or-not-do-wireless-network-operators-really-need-more-spectrum).

The telco giant has reached a deal to buy remnants of the Alltel (ATN) wireless network for about $780 million to boost its spectrum holdings in rural areas. AT&T is buying the licenses, retail stores and network assets, along with about 585,000 subscribers, from Atlantic Tele-Network Inc. The acquisition includes spectrum in the 700 MHz, 850 MHz and 1900 MHz bands and is largely complementary to AT&T’s existing network.

The Alltel wireless network covers about 4.6 million people in mainly rural areas across six states – Georgia, Idaho, Illinois, North Carolina, Ohio and South Carolina. It generated revenue of about $350 million for the first nine months of 2012. Alltel was a wireless network that operated in 34 states until it was bought by Verizon Wireless in 2009. Federal regulators made Verizon sell off parts of the network to AT&T and ATN.

Analyst Christopher King at Stifel Nicolaus observed that ATN bought its six-state holdings for $223 million in 2010, meaning it more than tripled its money in three years.

AT&T said it expects that as it upgrades the network in the acquired areas, mobile Internet service will improve for both Alltel and AT&T customers. However, it will need to convert the cell towers from the “CDMA” technology Alltel uses to the “GSM” technology AT&T’s network uses. That means Alltel subscribers will need new phones.

The deal remains subject to approval by the Federal Communications Commission and Department of Justice. The companies said they expect the deal to close in the second half of the year. For more info, see this press release:

http://www.att.com/gen/press-room?pid=23674&cdvn=news&newsarticleid=35955&mapcode=corporatefinancial

Meanwhile, Verizon Wireless (VZW) is evidently content with the spectrum they already own. The Verizon Communications-Vodafone joint venture sold a record 9.9m smartphones in the fourth quarter, including 6.2m iPhones. Both figures were slightly higher than analysts had expected. About 65 per cent of the smartphones Verizon Wireless sold in the quarter, and about half of the iPhones, were LTE devices. Overall, Verizon Wireless sold 12.5m LTE devices in the quarter, and 58 per cent of its subscribers were using a smartphone at the end of December, up from 44 per cent a year earlier.

During the quarter VZW added a net 2.1m monthly contract subscribers, bringing its total number of subscribers, including pre-paid, to 98.2m.

“We made a stragic decision to take advantage of our 4G LTE lead and invest in growth which resulted in record high postpaid (monthly contract) gross and net adds in the quarter,” said Fran Shammo, Verizon’s chief financial officer.

Mr Shammo said LTE is also about five times more efficient to operate than the older 3G technology, helping the company to offset the impact on margins of higher sales of heavily subsidised smartphones.

More info at:

http://www.ft.com/intl/cms/s/0/ebbff94e-649b-11e2-934b-00144feab49a.html#axzz2IqIFrPsc

AW Comment: We think that both AT&T and VZW control too much spectrum in the U.S. and have formed a wireless telco duopoly. Would like to see more competition from a re-energized Sprint (with Softbank’s financial backing) and a merged T-Mobile-Metro PCS. Will that happen? Only time will tell.

Infonetics: Small cell operators face myriad operational and financial challenges

Market research firm Infonetics Research released excerpts from its Small Cell and LTE Backhaul Strategies: Global Service Provider Survey, which provides insights into operators’ current and future plans for outdoor small cells and backhaul. Contrary to popular belief, it won’t be a cake walk for small cell operators, according to Infonetics.

SMALL CELL AND LTE BACKHAUL SURVEY HIGHLIGHTS:

For its 36-page small cell and LTE backhaul survey, Infonetics interviewed purchase decision makers at 22 independent wireless, incumbent, competitive, and cable operators from EMEA, North America, and Asia Pacific about their current and future plans for small cell and macrocell backhaul. The study provides insights into mobile traffic handling and specific backhaul issues related to outdoor small cells, in-building small cells, and macrocells.

