5G in India

Adani Group to launch private 5G network services in India this year

Adani Group, the newest entrant in India’s telecom space, is looking to launch private 5G services for enterprises in 2023. The conglomerate also announced that it would be launching consumer apps this year as part of its digital strategy.

Addressing his employees in the New Year, Chairman Gautam Adani said they will invest in expanding the network of data centers, building AI-ML and industrial cloud capabilities, along with rolling out 5G services and launching B2C apps.

“While we are fully invested in building India, it is an opportune time to contribute to nation-building outside India. All of these are big ticket, independent yet mutually connected digital opportunities that are backed by our adjacency in the energy business,” he said.

The Gujarat-based conglomerate surprised industry incumbents when it took part in 5G auctions in 2022. While Adani has not purchased spectrum across all 5G bands and thus cannot provide consumer telephony, the conglomerate parted with Rs. 212 crore to buy 400MHz spectrum in the mm-wave band. Adani is gunning to provide private network services to enterprises, including its own.

However, telecom operator Bharti Airtel beat Adani to the punch, bagging the first private 5G network deal with Mahindra Group late last year.

Reliance Jio has also indicated that private 5G will be a key avenue for monetization for the operator in the future. Chairman Mukesh Ambani has committed Rs 2 trillion investment for rolling out a 5G network across the country by December 2023, according to a recent report by the Press Trust of India.

Other entities, such as IT major Tata Consultancy Services (TCS), could also participate in the private 5G network market. They are awaiting spectrum assignment rules from the DoT and TRAI, who are still deliberating the spectrum bands, which will be given to enterprises for private network use through administrative allocation.

References:

Hindu businessline: Indian telcos deployed 33,000 5G base stations in 2022

As 2022 nears an end, India based telcos like Reliance Jio and Bharti Airtel have deployed about 33,000 base stations for 5G services. Sources in India’s Department of Telecommunications told businessline that the telcos deployed around 10,000 base stations in December, taking the cumulative number of base stations deployed for 5G services to about 33,000.

[For another report on 5G base stations in India see; 20,980 base stations installed for 5G, about 2,500 being set up per week, Government tells Rajya Sabha | Headlines (devdiscourse.com)]

