5G in India

Tata Consultancy Services: Critical role of Gen AI in 5G; 5G private networks and enterprise use cases

“In the realm of network management, Generative AI could play a critical role in predicting 5G data flow patterns and optimizing performance, ultimately improving the customer experience. Similarly, in the area of security, Gen AI could be pivotal in identifying and predicting threats before they occur, strengthening overall network security,” Mayank Gupta, Global Head (Sales and Strategy Network Solutions and Services) at Tata Consultancy Services (TCS), told the Economic Times of India.

5G adoption has been happening in stages he said. When asked about the 5G monetization challenges, Gupta opined that one of the main challenges has been fully understanding the business case or use case required by the industry. “It is not the traditional ‘design, deploy and get paid’ model. Instead, you have to engage with the industry, collaborate with various stakeholders and take an ecosystem approach. It is essential to understand the specific business needs, define the problem and then build solutions around that,” Gupta said.

“Two years ago, 5G was moving at a very slow pace, but it has gained significant momentum. Globally, the U.S. and Canada are leading the way, while countries like South Korea and Brazil are accelerating their adoption, largely due to the liberalization of their spectrum. From a deployment standpoint, mobile private networks are among the first areas seeing significant progress, with deployments growing rapidly. “The focus is shifting from just connectivity to a broader transformation of operational technology,” he added.

Over 50% of 5G mobile data is now coming from the enterprise sector, which has become a major focus. Different countries prioritize different use cases based on their needs.

Watch the video interview here:

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………….

References:

Tata Communications launches global, cloud-based 5G Roaming Lab

5G Made in India: Bharti Airtel and Tata Group partner to implement 5G in India

LightCounting & TÉRAL RESEARCH: India RAN market is buoyant with 5G rolling out at a fast pace

Reliance Jio in talks with Tesla to deploy private 5G network for the latter’s manufacturing plant in India

Communications Minister: India to be major telecom technology exporter in 3 years with its 4G/5G technology stack

India to set up 100 labs for developing 5G apps, business models and use-cases

Adani Group to launch private 5G network services in India this year

Nokia wins multi-billion dollar contract from Bharti Airtel for 5G equipment

Nokia has secured a multi-billion dollar contract with India’s Bharti Airtel, one of the country’s leading telecom operators, which is expanding its 5G network. The deal with Airtel would be for Nokia’s latest AirScale mobile radios that support upgrading an existing network to 5G-Advanced and reduces energy costs, according to the sources.

- Ericsson won a multi-billion dollar contract from Bharti Airtel, Reuters reported on Monday. Airtel is also in talks with Samsung about buying 5G equipment, a source told Reuters.

- Samsung has been trying to grow its network equipment business, but has so far lagged Nokia and Ericsson. Samsung won its first 5G contract with Airtel in 2022. India has blocked its mobile carriers from using 5G telecom equipment made by China’s Huawei.

Backgrounder:

India is the world’s second-largest smartphone market where telcos such as Airtel, Reliance Jio and Vodafone Idea have been spending billions of dollars to upgrade their networks to 5G. Bharti Airtel’s 5G market share in India is over 90 million subscribers, as of June 2024. Airtel and Reliance Jio are the only two telcos in India that offer 5G services.

……………………………………………………………………………………………………………………………………..

……………………………………………………………………………………………………………………………………..

The Nokia-Bharti Airtel deal is indicative of the intensifying competition among telecom operators and equipment manufacturers in India’s 5G market. For Nokia, the agreement represents a significant rebound and consolidation of its presence in India, amidst previous challenges and the competitive pressures exerted by rivals such as Ericsson and Samsung.As India stands on the cusp of a 5G revolution, the successful execution of this deal could serve as a blueprint for similar agreements, thereby accelerating the pace of 5G deployment across the nation.

