Cloud Computing

AT&T tests 5G and network edge computing with Microsoft Azure; Partners with Vodafone Business for IoT

AT&T announced at MWC 2019 that it is working with Microsoft on a proof of concept to integrate network edge compute (NEC) capabilities with its 5G network and Microsoft Azure cloud services. The solution would be important for the industries and Internet of Things (IoT) use cases of retail, healthcare, public safety, entertainment, and manufacturing, AT&T said, as it would provide businesses with lower latency, access to high compute power, and network routing without needing on-premises hardware.

“We’re testing our ability to substantially reduce latency and improve user experience by deploying advanced cloud services in specific geographic locations closer to business sites. A fully-scaled deployment will give businesses access to compute power, lower latency and optimized network routing without the need for dedicated on-premises hardware.” These advantages will be important for the low-latency cloud and IoT solutions used by retail, healthcare, public safety, manufacturing and entertainment.

Last month, AT&T* announced its approach to 5G for businesses, laying out three key pillars: mobile, fixed and edge computing.

“Our collaboration will pave the way to enable Microsoft Azure cloud services to connect to more customers and devices across the US through AT&T’s nationwide wireless network,” Microsoft corporate VP of Azure Networking Yousef Khalidi said. “Our two companies are working together to achieve the low-latency connectivity needed for the explosion of devices and immense amount of data being created by computing at the edge,” he added.

AT&T is using drones to test the network edge compute capabilities with Azure, working with Israel-based startup Vorpal in its foundry in Plano, Texas. Vorpal’s VigilAir product detects and geo-locates drones in real-time, which could be used by law enforcement agencies and airports.

“By running their VigilAir application using Azure cloud services delivered through the Plano AT&T test environment, and connecting their drone-tracking sensors using AT&T LTE and 5G networks, Vorpal could achieve the low latency and compute scalability required,” the carrier said.

AT&T expects to share more details about NEC services with Microsoft Azure later this year. NEC is part of AT&T’s broader edge compute strategy that also includes AT&T Multi-Access Edge Compute (MEC).

………………………………………………………………………………………………………………………………………………………………………………….

Earlier at MWC 2019, AT&T announced it’s working with Vodafone Business on IoT applications for the automotive space, including safety, security, and entertainment.

“This alliance with Vodafone Business is a natural extension of our existing relationship,” said Chris Penrose, President, Internet of Things Solutions, AT&T. “We each have rich experience in connected vehicle technology. By working together, we can innovate faster and help our global customers bring connectivity, entertainment and telematics to more vehicles across our respective footprints.”

“Our work with AT&T will benefit automotive manufacturers and their customers around the world as we simplify processes and provide a consistent experience to accelerate IoT adoption in this fast-moving market,” said Stefano Gastaut, IoT Director, Vodafone Business. “As technology complexity increases, this is the right time to make technology adoption easier for the automotive industry to help them achieve their business outcomes. This is the goal of this alliance.”

The two companies said they would develop connected car solutions across 5G and autonomous vehicle technology; vehicle-to-everything (V2X) capabilities; in-vehicle entertainment; connected car applications and services; global service quality models; and the intersection of connected cars and smart cities.

The companies will prioritize projects to enhance safety, security and entertainment capabilities. Key areas of focus will be:

- 5G and autonomous vehicle technology

- V2X capabilities (vehicle-to-everything)

- In-vehicle entertainment

- Connected car applications and services

- Global service quality models

- Connected car/ smart cities intersection

AT&T and Vodafone Business each provide connected car services and products for the automotive, fleet and insurance industries. They integrate electronic and telematics systems into complex vehicles, both at the point of manufacture and beyond. Together, the companies bring more than 50 years of experience in the automotive industry. And they collectively work with nearly 50 global automotive brands and connect more than 43 million cars and trucks on the road today.

