European Telcos

Strand Consult: Market for 5G RAN in Europe: Share of Chinese and Non-Chinese Vendors in 31 European Countries

With its new report “The Market for 5G RAN in Europe: Share of Chinese and Non-Chinese Vendors in 31 European Countries,” Strand Consult brings valuable evidence of the location, amount, and share of Chinese and non-Chinese equipment in European telecom networks. This report, the second of its kind, describes the respective amounts of 5G equipment from Huawei, ZTE, and non-Chinese vendors in European mobile networks and the share of such in equipment in the 5G Radio Access Network (RAN). Here are the highlights from the new report.

- There is little transparency about the amount, type, location, and share of 4G and 5G Chinese equipment in European networks.

- In 8 of 31 countries, more than 50% of the 5G RAN equipment comes from Chinese vendors. In 2020, it was 16 of 31 countries in which the 4G RAN equipment came from Chinese vendors.

- In one country, 100% of the 5G RAN comes from Chinese vendors. In 2020 there were 3 European countries with 100% 4G RAN equipment from Chinese vendors.

- Only 11 of 31 European countries can offer their users access to clean, non-Chinese networks.

- 41% of the mobile subscribers in Europe have access to 5G RAN from Chinese vendors. In 2020, 51% of European mobile subscribers had access to 4G RAN from Chinese vendors.

- The large European countries–Germany, Italy, Poland, Portugal, Austria, and Spain–purchase significant amounts of 5G equipment from Chinese vendors.

- Operators like Telenor and Telia in Norway, TDC in Denmark, 3 in Denmark and Sweden, T-Mobile Nederland’s, and Proximus in Belgium have switched out Chinese suppliers. None of those operators report increased networks cost or delay in 5G rollout.

- The data suggests that Germany appears not to take the security threat of China seriously. Nord Stream 2 was Germany’s debacle oil energy supplies from Russia; it appears that Germany sets up a similar scenario in the communications domain with Huawei and ZTE.

- As Germany accounts for 25% of European mobile customers, the German government’s lax approach to communications infrastructure creates a risk for Germany and all people who interconnect with German networks.

- Germany together with Italy, Poland, and Austria, comprise 50% of European mobile customers. These countries are heavily dependent on Chinese equipment, creating risk for their own nations and others which use their networks.

- In 2020, 57% of Germany’s 4G RAN came from Chinese vendors. In 2022, 59% of the 5G RAN in Germany comes from Chinese vendors.

- Huawei enjoys a higher market share in Berlin than in Beijing where it shares the market with ZTE and other vendors.

- US General Darryl A. Williams serves as the commanding general of the United States Army Europe and Africa (based in Wiesbaden, German) and commander of the Allied Land Command. He oversees more than 20,000 staff. Unwittingly when he uses a commercial mobile phone, the traffic is sent through a network built with Chinese equipment. Similarly when American military use their personal devices, they engage on a Chinese network at risk for intrusion.

Strand Consult’s report delivers detailed information about Chinese and non-Chinese network equipment in Europe at country level. The report highlights of the importance of the EU’s 5G toolbox and provides recommendations to improve its implementation. The toolbox applies to most of Europe’s 102 mobile operators across 31 countries serving some 673 million mobile customers. The report also provides valuable economic context to understand the market for RAN equipment.

The focus on 5G and 4G RAN reflects the shift of the security debate. There is consensus across most countries outside China that equipment provided by vendors owned and affiliated with the Chinese government and military poses unacceptable risk for the security and integrity of the core of the network. The discussion has evolved to whether and to what degree should such vendors be allowed to supply the RAN.

The 4G RANs studied in the 2020 report were purchased in the 12-year period of 2008-2020. Most of RANs were delivered and installed during 2009-2016 when operators upgraded their 2G and 3G networks to 4G networks. The main part of the 5G RAN was purchased, delivered, and installed after 2020.

When performing a financial analysis of the cost of restricting Huawei, one must consider that network upgrades will happen regardless of selection of vendor. There is a sunk cost to network upgrades which must be subtracted from the total cost of using a Chinese vendor.

Despite the widespread knowledge of the threat associated with using Chinese equipment, some of Europe’s largest operators have purchased and deployed Chinese 5G equipment in their networks after 2020. That decision could have major consequences for their shareholders if Europe’s policymakers conclude that it is not smart to depend on Chinese telecommunications infrastructure in the same way as it did for Russian gas.

The report is valuable for mobile operators and their shareholders, communications policymakers, security and defense analysts, network engineers, and other professionals in the field. Contact Strand Consult today to get your free copy of the report “The Market for 5G RAN in Europe: Share of Chinese and Non-Chinese Vendors in 31 European Countries.”

References:

https://strandconsult.dk/field/reports/

Strand Consult: Open RAN hype vs reality leaves many questions unanswered

O-RAN Alliance tries to allay concerns; Strand Consult disagrees!

Strand Consult: What NTIA won’t tell the FCC about Open RAN

Strand Consult: MWC 2022 Preview and What to Expect

Strand Consult: 5G in 2019 and 2020 telecom predictions

European Commission DESI report reveals broadband network status is lagging

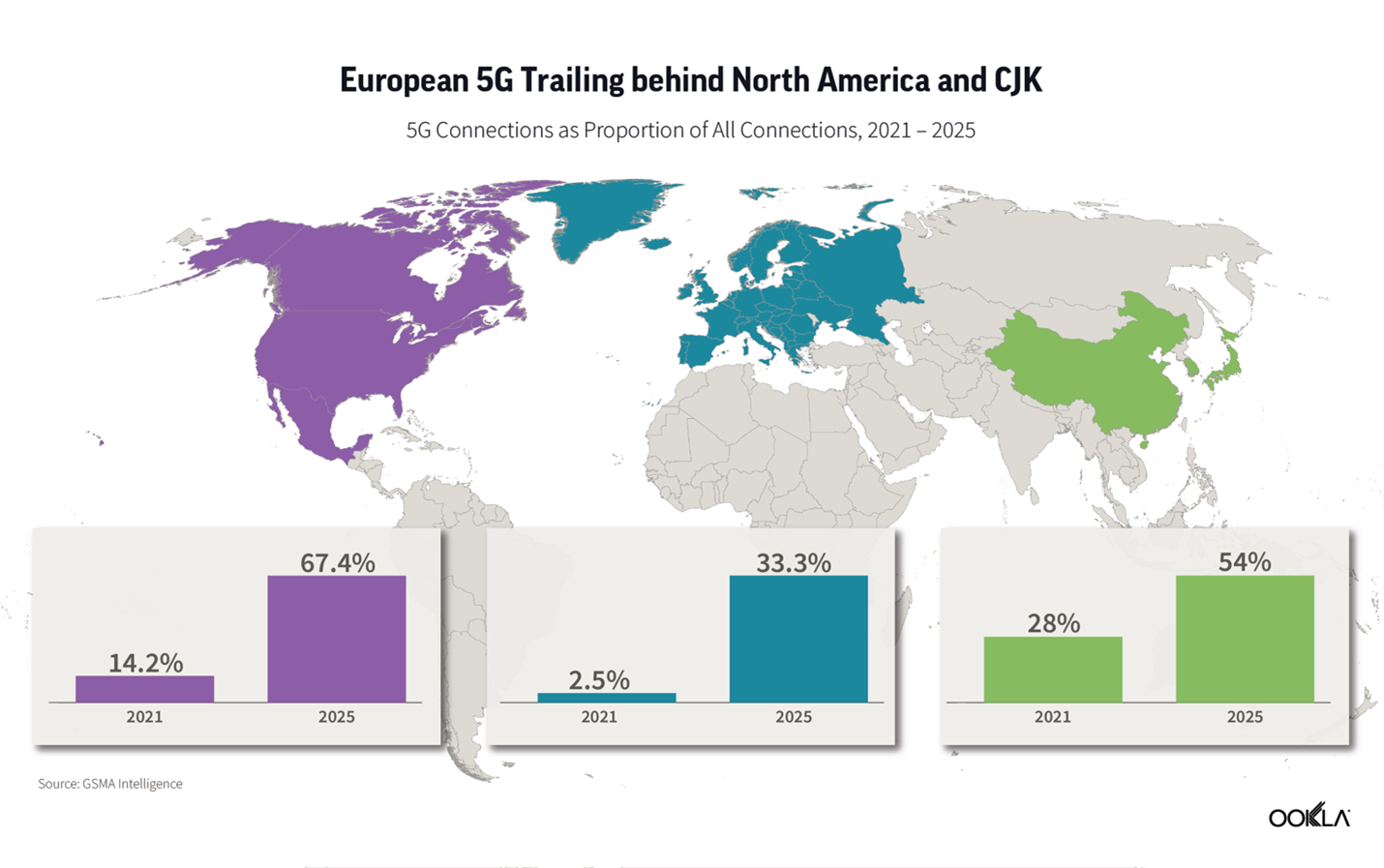

European Union member states are still lagging behind most of the world when it comes to the deployment of 5G networks. That’s one of the findings in the latest Digital Economy and Society Index (DESI), published by the European Commission. “Efforts need to be stepped up to ensure the full deployment of connectivity infrastructure (notably 5G) that is required for highly innovative services and applications,” the Commission wrote. DESI also found that businesses’ adoption of key digital technologies – such as artificial intelligence and “big data” analytics – remains worryingly low.

Mobile broadband is still mainly complementary to fixed broadband, when it comes to subscriptions for households. Europeans primarily use fixed technologies at home to access the internet (even if using a mobile device). In 2021, 13% of EU households accessed the internet only through mobile technologies.

->Finland (34% of households), Latvia (24%), Poland (23%), Romania (22%) and Bulgaria (21%) were the leaders in mobile-only access.

With respect to connectivity, Denmark has the highest score, followed by the Netherlands and Spain. Belgium and Estonia have the weakest performance on this dimension of the DESI. Coverage of Next generation access (NGA) technologies (VDSL, VDSL2 vectoring, FTTP, DOCSIS 3.0, DOCSIS 3.1) capable of delivering download speeds of at least 30 Mbps reached 90% in 2021, following a slight increase of 2.9 percentage points compared to the previous year. This mainly resulted from a 7-point growth in FTTP. VDSL coverage remained stable, while cable DOCSIS 3.0 declined slightly (by 0.8 percentage points).

Fixed very high capacity networks (VHCN) covered 70% of EU homes in 2021, up from 60% in the previous year. FTTP deployments were mainly responsible for this increase. Regarding mobile technologies, while 4G coverage of populated areas is almost universal, reaching 99.8%, 5G commercial services were launched in all but two Member States (Latvia and Portugal) by mid-2021. 5G coverage grew substantially from 14% in 2020 to 66% of populated areas in 2021.

