Fiber to the building

Google Fiber drops 100Mb/s; Goes ‘All In’ on 1 Gig Internet Access

Google’s affordable, high-speed Fiber internet service has been around for quite some time, but only in select areas of the U.S. As it continues its very slow expansion to more cities and regions, Google is looking to streamline its operations by eliminating one of its only two Fiber based Internet access subscription plans. Google Fiber is dropping its $50/month, 100Mb/s subscription for NEW CUSTOMERS. 100Mb/s FTTP has always been a slightly cheaper alternative to its 1 Gigabit plan, which is only $20 more at $70/month.

“Starting today, we’re recommitting to our roots. We’re going all in on a gig, just like we did all those years ago. We will no longer offer a 100Mbps plan to new customers,” Google said in a blog post. “We are excited to turn our attention back to our gig service, still offered for $70/month—the exact same price it cost back in 2012 when we first launched,” Google added.

Currently, the Fiber service is available in 18 U.S. cities: Atlanta, Georgia; Austin, Texas; Charlotte, North Carolina; Chicago, Illinois; Denver, Colorado; Huntsville, Alabama; Kansas City, Missouri; Miami, Florida; Nashville, Tennessee; Oakland, California; Orange County, California; Provo, Utah; San Antonio, Texas; San Diego, California; San Francisco, California; Salt Lake City, Utah; Seattle, Washington; and The Triangle, North Carolina.. Even in Fiber-connected cities, not every geographic area within the city will have access to the 1 Gig service.

“With increasingly connected homes and ever-improving technologies, speed is more important than any time in our history—and becoming more important every day. And with our fiber networks, we’re uniquely positioned to deliver it,” Google said. “You won’t have any data caps to interrupt even the most impressive binge-watching session. And with the power of a gig, you’re able to use all your connected devices at home at the same time,” the company added.

If Google Fiber sounds like the internet plan for you, please visit the Google units official website to check if your location is supported.

………………………………………………………………………………………………………………………………………………………………………………………………………….

In its seven-year lifespan, Google Fiber has never had a single price increase. Its straightforward, month-to-month (cancel any time) payment model has always been more attractive than what many competing services offer (many require a one year contract with huge cancellation fee).

Google Fiber’s ambitions are a lot more modest than they used to be. So the news applies to a pretty small percentage of Americans. Fiber scaled back its roll-outs in the mid-2000’s and had to pull out of Louisville, Kentucky earlier this year, following problems with its cable installations beneath the city’s roads. Google put the brakes on most of its expansion efforts, like in the author’s home town – Santa Clara, CA. Apparently, there were just too many hurdles, including the cost of expanding into certain areas, getting permission from the city councils, disputes over access to utility poles, and other challenges.

References:

Altice Portugal Interview: 10Gbps services to build the ultra-connected future

Interview of Alexandre Fonseca, CEO of Altice Portugal by Chris Kelly of Total Telecom

Portugal is one of the most ambitious nations in Europe with regards to FTTH penetration targets. How are you progressing with this and what challenges are you facing?

Due to the work developed by Altice Portugal in the last years, Portugal is today an international case study with proven experience in several countries, such as USA, France, Russia, New Zealand, India, the UK or Brazil, regarding FTTH projects. Altice Portugal presents one of the best and largest next generation network infrastructures, reaching 4.8 million of households in Optical Fiber, moving closer to the 2020 target of 5.3 million. This brings Portugal as one of the first countries in Europe to reach nearly 100% of the population. We deployed FTTH throughout the country, both in urban and rural areas, boosting the economic development and digital inclusion.

Despite the significant investment performed, it is important to underline that Portugal still awaits for a 5G Roadmap, regarding the availability of frequencies and licenses in order to launch 5G commercial networks. The country needs a clear strategy and vision for 5G, to continue to take the lead, as in previous technology generations of telecommunications.

Does Europe need to agree a single unified switch off date for its existing copper networks?

The optical fiber infrastructure is more robust and more reliable in technological terms, being more immune to adverse weather conditions, thefts or vandalism, with a much lower failure rate than the copper networks and, consequently having better operational responsiveness, besides the significantly better performance it brings to Services.

The replacement of copper by optical fiber, being a natural evolution both for technological and business reasons, depends on each country´s dynamics, not being determinant the existence of a single date for this to happen. However, this change is essential for Portugal to remain at the forefront of Europe and is also sustained by the fact that copper networks are obsolete and unable to support new innovative services. Optical fiber is undoubtedly the technology that makes it possible to offer a set of new future proof services and features that copper no longer supports. Altice Portugal has started a pilot project in parishes of six Portuguese municipalities that were 100% covered by fiber. The project contributes to digital inclusion growth, broadening access to advanced services, promoting economic development and modernization and of course, copper decommissioning.

With the emergence of new technologies, what scope is there for delivering 10Gbps services?

10Gbps services will help us build the ultra-connected future we all require. The predicted increase in number of devices and data volumes requires intelligent networks with a new level of speed and capacity. Homes with 50-100 connected devices will drive unprecedented demand. Now, life-changing technologies for connected health, augmented and virtual reality, will deliver incredible experiences and require significant speed, low latency and high capacity. 10Gbs services are becoming more crucial for the enterprise market, namely for data center access, data center interconnection and trunk circuits to collect high bandwidth traffic from data, video & voice under virtual private networks.

The launch of new technologies is not a goal in itself – what really matters is the experience provided by services and the added value for customers. That’s the world we are building, one in which everything is connected everywhere.

What role will fibre play in underpinning 5G mobile network rollout in Portugal?

5G technology is not simply about faster internet connections, it will bring huge changes in network architecture and services. It will enable a step change of ultrafast broadband connections, boosted by low latency, ultra-reliable communications, massive machine-type communications and slicing capabilities. The major characteristics introduced by 5G can be summarized in the Throughput, Latency and Density of the connections.

Fibre optics will be a key enabler of 5G, especially as a backhauling technology, once it provides the extremely high speeds, capacity and low latency required to connect each 5G station. FTTH rollout is a key differentiator for providing nationwide 5G coverage and Altice Portugal is ready and prepared for 5G rollout, with over 95% of its mobile stations already connected through fiber. Besides the FTTH deployment, Altice Portugal performed the first 5G live demonstration in a commercial network environment with pre-commercial terminals in July 2018 and the first live television broadcast in Portugal using the 5G network in real environment in June 2019.

How much of a game changer is 5G going to be in regard to IoT uptake?

5G will have a fundamental role boosting the era of smart connectivity, capable of taking advantage of unreachable response times with today’s technologies, to grant new scenarios of digital interactivity on multiple devices. 5G will reinforce applications for B2B, B2C and B2B2C markets, especially in areas as IoT, or IIoT, industrial automation and critical services, especially in Healthcare, Smart Grids, Smart cities, Industry 4.0 or Autonomous Vehicles, being a relevant factor in the development of the economy of each country and the world in general.

Altice Portugal has been exploring, for a long time, the opportunities related to IoT. In 2018 we opened the Golabs.IoT, a live technology Lab that generates synergies between developers, universities, startups and industry players.

Altice Labs, our R&D unit, also has projects in 5G and IoT landscape, with several national and international institutions, including Portuguese municipalities, such as the city of Aveiro, with 5G being available for the development of early adoption services for cities or citizens, on an open community enviroment.

What predictions do you have for the industry over the next 12-18 months?

Companies and businesses are undergoing a very important digital transformation process…the telecommunications sector is amongst the ones suffering the most, but also well positioned to have a leading role on this transformation.

We will surely see a transition´s process from automation to true digitalization. Digitalization has accelerated information production and distribution, innovation and process disruption, together with the integration of the physical and virtual worlds and the use of real time data. All this has a huge impact on organizational structures, business models, logistics operations and products and services themselves.

But this is not just a business-level transformation. This represents a social transformation, with new ways for people to relate themselves, to learn, to work and providing all equal access to technologies.

The process of digital transformation and technological development requires us to always innovate and our effort and commitment must be dedicated to always bring more and better services to the Portuguese.

We believe that the Smart Living concept will bring forward a set of new and combined technologies, for personal and business usage that will improve our live, generate the opportunity to save time and therefore improving our work life balance. Technology will continue to improve people’s life’s and business productivity, providing quality time to individuals, families and communities, turning content and experience the most relevant killers Apps in this new technology generation.

https://www.totaltele.com/503944/Altice-Portugal-10Gbps-services-will-help-us-build-the-ultra-connected-future-we-all-require

…………………………………………………………………………………………………………………………………………………………………………

Backgrounder:

Altice Portugal is the largest telecommunications service provider in Portugal. Since June 2, 2015, the company is a wholly owned subsidiary of Altice Group, a multinational cable and telecommunications company with a presence in France, Israel, Belgium, Luxembourg, Portugal, French West Indies/Indian Ocean Area, the Dominican Republic (“Overseas Territories”), Switzerland, and the United States. Its assets in Portugal were sold to Altice in 2015 per request of, Oi SA,[4] to reduce debt. The African assets were mostly sold for the same reason. Portugal Telecom, SGPS SA was split in separate companies: PT Portugal (now Altice Portugal) and Pharol (formerly PT SGPS), which owns a 27,5% stake in Oi.

The company owns MEO, the largest landline operator in Portugal. Its operating brands include MEO, a quadruple play service provider and SAPO, an ISP and producer of web content. Portugal Telecom also owns Altice Labs (formerly known as PT Inovação), an IT services and research and development company; PT Contact, focused in the business of managing contact centers.

Altice Portugal Building in São Jorge de Arroios

Reference:

CenturyLink CEO Jeff Storey: “Expanding our fiber footprint is major focus; Fiber beats wireless, whether it’s 5G or not”

CenturyLink wants to become the premier U.S. fiber-based provider for business customers, according to Jeff Storey, CenturyLink’s president, CEO, and former Level 3 CEO. Storey pledged to continue to aggressively expand its fiber footprint because fiber, he said, will ultimately beat out all other connectivity options in terms of performance, especially for next-generation use cases that are happening at the edge of the network. Two such edge computing customer examples were given (see below).

“Expanding our fiber is a major area of focus for us … Fiber beats twisted pair copper, hybrid fiber coax, and it beats wireless, whether it’s 5G or not, fiber wins,” Storey told investors during the telecom’s Q2 2019 earnings call on Wednesday evening, August 7th. Fiber is one way that CenturyLink plans to boost its Enterprise and Small and Medium Business revenues, executives said. From the Century Link earnings call transcript, Storey said:

As I mentioned last quarter, we added 4,500 new fiber-fed buildings to our on-net footprint in the first quarter of 2019. We continued that focus in the second quarter with the addition of approximately 5,000 new fiber-fed buildings. For contrast, Level 3 used to add something closer to 500 buildings per quarter, so I want to emphasize expanding our fiber footprint is a major area of focus for us.

We know that when we have a building on-net, our fiber based services provide a better, more reliable, and higher margin solution than competing infrastructure. [indiscernible] wireless whether that’s 5G or not, fiber wins. It’s highly flexible and increasing speeds, it is secure and really is the basis for all the other competing technologies. We just do one thing differently. We take fiber all the way to the customer, and customers always want fiber when they can get it. You can expect us to continue investing to expand the reach of our access fiber network.

Beyond just being a superior technology, though, fiber is well suited to meet the demands of emerging opportunities driven by artificial intelligence, machine learning, and big data applications. Fiber-based solutions are better able to satisfy what we see as four key market trends. The need for highly scalable capacity, now ranging into multi gigabits per second; the need for connecting and increasing number of widely distributed locations; the need for the network itself to protect the privacy and security of our customers; and finally, the need to move bandwidth intensive computing resources closer and closer to the edge to reduce latency and unnecessary backhaul of traffic.

Expanding our on-net building footprint certainly helps us meet these needs. But we’ve implemented a number of other initiatives to ensure CenturyLink maintains our position as the premier fiber based provider for enterprise customers.

Our North American subsea fiber routes are a unique asset, and as I said earlier, we believe it represents the world’s most scalable and efficient fiber network. However, we are further augmenting our capabilities. We also own an extensive and unparalleled conduit system that we leverage to bring the latest generation fiber capabilities to market with extraordinary speed and economic efficiency. Each of the long haul networks we’ve acquired Level 3, Qwest, WilTel, Broadwing all had multi conduit builds.

Within the Level 3 network alone, we built 12 conduits to ensure we had sufficient space to grow and evolve this capacity in fiber technology evolved. Most of those conduits are still available for further network augmentation. But we’ve also interconnected all of those conduit systems to cherry-pick the shortest and lowest latency pass across the country. As illustrated on slide five, we recently announced the deployment of Corning’s latest generation of ultra-low loss fiber to build the world’s best, most scalable optical infrastructure. This new technology enables higher capacity and more efficient optical design than earlier fiber technologies.

Coupled with the selecting the shortest physical path between any two endpoints, we also improved latency significantly, which is a key factor for hyper scalars, bandwidth intensive enterprises, and dark fiber customers. We’ve completed 3.5 million miles of our current plan to build a total of 4.7 million fiber miles with ultra-low loss fiber roughly 75%. We continue to see demand for additional routes, and we’ll consider those to meet future customer needs.

We recognized that access and long haul transport only part of the solution. There’s increasing demand for computing capabilities at the edge of the network, and we believe we’re uniquely positioned to capitalize on this market opportunity. In addition to our far-reaching fiber network, we operate a large number of edge locations that are well suited to enable edge computing. In the coming weeks. We expect to announce the details of our investments in our widely distributed and extremely well connected edge computing infrastructure.

Storey gave two examples of Edge Computing using Century Link’s scaleable fiber network:

Let me give you a specific example from a customer of what fiber-based edge computing capabilities can mean for them. Slide 6 shows an actual customer with close to 2,000 nationwide locations. We are working with this customer to evaluate the effectiveness of our edge computing solutions to more efficiently run applications and process huge amounts of data very close to the origin of that data. On this slide, you can see that our existing infrastructure is positioned within five milliseconds transport time for 95% of their sites. This means that the customers applications and data can be processed more efficiently from a 100 or so of our edge locations, rather than processed on premise at 2,000 separate sites, even worse with the customer or backhaul to a central location.

In addition, our dynamic networking capabilities can provide real-time network provisioning from the customer premise to our edge, and then onto major cloud service providers. This example is for a specific customer, but the results are indicative of what we see from other customers we are currently working with.

This application can be an important solution for retail, banking, and really anyone that has a number of dispersed service locations that need to process large amounts of data in real time. The combination of our fiber network with edge computing infrastructure and managed services support is a very powerful and differentiated service offering. We are not suggesting that edge computing will eliminate the need for today’s hybrid computing or hybrid networking. To the contrary, our customers will continue to build and operate their own data centers, continue to move compute resources to public data centers and specific applications to cloud service providers.

Our customers want to dynamically manage their network and put different types of workloads in different environments. Through our wide array of hybrid networking solutions. CenturyLink provides the flexibility to do so easily. CenturyLink enables this flexibility with services like dynamic connections, which allows our customers to make instantaneous changes to their network, capacity, and configuration, and our cloud application manager, which allows customers to manage their applications across hybrid cloud environments through a single seamless interface.

Our network was purpose built to enable us to expand at the lowest cost in the industry. That’s a big advantage. It allows us to go to market quickly and invest in these types of growth initiatives within the bounds of our ongoing capital plans. The sufficiency is demonstrated in our ability to invest in all of these initiatives as well as other growth opportunities within the scope of the capex outlook we provided for the full-year 2019.

I’ll give you another specific customer example of how investments in flexible scalable fiber-based connectivity are helping us win in the market. We recently won a contract provide secured cloud connectivity to the US Census Bureau for the upcoming 2020 census. We will formally announce this contract later this week. To support the Census Bureau’s objectives, to provide the best mix of timeliness, relevancy, quality, and cost for the data they collect and the services they provide, CenturyLink will help to collect the census digitally by providing the bureau with managed trusted internet protocol services or MTIPS at speeds of 40 gigabits and higher.

MTIPS, a managed security service that provides secure cloud-based connectivity, will support the online system that will be available to all households completing the 2020 survey. The solution also allows the Census Bureau to access the responses via secured-cloud applications for the first time. CenturyLink was selected by the Bureau due to our ability to meet their requirements for scalable connectivity and will play an integral role in helping the US Census go digital in the most secure, reliable, and cost effective way as it takes an important mission of completing the 2020 census.

The census is obviously a unique example, but that’s the point of hybrid networking solutions from CenturyLink. Our customers can enable the capabilities to address their particular need. This solution highlights our ability to provide scalable, flexible network solutions that we believe are defining the next generation of enterprise networking.

Enterprise networking, a segment that includes CenturyLink’s high-bandwidth data services, managed services and SD-WAN services, declined 1.2% and was at $1.50 billion during the carrier’s fiscal second quarter compared to $1.52 billion in 2018’s Q2. However, Storey said that the company expects enterprise revenues to rise during the second-half of the year.

Small and medium business sales fell 11 percent during the quarter to $736 million compared to $819 million in Q2 2018 despite CenturyLink trying to focus strategic IT services geared toward the small and medium business market. Neel Dev, CenturyLink’s executive vice president and CTO, said that SMB revenue declines are largely driven by legacy products, but that the carrier “feels confident” it can return to profitability by selling to more businesses on its on-net fiber footprint.

Lisa Miller, CenturyLink’s president of wholesale and indirect channels and alliances, is “committed” to selling to small and midsized businesses who were outside of the legacy CenturyLink footprint.

“Level 3 didn’t focus there because they weren’t the type of customer we focused on, CenturyLink never focused there because they didn’t have the network to sell to those types of customers,” Storey explained. “It’s now a great opportunity for us and we need to focus and drive toward new opportunities with these customers.”

Consumer revenues continued its downward trajectory, falling by 8.4 percent to $1.42 billion during the quarter compared to Q2 2018’s result of $1.54 billion. CenturyLink today generates three-quarters of its revenue from business customers. During the provider’s Q1 2019 earnings call, Storey revealed that it was considering shopping around its consumer business. The executive said that CenturyLink’s internal teams are making “good progress” with the review, but that it will be a lengthy and complex process. In the meantime, Storey said the company won’t modify consumer investments and will continue to transform the Consumer business unit.

………………………………………………………………………………………………………………………………………………………………………..

Financial Results:

For the quarter which ended on June 30, Monroe, La.-based CenturyLink reported net income of $371 million in Q2 2019, which increased 21 percent compared to last year’s result of $292 million. The company reported total revenue of $5.58 billion and diluted earnings per share of 35 cents, a decline of 5.4 percent compared to $5.90 billion and 27 cents per share in the year-ago quarter. CenturyLink’s revenue came in just slightly lower than Wall Street analysts’ estimate of $5.59 billion.

In the first half of 2019, CenturyLink grew adjusted EBITDA by 80 million compared to the first half of 2018, while revenue declined more than 600 million over the same period. This was driven in part by our focus on adding profitable revenue in de-emphasizing unprofitable lines of businesses, managing legacy product declines, along with synergies and our cost transformation initiatives.

Total revenue in the first quarter declined 5.5% to 5.58 billion. Quarter-over-quarter, total revenue declined 1.2% compared to the 2.3% sequential decline we saw last quarter. In the enterprise segment, revenue declined 1.2% both year over year and sequentially. This compares to a decline of 1.6% year over year and 2.2% sequentially in the first quarter 2019. SMB revenue decreased 10% year over year compared to a decline of 3.7% in the first quarter 2019.

Neel Dev: “The revenue declines on the SMB business are largely driven by legacy voice. We feel good about our ability to sell into our on-net building footprint with a large addressable market opportunity. Wholesale revenue decreased 8.8% year over year. As we referenced last year, in the second quarter 2018, wholesale revenue included a favorable dispute settlement with a large carrier. Sequentially, we saw a decline of 1.8% compared to a 3.4% decline last quarter.”

Broadband revenue for the second quarter 2019 grew 1.8% year over year which compares to growth of 1.4% last quarter, driven by our efforts to increase penetration in our competitive assets and investing in fiber.

Voice revenue on a year over year basis declined 13% this quarter compared to 12% last quarter. The decline in other revenue continues to be driven by our decision to de-emphasize our Prism video product. Regulatory revenue is down year over year due to the adoption of new lease accounting standard.

In summary, we remain focused on execution specifically on improving revenue trajectory for the second half of 2019, maximizing profitability and remain discipline on our cost transformation and deleveraging initiatives.

References:

https://www.crn.com/news/networking/centurylink-ceo-5g-or-not-fiber-wins-

AT&T Fiber Build-Out Ahead of Schedule; Moffett report on AT&T Fiber questions subscriber growth

AT&T Fiber Build-Outs:

For the first quarter 2019, AT&T reported 297,000 AT&T fiber customer gains and 45,000 broadband net adds, with broadband revenue growing more than 8%.

As part of its 2015 acquisition of DirecTV, the FCC required that AT&T expand its deployment of its high-speed, fiber-optic broadband internet service to 12.5 million customer locations, as well as to E-rate eligible schools and libraries, by July 2019.

Speaking Wednesday, June 5th at the Credit Suisse 21st Annual Communications Conference (see webcast url below), AT&T Communications CEO John Donovan said that AT&T now has a large inventory of fiber-based assets and that their fiber build-out has already reached 14.5 million customer locations.

…………………………………………………………………………………………………………

Editor’s Note:

Indeed, AT&T is offering fiber based internet in the SF Bay area via a KCBS radio commercial. However, they say availability is limited.

AT&T webcast url: https://event.webcasts.com/starthere.jsp?ei=1245728&tp_key=70a2932a9e&tp_special=8

…………………………………………………………………………………………………………

AT&T will be a bit slower in future fiber build-outs. Donovan said “We’ll continue to invest in fiber but we’ll do it based on the incremental, economic case. We’re not running to any household target.”

While it used to take AT&T 36 months to get fiber into roughly 30% of a market, AT&T can now reach 50% to 55% in 24 months time, according to Donovan.

“So I really like the cadence and the momentum that we’ve got in our brand, which is AT&T Fiber,” he said. “Where we have fiber we’re doing exceedingly well. Where we have slower speeds, sub 40 megabits per second, that’s where the majority of our churn is. But right now if you look at this year, we will add a million high-speed fiber broadband subs. And roughly two thirds of those come from cable. So we’re doing extremely well.”

AT&T’s pre-standard “5G” deployments, which will be launched in 29 cities by the end of the year, also benefit from the fiber build-out as fiber is needed for high bandwidth backhaul. Note yet again that an AT&T representative chairs ITU-R WP 5D where IMT 2020 (radio aspects) is being standardized.

……………………………………………………………………………………………………………..

Moffett-Nathanson report: “U.S. Broadband: Where Are AT&T Fiber’s Subscriber Gains Coming From?“

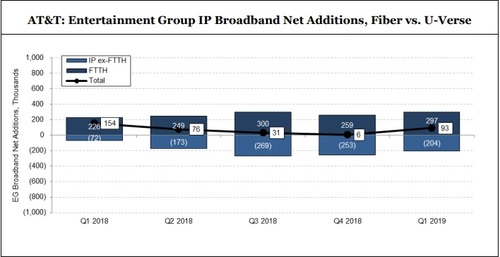

However, LightReading says that the bulk of AT&T Fiber subscriber growth is coming from AT&T. AT&T Fiber’s subscriber base is growing rapidly. AT&T disclosed that AT&T Fiber — the expanding FTTP portion of its footprint capable of delivering speeds up to 1 Gbit/s — gained about 1.1 million subscribers over the past year, bringing the total AT&T Fiber subscriber base to about 3.1 million.

However, AT&T appears to be benefiting largely from speed upgrades from its existing high-speed Internet customers rather than by stealing share away from cable rivals, according to a new subscribers only analysis of the U.S. broadband market by MoffettNathanson titled “U.S. Broadband: Where Are AT&T Fiber’s Subscriber Gains Coming From?”

“The short answer appears to be… from AT&T itself,” wrote Craig Moffett, lead analyst with Moffett-Nathanson, surmising that the bulk of new AT&T Fiber subs are coming from the company’s own broadband subscriber base, usually in the form of upgrades or migrations of existing U-verse customers.

Moffet said AT&T’s broader “IP Broadband” category” — which includes AT&T Fiber and U-verse/fiber-to-the-neighborhood customers — has posted comparatively modest subscriber gains over the past year.

Source: Company reports, MoffettNathanson estimates and analysis

………………………………………………………………………………………………………….

“Therefore, unless AT&T’s U-verse broadband customers are suddenly fleeing for other providers in droves (unlikely), one obvious possibility is that many, or even most, of AT&T’s fiber gains are simply migrations of their existing customer base from one product to another,” Moffett explained, estimating that about 81% of AT&T Fiber net adds over Q1 2018 to Q1 2019 were migrations from U-verse.

Moffett said that migration story isn’t necessarily a surprising one. While the initial U-verse deployments in the early 2000s targeted some of the densest parts of the telco’s footprint, AT&T has predictably targeted FTTP deployments in many of the same dense areas, he added.

Also of note: AT&T Fiber’s base tier is $60 per month for a symmetrical 80 Mbit/s to 100 Mbit/s, the same as the U-verse standalone broadband product. “Even if a customer doesn’t really need faster upload speeds, if AT&T offers to upgrade a customer for no added cost why wouldn’t they switch?” Moffett asks.

And though AT&T Fiber subscribers appear to be largely coming way of upgrades or migrations of existing AT&T broadband subs, Moffett said that doesn’t mean that AT&T Fiber won’t have a bigger impact on competitors (like cable operators) eventually. “It’s just that it’s not having much impact yet,” he wrote, adding that AT&T Fiber’s expansion, expected to pass 14 million residential and small business locations by June 2019, remains a threat to cable that’s “worth watching.”

According to Moffett’s report, US MSOs added 1.04 million broadband subs in Q1, up from 962,000 in the year-ago quarter. US telcos added just 23,000 broadband subs in Q1 fueled by ongoing depletion of legacy DSL subs, but improved from a year-ago loss of 44,000 customers. The US satellite broadband sector, still a small player, added 15,000 subs in the quarter.

Combined, US broadband providers added 1.07 million subs in Q1 — a year-on-year growth rate of 2.9% — for a grand total of 107.81 million subs. Broken down by provider type, US cable led with 71.58 million, followed by the telcos (34.4 million) and satellite (1.82 million).

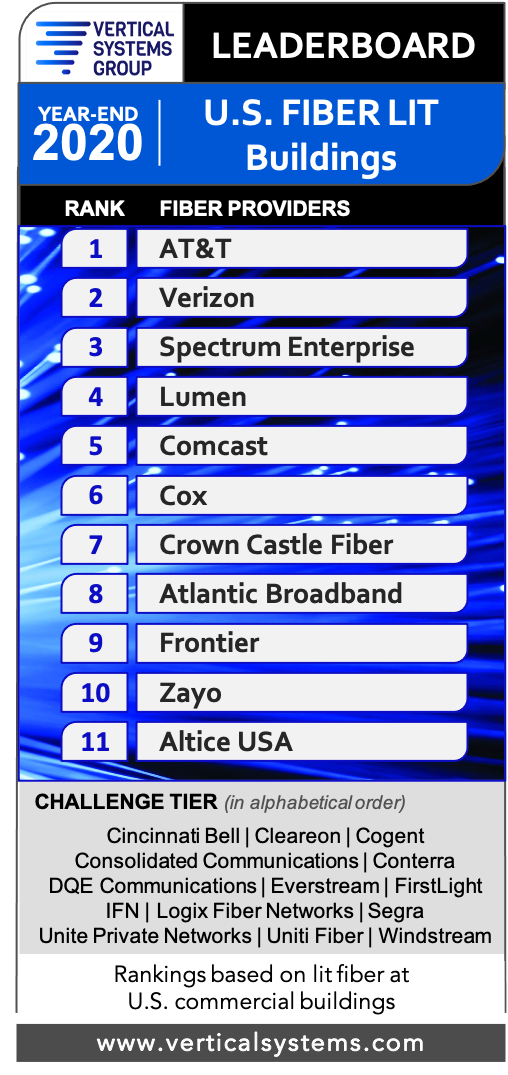

VSG LEADERBOARD : AT&T #1 in Fiber Lit Buildings- Year end 2020

Vertical Systems Group’s 2020 U.S. Fiber Lit Buildings LEADERBOARD results are as follows (in rank order by number of on-net fiber lit buildings): AT&T, Verizon, Spectrum Enterprise, Lumen, Comcast, Cox, Crown Castle Fiber, Atlantic Broadband, Frontier, Zayo and Altice USA. These eleven retail and wholesale fiber providers qualify for this benchmark with 15,000 or more on-net U.S. fiber lit commercial buildings as of year-end 2020.

Additionally, fourteen companies qualify for the 2020 Challenge Tier as follows (in alphabetical order): Cincinnati Bell, Cleareon, Cogent, Consolidated Communications, Conterra, DQE Communications, Everstream, FirstLight, IFN, Logix Fiber Networks, Segra, Unite Private Networks, Uniti Fiber and Windstream. These fiber providers each qualify for the 2020 Challenge Tier with between 2,000 and 14,999 U.S. fiber lit commercial buildings.

“The base of fiber lit buildings in the U.S. expanded in 2020, although the pace of new installations was hampered by the pandemic. Challenges for fiber providers ranged from impeded installations due to commercial building closures and business shutdowns to supply chain disruptions,” said Rosemary Cochran, principal of Vertical Systems Group. “As the economy rebounds in 2021, fiber providers have opportunities to monetize the millions of small and medium U.S. commercial buildings without fiber, as well as larger multi-tenant buildings with only a single fiber provider. However it remains uncertain how changes in U.S. regulatory policies and federal funding could alter fiber investments and deployment plans in the next several years.”

2020 Fiber Provider Research Highlights:

- AT&T retains the top rank on the U.S. Fiber Lit Buildings LEADERBOARD for the fifth consecutive year.

- The threshold for a rank position on the 2020 Fiber LEADERBOARD is 15,000 fiber lit buildings, up from 10,000 buildings previously.

- Atlantic Broadband advanced to eighth position on the LEADERBOARD, up from eleventh in the previous year.

- Windstream and Consolidated Communications move into the Challenge Tier from the LEADERBOARD.

- Vertical Systems Group’s 2020 U.S. fiber research analysis for five building sizes shows that fiber availability varies significantly based on number of employees. The Fiber 20+ segment, which covers four building sizes with twenty or more employees, has a 69.2% fiber lit availability rate. This compares to 14.1% availability for the Fiber <20 segment, which covers buildings with fewer than twenty employees.

Market Players include all other fiber providers with fewer than 2,000 U.S. commercial fiber lit buildings. The 2020 Market Players tier includes more than two hundred metro, regional and other fiber providers, including the following companies (in alphabetical order): ACD.net, Armstrong Business Solutions, C Spire, Centracom, CTS Telecom, Douglas Fast Net, EnTouch Business, ExteNet Systems, Fatbeam, FiberLight, Fusion Connect, Google Fiber, GTT, Hunter Communications, LS Networks, Mediacom Business, MetroNet Business, Midco Business, Pilot Fiber, PS Lightwave, Shentel Business, Silver Star Telecom, Sonic Business, Syringa, TDS Telecom, TPX Communications, U.S. Signal, Veracity, Wave Broadband, WOW!Business, Ziply Fiber and others.

For this analysis, a fiber lit building is defined as a commercial site or data center that has on-net optical fiber connectivity to a network provider’s infrastructure, plus active service termination equipment onsite. Excluded from this analysis are standalone cell towers, small cells not located in fiber lit buildings, near net buildings, buildings classified as coiled at curb or coiled in building, HFC-connected buildings, carrier central offices, residential buildings, and private or dark fiber installations.

AT&T Fiber Expansion Adds 12 More Markets, Now Reaches 10M Locations

AT&T has expanded its AT&T Fiber service (Fiber to the Premises or FTTP) to 12 additional markets, including three in Texas and three in Florida. The telco’s FTTP offering now reaches more than 10 million locations in 84 metro areas, with 3 million of those having come this year. The company hopes to reach at least 14 million locations by mid-2019. That’s impressive!

AT&T now has fiber to more than 2 million business customer locations – with another 6 million locations within 1000 feet of fiber.

In a press release, the company said that mobile 5G success will rely on a quality fiber connection to the wireless towers or small cells, which then translate the fiber connection into an ultra-fast wireless signal for customers. Under the AT&T plans, eligible broadband customers can choose from a range of internet speed plans.

New research conducted for the Fiber Broadband Association by research firm RVA, LLC found 18.4 million U.S. fiber broadband homes as of September 2018, up from approximately 15 million a year earlier. Service providers made broadband available to a record-breaking 5.9 million new homes in the year ending September 2018, RVA said.

Network operators now market fiber broadband to 39.2 million U.S. homes, including 1.6 million homes that can get fiber broadband from two or more providers, according to the research.

Note:

AT&T says it offers Fiber to the premises in Santa Clara, CA (my home town for almost 49 years), but it’s not available anywhere in ny neighborhood. When I enter my zip code and address in the box on their website, I get no mention of fiber availability, but instead this box:

We found existing AT&T wireless service at your address.

This is my account and I’d like to see my offers and deals.

…………………………………………………………………………………………………………………………………………………………….

In other words, it’s a frustrating cop-out on FTTP for Santa Clara, CA. Suggest readers check AT&T Fiber availability for your address/zip code.

References:

https://about.att.com/story/2018/internet-powered-by-att-fiber-available-12-metros.html

https://www.telecompetitor.com/att-fiber-expansion-12-more-cities/

AT&T Fiber Expansion Adds 12 More Markets, Now Reaches 10M Locations

AT&T has expanded its AT&T Fiber service (Fiber to the Premises or FTTP) to 12 additional markets, including three in Texas and three in Florida. The telco’s FTTP offering now reaches more than 10 million locations in 84 metro areas, with 3 million of those having come this year. The company hopes to reach at least 14 million locations by mid-2019. That’s impressive!

AT&T now has fiber to more than 2 million business customer locations – with another 6 million locations within 1000 feet of fiber.

In a press release, the company said that mobile 5G success will rely on a quality fiber connection to the wireless towers or small cells, which then translate the fiber connection into an ultra-fast wireless signal for customers. Under the AT&T plans, eligible broadband customers can choose from a range of internet speed plans.

New research conducted for the Fiber Broadband Association by research firm RVA, LLC found 18.4 million U.S. fiber broadband homes as of September 2018, up from approximately 15 million a year earlier. Service providers made broadband available to a record-breaking 5.9 million new homes in the year ending September 2018, RVA said.

Network operators now market fiber broadband to 39.2 million U.S. homes, including 1.6 million homes that can get fiber broadband from two or more providers, according to the research.

Note:

AT&T says it offers Fiber to the premises in Santa Clara, CA (my home town for almost 49 years), but it’s not available anywhere in ny neighborhood. When I enter my zip code and address in the box on their website, I get no mention of fiber availability, but instead this box:

We found existing AT&T wireless service at your address.

This is my account and I’d like to see my offers and deals.

…………………………………………………………………………………………………………………………………………………………….

In other words, it’s a frustrating cop-out on FTTP for Santa Clara, CA. Suggest readers check AT&T Fiber availability for your address/zip code.

References:

https://about.att.com/story/2018/internet-powered-by-att-fiber-available-12-metros.html

https://www.telecompetitor.com/att-fiber-expansion-12-more-cities/

Point Topic: China leads FTTH adoption with 80% of net adds through 1Q-2018

|

|

|

Vertical Systems Group: U.S. Business Fiber Availability Reaches 54.8%

The availability of optical fiber connectivity to large and medium size commercial buildings in the U.S. jumped to 54.8% in 2017, based on latest research from Vertical Systems Group. AT&T, Verizon and CenturyLink’s aggressive build-outs of fiber into commercial buildings have continued to increase the availability of fiber connectivity.

As a result, the U.S. Fiber Gap has dropped to less than fifty percent (45.2%) for the first time. This annual benchmark quantifies the scope of fiber lit buildings in the U.S. with twenty or more employees. Encompassing more than two million individual business establishments, this base of commercial buildings maps directly to the addressable market for higher speed Carrier Ethernet, Cloud, Data Center, Hybrid VPN and emerging SDN-enabled services.

“More commercial U.S. buildings were newly lit with fiber during 2017 than in any other year since we initiated this research in 2004…..

AT&T told investors that it reached 400,000 business buildings with its own lit fiber facilities. Due to AT&T’s aggressive build-out, the service provider now covers over 1.8 million U.S. business customer locations. The telco said it is “adding thousands more buildings each month.”

CenturyLink and Verizon took the M&A path to enhance their on-net fiber holdings.

In a huge M&A deal, CenturyLink’s purchase of Level 3 increased its on-net building reach by nearly 75% to approximately 100,000 buildings, including 10,000 buildings in EMEA and Latin America, which gives the #3 U.S. telco a larger footprint to deliver carrier Ethernet and software-defined network services.

Verizon’s purchase of XO Communications gave the telco additional metro fiber networks in 40 major U.S. markets with over 4,000 on-net buildings and 1.2 million fiber miles.

Consolidated Communications also enhanced its on-net fiber holdings via its acquisition of FairPoint. By acquiring FairPoint, Consolidated immediately established itself as the ninth largest fiber player with a presence in 24 states and 8,000 on-net buildings.

This greater density will enable Consolidated to pursue more dark fiber and lit Ethernet service opportunities with a larger mix of business and wholesale customers.

What was also notable about this year’s M&A on-net building rush was the presence of nontraditional players like Uniti Fiber, which acquired two regional fiber providers, Southern Light and Hunt Telecom. These two deals give the REIT more fiber to pursue a mix of wireless, E-Rate, military, enterprise and wholesale opportunities, including fiber-to-the-tower backhaul, small cell networks and dark fiber. The acquisition of Southern Light in particular gives Uniti access to an additional 4,500 on-net locations.

Fueling Ethernet, 5G deployments

Having more available on-net fiber is another factor that plays into service providers’ U.S. Ethernet service reach and 5G plans by creating pipes through which wireless operators can build small cell and distributed antenna systems (DAS) to improve wireless coverage in business buildings.

Encompassing more than 2 million individual business establishments, this base of commercial buildings maps directly to the addressable market for higher speed carrier Ethernet, cloud, data center, hybrid VPN and emerging SDN-enabled business services.

Several of the service providers that have high on-net fiber building counts represent some of the largest Ethernet providers in the U.S.

On the Ethernet end, AT&T, CenturyLink and Verizon continue to demand high spots in the Ethernet space. However, the effect of M&A clearly has altered the Ethernet landscape.

CenturyLink knocked AT&T from its nearly 13-year reign as the top domestic Ethernet provider in the U.S. by completing its acquisition of Level 3 Communications. The service provider’s move up the ranks of VSG’s year-end 2017 U.S. Ethernet Leaderboard was also a function of continued growth in Ethernet ports for both companies. Earlier, Level 3 ranked second to AT&T and CenturyLink ranked fifth on the Mid-2017 U.S. Ethernet Leaderboard.

But Ethernet is only one factor driving ongoing on-net fiber builds. Cochran noted in an e-mail to FierceTelecom that “larger providers larger providers are accelerating deployments” to position themselves for 5G.

Verizon, for example, acquired WideOpenWest’s fiber assets in Chicago, securing fiber to more than 500 macro-cell wireless sites and more than 500 small-cell wireless sites in the area.

Crown Castle advanced its fiber standing by acquiring Lightower—a deal that gave it greater fiber density to address businesses and its traditional wireless business customers deploying small cells in buildings. This acquisition gave Crown Castle rights to approximately 60,000 route miles of fiber, with a presence in all the top 10 and 23 of the top 25 metro markets.

As the expectations for higher speed Ethernet, cloud and in-building wireless coverages continues to ramp, service providers will continue to further narrow the fiber gap inside buildings. But unlike the speculative builds of the 1990s, these are focused on bandwidth hungry applications that are showing no signs of slowing.

Editor’s Note:

For this Vertical Systems Group analysis, a fiber lit building is defined as a commercial site or data center that has on-net optical fiber connectivity to a network provider’s infrastructure, plus active service termination equipment onsite. Excluded from this analysis are standalone cell towers, small cells not located in fiber lit buildings, near net buildings, buildings classified as coiled at curb or coiled in building, HFC-connected buildings, carrier central offices, residential buildings, and private or dark fiber installations.

References: