CableLabs

CableLabs to bring mobility to WiFi for a better user experience

Introduction:

CableLabs said it has developed a new technology that brings mobile, cellular-like capabilities to Wi-Fi networks. That, of course goes beyond the charter of IEEE 802.11 Working Group[1.]. CableLabs also believes its technology will enable cable operators to cut down on MVNO costs by offloading even more data to their Wi-Fi networks (this author frequently uses Xfinity WiFi when away from home for mobile Internet access).

The cable networks research organization is focusing the technology on home networks that are comprised of multiple Wi-Fi access points (APs) and extenders, but also believes the pieces are in place to support other use-cases, such as Wi-Fi network deployments in commercial buildings and the Cable Wi-Fi roaming initiative that now comprises about 4 million hotspots.

There have been many attempts to do this over the years, typically relying on coercing the device to reconnect to the new AP, but this frequently seems not to work quite right. Sometimes, there’s a lag before a device switches APs, and sometimes the device never switches APs. Or sometimes, the device insists that an AP is still present, even though it no longer is—for example, when you leave your house in your car and your phone insists it’s still connected to your home Wi-Fi.

Note 1. The IEEE 802.11™ Working Group (WG) is responsible for developing Wireless Local Area Network (WLAN) standards under the authority of the IEEE® Project 802 LAN/MAN Standards Committee (802 LMSC). The 802.11 WG is one of several WGs that comprise the Project 802 LAN/MAN Standards Committee (such as IEEE 802.3 Ethernet).

How Does CableLabs Mobile Wi-Fi Work?

CableLabs Mobile Wi-Fi uses a central controller to group multiple access points or APs (WiFi routers) into one continuous network. The central controller detects which AP your device is closest to and connects your device to that AP. If you move—for example, getting up and walking to a different room—then the controller evaluates whether you would get the best experience by staying connected to the old AP or if your experience would be better by switching to a new one. If it’s the latter, the controller moves your device to the new AP without you even noticing.

Instead of asking the phone to reconnect to a different AP, CableLabs Mobile Wi-Fi moves the network itself to the new AP. It does this using a virtual Basic Service Set, or VBSS. A VBSS is a network set up exclusively for use by one device and can be moved from AP to AP without the device disconnecting and reconnecting. This makes the transitions between APs seamless and transparent to the phone.

So now, as you walk around your house with your device, the CableLabs Mobile Wi-Fi controller is moving your VBSS such that it follows along with you, hopping from one AP to another as you go. If you wander too far and go outside the range of all your APs (like when you drive away in your car), the CableLabs Mobile Wi-Fi controller detects this, closes your connection and tears down your VBSS so that your phone immediately knows there is no longer a Wi-Fi connection. The phone will then immediately switch to cellular data.

The result is that your device will be consistently connected to the best available AP in your space. Gone will be the days of being connected to an AP across the house instead of the one right next to you. Your Wi-Fi will be better and faster.

When Can I Get It?

CableLabs Mobile Wi-Fi is not yet available to end consumers. For the next step toward a commercial implementation of CableLabs Mobile Wi-Fi, CableLabs has joined and is working with the prpl Foundation to include Mobile Wi-Fi in the open-source prplMesh implementation of Wi-Fi Alliance EasyMesh™️. Go to the prpl website for more information about prplMesh and access to the prplMesh codebase. CableLabs is also working in Wi-Fi Alliance to support Wi-Fi CERTIFIED EasyMesh.

For more information on CableLabs Mobile Wi-Fi, reach out to Steve Arendt, Principal Architect & Director, Advanced Technology Group, CableLabs.

…………………………………………………………………………………………………………………………………………………………………………………………………………………….

Steve Glennon, a distinguished technologist at CableLabs, told Light Reading that Wi-Fi has done well in new iterations to beef up physical data rates as home broadband speeds continue to climb to 1 Gbit/s and beyond. But he argues that Wi-Fi has fallen short of the mark in attempts to seamlessly connect smartphones to the best link in multiple-AP environments after the initial Wi-Fi connection is established.

“In general, phones go down the path of saying, ‘I’m connected, life is good.’ And they spend a bunch of battery and compute trying to scan and work out what’s around and when should I switch,” Glennon said. “You might be sitting right next to a Wi-Fi extender and your phone is still getting cruddy throughput. The problem is it’s associated with the main AP back in the living room of the house and in fact you’re upstairs in the bedroom sitting right next to the extender.”

Glennon said Wi-Fi roaming work around 802.11k, 802.11r, and 802.11v help to recognize this issue, but suggests they’ve not been super-successful at fixing it by giving the phone more information to help select the best AP.

