China 5G

Trump and FCC crack down on China telecoms; supply chain security at risk

Excerpt of a Wired article by Justin Sherman (edited by Alan J Weissberger):

The Trump administration is clearly and publicly upping its scrutiny of Chinese-incorporated telecoms. After Washington’s crusade against Huawei, and a forthcoming Senate report that allegedly blasts U,S. regulators for failing to properly oversee Chinese telecoms and their handling of data, these recent actions aren’t exactly surprising. But even if they’re genuinely focused on real national security risks, that doesn’t change the fact that President Trump’s administration doesn’t have a broader strategy.

What the FCC sent to the four companies are called Orders to Show Cause. These orders instruct a recipient firm to demonstrate that its continued operation in the United States doesn’t pose national security risks. Specifically, the ones issued here demand evidence from the four telecoms of why the FCC shouldn’t “initiate proceedings to revoke their authorizations” to operate in the U.S., under Section 214 of the Communications Act.

“The Show Cause Orders reflect our deep concern … about these companies’ vulnerability to the exploitation, influence, and control of the Chinese Communist Party, given that they are subsidiaries of Chinese state-owned entities,” said FCC chair Ajit Pai. “We simply cannot take a risk and hope for the best when it comes to the security of our networks,” he added.

The orders to China Telecom (Americas) Corporation, China Unicom (Americas) Operations Limited, Pacific Networks Corporation, and ComNet (USA) LLC gave the companies until May 24 to respond. Included in this answer must be a “detailed description” of the firm’s “corporate governance,” network diagrams describing how its systems are used, lists and copies of interconnection agreements with other carriers, and descriptions of the extent to which the firm “is or is not otherwise subject to the exploitation, influence, and control of the Chinese government”—neither a small request nor a mere formality.

Editor’s Note: China Mobile, the largest wireless telecom carrier in China is missing from the above list!

Pacific Networks (of which ComNet is a subsidiary) is owned by the state-owned CITIC Telecom International; the government connection here is almost as direct. Linking its board room to the CCP’s Zhongnanhai headquarters is certainly a bit clearer here than with Huawei, which isn’t outright state-owned but has nonetheless been subject to many questions, especially from the White House, about its Chinese government ties. Again, Beijing’s potential access to data from Pacific Networks Corporation is a legitimate risk.

The clock is ticking for these companies to respond to the U.S. government. China Telecom asked the FCC for a 30-day extension on the original May 24 deadline. Its lawyers got a reply this past week considering extra time, conditioned on specifying by May 11 which parts of the order they want clarified. Meanwhile, the executive branch is forging ahead—per the recently issued executive order—with formalizing a committee to scrutinize foreign telecoms’ presence in the US. Recommendations to the FCC could include modifying a company’s FCC license with “mitigation” measures or even outright revoking it.

Many issues plague the recent executive order. There is broad language about which kind of FCC licenses can be reviewed; the EO’s title would suggest only those of foreign telecoms, but it appears it could be much bigger. The EO also leaves many questions of implementation up to a memorandum of understanding, which is due several weeks from now.

After the order’s publication, multiple people I spoke with had additionally drawn attention to the future head of this newly called-for, yet-to-be-created committee: the attorney general. In different times, perhaps that’d be a reasonable way to balance represented interests, from the intelligence community to the Departments of Defense and Homeland Security. But these are not normal times—and William Barr is hardly known for his impartiality or respect for the rule of law.

Zooming out even further, the U.S. government lacks clear and objective criteria to define and articulate what makes one foreign telecommunications supplier more trustworthy than another. After all, post-Snowden, it’s a bit hard for the U.S. to beat the “other countries backdoor their systems” argument, sans evidence, without raising eyebrows. The Trump administration also continues throwing digital sovereignty policies in other countries—from onerous source code inspection requirements to limited data localization provisions—into the same “protectionist” bucket. Given this reality, how will these telecom reviews be diplomatically handled?

Even the recent FCC orders don’t get especially detailed. Beyond citing that the companies are state-owned or are controlled by those that are state-owned, the documents don’t elaborate much on why these firms cannot be trusted. So, is it more about ownership, corporate governance, and legal authorities in the country of incorporation than it is about technical security issues?

Or for the administration’s China hawks, is it the mere connection to Beijing? Because as the Trump administration and the president in particular continue China-bashing, spreading xenophobic rhetoric (e.g., around coronavirus’ origins), and preferring in general a zero-sum engagement with counterparts in Beijing, it seems more likely that factor overshadows all else.

There are real national security risks that must be weighed around foreign telecommunications companies. Questions of foreign state ownership should be explored, especially as the world becomes more digitally interconnected and the technological supply chain is a growing vector for hacking and exploitation. But foregoing a broader strategy on supply chain security is not an effective, long-term option for parsing these modern digital risks. Despite the recent China focus, these questions of supply chain policy go far beyond Chinese technology firms, and the U.S. government needs a comprehensive and repeatable process for answering them.

China Mobile and Huawei deploy 5G base station at 6,500m on Mt Everest!

China Mobile and Huawei have together built the highest elevation 5G (or any other) base station on this planet– at 6500 meters (21,300 feet) at Mount Everest where there are no roads or trails. [Note that the summit is 8,848 meters, but will be measured again this year].

The base station along with two others at lower elevations, will enable China Mobile to run its 5G wireless network on the world’s highest mountain. It will surely be a great aid to climbers which had to previously use satellite phones for ultra high altitude communications with their high camps.

Zhou Min, general manager of Tibet branch of China Mobile, said the facility will ensure reliable telecommunication for the activities of mountain climbing, scientific research, environmental monitoring and high-definition live streaming. The building of 5G infrastructure is in tandem with the measuring of the height of the peak, which officially started on Thursday.

“It comes on the 60th anniversary of the first successful ascent of Mount Everest from the northern slope and the 45th anniversary of China’s first official accurate measurement of Mount Everest,” declared the press release. “Significantly, the 5G network on Mount Everest will provide communication services for the 2020 Mount Everest re-measurement.”

The base station launch marks the 60th anniversary of the first successful ascension of Mount Everest from the northern slope. Base stations are now at the Mount Everest Base Camp at 5,300 metres, the Transition Camp at 5,800 metres, and the Forward Camp at 6,500 meters.

A China Mobile technician told state media that the new 5G network is fast enough for climbers and scientists to have 4K and VR live streaming on the mountain.

Huawei’s 5G AAU and SPN technologies were applied at the base stations, managed and maintained by a dozen network specialists stationed there 24/7 at altitudes of 5,300 meters and above.

Huawei claims that its 5G AAU is highly integrated into a compact size, making it easy for deployment and installation and it fits particularly well for infrastructure in extreme environments such as Mount Everest. In this project, a network in the “stand-alone plus non-stand alone” (SA+NSA) mode connects five 5G base stations.Meanwhile, the 5G connectivity is achieved by Huawei’s Massive MIMO technology.

Huawei’s Massive MIMO comes with three-dimensional narrow beams. At an altitude of 5,300 meters, the 5G download speed exceeded 1.66 Gbps, where the upload speed tops 215 Mbps, claims Huawei. Some of the other technologies being employed by the Chinese telecom equipment giant are Intelligent OptiX Network and HoloSens intelligent video surveillance system. The 5G base station at Everest base camp includes a Gigabit ONT, Huawei’s 10G PON OLT and 200G ultra-high-speed transmission platform, and the HoloSens intelligent video surveillance system.

Pictures of 5G Base station at 6500 meters Photo credits: Huawei

…………………………………………………………………………………………………………………..

The press release concluded as follows:

Huawei strongly believes that technology means to make the world better. The beauty of Mount Everest can be displayed via 5G high-definition video and VR experience, which also provides further insights for mountaineers, scientists and other specialists into the nature. The ground-breaking establishment on Mount Everest once again proves that 5G technology connect mankind and the Earth harmoniously.

References:

https://www.huawei.com/en/press-events/news/2020/4/china-mobile-huawei-deliver-world-highest-5g

https://www.bloombergquint.com/technology/5g-signal-now-available-on-mount-everest-peak

ZTE reports Q1 revenue & profit declines; boosts R&D; telemedicine diagnosis with hospitals to fight COVID-19

ZTE reported operating revenues for the first quarter were CNY 21.48 billion – down from 22.02 billion or -3.23% from the previous year. Net profit declined to CNY 780 million from 863 million or -9.58% year-over-year. ZTE’s net profit after extraordinary items rose 20.5% to CNY 160 million.

The company said the quarter was marked by the coronavirus pandemic and measures taken to alleviate the distress cause by it, as well as by the deployment of new infrastructures such as 5G and the Industrial Internet. ZTE’s R&D costs in the quarter increased to CNY 3.24 billion, comprising over 15.1% of revenues and up 1.2% from the year earlier.

ZTE CORPORATION –a joint stock limited company incorporated in the People’s Republic of China with limited liability. As at 31 March 2020 There were 483,643 shareholders in total (comprising 483,330 holders

of A shares and 313 holders of H shares).

Here are the shareholders holding 5% or above or top 10 shareholders:

- Zhongxingxin Telecom Company Limited

- HKSCC Nominees Limited

- Bank of China Limited

- Hong Kong Securities Clearing Company Ltd

- NSSF Portfolio #101

- Central Huijin Asset Management Co. Ltd

- Shenzhen Huitong Rongxin Investment Co. Ltd

- Nanjing Xinchuangxing Consulting and Management Partnership Ltd

- New China Life Insurance Company Ltd

- Shenzhen Investment Holding Capital Company Ltd

- Guangdong Hengjian Asset Management Company Ltd.

……………………………………………………………………………………………………………………………………………………………………………

ZTE continued to strengthen its R&D investment to build up its core competitiveness. For the three months ended 31 March 2020, the research and development costs amounted to RMB3.241 billion, 15.1% of operating revenue, increased by 1.2% compared to the same period last year.

During the first quarter of 2020, ZTE has placed great priority on its employee health and global customer services by promptly building and upgrading a remote office and customer service platform for all its employees. Moreover, the company has coordinated with partners to fight against COVID-19 and facilitate the resumption of production with digital means in an orderly manner. The company has been proactively promoting the new infrastructure-related services, and has managed to maintain the steady growth of its businesses during the review period.

Meanwhile, ZTE has been actively practicing social responsibilities. The company has collaborated with operators to guarantee the communication services of the front line against COVID-19. It has constructed 4G/5G networks and telemedicine diagnosis systems for hundreds of hospitals in China.

Teaming up with industry partners, ZTE has been committed to empowering various industries to fight against COVID-19 by leveraging its leading technological strength like 5G and AI. Specifically, ZTE has released 5G remote diagnosis and mobile diagnosis services, as well as the smart video cloud solution for epidemic prevention and control.

Moreover, the company has launched the family “cloud classroom” services to support online education. Featuring high efficiency and collaborativeness, ZTE’s secure remote office solution has enabled users of different industries to have remote office services during the outbreak of COVID-19, thereby facilitating the safe and rapid resumption of work and enhancing economic resilience.

With the acceleration of new infrastructures, such as 5G and the Industrial Internet, ZTE has been actively involved in the deployments of operators’ 5G infrastructure, and constantly scaled up its 5G production capacity. Meanwhile, the company has solidified cooperation with top industry players to promote the digital transformation of power, transportation, finance, government affairs and other key industries.

By the end of the first quarter of 2020, ZTE has consecutively secured significant shares for the 5G RAN, 5G SA core network, 5G transport centralized procurement of China Mobile, China Telecom and China Unicom. The company has constructed 5G demonstration networks in multiple cities in China, achieving Giga+ 5G continuous coverage experience. Moreover, the company has completed 5G commercial deployments in Europe, Asia-Pacific, the Middle East and other major 5G markets.

In addition, ZTE has sustained high growth in market shares in optical networks, as well as in the segments of Metro WDM and Backbone WDM. The company and its partners have jointly explored 86 application scenarios and carried out over 60 demonstration projects on a global scale, building a series of 5G intelligent manufacturing demonstration projects along with top industry players.

With respect to terminal devices, ZTE has unveiled its first 5G video smartphone ZTE Axon 11 5G. The company has continuously strengthened its 5G terminal devices cooperation with more than 30 operators worldwide. It has embarked on the 5G terminal market in Japan by partnering with operators.

Looking ahead , ZTE will pay close attention to the global epidemic situation, and make reasonable coordination accordingly with its global customers and partners to cope with the global epidemic. The company will strongly concentrate on its major businesses while leveraging the opportunities of new infrastructure construction, expecting to create more value for its telco customers.

References:

https://res-www.zte.com.cn/mediares/zte/Investor/20200424/E3.pdf

ZTE reports Q1 revenue & profit declines; boosts R&D; telemedicine diagnosis with hospitals to fight COVID-19

ZTE reported operating revenues for the first quarter were CNY 21.48 billion – down from 22.02 billion or -3.23% from the previous year. Net profit declined to CNY 780 million from 863 million or -9.58% year-over-year. ZTE’s net profit after extraordinary items rose 20.5% to CNY 160 million.

The company said the quarter was marked by the coronavirus pandemic and measures taken to alleviate the distress cause by it, as well as by the deployment of new infrastructures such as 5G and the Industrial Internet. ZTE’s R&D costs in the quarter increased to CNY 3.24 billion, comprising over 15.1% of revenues and up 1.2% from the year earlier.

ZTE CORPORATION –a joint stock limited company incorporated in the People’s Republic of China with limited liability. As at 31 March 2020 There were 483,643 shareholders in total (comprising 483,330 holders

of A shares and 313 holders of H shares).

Here are the shareholders holding 5% or above or top 10 shareholders:

- Zhongxingxin Telecom Company Limited

- HKSCC Nominees Limited

- Bank of China Limited

- Hong Kong Securities Clearing Company Ltd

- NSSF Portfolio #101

- Central Huijin Asset Management Co. Ltd

- Shenzhen Huitong Rongxin Investment Co. Ltd

- Nanjing Xinchuangxing Consulting and Management Partnership Ltd

- New China Life Insurance Company Ltd

- Shenzhen Investment Holding Capital Company Ltd

- Guangdong Hengjian Asset Management Company Ltd.

……………………………………………………………………………………………………………………………………………………………………………

ZTE continued to strengthen its R&D investment to build up its core competitiveness. For the three months ended 31 March 2020, the research and development costs amounted to RMB3.241 billion, 15.1% of operating revenue, increased by 1.2% compared to the same period last year.

During the first quarter of 2020, ZTE has placed great priority on its employee health and global customer services by promptly building and upgrading a remote office and customer service platform for all its employees. Moreover, the company has coordinated with partners to fight against COVID-19 and facilitate the resumption of production with digital means in an orderly manner. The company has been proactively promoting the new infrastructure-related services, and has managed to maintain the steady growth of its businesses during the review period.

Meanwhile, ZTE has been actively practicing social responsibilities. The company has collaborated with operators to guarantee the communication services of the front line against COVID-19. It has constructed 4G/5G networks and telemedicine diagnosis systems for hundreds of hospitals in China.

Teaming up with industry partners, ZTE has been committed to empowering various industries to fight against COVID-19 by leveraging its leading technological strength like 5G and AI. Specifically, ZTE has released 5G remote diagnosis and mobile diagnosis services, as well as the smart video cloud solution for epidemic prevention and control.

Moreover, the company has launched the family “cloud classroom” services to support online education. Featuring high efficiency and collaborativeness, ZTE’s secure remote office solution has enabled users of different industries to have remote office services during the outbreak of COVID-19, thereby facilitating the safe and rapid resumption of work and enhancing economic resilience.

With the acceleration of new infrastructures, such as 5G and the Industrial Internet, ZTE has been actively involved in the deployments of operators’ 5G infrastructure, and constantly scaled up its 5G production capacity. Meanwhile, the company has solidified cooperation with top industry players to promote the digital transformation of power, transportation, finance, government affairs and other key industries.

By the end of the first quarter of 2020, ZTE has consecutively secured significant shares for the 5G RAN, 5G SA core network, 5G transport centralized procurement of China Mobile, China Telecom and China Unicom. The company has constructed 5G demonstration networks in multiple cities in China, achieving Giga+ 5G continuous coverage experience. Moreover, the company has completed 5G commercial deployments in Europe, Asia-Pacific, the Middle East and other major 5G markets.

In addition, ZTE has sustained high growth in market shares in optical networks, as well as in the segments of Metro WDM and Backbone WDM. The company and its partners have jointly explored 86 application scenarios and carried out over 60 demonstration projects on a global scale, building a series of 5G intelligent manufacturing demonstration projects along with top industry players.

With respect to terminal devices, ZTE has unveiled its first 5G video smartphone ZTE Axon 11 5G. The company has continuously strengthened its 5G terminal devices cooperation with more than 30 operators worldwide. It has embarked on the 5G terminal market in Japan by partnering with operators.

Looking ahead , ZTE will pay close attention to the global epidemic situation, and make reasonable coordination accordingly with its global customers and partners to cope with the global epidemic. The company will strongly concentrate on its major businesses while leveraging the opportunities of new infrastructure construction, expecting to create more value for its telco customers.

References:

https://res-www.zte.com.cn/mediares/zte/Investor/20200424/E3.pdf

Europe and U.S. to delay 5G deployments; China to accelerate 5G

Up until the COVID-19 pandemic hit the world hard in late February, 5G seemed a priority for most wireless network operators. Now, with across the board cutbacks everywhere, it will be much further down the must do list for 2020.

In the absence of any new 5G applications or completion of 3GPP 5G Phase 2 and ITU-R IMT 2020, 5G was not expected to ramp this year, despite ridiculous hype and false claims (especially ultra low latency which has not yet been specified let alone standardized yet).

Now the new technology faces an unprecedented slow down to launch and expand pilot deployments. Why? It’s because of the stay at home/shelter in place orders all over the world. Non essential business’ are closed and manufacturing plants have been idled. Also, why do you need a mobile network if you’re at home 95% of the time?

One reason to deploy 5G is to off load data (especially video) traffic on congested 4G-LTE networks. But just like the physical roads and highways, those 4G networks have experienced less traffic since the virus took hold. People confined to their homes need wired broadband and Wi-Fi, NOT 4G and 5G mobile access.

“5G deployment in Europe will certainly be delayed,” said Eric Xu, one of Huawei’s rotating CEOs, during a Huawei (private company) results presentation today. Xu also told reporters the delays could last until “the time when the pandemic is brought under control.”

Huawei’s Eric Xu said the current crisis would “certainly” delay 5G rollouts

………………………………………………………………………………………………………..

Answering questions about its annual report, published on Tuesday, Huawei vice-president Victor Zhang said there would “definitely” be an impact but it would likely be worse in Europe than in the UK.

A few data points from European telcos in the aftermath of COVID-19:

- On March 20, the UK’s BT reported a 5% drop in mobile data traffic, compared with normal levels.

- Today, Belgian incumbent Proximus said capital expenditure would go down this year to offset the impact of COVID-19 on profits.

- A growing number of European countries are delaying 5G spectrum auctions, as restrictions related to the Covid-19 pandemic make it difficult to maintain planning. The EU’s deadline of June for the release of the 700 MHz band for 5G will be missed by several countries, including Spain and Austria.

- In Portugal, MEO, NOS and Vodafone Portugal now face a further wait for frequency rights in the 700MHz, 900MHz, 1800MHz, 2.1GHz, 2.6GHz and 3.6GHz bands

- German company United Internet’s CEO, Ralph Dommermuth, said that the construction of subsidiary 1&1 Drillisch’s 5G network would experience delays due to current measures adopted in the country to prevent a further spread of the COVID-19 pandemic in Germany, local paper Handelsblatt reported.

- In Sweden, which has controversially avoided a total lockdown, telecom incumbent carrier Telia has now cut dividends as it prepares for a hit.

Huawei’s statements imply the U.S. will also face a delay in 5G rollouts. It has overtaken Italy as the country with the highest number of coronavirus infections, and its response to the outbreak has been lackluster and confusing at best, horrendous at worst.

As a mobile-only network equipment vendor, Ericsson looks the most exposed to a 5G slow down. More than 50% of its business is generated in Europe and the Americas, where the rate of COVID-19 infections is rising.

Although less reliant on the 5G wireless base station business than Ericsson, Nokia could also be in trouble due to the slowdown in 5G deployments. Approximately 30% of its sales came from North America last year, and another 28% from Europe.

…………………………………………………………………………………………….

“After the pandemic was brought under control, China has accelerated its 5G deployments,” according to Huawei’s Xu.

China has accelerated its own 5G deployment after the number of cases of Covid-19 subsided, according to Xu, but in other countries, it would depend “on several factors”, including whether telecoms companies had the budget and resources to “win back the time” lost.

Indeed, China Mobile this week awarded 5G contracts worth $5.2 billion with approximately 90% of the contracts going to Huawei and ZTE. Ericsson won contracts worth RMB4.2 billion ($593 million) and small local vendor CICT will net RMB965 million ($136 million). Nokia reportedly bid, but failed to win any of the contracts from China Mobile.

This centralized procurement involves 28 China provinces, autonomous regions and municipalities directly under the central government. According to C114, the total demand is 232,143 5G base stations. At the end of February, the number of 5G base stations owned China Mobile has exceeded 80,000.

References:

https://www.bbc.com/news/technology-52108172

https://www.lightreading.com/5g/covid-19-will-help-china-to-extend-its-5g-lead/d/d-id/758596?

https://www.lightreading.com/5g/5g-auctions-delayed-across-europe-due-to-covid-19/d/d-id/758606?

…………………………………………………………………………………………………

9 April 2020 Update:

5G is looking like a casualty of COVID-19

All 5G companies had accomplished was the design of a technology that provides faster connections and additional capacity on smartphone networks. A few have already been launched, and South Korea, the most advanced market, already has millions of subscribers. Yet local news reports suggest many have been underwhelmed by the 5G experience. For service providers, it has had minimal impact on sales while marketing and rollout costs have made a huge dent in profits.

This will discourage 5G investment in countries under COVID-19 lockdown. As customers downgrade to cheaper services and dump TV sports packages rerunning last year’s highlights, many operators will cut spending. Concerned about exposing field workers to unnecessary health risks, they will prioritize the maintenance of networks already used by the majority. Moreover, people confined to their broadband-equipped homes for most of the day have little use for mobile data networks. Any additional investment is likely to go into fiber-optic equipment.

5G launches will also be delayed in European markets that have postponed auctions of the spectrum needed to support services. Austria, the Czech Republic, France, Portugal and Spain are all now reported to have delayed auctions. Without spectrum, 5G will obviously not fly.

Fear mongering stories linking 5G to illness could also hinder rollout. Countries such as Belgium and Switzerland have imposed limits on the use of 5G antennas amid lingering concern that radiofrequency emissions are carcinogenic. The World Health Organization says mobile frequencies are too low to be dangerous, but activists are unconvinced.

In the UK, operators now have to contend with the ludicrous suggestion that 5G networks transmit COVID-19. After misinformed tweets by celebrities including Amanda Holden, a British actress and reality-TV regular, 5G masts were burnt in the cities of Belfast, Birmingham and Liverpool.

China, meanwhile, remains determined to erect more than half a million 5G base stations by the end of this year. Claiming to have beaten COVID-19, it has lifted restrictions on the movement of people and reopened its factories. For the equipment makers building those 5G networks, this investment program could be essential medicine. Just last month, China Mobile, the country’s largest operator, awarded 5G contracts worth $5.2 billion. Unfortunately, with almost 90% of the work going to domestic suppliers Huawei and ZTE, Western vendors will not be able to count on China for a boost.

https://www.lightreading.com/5g/5g-is-looking-like-a-casualty-of-covid-19/a/d-id/758804?

China Telcos Lose Subscribers; 5G “Co-build and Co-share” agreement to accelerate

Decrease in China’s Mobile Subscribers:

China’s wireless carriers are reporting substantial drops in subscribers as the coronavirus crisis reduces business activity.

China Mobile Ltd., the world’s largest wireless carrier, reported its first net decline since starting to report monthly data in 2000. China Mobile subscriptions fell by more than 8 million over January and February, data on the company’s website show.

China Telecom Corp. said it lost 5.6 million users in February, while China Unicom Hong Kong Ltd. subscribers fell by 1.2 million in January.

The across the board China subscriber slump indicates that the coronavirus pandemic crisis, which first emerged in China late last year, is crimping growth, even at businesses that provide essential services and earn monthly revenue. ARPU will likely also decline, according to analysts.

Chris Lane, an analyst at Sanford C. Bernstein & Co said that part of the decrease in wireless subscribers could be due to migrant workers — who often have one subscription for where they work and another for their home region — canceling their work-region account after the virus prevented them from returning to work after the Lunar New Year holidays which began in late January.

While the drop in users is unusual, the total is small relative to total wireless subscriptions, which have risen to a combined 1.6 billion for the three carriers. Things may improve starting this month as work in factories and other businesses in China resumes, Lane said.

Net income fell 9.5% last year at China Mobile, partly on government mandates to cut prices and improve service, but also due to a spike in financing costs – up from RMB144 million ($20.2 million) to RMB3.25 billion ($460 million).

The company, which reported earnings last week, told analysts revenue would remain stable this year, a sign management was not worried about the fall in subscribers.

China Unicom overcame flat revenue growth to post an 11.1% increase in net earnings for 2019. The state-owned telco slashed opex by 22% and marketing cost by 5% to record a 11.3 billion yuan ($1.6 billion) full-year profit.

“In 2019, the domestic telecommunications industry development experienced a short-term pain with weak revenue growth and pressure on industry value,” Chairman and CEO Wang Xiaochu said.

………………………………………………………………………………………..

Co-build and Co-share Agreement:

In September 2019, China Unicom entered into a cooperation agreement with China Telecom to jointly build one 5G access network across the country. China Unicom would be doubling it’s own 5G network coverage, bandwidth, capacity and transmission speed, providing users with better experience.

China Unicom said it will actively step up the “co-build and co-share” with China Telecom in areas such as 4G indoor distributed antenna systems, server rooms, optical fiber and pipelines to further enhance network advantages and corporate value.

References:

https://www.bnnbloomberg.ca/china-s-mobile-carriers-lose-15-million-users-as-virus-bites-1.1410626

https://www.telecomlead.com/5g/china-unicom-reveals-5g-network-capex-plans-94530

China Mobile has 15.4 million 5G customers; 5G+ is primary focus area

China Mobile today published its 2019 annual financial report, stating that the company’s operating revenue reached CNY745.9 billion -a year-on-year increase of 1.2% – and its net profit was CNY106.6 billion ($15 billion) – a year-on-year decrease of 9.5%.

The fall in net profits was largely due to a spike in financing costs – up from RMB144 million ($20.2 million) to RMB3.25 billion ($460 million).

Operating revenue was just 1.2% higher, at RMB745.9 billion ($104.8 billion), while telecom services revenue improved by a meager 0.5%.

A few highlights:

- The largest China telecom network provider acquired 15.4 million 5G customers in the first three months after launch.

- In 2019, China Mobile’s mobile users increased by 25.21 million, reaching a total of 950 million. Its mobile Internet data traffic increased by 90.3% year-on-year and its mobile Internet DOU reached 6.7GB.

- Wireline broadband customers grew by 30.35 million to a total of 187 million.

- China Mobile’s family broadband users reached 172 million, an increase of 17.1% year-on-year. Its family broadband comprehensive ARPU reached CNY35.3.

- At the end of 2019, China Mobile’s government and corporate clients reached 10.28 million, a year-on-year increase of 43.2%. The company’s international business revenue saw a year-on-year increase of 31.4%.

Mr. Yang Jie, China Mobile’s Chairman of the Board said in the press release:

“We were faced with a challenging and complicated operating environment in 2019 where the upside of data traffic was rapidly diminishing and competition within the telecommunications industry and from cross-sector players was becoming ever more intense. Coupled with this was the impact of government policies, including the continued implementation of the “speed upgrade and tariff reduction.”

Against this backdrop, all of us at China Mobile joined together to overcome these hurdles and work towards our ultimate goal of becoming a world-class enterprise by building a dynamic “Powerhouse”. This was centred on the key strategy of high-quality development, supported by a value-driven operating system that leverages our advantages of scale to drive further convergence, integration and digitization across the board.

We structured our organization to enable effective and synergetic capability building and collaborative growth, while nurturing internal vitality. In addition, we further implemented our “5G+” plan to spearhead the development of “four growth engines”, comprising the “customer,” “home,” “business” and “new” markets. These measures have helped us obtain positive momentum in overall operating results, which was a hard-earned achievement for us in a tough year.”

Yang noted that the COVID-19 epidemic had driven more and more businesses and consumers online and encouraged greater takeup of digital and cloud-based services. “We will leverage these opportunities, as well as the 5G network, to further develop the information and communications services market.”

Business Market:

The “business” market was China Mobile’s new growth engine and we strove to nurture new growth points by fully leveraging our cloud and network convergence advantages, building on our DICT (data, information and communications technology) infrastructure comprising IDC, ICT, Mobile Cloud, big data and other corporate applications and information services. Buoyed by active promotion of our “Network + Cloud + DICT” smart services, customers and revenue recorded rapid growth.

As of the end of 2019, the number of corporate customers increased to 10.28 million, representing year-on-year growth of 43.2%.

Focusing on key sectors such as industry, agriculture, education, public administration, healthcare, transportation and finance, the company deepened go-to-market resources to promote DICT solutions that cater to sector-specific scenarios. This strategy has boosted DICT revenue to RMB26.1 billion, or growth of 48.3% year-on-year, contributing a larger portion of our overall revenue.

“5G+” Achieved a Good Start:

China Mobile sped up the development of 5G and have been fully implementing its “5G+” plan since June 2019, when we were granted the 5G licence. These initiatives have shown good initial results.

The company actively participated in setting international standards for 5G to drive technological development. It led 61 key projects in relation to 5G international standards setting and own more than 2,000 5G patents. It also helped to continuously strengthen the Standalone 5G (within 3GPP Release 15 and 16).

Its “six international standards (3GPP specifications are not standards) on 5G system architecture” and “38 international standards including 5G NR (New Radio) terminals and base station radio frequency” scooped all the top prizes in the 2019 Science and Technology Awards presented by the China Communications Standards Association, demonstrating our leadership in 5G communications standards.

At the same time, the company accelerated the implementation of “5G+” by formulating well- coordinated development of 5G and 4G. It constructed and began operating more than 50,000 5G base stations and launched 5G commercial services in 50 cities. Emerging technologies such as AI, IoT (Internet of Things), cloud computing, big data and edge computing were assimilated into 5G (5G+AICDE) and developed more than 200 critical capabilities, while making breakthroughs in over 100 5G joint projects.

In terms of 5G+Eco, we aimed to develop the ecosystem with other industry players. Through its 5G Innovation Centre and 5G Industry Digital Alliance, more than 1,900 partners were attracted.

The 5G Device Forerunner Initiative, guiding manufacturers to launch 32 5G devices, was established. The level of maturity was basically the same between the 2.6 GHz and 3.5 GHz industry chains. Benefiting from forward-looking planning and effective execution, we expanded 5G+X, where “X” stands for the wider application of 5G, in applications that have been adopted by a plethora of industry sectors, as well as the mass market. For the latter, we launched exclusive plans for 5G customers and feature services such as ultra-high definition videos, cloud-based games and full-screen video connecting tones. As of the end of February 2020, our 5G plans attracted 15.40 million package customers – maintaining an industry-leading position.

In terms of vertical sector, China Mobile explored the possibility of combining 5G with AICDE capabilities, extending collaboration in the industry and deep-diving into classic manufacturing scenarios to develop our leadership in 5G smart manufacturing, 5G remote medical services and 5G automated mining, among other sectors. A total of 50 group-level demo application projects were implemented.

Looking ahead, 5G presents infinite possibilities. China Mobile will continue to take a systematic approach to planning and steadily implementing our “5G+” initiatives. The company will speed up technology, network, application, operations and ecosystem upgrades, accelerate industry transformation by converging technologies, integrate data to strengthen information transmission in society, and introduce digitized management to build the foundation for digital society development. By doing so, China Mobile will seek more extensive 5G deployment, covering more sectors and creating greater efficiency and social value.

…………………………………………………………………………………………….

References:

https://www.chinamobileltd.com/en/file/view.php?id=226450

https://www.chinatechnews.com/2020/03/19/26442-china-mobile-net-profit-down-9-5-in-2019

https://www.lightreading.com/asia/china-mobile-reports-154m-5g-customers/d/d-id/758329?

Investment Analysts: Soft Telecom Capital Spending (CAPEX), but 5G in China to Grow 25% in 2020

Investor’s Business Daily reports that Goldman Sachs‘ Rod Hall and Bank of America‘s Tal Liani issued separate notes Tuesday and Wednesday which came to the same conclusion: Despite the ultra hyped 5G buildup, they see overall telecom capital spending remaining soft in 2020.

Hall said, “Telco capital spending trends look set to be muted with China being the only driver of growth,” in his note, issued Tuesday. He sees 5G growth in China of 25% this year, but predicts only a 2% hike in global telecom capital spending.

Hall added: “The carrier environment is challenged globally by flat or declining revenue streams with 5G thus far offering limited or no additional revenue opportunities.”

BofA’s Liani concurred in his Wednesday note. He sees global telecom capital spending up only 1% to 2% in 2020, despite 5G network build-outs. The 5G build-out may fail to impress U.S. wireless customers over the next 12 months, he adds. “Contrary to the belief that the U.S. is an early leader with 5G, we see potential for users to be disappointed with either lack of coverage or lack of improvement, or both,” Liani said. Here is an excerpt of his January 8, 2020 note to clients:

5G becomes mainstream, but the U.S. will likely lag:

5G traction remains front and center for 2020, and we expect the first phase of a major smartphone refresh cycle in 2H20, with all major vendors launching 5G devices. In 2019, we saw initial network build-outs, and we expect the device/semiconductor ecosystem to catch up in 2020, supporting and enabling ubiquitous 5G devices. However, some regions may lag behind, particularly the US where a lack of quality 5G spectrum injects delays vs. certain parts of Europe, China, Korea and Japan where mid-band spectrum is more readily available. Our top pick related to this theme is Qualcomm as the semi provider benefits from 5G devices and the China launch.

Verizon Communications and AT&T likely will lower spending on existing fourth-generation networks, says Goldman Sachs’ Hall. They’ll also pare back spending on wireline networks. “Although U.S. 5G deployments should advance in 2020 our U.S. telecom team expects wireless capex to be roughly flat in 2020 as 5G increases are mostly offset by slowing non-5G spending,” Hall said.

Makers of electronic chips, network gear and fiber-optic technologies should gain from the 5G build-out, analysts say. Other5G stocks to watch will be tied to the deployment of “small cell” antennas, radio access network equipment as well as cloud computing infrastructure. Goldman Sachs favors fiber-optic play Corning. It’s cautious on gear makers Nokia and Ericsson.

Liani said Apple’s expected launch of 5G iPhones in late 2020 could be a game-changer. However, he says consumers may be disappointed in the 5G network coverage and 5G speeds provided by Verizon, AT&T, T-Mobile US and Sprint. That’s because not enough mid-band radio spectrum is available yet for 5G services, Liani said.

He calls Qualcomm one of the best 5G stocks to buy because it’s dependent on smartphone sales, not core network upgrades. Qualcomm‘s customers include Apple and Chinese smartphone makers.

In 2020, we see potential for mass device availability to usher in the first meaningful device upgrade cycle for 5G,” Liani added. “In 2021 and 2022, we expect the network equipment investments to potentially pick up once again as 5G usage accelerates and new applications emerge. Most importantly, however, spectrum availability drives both network upgrades and likely customer satisfaction with the new 5G networks.

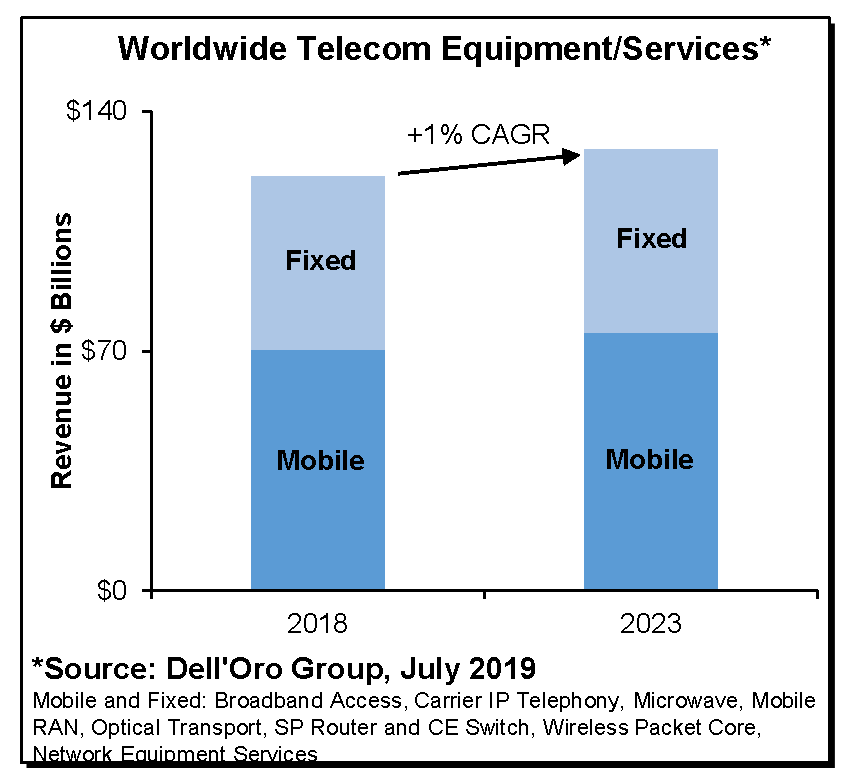

Let’s close with an interesting graph from Dell’Oro Group which shows very little growth in telecom equipment/services through 2023:

Reference:

https://www.investors.com/news/technology/5g-stocks-telecom-capital-spending/

……………………………………………………………………………………………………………………………………………………………………………..

Addendum: BoAML – Hardware vendors bow to the white box:

Hardware standardization and white box networking continue and drive changes in IT equipment purchasing behavior. Hardware vendors are increasingly being forced to react to three major realities:

1) public cloud capex represents the majority of growth and some companies (e.g. Cisco) find it hard to penetrate,

2) software is taking the forefront, with vendors of traditional networking gear, like ADC, switching, or routing, facing significant pricing pressure and a new breed of competitors, and

3) the value is also pushed to semiconductors, with Cisco’s SiliconOne semiconductor strategy and the proposed acquisition of Acacia designed to address the associated risk and opportunity

Lastly, the trends of software-defined networking, white boxes, and cloud migration come together to support our fifth major trend for 2020: the shift to software-defined branch/campus offices. In our view, this trend began with SD-WAN, continued with Cisco’s Catalyst 9k introduction, and comes fully together with the acceleration of WiFi 6.

China to complete Beidou satellite-based positioning system by June 2020- to be used with 5G

The Nikkei Asian Review reported on Friday that China will soon be completing its Beidou satellite-based positioning system as it moves to reduce its reliance on America’s GPS in both in telecommunications and for its military. The final two satellites for its Beidou satellite-based positioning system will be launched by June 2020, completing the 35-satellite network, Ran Chengqi, spokesperson for the Beidou Navigation Satellite System, told reporters in Beijing.

From modern farming to smart ports to a text messaging service, China is trying to build an ecosystem independent of the GPS and open it to Southeast Asia, South Asia, Africa and Eastern Europe. This effort pushes decoupling between Washington and Beijing, which are poised to enter year three of a trade war, to the final frontier of space.

Over 70% of Chinese smartphones are equipped to tap into Beidou’s positioning services, Ran said. The system also plays a role in fifth-generation wireless communications (5G), an area where China’s Huawei Technologies is in the vanguard of technological development.

“The integration of Beidou and 5G is an important sign on the path toward China’s development of information technology,” Ran said. “As a major space infrastructure for China to provide public services to the world, the Beidou system will always adhere to the development concept of ‘China’s Beidou, the world’s Beidou, and the first-class Beidou,’ serving the world and benefiting mankind,” he added.

China’s goal for Beidou is to rely less on the US for both its telecommunications and its military and to build an ecosystem independent of the GPS that would be open to Southeast Asia, South Asia, Africa and Eastern Europe.

Beidou was named after the Chinese term for the Big Dipper constellation. Beidou said its services will be enhanced by the end of next year. For example, the level of positioning accuracy will improve from within 5 meters to within centimeters, an advance that will aid search-and-rescue missions and also prove crucial for self-driving vehicles. Both Beidou and 5G will be employed by self-driving buses set to begin operation soon in the city of Wuhan. Beidou will also differentiate itself from GPS by supporting communication through its constellation of satellites.

China has launched 53 Beidou satellites since 2000, including those no longer in operation. The navigational system began worldwide services in late 2018. Beidou started offering positioning services to private-sector companies in late 2011.

The economic scale of services and production of goods tied to Beidou will grow to 400 billion yuan ($57 billion) in 2020, according to Chinese media.

Beijing aims to expand the system worldwide. China and Russia have allied on satellite positioning. Chinese officials are also pouring resources into collaborating with global organizations representing the airline industry and other sectors.

Space is one of the priority areas of Beijing’s “Made in China 2025” plan for boosting self-reliance in vital technologies. By 2030, China aims to become a “space power” alongside the US and Russia. The launch of a Martian probe is set for as early as next year, followed by the completion of a Chinese space station around 2022.

May 27, 2020 Update: Measuring the height of Mt. Everest

China’s network of Beidou satellites are being used in the survey to determine Mt. Everest’s current height and natural resources, the Xinhua News Agency reported. Data on snow depth, weather and wind speed is also being measured to aid in glacier monitoring and ecological protection.

……………………………………………………………………………………………………………………………………………..

References:

https://time.com/5755791/china-beidou-completion/

https://www.space.com/china-launches-beidou-3-satellite.html

China to launch first private 5G satellite by end of 2019

Sources: China Daily/Asia News Network and Beijing Daily (see References blow)

China’s first private 5G low-orbit broadband satellite has passed factory tests and is expected to be launched at the end of the year, chinanews.com reported. The 5G satellite is expected to be put into orbit via Kuaizhou-1A (KZ-1A) rocket by the end of December.

It is China’s first satellite developed by a commercial aerospace company GalaxySpace and weighs approximately 200 kg. The launch will be the first Q/V band and 200-kilogram private (non-government owned) satellite.

With an orbit altitude of 1,200 meters, it will cover 300,000 square kilometers, roughly equivalent to 50 Shanghai cities. The satellite will gradually provide 5G signal services to various places through ground stations. From this starting point, China has taken the first step in its 5G “space communications” journey.

The satellite, made by Galaxy Space, will be launched via the domestically made KZ-1A carrier rocket at the end of December. Xu Ming, founder of GalaxySpace, said the launch of the satellite could mark the first step of its “space internet” project. The company wants to develop more low-cost, high-performance 5G satellites in the future, so as to fill digital gaps and connect the world with the 5G satellite network, he added.

“The coverage of 5G signals from the sky is huge, and the signals of each 5G low-orbit broadband satellite can evenly cover a range of 300,000 square kilometers. Large cities such as Beijing, Shanghai, Guangzhou, and Shenzhen can easily achieve full coverage for autonomous driving, aircraft, ships, high-speed rail And other mobile platforms to provide high-speed, stable, low-latency 5G network connection services. “Liu Chang said.

“China Telecom has proposed to promote the integration of mobile phone communications and satellites through software and hardware technologies such as mobile phone multi-mode.” Biqi, the chief expert of China Telecom and a member of Bell Labs in the United States, who is participating in the World 5G Conference, told reporters that Among the operators, China Telecom is currently the only operator with satellite spectrum related resources.

In order to make commercial use of 5G satellite signals as early as possible, Liu Chang said that Galaxy Aerospace is indeed expected to cooperate with operators.

Low-orbit broadband communications satellites could overcome challenges that ground base stations currently confront in covering areas such as deserts and the ocean, and shed light on those living in places where communication signals rarely reach, the report said.

References:

https://www.thestar.com.my/news/regional/2019/12/13/china-to-launch-first-private-5g-satellite

http://bjrb.bjd.com.cn/html/2019-11/23/content_12431015.htm

https://www.chinadaily.com.cn/a/201912/12/WS5df20a57a310cf3e3557dc80.html