McKinsey: AI infrastructure opportunity for telcos? AI developments in the telecom sector

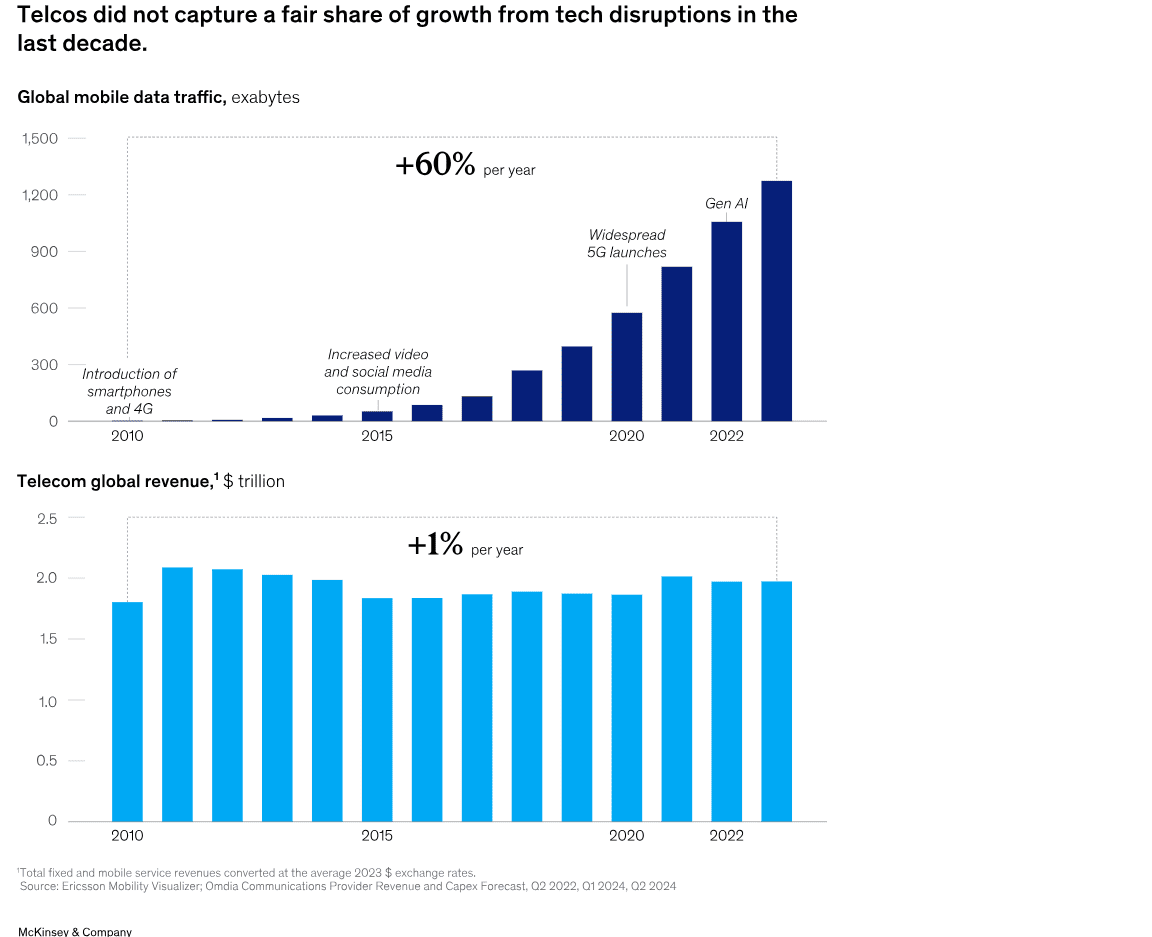

A new report from McKinsey & Company offers a wide range of options for telecom network operators looking to enter the market for AI services. One high-level conclusion is that strategy inertia and decision paralysis might be the most dangerous threats. That’s largely based on telco’s failure to monetize past emerging technologies like smartphones and mobile apps, cloud networking, 5G-SA (the true 5G), etc. For example, global mobile data traffic rose 60% per year from 2010 to 2023, while the global telecom industry’s revenues rose just 1% during that same time period.

“Operators could provide the backbone for today’s AI economy to reignite growth. But success will hinge on effectively navigating complex market dynamics, uncertain demand, and rising competition….Not every path will suit every telco; some may be too risky for certain operators right now. However, the most significant risk may come from inaction, as telcos face the possibility of missing out on their fair share of growth from this latest technological disruption.”

McKinsey predicts that global data center demand could rise as high as 298 gigawatts by 2030, from just 55 gigawatts in 2023. Fiber connections to AI infused data centers could generate up to $50 billion globally in sales to fiber facilities based carriers.

Pathways to growth -Exploring four strategic options:

- Connecting new data centers with fiber

- Enabling high-performance cloud access with intelligent network services

- Turning unused space and power into revenue

- Building a new GPU as a Service business.

“Our research suggests that the addressable GPUaaS [GPU-as-a-service] market addressed by telcos could range from $35 billion to $70 billion by 2030 globally.” Verizon’s AI Connect service (described below), Indosat Ooredoo Hutchinson (IOH), Singtel and Softbank in Asia have launched their own GPUaaS offerings.

……………………………………………………………………………………………………………………………………………………………………………………………………………………………….

Recent AI developments in the telecom sector include:

- The AI-RAN Alliance, which promises to allow wireless network operators to add AI to their radio access networks (RANs) and then sell AI computing capabilities to enterprises and other customers at the network edge. Nvidia is leading this industrial initiative. Telecom operators in the alliance include T-Mobile and SoftBank, as well as Boost Mobile, Globe, Indosat Ooredoo Hutchison, Korea Telecom, LG UPlus, SK Telecom and Turkcell.

- Verizon’s new AI Connect product, which includes Vultr’s GPU-as-a-service (GPUaaS) offering. GPU-as-a-service is a cloud computing model that allows businesses to rent access to powerful graphics processing units (GPUs) for AI and machine learning workloads without having to purchase and maintain that expensive hardware themselves. Verizon also has agreements with Google Cloud and Meta to provide network infrastructure for their AI workloads, demonstrating a focus on supporting the broader AI economy.

- Orange views AI as a critical growth driver. They are developing “AI factories” (data centers optimized for AI workloads) and providing an “AI platform layer” called Live Intelligence to help enterprises build generative AI systems. They also offer a generative AI assistant for contact centers in partnership with Microsoft.

- Lumen Technologies continues to build fiber connections intended to carry AI traffic.

- British Telecom (BT) has launched intelligent network services and is working with partners like Fortinet to integrate AI for enhanced security and network management.

- Telus (Canada) has built its own AI platform called “Fuel iX” to boost employee productivity and generate new revenue. They are also commercializing Fuel iX and building sovereign AI infrastructure.

- Telefónica: Their “Next Best Action AI Brain” uses an in-house Kernel platform to revolutionize customer interactions with precise, contextually relevant recommendations.

- Bharti Airtel (India): Launched India’s first anti-spam network, an AI-powered system that processes billions of calls and messages daily to identify and block spammers.

- e& (formerly Etisalat in UAE): Has launched the “Autonomous Store Experience (EASE),” which uses smart gates, AI-powered cameras, robotics, and smart shelves for a frictionless shopping experience.

- SK Telecom (Korea): Unveiled a strategy to implement an “AI Infrastructure Superhighway” and is actively involved in AI-RAN (AI in Radio Access Networks) development, including their AITRAS solution.

- Vodafone: Sees AI as a transformative force, with initiatives in network optimization, customer experience (e.g., their TOBi chatbot handling over 45 million interactions per month), and even supporting neurodiverse staff.

- Deutsche Telekom: Deploys AI across various facets of its operations

……………………………………………………………………………………………………………………………………………………………………..

A recent report from DCD indicates that new AI models that can reason may require massive, expensive data centers, and such data centers may be out of reach for even the largest telecom operators. Across optical data center interconnects, data centers are already communicating with each other for multi-cluster training runs. “What we see is that, in the largest data centers in the world, there’s actually a data center and another data center and another data center,” he says. “Then the interesting discussion becomes – do I need 100 meters? Do I need 500 meters? Do I need a kilometer interconnect between data centers?”

……………………………………………………………………………………………………………………………………………………………………..

References:

https://www.datacenterdynamics.com/en/analysis/nvidias-networking-vision-for-training-and-inference/

https://opentools.ai/news/inaction-on-ai-a-critical-misstep-for-telecos-says-mckinsey

On its recent earnings call, Nvidia CEO Jensen Huang said demand for the company’s AI infrastructure products is still improving. “AI is this incredible technology that’s going to transform every industry,” he said on the earnings call with investors. “We’re really at the very beginning of it, because the adoption of this technology is in its early, early stages.” Nvidia’s next AI server, the Blackwell Ultra, is on track. The company sent test shipments of the Blackwell Ultra GB300 NVL72 AI server to some customers in May, Kress said, and expects to start production shipments later this quarter.

Demand from the largest technology companies continues to rise. Heading into the latest earnings season, some on Wall Street were concerned that the industry would lower its full-year capex budgets to spend hundreds of billions on AI infrastructure amid macro uncertainty. Instead, the opposite has happened. Meta Platforms/Facebook revealed it planned to spend more on AI and Microsoft said it was more supply-constrained for AI capacity than they anticipated.

Huang pointed to several growth drivers behind the rising demand for AI; so-called reasoning, agents, and sovereign AI.

The latest AI models have a reasoning feature that allows them to reflect more thoroughly on a query by performing numerous thought computations to arrive at a higher-quality response. Huang says reasoning consumes more than 100 times more compute resources compared with prior AI models. “Reasoning models are driving a step-function surge in inference demand,” he said. Inference is the process of generating answers from AI models.

Then there are the AI agents, which according to Huang, are starting to become a reality. Agents can take simple directions and complete multistep computer actions often used to automate tedious business and personal tasks. “Agentic AI is game changing,” he said, adding the technology is finally working and being successfully implemented by enterprises.

Lastly, there’s sovereign AI. Nvidia recently announced large deals with Saudi Arabia and the United Arab Emirates. The first phase of Saudi Arabia’s AI factory buildout features an order for 18,000 Nvidia AI servers with potential for “several hundred thousand” GPUs over the next five years. The U.A.E. agreement expects its first AI cluster to go live next year. Huang said on the conference call that there are “a whole bunch” of other deals that haven’t been announced, noting that he would be traveling to Europe next week to announce some of them.

https://www.barrons.com/articles/nvidia-stock-price-china-trade-war-23cbe8c7

June 18, 2025: Deloitte launches Agentic AI Blueprint to help unlock US$150 billion in value for telecom organizations

Deloitte announced today the launch of its Agentic AI Blueprint for Telcos to help telecom organizations scale and accelerate their AI transformation. With telcos facing rising complexity and margin pressure, the industry is primed to benefit from the transformational impact of AI. While traditional AI delivers incremental improvements, agentic AI can enable true automation—empowering intelligent systems to reason, act, and adapt across core telco functions like network management, service delivery, and customer care.

https://www.prnewswire.com/news-releases/deloitte-launches-agentic-ai-blueprint-to-help-unlock-us150-billion-in-value-for-telecom-organizations-302484415.html

Deloitte’s Agentic AI Blueprint can give telcos a clear, scalable path to move beyond pilots and deliver agentic AI solutions that can help boost efficiency and drive value. The solution enables telecom teams to identify and implement high-impact AI use cases—such as network management, billing, and customer service— within their existing infrastructure. Built on TM Forum’s widely adopted enhanced telecoms operation map (eTOM), powered by AI and Deloitte’s proprietary industry data, it helps accelerate deployment and maintain consistency with industry standards.

“Agentic AI presents a US$150 billion opportunity for the telecom industry—and the race to capture that value has already begun. To move beyond pilots and drive modernization, telcos can utilize a clear, scalable path to embed AI across their operations. Deloitte’s Agentic AI Blueprint provides organizations the tools to help build and scale agentic AI solutions quickly, and efficiently.”

— Baris Sarer, Telecom, Media and Entertainment, and Technology Industry AI leader, Deloitte Consulting LLP

The blueprint in action: A telecom-specific approach

The Agentic AI Blueprint helps telecom executives pinpoint where AI can have the most impact and design agentic workflows that help align with their operations. It includes a model for prioritizing AI use cases based on impact, a library of telecom-specific workflows aligned to TM Forum’s eTOM framework, automated process engineering tools, and practical playbooks for design and implementation. Additionally, the blueprint leverages Deloitte’s relationships with leading cloud and AI technology providers to help support integration.

“Deloitte’s Agentic AI Blueprint will provide TM Forum members with a clear path-to-production solution using TM Forum’s Open Digital Architecture (ODA), an industry-standard framework, designed to enable agile, modular, and open digital business capabilities. As we introduce our own ODA AI-Native Integration Blueprint, we believe such resources will collectively accelerate the implementation of Agentic AI use cases. Together, we’re helping telecom organizations to quickly and strategically integrate Agentic AI into their operations to deliver intuitive, intelligent experiences that will turn everyday customer interactions into lasting loyalty.”

During Nvidia’s recent earnings call, CEO Jensen Huang emphasized that demand for the company’s AI infrastructure continues to grow steadily. He described AI as a transformative force poised to revolutionize every industry, noting, “We’re still in the very early stages of adoption.” Huang also confirmed that Nvidia’s upcoming AI server, the Blackwell Ultra, remains on schedule. According to CFO Colette Kress, the company began sending test units of the Blackwell Ultra GB300 NVL72 to select customers in May and expects full production shipments to begin later this quarter.

Meanwhile, demand from major tech players is accelerating. Despite earlier concerns from Wall Street that macroeconomic uncertainty might lead to reduced capital expenditures for AI, the trend has gone the other way. Companies like Meta (Facebook) have announced plans to increase AI investments, and Microsoft indicated its AI infrastructure is experiencing greater supply constraints than initially expected.

Insightful analysis of how AI infrastructure is reshaping opportunities for telcos. The link between network capabilities, cloud, and AI workloads is clearly explained and very timely. Recent AI developments in the telecom sector was especially enlightening. Many thanks!

The potential for Telcos to pivot from traditional connectivity providers to AI infrastructure powerhouses is immense, especially with the integration of edge computing. McKinsey’s insights on how the telecom sector can monetize these AI developments are very timely as we shift toward more autonomous networks.

Keeping up with such rapid technological changes requires constant mental agility and a high level of focus. When I’m deep into researching these infrastructure trends, I find that a quick ‘synapse reset’ is essential to stay productive. I’ve been playing Slice Master during my breaks. It’s a very satisfying video game that helps me decompress and sharpens my timing and precision—skills that are surprisingly useful when dealing with complex system architectures. It’s a great way to stay mentally tuned. Thanks for sharing this detailed outlook on the future of telcos!