AI Frenzy Backgrounder; Review of AI Products and Services from Nvidia, Microsoft, Amazon, Google and Meta; Conclusions

Backgrounder:

Artificial intelligence (AI) continues both to astound and confound. AI finds patterns in data and then uses a technique called “reinforcement learning from human feedback.” Humans help train and fine-tune large language models (LLMs). Some humans, like “ethics & compliance” folks, have a heavier hand than others in tuning models to their liking.

Generative Artificial Intelligence (generative AI) is a type of AI that can create new content and ideas, including conversations, stories, images, videos, and music. AI technologies attempt to mimic human intelligence in nontraditional computing tasks like image recognition, natural language processing (NLP), and translation. Generative AI is the next step in artificial intelligence. You can train it to learn human language, programming languages, art, chemistry, biology, or any complex subject matter. It reuses training data to solve new problems. For example, it can learn English vocabulary and create a poem from the words it processes. Your organization can use generative AI for various purposes, like chatbots, media creation, and product development and design.

Review of Leading AI Company Products and Services:

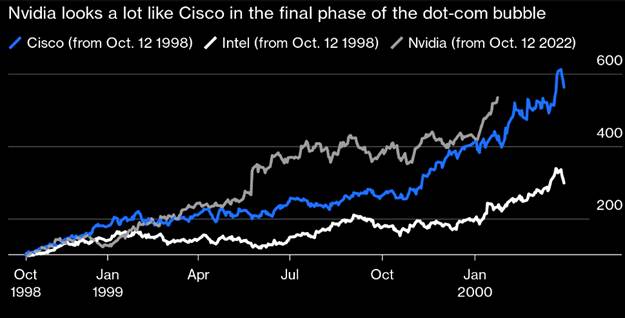

1. AI poster child Nvidia’s (NVDA) market cap is about $2.3 trillion, due mainly to momentum-obsessed investors who have driven up the stock price. Nvidia currently enjoys 75% gross profit margins and has an estimated 80% share of the Graphic Processing Unit (GPU) chip market. Microsoft and Facebook are reportedly Nvidia‘s biggest customers, buying its GPUs last year in a frenzy.

Nvidia CEO Jensen Huang talks of computing going from retrieval to generative, which investors believe will require a long-run overhaul of data centers to handle AI. All true, but a similar premise about an overhaul also was true for Cisco in 1999.

During the dot-com explosion in the late 1990s, investors believed a long-run rebuild of telecom infrastructure was imminent. Worldcom executives claimed that internet traffic doubled every 100 days, or about 3.5 months. The thinking at that time was that the whole internet would run on Cisco routers at 50% gross margins.

Cisco’s valuation at its peak of the “Dot.com” mania was at 33x sales. CSCO investors lost 85% of their money when the stock price troughed in October 2002. Over the next 16 years, as investors waited to break even, the company grew revenues by 172% and earnings per share by a staggering 681%. Over the last 24 years, CSCO buy and hold investors earned only 0.67% per year!

2. Microsoft is now a cloud computing/data-center company, more utility than innovator. Microsoft invested $13 billion in OpenAI for just under 50% of the company to help develop and roll out ChatGPT. But much of that was funny money — investment not in cash but in credits for Microsoft‘s Azure data centers. Microsoft leveraged those investments into super powering its own search engine, Bing, with generative AI which is now called “Copilot.” Microsoft spends a tremendous amount of money on Nvidia H100 processors to speed up its AI calculations. It also has designed its own AI chips.

3. Amazon masquerades as an online retailer, but is actually the world’s largest cloud computing/data-center company. The company offers several generative AI products and services which include:

- Amazon CodeWhisperer, an AI-powered coding companion.

- Amazon Bedrock, a fully managed service that makes foundational models (FMs) from AI21 Labs, Anthropic, and Stability AI, along with Amazon’s own family of FMs, Amazon Titan, accessible via an API.

- A generative AI tool for sellers to help them generate copy for product titles and listings.

