Strand Consult

Lack of wireless network operator consolidation & EU over-regulation weakened mobile network infrastructure investments

by John Strand of Strand Consult

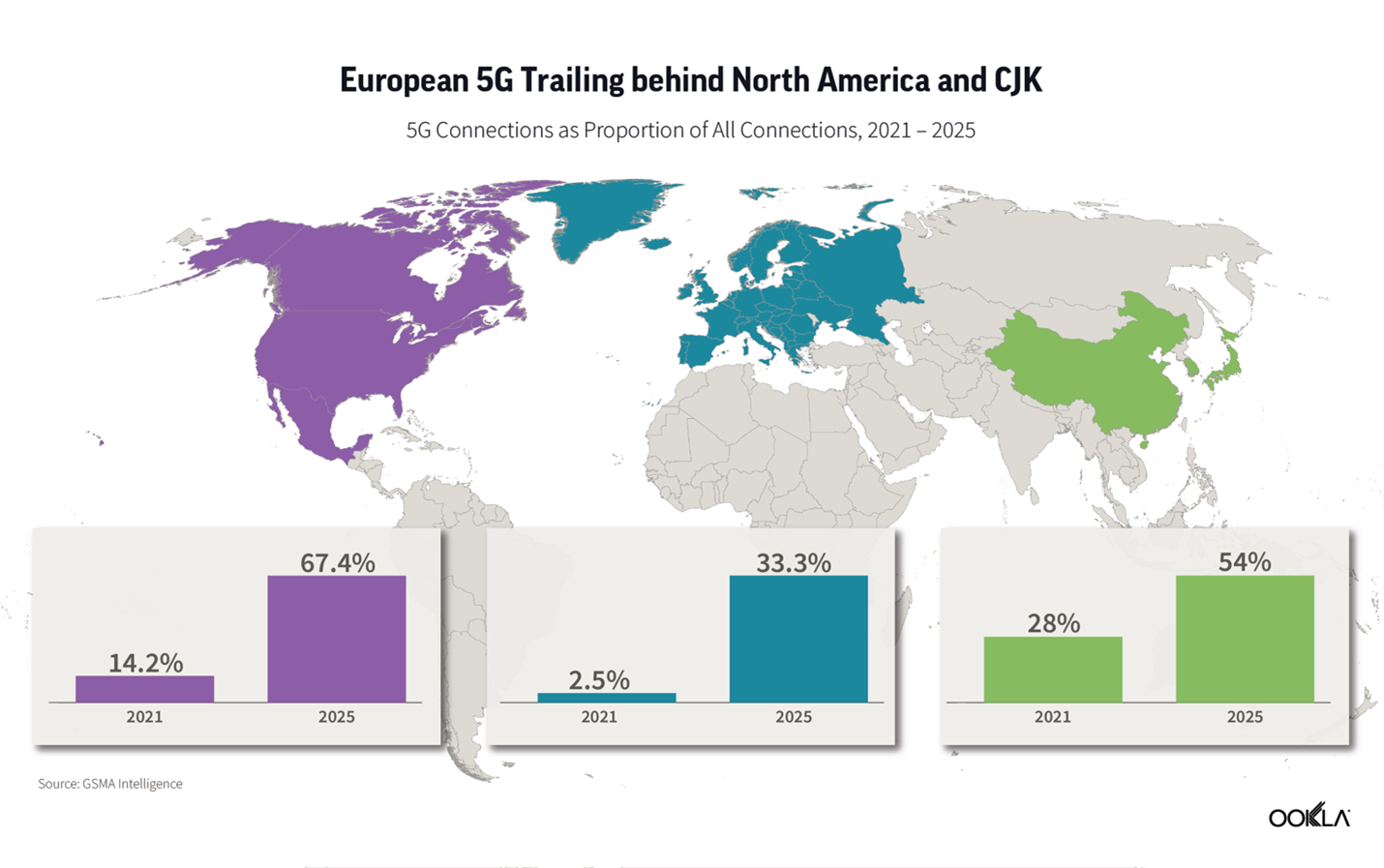

Over-regulation in the European Union (EU) has had a negative impact on mobile network operator’s investment in both fixed and mobile infrastructure. Years ago, the EU identified a €100 billion investment gap in telecommunications. By 2025, this gap has reportedly doubled to €200 billion. Why did that happen?

The EU telecom market has a large number of operators, many of whom lack the subscriber base to generate sufficient returns on capital to justify large infrastructure investments. In contrast, countries like the US and China have a smaller number of larger operators, allowing for greater economies of scale and more investment per operator.

Regulatory Complexity and Costly Landscape: Overregulation and fragmented national rules create a complex and costly environment that stifles innovation and adds uncertainty for telecom companies, says the ECIPE. This impacts the ability to attract investment, according to the European Investment Bank.

Mobile operators around the world would like to merge four mobile networks in their respective nations into three. This would improve the business case for investment by eliminating duplicative administrations, improving spectrum synergies, and upgrading customers to better networks. Strand Consult has studied mobile industry consolidation since 2000 with the groundbreaking case of South Korea merging five operators into three and being first in the world to launch 3G. South Korea has remained at the forefront of mobile industry innovation, investment, and rollout ever since.

Unfortunately, during the period 2014 to 2024 European Union Vice President for Competition Margrethe Vestager had a crude view on in market consolidation. She did not understand that market consolidation could have a positive impact on the wireless infrastructure that citizens have access to.

The result is that this proceeding appears to overlook that critical lever—making it unlikely to achieve its core goal of boosting private-sector investment in broadband, fiber, and next-generation networks like 5G and 6G. While reducing compliance and reporting burdens is welcome, if the overarching regulatory model remains flawed, the fundamental barriers to investment will persist.

If you look at countries such as the United States, India and Brazil, the in-market consolidation has had a positive impact on the infrastructure to which citizens have access. Today, in a country like India, there is better 5G infrastructure than there is in large parts of Europe.

There is no requirement that EU Competition authorities justify their merger decisions empirically. Only occasionally are official post-mortems issued examining whether their decision was right. Generally, such reports conclude that prices remain low. However, in a world in which mobile prices are flat or falling anyway, a merger rejection is not needed to ensure competitive prices. Competing voice technologies like WhatsApp and Telegram drive down mobile prices, as do the competitive wireless offerings by fixed line providers.

Notably few, if any, competition authorities have studied how the length of merger review impacts network investment. When companies request permission to merge, it’s as if time stops. Operators must hold back on critical capital decisions while authorities assess the merger request.

In the United Kingdom, some analysts have blamed poor mobile coverage on new restrictions placed on Huawei and ZTE. This is nonsense. Operators across the EU have switched and upgraded to trusted equipment vendors without impacting coverage. See TDC Denmark, Telenor and Telia in Norway, T-Mobile in the Netherlands (Odido), and Proximus in Belgium.

The UK has had two recent mobile merger attempts: O2/Hutchison (2015-2016), which Vestager blocked in May 2016. The parties sued the Commission and won in 2020. However, the EC appealed and won in 2023. By that point, the issue was moot as the UK had left the Union. Most competition authorities don’t care that their review of transactions can take years, but markets do. Few companies can afford to tie up so much capital for so long, and fewer still can afford to challenge such decisions when they are unfavorable. Hence the Draghi report is on to something.

Vodafone and Hutchison have tried to merge since June 2023. Upon leaving the EU, UK merger decisions were restored to local authorities. The UK Competition and Markets Authority issued a favorable decision last year.

Slow merger review process is almost as bad as a merger rejection. Before firms announce a merger, they have done their internal due diligence, perhaps over 12-18 months. Once submitted, a merger review can take 12 to 24 months. If approved, the merger can take another 18 to 24 months to implement. This process can take from 36-66 months from start to finish. This period of planning, submission, review, merger, and implementation puts network investment on hold. The numbers speak for themselves just look at Ookla´s numbers for the UK.

T-Mobile – Sprint Merger:

In US, it’s a wonder that the merger of #3 T-Mobile and operator #4 Sprint happened at all. Depending on the asset and transfer, telecom merger review can include the Department of Justice, the Federal Communications Commission, the Attorneys General of the 50 states and other gatekeepers, all of whom want to extract concessions from the transaction. While there are fewer authorities in the case of Vodafone and Hutchison, it still takes time.

With the Sprint acquisition, T-Mobile wanted to create an operator to compete at scale with AT&T and Verizon. Today the merger is an unqualified success; customers have gained access to a better network, while T-Mobile today has grown the muscle to compete head on with AT&T and Verizon.

