subsea cable

Google’s Bosun subsea cable to link Darwin, Australia to Christmas Island in the Indian Ocean

“Vocus is thrilled to have the opportunity to deepen our strategic network partnership with Google, and to play a part in establishing critical digital infrastructure for our region. Australia Connect will bolster our nation’s strategic position as a vital gateway between Asia and the United States by connecting key nodes located in Australia’s East, West, and North to global digital markets,” said Jarrod Nink, Interim Chief Executive Officer, Vocus.

“The combination of the new Australia Connect subsea cables with Vocus’ existing terrestrial route between Darwin and Brisbane, will create a low latency, secure, and stable network architecture. It will also establish Australia’s largest and most diverse domestic inter-capital network, with unparalleled reach and protection across terrestrial and subsea paths.

“By partnering with Google, we are ensuring that Vocus customers have access to high capacity, trusted and protected digital infrastructure linking Australia to the Asia Pacific and to the USA. “The new subsea paths, combined with Vocus’ existing land-based infrastructure, will provide unprecedented levels of diversity, capacity and reliability for Google, our customers and partners,” Nink said.

“Australia Connect advances Google’s mission to make the world’s information universally accessible and useful. We’re excited to collaborate with Vocus to build out the reach, reliability, and resiliency of internet access in Australia and across the Indo-Pacific region,” said Brian Quigley, VP, Global Network Infrastructure, Google Cloud.

Perth, Darwin, and Brisbane are key beneficiaries of this investment and are now emerging as key nodes on the global internet utilizing the competitive and diverse subsea and terrestrial infrastructure established by the Vocus network. Vocus will be in a position to supply an initial 20-30Tbps of capacity per fiber pair on the announced systems, depending on the length of the segment.

References:

Google’s Equiano subsea cable lands in Namibia en route to Cape Town, South Africa

Google’s Topaz subsea cable to link Canada and Japan

“SMART” undersea cable to connect New Caledonia and Vanuatu in the southwest Pacific Ocean

Telstra International partners with: Trans Pacific Networks to build Echo cable; Google and APTelecom for central Pacific Connect cables

HGC Global Communications, DE-CIX & Intelsat perspectives on damaged Red Sea internet cables

Orange Deploys Infinera’s GX Series to Power AMITIE Subsea Cable

NEC completes Patara-2 subsea cable system in Indonesia

SEACOM telecom services now on Equiano subsea cable surrounding Africa

Bharti Airtel and Meta extend 2Africa Pearls subsea cable system to India

China seeks to control Asian subsea cable systems; SJC2 delayed, Apricot and Echo avoid South China Sea

Intentional or Accident: Russian fiber optic cable cut (1 of 3) by Chinese container ship under Baltic Sea

Altice Portugal MEO signs landing party agreement for Medusa subsea cable in Lisbon

2Africa subsea cable system adds 4 new branches

Echo and Bifrost: Facebook’s new subsea cables between Asia-Pacific and North America

Equinix and Vodafone to Build Digital Subsea Cable Hub in Genoa, Italy

HGC Global Communications, DE-CIX & Intelsat perspectives on damaged Red Sea internet cables

Earlier this week, four underwater data cables were damaged in the Red Sea. Hong Kong telecom HGC Global Communications said about 25% of internet traffic in Asia, Europe, and the Middle East had to be rerouted.

There are more than 15 undersea internet cables in the Red Sea. To have four damaged at a single time is ”exceptionally rare,” HGC said in a separate earlier statement.

The disruption of the cables did not disconnect any country from the internet, but the Wall Street Journal reports service in India, Pakistan, and parts of East Africa was noticeably degraded.

No services have yet offered a reason for the cuts. Yemen’s telecom ministry denied speculation it was responsible for the failures, saying it was “keen to keep all telecom submarine cables…away from any possible risks.”

Underwater cables are responsible for most of the internet’s data traffic. They’re cheaper than land-based cables, but are prone to damage from ships’ anchors.

The ongoing conflict in the Middle East has experts wondering about the timing and severity of this outage, though. Iran-based Houthi has been particularly aggressive in the Red Sea, including in mid-February when a cargo ship was abandoned by its crew following an Houthi attack. The ship, which had weighed anchor, drifted for weeks before sinking.

According to U.S. officials, the anchor of the Rubymar, a UK-owned ship, likely severed three cables in the Red Sea on February 18, 2024. The Rubymar was struck by a Houthi missile on February 18, 2024, and sank after taking on water. As it was sinking, its anchor likely cut the cables that provide global telecommunications and internet data.

Houthi control of the region and the ongoing strife in Yemen makes repairing the damaged cables more complicated. One of the four companies affected said it expects to start that process early in the second quarter, though permit issues, weather, and the civil war in that country could impact that.

Statement by Dr. Thomas King, Chief Technology Officer, DE-CIX:

“As a global Internet Exchange (IX) operator, DE-CIX rents capacity on submarine cables in the Red Sea as part of its global network, which interconnects more than 50 IXs and Cloud Exchanges around the world. One of our data pathways from Asia to Europe makes use of the Asia-Africa-Europe 1 (AAE1) cable, one of three that were damaged in a recent incident. According to the information we have, the cause of the damage was the anchor of a freighter that the Houthi rebels had attacked. At some point, the crew abandoned the ship and dropped anchor so that the unmanned ship would not drift out of control. Unfortunately, the anchor did not hold, and the drifting wreck dragged the anchor across the seabed, rupturing the three affected lines before the ship finally sank.”

“From a telecommunications perspective, the Red Sea is a neuralgic point connecting Europe and Asia. DE-CIX has leased capacity on two separate submarine cables in the Red Sea, located several kilometers apart. We operate them in active-active mode, which means that the second cable is fully available if one should fail. The data is rerouted fully automatically, without manual intervention. As we monitor all of our systems automatically 24/7, we were alerted immediately to the failure of the connection. At the same time, the carrier that we rent our capacity from also informed us of the incident.”

“Given that we always work with redundant connections, the impact of the incident is not critical for DE-CIX customers. We share our capacities across multiple submarine cable routes worldwide and check the exact routes, including GPS coordinates, to ensure that these routes do not overlap at any point. We plan in such a way that we can fully compensate for the failure of at least one submarine cable, and we can always use different data pathways. We generally expect damage to submarine cables to take two to three months to repair because special ships are needed for this. In the meantime, we are also working to establish alternative redundancy channels.”

“In terms of the impact on Internet users in Europe and Asia, if Internet service providers and carriers have built their networks redundantly and therefore resiliently, Internet users should not experience any disruption. If Internet service providers choose a different risk scenario for cost reasons, for example, then even the failure of a single cable can lead to disruption for users/customers. Such a disruption is noticeable in the latency, i.e. the time it takes for the data to reach its destination. This could, for example, lead to the participants in a video conference interrupting each other because it takes too long for the spoken word to reach the other person.”

…………………………………………………………………………………………………………

Rhys Morgan, general manager and VP, media and networks, EMEA at Intelsat is seeing demand for satellite capacity as well.

“We’ve had reports from customers that they’re seeing a slowdown in some of their Internet connectivity,” he tells Capacity Media.

Morgan notes that disruption to data traffic passing through the Red Sea has been a concern for sometime due to the Houthi militants potential to target the infrastructure.

“It’s something we’ve been keeping an eye on more broadly over a long period of time,” he says. “We’ve been working with large customers to make sure that they’ve got a hybrid approach to networking.”

Morgan is keen to emphasise that a hybrid approach to networking is crucial in times of disruption, as seen this week.

Intelsat have implemented short-term services for customers that have suffered disruption in light of the cuts.

“As part of a hybrid network approach, customers will look for mission critical or highly sensitive communications to be passed through different means,” he explains. “Fibre may be their primary method, but satellite connectivity could be on standby as a backup”.

Satellite connectivity in its current form is not well enough equipped to completely replace the vast quantities of data that travel through subsea cables every day. But for certain types of data, the technology can offer a suitable alternative.

References:

https://fortune.com/2024/03/04/internet-cables-cut-red-sea/

https://www.networkcomputing.com/author/dr-thomas-king-cto-de-cix

“SMART” undersea cable to connect New Caledonia and Vanuatu in the southwest Pacific Ocean

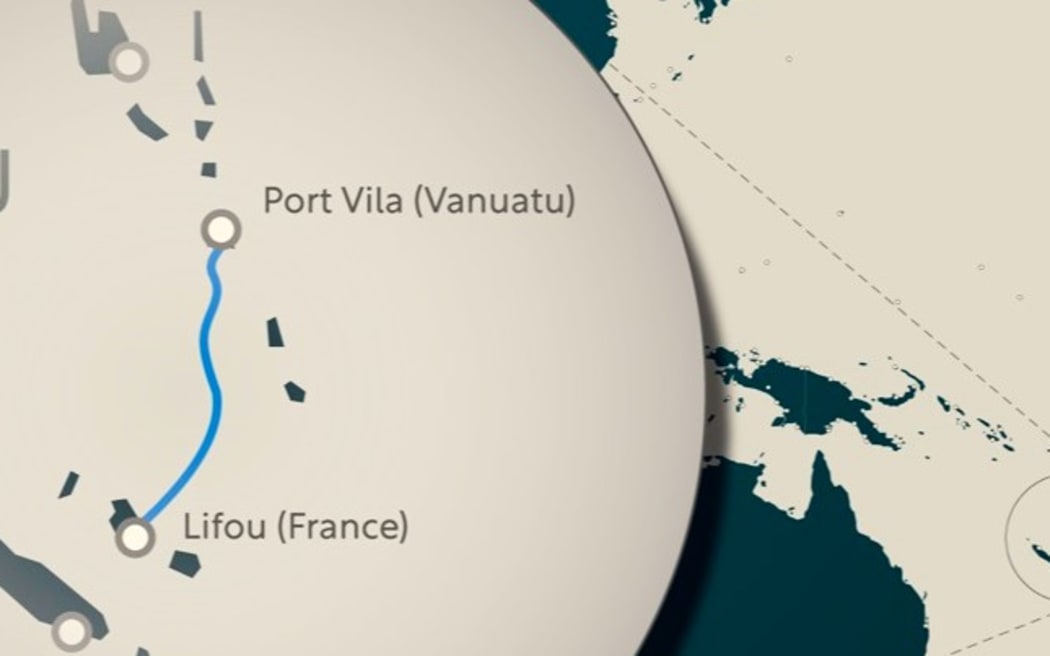

A new kind of multi-purpose “SMART” undersea cable is scheduled to connect New Caledonia (landing on Lifou Island, Loyalty Islands group) and Vanuatu (Port Vila) by 2026, a telecom joint venture has announced. The project ‘s partnership is between Vanuatu-based telecom and infrastructure company Prima and cable laying specialist Alcatel Submarine Networks, the two partners said in a release earlier this month. Other parties supporting the project are the government of Vanuatu, New Caledonia’s telecom company OPT (Office des Postes et Télécommunications) and the French government.

Described as a “world first,” the cable would provide telecommunications, but is also equipped with built-in “Climate Change Nodes”, sensors designed to feedback real-time data for tsunami and earthquakes monitoring. The “SMART” cable (for Science Monitoring And Reliable Telecommunications) is said to “symbolize the strength of international collaboration in addressing global challenges…merging telecommunications with environmental monitoring technologies…will substantially enhance the safety, connectivity, and scientific insight of the Pacific region.”

Vanuatu-New Caledonia first SMART cable system. Photo: Image Courtesy of ASN

The signing ceremony between partners took place during the recent Pacific Telecoms Council Meeting in Hawaii late January. The Pacific Peering website describes the project as follows:

“As part of the TAM TAM project, Pacific Peering will integrate the installation of a SMART cable between Port-Vila (Vanuatu) and Lifou (New Caledonia). This first world use of this technology in the New Hebrides fault will allow the study of a sensitive seismic zone and better protection of the 650,000 inhabitants directly exposed to the risks of tsunami and earthquakes. The data will be accessible without a license by the scientific community and civil protection. The data will be hosted in a data center in New Caledonia meeting the latest security and connection standards (redundancy, latency). This system of sensors integrated into telecommunications cables makes it possible to pool installation costs and thus reduce the CAPEX and OPEX of the seabed observation system. Our objective is to have all submarine cables equipped by 2030.”

“This groundbreaking project is set to provide not only a supplementary telecom cable to New Caledonia, extending to Australia and Fiji, but also a vital component in environmental monitoring. This innovative technology promises to revolutionize warning systems throughout the Pacific, enhancing security and preparedness against natural disasters,” the partners said.

References:

https://w.media/contract-signed-for-worlds-first-smart-cable-to-connect-vanuatu-and-new-caledonia/

Telstra International partners with: Trans Pacific Networks to build Echo cable; Google and APTelecom for central Pacific Connect cables

Orange Deploys Infinera’s GX Series to Power AMITIE Subsea Cable

NEC completes Patara-2 subsea cable system in Indonesia

SEACOM telecom services now on Equiano subsea cable surrounding Africa

China seeks to control Asian subsea cable systems; SJC2 delayed, Apricot and Echo avoid South China Sea

China plans $500 million subsea internet cable to rival US-backed project

Telstra International partners with: Trans Pacific Networks to build Echo cable; Google and APTelecom for central Pacific Connect cables

Telstra International, the global arm of leading telecommunications and technology company Telstra, and Trans Pacific Networks (TPN) have partnered to build the Echo cable, the first subsea cable to directly connect the U.S. to Singapore, creating a new route and delivering vital connectivity in the Trans-Pacific.

Echo’s subsea system is a unique express route connecting California, Jakarta, Singapore, and Guam. The system creates a new path and offers low latency, high-speed, resilient network infrastructure connecting South Asia to the US. The first Echo segments (Guam-US) will launch in mid-2024, with the remaining segments in 2025. Telstra will become TPN’s operating partner to provide secure, long-term stability on an efficient route.

In addition, Telstra will be delivering cable landing station services for Echo in Singapore and the Network Operations Centre services. XL Axiata is landing the cable in Indonesia and our partner for delivering services into Indonesia. Telstra International CEO said the geographical area the new cable would be built in was one of the more challenging regions globally in terms of regulation as well as subsea cable cuts. “Our subsea network scale makes Telstra International uniquely placed to successfully navigate the complexity of these environments to ensure the stability of the world’s digital connectivity,” said Roary Stasko, CEO Telstra International.

In the Trans-Pacific, demand for bandwidth is growing at one of the fastest rates in the world, with forecasts showing it will increase by 39% year on year until 2029[1]. As our lives become increasingly digital and new technologies like AI, IoT and cloud computing continue to evolve, bandwidth plays a critical role in supporting these and is set to soar further as the need for reliable, low latency connectivity grows to serve businesses and consumers.

“Trans Pacific Networks is thrilled to partner with industry leader Telstra to expand telecommunication access between the US and Asia. To be partially funded by the US International Development Finance Corporation, the Echo subsea cable system will be a critical element of the Indo-Pacific’s digital infrastructure, ultimately strengthening networks and increasing capacity while reducing internet costs in the region,” said Aaron Knapik, CFO TPN.

“The Trans-Pacific is a critical connection point to reach the US, and the geography of these regions means they will rely on new submarine cable routes like Echo for international connectivity. We’re delighted to partner with TPN to launch capacity via Echo which will significantly enhance the vital data demands of people and businesses and provide much needed diversity, resiliency and reliability which has become critical to keep our everyday lives connected.”

“We’re accelerating growth in our international digital infrastructure with investments in subsea fibre capacity on unique, diverse routes – helping to move more traffic around the world and strengthening connections from Asia to the US. Echo’s cable system has the ability to allow other countries to take advantage of its redundancy. In addition, we’ve recently added 3Tbps of capacity through the SEA-US cable connecting US mainland to Hawaii, Guam and Philippines which complements our existing Trans-Pacific cables like AAG, UNITY, FASTER, NCP and JUPITER,” Roary said.

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………

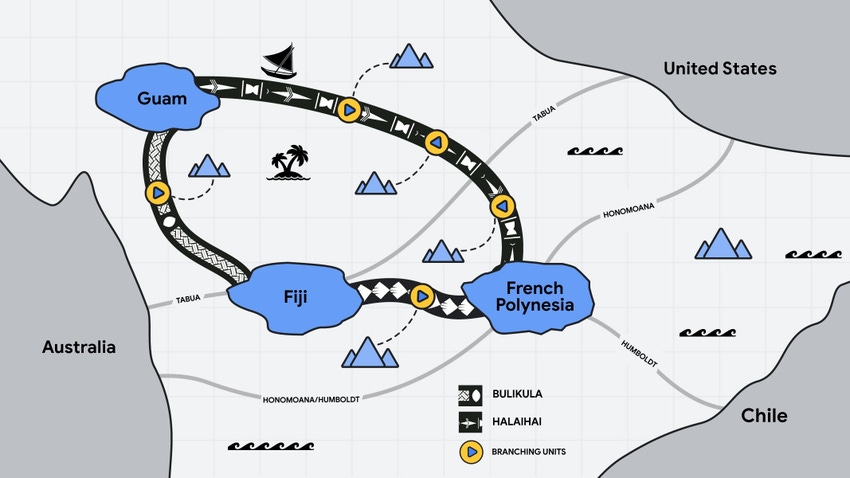

In addition, Telstra International will be partnering with Google and APTelecom to deliver the new central Pacific Connect initiative which will significantly uplift connectivity for people and businesses of the Pacific. The two cables – which make up the central Pacific Connect initiative – Bulikula will connect Guam and Fiji, and Halaihai will connect and Guam and French Polynesia.

Telstra will be one of the key telecommunications providers of central Pacific Connect and will own and operate a fiber pair on the core trunk on the Bulikula cable connecting Guam and Fiji. Bulikula is the Fijian word for “golden cowrie,” a rare shell found in the Pacific Ocean often worn by local chieftains as a badge of rank. The next step will be partnering with other carriers and governments to assist in building and operating branches to the Pacific islands. These branches will power access to vital digital services across the region and will improve network performance, redundancy and reliability.

Bulikula and Halaihai cable systems

“Telstra has decades of experience providing international connectivity in the Pacific, and with our network scale and local expertise, we are looking forward to partnering with Google and APTelecom to build reliable, high-performance connectivity for island countries. We’re committed to improving infrastructure across the region which will support the future growth of local economies,” said Roary Stasko, CEO Telstra International.

In addition, Telstra is partnering with Google on the Tabua cable which combined with the central Pacific Connect initiative, will dramatically improve the diversity of paths between Guam to Australia via Fiji and other Pacific islands, and between the US mainland and Australia.

About Telstra International:

Telstra is a leading telecommunications and technology company with a proudly Australian heritage and a longstanding, growing international business. Telstra International provides services to thousands of business, government, carrier and OTT customers. Over several decades we have established the largest wholly-owned subsea cable network in the Asia-Pacific, with a unique and diverse set of infrastructure that offers access to the most intra-Asia lit capacity. We empower businesses with innovative technology solutions including data and IP networks, and network application services such as managed networks, unified communications, cloud, industry solutions, integrated software applications and services. These services are underpinned by our subsea cable network, with licenses in Asia, Europe and the Americas and access to more than 2,000 Points of Presences (PoPs) in more than 200 countries and territories globally. In July 2022 Telstra completed the acquisition of Digicel Pacific, the largest mobile operator in the South Pacific region.

For more information, please visit www.telstra.com/global.

References:

https://www.telstra.com.au/aboutus/telstra-international

https://www.telecoms.com/fixed-networks/google-preps-for-more-island-hopping-with-telstra

Infinera trial for Telstra InfraCo’s intercity fiber project delivered 61.3 Tbps between Melbourne and Sydney, Australia

Telstra partners with Starlink for home phone service and LEO satellite broadband services

Orange Deploys Infinera’s GX Series to Power AMITIE Subsea Cable

Optical network equipment maker Infinera announced today that Orange deployed Infinera’s GX Series-based ICE6 “coherent optical engine” on its new AMITIE subsea cable, which is ready for service today from an end-to-end point of view and offers network operators unique and robust transatlantic connectivity with ultra-low latency.

Orange owns two pairs of fiber optic cables as part of the AMITIE subsea cable system, offering capacity up to 23 Tbp/s each.

………………………………………………………………………………………………………………..

Orange selected Infinera’s solution based on its industry-leading optical performance to offer up to 400 GbE services to its customers from the U.S. to France, and across its long-haul terrestrial backhaul network from Boston to New York and Le Porge to Bordeaux in France.

The sixth-generation Infinite Capacity Engine (ICE6), from Infinera’s Advanced Coherent Optical Engines and Subsystems, is a 1.6 Tb/s optical engine that delivers two independently programmable wavelengths at up to 800 Gb/s each. Utilizing a 7-nm CMOS process node DSP and advanced PIC technology, ICE6 leverages ultra-high baud rates, high modem SNR, and innovative features to break performance and spectral efficiency barriers, including 800G single-wavelength performance over 1000+ km in a commercial network.

Infinera’s ICE6- 800G Generation Optical Engine Photo credit: Infinera

………………………………………………………………………………………………………………..

Orange powers fully resilient global connectivity capability along the world’s busiest route, using two state-of-the-art subsea mega cables, Dunant and AMITIE, to connect France and the U.S. Deploying Infinera’s innovative ICE6 technology on the GX Series Compact Modular Platform enables Orange to keep pace with future generations of optical transmission technologies while maintaining a high level of performance for the next 20 years. This deployment also significantly reduces Orange’s energy cost per megabit and minimizes its carbon footprint.

“We are pleased to integrate Infinera’s industry-leading technology for the first time on one of our key transatlantic routes and terrestrial backhaul. With this future-proof technology, Orange is well-positioned to continue to be a major player in the global wholesale market, developing our infrastructure to connect continents together and delivering a unique, high-performance, and robust solution to our customers,” said Aurélien Vigano, VP International Transmission Network at Orange.

“Infinera is delighted to partner with Orange to deliver our innovative ICE6 solution across Orange’s critical subsea and terrestrial backhaul routes, offering network operators, wholesale carriers, and enterprise customers resilient and reliable global connectivity capability,” said Nick Walden, Senior Vice President, Worldwide Sales, Infinera.

References:

https://www.infinera.com/innovation/ice6-800g-wavelengths/

Infinera trial for Telstra InfraCo’s intercity fiber project delivered 61.3 Tbps between Melbourne and Sydney, Australia

Orange Telco Cloud to use Equinix Bare Metal to deliver virtual services with <10 ms latency

Intentional or Accident: Russian fiber optic cable cut (1 of 3) by Chinese container ship under Baltic Sea

A Russian fiber optic cable under the Baltic Sea was completely severed last month when a Chinese container ship passed over it, state company Rostelecom said on Tuesday.

Finnish investigators have already said they suspect the vessel, the NewNew Polar Bear, of causing serious damage to the nearby Balticconnector gas pipeline by dragging its anchor over the sea bed during the same voyage.

Two other Baltic telecoms cables were damaged on the same night of October 7th, along the route that the ship was travelling, according to shipping data reviewed by Reuters.

The incidents have highlighted the vulnerability of marine cables and pipelines at a time when security fears are running high because of the Ukraine war. Investigators have yet to establish who was responsible for blowing up Russia’s Nord Stream gas pipelines under the Baltic last year.

A Rostelecom spokesperson, responding to emailed questions from Reuters, said the double armored fiber optic cable, with a thickness of 40.4 mm (1.6 inches), had been cut completely.

Asked if the company believed the Chinese ship had caused the damage, the spokesperson said: “At the time of the damage to the fiber optic cable, the Chinese ship New Polar Bear was at a point with coordinates coinciding with the route of the communication line.”

China has said it is willing to provide necessary information on the incident in accordance with international law. NewNew Shipping, the owner and operator of the NewNew Polar Bear, has previously declined to comment when contacted by Reuters.

In a statement earlier on Tuesday, Rostelecom publicly acknowledged the damage to its cable for the first time, describing it as an accident and without mentioning the cause. It said the site of the damage was only 28 km (17 miles) from where the Balticconnector gas pipeline was ruptured soon afterwards.

In total, three Baltic telecoms cables and one pipeline were damaged in the space of less than nine hours.

Data from shipping intelligence firm MarineTraffic, reviewed by Reuters, showed that the New Polar Bear passed over a Swedish-Estonian telecoms cable at 1513 GMT, then over the Russian cable at around 2020 GMT, the Balticconnector at 2220 GMT and a Finland-Estonia telecoms line at 2349 GMT.

Rostelecom said the damage to its cable was recorded at 2030 GMT.

As far back as Oct. 13, President Vladimir Putin dismissed as “complete rubbish” suggestions that Russia might have been to blame for the Balticconnector damage and floated the possibility that a ship’s anchor could have caused it.

On Tuesday, the Kremlin referred further questions to the Communications Ministry, which did not respond to a Reuters request for comment.

Finnish police announced on Oct. 24 that they had found a ship’s anchor near the broken gas pipeline. They have not concluded whether the damage was caused accidentally or deliberately. Operator Gasgrid has said the pipeline could be out of commission until April or longer.

Rostelecom said a specialised vessel had started repairs on the fiber optic cable on Sunday and that the work was expected to take 10 days, depending on weather conditions.

The cable runs from St Petersburg to Russia’s Baltic exclave of Kaliningrad. The company said users had not been affected because data was transmitted via terrestrial routes and backup satellite channels.

References:

China seeks to control Asian subsea cable systems; SJC2 delayed, Apricot and Echo avoid South China Sea

Sabotage or Accident: Was Russia or a fishing trawler responsible for Shetland Island cable cut?

Geopolitical tensions arise in Asia over subsea fiber optic cable projects; U.S. intervened to flip SeaMeWe-6 contractor

Nokia Bell Labs claims new world record of 800 Gbps for transoceanic optical transmission

Nokia today announced it has set two new world records in submarine optical transmission, both of which will shape the next generation of optical networking equipment.

The first sets a new optical speed record for transoceanic distances. Nokia Bell Labs researchers were able to demonstrate an 800-Gbps data rate at a distance of 7865 km using a single wavelength of light. That distance is two times greater than what current state-of-the-art equipment can transmit at the same capacity and is approximately the geographical distance between Seattle and Tokyo. Nokia Bell Labs achieved this milestone at its optical research testbed in Paris-Saclay, France.

The second record was achieved by both Nokia Bell Labs and Nokia subsidiary Alcatel Submarine Networks (ASN), establishing a net throughput of 41 Tbps over 291 km via a C-band unrepeated transmission system. C-band unrepeated systems are commonly used to connect islands and offshore platforms to each other and the mainland proper. The previous record for these kinds of systems is 35 Tbps over the same distance. Nokia Bell Labs and ASN broke the record at ASN’s research testbed facility, also in Paris-Saclay.

Nokia Bell Labs and ASN presented the scientific findings behind both records on the 4th and 5th of October at the European Conference on Optical Communications (ECOC), held in Glasgow, Scotland.

Making lasers that blink faster:

Nokia Bell Labs and Alcatel Submarine Networks were able to achieve both world records through the innovation of higher-baud-rate technologies. “Baud” measures the number of times per second that an optical laser switches on and off, or “blinks”. Higher baud rates mean higher data throughput and will allow future optical systems to transmit the same capacities per wavelength over far greater distances. In the case of transoceanic systems, these increased baud rates will double the distance at which we could transmit the same amount of capacity, allowing us to efficiently bridge cities on opposite sides of the Atlantic and Pacific oceans. In the case of C-band unrepeated systems, higher baud would allow service providers connecting islands or off-shore platforms to achieve higher capacities with fewer transceivers and without the addition of new frequency bands.

The research behind these two records will have significant impact on the next generation of submarine optical transmission systems. While future deployments of submarine fiber will take advantage of new fiber technologies like multimode and multicore, the existing undersea fiber networks can take advantage of next-generation higher-baud-rate transceivers to boost their performance and increase their long-term viability.

Sylvain Almonacil, Research Engineer at Nokia Bell Labs, said: “With these higher baud rates, we can directly link most of the world’s continents with 800 Gbps of capacity over individual wavelengths. Previously, these distances were inconceivable for that capacity. Furthermore, we’re not resting on our achievement. This world record is the next step toward next-generation Terabit-per-second submarine transmissions over individual wavelengths.”

Hans Bissessur, Unrepeated Systems Group leader at ASN, said: “These research advances show that that we can achieve better performance over the existing fiber infrastructure. Whether these optical systems are crisscrossing the world or linking the islands of an archipelago, we can extend their lifespans.”

………………………………………………………………………………………………………………………….

According to TeleGeography, there were an estimated 1.4 million km of submarine cables in service globally at the start of 2023 and that number is rapidly increasing.

Recent highlights include Orange and ASN agreeing in July to construct the new Medusa cable system between multiple locations in North Africa and Southern Europe. In late September, Telecom Egypt agreed to extend Medusa all the way to the Red Sea.

On a slightly smaller scale, early last month, Telecom Italia Sparkle began offering commercial services on a stretch of the Blue cable system, linking Palermo with Genoa to Milan. It is part of the larger Blue and Raman system, being built in partnership with Google. Once completed, the Blue part will connect various locations on the Med – including Greece and Israel in addition to Italy – while the Raman part will connect Jordan, Saudi Arabia, Oman and eventually India.

Resources and additional information:

https://telecoms.com/524184/nokia-bell-labs-makes-submarine-cables-go-blinkin-fast/

NEC completes Patara-2 subsea cable system in Indonesia

NEC Corp. announced that the Patara-2 submarine cable system connecting multiple islands across Indonesia is complete and operational. This subsea cable is owned by Telkom Indonesia, the biggest digital telco company in Indonesia, which is strongly committed to accelerating the country’s digitalization.

The Patara-2 is a 100 Gigabit per second (Gbps) x 80 wavelengths (wl) x 2 fiber pairs (fp) optical fiber submarine cable system measuring approximately 1,200 kilometers. In addition to the existing Sulawesi Maluku Papua Cable System (SMPCS) and others in Indonesia provided by NEC, this new cable system enhances connectivity among the cities of Waisai, Manokwari, and Supiori.

NEC’s major supply record in Indonesia and the Patara-2 cable system

……………………………………………………………………………………………………………………..

“Both the Patara-2 and SMPCS cable systems enable the network in the north of Papua to have a redundant configuration, providing highly reliable communications in Papua,” said Herlan Wijanarko, Director of Network & IT Solutions, Telkom.

“NEC, in cooperation with NEC Indonesia, is honored to provide advanced connectivity among Indonesian cities, and has been involved in a variety of submarine cable projects for Telkom since 1991, including IGG and SMPCS,” said Atsushi Kuwahara, Managing Director, Submarine Network Division, NEC Corporation. “We have laid more than 10 submarine cable systems in the region and are proud to continue contributing to the expansion of Indonesia’s connectivity.”

NEC has been a leading supplier of submarine cable systems for more than 50 years, and has built more than 400,000 km of cable, spanning the earth nearly 10 times. NEC is well-established as a reliable partner in the submarine cable field as a system integrator that provides all aspects of submarine cable operations, including the manufacture and installation of optical submarine cables and repeaters, provision of ocean surveys and route designs, delivery, training and testing. NEC subsidiary OCC Corporation manufactures optical submarine cables capable of withstanding water pressures at ocean depths beyond 8,000 meters.

Also, NEC recently completed a long-distance field trial on the IGG cable system owned by Telkom Indonesia. The trial involved using NEC’s latest XF3200 transponder, which the Japanese cable manufacturer says has the world’s highest level of transmission performance at 800 Gbit/s.

References:

https://www.nec.com/en/press/202310/global_20231002_01.html

https://www.telkom.co.id/sites

https://www.lightreading.com/cable-technology/nec-completes-indonesia-s-new-subsea-cable-system

Geopolitical tensions arise in Asia over subsea fiber optic cable projects; U.S. intervened to flip SeaMeWe-6 contractor

Multimillion-dollar undersea/subsea fiber optic cable projects have become the latest focal point of geopolitical tensions in Asia as China intensifies its highly contested claims over the South China Sea, writes Nikkei Asia’s Singapore correspondent Tsubasa Suruga. These cables are crucial for keeping information flowing throughout the region and across the Pacific. Most countries require builders to get approval if they plan to lay cables in their territorial waters, but not in their exclusive economic zones, which extend 200 nautical miles out from a country’s coast.

China, however, insists that projects within its self-proclaimed “nine-dash line” — an area encompassing virtually the entire South China Sea — need Beijing’s approval. A nonobjection letter must be obtained from China’s People’s Liberation Army before the formal application process can even begin. Beijing imposes the policy even though an international tribunal found in 2016 that the nine-dash line lacked a legal basis.

“It is no secret the whole industry is more confronted by politics,” said Takahisa Ohta, senior director of the submarine network division at NEC, one of the world’s top three suppliers of subsea cables. Some of the companies involved, like Singtel, are looking for ways to diversify their routes.

Tay Yang Hwee, a 30-year industry veteran who heads subsea cable development at the Singaporean telecom provider, said it is “exploring alternate paths” for connecting data hubs, but he admits it is “very difficult” to avoid the South China Sea as a whole.

The Singapore-to-France cable would have been HMN Tech’s biggest such project to date, cementing it as the world’s fastest-rising subsea cable builder, and extending the global reach of the three Chinese telecom firms that had intended to invest in it.

But the U.S. government, concerned about the potential for Chinese spying on these sensitive communications cables, ran a successful campaign to flip the contract to SubCom through incentives and pressure on consortium members. It’s one of at least six private undersea cable deals in the Asia-Pacific region over the past four years where the U.S. government either intervened to keep HMN Tech from winning that business, or forced the rerouting or abandonment of cables that would have directly linked U.S. and Chinese territories.

SubCom had no comment on the SeaMeWe-6 battle, and HMN Tech did not respond to requests for comment. In a statement last year about infrastructure projects, the White House briefly noted that the U.S. government helped SubCom to win the Singapore-to-France cable contract, without giving details. China’s foreign ministry did not respond to requests for comment. China Telecom, China Mobile, China Unicom and Orange did not respond to requests for comment. Microsoft declined to comment.

Undersea cables are central to U.S.-China technology competition. Across the globe, there are more than 400 cables running along the seafloor, carrying over 95% of all international internet traffic, according to TeleGeography, a Washington-based telecommunications research firm. These data conduits, which transmit everything from emails and banking transactions to military secrets, are vulnerable to sabotage attacks and espionage, a U.S. government official and two security analysts told Reuters.

The potential for undersea cables to be drawn into a conflict between China and self-ruled Taiwan was thrown into sharp relief last month. Two communications cables were cut that connected Taiwan with its Matsu islands, which sit close to the Chinese coast. The islands’ 14,000 residents were disconnected from the internet.

Taiwanese authorities said they suspected a Chinese fishing vessel and a Chinese freighter caused the disruption. However, they stopped short of calling it a deliberate act and said there was no direct evidence showing the Chinese ships were to blame. China, which considers Taiwan a breakaway province, has ratcheted up military and political efforts to force the island to accept its dominion.

China plans $500 million subsea internet cable to rival US-backed project

Reuters reports that China state-owned telecom firms are developing a $500 million undersea fiber-optic internet cable network that would link Asia, the Middle East and Europe to rival a similar U.S.-backed project, four people involved in the deal told Reuters. The plan is a sign that an intensifying tech war between Beijing and Washington risks tearing the fabric of the internet.

China’s three main carriers – China Telecommunications Corporation (China Telecom), China Mobile Limited and China United Network Communications Group Co Ltd(China Unicom) – are mapping out one of the world’s most advanced and far-reaching subsea cable networks, according to the four people, who have direct knowledge of the plan.

Known as EMA (Europe-Middle East-Asia), the proposed cable would link Hong Kong to China’s island province of Hainan, before snaking its way to Singapore, Pakistan, Saudi Arabia, Egypt and France, the four people said. They asked not to be named because they were not allowed to discuss potential trade secrets.

The cable, which would cost approximately $500 million to complete, would be manufactured and laid by China’s HMN Technologies Co Ltd, a fast-growing cable firm whose predecessor company was majority-owned by Chinese telecom giant Huawei Technologies Co Ltd, the people said.

They said HMN Tech, which is majority-owned by Shanghai-listed Hengtong Optic-Electric Co Ltd, would receive subsidies from the Chinese state to build the cable.

China Mobile, China Telecom, China Unicom, HMN Tech, and Hengtong did not respond to requests for comment.

The Chinese foreign ministry said in a statement to Reuters that it “has always encouraged Chinese enterprises to carry out foreign investment and cooperation” without commenting directly on the EMA cable project.

News of the planned cable comes in the wake of a Reuters report last month that revealed how the U.S. government, concerned about Beijing eavesdropping on internet data, has successfully thwarted a number of Chinese undersea cable projects abroad over the past four years. Washington has also blocked licenses for planned private subsea cables that would have connected the United States with the Chinese territory of Hong Kong, including projects led by Google LLC, Meta Platforms, Inc and Amazon.com Inc.

Undersea cables carry more than 95% of all international internet traffic. These high-speed conduits for decades have been owned by groups of telecom and tech companies that pool their resources to build these vast networks so that data can move seamlessly around the world.

But these cables, which are vulnerable to spying and sabotage, have become weapons of influence in an escalating competition between the United States and China. The superpowers are battling to dominate the advanced technologies that could determine economic and military supremacy in the decades ahead.

The China-led EMA project is intended to directly rival another cable currently being constructed by U.S. firm SubCom LLC, called SeaMeWe-6 (Southeast Asia-Middle East-Western Europe-6), which will also connect Singapore to France, via Pakistan, Saudi Arabia, Egypt, and half a dozen other countries along the route.

The consortium on the SeaMeWe-6 cable – which originally had included China Mobile, China Telecom, China Unicom and telecom carriers from several other nations – initially picked HMN Tech to build that cable. But a successful U.S. government pressure campaign flipped the contract to SubCom last year, Reuters reported in March.

The U.S. blitz included giving millions of dollars in training grants to foreign telecom firms in return for them choosing SubCom over HMN Tech. The U.S. Commerce Department also slapped sanctions on HMN Tech in December 2021, alleging the company intended to acquire American technology to help modernize China’s People’s Liberation Army. That move undermined the project’s viability by making it impossible for owners of an HMN-built cable to sell bandwidth to U.S. tech firms, usually their biggest customers.

China Telecom and China Mobile pulled out of the project after SubCom won the contract last year and, along with China Unicom, began planning the EMA cable, the four people involved said. The three state-owned Chinese telecom firms are expected to own more than half of the new network, but they are also striking deals with foreign partners, the people said.

The Chinese carriers this year signed separate memoranda of understanding with four telecoms, the people said: France’s Orange SA, Pakistan Telecommunication Company Ltd (PTCL), Telecom Egypt and Zain Saudi Arabia, a unit of the Kuwaiti firm Mobile Telecommunications Company K.S.C.P.

The Chinese companies have also held talks with Singapore Telecommunications Limited, a state-controlled firm commonly known as Singtel, while other countries in Asia, Africa and the Middle East are being approached to join the consortium as well, the people involved said.

Orange declined to comment. Singtel, PTCL, Telecom Egypt and Zain did not respond to requests for comment.

American cable firm SubCom declined to comment on the rival cable. The Department of Justice, which oversees an interagency task force to safeguard U.S. telecommunication networks from espionage and cyberattacks, declined to comment about the EMA cable.

A State Department spokesperson said the U.S. supports a free, open and secure internet. Countries should prioritize security and privacy by “fully excluding untrustworthy vendors” from wireless networks, terrestrial and undersea cables, satellites, cloud services and data centers, the spokesperson said, without mentioning HMN Tech or China. The State Department did not respond to questions about whether it would mount a campaign to persuade foreign telecoms not to participate in the EMA cable project.

The Chinese foreign ministry said in its statement that it was opposed to the United States’ “violation of established international rules” around submarine cable cooperation.

“The U.S. should stop fabricating and spreading rumours about so-called ‘data surveillance activities’ and stop slandering and smearing Chinese companies,” the statement said.

Large undersea cable projects typically take at least three years to move from conception to delivery. The Chinese firms are hoping to finalize contracts by the end of the year and have the EMA cable online by the end of 2025, the people involved said.

The cable would give China strategic gains in its tussle with the United States, one of the people involved in the deal told Reuters.

Firstly, it would create a super-fast new connection between Hong Kong, China and much of the rest of the world, something Washington wants to avoid. Secondly, it gives China’s state-backed telecom carriers greater reach and protection in the event they are excluded from U.S.-backed cables in the future.

“It’s like each side is arming itself with bandwidth,” one telecom executive working on the deal said.

The construction of parallel U.S.- and Chinese-backed cables between Asia and Europe is unprecedented, the four people involved in the project said. It is an early sign that global internet infrastructure, including cables, data centers and mobile phone networks, could become divided over the next decade, two security analysts told Reuters.

Countries could also be forced to choose between using Chinese-approved internet equipment or U.S.-backed networks, entrenching divisions across the world and making tools that fuel the global economy, like online banking and global-positioning satellite systems, slower and less reliable, said Timothy Heath, a defense researcher at the RAND Corporation, a U.S.-based think tank.

“It seems we are headed down a road where there will be a U.S.-led internet and a Chinese-led internet ecosystem,” Heath told Reuters. “The more the U.S. and Chinese disengage from each other in the information technology domain, the more difficult it becomes to carry out global commerce and basic functions.”

Antonia Hmaidi, an analyst at the Berlin-based Mercator Institute for China Studies, said the internet works so well because no matter where data needs to travel, it can zip along multiple different routes in the time it takes to read this word.

Hmaidi said if data has to follow routes that are approved in Washington and Beijing, then it will become easier for the United States and China to manipulate and spy on that data; internet users will suffer a degradation of service; and it will become more difficult to interact or do business with people around the world.

“Then suddenly the whole fabric of the internet doesn’t work as it was intended,” Hmaidi said.

The tit-for-tat battle over internet hardware mirrors the conflict taking place over social media apps and search engines created by U.S. and Chinese firms.

The United States and its allies have banned the use of Chinese-owned short video app TikTok from government-owned devices due to national security concerns. Numerous countries have raised fears about the Chinese government gaining access to the data that TikTok collects on its users around the world.

China, meanwhile, already restricts what websites its citizens can see and blocks the apps and networks of many Western technology giants, including Google, YouTube, Facebook and Twitter.