Analysys Mason: 40 operational 5G SA networks worldwide; Sub-Sahara Africa dominates new launches

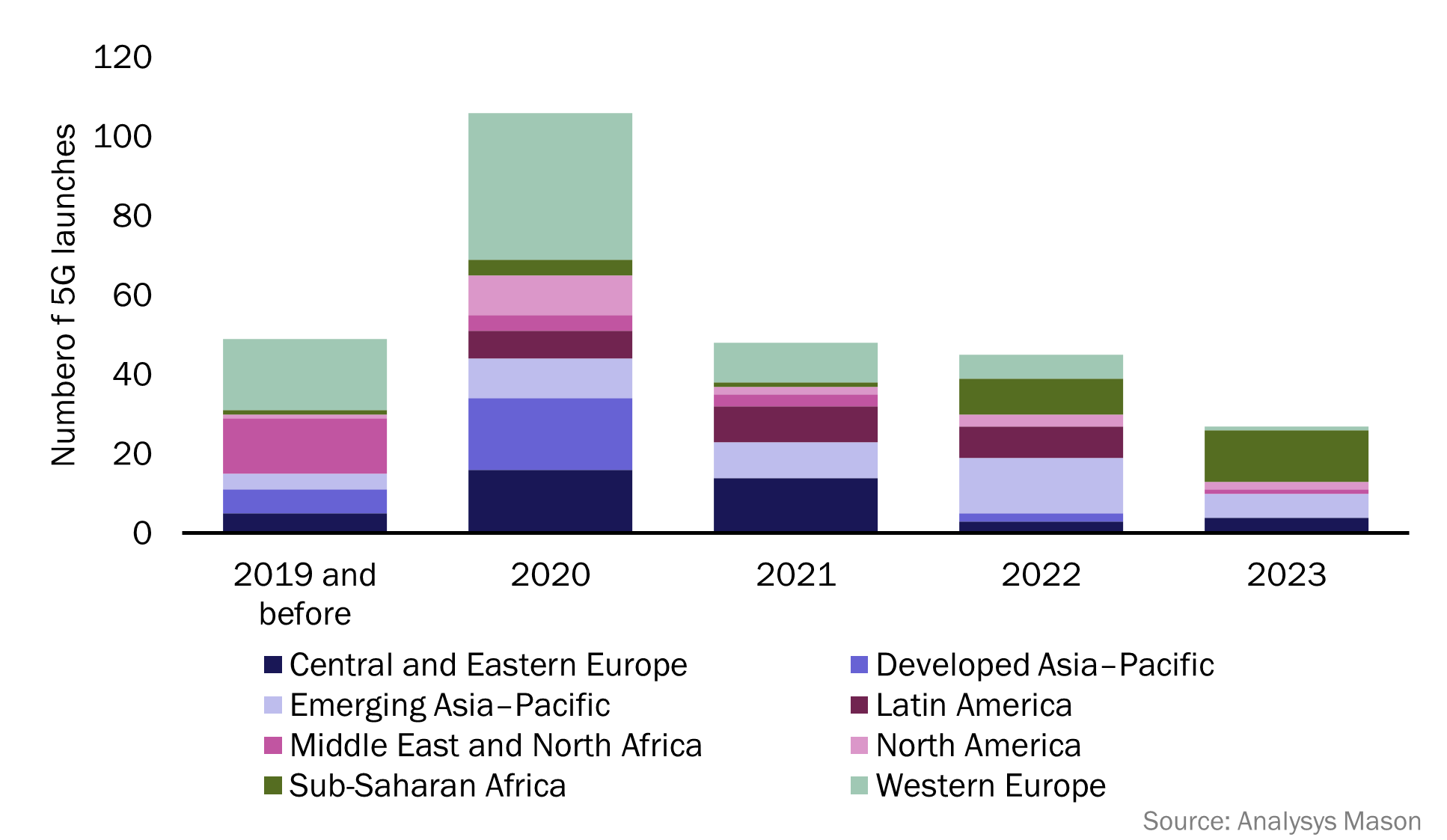

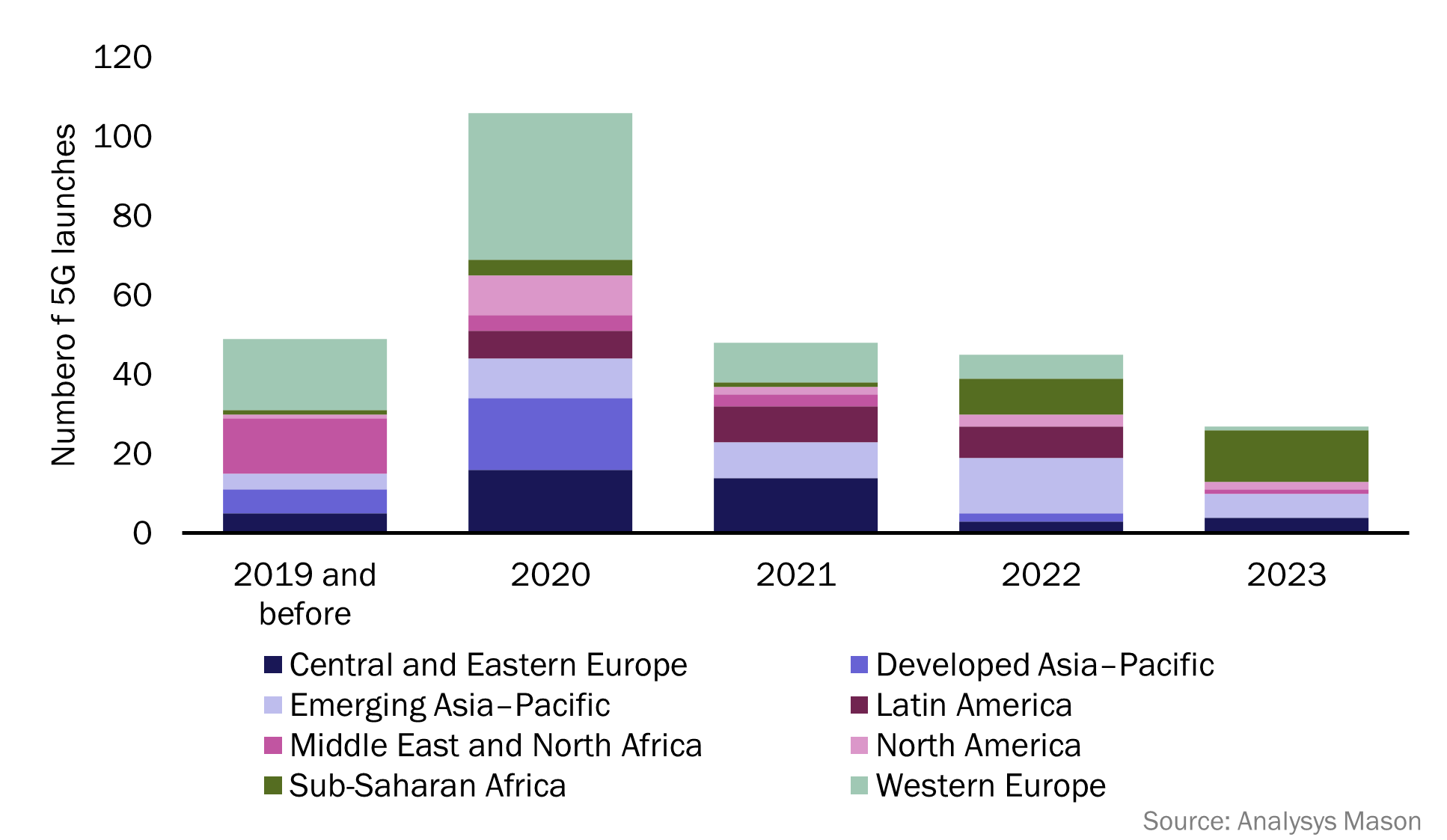

According to the latest edition of Analysys Mason’s 5G deployment tracker, 26 new 5G networks have been commercially launched across 22 countries so far in 2023, with an additional 55 5G networks either in deployment or scheduled for launch later this year.

