Dell’Oro

Highlights of Dell’Oro’s 5-year RAN forecast

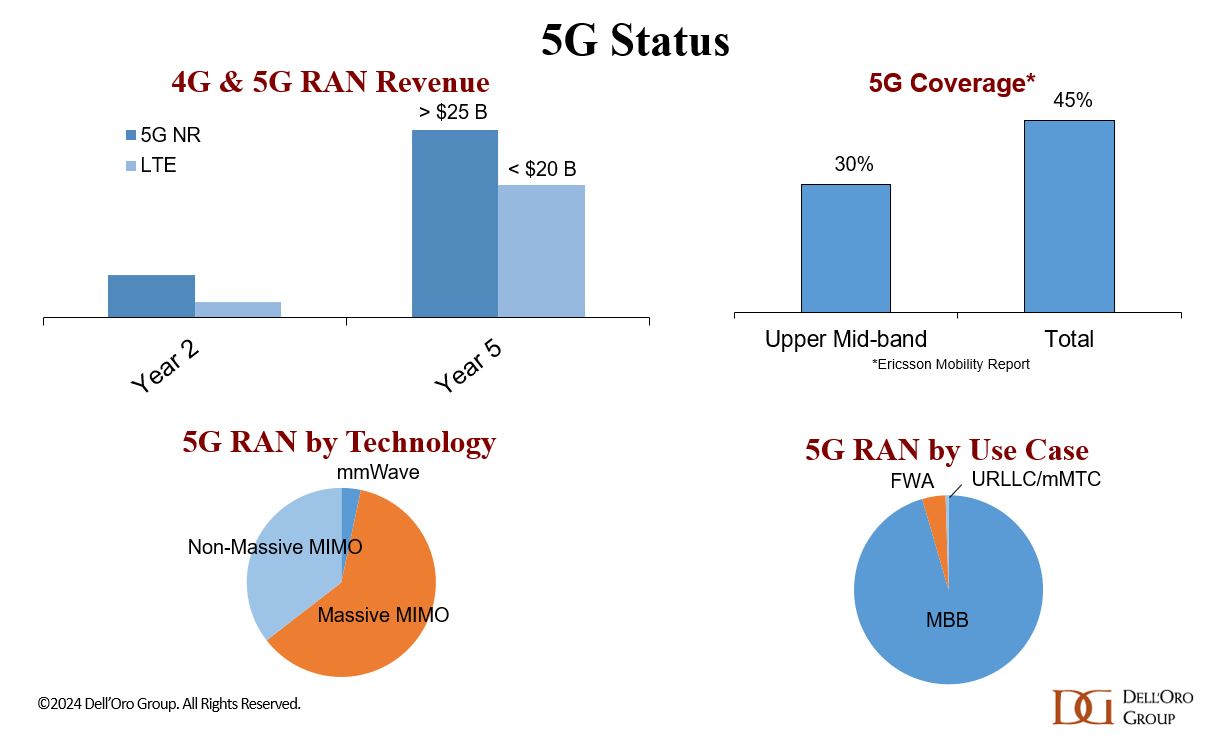

Market conditions remain challenging for the broader RAN market. Following the 40% to 50% ramp between 2017 and 2021, the RAN market has been declining since then. These trends are expected to prevail throughout the forecast period. However, the pace of the decline should moderate somewhat after 2024.

“It is not a surprise that there is rain after sunshine,” said Stefan Pongratz, Vice President for RAN market research at Dell’Oro Group. “In addition to MBB-based coverage-related challenges, this disconnect between mobile data traffic growth and the capacity boost provided by the mid-band, taken together with continued monetization uncertainty, is clearly weighing on the market,” Pongratz added.

- Worldwide RAN revenues are projected to decline at a 2 percent CAGR over the next five years, as continued 5G investments will be offset by rapidly declining LTE revenues.

- The Asia Pacific region is expected to lead the decline, while easier comparisons following steep contractions in 2023 will improve the growth prospects in the North American region. Even with some recovery, North American RAN revenues are expected to remain significantly lower relative to the peak in 2022.

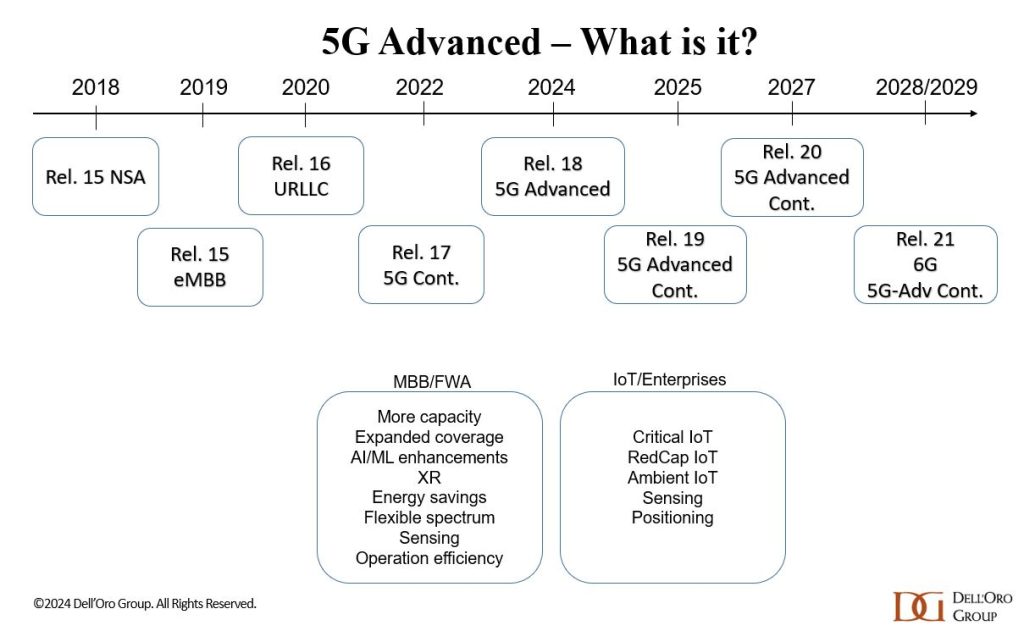

- 5G-Advanced positions remain unchanged. The technology will play an essential role in the broader 5G journey. However, 5G-Advanced is not expected to fuel another major capex cycle. Instead, operators will gradually transition their spending from 5G towards 5G-Advanced within their confined capex budgets.

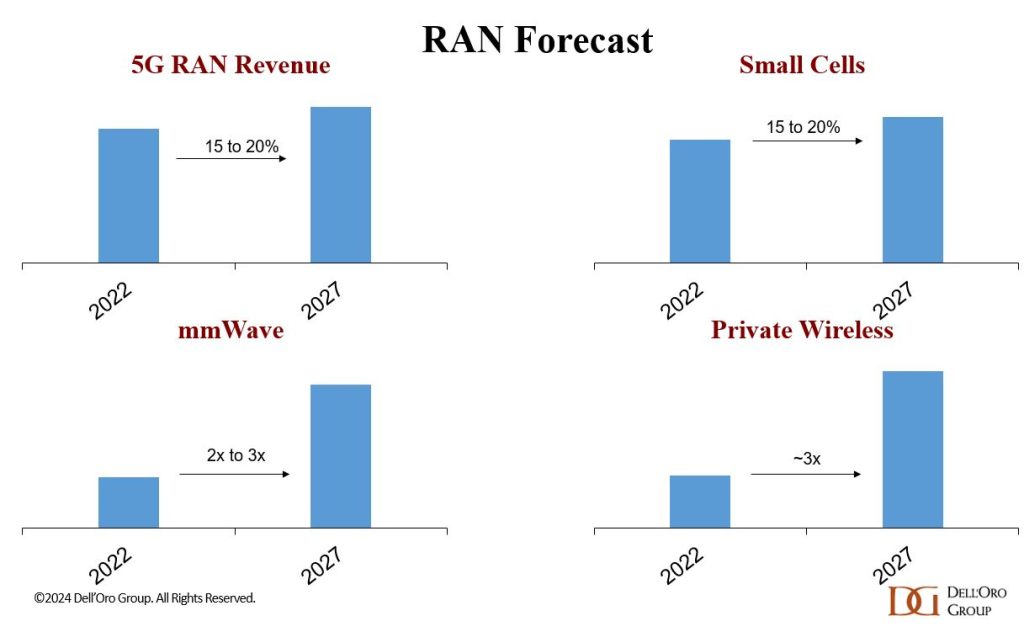

- RAN segments that are expected to grow over the next five years include 5G NR, FWA, mmWave, Open RAN, vRAN, private wireless, and small cells.

