Telecom company layoffs

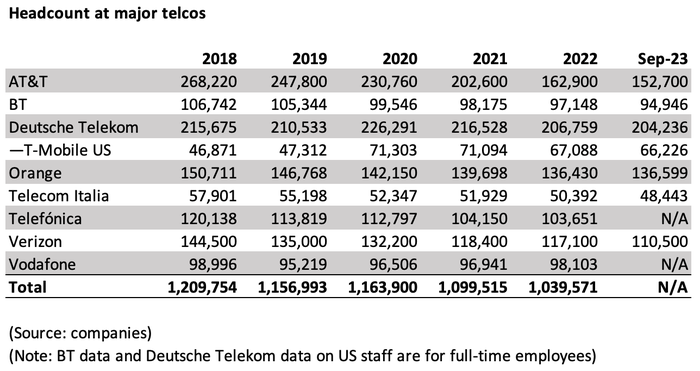

Verizon and AT&T cut 5,100 more jobs with a combined 214,350 fewer employees than 2015

Verizon and AT&T won’t stop cutting jobs. Will it ever end?

In a September security filing, Verizon said 4,800 jobs would be cut by March 2025 at a severance cost of about $1.8 billion. Its latest results this week showed headcount had fallen by another 2,700 between July and September, to about 101,200 total employees. Sales growth was flat year over year, reaching $33.33 billion. Service and other revenue growth was offset by declines in wireless equipment revenue

At AT&T, job losses were 2,400 during the same time period, to 143,600 employees down from 149,900 on January 31, 2024. AT&T is expanding its $8 billion cost-reduction program, which includes significant layoffs. The company has reduced its workforce by more than 115,000 employees over the past five years, with further cuts expected in 2024 (Sources: TechBlog, WRAL TechWire).

Combined, the two major U.S. telcos now have only 244,800 employees and that number will surely shrink from now till March 2025. Yet in 2015, they had a combined headcount of 459,150, according to filings with the Securities and Exchange Commission. The disappearance of 214,350 positions since then, almost half the entire workforce, has occurred as telecom has become a more critical feature of most people’s lives with mobile everything and video streaming (mostly over wireline networks).

Tarathip Kwankeeree/iStock/Getty Images Plus

Combined revenues fell from $278.4 billion in 2015 to $256.4 billion last year due entirely to a sales decline at AT&T. Last year, its turnover of $122.4 billion represented a 16% drop on the figure in 2015. But this meant sales per employee rose from about $520,000 to $813,000. At Verizon, they have grown from roughly $741,000 to $1.27 million. The only telecom rival they have had to worry about is T-Mobile US, which launched its disruptive “Uncarrier” campaign before 2015.

For sure, automation, digitization and reliance on artificial intelligence (AI) have all been acknowledged by telco executives as factors in headcount shrinkage. Their objective now is to realize “zero-touch” or “fully autonomous” or “intent-based” networks, which are able to operate themselves and perform tasks with minimal or no human intervention. Such a network essentially manages itself by performing tasks based on predefined goals or “intents,” without requiring manual configuration or troubleshooting. Here’s a quick summary:

-

Zero-touch:This term emphasizes the ability to automatically provision and configure new devices on a network without any manual intervention, essentially “plug and play” functionality.

-

Fully autonomous:This signifies a network that can not only self-configure but also monitor its own health, diagnose issues, and take corrective actions independently, adapting to changing conditions without human input.

-

Intent-based:This concept focuses on expressing the desired network behavior or outcome through high-level instructions (“intents”), which the system then translates into specific actions to achieve that goal.

It remains to be seen if such zero-touch, autonomous, intent based networks will live up to their potential and promise.

References:

https://www.lightreading.com/ai-machine-learning/AT&T-and-Verizon-cut-5,100-jobs-as-AI-fears-grow-

Telecom layoffs continue unabated as AT&T leads the pack – a growth engine with only 1% YoY growth?

Inside AT&T’s newly expanded $8 billion cost-reduction program and huge layoffs

Tech layoffs continue unabated: pink slip season in hard-hit SF Bay Area

Big Tech post strong earnings and revenue growth, but cuts jobs along with Telecom Vendors

US cable and telecom network operators feel the pain

According to the financial analysts at TD Cowen, prominent cable companies like Charter and Comcast collectively lost 186,000 customers in the first quarter 2024, ahead of their estimates of 141,000.

“The quarter is proving that Cable and Wireless are in the throes of market maturity, both facing a smaller pool with churn at historically low levels,” wrote TD Cowen in a recent note to investors.

“Cable has lost subscribers for a fourth consecutive quarter and [it’s] getting worse,” the analysts wrote. “The Broadband market is clearly maturing and churn is at historic lows, meaning there are less [customer] adds to go around. Therefore, even with FWA [fixed wireless access] adds trending lower, Cable will continue to struggle to grow subscribers in the near-to-mid-term.”

“During the first quarter, our Internet customer growth remained challenged by a low move and generally low activity environment, coupled with continued elevated competition at least in the short term and a small impact from fewer low income connects due to discontinued ACP availability,” explained Charter CEO Chris Winfrey during his company’s quarterly conference call, according to Seeking Alpha.

Wireless carriers AT&T, Verizon and T-Mobile collectively reported more postpaid phone growth than expected, but the TD Cowen analysts noted their gross customer additions were “light across the board.”

MoffettNathanson analysts wrote that T-Mobile’s numbers during the first quarter “were met only after adopting a dramatically sweetened free-iPhone offer in the waning days of the quarter. That offer was pulled as soon as the quarter ended. Industry growth is slowing, Cable is taking share (and threatens re-pricing the industry lower in the process), and the ever-lengthening upgrade cycles for handsets have to reverse eventually. None of that is terrifying. But it is worrying.”

Telco job cuts are continuing after many years of layoffs.

AT&T and Verizon have been shedding jobs/ reducing headcount for many years and wireline carrier Lumen Technologies is following:

- AT&T cut the most total number of jobs in 2023, reducing its headcount from 162,920 employees at the end of 2022, to 150,470 employees at the end of last year. That was below the nearly 40,000 jobs AT&T managed to cut in 2022.

- Verizon cut slightly fewer jobs than AT&T last year, though it was a higher overall percentage of its employee base. The #2 U.S. carrier slashed 11,700 positions in 2023, ending the year with 105,400 total employees.

- Lumen Technologies recently announced it would cut almost 1,000 positions, or 7% of its workforce, to “right-size our business through automation and AI.”

The very tough telecom market may be pushing operators to raise money or pursue M&A. “The capital markets are becoming more favorable, further opening up the possibility for M&A,” wrote the financial analysts at TD Cowens.

- Cogent is raising around $200 million with some of its IPv4 Internet addresses.

- According to Bloomberg, Uniti Group is preparing to reunite with Windstream in a $15 billion merger.

Uniti and Windstream aren’t alone. For example, Bloomberg reported that European satellite operators SES and Intelsat have also restarted merger negotiations.

Meanwhile, T-Mobile now expects to close its $1.3 billion purchase of MVNO Mint Mobile in the coming days. The company also recently inked a $1.5 billion plan to invest into fiber operator Lumos.

It’s unclear when the next big M&A transaction might arrive in the telecom industry. There are plenty of assets up for sale, including UScellular’s mobile business and Crown Castle’s fiber and small cell operations.

………………………………………………………………………………………………..

Hovering over all of this is the apparent end of the U.S. government’s Affordable Connectivity Program (ACP). That program currently provides up to $30 per month to 23 million U.S. households for their telecom services, money that ultimately runs into the coffers of network operators.

“We’re expecting that the program funding is going to end,” said T-Mobile’s Michael Katz during his company’s quarterly conference call.

Katz said T-Mobile counts “a couple hundred thousand” prepaid customers on the program. But he suggested that the end of ACP might help funnel some customers to T-Mobile’s cheaper offerings, including its new Mint Mobile brand.

Meanwhile, other US subsidies are scheduled to hit the US broadband market in the coming months and years. For example, money from the Biden administration’s $42.5 billion Broadband Equity Access and Deployment (BEAD) program is expected to begin running through U.S. states starting next year. That money will arrive in the form of grants for the construction of networks in rural areas.

It’s unclear how that shifting subsidy landscape will affect a U.S. broadband market that’s showing signs of slowing.

“We now have confidence that industry [customer] adds will land at a little more than 400,000, down from a normal pace of 700-800,000,” wrote the financial analysts at New Street Research in a note to investors following the release of Charter’s earnings. “If we annualize this, based on normal seasonality, we land at a little more than 1 million adds for the year, down from a normal pace of ~2.5 million.”

The New Street Research analysts explained that growth in the U.S. broadband market is generally keeping pace with the formation of new households, which is also slower than normal.

“The big question: have we hit saturation for the broadband market or are there temporary pressures impacting growth,” wrote the analysts. “If it is the former, then this is the new normal. If the latter, growth should reaccelerate at some point.”

……………………………………………………………………………………………………………………..

References:

https://www.lightreading.com/finance/things-are-getting-tight-for-us-telecom-network-operators

https://techblog.comsoc.org/category/affordable-connectivity-program-acp/

Telecom layoffs continue unabated as AT&T leads the pack – a growth engine with only 1% YoY growth?

High Tech Layoffs Explained: The End of the Free Money Party

Telecom layoffs continue unabated as AT&T leads the pack – a growth engine with only 1% YoY growth?

As we have repeatedly stated, the entire telecom industry is in a funk and the 2024 outlook is looks just as gloomy as this year. MTN claims that telecom is a zero growth industry (see References below) and that certainly seems to be true. Let’s start with AT&T – the largest telco in the U.S. with 229.2M wireless subscribers as of Q2-2022.

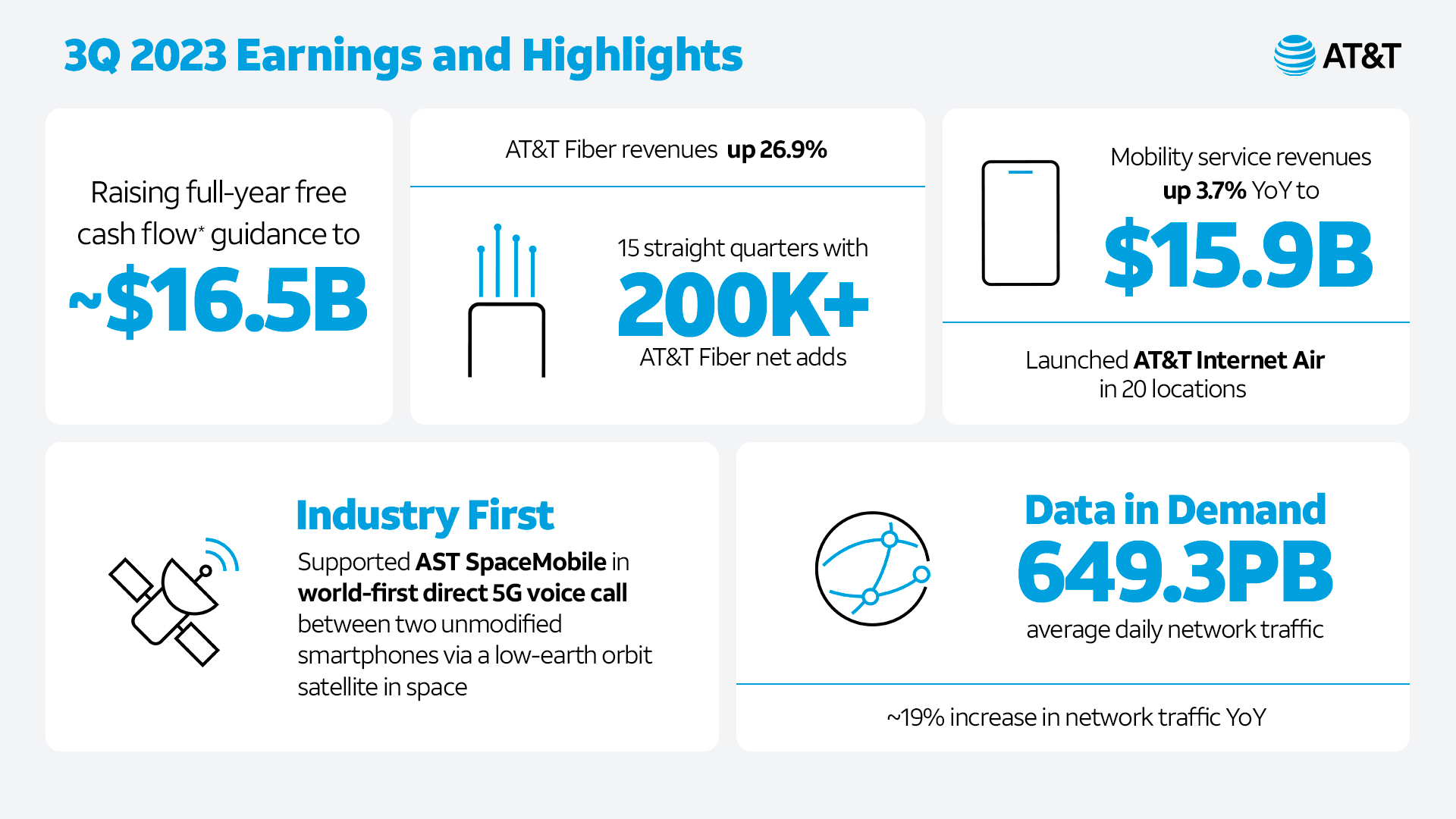

In the first nine months of 2023, AT&T has shed 10,200 employees, including nearly 4,000 in the recent third quarter alone. AT&T cut many more jobs – 39,700 in total – in 2022 when it was in the process of spinning out Warner Media to Warner Brothers Discovery (the deal closed on April 8, 2022).

AT&T’s CEO told reporters last week that the U.S. based teclo plans to reduce costs by another $2 billion over the next three years. That’s after Stankey boasted that the company has cut costs by $6 billion in the last three and in an “inflationary environment.”

AT&T is hardly a growth company and has tons of debt. In the 3rd quarter of 2023, AT&T reported revenues of $30.4 billion, up only 1% year over year. Yet Stankey had the audacity to say in a press release, “Our investments in best-in-class 5G and fiber connectivity are fueling our growth engine. We’re gaining profitable customer relationships and becoming more efficient. This is powering our strong business performance.”

Today, LightReading announced the departure of a key AT&T executive. Jason Inskeep, previously the senior assistant VP for AT&T’s 5G Center of Excellence and focusing on the operator’s work in private wireless networking and edge computing, recently left the company for a senior director position at consulting firm Slalom.

Iain Morris of LightReading wrote on October 20th, “The future AT&T is conceivably a cohort of antenna-carrying robots, some AI that writes code and Stankey with his feet up on the table, providing the only whiff of humanity.”

AT&T is not the only U.S. telco reducing its workforce. Earlier this year, T-Mobile announced that it will be laying off ~5,000 workers or around 7% of its workforce. This latest job cutting move will primarily impact employees in corporate, back-office, and technology roles, while those in retail or customer care positions will not be affected.

……………………………………………………………………………………………………………………………….

Network Equipment Vendors Layoffs and Gloomy Outlook:

Last week, Nokia said the company plans to cut at least 9,000 jobs and as many as 14,000 over the next three years. That’s mainly due to weak 5G equipment demand. Nokia CEO Pekka Lundmark told reporters that Nokia’s sales have plummeted in North America (sales were down 40%) and that India’s 5G rollout is now slowing down as expected.

Over the next three years, his latest target is to reduce annual costs by between €800 million (US$843 million) and €1.2 billion ($1.3 billion). It’s a move that will reduce Nokia’s headcount by at least 9,000 roles from its current level of roughly 86,000. And at the upper end of the range, it will see an exodus of 14,000 employees, more than 16% of the total.

Ericsson CEO Borje Ekholm cautioned of persistent macroeconomic uncertainty into 2024 which it expects will impact customers’ investment ability, as the wireless network equipment vendor reported a year-on-year net loss of SEK30.5 billion ($2.8 billion) from net income of SEK5.4 billion in Q2 2022, due to a SEK32 billion charge related to the acquisition of cloud company Vonage in 2022. In February, Reuters reported that Ericsson will lay off 8,500 employees globally as part of its plan to cut costs, a memo sent to employees.

……………………………………………………………………………………………………………………..

Semiconductor Layoffs:

Wireless network chip maker Qualcomm is slashing 1,258 jobs in California, including nearly 200 in the Bay Area, in the latest tech layoffs to hit the region. Qualcomm said in state filings that it will lay off approximately 194 workers in its Santa Clara offices and another 1,094 employees at its San Diego headquarters. The cuts are slated to begin Dec. 13th, based on a notice submitted to state officials this week. The job cuts represent roughly 2.5% of Qualcomm’s workforce and mark the second round of layoffs for the wireless semiconductor company this year.

The Qualcomm layoff news comes about a month after the company announced a deal with Apple to provide 5G chips through at least 2026. Qualcomm is also the chip supplier for the newly announced Meta Quest 3. It is only 1 of 2 companies that sell 5G end point silicon on the merchant market (Taiwan based MediaTek is the other one).

It’s not a pretty picture to say the least for telecom industry employees.

References:

https://www.lightreading.com/ai-machine-learning/at-t-seems-on-a-mission-to-be-a-zero-employee-telco

https://www.lightreading.com/private-networks/at-t-s-private-wireless-chief-departs

https://about.att.com/story/2023/q3-earnings.html

Inside AT&T’s newly expanded $8 billion cost-reduction program & huge layoffs

High Tech Layoffs Explained: The End of the Free Money Party

MTN Consulting’s Network Operator Forecast Through 2027: “Telecom is essentially a zero-growth industry”