- Generative AI capabilities that simplify how Amazon sellers create more thorough and captivating product descriptions, titles, and listing details.

Amazon CEO Jassy recently said the the company’s generative AI services have the potential to generate tens of billions of dollars over the next few years. CFO Brian Olsavsky told analysts that interest in Amazon Web Services’ (AWS) generative AI products, such as Amazon Q and AI chatbot for businesses, had accelerated during the quarter. In September 2023, Amazon said it plans to invest up to $4 billion in startup chatbot-maker Anthropic to take on its AI based cloud rivals (i.e. Microsoft and Google). Its security teams are currently using generative AI to increase productivity

4. Google, with 190,000 employees, controls 90% of search. Google‘s recent launch of its new Gemini AI tools was a disaster, producing images of the U.S. Founding Fathers and Nazi soldiers as people of color. When asked if Elon Musk or Adolf Hitler had a more negative effect on society, Gemini responded that it was “difficult to say.” Google pulled the product over “inaccuracies.” Yet Google is still promoting its AI product: “Gemini, a multimodal model from Google DeepMind, is capable of understanding virtually any input, combining different types of information, and generating almost any output.”

5. Facebook/Meta controls social media but has lost $42 billion investing in the still-nascent metaverse. Meta is rolling out three AI features for advertisers: background generation, image cropping and copy variation. Meta also unveiled a generative AI system called Make-A-Scene that allows artists to create scenes from text prompts . Meta’s CTO Andrew Bosworth said the company aims to use generative AI to help companies reach different audiences with tailored ads.

Conclusions:

Voracious demand has outpaced production and spurred competitors to develop rival chips. The ability to secure GPUs governs how quickly companies can develop new artificial-intelligence systems. Tech CEOs are under pressure to invest in AI, or risk investors thinking their company is falling behind the competition.

As we noted in a recent IEEE Techblog post, researchers in South Korea have developed the world’s first AI semiconductor chip that operates at ultra-high speeds with minimal power consumption for processing large language models (LLMs), based on principles that mimic the structure and function of the human brain. The research team was from the Korea Advanced Institute of Science and Technology.

While it’s impossible to predict how fast additional fabricating capacity comes on line, there certainly will be many more AI chips from cloud giants and merchant semiconductor companies like AMD and Intel. Fat profit margins Nvidia is now enjoying will surely attract many competitors.

………………………………………………………………………………….,……………………………………….

References:

https://www.zdnet.com/article/how-to-use-the-new-bing-and-how-its-different-from-chatgpt/

https://cloud.google.com/ai/generative-ai

https://aws.amazon.com/what-is/generative-ai/

https://www.wsj.com/articles/amazon-is-going-super-aggressive-on-generative-ai-7681587f

Curmudgeon: 2024 AI Fueled Stock Market Bubble vs 1999 Internet Mania? (03/11)

Korea’s KAIST develops next-gen ultra-low power Gen AI LLM accelerator

Telco and IT vendors pursue AI integrated cloud native solutions, while Nokia sells point products

MTN Consulting: Generative AI hype grips telecom industry; telco CAPEX decreases while vendor revenue plummets

Proposed solutions to high energy consumption of Generative AI LLMs: optimized hardware, new algorithms, green data centers

Amdocs and NVIDIA to Accelerate Adoption of Generative AI for $1.7 Trillion Telecom Industry

Cloud Service Providers struggle with Generative AI; Users face vendor lock-in; “The hype is here, the revenue is not”

Global Telco AI Alliance to progress generative AI for telcos

Bain & Co, McKinsey & Co, AWS suggest how telcos can use and adapt Generative AI

Generative AI Unicorns Rule the Startup Roost; OpenAI in the Spotlight

Generative AI in telecom; ChatGPT as a manager? ChatGPT vs Google Search

Generative AI could put telecom jobs in jeopardy; compelling AI in telecom use cases

Impact of Generative AI on Jobs and Workers

7 thoughts on “AI Frenzy Backgrounder; Review of AI Products and Services from Nvidia, Microsoft, Amazon, Google and Meta; Conclusions”

Comments are closed.

Orange CTO Bruno Zerbib clearly belongs in the camp of the Nvidia skeptics.

“This is a very weird moment in time where power is very expensive, natural resources are scarce and GPUs are extremely expensive,” he told Light Reading during an interview at this year’s Mobile World Congress, held last month in Barcelona. “You have to be very careful with our investment because you might buy a GPU product from a famous company right now that has a monopolistic position.” Low-cost alternatives are coming, said Zerbib.

He is not the only telco individual right now who sounds worried about this Nvidia monopoly. The giant US chipmaker’s share price has doubled since mid-October, valuing Nvidia at nearly $2.2 trillion on the Nasdaq. But a 6% drop on March 8, sparked by wider economic concerns, illustrates its volatility. Its gross margin, meanwhile, has rocketed by 10 percentage points in just two years. The 77% figure it reported last year screams monopoly. And Nvidia controls not just the GPUs but also the Infiniband technology that connects clusters of them in data centers. Howard Watson, who does Zerbib’s job at the UK’s BT, wants to see Ethernet grow muscle as an Infiniband alternative.

But Zerbib spies the arrival of alternatives to GPUs “for a fraction of the price, with much better performance” in the next couple of years. In his mind, that would make an Orange investment in GPUs now a very bad bet. “If you invest the money at the wrong time, depreciation might be colossal and the write-off could be huge,” he said.

What, then, could be the source of these GPU rivals? Established chipmakers and chip design companies such as Intel and Arm have pitched other platforms for AI inferencing. But disruption is likely to come from the hyperscalers or the startups they eventually buy, according to Zerbib. “Right now, the hyperscalers are spending billions on this,” he said. “There are startups working on alternatives, waiting to be acquired by hyperscalers, and then you are going to have layers of optimization.”

While Zerbib did not throw out any names, Google’s own tensor processing units (TPUs) have already been positioned as a GPU substitute for some AI workloads. More intriguing is a startup called Groq, founded in 2016 by Jonathan Ross, an erstwhile Google executive who led the development of those TPUs. Tareq Amin, the CEO of Aramco Digital and a former telco executive (at Japan’s Rakuten), thinks Groq’s language processing units (LPUs) might be more efficient than GPUs for AI at the edge.

Efficiency is paramount for Zerbib as Orange strives to reach a “net zero” target by 2040. “We need to reduce by ten the amount of resource consumption for a given number of parameters,” he said. “It is unacceptable. Right now, we are going to hit a wall. We cannot talk about sustainability and then generate a three-minute video that is equivalent to someone taking a car and doing a long trip. It makes no sense.”

Orange appears to have no interest in building an LLM from scratch. Instead, Zerbib is an advocate of fine-tuning for telecom purposes the LLMs that already exist.

Orange has, accordingly, spent money on building an AI tool it can effectively plug into the most appropriate LLM for any given scenario. “We have built internally a tool that is an abstraction layer on top of all those LLMs and based on the use case is going to route to the right LLM technology,” said Zerbib. “We are very much proponents of open models, and we believe that we need to take huge models that have been trained at scale by people that have invested billions in infrastructure.”

The most obvious AI attractions are still on the cost side. AI-generated insights should clearly help telcos reduce customer churn, minimize network outages and “essentially extract more value from the infrastructure for the same amount of capital investment,” as Zerbib describes it. The telco dream, though, is of AI as a catalyst for sales growth. “There is a question mark with slicing, with the emergence of new use cases and low-latency capabilities,” said Zerbib. “We might be able to monetize that.” Conscious of the telecom sector’s historical tendency to oversell, Zerbib is – for now – putting a heavy emphasis on that “might.”

https://www.lightreading.com/ai-machine-learning/orange-cto-now-s-not-the-time-to-invest-in-nvidia-chips-for-ai

Oracle claims to have a unique approach to AI

https://www.oracle.com/artificial-intelligence/

Their “Select AI” makes it easy to query your data using natural language

https://blogs.oracle.com/machinelearning/post/announcing-select-ai-with-azure-openai-service

You can now use Select AI with Microsoft Azure OpenAI Service

Cisco and NVIDIA to Help Enterprises Quickly and Easily Deploy and Manage Secure AI Infrastructure

-Companies to offer enterprises simplified cloud-based and on-premises AI infrastructure, networking and software, including infrastructure management, secure AI infrastructure, observable end-to-end AI solutions and access to NVIDIA AI Enterprise software that supports the building and deployment of advanced AI and generative AI workloads.

-Cisco and NVIDIA’s purpose-built Ethernet networking-based solutions will be sold through Cisco’s vast global channel, offering professional services and support through key partners who are committed to helping businesses deploy their GPU clusters via Ethernet infrastructure.

-The collaboration has attracted key customers like ClusterPower, a cloud services provider in Europe, to help drive data center operations with innovative AI/ML solutions that are foundational for its client infrastructure and services.

https://newsroom.cisco.com/c/r/newsroom/en/us/a/y2024/m02/cisco-nvidia-ai-collaboration.html

AI from Dell Technologies: https://www.dell.com/en-us/dt/solutions/artificial-intelligence/index.htm

AI from IBM: https://www.ibm.com/artificial-intelligence

AI from Juniper: https://www.juniper.net/us/en/forms/wired-wireless-aide-demos.html

AI from HPE (acquiring Juniper): https://www.hpe.com/us/en/solutions/ai-artificial-intelligence.html

At its GTC meeting this week, Nvidia included the first official details of the company’s Blackwell B100 systems, which will succeed its popular H100 systems that have become the workhorse of generative AI workloads. Even those chips are still catching up with demand.

The bigger risk for Nvidia—or at least to the incredible sales momentum it has been enjoying of late—is if the generative AI services being propagated by companies such as Microsoft, Google, Amazon, Meta Platforms and Adobe see tepid demand from consumers and business customers. Adobe’s first-quarter report last week fell flat with investors as the results and accompanying forecast showed little uplift from the company’s new Firefly service. The Wall Street Journal reported last month that early corporate testers of Microsoft’s Copilot are mixed on whether the new AI tools are worth their premium price.

Such a trend could ultimately cool the billions that those companies are currently dropping on Nvidia’s chips. But even that doesn’t seem in the cards this year based on the capital-spending forecasts in the latest round of earnings reports.

https://www.wsj.com/tech/ai/nvidia-is-now-competing-mostly-with-itselfand-ai-fatigue-326a7f54

Interesting read on generative AI. Curious about its ethical implications. https://colaninfotech.com/blog/google-generative-ai-search-vs-chatgpt/

January 26, 2026 UPDATE:

-Microsoft debuted its Maia 200 AI accelerator chip and system

-The chip has a beefy amount of memory and an Ethernet-based Interconnect system

-It could help telcos offer differentiated AI services and lower costs — if Microsoft decides to make the chip available to partners

-Analysts said Maia could potentially provide a way for telcos to escape the dumb pipe trap and boost enterprise AI performance without increasing costs.

The new chip is the second from Microsoft, following its Maia 100 chip that was introduced in 2023. But there’s a notable difference: Maia 200 is Microsoft’s first “silicon and system platform optimized specifically for AI inference,” Microsoft’s Saurabh Dighe wrote. That means it was designed for efficiency, both in terms of its ability to deliver tokens per dollar and performance per watt of power used.

In concrete terms, Maia 200 can deliver “30% better performance per dollar than the latest generation hardware in our fleet today,” Microsoft EVP for Cloud and AI Scott Guthrie wrote in a blog.

https://blogs.microsoft.com/blog/2026/01/26/maia-200-the-ai-accelerator-built-for-inference/