Author: Alan Weissberger

Cogent Communications still growing strongly -18 years after the Fiber Optic Bust

Cogent Communications, one of the world’s largest ISPs, is carrying more traffic on its network than most incumbent telcos. During its most recent earnings report, Cogent said its quarterly traffic growth came in at 10%, while year-over-year traffic growth hit 44%. Let’s break that down into on-net and off-net services/customers:

On-net service is provided to customers located in buildings that are physically connected to Cogent’s network by Cogent facilities. On-net revenue was $93.0 million for the three months ended June 30, 2018; an increase of 0.7% from the three months ended March 31, 2018 and an increase of 8.7% over the three months ended June 30, 2017. Cogent’s more than 65,000 on-net customer connections and its nearly 2,600 on-net office buildings and carrier-neutral data centers send traffic over its all-IP-over-DWDM network, protected at Layer 3, using Ethernet as its network interface. On-net customers are obviously the most profitable customers for Cogent.

Off-net customers are located in buildings directly connected to Cogent’s network using other carriers’ facilities and services to provide the last mile portion of the link from the customers’ premises to Cogent’s network. Off-net revenue was $36.1 million for the three months ended June 30, 2018; the same amount as the three months ended March 31, 2018 and an increase of 6.3% over the three months ended June 30, 2017.

Total customer connections increased by 13.8% from June 30, 2017 to 76,193 as of June 30, 2018 and increased by 3.1% from March 31, 2018. On-net customer connections increased by 14.1% from June 30, 2017 to 65,407 as of June 30, 2018 and increased by 3.2% from March 31, 2018. Off-net customer connections increased by 12.3% from June 30, 2017 to 10,480 as of June 30, 2018 and increased by 2.3% from March 31, 2018. The number of on-net buildings increased by 161 on-net buildings from June 30, 2017 to 2,599 on-net buildings as of June 30, 2018 and increased by 58 on-net buildings from March 31, 2018.

Cogent classifies all of their customers into two types: NetCentric customers and Corporate customers.

- NetCentric customers buy large amounts of bandwidth from us and carrier neutral data centers and our Corporate customers buy bandwidth from us in large multi-tenant office buildings. Revenue in customer connections by customer type. There were 33,520 NetCentric customer connections on our network at quarter-end, which declined from last quarter due to significant circuit grooming, consolidating multiple 10 gig circuits to fewer 100 gig circuits at the same location from some of our larger NetCentric customers.

- Corporate customer revenue grew sequentially by 2.7% to $83.3 million and grew year-over-year by 11.9%. We had 42,673 Corporate customer connections on our network at quarter-end. Quarterly revenue from our NetCentric customers declined sequentially by 3.4% and grew year-over-year by 1.4%.

……………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

CEO Dave Schaeffer’s Earnings Call Remarks:

The size and scale of our network continues to grow. We have over 927 million square feet of multi-tenant office space on-net in North America. Our network consists of over 31,900 metro fiber miles and over 57,400 intercity route miles of fiber.

Cogent remains the most interconnected network in world, where we are directly connected with over 6,360 networks. Less than 30 of these networks are settlement-free peers. The remaining over 6,330 networks are paying Cogent transit customers.

We are currently utilizing 27% of the lit capacity in our network. We routinely augment capacity in sections of our network to maintain these low utilization rates. For the quarter, we achieved sequential quarterly traffic growth of 10% in what is traditionally a slow seasonal period for traffic growth and we saw a significant improvement in our year-over-year quarterly traffic growth to over 44%.

We operate 52 Cogent-controlled data centers with 587,000 square feet of space and we are operating those facilities at 32% utilization. Our sales force turnover rate in the quarter was 4.8% per month, again better than our long-term average turnover rate of 5.7% per month. And I think a testament to the training and retention programs that we’ve put in place. We ended the quarter with 438 reps selling our services.

Cogent remains the low cost provider of internet access and transit services. Our value proposition to our customers remains unparalleled in the industry. Our business remains entirely focused on the Internet and IP connectivity and data colocation services. Our services provide a necessary utility to our customers. Beginning at the start of Q2 and April 1st, we began selling our SD-WAN services. We do not expect a material contribution from these services for the next several quarters.

We expect our annualized constant currency long-term revenue growth to be consistent with our annualized guidance of 10% to 20%, and our long-term EBITDA margin expansion rates to remain approximately 200 basis points per year for the next several years.

We expect to grow the sales force at between 7% and 10% per year for the next several years, while we expect operational head count growth to be slower at probably 2% to 3%. So the mix will increasingly become more sales-centric. Because of the efficiencies in running our business and the standardization of our products and the systems that we’ve deployed, we can sustain 44% traffic growth, 20% growth in unit number of connections and do that with a increase in operational and overhead employees of only about 2% to 3% per year. The sales force, however, is the engine that will drive accelerating revenue growth. And investing in that sales force has been and continues to be our major focus.

Analysis:

Cogent is trying to provide the most bandwidth at the lowest possible price, which means it’s in a race to run its network at the lowest possible cost, which means it’s in a race to take every advantage of new optical networking and routing technologies, as soon as they’re available.

“We divide the network into four big technology regions — edge routing, core routing, metro transport and long-haul transport,” Schaeffer told Light Reading. “In all of those functional areas we are on our third generation of equipment — we’ve done two complete forklift upgrades in 19 years — and, you know, I’m sure we’ll go to a fourth generation soon,” he added.

Webcast Replays:

The KeyBanc Capital Markets 20th Annual Global Technology Leadership Forum was held at the Sonnenalp in Vail, CO. Dave Schaeffer will be presenting on Monday, August 13th at 10:00 a.m. MT. Investors and other interested parties may access the live webcast of the presentation by visiting the webcast page.

The Oppenheimer 21st Annual Technology, Internet & Communications Conference was held at the Four Seasons Hotel in Boston, MA. Dave Schaeffer will be presenting on Wednesday, August 8th at 1:05 p.m. ET. Investors and other interested parties may access the live webcast of the presentation by visiting the webcast page.

The Cowen 4th Annual Communications Infrastructure Summit was held at the St. Julien Hotel and Spa in Boulder, CO. Dave Schaeffer will be presenting on Tuesday, August 7th at 3:30 p.m. MT. Investors and other interested parties may access the live webcast of the presentation by visiting the webcast page.

Busting a Myth: 3GPP Roadmap to true 5G (IMT 2020) vs AT&T “standards-based 5G” in Austin, TX

TRUTH about 3rd Generation Partnership Project (3GPP) and the path to 5G Standards:

3GPP is a very honest, focused and effective engineering organization that develops technical specifications – not standards. Not once has 3GPP contributed to the hype and spin embedded in “5G” propaganda and fake news. It is the 3GPP member companies, service providers, and the press that’s guilty of that disinformation campaign.

From the 3GPP website under the heading Official Publications:

The 3GPP Technical Specifications and Technical Reports have, in themselves, no legal standing. They only become “official” when transposed into corresponding publications of the Partner Organizations (or the national / regional standards body acting as publisher for the Partner). At this point, the specifications are referred to as UMTS within ETSI and FOMA within ARIB/TTC.

Some TRs (mainly those with numbers of the form xx.8xx) are not intended for publication, but are retained as internal working documents of 3GPP. Once a Release is frozen (see definition in 3GPP TR 21.900), its specifications are published by the Partners.

All of the above and more were explained in this blog post, but apparently no one paid any attention as the claims of being compliant with “3GPP standards” abound. Here are two from AT&T:

1. After the 3GPP New Radio (NR) description/specification was completed in 3GPP Release 15:

“We’re proud to see the completion of this set of standards. Reaching this milestone enables the next phase of equipment availability and movement to interoperability testing and early 5G availability,” said Hank Kafka, VP Access Architecture and Analytics at AT&T. “It showcases the dedication and leadership of the industry participants in 3GPP to follow through on accelerating standards to allow for faster technology deployments,” he added.

2. In AT&Ts recent FCC application for an experimental radio license in Austin, TX, which is in this FCC filing:

“3GPP has developed 5G standards that became available in 2018.”

That statement was echoed in a Light Reading blog post titled: AT&T to Show Off Standards-Based 5G in Austin.

My rebuttal in an email to AT&T executives included this paragraph:

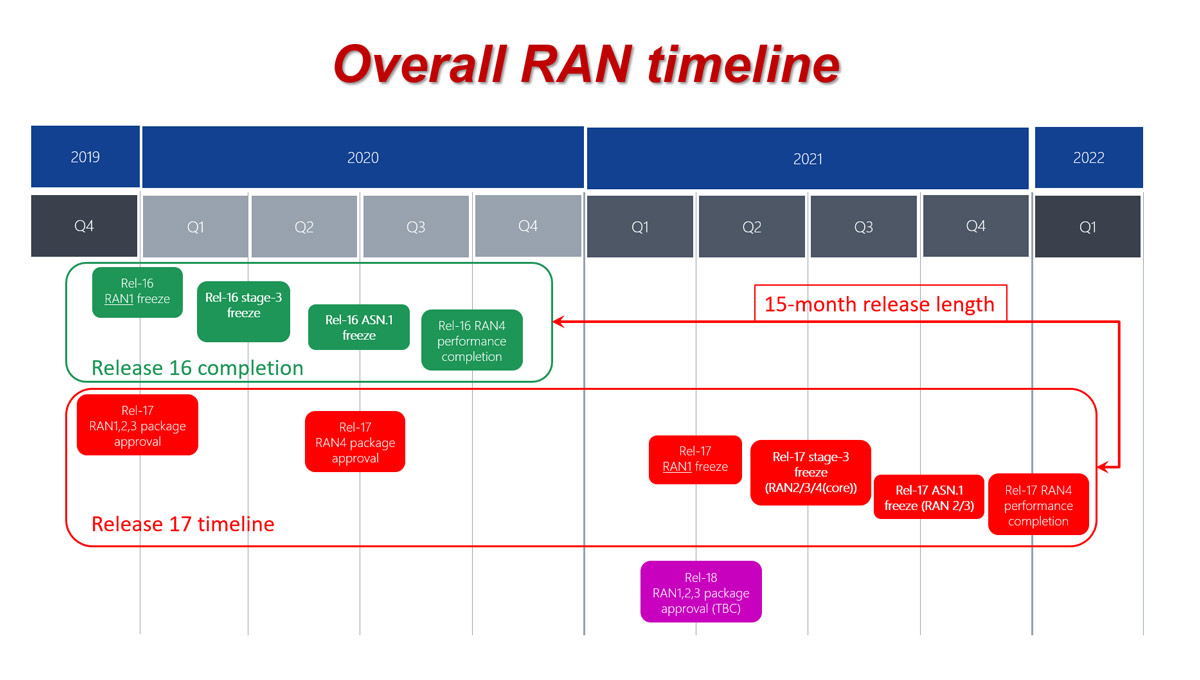

As you should be very well aware, 3GPP specifications have no official status and are not standards (as per their website). More importantly, 3GPPs “final 5G” spec will be in release 16 which won’t be completed till July 2019. Release 16 and parts of Release 15 will then be submitted for consideration as an IMT 2020 Radio Interface Technology (RIT) at the July 2019 ITU-R WP5D meeting- the first meeting which will evaluate IMT 2020 RIT/SRITs. All this info and much more is available at the 3GPP website with no log in required for access!…………………………………………………………………………………………………………………………………………………………………………

Here’s the actual status of 3GPP specs directed at 5G standards (IMT 2020) from 3GPP’s Submission of initial 5G description for IMT-2020:

This document December 2017 version of 3GPP Release 15) is the first of three planned steps spanning two releases from 3GPP, following the decision to submit preliminary descriptions of the solution only when milestones of high relevance are achieved:

- Release 15 December 2017 version;

- Release 15 June 2018 version and

- Release 16 (scheduled for July 2019)

The final and fully comprehensive 3GPP IMT-2020 submission (encompassing both Release 15 and Release 16) for IMT 2020 is planned for July 2019.

To help the ITU-R Evaluation Groups in their work, 3GPP is currently planning a workshop to present the 5G solutions to interested external bodies – specifically the Evaluation Groups – to allow a better understanding of the 3GPP technologies for 5G.

Here’s a free 3GPP webinar where you can get more information:

http://www.3gpp.org/news-events/3gpp-news/1966-webinar2_ran

……………………………………………………………………………………………………………………………………………………………………..

Comment from Kevin Flynn of 3GPP, which was inadvertently deleted when this website was move to a new compute server in early May 2019:

Hi Alan,

I have now updated the 3GPP page on Official Publications (http://www.3gpp.org/specifications/63-official-publications), referenced above. I hope that this does not undermine your excellent article in any way. I have updated the Partners & their web sites and modified the text to bring it up-to-date.

Thanks & best regards,

Kevin Flynn

3GPP Marketing Officer

……………………………………………………………………………………………………………………………………………………………………..

Debunking the 5G carrier and vendor claims:

As we’ve repeatedly stated, ITU-R WP 5D is the official standards organization for IMT 2020 (5G mobile). They will evaluate RIT/SRIT submissions at their July 2019 meeting. To date, 3GPP, South Korea, China, ETSI/DECT Forum, and TDSI have all indicated their intent to submit detailed RIT/SRIT proposals at the July 2019 ITU-R WP 5D meeting. There are significant differences amongst these proposed RITs which WP 5D must sort out and approve before the IMT 2020 standard is completed at the end of 2020.

Note also that there is NO IMT 2020 USE CASE FOR 5G FIXED WIRELESS ACCESS (FWA), so all claims about standards compliant 5G FWA (based on 3GPP release 15 “5G NR – Non Stand Alone” are bogus/fake.

“Non Stand Alone” (NSA) 5G NR means that a 4G-LTE network anchors the 5G NR access (see comments below this post). That LTE network is used for control plane signaling and for the Evolved Packet Core (EPC). In 5G NR NSA access, the LTE base station (eNB) and the 5G NR base station are interconnected with dual connectivity. The IMT 2020 standard will include a 5G packet core without any LTE components.

In addition to the IMT 2020 specified (by ITU-R) packet core there is the transport network for 5G, which is described in this ITU-T Technical Report (TR). There are fronthaul, midhaul and backhaul components described in that TR. It is a work in progress.

…………………………………………………………………………………………………………………………………………………………………………

AT&T to test “standards based 5G” at the Austin, TX Convention Center:

The FCC has just granted AT&T an experimental radio license to test what the mega carrier calls “standards-based 5G” in the convention center in Austin, Texas. The test will begin at the end of July. AT&T will run “up to 3” 28GHz fixed base stations in the convention center with connections to “up to 6” compatible user devices at up to 100 meters. AT&T promises demonstrations of 4K TV, volumetric video and eSports, as well mobile gaming, over the air, and more.

Indeed, Austin has been a hotbed for AT&T’s 5G developments. In February, the company announced plans to open a new 5G lab there. One of the first in-house projects built at the lab is the Advanced 5G NR Testbed System (ANTS), which AT&T describes as a first-of-its kind 5G testbed system that is proprietary to AT&T.

AT&T said in January 2018 that it plans to launch 3GPP release 15 based mobile 5G in up to 12 markets by the end of the year. The mega carrier (and now via Time Warner acquisition an entertainment content company) has been using special events around the country to showcase its 5G technology.