References:

https://about.att.com/story/2019/att_nec.html

https://www.zdnet.com/article/mwc-2019-at-t-tests-5g-and-edge-computing-with-microsoft-azure/

NTT Communications leads APAC telco cloud market; Telstra and Orange close behind

Japanese telecommunications network provider NTT Communications is the market leader in the Asia-Pacific telecom cloud segment, and is well placed to maintain its position, according to GlobalData. In a new report, the market research company said NTT Communications has carved out a lead due to its software-defined capabilities, wide network and data center coverage and an expanded portfolio thanks to its integration with sister companies. According to the report, the cloud market landscape is evolving in the Asia-Pacific region. While web-scale players such as Amazon, Google, Microsoft and Alibaba are continually expanding in the regions, telecoms operators are carving out a niche by offering integrated network and cloud services.

NTT Communications is the leader in the APAC telco cloud services market with the highest overall score based on four categories – cloud portfolio, data center footprints, software-defined infrastructure and supplemental services.

“Cloud products offered by telcos are comparable in terms of technical capabilities and ecosystem partners,” GlobalData analyst Alfie Amir said. “What differentiates NTT Communications from the rest is its wide footprint and presence in the region to address data residency and latency requirements, as well as its software-defined capabilities which offer better workload management and service orchestration,” he added.

Australia-based Telstra and France-based Orange Business Services are in second and third place. While these providers have similar capabilities to NTT Communications, they are slightly behind with their footprints in the region. However, they are rapidly closing the gap, with Orange Business Services having partnered with Huawei to drive expansion in the region – particularly in China, and Telstra recently announcing a partnership with Equinix for direct access to more infrastructure globally.

The initiatives by telco cloud providers to add software defined capabilities, expand their footprints and enhance service capabilities are in-line with enterprises’ digital transformation directions. Enterprises today are looking for cloud providers with extensive cloud portfolios, not just the traditional IaaS, PaaS, and SaaS, but also cloud-based IT services such as IoT platform, UCaaS, security and marketplace that offer various horizontal and vertical applications.

“The APAC cloud market is still growing fast as the market emerges, while the competition is getting more intense driven by the web-scale players,” Amir said. “Telcos need to continue to leverage their network strengths and at the same time, include latest technologies such as self-service tools, analytics and AI in their offerings to gain competitive advantage,” he added.

Above illustration courtesy of K-Hits which has a report on the global telecom cloud market.

Reference:

Synergy Research: Cloud Service Provider Rankings (See Comments for Details)

………………………………………………………………………………………………………………………………………………………………………

According to Larry Dignan of ZDNET, “the cloud computing market in 2019 will have a decidedly multi-cloud spin, as the hybrid shift by players such as IBM, which is acquiring Red Hat, could change the landscape. This year’s edition of the top cloud computing providers also features software-as-a-service giants that will increasingly run more of your enterprise’s operations via expansion.

One thing to note about the cloud in 2019 is that the market isn’t zero sum. Cloud computing is driving IT spending overall. For instance, Gartner predicts that 2019 global IT spending will increase 3.2 percent to $3.76 trillion with as-a-service models fueling everything from data center spending to enterprise software. In fact, it’s quite possible that a large enterprise will consume cloud computing services from every vendor in this guide. The real cloud innovation may be from customers that mix and match the following public cloud vendors in unique ways. ”

Key 2019 themes to watch among the top cloud providers include:

- Pricing power. Google recently raised prices of G Suite and the cloud space is a technology where add-ons exist for most new technologies. While compute and storage services are often a race to the bottom, tools for machine learning, artificial intelligence and serverless functions can add up. There’s a good reason that cost management is such a big theme for cloud computing customers–it’s arguably the biggest challenge. Look for cost management and concerns about lock-in to be big themes.

- Multi-cloud. A recent survey from Kentik highlights how public cloud customers are increasingly using more than one vendor. AWS and Microsoft Azure are most often paired up. Google Cloud Platform is also in the mix. And naturally these public cloud service providers are often tied into existing data center and private cloud assets. Add it up and there’s a healthy hybrid and private cloud race underway and that’s reordered the pecking order. The multi-cloud approach is being enabled by virtual machines and containers.

- Artificial intelligence, Internet of things and analytics are the upsell technologies for cloud vendors. Microsoft Azure, Amazon Web Services and Google Cloud Platform all have similar strategies to land customers with compute, cloud storage, serverless functions and then upsell you to the AI that’ll differentiate them. Companies like IBM are looking to manage AI and cloud services across multiple clouds.

- The cloud computing landscape is maturing rapidly yet financial transparency backslides. It’s telling when Gartner’s Magic Quadrant for cloud infrastructure goes to 6 players from more than a dozen. In addition, transparency has become worse among cloud computing providers. For instance, Oracle used to break out infrastructure-, platform- and software-as-a-service in its financial reports. Today, Oracle’s cloud business is lumped together. Microsoft has a “commercial cloud” that is very successful, but also hard to parse. IBM has cloud revenue and “as-a-service” revenue. Google doesn’t break out cloud revenue at all. Aside from AWS, parsing cloud sales has become more difficult.

IBM is more private cloud and hybrid with hooks into IBM Cloud as well as other cloud environments. Oracle Cloud is primarily a software- and database-as-a-service provider. Salesforce has become about way more than CRM.

………………………………………………………………………

CenturyLink offers Multi Cloud Connect L2 Service for Fiber-fed Buildings

CenturyLink has unveiled its Dynamic Connections, a Layer 2 (L2) based offering that provides access to many different cloud computing services. The third biggest U.S. wire-line carrier has partnered with Amazon Web Services and AWS GovCloud, saying it will add connections to Google Cloud and Microsoft Azure in coming weeks, then will add IBM, Oracle and other cloud computing services.

With growing day-to-day operations, organizations need a fast and easier way to connect their locations and data centers to cloud service providers. CenturyLink says they offer a complete portfolio of solutions for cloud connectivity. The company’s global access and extensive wavelength, Ethernet and IP VPN connectivity options are designed to meet today’s hybrid cloud requirements.

CenturyLink says they will provide high-performance connections to AWS, Microsoft Azure, Google Cloud, IBM Cloud, Oracle Cloud Infrastructure, and other leading public and private clouds along with more than 2,200 third-party data centers.

Dynamic Connections is available to enterprise and government customers in fiber-fed buildings globally. CenturyLink has about 130,000 of those today, via an optical Ethernet port.

According to CenturyLink, the customer needs the right hardware and the right size port, but assuming that, they can turn up bandwidth from “as small as 10 Megabits/sec to up to 3 Gigabits/sec,” says Paul Savill, senior vice president of core network and technology solutions at CenturyLink.

“They would use log-in credentials to pull an inventory of all Ethernet ports they have at that enterprise in their locations across the world and they can then see that either in a map view or a list view,” Savill explains. “Then they can drill down to whatever location they want to connect- pick that Ethernet port and then pick the cloud service provider they want, at wherever location that is in the world, whatever data center it is running in, and then indicate the size of the bandwidth.”

Savill said that competing multi-cloud connect offerings –from AT&T’s NetBond, Verizon’s Secure Cloud Interconnect and Orange Business Services’ private and public cloud connections, etc. “can’t match our scale and flexibility.” [There is also Equinix Cloud Exchange Fabric].

As a L2 service, it doesn’t touch the Internet, which thereby provides greater security. In addition, CenturyLink is offering an open API for the service so that enterprise customers can build it into their own back-office systems and use those for provisioning instead of the portal.

Editor’s Note:

After CenturyLink acquired Savvis in 2011, the combined company attempted to promote its own cloud computing service using MPLS IP VPN for customer access to it. This new multi-cloud connect service is a huge improvement over that earlier solution. It will be interesting to see how it competes with AT&T Netbond, Verizon’s Secure Cloud Interconnect service, and Equinix Cloud Exchange Fabric.

References:

https://www.nasdaq.com/article/centurylink-introduces-cloud-connect-dynamic-connections-cm1035159

Cignal AI’s Optical Customer Markets Report: Optical spending up in China & NA; Down for cloud service providers & other regions

Cignal AI’s (Andrew Schmitt) latest Optical Customer Markets Report states that spending growth by cable Multiple System Operators (MSOs) led all other North American industry verticals during first quarter 2018. The report also reveals that contrary to continued increase in China’s optical spending, incumbent network operator spending in North America and Europe, Middle East and Africa (EMEA) on optical transport equipment continues to decline. Spending in North America grew 30 percent and outpaced all other customer verticals, including cloud operators.

