Month: August 2023

UScellular’s Home Internet/FWA now has >100K customers

UScellular now has more than 100,000 Home Internet/Fixed Wireless Access (FWA) customers and it anticipates even more growth over the coming years.

In 2022, fixed wireless services accounted for 90% of home broadband net additions, according to Leichtman Research Group. In the U.S., Verizon is by far the leader in 4G/5G FWA ending 2022 with 1.452 million fixed wireless home internet customers. The telco added 384K, 393K, 379K, and 342K in the last four quarters. It now has 2.229 million FWA internet subscribers.

In a press release on Tuesday, UScellular Chief Marketing Officer Eric Jagher said they knew rural areas in particular would see great benefit from having a FWA solution.

“We continue to enhance our Home Internet experience for customers, and the growth and positive response we’ve received to this service has us excited for the future. As we celebrate this milestone, we look forward to further updating the service so we can soon surpass hundreds of thousands of Home Internet customers,” Jagher stated.

As UScellular continues to build out its 5G mid-band network, more customers will be able to realize the fast, dependable connectivity that Home Internet provides. Earlier this year, UScellular launched its 5G mid-band network in parts of 10 states and expects to cover 1 million households by the end of the year and 3 million households by the end of 2024. This network can deliver speeds up to 10x faster than its 4G LTE network and low-band 5G.

UScellular initially offered Home Internet on its 4G LTE network and has upgraded the service with low-band, mid-band and mmWave 5G in select markets across the country. Most customers today can access 5G speeds on the service, which has led to a doubling of the customer base over the last 18 months. The company currently offers self-install, plug-and-play internal antennas and routers and a professionally installed external antenna in certain areas. Later this year, the company expects to have additional self-install options available to help meet the evolving needs of customers.

Additionally, UScellular offers a free Internet Setup Coach for all new customers. Experts from Asurion are available via phone to help customers with router placement for the best speeds and getting all essential devices – like computers, TVs and doorbells – connected to their home’s Wi-Fi network.

As UScellular looks to further enhance and expand its Home Internet service especially in rural areas, funding from the National Telecommunications and Information Administration’s Broadband Equity Access and Deployment (BEAD) program will be important. Fixed wireless technology will likely be the best and most affordable option in many under- and un-served areas to help bridge the digital divide in the United States.

Indeed, UScellular has made it clear that it wants to use funds from the BEAD program to build more towers and serve more rural areas with FWA while increasing its 5G mobile coverage.

The telco this week reiterated the importance of that BEAD funding. “Fixed wireless technology will likely be the best and most affordable option in many under- and un-served areas to help bridge the digital divide in the United States,” the company stated.

About UScellular:

UScellular is the fourth-largest full-service wireless carrier in the United States, providing national network coverage and industry-leading innovations designed to help customers stay connected to the things that matter most. The Chicago-based carrier provides a strong, reliable network supported by the latest technology and offers a wide range of communication services that enhance consumers’ lives, increase the competitiveness of local businesses and improve the efficiency of government operations. Through its After School Access Project, the company has pledged to provide hotspots and service to help up to 50,000 youth connect to reliable internet. Additionally, UScellular has price protected all of its plans, promising not to increase prices through at least the end of 2024. To learn more about UScellular, visit one of its retail stores or www.uscellular.com. To get the latest news, visit newsroom.uscellular.com.

References:

For more information about UScellular’s efforts:

https://newsroom.uscellular.com/connecting-us/

https://www.fiercewireless.com/5g/uscellular-marks-100000-fwa-customers

UScellular Launches 5G Mid-Band Network in parts of 10 states

US Cellular touts 5G millimeter wave and cell tower agreement with Dish Network

GSA 5G SA Core Network Update Report

GSA is tracking the emergence of the 5G SA core network, including the availability of chipsets and devices for customers, plus the testing and deployment of 5G SA networks by public mobile network operators as well as private network operators.

5G SA networks can be deployed in a variety of scenarios: as an overlay for a public 5G non-SA network, as a greenfield 5G deployment for a public network operator without a separate LTE network, or as a private network deployment for an enterprise, utility, education, government or other organization requiring its own private campus network.

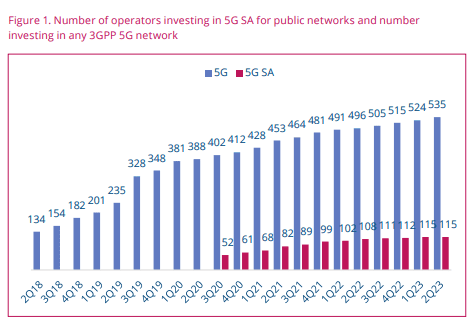

GSA has identified 115 operators in 52 countries and territories worldwide that have been investing (?) in public 5G SA networks in the form of trials, planned or actual deployments (see Figure 1.). This equates to 21.4% of the 535 operators known to be investing in 5G licenses, trials or deployments of any type.

At least 36 operators in 25 countries and territories are now understood to have launched or deployed public 5G SA networks, two of which have only soft-launched their 5G SA networks.

NOTE: Incredibly, that’s a DECREASE from GSA’s June 5G SA report which stated “GSA has catalogued 41 operators as having deployed or launched 5G standalone (SA) in public networks.”

Also, 19 cellular network operators have been catalogued as deploying or piloting 5G SA for public networks, and 29 as planning to deploy or evaluating, testing or trialing the technology.

Several organizations are testing, piloting or deploying 5G SA technologies for private networks. As of May 2024, 66 (just over 13% of total cellular private networks) organizations are known to be working with 5G SA core networks. These organizations include manufacturers, academic institutions, commercial research institutes, construction, communications and IT services, rail and aviation industries.

The number of 5G SA devices as a percentage of all 5G devices announced has been steadily increasing. They accounted for 35.6% of 5G devices in December 2019, 49.7% in December 2020 and 54.6% in December 2021 and a large increase to 81.8% in December 2022. As of June 2023, they account for 85.8%.

Software upgrades are almost always needed to enable 5G SA capability for existing 5G devices. There is a range of form factors to cater for different users, including modules for equipment manufacturers and vendors; customer-premises equipment (CPE), routers and gateways for enterprise or industrial customers or their systems integrators; CPE for home and business broadband; phones; and battery-operated hot spots for portable services.

Smartphones make up over half (59.0%) of the announced 5G devices with stated 5G SA support (1,034 phones), followed by fixed wireless access CPE (246) and modules (220).

Spectrum Support in 5G SA Devices:

Selected sub-6 GHz frequencies are increasingly well supported in 5G SA devices. The pattern of most-supported bands in sub-6 GHz 5G SA devices largely matches the pattern for most-supported bands across all 5G devices, with C-band, 2.6 GHz, 2 GHz, 1.8 GHz and 700 MHz.

Sub-6 GHz support by band, announced 5G SA devices, most-supported bands by most devices. Support for millimeter wave is not yet common.

Chipsets are being developed to support this capability — GSA has currently only catalogued eight chipsets specifically supporting 5G SA in millimeter-wave spectrum (eight mobile processors and platforms). 320 393 397 421 449 519 739 741 743 817 846 979 1,025 1,115 1,183 1,257 1,309 1,444 1,465 n48 n25 n66 n71 n12 n2 n20 n40 n79 n38 n7 n8 n5 n3 n28 n77 n1 n41 n78 We can expect support for spectrum bands above 6 GHz to increase in the future, as these bands are being promoted as an option for deployment of private 5G networks by regulators in various countries, as well as being promoted as capacity bands for high-traffic locations in public networks.

Summary:

The market is seeing the emergence of a strong 5G SA ecosystem with chipsets, devices of many types and users of public as well as private networks. We can expect to see the market go from strength to strength.

–>This author opines the 5G SA market is going from nowhere to no place!

As it does, GSA will continue to track its evolution and will be looking out for important new trends as they emerge.

Topics likely to become more important in the coming year in this context include 5G carrier aggregation in SA networks, ultrareliable low-latency communications (can’t be accomplished till 3GPP Release 16 URLLC in the RAN spec has been completed and performance tested) capabilities to support machine-to-machine connections in 5G SA systems, increasing support for millimeter-wave connections, network slicing in 5G networks and the introduction of VoNR in 5G SA networks.

……………………………………………………………………………………………………………………..

References:

GSM 5G-Market Snapshot Highlights – July 2023 (includes 5G SA status)

5G SA networks (real 5G) remain conspicuous by their absence

ABI Research: Expansion of 5G SA Core Networks key to 5G subscription growth