Fiber to the building

AT&T’s fiber buildout reduced due to supply constraints

AT&T has experienced recent disruptions in the supply of fiber optic cable, which has caused the company to trim back its planned fiber-to-the-premises (FTTP) buildout for 2021, according to senior EVP and CFO Pascal Desroches.

AT&T had previously said it would build out its fiber network to an additional 3 million homes passed this year. But that’s now been reduced by 1/2 million.

“Since the start of the third quarter, we are seeing dislocation across the board, including in fiber supply. We’re probably going to come in a little bit light of 3 million homes passed, probably around 2.5 million,” Desroches said Tuesday at the Oppenheimer Technology, Internet & Communications Conference, according to this transcript.

An AT&T technician working on a fiber project

………………………………………………………………………………………….

Specifically, this is what Pascal said:

But since the start of the third quarter, we are seeing dislocation across the board, including in fiber supply. And as a result of those dislocations, we had previously provided guidance of 3 million homes past this year (unedited- very bad grammar). We’re probably going to come in a little bit in light of that, probably around 2.5 million. We don’t think it’s going to impact us long term. But I think it’s really important context because if we’re feeling the pain of this, I can only imagine what others in the industry are experiencing.

John Stankey (AT&T CEO) has always been a believer in fiber. I think when he took over he identified that as a priority area because he understood from a technology standpoint, there is no better technology for connectivity. And therefore, in a world where the demands for symmetrical speed are increasing significantly, this is the technology to bet heavily on. And so we have a great position, and we are leaning into adding to that position. So it’s really a function of when you — and I think others are now recognizing it as a result of what you’ve seen in the last year in the pandemic, the need to do what we’re doing now, 2-way communication can only happen with symmetrical speed. So I think everyone has had an aha moment, like we need to deploy fiber. And so we’ve long believed that. John has long believed that, and this is just really leading into that opportunity.

As we deploy fiber, our goal is to get at least 40% penetration on homes passed. And we think in certain markets, we’ll have an opportunity to do better than that. And the other thing that is great about is when you lay fiber, you lay fiber to a community where there is both homes and businesses. So it also helps boost returns in your enterprise business. And so that’s why it is so critical that we roll this out because the ability to grow both your enterprise and your consumer business is attractive. And we think these investments will provide us with mid-teen returns over time.

I know we’re largest fiber purchaser in the country. And we have prices that are at the best and most competitive among the industry. So we feel really good about the ability to secure inventory, fiber inventory and at attractive price points and the ability to execute and the build-out at scale, something that many others don’t have.

Oppenheimer moderator question: “Can you talk a little bit about where your supply comes from, I guess, both the fiber and the optical components or any other key suppliers? Is that U.S. sourced? Or is it a lot of it outsourced internationally?”

Pascal’s answer: “It is a U.S. company which has locations both domestically and outside the U.S.” [We suspect that it’s Corning].

AT&T typically has had no problem getting fiber at a low cost, Desroches said. “We’re the largest fiber purchaser in the country and we have prices that are the best and most competitive in the industry,” he said. “We feel really good about the ability to secure fiber inventory at attractive price points and the ability to execute the buildout at scale, something that many others don’t have.”

AT&T expects to catch up to its original fiber-construction estimates in the years after 2021, largely because of what Desroches called its “preferred place in the supply chain” and “committed pricing.” As AT&T said in a news release yesterday, AT&T is “working closely with the broader fiber ecosystem to address this near-term dislocation” and “is confident it will achieve the company’s target of 30 million customer locations passed by the end of 2025.”

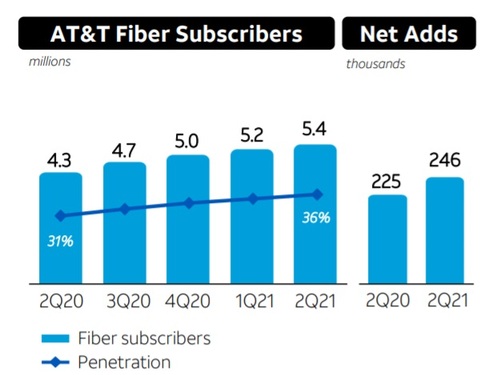

AT&T added another 246,000 fiber broadband subs in Q2 2021, extending its total to 5.43 million, and said last month it was on pace to add about 1 million net fiber subscribers for all of 2021.

AT&T has estimated that nearly 80% of new fiber subscribers are also new AT&T customers, reversing a previous trend that saw a sizable portion of its FTTP customer net adds coming from upgrades of existing AT&T high-speed Internet customers on older VDSL and DSL platforms (which have been largely discontinued).

Speaking on AT&T’s 2Q-2021 earnings call last month, Desroches stated that the company’s consumer wireline business had reached a “major inflection point” as broadband revenues continue to surpass legacy declines. Meanwhile, AT&T’s broadband average revenue per user (ARPU) reached $54.76 in Q2 2021, improving from $51.61 in the year-ago period.

References:

Will AT&T’s huge fiber build-out win broadband market share from cablecos/MSOs?

Frontier Communications Accelerates Fiber Build Out -10 Million locations passed by 2025

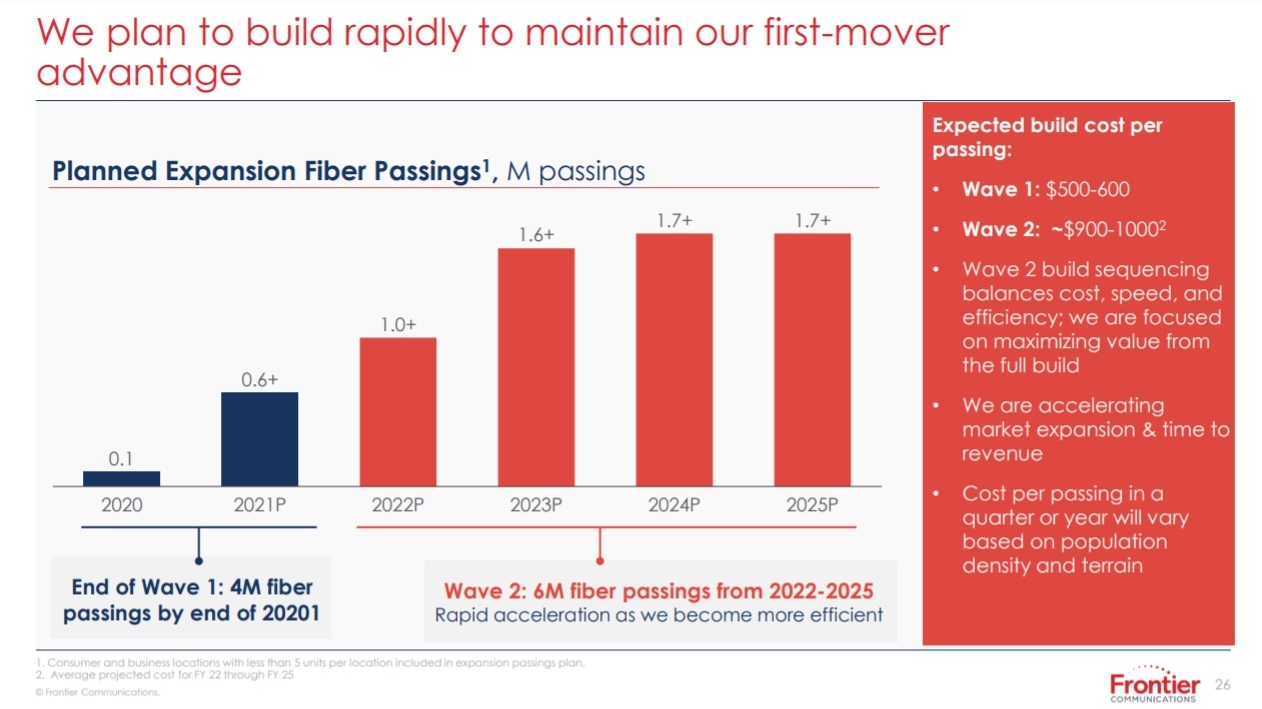

On August 5th, Frontier Communications announced an accelerated fiber optics buildout plan that will result in their fiber-to-the-premises (FTTP) network passing 10 million locations (homes/offices) by 2025. Frontier says they will end 2021 with 4 million locations passed by fiber and will then add another 6 million in a revised, multi-year “Wave 2” plan.

Nick Jeffery, President and Chief Executive Officer of Frontier, said, “The acceleration of our fiber network expansion is clear evidence that Frontier’s transformation is taking hold. Over the past several months, we’ve made real progress in executing our strategy – by adding world-class leadership, introducing a purpose-driven culture, improving the customer experience, and making our operations more efficient and sustainable.

“Demand for high-speed broadband is growing rapidly, and fiber is the best product to meet the needs of consumers and businesses. Frontier is already doing what customers want and cable can’t – delivering symmetrical download and upload speeds with far lower latency than our competition. Early next year, we will start delivering 2 gigabit per second services, further stretching our performance lead to where only fiber can compete. We have hard work ahead of us, but momentum is increasing as we rally the Frontier team around our mission to Build Gigabit America.”

Jeffery added, “Our second-quarter results reflect continuing momentum in our fiber expansion strategy, with all key fiber metrics in line or above expectations. In particular, we accelerated our fiber build out, continued our customer momentum with another strong quarter of consumer fiber net adds, and reduced our consumer churn. Taken together, it was another strong quarter that positions Frontier well as we head into the second half of the year.”

At its virtual investor day, Frontier provided an update on the fiber buildout and other priorities resulting from its strategic review. These include:

- Frontier’s current ability to provide a best-in-class offering featuring symmetrical 1 gigabit per second download and upload speeds;

- Plans to launch a symmetrical 2 gigabit per second offering in the first quarter of 2022 that will unlock next-generation digital experiences for customers;

- Plans to deploy fiber to reach 10 million locations by 2025; and

- A new target of $250 million run rate savings by 2023 from simplifying the Company’s operations and improving the customer experience.

Image Credit: Frontier Communications

……………………………………………………………………………………….

Frontier also offered some revised predictions on service penetration, expecting them to be in the mid-teens to 20% at the end of year one, rise to 25% to 30% at the end of year two, and then on up to 45%. Frontier introduced new pricing for residential fiber broadband service, with entry-level service at 500 Mbit/s.

MoffettNathanson analyst Nick Del Deo (a colleague) wrote in a note to clients:

The single most important data points from today’s analyst day relate to Frontier’s FTTH deployment plans (Exhibit 1). For 2021, the company increased its expectation for new passings from 495K to >600K, which will complete “wave one” of its fiber upgrade project and leave it with ~4M total FTTH passings. Between 2022 and 2025, the company plans to build to another 6M passings, bringing its total to 10M, or about two thirds of its broadband-enabled locations. The remaining 5M, part of wave three, are currently in a holding pattern, with the company working through the optimal approach: do nothing, upgrade, upgrade with government assistance, divest, swap, or do something more creative that we haven’t come up with.

Image Credit: Frontier Communications

…………………………………………………………………………………….

The company also announced it will start to introduce 2-Gig services over FTTP in early 2022, but didn’t disclose pricing.

Del Deo summarized his assessment of Frontier’s fiber buildout (emphasis added):

Frontier plans to build FTTH to 7M incremental homes through 2025, a rapid acceleration from its current pace. This will leave two thirds of its broadband-enabled footprint served by fiber, with the status of the remaining one third TBD. The deployment costs appear somewhat higher, and returns a bit lower, than what we would have expected, but we had haircut the value of its FTTH expansion in our prior work to account for such risks. The faster pace and certainty now reduce the need for such haircuts. The path to financing the build remains open, but the company will need at least a couple of billion dollars in fresh funding. It’s not clear to us that management’s optimism regarding the commercial unit is warranted, but time will tell whether it can engineer a turnaround.

Management has high hopes for the commercial part of its business, and we don’t doubt that growth can get better from where it is today, but we think this will continue to be a segment that weighs on the company’s overall results.

Light Reading’s Jeff Baumgartner opines that “Frontier’s accelerated FTTP buildout plan, revised pricing and plans for 2-Gig service should pressure cable competitors to match up with speeds and pricing. Frontier’s moves might also cause those cable operators to give more consideration to “mid-split” or “high-split” upgrades that dedicate more upstream capacity to their DOCSIS 3.1 networks, accelerate their pursuit of new DOCSIS 4.0 technologies, or shift to full FTTP upgrades in select areas.”

………………………………………………………………………………………….

References:

Will AT&T’s huge fiber build-out win broadband market share from cablecos/MSOs?

AT&T added 235,000 fiber connections in the first quarter, ending the period with nearly 5.2 million total fiber customers. AT&T says they have a total of around 15 million fiber and non-fiber customers, so fiber access is approximately 1/3 of total customers now.

The company recently announced it plans to build fiber to 3 million new customer locations this year and 4 million next year. AT&T plans to double the number of locations where it offers fiber Internet, from approximately 15 million to about 30 million, by 2025. To do that, AT&T is planning to increase its annual capital expenses from $21 billion to around $24 billion.

AT&T’s new focus on connectivity over content is a direct result of its spinning off Warner Media to Discovery, as we chronicled in this IEEE Techblog post. Thaddeus Arroyo, head of AT&T’s consumer business, made that crystal clear at a recent BoA investor event:

“We expect capital expenditures of about $24 billion a year after the Warner Media discovery transaction closes. That’s an incremental investment that’s going to go to fiber to 5G capacity and 5G C-band deployment.

We have another great opportunity, the one we continue to talk around fiber. So as part of this capital, we’re going to be investing in fiber expansion to meet the growing needs for bandwidth that require a much more robust fiber network regardless of the last mile serving technology. Fiber is the foundation that fuels our network. Expanding our fiber reach serves multiple services hanging off at each strand of fiber. It includes macro cell sites, small cell sites, wholesale services, enterprise, small business, and fiber that’s extended directly into our customers’ homes and into businesses.

We plan to reach 30 million customer locations passed with fiber by the end of 2025. That’s going to double our existing fiber footprint. And investing in fiber drives solid returns because it’s a superior product. Where we have fiber we win, we’re improving share in our fiber footprint, and the penetration rates are accelerating and growing, given our increased financial flexibility. We’re comfortable in our ability to invest and achieve our leverage targets that we outlined of getting to 2.6% at close and below 2.5% by the end of 2023.”

Mo Katibeh, the AT&T executive responsible for fiber and 5G build-outs, added on via a recent post on LinkedIn: “We are building MORE Fiber to MORE homes and businesses. And we’re talking A LOT of fiber – MILLIONS of new locations every year, planning to cover 30 MILLION customer locations by the end of 2025! And you know what comes with all that investment in America? JOBS. Our AT&T Network Build team is GROWING..”

Previously, Katibeh wrote on LinkedIn : “Contributing to a large portion of the $105B Capital spend between 2016 and 2020 – our team is building out AT&T #Fiber to MILLIONS of new customer locations in 2021, as well as augmenting America’s best mobility network with more capacity, more speed – and more #5G (you know I love 5G!).”

…………………………………………………………………………………………………………………………………………………………..

So with all that said, will AT&T’s fiber build-out keep pace with cable companies/MSOs DOCSIS networks?

Tom Rutledge, Charter’s CEO, made a brief comment about plant upgrades on the earnings call (note – Dave Watson made similar comments on the Comcast earnings call):

“We’re continuously increasing the capacity in our core and hubs and augmenting our network to improve speed and performance at a pace dictated by customers in the marketplace. We have a cost-effective approach to using DOCSIS 3.1, which we’ve already deployed, to expand our network capacity 1.2 gigahertz, which gives us the ability to offer multi-gigabit speeds in the downstream and at least 1 gigabit per second in the upstream.”

According to Leichtman Research Group, the top cable companies had 68 million broadband subscribers, and top wireline telecom companies had 33.2 million subscribers at the end of 2019.

“Based on the currently available information, cable stole wired broadband market share in Verizon and AT&T markets as well. Oy vey!” said Jim Patterson of Patterson Advisory Group in his May 2, 2021 newsletter. “Think about Comcast and AT&T as having roughly the same number of homes passed (AT&T probably closer to 57 million homes versus the nearly 60 million shown for Comcast),” he added. Patterson noted that top cable companies Comcast, Charter and Altice managed to capture 86% of broadband customer growth in the U.S. in the first quarter of this year.

“(AT&T) fiber connections simply aren’t growing fast enough to keep up,” wrote colleague Craig Moffett of MoffettNathanson in a recent note to clients. Here’s more:

To be sure, there are questions about the extent to which these deployments will overlap cable (or will instead be focused on unserved rural communities), and the extent to which labor and supply chain contraints might limit acheivability of announced targets. Still, taken together, these deployments suggest that, after a precipitous decline in new fiber construction in 2020, planned fiber deployments do, indeed, rise over the next two years; we expect that both 2021 and 2022 will represent new all-time peaks in total number of fiber homes passed. Typically, the competitive impact from overbuilds is felt with some lag, suggesting the impact on cable operators will peak in 2024/2025.

At the same time, we expect that federal stimulus to accelerate broadband market growth in 2021 and 2022, perhaps significantly, with new household formation, in particular, driving upside to 2021 and 2022 forecasts.

Longer term, however, Cable operators will have to contend with more fiber overbuilds, as TelCos increasingly see both more favorable economics for fiber deployment and increasingly acknowledge that their copper plant faces imminent obsolescence without it. The forecasts for fiber deployment in this note suggest that 2021 will be a record for fiber construction – assuming labor and materials capacity can accommodate the TelCos’ own forecasts – and 2022 will step up higher still. After that, deployments are expected to abate, at least to a degree.

“Cable can upgrade its plant quickly and at low cost to offer at least 4.6Gbit/s down and 1.5Gbit/s up, well beyond current fiber offerings. They can do this before the move to DOCSIS 4.0, which is still years off,” wrote the financial analysts at New Street Research in a recent note to investors. The result, according to the New Street analysts, is that fiber providers like AT&T won’t necessarily be able to dominate the fiber market with a 1 Gbit/s FTTH/FTTP connection and take market share from cable incumbents.

“Cable will face new fiber competition in more of its markets over the next few years; however, there is little to no prospect of fiber delivering a service in those markets that cable can’t easily match or beat,” New Street concluded.

…………………………………………………………………………………………………………………………………………………………….

“Looking back and being a little critical, we probably allowed the cable companies to execute and to take share in that market in a significant way,” AT&T CFO Pascal Desroches said at a recent Credit Suisse investor event.

AT&T executives have said that the company’s fiber investment ultimately will generate internal returns of around 15%. Desroches said that return on investment will be due to a variety of factors. Fiber “supports not only consumer needs, it supports needs for our enterprise businesses as well as needs for potentially our reseller business. So being able to look across and integrate the planning for fiber deployment such that it not only serves consumer needs, but it serves these other market adjacencies as well is something that we haven’t been very good at historically, That’s why we’re really bullish and we believe we’re going to be able to execute really well here,” AT&T’s CFO concluded.

References:

https://www.lightreading.com/opticalip/is-atandts-fiber-investment-good-idea/d/d-id/770468?

https://www.linkedin.com/feed/update/urn:li:activity:6813211481950318592/

FTTH Council Europe: FTTH/B reaches nearly 183 million (>50% of all homes)

Europe has passed over half of homes able to receive fiber broadband. According to the latest figures compiled by Idate for the FTTH Council Europe, 52.5% of homes will be covered by FTTH/B at the end of September 2020. That’s up from 49.9% a year earlier.

FTTH Council Europe revealed the following:

• Number of homes passed by fiber (FTTH/B) reaches nearly 183 million homes in EU39.

• Europe’s fiber footprint (number of homes passed) expanded the most in the past year in France (+4.6M homes passed), Italy (+2.8M), Germany (+2.7M) and the UK (+1.7M).

• Three countries are accounting for almost 60% of homes left to be passed with fiber in the EU27+UK region.

• FTTH/B Coverage in Europe surpasses more than half of total homes.

• 16.6% growth in the number of fiber subscribers.

• Iceland leads the European FTTH/B league table second year in a row. 70.7% of its households having fiber connections. Belarus (70.4%) and Spain (62.6%) came in second and third.

• Belgium, Israel, Malta and Cyprus enter the FTTH/B ranking for the first time.

The above figures cover 39 countries across Europe, where nearly 183 million homes have fibre access. For the EU and UK alone, penetration reached 43.8 percent in September, up from 39.4 percent a year earlier.

The report also shows fiber take-up is accelerating, with a subscriber penetration of 44.9 percent of lines in the 39 countries, compared to 43 percent in September 2019. In total there were 81.9 million FTTH/B subscribers in September 2020, up 16.6 percent from a year earlier. Annual growth was again strongest in France, with nearly 2.8 million subscribers added in the 12 months, followed by Russia with 1.7 million and Spain with 1.4 million.

The countries with the highest fiber penetration across Europe are Iceland and Belarus, with over 70 percent of households using fiber broadband. Spain and Sweden are at over 60 percent, and Norway, Lithuania and Portugal over 50 percent.

“The telecoms sector can play a critical role in Europe’s ability to meet its sustainability commitments

by reshaping how Europeans work, live and do business. As the most sustainable telecommunication

infrastructure technology, full fibre is a prerequisite to achieve the European Green Deal and make the

European Union’s economy more sustainable. Competitive investments in this technology should,

therefore, remain a high political priority and we look forward to working with the EU institutions,

national governments and NRAs towards removing barriers in a way to full-fibre Europe” said Vincent

Garnier, Director General of the FTTH Council Europe.

About the FTTH Council Europe:

The FTTH Council Europe is an industry organization with a mission to advance ubiquitous full fibre based connectivity to the whole of Europe. Our vision is that fiber connectivity will transform and

enhance the way we live, do business and interact, connecting everyone and everything,

everywhere.

Fiber is the future-proof, climate-friendly infrastructure which is a crucial prerequisite for

safeguarding Europe’s global competitiveness while playing a leading global role in sustainability.

The FTTH Council Europe consists of more than 150 member companies.

Contacts:

Eric Joyce, Chair, Market Intelligence Committee

[email protected]

Sergejs Mikaeljans. Communications and Public Affairs Officer

[email protected] Tel: +32 474 81 04 54

……………………………………………………………………………………………………………………

Separately, BT has increased its its total FTTP network build target from 20 million to 25 million premises by December 2026, with Openreach working to connect up to 4 million premises a year.

……………………………………………………………………………………………………………………..

References:

https://www.ftthcouncil.eu/documents/Fibre_Market_Panorama_2021_PR_final.pdf

https://register.gotowebinar.com/register/2424555495368131344 (webinar registration)

AT&T ends DSL sales while CWA criticizes AT&T’s broadband deployments

AT&T: DSL is Dead:

According to a message board post on DSL Reports, AT&T notified customers on billing statements in August that effective Oct. 1 it would no longer accept new orders for its copper-based DSL service. The notice also said that existing DSL subs will no longer be able to make speed changes to their respective DSL service.

The message board author wrote:

“On my August AT&T statement, traditional DSL is officially grandfathered effective October 1st. No new orders (moves, installs, speed change, etc.). Hopefully they will still allow promos….”

That’s no surprise to this author. AT&T’s DSL subscriber base has been eroding steadily – losing almost 350,000 subs over the past couple of years. In Q2 2020, AT&T shed 23,000 DSL subs, ending the period with just 463,000.

“We are focused on enhancing our network with more advanced, higher speed technologies like fiber and wireless, which consumers are demanding,” AT&T said in a statement. “We’re beginning to phase out outdated services like DSL and new orders for the service will no longer be supported after October 1. Current DSL customers will be able to continue their existing service or where possible upgrade to our 100% fiber network.”

……………………………………………………………………………………………………………………….

AT&T Fiber Update:

AT&T also announced three new price points for its AT&T Fiber tiers and said that all new and existing AT&T Fiber Internet 100, Internet 300 and Internet 1000 subscribers would enjoy unlimited data without additional charges. AT&T Fiber started offering the new deals as a standalone product with no annual contracts for new customers on Sunday.

As of Q2-2020, AT&T had 4.3 million AT&T Fiber customers with nearly two million of them on 1-gigabit speeds. Overall, AT&T has about 15.3 million broadband subscribers while Charter has 28 million and Comcast has over 29 million.

AT&T’s fiber tier announcement comes after AT&T CEO John Stankey told a Goldman Sachs investor conference in September that “priority number one” is investing in fiber for 5G and FTTP services.

The new prices are also an indication that AT&T intends to ramp up its drive on FTTP sales in the wake of a recent study showing that many of AT&T’s new subs were coming from existing customers upgrading to fiber rather than from gaining market share from cable Internet operators (MSOs).

………………………………………………………………………………………………….

CWA Calls Out AT&T’s broadband efforts:

Coincidently today, the Communications Workers of America (CWA) criticized AT&T’s lack of fiber deployments. The report, co-authored with the National Inclusion Alliance (NDIA) stated:

AT&T is making the digital divide worse and failing its customers and workers by not investing in crucial buildout of fiber-optic infrastructure that is the standard for broadband networks worldwide. The company’s recent job cuts — more than 40,000 since 2018 — are devastating communities and hobbling the company’s ability to meet the critical need for broadband infrastructure.

An in-depth analysis of AT&T’s network shows the company has made fiber available to fewer than a third of households in its footprint, halting most residential deployment after mid-2019. The analysis also shows that 28% of households in AT&T’s footprint do not have access to service that meets the FCC’s standard for high-speed internet, and in rural counties 72% of households lack this access. In some places, AT&T is decommissioning its outdated DSL networks and leaving customers with no option but wireless service, which is not a substitute for wireline service.

In all, AT&T has made fiber-to-the-home available for fewer than one-third of the households in its network. AT&T’s employees — many of whom are Communications Workers of America (CWA) members — know that the company could be doing much more to connect its customers to high-speed Internet if it invested in upgrading its wireline network with fiber. They know the company’s recent job cuts — more than 40,000 since 2018 — are devastating communities and hobbling the company’s ability to meet the critical need for broadband infrastructure.

CWA recommends that AT&T dedicate a substantial share of its free cash flow to investment in next-generation networks across rural and urban communities, make its low-income product offerings available widely, and stop laying off its skilled, unionized workers and outsourcing work to low-wage, irresponsible subcontractors.

Editor’s Note:

According to CWA, AT&T has deployed fiber-to-the-home (FTTH) to only 28% of the households in its fiber coverage area as of the end of June 30, 2019.

……………………………………………………………………………………………………………………………………………………………………………………………………..

The CWA/NDIA report said AT&T has targeted more affluent, non-rural areas for its fiber upgrades. Houses with fiber have a median income that’s 34% higher than those with DSL only. Across the rural counties in AT&T’s 21-state footprint, only a miniscule 5% have access to fiber, according to the report.

According to the report, 14.93 million—out of almost 53 million households—have access to AT&T’s fiber service. Among states, AT&T’s FTTH build out is the lowest in Michigan with 14% have access followed by Mississippi (15%) and Arkansas (16%).

“AT&T is also failing to make fiber available to the majority of its customer base in cities,” according to the report. “While most of AT&T’s fiber build has focused on urban areas—96 percent of households with access to fiber in AT&T’s footprint are in predominantly urban counties—the company hasn’t built enough fiber to reach the majority of urban residents. Seventy percent of households in urban counties still lack access to fiber from AT&T because the company has made fiber available to only 14.7 million households out of 48.4 million total households in these counties.”

The report also said there were many areas in AT&T’s footprint where it doesn’t offer the Federal Communications Commission’s “broadband” definition of 25 Mbps downstream and 3 Mbps upstream.

“For 28% of the households in its network footprint, AT&T’s internet service does not meet the FCC’s 25/3 Mbps benchmark to be considered broadband,” the report said. A key recommendation is that “AT&T must upgrade its network in rural communities to meet the FCC’s broadband definition, at least, and renew its efforts to deploy next-generation fiber.”

The report noted that in some areas where AT&T doesn’t provide faster speeds, cable operators, such as Comcast and Charter do.

“Even where that access is available from another provider—typically a cable provider—consumers are deprived of the benefits of competition in price, choice and service quality,” the report said.

…………………………………………………………………………………………………………

AT&T is counting on fiber for both residential and commercial services, including AT&T TV. In order to win over customers from cable operators, AT&T has paired its 1-Gig service with AT&T TV.

Regarding DSL, the report states: “AT&T’s poor maintenance of its DSL networks, with limited capacity for new connections, results in would-be new customers in some areas being denied service entirely or told they can only subscribe to fixed wireless service (a 4G wireless connection for home use, designed for rural areas).”

As expected, AT&T refuted the claims made in the CWA/NDIA report in a statement to FierceTelecom and Broadband World News on Monday afternoon.

“Our investment decisions are based on the capacity needs of our network and demand for our services. We do not ‘redline’ internet access and any suggestion that we do is wrong. We have invested more in the United States over the past 5 years (2015-2019) than any other public company. We have spent more than $125 billion in our U.S. wireless and wireline networks, including capital investments and acquisition of wireless spectrum and operations. Our 5G network provides high-speed internet access nationwide, our fiber network serves more 18 million customer locations and we continue to invest to expand both networks.”

……………………………………………………………………………………………………………………………………………………..

New Fiber Optics Market Report:

Finally, a new report by Technavio forecasts that the global fiber optics market size will grow by USD 2.44 billion during 2020-2024, progressing at a CAGR of almost 5% throughout the forecast period.

Image Credit: Technavio

The increase in the number of FTTH homes and subscribers is the key factor driving the market growth. A higher number of customers are opting for fiber optic connections to leverage broadband services. This reduces the requirements for customer premises equipment (CPE) and distribution point unit (DPU).

References:

https://cwa-union.org/sites/default/files/20201005attdigitalredlining.pdf

https://www.fiercetelecom.com/telecom/cwa-calls-out-at-t-s-lack-fiber-its-dsl-footprint

http://www.broadbandworldnews.com/document.asp?doc_id=764417

AT&T CEO: Fiber, Stories and (Video) Content to drive future revenues and growth

https://www.businesswire.com/news/home/20201005005444/en/

Arthur D Little: 10 countries provide >= 95% FTTH coverage; Gigabit Fiber driving take-up of new apps and services

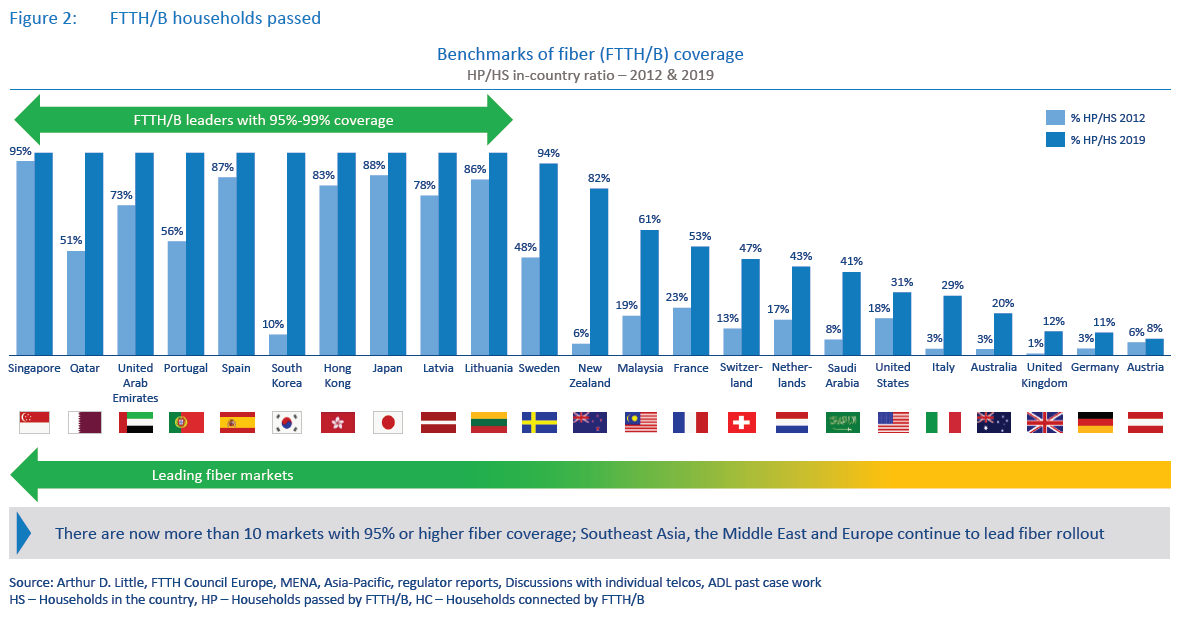

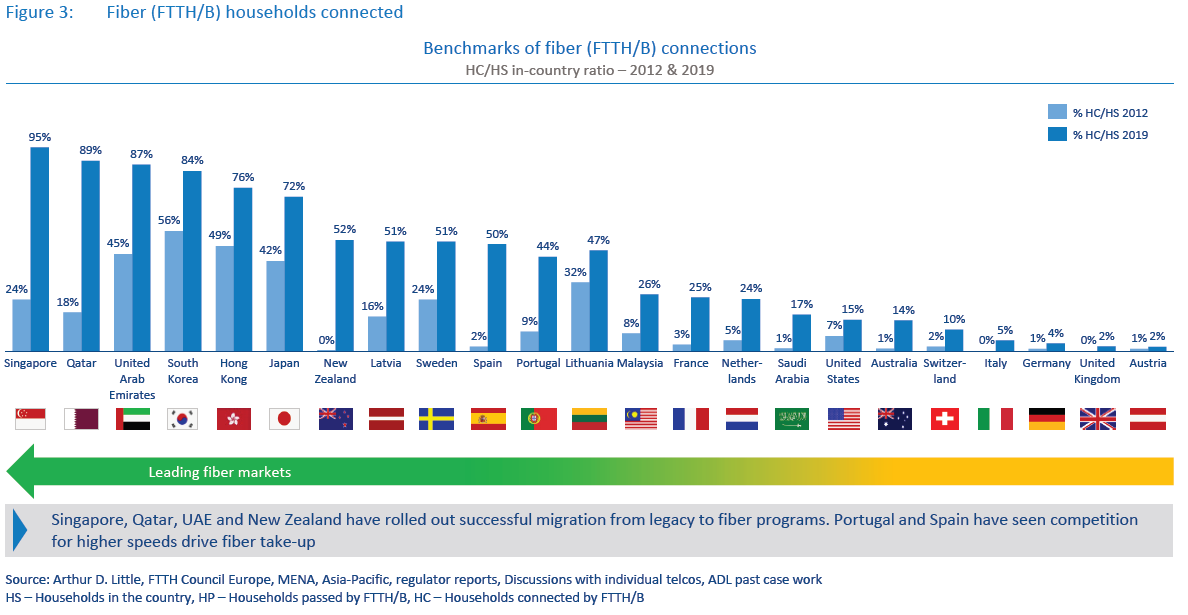

Gigabit broadband can be delivered using cable DOCSIS, fiber or other 5G-based technologies. This ADL report focuses on the rollout, take-up and services delivered with fiber -based gigabit broadband networks. ADL especially considers the developments made in fiber take-up and gigabit services enabled by fiber. See the previous edition of this study, “Race to gigabit fiber: Telecom incumbents pick up pace”4 for further details on which markets are taking the lead on fiber rollout and the deployment models used for it.

Non-telecom entities such as energy companies, railway operators and local municipalities are also entering the market, with large fiber rollout plans in fiber-lagging countries such as Italy, Germany and Austria, to bridge the gigabit broadband gap.With 5G deployment models crystallizing, operators are also considering 5G-based technologies to complement high-cost,

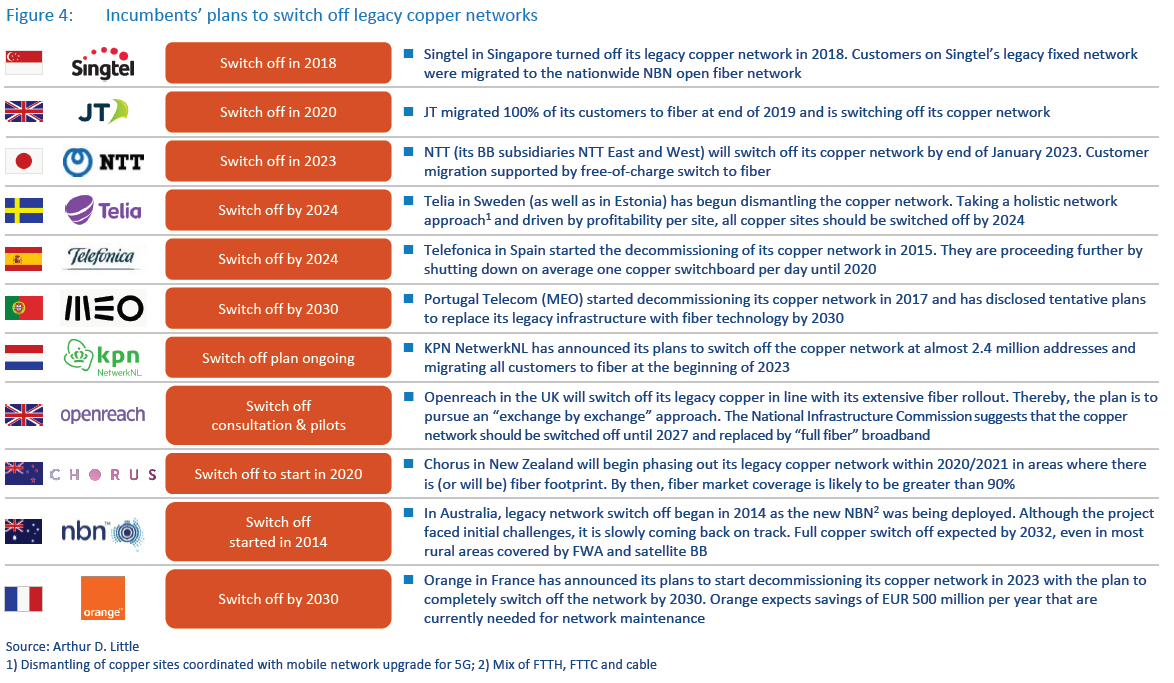

last-mile fiber access, especially in rural areas.While there were big improvements in fiber rollout from 2012 to 2017, take-up was still lagging behind, even though several markets invested large amounts of capex into nationwide fiber. However, we now see take-up rapidly improving, driven by both effective migration of legacy customers to fiber and competition driving demand for higher-speed broadband adoption at home.As the fiber coverage and take-up rates continue to grow, incumbents are increasingly announcing plans to switch off and dismantle their legacy copper networks. Singtel in Singapore turned off its copper network in 2018 and migrated its copper and cable subscribers to fiber, allowing the incumbent Singtel and cable company StarHub to switch off their copper and cable networks. Another example is JT Global in Jersey, which already migrated its entire fixed broadband customer base to fiber and will switch off the copper infrastructure in 2020. Operators in at least three other countries plan to completely migrate their customer base to fiber in the next four to five years (see Figure 4 below).

However, before decommissioning their legacy networks, telcos will need to overcome regulatory and other obstacles, such as providing an alternative to existing regulatory wholesale products and replacing some copper-specific B2B use cases with other technologies. With legacy network switch off, incumbents hope to achieve cost efficiencies especially in network operations. In recent projects, we estimate that fiber networks have up to a 15x lower fault rate and use up to 85 percent less energy compared to legacy copper-based networks.

Fiber is undoubtedly an advanced fixed broadband technology that can efficiently deliver multi-gigabit speeds to a large volume of customers in real-life conditions, especially in dense urban areas. Offering 1 Gbps plans has become the norm in the leading Asian fiber markets such as Singapore, Japan, South Korea and Hong Kong, opening the way for multi-gigabit tariffs.

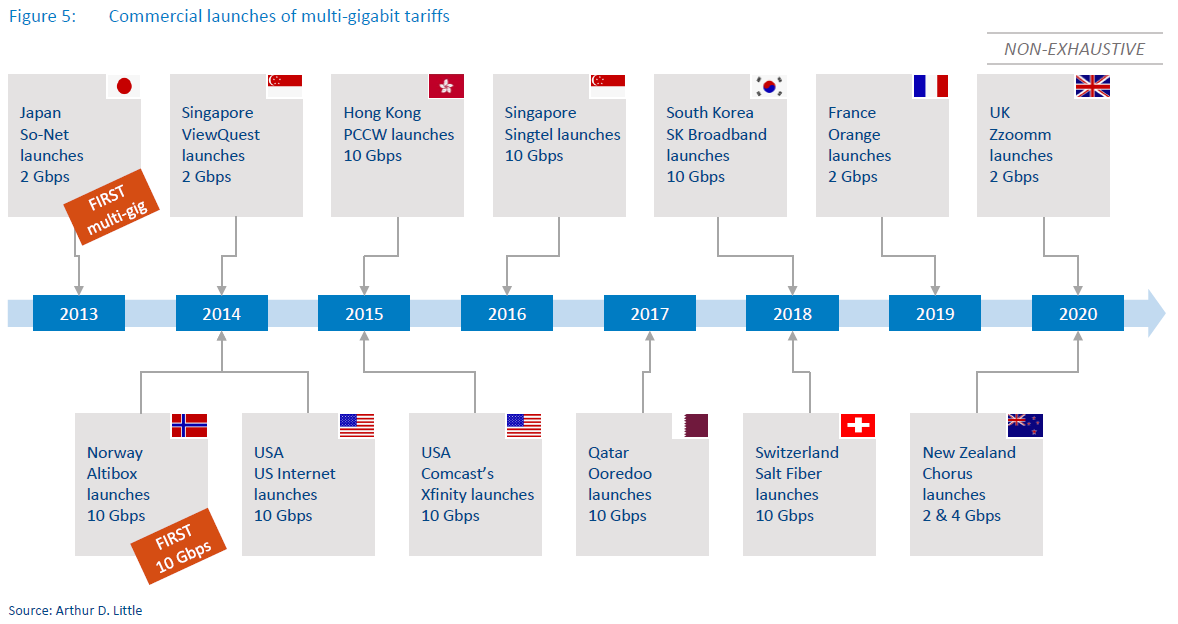

It has been more than five years since the first 10 Gbps plans were initially introduced in the US, Singapore, Hong Kong and Norway (see Figure 5. below). As of September 2020, we are not aware of any faster commercially available plan for the residential segment. Availability of multi-gigabit plans is still limited to a handful of markets and approximately 10-15 ISPs. However, just in the first half of 2020, there have been at least three ISPs that launched multi-gigabit offers: Zzoomm in the UK, Orange in France and Chorus in New Zealand.

Incumbent operator led deployments continue to play the leading role in fiber deployment today. However, we believe the importance of open access fiber providers will gain in significance, especially in important markets such as Italy, Germany, UK and Saudi Arabia, among others. Large-scale investment by non-telco entities such as energy companies and infrastructure funds, among others, will continue to expand fiber coverage in these markets. (For further details on open access fiber developments, please refer to our other report on this topic.)

An increasing number of incumbents acknowledge the inevitability of switching off and dismantling their legacy copper networks as fiber coverage becomes ubiquitous, while the cost economics of maintaining a fiber network are far superior to maintaining a legacy fixed network. Initiatives for legacy network switch off have been announced in multiple markets, and we expect to see results in larger markets such as Spain, France or Sweden soon. We also see regulators opening up to the idea that fiber-based solutions can eventually replace regulated legacy network–based products, giving a further impetus to open access fiber rollout in some regions.

Gigabit tariffs have become commonplace in developed fiber markets (mostly in Asia) and are increasingly being offered to customers worldwide. However, multi-gigabit speeds are still available only in a handful of markets. Salt in Switzerland is an example of a provider that uses its aggressively priced multigigabit offer to differentiate and disrupt the fiber market and not only as a marketing tool. We expect that, with new fiber rollouts and increasing competition on the broadband markets, the number of multi-gigabit offerings will continue to grow.

Note: This report, “The race to gigabit fiber,” is the 2020 update to Arthur D. Little’s Global FTTH study, published in 2010, 2013, 2016 and 2018.

……………………………………………………………………………………………………………………………………………………………………………………………………..

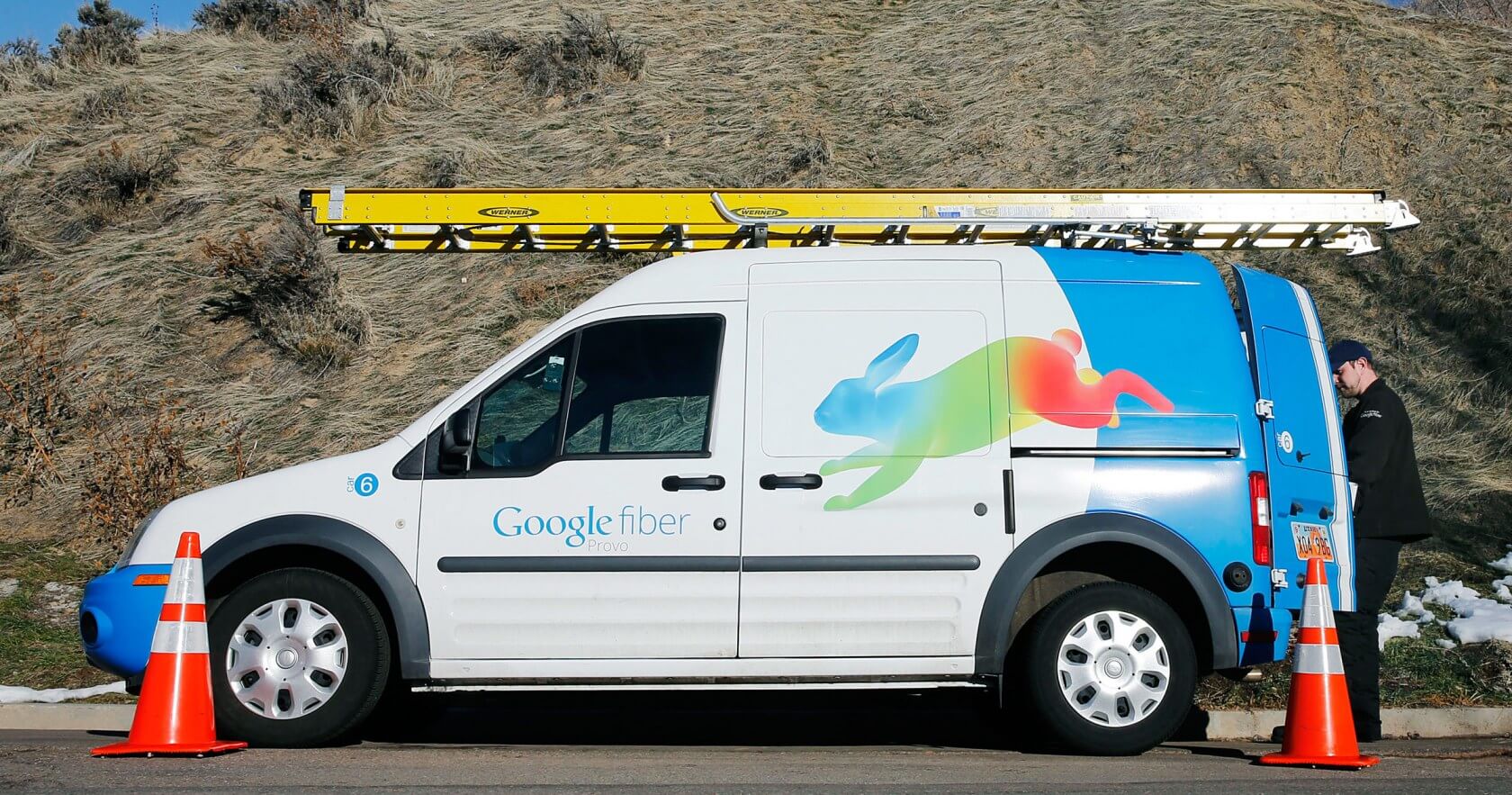

Google Fiber drops 100Mb/s; Goes ‘All In’ on 1 Gig Internet Access

Google’s affordable, high-speed Fiber internet service has been around for quite some time, but only in select areas of the U.S. As it continues its very slow expansion to more cities and regions, Google is looking to streamline its operations by eliminating one of its only two Fiber based Internet access subscription plans. Google Fiber is dropping its $50/month, 100Mb/s subscription for NEW CUSTOMERS. 100Mb/s FTTP has always been a slightly cheaper alternative to its 1 Gigabit plan, which is only $20 more at $70/month.

“Starting today, we’re recommitting to our roots. We’re going all in on a gig, just like we did all those years ago. We will no longer offer a 100Mbps plan to new customers,” Google said in a blog post. “We are excited to turn our attention back to our gig service, still offered for $70/month—the exact same price it cost back in 2012 when we first launched,” Google added.

Currently, the Fiber service is available in 18 U.S. cities: Atlanta, Georgia; Austin, Texas; Charlotte, North Carolina; Chicago, Illinois; Denver, Colorado; Huntsville, Alabama; Kansas City, Missouri; Miami, Florida; Nashville, Tennessee; Oakland, California; Orange County, California; Provo, Utah; San Antonio, Texas; San Diego, California; San Francisco, California; Salt Lake City, Utah; Seattle, Washington; and The Triangle, North Carolina.. Even in Fiber-connected cities, not every geographic area within the city will have access to the 1 Gig service.

“With increasingly connected homes and ever-improving technologies, speed is more important than any time in our history—and becoming more important every day. And with our fiber networks, we’re uniquely positioned to deliver it,” Google said. “You won’t have any data caps to interrupt even the most impressive binge-watching session. And with the power of a gig, you’re able to use all your connected devices at home at the same time,” the company added.

If Google Fiber sounds like the internet plan for you, please visit the Google units official website to check if your location is supported.

………………………………………………………………………………………………………………………………………………………………………………………………………….

In its seven-year lifespan, Google Fiber has never had a single price increase. Its straightforward, month-to-month (cancel any time) payment model has always been more attractive than what many competing services offer (many require a one year contract with huge cancellation fee).

Google Fiber’s ambitions are a lot more modest than they used to be. So the news applies to a pretty small percentage of Americans. Fiber scaled back its roll-outs in the mid-2000’s and had to pull out of Louisville, Kentucky earlier this year, following problems with its cable installations beneath the city’s roads. Google put the brakes on most of its expansion efforts, like in the author’s home town – Santa Clara, CA. Apparently, there were just too many hurdles, including the cost of expanding into certain areas, getting permission from the city councils, disputes over access to utility poles, and other challenges.

References:

Altice Portugal Interview: 10Gbps services to build the ultra-connected future

Interview of Alexandre Fonseca, CEO of Altice Portugal by Chris Kelly of Total Telecom

Portugal is one of the most ambitious nations in Europe with regards to FTTH penetration targets. How are you progressing with this and what challenges are you facing?

Due to the work developed by Altice Portugal in the last years, Portugal is today an international case study with proven experience in several countries, such as USA, France, Russia, New Zealand, India, the UK or Brazil, regarding FTTH projects. Altice Portugal presents one of the best and largest next generation network infrastructures, reaching 4.8 million of households in Optical Fiber, moving closer to the 2020 target of 5.3 million. This brings Portugal as one of the first countries in Europe to reach nearly 100% of the population. We deployed FTTH throughout the country, both in urban and rural areas, boosting the economic development and digital inclusion.

Despite the significant investment performed, it is important to underline that Portugal still awaits for a 5G Roadmap, regarding the availability of frequencies and licenses in order to launch 5G commercial networks. The country needs a clear strategy and vision for 5G, to continue to take the lead, as in previous technology generations of telecommunications.

Does Europe need to agree a single unified switch off date for its existing copper networks?

The optical fiber infrastructure is more robust and more reliable in technological terms, being more immune to adverse weather conditions, thefts or vandalism, with a much lower failure rate than the copper networks and, consequently having better operational responsiveness, besides the significantly better performance it brings to Services.

The replacement of copper by optical fiber, being a natural evolution both for technological and business reasons, depends on each country´s dynamics, not being determinant the existence of a single date for this to happen. However, this change is essential for Portugal to remain at the forefront of Europe and is also sustained by the fact that copper networks are obsolete and unable to support new innovative services. Optical fiber is undoubtedly the technology that makes it possible to offer a set of new future proof services and features that copper no longer supports. Altice Portugal has started a pilot project in parishes of six Portuguese municipalities that were 100% covered by fiber. The project contributes to digital inclusion growth, broadening access to advanced services, promoting economic development and modernization and of course, copper decommissioning.

With the emergence of new technologies, what scope is there for delivering 10Gbps services?

10Gbps services will help us build the ultra-connected future we all require. The predicted increase in number of devices and data volumes requires intelligent networks with a new level of speed and capacity. Homes with 50-100 connected devices will drive unprecedented demand. Now, life-changing technologies for connected health, augmented and virtual reality, will deliver incredible experiences and require significant speed, low latency and high capacity. 10Gbs services are becoming more crucial for the enterprise market, namely for data center access, data center interconnection and trunk circuits to collect high bandwidth traffic from data, video & voice under virtual private networks.

The launch of new technologies is not a goal in itself – what really matters is the experience provided by services and the added value for customers. That’s the world we are building, one in which everything is connected everywhere.

What role will fibre play in underpinning 5G mobile network rollout in Portugal?

5G technology is not simply about faster internet connections, it will bring huge changes in network architecture and services. It will enable a step change of ultrafast broadband connections, boosted by low latency, ultra-reliable communications, massive machine-type communications and slicing capabilities. The major characteristics introduced by 5G can be summarized in the Throughput, Latency and Density of the connections.

Fibre optics will be a key enabler of 5G, especially as a backhauling technology, once it provides the extremely high speeds, capacity and low latency required to connect each 5G station. FTTH rollout is a key differentiator for providing nationwide 5G coverage and Altice Portugal is ready and prepared for 5G rollout, with over 95% of its mobile stations already connected through fiber. Besides the FTTH deployment, Altice Portugal performed the first 5G live demonstration in a commercial network environment with pre-commercial terminals in July 2018 and the first live television broadcast in Portugal using the 5G network in real environment in June 2019.

How much of a game changer is 5G going to be in regard to IoT uptake?

5G will have a fundamental role boosting the era of smart connectivity, capable of taking advantage of unreachable response times with today’s technologies, to grant new scenarios of digital interactivity on multiple devices. 5G will reinforce applications for B2B, B2C and B2B2C markets, especially in areas as IoT, or IIoT, industrial automation and critical services, especially in Healthcare, Smart Grids, Smart cities, Industry 4.0 or Autonomous Vehicles, being a relevant factor in the development of the economy of each country and the world in general.

Altice Portugal has been exploring, for a long time, the opportunities related to IoT. In 2018 we opened the Golabs.IoT, a live technology Lab that generates synergies between developers, universities, startups and industry players.

Altice Labs, our R&D unit, also has projects in 5G and IoT landscape, with several national and international institutions, including Portuguese municipalities, such as the city of Aveiro, with 5G being available for the development of early adoption services for cities or citizens, on an open community enviroment.

What predictions do you have for the industry over the next 12-18 months?

Companies and businesses are undergoing a very important digital transformation process…the telecommunications sector is amongst the ones suffering the most, but also well positioned to have a leading role on this transformation.

We will surely see a transition´s process from automation to true digitalization. Digitalization has accelerated information production and distribution, innovation and process disruption, together with the integration of the physical and virtual worlds and the use of real time data. All this has a huge impact on organizational structures, business models, logistics operations and products and services themselves.

But this is not just a business-level transformation. This represents a social transformation, with new ways for people to relate themselves, to learn, to work and providing all equal access to technologies.

The process of digital transformation and technological development requires us to always innovate and our effort and commitment must be dedicated to always bring more and better services to the Portuguese.

We believe that the Smart Living concept will bring forward a set of new and combined technologies, for personal and business usage that will improve our live, generate the opportunity to save time and therefore improving our work life balance. Technology will continue to improve people’s life’s and business productivity, providing quality time to individuals, families and communities, turning content and experience the most relevant killers Apps in this new technology generation.

https://www.totaltele.com/503944/Altice-Portugal-10Gbps-services-will-help-us-build-the-ultra-connected-future-we-all-require

…………………………………………………………………………………………………………………………………………………………………………

Backgrounder:

Altice Portugal is the largest telecommunications service provider in Portugal. Since June 2, 2015, the company is a wholly owned subsidiary of Altice Group, a multinational cable and telecommunications company with a presence in France, Israel, Belgium, Luxembourg, Portugal, French West Indies/Indian Ocean Area, the Dominican Republic (“Overseas Territories”), Switzerland, and the United States. Its assets in Portugal were sold to Altice in 2015 per request of, Oi SA,[4] to reduce debt. The African assets were mostly sold for the same reason. Portugal Telecom, SGPS SA was split in separate companies: PT Portugal (now Altice Portugal) and Pharol (formerly PT SGPS), which owns a 27,5% stake in Oi.

The company owns MEO, the largest landline operator in Portugal. Its operating brands include MEO, a quadruple play service provider and SAPO, an ISP and producer of web content. Portugal Telecom also owns Altice Labs (formerly known as PT Inovação), an IT services and research and development company; PT Contact, focused in the business of managing contact centers.

Altice Portugal Building in São Jorge de Arroios

Reference:

CenturyLink CEO Jeff Storey: “Expanding our fiber footprint is major focus; Fiber beats wireless, whether it’s 5G or not”

CenturyLink wants to become the premier U.S. fiber-based provider for business customers, according to Jeff Storey, CenturyLink’s president, CEO, and former Level 3 CEO. Storey pledged to continue to aggressively expand its fiber footprint because fiber, he said, will ultimately beat out all other connectivity options in terms of performance, especially for next-generation use cases that are happening at the edge of the network. Two such edge computing customer examples were given (see below).

“Expanding our fiber is a major area of focus for us … Fiber beats twisted pair copper, hybrid fiber coax, and it beats wireless, whether it’s 5G or not, fiber wins,” Storey told investors during the telecom’s Q2 2019 earnings call on Wednesday evening, August 7th. Fiber is one way that CenturyLink plans to boost its Enterprise and Small and Medium Business revenues, executives said. From the Century Link earnings call transcript, Storey said:

As I mentioned last quarter, we added 4,500 new fiber-fed buildings to our on-net footprint in the first quarter of 2019. We continued that focus in the second quarter with the addition of approximately 5,000 new fiber-fed buildings. For contrast, Level 3 used to add something closer to 500 buildings per quarter, so I want to emphasize expanding our fiber footprint is a major area of focus for us.

We know that when we have a building on-net, our fiber based services provide a better, more reliable, and higher margin solution than competing infrastructure. [indiscernible] wireless whether that’s 5G or not, fiber wins. It’s highly flexible and increasing speeds, it is secure and really is the basis for all the other competing technologies. We just do one thing differently. We take fiber all the way to the customer, and customers always want fiber when they can get it. You can expect us to continue investing to expand the reach of our access fiber network.

Beyond just being a superior technology, though, fiber is well suited to meet the demands of emerging opportunities driven by artificial intelligence, machine learning, and big data applications. Fiber-based solutions are better able to satisfy what we see as four key market trends. The need for highly scalable capacity, now ranging into multi gigabits per second; the need for connecting and increasing number of widely distributed locations; the need for the network itself to protect the privacy and security of our customers; and finally, the need to move bandwidth intensive computing resources closer and closer to the edge to reduce latency and unnecessary backhaul of traffic.

Expanding our on-net building footprint certainly helps us meet these needs. But we’ve implemented a number of other initiatives to ensure CenturyLink maintains our position as the premier fiber based provider for enterprise customers.

Our North American subsea fiber routes are a unique asset, and as I said earlier, we believe it represents the world’s most scalable and efficient fiber network. However, we are further augmenting our capabilities. We also own an extensive and unparalleled conduit system that we leverage to bring the latest generation fiber capabilities to market with extraordinary speed and economic efficiency. Each of the long haul networks we’ve acquired Level 3, Qwest, WilTel, Broadwing all had multi conduit builds.

Within the Level 3 network alone, we built 12 conduits to ensure we had sufficient space to grow and evolve this capacity in fiber technology evolved. Most of those conduits are still available for further network augmentation. But we’ve also interconnected all of those conduit systems to cherry-pick the shortest and lowest latency pass across the country. As illustrated on slide five, we recently announced the deployment of Corning’s latest generation of ultra-low loss fiber to build the world’s best, most scalable optical infrastructure. This new technology enables higher capacity and more efficient optical design than earlier fiber technologies.

Coupled with the selecting the shortest physical path between any two endpoints, we also improved latency significantly, which is a key factor for hyper scalars, bandwidth intensive enterprises, and dark fiber customers. We’ve completed 3.5 million miles of our current plan to build a total of 4.7 million fiber miles with ultra-low loss fiber roughly 75%. We continue to see demand for additional routes, and we’ll consider those to meet future customer needs.

We recognized that access and long haul transport only part of the solution. There’s increasing demand for computing capabilities at the edge of the network, and we believe we’re uniquely positioned to capitalize on this market opportunity. In addition to our far-reaching fiber network, we operate a large number of edge locations that are well suited to enable edge computing. In the coming weeks. We expect to announce the details of our investments in our widely distributed and extremely well connected edge computing infrastructure.

Storey gave two examples of Edge Computing using Century Link’s scaleable fiber network:

Let me give you a specific example from a customer of what fiber-based edge computing capabilities can mean for them. Slide 6 shows an actual customer with close to 2,000 nationwide locations. We are working with this customer to evaluate the effectiveness of our edge computing solutions to more efficiently run applications and process huge amounts of data very close to the origin of that data. On this slide, you can see that our existing infrastructure is positioned within five milliseconds transport time for 95% of their sites. This means that the customers applications and data can be processed more efficiently from a 100 or so of our edge locations, rather than processed on premise at 2,000 separate sites, even worse with the customer or backhaul to a central location.

In addition, our dynamic networking capabilities can provide real-time network provisioning from the customer premise to our edge, and then onto major cloud service providers. This example is for a specific customer, but the results are indicative of what we see from other customers we are currently working with.

This application can be an important solution for retail, banking, and really anyone that has a number of dispersed service locations that need to process large amounts of data in real time. The combination of our fiber network with edge computing infrastructure and managed services support is a very powerful and differentiated service offering. We are not suggesting that edge computing will eliminate the need for today’s hybrid computing or hybrid networking. To the contrary, our customers will continue to build and operate their own data centers, continue to move compute resources to public data centers and specific applications to cloud service providers.

Our customers want to dynamically manage their network and put different types of workloads in different environments. Through our wide array of hybrid networking solutions. CenturyLink provides the flexibility to do so easily. CenturyLink enables this flexibility with services like dynamic connections, which allows our customers to make instantaneous changes to their network, capacity, and configuration, and our cloud application manager, which allows customers to manage their applications across hybrid cloud environments through a single seamless interface.

Our network was purpose built to enable us to expand at the lowest cost in the industry. That’s a big advantage. It allows us to go to market quickly and invest in these types of growth initiatives within the bounds of our ongoing capital plans. The sufficiency is demonstrated in our ability to invest in all of these initiatives as well as other growth opportunities within the scope of the capex outlook we provided for the full-year 2019.

I’ll give you another specific customer example of how investments in flexible scalable fiber-based connectivity are helping us win in the market. We recently won a contract provide secured cloud connectivity to the US Census Bureau for the upcoming 2020 census. We will formally announce this contract later this week. To support the Census Bureau’s objectives, to provide the best mix of timeliness, relevancy, quality, and cost for the data they collect and the services they provide, CenturyLink will help to collect the census digitally by providing the bureau with managed trusted internet protocol services or MTIPS at speeds of 40 gigabits and higher.

MTIPS, a managed security service that provides secure cloud-based connectivity, will support the online system that will be available to all households completing the 2020 survey. The solution also allows the Census Bureau to access the responses via secured-cloud applications for the first time. CenturyLink was selected by the Bureau due to our ability to meet their requirements for scalable connectivity and will play an integral role in helping the US Census go digital in the most secure, reliable, and cost effective way as it takes an important mission of completing the 2020 census.

The census is obviously a unique example, but that’s the point of hybrid networking solutions from CenturyLink. Our customers can enable the capabilities to address their particular need. This solution highlights our ability to provide scalable, flexible network solutions that we believe are defining the next generation of enterprise networking.

Enterprise networking, a segment that includes CenturyLink’s high-bandwidth data services, managed services and SD-WAN services, declined 1.2% and was at $1.50 billion during the carrier’s fiscal second quarter compared to $1.52 billion in 2018’s Q2. However, Storey said that the company expects enterprise revenues to rise during the second-half of the year.

Small and medium business sales fell 11 percent during the quarter to $736 million compared to $819 million in Q2 2018 despite CenturyLink trying to focus strategic IT services geared toward the small and medium business market. Neel Dev, CenturyLink’s executive vice president and CTO, said that SMB revenue declines are largely driven by legacy products, but that the carrier “feels confident” it can return to profitability by selling to more businesses on its on-net fiber footprint.

Lisa Miller, CenturyLink’s president of wholesale and indirect channels and alliances, is “committed” to selling to small and midsized businesses who were outside of the legacy CenturyLink footprint.

“Level 3 didn’t focus there because they weren’t the type of customer we focused on, CenturyLink never focused there because they didn’t have the network to sell to those types of customers,” Storey explained. “It’s now a great opportunity for us and we need to focus and drive toward new opportunities with these customers.”

Consumer revenues continued its downward trajectory, falling by 8.4 percent to $1.42 billion during the quarter compared to Q2 2018’s result of $1.54 billion. CenturyLink today generates three-quarters of its revenue from business customers. During the provider’s Q1 2019 earnings call, Storey revealed that it was considering shopping around its consumer business. The executive said that CenturyLink’s internal teams are making “good progress” with the review, but that it will be a lengthy and complex process. In the meantime, Storey said the company won’t modify consumer investments and will continue to transform the Consumer business unit.

………………………………………………………………………………………………………………………………………………………………………..

Financial Results:

For the quarter which ended on June 30, Monroe, La.-based CenturyLink reported net income of $371 million in Q2 2019, which increased 21 percent compared to last year’s result of $292 million. The company reported total revenue of $5.58 billion and diluted earnings per share of 35 cents, a decline of 5.4 percent compared to $5.90 billion and 27 cents per share in the year-ago quarter. CenturyLink’s revenue came in just slightly lower than Wall Street analysts’ estimate of $5.59 billion.

In the first half of 2019, CenturyLink grew adjusted EBITDA by 80 million compared to the first half of 2018, while revenue declined more than 600 million over the same period. This was driven in part by our focus on adding profitable revenue in de-emphasizing unprofitable lines of businesses, managing legacy product declines, along with synergies and our cost transformation initiatives.

Total revenue in the first quarter declined 5.5% to 5.58 billion. Quarter-over-quarter, total revenue declined 1.2% compared to the 2.3% sequential decline we saw last quarter. In the enterprise segment, revenue declined 1.2% both year over year and sequentially. This compares to a decline of 1.6% year over year and 2.2% sequentially in the first quarter 2019. SMB revenue decreased 10% year over year compared to a decline of 3.7% in the first quarter 2019.

Neel Dev: “The revenue declines on the SMB business are largely driven by legacy voice. We feel good about our ability to sell into our on-net building footprint with a large addressable market opportunity. Wholesale revenue decreased 8.8% year over year. As we referenced last year, in the second quarter 2018, wholesale revenue included a favorable dispute settlement with a large carrier. Sequentially, we saw a decline of 1.8% compared to a 3.4% decline last quarter.”

Broadband revenue for the second quarter 2019 grew 1.8% year over year which compares to growth of 1.4% last quarter, driven by our efforts to increase penetration in our competitive assets and investing in fiber.

Voice revenue on a year over year basis declined 13% this quarter compared to 12% last quarter. The decline in other revenue continues to be driven by our decision to de-emphasize our Prism video product. Regulatory revenue is down year over year due to the adoption of new lease accounting standard.

In summary, we remain focused on execution specifically on improving revenue trajectory for the second half of 2019, maximizing profitability and remain discipline on our cost transformation and deleveraging initiatives.

References:

https://www.crn.com/news/networking/centurylink-ceo-5g-or-not-fiber-wins-

AT&T Fiber Build-Out Ahead of Schedule; Moffett report on AT&T Fiber questions subscriber growth

AT&T Fiber Build-Outs:

For the first quarter 2019, AT&T reported 297,000 AT&T fiber customer gains and 45,000 broadband net adds, with broadband revenue growing more than 8%.

As part of its 2015 acquisition of DirecTV, the FCC required that AT&T expand its deployment of its high-speed, fiber-optic broadband internet service to 12.5 million customer locations, as well as to E-rate eligible schools and libraries, by July 2019.

Speaking Wednesday, June 5th at the Credit Suisse 21st Annual Communications Conference (see webcast url below), AT&T Communications CEO John Donovan said that AT&T now has a large inventory of fiber-based assets and that their fiber build-out has already reached 14.5 million customer locations.

…………………………………………………………………………………………………………

Editor’s Note:

Indeed, AT&T is offering fiber based internet in the SF Bay area via a KCBS radio commercial. However, they say availability is limited.

AT&T webcast url: https://event.webcasts.com/starthere.jsp?ei=1245728&tp_key=70a2932a9e&tp_special=8

…………………………………………………………………………………………………………

AT&T will be a bit slower in future fiber build-outs. Donovan said “We’ll continue to invest in fiber but we’ll do it based on the incremental, economic case. We’re not running to any household target.”

While it used to take AT&T 36 months to get fiber into roughly 30% of a market, AT&T can now reach 50% to 55% in 24 months time, according to Donovan.

“So I really like the cadence and the momentum that we’ve got in our brand, which is AT&T Fiber,” he said. “Where we have fiber we’re doing exceedingly well. Where we have slower speeds, sub 40 megabits per second, that’s where the majority of our churn is. But right now if you look at this year, we will add a million high-speed fiber broadband subs. And roughly two thirds of those come from cable. So we’re doing extremely well.”

AT&T’s pre-standard “5G” deployments, which will be launched in 29 cities by the end of the year, also benefit from the fiber build-out as fiber is needed for high bandwidth backhaul. Note yet again that an AT&T representative chairs ITU-R WP 5D where IMT 2020 (radio aspects) is being standardized.

……………………………………………………………………………………………………………..

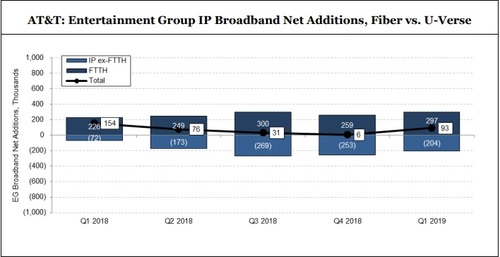

Moffett-Nathanson report: “U.S. Broadband: Where Are AT&T Fiber’s Subscriber Gains Coming From?“

However, LightReading says that the bulk of AT&T Fiber subscriber growth is coming from AT&T. AT&T Fiber’s subscriber base is growing rapidly. AT&T disclosed that AT&T Fiber — the expanding FTTP portion of its footprint capable of delivering speeds up to 1 Gbit/s — gained about 1.1 million subscribers over the past year, bringing the total AT&T Fiber subscriber base to about 3.1 million.

However, AT&T appears to be benefiting largely from speed upgrades from its existing high-speed Internet customers rather than by stealing share away from cable rivals, according to a new subscribers only analysis of the U.S. broadband market by MoffettNathanson titled “U.S. Broadband: Where Are AT&T Fiber’s Subscriber Gains Coming From?”

“The short answer appears to be… from AT&T itself,” wrote Craig Moffett, lead analyst with Moffett-Nathanson, surmising that the bulk of new AT&T Fiber subs are coming from the company’s own broadband subscriber base, usually in the form of upgrades or migrations of existing U-verse customers.

Moffet said AT&T’s broader “IP Broadband” category” — which includes AT&T Fiber and U-verse/fiber-to-the-neighborhood customers — has posted comparatively modest subscriber gains over the past year.

Source: Company reports, MoffettNathanson estimates and analysis

………………………………………………………………………………………………………….

“Therefore, unless AT&T’s U-verse broadband customers are suddenly fleeing for other providers in droves (unlikely), one obvious possibility is that many, or even most, of AT&T’s fiber gains are simply migrations of their existing customer base from one product to another,” Moffett explained, estimating that about 81% of AT&T Fiber net adds over Q1 2018 to Q1 2019 were migrations from U-verse.

Moffett said that migration story isn’t necessarily a surprising one. While the initial U-verse deployments in the early 2000s targeted some of the densest parts of the telco’s footprint, AT&T has predictably targeted FTTP deployments in many of the same dense areas, he added.

Also of note: AT&T Fiber’s base tier is $60 per month for a symmetrical 80 Mbit/s to 100 Mbit/s, the same as the U-verse standalone broadband product. “Even if a customer doesn’t really need faster upload speeds, if AT&T offers to upgrade a customer for no added cost why wouldn’t they switch?” Moffett asks.

And though AT&T Fiber subscribers appear to be largely coming way of upgrades or migrations of existing AT&T broadband subs, Moffett said that doesn’t mean that AT&T Fiber won’t have a bigger impact on competitors (like cable operators) eventually. “It’s just that it’s not having much impact yet,” he wrote, adding that AT&T Fiber’s expansion, expected to pass 14 million residential and small business locations by June 2019, remains a threat to cable that’s “worth watching.”

According to Moffett’s report, US MSOs added 1.04 million broadband subs in Q1, up from 962,000 in the year-ago quarter. US telcos added just 23,000 broadband subs in Q1 fueled by ongoing depletion of legacy DSL subs, but improved from a year-ago loss of 44,000 customers. The US satellite broadband sector, still a small player, added 15,000 subs in the quarter.

Combined, US broadband providers added 1.07 million subs in Q1 — a year-on-year growth rate of 2.9% — for a grand total of 107.81 million subs. Broken down by provider type, US cable led with 71.58 million, followed by the telcos (34.4 million) and satellite (1.82 million).