Indeed, optical equipment spending by cloud operators has stalled due to rapidly declining prices and the use of IP-over-WDM as a substitute. Despite the downward trend, however, Ciena and Infinera continue to increase market share in the cloud optical network market.

“In North America, cable MSOs were the strongest performing customer market during the first quarter of 2018,” says Andrew Schmitt, lead analyst at Cignal AI. “Cloud operators are not increasing purchases of optical equipment, though common belief right now is just the opposite. The revenue growth from cloud operators experienced by Ciena and Infinera came at the expense of other vendors’ sales.”

Other key findings in the report include China being the largest source of optical hardware market growth, almost single-handedly representing the one-third global spending by Asia. Global spending by cable MSOs grew 5% year-over-year in the first quarter, with North America increasing 30%.

Other findings of the report were outlined in the press release and included:

- Ciena and Infinera sales growth in the cloud and colo market came during a period of overall spending decline among these customers (see above chart).

- Optical equipment spending by cloud operators has stalled, which contradicts the common perception that cloud operators like Amazon, Google and Microsoft are increasing spending on optical transport equipment. Growth in the cloud market has been inhibited by rapidly declining prices and the use of IP over WDM as a substitute.

- One third of global spending on optical hardware is in Asia, with almost all coming from Chinese incumbent operators.

- Cable MSO global spending grew 5 percent year-over-year in the first quarter.

Cignal AI’s Optical Customer Markets Report is issued quarterly and quantifies optical equipment sales to five key customer markets as well as equipment vendor market share for sales to cloud operators.

………………………………………………………………………………………………………………………………………………………..

From a separate Cignal AI market research report, here’s the latest YoY Revenue % increase/decrease for various segments of the optical networking market by country or region and Grand Total:

Chart courtesy of Cignal AI

China Permits Virtual Telecom Operators vs Amazon Virtual Private Cloud (VPC)

China has granted the official go ahead for virtual telecom operator businesses after piloting the practice for almost five years. The China Ministry of Industry and Information Technology has issued official licenses to 15 private virtual telecoms to resell internet access, the ministry said in a statement released Monday on its website. These virtual operators, including Chinese tech giants Alibaba and Xiaomi, do not maintain the network infrastructure but rent wholesale services like roaming and text messages from the country’s three major telecom infrastructure operators China Mobile, China Unicom, and China Telecom.

In a move to further open up the telecom sector, China started to issue pilot licenses in May 2013 to private companies to allow them to offer repackaged mobile services to users. It issued pilot operation licenses to eleven ‘mobile virtual network operators’, or MVNOs, at the end of 2013 which has gradually increased to A 42 virtual telecom businesses.

Granting virtual telecom operators official licenses is aimed at encouraging mobile telecom business innovation and improving the sector’s overall service quality, the statement said.

Reference:

http://usa.chinadaily.com.cn/a/201807/23/WS5b559eb4a310796df4df82ed.html

………………………………………………………………………………………………………………………..

While Amazon is not a virtual ISP, they do offer Virtual Private Cloud (VPC) service:

To securely transfer data between an on-premises data center and Amazon Web Services (AWS), consider implementing a transit Virtual Private Cloud (VPC). Transit VPCs not only manage your networks more efficiently, but also add dynamic routing and secure connectivity in your cloud environment. Because these transit VPCs are deployed with high availability on AWS, downtime is limited.

Amazon’s VPC lets a company or enterprise provision a logically isolated section of the AWS Cloud where you can launch AWS resources in a virtual network that the user defines. The user has complete control over the enterprise virtual networking environment, including selection of IP address range, creation of subnets, and configuration of route tables and network gateways. You can use both IPv4 and IPv6 in your VPC for secure and easy access to resources and applications.

These AWS resource requests are implemented virtually and can be used to connect Amazon VPCs, whether they are running in different parts of the world and/or running in separate AWS accounts, to a common Amazon VPC that serves as a global network transit center. This approach uses host-based Virtual Private Network (VPN) appliances in a dedicated Amazon VPC and helps to simplify network management by reducing the amount of connections required to connect multiple Amazon VPCs and remote networks.

Simplify network management and reduce your total number of connections by deploying a highly available, scalable, and secure transit Virtual Private Cloud (VPC) on AWS.

Download the eBook to learn more about:

- How to build a private network that spans two or more AWS Regions

- Sharing connectivity between multiple Amazon VPCs and on-premises data centers

- How transit VPCs enable you to share Amazon VPCs and AWS resources across multiple AWS accounts

For more info please refer to https://aws.amazon.com/networking/partner-solutions/featured-partner-solutions/

Cloud services to reach $374 billion in 2022; Integration of AI & ML into enterprise business apps to drive growth

by IHS Markit analysts Clifford Grossner, PhD and Devan Adams

Executive Summary:

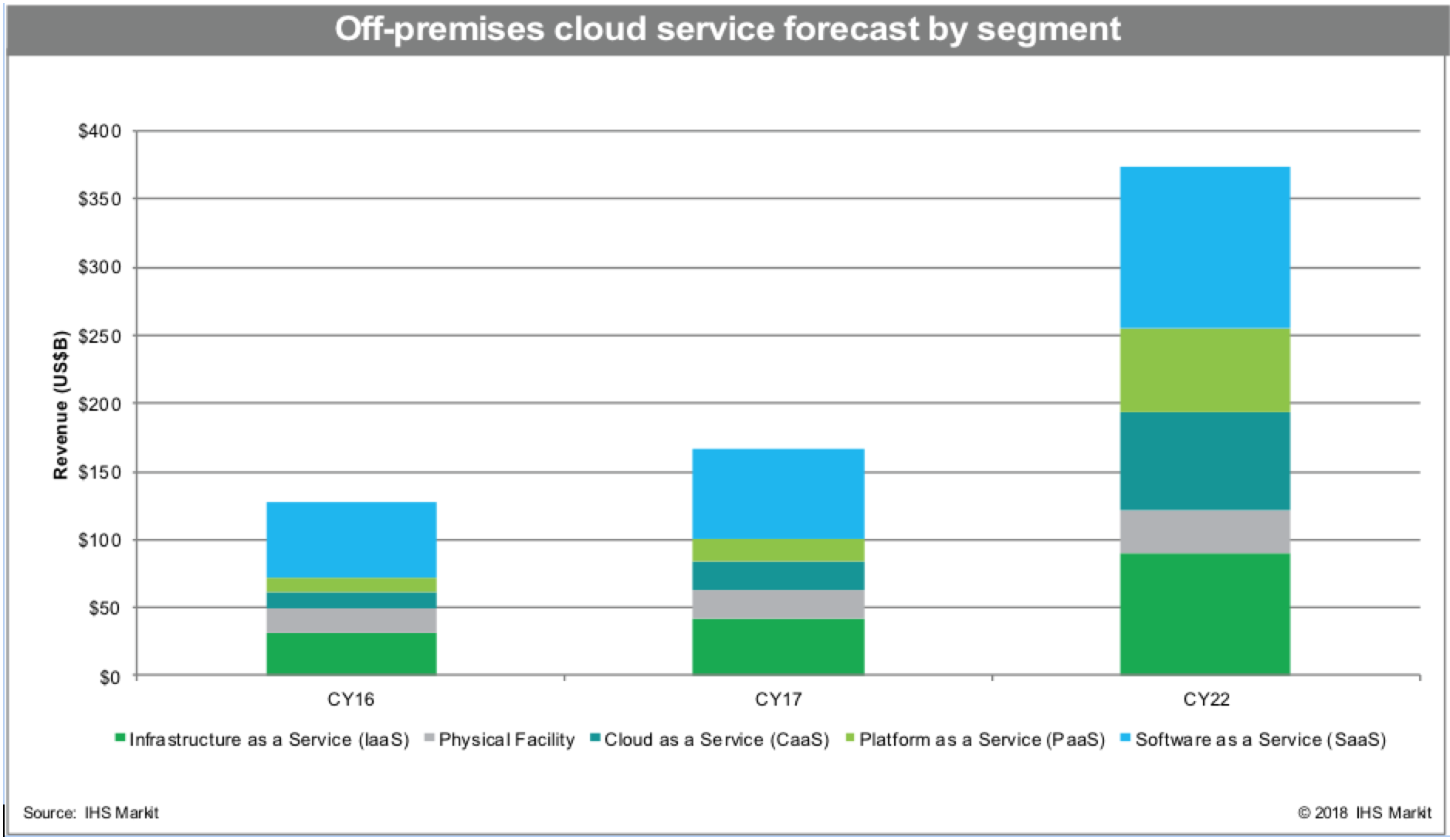

To grow market share, many cloud service providers (CSPs) are introducing specialized compute instances, which target data-intensive workloads and ease the integration of artificial intelligence (AI) and machine learning (ML) into enterprise business applications as a strategy to capture market share. This type of activity is expanding the high-growth cloud-as-a-service (CaaS) and platform-as-a-service (PaaS) segments. The off-premises cloud service market is expected to reach $374 billion in 2022, at a five-year compound annual growth rate (CAGR) of 17.7 percent.

Innovative service offerings by CSPs are multiplying, including the introduction of blockchain technology in PaaS service offers. They are also introducing new services focused on enterprise verticals, including the following: healthcare, to aid diagnosis; energy, for oil and gas exploration; financial services, for transaction monitoring; and supply chain efficiencies in retail and government, for smart city infrastructure. These services package expert domain knowledge acquired by CSPs and make it available to enterprises.

“Amazon made a smart move when it integrated Alexa into Amazon Web Services business applications — and by launching several machine learning services, further expanding its breadth of intelligent solutions,” said Clifford Grossner, Ph.D., senior research director and advisor, cloud and data center research practice, IHS Markit. “Google and Cisco also upped their AI and ML game, targeting hybrid cloud deployments with a collaboration aimed at running these tasks, both on-premises and from Google Cloud.”

As certain market segments mature, consolidation continues for two reasons: buying competitors for access to their client base and expanding service portfolios. Some recent notable mergers and acquisitions include the following: Equinix announced its intention to buy Infomart Dallas, GTT Communications is planning to acquire Interoute, INAP acquired SingleHop, Google agreed to acquire Xively and Microsoft agreed to acquire Avere Systems.

The types of partnerships CSPs are striking evolved from partnerships with enterprise software vendors, as a way to gain a foothold in on-premises data centers, to establishing relationships between providers for cross selling. Some recent noteworthy partnerships include the following: SAP and Microsoft announced a partnership to integrate SAP’s S/4HANA ERP suite with MS Azure; China Unicom plans to expand its reach across various industry verticals, by partnering with YonYou; British Telecom partnered with IBM, to extend its BT Cloud Connect Direct multi-cloud platform; and Salesforce also partnered with IBM, to enhanced its go-to-market strategy.

Highlights:

- The CaaS category is expected to grow 56 percent in 2018, with a five-year CAGR of 29 percent; PaaS will grow 55 percent, with a five-year CAGR of 31 percent.

- North America, the birthplace of off-premises cloud services, will remain the lead market through 2022, delivering approximately 53 percent of all global off-premises cloud service revenue.

- IBM continued to lead the market for software-as-a-service (SaaS) in 2017, with 18 percent of revenue; Amazon led infrastructure-of-a-service (IaaS), with 41 percent of revenue; Microsoft topped the list for PaaS, with 26 percent of revenue; Microsoft’s lead in CaaS continued, with 21 percent revenue; and Equinix led the physical facility market, with 15 percent of revenue.

Research Synopsis:

The biannual IHS Markit Cloud Services for IT Infrastructure and Applications market research report tracks public or private network delivered services offered by a third party (cloud service provider or telco); cloud brokering is not tracked. The research service provides worldwide and regional market size, cloud service provider (CSP) market share, forecasts through 2022, analysis and trends. CSPs tracked include Amazon, Alibaba, Baidu, IBM, Microsoft, Salesforce, Google, Oracle, SAP, China Telecom, Equinix, Digital Realty, Deutsche Telekom Tencent, China Unicom and others.

Telcos need to do much more to gain significant cloud market share

Synergy Research Group said that the global cloud computing and storage market grew 24% annually for the period ending September 2017. The market research firm said that of the six cloud services and infrastructure market segments, operator and vendor revenues, IaaS (Infrastructure as a Service) and PaaS (Platform as a Service) had the highest growth rate at 47%, followed by enterprise SaaS (Software as a Service) at 31%, and hosted private cloud infrastructure services at 30%.

Data suggested that 2017 widened the gap between cloud services spending vs. hardware and software used to build public and private clouds. Synergy noted that 2016 was the year in which spending on cloud services overtook spending on cloud infrastructure.

John Dinsdale, a chief analyst and research director at Synergy Research Group, noted that in 2015 cloud became mainstream and by 2016 it started to dominate many IT market segments.

“Major barriers to cloud adoption are now almost a thing of the past, with previously perceived weaknesses such as security now often seen as strengths. Cloud technologies are now generating massive revenues for cloud service providers and technology vendors and we forecast that current market growth rates will decline only slowly over the next five years,” he concluded.

The researcher noted eight cloud services vendors were among the 2017 market segment leaders.

Figure 1: Movers and shakers in 2017 cloud market

…………………………………………………………………………………………………………….

Over the period Q4 2016 to Q3 2017, total spend on hardware and software to build cloud infrastructure approached $80 billion, split evenly between public and private clouds, though spend on public cloud is growing more rapidly.

Infrastructure investments by cloud service providers helped them to generate over $100 billion in revenues from cloud infrastructure services (IaaS, PaaS, hosted private cloud services) and enterprise SaaS – in addition to which that cloud provider infrastructure supports internet services such as search, social networking, email, e-commerce and gaming.

Meanwhile UCaaS (Unified Communications as a Service), while in many aspects is a different market, is also growing strongly and is driving some radical changes in business communications.

Carriers, for their part, are not standing still. According to Gartner Group, communications service providers (CSPs) worldwide face profound challenges related to traditional telco network-based to cloud-based service delivery across several functional and technical domains.

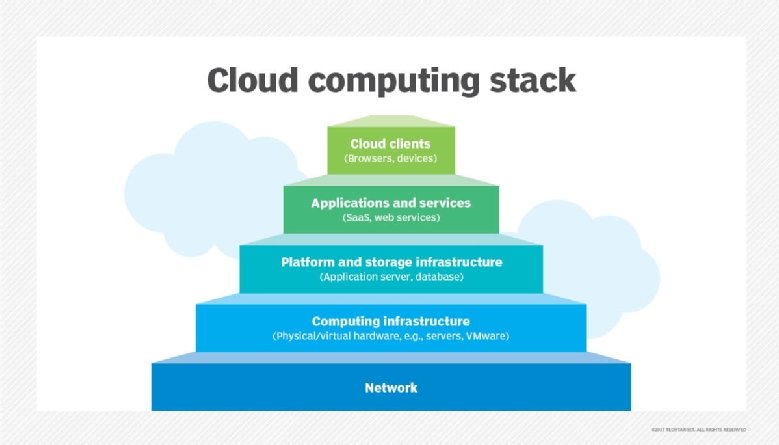

Gartner research director Martina Kurth said “CSPs are embarking upon an evolutionary path that unifies cloud instances of SDN/NFV, OSS/BSS (e.g. Paas/SaaS/Iaas) and enterprise IT. Coupled with microservices, container based service design principles and cloud integration services, CSPs endeavor to create synergies between their various cloud domains and drive flexibility and agility across their cloud deployments.”

Gartner predicts that vendors which are well positioned in the end-to-end Telco Cloud stack market, are also likely to take market share in corresponding future network and/or IT technology markets such as digital technology platforms and ecosystems, Data/AI, IoT and 5G.

Gartner Group says that a fully integrated, interoperable, cloud and virtualied telco protocol stack will pave the evolutionary technology adoption path from SDN/NFV to network slicing to 5G and IoT in the future. But no time frame was given for that to be realized.