Sub-Saharan Africa (SSA) has dominated 5G launch figures in 2023, with 13 new launches across 10 countries, accounting for over 48% of 5G launches during the period. Emerging Asia–Pacific (EMAP) has recorded 6 new 5G launches in 2023 so far, while Central and Eastern Europe (CEE) recorded 4 new 5G launches, respectively. Additionally, North America (NA) recorded 2 new 5G launches, while Western Europe (WE) and the Middle East and North Africa (MENA) each reported one new 5G launch in the same period. 5G standalone (SA) launches for the last 12 months (August 2022–2023) have continued to grow steadily, with 11 new operators commercially launching 5G SA networks. Five of these launches have occurred in 2023, with 3 operators launching in WE and 2 launching in MENA.

The market research firm’s 5G deployment tracker includes 338 entries from 2018 to 1H 2023, with 274 confirmed launches of 5G networks and 40 commercial launches of 5G SA networks, worldwide.

According to the latest edition of Analysys Mason’s 5G deployment tracker, 26 new 5G networks have been commercially launched across 22 countries so far in 2023, with an additional 55 5G networks either in deployment or scheduled for launch later this year.

Sub-Saharan Africa (SSA) has dominated 5G launch figures in 2023, with 13 new launches across 10 countries, accounting for over 48% of 5G launches during the period. Emerging Asia–Pacific (EMAP) has recorded 6 new 5G launches in 2023 so far, while Central and Eastern Europe (CEE) recorded 4 new 5G launches, respectively. Additionally, North America (NA) recorded 2 new 5G launches, while Western Europe (WE) and the Middle East and North Africa (MENA) each reported one new 5G launch in the same period. 5G standalone (SA) launches for the last 12 months (August 2022–2023) have continued to grow steadily, with 11 new operators commercially launching 5G SA networks. Five of these launches have occurred in 2023, with 3 operators launching in WE and 2 launching in MENA.

The 5G deployment tracker includes 338 entries from 2018 to 1H 2023, with 274 confirmed launches of 5G networks and 40 commercial launches of 5G SA networks, worldwide.

Figure 1: 5G network launches, worldwide, 2019 (and before)–2023

Network operators in SSA have long prioritised investment in 4G networks over 5G. This is due to the lower cost of 4G devices and infrastructure, and the high number of users on legacy networks, such as 2G and 3G, across the region. As a result, operators have prioritised the migration of these users to 4G networks over new 5G deployments. In 2021, 79.8% of all mobile connections in SSA were 2G or 3G connections, and there were only 6 operational 5G networks in the region. This changed in 2022, with operators launching 9 new 5G networks across the region.1 This number has continued to climb so far in 2023, with a total of 13 new 5G network launches since January.

SSA now accounts for over 48% of all 2023 5G launches, with the region now having more operational 5G networks than MENA, NA, Latin America (LATAM) and developed Asia–Pacific (DVAP). Airtel has launched the most 5G networks in SSA so far in 2023, with the group launching 4 new 5G networks in 4 different countries. These include:

- Kenya: Airtel became the second operator to launch a 5G network in Kenya, following Safaricom’s launch in October 2022. Airtel claims coverage across 370 areas including Mombasa, Nakuru, Nairobi and Kakamega.

- Nigeria: Airtel launched its 5G network in June 2023, with coverage in multiple areas including Abuja, Port Harcourt and Lagos. Airtel is the third operator to launch a 5G network in Nigeria, following MTN (2022) and Mafab (January 2023).

- Uganda: Airtel launched its 5G services in various areas of Kampala in August 2023, one month after MTN launched the first 5G network in Uganda.

- Zambia: Airtel became the second operator to launch a 5G network in Zambia in July 2023, following MT’s 5G launch in November 2022.

Other notable launches across SSA include:

- French Guiana: Orange Caraibe and SFR Caraibe both launched their 5G networks in 2023 in the 3.5GHz band. These are the first 5G networks in French Guiana.

- The Gambia: QCell became the first operator to launch 5G in The Gambia in June 2023, launching in selected areas of the capital city, Banjul.

- South Africa: Telkom South Africa launched their 5G network in 2023, becoming the fourth operator to launch 5G in South Africa after Rain, MTN and Vodacom.

…………………………………………………………………………………………………………………………………

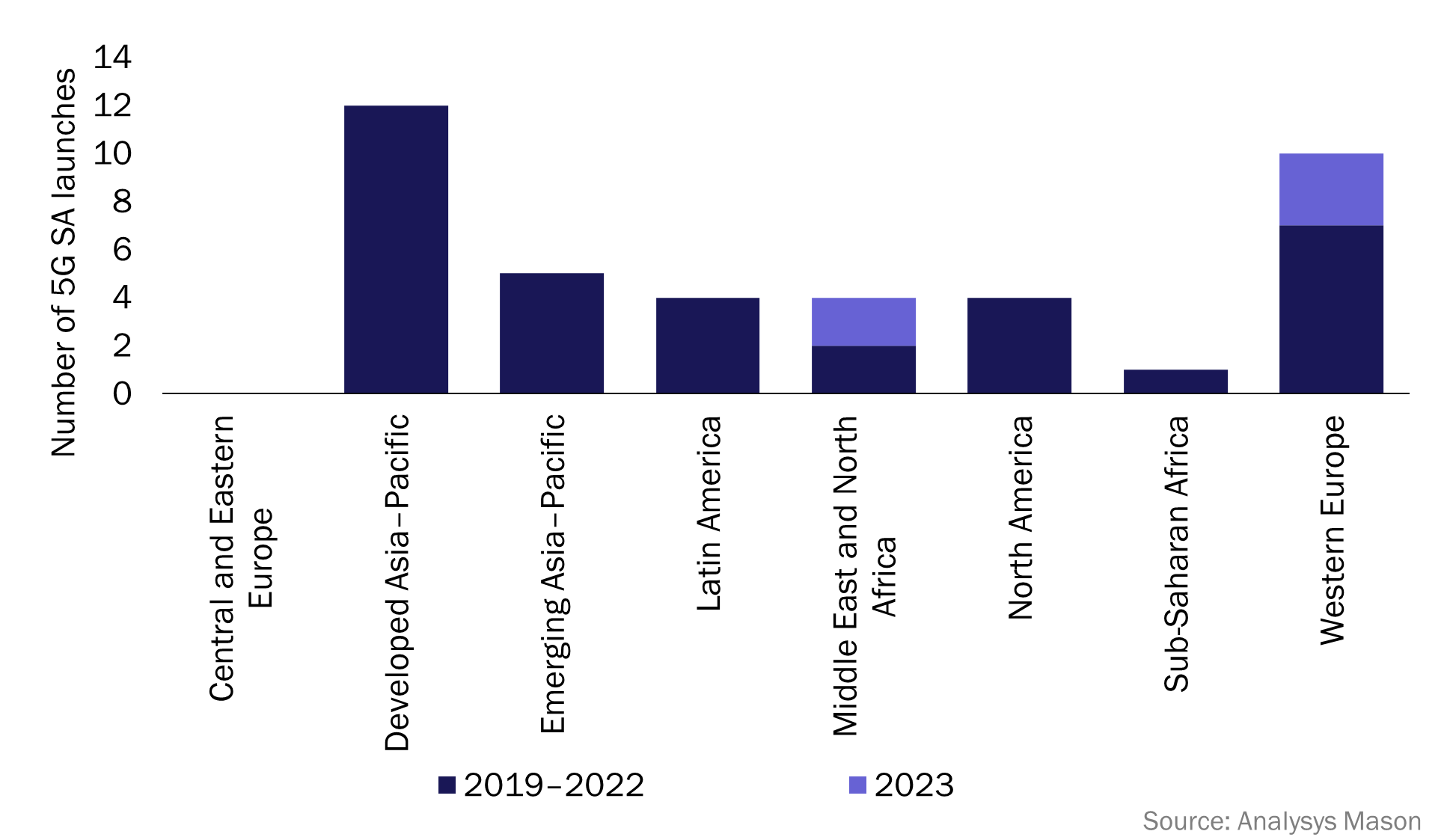

There are now 40 operational 5G SA networks worldwide, spanning 24 countries and 34 different operators. In the previous 12 months (from September 2022 to September 2023) there have been 11 new 5G SA launches, with 5 of these occurring in 2023. These 5 launches were spread across WE (3 new launches) and MENA (2 new launches). More 5G SA launches are expected in 2023, as launch figures have historically peaked in the second half of a calendar year. 5G SA launch figures are expected to accelerate over the next few years, and operators that have already launched 5G SA networks are likely to continue to expand their standalone coverage.

Analysys Mason predicts that by 2024, 5G SA will be the main source of revenue for vendors.

…………………………………………………………………………………………………………………………….

Editor’s Note: We strongly disagree with that 5G SA forecast and we don’t know if the “vendors,” like Ericsson, Nokia, Huawai, ZTE, Samsung, NEC, also provide 5G RAN equipment. Other 5G SA core network vendors, don’t make RAN equipment, e.g. Amazon AWS, Microsoft Azure, Cisco, VMware, Parallel Wireless and Mavenir

In the U.S., only T-Mobile and Dish Network have deployed 5G SA core networks. AT&T and Verizon have been talking the talk about 5G SA core networks but have no commercial deployments. UScellular 5G SA is in test mode. UScellular’s CTO Mike Irizarry said it’s now testing Nokia’s 5G SA core, but doesn’t plan to rush headlong into the SA 5G future.

Also, because there are no specification for 5G SA core network interoperability or roaming, 5G SA endpoint mobility will be extremely limited.

…………………………………………………………………………………………………………………………….

With three new launches so far in 2023, WE is beginning to compete with DVAP for the total number of 5G SA network launches. DVAP has led the total 5G standalone network launch figures since 2021 (see Figure 2), with 11 new launches in the last 2 years across Australia, Japan, Singapore and South Korea. Western Europe now accounts for 25% of all 5G SA networks worldwide, 5 percentage points less than DVAP which accounts for 30%. All regions have now launched at least one 5G SA network, excluding CEE (see Figure 2).

Figure 2: 5G SA launches, worldwide, 2019–2023

In 2023, notable deployments of standalone networks have included:

- Saudi Arabia: Zain launched the first 5G SA network in Saudi Arabia in March 2023, making Saudi Arabia the third country in MENA to have an operational 5G SA network, after Bahrain and Kuwait.

- Spain: Orange and Telefónica both launched 5G SA networks in 2023. These are the first two 5G SA networks in Spain.

- United Arab Emirates (UAE): E& (formerly Etisalat) launched its 5G SA network in February 2023, becoming the fourth operator to launch 5G SA services within MENA and the first in the UAE.

- United Kingdom: Vodafone launched the first 5G SA network in the UK, in June 2023, with coverage across Cardiff, Glasgow, London and Manchester. Vodafone has branded its 5G SA as ‘5G Ultra’.

References:

https://www.analysysmason.com/research/content/articles/5g-deployment-launches-rma18/

GSA 5G SA Core Network Update Report

ABI Research: Expansion of 5G SA Core Networks key to 5G subscription growth

Counterpoint Research: Ericsson and Nokia lead in 5G SA Core Network Deployments

Tech Mahindra and Microsoft partner to bring cloud-native 5G SA core network to global telcos

Omdia and Ericsson on telco transitioning to cloud native network functions (CNFs) and 5G SA core networks

Dell’Oro: RAN market declines at very fast pace while Mobile Core Network returns to growth in Q2-2023

Dell’Oro: RAN Market to Decline 1% CAGR; Mobile Core Network growth reduced to 1% CAGR

Dell’Oro: Mobile Core Network & MEC revenues to be > $50 billion by 2027

Dell’Oro: Market Forecasts Decreased for Mobile Core Network and Private Wireless RANs

Dell’Oro: Mobile Core Network market driven by 5G SA networks in China

Counterpoint Research – 5G SA Core Deployments Decelerate in H1 2023