Commentary:

Worldwide RAN revenues are projected to decline at a 2% CAGR between 2023 and 2028, as rapidly declining LTE revenues will offset continued 5G investments. This is predicated on the assumption that the MBB portion of the RAN market will continue to trend downward, and the upside from new growth opportunities is not enough to change the trajectory.

The mix between existing and new use cases has not changed. We still forecast private/enterprise RAN to grow at a 20%+ CAGR while public RAN investments decline. At the same time, because of the lower starting point, it will take some for private RAN to move the broader RAN needle.

As the investment focus gradually shifts from coverage to capacity, one of the most significant forecast risks is slowing mobile data traffic growth. Given current network utilization levels, there are serious concerns about the timing of capacity upgrades. The network utilization metric will play a much more significant role as we move further into the capacity phase.

Generally, the less advanced 5G regions are expected to perform better than the mature 5G markets. As a result, markets with lower 5G POP coverage, including Middle East & Africa, Caribbean and Latin America, and APAC Excluding China/India should perform better.

Easier comparisons following steep contractions in 2023 will improve the North American region’s growth prospects. Even with some recovery, North American RAN revenues are expected to remain significantly below peak levels in 2022.

5G-Advanced will play an essential role in the broader 5G journey. However, 3GPP Releases 18-20 are not expected to fuel another major capex cycle. Instead, operators will gradually transition their spending from 5G towards 5G-Advanced within their confined capex budgets. Also, ITU-R WP5D has not started any work related to a 5G-Advanced recommendation(s).

More importantly, some RAN segments will stand out even as the broader RAN market shrinks. RAN segments expected to grow over the next five years include 5G NR, Non-MM 5G NR, FWA, mmWave, Open RAN, vRAN, private wireless, and small cells.

References:

Analysts: Telco CAPEX crash looks to continue: mobile core network, RAN, and optical all expected to decline

Dell’Oro: 2023 global telecom equipment revenues declined 5% YoY; Huawei increases its #1 position

Dell’Oro & Omdia: Global RAN market declined in 2023 and again in 2024

Dell’Oro: RAN market declines at very fast pace while Mobile Core Network returns to growth in Q2-2023

Dell’Oro: RAN Market to Decline 1% CAGR; Mobile Core Network growth reduced to 1% CAGR

Global 5G Market Snapshot; Dell’Oro and GSA Updates on 5G SA networks and devices

ITU-R: IMT-2030 (6G) Backgrounder and Envisioned Capabilities

Analysys Mason’s gloomy CAPEX forecast: “there will not be a cyclical recovery”

Telco capex declined worldwide in 2023, and predictions in end-of-financial year results indicate further declines this year. Analysys Mason warns that a “long decline” in capital expenditure has now started. “There will not be a cyclical recovery,” says one subhead (see below). Analysys Mason crunched a lot of numbers to arrive at this conclusion, processing historical data for about 50 of the largest operators in the world. Importantly, it also looked at the long-term guidance issued by those companies. Capex has peaked partly because telcos in many regions have completed or are near completing a once-in-a-lifetime upgrade to full-fiber networks. Clearly, that’s bad news for companies selling the actual fiber. Operators will continue to invest in the active electronics for these lines, but that represents a “tiny fraction” of the initial cost.

This new Analysys Mason gloomy CAPEX forecast comes after Dell’Oro and Omdia (owned by Informa) previously forecast another sharp fall in telco spending on mobile network products this year after the big dip of 2023.

Figure 1. below aggregates change in capex, excluding spectrum, in 2023 (or FY2023/2024) for 50 of the largest operators in the world, all with annual capex of over USD1 billion in 2023. These operators account for about 78% of telecoms capex worldwide. Of the 42 operators that provided guidance on capex in 2024, 28 forecast a fall. A notable class of exceptions consisted of cable operators and latecomers to FTTP upgrade, but most of the emerging-market-focused operators indicated a decline.

The steepest decline was in North America. The decline was steeper for the three largest mobile network operator (MNO) groups (–18.1%). This was offset by rises in capex by the two large US cablecos, for which upgrades of HFC plant are now an imperative. The obvious reason for the sharp decline is the near-completion of 5G roll-out, although FTTP capex remains flat.

In China, capex was flat overall. This disguises a decline in 5G and fixed broadband capex, which, taken together with transmission, fell 7% in 2023. The delta of capex has gone on what operators call ‘computility’ (compute power in data centers and edge) and capabilities (developing the ability to serve mainly the industrial enterprise). Together these two items now account for about 35% of operator capex.

In Japan and South Korea, capex was also more or less flat (+0.5%). As in China, a high proportion of capex in Japan now goes on adjacent lines of business.

Capex declined by 5.5% in Europe. The European figure disguises the impact of the large number of smaller players in the continent. 5G spending has peaked, but so too has FTTP spending. FTTP spend represents a very high share of capex in Europe (about one half), although this is distributed differently across individual countries. Countries like France and Spain have passed that peak, but even in the UK, a relatively late starter, spend has plateaued. Among operators in emerging markets, the smallest group in absolute capex terms, there was a rise of 8%, steady now for three years running, driven almost entirely by India, and offset by declines elsewhere.

There will not be cyclical recovery of capex:

Operators’ longer-term projections of capex suggest, if anything, steepening declines in capex. Our forecasts indicate that capital intensity (capex/revenue) will fall from around 20% now to 12–14% by the end of the decade. Capex will fall basically because customers do not need more than the 1Gbit/s fibre and unlimited 5G that the current networks are easily capable of delivering, and growth in measurable demand slows every year. This will have the following effects:

•Fall in fixed access spend. Capex on FTTP is essentially a one-off investment in passive assets with very long useful lives. Future capex on upgrades (in effect replacements) of FTTP actives will come at a tiny fraction of this cost. The pipeline of plans for commercial build is running dry, although this is offset by some hefty subsidies for rural build, particularly in the USA. Those cablecos that have not already started will have to brace themselves for programs of replacement of HFC/DOCSIS by FTTP/xPON.

•We expect only limited uplift for 5G SA/5G Advanced. This is in part because some operators will not be able to justify a further upgrade after 5G NSA, in part because of slack demand, and in part because the sums involved will be lower than for the roll-out of 5G NSA.

•6G will not be capex-intensive. There is little appetite in free-market economies without centralised planning (and perhaps not so much even there) for a capex-intensive generational upgrade to 6G. There will be no cyclical uplift.

•There will be more outsourcing, i.e. replacement of capex by an opex line. This occurs mainly in infrastructure, but also in migrations of operations (IT capex) to the cloud. Yet this does not mean that capex is simply shifting from one class of business to another; infra companies exist in a world with similar constraints.

•In these circumstances there is a clear case for capex investment in anything that maximizes the efficient (and sustainable) use of the physical assets as they stand, and unlocks any opportunities that exist in new business-models. This is prominent in many operator outlooks.

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………

William Webb, an independent consultant and former executive at UK telecom regulator Ofcom, forecasts an S-curve flattening by 2027. In a forthcoming book called “The end of telecoms history,” Webb returns to predictions he first made in 2016 to gauge their accuracy. Using recent historical data from Barclays, he was able to show a close alignment with the S-curve he drew about eight years ago. If this behavior continues, growth rates “will fall to near zero by around 2027, with significant variations by country,” says Webb in his book, giving a sneak preview to Light Reading.

Webb’s broad rationale is that there is an upper limit on daily gigabyte consumption, just as there is only so much the average person can eat or drink. All Webb had to do was assume there will be some future gorging by customers on high-quality video, the most calorific meal for any smartphone. “Once they are watching video for all their free moments while downloading updates and attachments there is little more that they could usefully download,” he writes.

What of future services people do not currently enjoy? Outside virtual reality – which, for safety reasons, will probably always happen in a fixed-line environment – no app seems likely to chew through gigabytes as hungrily as moving images do in high definition. Webb clearly doubts the sort of artificial intelligence (AI) services being advertised by Apple will have much impact whatsoever.

“There may be substantially more traffic between data centers as models are trained but this will flow across high-capacity fiber connections which can be expanded easily if needed,” he told Light Reading by email. “At present AI interactions are generally in the form of text, which amounts to miniscule amounts of traffic.”

“Indeed, if time is diverted from consuming video to AI interactions, then AI may reduce the amount of network traffic,” he continued. Even if AI is used in future to create images and videos, rather than words, it will probably make no difference given the amount of video already consumed, merely substituting for more traditional forms of content, said Webb.

For those confident that data traffic growth stimulates investment, the other problem is the lack of any correlation between volumes and costs. Advanced networks are designed to cope with usage up to a certain high threshold before an upgrade is needed. Headline expenses have not risen in lockstep with gigabytes.

References:

https://www.lightreading.com/5g/ericsson-and-nokia-may-be-stuck-with-skinflint-customers-for-years

Dell’Oro & Omdia: Global RAN market declined in 2023 and again in 2024

U.S. Network Operators and Equipment Companies Agree: 5G CAPEX slowing more than expected

Dell’Oro: Optical Transport, Mobile Core Network & Cable CPE shipments all declined in 1Q-2024

Dell’Oro: 2023 global telecom equipment revenues declined 5% YoY; Huawei increases its #1 position

Where Have You Gone 5G? Midband spectrum, FWA, 2024 decline in CAPEX and RAN revenue

“The “5G Train Wreck” we predicted five years ago has come to pass. With the possible exception of China and South Korea, 5G has been an unmitigated failure- for carriers, network equipment companies, and subscribers/customers. And there haven’t been any significant performance advantages over 4G.”

Dell’Oro & Omdia: Global RAN market declined in 2023 and again in 2024

A new report from the Dell’Oro Group reveals that the global Radio Access Network (RAN) market concluded the year with another difficult quarter, resulting in a global decrease of nearly $4 billion in RAN revenues for the full year of 2023. However, despite these challenges, the results for the quarter exceeded expectations, partly due to robust 5G deployments in China.

“Following the intense rise between 2017 and 2021, it’s clear that the broader RAN market is now experiencing a setback, as two out of the six tracked regions are facing notable declines,” said Stefan Pongratz, Vice President for RAN market research at the Dell’Oro Group. “In addition to challenging conditions in North America and Europe, the narrowing gap between advanced and less advanced operators (e.g. India) in this first 5G wave, compared to previous technology cycles, initially had a positive impact but is now constraining global 5G and broader RAN growth prospects,” Pongratz added.

Additional highlights from the 4Q 2023 RAN report:

- Overall concentration in the RAN market showed signs of improvement in 2021 and 2022, but this progress slowed down in 2023.

- While full-year RAN rankings remained mostly unchanged for major suppliers, revenue shares within the RAN market showed more variability, with Huawei and ZTE enhancing their global revenue shares. Similarly, Huawei and Nokia saw improvements in their revenue shares outside of China.

- The top 5 RAN suppliers based on worldwide revenues are Huawei, Ericsson, Nokia, ZTE, and Samsung.

- Regional projections are mostly unchanged, with market conditions expected to remain tough in 2024 due to difficult comparisons in India. Nevertheless, the base-case scenario anticipates a more moderate pace of decline this year.

…………………………………………………………………………………………………………………………

Source: Dell’Oro Group

…………………………………………………………………………………………………………………………

Separately, Rémy Pascal of Omdia says that global RAN revenues (including both hardware and software) declined by 11% last year to just over $40 billion. The worst performing region by far was North America, which almost halved, but this should be viewed in the context of a relatively strong 2022.

India and China were been the best performing countries for new RAN deployments. This partly explains why Huawei continues to be the top RAN vendor despite attempts by the U.S. and its allies to prevent that, but as the Omdia table below shows, the Chinese vendor is still doing well in many other regions too. We’re told this table looked pretty much the same last year.

Top RAN vendors by region, full year 2023:

|

North America |

Asia & Oceania |

Europe, Middle East and Africa |

Latin America & the Caribbean |

|

Ericsson |

Huawei |

Ericsson |

Huawei |

|

Nokia |

ZTE |

Nokia |

Ericsson |

|

Samsung |

Ericsson |

Huawei |

Nokia |

Source: Omdia

Omdia expects the RAN market size to decrease by around 5% compared to 2023. That’s an improvement on the 11% 2022-23 decline but still not good news for the RAN industry.

For all the talk of Open RAN, it clearly has yet to inspire significant capex from operators. The same goes for private 5G or programmable networks. Less than halfway through the presumed 5G cycle, spending has stalled and it’s not at all clear what will restart it.

Dell’Oro Group’s RAN Quarterly Report offers a complete overview of the RAN industry, with tables covering manufacturers’ and market revenue for multiple RAN segments including 5G NR Sub-7 GHz, 5G NR mmWave, LTE, macro base stations and radios, small cells, Massive MIMO, Open RAN, and vRAN. The report also tracks the RAN market by region and includes a four-quarter outlook. To purchase this report, please contact us by email at [email protected].

References:

RAN Market Shows Faint Signals of Life in 4Q 2023, According to Dell’Oro Group

https://www.telecoms.com/wireless-networking/global-ran-market-declined-by-11-in-2023

Dell’Oro: RAN market declines at very fast pace while Mobile Core Network returns to growth in Q2-2023

Dell’Oro: RAN Market to Decline 1% CAGR; Mobile Core Network growth reduced to 1% CAGR

https://www.silverliningsinfo.com/5g/ericsson-nokia-and-state-global-ran-2024

LightCounting: Open RAN/vRAN market is pausing and regrouping

What is 5G Advanced and is it ready for deployment any time soon?

The 3GPP roadmap (see figure below) is continuously evolving to fulfill the larger 5G vision. In this initial 5G wave that began in 2018, 3GPP has completed three major releases (new releases every 1.5 to 2 years): 15, 16, and 17.

Release 17 is included in the ITU-R M.2150-1 recommendation which is the only standard for IMT 2020 RIT/SRIT (i.e. 5G RAN interface). 3GPP contributes its completed radio interface specifications to ITU-R WP5D via ATIS where they are discussed and approved for inclusion into the next version of the ITU-R M.2150 recommendation. The same procedure is likely for IMT 2030 RIT/SRIT (i.e. 6G RAN).

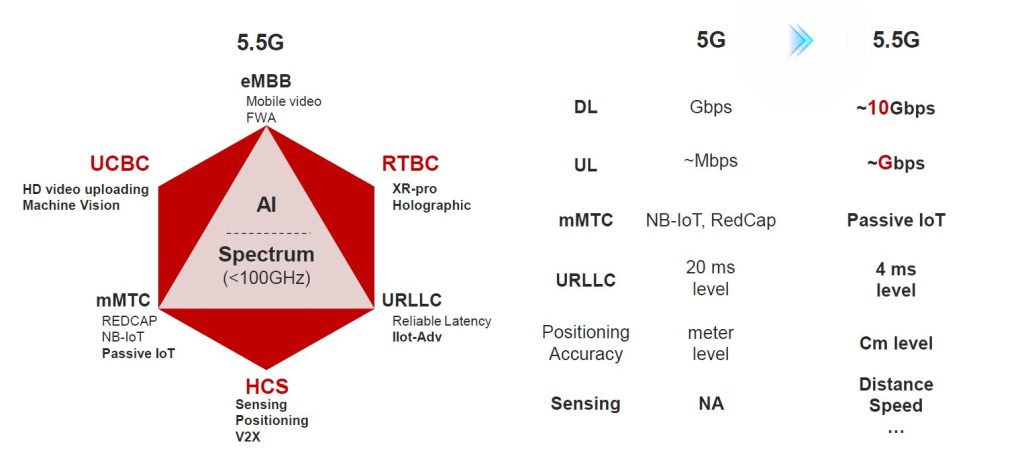

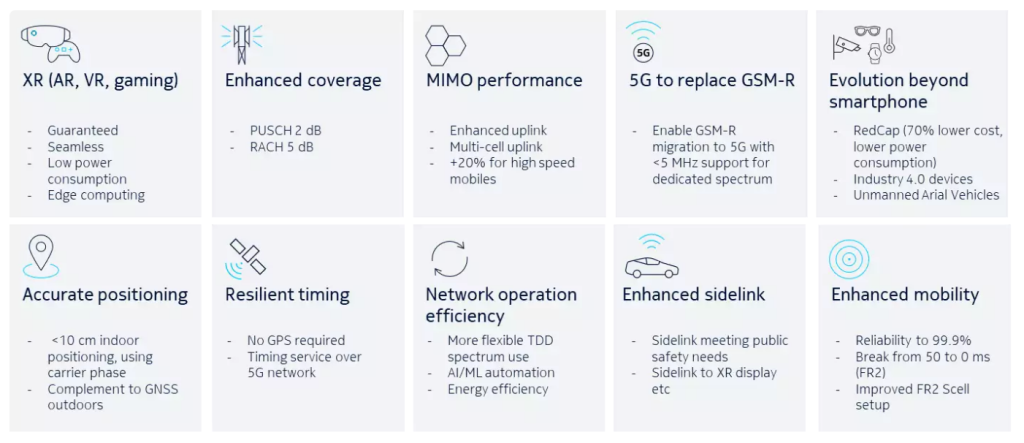

3GPP Release 18 and beyond (often referred to as 5G-Advanced or 5.5G) involve gradual technology improvements aimed at elevating 5G to the next level, creating a foundation for more demanding applications and a broader set of use cases. In addition to performance improvements and support for new applications, sustainability and intelligent network automation are also important building blocks in the broader 5G-Advanced vision (source: Ericsson).

The scope of 5G Advanced in Release 19 was approved at the December 2023 3GPP Plenary Meeting in Edinburgh, Scotland. Release 19 builds on Release 18 and focuses on enhancing 5G performance while expanding the capability of 5G across devices and deployments. In addition, it will establish the technical foundations for 6G and will include preliminary work on new 6G capabilities. Release 19 will be followed by Release 20, the first 3GPP release for 6G studies.

5G Advanced continues to push the spectral efficiency limits and coverage in both sub-7GHz and millimeter wave spectrum. In addition to continued enhancements to massive MIMO radios and mobility, 3GPP Release 19 provides advancements for new use cases such as XR and Non-Terrestrial Networks.

- Massive MIMO Radio – Release 18 introduced improvements to massive MIMO uplink and downlink throughput. Release 19 will boost capacity further by improving multi-user MIMO, which enables more UEs to share the same time and frequency resources.

Release 19 will also enable the cost-efficient realization of distributed transmitters and receivers, thus improving signal quality. This is an important step towards enabling fully distributed MIMO (D-MIMO) systems. Other enhancements include 5G beam management with UE-initiated measurement reporting, thus resulting in faster beam selection. - Mobility – 5G Advanced introduces a new handover procedure known as low-layer (i.e. L2) triggered mobility (LTM). In Release 18, LTM is supported between cells served by the same gNB. In Release 19, the LTM framework will be extended to support handover between cells served by different gNBs.

- XR and the Metaverse – Release 19 builds on the low latency and power saving features of Release 18 by enabling higher XR capacity by adding improved uplink and downlink scheduling using packet delay information.

- Non-Terrestrial Networks – 5G Advanced combines terrestrial and satellite communications under one standard for the first time. Release 19 will build on the enhancements introduced in Release 18 with a focus on increasing satellite downlink coverage, introducing UEs with higher output power and providing Redcap device support. It will also investigate whether additional support is required for regenerative payloads.

Current priorities for 5G-Advanced include:

- More capacity and better performance. Some estimates suggest that MIMO enhancements, better beam management, and full duplex technologies taken together with other advancements, including multi-band serving cell (MB-SC) and Extremely Large Antenna Array (ELAA) will deliver another 20% of efficiency improvements relative to today’s 5G. Enhanced uplink (UL) and multi-cell UL improvements could pave the way for greater data rate and latency improvements in the UL. For reference, Huawei defines 5G-Advanced as a site that can support at least 10 Gbps of cell capacity. ZTE is also targeting 10 Gbps+ with 5G-Advanced.

- Expanded coverage. In addition to MIMO and IAB coverage enhancements, 5G-Advanced includes Non-Terrestrial Network (NTN) connectivity improvements, building on the NR/LTE-based NTN support that was introduced with Release 17.

- More intelligence. Releases 15-17 already include some AI/ML features. 5G-Advanced will offer AI/ML enhancements in the RAN (including the air interface) and the management layers. In addition, Intelligent RAN and AI-powered analytics will help operators to improve the performance and proactively address network issues before they become a problem.

- Energy savings. Release 18 includes a confluence of static and dynamic power-saving enhancements for the radios and the overall RAN. Also, the specification is targeting to define a base station energy consumption model with various KPIs to better evaluate transmission and reception consumption/savings.

- Flexible spectrum (FD, DSS, CA). NR is currently based on TDD or FDD spectrum. Full duplex (FD), a 5G-Advanced contender, improves spectrum utilization by allowing UL and DL to share the same spectrum (FD should improve capacity and latency, especially in the UL). Release 18 also includes DSS capacity enhancements (increasing PDCCH capacity by allowing NR PDCCH to be transmitted in symbols overlapping with LTE CRS). Other spectrum-related upgrades with 5G-Advanced include multi-carrier enhancements and NR support for dedicated spectrum bandwidths below 5 MHz.

- Critical IoT. 5G-Advanced includes multiple industrial and IoT related advancements. Release 17 included support for Time Sensitive Networking (TSN), which will be expanded in 5G-Advanced to support Deterministic Networking (DetNet).

- RedCap IoT. 5G NR-Light or Reduced Capability (RedCap) was introduced with 3GPP NR Release 17. 5G-Advanced will introduce lower-tier RedCap devices, seeking to find a better set of tradeoffs between cost, performance, and power consumption.

- Ambient IoT. Passive IoT, sometimes referred to as Ambient IoT, will allow devices/objects to connect without a power source.

- Sensing. Harmonized communication and sensing (HCS) is a Release 19 study item.

- Positioning. Positioning is already supported in Release 16/17, though 5G-Advanced is expected to improve positioning accuracy and power consumption (Nokia has said sub-10 cm positioning is doable). In addition, Release 18 will include support for RedCap devices.

Role of AI/ML in 5G Advanced:

AI/ML will become a key feature of 5G networks with numerous applications ranging from network planning and network operations optimization to full network automation. Another important application is the use of AI/ML to improve the performance and functionality of the 5G air interface.

3GPP studied the use of AI/ML in the air interface in Release 18 and defined three use cases: channel state feedback (CSF) information, beam management and positioning. Based on the conclusions of Release 18 studies, Release 19 will specify a general AI/ML framework, i.e. actual specifications to support the above three use cases as well as specific support for each individual use case. Release 19 will also explore new areas in the AI/ML air interface such as mobility improvement and AI/ML-related model training, model management and global 5G data collection.

AI/ML is another major focus for Qualcomm. The company has dedicated significant technical resources to develop full-scale demonstrations of the three Release 18 defined use cases. For example, it recently demonstrated CSF-based cross-node machine learning involving E2E optimization between devices and the network. This reduces device communication overheads resulting in improved capacity and throughput. Qualcomm has also demonstrated the use of AI/ML to improve beam prediction on its 28GHz massive MIMO test network and is heavily involved in positioning technologies. For example, it has showcased its outdoor precise positioning technology, which uses multi-cell roundtrip (RTT) and angle-of-arrival (AoA) based technologies, as well as its RF finger printing technology operating in an indoor industrial private network.

Over the next few months, 3GPP will continue exploring the applicability of AI/ML based solutions for other use cases such as load balancing between cells, mobility optimization and network energy savings. For example, there will be support for conditional Layer 2 mobility in Release 19 and a new study item targeting new use cases designed to improve coverage and capacity optimization, such as AI-assisted dynamic cell shaping.

Enhancing Device and Network Sustainability:

5G Advanced focuses on sustainability and introduces energy-saving features for devices and networks as well as exploring end-to-end energy saving opportunities that benefit devices. There are also improved features for RedCap and the study of ambient IoT as a new device type.

- Power-optimized devices – Releases 18 and 19 build on existing energy saving features, for example, a new low-power wakeup signal (LP-WUS). A low-complexity, power-optimized receiver is specified to monitor low-power wake-up signals from the network which only wakes-up the main radio when data is available at the device. This avoids the significant power consumption required to keep the main radio monitoring control signals from the network.

- Ambient IoT – enables new use cases enabled by very-low power devices that harvest energy from the ambient environment, for example, RF waves. Release 19 will investigate new architectures for ambient IoT devices and will include the development of a harmonized specification. Numerous use cases will be studied, including smart agriculture, industrial wireless sensor networks, smart logistics, warehousing, etc.

- Network energy savings – 5G Advanced reduces network energy consumption by dynamically adjusting the network’s operation based on feedback from the device, i.e. shutting down parts of the network when idle and transmitting less power depending on the overall traffic load or using more efficient antennas.

Dell’Oro’s Stefan Pongratz says “one fundamental aspect of 5G-Advanced will be to support more demanding consumer MBB applications. The days of exponential data traffic growth are clearly in the past; however, global mobile data traffic is still projected to increase threefold over the next five years, reaching 0.5 ZB/month by 2028 (mobile plus FWA). While operators are currently in a fairly good position from a capacity perspective, especially those not aggressively pursuing FWA, some of the technology improvements with 5G-Advanced can help to address capacity limitations in hotspot areas.”

Omdia (owned by Omdia) expects leading network service providers in Asia and Oceania are expected to launch 5G-Advanced between 2024 and 2025. They aim to leverage the new capabilities and features offered by 5G-Advanced to enhance their network infrastructure and offer innovative services to their customers. These advancements include enhanced performance metrics such as higher data rates, lower latency, improved reliability, and greater network efficiency.

During the next few years, 5G Advanced will continue to evolve within 3GPP while the specification of 6G officially starts to ramp up in parallel, leading to the ITU-R IMT 2030 standard.

Setting The Stage For 6G:

Although Release 19 will be the last release focused on 5G, it will also include some longer-term technologies that will become the foundation of 6G, thus setting the direction for Release 20. For example, Integrated Sensing and Communications (ISAC), which combines wireless communications with RF sensing, will enable a raft of new position-based use cases. Release 19 will study channel characteristics suitable for the sensing of various objects, including vehicles, UAVs and humans. Full duplex, another 6G technology, allows transmitters and receivers to operate simultaneously on the same frequency, potentially resulting in a doubling of network capacity. Release 19 will study sub-band full duplex, a type of full duplex, which will improve capacity and latency, particularly for the uplink. Release 19 will also include channel model studies for the upper mid-band spectrum (7-16GHz), which will be supported by “Giga-MIMO” in the 6G timeframe, in order to enable wide-area coverage in this higher band.

Whereas AI/ML is a key pillar of 5G Advanced, it will be a core foundational technology of 6G and will underpin the key features that will make 6G revolutionary. For example, 6G will start to move away from the traditional, model-driven approach of designing communication systems and transition towards a more data-driven design. Indeed, it is likely that the 6G air-interface will be designed to be AI-native from the outset, thus signalling a paradigm change in the way communication systems are designed. An AI-native air interface could offer many benefits. For example, it could refine existing communication protocols by continuously learning and improving them, thereby enabling the air interface to be customized dynamically to suit local radio environments.

References:

NGMN issues ITU-R framework for IMT-2030 vs ITU-R WP5D Timeline for RIT/SRIT Standardization

Nokia plans to investment €360 million in microelectronics & 5G Advanced/6G technology in Germany

ZTE and China Telecom unveil 5G-Advanced solution for B2B and B2C services

ABI Research: 5G-Advanced (not yet defined by ITU-R) will include AI/ML and network energy savings

Draft new ITU-R recommendation (not yet approved): M.[IMT.FRAMEWORK FOR 2030 AND BEYOND]

Dell’Oro: Broadband access equipment sales to increase in 2025 led by XGS-PON deployments

Dell’Oro Group expects broadband access equipment sales to decline by 1% in 2024 versus 2023, with the first half of 2024 seeing continued weakness followed by a surge in spending in the second half of the year. The first half of 2024 will continue to see some of the inventory corrections that marked a tough 2023 that saw a spending decline of 8% to 10%, according to Dell’Oro VP Jeff Heynen.

“Although the inventory corrections seen in 2023 will continue through the first half of 2024, the second half of the year is expected to be the turning point towards renewed growth,” said Jeff Heynen, Vice President at Dell’Oro Group. “Service providers still have the same goals of increasing their fiber footprint, increasing the bandwidth they can offer their customers, and improving the reliability of their broadband services through the distribution of intelligence closer to subscribers,” added Heynen.

Additional highlights from the Broadband Access & Home Networking 5-Year January 2024 Forecast Report:

- PON equipment revenue is expected to grow from $10.8 B in 2023 to $11.8 B in 2028, driven largely by XGS-PON deployments in North America, EMEA, and CALA and early 50 Gbps deployments in China.

- Revenue for Cable Distributed Access Equipment (Virtual CCAP, Remote PHY Devices, Remote MAC/PHY Devices, and Remote OLTs) is expected to reach $1.3 B by 2028, as operators continue their DOCSIS 4.0 and early fiber deployments.

- Revenue for Fixed Wireless CPE is expected to reach $2.5 B by 2028, led by shipments of 5G sub-6GHz and a growing number of 5G Millimeter Wave units.

- Revenue for Wi-Fi 7 residential routers and broadband CPE with WLAN will reach $9.3B by 2028, as the technology is rapidly adopted by consumers and service providers alike.

Source: Dell’Oro Group

About the Report:

The Dell’Oro Group Broadband Access & Home Networking 5-Year Forecast Report provides a complete overview of the Broadband Access market with tables covering manufacturers’ revenue, average selling prices, and port/unit shipments for PON, Cable, Fixed Wireless, and DSL equipment. Covered equipment includes Converged Cable Access Platforms (CCAP), Distributed Access Architectures (DAA), DSL Access Multiplexers (DSLAMs), PON Optical Line Terminals (OLTs), Customer Premises Equipment ([CPE] for Cable, DSL, PON, Fixed Wireless), along with Residential WLAN Equipment, including Wi-Fi 6E and Wi-Fi 7 Gateways and Routers. For more information about the report, please contact [email protected].

References:

Calix and Corning Weigh In: When Will Broadband Wireline Spending Increase?

Dell’Oro: Broadband network equipment spending to drop again in 2024 to ~$16.5 B

Dell’Oro: Broadband Equipment Spending to exceed $120B from 2022 to 2027

Dell’Oro: XGS, 25G, and Early 50G PON Rollouts to Fuel Broadband Spending

Alaska Communications uses XGS-PON, FWA, DSL in ~5K homes including Fairbanks and North Pole

AT&T to deploy FTTP network based on XGS-PON in Amarillo, TX

Telefonica España to activate XGS-PON network in 2022; DELTA Fiber to follow in Netherlands

Dell’Oro: Broadband network equipment spending to drop again in 2024 to ~$16.5 B

Executive Summary:

Operator spending on broadband network equipment will remain sluggish well into 2024, forecasts Dell’Oro’s Jeff Heynen. “Inventory Correction, Inventory Realignment,” or whatever term you prefer to call the root cause of 2023’s broadband spending slowdown will likely persist well into 2024, he wrote. Without the benefit of fourth quarter numbers, total spending on broadband equipment in 2023 is expected to show a decline of around 10%. Early projections for 2024 indicate an additional 5% year-over-year decrease, as the lagging impact of interest rate increases to curb inflation will be felt more acutely. This additional 5% decrease would put total spending to around $16.5 B—roughly equal to 2021 spending levels.

The expected declines in 2023 and 2024 follow three straight years of white-hot growth in broadband network and service investments from 2020 to 2022. During this period, year-over-year growth rates reached 9%, 15%, and 17%, respectively. Similar periods of growth from 2003-2006 and 2010-2014 were both followed by two subsequent years of reduced spending, as operators—particularly in China—shifted their capital expenditure focus from broadband to mobile RAN.

However, there are signs of a return to growth in 2025 as money from BEAD and other broadband subsidy programs trickle down to broadband equipment suppliers. Well before that, pockets of growth in fixed wireless CPE, cable DAA equipment and CPE, and continued spending on PON equipment by tier 2 and tier 3 operators should make the broadband market one in which the headlines might communicate malaise, but a peek under the hood shows clear signs of resilience powering an inevitable return to growth.

Cable Operators Travel Different Paths to Fend off Fixed Wireless and Fiber:

Just like last year, in the minds of cable consumers, cable operators find themselves stuck battling against the perception that they are the provider with inferior copper technology that can’t be flexible when it comes to offering plans that meet a consumer’s budget, like fixed wireless currently can. As a result of this situation, larger cable operators are seeing increased broadband subscriber churn and quarters of net subscriber losses.

Comcast is pushing hard to counter those perceptions and is already offering its X-Class Internet tiers, which offer symmetrical speeds of 2 Gbps in Atlanta, Colorado Springs, and Philadelphia. Additional cities are expected to roll out these service tiers in 2024. Comcast’s use of full-duplex DOCSIS 4.0 (FDX), including brand new CPE using Broadcom’s D4.0 silicon in a two-box configuration. Later this year, we expect to see a combined gateway that also incorporates Wi-Fi 7, as Comcast looks to battle back against FTTH providers by providing the most advanced residential gateway to customers.

Meanwhile, in 2024, Charter’s Remote PHY and vCMTS rollouts will kick into high gear. (At the time of this publication, we are awaiting fourth quarter earnings from both Harmonic and Vecima, the announced RPD partners for Charter’s buildout to determine how much equipment the operator purchased in advance of this significant deployment.) For Charter, which is employing Extended Spectrum DOCSIS 4.0, 2024 will also bring much wider availability of 1.8 GHz amplifiers and taps, as well as a choice of CPE with dedicated silicon for ESD, as well as silicon that combines both FDX and ESD variants.

Charter will likely also announce additional vendors for its upgrade efforts, as the operator has been public about its desire for a multi-vendor environment.

Cox will also begin rolling out 1.8 GHz amplifiers this year but, like Charter, will likely run those at 1.2 GHz until taps and CPE become more widely available.

Meanwhile, for those operators that weren’t part of the initial DOCSIS 4.0 Joint Development Agreement (JDA) with Broadcom (and for some of those who were), DOCSIS 3.1 Plus is quickly becoming an important stopgap measure to help increase throughput within the existing DOCSIS 3.1 framework by leveraging additional OFDM channels. Operators can either use existing integrated CCAP chassis (with either legacy line cards supporting 3 OFDM blocks or newer cards supporting 4 OFDM blocks) or vCMTS platforms. This can be combined with either DOCSIS 4.0 modems or modems designed specifically for D3.1 Plus deployments, which won’t require the additional gain amplifier (and cost) needed for full DOCSIS 4.0.

While it remains to be seen which type of CPE operators deploying DOCSIS 3.1 Plus will move forward with, the fact that there is significant interest in the technology means that there will now be additional operators who will likely move on from DOCSIS 4.0 and instead buy themselves time with DOCSIS 3.1 Plus before moving forward with fiber overbuilds. The biggest question here is just how many operators will do so.

As Light Reading previously reported, Broadcom and MaxLinear are working on new D3.1 chipsets that can beef up downstream capacity and speed through the support of additional OFDM (orthogonal frequency-division multiplexing) channels. Some operators are likewise exploring the deployment of new D4.0 modems on their D3.1 networks to achieve similar capacity gains.

That approach could extend the life of DOCSIS 3.1 networks, delay D4.0 upgrades or become an interim step before a future leap to fiber-to-the-premises. But it’s still not clear how many operators will pursue this path.

Heynen expects to see additional FTTH deployments—both greenfield and overbuild—by cable operators around the world. Whether using Remote OLT platforms or more traditional OLT platforms, cable operators will take advantage of work being done at CabeLabs to standardize the integration of ITU-T PON recommendations into existing DOCSIS management frameworks. This will make it far easier for MSOs (aka Cablecos) to deploy XGS-PON, as well as 25GS-PON and, potentially 50G- and 100G-PON.

XGS-PON to Dominate Fiber Spend This Year:

The PON equipment market will be the most dynamic this year, with tier 1 operators besides of BT OpenReach and Deutsche Telekom, all continuing to better align their inventories with anticipated subscriber growth, as well as reduced homes passed goals. For larger tier 1s, the short-term reduction in homes passed goals will ultimately give way to a renewed construction phase beginning in 2025 that should propel the overall PON market through the end of the decade.

But while the tier 1s slow, there will be no slowing the continued efforts by tier 2 and tier 3 operators in both North America and Europe to both upgrade and expand their fiber networks. In fact, the same dynamic that played out in North America in 2023 will likely repeat in 2024, as tier 2, tier 3, utilities, municipalities, and co-ops all continue their buildouts.

The technology beneficiary will be XGS-PON, which already surpassed 2.5 Gbps GPON revenue back in 2022, but will more than double it in 2024. And in markets where operators are beginning to see cable operators deliver symmetric 2 Gbps services, there is a strong chance they will also sprinkle in some 25GS-PON to comfortably deliver symmetric 5-10 Gbps services.

Meanwhile in China, which is expected to show a marked decline in new OLT port shipments in 2023, will likely see another decline until 50G-PON rollouts begin in earnest later this decade. On the flip side, ONT unit shipments in China are expected to increase as FTTR (Fiber to the Room) deployments expand, delivering 2-3 ONTs per home as opposed to the traditional architecture of using a single ONT to terminate fiber.

Wi-Fi 7 Progress Will Accelerate:

With the Wi-Fi Alliance recently announcing the opening of certification testing for Wi-Fi 7 products, don’t be surprised to see dozens of Wi-Fi 7 residential routers and broadband CPE models being deployed by operators by the end of this year. Early gateway models, though pricey, have already been introduced to the market and will become much more widely available this Spring, and then well before the Holiday season. As of our July 2023 forecast, we expect over 2.5 million residential Wi-Fi routers and broadband gateways to ship in 2024, though we are undoubtedly increasing this forecast based on the certification testing opening up.

Operators can’t wait to deploy Wi-Fi 7 products to help differentiate themselves in increasingly crowded broadband markets and to eliminate much of the confusion in the market with the coexistence of Wi-Fi 6 and Wi-Fi 6E.

References:

2024 Outlook: Broadband Market Faces Challenge Amidst Lower Spending from 2023

https://www.lightreading.com/broadband/broadband-equipment-spending-to-dip-again-in-2024-dell-oro

Dell’Oro: Broadband Equipment Spending to exceed $120B from 2022 to 2027

MTN Consulting: Top Telco Network Infrastructure (equipment) vendors + revenue growth changes favor cloud service providers

Dell’Oro: U.S. suppliers ~20% of global telecom equipment market; struggling in RAN business

Dell’Oro: Worldwide Telecom Equipment Market Growth +3% in 2022; MTN: +2% Network Infrastructure Growth in 2022

Dell’Oro: XGS, 25G, and Early 50G PON Rollouts to Fuel Broadband Spending

Dell’Oro: U.S. suppliers ~20% of global telecom equipment market; struggling in RAN business

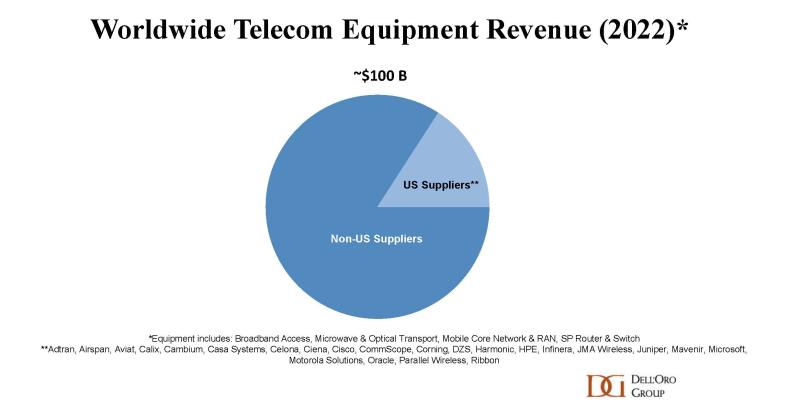

According to Stefan Pongratz of Dell’Oro, U.S. suppliers collectively accounted for around 16% of the global telecom equipment market in 2022, underpinned by strong presence in broadband access, optical transport and Service Provider Routers. Not surprisingly, this global view is masking the progress to some degree. If we exclude China, we estimate that the 20+ American suppliers comprise ~20% of the broader telecom equipment market.

U.S. suppliers appear to be struggling more in the RAN market. Per Dell’Oro’s 4Q22 RAN report, the American-based vendors still accounted for less than 1% of the global RAN market in 2022. Even if China is removed, the aggregate revenue share remains in the same range.

…………………………………………………………………………………………………………………………………………………………………….

Editor’s Note: The big 5 have dominated the global RAN market for over 15 years. Huawei, Ericsson, Nokia, ZTE, and Samsung together have about 95% of the global RAN market. Pongratz expects global RAN revenues to decline at a low-single-digit rate for 2023, with a surge in spending from India-based operators to fuel their 5G plans offset by dropping demand in China, Europe, and North America.

“After four years of extraordinary growth that catapulted the RAN market to record levels in 2021, the RAN market is now entering a new phase,” Pongratz wrote. “Even with 5G still increasing at a healthy pace, comparisons are more challenging and the implication for the broader RAN market is that growth is decelerating.”

…………………………………………………………………………………………………………………………………………………………………….

Dell’Oro estimates that the collective RAN revenues for the U.S. suppliers had an increased of 60% in 2022 relative to 2020, in part because of the improved entry points with Open RAN. U.S. network equipment vendors are fairly optimistic about the growth prospects:

- Mavenir is targeting 30%+ growth in 2023. While the mobile core network continues to drive the lion’s share of its revenue mix, Mavenir’s 10,000+ macro-site brownfield pipeline is expected to play a pivotal role in reaching this $1 billion group revenue target for FY23.

- Celona is working with 100+ customers and has seen a 300%+ increase in the number of connected devices across its 5G installed base. The vendor is now targeting to more than double its revenues this fiscal year.

- JMA has not shared any growth objectives for its wireless business. Even so, the vendor has announced multiple DoD wins and believes its all-American team is well positioned to support advanced private 5G networks for the U.S. government.

- Verana Networks is set to work on a trial with Verizon later this year.

- Dell is planning to enter the vRAN market over the next year, allegedly.

- Airspan’s equipment and software revenue growth slowed in 2022. Still, trial activity is on the rise and Airspan remains hopeful that its 400+ private network wins will soon have a more meaningful impact on the topline.

At the same time, it is early days in this process of re-shaping the RAN. And even if global market concentration as measured by the Herfindahl-Hirschman Index (HHI) is actually trending in the right direction, vendors with smaller footprints are still trying to figure out the best near-term and long-term approaches to improve their respective RAN positions – some think that open RAN can be an entry point for brownfield macro opportunities while others believe the likelihood of winning is greater in greenfield settings (public or private).

Open RAN might help to open the door, but this movement does not change the fact that RAN remains a scale game and double-digit RAN revenue shares are still required to maintain competitive portfolios.

Currently, this vendor asymmetry between RAN and the broader telecom equipment market then also implies that the U.S. suppliers are actually doing rather well beyond the wireless scope. In fact, if we remove the RAN from the picture, we estimate that the U.S. vendors accounted for around a fourth of the global non-RAN telecom equipment market. Better yet, if we take it one step further and also strip out China, the data shows that the American team comprised around one third of the non-RAN telco equipment market excluding China.

Dell’Oro’s assessment is that the U.S. suppliers hold a strong position in the non-RAN telecom equipment market. When it comes to RAN, however, the data shows that the American-based suppliers are moving in the right direction, especially in private wireless. But the overall progress has been slow, and it is still a long road ahead before we can establish that the U.S. suppliers are back at full speed in the broader public plus private 5G RAN business

…………………………………………………………………………………………………………………………………………………………

Stefan Pongratz is a vice president at the Dell’Oro Group. He joined Dell’Oro in 2010 after spending 10 years with the Anritsu Company. Pongratz is responsible for the firm’s Radio Access Network and Telecom Capex programs and has authored advanced research reports on the wireless market assessing the impact and the market opportunity with small cells, C-RAN, 5G, IoT and CBRS.

References:

https://www.fiercewireless.com/wireless/what-state-us-ran-and-non-ran-suppliers-pongratz

Dell’Oro: Worldwide Telecom Equipment Market Growth +3% in 2022; MTN: +2% Network Infrastructure Growth in 2022

Dell’Oro: Private 5G ecosystem is evolving; vRAN gaining momentum; skepticism increasing

Dell’Oro: 5G RAN growing; total RAN growth is slowing over next 5 years

Dell’Oro: RAN Market Disappoints in 2Q-2022

Dell’Oro: Market Forecasts Decreased for Mobile Core Network and Private Wireless RANs

Gartner: AWS, Azure, and Google Cloud top rankings for Cloud Infrastructure and Platform Services

Gartner’s latest Magic Quadrant report for cloud infrastructure and platform services (CIPS) ranks Amazon Web Services (AWS), Microsoft Azure, and Google Cloud as the top cloud service providers.

Beyond the top three players, Gartner placed Alibaba Cloud in the “visionaries” box, and ranked Oracle, Tencent Cloud, and IBM as “niche players,” in that order.

The scope of Gartner’s Magic Quadrant for CIPS includes infrastructure as a service (IaaS) and integrated platform as a service (PaaS) offerings. These include application PaaS (aPaaS), functions as a service (FaaS), database PaaS (dbPaaS), application developer PaaS (adPaaS) and industrialized distributed cloud offerings that are often deployed in enterprise data centers (i.e. private clouds).

Figure 1: Magic Quadrant for Cloud Infrastructure and Platform Services

……………………………………………………………………………………………..

……………………………………………………………………………………………..

1. Gartner analysts praise Amazon AWS for its broad support of IT services, including cloud native, edge compute, and processing mission-critical workloads. Also noteworthy is Amazon’s “engineering prowess” in designing CPUs and silicon. This focus on owning increasingly larger portions of the supply chain for cloud infrastructure bolsters the No. 1 cloud provider’s long-term outlook and earns it advantages against competitors, according to the Gartner report.

“AWS often sets the pace in the market for innovation, which guides the roadmaps of other CIPS providers. As the innovation leader, AWS has materially more mind share across a broad range of personas and customer types than all other providers,” the analysts wrote.

AWS, which recently achieved $59 billion in annual revenues, contributed 13% of Amazon’s total revenue and almost 54% of its profit during second-quarter 2021.

AWS’s future focus is on attempting to own increasingly larger portions of the supply chain used to deliver cloud services to customers. Its operations are geographically diversified, and its clients tend to be early-stage startups to large enterprises.

……………………………………………………………………………………

2. Microsoft Azure, which remains the #2 Cloud Services Provider, sports a 51% annual growth rate. It earned praise from Gartner for its strength “in all use cases, which include the extended cloud and edge computing,” particularly among Microsoft-centric organizations.

The No. 2 public cloud provider also enjoys broad appeal. “Microsoft has the broadest set of capabilities, covering a full range of enterprise IT needs from SaaS to PaaS and IaaS, compared to any provider in this market,” the analysts wrote.

Microsoft has the broadest sets of capabilities, covering a full range of enterprise IT needs from SaaS to PaaS and IaaS, compared to any provider in this market. From the perspective of IaaS and PaaS, Microsoft has compelling capabilities ranging from developer tooling such as Visual Studio and GitHub to public cloud services.

Enterprises often choose Azure because of the trust in Microsoft built over many years. Such strategic alignment with Microsoft gives Azure advantages across nearly every vertical market.

“Strategic alignment with Microsoft gives Azure advantages across nearly every vertical market,” Gartner said. However, Gartner criticized Microsoft for very complex licensing and contracting. Also, Microsoft sales pressures to grow overall account revenue prevent it from effectively deploying Azure to bring down a customer’s total Microsoft costs.

Microsoft Azure’s forays in operational databases and big data solutions have been markedly successful over the past year. Azure’s Cosmos DB and its joint offering with Databricks stand out in terms of customer adoption.

………………………………………………………………………………………

3. Google Cloud Platform (GCP) is strong in nearly all use cases and is slowly improving its edge compute capabilities. Google continues to invest in being a broad-based provider of IaaS and PaaS by expanding its capabilities as well as the size and reach of its go-to-market operations. Its operations are geographically diversified, and its clients tend to be startups to large enterprises.

The company is making gains in mindshare among enterprises and “lands at the top of survey results when infrastructure leaders are asked about strategic cloud provider selection in the next few years,” Gartner analysts wrote. Google is also closing “meaningful gaps with AWS and Microsoft Azure in CIPS capabilities,” and outpacing its larger competitors in some cases, according to the report.

The analysts also noted that Google Cloud “is the only CIPS provider with significant market share that currently operates at a financial loss.” The No. 3 public cloud provider reported a 54% year-over-year revenue increase and a 59% decrease in operating losses during Q2.

………………………………………………………………………………..

Separately, Dell’Oro Group Research Director Baron Fung recently said that hyperscalers make up a big portion of the overall IT market, with the 10 largest cloud-service providers, including AWS, Google, and Alibaba, accounting for up to 40% of global data center spending, and “some of these companies can have really tremendous weight on the ecosystem.”

The Dell’Oro report noted that some providers have deployed accelerated servers using internally developed artificial intelligence (AI) chips, while other cloud providers and enterprises have commonly deployed solutions based on graphics processing units (GPUs) and FPGAs.

Fung explained that this model has also spilled over into those cloud providers also building their own servers and networking equipment to better fit their needs while “moving away from the traditional model in which users are buying equipment from companies like Dell and [Hewlett Packard Enterprise]. … It’s really disrupting the vendor landscape.”

Certain applications—such as cloud gaming, autonomous driving, and industrial automation—are latency-sensitive, requiring Multi-Access Edge Compute, or MEC, nodes to be situated at the network edge, where sensors are located. Unlike cloud computing, which has been replacing enterprise data centers, edge computing creates new market opportunities for novel use cases.

…………………………………………………………………………………

References:

https://www.gartner.com/doc/reprints?id=1-26YXE86I&ct=210729&st=sb

Dell’Oro: Telecom equipment revenues to grow 5% through 2020; Huawei increases market share

Dell’Oro analysts say first half global telecom equipment [1.] revenues were up 4% YoY in 1st half of 2020, as 5G infrastructure investments offset declines due to the impact of the coronavirus pandemic. The market research firm forecasts a 5% advance for the entire year.

Rollouts of 5G wireless, especially in China, were a primary cause of the first half increases, which benefit the entire supply chain, including telecommunications semiconductors. China 5G spending surely helped Huawei increase its market share, despite U.S. sanctions.

Note 1. Dell’Oro includes the following types in the telecom equipment market: Broadband Access, Microwave & Optical Transport, Mobile Core & Radio Access Network, SP Router & Carrier Ethernet Switch

In the first half of 2020, double digit growth in mobile infrastructure offset declining investments in broadband access, microwave and optical transport and service provider routers and ethernet switches, Dell’Oro said. Statista analysts in June said 2020 telecom equipment revenues should nearly reach $50 billion.

Rankings of the biggest telecom equipment providers remained the same in the first half of 2020, with Huawei dominating at 31%, followed by Nokia and Ericsson tied at 14% each, then ZTE at 11% and Cisco at 6%, according to Dell’Oro.

Second quarter results were stronger than expected following a 4% decline in the first quarter. The biggest driver was a strong rebound in China across 5G Radio Access Network, 5G Core and other areas. Supply chain disruptions of the first quarter also stabilized in the second quarter, Dell’Oro said.

Additional key takeaways from the 2Q20 reporting period include:

- Following the 4% Y/Y decline during 1Q20, the overall telecom equipment market returned to growth in the second quarter, with particularly strong growth in mobile infrastructure and slower but positive growth for Optical Transport and SP Routers & CES, which was more than enough to offset weaker demand for Broadband Access and Microwave Transport.

- For the 1H20 period, double-digit growth in mobile infrastructure offset declining investments in Broadband Access, Microwave and Optical Transport, and SP Routers & CES.

- The results in the quarter were stronger than expected, driven by a strong rebound in China across multiple technology segments including 5G RAN, 5G Core, GPON, SP Router & CES, and Optical Transport.

- Also helping to explain the output acceleration in the quarter was the stabilization of various supply chain disruptions that impacted the results for some of the technology segments in the first quarter.

- Shifting usage patterns both in terms of location and time and surging Internet traffic due COVID-19 has resulted in some infrastructure capacity upside, albeit still not proportional to the overall traffic surge, reflecting operators ability to address traffic increases and dimension the network for additional peak hours throughout the day using a variety of tools.

- Even though the pandemic is still inflicting high human and economic losses, the Dell’Oro analyst team believes the more upbeat trends in the second quarter will extend to the second half, propelling the overall telecom equipment market to advance 5% in 2020.

Semiconductor officials are less optimistic for the rest of the year with SIA President John Neuffer recent saying “substantial market uncertainty remains for the rest of the year.” Semiconductor sales were up 5% in July, reaching $35 billion, but dropped in early August, according to reports.

According to the Semiconductor Industry Association, about 33% of all semiconductors made (the largest category) are devoted to communications, including networking equipment and radios in smartphones.

…………………………………………………………………………………………………………………………………………………………………………………………………….

References:

https://www.fierceelectronics.com/electronics/telecom-equipment-revenues-to-grow-5-through-2020