LightCounting & TÉRAL RESEARCH: India RAN market is buoyant with 5G rolling out at a fast pace

The India Wireless Infrastructure Report provides an update on the 5G radio access (RAN) developments in India, including geopolitics trends and technology. The report says that The RAN market in India is buoyant with a swelling local ecosystem that boasts big international ambitions.

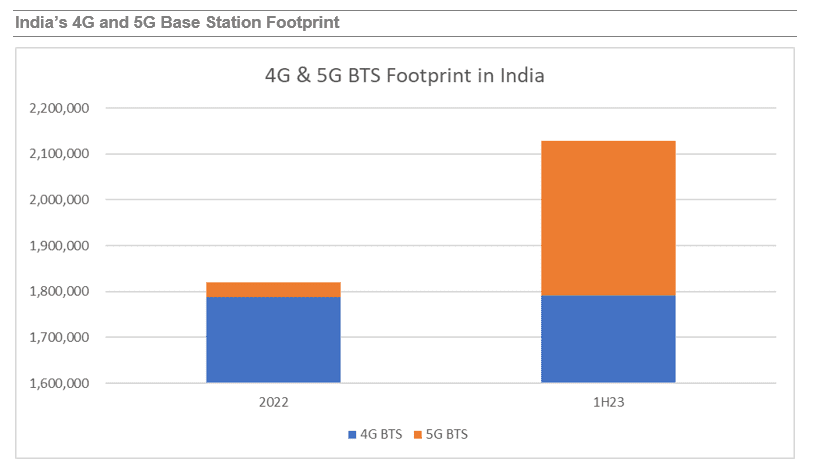

Reliance Jio is rolling out 5G at a fast pace, followed by Bharti Airtel. As a result,1H23 RAN sales surged 300% YoY, and kept Ericsson in the driver’s seat, followed by Nokia and Samsung. Although the rollout pace has slowed down, 2023 is looking up, looks like the peak year, and we expect RAN equipment sales to more than double compared to last year, still driven by Jio and Airtel while BSNL will contribute with its 4G deployment.

“It’s a two-horse race, the near Jio / Airtel duopoly is quickly blanketing the country with 5G while the rest are struggling and catching up with 4G.” said Stéphane Téral, Chief Analyst at LightCounting Market Research and Founder of TÉRAL RESEARCH.

Source: LightCounting

………………………………………………………………………………………………………………………….

- 2024 is shaping up as a shift year from 5G network buildout to how to foster utilization and some midband FWA experiments.

- Due to the looming formation of a CSP duopoly, the looming merger of MTNL into BSNL, and Vodafone Idea’s unsustainable indebtment, our long-term forecast points to a lumpy RAN market. There is no surprise that India is a tough cellular market characterized by flat subscriber growth, ultralow ARPUs and low equipment average sales pricing.

- Open RAN is the brightest spot with a penetration of the total RAN market that will surpass 50% by 2028.

- At the same time, a mushrooming energetic local ecosystem is rising with great international ambitions enabled by strong ties between the U.S. and India.

…………………………………………………………………………………………………………..

References:

https://www.lightcounting.com/report/september-2023-india-wireless-infrastructure-217

https://www.lightcounting.com/report/september-2023-open-vran-market-213

Reliance Jio in talks with Tesla to deploy private 5G network for the latter’s manufacturing plant in India

OTT players in India struggle in telco partnerships

Communications Minister: India to be major telecom technology exporter in 3 years with its 4G/5G technology stack

India to set up 100 labs for developing 5G apps, business models and use-cases

Adani Group to launch private 5G network services in India this year

Reliance Jio to sign $1.5 billion 5G network equipment deal with Nokia (“Home grown 5G” never happened)

Whatever happened to Jio’s claim of “home grown 5G“? Answer: It was a big bold faced lie! Almost 3 years ago, Jio Chairman Mukesh Ambani said his company had developed its own 5G solution “from scratch.” He said at the time, “Jio plans to launch “a world-class 5G service in India…using 100% home grown technologies and solutions,” he said in a statement at the Reliance Industries annual shareholders meeting. “Once Jio’s 5G solution is proven at India-scale, Jio Platforms would be well-positioned to be an exporter of 5G solutions to other telecom operators globally, as a complete managed service,” he added.

…………………………………………………………………………………………………………………………………………………………….

Fast forward to today. Jio, India’s largest telecoms operator, is set to sign a contract at Nokia’s Headquarters in Helsinki, Finland, according to sources speaking to the Economic Times.

The purchase will be financed by several global banks, including HSBC, Citigroup, and JP Morgan, whose combined loans will total around $4 billion. Finnish state-owned export credit agency Finnvera is set to issue guarantees to the lenders. Representatives from the banks are likely to be present at the signing, as well as Senior Executives from Reliance Group.

At the time, financial details of the deals were not disclosed; however, media reports have since suggested that the deal with Ericsson was worth $2.1 billion. Now, this deal with Nokia will see the total 5G investment reach roughly $3.6 billion.

Earlier this year, Jio’s president Mathew Oommen said the company aimed to become “the largest 5G SA (standalone) only network operator in the world in the second half of 2023”, with the company targeting nationwide coverage by the end of the year.

In October 2022, Jio signed 5G equipment contracts with both Nokia and Ericsson.

In related news, earlier this week, Reliance Industries announced the launch of a budget 4G phone, (costing $12), aiming to convert the 250 million 2G users in India to 4G. The company says its goal is to pass the benefits of the internet-capable mobile technology to every Indian.

References:

https://totaltele.com/indias-jio-to-sign-1-5-billion-5g-equipment-deal-with-nokia/

Reliance Jio’s “Home Grown” 5G? Ericsson and Nokia in multi-year deals with Jio to build a mega 5G network

Reliance Jio claim: Complete 5G solution from scratch with 100% home grown technologies

Vodafone Idea (Vi) is worth ZERO; needs additional liquidity support from lenders

While announcing its FY23 earnings, UK telecom company, Vodafone Plc said the Group’s carrying value of investment in Indian listed firm Vodafone Idea (Vi) is Zero. Also, that the Group is recording no further losses related to Vi. The troubled-laden Vi is still in need of additional liquidity and plans to raise funds going forward. In its FY23 report, Vodafone Plc said, “VIL remains in need of additional liquidity support from its lenders and intends to raise additional funding.”

Vodafone seems to be backing away from Vi. The business needs more money, that Vodafone is certainly not willing to provide, and that zero valuation indicates that it will put no more effort into saving it. There are significant uncertainties in relation to Vi’s ability to make payments in relation to any remaining liabilities covered by the mechanism and no further cash payments are considered probable from the Group as at 31 March 2023, it added.

“VIL [Vodafone Idea Ltd] remains in need of additional liquidity support from its lenders and intends to raise additional funding. There are significant uncertainties in relation to VIL’s ability to make payments in relation to any remaining liabilities covered by the mechanism and no further cash payments are considered probable from the Group as at 31 March 2023,” Vodafone said, in the notes to its consolidated financial statements for the 2023 financial year.

Furthermore, Vodafone said, “the carrying value of the Group’s investment in VIL is nil and the Group is recording no further share of losses in respect of VIL.”

It should be noted that Vi is the only Indian telco that has NOT yet deployed 5G services. Since the launch of 5G last October, Reliance Jio’s 5G services have become available in more than 400 cities and towns, while Airtel’s 5G services can be accessed in more than 500. Jio plans to provide all-India 5G coverage by December, with Airtel aiming for blanket availability by March next year.

Recently, Vodafone Idea complained to the Telecom Regulatory Authority of India (TRAI), accusing its rivals of predatory 5G pricing. Although it has been shedding customers for years, there can be little doubt that losses have accelerated since the launch of 5G. Vodafone Idea had lost about 7 million in the four months leading up to 5G’s launch in October last year. In the four months following the introduction of 5G services by Airtel and Jio, its losses soared to about 10 million.

Vodafone Idea is known to have a significant percentage of high-spending customers who have remained loyal to it. These customers typically show limited interest in lower tariffs, but many will have been drawn to 5G services available only from other telcos, with Vodafone Idea’s 5G plan nowhere close to fruition. Airtel and Jio, accordingly, are racing to build 5G networks and attract as many Vodafone Idea subscribers as possible.

………………………………………………………………………………………………………………………………………………………………………………..

When Vodafone and Idea Cellular entered into an merger agreement in 2017, the parties had agreed to a mechanism for payments between the Group and Vodafone Idea, pursuant to the difference between the crystallisation of certain identified contingent liabilitiesin relation to legal, regulatory, tax and other matters, and refunds relating to Vodafone India and Idea Cellular. Cash payments s or cash receipts relating to these matters must have been made or received by Vi before any amount becomes due from or owed to the Group.

Hence, any future future payments by the Group to VIL as a result of this agreement would only be made after satisfaction of this and other contractual conditions. Thereby, the UK-based telco said, “Vodafone Group’s potential exposure to liabilities within VIL is capped by the mechanism described above; consequently, contingent liabilities arising from litigation in India concerning operations of Vodafone India are not reported.”

Vodafone Plc’s potential exposure under this mechanism is capped at ₹64 billion n (€719 million) following payments made under this mechanism from Vodafone to VIL, in the year ended 31 March 2021, totalling ₹19 billion (€235 million).

In FY23, Vodafone Plc’s revenue increased by 0.3% to €45.7 billion driven by growth in Africa and higher equipment sales, offset by lower European service revenue and adverse exchange rate movements. While adjusted EBITDAal declined by 1.3% to €14.7 billion due to higher energy costs, and commercial underperformance in Germany.

References:

https://telecoms.com/521728/vodafone-sees-no-remaining-value-in-indian-operation/

Vodafone Idea (Vi) to launch 5G services “soon;” Awards optical network equipment contract to ZTE

Hindustan Times: Although India telco competitors Reliance Jio and Airtel have launched and made fully operational their 5G services in several regions, the Aditya Birla Group and Vodafone Group collaboration telco is yet to announce the launch of next generation service. However, Kumar Mangalam Birla, chairman of the Aditya Birla Group, indicated that the Vi will soon launch 5G services. Speaking on the side-lines of the AIMA Awards to CNBC -TV18, Birla said, “5G rollout will begin soon.” He did not, however, provide a specific launch date.

Kumar Mangalam Birla is chairman of Aditya Birla Group.(YouTube/@IIT Bombay Official Channel)

Vi is now lagging far behind in the race to 5G with being the only private telecom operator to not have this next-gen services. In October of last year, Bharti Airtel launched its Airtel 5G Plus service in select areas. Reliance Jio, its competitor, is also offering Jio True 5G in multiple locations. The state-owned telecom operator BSNL is also planning to launch 5G by this August.

Vodafone Idea has been losing subscribers. The debt-ridden telco lost 2.47 million subscribers in December 2022. During the same period, Mukesh Ambani-led Reliance Jio gained 1.7 million subscribers, followed by Airtel, which gained 1.52 million subscribers, reported Business Insider.

Airtel, like its rival Reliance Jio, is offering 5G services at the same tariff levels as 4G, luring users away from competitors, primarily Vodafone Idea. According to data from the Telecom Regulatory Authority of India, the number of porting requests increased over the last year to more than 12 million in November.

References:

Communications Minister: India to be major telecom technology exporter in 3 years with its 4G/5G technology stack

Adani Group to launch private 5G network services in India this year

Hindu businessline: Indian telcos deployed 33,000 5G base stations in 2022

Nokia Executive: India to Have Fastest 5G Rollout in the World; 5Gi/LMLC Missing!

At long last: India enters 5G era as carriers spend $ billions but don’t support 5Gi

Bharti Airtel to launch 5G services in India this August; Reliance Jio to follow

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………

Vodafone Idea earlier this month awarded a fresh optical transmission equipment network order worth around Rs 230 crore to Chinese company ZTE for Gujarat, Maharashtra, and Madhya Pradesh-Chhattisgarh. The telco is upgrading its network, and for a fresh network deployment or upgrade and maintenance, telcos have to take approval from the National Security Council Secretariat (NSCS) and provide information regarding vendors and their technology. Notably, ZTE hasn’t been given the trusted sources approval by the NSCS (India’s National Security Council), said an ET report. Vodafone Idea’s optical transmission network has deployments from both Huawei and ZTE across all telecom circles.

Airtel, another Indian telecom operator, had last year awarded a telecom infrastructure expansion contract worth Rs 150 crore to Huawei. Under the deal, Huawei upgraded and expanded Airtel’s National Long Distance (NLD) network. Airtel awarded a similar contract to Huawei worth Rs 300 crore in 2021. Both these contracts were given to Huawei despite the latter not having the trusted sources approval.

India unveils Bharat 6G vision document, launches 6G research and development testbed

Despite being very late in rolling out 5G [1.], without TSDSI’s 5Gi ITU-R standard, India is ONCE AGAIN talking up 6G. Prime Minister Narendra Modi opened the new United Nations’ ITU area office and Innovation Centre on Wednesday and revealed the Bharat 6G Vision document and launched the 6G R&D Test Bed.

Note 1. Indian telecom service providers started to deploy 5G services in October 2022.

The Indian government’s Bharat 6G vision document was prepared by the Technology Innovation Group on 6G (TIG-6G), which was formed in November 2021 to build a roadmap and action plans for 6G in India, according to an official statement. Officials from Ministries/Departments, experts from research and development institutions, academia, standardisation bodies, telecom service providers, and business are among the members.

The 6G Test Bed will provide a platform for academic institutions, industry, start-ups, MSMEs, and industry, among others, to test and verify evolving ICT technologies.

The Bharat 6G Vision Document and 6G Test Bed, according to Centre, will create an enabling environment for innovation, capacity building, and faster technology adoption in India.

India PM Modi unveiling Bharat 6G vision document (Photo – PM Modi/YouTube)

………………………………………………………………………………………………………………………………………………….

“Today India is the fastest 5G rollout country in the world. In just 120 days, 5G has been rolled out in more than 125 cities. Today 5G services have reached about 350 districts of the country. Moreover, today we are talking about 6G only after six months of 5G rollout and this shows India’s confidence,” Modi said, according to a transcript of his address at the inauguration of a new ITU Area Office & Innovation Center in New Delhi. “Today we have also presented our vision document. This will become a major basis for 6G rollout in the next few years,” Modi added.

The Bharat 6G vision document foresees 6G services launched in India by the second or third quarter of 2024. That would enable India to move ahead from 5G services in just 2 short years. According to government sources, India’s 6G mission will be completed in two phases- 1] from 2023 to 2025 and 2] from 2026 to 2030.

………………………………………………………………………………………………………………………………………………….

References:

Communications Minister: India to be major telecom technology exporter in 3 years with its 4G/5G technology stack

Despite being very late to deploy 5G due to tardy licensed spectrum auctions, and with no known indigenous 5G network equipment vendors, India’s Communications Minister Ashwini Vaishnaw believes the country’s indigenous 4G/5G technology stack is “now ready” and the country is poised to emerge as a major telecom technology exporter to the world in the coming three years. Speaking at the Economic Times Global Business Summit 2023, Vaishnaw, who is also the Minister for Railways, categorically said there is no program for the privatization of the national transporter.

The 5G services were launched on October 1, 2022, and within a span of 100 days have been rolled out in 200-plus cities. The sheer speed of rollout has been appreciated by industry leaders globally and is being described in many international forums as the “fastest deployment happening anywhere in the world,” he said. Vaishnaw highlighted the population-scale solutions being tested on India stack, across platforms such as payments, healthcare and identity. Each of these platforms is powerful in itself, but together become a dynamic force that can solve “any major problem in the world.”

The minister said India is set to emerge as a telecom technology exporter to the world in the next three years. “Today there are two Indian companies that are exporting to the world…telecom gear. In the coming three years, we will see India as a major telecom technology exporter in the world,” Vaishnaw said.

The minister talked of the rapid strides taken by India in developing its own 4G and 5G technology stack, a feat that caught the attention of the world. “The stack is now ready. It was initially tested for 1 million simultaneous calls, then for 5 million, and now it has been tested for 10 million simultaneous calls,” he said terming it a “phenomenal success.” At least 9-10 countries want to try it out, he added.

The minister gave a presentation outlining key initiatives under his three ministries of telecom, IT and Railways. For Railways, the focus is on transforming passenger experience, he said as he presented slides on how railways is redeveloping stations and terminals (New Delhi, Ahmedabad, Kanpur, Jaipur among others) with modern and futuristic design blueprint, and in the process creating new urban spaces while also preserving rich heritage.

The minister also gave an overview on the Vande Bharat train, the indigenous train protection system Kavach and progress on the bullet train project. To a question on the past talks around private freight rail corridors to boost logistics, the minister said “there is no program for Railway privatization.” “In a country where we have 1.35 billion people, 8 billion people moving every year on Railways, we thought that it is prudent to learn from the experience of others, and keep it within the Government set-up,” Vaishnaw said.

India’s Communications Minister Ashwini Vaishnaw (Photo Credit: PT)

To another query on dedicated freight corridor for food grains, the minister explained that when it comes to transport economics it is important not to divide assets between different applications.

“Today, the thought process has got very refined, and we are adding close to 4500 km of network every year, which amounts to 12 km of new tracks per day. So we have to increase the capacity to such a large extent that there is enough capacity for food grains, enough for coal, small parcels, and every kind of cargo,” he said. While Railways had been consistently losing market share over the last 50-60 years, it has started clawing it back.

“The lowest point was 27 per cent. I am happy to share that from the 27 per cent level, last year Railways increased to 28 per cent, this year we are doing close to 29-29.5 per cent, and in the coming 2-3 years Railways will go towards 35 per cent market share,” he added.

People will choose between transport via road, railways or air based on the distance to be travelled, and “there will be enough for everybody”. “The country will have enough for everybody, is my point. Up to 250 kilometres road is very good, 250 to 1000 kilometres railway is the ideal mode. Beyond 1000 kilometres air will be the ideal mode. So there will be enough for everybody,” the minister said.

References:

India to set up 100 labs for developing 5G apps, business models and use-cases

Even as India’s long delayed 5G network roll-out continues at a rapid pace, the government has outlined plans for expanding 5G’s use beyond consumers and enterprises. In her Budget speech, Union Finance minister Nirmala Sitharaman called for the development of new applications and business models, which will also create more jobs. There are plans to set up 100 labs in engineering institutions to develop applications and use-cases for 5G services. It should be noted that GE setup India’s first 5G innovation lab in July 2022.

“The labs will cover, among others, applications such as smart classrooms, precision farming, intelligent transport systems, and health care applications,” Sitharaman said in her speech.

“The proposed outlay for 5G labs will further push the development of use-cases and the set-up of private networks in India. The research across universities will push innovations and job opportunities,” said Peeyush Vaish, partner and telecom sector leader, Deloitte India.

The speed at which commercial 5G networks have rolled out, since the official launch in October, has been impressive. India’s 5G auctions, which culminated in the second half of 2022, saw Bharti Airtel, Reliance Jio and Vi acquire 5G spectrum for commercial networks, while Adani Data Networks is expected to launch enterprise 5G services with the spectrum it bought. In particular, Reliance Jio confirms it has enabled 5G networks (SA) in 225 cities across India. Airtel doesn’t give a confirmed count of its 5G NSA network service coverage, but continues to add cities every day. Vi is yet to launch 5G services.

“We believe 5G will have country-specific use-cases and India is no different. In fact, India can set an example for the rest of the world,” said Tarun Pathak, research director at Counterpoint Research.

“5G networks and devices without use-cases is akin to highways without places to travel to,” said Muralikrishnan B, president, Xiaomi India.

Test labs for 5G applications provide a sandboxed environment for testing use-case prototypes. Indian telecom equipment company Himachal Futuristic Communications Limited (HFCL) is working closely with tech giant Qualcomm and has a 5G lab which focuses on rural mobile broadband.

GE’s 5G Innovation Lab in India. Top: Jan Makela, president and CEO of imaging at GE Healthcare (center), cuts the ribbon to open the 5G Innovation Lab. Second from left: Girish Raghavan, vice president of engineering for GE Healthcare.

………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………

Bipin Sapra, Tax & Regulatory Services, Partner, EY India said that the government had taken a big leap to embrace 5G much more swiftly by setting up these labs. He agreed that they would indeed further boost employment and business opportunities in the country. “Amrit Kaal focuses on being a technology-driven and knowledge-based economy with one of the primary visions of growth and job creation. India has made remarkable advancements in the digital realm and various new initiatives have been adopted to improve the lives of people, accelerating the societal benefits of these technologies,’‘ added Mr. Sapra.

“The setting up of 100 labs to develop 5G will better network connectivity in every nook and corner of the country and further help more sectors and communities to access the benefits of 5G networks,” said Sanmeet Singh Kochhar, vice-president – India and MENA at HMD Global.

Piyush N. Singh, Senior Managing Director, Accenture, said setting up new centers of excellence for AI and 5G labs for developing apps would help democratize AI and push for wider adoption of 5G services. “It will be important for the private sector ecosystem to work closely with the government to realize the digital future of India,’‘ Mr. Singh said.

References:

https://www.gehealthcare.com/insights/article/new-5g-innovation-lab-in-india-poised-to-unlock-the-future-of-healthcare

Adani Group to launch private 5G network services in India this year

Adani Group, the newest entrant in India’s telecom space, is looking to launch private 5G services for enterprises in 2023. The conglomerate also announced that it would be launching consumer apps this year as part of its digital strategy.

Addressing his employees in the New Year, Chairman Gautam Adani said they will invest in expanding the network of data centers, building AI-ML and industrial cloud capabilities, along with rolling out 5G services and launching B2C apps.

“While we are fully invested in building India, it is an opportune time to contribute to nation-building outside India. All of these are big ticket, independent yet mutually connected digital opportunities that are backed by our adjacency in the energy business,” he said.

The Gujarat-based conglomerate surprised industry incumbents when it took part in 5G auctions in 2022. While Adani has not purchased spectrum across all 5G bands and thus cannot provide consumer telephony, the conglomerate parted with Rs. 212 crore to buy 400MHz spectrum in the mm-wave band. Adani is gunning to provide private network services to enterprises, including its own.

However, telecom operator Bharti Airtel beat Adani to the punch, bagging the first private 5G network deal with Mahindra Group late last year.

Reliance Jio has also indicated that private 5G will be a key avenue for monetization for the operator in the future. Chairman Mukesh Ambani has committed Rs 2 trillion investment for rolling out a 5G network across the country by December 2023, according to a recent report by the Press Trust of India.

Other entities, such as IT major Tata Consultancy Services (TCS), could also participate in the private 5G network market. They are awaiting spectrum assignment rules from the DoT and TRAI, who are still deliberating the spectrum bands, which will be given to enterprises for private network use through administrative allocation.

References: