Mobile Experts: Ericsson #1 in RAN market; Huawei falls to #3

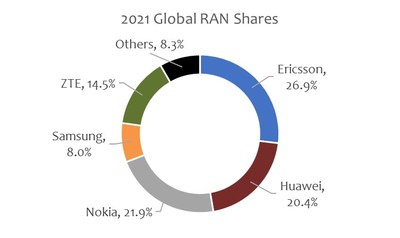

According to a new report from analyst firm Mobile Experts, Ericsson leapt into the #1 position in the RAN market for 2021. Ericsson (see Table 1. at bottom of this article), which achieved a 26.9% share of a market that grew by about 3% in value to be worth in the region of $45 billion last year.

Sanctions hit Huawei very hard as the Chinese tech giant dropped to third place in the RAN market in terms of the value of sales with a 20.4% market share. Huawei had a shortfall of roughly $4B last year due to the company’s inability to produce high-capacity TDD base stations. That was because of U.S. Government sanctions on the critical components needed. As a result, Huawei achieved much lower dollar value than their western competitors.

Nokia (21.9% market share) placed third while ZTE achieved fourth place (14.5%) ahead of Samsung (8% market share).

“Our approach to forecasting is deeply analytical, using data from more than 100 sources, rather than simply the inputs of five OEMs. Our approach works. This analyst team has been creating some of the most accurate, detailed forecasting on the market for over a decade,” commented Chief Analyst of Mobile Experts, Joe Madden. “We have developed relationships with suppliers, operators, and vendors that give us data for a three-pronged approach to triangulation on mobile infrastructure revenue.”

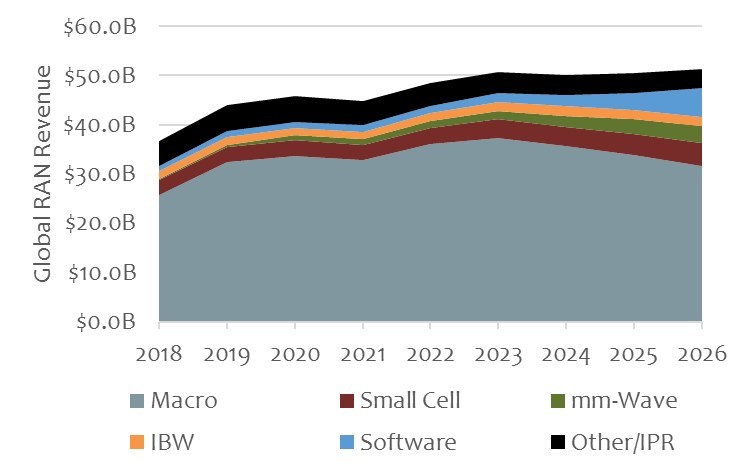

Mobile Experts’ models show the RAN market growing at a CAGR (Cumulative Annualized Growth Rate) of 3%, with -1% growth in macro base stations and 25%-35% growth in millimeter wave and software segments. The analyst firm, known for their unmatched accuracy, leverage over a decade of ear-to-ground experience in this market to present this detailed market forecast that presents last year’s findings concisely and completely as well as presenting what’s next for the RAN market and its players.

“Overall, the RAN market is looking up. After 30 years of boom-and-bust cycles, the market is currently reaching a peak with 5G deployment in its active mode this year. In coming years, we see new revenue coming in from private enterprises to offset the natural drop in CSP sales; specifically, the private LTE/5G market will grow by 19%, accounting for more than $4 billion in 2026. As a result, the total RAN market will remain near its 5G peak for a few years, with the possibility for growth in the longer term,” commented Chief Analyst Joe Madden.

Total Year Review for 2021 – Global RAN Revenue:

This pre-earnings report offers a comprehensive overview of the RAN market with Mobile Experts’ signature accuracy and detailed breakdowns. This quarter’s report includes revenue estimates for the top 25 vendors in the RAN market for 2021. This is the first of a series of quarterly updates, and it is available today for instant download with purchase at www.mobile-experts.net.

For more about this research and buy the report, click here.

About Mobile Experts Inc.:

Mobile Experts provides insightful market analysis for the mobile infrastructure and mobile handset markets. Our analysts are true Experts, who remain focused on topics where each analyst has 25 years of experience or more. Research topics center on technology introduction for radio frequency (RF) and communications innovation. Recent publications include: RAN Revenue, Cellular V2X, Fixed Mobile Convergence, Edge Computing, In-Building Wireless, CIoT, URLLC, Macro Base Station Transceivers, Small Cells, VRAN, and Private LTE.

……………………………………………………………………………………………..

Table 1: Ericsson’s headline figures (Swedish Krona-SEK billions)

| 2021 | 2020 | Change | |

| Net sales | 232.3 | 232.4 | 0% |

| Gross income | 100.7 | 93.7 | 7% |

| Gross margin | 43.4% | 40.3% | – |

| Research and development expenses | -42.1 | -39.7 | – |

| Selling and administrative expenses | -27.0 | -26.7 | – |

| Impairment losses on trade receivables | 0.0 | 0.1 | -134% |

| Other operating income and expenses | 0.4 | 0.7 | -45% |

| Share in earnings of JV and associated companies | -0.3 | -0.3 | – |

| EBIT | 31.8 | 27.8 | 14% |

| – of which networks | 37.3 | 30.9 | 21% |

| – of which digital services | -3.6 | -2.2 | – |

| – of which managed services | 1.5 | 1.6 | -6% |

| – of which emerging business and other | -3.4 | -2.4 | – |

| EBIT margin | 13.7% | 12.0% | – |

| Financial income and expenses, net | -2.5 | -0.6 | – |

| Income tax | -6.3 | -9.6 | 30% |

| Net income | -0.5 | -1.3 | – |

| Source: Ericsson | |||