In early June, AT&T staged its Shape conference at Time Warner’s Warner Bros. Studios in Burbank, California, where it showed presentations on edge technologies, artificial intelligence and immersive entertainment, as well as a 5G demonstration with Ericsson and Intel.

At the Electronic Entertainment Expo (E3) in Los Angeles, AT&T conducted a 28 GHz demo to give gamers an up-close look at how a 5G connection can give them a live gaming experience virtually anywhere there’s network coverage. That demo also involved Ericsson, Intel and ESL.

Also in June, there was the 2018 5G demo at the U.S. Open, which took place at the Shinnecock Hills Golf Club in Tuckahoe, New York. Ericsson, Intel and Fox Sports were also participated in that demo.

………………………………………………………………………………………………………………………

Highlights of IDTechEx: IoT Connectivity Sessions and Exhibits: November 15-16, 2017

Introduction:

The Internet of Things (IoT) will connect existing systems and then augment those by connecting more things, thanks to wireless sensor networks and other technologies. Things on the ‘edge’ form mesh networks and can make their own automated decisions. This article reviews key messages from conference technical sessions on IoT connectivity and describes a new Wireless Mesh Sensor network which is an extension of IEEE 802.15.4.

Sessions Attended:

1. Overcoming Adoption Barriers To Achieve Mass IIoT Deployment, Iotium

Early adopters are realizing the complexities involved in scalable mass deployment of Industrial IoT. These includes deployment complexities, security issues starting from hardware root of trust to OS, network, cloud security and application vulnerabilities, and extensibility. This session will focus on these 3 areas in-depth to help you successfully deploy your own IIoT strategy.

2. Overcoming The Connectivity Challenge Limiting IoT Innovation, Helium

The hardware and application layers of IoT systems are supported by robust, mature markets, with devices tailored for any use case and pre-built infrastructure platforms from Microsoft, Google and AWS. But the connectivity layer, without which the entire system is useless, still has numerous challenges. It takes too much knowledge and time to get data from sensors to apps that most staffs don’t have. The speaker discussed a streamlined, secure approach to connectivity that will make building a wireless IoT network as easy as designing a mobile app, thereby removing the greatest barrier to mass IoT adoption.

3. Whitelabel The Future: How White Label Platforms Will Streamline The IoT Revolution, Pod Group

As expectations tend towards personalized, data-driven services, responding immediately to market changes is becoming a key differentiator, creating the need for mutual insight on both sides of the market. Whitelabelled platforms are an effective intermediary, allowing unprecedented levels of customer interaction and paving the way for truly end-to-end IoT systems.

Barriers to achieving a sustainable IoT business model:

-Businesses must have flexible resources and structures:

a] lacking tools to implement (new technology/billing)

b] organizational changes (retraining staff/expertise at top level)

-55% of large enterprises are not pursuing IoT (Analysys Mason)

-Digital proficiency lacking in 50% of companies (Price Waterhouse Cooper)

-IoT platforms can introduce users to systems as a whole & streamline management

There are several different types of IoT platforms:

-IoT Application Enablement Platform – in-field application (eg. device) management

-Connectivity Management Platform (CMP) – management of network connections

-Back-end Infrastructure as a Service (IaaS) – hosting space and processing power

-Hardware-specific Platform – only works with one type of hardware

Many platforms tied to specific provider/device:

– ‘Agnostic’ platforms ideal to integrate different types & retain adaptability (eg. connectivity management integrating device mgmt. & billing capabilities).

-CMPs offer a range of services: managing global connections, introducing providers to clients, integration with hardware vendors, etc.

-CMPs focus on centralized network management- not on building new services.

-Application Enablement Platforms focus on device management/insight–billing hierarchy enables new business services with additional layers, e.g. analytics.

What will the IoT landscape look like in the near future?

-Various connectivity technologies competing, platform technology and open-source driving software/service innovation.

-Hybrid platform offers ease of management, solid foundation for building recurring revenue from value-added services – ensures business is scalable and able to roll-out services quickly.

-Capable platform shifts focus from day-to-day management to building new bus. models and recurring rev. streams..

-Whitelabel platforms help to implement new business models throughout business, consolidate management of legacy and future systems, and build recurring revenue from end-to-end value-added services.

Choose right platform for your business – ease-of-use, billing hierarchies, multi-tech integration key to generating recurring revenue.

With a strong platform in place to future-proof devices and manage customer accounts and business, enterprise can be part of full IoT ecosystem, gaining value from every stage.

4. From Disappointing To Delightful: How To build With IoT, Orange IoT Studio

Many engineers, designers and business folks want to work with IoT devices, but don’t know where to begin. Come learn which mistakes to avoid and which best practices to copy as you integrate with IoT or build your own IoT products. This presentation examines the consistent, systematic ways that IoT tends to fail and delight. The talk explained what makes IoT unique, and examined why it’s not at all easy to classify IoT platforms and devices.

5. Many Faces Of LPWAN (emphasizing LoRaWAN), Multi-Tech Systems

Until recently, most M2M and Internet of Things (IoT) applications have relied on high-speed cellular and wired networks for their wide area connectivity. Today, there are a number of IoT applications that will continue to require higher-bandwidth, however others may be better suited for low-power wide-area network options that not only compliment traditional cellular networks, but also unlock new market potential by reducing costs and increasing the flexibility of solution deployments.

Low-Power Wide-Area Networks (LPWAN)s are designed to allow long range communications at low bit rates. LPWANs are ideally suited to connected objects such as sensors and “things” operating on battery power and communicating at low bit rates, which distinguishes them from the wireless WANs used for IT functions (such as Internet access).

Many LPWAN alternative specifications/standards have emerged – some use licensed spectrum such as ITU-R LTE Cat-M1 and 3GPP NB-IoT, while other alternatives such as LoRaWAN™ are based on as specification from the LoRA Alliance and uses unlicensed industrial, scientific, and medical (ISM) radio band/spectrum.

IoT has many challenges – from choosing the right device, to adding connectivity and then managing those devices and the data they generate. Here are just a few IoT connectivity challenges:

- Long battery life (5+ yrs) requires low power WAN interface

- Low cost communications (much lower than cellular data plans)

- Range and in-building penetration

- Operation in outdoor and harsh environments

- Low cost infrastructure

- Robust communications

- Permits mobility

- Scalable to thousands of nodes/devices

- Low touch management and provisioning – Easy to attach assets

- Highly fragmented connectivity due to a proliferation of choices

Mike Finegan of Multi-Tech presented several LPWAN use case studies, including tank monitoring in Mt. Oso, CA; point of sales terminals, kiosks, vending machines; oil and gas; distributed energy resources; agriculture; and a real time control school traffic sign (T-Mobile using NB-IoT equipment from MultiTech (the first public NB-IoT demo in North America).

Mr. Finegan concluded by emphasizing the importance of security functions needed in an IoT Connectivity Platform. A “trusted IoT platform” should reduce attack vectors, provide secure and reliable end to end communications, and device to headquarters management services.

6. What Makes a City Smart? Totem Power

The framework necessary to build holistic infrastructure that leverages capabilities essential to realizing the full potential of smart cities – concepts including curbside computing power, advanced energy resiliency and ubiquitous connectivity.

An interesting observation was that fiber trenches being dug to facilitate 5G backhaul for small cells and macro cells could accommodate electrical wiring for power distribution and charging of electric vehicles within the city limits.

………………………………………………………………………………………………

At it’s booth, Analog Devices/ Linear Technology displayed an exhibit of SmartMesh® – a Wireless Mesh Sensor Network that was based on a now proprietary extension of IEEE 802.15.4 [1]. SmartMesh® wireless sensor networking products are chips and pre-certified PCB modules complete with mesh networking software; enabling sensors to communicate in tough Industrial Internet of Things (IoT) environments.

Note 1. IEEE 802.15.4 is a standard which defines the operation of low-rate wireless personal area networks (LR-WPANs) via PHY and MAC layers. It focuses on low-cost, low-speed ubiquitous communication between devices.

……………………………………………………………………………………………………….

The Industrial Internet of Things (IoT) wireless sensor networks (WSNs) must support a large number of nodes while meeting stringent communications requirements in rugged industrial environments. Such networks must operate reliably more than ten years without intervention and be scalable to enable business growth and increasing data traffic over the lifetime of the network.

More information on SmartMesh® is here.

……………………………………………………………………………………………….

References:

https://www.idtechex.com/internet-of-things-usa/show/en/

https://www.idtechex.com/internet-of-things-usa/show/en/agenda

http://www.linear.com/dust_networks/

Wi-Fi hotspots in Cuba Create Strong Demand for Internet Access

by Alexandre Meneghini, Sarah Marsh of Reuters

The introduction of Wi-Fi hotspots in Cuban public spaces two years ago has transformed the Communist-run island that had been mostly offline. Nearly half the population of 11 million connected at least once last year.

That has whet Cubans’ appetite for better and cheaper access to the internet.

“A lot has changed,” said Maribel Sosa, 54, after standing for an hour with her daughter at the corner of a park in Havana, video chatting with her family in the United States, laughing and gesticulating at her phone’s screen.

She recalled how she used to queue all night to use a public telephone to speak with her brother for a few minutes after he emigrated to Florida in the 1980s.

Given the relative expense of connecting to the internet, Cubans use it mostly to stay in touch with relatives and friends. Although prices have dropped, the $1.50 hourly tariff represents 5 percent of the average monthly state salary of $30.

“A lot more could change still,” said Sosa. “Why shouldn’t we be able to have internet at home?”

A tiny share of homes has had broadband access until now, subject to government permission granted to some professionals such as academics and journalists.

The state telecoms monopoly has vowed to hook up the whole island and connected several hundred Havana homes late last year as a pilot project. In September, it said it would roll that service out nationwide by the end of 2017.

Cubans say previous promises for such access have not been fulfilled, so their expectations are not high. They also say the cost is prohibitive, with the cheapest monthly subscription priced at $15.

Cubans use their mobile devices to connect to the Internet via WiFi Hotspot near their street.

…………………………………………………………………………………………………..

Havana says it has been slow to develop network infrastructure because of high costs, attributed partly to the U.S. trade embargo. Critics say the government fears losing control.

Cubans who can afford it flock to Internet cafes and 432 outdoor hotspots where they brave ants, mosquitoes and the elements.

Here they laugh, cry, shout, and whisper. Black market vendors weave in and out among them, trying to hawk pre-paid scratchcards allowing Wi-Fi access. The ping of incoming messages and ring of calls fill the air.

“There’s absolutely no privacy here,” said Daniel Hernandez, 26, a tourist guide, after video chatting with his girlfriend in Britain.

“When I have sensitive things to talk about, I try shutting myself into my car and talking quietly.”

The quality of connections is often good only at specific spots, he said, and when fewer users are connected. Otherwise, the screen tends to freeze mid-chat.

Hernandez said he also uses the internet to search for news. In Cuba, the state has the monopoly on print and broadcast media.

A few meters further on, Rene Almeida, 62, sat in his taxi checking email. He said he felt lucky that his two children had moved to the United States where communications are better than ever. It was only in 2008 that the government first allowed Cubans to own cell phones.

He, too, complained of the lack of privacy and the expense.

“It’s better than nothing,” he said. “But it should improve. It will.”

…………………………………………………………………………………………………

References:

https://techblog.comsoc.org/2017/08/18/whats-the-real-status-of-internet-access-in-cuba/

SNS Telecom: U.S. Network Operators will reap $1B from fixed wireless by late 2019

Summary:

U.S. wireless network operators will realize about $1 billion in revenue from 5G fixed wireless access (FWA) networks by the end of 2019, market research firm SNS Telecom predicts in a newly released report “5G for FWA (Fixed Wireless Access): 2017 – 2030 – Opportunities, Challenges, Strategies & Forecasts.” The report predicts that the market will reach $40 billion by 2025. It will enjoy a compound annual growth rate (CAGR) of 84 percent between the expected beginning of standardized deployments of 5G fixed wireless access in 2019 and 2025, according to a press release.

Verizon and AT&T are seen as the leaders to deploy 5G FWA networks in the United States. Verizon has made no secret of their 5G FWA plans, announcing an initial roll out of the technology in 11 markets, including Ann Arbor; Atlanta; Bernardsville (NJ); Brockton (MA); Dallas; Denver; Houston; Miami; Sacramento; Seattle; and Washington, D.C. Some, if not all of these markets will utilize a Samsung 5G access platform, operating in the 28 MHz spectrum band. The carrier has promised gigabit type performance, even suggesting it as comparable to FTTH.

AT&T is already active as well, with 5G FWA trials in Austin and Middleton (NJ), that also feature DIRECTV NOW video streaming. These trials are in prep for a 2018 commercial 5G FWA launch, the company reported back in June.

Juniper Research Ltd. analysts recently said that they expect 1 million 5G connections to go live in 2019. If the SNS predictions are right, then many of those connections may be for FWA services in the US.

………………………………………………………………………………………

About the Report:

The SNS Telecom report has the following key findings:

• 5G-based FWA subscriptions are expected to account for $1 Billion in service revenue by the end of 2019 alone. The market is further expected to grow at a CAGR of approximately 84% between 2019 and 2025, eventually accounting for more than $40 Billion.

• SNS Research estimates that 5G-based FWA can reduce the initial cost of establishing last-mile connectivity by as much as 40% – in comparison to FTTP (Fiber-to-the-Premises). In addition, 5G can significantly accelerate rollout times by eliminating the need to lay cables as required for FTTP rollouts.

• The 28 GHz frequency band is widely preferred for early 5G-based FWA deployments, as many vendors have already developed 28 GHz-capable equipment – driven by demands for early field trials in multiple markets including the United States and South Korea.

• Millimeter wave wireless connectivity specialists are well-positioned to capitalize on the growing demand for 5G-based FWA. However, in order to compete effectively against existing mobile infrastructure giants, they will need to closely align their multi-gigabit capacity FWA solutions with 3GPP specifications.

• While many industry analysts believe that 5G-based FWA is only suitable for densely populated urban areas, a number of rural carriers – including C Spire and U.S. Cellular – are beginning to view 5G as a means to deliver last-mile broadband connectivity to under-served rural communities.

………………………………………………………………………………………..

The report provides answers to the following key questions:

How big is the opportunity for 5G-based FWA?

What trends, challenges and barriers will influence the development and adoption of 5G-based FWA?How have advanced antenna and chip technologies made it possible to utilize millimeter wave spectrum for 5G-based FWA?

What are the key application scenarios for 5G-based FWA?

Can 5G-based FWA enable mobile operators to tap into the pay TV market?

How can mobile operators leverage early deployments of 5G-based FWA to better prepare their networks for planned 5G mobile service rollouts?

What will be the number of 5G-based FWA subscriptions in 2019 and at what rate will it grow?

Which regions and countries will be the first to adopt 5G-based FWA?

Which frequency bands are most likely to be utilized by 5G-based FWA deployments?

What is the cost saving potential of 5G-based FWA for last-mile connectivity?

Who are the key market players and what are their strategies?

What strategies should 5G-based FWA vendors and service providers adopt to remain competitive?

References:

What’s the real status of Internet access in Cuba?

by Matteo Ceurvels of eMarketer (edited with Notes by Alan J Weissberger)

Few people in Cuba have regular access to the Internet, and those who do encounter slow download speeds, according to an eMarketer study. Although Cuba’s state-run service provider (see details below) has built WiFi hotspots throughout the country, the relatively high rate of $1.50 an hour is too much for most Cubans to pay. [Please see references below for additional information on the WiFi hotspots in Cuba- mostly in Havana]

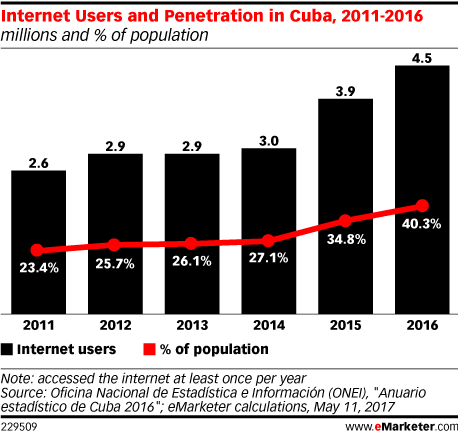

eMarketer estimates that there will be 360.4 million internet users in Latin America in 2017. While the market research firm does not break out specific metrics for Cuba, the latest figures from the government’s National Office of Statistics and Information (ONEI) show that over 4.5 million people, or roughly 40.3% of the total population, accessed the Internet at least once during 2016.

…………………………………………………………………………………………………………..

Editor’s Note: The actual ONEI ICT report (via Google Translate) states that for 2016 there were 403 people that accessed the Internet out of every 1,000 people living on the island. That compares with 348, 271, 261, 257 and 232 people for the years 2015, 2014, 2013, 2012, 2011, respectively.

The same report (which I don’t trust) says the mobile population coverage (not usage) has been 85.3% of the population from 2012-2016, up from 83.7% in 2011.

…………………………………………………………………………………………………..

The number of people with internet access in their homes was significantly lower: The BBC reported in March of last year that the at-home internet penetration rate was roughly 5%.

Web access in the country remains relegated to a few options. State-run telecom Empresa de Telecomunicaciones de Cuba S.A. (ETECSA), which first began offering public Wi-Fi spots in 2015, claims to provide 391 such spots across the country. But at a cost of about $1.50 per hour, access remains too expensive for most Cubans, and internet speeds are reportedly excruciatingly slow.

ETECSA also began a pilot program in December of last year to provide some 2,000 users in Havana, Cuba’s capital, with fixed broadband internet access for a free two-month trial period. In March, ETECSA said 358 participants in the program signed up to pay for the service, which offered data speeds of between 128 kilobits per second (Kbps) and 2 megabits per second (Mbps).

And when residents of the country do manage to get online, they are subject to strict internet censorship overseen by the government. Some websites and services are blocked, and communications can easily be monitored by government figures.

During parliamentary sessions held in July, Vice President Miguel Díaz-Canel acknowledged that Cuba has one of the lowest internet access rates, but rejected the notion that its society was “fully disconnected.”

He added that tech companies that had entered into agreements with the country’s government to provide them with the infrastructure necessary to expand internet access had been met with “fierce financial prosecution.”

Despite these claims, the government has sought out partnerships with some of the world’s leading tech companies. In April, Google brought servers in the country online for the first time, making it the first foreign tech firm to host its own content in Cuba.

At the parliamentary sessions, Díaz-Canel also claimed that the penetration of social media platforms had grown by 346% in 2016. (The government did not respond to eMarketer’s request to verify this figure.)

However, Martín Utreras, vice president of forecasting at eMarketer, noted that the majority of social media users in the country were most likely foreign tourists looking to stay connected while on vacation.

According to data from StatCounter, there are signs that Facebook is a leading social media platform in the country. Facebook was responsible for 83.3% of page views resulting from social network referrals in Cuba in July, more than either Pinterest (8.4%) or Twitter (4.3%). (StatCounter’s figures take into consideration website referral traffic from both locals and visitors in Cuba.)

Despite signs that internet access is increasing in the country, Cuba still has a long way to go before getting online is something residents consider normal. In fact, many in the country rely on “el paquete semanal,” or the weekly package—a hard drive that is loaded with contraband content such as news, music, TV shows and other videos and passed from person to person.

“Cuba’s journey resembles that of similar trends we’ve seen in the case of China or Vietnam,” Utreras said. “Although Cuba is still many years behind in terms of private telecom investment, infrastructure development and overall internet adoption, by comparison, the immediate future will most likely be driven by government interests rather than the market itself.”

……………………………………………………………………………………………..

References:

https://www.emarketer.com/Article/Cuba-on-Slow-Crawl-Toward-Increased-Internet-Access/1016352

http://www.one.cu/aec2016/17%20Tecnologias%20de%20la%20Informacion.pdf

http://www.businessinsider.com/is-there-internet-in-cuba-2017-1

https://insightcuba.com/blog/2017/03/05/havanas-wifi-hotspots-and-getting-online-cuba

Cuba to expand Internet access and lower price of WiFi connections

Schedule for Development of IMT-2020 “5G” Radio Interface Recommendations

Editor’s Note:

While Verizon [1] and many other wireless network operators plan to roll out their “5G” services between 2018 and 2020, that will be in ADVANCE OF THE ITU-R IMT 2020 “5G” standard. We believe these “5G” roll-outs are extremely negative for the REAL market for standardized “5G,” which won’t begin till 2021 at the earliest.

Note 1. According to Light Reading, a Verizon executive said that the operator’s home-brewed fixed 5G service will get up in running in 2018 but that he doesn’t expect true mobile 5G to arrive until 2020.

John Stratton, executive vice president and president of operations for Verizon Communications Inc., talking at the Deutsche Bank 25th Annual Media & Telecom Conference in Florida, said that Verizon will deliver fixed 5G in 2018. It is working on customer trials in 11 US cities now. (See Verizon Fixed 5G Tests to Top 3Gbit/s? and Verizon to Start Fixed 5G Customer Trials in April.)

Stratton promised a “meaningful commercial deployment of 5G” in 2018 from Verizon. He was cagey about what exact services the fixed system will provide, but it seems clear that a wireless alternative to cable/DSL services is high on Verizon’s priority list.

“The way we’re thinking about 5G… the ability to leverage the full scale of our business is an important factor,” Stratton added.

The customer trials, Stratton says, will allow Verizon to better understand the signal propagation characteristics of the fixed 5G system and “the load per node.” Verizon has previously said that it has been testing at ranges of up to 1,500 feet in diverse environments for its fixed option.

…………………………………………………………………………………………………………..

| Draft REVISION of ITU-R WP5 document IMT-2020/2: |

| Submission, evaluation process and consensus building for IMT-2020 |

This document describes the process and activities identified for the development of the IMT‑2020 terrestrial components radio interface Recommendations.

1. Time schedule

The time schedule described below applies to the first invitation for candidate RITs (Radio Interface Technologies) or SRITs (Set of Radio Interface Technologies). Subsequent time schedules will be decided according to the submissions of proposals.

Submission of proposals may begin at 28th meeting of Working Party 5D (WP 5D) (currently planned to be 3-11 October 2017) and contribution to the meeting needs to be submitted by 1600 hours UTC, 7 calendar days prior to the start of the meeting. The final deadline for submissions is 1600 hours UTC, 7 calendar days prior to the start of the 32nd meeting of WP 5D in July 2019. The evaluation of the proposed RITs and SRITs by the independent evaluation groups and the consensus-building process will be performed throughout this time period and thereafter. The detailed schedule can be found in Figure 1.

2 Process

2.1 General

Resolution ITU-R 65 on the “Principles for the process for future development of IMT for 2020 and beyond” outlines the essential criteria and principles that will be used in the process of developing the Recommendations and Reports for IMT-2020, including Recommendation(s) for the radio interface specification.

Recommendation ITU-R M.2083, IMT Vision – “Framework and overall objectives of the future development of IMT for 2020 and beyond” identifies three usage scenarios for IMT-2020 and envisions a broad variety of capabilities, tightly coupled with intended usage scenarios and applications for IMT-2020, resulting in a great diversity/variety of requirements. Recommendation ITU-R M.2083 also identifies the capabilities of IMT-2020, recognising that they will have different relevance and applicability for the different use cases and scenarios addressed by IMT‑2020, some of which are currently not foreseen. In addition, IMT-2020 can be applied in a variety of scenarios, and therefore different test environments are to be considered for evaluation purposes.

A test environment is defined as the combination of usage scenario and geographic environment as described in the draft new Report ITU-R M.[IMT-2020.EVALUATION]

2.2 Detailed procedure

The detailed procedure is illustrated in Figure 2 and is described below. Some activities are external to ITU-R and others are internal.

IMT-2020 terrestrial component radio interface development process

Step 1 – Circular Letter to invite proposals for radio interface technologies and evaluations

The ITU Radiocommunication Bureau, through Circular Letter 5/LCCE/59, invites the submission of candidate RITs or SRITs addressing the terrestrial component of IMT-2020. Addenda to the Circular Letter provide further details on the invitation for submission of proposals (including technical performance requirements, evaluation criteria and template for submission of candidate technologies).

This Circular Letter and its Addenda also invite subsequent submission of evaluation reports on these candidate RITs or SRITs by registered independent evaluation groups in addition to the initial evaluation report endorsed by the proponent.

Step 2 – Development of candidate RITs or SRITs

In this step, which is typically external to ITU-R, candidate terrestrial component RITs or SRITs are developed to satisfy a version of the minimum technical performance requirements and evaluation criteria of IMT-2020 currently in force (as defined in Resolution ITU-R 65, resolves 6 g)) that will be described in the Draft New Report ITU-R M.[IMT‑2020.SUBMISSION][4].

The required number of test environments for an RIT or SRIT to be fulfilled is as follows:

An RIT needs to fulfil the minimum requirements for at least three test environments; two test environments under eMBB and one test environment under mMTC or URLLC.

An SRIT consists of a number of component RITs complementing each other, with each component RIT fulfilling the minimum requirements of at least two test environments and together as an SRIT fulfilling the minimum requirements of at least four test environments comprising the three usage scenarios.

Step 3 – Submission/reception of the RIT and SRIT proposals and acknowledgement of receipt

The proponents of RITs or SRITs may be Member States, Sector Members, and Associates of ITU‑R Study Group 5, or other organizations in accordance with Resolution ITU-R 9-5.

The submission of each candidate RIT or SRIT must include completed templates (these templates will be provided in draft new Report ITU-R M.[IMT-2020.SUBMISSION], together with any additional inputs which the proponent may consider relevant to the evaluation. Each proposal must indicate the version of the minimum technical performance requirements and evaluation criteria of the IMT-2020 currently in force that it is intended for and make reference to the associated requirements.

The entity that proposes a candidate RIT or SRIT to the ITU-R (the proponent) shall include with it either an initial self-evaluation or the proponents’ endorsement of an initial evaluation submitted by another entity. The submission will not be considered complete without an initial self-evaluation or the proponents’ endorsement of an initial evaluation submitted by another entity.

Proponents and IPR holders should indicate their compliance with the ITU policy on intellectual property rights, as specified in the Common Patent Policy for ITU‑T/ITU-R/ISO/IEC available at: http://www.itu.int/ITU-T/dbase/patent/patent-policy.html (See Note 2 in Section A2.6 of Resolution ITU-R 1-7).

The Radiocommunication Bureau (BR) receives the submission of technical information on the candidate RITs and SRITs and acknowledges its receipt

Submissions should be addressed to the Counsellor for ITU-R Study Group 5, Mr. Sergio Buonomo ([email protected]). These submissions will be prepared as inputs to ITU-R Working Party

Working Party 5D (WP 5D) and will also be made available on the ITU web page for the IMT-2020 submission and evaluation process.

Step 4 – Evaluation of candidate RITs or SRITs by independent evaluation groups (mid 2018-2010)

Candidate RITs or SRITs will be evaluated. The ITU-R membership, standards organisations, and other organizations are invited to proceed with the evaluation. Organizations wishing to become independent evaluation groups are requested to register with ITU-R[6] preferably before the end of 2017. The independent evaluation groups are kindly requested to submit evaluation reports to the ITU-R. The evaluation reports will be considered in the development of the ITU-R Recommendation describing the radio interface specifications.

The evaluation guidelines, including criteria and test models, will be provided in draft new Report ITU‑R M.[IMT-2020.SUBMISSION] as announced in Circular Letter 5/LCCE/59 and its Addenda.

In this step the candidate RITs or SRITs will be assessed based on draft new Report ITU-R M.[IMT-2020.SUBMISSION]. If necessary, additional evaluation methodologies may be developed by each independent evaluation group to complement the evaluation guidelines in draft new Report ITU-R M.[IMT-2020.SUBMISSION]. Any such additional methodology should be shared between independent evaluation groups and sent to the BR for information to facilitate consideration of the evaluation results by ITU-R.

Coordination between independent evaluation groups is strongly encouraged to facilitate comparison and consistency of results, to assist ITU-R in developing an understanding of differences in evaluation results achieved by the independent evaluation groups and to form some preliminary consensus on the evaluation results. Consensus building is encouraged, such as grouping and/or syntheses by proponents in order to better meet the requirements of IMT-2020.

Each independent evaluation group will report its conclusions to the ITU-R. Evaluation reports should be addressed to the Counsellor for ITU-R Study Group 5, Mr. Sergio Buonomo ([email protected]).

The evaluation reports will be prepared as inputs to WP 5D and will also be made available on the ITU web page for the IMT-2020 submission and evaluation process.

The technical performance requirements and evaluation criteria for IMT-2020 are subject to reviews which may introduce changes to the technical performance requirements and evaluation criteria for IMT-2020. Proponents may request evaluation against any of the existing versions of the technical performance requirements and evaluation criteria that are currently in force for IMT-2020.

Step 5 – Review and coordination of outside evaluation activities

WP 5D will act as the focal point for coordination between the various independent evaluation groups. In this step, WP 5D monitors the progress of the evaluation activities, and provides appropriate responses to problems or requests for guidance to facilitate consensus building.

Step 6 – Review to assess compliance with minimum requirements

In this step WP 5D makes an assessment of the proposal as to whether it meets a version of the minimum technical performance requirements and evaluation criteria of the IMT-2020 in draft new Report ITU-R M.[IMT-2020.SUBMISSION].

In this step, the evaluated proposal for an RIT/SRIT is assessed as a qualifying RIT/SRIT, if an RIT/SRIT fulfils the minimum requirements for the five test environments comprising the three usage scenarios.

Such a qualified RIT/SRIT will go forward for further consideration in Step 7.

According to the decision of the proponents, earlier steps may be revisited to complement, revise, clarify and include possible consensus-building for candidate RITs or SRITs including those that initially do not fulfil the minimum requirements of IMT-2020 that will be described in the draft new Report ITU-R M.[IMT-2020.SUBMISSION].

WP 5D will prepare a document on the activities of this step and assemble the reviewed proposals and relevant documentation. WP 5D will keep the proponents informed of the status of the assessment.

Such documentation and feedback resulting from this step can facilitate consensus building that might take place external to the ITU-R in support of Step 7.

Step 7 – Consideration of evaluation results, consensus building and decision

In this step WP 5D will consider the evaluation results of those RITs or SRITs that have satisfied the review process in Step 6.

Consensus building is performed during Steps 4, 5, 6 and 7 with the objective of achieving global harmonization and having the potential for wide industry support for the radio interfaces that are developed for IMT-2020. This may include grouping of RITs or modifications to RITs to create SRITs that better meet the objectives of IMT-2020.

An RIT or SRIT will be accepted for inclusion in the standardization phase described in Step 8 if, as the result of deliberation by ITU-R, it is determined that the RIT or SRIT meets the requirements of Resolution ITU-R 65, resolves 6 e) and f) for the five test environments comprising the three usage scenarios.

Step 8 – Development of radio interface Recommendation(s)- mid 2018 till Dec 2020

In this step a (set of) IMT-2020 terrestrial component radio interface Recommendation(s) is developed within the ITU-R on the basis of the results of Step 7, sufficiently detailed to enable worldwide compatibility of operation and equipment, including roaming.

This work may proceed in cooperation with relevant organizations external to ITU in order to complement the work within ITU‑R, using the principles set out in Resolution ITU-R 9-5.

Step 9 – Implementation of Recommendation(s)

In this step, activities external to ITU-R include the development of supplementary standards (if appropriate), equipment design and development, testing, field trials, type approval (if appropriate), development of relevant commercial aspects such as roaming agreements, manufacture and deployment of IMT-2020 infrastructure leading to commercial service.

________________

[1] The term RIT stands for Radio Interface Technology.

[2] The term SRIT stands for Set of RITs.

[3] The draft new Report ITU-R M.[IMT-2020.EVAL] is under development and will be finalized in June 2017.

[4] The draft new Report ITU-R M.[IMT-2020.SUBMISSION] is under development and will be finalized in June 2017.

[5] Provides the confirmation to the sender that the submission was received by the BR and that the submission will be forwarded to WP 5D for subsequent consideration.

[6] Independent evaluation group registration forms are available at:

http://www.itu.int/en/ITU-R/study-groups/rsg5/rwp5d/imt-2020/Pages/submission-eval.aspx.

[7] As defined in Step 2, each component RIT of the SRIT needs to still fulfil the minimum requirements of at least two test environments.

[8] As defined in Step 2, each component RIT of the SRIT needs to still fulfil the minimum requirements of at least two test environments.

Weightless SIG Hopes to Drive LPWA Standard in ETSI; Ubiik as IoT Game Changer?

The Weightless Special Interest Group (SIG) is expanding its effort to drive open standards in low-power, wide-area (LPWA) networks for the Internet of Things (IoT). That area is one of many where there are a plethora of competing standards which results in IoT wide area connectivity market fragmentation.

Three different Weightless specifications are available for LPWA networks: Weightless-N, Weightless-P and Weightless-W.

Each spec is designed to be deployed in different use cases depending on a number of key priorities. These are summarized in the table below:

| Weightless-N | Weightless-P | Weightless-W | |

| Directionality | 1-way | 2-way | 2-way |

| Feature set | Simple | Full | Extensive |

| Range | 5km+ | 2km+ | 5km+ |

| Battery life | 10 years | 3-8 years | 3-5 years |

| Terminal cost | Very low | Low | Low-medium |

| Network cost | Very low | Medium | Medium |

- If low cost is the priority and 1-way communication is adequate for your application, use Weightless-N

- If high performance is the priority, or 2-way communication is required, use Weightless-P

- If TV white space spectrum is available in the location where the network will be deployed and an extensive feature set is required, use Weightless-W

Source: http://www.weightless.org/about/which-weightless-standard

……………………………………………………………………………………………….

In a November 1, 2016 press release, the Weightless SIG said “Ubiik emerges as IoT game changer.”

“Operating out of Taiwan and Japan, Ubiik. is creating the next wave of smarter LPWAN products and is bringing substantive disruption to this dynamic technology space.

Showcased recently at CTIA in Las Vegas, Weightless offered an early insight into Ubiik’s revolutionary LPWAN technology offering a step change in performance expectations. Formed from the core team responsible for the groundbreaking LPWAN technology behind the Weightless-P open standard, Ubiik is set to deliver transformative change in every one of the key parameters that define IoT performance. Integrating cutting edge design philosophy with established, best in class cellular approaches Ubiik is building the high performance, carrier grade, industrial IoT infrastructure of the future.”

Ubiik hopes to roll out hardware in February for Weightless-P, the Weightless SIG’s third effort at defining a spec for LPWA networks. Fabien Petitgrand, chief technologist at Ubiik said that technology has an edge over current market leaders, Sigfox and LoRa, that will help it find traction in the still-emerging sector of IoT LPWA networks.

“We don’t expect significant revenue from meaningful deployment [of Weightless-P] for the next potentially two years,” he said. “Weightless-P is coming later to the game, but we are only at the beginning of this LPWA market.”

In a white paper, Ubiik makes the case that Weightless-P is the lowest-cost approach to applications such as smart meters. The technology could serve an area the size of San Diego with 542 base stations at a total cost of about $2.7 million per year. By contrast, Sigfox and LoRa would need 1,900 and 29,000 base stations and cost $9.5 million and $14.4 million a year, respectively, it said.

……………………………………………………………………………………………………………………………………………….

Weightless SIG chief executive William Webb makes the case that it’s still in the early days for a highly fragmented sector of LPWA networks. To realize predictions of 50 billion IoT nodes by 2020, vendors need to deploy nearly 13 million a day, but so far, market leaders in LPWA such as Sigfox and LoRa each have connected an estimated 7–10 million total to date.

“The message we are hearing very strongly is that the biggest problem in LPWA is the fragmentation of the industry,” said Webb. “If you are making a sensor what wireless chip do you put in it? Most people stop because they don’t want to use the wrong one. We are bumbling along the bottom,” Webb added.

Machina Research estimates that Sigfox now has public networks in the works or running in 26 countries, with LoRa following at 19 and Ingenu at 10. At CES, many top cellular carriers and module makers announced that they were ready to start trials of the (2nd generation) LTE Category-M (also known as LTE Category M1) intended for IoT LPWA networks.

“We project [that,] as of the end of 2017, the LPWA networks using unlicensed spectrum will collectively cover 32% of the world’s population with 11% for licensed LPWA,” which includes both cellular operators and other spectrum holders such as M2M Spectrum Networks, according to Machina Research analyst Aapo Markkanen.

………………………………………………………………………………………………………………………………………….

ETSI’s Task Group 28 has an informal subgroup called Low Throughput Networks (LTN) that will act as a “document rapporteur.” It expects to release a suite of LPWA specifications by the end of the year. The Weightless SIG plans to take their specs to ETSI for approval.

“The way ahead for us is to transfer our standards into ETSI and let Weightless act like the Wi-Fi Alliance, a public face for the ecosystem and a forum for regulator input and future directions,” Webb said.

Sigfox, Germany’s Fraunhofer Institute, and Weightless members such as Telensa are expected to make submissions to the ETSI process, which opens in March. The Weightless SIG will submit its specs to the group.

”Our intention is to produce a single LTN standard…that will consist in a set of three documents–LTN use cases and system requirements, LTN architecture and LTN protocols and interfaces,” said Benoit Ponsard, a representative from Sigfox that runs the ETSI subgroup.

“I suspect that [ETSI] will have a family of standards, and you can argue that that will defeat the aim of ending fragmentation, but we hope that a single-chip design could implement all of them, although not all at the same time,” Webb said.

Here’s a comparison of Weightless P vs. LoRaWAN vs. Sigfox from Ubiik. It considers capacity and range for a single LPWA base station.

…………………………………………………………………………………………………………………………………………………………

“The real success [of Weightless-P] will be if we can bring on more players,” said Webb. “We’re talking to quite a few semiconductor companies, and a number of them like Weightless as a vehicle for LPWA.”

The current effort marks the third change in direction for the Weightless SIG. It started in 2010 to work on a Weightless-W specification for the 700-MHz “white spaces” TV bands with technology from startup Neul.

When it became clear that those bands would not become available as expected, the group developed an ultra narrowband spec, called Weightless-N, using technology from NWave. It was a uni-directional link aimed at lowest cost and data rate to compete directly with Sigfox in the 800- to 900-MHz bands. But NWave struggled to gain traction, and Weightless ultimately transferred the technology to ETSI.

References:

http://www.weightless.org/about/the-argument-for-lpwan-in-the-internet-of-things

http://www.eetimes.com/document.asp?doc_id=1331207

https://en.wikipedia.org/wiki/LPWAN

http://internetofthingsagenda.techtarget.com/definition/LPWAN-low-power-wide-area-network

http://www.eetimes.com/document.asp?doc_id=1330671

http://community.comsoc.org/blogs/posts?page=51&sort=date&order=asc

Facebook & AT&T to Test Drones for Wireless Communications Capabilities

1. Facebook to Test Drones over Menlo Park, CA Campus:

Facebook recently filed documents with the FCC to request the right to operate a drone over its Menlo Park, CA campus using an experimental radio in the 2.4 GHz band. The company plans to fly at least one small, wireless-beaming drone at an altitude of 400 feet around its headquarters in the coming months. The smaller drone is simply being used to test the wireless technology, which Facebook thinks could be used with its larger Aquila drones which are for wireless broadband Internet access in developing countries.

“The purpose of this operation is to test potential new communications applications and equipment in a controlled, low-altitude airborne environment,” one filing says. Another filings specifies the drone will fly at an altitude of 400 feet. The filings, which Facebook made under its FCL Tech drone subsidiary, says it wants to conduct the tests between October and April. Mike Johnson, Facebook’s Deputy General Counsel, is listed as the point of contact on the filing.

More information at: http://www.businessinsider.com/facebook-to-test-wireless-equipment-on-small-drone-2016-10

and http://fortune.com/2016/10/12/facebook-drone-fcc-headquarters/

Mark Zuckerberg, founder and CEO of Facebook Inc., views a drone flying.

Photo credit: Michael Short—Bloomberg via Getty Images

2. Telecom Council’s 2016 TC3 Summit featured a case study with AT&T and Qualcomm on Cellular Drone Communication with 4G LTE:

Abstract: Wide-scale deployments of Unmanned Aircraft Systems (UAS), or drones, are expected to reshape countless industries, including agriculture, delivery, insurance, public safety, and real estate to name a few. Cellular networks can bring a new dimension of reliability, security, coverage and seamless mobility to commercial drone operation, enabling connectivity and control of drones Beyond Visual Line Of Sight (BVLOS). This will be key to safe, wide-scale drone operation and the many new services enabled by them in the years to come. AT&T and Qualcomm are joining forces to trial drone operation on AT&T’s commercial 4G LTE networks — testing key performance indicators (KPI’s) such as coverage, signal strength, throughput, latency and mobility under various real-world scenarios. Findings from this research will not only help us optimize 4G LTE networks for safe and reliable drone operation, but also inform positive developments in drone regulations and 5G specifications as they relate to wide-scale deployment of numerous drone and other mission-critical use cases.

Discussion: Greg Belaus ([email protected]), Lead Business Development – UAV, Internet of Things (IoT) Solutions Group, said AT&T’s “drone play” was to build a technology foundation for connected drones that would create a supporting ecosystem which is part of the Internet of Things (IoTs).

AT&T’s IoT DNA includes:

- 2.9M connected devices

- 9.4M connected vehicles

- IoT Platform tools include: M2X, global SIM card, LTE modem, internal use cases and collaboration

- IoT starter kit

AT&T plans to use drones for: cell tower inspection, a venue for real time performance validation, potential future use cases, eg. flying Cellular On Wheels (COWs). AT&Ts IoT Solutions Group is developing drone solutions for AT&T’s business customers.

Qualcomm is helping to build the drone ecosystem foundation. It will be used to characterize AT&Ts commercial LTE network at altitude, across its network infrastructure and locations. Recordings will include: flight path, time of day, network parameters (e.g. frequencies, hand-offs).

The Connected Drone Platform consists of:

- 4G LTE cellular connectivity

- Video transmitter

- GPS receiver

- Camera Printed Circuit Board (PCB)

- WiFi PCB

- Flight Controller PCB

The trials will analyze how UAS can operate safely and more securely on commercial 4G LTE and wireless networks of the future (such as “5G”). The research will look at elements that would impact future drone operations.

–>A key objective is to optimize AT&T’s LTE network for safe drone operations that use it.

Drone Applications mentioned were:

- Small farmer/agriculture

- Certify drone operators

- Drone fleet management

- Precision location tracking

More information at: https://www.qualcomm.com/news/releases/2016/09/06/qualcomm-and-att-trial-drones-cellular-network-accelerate-wide-scale

Other 2016 TC3 Session Summaries:

Highlights of Telecom Council TC3 Panel on 5G Telecom Regulation

Summary & Conclusions of SD-WAN sessions at Telecom Council’s TC3 Summit

Telecom Council 2016 SPIFFY Award Winners include Simless (Virtual SIM Card)

AT&T to use LTE, Cat-M1 & M2 for IoT Applications

AT&T is moving forward with LTE future for its cellular Internet of Things (IoT) applications, despite earlier suggestions that the network operator could consider other low-power, wide-area (LPWAN) specifications. The LTE only decision is consistent with AT&T’s existing LTE based IoT platform, which we described in an earlier article:

AT&T claims to have the largest share of the connected device market with 19.8M IoT devices or 47% of the U.S. total IoT market in 2013. There are GSM location tracking capabilities in over 100 countries with roaming access in more than 200 countries.

AT&T is a founding member of the Industrial Internet Consortium where over 100 companies are now involved. As part of that effort:

- IBM and AT&T are collorating on IoT solutions for cities, institutions, and enterprises.

- GE and AT&T are working on remotely controlled industrial machines.

“I think the decision that we have made as a company is that AT&T is going to standardize on the LTE stack as opposed to unlicensed bands,” Mobeen Khan, AVP of AT&T IoT Solutions, at AT&T Mobile and Business Solutions, told Light Reading Wednesday, June 22nd. AT&T has “many reasons” for the decision: The specialized IoT LTE technologies uses AT&T’s existing spectrum; it’s more secure and can be managed using existing infrastructure. “It has a lot of benefits for our customers,” Khan said.

AT&T is going to standardize on Cat-M1 (a.k.a. LTE-M) for devices like smart meters and wearables. Cat-M1 is optimized to offer a 1Mbit/s connection but with superior battery life compared to the typical 4G smartphone radio chipset. The operator has just approved its first modules for this specification. There will be trials in the forth quarter.

For even lower-power applications, AT&T will use Cat-M2 modules in units like smoke detectors and networked monitors. Cat-M2 is “still being specced out” but is anticipated to go to kilobits-per-second connection rates to further extend battery life, Khan said. AT&T will test Cat-M2 devices on the network in 2017 and hopes to go commercial early in 2018.

This doesn’t mean that AT&T won’t support any other types of networking for IoT. WiFi, Bluetooth and mesh networking will all be part of the mix. “We’re living in a multi-network world,” Khan said.

References:

http://www.lightreading.com/iot/iot-strategies/atandt-settles-on-lte-for-cellular-iot/d/d-id/724289

http://www.lightreading.com/iot/m2m-platforms/atandt-readies-low-power-lte-for-iot/d/d-id/720150

Energy versus security–the IoT tradeoff:

AT&T and other leading telcos are highlighting the security advantages of using cellular networks in licensed spectrum to connect IoT devices. They point to the benefits of having a SIM card authenticate the device on the network, such as being able to remotely bar devices, where necessary. Without a secure link, IoT applications may be more vulnerable to attacks, such as spoofing, where a fraudulent end device injects false data into the network or a fraudulent access point hijacks the data captured by a device.