Month: September 2018

Superb Article on What’s Wrong with Communications Industry by Steve Saunders, co-founder of Light Reading

Here’s the url for Steve Saunder’s spot on the money article: https://www.linkedin.com/pulse/future-communications-steve-saunders/

The only add on I have to Steve’s exquisite post is that the lack of standards is pervasive throughout the WAN space:

- SD WANs are a single vendor solution – no UNI or NNI specified or being worked on by an accredited standards body.

- NFV: No standards for exposed interfaces, APIs (NFV orchestrator (NFVO) to/from virtual appliances), no backward compatibility between virtual appliances and physical appliances, no standard for network management or fault isolation/repair, etc.

- Every major Cloud Service Provider (CSP) has their own defacto standards/specs and APIs, e.g. Amazon, Google, MSFT, etc

- Every major CSP has their own connectivity solution(s) from customer premises network to their point of presence (PoP); and their own method for realizing a virtual private cloud (VPC)

- Every CSP and network service provider has their own definition and implementation of SDN, including one or more southbound API (s) to/from Control Plane to data plane. That southbound API was supposed to be ONLY OpenFlow according to the ONF. The Northbound API was never standardized and there are many options. Many SDNs use an overlay network and virtualization of network functions while others do not. Equipment and software built for one provider’s SDN won’t operate on another’s as the specs are different and usually proprietary.

- Far too many LPWANs for IoT: Sigfox (by company with same name), LoRa WAN, Weightless SIG (unidirectional Weightless-N, bidirectional Weightless-P and Weightless-W), NB-IoT, LTE Cat M1, many other proprietary versions like RPMA (from Ingenu).

- The message sets between “things”/IoT devices and the cloud controller have not been standardized. Neither is the functions of an “IoT Platform” which has become a wild west menagerie of incompatible platforms from hundreds of vendors.

- Every so called “5G” deployment planned before IMT 2020 has been completed (end of 2020) is proprietary. The only thing in common seems to be use of 3GPP release 15 “5G New Radio” which is not a standard. That implies mobile 5G will have severe roaming problems when moving from one 5G carrier to another.

And the list goes on and on and on……………………………………….

Without agreed upon standards, the upshot is that the big cloud players (Google, Amazon, FB, Microsoft, Tencent, Alibaba, Baidu, etc) will dominate communications in the future (I think they already dominate all of IT!!)

Also, the rise of open source hardware organizations (OCP, TIP, ONF, etc) along with Taiwan/China ODMs have profoundly changed the communications industry. With so many open source white boxes and bare metal switches available, there is little or no value add for vendor specific network equipment other than possibly higher performance (e.g. throughput).

India Selects Cisco, Samsung, Nokia, Ericsson for 5G trials; Bars Huawei and ZTE

India’s Department of Telecommunications (DoT) has excluded Huawei and ZTE from its list of companies asked to partner for trials to develop 5G use cases for India. New Delhi may well follow the US and Australia in limiting involvement of Chinese telecom equipment makers in the roll-out of the next-gen technology.

“We have written to Cisco, Samsung, Ericsson and Nokia, and telecom service providers to partner with us to start 5G technology-based trials, and have got positive response from them,” telecom secretary Aruna Sundararajan told ETTelecom.

“We have excluded Huawei from these trials,” she said, when asked if Huawei has been eliminated from the trials for security reasons. The government is planning to show case India-specific 5G use cases by early 2019.

People familiar with the matter said besides Huawei, the government has also excluded ZTE for the 5G trials.

India’s move comes shortly after both the US and Australia moved to act against Huawei and ZTE amid concerns about possible cyber snooping by China. Last month, Australia barred both Huawei and ZTE from its 5G network roll-outs. Before that, the US had barred government use of equipment from the two Chinese gear makers, in what is perceived as wider efforts to keep the companies away from 5G roll-outs in the country. The UK has also found “shortcomings” in Huawei’s engineering processes, which the company said it was trying to address.

“This appears more a move to restrict government ties with Chinese equipment makers given the sensitive nature of security issues, especially after what happened in some other countries,” said an industry executive who asked not to be named.

This though isn’t the first time Chinese equipment makers have faced trouble in India over security issues. Back in 2010, the government had for several months unofficially barred mobile phone operators from importing and using telecom equipment from Chinese companies on suspicion that they may have technology built in for spying into sensitive communication. The ban was lifted after the companies agreed to more stringent testing rules.

The latest government move could deal a huge setback to the two companies, especially Huawei – among the largest equipment makers globally – which considers itself the leader in 5G technology and hopes to tap into huge demand for 5G software and equipment in the years ahead as telcos roll-out the next-gen technology globally.

That bid faces a huge challenge as more and more countries try to prevent the companies from participating in their 5G roll-out plans.

In India, Huawei has already been facing huge pressure on revenue owing to rapid consolidation in the telecom market, which has slashed the number of telcos by more than half. The company, staring at a 40% slump in revenue in 2018, has already stopped assembly of its products out of its local plants and has resorted to import to meet the reduced demand. Huawei’s India revenue is likely to come down to roughly $700-800 million (Rs 4,740-5,415 crore) this year from around $1.2 billion in 2017.

And with the DoT’s decision, Huawei’s business could come under more pressure even as India chalks out aggressive 5G plans.

“We are in regular touch with DoT and concerned government officials. The Indian government has always supported Huawei and has been appreciative of our path-breaking technologies and solutions,” Huawei in a statement late Thursday said, adding that the company was confident that showcasing its 5G technology would lead to a collaboration with the government and other ecosystem, allowing it to partner India in its journey to enable 5G and digital transformation.

The Chinese gear maker also said that it is working closely with various telecom operators as they would play a crucial role in conducting 5G field trial for India specific use cases. ZTE didn’t respond to ET’s emailed query as of press time.

“We are going to set up core group in the department to push this (trials) further, so that by early next year, we would be able to demonstrate 5G use cases in India,” Sundararajan said.

“As of now, we are at par with all major economies and have set up a high-level task force, which in its report has given the recommendations for the spectrum, standards, skills and early roll-outs,” she added.

The government is confident that India will roll-out 5G in tandem with global markets in 2020 and is making all efforts to keep the timeline for the next-generation technology, which could have an economic impact of more than $1 trillion in the country.

“We are committed to support the government’s 5G for India programme, aimed at bringing 5G to India by 2020,” Ericsson India managing director Nitin Bansal said, adding that the Swedish company is looking at developing the 5G ecosystem in India through industry partnerships.

Telstra on 5G: “Where Promise Meets Reality” + 3GPP Release 16 status

Fears that 5G use cases do not justify the extensive investments required to roll out the technology are unfounded, and the technology is going to change the world, according to Telstra CEO Andy Penn’s blog post, published to coincide with the 3GPP meeting this week,. More than 600 delegates from the 3GPP (3rd Generation Partnership Project) – the body that produces specifications used in “5G” trials/early commercial “5G” deployments, and inputs submissions to ITU-R WP5D for IMT 2020, will be meeting at Australia’s Gold Coast this week.

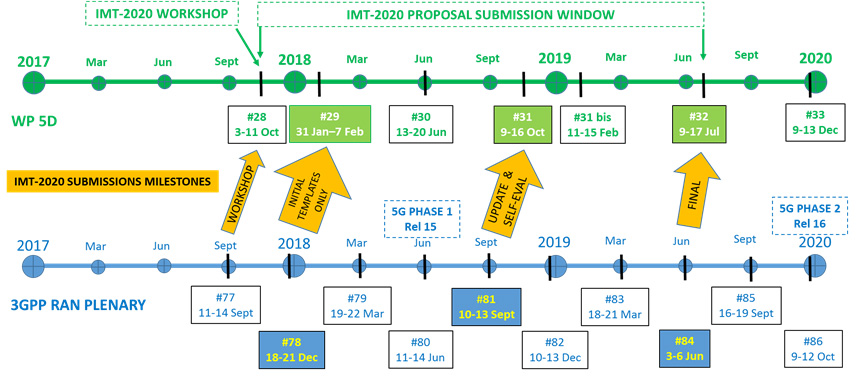

–>See below for status of 3GPP Release 16 which will be the real deal 5G spec to be submitted as a candidate IMT 2020 Radio Interface Technology (RIT) to ITU-R WP5D in July 2019.

Penn wrote in the aforementioned blog post: “Will 5G change the world?” The short answer is absolutely yes. The best way to understand 5G is to realise it is more than just a faster, more efficient technology for mobile phones. What sets 5G apart from every earlier “G” is its ability to carry signals significantly faster. Latency – the time gap between a request for data being sent and the data being received – on 5G is reduced dramatically.

Penn said skepticism about the potential for new mobile technologies has been a common theme with each evolution. “Before 2G it was hard to conceive of the mobile phone becoming a mass market device owned by billions of people. Before 3G, it was questionable that enough people would want to access the internet on their phones. And before 4G, it was a brave call to suggest enough people wanted access to HD video at all times,” he said.

“But in every one of these occasions the demand not only materialized it did so with remarkable speed and on a remarkable scale. Indeed, each new technology has been embraced more quickly than the last. 4G took just five years to reach 2.5 billion people, compared to eight years for 3G.”

According to some forecasts, 5G will enable $12 trillion in economic output globally and support the creation of 22 million jobs by 2035, Penn said.

He said from Telstra’s perspective the baseline business case for 5G is meeting rapidly growing demand for mobile data traffic and addressing ways to more efficiently meet these demands.

“On top of that we see incredibly exciting opportunities to open up new applications and services delivered over mobile using 5G – everything from IoT on a massive scale, to 4K and 8K video, to mission critical services, to remote robotics will be brought to a whole new level by 5G.”

Penn added that the full range of opportunities that will be enabled by 5G will not be clear when 5G capability is switched on. He said Telstra is investing heavily in 5G, including through the planned deployment of 200 5G-enabled sites across Australia by the end of the year, out of a belief that first-movers will enjoy the earliest and greatest benefits from adopting the technology.

About the Author:

Andrew Penn became Chief Executive Officer of Telstra on May 1, 2015 after serving as Telstra’s Chief Financial Officer and Group Executive International. Andrew is an experienced senior executive with a career spanning more than 30 years. Prior to joining Telstra, Andrew was with AXA Asia Pacific for 20 years where he held a number of positions including Group Chief Executive (2006-2011), Chief Executive Officer for Australia and New Zealand, Group Chief Financial Officer, Chief Executive for Asia and spent time based in Australia, Hong Kong, Thailand and Indonesia. Under Andrew’s leadership AXA built a successful Asian platform, which was sold to its parent company in 2011 for $10.4bn. In addition to his business activities, Andrew has contributed widely to not-for-profit and community organisations. He is Life Governor and Foundation Board member of Very Special Kids. He is also a member of the Juvenile Diabetes Research Foundation Advisory Council, The Big Issue Advisory Group, and an Amy Gillet Foundation Ambassador.

……………………………………………………………………………………………………………………………………………………………………….

3GPP Release 16, to be completed at the end of 2019, will meet the ITU-R IMT-2020 submission requirements and the time-plan as outlined in RP-172101:

From Sep 2018 to June 2019, targeting “Final” submission in June 2019

- Performance evaluation update by taking into account Rel-16 updates in addition to Rel-15

- Update description template and compliance template to take into account Rel-16 updates in addition to Rel-15

- Provide description template, compliance template, and self evaluation results based on Rel-15 and Rel-16 in June 2019.

Some Background on Release 16

- “Working towards full 5G in Rel-16″…See a webinar presentation (Brighttalk webinar)

- Preparing the ground for IMT-2020

- SA1 completes its study into 5G requirements

T-Mobile in $3.5B deal with Ericsson for “5G” Equipment; Offers extended range LTE in U.S. and Puerto Rico

Ericsson has signed a $3.5 billion multi-year deal with T-Mobile to provide the “un-carrier” with “5G” network equipment. It’s the biggest 5G order that Ericsson has announced to date. That is in addition to the $3.5 billion “5G” agreement that T-Mobile inked with Nokia back in July.

As it moves from LTE Advanced (true 4G) to whatever it envisions as 5G, T-Mobile will use the Ericsson portfolio of products. Ericsson will be providing T-Mobile with 5G New Radio (NR) hardware and 3GPP-compatible software. Ericsson’s digital services like dynamic orchestration, business support systems and Ericsson cloud core will be used to help T-Mobile roll out “5G” services to its customers.

“We have recently decided to increase our investments in the U.S. to be closer to our leading customers and better support them with their accelerated 5G deployments; thereby bringing 5G to life for consumers and enterprises across the country,” Niklas Heuveldop, President of Ericsson North America, said in a statement. “This agreement marks a major milestone for both companies. We are excited about our partnership with T-Mobile, supporting them to strengthen, expand and speed up the deployment of their nationwide 5G network.”

The partnership with Ericsson implies that T-Mobile’s installed base of Ericsson Radio Systems will be able to run 3GPP release 15 spec. 5G NR with a remote software installation.

Ericsson increased its market share of the mobile networks market in the second quarter, partly due to faster network upgrades in the North American, where it ranks as the biggest supplier ahead of Nokia.

T-Mobile, the third biggest U.S. mobile carrier, said in February it was working with Ericsson and rival network vendor Nokia of Finland to build out 5G networks in 30 U.S. cities during 2018.

“While the other guys just make promises, we’re putting our money where our mouth is. With this new Ericsson agreement we’re laying the groundwork for 5G – and with Sprint we can supercharge the 5G revolution,” said Neville Ray, T-Mobile’s Chief Technology Officer. (Note that the FCC says it needs more time to review the T-Mobile-Sprint merger).

………………………………………………………………………………………………………………………………………………………

In an earlier announcement, T-Mobile says it has deployed 600 MHz (Band 71) Extended Range LTE in 1,254 cities and towns in 36 states, including the island of Puerto Rico. The Un-carrier’s furiously paced deployment of 600 MHz LTE is expanding network coverage and capacity, particularly in rural areas, and lays the foundation for nationwide 5G in 2020 with 5G-ready equipment.

T-Mobile’s Extended Range LTE signals travel twice as far from the tower and are four times better in buildings than mid-band LTE, providing increased coverage and capacity. The Un-carrier has already deployed Extended Range LTE to more than 80 percent of Americans with 700 MHz (Band 12), and rapidly began deploying it with 600 MHz (Band 71) last year to expand coverage and capacity even further.

In April 2017, T-Mobile made its largest network investment ever, tripling its low-band spectrum holdings by purchasing spectrum sold in the US government’s 600 MHz auction. Those licenses cover 100% of the US, including Puerto Rico. Immediately after receiving the licenses, T-Mobile began its rapid 600 MHz Extended Range LTE rollout. To accelerate the process of freeing up the spectrum for LTE, T-Mobile is working with broadcasters occupying 600 MHz spectrum to assist them in moving to new frequencies.

IHS Markit: Microwave Network Equipment Market -1%; YoY; 5G to Boost Growth

By Richard Webb, associate director of research and analysis, service provider technology, IHS Markit

Highlights:

- The total worldwide microwave network equipment market declined by 5 percent quarter over quarter – and by 1 percent year over year – in the second quarter of 2018 (Q2 2018), falling to $1.03 billion.

- Revenue in the second quarter was comprised of 80 percent backhaul, 7 percent transport and 13 percent access. Also within revenue, 16 percent was dual Ethernet/TDM, 71 percent was Ethernet only, 2 percent was V-band millimeter wave and 11 percent was E-band millimeter wave.

- Regionally, 10 percent of revenue in the second quarter came from North America, 39 percent from Europe, Middle East and Africa (EMEA), 37 percent from Asia Pacific, and 13 percent from Caribbean and Latin America (CALA).

- Ericsson (see Addendum) led the microwave network equipment market share ranking with 21.6 percent of revenue, followed by Huawei at 18.6 percent, Nokia at 12.5 percent, NEC at 10.6 percent, Ceragon at 8.5 percent, Aviat Networks at 4.2 percent, SIAE at 4 percent and ZTE at 3.8 percent.

IHS Markit Analysis:

Microwave equipment market declines in the second quarter of 2018 followed a stronger-than-expected first quarter, with second half of the year expected to be flat-to-slightly up.

Aside from performance by individual vendors, the market has been slow over the last two years. Mobile operators are typically cash conservative, and many operators in developed markets have undergone most of their backhaul upgrades for LTE. Although upgrades for LTE-A and LTE-Pro (and late-phase LTE deployment in developing regions) prop up the market, the early shoots of growth driven by 5G are now visible and will gain momentum over the next two to three years.

In the long term, the market will get an injection from 5G upgrades, driven by demand for higher-capacity backhaul combined with growing traction for outdoor small cell deployments. Although market growth will be muted in the short term, these drivers will push the market back to revenue growth in 2019 and beyond.

The effect of 5G on the microwave equipment market will be mainly felt in two ways:

- Backhaul and fronthaul for mobile broadband: Increased capacity requirements for macrocells and small cells or remote radio heads to deliver high-speed mobile broadband connectivity.

- Fixed-wireless access: In-home broadband for consumers, utilizing millimeter wave as a wireline (DSL/cable/fiber) equivalent, to deliver high-speed fixed broadband connectivity.

SDN, NFV and network slicing will impact transport networks over the next few years. Although they will make backhaul more flexible, they do not reduce the need for equipment at the endpoint of the backhaul link. However, the fact that SDN enables coordination between the radio access network (RAN) and backhaul network to optimize traffic and allocated network resources, is likely to strengthen the opportunity for microwave vendors with RAN portfolios to increase market share. Over the past few years, the market has been experiencing some consolidation among microwave-only specialists.

Microwave Network Equipment Quarterly Market Tracker:

The “Microwave Network Equipment Market Tracker” examines the vendors, markets and trends related to wireless radio equipment that uses microwave to transmit digital or analog signals between two locations on a radio path. The report tracks Ethernet, TDM microwave, Dual Ethernet/TDM microwave, and V-Band and E-Band millimeter wave equipment by spectrum, capacity, form factor, architecture and line of sight.

…………………………………………………………………………………….

Addendum:

Huawei Launches the Industry’s First 5G Microwave Equipment at MWC 2018

Verizon & Nokia demo “5G NR” transmission on a “commercial network”

Verizon and Nokia have completed the first over-the-air, end-to-end “5G NR” data transmission on a commercial 3GPP 5G New Radio (NR) network, the companies announced. The transmission was between commercially deployed Nokia radio equipment and Verizon’s 5G network core and millimeter wave spectrum to a Nokia test van parked in the downtown area of Washington, D.C.

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

Editor’s Note:

“5G NR” is based on 3GPP release 15 spec, whereas it’s 3GPP release 16 (with parts of release 15) which will be submitted as a candidate IMT 2020 Radio Interface Technology (RIT) at the July 2019 ITU-R WP 5D meeting. Also, we don’t consider an end to end transmission using only Nokia endpoint terminals a “commercial network,” which is one in which there are many paying customers and endpoint terminals from several vendors (not just Nokia).

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

Verizon and Nokia said that the transmission was another of their ongoing demonstrations of 5G NR technology. They expect to launch commercial 5G mobile service in 2019. In June, the two companies completed a series of outdoor data sessions over the 5G NR standard, and used multi-carrier aggregation to boost those signals into the gigabit-per-second range. Last month, Verizon and Nokia said they completed the first successful transmission of a 3GPP NR 5G signal to a receiver in a moving vehicle.“The cadence and frequency of these significant milestone achievements from Verizon and Nokia show just how quickly we’re taking the promise of 5G technology from the lab to the field and to the marketplace where our customers will ultimately use this revolutionary technology,” said Bill Stone, Verizon vice president, technology development and planning, in a prepared statement. “We said Verizon will be first to 5G, and our latest milestone moves us closer to fulfilling that promise.”

“Nokia and Verizon have had a tremendous summer for 5G innovations and technology advancements,” said Marc Rouanne, Nokia president mobile networks, in a prepared statement. “We are thrilled to be on the forefront of this new technology, helping Verizon make yet another significant stride towards becoming the first-mover to the market.”

The announcement followed Verizon and Nokia last month transmitting a pre-standard 5G signal between two radio sectors to a moving vehicle, calling the successful trial a “major 5G milestone”.

Verizon earlier announced it would launch 5G residential broadband service in Los Angeles, Sacramento, Houston and Indianapolis, in the second half of this year (based on Verizon’s proprietary spec), to be followed by a mobile 5G solution. That’s all before the ITU-R IMT 2020 standards are finalized in late 2020.

References:

https://www.telecompetitor.com/verizon-claims-first-5g-nr-data-transmission-on-a-commercial-network/

https://www.zdnet.com/article/verizon-trials-5g-in-washington-dc-with-nokia/

IHS Markit: SD-WAN revenue was $221M in 2Q-2018; P&S Intelligence: CAGR of 54.1% during 2018-2023

IHS-Markit Analysis, by Cliff Grossner, PhD, IHS Markit Sr Research Director

SD-WAN (appliance + control and management software) revenue reached $221M in 2Q18, up 25% QoQ and 2x over 2Q17. VMware led the SD-WAN market with 18% share of 2Q18 revenue, Aryaka was in second place with 15% revenue share, and Cisco enters the top 3 with 12%, according to the DC Network Equipment market tracker early edition from IHS Markit.

“With SD-WAN deals becoming more competitive within the North American market, the race to expand into other regions is now well underway. VNF certifications with EMEA and Asia Pacific based service providers are now in full swing where SD-WAN vendors are in the final stages of VNF certifications with BT, Telefonica, Vodafone and China Mobile” said Cliff Grossner, senior research director and advisor for cloud and data center at IHS Markit, a world leader in critical information, analytics and solutions.

“Countries top of the agenda for hiring and office expansions for SD-WAN vendors are the United Kingdom, Germany, Singapore, Japan and China where SD-WAN vendors indicate there is heavy SaaS and IaaS traffic between multiple on- and off-premises DCs.” said Grossner.

More Data Center Network Market Highlights

· 2Q18 ADC revenue declined 2% from 1Q18 to $443M and declined 2% over 2Q17

· Virtual ADC appliances stood at 33% of 2Q18 ADC revenue

· F5 garnered 47% ADC market share in 2Q18 with revenue up 0.4% QoQ. Citrix had the #2 spot with 28% of revenue, and A10 (8%) rounded out the top 3 market share spots.

Data Center Network Equipment Report Synopsis

The IHS Markit Data Center Network Equipment market tracker is part of the Data Center Networks Intelligence Service and provides quarterly worldwide and regional market size, vendor market share, forecasts through 2021, analysis and trends for (1) data center Ethernet switches by category [purpose built, bare metal, blade and general purpose], port speed [1/10/25/40/50/100/200/400GE] and market segment [enterprise, telco and cloud service provider], (2) application delivery controllers by category [hardware-based appliance, virtual appliance], and (3) software-defined WAN (SD-WAN) [appliances and control and management software]. Vendors tracked include A10, ALE, Arista, Array Networks, Aryaka, Barracuda, Cisco, Citrix, CloudGenix, CradlePoint, Dell, F5, FatPipe, HPE, Huawei, Hughes, InfoVista, Juniper, KEMP, Nokia (Nuage), Radware, Riverbed, Silver Peak, Talari, TELoIP, VMware, ZTE and others.

……………………………………………………………………………………………………………………………………………………………………………..

In a different report, Prescient & Strategic (P & S) Intelligence says:

The global software defined wide area network (SD-WAN market) was valued at $676.9 million in 2017 and is forecast to witness a CAGR of 54.1% during 2018-2023 and will reach $9,691.0 million by 2023. The demand for cost effective WAN management solutions, increasing adoption of cloud technologies, need for simplified network architecture, end-to-end network security and visibility are driving the market globally.

The SD-WAN market is classified into solution and service. The solution category held a larger revenue share in the market accounting for nearly 78% in 2017. During the forecast period, the market for SD-WAN service is expected to witness higher growth, as the need for traffic management to optimize bandwidth and cost reduction by replacement of dedicated WAN network with broadband network without compromising on security, increases.

Based on appliances, the SD-WAN market is categorized into virtual, physical and hybrid appliances. Virtual appliance accounted for largest revenue share in the market in 2017. During the forecast period, it will continue to contribute largest revenue share owing to the fact that it reduces the cost incurred in installation and offers configuration and maintenance of complex stack of software virtually.

The Asia-Pacific (APAC) SD-WAN market is expected to witness a CAGR of 57.9% during the forecast period. Since the internet speed and internet quality have significantly improved in the region, IT departments are looking for cost effective, secure, performance related solutions to reduce their dependency on multi-protocol label switching (MPLS). Organizations in the IT and telecom industry in the region are focusing on agile, secure, and end-to-end visible WAN management solution, which will support the market growth in future.

Some of the key players operating in the market are Cisco Systems, Inc, Citrix Systems, Inc, Silver Peak Systems Inc, CloudGenix Inc, Ecessa Corporation, Viptela Inc, Riverbed Technology, Inc, Mushroom Networks, Inc, VeloCloud networks Inc, Glue Networks Inc, Elfiq Inc.

About P & S Intelligence

P & S Intelligence, a brand of P & S Market Research, is a provider of market research and consulting services catering to the market information needs of burgeoning industries across the world. Providing the plinth of market intelligence, P & S as an enterprising research and consulting company, believes in providing thorough landscape analyses on the ever-changing market scenario, to empower companies to make informed decisions and base their business strategies with astuteness.

Reliance Jio Blankets India with Inexpensive 4G Service; Where are the Profits?

India has the second largest number of Internet users in the world- second only to China. But only in the last two years has India moved to true broadband wireless service. Mukesh Ambani, head of Reliance Industries, one of India’s largest conglomerates, has shelled out $35 billion of the company’s money to blanket the South Asian nation with its first all-4G network. By offering free calls and data for pennies, the telecom latecomer has upended the industry, setting off a cheap internet tsunami that is opening the market of 1.3 billion people to global tech and retailing titans.

The unknown factor: Can Reliance reap profits itself after unleashing a cutthroat price war? Analysts say the company’s ultimate plan, after connecting the masses, is to use the platform to sell content, financial services and advertising. It could also recoup its massive investment in the years to come by charging for high-speed broadband to consumers’ homes and connections for various businesses, according to a person familiar with the matter.

Sidebar: Reliance Jio gaining ground on incumbents via price war

Business Standard says that according to revenue figures of the industry for the April-June quarter, Jio has become the second biggest wireless network operator by revenues, overtaking Vodafone.

In fact, both Vodafone and Idea reported a revenue decline of 7 per cent and 5.2 per cent respectively in the reported quarter. Airtel though managed to increase its adjusted gross revenue (AGR) by 1 per cent, thanks to income from national long distance (NLD) services.

According to a report by JP Morgan, Reliance Jio keeps flourishing in a continually stressed industry, which is why the industry may continue to be in stress.

Meanwhile, zeebiz.com reports “Reliance Jio impact: 15,000 people lost jobs, just 3 companies left in 2 years.” Apart from declining financial health of incumbents, there have been massive job losses owing to mergers and sector consolidation. Experts estimate the number of job losses to be around 12,000-15,000 in the last two years, with a major shedding from Vodafone and Idea Cellular duo.

Reliance Jio has been gaining subscribers and revenue market share at a rapid pace. But for the incumbents, including Bharti Airtel, Vodafone India, Idea Cellular, there has been declining average revenue per user (Arpu) and margins with high debt levels. Together, the telecom industry has a cumulative debt of Rs 3.6 lakh crore.

Analysts from Jefferies say that the competitive intensity will remain high as Jio and Bharti focus on subscriber additions. “We expect increased competitive intensity in the postpaid and feature phone segments. The market share is expected to stabilise in the next 12 months. Post that, there will be a gradual Arpu recovery due to customer willingness to pay higher.”

“The next battleground is the 500 million non-LTE subscriber base, which would include 400 million 2G subscribers. Half of the 2G subscribers are low-value subscribers with monthly spend of Rs 50-80. Content and advertising will emerge as key pillars to increase average revenue per user and profitability for the sector in the medium term,” according to Deutsche Bank Research.

…………………………………………………………………………………………………………………………………………………………………………………………………….

Mr. Ambani’s project has the potential to give India the largest—and most diverse—connected population in the world, with low-cost access to data helping to level the playing field between rich and poor.

It also could revolutionize retail. Mr. Ambani’s success or failure could affect Alphabet Inc.’s Google and Facebook Inc.’s WhatsApp, which have poured resources into developing products for the Indian market, and Walmart Inc. and Amazon.com Inc., which have invested billions here on logistics for online shoppers. To profit, they all need people connected to the internet.

Underserved Population

India has more internet users than the U.S., but a low percentage of the country is online. Slow download speeds are a drag on building subscribers.

………………………………………………………………………………………………………………………………………………………

Mr. Ambani wasn’t available to comment, according to a Reliance spokesman. The company “has unleashed huge data potential in the country,” the spokesman said. “Digital life will no longer be the privilege of the affluent few.”

There are 390 million internet users in India, according to Bain & Co., but the penetration rate is still only 28%, compared with 88% in the U.S. The country’s e-commerce market is expected to be worth $33 billion this year, three times what it was in 2015, but less than 3% of India’s overall retail market, according to research firm eMarketer.

Companies are after customers like 59-year-old potato farmer Govind Singh Panwar. His home in the Himalayan foothills is built of mud and stone, and his village has no paved roads or indoor plumbing. Still, broadband internet has arrived.

“I bought our first fridge” online, Mr. Panwar said. “It’s a rare thing in a village.” He got online last year with Reliance Jio Infocomm Ltd., Mr. Ambani’s telecom company, which built a tower nearby that beams his phone nearly unlimited 4G data for about $2.10 a month.

Jio, which means “to live” in Hindi, has signed up 215 million subscribers since it went live in 2016, making it India’s No. 4 mobile provider, after Bharti Airtel Ltd., with 345 million, Vodafone Group PLC and Idea Cellular Ltd.

Mr. Ambani’s foray started in 2010, when he bought a company that had just acquired a pan-India 4G license. That was a risky move at a time when fewer than one in 10 Indians were online. Airtel and Vodafone were still focused on rolling out 3G services, and few Indians owned 4G-capable smartphones.

Fourth generation, or 4G-LTE networks provide significantly faster speeds than 3G, enabling more content like streaming video and music. They also provide the steadier connections important for online shopping, which can be difficult on patchy networks. 4G networks are common in the U.S., Europe and East Asia.

Mr. Ambani, now 61 and worth more than $48 billion, had just finished building what some have dubbed the world’s most expensive home, a 27-story mansion on a hill with views of the Arabian Sea. It was packed with bling—helipad, home theater, gym, garden, pool—but the internet connection was bad.

When his daughter came home from Yale University during a break, she struggled to submit her course work online. “Dad, the internet in our house sucks,” she complained, according to a story Mr. Ambani later recounted at an event.

At the time, India’s telecom industry executives and analysts agreed there was need for more speed, but they doubted enough people would be willing to pay for it. Indians then were spending only about $2 a month on their cellphones, the vast majority of that on voice calls.

Subscribers in India typically use prepaid plans without contracts, making it easy to switch carriers by swapping in a new SIM card from a competitor. One adversary that has thrown in the towel: Reliance Communications Ltd., formerly part of the Reliance empire but taken separate by Mr. Ambani’s brother, Anil Ambani, after a family dispute. The company, under pricing pressure from Jio, closed its mobile business in late 2017.

The price war has cut industry wide revenue per user—now averaging $1.53 a month, compared with about $2.50 in 2016. Jio beats the average, at $1.89 a month, but the number has been falling since its launch.

The result has been a data binge. Jio transmitted more data in the first year of its operation than any carrier ever world-wide, according to research firm Strategy Analytics. India last year surpassed the U.S. in the number of apps downloaded from the Google Play store, according to mobile-app analytics firm App Annie. Monthly data traffic in India per user has jumped 570% in the two years since Jio launched, according to Morgan Stanley .

When Jio realized it was reaching the consumers who could afford the data but not the 4G-enabled smartphones, it built a new type of “smart” feature phone that worked on 4G and had some smartphone features. Consumers could own a JioPhone for a $23 security deposit—refundable if they return the phone. It launched in September 2017 and has overtaken Samsung Electronics Co. to capture 47% of the feature phone market, according to research firm Counterpoint.

Companies such as Amazon.com are depending on the new pool of users. Amazon has tweaked its model in India by introducing services like cash on delivery, in which customers can pay with cash when items arrive at their door, since few people have credit cards. The retailer has also deployed swarms of delivery men on motorbikes, so they can negotiate chaotic city traffic.

Google, which has been effectively shut out of China since 2010, has been rolling out new features to cater to users in India, testing products that might also work in other emerging markets, such as Indonesia. It launched a version of its YouTube app, called YouTube Go, designed to work on inexpensive smartphones. It created a mobile payment app for India, called Tez, that works without a credit or debit card. It is also working to make many of its services work with local languages.

At a July investors’ meeting, Mr. Ambani made his ambitions clear. “Even after serving the needs of our 215 plus million customers, the capacity utilization of the Jio network is less than 20%,” he said. “We are determined to connect everyone and everything, everywhere.”

Ericsson partners with Juniper, ECI for 5G transport equipment & will buy CENX

Ericsson has selected Juniper and ECI Telecom to provide 5G transport network gear, citing their expertise with optical and packet networks.

Alignment between the radio, core and transport layers of the network has never been more critical to meet the requirements of 5G use cases such as enhanced mobile broadband, fixed-wireless access, and massive and critical IoT. In this environment transport needs to keep pace with the rapid radio and architectural evolution in 5G networks.

With its focus on transport between radio and core functions, Ericsson delivers transport portfolios specifically for backhaul and fronthaul. Ubiquitous transport solutions for both 4G and 5G are gaining strong momentum with service providers and Ericsson’s flagship mobile backhaul product – Router 6000 – empowers close to 60 operators. More than 110 operators also use Ericsson’s 5G-ready microwave technology, MINI-LINK solutions.

Ercsson will use Juniper’s edge and core packet transport technologies (the MX and PTX series platforms) to support connectivity between radio cell sites and an operator’s core network. Ericsson will continue to offer its own Router 6000 and microwave products as packet backhaul options for 5G transport network deployments and will sell Juniper’s SRX Series Services Gateway network security system. “With Juniper there is no overlap and a good fit,” says Nishant Batra, Ericsson’s global head of network products.

ECI Telecom Ltd. will provide optical transport gear for the metro market for service providers as well as so-called “critical infrastructure” customers of Ericsson.

Ericsson notes that the Juniper and ECI platforms are “fully interoperable with Ericsson’s transport portfolio and will be managed by the same Ericsson management and orchestration solution. This will simplify the overall management and control of 5G across the radio, transport and core network.” It adds that the “management and orchestration solution will also provide integrated software-defined networking (SDN) control for Ericsson, Juniper and ECI nodes, enabling automated network control for applications such as network slicing and traffic optimization, to ensure the best possible user experience.”

“The partnerships help us strengthen areas where we are not building organically,” says Batra. “Instead of making a blanket commitment to be in IP, we have segmented into radio near, core and edge, and it’s the radio-near part we’ll address with our own products.”

Fredrik Jejdling, Executive Vice President and Head of Business Area Networks at Ericsson, says: “Our radio expertise and knowledge in network architecture, end-user applications and standardization work put us in an excellent position to understand the requirements 5G places on transport. By combining our leading transport portfolio with best-in-class partners, we will boost our transport offering and create the critical building blocks of next-generation transport networks that benefit our customers.”

………………………………………………………………………………………………………………………………………………………………………………………………….

Separately, Ericsson will acquire service assurance firm CENX, saying the company’s closed-loop automation work will be a boon to Ericsson’s virtualization plans.

Mats Karlsson, Head of Solution Area OSS, Ericsson, says: “Dynamic orchestration is crucial in 5G-ready virtualized networks. By bringing CENX into Ericsson, we can continue to build upon the strong competitive advantage we have started as partners. I look forward to meeting and welcoming our new colleagues into Ericsson.”

Closed-loop automation ensures Ericsson can offer its service provider customers an orchestration solution that is optimised for 5G use cases like network slicing, taking full advantage of Ericsson’s distributed cloud offering. Ericsson’s global sales and delivery presence – along with its strong R&D – will also create economies of scale in the CENX portfolio and help Ericsson to offer in-house solutions for OSS automation and assurance.

Ed Kennedy CEO, CENX says: “Ericsson has been a great partner – and for us to take the step to fully join Ericsson gives us the best possible worldwide platform to realize CENX’s ultimate goal – autonomous networking for all. Our closed-loop service assurance automation capability complements Ericsson’s existing portfolio very well. We look forward to seeing our joint capability add great value to the transformation of both Ericsson and its customers.”

CENX, founded in 2009, is headquartered in Jersey City, New Jersey. The company achieved significant year-over-year revenue growth in the fiscal year that ended December 31, 2017. CENX employs 185 people.

HKT & Huawei Open Digital Transformation Practice Center in Hong Kong; Indoor 5G Whitepaper

Hong Kong network operator HKT and China IT powerhouse Huawei jointly inaugurated the Digital Transformation Practice Center (DTPC) yesterday in Hong Kong. The DTPC will share the experience and practices of HKT gained during its digital transformation journey, and help guide the digitalization process of other carriers in their development of digital transformation, HKT said.

The DTPC will provide on-site sharing of HKT’s experience and practices gained in its successful digital transformation journey.

At the DTPC, a project team will assess different transformational scenarios through the five stages of digital transformation: Envisioning, Ideating, Prototyping, Realizing and Scaling. The goal is to realize digital transformation in a more agile and low-cost manner. By connecting to Huawei Cloud Open Labs, visitors can also experience on-the-spot the transformed services.

“We are glad to cooperate with Huawei to carry out the digital transformation project. During the process, we have encountered many challenges in terms of user experience, business processes, business support systems and network infrastructure,” HKT head of strategic wireless technology and core networks Dr Henry Wong said. “Thanks to the joint team, the company has launched new services through the transformed cloud platform and gained a lot of valuable experience in the process. We hope to share our digital transformation experience with the industry around the world through the DTPC,” Wong added.

The digital transformation practice facility aims to offer consultancy from half a day or a full day to chief executives, through to several weeks with specialist staff, said Derry Li, Huawei’s vice president of consulting and systems integration. “The center will support the construction of solutions. We will uncover user pain points,” Li said. The process will include prototyping of front-end and back-end solutions, he added.

By the end of this year, the facility will also advise on other technologies such as internet of things (IoT), the executive said. Li also said that Huawei and Hong Kong Telecom plan to extend the scope of the new facility to include 5G services in the first half of 2019.

HKT had previously worked with Huawei to carry out the end-to-end digital business transformation project, covering service and operation transformation as well as infrastructure cloudification for the realization of customer-centric “ROADS” (Real-time, On-demand, All-online, DIY, Social) experience.

During his keynote presentation at the opening of the event, Huawei’s board Chairman Liang Hua said that a full digitalization process can take at least 18 months to get through the toughest period of the implementation.

………………………………………………………………………………………………………………………………………

Separately, HKT, Global mobile Suppliers Association (GSA), and Huawei have jointly issued Indoor 5G Networks White Paper which explains the complexity of indoor 5G network deployment. It discusses 5G indoor service network requirements, the evolution of existing network, and challenges in target network deployment, and recommends appropriate construction strategies.

The white paper points out that more than 80% of service usage on 4G mobile networks occurs indoors. The industry predicts that a greater number of mobile services will take place indoors as 5G spurs service diversity and extends business boundaries. As a result, says the white paper, indoor mobile networks in the 5G era will become essential to operators’ competitiveness.

The white paper discusses key requirements and performance indicators for indoor 5G target networks based on the features of the three major types of 5G services (enhanced mobile broadband, ultra-reliable low-latency communication and massive machine-type communication). The specific requirements of augmented reality (AR), VR, high-definition (HD) video, telemedicine, and smart manufacturing are elaborated.

References:

https://www.huawei.com/en/press-events/news/2018/9/hkt-huaei-practice-center

https://www.huawei.com/en/press-events/news/2018/2/Huawei-HKT-Digital-Transformation-Practice-Center

https://www.huawei.com/en/press-events/news/2018/9/indoor-5g-networks-whitepaper