China 5G

China to accelerate 5G roll-outs while FCC faces “rip and replace” funding shortfall

China Daily reports that local governments in China are doubling down on plans to accelerate 5G rollouts in 2022. More than 20 provincial and municipal governments in China have emphasized efforts to accelerate construction of “new infrastructure” like 5G and data centers in their work plans for this year.

Shanghai plans to build more than 25,000 5G base stations this year (do you really believe that?) to push forward the in-depth coverage of the superfast wireless network. The city also has ambitions to build super large computing power platforms to meet growing demand.

Zhao Zhiguo, spokesman for the Ministry of Industry and Information Technology, China’s top industry regulator, said earlier:

“2022 is a critical year for the large-scale development of 5G applications. We will continue to improve 5G network coverage and accelerate the in-depth integration of 5G and vertical industries.”

One of the priorities is to moderately speed up the coverage of 5G in counties and rural towns in China, Zhao said.

Ten ministries, including the Cyberspace Administration of China, recently unveiled a digital rural development action plan for the period from 2022 to 2025, which called for an intensified push to promote digital infrastructure upgrades in rural areas.

Telecom operators are also moving fast. China Mobile, the nation’s largest telecom carrier, said it aims to achieve continuous 5G coverage in rural towns across the country by the end of this year.

Telecom carriers’ 5G plans seek to harness the power of more than 1.4 million 5G base stations that were deployed in China by the end of last year (but can you really trust that China government reported number?). 5G signals are already available in urban areas of all of China’s prefecture-level cities, more than 98% of county-level towns and 80 percent of rural towns, MIIT data showed.

5G Cell Tower in China. Image courtesy of China Daily

…………………………………………………………………………………………………………………………….

In the U.S., it’s a different story. The Federal Communications Commission (FCC) found a shortfall in funding for its plan to replace Chinese telecom equipment. Inadequate finance is likely to pose connectivity challenges to people in remote areas in the US, experts said.

According to a report on MobileWorld Live, a telecom industry website, the FCC said local telecom operators’ requests for funding to replace network equipment made by Chinese companies Huawei and ZTE totaled $5.6 billion, almost three times the $1.9 billion allocated by the US federal government. Network operators serving less than 10 million customers which used government subsidies to buy Huawei or ZTE equipment before 30 June 2020 were eligible to apply for funding to cover costs associated with removing, replacing and disposing of the Chinese network equipment.

In a statement released last week, FCC Chairwoman Jessica Rosenworcel said that 181 carriers submitted initial reimbursement application requests totaling approximately $5.6 billion. Carriers are required to remove and replace existing network gear from Huawei and ZTE after the vendors were deemed national security risks. Congress in late 2020 set aside around $1.9 billion to fund and carry out the effort under the Secured and Trusted Communications Act 2019.

“Last year Congress created a first-of-its kind program for the FCC to reimburse service providers for their efforts to increase the security of our nations communications networks,” Rosenworcel said. “We’ve received over 181 applications from carriers who have developed plans to remove and replace equipment in their networks that pose a national security threat,” she added.

The FCC banned U.S. telecom carriers from buying Huawei and ZTE’s equipment via federal subsidies, citing what it alleged were national security concerns. The two Chinese tech companies have repeatedly denied the accusations, which they said are groundless.

Xiang Ligang, director-general of the Information Consumption Alliance, a telecom industry association in China, said Huawei and ZTE’s products are currently used by US telecom carriers to offer network and broadband services in some of the most remote regions in the US. Xiang said that the U.S. order to replace Huawei/ZTE wireless network equipment in rural areas will result in the lack of quality telecom services.

Steve Berry, president and CEO of the Competitive Carriers Association, a trade group for about 100 wireless providers in the US, issued a statement calling on the U.S. government to ensure the FCC program is fully funded so that connectivity is maintained during the operators’ transition to new wireless telecom equipment for their cellular networks.

…………………………………………………………………………………………………………………………….

Table 1: All the companies asking for FCC “rip and replace” funding

| Company | Applicant | Wireless | Wireline | Total | Vendor |

| Viaero Wireless | NE Colorado Cellular Inc | X | $1,194,000,000 | Ericsson | |

| Union Wireless | Union Telephone Company | X | $688,000,000 | Nokia | |

| ATN International | Commnet Wireless, | X | $418,768,726 | ||

| Gogo | Gogo Business Aviation LLC | X | $332,770,202 | ||

| NTCH | PTA-FLA, Inc. | $273,971,426 | |||

| Lumen | Level 3 Communications, LLC | X | $269,999,994 | ||

| Stealth Communications | X | $199,066,226 | |||

| SI Wireless, LLC | X | $181,023,489 | |||

| United Wireless Communications, Inc. | X | $173,471,477 | |||

| Hotwire Communications, Ltd. | X | $141,299,003 | |||

| Latam Telecommunications, L.L.C. | $138,060,092 | ||||

| NEMONT TELEPHONE COOPERATIVE INC | X | $125,551,024 | |||

| NTUA Wireless, LLC | X | $124,447,019 | |||

| Windstream Communications LLC | X | $118,271,652 | |||

| Rise Broadband | Skybeam, LLC | X | $106,159,884 | ||

| Pine Telephone Company | X | $87,095,419 | |||

| Mediacom Communications Corporation | X | $86,171,976 | |||

| Flat Wireless, LLC | X | $76,284,671 | |||

| Pine Belt Cellular, Inc. | X | $74,856,191 | |||

| James Valley Cooperative Telephone Company | X | $53,000,000 | |||

| AST Telecom, LLC d/b/a Bluesky | X | $49,959,592 | |||

| Country Wireless LLC | X | $47,508,982 | |||

| Point Broadband Fiber Holding, LLC | X | $47,172,086 | |||

| Board of Trustees, Northern Michigan University | X | $45,796,636 | |||

| Hargray Communications Group, Inc. | X | $42,785,933 | |||

| NfinityLink Communications, Inc. | $37,535,905 | ||||

| Plateau Telecommunications, Incorporated | X | $30,000,000 | |||

| Texas 10, LLC | $29,088,795 | ||||

| Mark Twain Communications Company | X | $29,000,000 | |||

| Panhandle Telecommunication Systems Inc | $28,925,552 | ||||

| TelAlaska Cellular, Inc. | X | $26,567,517 | |||

| Central Louisiana Cellular, LLC | X | $26,264,528 | |||

| TRANSTELCO INC. | X | $25,573,213 | |||

| Beamspeed, L.L.C. | X | $19,596,157 | |||

| Triangle Telephone Cooperative Association, Inc. | X | $18,336,507 | Mavenir | ||

| Eastern Oregon Telecom, LLC | X | $18,122,185 | |||

| Puerto Rico Telephone Company, Inc. | X | $16,857,851 | |||

| Vitelcom Cellular, Inc. d/b/a Viya Wireless | X | $15,716,011 | |||

| Santel Communications Cooperative, Inc. | X | $14,604,337 | |||

| MHG Telco LLC | X | $14,456,482 | |||

| WorldCell Soutions, LLC | X | $12,673,559 | |||

| LIGTEL COMMUNICATIONS INC. | X | $12,000,000 | |||

| Point Broadband Fiber Holding, LLC | X | $11,344,724 | |||

| Copper Valley Wireless, LLC | X | $11,151,417 | |||

| Premier Holdings LLC | $9,759,680 | ||||

| Eltopia Communications, LLC | X | X | $7,741,951 | ||

| Metro Fibernet, LLC | X | $7,567,518 | |||

| Bestel (USA), Inc. | $6,887,500 | ||||

| PocketiNet Communications Inc. | $6,741,452 | ||||

| Carrollton Farmers Branch ISD | X | $5,943,974 | |||

| Windy City Cellular | X | $5,562,067 | |||

| Bristol Bay Cellular Partnership | X | $5,269,183 | |||

| Kings County Office of Education | $5,221,191 | ||||

| Interoute US LLC | $4,867,140 | ||||

| Pasadena ISD | $4,387,311 | ||||

| Velocity Communications, Inc. | X | $4,158,729 | |||

| Advantage Cellular Systems, Inc. | X | $3,479,000 | |||

| New Wave Net Corp | $3,365,772 | ||||

| FirstLight Fiber, Inc. | $3,306,644 | ||||

| Gigsky, Inc. | X | $3,128,678 | |||

| Triangle Communication Systems Inc | $2,779,371 | ||||

| FIF Utah LLC | X | $2,662,538 | |||

| Gallatin Wireless Internet, LLC | X | $2,399,162 | |||

| Moore Public Schools | $2,023,243 | ||||

| HUFFMAN ISD | $1,920,588 | ||||

| Crowley ISD | $1,720,496 | ||||

| Castleberry Independent School District | X | $1,672,527 | |||

| One Ring Networks, Inc. | $1,649,281 | ||||

| University of San Francisco | $1,570,437 | ||||

| Leaco Rural Telephone Cooperative, Inc. | $1,511,617 | ||||

| Zito West Holding, LLC | X | $1,453,469 | |||

| Southern Ohio Communication Services Inc | $1,312,844 | ||||

| Xtreme Enterprises LLC | X | $1,097,283 | |||

| Virginia Everywhere, LLC | X | $562,001 | |||

| South Canaan Telephone Company | $542,139 | ||||

| Palmer ISD | $520,146 | ||||

| Waxahachie ISD | X | $457,396 | |||

| Hunter Communications & Technologies LLC | $432,348 | ||||

| Utah Telecommunication Open Infrastructure Agency | $413,760 | ||||

| COMMSELL | $302,400 | ||||

| VTel Wireless, Inc. | X | $283,618 | |||

| Trinity Basin Preparatory, Inc. | $242,510 | ||||

| NTInet, inc | $198,340 | ||||

| LakeNet LLC | X | $193,277 | |||

| IdeaTek Telcom, LLC | X | $181,899 | |||

| Millennium Telcom, L.L.C., dba OneSource Communications | $165,195 | ||||

| Inland Cellular LLC | X | $117,183 | |||

| Roome Telecommunications Inc | $92,144 | ||||

| Milford Independent School District | $40,399 | ||||

| Angeles Enterprises | X | $33,368 | |||

| Crystal Broadband Networks | X | $28,704 | |||

| Natural G.C. Inc. | $27,313 | ||||

| Webformix Internet Company | X | $22,400 | |||

| Northern Cambria School District | $14,400 | ||||

| Deer Creek Independent School District | $- | ||||

| $5,609,338,024 | |||||

| This FCC data was initially compiled by vendor Mavenir and then expanded, checked and edited by Light Reading staff. | |||||

“We’ve received over 181 applications from carriers who have developed plans to remove and replace equipment in their networks that pose a national security threat. While we have more work to do to review these applications, I look forward to working with Congress to ensure that there is enough funding available for this program to advance Congress’s security goals and ensure that the US will continue to lead the way on 5G security,” FCC Chairwoman Jessica Rosenworcel said in a statement.

References:

http://www.chinadaily.com.cn/a/202202/09/WS620303dfa310cdd39bc85734.html

Are China’s huge 5G numbers to be believed?

Disclosure:

Many experts believe you can not trust any economic numbers reported by China’s government. China has a long history of opaqueness when it comes to reporting economic statistics. Here’s a reference: https://www.heritage.org/international-economies/commentary/the-problem-false-chinese-economic-data

…………………………………………………………………………………………………………………………….

Summary:

Xie Cun, Director of China’s Information and Communication Development Department of the Ministry of Industry and Information Technology (MIIT), stated last week that China has built more than 1.15 million 5G base stations, accounting for more than 70% of the world.

Prefectural-level cities, more than 97% of counties and 40% of towns and towns have achieved 5G network coverage. China’s network operators report they have a total of 450 million 5G terminal users, accounting for 27% of all mobile subscribers in China and more than 80% of the world.

210 million 5G smartphones have been sold in China so far this year, up 69% over 2020 and representing nearly three-quarters of all handsets sold in China.

………………………………………………………………………………………………………………………….

Analysis:

The overarching factor in China’s spectacular 5G statistics is the role of the national government. In addition to its direct control of the three state owned network operators [1.], the CCP has ensured – through its high-profile national plans, the supportive Chinese media, and the now-ubiquitous enterprise party committees – that the entire industry is in sync with its prolific 5G ambitions.

Note 1. China Mobile, China Telecom and China Unicom are together allocating 185 billion yuan ($29 billion) for 5G capex this year alone. 5G plans are available at ultra-low prices, with China Mobile’s entry-level package around $12 a month.

According to the China telecom operators’ numbers, the total number of ‘5G package’ subscribers is 667 million – more than 50% higher than the number of actual 5G users. That’s because there are a tremendous number of 4G subscribers buying the bigger 5G packages.

Light Reading’s Robert Clark wrote:

The operators and the MIIT do not disclose the kind of meaningful network rollout data used by operators in the rest of the world, like percentage of population covered.

So we know nothing about the actual reach of China’s giant 5G project. Most likely, the two giant networks – China Mobile’s and the shared China Telecom-China Unicom network – each covers exactly the same population.

Which leads to the second problem – the distortions of a top-down plan driven by bureaucratic dynamics rather than market needs.

Major cities have rushed to offer rent and tax rebates to speed up rollouts and, of course, to catch the eye of their Beijing bosses.

According to Light Reading’s count, a year ago the wealthy cities of Shanghai, Beijing and Shenzhen accounted for nearly a third of the total 5G rollout.

That is why the MIIT’s new five-year plan makes a point of demanding that 5G be extended to 80% of all rural administrative villages by 2025. Currently, 5G is available in exactly 0% of them.

The other problem in this approach is the built-in irrational exuberance. Since launching 5G, the telcos have worked tirelessly to build out a portfolio of enterprise use cases, as anticipated by the national 5G plans. China Mobile, for one, has developed 470 enterprise apps and nine industry platforms.

But the operators are now tapping out, acknowledging the futility of developing thousands of customized applications, most of which they now admit are “showroom-only.” That’s without getting into the complexities of telco generalists trying to sell into highly specialized segments.

At first look, the scale of China’s government mandated 5G project seems quite impressive. However, in reality it’s a story of fake numbers, rapid rollouts and low subscriber prices.

…………………………………………………………………………………………………………………………………..

References:

https://www.finet.hk/newscenter/news_content/61944e4dbde0b33639732370

https://spectrum.ieee.org/how-america-can-prepare-to-live-in-chinas-5g-world

China plans to triple the number of 5G base stations by end of 2025

China’s Ministry of Industry and Information Technology (MIIT) plans to more than triple the number of 5G base stations over the next four years, targeting a total of 3.64 million by end-2025, local newspaper China Daily reported.

China aims to have about 3.64 million 5G base stations by the end of 2025. That’s 26 5G base stations for every 10,000 people. In comparison, there were only five 5G base stations for every 10,000 people in China in 2020.

Xie Cun, director of MIIT, said the overall goal proposed in a five-year plan for the information and communication industry is to basically build a high-speed, ubiquitous, smart, green, safe and reliable new digital infrastructure by 2025.

The plan also proposed that the penetration rate of 5G users in China will increase from 15 percent in 2020 to 56 percent in 2021, and by then, 80 percent of China’s administrative villages will have 5G signal accessibility.

Xie said that China so far has already built more than 1.15 million 5G base stations, accounting for more than 70 percent of the global total, and 5G network coverage has been achieved in urban areas of all prefecture-level cities, 97 percent of counties and 40 percent of rural towns across the country.

The 5G mobile subscriber accounts in China, numbering some 450 million, make up over 80 percent of the global total, Xie added.

The five-year plan also forecast that by the end of 2025, the information and communication industry will maintain an annual growth rate of about 10 percent to reach a total revenue of 4.3 trillion yuan ($674.2 billion) in 2025. The plan also forecast that the cumulative investment in telecom infrastructure will increase from 2.5 trillion yuan in 2020 to 3.7 trillion yuan in 2025.

Widening the industrial use of 5G will also be a key focus for China. Xie said 5G has already been used in 22 industries. The application of 5G in industrial manufacturing, mining and ports is relatively mature, where 5G has been expanded from production assistance to core businesses such as equipment control and quality control. Meanwhile, a number of 5G-powered applications have also emerged in industries such as medical care, education and entertainment.

“In the next step, we will work with other parties to focus on promoting 5G applications in 15 industries that target information consumption, real economy and people’s livelihood services,” Xie said.

Wang Zhiqin, deputy head of the China Academy of Information and Communications Technology, a government think tank, said China is likely to achieve several breakthroughs in 5G technological evolution, network construction and applications by 2025.

“By the end of the 14th Five-Year Plan period (2021-25), China will have built the world’s largest and most extensive stand-alone 5G network and basically achieve full network coverage in urban and rural areas,” Wang said.

Ding Yun, president of Huawei Technologies carrier business group, said:

“5G is no longer for early adopters. It is improving our daily lives. This year is the first year with large-scale 5G industry applications. Operators will need new capabilities in network planning, deployment, maintenance, optimization and operations, in order to achieve zero to one, and replicate success from one to many.”

……………………………………………………………………………………………………………………………..

Technicians check a 5G base station in Tongling, Anhui province, China

[Photo by Guo Shining/For China Daily]

Chinese operators recorded a net gain of 43.88 million 5G subscribers in September, according to the carriers’ latest available figures.

China Mobile, the world’s largest operator in terms of subscribers, added a total of 27.08 million 5G subscribers in September. The state owned #1 carrier said it ended last month with 331.22 million 5G subscribers, compared to 113.59 million 5G customers in September 2020. China Mobile has added a total of 166.22 million subscribers in the 5G segment since the beginning of the year.

Rival operator China Unicom said it added a total of 7.88 million 5G subscribers during last month. During the first nine months of the year, the carrier added a total of 66.11 million 5G subscribers. The telco ended September with 136.94 million 5G subscribers. China Unicom started to provide 5G statistics earlier this year.

China Telecom added 8.92 million 5G subscribers in September to take its total 5G subscribers base to 155.54 million. During the January-September period, the telco added a total of 69.04 million 5G subscribers.

2021 World 5G Convention in Beijing: “5G+ By All For All”

The 2021 World 5G Convention, themed “5G+ By All For All, ” kicked off in Beijing Etrong International Exhibition & Convention Center on 31st August 2021. With more than 1,500 experts, scholars and entrepreneurs from 20 countries participating online and offline, the convention aims to discuss the future application of 5G in the fields of “industry”, “economy” and “innovation” .

Co-hosted by The People’s Government of Beijing Municipality, National Development and Reform Commission, Ministry of Science and Technology and Ministry of Industry and Information Technology, the three-day event features forums, exhibitions and a 5G-based application design competition.

According to the Ministry of Industry and Information Technology (MIIT), since 5G came into commercial use in China, 993,000 5G base stations have been built. With more than 392 million households connected to 5G terminals, 5G base stations has covered all prefecture-level cities, more than 95% of counties and 35% of townships.

By now, over 10,000 5G application cases have covered 22 important industries and related fields of China’s economy, including steel, electric power and mining. Besides, a large number of colorful application scenarios are becoming new engines leading China’s high-quality development.

The convention unveiled 10 projects for 5G applications, all of which best represented 5G industrial practices and cutting-edge business patterns.

Eight white papers and research reports on 5G technologies were released during the event, and 18 strategic cooperative projects including the application of 5G technologies in Beijing’s municipal parks were signed at the closing ceremony.

As the host city of the event, Beijing will step up efforts to promote the construction of 5G network, industrial internet, and big data platform, accelerating the use of 5G technologies in telemedicine, self-driving vehicles, high-definition live streaming, and other fields during the 14th Five-Year Plan period (2021-2025).

Li Meng, Vice Minister of Science and Technology, said that at present, the new generation of information technology, represented by the mobile Internet, artificial intelligence, big data and supercomputing, is booming and evolving at a faster pace, bringing significant and far-reaching impact on economic development, the improvement of people’s livelihood and the environment and ecology of all countries.

“As China enters a new stage of development, implementing new development concepts, building a new development pattern and achieving high-quality development, sci-tech innovation are more than ever needed,” Li said. “At the same time, the huge potential market, diversified consumer demands and emerging industrial forms will also provide more diversified application scenarios and broader space for sci-tech innovation.”

As for how to promote the maturity of 5G enhanced technology, Li elaborated, “We are willing to continuously uphold the idea of opening up and cooperation, mutual benefit and win-win result, with more open attitudes and more pragmatic approaches, further strengthen the international cooperation of the evolution of 5G technology.”

Visitors experience 5G stereo photography at a venue of the 2021 World 5G Convention in Beijing, capital of China, Sept. 1, 2021. (Photo: China News Service/Yi Haifei)

Relying on 5G application technology and industrial base, exploring the secondary technology development system of 5G vertical industry application system, with joint efforts, we are endeavoring to address imperative needs of 5G frequency expansion and coverage enhancement, carry out standards of 5G enhanced technology and equipment R&D, and enhance the adaptability of 5G vertical industry applications, noted Li.

Li stressed that the Ministry of Science and Technology warmly welcomes entrepreneurs, universities and research institutions from all over the world to join in the future R&D of 5G, seizing the new trends and opportunities of global information technology development. With joint efforts and deep cooperation, create more breakthrough and leading technological achievements.

The World 5G Convention is claimed by China Daily to be the world’s first international conference in the 5G field. The first edition of this event took place in Beijing in 2019.

SOURCE: Science and Technology Daily

………………………………………………………………………………………………………………………………….

References:

http://www.china.org.cn/business/2021-09/02/content_77729828.htm

http://en.people.cn/n3/2021/0902/c90000-9891257.html

https://global.chinadaily.com.cn/a/202109/01/WS612f435ba310efa1bd66cac6.html

China telcos add 43.71 5G subscribers in July, while capital spending declines

5G Subscriber Adds:

China’s network operators recorded a net addition of 43.71 million 5G subscribers in July, according to the carriers’ latest available reports.

- China Mobile, the world’s largest operator in terms of subscribers, added 28.91 million 5G subscribers in July. It had 279.60 million 5G subscribers at the end of July, compared to 84.05 million 5G customers in July 2020. The telco’s overall mobile subscriber base at the end of July reached 947.46 million, up compared to 945.50 million in June 2020.

- China Unicom said it added a total of 7.74 million 5G subscribers during July. During the first seven months of the year, Unicom added a total of 50.24 million 5G subscribers. The telco ended July with 121.07 million 5G subscribers. China Unicom reported an overall mobile base of with 311.61 million subscribers at the end of last month, up from 310.45 million in June.

- China Telecom added 7.06 million 5G subscribers in July to take its total 5G subscribers base to 138.21 million. The telco added 51.71 million 5G customers in the January-July period. China Telecom’s overall mobile base amounted to 364.62 million subscribers at the end of the July, after adding 2.13 million customers during the month.

China Telco CAPEX Crash:

However, total capital spending by the three state owned China telecom operators declined by 35% in the first half, with the number of new 5G base stations down 34% compared with last year. Spending on 5G by the two biggest telcos, China Mobile and China Telecom, slid 19%. China Unicom, has not disclosed its 5G spending but said it had reached only a fifth of its full-year capex target.

China Unicom revealed it had spent only RMB14 billion ($2.2 billion) of its 2021 capex budget of RMB70 billion ($10.8 billion), down 45% from 2020. It has a year-end target for 5G of RMB35 billion ($5.4 billion), the same as 2020.

China Mobile’s 5G investment of RMB50.2 billion ($7.8 billion) was 9% lower than last year, and only 46% of its full-year target of RMB110 billion ($17 billion).

China Tower reported a 28% fall in capex to 10.4 billion yuan ($1.6 billion).

China Telecom’s 5G spend plunged 45% to RMB11.1 billion ($1.71 billion), just over a quarter of its full-year forecast of RMB39.7 billion ($6.1 billion). Total capex declined 37% for the half. From the Chinese website Yicai.com:

From the data point of view, China Telecom’s capital expenditure in the first half of this year was less than one-third of the annual capital expenditure, and the investment progress was lagging behind. Liu Guiqing said that 5G was the largest investment in the first half of the year, including investment in 3.5GHz and 2.1GHz equipment. “On the whole, the investment in 3.5GHz equipment is relatively normal; for 2.1GHz investment, we make corresponding adaptations according to the current situation of the entire industry chain and the terminal ecology. At present, the purchase of 2.1GHz equipment has been completed, 3.5GHz telecom equipment is being negotiated, and there will be results soon.” He said that 87 billion yuan of investment can be completed this year, of which 5G investment is 39.7 billion yuan.

The China telcos maintain the same capex guidance for the full year of around 185 billion yuan ($28.6 billion), slightly up from last year’s 182 billion yuan ($28.1 billion). Yet for China Telecom and China Unicom, those capex numbers look quite challenging.

…………………………………………………………………………………………………………………………………….

5G Base Station Builds:

China’s three major mobile carriers have already activated 961,000 5G base stations and connected 365 million 5G-compatible devices by end-June, Chinese press reported, citing comments by press secretary for the Ministry of Industry and Information Technology (MIIT) Tian Yulong.

Unicom said it had built just 80,000 new base stations in the first half and was aiming to deploy another 240,000 in the latter half of this year.

Meanwhile, China Broadcast Network and China Mobile have recently completed a tender to deploy 400,000 5G base stations this year, as part of the companies’ efforts to launch a shared 5G network. The contracts had been won by Huawei, ZTE, Datang, Nokia and Ericsson.

China Mobile has attributed its lower 5G investment to issues around its partnership with China Broadcast Network in building a new 5G network in the 700MHz band. The main tender was set in July. China’s 5G rollout is a high priority infrastructure project closely supervised by the national government. The two carriers expect this shared 5G network to reach nationwide coverage within the next two years.

………………………………………………………………………………………………………………………………….

5G Subscriber Forecast & 5G SA Core Network:

China is forecast to reach 739 million 5G subscribers by 2025, according to a recent study by ABI Research. That would represent nearly 40% of the total global 5G subscriber market.

Earlier this year, Liu Liehong, vice minister of industry and information technology, had said that 5G Standalone (5G SA) networks covered all prefecture-level cities across China.

We wonder if all China’s telcos have implemented the same specification for 5G SA/core network and whether it is “cloud native” or not? Also, whether they use NFV (virtual machines) or containers?

Note there is no standard or implementation specification(s) that would ensure vendor interoperability on 5G SA networks from different telcos.

……………………………………………………………………………………………………………………………………………

References:

https://www.rcrwireless.com/20210824/5g/chinese-carriers-add-43-million-5g-subscribers-july

https://www.lightreading.com/5g/chip-shortage-taking-its-toll-on-china-5g-rollout/d/d-id/771681?

https://www.yicai.com/news/101136803.html

China Telcos Lose Subscribers; 5G “Co-build and Co-share” agreement to accelerate

GlobalData: 5G to drive mobile services market in China through 2026

The total mobile service revenues in China are poised to grow at a compounded annual growth rate (CAGR) of 3.1% from US$131.3bn in 2021 to US$152.7bn in 2026, mainly supported by growing 5G subscriptions, according to GlobalData, a leading data and analytics company.

According to GlobalData’s China Mobile Broadband Forecast Pack, mobile voice revenues will decline at a CAGR of 5.2% between 2021 and 2026, due to falling voice average revenue per user (ARPU) levels. Mobile data revenues, on the other hand, will increase at a CAGR of 6.8%, driven by rising adoption of 5G services and the subsequent rise in data ARPU.

The three leading (state owned) network operators in China greatly increased their 5G CAPEX. China Mobile’s 2020 5G CAPEX totaled US$15.7bn (RMB 102.5bn), 57% of all CAPEX up from US$3.7bn (RMB 24.0bn) (14% of total CAPEX) in 2019.

Meanwhile, the combined 5G CAPEX of China Telecom and China Mobile, who are sharing 5G infrastructure, totaled US$11.3bn (RMB 73bn) in 2020, 48% of total combined CAPEX, up from US$2.7 (17.2 bn) in 2019 (13% of total combined CAPEX).

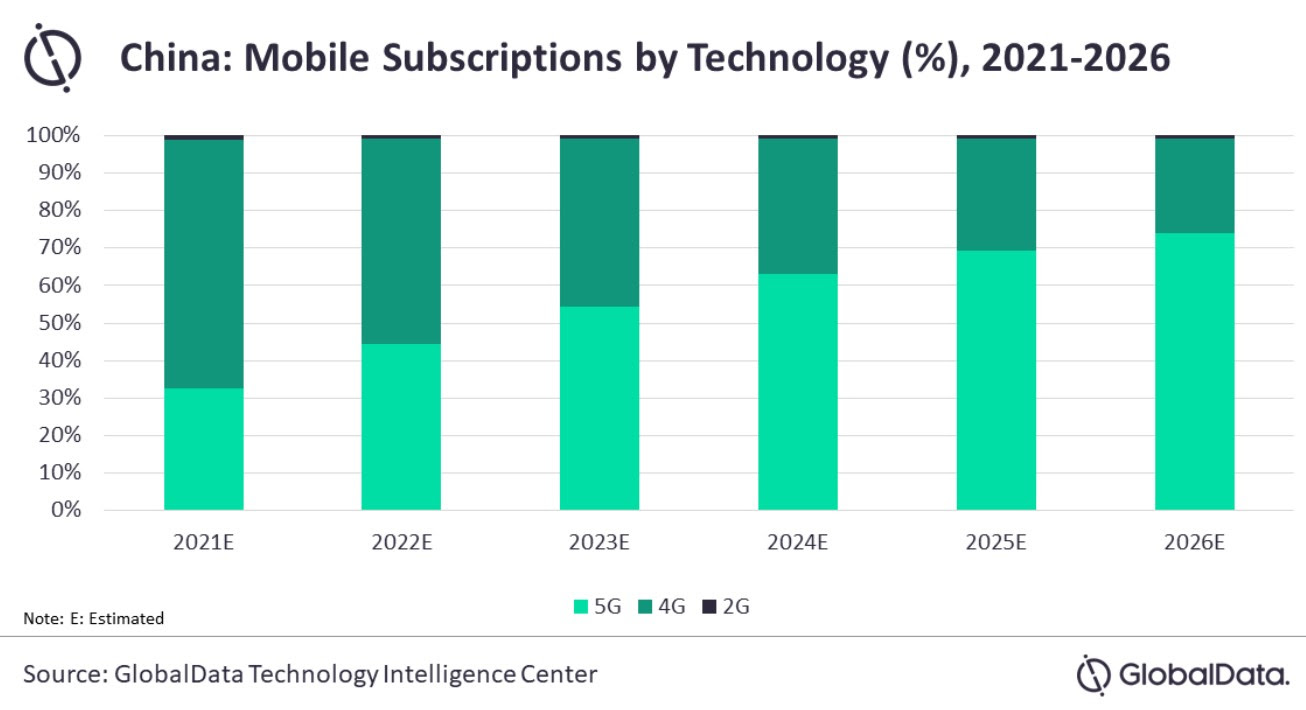

Harika Damidi, Telecoms Analyst at GlobalData, says: “5G subscriptions will surpass 4G subscriptions in 2023 and go on to account for 73.8% of the total mobile subscriptions share in 2026, driven by the ongoing 5G network expansion by operators and increase in the availability of 5G-enabled smartphones. Moreover, increasing penetration of IoT and M2M services are also expected to drive market growth during the forecast period.”

The average monthly mobile data usage is forecasted to increase from 9.9GB per month in 2021 to around 32.6GB per month in 2026, driven by the growing consumption of high-bandwidth online entertainment and social media content over smartphones.

Ms Damidi concludes: “China Mobile led the Chinese telecom market in terms of mobile subscriptions in 2020, followed by China Telecom. Moreover, China Mobile is the leading provider of 5G services which are poised to dominate the Chinese market in the future. In addition, the operator is making strategic investments in 5G base stations, data centers, industrial Internet, and IoT to ensure its leadership.”

…………………………………………………………………………………………….

According to GlobalData’s mobile broadband forecasts, by end of 2020 China and South Korea outpaced the world in adoption with 26% and 24% 5G subscription penetration of the population respectively compared to the Global penetration of 5% at the end of the same period. This rapid adoption is beginning to help operators in these markets grow revenue from mobile services and drive ARPU uplift in China and South Korea with overall 2021 mobile service ARPU expected to rise.

5G in China and South Korea are supporting both consumers and enterprise and even contributing to social welfare. On the consumer side new value and revenue streams for consumer 5G is being driven by next gen content like AR/VR experiences, the ability to stream 8K anywhere, providing multi-camera views for live events, offering dedicated gaming networks and new consumer IoT applications.

Enterprise networks are being deployed as an enabler for enterprise services alongside technologies like multi-access edge computing (MEC) and IoT platforms and industrial applications to support use cases like (industrial automation, AI video applications, drones, smart city). Often these enterprise solutions are supported by a combination of 5G, IoT and multi-access edge computing (MEC). China Mobile alone has entered contracts to construct dedicated 5G networks for private industry with 470 enterprise customers, in 2020. The company claims these projects support 15 different industry segments and represent over US$620m (RMB 4bn) in revenues.

Beyond typical consumer and enterprise services, 5G has supported the pandemic response in both countries, with hospitals in Wuhan being rapidly connected with 5G networks and telehealth for the elderly being delivered in South Korea.

References:

5G to drive mobile services market in China through 2026, forecasts GlobalData

Optimistic 5G Market forecasts by GlobalData and Research&Markets

Qualcomm’s designing custom CPU’s for dominance in laptop markets; CEO: “We will go big in China”

Qualcomm’s new CEO believes that by next year his company will supply CPU chips for laptop makers competing with Apple. Last year, the Cupertino, CA based company introduced laptops using a custom-designed central processor chip that boasts longer battery life. Longtime processor suppliers Intel Corp and Advanced Micro Devices have no chips as energy efficient as Apple’s.

Qualcomm Chief Executive Cristiano Amon told Reuters on Thursday he believes his company can have the best chip on the market, with help from a team of chip architects who formerly worked on the Apple chip but now work at Qualcomm. In his first interview since taking the top job at Qualcomm, Amon also said the company is also counting on revenue growth from China to power its core smartphone chip business despite political tensions.

/cloudfront-us-east-2.images.arcpublishing.com/reuters/RRPGOKG4OVID5I2WPBB3GWCY2Q.jpg)

“We will go big in China,” he said, noting that U.S. sanctions on Huawei Technologies Co Ltd (HWT.UL) give Qualcomm an opportunity to generate a lot more revenue.

Amon said a cornerstone of his strategy comes from a lesson learned in the smartphone chip market: It was not enough just to provide modem chips for phones’ wireless data connectivity. Qualcomm also needed to provide the brains to turn the phone into a computer, which it now does for most premium Android devices.

Now, as Qualcomm looks to push 5G connectivity into laptops, it is pairing modems with a powerful central processor unit, or CPU, Amon said. Instead of using computing core blueprints from longtime partner ARM Ltd, as it now does for smartphones, Qualcomm concluded it needed custom-designed chips if its customers were to rival new laptops from Apple.

As head of Qualcomm’s chip division, Amon this year led the $1.4 billion acquisition of startup, whose ex-Apple founders help design some those Apple laptop chips before leaving to form the startup. Qualcom will start selling Nuvia-based laptop chips next year.

“We needed to have the leading performance for a battery-powered device,” Amon said. “If ARM, which we’ve had a relationship with for years, eventually develops a CPU that’s better than what we can build ourselves, then we always have the option to license from ARM.”

ARM is in the midst of being purchased by Nvidia Corp for $40 billion, a merger that Qualcomm has objected to with regulators.

Amon said Qualcomm has no plans to build its own products to enter the other big market for CPUs – data centers for cloud computing companies. But it will license Nuvia’s designs to cloud computing companies that want to build their own chips, which could put it in competition with parts of ARM.

“We are more than willing to leverage the Nuvia CPU assets to partner with companies that are interested as they build their data center solutions,” Amon said.

Smartphone chips accounted for $12.8 billion of its $16.5 billion in chip revenue in its most recent fiscal year. Some of Qualcomm’s best customers, such as phone maker Xiaomi Corp are in China.

Qualcomm is counting on revenue growth as its Android handset customers swoop in on former users of phones from Huawei, which was forced out of the handset market by Washington’s sanctions.

Kevin Krewell, principal analyst at TIRIAS Research, called it a “political minefield” due to rising U.S.-China tensions. But Amon said the company could do business as usual there.

“We license our technology – we don’t have to do forced joint ventures with technology transfers. Our customers in China are current with their agreements, so you see respect for American intellectual property,” he said.

Another major challenge for Amon will be hanging on to Apple as a customer. Qualcomm’s modem chips are now in all Apple iPhone 12 models after a bruising legal battle. Apple sued Qualcomm in 2017 but eventually dropped its claims and signed chip supply and patent license agreements with Qualcomm in 2019. Apple is now designing chips to displace Qualcomm’s communications chips in iPhones.

“The biggest overhang for Qualcomm’s long-term stock multiple is the worry that right now, it’s as good as it gets, because they’re shipping into all the iPhones, but someday, Apple will do those chips internally,” said Michael Walkley, a senior analyst at Canaccord Genuity Group.

Amon said that Qualcomm has decades of experience designing modem chips that will be hard for any rival to replicate and that the void in the Android market left by Huawei creates new revenue opportunities for Qualcomm.

Another challenge for Amon, a gregarious executive who is energetic onstage during keynote presentations, will be that Qualcomm is not well known to consumers in the way that Intel or Nvidia are, even in Qualcomm’s hometown.

“I flew into San Diego and got an Uber driver at the airport and told him I was going to Qualcomm. He said, ‘You mean the stadium?'” Krewell said, referring to the football arena formerly home to the San Diego Chargers.

Amon has started a new branding program for the company’s Snapdragon smartphone chips to try to change that. “We have a mature smartphone industry today. People care what’s behind the glass,” he said.

References:

https://www.reuters.com/technology/qualcomms-new-ceo-eyes-dominance-laptop-markets-2021-07-01/

China Broadcasting Network tender for 480,400 5G macro base stations & multi-band antenna products

China Broadcasting Network (CBN), China’s fourth mobile operator, has issued a tender for the radio access portion of its national 5G network via its network partner China Mobile. Previously, the two companies entered into a 5G Network Co-construction and Sharing Collaboration Agreement along with other 5G collaborations.

The CBN/China Mobile tender requests bids for 480,397 5G macro base stations in the 700 MHz band which is roughly equivalent to the number of 2.6 GHz base stations already deployed by China Mobile. Based on past big 3 (China Mobile, China Telecom, China Unicom) tender results, Huawei and ZTE are expected to win approximately 85% of the business. That would leave only 15% for Ericsson or other well known 5G base station vendor, but probably NOT Nokia which was shut out of the last China 5G contract awards.

China granted a 5G license for use of the 700 MHz frequency to CBN, the country’s fourth telecoms operator, in June 2019. The other three obtained 5G licenses for 2.6 GHz and 4.9 GHz. Founded in 2014, Beijing-based CBN is the most recently established, so lacks users and infrastructure, which is partly why it is cooperating with China Mobile on 5G.

Concurrently, a bidding announcement for the centralized procurement of multi-band (including 700MHz) antenna products was also issued. This project is a centralized bidding project. The purchased products are multi-band (including 700M) antenna products. There are three types of 6 antennas: 4+4+4 antennas (700/900/1800MHz), divided into ordinary gain and high gain; 4+4+ 4+8 antennas (700/900/1800/FA), divided into long and short models; single 4 antenna (700MHz), divided into normal gain and high gain. The procurement scale is approximately 1.74 million antennas, of which 4.448 antennas require 1.14 million antennas, and the remaining model antennas such as 444 are 600,000 antennas.

China Mobile will complete the deployment of 700MHz 400,000 stations within this year. In the first half of 2022, they plan to open 480,000 seats and fully support 5G broadcasting services. Within two years full network coverage will be achieved.

There are now nearly 100 5G mobile phones supporting the 700MHz frequency band, covering high, middle and low end consumer groups. China Mobile earlier made it clear that in 2021, it will promote the joint construction and sharing of 700MHz to achieve 700MHz commercialization. It requires: starting from March 1, 2021, terminals of 4,000 yuan and above must support 700MHz; from October 1, 2021, The newly added terminal must support 700MHz.

The tender is a milestone for the China telecom sector, marking the start of the rollout of the new entrant, who is also the first network operator not linked to the Ministry of Industry and IT. CBN said the network will be configured around video and streaming to serve its existing cable TV customer base and to provide differentiation from the incumbent telcos. The rollout will include 5G mobile broadcasting capabilities, including 3,000 transmission towers.

The 700MHz frequency band is part of the wider ultra-high frequency (UHF) band used previously for terrestrial broadcasting. The 700MHz frequency band will improve connectivity in rural areas thanks to its ability to support better coverage in open spaces. Moreover, with its wide territorial reach and good penetration in buildings, the 700MHz band will help service providers meet the rising consumer demand for audiovisual content and other broadband services over wireless networks.

Li Shuang, Deputy Director of Department of Technology Development, CBN, said: “CBN always extensively cooperates with domestic and international industry partners with innovation-driven, open and win-win concepts in mind, promoting continuous maturation of the global industry chain of 5G 700MHz network and committed to building a high-quality nationwide 5G network in China. The successful test by Ericsson based on the 3GPP 5G specifications contributed by CBN, including the 700MHz technology standard and n28 band terminal enhancements standard, has improved the 700MHz network capability efficiently, which is of great significance to the innovation of low-band 5G networks in various scenarios.”

…………………………………………………………………………………………………………………………………………………………………………….

CBN and China Mobile are reportedly promising to deploy 400,000 base stations this year.

Robert Clark of Light Reading wrote, “That seems unlikely – it took the incumbent operators nearly two years to reach that mark – but it seems certain that CBN will offer its first commercial services late this year or early 2022. The bid documents state that the tender is fully funded, a positive sign for the cash-strapped CBN.

As Rakuten in Japan is learning, it is not easy to compete against big legacy players each with a large installed base and deep marketing channels. Even in the capital markets, CBN may find itself competing again with its industry rivals.”

References:

http://www.cctime.com/html/2021-6-30/1579416.htm

https://www.lightreading.com/asia/cbn-issues-massive-5g-base-station-tender/d/d-id/770623?

x-China Mobile Chairman: 5G phones have no new features, new 5G devices urgently needed

The 2021 Sohu Technology 5G&AI Summit was held in Beijing on May 17. Wang Jianzhou, former chairman of China Mobile and senior consultant at GSMA shared his views on 5G in his speech.

Wang Jianzhou believes that the current 5G industry applications have achieved many results, such as smart control, smart logistics, smart security, telemedicine, etc., but the perception of the consumer market is not strong.

“There is no ready-made experience for 5G consumer-level applications to learn from. Every year at the Barcelona Communications Exhibition, I am most concerned about what applications are there, but they are all industrial applications.” Wang Jianzhou said.

In addition to chips and antenna modules, 5G mobile phones don’t really have any new features. Indeed, compared with the overwhelming hype, the perception of 5G on the consumer side is not strong. Major mobile phone manufacturers are looking forward to using 5G to boost mobile phone sales, but with the limited application of 5G consumption scenarios and expensive packages, it is unknown whether 5G can stimulate significant smartphone upgrades.

Despite the huge scale of China’s 5G efforts, with 819,000 base stations deployed and 285 million package subscribers signed up, industry leaders are worried about the lack of innovative services and rising energy costs. Wang said only “massive consumer-level applications” could take full advantage of the coverage and huge capacity of 5G networks. He said that while many industrial use cases had already become a reality, new consumer 5G applications were rare.

“I think the tipping point of 5G consumer-level applications is likely to be the device,” he said.

“They are not yet ideal 5G mobile phones. Consumers need 5G mobile devices with new functions,” he said, citing the impact of browser-enabled phones, led by the iPhone, that drove the explosion of 3.5G and 4G mobile Internet.

“Except for a faster video download speed, I didn’t find any other use for 5G. The 5G package is so expensive, and the first thing a 5G phone is to turn off 5G. So what’s the use of 5G? But it only increases power consumption.”

A repeat complaint of China’s “5G package” customers is: “I got a 5G package upgrade, I have a 4G mobile phone, and I don’t have a 5G network, so I got lonely.” That’s according to China’s Weibo microblogging website.

Indeed, global smartphone sales have recently decreased:

- According to Gartner, global smartphone sales fell by 20.2% and 20.4% year-on-year, in the quarter and second quarter of 2020, respectively.

- According to the latest data from IDC, global smartphone shipments fell 1.3% year-on-year in the third quarter of this year.

- According to a report from the China Academy of Information and Communications Technology, the cumulative shipments of 5G mobile phones from January to September last year were 108 million, and the total number of new models on the market was 167, accounting for 47.7% and 46.5%, respectively. Whether it is shipments or models, it accounts for less than half.

Wang Jianzhou made several suggestions for 5G consumer-level applications:

First, pay attention to consumer-level IoT applications. “Consumers will pay more attention to entertainment, such as cloud gaming. In addition, if we can combine AR, VR and the Internet of Things, we can create many new consumer-level applications.”

Second, extend the functions of mobile phones. “The explosion of 3G applications is the popularization of smart phones. The tipping point of 5G consumer-level applications is likely to be terminals. Except for 5G chips and 5G antenna modules, current 5G mobile phones do not see new functions, which is not ideal. The state of 5G mobile phone.”

“I think the functions of 5G mobile phones should extend from communication, social networking, browsing, shopping, payment, navigation, verification, entertainment to the Internet of Things and artificial intelligence, and make mobile phones a controller that connects everything. This extension is actually becoming a reality. Nowadays, some mobile phones have been equipped with laser rangefinders, so that the mobile phones have the function of measuring distance, which can produce some new applications.”

Third, focus on wearable devices. “5G’s application flashpoint is also likely to be wearable devices. The combination with 5G smartphones will produce many new functions. For example, camera and laser systems are installed in glasses and helmets and connected to 5G mobile phones for processing.” Wang Jianzhou said.

5G’s outlook was clouded by “a serious shortage” of both low-end and middle-range spectrum, Wang said. “It is essential to establish multi-band coordinated 5G networks as soon as possible.”

He also said operators should be further encouraged to expand network co-construction and sharing.

Network sharing and rollout had already become a trend, he noted, with China Unicom and China Telecom saving billions of dollars from their shared 5G project.

Jianzhou also called on the industry to drive down energy consumption by adding network intelligence. The huge power consumption and high operating costs of 5G networks meant it was necessary to further improve 5G network efficiency and to implement intelligent networks.

References:

https://min.news/en/economy/339e0871cb5dccd09cf1f411dcf0e226.html

China Mobile reports 9.5% increase in sales; depreciation and electricity expenses will increase at relatively high rates

China Mobile is the world’s largest wireless network operator by customers, serving 940 million total subscribers in the Q1 2021. The #1 China carrier had 189 million 5G customers a March, an increase of 24 million since December. Its 4G-LTE use base also grew during Q1 2021, up 36 million year-on-year to 788 million.

China Mobile reported a 9.5% year-on-year increase in sales, to 198.4 billion Chinese yuan ($30.6 billion), for its first quarter of 2021. China Mobile’s net profit increased by 2.3% to about RMB24.1 billion ($3.7 billion).

The company states that continued to devote concerted efforts to promoting digitalized and intelligent transformation and achieving high-quality development. Placing a special focus on its “4×3” strategic core and fully implementing the “5G+” plan, it managed to maintain stable growth in key business performance indicators and delivered sound development momentum, taking solid steps towards becoming a world-class enterprise by building a dynamic “Powerhouse.”

China Mobile Chairman Yang Jie said following its large-scale 5G network deployment, it expects corresponding depreciation and electricity expenses to increase at relatively high rates.

Following the large scale operation of 5G, the China Mobile Group expects the corresponding depreciation and electricity expenses will increase at relatively high rates. As the Group scales up the development of DICT and other information services, the demand for resources to address the need for business transformation and upgrade will remain robust.

Facing these challenges and pressure, the Group will continue to explore new sources to increase revenue, and at the same time take measures to lower costs and enhance efficiency. It will also precisely allocate resources by adhering to the principle of ensuring a sufficient budget for areas essential to promote growth, while reducing and controlling expenses on certain selected areas.

While fostering business transformation, promoting innovation and nurturing new areas of growth, the Group will strive to achieve stable and healthy growth in telecommunications services revenue and net profit, maintain good profitability and continuously create value for investors.

China Mobile said it was under pressure to make other cutbacks to cope with the increase in electricity fees and depreciation charges in 2020.

China Mobile’s The revenue growth was mainly due to a 67 per cent increase in handset sales to CNY20.8 billion, which the operator credited to a wider range of 5G models at more affordable prices. Telecoms service turnover increased 5.2 per cent to CNY177.7 billion.

Total subscribers fell by 6 million to 940 million. ARPU edged up 1.1 per cent to CNY47.40, while average monthly data usage increased 34.9 per cent to 11.2GB. The volume of total voice minutes increased 8.3 per cent and SMS usage dropped 12.6 per cent.

China Mobile also faces a huge capital expenditure bill this year as it extends 5G services outside the big cities and into less densely populated communities. It plans to spend RMB183.6 billion ($28.3 billion) in total, up from RMB180.6 billion ($27.8 billion) last year. In its last annual report, it said that approximately RMB110 billion ($17 billion) would go toward 5G rollouts.

…………………………………………………………………………………………………………………………………..

References:

https://www.chinamobileltd.com/en/file/view.php?id=246145

https://www.lightreading.com/5g/china-mobile-warns-of-mounting-5g-costs/d/d-id/768941?