ANALYST NOTE:

“The challenge is on for small cell operators. They’ve been scrambling to test and trial a large number of technologies, products, and topologies for outdoor small cells, and they’re under growing pressure to make the rubber meet the road—not only from their technology and operations people, but even their business planners,” notes Michael Howard, co-founder and principal analyst for carrier networks at Infonetics Research.

“But it won’t be easy,” continues Howard. “These operators face some daunting challenges: outdoor small cell gear isn’t small enough or cheap enough yet, and there are problems backhauling in dense urban areas, not to mention municipal regulations regarding the look, size, and color of the equipment and who can mount equipment on streetlights, utility poles and building sides. Even if they managed to solve all these issues, they’re still going to have to pass the fiscal test. Outdoor small cells won’t fly without a viable business model.”

To buy the report, contact Infonetics: http://www.infonetics.com/contact.asp

Meanwhile, Alcatel-Lucent is a huge supporter of small cells:

Small cells could solve the mobile broadband capacity crunch, By Paul Golden

A combination of more data-hungry devices and higher service expectations on the part of users has created

a ‘perfect storm’ for mobile broadband providers, who are likely to look to small cells to address some of their

network coverage and congestion issues. According to the International Telecommunication Union, there were 872 million active mobile broadband subscriptions last year. Based on growth rates for the previous 12 months it is reasonable to assume that there are now more than one billion users worldwide.

The pressure this growth is placing on networks has been well documented. A survey conducted by YouGov found

that 77% of mobile broadband users in the UK encountered some form of quality of experience issue over the last 12

months. More than half complained of slow speeds and 42% reported connection problems. The survey suggests that the availability of time sensitive, data-heavy applications and services has created a generation of more demanding users, but this does not mean that coverage and broadband speeds are not a legitimate cause for concern. UK regulator Ofcom’s research into mobile broadband speeds published earlier this year found that network availability and performance varied significantly – even within small geographic areas.

http://www.alcatel-lucent.com/small-cells/

Related Articles:

http://viodi.com/2012/12/05/infonetics-mobile-infrastructure-market-down…

https://techblog.comsoc.org/2012/10/14/comsocscv-oct-meeting…

AT&T partners with Polycom to compete with Cisco in Telepresence market

AT&T will OEM Polycom made equipment to market video collaboration tools for businesses by integrating their respective telepresence products. Under the agreement, enterprise users of AT&T’s Telepresence Solution in 40 nations will have access to expanded features offered by Polycom RealPresence — including on-demand virtual meeting rooms and enhanced video collaboration — as part of a managed service bundle.

AT&T will incorporate the Polycom RealPresence platform as part of the AT&T Telepresence solution video infrastructure in the AT&T Business Exchange, leading to on-demand virtual meeting room capabilities that increase customer choice through expanded interoperability, more flexible and user-friendly video collaboration experiences and new forms of collaboration with business customers, partners and suppliers on the AT&T Business Exchange.

“AT&T and Polycom’s announcement is a big win for customer choice and interoperability, and it will help accelerate video collaboration as businesses increasingly look to cloud-delivered options,” Zeus Kerravala, ZKResearch principal analyst, said. “In addition, this agreement opens new revenue streams and business opportunities for AT&T, and demonstrates the momentum Polycom is having with service providers and in the video cloud market.”

http://www.eweek.com/networking/polycom-att-partner-on-video-communications

For several years now, Cisco has increased their telepresence market penetration and will offer stiff competition for AT&T. Cisco remains the clear market leader and now holds 50.6% of the market, which is an improvement over its 44.3% share in 1Q11 but a decrease from its 54.3% market share in 4Q11.

http://www.cisco.com/en/US/products/ps7060/index.html

http://www.cisco.com/en/US/products/ps7060/products.html

http://www.idc.com/getdoc.jsp?containerId=prUS23507712#.UPW9hB37Kz4

FTTH Deployment to Increase Sharply; Google Fiber Project in KC; & Feb 2013 ComSocSCV meeting

Market research firm RVA LLC forecasts that direct investment in North American fiber to the home (FTTH) deployment will reach $4.7 billion annually by 2017. Altogether, the market will be worth $18 billion across the next five years, RVA asserts. Meanwhile, operators will see FTTH services revenues grow to $4 billion by 2017, almost half of the cumulative $9 billion North American service providers will see over the same fiber-year period.

North American Fiber to the Home and Advanced Broadband Review and Forecast to 2017, tracks both FTTH deployments and consumer demand for high-bandwidth services. The report states that deployment growth will continue over the next five years despite the wrap-up of the ARRA broadband stimulus program, the evolution of the FCC’s Universal Service program to the Connect America Fund, and potential continuation of past economic uncertainties. Market expansion will come via what an RVA press release described as “a diverse group of small to large providers” who will supplant Verizon as the primary market catalysts. Meanwhile, the deployment focus will shift from overbuilds to greenfield applications over the five-year forecast period, RVA says.

RVA also expects the number of subscribers for high-bandwidth services ranging to the 1-Gbps will increase rapidly. These high-bandwidth users will create an important market for for application, software, and programming developers.

http://www.rvallc.com/ftth_subpage4.aspx

A great example of this trend is the Google FTTH project in Kansas City, KS and MO. A new study from media and technology marketing consultancy Ideas & Solutions! Inc. suggests that while Google’s brand recognition played a large role in the initial success of Google Fiber, the company’s marketing campaign also helped get its Kansas City fiber-to-the-home (FTTH) project off to a good start.

The Ideas & Solutions! “Google Fiber Matters: Consumer Demand Study” is based on 1,303 interviews about the Google Fiber project. The company conducted 532 online interviews among Kansas City “fiberhoods” with adults 18-74 years of age from October 19 to November 4, 2012, a few weeks just prior to Google Fiber’s initial customer installations. The remaining interviews were conducted during roughly the same timeframe from among 18- to 74-year old adults nationwide for benchmarking purposes. The study measured respondents’ perceptions of Google, its competition, and the Google Fiber project itself.

In addition to those Google successfully pre-registered for the Google Fiber – about 30% of the target market – another 30% of survey respondents expressed interest in the FTTH services.

http://googleblog.blogspot.com/2012/07/super-fast-fiber-for-kansas-city.html

http://www.dslreports.com/shownews/Google-Fiber-the-Free-Market-Success-Story-That-Wasnt-121078

IEEE ComSocSCV Feb 13, 2013 meeting: Fiber Deployments for Broadband Wired and Wireless Access

This decade will see unprecedented growth in broadband networks, both mobile as well as fixed (to the home). On the home access side, new fiber optic deployments are enabling a quantum leap in the access rates that are available to consumers. On the mobile side, one of the key bottlenecks has been in backhaul to the cellular base stations, and the growth of small cells providing high-speed 4G and WiFi access has exacerbated this issue. This session will deal with these two market drivers and the resulting growth in fiber-based deployments.

Milo Medin will discuss the Gigabit access networks that Google is currently building out in Kansas City and elsewhere, and John Georges will talk about the rapid growth of small cells and the capacity needs which are driving the fiber build-out to provide the necessary backhaul.

Our two speakers have been instrumental in creating access networks over the past couple of decades. Milo Medin was founder and CTO of @Home, which enabled millions of homes gain access to high-speed cable Internet service through the television cable infrastructure. In his current role running access services at Google he is responsible for deploying Gigabit access networks for residential use. John Georges is a pioneer of RF-over-fiber technology. Prior to his current position at Vodafone USA, John founded and ran NextG Networks (acquired by Crown Castle International) which built out a fiber network to connect cellular base stations.

Talk Titles

· Milo Medin, Moving the Web forward: Moving the access network to Gigabit

· John Georges, Wireless Access and Fiber Backhaul for Small Cells

The Feb 2013 meeting description, along with logistics, will be published at: http://comsocscv.org