Dell’Oro: Mobile Core Network & MEC revenues to be > $50 billion by 2027

According to a recently published report from Dell’Oro Group, the Mobile Core Networks (MCN) [1.] and Multi-access Edge Computing (MEC) market revenues are expected to reach over $50 billion by 2027.

Note 1. The Mobile Core Network is in a transitional stage from 4G to 5G and a new type of core network called the 5G Core Service Based Architecture (SBA). The 5G Core SBA is designed to be a universal core that can be the core for mobile and fixed wireless networks, wireline networks, and Wi-Fi networks. This includes the ability to be the core for 2G/3G/4G, so only one core is necessary for the long term. In addition, the IMS Core will migrate into the 5G Core SBA.

…………………………………………………………………………………………………………………………………………………………………

“The MNC and MEC market revenues are expected to grow at a 2 percent CAGR (2022-2027). We expect the MCN market for the China region to reach maturity first—due to its early start on 5G SA deployments—and is projected to have -4 percent CAGR throughout the forecast period,” stated Dave Bolan, Research Director at Dell’Oro Group.

“The worldwide market, excluding China, is projected to have a 3 percent CAGR. The Asia Pacific (APAC) and the Europe, Middle, East, and Africa (EMEA) region are expected to have the highest CAGRs throughout the forecast period as MNOs accelerate the deployments of 5G SA networks and expand their respective coverage footprints.

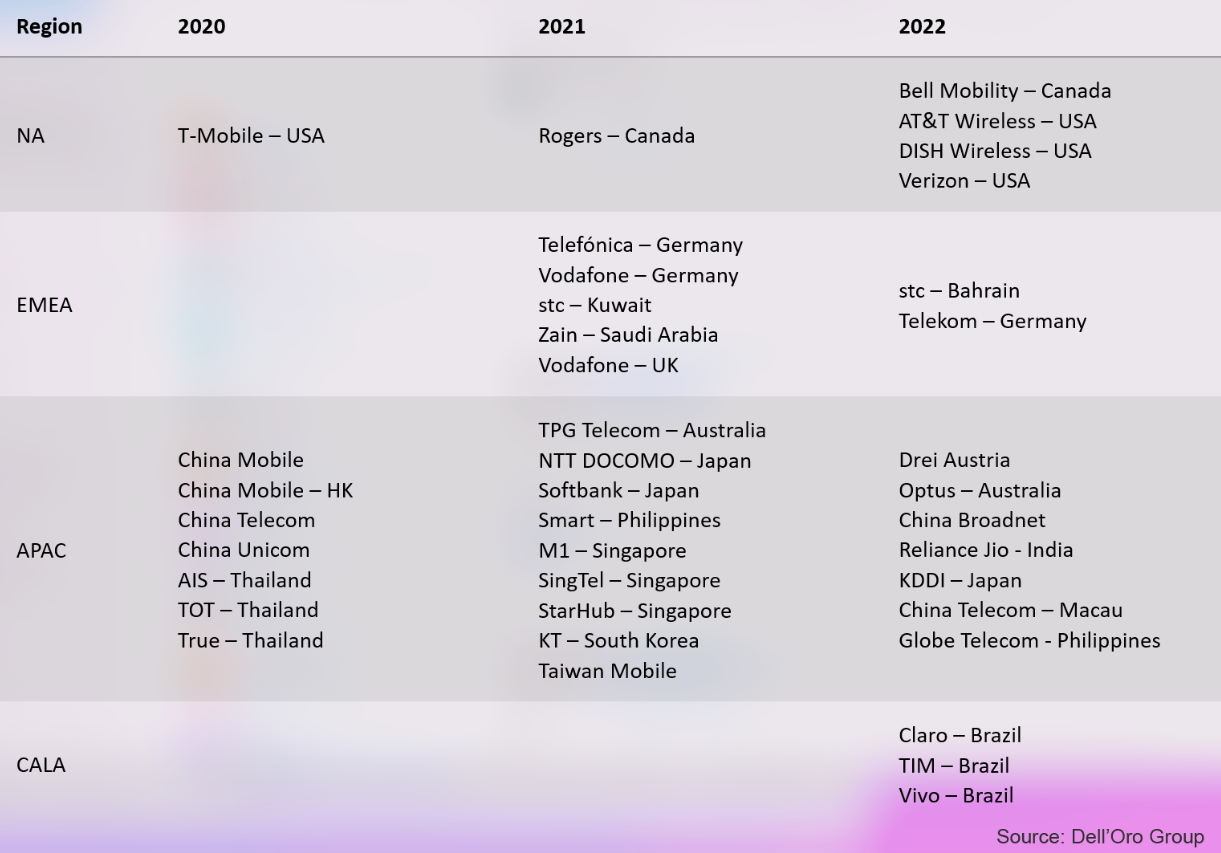

“There were hopes early in the year that many more [SA networks] would be launched in 2022, but the hopes were lowered as the year progressed,” Bolan explained. At the close of 2022, Dell’Oro identified 39 MNOs (Mobile Network Operators) that have commercially launched 5G SA eMMB networks.

“Reliance Jio, China Telecom-Macau, and Globe Telecom were new MNOs added to the list of 39 MNOs launching 5G SA eMMB networks in the fourth quarter of 2022. Reliance Jio has announced a very aggressive deployment schedule to cover most of India by the end of 2023. In addition, AT&T and Verizon plan large expansions to their 5G SA coverage in 2023, raising the projected Y/Y growth rate for the total MCN and MEC market for 2023 higher than 2022,” added Bolan.

Additional highlights from the January 2023 MCN and MEC 5-Year forecast report:

- The MEC segment of the MCN market will have the highest CAGR, followed by the 5G MCN market and the IMS Core market.

- As networks migrate to 5G SA, the 4G MCN market is expected to decline at a double-digit percentage CAGR.

The Dell’Oro Group Mobile Core Network & Multi-Access Edge Computing Quarterly Report offers complete, in-depth coverage of the market with tables covering manufacturers’ revenue, shipments, and average selling prices for Evolved Packet Core, 5G Packet Core, Policy, Subscriber Data Management, and IMS Core including licenses by Non-NFV and NFV, and by geographic regions. To purchase this report, please contact us at [email protected].

………………………………………………………………………………………………………………………………………………………………

From Deloitte:

“The coming migration to 5G standalone core networks is expected to allow for increased device density, reliability, and latency, opening the door to advanced enterprise applications,” according to several analysts from Deloitte’s Technology, Media & Telecommunications industry group.

“5G SA’s big attraction for MNOs are the new service and revenue opportunities it creates, Along with near-zero latency and massive device density, 5G SA enables MNOs to provide customers – specifically enterprise customers – access at scale to fiber-like speeds, mission-critical reliability, precise location services, and tailored network slices with guaranteed service levels.”

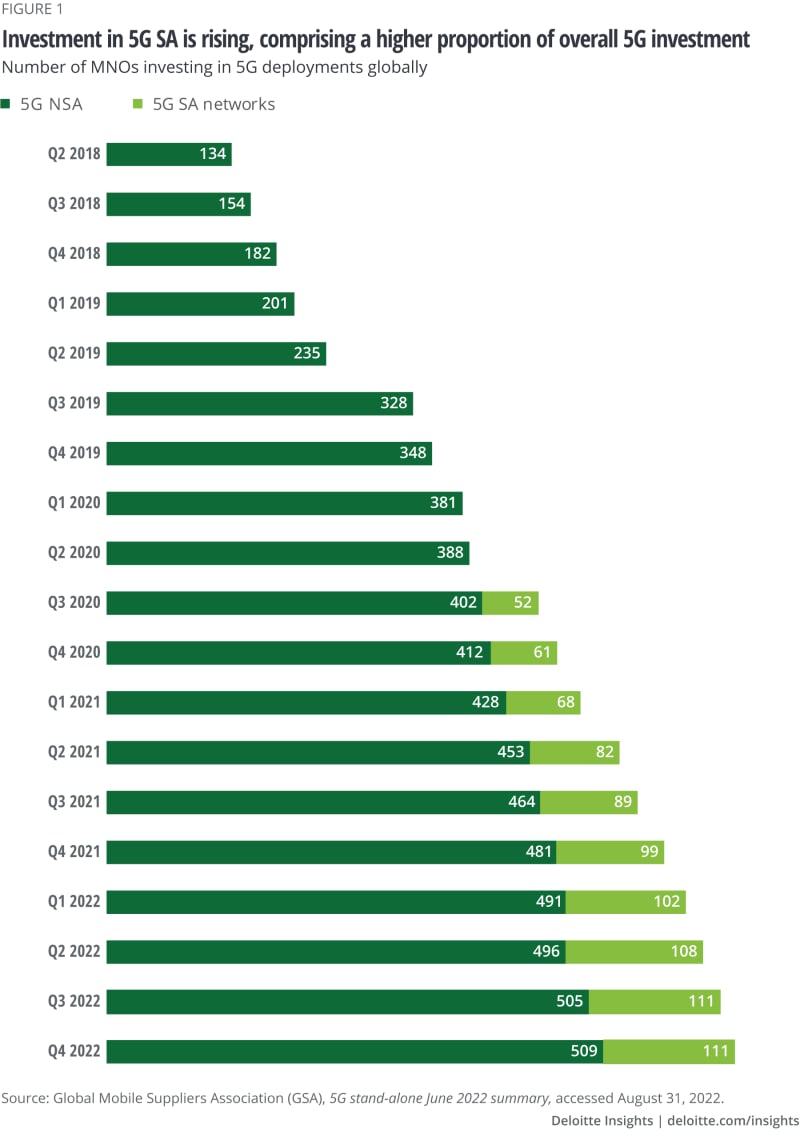

Deloitte expects the number of mobile network operators investing in 5G SA networks – with trials, planned deployments, or rollouts – to double from more than 100 operators in 2022 to at least 200 by the end of 2023.

References:

Mobile Core Network Market to Reach over $50 billion by 2027, According to Dell’Oro Group

Mobile Core Network (MCN) growth to slow due to slow roll-out of 5G SA networks

Dell’Oro: Mobile Core Network market driven by 5G SA networks in China

One thought on “Dell’Oro: Mobile Core Network & MEC revenues to be > $50 billion by 2027”

Comments are closed.

T-Mobile and AWS are working together to pair T-Mobile’s 5G Advanced Network Solutions portfolio with AWS cloud-based services and scalable, pre-integrated applications, so customers can more easily discover, customize and deploy 5G edge compute.

They will also collaborate on customizable, use case specific offerings as part of the new Integrated Private Wireless on AWS program. These offerings help businesses get the performance and applications they need for their unique use cases – for example, monitoring worker safety on remote industrial campuses, performing predictive maintenance on manufacturing equipment, or ensuring faster aircraft turnaround times at the airport.

“T-Mobile and AWS are coming together to do what industry-leading companies do best – make things easier for customers,” said Callie Field, President, T-Mobile Business Group. “Businesses need a combination of connectivity and compute that fits into their current infrastructure. With our flexible 5G network deployment options and AWS’s cloud compute capabilities, we can quickly provide customers a right-sized solution to make their applications – new and existing – perform like never before.”

“AWS and T-Mobile share a common desire to work backwards from customer feedback to deliver innovation,” said Adolfo Hernandez, Vice President, Telco Industry at AWS. “One of the biggest challenges in galvanizing industries and revenue for 5G services has been the lack of flexible 5G solutions that meet the compute and connectivity needs for customers. Together with T-Mobile’s innovative suite of 5G Advanced Network Solutions and our Integrated Private Wireless Program, we have the power to meet customers where they are.”

After years of industry excitement, 5G private network adoption has underwhelmed, but the potential is undeniably huge. The challenge has been the complexity and cost businesses face in unlocking that potential – requiring them to work across multiple vendors for compute, connectivity, applications, integration and more at a time of increased budget pressures. With some connectivity vendors insisting on a costly one-size-fits all approach to private networking – instead of a flexible set of private, hybrid and public networking options – it’s no wonder adoption has been slow to take off.

By working together, T-Mobile and AWS can help customers more easily discover, customize, and deploy 5G edge compute. Current AWS customers or businesses wanting AWS services can use the Integrated Private Wireless on AWS portal to explore customized solutions, browsing by industry or use case. Then they simply choose T-Mobile as their 5G provider. For U.S. businesses new to any advanced network or compute solution, T-Mobile will be able to work with them to set up a 5G public, hybrid or private network that’s already integrated with AWS’s customizable edge infrastructure and services.

For more information on T-Mobile’s 5G Advanced Network Solutions (5G ANS), head to https://www.t-mobile.com/business/solutions/networking/5G-advanced-solutions. Customers can also visit https://aws.amazon.com/telecom/integrated-private-wireless to learn more through the Integrated Private Wireless portal.

https://www.t-mobile.com/news/business/t-mobile-and-amazon-web-services-join-forces-on-5g-advanced-network-solutions/nr-hero-5g-aws-2-16-23-1