The military needs to get access to 5G SA:

In the telecommunications industry, there has been talk for many years about how mobile companies can gain access to new sources of revenue. 5G and not least 5G SA and 5G private networks have received a lot of attention. Conversely, there has not been much talk about what communication solutions the defense system needs in the future.

The war in Ukraine and shifting geopolitical realities have dramatically changed perspectives in recent years. There is now a fundamentally different understanding of why and how defense investments must be made. We live in a world in which Russia has invaded Ukraine; China counts Russia, North Korea, and Iran as allies; and these countries support Russia’s invasion of Ukraine

All countries across NATO are in the process of modernizing the defense systems, gigantic sums will be invested in new and advanced equipment. The shopping list is very long, on the other hand, all these new defense solutions have in common that they need access to modern communication solutions.

Modern militaries cannot function without secure, advanced, and integrated communications. 5G SA is the go-to solution for its speed, security, and adaptability. When it comes to the limited rollout of 5G SA in Europe, it has major implications for NATO´s access to access to a single national network free from untrusted vendors like Huawei and ZTE.

At the same time NATO does not use equipment from countries like China, Russia, North Korea, or Iran. Indeed, NATO’s procurement rules prohibit its contracting with communist countries. NATO would not purchase Chinese fighter jets from Chengdu Aircraft Corporation and Shenyang Aircraft Corporation, nor Huawei network equipment. The rationale is that ill-advised to acquire critical supplies from one’s adversary.

One of NATO´s key problems in Europe is a large number of operators have chosen to use equipment from suppliers like Huawei and ZTE there are unlikely to meet the security requirements from NATO. The qualification review and exercise which will be undertaken among the 32 NATO countries and many other nations around the world aligned with NATO, countries like Japan, the Philippines, and others. Countries which consider China a military partner (Pakistan, Belarus, and Cambodia) use Huawei and ZTE equipment.

The European Commission wants to transform telecom regulation in Europe:

The EU will have a public consultation regarding The Digital Networks Act (DNA). It is EU’s initiative to modernize telecom regulation by harmonizing rules, spurring infrastructure investment, and cutting red tape. It seeks to streamline spectrum licensing, network authorizations, and reporting across member states, while promoting sustainability and consumer protection. These are worthy aims—but past experience suggests the European Commission lacks the resolve, or the “DNA,” to turn vision into action. While Strand Consult supports the effort to bring telecom policy into the 21st century, the proposals arrive too little, too late to inspire investors, entrepreneurs, or citizens. Outside of standout digital performers like Denmark, Europe’s digital sector has long trailed the U.S., South Korea, Norway, and Switzerland by most competitive benchmarks.

At Strand Consult, we are concerned that the EU’s ongoing regulatory reforms will once again fail to address the fundamental challenges. Years ago, the EU identified a €100 billion investment gap in telecommunications. By 2025, this gap has reportedly doubled to €200 billion.

The EU’s record on AI is similarly illustrative. In 2018, the EU announced its ambition to lead in AI. However, by 2023, it had passed legislation that imposed significant constraints on AI development. In 2025, despite limited presence in the global AI landscape, the EU reiterated its ambition to lead, this time with an “AI Continent Action Plan.”

These historical examples suggest that the European Commission excels at producing regulations that slow technological development and deter investment. There are few—if any—notable technology firms that owe their success to EU regulatory frameworks. In contrast, we see a steady decline in key sectors like telecommunications and hardware, driven by regulatory missteps.

The European Commission has now pledged to transform telecom regulation in Europe. It may be too little, too late to address the deep-rooted challenges the EU itself has acknowledged and in part, created.

The bottom line is that The European figures from Ookla speak for themselves. The problem that they have uncovered is a problem that many of us have talked about a lot for many years.

………………………………………………………………………………………………………………………………………………………………………………………………

References:

Consolidation would renew European telecoms, says digital industry chief

https://www.eib.org/files/publications/thematic/accelerating_the_5g_transition_in_europe_en.pdf

………………………………………………………………………………………………………………………………………………………………………………………………..

John Strand is the CEO of Strand Consult. He founded Strand Consult in 1995. Strand Consult is an independent telecom consultancy known for its expert knowledge and many reports which help mobile operators and their shareholders navigate an increasing complex world. It has 170 mobile operators from around the world on its client list.

Strand Consult: Market for 5G RAN in Europe: Share of Chinese and Non-Chinese Vendors in 31 European Countries

With its new report “The Market for 5G RAN in Europe: Share of Chinese and Non-Chinese Vendors in 31 European Countries,” Strand Consult brings valuable evidence of the location, amount, and share of Chinese and non-Chinese equipment in European telecom networks. This report, the second of its kind, describes the respective amounts of 5G equipment from Huawei, ZTE, and non-Chinese vendors in European mobile networks and the share of such in equipment in the 5G Radio Access Network (RAN). Here are the highlights from the new report.

- There is little transparency about the amount, type, location, and share of 4G and 5G Chinese equipment in European networks.

- In 8 of 31 countries, more than 50% of the 5G RAN equipment comes from Chinese vendors. In 2020, it was 16 of 31 countries in which the 4G RAN equipment came from Chinese vendors.

- In one country, 100% of the 5G RAN comes from Chinese vendors. In 2020 there were 3 European countries with 100% 4G RAN equipment from Chinese vendors.

- Only 11 of 31 European countries can offer their users access to clean, non-Chinese networks.

- 41% of the mobile subscribers in Europe have access to 5G RAN from Chinese vendors. In 2020, 51% of European mobile subscribers had access to 4G RAN from Chinese vendors.

- The large European countries–Germany, Italy, Poland, Portugal, Austria, and Spain–purchase significant amounts of 5G equipment from Chinese vendors.

- Operators like Telenor and Telia in Norway, TDC in Denmark, 3 in Denmark and Sweden, T-Mobile Nederland’s, and Proximus in Belgium have switched out Chinese suppliers. None of those operators report increased networks cost or delay in 5G rollout.

- The data suggests that Germany appears not to take the security threat of China seriously. Nord Stream 2 was Germany’s debacle oil energy supplies from Russia; it appears that Germany sets up a similar scenario in the communications domain with Huawei and ZTE.

- As Germany accounts for 25% of European mobile customers, the German government’s lax approach to communications infrastructure creates a risk for Germany and all people who interconnect with German networks.

- Germany together with Italy, Poland, and Austria, comprise 50% of European mobile customers. These countries are heavily dependent on Chinese equipment, creating risk for their own nations and others which use their networks.

- In 2020, 57% of Germany’s 4G RAN came from Chinese vendors. In 2022, 59% of the 5G RAN in Germany comes from Chinese vendors.

- Huawei enjoys a higher market share in Berlin than in Beijing where it shares the market with ZTE and other vendors.

- US General Darryl A. Williams serves as the commanding general of the United States Army Europe and Africa (based in Wiesbaden, German) and commander of the Allied Land Command. He oversees more than 20,000 staff. Unwittingly when he uses a commercial mobile phone, the traffic is sent through a network built with Chinese equipment. Similarly when American military use their personal devices, they engage on a Chinese network at risk for intrusion.

Strand Consult’s report delivers detailed information about Chinese and non-Chinese network equipment in Europe at country level. The report highlights of the importance of the EU’s 5G toolbox and provides recommendations to improve its implementation. The toolbox applies to most of Europe’s 102 mobile operators across 31 countries serving some 673 million mobile customers. The report also provides valuable economic context to understand the market for RAN equipment.

The focus on 5G and 4G RAN reflects the shift of the security debate. There is consensus across most countries outside China that equipment provided by vendors owned and affiliated with the Chinese government and military poses unacceptable risk for the security and integrity of the core of the network. The discussion has evolved to whether and to what degree should such vendors be allowed to supply the RAN.

The 4G RANs studied in the 2020 report were purchased in the 12-year period of 2008-2020. Most of RANs were delivered and installed during 2009-2016 when operators upgraded their 2G and 3G networks to 4G networks. The main part of the 5G RAN was purchased, delivered, and installed after 2020.

When performing a financial analysis of the cost of restricting Huawei, one must consider that network upgrades will happen regardless of selection of vendor. There is a sunk cost to network upgrades which must be subtracted from the total cost of using a Chinese vendor.

Despite the widespread knowledge of the threat associated with using Chinese equipment, some of Europe’s largest operators have purchased and deployed Chinese 5G equipment in their networks after 2020. That decision could have major consequences for their shareholders if Europe’s policymakers conclude that it is not smart to depend on Chinese telecommunications infrastructure in the same way as it did for Russian gas.

The report is valuable for mobile operators and their shareholders, communications policymakers, security and defense analysts, network engineers, and other professionals in the field. Contact Strand Consult today to get your free copy of the report “The Market for 5G RAN in Europe: Share of Chinese and Non-Chinese Vendors in 31 European Countries.”

References:

https://strandconsult.dk/field/reports/

Strand Consult: Open RAN hype vs reality leaves many questions unanswered

O-RAN Alliance tries to allay concerns; Strand Consult disagrees!

Strand Consult: What NTIA won’t tell the FCC about Open RAN

Strand Consult: MWC 2022 Preview and What to Expect

Strand Consult: 5G in 2019 and 2020 telecom predictions

Strand Consult: MWC 2022 Preview and What to Expect

by John Strand

Tomorrow the Mobile World Congress (MWC) opens physically in Barcelona and also online. Every year for the last 19 years, Strand Consult has published previews of the Mobile World Congress (MWC). After its cancellation in 2020, MWC 2021 was a shadow of its former self, though the hybrid in person/online format brought 30,000 participants. 2022 promises to bring some 50,000, one of the largest gatherings since the pandemic began.

Recall that 2019 MWC had some 110,000 participants and 2400 exhibitors. It’s come a long way from its start 36 years ago in Cannes, cozy enough that attendees to mingle at the Hotel Majestic’s bar following each day’s events.

Like the process for MWC, many people have been returning to normal after Covid. However the world has been gripped by the invasion of Ukraine by Russia, an absurd act against a sovereign, democratic nation which became independent in August 1991. Most democratic countries are united against Russia’s action. GSMA canceled the event’s Russian Pavilion and barred some Russian firms per international sanctions. Consider how Telenor stood up to dictatorship in Myanmar: by selling their assets and leaving the country. Pressure could grow for GSMA to suspend its Russian members.

Covid-19 has had a big impact on how people use mobile telecom services as well as the over-top players like Google, Facebook, Amazon, Apple etc. Historically GSMA kept a low profile on political matters. However that is increasingly difficult in a connected world when people communicate globally and have expectations of their service providers. Mobile operators and trade organizations like GSMA no longer have the luxury to focus solely on short-term profit and remain passive to aggression and autocracy.

MWC Buzzwords: 5G, OpenRAN, AI, Cloud, IoT, Green, and Diversity:

GSMA Director General Mats Granryd will open the conference, and it’s natural that this Swede would look to create consensus among 750 mobile operator members. He has a tough job to tell regulators that the industry needs better conditions while defending his members’ request for subsidies among other industries which have fared far worse than mobile telecommunications. As usual, he will focus on the latest hype and avoid the uncomfortable, which is too bad for journalists who want answers to critical questions.

Granryd will probably make the point that 5G is growing quickly: over 200 5G mobile networks based on 3GPP standards have now been launched around the world. If 4G was about the smartphone app economy, 5G is about disrupting the wireline home broadband market and opportunities for industry to integrate people and machines intelligently. There are hundreds of millions of new 5G customers. It’s an impressive accomplishment, but it’s doubtful that this can be turned into greater revenue for mobile operators’ shareholders. To date, the money has flowed to Big Tech.

Granryd will also tout the greening of the industry, though careful not to point out that the total energy footprint of the industry is growing. More traffic, devices, connections, network sites, and applications means more energy use. Not all of this is green and much is “greenwashing.”

The other hot topic is diversity, which has been moved from the last day of the conference to the first. The new Diversity4Tech replaces what was Women4Tech, an effort ended prematurely without success. Indeed, half of the world’s mobile subscribers are women, but there are still too few female executives in the mobile industry. Only 3 of GSMA’s 26 board members are women. It’s embarrassing that GSMA has not performed better on this metric. The only woman in the mobile leader line up is President & CEO of Telia Allison Kirkby who speaks on the New Tech Order. Tellingly, the session features three Chinese men: Yang Jie, Chairman, China Mobile; Ruiwen Ke, Chairman & CEO, China Telecom; and LieHong Liu, Chairman & CEO, China Unicom. Diversity, equity, and inclusion (DEI) are unlikely to be themes in the remarks of China’s state-owned operators. Moreover, they are unlikely to mention state-sponsored cyberattacks which are growing more frequent, more sophisticated, and more severe.

Oddly enough this MCW features a keynote by FC Barcelona President Joan Laporta. The program text boasts that the European football market is worth over $25 billion dollars and growing. In reality, football (soccer) is not an industry that mobile operators should emulate. Not only is FC Barcelona $1.57 billion in debt, it had to let Lionel Messi go because it couldn’t honor its financial contract. More largely, the salaries for superstars like Messi, Ronaldo and, others are breaking the cable industry. GSMA is probably thanking its lucky stars that it didn’t feature Chelsea FC owner Roman Abramovich, a Russian oligarch and Friend of Putin who invested in the UK’s Truphone in 2006.

In any event, Ukraine is a communication game changer. Look at Germany’s Chancellor Olaf Scholz now committing to pay the full freight of NATO dues, something that former Chancellor Merkel refused do to.

Regulation, the never-ending story:

MWC should be the opportunity for mobile operators take a victory lap. The mobile telecom industry salvaged society from the pandemic, allowing people to work, learn and receive health care from home. Moreover, many operators have commendable plans to be carbon neutral in the near future. Yet GSMA has failed utterly to build on mobile operators’ good citizenship to modernize regulation and kick start much-needed consolidation. Instead many authorities want to double-down on failed regulatory policies like net neutrality and are even-more entrenched against mergers. GSMA lacks a coherent strategy of policy and communication to convince competition authorities and regulators to adopt a modern framework for consolidation, investment, and innovation.

Strand Consult has studied mobile industry consolidation globally for more than 20 years and just published the definitive report on 4 to 3 mobile mergers. It describes why European operators don’t pass the acid test on consolidation and why they fail to succeed.

Strand Consult has published hundreds of research notes, reports, and articles about net neutrality around the world. Notably the leading countries for 5G; Japan, South Korea, China, and USA have no net neutrality rules, or only soft rules. It is no surprise that European countries were late to 5G. Strand Consult has documented how the Body of European Regulators (BEREC) has consistently prioritized the needs of a small cadre of so-called “civil society” advocates over Europeans as whole who want more mobile telecom innovation and investment.

More largely, the measures taken by the European Union to “tame” Big Tech have had the opposite effect. Since Margrethe Vestager became Competition Commissioner in November 2017, Big Tech companies have increased their turnover, market share and earnings.

GSMA promotes Clouds:

Where GSMA fails to communicate the value proposition of mobile operators and demand the needed regulatory update, it does a great job to promote cloud providers. Once again, mobile operators are set up to be the biggest losers while Big Tech firms Google, Apple, Amazon, and Microsoft are poised take the lion’s share of the 5G profits of connectivity, just as they did with 4G.

Few understand what AWS means for Amazon. AWS controls about a third of the global cloud market, substantially more its closest competitors Microsoft Azure and Google Cloud. In Q4 FY 2021 AWS generated net sales of $17.8 billion and operating income of $5.3 billion. Net sales grew 39.5% while operating income rose 48.5% compared to the year ago quarter. The value continues to increase as cloud services are integrated with artificial intelligence (AI) and other services.

Here are some critical questions to help you navigate the “cloudnet” sessions

- Why are clouds, which are fundamental to the running of 5G and 5G services, not subject to regulation, like mobile operators?

- Why do regulators obsess about market power of mobile operators while being oblivious to cloud providers Google, Microsoft, Amazon, and increasingly Huawei?

- What has been governments’ strategic blunder in the focus of restricting Huawei in 5G? (Hint: They forget about Huawei in the cloud. See Strand Consult’s note.

- How easy or difficult is it for customers to migrate from one cloud to another? Is data portable from Amazons AWS to Microsoft´s Azure?

3G, 4G, 5G: Where does the cash flow?

At MWC, there is always discussion about the next generation or G. However there is little discussion of the cash flow. Here are the cold, hard facts to consider.

- Many mobile operators believed in 2000 that 3G would be a gold mine for their revenues. They spent billions of euros on spectrum, but the revenue projections that ARPU will grow from to €36 to €72 per month fell far below expectation, ARPU declined.

- There are very few examples of successful partnerships that mobile operators have realized under 3G and 4G. In general, the revenue has flowed to the OTT or third-party providers, not operators.

- The value created in 4G has flowed to Google’s and Apple’s app stores which take a significant revenue cut of the apps on offer.

- Over the years, operators have attempted to launch various application programming interfaces (APIs) that third parties could integrate into their services. Some of these actions have been successful, like premium SMS. From 1998 onwards, mobile operators have been successful to offer premium SMS to pay for various digital services. Strand Consult was the first to publish research on this market and business models. Many of the world’s mobile operators followed our recommendations when it came to how to implement and operate a market with a short code where mobile customers could use to pay for services. See Strand Consult’s old report and research note about premium SMS

- Later around 2009 at MWC, GSMA launched OneAPI, about which we published a lot of research. Unfortunately, the operators did not know how to operate this market and create an ecosystem. Look at the research note ”One API is good news”. While this was a welcome development at the time, it did not develop into a revenue stream.

- Since that time, operators have been transformed into “dumb pipes”, mainly generating revenue from traffic they sell, not by adding value with better or different services. Mobile operators have little to no ability to monetize their own value-added services. In fact WhatsApp has cannibalized mobile operators’ SMS revenue. For example from 2012 to 2013, KPN´s SMS revenue declined by €100 million as customers switched to WhatsApp for messaging.

- There is only limited experience to reference for mobile operators’ 5G partnerships. The current version of 5G is 3GPP release 14 and 15 which do not have a functionality that is more advanced than 4G. Mobile operators have a dream to make money from 5G in the same way they dreamed it for 3G and 4G.

- Moreover, the EU regulatory environment with hard net neutrality rules and BEREC’s draconian over-interpretation of the rules have created an environment which discourages, if not prohibits, partnerships for mobile operators in 5G. It is not surprising that telecom investment has languished for years in EU.

- At MWC there are likely many PowerPoint presentations which describe proposed partnerships between mobile operators and other technology providers. However the business models are not in place, and many mobile operators have an unrealistic view of their ability to monetize value-added services.

- The reality is that to innovate in 5G, firms like Apple and Google, only need to add a new layer on their existing business. They are a proven partner. However mobile operators are required to do the essential retooling of networks. Mobile operators thus have a higher bar for 5G. They have to build an new ecosystem to convince a partner to join, where as Apple, Google and AWS only need, to extend their ecosystem with 5G services.

The role of mobile operators in the value chain has been decimated in the last two decades. It is not a question how mobile operators will react to 5G, but whether they have the skills at all to execute.

OpenRAN and Vendor Diversity – What does that mean?

The latest MWC hype is OpenRAN and the invented term “vendor diversity”. Much of the hype is driven by OpenRAN players which claim that the market for mobile infrastructure equipment is controlled by Huawei, Ericsson, Nokia and ZTE. However, MWC features some 2000 exhibitors which supply infrastructure equipment to over 750 mobile operators. Note that the need for “vendor diversity” is not addressed with cloud providers.

Many OpenRAN pronouncements sound too good to be true, for example a technology that can reduce mobile operators infrastructure CAPEX and OPEX by 30-40 percent. Investors and other decision makers want objective information about the latest mobile industry hype. Strand Consult’s free report Debunking 25 Myths of OpenRAN examines the claims made by OpenRAN proponents. Strand Consult, having witnessed the launch of WiMax, OneAPI, and the iPhone among other hyped technologies promised to bring windfall revenues to mobile operators, provides critical questions to evaluate OpenRAN in its latest report.

The main challenge for OpenRAN is whether it can be relevant for operators which have very little room for margin of error. OpenRAN is far from being able to replace classic infrastructure on a 1:1 basis.

OpenRAN testing has been launched in a world in which mobile operators buy and build classic RAN at a high rate. There are two reference cases. One is Rakuten in Japan driven by charismatic CEO Tareq Amin. Rakukten gives away free traffic without getting paying customers into the store. It’s solution is proprietary, not open.

The US-based Dish is the second. It faces many challenges which make it hard to see how it can become a serious alternative to Verizon, AT&T and T-Mobile

The Federal Communication Commission (FCC) proceeding on OpenRAN showed few, if any examples, of US mobile operators and their trade associations (CTIA, Rural Wireless Association, and Competitive Carriers Association) testifying that OpenRAN is a serious alternative to classic RAN installations.

MWC offers an opportunity to meeting mobile operators’ Chief Technology Officers. Ask them what they think of OpenRAN why they have launched 5G using classic RAN based on 3GPP standards.

The history of OpenRAN is reminiscent of WiMax. If you have some of the PowerPoints from the early 2000s, you will see how infrastructure vendors talked about why WiMax was so amazing. These points are almost identical to what is asserted about OpenRAN.

To assess claims about vendor diversity, it’s important to look at facts and history. The infrastructure supplier market has consolidated from 20 top tier providers in the 2G market in 1989 to 12 top tier providers in 1999 to 5 top tier providers in 2019. Many of the first-generation enthusiasts did not make it out of the 1G analogue cellular world into the world of 2G digital cellular. Over time the GSM standards family (GSM, WCDMA, LTE etc.) became the de facto basis for the roadmap, the standard for global economies of scale and the industry benefits such as lower unit costs. Those equipment suppliers which focused on CDMA and analog exited the market.

There is also the practical issue of math. The notion of vendor diversity for its own sake challenges operators to reduce complexity and cost in their networks. Operators frequently reduce the number of vendors to improve security (ability to vet vendors and develop trusted relationships) and to lower cost (ability to secure volume discounts). Indeed operators want concentration in part to get better value for money.

Note how Neil McRae, Managing Director and Chief Architect at British Telecom described when he got the question; “The major operators have been telling their shareholders since 2000 that they should reduce suppliers to save money?”. He replied, I have worked with BT for 10 years. When I arrived, BT had a 21 C fixed network with 50 vendors. I reduced it to 4 vendors and saved BT £1 billion in 3 years. The key was reducing complexity, which is the killer in telecommunications. When I hear about Open architectures with 5- 50 vendors, I run for the hills. Reducing vendors was the right thing to do and we would do it again.” RAN, while important, is just one part of an operator’s infrastructure requirements.

Moreover, the consolidation of European infrastructure is the result of many European operators having opted into Huawei and opted out of European suppliers.

The active customer base of Europe’s 102 mobile operators is 673 million subscribers. Huawei’s and ZTE’s share of 4G RAN mobile networks are 44% and 4% respectively, total 48%.This means that 325 million European mobile customers access Chinese infrastructure, primarily from Huawei. Countries are divided into four categories of share of 4G RAN equipment from Chinese suppliers: 75-100%; 50-75%; 25-50%; and less than 25%.In its RAN report Strand Consult has mapped the market for 4G RAN in Europe.

More than 40% of the CAPEX that European operators have used every year for the last 10 years has been shipped to China and Chinese suppliers like Huawei and ZTE. If you look at the American operators, most of their CAPEX has gone to European suppliers Nokia and Ericsson. We thought that the EU should thank the US operators and the US government for their massive support for European manufacturers and for their fight against the use of Chinese equipment from Huawei and ZTE. The five operators Vodafone, TIM, Telefonica, Orange and Deutsche Telekom have for several years opted for Chinese manufacturers at the expense of European vendors. 62% of Vodafone´s 4G RAN in Europe are from Huawei.

The fact is that RAN Capex makes up less than 3 percent of a mobile operator’s ARPU. The global RAN market is today $29 billion and can be pitted against Verizon’s Capex which amounts to $18 billion.

The bottom line for MWC

Strand Consult has limited expectation for mobile operators’ profitability in 5G. Operators may have ambitions, but the question is whether they have the skills to build an ecosystem that can compete with Apple, Google, and AWS. However, operators can do better on the policy front to modernize regulation and promote consolidation.

Under the current frameworks, there is little to no upside for operators. Mobile operators must consolidate to cut cost and increase profitability. They will probably continue to sell off infrastructure. They continually become dumb pipes. There’s nothing wrong with being a dumb pipe; it’s a business model that works quite fine in water and energy. But don’t expect it to be innovative.

In practice, this development means that many functions from telecom regulators have become irrelevant. The primary task of the telecom regulator of the future will be to deal with spectrum.

Technology companies build services on top of US and Chinese platforms. Many of the smaller technology companies are driven by the construction of a business with the aim of being acquired by these tech companies. A good example is Facebook’s purchase of WhatsApp for $16 billion in February 2014.

There will be many interesting discussions on 5G, OpenRAN, IOT and AI, including the need for more security and transparency. In any event, MWC is always a party because of the cool people who attend giving food for thought to those who want to be stimulated intellectually. Moreover Barcelona’s bars and restaurants rarely disappoint.

Strand Consult provides both pre and post review of the Mobile World Congress. Read reviews from the past years.

Meet Strand Consult at the Mobile World Congress:

If you would like to meet with Strand Consult during the MWC, please email your contact details and the details/purpose of the meeting, and we will get back to you. Journalists are most welcome!

………………………………………………………………………………………………………………………………………………………………………

Biography:

John Strand founded Strand Consult in 1995. Since then, hundreds of companies in the telecom, media and technology industries have attended Strand Consult’s workshops, purchased reports, consulted with the company to develop strategy, launch new products, and conduct a dialogue with policymakers.

John Strand sits on the advisory board of a number of Scandinavian and International companies and is a member of the Arctic Economic Council Telecommunications Working Group. He served on the Advisory Board for the 3GSM World Congress, the event known as the Mobile World Congress in Barcelona.

References:

Strand Consult: Open RAN hype vs reality leaves many questions unanswered

O-RAN Alliance tries to allay concerns; Strand Consult disagrees!

Strand Consult: What NTIA won’t tell the FCC about Open RAN

by John Strand, CEO and Founder of Strand Consult (see company profile and bio below)

Introduction:

In “NTIA Comments on Promoting the Deployment of 5G Open Radio Access Networks,” (Docket Number: GN-Docket No. 21-63) the National Telecommunications and Information Administration (NTIA) makes many claims about Open RAN [1] and states what appears to be official U.S. Executive Branch policy promoting that technology. In particular:

As stated in the Implementation Plan of the National Strategy to Secure 5G, the U.S. Executive Branch agrees that “close coordination between the United States Government, private sector, academic, and international government partners is required to ensure adoption of policies, standards, guidelines, and procurement strategies that reinforce 5G vendor diversity and foster market competition.” One promising solution in line with these objectives is open, interoperable networks, including Open RAN. While this response focuses on Open RAN, the Executive Branch’s policy is to promote the development of Open RAN alongside other policies, technologies, and architectures that support 5G vendor diversity and foster market competition.

Strand Consult analyzes these claims, their references, and the assumptions underpinning them from security and economics perspectives. Strand Consult’s report also includes an appendix fact checking 35 claims by NTIA and well as 133 additional references to help investigate the technology.

OpenRAN (open radio access network) is an evolving topic. It is an industrial concept, not a technical standard. Stakeholders, including NTIA may define OpenRAN differently, provide different definitions, ascribe different purposes to it, and have different expectations.

Editor’s Note:

There are two Open RAN spec writing bodies- the O-RAN Alliance and the Telecom Infra Project Open RAN Group. Neither of them have a liaison with either 3GPP or ITU-R WP 5D which have produced specifications/standards for 4G-LTE Advanced and 5G RAN/RIT specifications (3GPP Release 10 and Release 15 & 16, respectively) and ITU-R standards (M.2012-4, and M.2150, respectively). The O-RAN Alliance does have a liaison arrangement with GSMA which this author claims was an Ultra-Oxymoron.

……………………………………………………………………………………….

Strand Consult’s research question is to determine if, when, and how OpenRAN and O-RAN will replace conventional RAN on a 1:1 basis without compromising network quality, security, energy efficiency, and other important factors. Mobile operators have little ability to raise price, so operators must compete on network quality coverage and other factors.

Executive Summary:

We don’t believe NTIA’s comments provide insight to answer our questions. Strand Consult has found that most of the comments in NTIA’s report restate talking points from the OpenRAN industry and present policy arguments as if they were fact or technical analysis. As advisor to the US President and policy lead for the Executive Branch on telecommunications, NTIA is considered an authority and is expected to produce serious, objective policy. Indeed it would be welcome for an objective report from NTIA on OpenRAN with an authoritative list of critical references and information from test installations of the technology. Unfortunately NTIA’s report falls short of this expectation.

In our opinion, the main shortcoming of the report is that NTIA has either overlooked, ignored, or is unaware of the role of Chinese vendors in the OpenRAN industry. The separate but related ORAN Alliance has 44 Chinese vendors, many which are explicitly state-owned and military-aligned. At least 7 of these entities are on the US Dept of Commerce Entity List and others have lost their Federal Communications Commission operating license. NTIA has not conducted a security assessment of OpenRAN and yet it blesses the technology and pronounces that it is Executive Branch policy to pursue it. Strand Consult investigates NTIA’s other comments about the infrastructure market, competition, prices, and innovation and finds that many of them are either unevidenced or proffered by self-interested OpenRAN actors.

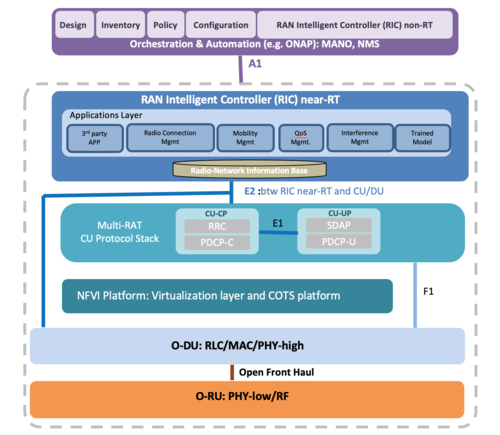

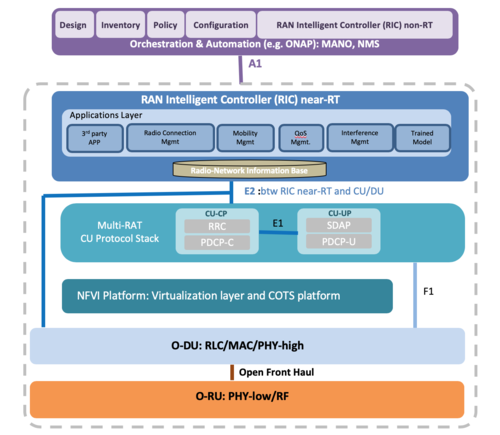

O-RAN Alliance Reference Architecture:

Image Credit: O-RAN Alliance

……………………………………………………………………………………………

Strand Consult’s Analysis:

In an effort to lift the level of policy discussion, Strand Consult reviewed “NTIA Comments on Promoting the Deployment of 5G Open Radio Access Networks” from July 16th to the U.S. Federal Communications Commission’s (FCC) a part of the Inquiry in the proceeding on open radio access networks (Open RAN). The highly respected NTIA is chartered to advise the President and represent the Executive Branch view on telecommunications, and there is an expectation that NTIA’s reports are objective, authoritative, and empirical, particularly with its roster of employee scientists and technologists. The document submitted to the FCC appears to be written by staff lawyers and makes many debatable claims which are either unsupported or based on advocacy materials from the OpenRAN industry.

NTIA’s OpenRAN document does not live up to expectations for the following reasons:

Its lack of objectivity and empirical support

Its overlooking role of Chinese vendors in OpenRAN ecosystem

Its misunderstanding of the economics of infrastructure and innovation

Its unfounded assertions about competition and the role of OpenRAN.

Lack of objectivity and empirical support. Citing of interested parties as experts. The OpenRAN document published by NTIA offers very little empirical, or even academic policy, evidence for its assertions. Most of references cited, 55%, come from OpenRAN advocacy groups or companies with a financial interest in OpenRAN, for example self-described OpenRAN vendors. The main part of the document’s references are not technical studies but rather policy arguments.

Moreover, NTIA fails to disclose that its preferred sources are advocacy organizations. While there is nothing illegal about citing advocacy organizations, government agencies like NTIA are supposed to be above touting advocacy as fact, science, and official policy.

The O-RAN Alliance [2] develops technical specifications for 4G and 5G RAN internal functions and interface, not for 2G and 3G. The O-RAN Alliance is not a standards development organization (SDOs) [3] like ITU-R and ITU-T. The O-RAN Alliance does not satisfy the openness criteria laid down in Word Trade Organization Principles [4] for the Development of International Standards, Guides and Recommendations.

The O-RAN Alliance is a closed industrial collaboration developing technical RAN specification on top of 3GPP specifications and ITU-R standards for 4G and 5G.

While industrial cooperation is important, there can be no mobile networks without the basic work of organizations like ITU-R WP 5D, 3GPP (which is NOT a SDO) and its seven regional members (which are SDOs) [5].

OpenRAN concepts include: cloudification, automation and open RAN internal interfaces do follow some elements of 3GPP specifications.

It appears that NTIA is attempting to elevate the O-RAN Alliance, essentially a closed association, with established WTO compliant SDOs (e.g. ITU and IEEE) and global consortia like 3GPP. Such an elevation is false and deceptive, and NTIA should clarify why it promotes a closed association that doesn’t meet openness requirements in WTO.

NTIA could have balanced this shortcoming by referencing some the widely published critical reviews of OpenRAN. Unfortunately, it does not. For example, U.S. federal documents can create credibility by objectively stating competing views and discussing the merits, similar to the Congressional Research Service [6].

Because NTIA appears only to provide favorable views of OpenRAN from interested parties, its document is tainted with bias. It reads like a set of talking points from the OpenRAN Policy Coalition, the a front for the OpenRAN industry’s interests.

Overlooking the role of Chinese vendors in the OpenRAN ecosystem:

Another shortcoming is the apparent ignorance of the role of Chinese vendors in the OpenRAN ecosystem. NTIA forgets to name the 44 Chinese companies that make up the second largest national group in the O-RAN Alliance. It failed to disclose that seven of these actors are either on the U.S. Entity List [7] and have lost their FCC license to operate [8] . Those companies include: China Mobile, China Telecom, China Unicom, ZTE, Inspur, Phytium and Kindroid, companies

which are integrated with the Chinese government and military.

Nor does NTIA disclose that the European telco Memorandum of Understanding (MoU) [between Deutsche Telekom, Telefonica, TIM, Vodafone and Orange] that OpenRAN should be built on top of Kubernetes [9], which is a software

technology platform that has been infiltrated by the Chinese.

While it began life in 2014 as a Google project, Kubernetes currently is under the jurisdiction of the Cloud Native Computing Foundation, an offshoot of the Linux Foundation (perhaps the world’s largest open-source organization).

By late 2017, Huawei had gained a seat on the Kubernetes Steering Committee. Huawei claims to be the fifth-biggest contributor of software code to Kubernetes.

According to the “Report on the 2020 FOSS Contributor Survey” [10] from The Linux Foundation & The Laboratory for Innovation Science at Harvard, the open source community spends very little time responding to security issues (an average of 2.27% of their total contribution time) and reports that it does not desire to increase this metric significantly.

It appears to be a problem that Huawei and ZTE are increasingly involved in the leading open source technology 11 used by OpenRAN developers. It is not clear how this acceptance of Chinese involvement in OpenRAN is consistent with President Biden’s tough stance on security vis-à-vis China and other threat actors [12].

Conclusions:

NTIA’s document appears to endorse the O-RAN Alliance for the security of OpenRAN. However, NTIA doesn’t provide technical analysis or a security assessment of O-RAN Alliance specifications. It is not clear from the document whether NTIA had access to these specifications to conduct an assessment. In any event, ORAN Alliance members exchange specifications on OpenRAN every 6 months. This means that the 44 Chinese companies in the O-RAN Alliance get fresh OpenRAN “code” at least twice a year, NTIA provides no threat analysis, risk assessment nor potential mitigation of these processes.

–>This is a breathtaking omission that alone warrants further attention by the NTIA.

NTIA could have strengthened its credibility by providing an authoritative, empirical document to inform policymakers objectively about OpenRAN. Instead NTIA offers a document which merely restates the talking points of OpenRAN advocacy groups and industry. This fails the U.S. Executive branch and the American people who expect quality information and impartial judgement from an expert agency.

More importantly, the NTIA document mis-informs readers about the security risks of OpenRAN which greatly extends the cyber security attack surface with its many “open interfaces.”

Hopefully, NTIA will review the empirical information and update its assessment in a new report.

…………………………………………………………………………………….

Readers who know something about OpenRAN are welcome to weigh in with their comments in the box below this article.

…………………………………………………………………………………….

Notes & Hyperlinks:

https://www.ntia.gov/files/ntia/publications/ntia_comments_-_open_ran_noi_gn_21-63_7.16.21.pdf

2. https://www.o-ran.org/

3. https://en.wikipedia.org/wiki/Standards_organization 4. https://www.wto.org/english/tratop_e/tbt_e/principles_standards_tbt_e.htm

5. https://www.3gpp.org/about-3gpp

6. Disruptive Analysis Report: Telecom & 5G Supply Diversification A long term view: demand diversification, Open

RAN & 6G path dependence

https://www.lightreading.com/open-ran/verizon-t-mobile-outline-their-open-ran-fears/d/d-id/769201 https://www.lightreading.com/open-ran/open-ran-has-missed-5g-boat-says-three-uk-boss/d/d-id/766258?

7. https://www.bis.doc.gov/index.php/policy-guidance/lists-of-parties-of-concern/entity-list

8. https://www.fcc.gov/document/fcc-denies-china-mobile-telecom-services-application-0

https://www.reuters.com/article/us-usa-china-telecom-idUSKBN2B92FE 9.https://www.telefonica.com/documents/737979/146026852/Open-RAN-Technical-Priorities-Executive-Summary.pdf/cdbf0310-4cfe-5c2f-2dfb-c68b8c8a8186

10. Page 5 of: https://www.linuxfoundation.org/wp-content/uploads/2020FOSSContributorSurveyReport_121020.pdf

11. https://merics.org/en/short-analysis/china-bets-open-source-technologies-boost-domestic-innovation

12. https://www.reuters.com/article/us-usa-biden-cyber-war-idUSKBN2EX2S9

………………………………………………………………………………………………..

About Strand Consult:

Strand Consult is an independent consultancy with 25 years of telecom industry experience. Strand Consult is known for its expert knowledge and many reports which help mobile operators and their shareholders navigate an increasing complex world. It has 170 mobile operators from around the world on its client list.

John Strand (photo below) is CEO of Strand Consult. He founded Strand Consult in 1995.

The mobile industry exploded in the 1990s, and Strand Consult grew along with its new clients from the mobile industry, analyzing market trends, publishing reports and holding executive workshops that have helped telecom operators, mobile services providers, technology manufacturers all over the world focus on their business strategies and maximizing the return on their investments.

References:

ntia_comments_-_open_ran_noi_gn_21-63_7.16.21.pdf (doc.gov)

Ultra Oxymoron: GSMA teams up with O-RAN Alliance without liaison with 3GPP or ITU

Strand Consult: The 10 Parameters of Open RAN; AT&T memo to FCC

Strand Consulting: Why the Quality of Mobile Networks Differs

44 Chinese companies have joined the O-RAN Alliance

by John Strand, Strand Consult (edited by Alan J Weissberger)

In 2019, the world’s mobile network operators earned just over $1 trillion and spent $30 billion on Radio Access Network (RAN) equipment, which was some 3 percent of revenue. To reduce cost, mobile operators leverage the pool of network equipment vendors, for example by developing new interfaces in network equipment to lower barriers to entry, under the industry term OpenRAN or “Open Radio Access Network.”

OpenRAN is not a standard, but a collection of technological features purported to allow different vendors to supply 5G networks with “standardized open interfaces” specified by the O-RAN ALLIANCE.

Source: O-RAN Alliance

……………………………………………………………………………………………………………………….

O-RAN only addresses internal RAN components. The wireless telecom industry still relies on 3GPP, the 3rd Generation Partnership Project, to build an end-to-end mobile cellular network and to connect end-user devices.

OpenRAN has become a hot topic in tech policy as an antidote to Huawei network equipment in mobile networks, but dozens of Chinese companies have joined the O-RAN ALLIANCE and are poised to drive OpenRAN standards and manufacturing

Chinese technological threats extend beyond Huawei

As the practices and relationships between Huawei and the Chinese government have been revealed, many nation state leaders have demanded the removal of Huawei equipment from communications networks. Huawei itself has not succeeded to demonstrate that it is an employee- owned company free from Chinese government control. China’s practice of civil military fusion means that all economic inputs can be commandeered for military purposes. Its de facto information policy asserts sovereignty over the internet and can thus enjoin any Chinese firm or subject to participate in surveillance and espionage. This means that restricting Huawei alone is not sufficient to secure 5G; the presence of any Chinese product in the network poses a security risk. Now that the Huawei brand name is toxic, many non-Chinese firms see an opportunity to enter the 5G network equipment market, but it is not clear whether and to what degree they will use Chinese standards, components, and manufacturing.

The O-RAN ALLIANCE was established in 2018 by Deutsche Telekom, NTT DOCOMO, Orange, AT&T, and China Mobile and has grown to 237 mobile operators and network equipment providers. The US has 82 O-RAN Alliance members; China, 44 (3 from Hong Kong); Taiwan, 20; Japan, 14; United Kingdom, 10; India, 10; and Germany, 7. Notably the 44 Chinese member companies exert significant control on the technical specifications and supply chain of OpenRAN 5G products and services. The conundrum of engagement with restricted Chinese entities does not end there. Citing security concerns, the Federal Communications Commission rejected a US operating license to China Mobile and may revoke approvals for China Telecom for its failure to demonstrate that it is not influenced the Chinese government. Other O-RAN ALLIANCE members include Inspur, Lenovo, Tsinghua, and ZTE, companies the US government restricts for security reasons given their ties to the Chinese government and/or military. The O-RAN ALLIANCE did not return a request for comment.

Some mobile operators cite OpenRAN to avoid ripping and replacing Huawei equipment

While many mobile operators are taking precautions to protect their customers by removing Huawei equipment, Vodafone, Telefonica, and Deutsche Telekom have resisted. They posit the promise of OpenRAN (with the O-RAN ALLIANCE specification) to justify a delay of rip and replace efforts, knowing that OpenRAN products will not be available for some years. Thus, these three operators can extend the life of Huawei in their 5G networks with the promise of using so called “open” equipment built with Chinese government standards. Separately the cost to rip and replace Huawei in European networks is minimal, about $7 per European mobile subscriber. The mobile operators which have switched out Huawei equipment have not experience increased cost or delay to the rollout of 5G.

Local politicians jump on the OpenRAN bandwagon thinking it has no Chinese connection

With the manufacturing base decimated in the countries they represent, many policymakers have looked to OpenRAN to get back into the network equipment game. Presumably OpenRAN would provide some high-end software jobs, though manufacturing is likely to be dominated by established Chinese entities. A US House bill would offer a whopping $750 million for OpenRAN development, though the location of manufacturing is not conditioned. Similar bills have been offered in UK, Japan, India, Germany, and Brazil. However commendable the notion of OpenRAN may be from a technical perspective, it appears that China has already outwitted Western leaders. China can afford to lose the Huawei battle if it wins the war on standardizing and building billions of “open”, “interoperable”, and “vendor neutral” devices. As long China influences the O-RAN specifications and manufacturing, it does not care whose brand is used.

Policymakers in the US and EU have today a lot of focus on communications network equipment from Chinese vendors. In 2019 and 2020 Strand Consult published many research notes and reports to help telecom companies navigate a complex world. We focused heavily on the problem of Chinese equipment in telecommunications networks. While the media has largely focused on Huawei, the discussion should be broadened to the many companies that are owned or affiliated with the Chinese government including but not limited to TikTok, Lexmark, Lenovo, TCL, and so on. Although some of our customers disagree with our views, Strand Consult’s job is to publish what is actually happening and how policy decisions may affect their business in the future.

Here are some of Strand Consult’s research.

44 Chinese companies have joined the OpenRAN effort, a strategy to reduce Huawei’s presence in 5G

https://www.o-ran.org/membership

…………………………………………………………………………………………………………………..

Open RAN first surfaced nearly three years ago at Mobile World Congress 2018. It promised a new set of interfaces that would allow service providers to mix and match vendors at the same mobile site, instead of buying all products from the same supplier. Operators hoped it would inject competition into a market dominated by Ericsson, Huawei and Nokia.

Since then, geopolitics has propelled it to the very top of the telecom agenda. Non-Chinese policymakers have latched onto open RAN as an alternative to Huawei, a Chinese vendor that governments are banning and operators are ditching because of its suspected links to an increasingly authoritarian Chinese state.

Avoiding Chinese equipment makers is one thing. Skirting Chinese technology expertise is not so easy. Already, there is concern that China, through Huawei and ZTE, has too much influence in the 3GPP, the group that develops the 5G standard. Further worsening of relations between Western democracies and China could prompt a future break-up of international standards-setting bodies, according to several experts.

Chinese influence:

These circumstances leave open RAN in an awkward situation. Anyone listening to the Open RAN Policy Coalition might think the technology was born in the USA and has never set foot in China. The O-RAN Alliance shows otherwise. Its most prominent Chinese members include ZTE, an equipment vendor that was on a US trade blacklist until it hawked up billions in fines. Also named are China Mobile and China Telecom, two state-backed operators that turned up on a Pentagon blacklist in June.

China Mobile is a busy member of the group, says a source who requested anonymity. That is hardly surprising as it was arguably the main force in the C-RAN Alliance, a Chinese group whose merger with the largely American xRAN Forum created the O-RAN Alliance in 2018. Today, the Chinese operator is a very active contributor to specifications, according to Light Reading’s source. ZTE has been similarly engaged, said sources within the company at the start of the year.

None of this will be very palatable to US politicians determined to block China’s influence. Yet any break-up of the O-RAN Alliance into C-RAN Alliance and xRAN Forum camps would be a major setback for open RAN. It would complicate development and threaten new disputes over intellectual property.

Right now, the issue of technology patents means the O-RAN Alliance faces a potential dilemma about involving Huawei. The group’s interfaces build heavily on specifications developed outside the O-RAN Alliance by Ericsson, Nokia, NEC and Huawei. The Nordic and Japanese vendors have all now joined the club, agreeing to license their patents on fair, reasonable and non-discriminatory (FRAND) terms. But Huawei has not. There is concern it could attempt to thwart open RAN by arguing its patents have been infringed.

While addressing that risk, its membership of the O-RAN Alliance would create other problems. For one thing, China’s biggest slab of tech R&D muscle would – paradoxically – have gained entry to the design room of the technology touted as a Huawei substitute. US policymakers able to live with China Mobile and China Telecom might balk at the involvement of telecom public enemy number one.

It would also make all three big telecom equipment vendors a part of the specifications group. That would increase the likelihood that Ericsson, Huawei and Nokia become the main suppliers of open RAN products, frustrating efforts to nurture competitors. There are already doubts that smaller rivals will be able to land much open RAN work. Appledore Research, an analyst firm, reckons open RAN will generate $11.1 billion in revenues in 2026. As much as $8 billion will go to the incumbents, it predicts.

Ever wary of open RAN, Huawei signaled its growing interest in the technology in July, when Victor Zhang, its vice president, was being grilled by UK politicians. “We are watching open RAN as one of the choices,” he told a parliamentary committee. “Once it has comparable performance to single RAN, we believe Huawei will be one of the best suppliers of open RAN as well.” Outside China, an open RAN ecosystem that makes space for Huawei could fast lose its appeal.

https://www.lightreading.com/open-ran/chinas-role-in-open-ran-is-looming-problem/d/d-id/766204?

Strand Consult: 5G in 2019 and 2020 telecom predictions

by John Strand – Strand Consult

Editor’s Note: This article is an abridged version of Strand Consult’s year end telecom review and 2020 forecast. Copy edits (spelling, grammar) were made for correctness- content has not been altered. Emphasis (bold font) was added in places the Editor deemed important.

Stand Consult’s full report is here.

…………………………………………………………………………………….

Introduction

Strand Consult has followed telecommunications industry for almost 25 years. 2019 was a year with much political and regulatory attention and a renewed appreciation for how the industry ensures the digital society that is ubiquitous, fast, safe, green, and inclusive.

5G became a mainstream topic in 2019 and rebooted the discussion of the value that telecommunications brings to society including innovation, security, and inclusion.

Consider the many transformations that the industry has delivered from the invention of the telephone, which required a person (a switchboard operator) to connect two people. Today the digital world, including its businesses, the communications of individuals, and the operations of the public sector is predicated on the advanced infrastructure that the telecom industry provides.

In 2019 Strand Consult published many research notes and reports to help telecom companies navigate a complex world. We focused heavily on the problem of Chinese equipment in telecommunications networks. While the media has largely focused on Huawei, the discussion should be broadened to the many companies that are owned or affiliated with the Chinese government including but not limited to TikTok, Lexmark, Lenovo, TCL, and so on. Although some of our customers disagree with our views, Strand Consult’s job is to publish what is actually happening and how policy decisions may affect their business in the future.

5G launched without a great vision

5G is coming faster and stronger than 2G, 3G or 4G. With each new G, implementation and adoption time gets shorter. However regulators in many countries are failing to keep pace with the technology, as they are behind on frequency allocation and rollout policy. Indeed few regulators have succeeded to make infrastructure rollout more efficient or auctions more speedy. The pressure is on the Federal Communications Commission (FCC) in 2020 to deliver an auction for the C-band so that the US can stay in the global 5G race and correct for the misguided history of handing out frequency to government users without accountability measures in place.

Strand Consult has worked on these problems for years and notes that it is still too difficult and expensive to role out new network in most countries. See our reports on How mobile operators can reduce cost for mobile masts and improve mast regulation, Why the Quality of Mobile Networks Differs, and How to deploy 5G: Best practices for infrastructure, regulation and business models which describe how to address these challenges effectively. In Denmark Strand Consult has helped to reduced total annual rental costs for mobile masts by about 20 percent. In most countries, 5G will be first marketed as an alternative to fixed line broadband. Wireless solutions based on 5G will help stimulate competition.

The performance of most EU countries on 5G is disappointing. Countries which used to lead the world in mobile standards are no where to be found with 5G. Unless the EU reverses course on its anti-investment telecom policy, don’t expect to see the EU lead in 5G or any other G in 2020, 2021, 2022, 2023 or for that matter in 2030. See Strand Consult’s research note Five Nordic Prime Ministers signed an agreement on 5G. Here are five reasons why Europe has already lost the 5G race.

5G will be a repeat of 4G in certain ways

Like 4G, most of the value in 5G will accrue to players other than the telecom operators providing the networks. In 4G, most of the value went to smartphone makers and over the top service (OTT) providers such as Google, Facebook, and Apple. In the vast majority of countries, ARPU and earnings for mobile operators have fallen year after year—even though the speed and quality of mobile networks has increased. Strand Consult would like mobile operators to focus on how partnerships and creative business models can use 5G to create value for their shareholders. Our new research How to deploy 5G: Best practices for infrastructure, regulation and business models can help. Mobile operators have had successful revenue partnerships with premium SMS to develop the service market and MVNO brand strategies to reduce their sales & marketing costs. Operators need to look at these models to find partners for 5G.

OTT, IOT, and all the other services

Already with 5G, we see the world moving to the over the top (OTT) providers and when it comes to Internet of Things (IoT). This creates a challenge for how mobile operators can engage in partnerships and business models. The big question is whether it will be a market that will be dominated by classic mobile operators or by MVNOs like Cisco IoT and Wireless Logic that offer corporate clients one stop shopping. Unless mobile operators are smart, they will relegate themselves to dumb pipes again.

Regulation will hit telecom operators again in 2020

The need for greater security in networks and removing vulnerable elements will hit operators in 2020 with new standards for resilience. While Huawei likes to spin that restrictions on its equipment are mere trade war tactics, the debate about security will become more holistic to encompass the many elements of security including software, practices, and risk management. See Strand Consult’s note on the topic The debate about network security is more complex than Huawei.

The need for network security can be traced through a century of telecom networks. More recently, Strand Consult documented that in 2005, restrictions were placed on Chinese technology for the 3G rollout. It is telling that the current US President defends European technology companies Ericsson and Nokia while many European operators defend their Chinese suppliers. It will be interesting to see whether the new European Commission will finally ”walk the walk” and demand the same safety and security standards of Chinese companies that European, US, Korean and Japanese firms have had to uphold in EU.

Similar to the financial industry, the telecommunications industry will be subject to accountability requirements and compliance to ensure security. The big question is whether it will be easier and cheaper to meet these requirements when using Chinese equipment. Strand Consult doubts this.

The mobile operator’s classic business model is probably dead and buried

Most of the world’s mobile operators have evolved their business model in face of competition and revenue erosion by OTT players. Mobile operator has realize that revenue from traditional streams of voice, SMS, and MMS is in free fall. In 2020 the industry will see a new direction in which operators divide into infrastructure companies and service companies. We believe that this split comes in many forms and models. We think we will see companies that make a classic split, but we also think that we will see companies that will make more creative splits in which divesting masters and towers is just the first step. We expect this trend could translate to spectrum. We envision an industry divided into three elements: infrastructure, services and spectrum.

Such fragmentation will require a new view of spectrum and who owns and how to use spectrum. When it comes to spectrum sharing, dynamic spectrum sharing will open up a number of new technical possibilities. The big question is who is going to use spectrum going forward and who is going to own spectrum on the other.

To see the future spectrum market, look at the introduction of CBRS in USA, a model likely to spread and which is creating a new value chain and dynamic market. Many new and exciting companies have already entered and created equipment and services. This is the same dynamic underpinning the introduction of premium SMS, MVNOs and in connection with the app industry that has emerged at the top of the smartphone universe.

There are now four models of spectrum:

1. Licensed spectrum owned by mobile operators.

2. Dedicated spectrum with optional synchronized sharing (see German model).

3. Unlicensed spectrum with asynchronous sharing.

4. Unlicensed spectrum with synchronized sharing.

Of note is massive rollout of 5G and fixed wireless access (FWA) solutions. If 5G is hot in 2020, then 5G/FWA will be super hot in 2020. Strand Consult’s forthcoming report on 5G/FWA will show how fixed line providers can extend their service and revenue with 5G. The business and economics of this development follow a similar dynamic to the MVNO market, and customers can reuse this knowledge from Strand Consult.

Editor’s Note: There is no standard for 5G/FWA, as IEEE refused to submit IEEE 802.11ax to ITU-R and there no other contenders have been submitted. FWA is not a IMT 2020 use case.

…………………………………………………………………………………………………..

Wireless solutions will battle FTTH for supremacy, but will also partner for opportunity

Remember the many pundits and policymakers who described fiber to the home (FTTH) as the only ”future-proof” solution. Not only was that prediction proven false, but wireless solutions are complements and substitutes. Those FTTH providers which have seen their business languish can get a boost from 5G. Mobile operators aiming for 4G/5G solutions can sharpen competition in the broadband market and cannibalize the DSL/fixed line market.

The year 2020 will see many operators will switch off their 3G network while 2G is on life support. Operators will see value by refarming spectrum to focus on 4G and 5G LTE solutions. The benefits of having a clean 4G / 5G network are so great that upgrading 2G / 3G / 4G to 4G / 5G will mean that operators worldwide will recognize that a total network swap is best.

During the period 2011 – 2016, operators worldwide implemented 4G. At that time, it turned out that the costs associated with rolling out 4G were similar to a network swap and upgrading the existing 2G and 3G networks. During this time many operators replaced their 2G / 3G networks with new networks supporting 2G/3G and 4G. In connection with the introduction of 5G, we will experience the same, and operators such as TDC in Denmark and Telia in Norway have chosen to replace their entire existing network. Read more: The real cost to rip and replace Chinese equipment from telecom networks

Privacy: EU, US and the rest of the world

The drive for online privacy regulation worldwide reflects distrust and disappointment in the large platforms, however regulation frequently has the opposite of the intended effect. 2020 will mark the two-year anniversary of the General Data Protection Regulation (GDPR) in the European Union. For all the policymakers’ promise of a new level playing field, the largest platform companies have increaszed their market share and revenue in the region. In some two decades of successive data protection regulation in the EU, small and medium sized internet companies have failed to grow, and consumer trust online is at its lowest point ever, according to Eurostat. This serves as a proof point for the historical US approach, supporting its risk-based policy which focuses on making rules based upon the sensitivity of data; preserving the mutual interests in accurate data between the user and collector of data; and solving for real, not theoretical, harms. The US has some two dozen information privacy laws and is predicated on a 220 year legal tradition which can deliver tougher oversight, enforcement and penalties that the European approach. A new California law will come into play in 2020 which will likely precipate Congress to make federal rules.

A new appreciation for the role that telecom companies provide for society

2019 was the year in which the telecommunications industry may have to acknowledge that the demands placed on the communication solutions used by the police, the fire department and other emergency units will spread to the mobile networks. We are talking about requirements that are closely linked to the national security policy.

In Europe and in large parts of the world, the focus is on protecting a democratic social model where freedom, freedom of expression, privacy and human rights are important elements. Europe attempts to focus on the rights of citizens, including data protection, and many want to preserve a role for technology to improve the quality of life and add value to our society. In a dictatorship like China, technology is instrumental for the state to fulfill its goals, regardless of whether it improves quality of life or promotes human rights.

Conclusion

We hope that our research note inspires you over the year. 2019 was Strand Consult’s 24th year in business and its 19th year in making predictions in which we try to inform, delight, and challenge our audience. We invite you to see for yourself whether we were right over the years.

Thank you for another great year. Merry Christmas and all the best for 2020.

Sincerely,

John Strand, CEO

………………………………………………………………………………………

Reference:

Again, the complete (unedited and uncut) report is available to read at: