Frontier Communications

Frontier Communications sets another fiber buildout record; raises FTTP buildout target for 2022

Frontier Communications reported better than expected 2nd quarter 2022 results on Friday. Operating income was $166 million and net income was $101 million for the 2nd quarter 2022. Adjusted EBITDA was $535 million, representing sequential growth of 5.1% from the first quarter of 2022, driven by the sequential increase in Consumer revenue, accelerating cost reductions, and a one-time $8 million sales tax refund. Adjusted EBITDA declined from $628 million in the second quarter of 2021 primarily due to subsidy-related revenue declines, partially offset by lower operating expenses and cost savings initiatives.

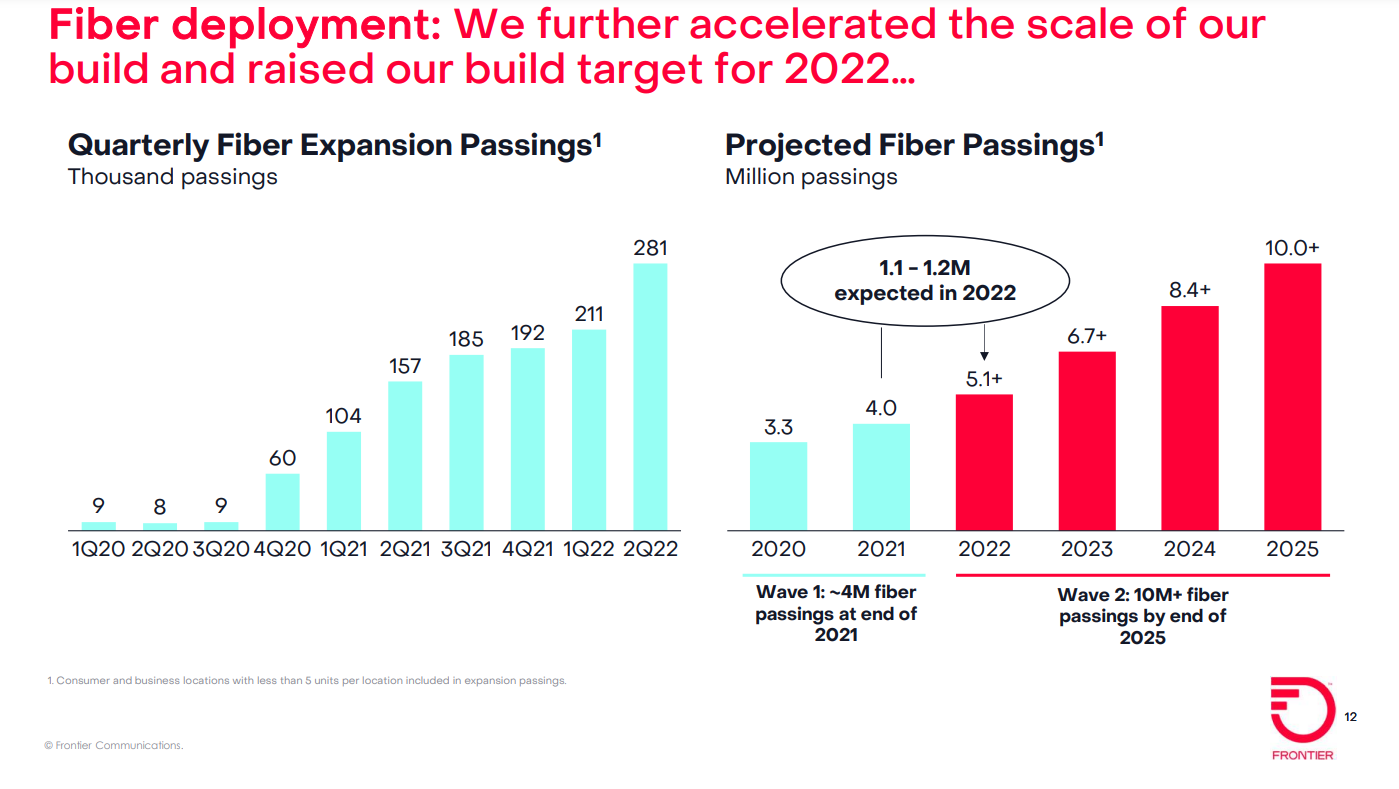

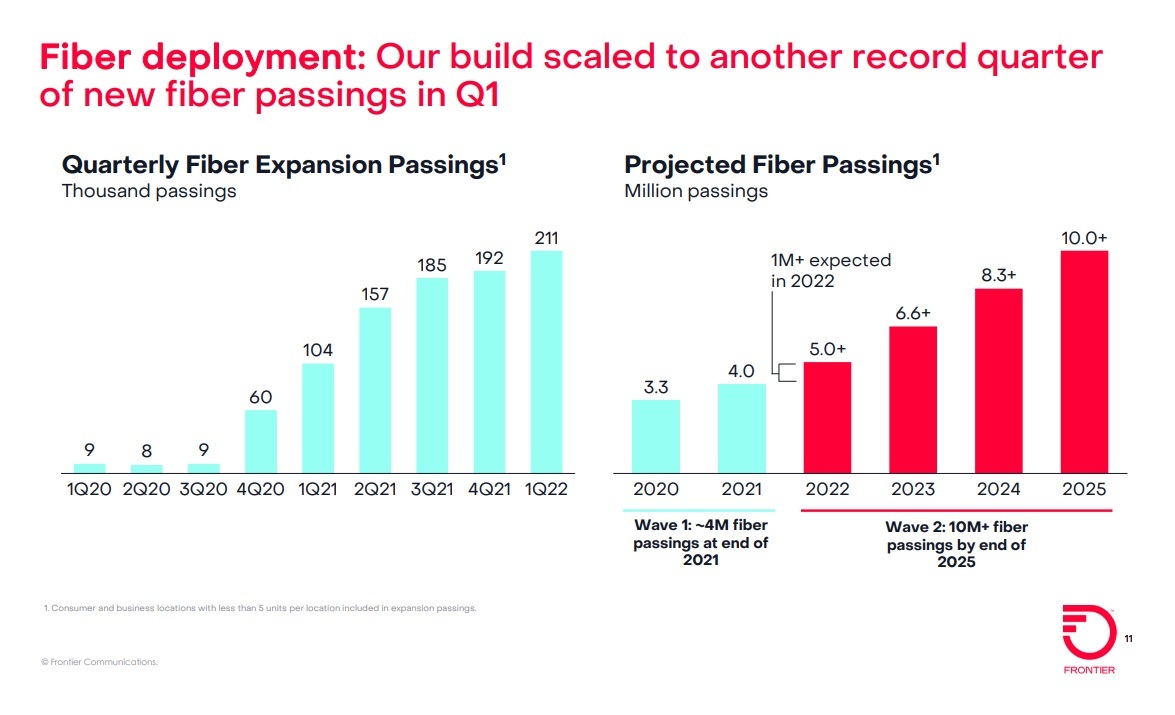

The fiber facilities based telco set another fiber network buildout record in the second quarter of 2022. Frontier also raised its fiber-to-the-premises (FTTP) buildout target for the full year to a range of 1.1 million to 1.2 million locations, up 10% to 20% from an earlier target of about 1 million locations.. Capital expenditures were $641 million, an increase from $385 million in the second quarter of 2021, as fiber expansion initiatives accelerated. Frontier’s fiber network passed 4.4 million locations (out of a total fiber footprint of 15 million locations covering parts of 25 states), a marker on the way to a grander plan to build FTTP to at least 10 million locations by 2025.

“Frontier is Building Gigabit America. We are deploying fiber and connecting people to the digital society at a record pace,” said Nick Jeffery, President and Chief Executive Officer of Frontier. “We have the second-largest fiber build in the country and this expansion is unlocking new opportunities to meet increased consumer demand for blazing-fast fiber broadband while driving efficiencies across our business.”

Mr. Jeffery continued, “In the second quarter, we saw the impact of our operational success translate into financial growth, and we delivered sequential EBITDA growth ahead of schedule. Our team’s operational discipline over the last year has improved Frontier’s financial trajectory and positioned us as the preferred digital partner for customers across our footprint.”

Second-quarter 2022 Highlights:

- Built fiber to a record 281,000 locations

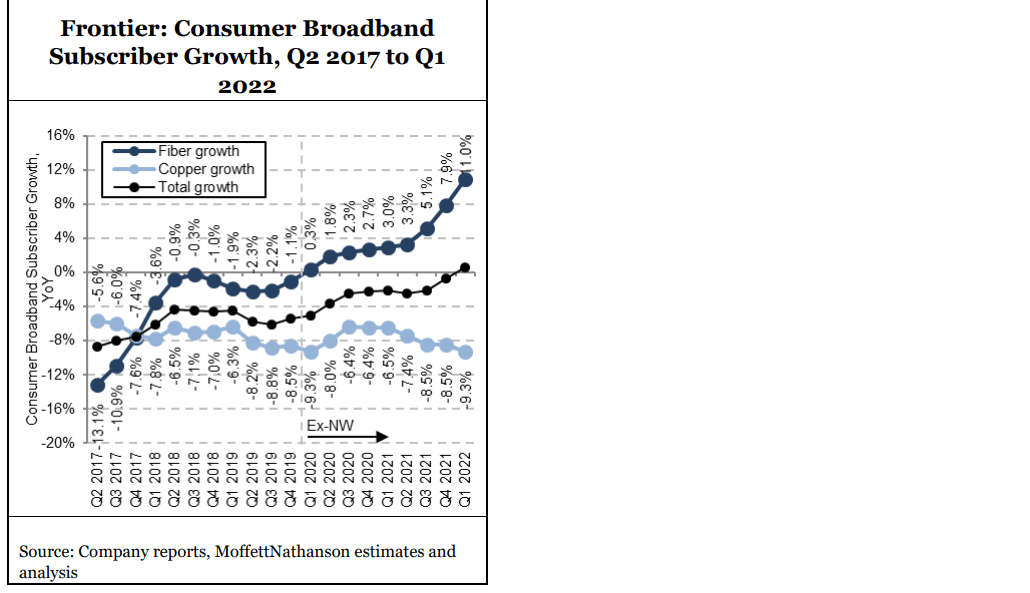

- Added 54,000 fiber broadband customer net additions, resulting in fiber broadband customer growth of 13.4% compared with the second quarter of 2021

- Revenue of $1.46 billion, net income of $101 million, and Adjusted EBITDA of $535 million

- Capital expenditures of $641 million, including $325 million of non-subsidy-related build capital expenditures

- Net cash from operations of $229 million, driven by healthy operating performance and increased focus on working capital management

- Raised $1.20 billion of debt in May, contributing to liquidity of approximately $3.70 billion

Frontier was able to accelerate its Q2 fiber buildout and expand its full 2022 target in the face of a “challenging supply chain and macroeconomic environment,” Jeffery said on the company’s Q2 earnings call on Friday August 5th. Jeffery noted that Frontier has diversified its fiber build into six additional states and plans to be building in at least 12 states by the end of the year. “This geographic diversity expands our opportunity to build fiber and provides redundancy for maintaining our build pace,” he said. Frontier is pairing that with additional contracts for both labor and equipment and realizing cost efficiencies using a blend of “cluster density” and new construction techniques – moves that are helping the company manage through both inflation and labor-related challenges, Jeffery added.

Frontier’s current FTTP buildout plan covering 10 million locations focuses on a portion of its footprint referred to as Wave 1 and Wave 2. The telco is also piecing together a plan for Wave 3 – a portion of its footprint with 5 million locations in rural areas deemed to be financially less attractive to build fiber.

However, Frontier execs said a fresh analysis indicates that between 1 million to 2 million of those Wave 3 locations can be converted to FTTP economically without government subsidies.

John Stratton, Frontier’s executive chairman, said the other 3 million to 4 million remaining locations in Wave 3 could also meet the company’s return-on-investment thresholds depending on how the distribution of some $42 billion in federal infrastructure funding pans out in the coming years. However, the overall funding plan for a Wave 3 build is still being ironed out. Frontier is also exploring other options for Wave 3, including partnerships and joint ventures.

As US cable operators and telcos struggled to gain broadband subs in Q2 2022, Frontier bucked the trend, adding 9,000 total broadband subs in the period when a loss of 41,000 legacy DSL/copper subs were included. Jeffery estimated that between 45% to 50% of all new Frontier fiber subs selected speeds of 1-Gig or more. Frontier launched a symmetrical 2-Gig fiber service in February.

Copper-to-fiber migrations are part of Frontier’s subscriber total, but the “vast majority” of those additions are coming from new customers, CFO Scott Beasley said.

“I think it’s clear to see from recent results that, as we’ve always said, fiber is a superior product to cable,” Jeffery said. “And while the cable and fiber market remains competitive, it’s also worth reminding ourselves that in our specific footprint, we have 84% of that where we have one or fewer competitors today. That said, in this quarter, we gained share against every competitor in every geography we operate in.”

……………………………………………………………………………………………………………………………………………………………………………………………………………………………………….

Comments from Nick Del Deo, Senior Analyst at MoffettNathanson:

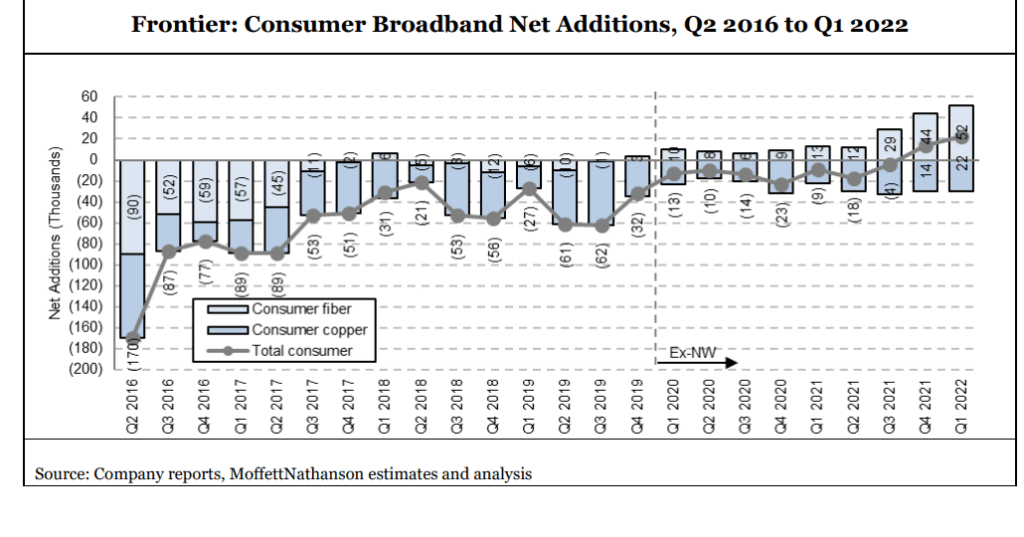

Frontier’s overall results in Q2 were solid, particularly with respect to financial metrics. On the subscriber front, Frontier continues to expand its fiber broadband base, adding 54K total fiber broadband customers (consumer and business), the same as in Q1, with a nice uptick in SMB adds (1K in Q4, 2K in Q1, and 4K in Q2). Gains came from both base markets and expansion markets. Copper losses also ticked up, but the company still added broadband customers overall, the third consecutive quarter it has done so. The company achieved this despite Q2 seasonality (primarily snowbirds in its Florida markets) and churning out nonpaying copper customers with the expiration of COVID-era requirements. Frontier is not seeing any deterioration in bad debt or customer payment trends with shifts in the macro environment.

In Q2, the cable industry posted total broadband net adds that were approximately zero, the first time this has happened since cable broadband was introduced about 25 years ago. Frontier’s telco peers reported weak results, too, with little change in fiber adds and heightened DSL losses. The management teams pegged the performance, to varying degrees, on: low gross connects stemming from low move rates; a return of seasonality that disappeared during the pandemic (e.g., college students); competition, most notably from fixed wireless (though this was not uniformly described as material); a pull-forward of some demand due to COVID over the past couple of years; and disconnects associated with government support programs rolling off. [Rightly or wrongly, market saturation has not been cited as a possible headwind.]

Frontier has banked the future of the company on broadband net adds, with a plan to upgrade a large portion of its footprint to FTTH and take share, primarily from the cable operators. The accelerating growth of Frontier’s fiber footprint offers some protection from market-wide trends, since it should mechanically gain net subscribers where it upgrades from copper to fiber. But Frontier has something else going for it, too: an ongoing transition from a company with weak management, a poorly received brand (to be generous), bad customer service, and no strategic focus to the opposite. These “softer” attributes matter.

Frontier stepped up the pace of its fiber expansion in Q2, adding 281K locations vs. 211K last quarter, and expects to reach 1.1-1.2M homes this year. While it remains early, Frontier’s expansion fiber cohort penetration rates remain encouraging; the 2020 build cohort stands at 22% at 12 months and 44% at 24 months, albeit on a small base of “golden” trials, while its larger 2021 build cohort stands at 17% at 12 months, right in the middle of its target range. While acknowledging “pockets” of expense pressure, the company remains confident in its $900-1,000 cost per location target. Management indicated that it now believes 1-2M of its 5M wave three locations, which have been set aside from an upgrade perspective, can be profitably converted to fiber without government subsidies (the 3-4M latter require support). The company did not announce specific changes to its fiber build plans with this update, but did note that some of these locations may be sprinkled in to the plans it has previously laid out. Management suggested these 1-2M locations would have a somewhat lower return profile than its wave two locations, in mid-teens rather than mid-to-high-teens. Financial results in Q2 were better than expected. Revenue was 0.8% ahead of consensus, with the effects of sustained fiber net adds and a jump in copper broadband ARPU driving the outperformance. EBITDA was 4.7% higher than consensus and was up sequentially.

References:

Frontier Communications Accelerates Fiber Build Out -10 Million locations passed by 2025

Frontier Communications and Ziply Fiber to raise funds for fiber optic network buildouts

“Fiber is the future” at Frontier, which added a record 54K fiber broadband customers in 1Q-2022

Frontier Communications added a record 54,000 fiber broadband customers in the first quarter of 2022, a 20% gain over the previous record set in Q4 2021 and somewhat higher than expectations coming in to the quarter. These fiber customer adds are coming from both new and existing fiber markets. Frontier’s data continues to track nicely: 22% penetration at the 12-month mark for its 2020 cohort and 18% for its larger 2021 cohort, and 44% at the 24-month mark for its (admittedly small and probably not broadly representative) 2020 cohort. Base market penetration was up 50 basis points in the quarter and 90 basis points over the past two quarters.

Frontier’s aggressive fiber network buildout and a record low churn of 1.19%, enabled the telco to offset copper losses and add 20,000 net broadband subs for Q1 2021. That’s a record nearly two times higher than that set in the prior quarter. Frontier ended the quarter with 1.38 million residential fiber broadband subs, up 11% YoY.

Frontier plans to expand its fiber-to-the-premises (FTTP) footprint to 10 million locations by 2025 – a figure that includes the company’s “Wave 1” and “Wave 2” builds. Frontier built fiber out to another 211,000 locations in the first quarter of 2022, and says it’s on track to add more than 1 million FTTP locations for all of 2022, and another 1.6 million in 2023.

Frontier passed another 211K locations with fiber in the quarter, up from the ~190K level of the prior two quarters, a nice accomplishment in light of the disruptions associated with Omicron early in the quarter (100K of the 211K passings were achieved in March alone). Management continues to expect to add at least 1M fiber locations in 2022, and it seems on track to meet or exceed that target.

“Positive net adds is the new normal,” Nick Jeffery, Frontier’s president and CEO, declared on Friday’s earnings call. The CEO continued:

“We gained momentum in business and wholesale, reaching a key inflection point in SMB and we made progress improving our employee engagement. And last week, we unveiled our new Frontier brand. A year ago, we said we will take a long and hard look at our brand and its future and after a thorough data-driven evaluation I am delighted with the results. Our new brand is modern, more relevant, more tech-oriented, and reflects our commitment to relentlessly being better in our business and for our customers. We also gained customers in our mature fiber market, what we refer to as our base fiber footprint. In our base fiber footprint, penetration increased 50 basis points sequentially to 42.4%. And our base fiber footprint serves as a target for where we expect to drive penetration in our expansion fiber footprint and we expect to steadily grow penetration to at least 45% over time.

In our expansion fiber footprint, we are also making excellent progress. At the 12-month mark, our 2021 build cohort reached penetration of 18%, consistent with our target range of 15% to 20%. And at the 24-month mark, our 2020 build cohort reached penetration of 44%, significantly outperforming our target range of 25% to 30%. As larger builds are pulled into our 2020 cohort throughout the year, we continue to expect penetration of 25% to 30% at the 24-month mark.”

Indeed, Frontier’s operations and service levels have improved dramatically over the past two years. Our colleague Nick Del Deo at MoffettNathanson wrote in a research note to clients:

By some measures, Frontier is now operating at as high a level as key competitor Charter in the California market. And this is having an effect on its customer perceptions and market traction. Its American Consumer Satisfaction Index scores are slowly moving up, while its net promoter score has surged, especially where it has rolled out FTTH. Churn has fallen, as have customer care call volumes.

Frontier’s post-emergence management team has taken a data-driven approach to running the business and making key decisions. Put simply, the choice to refresh the company’s font and logo rather than totally rebrand is further evidence that changes to the business are working.”

To reiterate, 1Q-2022 fiber penetration rates rose to 42.45% in the company’s base fiber footprint. Frontier expects to reach penetration rates of at least 45% over time.

In the expansion areas, Frontier realized a penetration rate of 12% at the 12-month mark in its 2021 fiber build cohort – within its target range of 15%-20%. In the 2020 FTTP build cohort, Frontier is seeing a 44% penetration rate at the 24-month mark, outperforming its target range of 25%-30%.

Source: Frontier Communications Q1 2022 earnings presentation

CEO Jeffery said Frontier’s fiber-powered services are taking share from incumbent cable operators, but didn’t elaborate on how much damage Frontier is inflicting. He also acknowledged that fixed wireless access (FWA) could present an attractive option in rural areas where fiber isn’t present. Jeffery also believes fiber represents “a fundamentally different proposition” over FWA, given current data usage trends. In March, the average Frontier fiber subscriber consumed about 900 gigabytes of data, up 30% from pre-pandemic levels, with a portion consistently consuming more than 1 terabyte per month.

Significantly, Frontier gained new customers in areas where fiber is being built out. “This is critical because we know our future is fiber and fiber customers are the ones that will drive our growth in the years to come,” said Jeffery, a former Vodafone UK exec who took the helm of Frontier in March 2021.

For the full 2022 year, Frontier is targeting adjusted EBIDTA of $2 billion to $2.15 billion, and capital expenditures in the range of $2.4 billion to $2.5 billion, the same as guidance issued last quarter. This implies $2,003M for the remainder of the year at the midpoint. Management continues to target FTTH builds in 2022 of at least 1,000K vs. 638K built in 2021.

References:

https://s1.q4cdn.com/144417568/files/doc_financials/2022/q1/Frontier-First-Quarter-2022-Results.pdf

Frontier Communications reports added 45,000 fiber broadband subscribers in 4Q-2021 – best in 5 years!

Frontier Communications added 45,000 fiber broadband subscribers in the fourth quarter, its best performance gains in five years, Frontier’s Scott Beasley said at the 2022 Citi Apps Economy Virtual Conference. The company hopes to expand by 1 million fiber locations this year as part of plan to reach 6 million by 2025.

Comment: That’s great progress for a company that filed for bankruptcy in April 2020 with a plan to cut more than $10 billion of its $17 billion debt load by handing ownership to bondholders. It was the biggest telecom filing since WorldCom in 2002, reflecting years of decline in its business of providing internet, TV and phone service in 29 states.

When combined with legacy DSL losses, Frontier added 9K net new broadband subscribers. Frontier is currently on an aggressive fiber build strategy that aims to add a total of 6 million locations by the end of 2025, resulting in 10 million locations reached in total. Beasley reports the company added 600K new fiber locations in 2021, with a goal of adding another million locations by the end of 2022. Beasley reports that the much discussed supply chain challenges facing the broadband industry have not had a significant impact at Frontier.

“We’ve managed through supply chain constraints and been able to perform very well in our fiber build and continue to ramp that up for 2022,” he said.

- This marked the first time in more than five years that the Company has posted total broadband customer growth in a quarter.

- The Company expects to continue growing the total broadband customer base as its fiber build accelerates.

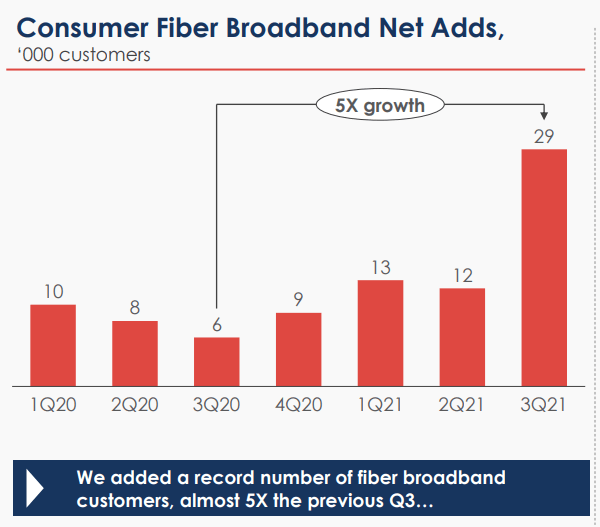

Source: Frontier Communications Q3 2021 earnings presentation

Frontier has completed ‘wave 1’ of this fiber expansion. The company is now beginning ‘wave 2,’ which will take them through 2025, getting them to 6 million new locations. Build costs in wave 2 are a bit higher at $900 to $1,000 per fiber location.

Frontier envisions a ‘wave 3’ coming, but that’s outside the scope of their current committed-to fiber build. Beasley says Frontier will look to leverage government funding programs and other partnerships to help fund wave 3 fiber builds.

“There could be scenarios where we accelerate the build of some locations in wave 3 into wave 2,’ he said in discussing Frontier broadband growth. “That will likely be a destination of significant government funding as the roughly $45 billion of infrastructure bill funding that goes to broadband will be targeted at locations like wave 3.”

Asked about potential competition from fixed wireless access (FWA) and satellite broadband services, Beasley said neither presents a material threat just yet. While FWA may gain traction in some ultra-dense urban locations and satellite in extremely rural areas, Beasley asserted neither technology will be able to stand up against Frontier’s gigabit fiber offerings. The company already offers 1 Gbps and is planning the rollout of a 2 Gbps plan in the first half of this year as well as a 10 Gbps tier somewhere down the line. “It’s a technology we’re watching closely but don’t think it can compete with our core symmetrical speeds in fiber,” Beasley said of FWA.

“Against our core gigabit plus offers, 1 gig symmetrical speeds now, we’ve said we’re going to launch 2 gig in the first half of 2022, eventually we’ll move to 10 gig, the core network is 10 gig capable now, we’ve trialed 25 gig successfully in certain parts of the network,” he said. “I don’t think fixed wireless has the capacity to compete with that core infrastructure. It will be competitive in certain niches of the market…but I don’t think it can compete with our core symmetrical speeds and fiber,” he added.

References:

https://kvgo.com/citi-apps-economy-conference/frontier-jan-2022

With 45K New Fiber Subscribers, Frontier Sees First Positive Broadband Growth in 5 Years