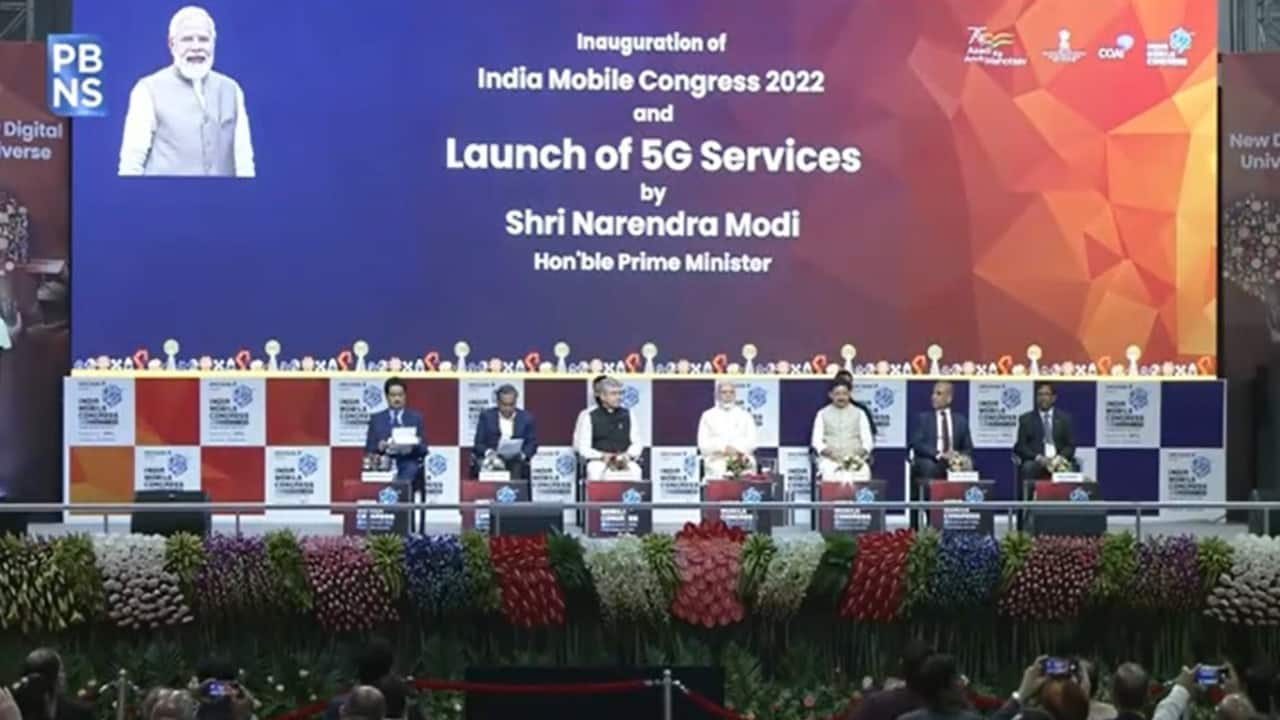

Telecom operators commenced deploying the 5G network after Prime Minister Narendra Modi inaugurated 5G services on October 2. Only Reliance Jio and Bharti Airtel have commenced 5G capex, as debt-laden Vodafone Idea is still trying to raise additional funds to commence capital expenditure for its 5G network.

Quoting the Ministry of Communications report to the Rajya Sabha, businessline reported last week that the telcos had deployed about 21,000 base stations for 5G services till November 26. According to senior DoT officials, the telcos have added more than 10,000 additional base stations to that number.

Since operators need to deploy 2–6 base stations per tower, the number of telecom towers for 5G has not increased substantially in the past three months. The two operators alone would have deployed 3,000 to 4,000 telecom towers for 5G services.

While telcos have commenced deploying 5G towers in the majority of Indian States, the national capital Delhi is experiencing the fastest deployment of 5G services. Almost a third of all the base stations deployed are located in Delhi. Therefore, users in Delhi NCR will experience the best 5G services.

References:

Telecom operators deploy 33,000 5G base stations this year – The Hindu BusinessLine

Nokia Executive: India to Have Fastest 5G Rollout in the World; 5Gi/LMLC Missing!

While speaking at an event organized by the Foreign Correspondent Club on Friday evening, Nokia India Head of Marketing and Corporate Affairs, Amit Marwah said India is going to record the fastest 5G rollout in the world and it is going to have the biggest success of the next -generation telecom service with the support of the government.

“We (India) are not late, we are at the right time. In the rest of the country compared to other countries where the ecosystem has to develop. We have a 5G-ready ecosystem. We have 10 per cent of smartphones in India which are 5G ready. India is going to witness the fastest rollout of 5G which will be at least three times faster than what we have seen in 4G,” Marwah said. The 5G services will progressively cover the entire country over the next couple of years — Reliance Jio promises to do that by December 2023 and Bharti Airtel by March 2024.

Marwah said telecom manufacturing is becoming robust in India backed by the production-linked incentive (PLI) scheme. “We were part of PLI 1.0. We were one of the only companies that met and exceeded our target of PLI 1.0. We let go-off that scheme and let go-off the incentive of one year because PLI 2.0 was even more interesting. Volumes and scale in India are increasing so much that you have let go for one year. We re-applied for PLI f2.0 and today we are part of PLI 2.0 which means we are investing more, adding more lines and adding more products,” he said.

The PLI scheme offers up to 20 times incentive on incremental sales of telecom equipment made in India. The government has added additional incentives for designing products in India in the second version of the PLI scheme. Marwah said that manufacturing is on a very positive note in India across the sectors but definitely in telecom.