Instead of putting a bunch of focus on the smartphone and requiring that device to be constantly scanning, CableLabs wants to flip things around by treating multiple APs like a mobile network. And instead of having the phone associate with a physical AP, the approach proposed by CableLabs is to create a virtual access point that moves from AP to AP without requiring the phone to know what’s going on.

CableLabs says it accomplishes that through a Virtual Basic Service Set (VBSS), which aims to virtualize the concept of an access point being a piece of hardware. The VBSS effectively is a network that is set up exclusively for use by one device and can be moved from AP to AP without the device (the smartphone, in this case) disconnecting and reconnecting.

“It’s like the binary version of the SSID [service set identifier],” Glennon explained. “It’s kind of like the magic, unique identifier for the access point. And rather than having physical access points, we virtualized the access point. You’re no longer associating with a physical access point; you’re associating with a virtual one. And because it’s virtual, we can move that virtualized access point between different pieces of hardware, without the phone even knowing … We can take the virtual access point and move it around between different physical access points.”

Glennon said the new Mobile Wi-Fi tech also has the smarts to automatically kick the phone off the Wi-Fi link if performance on the closest AP is degrading and to shift the phone to the cellular network. And when the Wi-Fi environment improves, the system will flip the phone back to Wi-Fi.

The broad aim here is to improve the customer experience when the phone connects to Wi-Fi as the user moves about. But Glennon notes there’s also some big, potential benefits to cable operators that are now in the mobile game: offloading more data on Wi-Fi and lowering MVNO costs.

“Offloading your mobile connection to Wi-Fi as frequently and as completely as possible is the best financial outcome for the cable operator who’s offering mobile service,” he said. “The whole point here is make the Wi-Fi experience be really good, because then you’ll do more Wi-Fi offload and there’s more financial benefit to our [members].”

Glennon said the project started about five years ago. The initial use case is for multiple APs in the home, but the pieces are there to extend the capability to commercial businesses and other venues where cable operators have set up Wi-Fi networks, he said.

References:

CableLabs Brings Mobile Wi-Fi’s Power to Wi-Fi Industry for a Better User Experience

https://www.lightreading.com/broadband/cablelabs-aims-to-bring-mobility-to-wi-fi-/d/d-id/781328?

https://www.ieee802.org/11/QuickGuide_IEEE_802_WG_and_Activities.htm

CableLabs to host NTIA’s 5G Challenge – includes 5G SA core network, testing and measurement

The U.S. Department of Commerce announced that CableLabs will host the NTIA- Information Administration’s Institute for Telecommunication Sciences (NTIA-ITS) 5G Challenge, in support of the U.S. Department of Defense (DoD), which seeks to advance open 5G networks with the goal of interoperability and plug-and-play operation from different vendor components. NTIA-ITS will leverage CableLabs’ state-of-the-art lab deployment of fully virtualized 5G networks, including multiple cores, multiple radio access network and new network emulation equipment.

The competition requires a 5G SA core network, testing and measurement capabilities. An important goal of the competition is to help spur a growing 5G supplier community with interoperable, multi-vendor solutions – and CableLabs says its facility has all the right makings to see participants compete in testing and validation on-site.

NTIA launched an inquiry in early 2021 seeking input on a 5G Challenge as it explored ways to speed up development and interoperability of the open 5G ecosystem to support DoD missions. It’s still working on design and execution of the competition, and previously received input from major vendors such as Ericsson and groups including the Open RAN Policy Coalition, which were among 51 responses submitted by a range of industry stakeholders.

“The Department of Defense recognizes that 5G technologies are foundational to strengthening our Nation’s warfighting capabilities as well as U.S. economic competitiveness. Open 5G systems would greatly bolster the Department’s ability to deliver on its missions, and we look forward to exploring new and innovative opportunities for their development,” said Michael Kratsios, Acting Under Secretary of Defense for Research and Engineering.

The effort is going to leverage the CableLabs 17,000-square-foot lab, where it has deployed fully virtualized 5G networks that include multiple cores, radio access network and new network emulation equipment. CableLabs has a 5G SA network prototype with engineering capabilities to integrate multiple vendors at the same time while also testing and measuring technical performance metrics.

In a blog post Wednesday, CableLabs VP of Wireless David Debrecht highlighted the group’s growing expertise focused on mobile networks, such as involvement in industry efforts to build flexible 5G technologies including at 3GPP, the O-RAN Alliance and the Telecom Infra Project. “CableLabs is well situated to host the 5G Challenge, given our long-standing role in the industry and our work with multiple vendors to drive interoperable network technologies,” Debrecht wrote.

CableLabs is deeply involved in the industry’s work to develop flexible 5G technologies—including at 3GPP, O-RAN Alliance and the Telecom Infra Project (TIP)—to enable new vendor opportunities, enhance network security and streamline integration and interoperability.

In a statement, CableLabs president and CEO Phil McKinney indicated work would continue beyond the challenge, as it’s committed to ongoing R&D and interoperability testing in mobile network technologies.

“CableLabs is honored to be the host lab for the 5G Challenge,” McKinney commented. “The recognition from the US Department of Commerce is a testament to CableLab’s continued and increasing investment in mobile wireless network technologies, and particularly, our focus on open and interoperable network technologies.”

The NTIA issued its initial notice of inquiry in support of the DoD’s 5G Initiative, the latter which has committed $600 million for 5G testbeds to see how the military could use the technology for its networking needs. The DoD’s focus on 5G is aimed at technology that will enable both military and commercial deployments.

The 5G challenge, meanwhile, is meant to specifically address the shift toward using open implementations of different components for a 5G system, and NTIA had said an aim is to maximize benefits for both 5G stakeholders and the DoD on an accelerated timeline.

It received feedback across standards and industry groups, equipment vendors, major operators, and others who weighed with comments on the NOI to help inform NTIA about how to structure the challenge and goals, incentives and scope, and timeframe and infrastructure.

Further information:

- Written comments may be submitted by email to [email protected]

- To receive updates, send an email request to [email protected]

About CableLabs:

As the leading innovation and R&D lab for the broadband cable industry, CableLabs creates global impact through its member companies around the world and its subsidiaries, Kyrio and SCTE. With a state-of-the-art research and innovation facility and collaborative ecosystem with thousands of vendors, CableLabs delivers impactful network technologies for the entire industry.

References:

https://www.ntia.doc.gov/5g-challenge

https://www.federalregister.gov/documents/2021/01/11/2021-00202/5g-challenge-notice-of-inquiry

Accelerating 5G Network Innovation: CableLabs Named Host Lab for 5G Challenge

https://www.fiercewireless.com/tech/cablelabs-chosen-host-ntia-dod-5g-challenge

https://www.fiercewireless.com/5g/ericsson-open-ran-coalition-weigh-ntia-5g-challenge

WBA field trial of Low Power Indoor Wi-Fi 6E with CableLabs, Intel and Asus

The Wireless Broadband Alliance (WBA) today announced results from a new field trial using technology from CableLabs®, Intel, and Asus. The purpose was to highlight the benefits of using Low Power Indoor Wi-Fi 6E for a wide variety of demanding residential applications, including video collaboration for telecommuting, multiplayer gaming, augmented and virtual reality, streaming video and more.

Since the 6 GHz band is higher frequency range than 2.4 GHz or 5 GHz typically used for Wi-Fi, signals have more of a challenge with obstruction the trial took place in a 3,600-square-foot, two-story home with a basement and the drywall, wood and other building materials typically found in a suburban residence. The Wi-Fi 6E enabled laptops with Intel® Wi-Fi 6E AX210 wireless cards were placed in various locations throughout the home and tests were conducted using a Wi-Fi 6E enabled access point from Asus.

The trial featured a range of tests on the downlink and uplink comparing throughput achieved on the 5 GHz and 6 GHz bands for wide channels (80 MHz and 160 MHz). CableLabs and Intel also analyzed the Wi-Fi 6E performance compared to Wi-Fi 6 on the 5 GHz band in the presence of overlapping neighbouring access points.

The trial’s key results include 1.7 TCP Gbps downlink and 1.2 TCP Gbps uplink speeds when using 160 MHz channels on Wi-Fi 6E in locations close to the access point. The larger channel bandwidth and the associated increase in total EIRP transmit power based on the channel bandwidth helped maximize both coverage and speed throughout the home.

These results clearly demonstrate the real-world benefits of using Wi-Fi 6E enabled devices over 6 GHz rather than 5 GHz. It is important to note that although Wi-Fi 6 devices perform better than Wi-Fi 5 devices over 5 GHz, next-level user experiences are possible with Wi-Fi 6E and the additional bandwidth available in the 6 GHz spectrum.

Tiago Rodrigues, CEO of the Wireless Broadband Alliance, said: “This field trial by CableLabs and Intel shows how Wi-Fi 6E and 6 GHz spectrum maximize coverage, capacity, throughput and the user experience in one of the most demanding real-world environments: people’s homes. Between HD and 4K streaming video, multiplayer gaming, dozens of smart home devices and videoconferencing for remote work, today’s home Wi-Fi networks are the foundation for how people live, work and play. This trial highlights that Wi-Fi 6E is more than capable of shouldering that load, especially when paired with 6 GHz spectrum.”

Lili Hervieu, Lead Architect of Wireless Access Technology at CableLabs, said: “CableLabs has been a proponent of making the 6 GHz band available for unlicensed use, and we were honored to conduct the Wi-Fi 6E trial in one of our employee’s homes for a truly real-world experience. The results confirmed the benefit of Wi-Fi 6E for increased capacity and data rate that will support the growing demand we are seeing for a large variety of applications and for new emerging technologies.”

Eric A. McLaughlin, VP Client Computing Group, GM Wireless Solutions Group, Intel Corporation, said: “Intel’s mission is to enable great PC experiences with industry leading platform capabilities like Wi-fi 6E. The wireless trial, in collaboration with CableLabs and the Wireless Broadband Alliance, helps demonstrate the versatility of Wi-fi 6E on Intel platforms. The speed, latency, and reliability improvements enabled by the new 6 GHz spectrum, with larger channels and freedom from legacy Wi-Fi interference, will help dramatically enhance user communication, entertainment, and productivity.”

About the Wireless Broadband Alliance:

Wireless Broadband Alliance (WBA) is the global organization that connects people with the latest Wi-Fi initiatives. Founded in 2003, the vision of the Wireless Broadband Alliance (WBA) is to drive seamless, interoperable service experiences via Wi-Fi within the global wireless ecosystem. WBA’s mission is to enable collaboration between service providers, technology companies, cities, regulators and organizations to achieve that vision. WBA’s membership is comprised of major operators, identity providers and leading technology companies across the Wi-Fi ecosystem with the shared vision.

WBA undertakes programs and activities to address business and technical issues, as well as opportunities, for member companies. WBA work areas include standards development, industry guidelines, trials, certification and advocacy. Its key programs include NextGen Wi-Fi, OpenRoaming, 5G, IoT, Testing & Interoperability and Policy & Regulatory Affairs, with member-led Work Groups dedicated to resolving standards and technical issues to promote end-to-end services and accelerate business opportunities.

The WBA Board includes Airties, AT&T, Boingo Wireless, Broadcom, BT, Cisco Systems, Comcast, Deutsche Telekom AG, GlobalReach Technology, Google, Intel, Reliance Jio, SK Telecom and Viasat. For the complete list of current WBA members, click here.

CableLabs Evolved MVNO Architectures for Converged Wireless Deployments

CableLabs and its members (cablecos/MSOs) initiated a technical working group to create an evolved architectural blueprint for mobile virtual network operators (MVNOs). The working group’s aim is to explore new converged architectures that will benefit CableLabs members’ wireless deployments while highlighting the benefits, impacts to existing deployments and features needed to be supported by both mobile network operator (MNO) and MVNO networks.

As cable operators in the US and abroad enter the mobile game or look to enhance their existing mobile services through MVNO partnerships, the working group’s intention is to “create an evolved architectural blueprint for mobile virtual network operators (MVNOs),” Omkar Dharmadhikari, wireless architect at CableLabs, explained this week in a blog post.

Many traditional broadband services providers—also known as multiple system operators (MSOs)—might not own mobile infrastructure but have (or are in the process of negotiating) MVNO arrangements with MNOs. These kinds of arrangements allow them to bundle fixed and mobile broadband services into a single service package. Traditionally, most MSOs adopt a reseller-type “Wi-Fi first” MVNO, where the MVNO doesn’t own any mobile network infrastructure and resells the services leveraging MNO infrastructure.

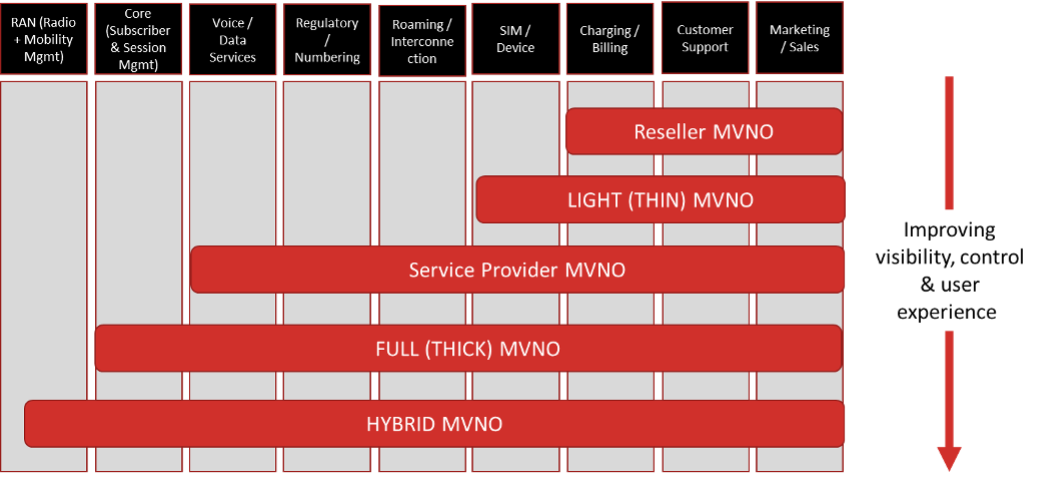

Source: CableLabs

The MVNO models vary based on the amount of mobile network infrastructure that the MVNO owns and the degree of control over the management of different aspects of MVNO subscriptions and their service offerings. One common aspect of all traditional MVNO models is leveraging the radio access network (RAN) of a partner MNO.

With the advent of 5G and the availability of shared spectrum, many MSOs are actively evaluating offload opportunities for enhancing MVNO economics and are contemplating deploying their own mobile radio infrastructure in specific geographic areas (in addition to their substantial Wi-Fi footprint).

Such MSOs now have to contend with three disparate sets of wireless infrastructures:

- the MSO’s community Wi-Fi network,

- the MNO’s 4G/5G network, and

- the MSO’s own 4G/5G network.

This creates a new type of MVNO model called hybrid-MVNO (H-MVNO) that enables MVNOs to offload their subscribers’ traffic from the MNO network—not just to their Wi-Fi networks but also to the MVNO-owned mobile network when inside the coverage footprint of their wireless network(s).

Maximizing data offload via the H-MVNOs’ own wireless assets—thus ensuring a consistent user experience and enforcing uniform and personalized policies as users move in and out of coverage of these three networks—will require the deployment of new converged network architecture and related capabilities.

While CableLabs working group’s focus on the hybrid MVNO challenge is new, several cable operators, including a group in North America, are already pursuing that initiative.

Comcast and Charter Communications have MVNO deals with Verizon, operate their own metro and in-home Wi-Fi networks, and have secured CBRS licenses in areas where mobile traffic is anticipated to be heaviest. Charter plans to launch a field trial involving “thousands” of CBRS small cells in one market in early 2022, and use that as a blueprint of sorts for deployments in additional markets.

Canada’s Cogeco plans to enter the wireless business in Canada via a proposed H-MVNO framework. Tied into that plan, Cogeco secured 38 spectrum licenses in the 3500MHz band at auction, and says it now has spectrum licenses to cover about 91% of its broadband footprint.

H-MVNOs intend to offload as much traffic as possible to help offset the costs of going to their mobile network operator partners. But they’ll also need a new converged network architecture and related capabilities to ensure a consistent user experience and the enforcement of uniform and personalized policies as customers move in and out of these different networks, Dharmadhikari explained.

The new CableLabs working group is exploring H-MVNO architectures that use dual-SIM and single-SIM approaches.

Unlike architectures with dual SIMs, single-SIM devices allow the H-MVNO network to enable seamless low-latency mobility for data applications across the MNO and H-MVNO networks. An ideal architecture for offering mobile services with single-SIM device usage is to combine the roaming architecture and a mobility interface, both of which are standardized in 3GPP.

However, due to the targeted nature of H-MVNO mobile deployments, the signaling load can increase on MNO mobility management core network elements, as the H-MVNO subscribers move in and out of H-MVNO network coverage.

To overcome this problem, CableLabs evaluated new MVNO architectures that make use of dedicated network elements within the MNO domain to serve H-MVNO subscriber traffic, thereby isolating it from the MNO subscriber traffic and eliminating the increase in signaling load on core network elements that serve MNO subscribers.

In addition, CableLabs evaluated voice handling in scenarios where H-MVNOs don’t want to deploy their own voice platforms. One option is to offer voice via a third-party voice service provider; another is to enable additional interfaces between the MNO and the H-MVNO network to leverage the MNO’s voice platform.

If you have any further questions, please feel free to reach out to the MVNO Interconnect Technical WG Lead, Omkar Dharmadhikari ([email protected]).

References:

https://www.lightreading.com/cable-tech/cablelabs-sizes-up-hybrid-mvno-architectures-/d/d-id/773484?