Bharti Airtel

Nokia wins multi-billion dollar contract from Bharti Airtel for 5G equipment

Nokia has secured a multi-billion dollar contract with India’s Bharti Airtel, one of the country’s leading telecom operators, which is expanding its 5G network. The deal with Airtel would be for Nokia’s latest AirScale mobile radios that support upgrading an existing network to 5G-Advanced and reduces energy costs, according to the sources.

- Ericsson won a multi-billion dollar contract from Bharti Airtel, Reuters reported on Monday. Airtel is also in talks with Samsung about buying 5G equipment, a source told Reuters.

- Samsung has been trying to grow its network equipment business, but has so far lagged Nokia and Ericsson. Samsung won its first 5G contract with Airtel in 2022. India has blocked its mobile carriers from using 5G telecom equipment made by China’s Huawei.

Backgrounder:

India is the world’s second-largest smartphone market where telcos such as Airtel, Reliance Jio and Vodafone Idea have been spending billions of dollars to upgrade their networks to 5G. Bharti Airtel’s 5G market share in India is over 90 million subscribers, as of June 2024. Airtel and Reliance Jio are the only two telcos in India that offer 5G services.

……………………………………………………………………………………………………………………………………..

……………………………………………………………………………………………………………………………………..

The Nokia-Bharti Airtel deal is indicative of the intensifying competition among telecom operators and equipment manufacturers in India’s 5G market. For Nokia, the agreement represents a significant rebound and consolidation of its presence in India, amidst previous challenges and the competitive pressures exerted by rivals such as Ericsson and Samsung.As India stands on the cusp of a 5G revolution, the successful execution of this deal could serve as a blueprint for similar agreements, thereby accelerating the pace of 5G deployment across the nation.

Bharti Airtel to launch 5G services in India this August; Reliance Jio to follow

After numerous delays, India’s government finally completed its 5G spectrum auction on its seventh day. 5G spectrum worth 1.5 trillion Indian rupees (US $18.99 billion) being sold to the country’s three mobile network operators – Reliance Jio, Bharti Airtel, Vodafone Idea – and Adani Group, with Jio emerging as the top bidder, according to media reports.

Bharti Airtel has announced that it has awarded its first 5G contract in the country to Ericsson with 5G deployment to get underway in August 2022. Ericsson is Airtel’s long-standing connectivity partner and pan-India managed services provider, with a partnership spanning more than 25 years. The latest 5G partnership follows the close of 5G spectrum auctions in India. In a statement, Airtel said that it will deploy power-efficient 5G Radio Access Network (RAN) products and solutions from the Ericsson Radio System and Ericsson microwave mobile transport solutions.

The company also signed agreements with Nokia and Samsung to build 5G capacity in India. Under the agreement, Nokia will provide equipment for AirScale portfolio, including modular and scalable baseband as well as high-capacity 5G massive MIMO radios.

Meanwhile, Ericsson will be providing 5G connectivity in 12 circles for Bharti Airtel. In addition to an enhanced user experience for Airtel customers – spanning ultra-high-speeds, low latency and large data handling capabilities – Ericsson 5G network products and solutions will also enable Bharti Airtel to pursue new, innovative use cases with its enterprise and industry customers, claimed the company.

Bharti Airtel has announced that it has acquired 19,800 MHz spectrum by securing a pan-India footprint of 3.5 GHz and 26 GHz bands. This spectrum bank was secured for a total consideration of Rs 43,084 crore in the latest spectrum auction conducted by the Department of Telecom, Government of India. Airtel acquired 19,867.8 MHz spectrum in 900 MHz, 1800 MHz, 2100MHz, 3300 MHz and 26 GHz frequency bands for Rs 43,084 crore. Airtel has secured 5G spectrum for 20 years in this auction.

Airtel CEO Gopal Vittal, MD and chief executive officer said, “As our trusted, long-term technology partner, we are delighted to award our first 5G contract to Ericsson for 5G deployment in India. “5G presents a game-changing opportunity to drive the digital transformation of industries, enterprises and the socio-economic development of India. With our 5G network, we aim to deliver the full benefits of 5G connectivity, fuel India’s journey towards a digital economy and strengthen the country’s position on the world stage.”

“5G presents a game-changing opportunity to drive the digital transformation of industries, enterprises and the socio-economic development of India. With our 5G network, we aim to deliver the full benefits of 5G connectivity, fuel India’s journey towards a digital economy and strengthen the country’s position on the world stage.”

Börje Ekholm, President and CEO, Ericsson, says: “We look forward to supporting Bharti Airtel with its deployment of 5G in India. With Ericsson’s unrivaled, global 5G deployment experience, we will help Bharti Airtel deliver the full benefits of 5G to Indian consumers and enterprises, while seamlessly evolving the Bharti network from 4G to 5G. 5G will enable India to realize its Digital India vision and foster inclusive development of the country.”

Reliance Jio may also launch 5G in August:

It is likely that arch rival Reliance Jio too may launch the 5G services this month. “We will celebrate ‘Azadi ka Amrit Mahotsav’ with a pan India 5G rollout. Jio is committed to offering world-class, affordable 5G and 5G-enabled services. We will provide services, platforms and solutions that will accelerate India’s digital revolution, especially in crucial sectors like education, healthcare, agriculture, manufacturing and e-governance,” said Akash M Ambani, Chairman, Reliance Jio Infocomm.

However, no disclosure of Jio’s 5G vendor(s) over two years after Ambani said Jio was developing its own “homegrown” 5G network equipment. The Business Standard reports that Jio had selected Samsung to build its pan-India 5G network.

References:

Bharti Airtel working with partners to enable 5G use cases in India

Bharti Airtel said that it is engaging new partners to enable 5G use cases for various consumer and enterprise use cases in India. It will also start a campaign to educate users about their next 5G smartphone to ensure if they can get the best experience with support to all relevant bands.

A handset to support all possibilities of 5G is very important, Bharti Airtel’s chief technology officer Randeep Sekhon told ET. Airtel will come out with a campaign for users who want to buy 5G handsets informing them about various checks of their particular handsets to make sure the handset works well in India across not just 5G but various other bands and carrier aggregation. “This is important when you choose a 5G handset to get the best experience,” he said.

The Sunil Mittal-led telecom operator had recently urged the India Department of Telecommunications to bring uniform guidelines to develop the 5G smartphone ecosystem. It recommended that any new 5G handset sold in India must support all existing bands in India for 5G, including the mmWave bands.

Indian telecom operators have spectrum in the 2G, 3G and 4G bands which can be refarmed and used for 5G NSA or 5G SA and also use Dynamic Spectrum Sharing (DSS) for fast deployment. They want handset brands to support all existing spectrum bands like 1800/2100/2300 MHz and sub-GHz bands 800/900 Mhz.

The telecom operator said that it successfully conducted a cloud gaming session on its 5G trial network in Manesar using the 3.5GHz spectrum band. Sekhon said that “immersive entertainment” will be another major consumer use case of 5G. “But, for A/R and V/R, content needs to be created and be personalized at the edge. We are seeing how we can make it real.”

Airtel is currently using the 3.5 GHz spectrum band for 5G trials in Delhi-NCR and Mumbai. Sekhon said that the telco hasn’t started 5G trials using mmwave band. “As and when we will get equipment, we will try that too. 3.5 GHz anchored with traditional 4G bands are currently being used for trials.”

“For the B2B, industry 4.0, high speed, high latency and mass concurrency around IoT cloud and 5G are required.. We are working with many of our industry customers on creating fir infra, FMCG, factory, mining. This will be relevant,” Sekhon added.

The CTO said that telecom operators can’t do everything by themselves and their main focus is to build the best infrastructure to enable partners. Airtel, he said, will have various partners to enable 5G use cases like education, e health and for industries.

“Some partnerships are for initial 5G trials and some will for massifying the roll out. The 5G real experience will happen when all stakeholders ecosystem partners are available,” Sekhon said.

Intel working with Reliance Jio and Bharti Airtel on 5G for India

Intel said that it is helping Reliance Jio make the transition from 4G to 5G as part of their 5G infrastructure deal. Intel and Jio are collaborating in the areas of 5G radio, core, cloud, edge and artificial intelligence.

“…our collaboration spans those areas, and it’s co.innovation. So, we have got our engineering and business unit teams working closely with Reliance Jio in those areas. And we are committed towards helping customers and partners like Reliance Jio to make the transition from 4G to 5G,” Prakash Mallya, vice president and MD of sales, marketing and communications group at Intel told ET.

Intel’s investment arm, Intel Capital, had in 2020 invested Rs 1,894.50 crore to buy a 0.39% equity stake in Jio Platforms.

Separately, Bharti Airtel Wednesday said it is collaborating with Intel for working towards 5G network development by leveraging Virtualized Radio Access Network (vRAN) and O-RAN technologies.

This is Intel’s second 5G-related partnership in India. As per the above, Intel is collaborating with Reliance Jio to help India’s #1 telco with its 5G network development, including in the areas of 5G radio, core, cloud, edge, and artificial intelligence.

Airtel will deploy Intel’s 3rd-generation Xeon Scalable processors, FPGAs, and eASICS, and Ethernet 800 series across its network to build a foundation for rolling out wide-scale 5G, mobile edge computing (MEC) and network slicing which requires a 5G SA core network.

The partnership will also allow Airtel to tap into the hyperconnected world where Industry 4.0, cloud gaming, and virtual/augmented reality (VR/AR) become an integral part of daily lives, according to an official statement.

Earlier this year, Airtel became the first telecom operator in India to demonstrate 5G over a live network in Hyderabad using liberalized spectrum.

The Sunil Mittal-led Bharti is also conducting 5G trials in major cities such as Gurgaon’s Cyber Hub in the Millennium city and in Mumbai’s Phoenix Mall in Lower Parel, in partnership with Swedish Ericsson and Finland’s Nokia, respectively, ET previously reported.

Airtel also entered into a partnership with Tata Sons and Tata Consultancy Services to deploy OpenRAN 5G solutions, including radio and core. It plans to begin pilot in January 2022.

Jio has developed and tested its homegrown 5G solutions together with its partners in India and plans to export the solutions to global markets once proven at a pan-India scale.

Prakash Mallya, vice president and MD of sales, marketing and communications group at Intel recently told ET that the company is helping Indian telecom operators. On Jio partnership, he said that Intel is helping the Mukesh Ambani-led telco transition from 4G to 5G as part of their 5G infrastructure deal.

Intel’s investment arm, Intel Capital, had in 2020 invested India Rupees 1,894.50 crore to buy a 0.39% equity stake in Jio Platforms.

Randeep Sekhon, CTO – Bharti Airtel said, “Airtel is delighted to have Intel as a part of its rapidly expanding partner ecosystem for 5G. Intel’s cutting-edge technologies and experience will contribute immensely to Airtel’s mission of serving India with world-class 5G services. We also look forward to working with Intel and home-grown companies to unlock India’s potential as a global 5G hub.”

“Airtel is delivering their next-generation enhanced network with a breadth of Intel technology, including Intel Xeon Scalable processors and FlexRAN software to optimize RAN workloads with embedded intelligence, to scale their infrastructure and deliver on the promise of a connected India,” Dan Rodriguez, Intel corporate vice president, Network Platforms Group said in a joint statement.

References:

https://www.intel.com/content/www/us/en/wireless-network/5g-business-opportunity-infographic.html

5G Made in India: Bharti Airtel and Tata Group partner to implement 5G in India

On June 21st, Bharti Airtel and Tata Group announced a strategic partnership for implementing 5G network solutions for India. A 5G pilot should start in January 2022, unless it’s delayed by India’s Department of Telecommunications (DoT).

The announcement underscores a push for indigenous made 5G solutions in India. Despite tremendous hype, the world’s second-largest telecom market has not yet launched commercial 5G service.

Airtel’s partnership with Tata Group allows the telecom operator to take head-on, rival Reliance Jio’s so called “homegrown 5G solutions.” Mukesh Ambani-led Reliance Jio is accelerating the rollout of digital platforms and indigenously-developed next-generation 5G stack.

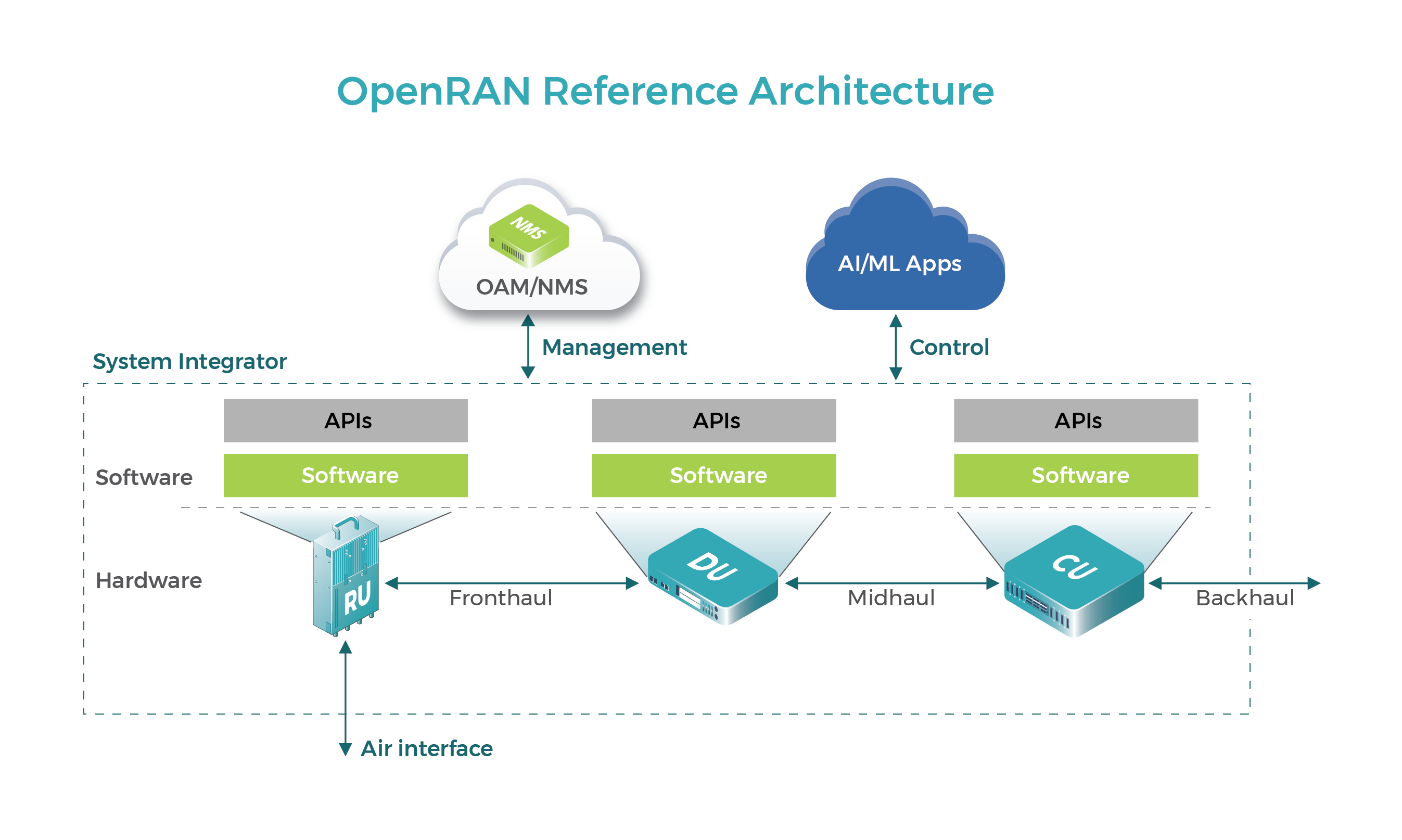

According to a statement, Tata Group has developed O-RAN (Open Radio Access Network) based radios and 5G NSA/SA (Non-Standalone=4G-LTE/Standalone) Core and has integrated a totally indigenous telecom stack, leveraging the Group capabilities and that of its partners.

“Tata Consultancy Services (TCS) brings its global system integration expertise and helps align the end-to-end solution to both 3GPP and O-RAN standards, as the network and equipment are increasingly embedded into software,” the Tata statement added.

Airtel will pilot and deploy this indigenous solution as part of its 5G rollout plans in India, with a pilot beginning in January 2022, as per the norms formulated by the government.

Gopal Vittal, Managing Director & CEO (India and South Asia) Bharti Airtel said, “We are delighted to join forces with the Tata Group to make India a global hub for 5G and allied technologies. With its world-class technology ecosystem and talent pool, India is well positioned to build cutting edge solutions and applications for the world. This will also provide a massive boost to India becoming an innovation and manufacturing destination.”

N Ganapathy Subramaniam from the Tata group/TCS said, “As a group, we are excited about the opportunity presented by 5G and adjacent possibilities. We are committed to building a world-class networking equipment and solutions business to address these opportunities in the networking space. We are pleased to have Airtel as our customer in this initiative.”

Airtel is a board member of the O-RAN Alliance and is committed to explore and implement O-RAN-based networks in India. Earlier this year, Airtel became the first telecom company in India to demonstrate 5G over its LIVE network in the city of Hyderabad. The company has started 5G trials in major cities using spectrum allocated by the Department of Telecom.

The Tata group’s telecom and media enterprises cater to the communication requirements of global business houses to SMEs, and from wholesale to home networks. TCS is a member of the O-RAN Alliance.

About Airtel:

Headquartered in India, Airtel is a global communications solutions provider with over 471 mn customers in 18 countries across South Asia and Africa. The company ranks amongst the top three mobile operators globally and its networks cover over two billion people. Airtel is India’s largest integrated communications solutions provider and the second-largest mobile operator in Africa. Airtel’s retail portfolio includes high-speed 4G/4.5G mobile broadband, Airtel Xstream Fiber that promises speeds up to 1 Gbps with convergence across linear and on-demand entertainment, streaming services spanning music and video, digital payments, and financial services. For enterprise customers, Airtel offers a gamut of solutions that includes secure connectivity, cloud and data centre services, cybersecurity, IoT, Ad Tech, and cloud-based communication. For more details visit www.airtel.com

About the Tata Group:

Founded by Jamsetji Tata in 1868, the Tata group is a global enterprise, headquartered in India, comprising 30 companies across ten verticals. The group operates in more than 100 countries across six continents, with a mission ‘To improve the quality of life of the communities we serve globally, through long-term stakeholder value creation based on Leadership with Trust’.

Tata Sons is the principal investment holding company and promoter of Tata companies. Sixty-six percent of the equity share capital of Tata Sons is held by philanthropic trusts, which support education, health, livelihood generation, and art and culture. In 2019-20, the revenue of Tata companies, taken together, was $106 billion (INR 7.5 trillion). These companies collectively employ over 750,000 people.

Each Tata company or enterprise operates independently under the guidance and supervision of its own board of directors. There are 29 publicly-listed Tata enterprises with a combined market capitalization of $123 billion (INR 9.3 trillion) as of March 31, 2020. Companies include Tata Consultancy Services, Tata Motors, Tata Steel, Tata Chemicals, Tata Consumer Products, Titan, Tata Capital, Tata Power, Tata Advanced Systems, Indian Hotels, and Tata Communications.

For more details visit www.tata.com.

For more information, please contact: Harsha Ramachandra [email protected]

…………………………………………………………………………………………………………………………………………

References:

https://www.tata.com/newsroom/business/tata-airtel-5g

Reliance Jio may deploy 5G SA while Bharti Airtel to trial both 5G NSA and SA

Reliance Jio may launch its much touted 5G services using the next generation 5G standalone (GSMA Option 2) architecture for its network, Business Standard reported.

The telco may skip the current non-standalone 5G. The NSA 5G architecture enables operators to leverage their existing investments in their 4G LTE networks and reduce capital costs. Mukesh Ambani recently said that Jio intends to roll-out 5G services in India in the second half of 2021.

Image Credit: Reliance Jio

Conversely, Sunil Mittal of Bharti Airtel said that 5G will take 2-3 years to reach mass scale in India’s market. Nonetheless, Airtel recently applied for both NSA and SA 5G trials to test its network architecture.

“Even though the majority of countries are offering 5G using NSA, SA is also being used for 5G services. Airtel feels it’s a good time to test its network using both modes,” a person familiar with the development told ETTelecom.

Airtel is planning to do Standalone 5G trials in Karnataka and Kolkata using Nokia and Ericsson 5G gear, respectively. In both circles, ZTE and Huawei currently power the Sunil Mittal-led telco’s 4G network.

Non-standalone (NSA) and standalone (SA) are two 5G tracks that communication service providers can opt for when transitioning from 4G to the next-generation mobile technology. In NSA, the existing 4G LTE network is used for everything except the 5G data plane, which is usually based on 3GPP Release 15 version of 5G NR. 5G NSA enables operators to leverage their existing investments in their 4G LTE networks and reduce capital costs, but it can’t support new 5G features such as network slicing.

Reliance Jio, Bharti Airtel, Vodafone Idea, and BSNL recently submitted a list of “preferred vendors” which includes European and American companies for 5G field trials with the telecom department (DoT).

Jio had submitted fresh applications for 5G trials with Samsung, Nokia, Ericsson, and for its own 5G technology. The largest Indian telco recently submitted an application trial of its own 5G technology in South Mumbai and Navi Mumbai areas, while it intends to do trials with Samsung in other areas like Bandra Kurla complex, Kamothe Navi Mumbai, and Solapur with Maharashtra.

Jio intends to 5G trials with Nokia in Pune and Ahmednagar, and with Ericsson in Delhi areas like Chandani chowk and Shashtri Nagar and in Dabwali in Haryana.

References:

Ambani: Reliance Jio to deploy 5G network in second half of 2021

Altiostar and NEC demonstrate front haul at India’s first O-RAN Alliance plugfest hosted by Bharti Airtel

Altiostar and NEC today said that they participated in the first plugfest event in the India region for the O-RAN ALLIANCE. Hosted by Bharti Airtel (“Airtel”), India’s largest integrated telecommunications services provider, the goal of the O-RAN Plugfest was to test and demonstrate the growing maturity of the O-RAN ecosystem.

Bharti Airtel plugfest was in partnership with telecom players like Altiostar, Altran, ASOCS, Mavenir, NEC, Sterlite Technologies (STL), VVDN, among others to demonstrate emerging technologies such as 5G.

“We are committed to evolving our network through an open architecture and are delighted to partner with the O-RAN community. This offers a great opportunity to Indian organizations with innovative hardware, software, and services capabilities to build a “’ Make in India – O-RAN solution’ – for Indian and global markets.” said Randeep Sekhon, CTO, Bharti Airtel.

The Indian telco is currently working with various US and Japanese vendors like Altiostar and NEC to develop OpenRAN based 5G telecom equipment, ETTelecom exclusively reported recently.

Airtel revealed that it is engaging with “Disruptive Telecom Equipment Vendors” to develop innovative solutions customized to Airtel’s requirements based on OpenRAN technology. “As a TSDSI Member, Airtel has proposed a new study Item on “Adoption of O-RAN Specification by TSDSI and contribution towards the development of India.

Specific use cases within the TSDSI Network Study Group (SG-N). Airtel will be submitting contributions in the form of a Study Report on O-RAN in SGN, and will also be collaborating with industry partners on the subject,” the telco had said.

“Testing and integration are crucial for developing a commercially available open RAN ecosystem and that’s why the O-RAN Alliance provides its member companies with an efficient global plugfest framework, which complements the O-RAN specification effort as well as the O-RAN Software Community,” said Andre Fuetsch, Chairman of the O-RAN Alliance and Chief Technology Officer of AT&T.

The telco has been a member of the O-RAN Alliance since its establishment in 2018. The first India edition of O-RAN Plugfest is part of Airtel’s commitment to building an open technology ecosystem, including O-RAN-based deployments, said the telco in an official statement.

It was also the first operator in India to commercially deploy a virtual RAN solution based on disaggregated and open architecture defined by the O-RAN Alliance.

Airtel, Altiostar and NEC teamed up for this project to demonstrate the world’s first interoperability testing and integration of massive MIMO radio units (O-RU) and virtualized distributed units (O-DU) running on commercial-off-the-shelf (COTS) servers. The project featured a commercial end-to-end Open Fronthaul interface based on O-RAN specifications. This demonstration was comprised of control, user, synchronization and management plane protocols, including 3GPP RCT and performance cases.

The purpose and scope of this demonstration was to show O-RAN option 7.2x split integration between a virtualized O-DU from Altiostar and an NR O-RU (i.e. 5G radio unit) from NEC. The demonstration also showed how this integrated setup can be used in an end-to-end EN-DC network setup (i.e. 5G non standalone architecture).

Going forward, Altiostar and NEC will continue to jointly drive new levels of openness in radio access networks (RAN) and across next-generation 5G networks.

“Today’s 4G and 5G radio access networks are undergoing a profound transformation, as the wireless industry is shifting to an open and cloud-native architecture that is being driven by vendors such as Altiostar and NEC, who are at the forefront of providing software and radio solutions based on O-RAN standards,” said Anil Sawkar, Vice President of Engineering and Operations at Altiostar. “Dozens of greenfield and brownfield wireless operators worldwide are trialling and deploying O-RAN networks as they realize the benefits of this new approach, including reduced costs, increased automation, and faster time to market with services.”

“Providing open innovations that conform to industry standards in the radio access network is critical to accelerating our customers’ journey towards Open RAN deployment and provisioning of more flexible and efficient networks that meet the requirements of cutting edge 5G use cases,” said Kazuhiko Harasaki, Deputy General Manager, Service Provider Solutions Division, NEC Corporation. “It is NEC’s honor to contribute to interoperability verification initiatives in India towards Open RAN innovation.”

Airtel has been a member of the O-RAN ALLIANCE since its inception in 2018. Airtel was the first operator in India to commercially deploy a virtual RAN solution based on a disaggregated and open architecture defined by O-RAN. “We are delighted to partner with the global O-RAN community. Our engagement with Altiostar and NEC for demonstrating O-RAN O-DU and O-RU, 5G RCT and E2E performance is another step forward towards building 5G systems with open network architecture,” said Randeep Sekhon, CTO at Bharti Airtel.

…………………………………………………………………………………………………………………………………………………………………………………………

About Altiostar:

Based outside Boston, Altiostar provides 4G and 5G open virtualized RAN (Open vRAN) software that supports open interfaces and virtualizes the baseband unit to build a disaggregated multi-vendor, web-scale, cloud-native mobile network. Operators can add intelligence, quickly adapt the network for different services and automate operations to rapidly scale the network and reduce Total Cost of Ownership (TCO). Altiostar collaborates with a growing ecosystem of partners to support a diverse Open RAN supply chain. The Altiostar Open vRAN solution based on O-RAN standards has been deployed globally, including the world’s first cloud-native commercial-scale mobile network with Rakuten Mobile in Japan. For more information, visit www.altiostar.com.

About NEC Corporation:

NEC Corporation has established itself as a leader in the integration of IT and network technologies while promoting the brand statement of “Orchestrating a brighter world.” NEC enables businesses and communities to adapt to rapid changes taking place in both society and the market as it provides for the social values of safety, security, fairness and efficiency to promote a more sustainable world where everyone has the chance to reach their full potential. For more information, visit NEC at http://www.nec.com.

About Airtel:

Headquartered in India, Airtel is a global telecommunications company with operations in 18 countries across South Asia and Africa. The company ranks amongst the top three mobile operators globally and its mobile network covers a population of over two billion people. Airtel is India’s largest integrated telecom provider and the second largest mobile operator in Africa. At the end of September 2020, Airtel had approx. 440 mn customers across its operations.

Airtel’s portfolio includes high speed 4G/4.5G mobile broadband, Airtel Xstream Fiber that promises speeds up to 1Gbps, converged digital TV solutions through the Airtel Xstream 4K Hybrid Box, digital payments through Airtel Payments Bank as well as an integrated suite of services across connectivity, collaboration, cloud and security that serves over one million businesses.

Airtel’s OTT services include Airtel Thanks app for self-care, Airtel Xstream app for video, Wynk Music for entertainment and Airtel BlueJeans for video conferencing. In addition, Airtel has forged strategic partnerships with hundreds of companies across the world to enable the Airtel platform to deliver an array of consumer and enterprise services.

References:

Massive MIMO Deployments in India: Bharti Airtel vs. Vodafone Idea?

by Danish Khan (edited and augmented by Alan J Weissberger)

The deployment of massive MIMO [1] technology has led to a series of claims and counter claims between India wireless network operators Vodafone Idea Ltd. (VIL) and Bharti Airtel. Both privately held telcos claim that they lead in terms of the deployment size of this pre-5G technology.

Note 1. Massive multiple-input, multiple-output, or massive MIMO, is an extension of MIMO, which essentially groups together antennas at the transmitter and receiver to provide better throughput and better spectrum efficiency.

Moving from MIMO to massive MIMO, according to IEEE, involves making “a clean break with current practice through the use of a large excess of service antennas over active terminals and time-division duplex operation. Extra antennas help by focusing energy into ever smaller regions of space to bring huge improvements in throughput and radiated energy efficiency.”

Many different configurations and deployment scenarios for the actual antenna arrays used by a massive MIMO system can be envisioned (see Fig. 1). Each antenna unit would be small and active, preferably fed via an optical or electric digital bus.

Figure 1. Some possible antenna configurations and deployment scenarios for a massive MIMO base station.

……………………………………………………………………………………………………………………………………………………………………………………………………..

In a statement, Huawei said that Bharti Airtel has deployed more than 100 hops of enhanced MIMO microwave link based on the latest MIMO technology developed by the Chinese gear maker. The deployment, Huawei said, will deliver 1Gbps capacity over a single 28 Mhz spectrum, improving the backhaul capacity by four times.

“Bharti implements the largest-scale MIMO deployment around the world,” Huawei said in the statement. Airtel had made its first commercial deployment of massive MIMO in September 2017.

Bharti Airtel today (Sept 26, 2017) announced the deployment of India’s first state-of-the-art Massive Multiple-Input Multiple-Output (MIMO) technology which is a key enabler for 5G networks. As one of the few commercial deployment of Massive MIMO globally, the deployment puts India on the world map of technology advancement and digital revolution. Airtel is starting with the first round of deployment in Bangalore & Kolkata and will expand to other parts of the country.

Deployed as part of Airtel’s ongoing network transformation program, Project Leap, the Massive MIMO technology will expand existing network capacity by five to seven times using the existing spectrum, thereby improving spectral efficiency. Customers will now be able to experience two to three times superfast speeds on the existing 4G network. Data speeds will now also be seamless, offering enhanced user experience even indoors, in crowded places and high rise buildings. It would enable multiple users and multiple devices to work simultaneously without facing any congestion or experience issues especially at hotspot locations.

But in an interview with ET last week, Vodafone Idea chief technology officer, Vishant Vora had claimed that it was the leader in MIMO deployments in India. “We have deployed over 10,000 massive MIMOs in India. This is the largest deployment of massive MIMOs in India and neither of my two competitors has that. They are 100-200 and we are at 10,000 plus. This is the largest deployment outside China and in the world,” Vora said.

Vodafone Idea told ET this past March:

Vodafone Idea has deployed more than 5000 massive MIMO, small cells and TDD sites across Church gate, Prabhadevi, Pali hill, Lokhandwala, Versova, Andheri, Jogeshwari, Bandra and Dadar among other regions. The telco has also installed over 1900 indoor coverage solutions for high rises and commercial places.

“With meticulous pre-merger planning and rigorous post-merger execution, we have ensured that our customers remain confidently connected and enjoy uninterrupted services even as we integrate and optimize our network in a phased manner across circles,” said Vishant Vora, CTO, Vodafone Idea.

………………………………………………………………………………………………………………………………………………………………………………………………

Huawei is also providing 4G equipment and massive MIMO technology to Vodafone Idea in seven circles. Huawei didn’t provide additional information.

The MIMO technology achieves four times capacity with same spectrum, allowing a telecom operator to build a 5G-ready transport network without investment in additional spectrum . MIMO deployment also allows telcos to address the capacity-related network issues in urban areas in India, besides deploying new sites to provide coverage in rural parts.

Mukesh Ambani-led Reliance Jio has also started to deploy massive MIMO technology in some of the metro cities that are seeing huge traffic growth resulting in bad data speed experience.

………………………………………………………………………………………………………………………………………………………………………………………………

References:

UBS: 5G capex at $30 billion for India telcos; 5G spectrum auction by January 2020?

UBS analysts say that India’s top three telecom operators will have to spend a little over $30 billion on 5G base stations and fiber infrastructure. According to UBS, the need for a dense site footprint and fiber backhaul for 5G access networks will likely shift the balance of power towards larger and integrated operators with strong balance sheets.

Bharti Airtel and Vodafone Idea would need $10 billion capex each over the next five years.

“Bharti has solidly defended its market share and has narrowed the gap with Jio on 4G network reach, with improving 4G net adds. The company recently revamped its digital offering and launched converged digital proposition ‘Airtel Xstream’ offering digital content across TV, PC and mobile devices along with IoT solutions for connected homes. Further, Jio’s recently announced fixed broadband plans starting at Rs 699 are not as aggressive as we (and the market) feared and, therefore, do not pose significant pricing pressure on Bharti’s broadband average revenue per user,” UBS said in a research note to clients.

Reliance Jio’s incremental 5G capex is estimated somewhat lower at around $8 billion. That’s because Jio already has more 5G-ready fiberised towers than the incumbents, having already spent around $2 billion on tower fiberization.

Analysts were skeptical about Vodafone Idea’s ability to sustain such big-ticket capex spends given its continuing market share losses and weak financials, which they said could limit its 5G deployment ambitions.

They also said the need for a dense site footprint and fibre backhaul in 5G would shift the balance of power towards larger and integrated operators with strong balance sheets like Jio and Airtel, while those with high gearing levels are at risk given the sustained high capex needs.

“Airtel and Vodafone Idea will each need to spend $2 billion annually on 5G radio and fiber capex spread across 5 years,” UBS said in a report, implying 65% and 85% of Airtel’s and Vodafone Idea’s current annual India capex run rates respectively.

By contrast, Jio’s 5G capex, “would be lower due to its larger tower footprint and higher proportion of towers on fibre backhaul compared with Airtel and Vodafone Idea.” The brokerage firm also expects Jio to transition to 5G in a “time-efficient manner,” given its in-house data centres and investments in a content distribution network (CDN).

“Vodafone Idea’s stretched balance sheet will limit its participation in the 5G opportunity, and the company will require a significant improvement in network quality to arrest market share loss and revert to revenue growth,” UBS said.

Credit Suisse backed the view, saying, “Vodafone Idea will lose the most market share, and will need additional equity capital by FY2021, given our expectation of no price increase”.

UBS estimates that Airtel’s India mobile revenue will grow 5-6% in this financial year and the next even if interconnect usage charges – a source of revenue for incumbents – get scrapped from January 2020.

According to analysts, the India telecom sector can reduce overall estimated $30.5 billion 5G capex spends by 15-20% if Airtel, Vodafone Idea and Jio share towers and fiber resources. However, there is currently no progress on that front.

“We estimate the sector can reduce overall capex by 15-20 per cent if the three Indian telcos share towers and fiber (either commercially or driven by the regulator) – third-party tenancy poses upside risks to our estimates,” UBS said in its report.

……………………………………………………………………………………………………………

India’s Department of Telecommunications wants to hold a 5G spectrum sale by January 2020 at the latest, according to referenced sources.

Credit Suisse doesn’t expect that 5G spectrum sale to attract much interest. That’s due to a mix of “high reserve prices, telcos’ focus on monetising 4G investments, stretched balance sheets, a nascent 5G ecosystem and lack of significant 5G use cases for mass consumption.”

Rajiv Sharma, co-head of research at SBICap Securities, said that Vodafone Idea is unlikely to bid for 5G spectrum at current base prices “as the telco doesn’t have an existing pan-India 4G network that is essential for any telco planning to spend top dollars on 5G,” according to the report.

Analysts believe that Reliance Jio will probably take part in the process, as it is the only profit-making telco in the Indian market.

The Department of Telecommunications (DoT) had recently asked the Trai to lower the starting prices, which the regulator refused. “There was a chance for the Trai to reduce 5G prices. Let’s see what the DoT does now. But at current rates, Airtel won’t buy,” Airtel’s executive reportedly said.

Vodafone Idea CEO Balesh Sharma has previously said that the prices recommended by the regulator were ‘exorbitant.’ The telco said it will participate in the next auction but did not confirm if it would buy 5G spectrum.

Hemant Joshi, partner at Deloitte India, said it would be “prudent to defer the 5G auction till 2020 at least since at Trai’s recommended base prices, the industry response may be very lukewarm.” He also said that the reserve prices need to be lowered, taking into account the experiences in countries where 5G spectrum was recently auctioned.

……………………………………………………………………………………………

Analysts said there are three things that India’s Centre for Telecom Excellence (within the DoT) must do immediately to hasten the adoption of 5G:

First, lay down a clear roadmap of spectrum availability and specify frequency bands aligned with global standards (IMT 2020 from ITU-R). Given that 5G services will be supporting massive data applications, operators will need adequate spectrum.

Editor’s Note: India’s TSDSI has proposed a candidate IMT 2020 RIT based on Low Mobility Large Cell (LMLC), but it hasn’t yet been accepted by ITU-R WP 5D. TSDSI posted a revised and more comprehensive proposal on 10 September 2019, which will be evaluated at the next ITU-R WP 5D meeting in December.

………………………………………………………………………………………………….

Second, there is a need to move away from the existing mechanism of pricing spectrum on a per MHz basis. 5G services require at least 80-100 Mhz of contiguous spectrum per operator. If the Centre were to fix the floor price based on the per Mhz price realised in the last auction then no operator would be able to afford buying 5G spectrum. The pricing, therefore, will have to be worked out anew, keeping in mind the financial stress in the telecom sector and affordability of services.

Finally, the Centre must rapidly complete the national fiber optic network rollout as 5G high speed services will require huge back-haul support for which existing microwave platforms will not be sufficient.