“The only challenge right now is the availability of fabs which are semiconductors. 60-80 per cent of what we manufacture requires semiconductors. That is the area where we still need to work on. There is still some kind of infiltration of equipment in telecom from neighboring countries which need to have a little more vigilance and kind of stopping at the customs,” Marwah added.

Note: In October, Nokia announced that it had won a multi-year deal with Reliance Jio India to build one of the largest 5G networks in the world.

Department of Telecom, Deputy Director General (Policy) YGSC Kishore Babu said that the 5G adoption and applications are expected to be more diverse in India compared to other countries. “However, most of the use cases across the world remind us we may have to innovate to meet most of the requirements in the coming months and years,” Babu said.

Tech Mahindra, Chief Strategy Officer and Head of Growth, Jagdish Mitra said 5G is the biggest opportunity in technology so far, for India to bridge what we have typically referred to as Bharat and India.

“We have 62 per cent of our workforce in the agriculture sector, and 5G presents us with a huge opportunity to convert that into the most profitable segment. We can enable high yields by producing smarter networks and delivering products to the farmers,” Mitra said.

Telecom Sector Skill Council, CEO, Arvind Bali said close to 25 lakh people need to be reskilled and up-skilled in the field of telecom in the next few years because there is a shift from 4G to 5G.

“We need to have at least one lakh technicians and engineers, in the next few years, who have been trained specifically on 5G courses for the new job requirements and we at TSSC are setting up Centers of Excellence and training labs with the help of the industry. 5G is going to open up big requirements for a talented workforce and we are training the youth in new-age technologies,” Bali said. He added that TSSC is also developing all the curriculum and the digital content for training people to meet the industry requirement.

End Note: Despite all the hype and hoopla about 5G in India, none of the 5G network announcements have stated support for 5Gi which is part of the ITU-R M.2150 5G standard for RIT/SRITs. The 5Gi standard uses Low Mobility Large Cell (LMLC) to extend 5G connectivity and the range of a base station. It does so by using bands of the spectrum, which are lower than 5G’s operational bands but offers a high-range waveform. Ideally, the 5G frequency band ranges from 700MHz to 52GHz, but 5Gi can go lower than 700MHz and up to 36GHz without sacrificing the range. 5Gi was contributed to ITU-R WP 5D by TSDSI and backed by the Indian government.

LMLC technology increases the inter cell site distance to 6 km from the 3GPPs 1.7 km, which should make the deployment cost-effective. Also, the 5Gi standard reduces the mobility speed from 3 km/h to 30 km/h to make 5G network usage satisfactory to India’s scenario. In contrast, the 3GPP RIT/SRIT in the ITU M.2150 5G standard has maintained the mobility requirement between 120 km/h to 500 km/h, which is inconceivable in India.

One year ago, Vodafone Idea said it was working with a “few companies” to prepare for trials using 5Gi. “We are already working with a few companies. As and when the product is ready, we will be keen and will be doing trials and deploy accordingly” Jagbir Singh, chief technology officer (CTO) of Vi said at the time. He didn’t divulge details of the partners are. At this time, Vodafone Idea has not stated when it would deploy 5G– only that it would be 5G NSA (with a LTE anchor for everything other than the radio access network).

References:

India’s TSDSI candidate IMT 2020 RIT with Low Mobility Large Cell (LMLC) for rural coverage of 5G services

At long last: India enters 5G era as carriers spend $ billions but don’t support 5Gi

Vodafone Idea to use 5Gi (ITU M.2150-LMLC) in trials

https://www.itu.int/dms_pubrec/itu-r/rec/m/R-REC-M.2150-1-202202-I!!PDF-E.pdf (ITU-R 5G RIT/SRIT standard is M.2150)

Reliance Jio’s “Home Grown” 5G? Ericsson and Nokia in multi-year deals with Jio to build a mega 5G network

What ever happened to “Home Grown 5G” at Reliance Jio? Over two years ago, Jio Chairman Mukesh Ambani said his company had developed its own 5G solution “from scratch.”

“Jio plans to launch “a world-class 5G service in India…using 100% home grown technologies and solutions,” he said in a statement at the Reliance Industries annual shareholders meeting. “Once Jio’s 5G solution is proven at India-scale, Jio Platforms would be well-positioned to be an exporter of 5G solutions to other telecom operators globally, as a complete managed service,” he added.

–>Since then we haven’t heard anything about Jio’s indigenously built 5G network. Jio has not disclosed whose network equipment is being used for its current 5G roll-out in India which started this month.

In stark contrast, telecom equipment vendors Ericsson and Nokia have signed separate multi-year deals with Reliance Jio to build a mega 5G network. The announcements neither divulged the deal sizes or time frames. They came amid large network deployments across India for 5G services.

- Swedish telecom gear maker Ericsson announced a long-term strategic 5G contract with Reliance Jio to roll out a 5G standalone (SA) network in the country.

- Finland headquartered Nokia will supply Reliance Jio, which has more than 420 million customers, with 5G radio access network (RAN) equipment in a multi-year deal, the Finnish company said in a statement.

Announcing the partnership with Ericsson, Akash Ambani, Chairman, Reliance Jio, says: “We are delighted to partner with Ericsson for Jio’s 5G SA rollout. Jio transformed the digital landscape in India with the launch of LTE services in 2016. We are confident that Jio’s 5G network will accelerate India’s digitalization and will serve as the foundation for achieving our nation’s ‘Digital India’ vision.”

Ericsson’s 5G RAN products and solutions from Ericsson Radio System and E-band microwave mobile transport solution will be deployed in the 5G network for Jio, the equipment company said. This is the first partnership between Jio and Ericsson for radio access network deployment in the country, according to the previously referenced press release.

Ericsson recently topped the Frost Radar™: Global 5G Network Infrastructure Market ranking for second year in a row. Ericsson was also named a Leader in the 2022 Magic Quadrant for 5G Network Infrastructure for Communications Service Providers report by Gartner. The Company invests around 18 percent of global revenue in R&D and holds the leading patent portfolio in the industry, with more than 60,000 granted patents worldwide. It is also the holder of the most 5G essential patents.

“Nokia will supply equipment from its AirScale portfolio, including base stations, high-capacity 5G Massive MIMO antennas, and Remote Radio Heads to support different spectrum bands, and self-organizing network software,” the company said. Nokia has a long-standing presence in India. This new deal will mean that Nokia is now supplying India’s three largest mobile operators.

Pekka Lundmark, President and CEO at Nokia stated: “This is a significant win for Nokia in an important market and a new customer with one of the largest RAN footprints in the world. This ambitious project will introduce millions of people across India to premium 5G services, enabled by our industry-leading AirScale portfolio. We are proud that Reliance Jio has placed its trust in our technology and we look forward to a long and productive partnership with them.”

5G data speeds in India are expected to be about 10 times faster than those of 4G, with the network seen as vital for emerging technologies like self-driving cars and artificial intelligence. Reliance snapped up airwaves worth $11 billion in a $19 billion 5G spectrum auction in August and had launched 5G services in select cities. It is also working with Alphabet Inc’s Google to launch a budget 5G smartphone. As India’s telecom service providers roll out 5G services, the government is also pushing top mobile phone manufacturers, like Apple Inc, Samsung and others to prioritise rolling out software upgrades to support 5G, amid concerns that many of their models are not ready for the high-speed service. The Reliance-Nokia deal comes at a time some gover nments, including India, have either banned or discouraged the use of China’s Huawei in national networks.

“Jio is committed to continuously investing in the latest network technologies to enhance the experience of customers,” Akash Ambani, chairman of Reliance Jio, said. Meanwhile, Jio is planning to raise an additional $1.5 billion via external commercial borrowings to fund its 5G capital expenditure plans, reports said. ABP Pvt. Ltd.

Analysts said the 5G rollout in the country would be much slower than 4G or 3G as the main revenue for the service would be generated from enterprise solutions. Indian telco deals with the equipment makers are meant for areas where enterprises would demand the service. Retail consumers will be wary of paying a higher price just for speed, they said.

References:

https://www.jio.com/5g-banner-3.jpg

Reliance Jio claim: Complete 5G solution from scratch with 100% home grown technologies

At long last: India enters 5G era as carriers spend $ billions but don’t support 5Gi

After years of 5G auction delays, India became the last major Asian economy to launch a 5G network, marking a new wave of spending by indebted Indian carriers. Prime Minister Narendra Modi made the first 5G video call on Saturday to school students to demonstrate use of the service in education. “5G is the beginning of an infinite space of opportunities,” especially for the country’s youth, he said. Well, that has yet to be proven!

Though 5G mobile technology — first introduced in South Korea three years ago — has been viewed by consumers as underwhelming so far because of a dearth of matching applications, local operators led by billionaire Mukesh Ambani’s Reliance Jio Infocomm Ltd. are betting that will change. They are counting on the nation’s 600 million-plus smartphone users to switch to the new network in due course and also on industries gearing for a digital transformation.

Carriers agreed to fork out $19 billion just two months ago for airwaves at a government auction, with Reliance’s $11 billion bid topping the list. The conglomerate proposes to invest 2 trillion rupees ($25 billion) more. Billionaire Sunil Mittal’s Bharti Airtel Ltd. and Vodafone Idea Ltd. haven’t disclosed their spending plans as yet.

While Reliance raised more than $25 billion from marquee investors in 2020 to help fund digital expansion, the need to spend big on 5G could weigh on the finances of rivals. Bharti and unprofitable Idea have a combined net debt of $37 billion, and the latter staved off bankruptcy by giving 36% of its equity to the Indian government earlier this year in lieu of back fees it couldn’t pay.

At the launch event on Saturday, Ambani said Jio’s 5G network will cover the entire country by December next year, while Mittal said Bharti Airtel plans to do so by 2024. Given the scale of spending, some experts said carriers are unlikely to undercut each other on prices once again — something that was tried in 2016 when Jio entered the market by offering free calls and cheap 4G data plans, which ended up putting some rivals out of business.

“They will likely provide 5G services to those segments of the market that are willing to pay higher and try and recover as much as possible before making it available to others,” said Rajat Kathuria, a senior visiting professor at the Indian Council for Research on International Economic Relations in New Delhi.

5G’s long road to India has been dogged by several controversies. The main one was about how secure Chinese equipment is — a crucial issue for a country engaged in a border conflict with its northern neighbor. Last year, carriers decided to avoid Chinese vendors such as Huawei Technologies Co. and ZTE Corp., and opted instead to tie up with makers like Ericsson AB, Nokia Oyj and Samsung Electronics Co., potentially adding to their costs.

“India may have started a little late, but we’ll finish first by rolling out 5G services that are of higher quality and more affordable,” Ambani said at the launch event. The technology can bring affordable, superior education and skill development to ordinary Indians and deliver high-quality healthcare to rural and remote areas, he said.

Despite India’s TSDSI getting 5Gi (5G for India or Low Mobility Large Cell) included in ITU M.2150 (previously known as IMT 2020), no Indian carrier has announced support of it. That is a major disappointment for TSDSI. Please refer to the numerous references below.

Offering low latency (that does not meet ITU-R M.2410 URLLC performance requirements) and data speeds about 100 times faster than 4G (depending how close your 5G endpoint is to the cell tower or small cell), the technology may someday have the potential to enable a variety of advanced applications such as holograms, 3D avatars of people in metaverses and telemedicine, in which near-instantaneous transmission of video and data would allow surgeons to operate remotely using a robotic scalpel. So far, such applications have been too slow to evolve. For average users, 5G has mostly meant faster video games and content streaming.

To capitalize on 5G, China has been rolling out smartphone apps and industrial projects such as super high-definition live streaming, remote manufacturing, virtual reality and robotic surgery arms. The country’s three state-owned carriers have introduced more than 25,000 such applications, according to a news article posted by the State Council on its website in August. In South Korea, despite mobile operators’ efforts to come up with killer apps, average revenue per person has only climbed slightly since the 4G era.

In India’s race to roll out 5G, the only winner to emerge so far has been the government: The airwave auction was set to raise a record amount, Telecom Minister Ashwini Vaishnaw said in July.

Proceeds from the spectrum auction could provide a big financial boost to Modi’s administration, which has been seeking to tame inflation and rein in fiscal deficits as economists warn of a looming global recession.

References:

https://ieeetv.ieee.org/2020-5g-world-forum-keynote-radha-krishna-ganti

https://tsdsi.in/wp-content/uploads/2020/02/LMLC_ver1_RIT-Prof-Ganti.pdf

TSDSI’s 5G Radio Interface spec advances to final step of IMT-2020.SPECS standard

India lagging in 5G unless spectrum prices decrease & 5Gi standard debate is settled

Jio and Airtel against 5Gi standard; 2 GHz of mid-band needed for India 5G demand

India’s Success in 5G Standards; IIT Hyderabad & WiSig Networks Initiatives

Bharti Airtel to launch 5G services in India this August; Reliance Jio to follow

After numerous delays, India’s government finally completed its 5G spectrum auction on its seventh day. 5G spectrum worth 1.5 trillion Indian rupees (US $18.99 billion) being sold to the country’s three mobile network operators – Reliance Jio, Bharti Airtel, Vodafone Idea – and Adani Group, with Jio emerging as the top bidder, according to media reports.

Bharti Airtel has announced that it has awarded its first 5G contract in the country to Ericsson with 5G deployment to get underway in August 2022. Ericsson is Airtel’s long-standing connectivity partner and pan-India managed services provider, with a partnership spanning more than 25 years. The latest 5G partnership follows the close of 5G spectrum auctions in India. In a statement, Airtel said that it will deploy power-efficient 5G Radio Access Network (RAN) products and solutions from the Ericsson Radio System and Ericsson microwave mobile transport solutions.

The company also signed agreements with Nokia and Samsung to build 5G capacity in India. Under the agreement, Nokia will provide equipment for AirScale portfolio, including modular and scalable baseband as well as high-capacity 5G massive MIMO radios.

Meanwhile, Ericsson will be providing 5G connectivity in 12 circles for Bharti Airtel. In addition to an enhanced user experience for Airtel customers – spanning ultra-high-speeds, low latency and large data handling capabilities – Ericsson 5G network products and solutions will also enable Bharti Airtel to pursue new, innovative use cases with its enterprise and industry customers, claimed the company.

Bharti Airtel has announced that it has acquired 19,800 MHz spectrum by securing a pan-India footprint of 3.5 GHz and 26 GHz bands. This spectrum bank was secured for a total consideration of Rs 43,084 crore in the latest spectrum auction conducted by the Department of Telecom, Government of India. Airtel acquired 19,867.8 MHz spectrum in 900 MHz, 1800 MHz, 2100MHz, 3300 MHz and 26 GHz frequency bands for Rs 43,084 crore. Airtel has secured 5G spectrum for 20 years in this auction.

Airtel CEO Gopal Vittal, MD and chief executive officer said, “As our trusted, long-term technology partner, we are delighted to award our first 5G contract to Ericsson for 5G deployment in India. “5G presents a game-changing opportunity to drive the digital transformation of industries, enterprises and the socio-economic development of India. With our 5G network, we aim to deliver the full benefits of 5G connectivity, fuel India’s journey towards a digital economy and strengthen the country’s position on the world stage.”

“5G presents a game-changing opportunity to drive the digital transformation of industries, enterprises and the socio-economic development of India. With our 5G network, we aim to deliver the full benefits of 5G connectivity, fuel India’s journey towards a digital economy and strengthen the country’s position on the world stage.”

Börje Ekholm, President and CEO, Ericsson, says: “We look forward to supporting Bharti Airtel with its deployment of 5G in India. With Ericsson’s unrivaled, global 5G deployment experience, we will help Bharti Airtel deliver the full benefits of 5G to Indian consumers and enterprises, while seamlessly evolving the Bharti network from 4G to 5G. 5G will enable India to realize its Digital India vision and foster inclusive development of the country.”

Reliance Jio may also launch 5G in August:

It is likely that arch rival Reliance Jio too may launch the 5G services this month. “We will celebrate ‘Azadi ka Amrit Mahotsav’ with a pan India 5G rollout. Jio is committed to offering world-class, affordable 5G and 5G-enabled services. We will provide services, platforms and solutions that will accelerate India’s digital revolution, especially in crucial sectors like education, healthcare, agriculture, manufacturing and e-governance,” said Akash M Ambani, Chairman, Reliance Jio Infocomm.

However, no disclosure of Jio’s 5G vendor(s) over two years after Ambani said Jio was developing its own “homegrown” 5G network equipment. The Business Standard reports that Jio had selected Samsung to build its pan-India 5G network.

References:

Bharti Airtel working with partners to enable 5G use cases in India

Bharti Airtel said that it is engaging new partners to enable 5G use cases for various consumer and enterprise use cases in India. It will also start a campaign to educate users about their next 5G smartphone to ensure if they can get the best experience with support to all relevant bands.

A handset to support all possibilities of 5G is very important, Bharti Airtel’s chief technology officer Randeep Sekhon told ET. Airtel will come out with a campaign for users who want to buy 5G handsets informing them about various checks of their particular handsets to make sure the handset works well in India across not just 5G but various other bands and carrier aggregation. “This is important when you choose a 5G handset to get the best experience,” he said.

The Sunil Mittal-led telecom operator had recently urged the India Department of Telecommunications to bring uniform guidelines to develop the 5G smartphone ecosystem. It recommended that any new 5G handset sold in India must support all existing bands in India for 5G, including the mmWave bands.

Indian telecom operators have spectrum in the 2G, 3G and 4G bands which can be refarmed and used for 5G NSA or 5G SA and also use Dynamic Spectrum Sharing (DSS) for fast deployment. They want handset brands to support all existing spectrum bands like 1800/2100/2300 MHz and sub-GHz bands 800/900 Mhz.

The telecom operator said that it successfully conducted a cloud gaming session on its 5G trial network in Manesar using the 3.5GHz spectrum band. Sekhon said that “immersive entertainment” will be another major consumer use case of 5G. “But, for A/R and V/R, content needs to be created and be personalized at the edge. We are seeing how we can make it real.”

Airtel is currently using the 3.5 GHz spectrum band for 5G trials in Delhi-NCR and Mumbai. Sekhon said that the telco hasn’t started 5G trials using mmwave band. “As and when we will get equipment, we will try that too. 3.5 GHz anchored with traditional 4G bands are currently being used for trials.”

“For the B2B, industry 4.0, high speed, high latency and mass concurrency around IoT cloud and 5G are required.. We are working with many of our industry customers on creating fir infra, FMCG, factory, mining. This will be relevant,” Sekhon added.

The CTO said that telecom operators can’t do everything by themselves and their main focus is to build the best infrastructure to enable partners. Airtel, he said, will have various partners to enable 5G use cases like education, e health and for industries.

“Some partnerships are for initial 5G trials and some will for massifying the roll out. The 5G real experience will happen when all stakeholders ecosystem partners are available,” Sekhon said.

India lagging in 5G unless spectrum prices decrease & 5Gi standard debate is settled

Bloomberg says India risks lagging in the rollout of the 5G wireless networks unless the government makes airwaves cheaper in an upcoming spectrum auction, a local telecom industry body said, citing the financial stress in the sector.

“The reserve prices are fixed so high that almost 50-60% of the spectrum may go unsold,” S.P. Kochhar, director general of Cellular Operators Association of India (COAI), said in an interview August 27th. “It is not viable because we are not passing on the extra price to the consumer as we continue to bleed. We have to reduce our cash outflow and one of the major things money goes into is auctions.”

Proceeds from the 5G airwaves auction, likely early next year, is an important source of revenue for the Indian Exchequer (UK term for Treasury Dept.) especially as the Narendra Modi-led government looks to spur India’s pandemic-hit economy. Too high a reserve price for spectrum risks putting off wireless network operators whose financial health has been battered by a brutal tariff war after the entry of billionaire Mukesh Ambani’s Reliance Jio Infocomm Ltd. in 2016. Most operators since have quit, gone bankrupt or merged.

Lowering the base price for auctioned spectrum and other government levies have been a longstanding industry demand. The local telecom industry is paying about 32% of its total revenue as levies and taxes and that’s “too high,” said Kochhar. “It’s the highest in the world.”

India’s government has set the reserve price for 5G airwaves at 4.92 billion rupees ($67.2 million) per megahertz of spectrum in 3,300 to 3,600 Mhz bands which are most suitable for the new technology. Kochhar expects the auction to happen in January or February 2022.

High reserve prices have hindered spectrum sales in some categories in the past. The 700 megahertz band, which is suitable for 5G technology, didn’t receive any bids in the March auction.

…………………………………………………………………………………………………………………………………………..

Sidebar: TSDSI’s 5Gi standard (included in ITU-R M.2150 recommendation/IMT 2020.specs)

Another important aspect of 5G in India deployments has been the deliberation on the development of specific 5G India standards (5Gi or LMLC). While the Telecommunications Standards Development Society of India (TSDSI) has been keen on pushing telcos to undertake trials based on 5Gi, a homegrown standard with a Large Cell Low Mobility enhancement for wider coverage in rural areas, the Cellular Operators Association of India (COAI) has argued for the implementation of the global 3GPP specification (5G NR in Release 15 & 16) for 5G in India. They remain convinced that 5Gi could lead to interoperability issues. This ongoing debate is further delaying the 5G launch in India.

Source: The Economic Times

……………………………………………………………………………………………………………………………………..

India remains a relative latecomer in the 5G space compared to some countries, including China and South Korea, which already have 5G networks in place.

If the government can “somehow have the right price point for spectrum,” it would boost the growth of 5G network traffic as well as the devices, Bharti Airtel Ltd. Chairman Sunil Mittal said in an investor call Monday. “We need to invest in fiber backhaul now.”

The market leader Jio and Bharti Airtel, India’s no. 2 operator, have been conducting 5G trials in preparation for a nationwide roll out once the airwaves are sold.

Debt-laden Vodafone Idea Ltd. — the only other private sector wireless operator left in India — has been posting losses for several quarters and is struggling to stay afloat. Bharti and Vodafone Idea also have to come up with billions of rupees in back dues to the government after India’s top court rejected their petitions seeking relief.

“At this point, the payouts in telecom are so excessive that even survival is becoming a problem,” said Kochhar. That strongly implies there will be only two 5G network operators in India- Jio and Bharti!

………………………………………………………………………………………………………………………

BSNL is aiming to upgrade the 4G network to 5G non-standalone (NSA) by 2022 (pending 5G spectrum to be purchased at the long delayed auction) and to 5G standalone (SA) by 2023. What about that? Almost every country has already deployed 5G NSA while operators are slowly evolving to 5G SA using different software technologies in the absence of any standard or implementation spec.

Light Reading says BSNL is unlikely to meet to this timeline, with shortlisted 4G network vendors still conducting tests. It is likely to be another year before BSNL can roll out a 4G network, while private-sector companies are gearing up for a 5G launch in the coming year.

References: