ZTE

China Mobile Partners With ZTE for World’s First 5G Non Terrestrial Network Field Trial

……………………………………………………………………………………………………………………………………………….

……………………………………………………………………………………………………………………………………………….

Separately, ZTE says they’ve produced the industry’s smallest 5G Core network product, dubbed the Mini5GC. The new Mini5GC features miniaturization, light weight, simple networking and ultra-high integration. The company states that it can well facilitate safe production, flexible adjustment of work sites, and efficient and accurate emergency rescue in mining areas.

References:

https://sdnfv.zte.com.cn/en/news/2022/2/ZTE-5G-Common-Core-Aims-to-Improve-Digital-Economy

https://www.zte.com.cn/global/products/core_network/packet_core/202003251501/5G-Common-Core

China to accelerate 5G roll-outs while FCC faces “rip and replace” funding shortfall

China Daily reports that local governments in China are doubling down on plans to accelerate 5G rollouts in 2022. More than 20 provincial and municipal governments in China have emphasized efforts to accelerate construction of “new infrastructure” like 5G and data centers in their work plans for this year.

Shanghai plans to build more than 25,000 5G base stations this year (do you really believe that?) to push forward the in-depth coverage of the superfast wireless network. The city also has ambitions to build super large computing power platforms to meet growing demand.

Zhao Zhiguo, spokesman for the Ministry of Industry and Information Technology, China’s top industry regulator, said earlier:

“2022 is a critical year for the large-scale development of 5G applications. We will continue to improve 5G network coverage and accelerate the in-depth integration of 5G and vertical industries.”

One of the priorities is to moderately speed up the coverage of 5G in counties and rural towns in China, Zhao said.

Ten ministries, including the Cyberspace Administration of China, recently unveiled a digital rural development action plan for the period from 2022 to 2025, which called for an intensified push to promote digital infrastructure upgrades in rural areas.

Telecom operators are also moving fast. China Mobile, the nation’s largest telecom carrier, said it aims to achieve continuous 5G coverage in rural towns across the country by the end of this year.

Telecom carriers’ 5G plans seek to harness the power of more than 1.4 million 5G base stations that were deployed in China by the end of last year (but can you really trust that China government reported number?). 5G signals are already available in urban areas of all of China’s prefecture-level cities, more than 98% of county-level towns and 80 percent of rural towns, MIIT data showed.

5G Cell Tower in China. Image courtesy of China Daily

…………………………………………………………………………………………………………………………….

In the U.S., it’s a different story. The Federal Communications Commission (FCC) found a shortfall in funding for its plan to replace Chinese telecom equipment. Inadequate finance is likely to pose connectivity challenges to people in remote areas in the US, experts said.

According to a report on MobileWorld Live, a telecom industry website, the FCC said local telecom operators’ requests for funding to replace network equipment made by Chinese companies Huawei and ZTE totaled $5.6 billion, almost three times the $1.9 billion allocated by the US federal government. Network operators serving less than 10 million customers which used government subsidies to buy Huawei or ZTE equipment before 30 June 2020 were eligible to apply for funding to cover costs associated with removing, replacing and disposing of the Chinese network equipment.

In a statement released last week, FCC Chairwoman Jessica Rosenworcel said that 181 carriers submitted initial reimbursement application requests totaling approximately $5.6 billion. Carriers are required to remove and replace existing network gear from Huawei and ZTE after the vendors were deemed national security risks. Congress in late 2020 set aside around $1.9 billion to fund and carry out the effort under the Secured and Trusted Communications Act 2019.

“Last year Congress created a first-of-its kind program for the FCC to reimburse service providers for their efforts to increase the security of our nations communications networks,” Rosenworcel said. “We’ve received over 181 applications from carriers who have developed plans to remove and replace equipment in their networks that pose a national security threat,” she added.

The FCC banned U.S. telecom carriers from buying Huawei and ZTE’s equipment via federal subsidies, citing what it alleged were national security concerns. The two Chinese tech companies have repeatedly denied the accusations, which they said are groundless.

Xiang Ligang, director-general of the Information Consumption Alliance, a telecom industry association in China, said Huawei and ZTE’s products are currently used by US telecom carriers to offer network and broadband services in some of the most remote regions in the US. Xiang said that the U.S. order to replace Huawei/ZTE wireless network equipment in rural areas will result in the lack of quality telecom services.

Steve Berry, president and CEO of the Competitive Carriers Association, a trade group for about 100 wireless providers in the US, issued a statement calling on the U.S. government to ensure the FCC program is fully funded so that connectivity is maintained during the operators’ transition to new wireless telecom equipment for their cellular networks.

…………………………………………………………………………………………………………………………….

Table 1: All the companies asking for FCC “rip and replace” funding

| Company | Applicant | Wireless | Wireline | Total | Vendor |

| Viaero Wireless | NE Colorado Cellular Inc | X | $1,194,000,000 | Ericsson | |

| Union Wireless | Union Telephone Company | X | $688,000,000 | Nokia | |

| ATN International | Commnet Wireless, | X | $418,768,726 | ||

| Gogo | Gogo Business Aviation LLC | X | $332,770,202 | ||

| NTCH | PTA-FLA, Inc. | $273,971,426 | |||

| Lumen | Level 3 Communications, LLC | X | $269,999,994 | ||

| Stealth Communications | X | $199,066,226 | |||

| SI Wireless, LLC | X | $181,023,489 | |||

| United Wireless Communications, Inc. | X | $173,471,477 | |||

| Hotwire Communications, Ltd. | X | $141,299,003 | |||

| Latam Telecommunications, L.L.C. | $138,060,092 | ||||

| NEMONT TELEPHONE COOPERATIVE INC | X | $125,551,024 | |||

| NTUA Wireless, LLC | X | $124,447,019 | |||

| Windstream Communications LLC | X | $118,271,652 | |||

| Rise Broadband | Skybeam, LLC | X | $106,159,884 | ||

| Pine Telephone Company | X | $87,095,419 | |||

| Mediacom Communications Corporation | X | $86,171,976 | |||

| Flat Wireless, LLC | X | $76,284,671 | |||

| Pine Belt Cellular, Inc. | X | $74,856,191 | |||

| James Valley Cooperative Telephone Company | X | $53,000,000 | |||

| AST Telecom, LLC d/b/a Bluesky | X | $49,959,592 | |||

| Country Wireless LLC | X | $47,508,982 | |||

| Point Broadband Fiber Holding, LLC | X | $47,172,086 | |||

| Board of Trustees, Northern Michigan University | X | $45,796,636 | |||

| Hargray Communications Group, Inc. | X | $42,785,933 | |||

| NfinityLink Communications, Inc. | $37,535,905 | ||||

| Plateau Telecommunications, Incorporated | X | $30,000,000 | |||

| Texas 10, LLC | $29,088,795 | ||||

| Mark Twain Communications Company | X | $29,000,000 | |||

| Panhandle Telecommunication Systems Inc | $28,925,552 | ||||

| TelAlaska Cellular, Inc. | X | $26,567,517 | |||

| Central Louisiana Cellular, LLC | X | $26,264,528 | |||

| TRANSTELCO INC. | X | $25,573,213 | |||

| Beamspeed, L.L.C. | X | $19,596,157 | |||

| Triangle Telephone Cooperative Association, Inc. | X | $18,336,507 | Mavenir | ||

| Eastern Oregon Telecom, LLC | X | $18,122,185 | |||

| Puerto Rico Telephone Company, Inc. | X | $16,857,851 | |||

| Vitelcom Cellular, Inc. d/b/a Viya Wireless | X | $15,716,011 | |||

| Santel Communications Cooperative, Inc. | X | $14,604,337 | |||

| MHG Telco LLC | X | $14,456,482 | |||

| WorldCell Soutions, LLC | X | $12,673,559 | |||

| LIGTEL COMMUNICATIONS INC. | X | $12,000,000 | |||

| Point Broadband Fiber Holding, LLC | X | $11,344,724 | |||

| Copper Valley Wireless, LLC | X | $11,151,417 | |||

| Premier Holdings LLC | $9,759,680 | ||||

| Eltopia Communications, LLC | X | X | $7,741,951 | ||

| Metro Fibernet, LLC | X | $7,567,518 | |||

| Bestel (USA), Inc. | $6,887,500 | ||||

| PocketiNet Communications Inc. | $6,741,452 | ||||

| Carrollton Farmers Branch ISD | X | $5,943,974 | |||

| Windy City Cellular | X | $5,562,067 | |||

| Bristol Bay Cellular Partnership | X | $5,269,183 | |||

| Kings County Office of Education | $5,221,191 | ||||

| Interoute US LLC | $4,867,140 | ||||

| Pasadena ISD | $4,387,311 | ||||

| Velocity Communications, Inc. | X | $4,158,729 | |||

| Advantage Cellular Systems, Inc. | X | $3,479,000 | |||

| New Wave Net Corp | $3,365,772 | ||||

| FirstLight Fiber, Inc. | $3,306,644 | ||||

| Gigsky, Inc. | X | $3,128,678 | |||

| Triangle Communication Systems Inc | $2,779,371 | ||||

| FIF Utah LLC | X | $2,662,538 | |||

| Gallatin Wireless Internet, LLC | X | $2,399,162 | |||

| Moore Public Schools | $2,023,243 | ||||

| HUFFMAN ISD | $1,920,588 | ||||

| Crowley ISD | $1,720,496 | ||||

| Castleberry Independent School District | X | $1,672,527 | |||

| One Ring Networks, Inc. | $1,649,281 | ||||

| University of San Francisco | $1,570,437 | ||||

| Leaco Rural Telephone Cooperative, Inc. | $1,511,617 | ||||

| Zito West Holding, LLC | X | $1,453,469 | |||

| Southern Ohio Communication Services Inc | $1,312,844 | ||||

| Xtreme Enterprises LLC | X | $1,097,283 | |||

| Virginia Everywhere, LLC | X | $562,001 | |||

| South Canaan Telephone Company | $542,139 | ||||

| Palmer ISD | $520,146 | ||||

| Waxahachie ISD | X | $457,396 | |||

| Hunter Communications & Technologies LLC | $432,348 | ||||

| Utah Telecommunication Open Infrastructure Agency | $413,760 | ||||

| COMMSELL | $302,400 | ||||

| VTel Wireless, Inc. | X | $283,618 | |||

| Trinity Basin Preparatory, Inc. | $242,510 | ||||

| NTInet, inc | $198,340 | ||||

| LakeNet LLC | X | $193,277 | |||

| IdeaTek Telcom, LLC | X | $181,899 | |||

| Millennium Telcom, L.L.C., dba OneSource Communications | $165,195 | ||||

| Inland Cellular LLC | X | $117,183 | |||

| Roome Telecommunications Inc | $92,144 | ||||

| Milford Independent School District | $40,399 | ||||

| Angeles Enterprises | X | $33,368 | |||

| Crystal Broadband Networks | X | $28,704 | |||

| Natural G.C. Inc. | $27,313 | ||||

| Webformix Internet Company | X | $22,400 | |||

| Northern Cambria School District | $14,400 | ||||

| Deer Creek Independent School District | $- | ||||

| $5,609,338,024 | |||||

| This FCC data was initially compiled by vendor Mavenir and then expanded, checked and edited by Light Reading staff. | |||||

“We’ve received over 181 applications from carriers who have developed plans to remove and replace equipment in their networks that pose a national security threat. While we have more work to do to review these applications, I look forward to working with Congress to ensure that there is enough funding available for this program to advance Congress’s security goals and ensure that the US will continue to lead the way on 5G security,” FCC Chairwoman Jessica Rosenworcel said in a statement.

References:

http://www.chinadaily.com.cn/a/202202/09/WS620303dfa310cdd39bc85734.html

ZTE and China Telecom deploy QCell 5G SuperMIMO solution

ZTE Corporation together with the Quanzhou Branch of China Telecom, have deployed the QCell 5G SuperMIMO solution in Quanzhou, China.

The Qcell 5G SuperMIMO solution can combine Super cell and MU-MIMO technologies, to adaptively perform multi-User Endpoint (UE) space division pairing. The solution is applicable to both digital QCell and traditional distributed antenna systems (DAS), which effectively solves the “interference” vs “capacity” tradeoff, while exponentially increasing user perception.

As the field test results show, the QCell super cell throughput is 1.07Gbps before SuperMIMO is enabled. It reaches 2.2Gbps, 3Gbps and 4.05Gbps respectively after it’s been enabled. That greatly improves user experiences with 2 UE, 3 UE and 4 UE performing services at the same time.

In 2020, ZTE and China Telecom jointly launched the innovative 2.1GHz NR eDAS indoor distribution solution, which is the first 5G network performance improvement solution based on the traditional 2.1GHz NR indoor distribution system in the industry. The solution successfully overcomes the bottleneck of the traditional system.

SuperMIMO has developed into another innovative indoor distribution technology following the eDAS solution, thereby demonstrating the strength of the Quanzhou Branch of China Telecom and ZTE in the research and innovative applications of communication networks.

Moving forward, both parties will be further committed to building high-quality 5G networks for their users through technical innovations.

Quanzhou, China. Photo Credit: ZTE Corporation

…………………………………………………………………………………….

Previously, ZTE and the Jiangsu branch of China Telecom deployed 5G 200 MHz Qcell 4T4R digital indoor distribution system in areas with high amounts of data traffic, such as shopping malls and subway stations, in Xuzhou, China.

The system provides high-quality 5G indoor coverage, and accelerates future 5G indoor system deployment. This commercial deployment has employed ZTE’s latest 5G Qcell ultra-wideband product series, which supports 200MHz continuous ultra-large bandwidth at 3.5 GHz frequency band, and 100MHz+100MHZ dual-carrier aggregation technology that doubles download rate.

References:

https://www.zte.com.cn/global/about/news/20210809e1.html

Dell’ Oro: Huawei still top telecom equipment supplier; optical transport market +1% in 2020

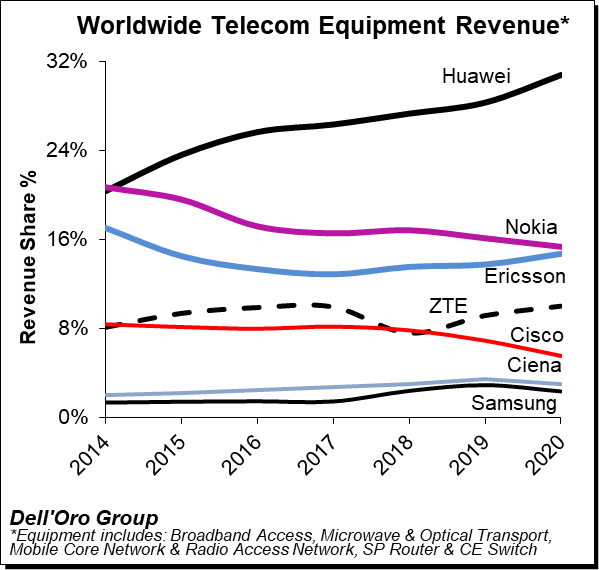

Huawei has increased its lead as the#1 global telecoms network equipment vendor, boosting its revenue share by a three percentage points last year, according to Dell’Oro Group. Nokia lost one percentage point of revenue share year-on-year, as did Cisco, the latter falling to 6%. Ericsson gained one percentage point to match Nokia at 15% of the market and ZTE also saw a 1% uptick to 10% of the global telecom market. (Please refer to chart below).

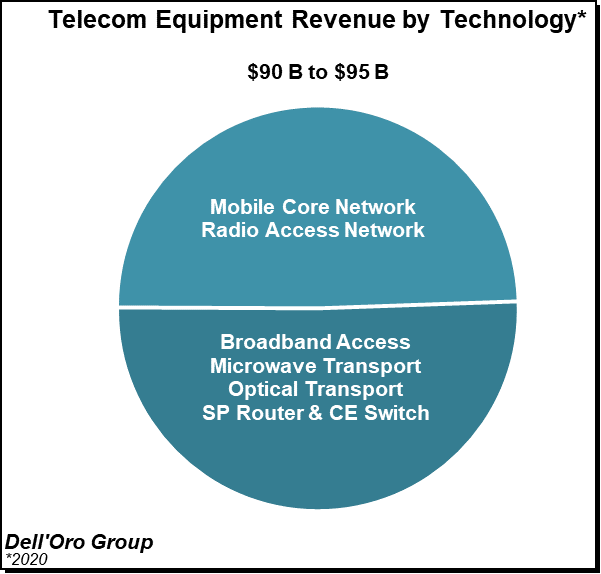

Dell’Oro Group’s preliminary estimates suggest the overall telecom equipment market – Broadband Access, Microwave & Optical Transport, Mobile Core & Radio Access Network, SP Router & Carrier Ethernet Switch (CES) – advanced 7% year-over-year (Y/Y) for the full year 2020, growing at the fastest pace since 2011.

The telecom and networking market research firm suggests revenue rankings remained stable between 2019 and 2020, with Huawei, Nokia, Ericsson, ZTE, Cisco, Ciena, and Samsung ranked as the top seven suppliers, accounting for 80% to 85% of the total market. At the same time, revenue shares continued to be impacted by the state of the 5G rollouts in highly concentrated markets. While both Ericsson and Nokia improved their RAN positions outside of China, initial estimates suggest Huawei’s global telecom equipment market share, including China, improved by two to three percentage points for the full year 2020.

Dell’Oro now estimates the following revenue shares for the top seven suppliers:

| Top 7 Suppliers | Year 2019 | Year 2020 |

| Huawei | 28% | 31% |

| Nokia | 16% | 15% |

| Ericsson | 14% | 15% |

| ZTE | 9% | 10% |

| Cisco | 7% | 6% |

| Ciena | 3% | 3% |

| Samsung | 3% | 2% |

Additional key takeaways from the 4Q2020 reporting period:

- Preliminary estimates suggest that the positive momentum that has characterized the overall telecom market since 1Q-2020 extended into the fourth quarter, underpinned by strong growth in multiple wireless segments, including RAN and Mobile Core Networks, and modest growth in Broadband Access and CES.

- Helping to drive this output acceleration for the full year 2020 is faster growth in Mobile Core Networks and RAN, both of which increased above expectations.

- Covid-19 related supply chain disruptions that impacted some of the telco segments in the early part of the year had for the most part been alleviated towards the end of the year.

- Not surprisingly, network traffic surges resulting from shifting usage patterns impacted the telecom equipment market differently, resulting in strong demand for capacity upgrades with some technologies/regions while the pandemic did not lead to significant incremental capacity in other cases.

- With investments in China outpacing the overall market, we estimate Huawei and ZTE collectively gained around 3 to 4 percentage points of revenue share between 2019 and 2020, together comprising more than 40% of the global telecom equipment market.

- Even with the higher baseline, the Dell’Oro analyst team remains optimistic about 2021 and projects the overall telecom equipment market to advance 3% to 5%.

Dell’Oro Group telecommunication infrastructure research programs consist of the following: Broadband Access, Microwave Transmission & Mobile Backhaul, Mobile Core Networks, Mobile Radio Access Network, Optical Transport, and Service Provider (SP) Router & Carrier Ethernet Switch.

…………………………………………………………………………………………….

Last week, Dell’Oro Group reported that the optical transport equipment revenue increased 1% in 2020 reaching $16 billion. In this period, all regions grew with the exception of North America and Latin America.

“Between concerns on starting new optical builds during the start of the pandemic and aggressive plans on 5G deployments that required a larger share of a service provider’s capital budget, the spending on optical transport dramatically slowed by the end of 2020,” said Jimmy Yu, Vice President at Dell’Oro Group.

“It was a really dramatic drop in optical equipment purchases in the fourth quarter. While we anticipated a slowdown near the end of the year due to concerns around COVID-19, we were surprised by a 29 percent year-over-year decline in WDM purchases in North America as well as a 12 percent decline in China. That said, there was good growth in the other parts of the world, especially Japan,” continued Yu.

| Optical Transport Equipment Market | |

| Regions | Growth Rate in 2020 |

| North America | -6% |

| Europe, Middle East and Africa | 2% |

| China | 1% |

| Asia Pacific excluding China | 13% |

| Caribbean and Latin America | -14% |

| Worldwide | 1% |

The Dell’Oro Group Optical Transport Quarterly Report offers complete, in-depth coverage of the market with tables covering manufacturers’ revenue, average selling prices, unit shipments (by speed including 100 Gbps, 200 Gbps, 400 Gbps, and 800 Gbps). The report tracks DWDM long haul, WDM metro, multiservice multiplexers (SONET/SDH), optical switch, optical packet platforms, data center interconnect (metro and long haul), and disaggregated WDM. To purchase this report, please email [email protected].

References:

ZTE reports Q1 revenue & profit declines; boosts R&D; telemedicine diagnosis with hospitals to fight COVID-19

ZTE reported operating revenues for the first quarter were CNY 21.48 billion – down from 22.02 billion or -3.23% from the previous year. Net profit declined to CNY 780 million from 863 million or -9.58% year-over-year. ZTE’s net profit after extraordinary items rose 20.5% to CNY 160 million.

The company said the quarter was marked by the coronavirus pandemic and measures taken to alleviate the distress cause by it, as well as by the deployment of new infrastructures such as 5G and the Industrial Internet. ZTE’s R&D costs in the quarter increased to CNY 3.24 billion, comprising over 15.1% of revenues and up 1.2% from the year earlier.

ZTE CORPORATION –a joint stock limited company incorporated in the People’s Republic of China with limited liability. As at 31 March 2020 There were 483,643 shareholders in total (comprising 483,330 holders

of A shares and 313 holders of H shares).

Here are the shareholders holding 5% or above or top 10 shareholders:

- Zhongxingxin Telecom Company Limited

- HKSCC Nominees Limited

- Bank of China Limited

- Hong Kong Securities Clearing Company Ltd

- NSSF Portfolio #101

- Central Huijin Asset Management Co. Ltd

- Shenzhen Huitong Rongxin Investment Co. Ltd

- Nanjing Xinchuangxing Consulting and Management Partnership Ltd

- New China Life Insurance Company Ltd

- Shenzhen Investment Holding Capital Company Ltd

- Guangdong Hengjian Asset Management Company Ltd.

……………………………………………………………………………………………………………………………………………………………………………

ZTE continued to strengthen its R&D investment to build up its core competitiveness. For the three months ended 31 March 2020, the research and development costs amounted to RMB3.241 billion, 15.1% of operating revenue, increased by 1.2% compared to the same period last year.

During the first quarter of 2020, ZTE has placed great priority on its employee health and global customer services by promptly building and upgrading a remote office and customer service platform for all its employees. Moreover, the company has coordinated with partners to fight against COVID-19 and facilitate the resumption of production with digital means in an orderly manner. The company has been proactively promoting the new infrastructure-related services, and has managed to maintain the steady growth of its businesses during the review period.

Meanwhile, ZTE has been actively practicing social responsibilities. The company has collaborated with operators to guarantee the communication services of the front line against COVID-19. It has constructed 4G/5G networks and telemedicine diagnosis systems for hundreds of hospitals in China.

Teaming up with industry partners, ZTE has been committed to empowering various industries to fight against COVID-19 by leveraging its leading technological strength like 5G and AI. Specifically, ZTE has released 5G remote diagnosis and mobile diagnosis services, as well as the smart video cloud solution for epidemic prevention and control.

Moreover, the company has launched the family “cloud classroom” services to support online education. Featuring high efficiency and collaborativeness, ZTE’s secure remote office solution has enabled users of different industries to have remote office services during the outbreak of COVID-19, thereby facilitating the safe and rapid resumption of work and enhancing economic resilience.

With the acceleration of new infrastructures, such as 5G and the Industrial Internet, ZTE has been actively involved in the deployments of operators’ 5G infrastructure, and constantly scaled up its 5G production capacity. Meanwhile, the company has solidified cooperation with top industry players to promote the digital transformation of power, transportation, finance, government affairs and other key industries.

By the end of the first quarter of 2020, ZTE has consecutively secured significant shares for the 5G RAN, 5G SA core network, 5G transport centralized procurement of China Mobile, China Telecom and China Unicom. The company has constructed 5G demonstration networks in multiple cities in China, achieving Giga+ 5G continuous coverage experience. Moreover, the company has completed 5G commercial deployments in Europe, Asia-Pacific, the Middle East and other major 5G markets.

In addition, ZTE has sustained high growth in market shares in optical networks, as well as in the segments of Metro WDM and Backbone WDM. The company and its partners have jointly explored 86 application scenarios and carried out over 60 demonstration projects on a global scale, building a series of 5G intelligent manufacturing demonstration projects along with top industry players.

With respect to terminal devices, ZTE has unveiled its first 5G video smartphone ZTE Axon 11 5G. The company has continuously strengthened its 5G terminal devices cooperation with more than 30 operators worldwide. It has embarked on the 5G terminal market in Japan by partnering with operators.

Looking ahead , ZTE will pay close attention to the global epidemic situation, and make reasonable coordination accordingly with its global customers and partners to cope with the global epidemic. The company will strongly concentrate on its major businesses while leveraging the opportunities of new infrastructure construction, expecting to create more value for its telco customers.

References:

https://res-www.zte.com.cn/mediares/zte/Investor/20200424/E3.pdf

ZTE reports Q1 revenue & profit declines; boosts R&D; telemedicine diagnosis with hospitals to fight COVID-19

ZTE reported operating revenues for the first quarter were CNY 21.48 billion – down from 22.02 billion or -3.23% from the previous year. Net profit declined to CNY 780 million from 863 million or -9.58% year-over-year. ZTE’s net profit after extraordinary items rose 20.5% to CNY 160 million.

The company said the quarter was marked by the coronavirus pandemic and measures taken to alleviate the distress cause by it, as well as by the deployment of new infrastructures such as 5G and the Industrial Internet. ZTE’s R&D costs in the quarter increased to CNY 3.24 billion, comprising over 15.1% of revenues and up 1.2% from the year earlier.

ZTE CORPORATION –a joint stock limited company incorporated in the People’s Republic of China with limited liability. As at 31 March 2020 There were 483,643 shareholders in total (comprising 483,330 holders

of A shares and 313 holders of H shares).

Here are the shareholders holding 5% or above or top 10 shareholders:

- Zhongxingxin Telecom Company Limited

- HKSCC Nominees Limited

- Bank of China Limited

- Hong Kong Securities Clearing Company Ltd

- NSSF Portfolio #101

- Central Huijin Asset Management Co. Ltd

- Shenzhen Huitong Rongxin Investment Co. Ltd

- Nanjing Xinchuangxing Consulting and Management Partnership Ltd

- New China Life Insurance Company Ltd

- Shenzhen Investment Holding Capital Company Ltd

- Guangdong Hengjian Asset Management Company Ltd.

……………………………………………………………………………………………………………………………………………………………………………

ZTE continued to strengthen its R&D investment to build up its core competitiveness. For the three months ended 31 March 2020, the research and development costs amounted to RMB3.241 billion, 15.1% of operating revenue, increased by 1.2% compared to the same period last year.

During the first quarter of 2020, ZTE has placed great priority on its employee health and global customer services by promptly building and upgrading a remote office and customer service platform for all its employees. Moreover, the company has coordinated with partners to fight against COVID-19 and facilitate the resumption of production with digital means in an orderly manner. The company has been proactively promoting the new infrastructure-related services, and has managed to maintain the steady growth of its businesses during the review period.

Meanwhile, ZTE has been actively practicing social responsibilities. The company has collaborated with operators to guarantee the communication services of the front line against COVID-19. It has constructed 4G/5G networks and telemedicine diagnosis systems for hundreds of hospitals in China.

Teaming up with industry partners, ZTE has been committed to empowering various industries to fight against COVID-19 by leveraging its leading technological strength like 5G and AI. Specifically, ZTE has released 5G remote diagnosis and mobile diagnosis services, as well as the smart video cloud solution for epidemic prevention and control.

Moreover, the company has launched the family “cloud classroom” services to support online education. Featuring high efficiency and collaborativeness, ZTE’s secure remote office solution has enabled users of different industries to have remote office services during the outbreak of COVID-19, thereby facilitating the safe and rapid resumption of work and enhancing economic resilience.

With the acceleration of new infrastructures, such as 5G and the Industrial Internet, ZTE has been actively involved in the deployments of operators’ 5G infrastructure, and constantly scaled up its 5G production capacity. Meanwhile, the company has solidified cooperation with top industry players to promote the digital transformation of power, transportation, finance, government affairs and other key industries.

By the end of the first quarter of 2020, ZTE has consecutively secured significant shares for the 5G RAN, 5G SA core network, 5G transport centralized procurement of China Mobile, China Telecom and China Unicom. The company has constructed 5G demonstration networks in multiple cities in China, achieving Giga+ 5G continuous coverage experience. Moreover, the company has completed 5G commercial deployments in Europe, Asia-Pacific, the Middle East and other major 5G markets.

In addition, ZTE has sustained high growth in market shares in optical networks, as well as in the segments of Metro WDM and Backbone WDM. The company and its partners have jointly explored 86 application scenarios and carried out over 60 demonstration projects on a global scale, building a series of 5G intelligent manufacturing demonstration projects along with top industry players.

With respect to terminal devices, ZTE has unveiled its first 5G video smartphone ZTE Axon 11 5G. The company has continuously strengthened its 5G terminal devices cooperation with more than 30 operators worldwide. It has embarked on the 5G terminal market in Japan by partnering with operators.

Looking ahead , ZTE will pay close attention to the global epidemic situation, and make reasonable coordination accordingly with its global customers and partners to cope with the global epidemic. The company will strongly concentrate on its major businesses while leveraging the opportunities of new infrastructure construction, expecting to create more value for its telco customers.

References:

https://res-www.zte.com.cn/mediares/zte/Investor/20200424/E3.pdf

ZTE and China Telecom: 5G network test on a high speed train; Uplink enhancement FAST verification

5G network test on a high speed train:

ZTE and China Telecom have jointly launched the world’s first commercial 5G maglev (magnetic levitation) high-speed network test in Shanghai, China. The test measured communications within a train travelling at a maximum speed of 500KM/h. During the test, the 5G commercial terminal was stable and easy to support various high performance mobile broadband services, demonstrating that the 5G network can provide high-speed maglev trains with ideal broadband communications.

Shanghai Maglev is the world’s first maglev line for commercial operation and at present it is also the fastest commercial high-speed train. It has been a business card for Shanghai and even for China since its operation. Built by China Telecom and ZTE together, the 5G network uses a full set of ZTE 5G system equipment, perfectly enabling passengers to get high-speed data access on a quick journey and enjoy services like mobile working, video conferencing, HD/UHD video or interactive games, ensuring a brand-new communication experience.

Due to special scenario restrictions, providing high-quality network coverage for high-speed trains has always been a challenge for both operators and equipment vendors. When a 5G network is deployed in a higher frequency than 2G, 3G and 4G networks, the situation will be even less ideal. To solve these problems, ZTE and China Telecom have made breakthroughs in multiple aspects by constantly challenging the technical limits through technological discussions and tests. With proprietary doppler frequency shift channel compensation technology, wireless channel deterioration caused by high-speed movement is eliminated. The solution can support a moving speed of over 500 KM/h, meeting the speed requirements of various high-speed trains. Besides, Multi-RRU (Remote Radio Unit) combination can realize single cell 6-12km belt shape coverage, reduce 90 percent of inter-cell handover and ensure continuous and stable access. Compared with the traditional 2T2R solution, ZTE is the first to introduce 8T8R RRU for high-speed railway coverage in the 5G industry. Multi-channel equipment, combined with 5G featured channels and beam scanning technology, can enhance the coverage significantly. It is also worth mentioning that the solution is implemented through technical innovation at the base station network side and has no special requirements for terminals.

The 5G network solution used for the Shanghai Maglev line can provide a complete set of network equipment for HSR (High Speed Rail) broadband communication. The radio units can support global mainstream 5G bands like N41 and N78. The top speed of Shanghai Maglev train is the highest among commercial trains in the world, which implies that this 5G network solution can be applied to various high-speed railways and maglev lines worldwide and has great market potential.

Over the years, ZTE and China Telecom have jointly provided broadband information channels for high-speed rail transit. LTE coverage has been deployed for multiple high-speed railway lines, which was highly appraised by users. Going forward, the two parties will continue to optimize the commercial performance of the 5G networks and steadily promote tests and verification according to specific service characteristics to facilitate ubiquitous high-speed broadband access.

……………………………………………………………………………………………………………………………………………………………………………………..

Uplink enhancement FAST verification:

On November 27th, ZTE announced a partnership with China Telecom to complete the verification of the industry’s first FAST (FDD Assists Super TDD) solution at 2.1GHz and 3.5GHz in Shenzhen, China. Based on China Telecom’s uplink enhancement technology, this solution enables spectrum to reach its full potential by integrating time and frequency domains and constructing high-quality 5G networks with excellent performance and coverage.

Editor’s Note: FDD=Frequency Division Duplexing; TDD= Time Division Duplexing

China Telecom’s innovation of the “uplink enhancement” concept enhances the 5G uplink by using low frequency bands, such as 1.8GHz and 2.1GHz, to improve 5G network coverage and performance. For China Telecom’s existing 2.1GHz FDD and 3.5GHz TDD bands, ZTE and China Telecom has launched the uplink enhancement FAST (FDD Assists Super TDD) solution.

Based on the complementary qualities of TDD and FDD, in 3.5GHz weak uplink area, the terminal can transmit data at a high speed based on the 2.1 GHz frequency band. In addition, it can continue to make use of the advantages of 3.5GHz in bandwidth and large-scale array antennas to benefit from the downlink ultra-high rate.

In other areas with quality 3.5GHz coverage, the potential of 2.1GHz and 3.5GHz frequency bands can be fully utilized. This enables the terminal to transmit uplink data, in conventional UL CA mode, via three channels on two frequency bands at the same time. In the time domain, all the uplink frequency bands of FDD are fully utilized.

In addition, by deeply analyzing the features of frequency division duplex at 2.1GHz and time division duplex at 3.5GHz, the innovative CA with transmission mode switching in time domain, is based on multiple uplink carriers for time division transmission. This makes the full use of downlink timeslot resources.

To make the most effective use of the uplink resources of TDD and FDD, the terminals that only support two Tx-channel transmissions can flexibly switch between two channels of NR 3.5GHz and one channel of FDD 2.1GHz. At the same time, the downlink throughput can be improved in the FDD and TDD band aggregation mode, so that the best performance can be obtained in the uplink and downlink directions in the complicated wireless environment.

The test shows that, the uplink rate of a single user can be up to 40% higher than that of a single carrier (3.5GHz) when time division multiplexing (CA) is used. When conventional UL CA is used, the maximum increase of the single-user uplink rate is 60%. In addition, through high and low-frequency aggregation, the downlink user experience rate in both conditions can be increased by 20%, compared with a 3.5GHz single carrier.

In the future, ZTE will continue to partner with China Telecom to explore the application of new 5G technologies and functions in commercial networks, improve network quality, build 4G and 5G top-quality networks and provide better network services.

ZTE is a provider of advanced telecommunications systems, mobile devices, and enterprise technology solutions to consumers, operators, companies and public sector customers. As a part of ZTE’s strategy, the company is committed to providing customers with integrated end-to-end innovations to deliver excellence and values as the telecommunications and information technology sectors converge. Listed in the stock exchanges of Hong Kong and Shenzhen (H share stock code: 0763.HK / A share stock code: 000063.SZ), ZTE sells its products and services in more than 160 countries.

To date, ZTE has obtained 35 commercial 5G contracts in major markets, such as Europe, Asia Pacific, Middle East and Africa (MEA). ZTE commits 10 percent of its annual revenues to research and development and takes leadership roles in international standard-setting organizations.

References:

https://www.zte.com.cn/global/about/news/20191129e1.html

https://www.zte.com.cn/global/about/news/20191127e1.html

ZTE, China Telecom and China Unicom complete 5G co-build, co-share verification

SK Telecom top winner at Global Telecoms Awards in London, UK

South Korean network operator SK Telecom’s early success in 5G helped it win three awards at the Global Telecoms Awards (GLOTEL Awards), held on November 7 in London, UK. SK Telecom received awards in the categories of ‘5G Implementation Excellence,’ ‘Best Operator,’ and ‘BSS/OSS Transformation Excellence.’

SK Telecom was also highly commended in the consumer IoT and fixed network categories, bringing its awards total on the night to five. Other notable performers were Huawei, with two wins and a highly commended, and ZTE with one win and two highly commended.

With the aim to provide customers with the best 5G service quality, SK Telecom has deployed the fastest and widest 5G network in Korea, arming it with quantum cryptography technologies and an AI-based network management system named TANGO (T Advanced Next Generation OSS). Moreover, by combining its 5G with cutting-edge ICT, the company has introduced a wide range of powerful solutions including 5G-AI Machine Vision, 5G Live Golf Broadcast, AI Video Security and 5G-based Cooperative Intelligent Transportation System.

“I feel confident in saying that this was the strongest set of entries to the awards we’ve had yet,” said Telecoms.com Editor Scott Bicheno (pictured above with Chang-min Park of SK Telecom), who hosted the awards alongside comedian Miles Jupp and was also one of the judges. “Our judges had a really tough job choosing between so many great products, services and projects this year and for that I thank them. The fact that so many entries were highly commended shows how close the scoring was. My congratulations to the winners and thanks everyone who contributed to our best awards yet.”

…………………………………………………………………………………………………

Here’s the complete list of winners:

5G Implementation Excellence

Winner – SK Telecom: World’s First 5G Commercialization

Advancing Artificial Intelligence

Winner – Telefónica: Aura

Highly Commended – Nokia: AI as a Service for CMCC Hainan

Automation Initiative of the Year

Winner – Huawei: AUTIN

Best 5G Innovation

Winner – Vodafone Germany: Automotive Factory of the Future

Highly Commended – China Mobile, China Southern Power and Huawei: Smart Grid 5G Slice Operation and Monetization

Best Digital Transformation Project

Winner – Infosys and Vodafone UK: Digital Platform

Highly Commended – Singtel: Unboxed

Best Operator

Winner – SK Telecom

Highly Commended – Reliance Jio Infocomm

BSS/OSS Transformation Excellence

Winner – SK Telecom: OSS Evolution for E2E integration and 5G Business

Connecting the Unconnected

Winner – Ufinet: Rural connectivity case studies

Consumer IoT Initiative of the Year

Winner – O2 and Accenture: Making UK homes smarter energy users

Highly Commended – SK Telecom: V2X Service Enabler (VSE)

Digital Transformation Innovation

Winner – BT: The Digital Business Marketplace

Highly Commended – Netcracker: Digital Transformation Solution

Fixed Network Evolution

Winner – Turkcell: Customer Oriented Failure Prioritization and Complaint Management

Highly Commended – SK Telecom: Giga Premium 10G Residential Broadband Internet Service

Ground-breaking Virtualization Initiative

Winner – AT&T: Edge Solutions

Industrial IoT Initiative of the Year

Winner – Dialog Axiata: Affordable and Purpose-built IoT Solutions for Industries in Emerging Markets

Highly Commended – ZTE: ZTE NMVP Solution

Innovating in the Cloud

Winner – MYCOM OSI: The Assurance Cloud

Managed Services Innovation of the Year

Winner – Ericsson and Telenor: Common Delivery Center for innovative Managed Services model

Highly Commended – Saudi Telecom Company: STC Fixed Network Customer Operations Service transformation

Mobile Device Innovation

Winner – Reliance Jio Infocomm: JioPhone

Mobile Money Mastery

Winner – AsiaHawala and Comviva: AsiaHawala powered by mobiquity Money

Most Innovative Cloud Service

Winner – Tata Communications Transformation Services: Cloud Networking and Security as a Service

Highly Commended – Red Hat: Red Hat open hybrid cloud technologies

Project Delivery Perfection

Winner – ZTE: ZTE for China Mobile ‘He-Fetion’ Project

Highly Commended – X by Orange: X by Orange with Red Hat

Security Solution of the Year

Winner – Mobileum Signalling Firewall

Highly Commended – CUJO AI: AI-powered cybersecurity technology

Telecoms Transformation

Winner – Huawei: NFV-SDN based telco cloud technology initiative

Highly Commended – ZTE: 5G Slicing Wholesale Solution for New B2B2C Business Model

………………………………………………………………………………………..

About SK Telecom

SK Telecom is the largest mobile operator in Korea with nearly 50 percent of the market share. As the pioneer of all generations of mobile networks, the company has commercialized the fifth generation (5G) network on December 1, 2018 and announced the first 5G smartphone subscribers on April 3, 2019. With its world’s best 5G, SK Telecom is set to realize the Age of Hyper-Innovation by transforming the way customers work, live and play.

Building on its strength in mobile services, the company is also creating unprecedented value in diverse ICT-related markets including media, security and commerce.

For more information, please contact: [email protected] or [email protected]

…………………………………………………………………………………………

ZTE and China Mobile demo 5G 8K+VR ultra-wide bandwidth and 5G MU-MIMO at Mobile World Congress Shanghai 2019

by Margaret Ma, ZTE

1. 5G 8K+VR ultra-wide bandwidth:

ZTE Corporation a leading provider of telecommunications, enterprise and consumer technology solutions for the mobile internet, and China Telecom have today demonstrated 5G 8K+VR ultra-wide bandwidth experience at a 5G experience zone at Mobile World Congress (MWC) Shanghai 2019.

The 5G commercial network-based demonstration has not only showcased the excellent performance and business-enabled capabilities of China Telecom’s commercial network, but also reflected ZTE’s excellent 5G end-to-end commercial capabilities, providing a good model for 5G business cases.

ZTE will fully support the construction of China Telecom’s 5G commercial networks, exploring the application and business models of the 5G industry, helping establish China Telecom’s 5G brand leadership and achieve a win-win co-operation in the 5G era.

In addition, for visitors to MWC Shanghai 2019, China Telecom and ZTE have arranged a 5G Tour, travelling 5km with continuous coverage of the 5G network onboard a 5G experience bus. On this trip, visitors can enjoy diversified service experiences, including 5G-8K VR panoramic live streaming, 16-channel HD video live streaming, and 5G commercial smartphone video calls.

A screen on the bus shows the real-time 5G date rate that visitors can achieve, with a peak date rate of more than 1GBPS.

Empowered by the technologies of China Telecom and ZTE, the 5G-8K VR panorama live streaming combines 8K and the VR technology. The images and data captured by a 8K VR 360-degree camera are transmitted through a 5G network, allowing visitors to wear VR glasses and enjoy an immersive viewing experience.

With the capability of providing complete 5G end-to-end solutions, ZTE looks forward to working closely with industry partners to actively promote 5G business applications and practices, thereby facilitating the digital transformation of vertical industries.

……………………………………………………………………………………………………………………………………………………………………………..

2. 5G MU-MIMO:

In addition, ZTE and China Mobile demonstrated a 5G MU-MIMO (Multi-User, Multiple-Input Multiple-Output) multi-user performance test based on 5G commercial base stations and smart phones at Mobile World Congress Shanghai 2019. The demonstration showcases both companies’ leading positions in commercial performance.

The MU-MIMO makes full use of multi-antenna features to maximize the utilization of spectrum resources, creating much greater revenue for users. It is the core technology of 5G to realize ultra-wide bandwidth.

This MU-MIMO test was carried out in China Mobile’s Guangzhou 5G field, employing ZTE’s industry-leading 160M full-band 4/5G dual-mode commercial base station. The base station supports dynamic spectrum sharing, achieving dual-network integration at 2.6GHz, and 16 ZTE commercial mobile phone Axon10 Pro.

The test result showcased that a 5G single cell throughput is over 3.7Gbps, while a single EU downlink data rate is more than 200Mbps. The result is also a four-time increase in network system capacity than that of the SU-MIMO technology. The test footage and data were also transmitted back to China Mobile’s booth at MWC Shanghai in real time from Guangzhou.

ZTE and China Mobile have been strategic partners for years, working together on 5G technical innovation and industry development. The two parties have witnessed a series of milestones in the path to 5G commercialization. China Mobile and ZTE jointly developed the world’s leading 5G prototype base station, the world’s leading 5G site, the world’s leading 2.6GHz NR IoDT and the world’s leading end-to-end system.

With great capability of providing complete 5G end-to-end solutions, ZTE looks forward to working closely with industry partners to actively promote 5G business applications and practices, thereby facilitating the digital transformation of vertical industries.

…………………………………………………………………………………………………………………………………………………………………………………………………

About ZTE:

ZTE is a provider of advanced telecommunications systems, mobile devices, and enterprise technology solutions to consumers, carriers, companies and public sector customers. As part of ZTE’s M-ICT strategy, the company is committed to provide customers with integrated end-to-end innovations to deliver excellence and value as the telecommunications and information technology sectors converge. Listed in the stock exchanges of Hong Kong and Shenzhen (H share stock code: 0763.HK / A share stock code: 000063.SZ), ZTE’s products and services are sold to over 500 operators in more than 160 countries. ZTE commits 10 per cent of its annual revenue to research and development and has leadership roles in international standard-setting organizations. ZTE is committed to corporate social responsibility and is a member of the UN Global Compact. For more information, please visit www.zte.com.cn.

…………………………………………………………………………………………………………………………………………………………………………………………………

Media Contact:

Margaret Ma

ZTE Corporation

Tel: +86 755 26775189

Email: [email protected]

References:

ZTE makes prototype smartphone call on China Unicom’s trial 5G network vs Huawei’s 5G NR @ 2.6GHz?

ZTE, which recently completed the 3rd phase of CMIIT IMT-2020 5G core network tests, just announced it made the a 5G mobile call using its 5G prototype smartphone on the Guangdong branch of China Unicom’s trial 5G network in Shenzhen, China. The trial was conducted in collaboration with China Unicom and involved placing a 3GPP Release 15 compliant New Radio (NR) non-standalone (NSA) mobile call using the prototype smartphone. It used ZTE’s 5G end-to-end solution, including radio access network, core network, transport network and prototype device. In addition to demonstrating a 5G call, the test verified key 5G technologies including Massive MIMO, 5G NR, non-standalone (NSA) dual connectivity, FlexE transport technology and 5G common core architecture (defined by who?).

ZTE says “the future 5G system should be a unified network adaptable to different scenarios.”

…………………………………………………………………………………………………………………………………………………………………………………

“ZTE’s 5G solution has passed the end-to-end test in the three months after the release of the 3GPP Rel-15,” ZTE said in a statement. “It showcases ZTE’s strong competency in 5G R&D and commercialization, demonstrating ZTE’s role as a reliable partner to global 5G operators and a key player in the 5G industry.”

Last year, ZTE announced a series of new-generation 5G base stations. The Chinese telecom and mobile phone vendor said that the new generation of 5G high/low frequency Active Antenna Unit (AAU) base stations support 3GPP release 15 “5G NR” NSA specification for the data plane. The latest ZTE base stations combine the radio and antenna parts. It is capable of integrating multiple frequency bands, which create what is known as the “AAU solution.” AAU supports 5G functions such as Massive MIMO and Beamforming.

Meanwhile, Huawei says it completed a 5G New Radio (NR) trial in the 2.6 GHz spectrum band. Huawei said 2.6 GHz is one of the “excellent choices for operators to deploy 5G NSA/SA commercial network.” The company noted that 2.6 GHz is an “abundant spectrum resource around the world, but not fully used in many areas.” Huawei’s tests in the 2.6 GHz band follows earlier trials in the 3.5 GHz and 4.9 GHz bands.

The two Chinese telecom vendors are vying to take the lead in 5G testing under the jurisdiction of China’s IMT-2020 (5G) Promotion Group, which was established in 2013 as China’s platform to promote 5G research in that country. The 5G R&D trial established three separate phases for verifying a 5G solution: key technologies, technical solutions, and system networking.

References:

https://www.zte.com.cn/global/about/press-center/news/201901/20190118

https://www.zte.com.cn/china/topics/zte-5g-en/index.html

https://www.sdxcentral.com/articles/news/huawei-takes-5g-supremacy-shot-at-zte/2019/01/

https://techblog.comsoc.org/tag/chinas-imt-2020-promotion-group/