The report further states:

“The connectivity dimension of the DESI looks at both the demand (take-up) and the supply side (coverage) of fixed and mobile broadband. Under fixed broadband, it assesses the take-up of overall, at least 100 Mbps and at least 1 Gbps broadband, the coverage of fast broadband (next generation access of at least 30 Mbps) and of fixed very high capacity networks (VHCNs) . Under mobile broadband, it includes the population coverage of 5G networks, the assignment of radio spectrum for 5G (5G spectrum indicator) as well as the take-up of mobile broadband6 . In addition, it captures the retail prices of fixed and mobile offers (price plans) and also those of converged bundles (consisting of fixed and mobile service components).

Broadband coverage of rural areas remains challenging, as 8.5% of households are not covered by any fixed network, and 32.5% are not served by any NGA technology. However, 4G is widely available also in rural areas (99.6%). On fixed technologies, there was a marked increase in the rural coverage of FTTP (from 26% in 2010 to 34% in 2021).

In the next 10 years a whole generation of new quantum technologies is likely to emerge, with far reaching impacts on many activities. The first devices, in the form of experimental physical platforms or advanced simulators, are already in use. Researchers are starting to build pilot quantum computers to act as accelerators interconnected with supercomputers, forming ‘hybrid’ machines that blend the best of quantum and classical computing technologies. Quantum computing facilitates innovation in complex fields of research (e.g., climate change, health, brain science, biology, sustainable energy, materials, etc.) and industrial development (e.g., simulation sciences, data analytics, AI, digital twins, etc.). The Digital Decade target ist that by 2025, the EU has its first computer with quantum acceleration, paving the way for the EU to be at the cutting edge of quantum capabilities by 2030.”

References:

https://digital-strategy.ec.europa.eu/en/policies/desi-connectivity

Big 4 European network operators call for content platforms to fund telecom infrastructure

Several large European network operators are calling for OTT platforms and cloud giants to contribute towards the cost of the telecom infrastructure they use to deliver content to end users. In an open letter published in the Financial Times, the CEOs of Vodafone, Telefónica, Deutsche Telekom, and Orange have expressed their serious concern that content platforms should contribute towards building the connectivity infrastructure they rely on.

“The current situation is simply not sustainable. The investment burden must be shared in a more proportionate way. Today, video streaming, gaming, and social media – originated by a few digital content platforms – account for over 70 percent of all traffic running over the networks. Digital platforms are profiting from hyper scaling business models at little cost while network operators are taking on the investment required for network connectivity. At the same time, our retail market profitability has been declining.”

The CEOs note that data traffic increasing by up to 50 percent annually and claim they’re unable to make a viable return on their investments. They say it puts further infrastructure development at risk. They cite Sandvine’s Global Internet Phenomena Report, released in January 2022, stating that video streaming, gaming and social media “generated by a handful of digital content platforms” account for more than 70 percent of all traffic on the web.

Source: Sandvine

………………………………………………………………………………………………………………………………………………………………………………………

Despite being the leading providers of mobile services throughout the continent, the executives claim they are no match for the “strong market positions, asymmetric bargaining power, and the lack of a level regulatory playing field” enjoyed by tech giants.

“Consequently, we cannot make a viable return on our very significant investments, putting further infrastructure development at risk,” the CEOs added. “If we don’t fix this unbalanced situation Europe will fall behind other world regions, ultimately degrading the quality of experience for all consumers.”

They noted that South Korea is discussing a national law that would create regulatory conditions for a more equitable sharing of internet costs — in part because of the popularity of Netflix’s “Game of Squids.” Following that success, South Korean network operator SK Telecom sued Netflix over the costs it claims to have incurred from increased network traffic and maintenance work

“In the U.S., policymakers are also turning to universal services that are also funded by digital platforms,” the CEOs added.

While the joint statement did not explicitly mention net neutrality, the CEOs complained that “network operators are unable to negotiate with these mega-platforms due to their own strong market positions, asymmetric bargaining power between the parties and lack of a level regulatory playing field. Fair terms.”

The joint statement also echoes recent comments by Marc Allera, chief executive of BT’s consumer division, who noted “a complete lack of coordination on many data-intensive events.” Allera said, “Every operator’s network is suffering from stress, everyone’s internet has become more unstable than before.”

………………………………………………………………………………………………………………………………………………………

References:

https://www.ft.com/content/68f989f5-96e6-440e-90f4-2a11840d9c99

https://min.news/en/tech/c3e4e694a7c423425fbdbefa8de94c01.html

European operators want platforms to contribute towards infrastructure

https://digital-strategy.ec.europa.eu/en/policies/digital-principles

ETNO Report: €300bn still missing for networks

European telecom operators have released a new report on how the sector can contribute to digital transformation and economic recovery. The “Connectivity and Beyond: How Telcos Can Accelerate a Digital Future For All” report from industry group ETNO (European Telecoms Network Operator’s association) and consulting firm BCG comes ahead of a summit of EU leaders to discuss industrial and digital policy, among other topics. The European network operators expressed the need for significant investments to realize the economic benefits of digital infrastructure.

The report sees the potential to create 2.4 million new jobs in the next four years through investment in digital transformation. This will require the telecom operators to invest EUR 300 billion in networks, along with additional action to stimulate demand and improve digital skills.

In order to achieve the opportunity, Europe must dramatically ramp up its network investment capacity to achieve gigabit speeds across territories and ensure full digital inclusion. BCG estimates €150bn is still needed to achieve a full-5G scenario in Europe, while an additional €150bn is required to finish upgrading fixed infrastructure to gigabit speeds.

However, increased investment is also much needed on the demand side, with 83% of EU SMEs still not using advanced cloud and 60% of 9 year-olds currently educated in schools that are not digitally equipped. BCG estimates that upgrading the digital infrastructure of all European schools would require €14bn/year, which corresponds to 1.8% of the Next Generation EU fund. Similarly, digitalizing all European SMEs would require €26bn/year, or 3.5% of the Next Generation EU fund.

BCG analysis finds that 5G alone can generate an annual increase of EUR 113 billion in GDP and 2.4 million new jobs in Europe by 2025. A widespread uptake of digital solutions can also help reduce carbon emissions, by up to 15 percent, the report said. This is based on rolling out smart city services and digital transformation in the transport sector.

The report highlighted the significant investment needed to realize these gains, saying Europe will need to ramp up network spending quickly to achieve its goals. BCG estimates it will cost EUR 150 billion to bring 5G to all of Europe and another EUR 150 billion to upgrade fixed infrastructure to gigabit speeds. More can be done also to stimulate demand, such as supporting digital transformation among small businesses and bringing internet infrastructure and digital skills training to schools, the report said.

The EU members agreed last year that 20 percent of the EUR 750 billion economic recovery fund should go to digital investment. ETNO members are hoping part of this funding can go towards supporting investment in the next generation of telecom networks.

The report details a series of “urgent” policy actions to support these aims, including increasing the attractiveness of investment in roll-out, allowing for more industry collaboration and scale in the sector, stimulating demand and digital transformation across industrial sectors, prioritizing leadership in European digital services and investment in digital skills.

References:

https://etno.eu/news/all-news/704-etno-bcg.html

https://etno.eu/library/reports/96-connectivity-and-beyond.html

Deutsche Telekom & Ericsson CEOs: Europe’s Dysfunctional Telecom Industry Must Consolidate

Europe’s telecommunications industry needs to consolidate, Deutsche Telekom Chief Executive Tim Hoettges said on Friday, as the region’s 100 operators invest more in 5G networks at a time when revenue and profits are under pressure.

“The industry is in a dilemma that it can only escape through cost synergies,” Hoettges told a news conference, repeating earlier calls for consolidation. “I believe deeply that European consolidation is necessary.” Yet the Germany-based telecom provider, that owns a majority stake in T-Mobile US, is not in active merger talks.

Earlier this month, Borje Ekholm, chief executive of Sweden based equipment maker Ericsson told the Financial Times that Europe has a “non-functioning” telecoms market. Ekholm suggested it was rational for Europe’s telecoms operators not to invest in 5G networks, because many of them failed to earn their cost of capital. “The problem is that the guys that are supposed to build out that infrastructure (wireless telcos) don’t make any money. There is a very big cost to waiting,” he added.

Ericsson is worried that Europe is falling far behind China and the U.S. in the rollout of 5G, which it argues will be crucial for the digitalization of businesses. The company has forecast that 5G could boost the continent’s gross domestic product by 2 percentage points a year.

“Without [5G], general industry will be less efficient and less competitive. Without the infrastructure, it’s hard to develop the digital industry, and that impacts huge value potential and potentially millions of future jobs,” said Ekholm.

The European 5G network equipment makers — Ericsson and Finland’s Nokia — also have a big strategic and security role, as Europe grapples with how much market access to give to their Chinese rival Huawei.

Europe has dozens of telecom operators, but attempts to consolidate in some countries have been blocked by the European Commission because of competition worries. That led some operators to complain their profitability lags far behind bigger U.S. rivals.

Several countries, including Germany and the UK, are pushing for the creation of additional telecom equipment makers, as well as the opening up of networks to other companies. Ekholm expressed surprise that Europe would do anything to undermine Ericsson and Nokia, as telecoms was one of the few technology sectors where the continent had “strategic autonomy,” he said.

“It is interesting to see that now there is a discussion about giving EU subsidies to develop competing companies, mostly they are based in the US and Asia.”

He added that it was vital for Ericsson “to be in markets at the forefront of tech development: China and the U.S.”

“For us to have a presence in both China and the U.S. allows us to be a global tech leader. It is high risk to be only in one ecosystem and not the other. It could ultimately lead to the Chinese ecosystem developing faster thanks to its scale.”

Ericsson’s CEO previously spoke out about Sweden’s ban of Chinese telecoms vendors, e.g. Huawei and ZTE. Ekholm insists that there are currently too many disincentives to invest in European telecom infrastructure. He’s probably right.

……………………………………………………………………………………………………

References:

https://www.ft.com/content/32b38192-8c77-412a-ab20-36f75d6f4995

https://services.eiu.com/wave-of-consolidation-in-the-eu-telecoms-market/

Telia International Carrier Business (#1 Internet Backbone Network) Sold for $1.3B to Swedish Pension Funds

Telia Company today announced that it reached an agreement with Polhem Infra for the sale of its international carrier business. At the same time, Telia Company entered a long-term strategic partnership with Telia Carrier, securing continuous world-leading network solutions to Telia’s customers. The acquisition is Polhem Infra’s first investment in this field. The company is jointly owned by the Swedish pension funds First AP Fund, Third AP Fund and Fourth AP Fund.

Allison Kirkby, president and CEO of Telia, confirmed that the majority of the proceeds from the sale of Telia Carrier to the Polhem Infra unit “will be used to strengthen our balance sheet and thereby provide a solid financial base for Telia Company and our shareholders. Telia can now fully concentrate on our Nordic and Baltic footprint.”

Telia Carrier holds the #1 position in the global ranking of companies with Internet backbone networks. Content, services and operator customers of Telia Carrier account for 65% of global Internet routes. Its network spans across Europe, North America, and Asia, connecting customers in more than 120 countries, with the Scandinavian footprint being particularly strong through the so-called Scandinavian Ring – the part of Telia Carrier’s network that connects major Baltic and Nordic cities.

The change of ownership will enable Telia Carrier, with its 530 employees, “to drive a level of investment in network development, services and customer care programs that brings benefits to content providers, operators and enterprises beyond that of any competitor.”

Kirkby has been CEO since early May, but has already been making her mark. As well as streamlining the Nordic telco’s operators, she has also assembled a new-look management team.

Jefferies said the sale of Telia Carrier appeared supportive and highlighted the use of near 30% of proceeds to top up the dividend. “This is a welcome first move of the new, highly respected CEO,” the investment bank said in a note to clients. Jefferies said the sale of Telia Carrier appeared supportive and highlighted the use of almost 30% of the proceeds to top up the dividend.

Nick Del Deo of Moffett-Nathanson wrote about Telia Carrier vs Cogent Communications (U.S.) in a note to clients:

While Telia Carrier doesn’t break out its business mix, a substantial share of its revenue comes from transit, likely in the same range as Cogent’s, or about one third of the total. It’s one of the four largest transit providers globally, along with CenturyLink, Cogent, and NTT. A broad suite of other services – DIA, wavelengths, wholesale voice, etc. – round out its product portfolio. Like Cogent, its internet backbone spans the globe, with its presence concentrated in Europe and North America. The comparisons may not be perfect, but Telia Carrier claims to have 67K km route miles of fiber vs. Cogent’s 93K km of intercity fiber, and 300 PoPs globally vs. the ~1K carrier-neutral data centers to which Cogent connects. Their route maps look quite similar, but Cogent extends into more small markets than Telia Carrier and has more of a presence in Latin America and Asia-Pacific.

Telia Carrier’s Global Fiber Optic Network:

Image Credit: Telia Carrier

References:

EU Recommendations on very high capacity broadband network infrastructure and a joint approach to 5G rollouts

Summary:

On September 18th, the European Commission (EC) released a recommendation on how all 27 European Union (EU) member states could ensure a timely and more cost-effective way of deploying very high-capacity broadband connectivity infrastructure and develop a “joint approach” to 5G rollouts. The EC says that 5G is the most fundamental block of the digital transformation and an essential pillar of the recovery.

The EC says “the timely deployment of 5G networks will offer significant economic opportunities for the years to come, as a crucial asset for European competitiveness, sustainability and a major enabler for future digital services.”

The EC’s joint approach to 5G is by means of a “toolbox” that defines best practices, including “realistic measures” to assign radio spectrum for 5G networks under investment-friendly conditions. The Commission aims to facilitate the deployment of very high capacity fixed and wireless networks “by, for example, removing unnecessary administrative hurdles and streamlining permit granting procedure.”

The objective is to agree on a toolbox by March 30, 2021. The commission has requested each member state provide it with a roadmap for implementation by April 30, 2021, reporting back by the same date the following year. Please refer to detail timeline in Next steps below.

……………………………………………………………………………………………………………………………………………………………………………………………….

In parallel, and closely linked to this Recommendation, the Commission proposed a new Regulation for the European High Performance Computing Joint Undertaking to maintain and advance Europe’s leading role in supercomputing technology to underpin the entire digital strategy and to ensure the Union’s competitiveness in the global setting.

The commission said the proposal “would enable an investment of €8 billion in the next generation of supercomputers – a substantially larger budget compared to the current one.” The EC noted that the COVID-19 crisis “has shown that connectivity is essential for people and businesses,” and that “very high capacity networks” have been enabling remote working and schooling, healthcare, and personal communication and entertainment. The EC said the pandemic “has changed the economic outlook for the years to come. Investment and reforms are needed more than ever to ensure convergence and a balanced, forward-looking and sustainable economic recovery.”

Executive Vice-President for a Europe fit for the Digital Age, Margrethe Vestager, said:

“Broadband and 5G connectivity lay the foundation for the green and digital transformation of the economy, regardless if we talk about transport and energy, healthcare and education, or manufacturing and agriculture. And we have seen the current crisis highlight the importance of access to very high-speed internet for businesses, public services and citizens, but also to accelerate the pace towards 5G. We must therefore work together towards fast network rollout without any further delays.”

Commissioner for the Internal Market, Thierry Breton, added:

“Digital infrastructures have proven to be crucial during the pandemic to help citizens, public services and businesses get through the crisis and yet recent investments have slowed down. At a time when access to broadband Internet represents both a fundamental commodity for Europeans and a geostrategic stake for companies, we must – together with Member States – enable and accelerate the rollout of secure fibre and 5G networks. Greater connectivity will not only contribute to creating jobs, boosting sustainable growth and modernising the European economy, it will help Europe building its resilience and achieve its technological autonomy.”

The Commission invites Member States to come together to develop, by 30 March 2021, a common approach, in the form of a toolbox of best practices, for the timely rollout of fixed and mobile very high-capacity networks, including 5G networks. Such measures should aim to:

- Reduce the cost and increase the speed of deployment of very high capacity networks, notably by removing unnecessary administrative hurdles;

- Provide timely access to 5G radio spectrum and encourage operators’ investments in expanding network infrastructure;

- Establish more cross-border coordination for radio spectrum assignments, to support innovative 5G services, particularly in the industry and transport fields.

The Recommendation also sets out guidance for best practices to provide timely access to radio spectrum for 5G as well as ensure stronger coordination of spectrum assignment for 5G cross-border applications. This is particularly important to enable connected and automated mobility, as well as the digitisation of industry and smart factories. Enhanced cross-border coordination will help to provide Europe’s main transport paths, particularly road, rail and in-land waterways, with uninterrupted 5G coverage by 2025. However, until mid-September 2020, Member States (and the UK) had assigned on average only 27.5% of the 5G pioneer bands. It is therefore essential that Member States avoid or minimise any delays in granting access to radio spectrum to ensure timely deployment of 5G.

The Recommendation also highlights the need to ensure that 5G networks are secure and resilient. Member States have worked together with the Commission and the EU Cybersecurity Agency (ENISA) on a respective toolbox of mitigating measures and plans, designed to address effectively major risks to 5G networks. In July, a progress report was published.

Sustainable network deployment for improved connectivity:

The Recommendation also builds upon the Broadband Cost Reduction Directive. It promotes the rollout of high-speed networks by reducing deployment costs through harmonised measures to ensure network providers and operators can share infrastructure, coordinate civil works and obtain the necessary permits for deployment. The Recommendation is calling on Member States to share and agree on best practices under this Directive, to:

- Support simpler and more transparent permit-granting procedures for civil works;

- Improve transparency on existing physical infrastructure, so that operators can access more easily all relevant information on the infrastructure available in a certain area, and facilitate permit-granting procedures, through a single information point in the administration of public authorities;

- Expand network operators’ rights to access existing infrastructure controlled by public sector bodies (i.e. buildings, street lamps and those belonging to energy and other utilities) to install elements for network deployment;

- Improve the effectiveness of the dispute resolution mechanism related to infrastructure access.

Improved connectivity can also minimise the climate impact of data transmission and thus contribute to achieving the Union’s climate targets. Member States are encouraged to develop criteria for assessing the environmental impact of future networks and provide incentives to operators to deploy environmentally sustainable networks.

Next steps:

The Recommendation calls for Member States to identify and share best practices for the Toolbox by 20 December 2020. The Member States should agree on the list of best practices by 30 March 2021.

As announced in its strategy “Shaping Europe’s digital future” in February, the Commission plans two further actions in this area:

- The update of its action plan on 5G and 6G in 2021. The updated plan will rely and expand on the spectrum-related actions in this Recommendation. It will look at the progress made so far, and set new, ambitious goals for 5G network roll-out.

- The revision of the Broadband Cost Reduction Directive. The next steps in this process are the launch of an open consultation in autumn 2020 and of a dedicated study to evaluate the current Directive and assess the impact of several policy options.

The Recommendation will contribute to the achievement of the objectives set out in the Broadband Cost Reduction Directive as well as the European Electronic Communications Code. The Code, which needs to be implemented into national law in Member States by 21 December 2020, aims to promote connectivity and access to very high-capacity networks by all citizens and businesses.

The Commission’s strategy on Connectivity for a European Gigabit Society sets the EU’s connectivity objectives. By 2025, all main socio-economic drivers (i.e. schools, hospitals, transport hubs) should have gigabit connectivity, all urban areas and major terrestrial transport paths should be connected with uninterrupted 5G coverage, and all European households should have access to connectivity offering at least 100 Mbps upgradable to Gigabit speeds.

Other EU Projects and Country Plans:

As announced in June 2020, the EU is funding 11 new technology and trial projects to enable 5G connectivity and pave the way for autonomous driving on main road, train and maritime routes in Europe.

Individual EU member states are also grappling with their own post-pandemic recovery plans. For example, France is earmarking €240 million ($284 million) for fiber networks as part of its €100 billion ($118 billion) stimulus package.

………………………………………………………………………………………………………………………………………………………..

References:

https://ec.europa.eu/commission/presscorner/detail/en/ip_20_1603

https://www.lightreading.com/5g/ec-pins-recovery-hopes-on-5g-and-supercomputing/d/d-id/764064?

Deutsche Telekom earnings beat, seeks to be #1 U.S. carrier

Deutsche Telekom AG (DT) said Wednesday that net profit rose 78% in 2019 as revenue climbed higher, and forecast further growth in the year ahead. Highlights of DT’s earnings report:

- Annual revenues increased 6.4 percent to EUR 80.5 billion.

- Adjusted net profit rose 8.9 percent to EUR 4.9 billion, and free cash flow was up 15.9 percent to EUR 7.0 billion.

- Adjusted EBITDA after leases improved 7.2 percent to EUR 24.7 billion, led by growth at T-Mobile US.

- CAPEX, before spectrum investments, was higher than forecast in 2019, at EUR 13.1 billion, a 7.6 percent increase over 2018. The increase was due to the accelerated 5G build-out in the US, the company said. Spending is expected down slightly to EUR 13.0 billion in 2020, with the US stable at EUR 7.8 billion.

- DT also grew to 3.3 million fiber homes passed in Europe, completed its FTTC build in Germany and expanded to 28 million premises with super-vectoring at up to 250 Mbps. The all-IP migration was completed in the consumer market in Germany and is expected finished in the B2B segment by end-2020. In the rest of Europe, 91 percent of lines were moved to IP, up 9 percent points over the year.

- DT ended the year with 9.6 million Magenta Eins subscribers taking both fixed and mobile services, up by 2 million from 2018. Mobile postpaid subscribers increased by 2.4 million in Europe to 58.0 million at year-end, and the US business grew by a total 6.4 million customers to 86.0 million.

In the fourth quarter of 2019, the company’s growth strengthened, with revenues up 5.4 percent to EUR 21.4 billion and adjusted EBITDA growing 8.2 percent to EUR 6.0 billion. Revenue growth reached 1.0 percent in Germany, 7.7 percent in the US, 3.0 percent in the rest of Europe and 0.2 percent at Systems Solutions. On an organic basis, adjusted EBITDA after leases rose 16.8 percent at Systems Solutions, 4.7 percent in the US, 3.1 percent in Europe and 2.4 percent in Germany.

“The results were strong, particularly in Europe, and reassuring on Germany,” said Citi analyst Georgios Ierodiaconou.

For 2020, the #1 German network operator forecast revenue growth and adjusted EBITDA up around 3% to EUR 25.5 billion, including EUR 13.9 billion outside of the U.S. That guidance does not take into account the impact of the U.S. merger and Deutsche Telekom will revise its outlook once it goes through.

……………………………………………………………………………

DT is aiming to become market leader in the United States, CEO Tim Hoettges said on Wednesday, now that a deal for its T-Mobile US unit to take over Sprint is within reach.

“We have the chance to become No.1 in the United States, to overtake AT&T and Verizon. That is our ambition,” Hoettges told reporters in Bonn after Deutsche Telekom reported record annual results in its 25th year as a listed company.

Ebullient, Hoettges brandished a coffee cup bearing a picture of U.S. World War Two character Rosie the Riveter and the slogan ‘We Can Do It’ in front of photographers.

“We’re going to build the best 5G network,” he added (see CNBC video reference below).

DT CEO Tim Höttges said the T-Mobile US/Sprint deal benefits Deutsche Telekom on all levels. (Deutsche Telekom)

…………………………………………………………………………………………………….

References:

https://www.marketwatch.com/story/deutsche-telekom-profit-soars-and-forecasts-growth-2020-02-19

https://www.cnbc.com/2020/02/19/deutsche-telekom-ceo-tim-hoettges-goes-on-offensive.html

Sigfox boosts its IoT global footprint, achieving national coverage in 17 countries

At Sigfox World IoT Expo last week in Prague-Czech Republic, Sigfox announced that its network now spans 36 countries, as part of its mission to offer a consistent level of connectivity quality and service anywhere in the world.

Here are the highlights of the Sigfox conference:

- Sigfox’s network is now available in 36 countries, including 17 countries with national coverage and the addition of four new operators in Costa Rica, Croatia, Thailand, and Tunisia.

- A new suite of connectivity services which includes the ability to turn any short-range wireless device into a long range IoT device, connect to the Sigfox network in markets where coverage hasn’t been deployed yet, and new interoperability capabilities which allows IoT devices to recognize and automatically adapt to local communications standards without any additional hardware.

- Partnering with GCT Semiconductor, Sigfox has now launched the first hybrid cellular/Sigfox IoT solution– a chip which can support LTE-M/NB-IoT/EC-GSM and Sigfox IoT connectivity.

- New partnerships with electronics manufacturer Alps Electric Europe, Bosch Connected Devices and Solutions, and strategy consultancy Roland Berger

“We’re excited to work with all of our new partners, this move marks yet another key milestone towards Sigfox’s vision of a global IoT network. We are looking forward to collaborating with our new Sigfox operators to help their local ecosystems to seamlessly scale IoT solutions wherever the Sigfox network is present in the world. Together, we’re building a future that will be better to live in,” said Rodolphe Baronnet-Frugès, Executive Vice President of Operators at Sigfox.

Sigfox operators are not only contributing to accelerate IoT development in their local markets, they are also committing to deploy and operate the network infrastructure and offer national coverage in their country. Up to now, almost 100 million euros have been invested by Sigfox operators to offer a unique access to the Sigfox IoT services, with the exact same quality of service.

This unique global offer is enriched with Sigfox new service Monarch, now allowing IoT devices to recognize and automatically adapt to every local communications standard in the world without roaming. By enabling ‘globe trotter’ assets that can seamlessly adapt as they move across borders, Monarch could be a game-changer for logistics, freight, and consumer goods industries.

……………………………………………………………………………………….

In Ireland, Sigfox Operator VT signed a €1-mill IoT subscription with Dunraven Systems, a market leader in the design and development of ultrasonic fuel tank monitors.

………………………………………………………………………………………..

In addition to its core IoT connectivity service, Sigfox offers a range of services to make even more simple to use Sigfox’s technology, to deploy and to adopt mass IoT solutions. These services allow to connect billions of wireless devices that are not yet connected to the internet.

Above illustration courtesy of Sigfox

………………………………………………………………………………………………………………..

This potential game-changing development has been made possible by the cognitive capabilities of the Sigfox network and its Software Defined Radio technology, where all the network and computing complexity is managed in the Cloud rather than on the device. This enables Sigfox to constantly improve its network features and make them available by simple software upgrade.

……………………………………………………………………………………………..

A key question for Sigfox is whether they’ll also support the new LPWAN standards and specs (LTE category M1, NB-IoT, LoRA WAN, etc). We’ve asked the company and are eagerly awaiting their reply. Stay tuned.

Telecom Italia “5G” trial to blanket San Marino in 2018

According to the Financial Times (on line subscription required):

Telecom Italia plans to test its home grown “5G” technology in the micro-state of San Marino next year, making it the first country in the world to boast a nationwide 5G network. The state of San Marino, which has little more than 30,000 citizens, extends to only 61 sq km, making it the smallest republic in the world.

Telecom Italia Mobile (TIM) has signed a memorandum of understanding with the government of the tiny country to upgrade the existing 4G-LTE network in advance of a trial of “5G” services in 2018. It will double the number of mobile sites and will install a network of small cells in downtown San Marino, a Unesco heritage site, this year that will provide the backbone of the future commercial network. Investment in 5G network trials are taking place around the world with carriers in South Korea, China and the US among the most active in testing 5G technology. Giovanni Ferigo, head of technology for Telecom Italia Mobile, said San Marino’s 5G network would be the first in Europe “for sure.”

It was not revealed who created the specs for the Italian telco’s “5G” network or where Telecom Italia will procure the end point devices/handsets. One would assume that Ericsson is supplying TIM with the “5G” base stations, based on a MOU signed between the two companies in March of this year. TIM wrote in a press release on March 2, 2017:

TIM and Ericsson are committing to share skills, projects, laboratories and resources for designing, testing and building the technological components of the new 5G network needed to create a complete and open ecosystem around next-generation digital services.

In particular, the agreement will directly involve the research and innovation structures of the two companies, focusing on the design and testing of access infrastructure, the respective antenna systems and network virtualisation solutions, particularly through joint participation in Italian and European research projects and integration of service platforms for testing in the field of innovative Use Cases.

The 5G system will provide peak speeds of up to dozens of Gbps for UltraHD services and cloud computing solutions, a decrease in communication latency, reducing it to a few milliseconds, reliability for mission-critical services and service density with the ability to connect up to a hundred thousand terminals per cell. These characteristics mean that 5G will become the reference mobile network for next-generation digital services (such as virtual reality) and for the industrial Internet (robotics, manufacturing, health, environment, self-driving logistics).

The agreement is part of the “5G for Italy” initiative launched in 2016 by TIM and Ericsson for the establishment of an ecosystem of experimental industrial partners, confirming the commitment of the two companies to innovating technologies and networks in support of the socio-economic growth of the country.

…………………………………………………………………………………………..

Telecom Italia is also testing “5G” in Milano and Torino, but has more freedom in San Marino to experiment because of fewer restrictions on the use of airwaves than in Italy.

“We need to experiment as soon as possible,” Mr Ferigo said. The work done in San Marino would play a critical role in the future of 5G technology in Italy but was also crucial to the wider European sector as standards for the new network are refined.

“For 5G, our intention is a European leadership in standardization,” he said. The European Commission published a 5G action plan last year when it estimated that sectors such as healthcare, transport, cars and utilities would see economic benefits of €113bn by 2025 from the technology. However, the European Commission does not generate any telecom standards. For Europe, that’s ETSI which contributes to 3GPP and its members contribute to ITU-R WP 5D which is standardizing true 5G (as we’ve noted in numerous blog posts/articles).

Earlier this year, Telecom Italia Mobile (TIM) said LTE customers are expected to account for around 90% of its mobile broadband customers by 2019; That’s due to almost blanket LTE coverage of Italy with network speeds up to 75 Mbps and peaks of 500 Mbps in the main cities via the use of LTE Advanced Carrier Aggregation.

The above referenced FT “5G” article states:

Some countries have committed to the first 5G launches in 2019 but the wider telecoms industry is still struggling to define exactly what 5G technology is and some have argued that it is not yet clear how they can justify spending billions on the new network.

Mr Ferigo said the San Marino launch would be “very important” in defining the use case for 5G that would transform all sectors from healthcare to robotics to public transport. Telecom Italia has started working with companies including Maserati and Ducati on the use of better wireless technology but also the makers of parmesan cheese who want to better monitor the cows in their fields. Small territories have been used in the past for telecoms testing. The first 3G trial in the UK took place on the Isle of Man, while the remote Isle of Bute in Scotland was used to test “white space” technology.

Copyright The Financial Times Limited 2017. All rights reserved.

……………………………………………………………………………………….

References:

http://www.telecomitalia.com/tit/en/archivio/media/note-stampa/market/2017/PN-TIM-Turin-5G-Day.html

https://www.ericsson.com/assets/local/publications/white-papers/wp-5g.pdf

https://www.ericsson.com/en/news-and-events/press-center/media-kits/5g