Uncategorized

Meta (Facebook) announces 200G/400G switch fabrics and Network OS with open API at 2021 OCP Summit

Next-generation 200G and 400G switch fabrics:

Meta’s data center fabrics have evolved from 100 Gbps to the next-generation 200 Gbps/400 Gbps. Meta has already deployed 200G-FR4 optics at scale in their data centers and contributed to specifications for 400G-FR4 optics that will be deployed in the future.

Meta has developed two next-generation 200G fabric switches, the Minipack2 [1.]. It is the latest version of Minipack, Meta’s own modular network switch) and the Arista 7388X5, in partnership with Arista Networks. Both of which are also backward compatible with previous 100G switches and will support upgrades to 400G.

Note 1. Minipack2 is Facebook’s 200G fabric switch (leaf/spine switch) that provides 128 x 200G Ethernet ports by a single 25.6Tbps switch ASIC. It supports 128 QSFP56 ports or 64 QSFP-DD ports when deployed in Facebook’s F16 data center networks. Similar to Minipack (128x 100G), Minipack2 has a modular architecture that supports multiple port interface types. The specification and the hardware design package of Minipack2 will be contributed to OCP. This workshop will go over hardware architecture of Minipack2 and details on key design decisions, including functional block diagrams, chassis architecture, external and internal interfaces, etc.

The Minipack2 is based on the Broadcom Tomahawk4 25.6T switch ASIC and Broadcom re-timer. The Arista 7388X5 is also based on the Broadcom Tomahawk4 25.6T switch ASIC, with versions of the 7388X5 also utilizing a Credo chipset. They’re high-performance switches that transmit up to 25.6 Tbps and 10.6 Bpps with modular line cards. They support 128x 200G-FR4 QSFP56 optics modules and can maintain a consistent SerDes speed at the switch ASIC, the optics host interface, and on the optics line/wavelength. They simplify connectivity without needing a gearbox to convert data streams. They also have significantly reduced power per bit compared with their previous models (the OCP-accepted Meta Minipack and OCP-Inspired Arista 7368X4, respectively).

Meta has deployed 200G optics (modules pictured above) in their data centers

………………………………………………………………………………………………………………………………………

The Minipack2, Meta’s own modular network switch, developed in partnership with Broadcom

………………………………………………………………………………………………………………………………………….

Meta’s network operating system now powered by an open API:

Meta’s network operating system for controlling the network, Facebook Open Switching System, traditionally used the specific API provided by the chip manufacturer. Now, FBOSS (Meta’s own network operating system for controlling network switches) has been adapted to use the Open Compute Project Switch Abstraction Interface, a standard and open API.

Additionally, Meta has worked with Cisco Systems to support FBOSS with SAI (Switch Abstraction Interface) with their ASICs. Adapting and migrating FBOSS to SAI enables Meta to onboard multiple ASICS from different vendors more quickly and easily onboard new ones in the future. SAI’s API lets engineers configure new networking hardware without needing to delve into the specifics of the underlying chipset’s SDK. Furthermore, SAI has been extended to even the PHY layer, with Credo Semi supporting FBOSS with their own SAI implementation.

That means data centers can quickly and easily migrate FBOSS across multiple ASICs from different manufacturers with greater ease. It also allows engineers to rapidly configure new networking hardware without the need to tinker with chipset development kits.

Meta expects that with hardware being shared through OCP, supporting SAI will also mean closer collaboration with and feedback from the wider industry. Developers and engineers from across the world will have a chance to work with this open hardware and contribute their own software that can be shared with the industry.

The Metaverse and More:

The metaverse will rely on many technologies, including advanced AI at scale. To deliver a diversity of new workloads that will be created as a result, we continue down the path of disaggregated global networks and data centers that will underpin all of this. The technologies that Meta and the wider industry will create will, of course, need to be fast and flexible, but more than that, they will need to operate efficiently and sustainably — from the data center all the way to edge devices. The only way to achieve this will be through collaboration through communities like OCP and other partnerships.

Open hardware drives the innovation necessary to reach these goals. And our collaborations with both long-standing and new vendors to create open designs for racks, servers, storage boxes, motherboards, and more will help push Meta and the wider industry onto the next major computing platform. We’re only about one percent along on the journey, but the road to the metaverse will be paved with open advanced networking hardware.

References:

OCP Summit 2021: Open networking hardware lays the groundwork for the metaverse

https://siliconangle.com/2021/11/09/meta-announces-next-gen-networking-hardware-2021-ocp-summit/

Amazon’s Sidewalk Low Power WAN is a dud, despite four announced partnerships

Amazon Sidewalk, quietly announced at Amazon’s annual hardware conference in Seattle in September 2019, is a shared network that is claimed to help its devices work better. Specifically, it’s a 900MHz-based low power wireless area network (LPWAN) to connect trackers, sensors, lightbulbs and other IoT devices. Amazon says you can use Sidewalk to simplify device setup, find lost items, and more. However, Amazon’s website only refers to Echo (“smart” speaker) devices as Sidewalk endpoints when BlueTooth is enabled.

Note that Amazon Sidewalk is optional and can be turned off at any time. Instructions to enable or disable Sidewalk for your Amazon devices is here. It comes at no additional cost and has a capped data usage of 500 MB per month, per account. To learn more, go to Welcome to Amazon Sidewalk. Amazon said that Sidewalk will have more range than Bluetooth and use less power than 5G.

“We’re going to build a reference design called Ring Fetch — a dog tracker that will use Sidewalk and ping you if your dog leaves a certain perimeter,” said Dave Limp, senior vice president of devices for Amazon at that conference. “This will be coming next year,” he added. Really?

Over two years later, there are no tangible benefits, visible results or new information about Sidewalk deployment in the U.S. or anywhere else. Sidewalk remains a mysterious mesh network with no coverage maps anywhere to be found on the amazon.com website.

“A lot of people might not even know it’s there,” said analyst Carolina Milanesi, president and principal analyst of Creative Strategies. “It’s not like Alexa, where you see a prompt for it.”

The Sidewalk network – which relies on Bluetooth Low Energy for short-range communication, 900MHz LoRa or frequency-shift keyring over longer distances – is set to max out at 80 Kbit/s on any one Amazon device operating as a Sidewalk “bridge.” And Amazon caps Sidewalk’s per-customer data usage at 500MB a month.

The fact that Amazon turned on Sidewalk without notification, much less permission, continues to draw complaints. “I think there’s value in the Sidewalk concept,” said analyst Mark Vena, president and CEO of SmartTech Research. “The problem is that Amazon conducted a Biblically disastrous rollout of this.” He added that Amazon “would have really put themselves in a much better position” if they’d made Sidewalk opt-in.

“I was very critical of their rollout,” emailed Jennifer King, a privacy and data policy fellow at the Stanford Institute for Human-Centered Artificial Intelligence, adding that she remains uneasy about it. “I have deep concerns about their practices.”

Privacy advocates point to the enormous amount of data Amazon collects about the tastes of its customers and also to its late adoption of such common trust-building measures as releasing transparency reports documenting how it responds to government requests for that data; Amazon’s reports remain remarkably thin compared to those of the other tech giants.

Amazon did not answer a Light Reading question about its Sidewalk opt-out rate, but provided a statement attesting to Sidewalk’s “strong coverage across major U.S. metro areas.” It did not include any individual user success stories, because Sidewalk’s encryption and data-minimization techniques obscure those details. This author opted out of Sidewalk a long time ago.

No security vulnerabilities seem to have been reported for Sidewalk thus far – the major criticism made in a report from Cato Networks released this summer was that IT admins would struggle to keep track of all the Sidewalk devices in an enterprise.

Amazon’s initial sales pitch for Sidewalk included a detailed white paper on its privacy and security features but suffered further from a lack of specific upsides for customers, leaving too much to their imagination.

In May 2021, Amazon announced a first set of partners that would use Sidewalk’s shared bandwidth for their own services: San Mateo, California, Tile; CareBand (a Chicago developer of senior-care systems); and Level (a smart-lock firm in Redwood City, California).

Image Credit: Amazon.com

Light Reading says that the Tile integration seems particularly significant “Expanding the area in which these device-tracking fobs can phone home can address a competitive disadvantage Tile faces against Apple’s AirTags, which can tap into Apple’s vast Find My network. But with Tile’s Sidewalk integration only live since June, Tile isn’t ready to talk details yet.”

“It’s been going well, but I can’t share any specific numbers,” Mira Dix, a Tile spokesperson, emailed Light Reading.

One analyst wondered how many Tile owners know of this new connectivity. “Sidewalk is still mostly promise, and I’d be shocked if most Tile buyers are aware of the partnership,” emailed Avi Greengart, president and lead analyst at Techsponential.

CareBand CEO Adam Sobol also said it was too soon to talk, adding “There should be more news in Q1/Q2 or next year.”

In September, Amazon announced a fourth partnership with Life360, a San Francisco firm that provides family-safety tools. Vena, of SmartTech Research, suggested more partnerships along the lines of the Tile deal would be in order and suggested one in particular with another vendor of device-tracking fobs. “I think you might see them partner with Samsung,” he said. “I think that would make logical sense.”

Ms. Milanesi suggested watching to see hyperlocal use cases get built out. “Instead of thinking about a neighborhood, you can think about a campus or a large manufacturing facility or whatever the case might be,” she said. “The technology behind it might be used in different ways.”

Analysts all agree that Amazon is overdue to persuade its customers to use Sidewalk.

“The idea that Amazon is building a crowdsourced network would be a lot easier for consumers to accept if Amazon could show concrete benefits to Echo owners,” said Greengart of Techsponential. “People are happy to participate in crowdsourced systems, like Waze’s traffic data, when the benefit to the user is clear.”

Author’s Note:

While not a Sidewalk user, I actively use many other Amazon devices (I have 3 echo “smart” speakers, 3 fire tablets, 2 fire tv sticks, a Toshiba Fire TV, and a Kindle eReader in my home).

In over 60 years of using tech devices, I have NEVER had as many PROBLEMS with the Fire TV/stick and Alexa on Echo devices.

The Fire TV/Fire TV stick issues seem to be due to very badly written Fire OS code (updated several times per week), while the Alexa issues are due to terrible voice recognition (which has incredibly deteriorated over the years, i.e. machine UNLEARNING) and back end communications failures (where the connection between the Amazon compute server terminating Alexa voice recognition loses the connection to an Amazon music server or 3rd party server (e.g. Sirius XM, Pandora, Spotify, etc).

The customer feels helpless as there is no serious Amazon tech support to resolve any of these problems. These problems have nothing to do with WiFi, Internet download speed/latency, IP address, etc. Yet Amazon tech support people always deflect blame for their bad software to your WiFi/Internet connection.

References:

https://www.amazon.com/gp/help/customer/display.html?nodeId=GZ4VSNFMBDHLRJUK

https://www.lightreading.com/iot/amazon-sidewalk-quietly-walks-on/d/d-id/773150?

https://www.aboutamazon.com/news/devices/echo-tile-and-level-devices-join-amazon-sidewalk

https://m.media-amazon.com/images/G/01/sidewalk/final_privacy_security_whitepaper.pdf

IBM says 5G killer app is connecting industrial robots: edge computing with private 5G

At 2021 MWC-LA, IBM CTO for networking and edge computing Rob High suggested that connecting maintenance robots (one named Spot is pictured below) as the so-called killer application for 5G. citing wide potential benefits for industry. In a keynote presentation made alongside robotics company Boston Dynamics, the IBM CTO (pictured left) highlighted the benefits of systems employing edge computing (more below) technology together with private 5G in industrial scenarios. The two companies highlighted Spot’s role to assess the performance of analog machinery still in use.

“For all my network operator friends in the audience who keep asking what’s the killer app for 5G? This is it,” High said. “It’s around production processes valuable to industries that are needed, and need 5G to accomplish their tasks to maintain operational readiness and efficiencies,” he added.

“That’s where 5G is going to have its biggest benefit,” he added, noting although the maintenance robot did a lot of local processing it needed to be on a communications network as it was programmed to raise urgent issues. However, High did not state what benefits/features 5G has that makes robot connectivity the killer app. In particular, ultra high reliability is required but neither ITU-R M.2150 or 3GPP Release 16 supports that in the 5G RIT/RAN.

Boston Dynamics’ chief sales officer Mike Pollitt highlighted Spot’s ability to assess machinery and other assets across industrial sites in difficult-to-reach areas and those dangerous for humans. Potential applications include taking readings from analog machines, proactive maintenance and general site investigation.

High added with a long asset life on much industrial machinery, these types of technological solutions could fill the “data gap” by assessing sites without the need to retrofit connectivity hardware into every piece of equipment.

The robotics company has been working with IBM on industrial deployments with Spot relying on the latter’s application management system.

IBM says that edge computing with 5G (requires 5G SA core network) creates tremendous opportunities in every industry. It brings computation and data storage closer to where data is generated, enabling better data control, reduced costs, faster insights and actions, and continuous operations. By 2025, 75% of enterprise data will be processed at the edge, compared to only 10% today.

IBM provides an autonomous management offering that addresses the scale, variability and rate of change in edge environments. IBM also offers solutions to help communications companies modernize their networks and deliver new services at the edge.

References:

https://www.mobileworldlive.com/featured-content/top-three/ibm-spots-killer-industrial-5g-app

https://www.ibm.com/cloud/edge-computing

Juniper Research: Mobile Roaming and the $2 Billion Revenue Leakage Problem

Juniper Research has found that the inability to distinguish between 4G and 5G data traffic using current standards will result in greater roaming revenue losses as the travel industry returns to pre-pandemic levels and 5G adoption increases. Juniper expects losses from roaming data traffic misidentification will rise to $2.1 billion by 2026 if the industry doesn’t implement the Billing & Charging Evolution Protocol (BCE), an end-to-end industry-wide standard defined by the GSMA that introduces new capabilities that identify roaming data traffic over different network technologies.

In response, the new research, Data & Financial Clearing: Emerging Trends, Key Opportunities & Market Forecasts 2021-2026, cited the support by operators for the BCE (Billing & Charging Evolution) protocol as being a key strategy to minimize the extent of revenue leakage. BCE is an end-to-end industry-wide standard defined by the GSMA that introduces new capabilities that identify roaming data traffic over different network technologies.

This issue of misidentifying roaming data will only be exacerbated by the rising number of 5G subscribers roaming internationally. The report forecasts that there will be over 200 million 5G roaming connections by 2026; rising from 5 million in 2021. This growth is driven by increasing 5G adoption and a return to pre-pandemic levels of international travel. In response, it urged operators to identify emerging areas of potential revenue leakage by leveraging machine learning in roaming analytics tools to efficiently assess roaming behavior and data usage.

In addition, the report found that, to effectively mitigate the growing complexity of clearing processes arising from increased demand for data when roaming, operators must move away from established roaming clearing practices in favor of BCE.

Research author Scarlett Woodford remarked:

“By combining BCE with AI-enabled roaming analytics suites, operators will be ideally positioned to deal with the rise in roaming data. Separating roaming traffic by network connectivity is essential to allow operators to charge roaming partners based on latency and download speed, and maximize overall 5G roaming revenue.”

Steering of Roaming Explained:

Roaming revenue can be drastically affected by regional regulations and pricing decreases; resulting in operators seeking alternative ways of generating profits from roaming traffic. The term ‘Steering of Roaming’ refers to a process in which roaming traffic is redirected to networks with whom an operator has the best wholesale rates. Operators are able to prioritize which network a device connects to when multiple networks are within range. Mobile operators are able to decide which partner network their subscribers will use whilst roaming, in order to reduce outbound roaming costs and ensure that roaming subscribers receive high-quality service.

Operators can rely on third-party enterprises to provide this service, such as BICS, with business analytics used to guide roaming traffic and identify preferential partner networks. If implemented correctly, steering of roaming can help operators increase margins through the reduction of operating costs. Roaming traffic is directed to the partner network offering the best rates, ultimately resulting in operators being able to pass these savings onto their subscribers with lower roaming charges.

References:

https://www.juniperresearch.com/pressreleases/roaming-revenue-losses-to-surpass-$2bn

https://www.juniperresearch.com/whitepapers/mobile-roaming-the-2-bn-revenue-leakage

Verizon lab trial reaches 711 Mbps upload speeds using mmWave spectrum

Summary:

Verizon said it has achieved a 5G upload speed of 711 Mbps in a technology lab trial using aggregated bands of mmWave spectrum. Samsung Electronics Co., Ltd., and Qualcomm Technologies, Inc. provided the 5G network equipment and 5G endpoint, respectively.

Samsung supplied its 28 GHz 5G compact macro and virtualized radio access network (vRAN) and vCore technology, along with a smartphone form-factor test device that used Qualcomm’s Snapdragon X65 5G modem-RF system.

“Our mmWave build is a critical differentiator, even as we drive towards massive and rapid expansion of our 5G service using our newly acquired mid-band spectrum, we are doubling down on our commitment to mmWave spectrum usage,” said Adam Koeppe, Senior Vice President of Technology Planning for Verizon. “You will see us continue to expand our mmWave footprint to deliver game changing experiences for the densest parts of our network and for unique enterprise solutions. We had over 17k mmWave cell sites at the end of last year and are on track to add 14k more in 2021, with over 30k sites on air by the end of this year, and we’ll keep building after that,” said Koeppe.

Although carriers have seen 5G download speeds above 1 Gbps, it has been more challenging to achieve fast speeds on the uplink. Verizon believes that faster upload speeds are valuable for both fixed and mobile users.

Applications for faster upload speeds:

Speeds approaching those seen in this recent trial (for comparison, 700+ Mbps is the equivalent of a one GB movie uploaded in about 10 seconds) will pave the way for uploading videos, pictures and data to the cloud, social media accounts, or sharing directly with others in densely populated venues like downtown streets, concerts and football stadiums. Whether using a traditional mobile link or fixed wireless access, these speeds will also allow students working from home or employees in distributed workforces the ability to upload and synchronize massive files, complete simultaneous editing of documents in the cloud, and collaborate with colleagues effortlessly.

Verizon says that ultra fast uplink speeds will also drive new private network use cases for enterprises. For example, faster uplink speeds can enable quality control solutions for manufacturers using artificial intelligence to identify tiny product defects in products visible only through ultra HD video feeds. Other upload-intensive solutions such as multi-location, massive security video capabilities and augmented reality centered customer experiences will also get a boost with these increased speeds.

About the trial:

The demonstration surpassed current peak upload speeds by combining 400 MHz of Verizon’s 5G mmWave frequency and 20 MHz of 4G frequency using the latest 5G technologies, including mmWave carrier aggregation and Single-User MIMO (SU-MIMO). Network technology used in the demo included Samsung’s 28 GHz 5G Compact Macro and virtualized RAN (vRAN) and Core (vCore) along with a smartphone form-factor test device powered by the flagship Snapdragon® X65 5G Modem-RF System.

Snapdragon X65 is Qualcomm Technologies’ 4th generation 5G mmWave Modem-RF System for smartphones, mobile broadband, compute, XR, industrial IoT, 5G private networks and fixed wireless access. Commercial mobile devices based on these Modem-RF solutions are expected to launch by late 2021.

Samsung’s Compact Macro delivers 5G mmWave by bringing together a baseband, radio and antenna in a single form factor. This compact and lightweight solution can be easily installed on the sides of buildings, as well as on utility poles, for the swift build-out of 5G networks. The Compact Macro achieved first Common Criteria (CC) certification against Network Device collaborative Protection Profile (NDcPP), an internationally recognized IT security standard.

“In collaboration with Qualcomm Technologies and Verizon, we are excited to begin to reach these ultra-fast uplink speeds, which will enable differentiated 5G experiences and deliver more immersive mobile services for all users”, said Junehee Lee, Executive Vice President and Head of R&D, Networks Business at Samsung Electronics. “Samsung looks forward to harnessing the full potential of 5G through new breakthroughs that will bring truly transformative benefits to people around the world and across the enterprise landscape.”

“Enhancing uplink speeds opens the door to new possibilities with 5G mmWave, in transit hubs, downtown areas, shopping malls and crowded venues, while also powering robust 5G fixed wireless access services in homes and small businesses,” said Durga Malladi, Senior Vice President and General Manager, 5G, Mobile Broadband and Infrastructure, Qualcomm Technologies, Inc. “Our collaboration with Samsung and Verizon exemplifies how we are collectively driving 5G mmWave commercialization and enabling new and exciting user experiences – everyday.”

References:

https://www.verizon.com/about/news/uploading-data-whole-lot-faster-5g

Ericsson, Singtel and global partners to power Singapore’s 5G enterprise ecosystem

Ericsson and Singtel have partnered to accelerate 5G adoption across multiple industries and leverage industry partnerships to develop and deploy advanced 5G solutions in Singapore. The partnership utilizes Ericsson’s networking expertise and Singtel’s 5G network, test facilities and capabilities, and also involves collaboration with global industry partners across various industries such as oil and gas, maritime, pharmaceutical, aerospace, financial services, retail and construction. The global partners are ABB, Axis Communications, Bosch, Bosch Rexroth, DHL Supply Chain, Hexagon, PTC and Rohde & Schwarz as well as Cradlepoint (part of Ericsson and provider of enterprise 5G wireless edge solutions).

Singtel recently announced a ramp up of its 5G roll out across Singapore and to accelerate the adoption of 5G by enterprises.

Bill Chang, Chief Executive Officer, Group Enterprise at Singtel said, “We are always looking for ways to stimulate conversations and drive even more innovation to encourage more 5G adoption by enterprises. Our partnership with Ericsson have been key to our 5G roll out and offers us a unique opportunity to come together to build an open platform for enterprises to ideate, co-create, test and eventually go-to-market. We have seen some encouraging outcomes from our early trials and key to that success is our common goal of transforming the future of business operations by harnessing the power of 5G. These trials are the springboard to more innovation and we welcome more enterprises to come on board with their ideas.”

“We have seen some encouraging outcomes from our early trials and key to that success is our common goal of transforming the future of business operations by harnessing the power of 5G. These trials are the springboard to more innovation and we welcome more enterprises to come on board with their ideas.””

The ABB single-arm YuMi® cobot used in a 5G setup. Photo Credit: ABB

With large scale applications of 5G as the end goal, Singtel and Ericsson are working with Hexagon on rolling out large scale autonomous shop floor measurement with 5G connection that can have potential benefits in the aerospace, oil and gas, construction, automotive, shipyard and wind energy industries. With a laser tracker device, non-contact, 3D precision measurements can be done easily, quickly and accurately on large pipes and aerospace parts, with the measured data then transmitted to the control center. The laser tracker device is connected to 5G for remote measurement and this allows for accurate measurements even in hard-to-reach areas and provides stability when measuring a freeform surface. With a more significant bandwidth, 5G technology also enables faster and more extensive measurements to be done.

Advances in technology are reshaping security capabilities and Axis Communications is leveraging 5G technology to innovate for a smarter and safer world. Trials have started using high performance Axis devices and cameras connected through Singtel’s MEC network. The trials demonstrate the ease and cost-effectiveness of deploying Axis devices with edge-based analytics for cities in areas that have previously been off-limits or too costly to do so, ultimately making cities safer and providing a better living environment. The new 5G network will also facilitate Axis Communications deployment of advanced analytics together with our devices in hard-to-reach places and enhancing security and protection in hitherto inaccessible areas.

Building a robust 5G ecosystem and shoring up capabilities

The partnership builds on the joint 5G initiatives rolled out by both companies in the past year. These include achieving Singapore’s fastest 5G speeds of 3.2 Gbps at Singtel’s unmanned pop-up retail store UNBOXED, using Ericsson’s high bandwidth, low latency 28 Ghz mmWave technology as well as Singtel’s GENIE, the world’s first portable 5G-in-a-box platform powered by Ericsson to enable enterprises to experience 5G’s capabilities and trial use cases in their own premises.

According to an Ericsson report – “5G for business: a 2030 market compass”, the total digitalisation revenue in Singapore is forecasted to reach US$17.41 billion by 2030, with 5G-enabled revenue estimated at US$6.48 billion. As a regional economic, business and technology hub, Singapore is an ideal launchpad for 5G-empowered industry 4.0 solutions including robotics, Augmented/Virtual/Mixed Reality, Artificial Intelligence and IoT which require fast speeds, high capacity and low latency connectivity.

Martin Wiktorin, Head of Ericsson Singapore, Brunei and Philippines, says: “As a global ICT leader with 97 live networks deployed worldwide, we are also pioneers for research in 5G for industries. Today, digitalization is a top priority for businesses, and 5G will enable a further shift towards digital transformation, accelerated by the current Covid-19 pandemic. With an extensive network of international partner engagements spanning a multitude of different ecosystems, this collaboration is built on the longstanding relationship we hold with Singtel and all global industry leaders. Together, we aim to further accelerate the 5G enterprise ecosystem and enhance Singapore’s leading edge as one of the world’s most competitive nations.”

On-going trials for industrial applications

A total of three trials are ongoing, with ABB, Axis Communications and Hexagon among the first companies to have started their trials. The trials span across advanced manufacturing, logistics, smart city development, analytics and industrial automation.

ABB has successfully tested the potential of 5G in the industrial manufacturing space, supporting the low latency operation of an ABB collaborative robot. The test was conducted in ABB’s workshop, where ABB’s single-arm YuMi® cobot was connected to Singtel’s 5G GENIE to access an on-site Multi-Access Edge Computing (MEC) platform.

Singtel’s 5G NSA and 5G SA network offerings:

Singtel had initially launched its 5G non-standalone (NSA) network in September of 2020, using spectrum in the 3.5 GHz frequency as well as existing 2.1 GHz spectrum.

Singtel had announced their 5G SA network in the country this May. Singtel had partnered with Samsung to launch 5G SA. The 5G SA sites use 3.5 GHz spectrum.

Singtel said it plans to intensify its 5G SA deployment across the island state in the coming months as handset manufacturers progressively roll out 5G SA software updates for existing 5G handsets and launch more 5G SA-compatible models in Singapore later this year.

The Asian telco said it is using 28 GHz mmWave spectrum, in addition to the 3.5 GHz and 2.1 GHz bands, to boost its 5G deployment in Singapore.

References:

https://www.rcrwireless.com/20211008/5g/ericsson-singtel-boost-adoption-5g-industries

Nokia and MediaTek use Carrier Aggregation to deliver 3.2 Gbps to end users

Nokia and MediaTek today announced that they have achieved a world’s first by successfully aggregating 5G Standalone (5G SA) spectrum using 3 Components Carrier (3CC) aggregation. This increases the sub-6Ghz 5G spectrum utilization by combining 210MHz of FDD and TDD spectrum more efficiently to reach 3.2Gbps peak downlink throughput. The move will enable communication service providers to deliver higher throughputs and better coverage to more customers.

- Successful validation test achieves first 3 Component Carriers sub-6GHz carrier aggregation combining FDD and TDD spectrum; Utilizes Nokia’s AirScale 5G Standalone Carrier Aggregation solution with commercial hardware and software

- The test combined 210MHz of spectrum from three component carriers to achieve 3.2Gbps downlink speeds

To achieve this performance, Nokia supplied its latest AirScale equipment including its AirScale 5G SA architecture powered by its energy-efficient ReefShark System-on-Chip (SoC) technology as well as its cloud-native 5G core. MediaTek provided its new M80 5G modem which combines mmWave and sub-6 GHz capabilities onto a single chip as well as the user equipment testing platform.

Carrier Aggregation (1st specified in LTE Advanced) combines frequency bands for higher rates and increased coverage, delivering superior network capacity by maximizing the spectral efficiency of 5G networks. Frequency division duplex (FDD) in 600MHz (n71) is a lower frequency band that provides a wide coverage area, improving cell edge performance. Time-division duplex (TDD) in 2600MHz (n41) has higher bandwidth and capacity. The combination of these spectrum bands supports a range of 5G deployment scenarios including indoor as well enhanced outdoor coverage. The high-band sub-6Ghz spectrum bands support high-capacity and extreme mobile broadband capabilities.

Telecoms.com’s Scott Bicheno wrote:

While claiming a ‘world first,’ the press release is a bit light on specifics. We’re told at least one of the carriers was in the 600 MHz band, using FDD technology, while at least one other was in the 2600 MHz band using TDD. A total of 210 MHz of spectrum were used but we’re not told the split. Our guess would be 10 MHz of the 600 band and 2×100 MHz of the 2600 band. The idea seems to be that this combo offers capacity when the higher frequency is available but can still fall back to a minimal level of coverage when it’s not.

JS Pan, General Manager, Wireless Communication System, and Partnerships at MediaTek, said: “This test demonstrates the importance of carrier aggregation in enabling mobile operators around the world to deliver best-in-class speed and capacity to their subscribers. The combination of Nokia’s AirScale portfolio and our technology boosts the possibilities of spectrum assets and 5G networks. We look forward to continuing to partner with Nokia to advance the 5G ecosystem.”

Mark Atkinson, SVP, Radio Access Networks PLM at Nokia, said: “Nokia continues to drive the 5G ecosystem by delivering new and important innovations. This validation test demonstrates how mobile operators can maximize their spectrum allocations and deliver enhanced coverage and capacity to subscribers. Nokia is committed to pushing the boundaries of 5G and delivering industry-leading performance. High-capacity Carrier Aggregation combinations can be achieved in both 5G Standalone (SA) and Non-Standalone (NSA) based on our scalable Airscale Baseband architecture.”

Mr. Bicheno commented:

It’s still not clear what the ‘world first’ claim refers to. Is it the aggregation of three carriers? Is it the combination of FDD and TDD in one transmission? Is it the total bandwidth achieved? It’s as if they’re trying to provoke journalists by failing to substantiate hyperbolic claims made in the headline. After all, that’s our job.

Yes, it is your job Scott and we are all grateful for that. Sadly, few other journalists (except a few like yours truly) hardly ever scrutinize a press release or news announcement.

Reference:

Nokia claims 3x carrier aggregation first with a bit of help from MediaTek

T-Mobile US talks up its 5G SA network, 5G data usage, AR and robotics applications

T-Mobile US Vice President of Technology Neville Ray provided an overview of the carrier’s 5G network during his “Building 5G for All” keynote presentation at the Wireless Infrastructure Associations (WIA) Connect X event. The association represents the nation’s cell tower owners and others in the wireless industry.

Ray said T-Mobile’s 5G standalone (5G SA) network, deployed nationwide using its 600 MHz spectrum, is “the future of wireless.” He said applications like connected vehicles, industrial robotics, mixed reality, and “supercharged IoT…can all be built on this foundation. It gives us a massive opportunity to work with partners on developing advanced 5G services.”

“We are seeing incredible growth in 5G data usage,” Ray said, referring to the average data usage among customers on T-Mobile’s new Magenta Max unlimited data plan, the operator’s most expensive unlimited data plan. Ray also reiterated many of the data points on Magenta Max that T-Mobile published last month. He said that T-Mobile’s Magenta Max customers typically stream 39% more video, use 36% more data for social media and use twice as much mobile hotspot data than other T-Mobile customers. “Our customers love this plan,” Ray said.

T-Mobile’s five-year, $60 billion investment into its 5G network seems to be paying off for the telco. The effort involves building thousands of new cell towers around the country in part to allow T-Mobile to broadcast speedy 5G signals on the 2.5GHz mid-band spectrum it acquired from Sprint. T-Mobile says that over 50% of its Magenta Max customers use a 5G smartphone.

T-Mo is planning to use 5G to offer fixed wireless access (FWA) to homes and offices. T-Mobile this week said it would reduce the price of its fixed wireless service by $10 per month in a direct challenge to wired broadband ISPs.

Furthermore, Ray said T-Mobile is also working to develop new 5G businesses around augmented reality (AR) services and other advanced offerings directed at 5G-based enterprise applications and use cases. To progress that initiative, T-Mo has partnered with companies working on video-streaming drones, with Sarcos Robotics on industrial robots, and with Fisk University. The latter project involves pre-med and biology students using a 5G-enabled headset to study human cadavers.

T-Mo is also working with Taqtile and Timberline Communications Inc., giving Timberline’s field technician headsets that can support instructional AR-overlays and other relevant content, and remote support from experts. The techs, in turn, use the headsets, connected to T-Mobile’s 5G network, to perform maintenance and other work on T-Mobile’s 5G network.

“AR and VR applications are going to transform virtually every industry,” according to Senior Director of Network Technology Erin Raney. “We are so excited to see how T-Mobile’s 5G network with that low latency and high bandwidth is going to fuel these great innovations.”

In a March 2021 blog post, T-Mo’s John Saw, EVP of Advanced & Emerging Technologies wrote:

Augmented and virtual reality (AR/VR) technology is a key area of focus at T-Mobile for 5G use case development and it is applicable to so many industries from healthcare to manufacturing, agriculture and more. Enterprises today have complex machinery, a shortage of skilled workers, and customers with no patience for downtime, making sophisticated training and technical support capabilities more important than ever. With T-Mobile’s low-latency, Ultra Capacity 5G network, we are seeing businesses boost productivity and speed as technicians use augmented reality for immersive training, and then to collaborate and fix problems fast.

Taqtile, a recent graduate of the 5G Open Innovation Lab co-founded by T-Mobile, is a company doing fascinating work building AR solutions for frontline workers. Timberline Communications Inc. (TCI), a communications infrastructure company, is using Taqtile’s AR solution running on T-Mobile 5G to perform cell site upgrades and maintenance on our network. With Taqtile, TCI’s technicians use AR headsets to view virtual service checklists and troubleshoot using remote assistance. AR solutions such as this enable frontline workers to improve their skills and perform complex tasks from anywhere exploring objects such as machinery in 3D from all angles.

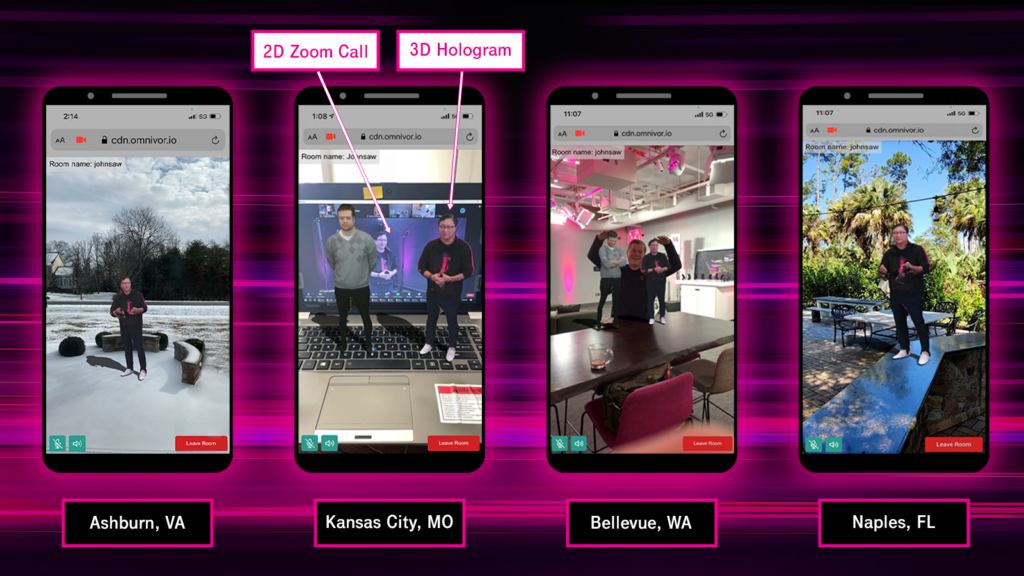

T-Mobile quarterly all-hands team meeting using holographic telepresence

…………………………………………………………………………………………………………………..

WIA recently joined the National Spectrum Consortium (NSC) to increase industry collaboration on the research and development of 5G and 5G-based technologies.

“In order to effectively address our country’s most pressing needs for wireless infrastructure, we must deliver unified solutions. WIA is looking forward to working with the Consortium to transform communications and bring next generation technology to our defense sector and communities across the U.S.,” said WIA CTO Dr. Rikin Thakker.

…………………………………………………………………………………………………………………..

References:

Frontier Communications and Ziply Fiber to raise funds for fiber optic network buildouts

Frontier Communications and Ziply Fiber have secured more funding for their respective fiber optic network building projects and network upgrades.

On October 4th, Frontier announced that it intends to offer, subject to market conditions and other factors, $1.0 billion aggregate principal amount of second lien secured notes due 2030 (the “Notes”) in a private transaction. This offering comes approximately five months after Frontier emerged from bankruptcy armed with a multi-year plan to upgrade millions of residential and business locations in its footprint. Frontier plans to deploy FTTP to about 600,000 homes this year and, more broadly, to extend FTTP to about 10 million homes by 2025.

According to Jeff Baumgartner of Light Reading, Frontier will deploy XGS-PON and is debating what to do with a remainder of its fiber and copper network. Its footprint includes rural areas that aren’t as economically attractive as the original portions of its upgrade plan. The company has discussed multiple ideas for a so-called “Wave 3” buildout that might include exploring joint ventures, securing private equity or pursuing asset swaps.

About Frontier:

Frontier offers a variety of services to residential and business customers over its fiber-optic and copper networks in 25 states, including video, high-speed Internet, advanced voice, and Frontier Secure® digital protection solutions. Frontier Business™ offers communications solutions to small, medium, and enterprise businesses.

………………………………………………………………………………………………………………………………….

Ziply Fiber, a company formed last year via the acquisition of Frontier’s operations in Washington, Oregon, Idaho and Montana, has raised $350 million in fresh funding from bond buyers.

In a prepared statement, Ziply says the new funding will support its ongoing fiber expansion. “It will ensure that we have the resources on hand to keep up the strong pace of construction we’ve set for ourselves as we head into the new year, and to continue to deliver on our goal to providing the best connected experience possible for people in the Northwest.”

At the time of its acquisition from Frontier, Ziply reported that 31% of its homes passed were fiber capable. Ziply fiber expansion goals targeted reaching 80% by 2024. The company reported passing 1.6 million locations when it was formed.

Washington state is the company’s largest market, and Montana is its smallest. Ziply employs more than 1,400 people, according to the statement about the additional funding.

The company says on its website that it is “investing $500 million to bring the best, fastest internet to our neighbors across the region.” And that was before the new $300 million funding offer.

Ziply Fiber currently serves about 500K customers across its four state footprint and has been pushing fiber deeper into its network. The company has been steadily announcing new fiber markets, adding 14 to its growing list in August 2021.

Earlier this year, Ziply Fiber announced it was moving ahead with an FTTP network upgrade that will deliver 1-Gig services to another 14 markets in Washington state and Oregon later this year. That ties into a broader commitment to deploy FTTP to 52 markets in its regions.

Like Frontier, Ziply Fiber is also starting to gear its efforts toward XGS-PON, a standard that paves the way for symmetrical 10Gbit/s services and beyond.

Ziply Fiber uses GPON today but is “fast approaching where everything will be XGS-PON,” Ziply Fiber CEO Harold Zeitz told Light Reading in a recent interview. “We are preparing all of our network for XGS. The only difference will be the ONT [optical network terminal] that goes on the home. Everything else will be XGS-ready.”

References:

Vodafone, Nokia, Cisco, etc. in multi-vendor test of Broadband Network Gateway

Vodafone, together with Benu Networks, Casa Systems, Cisco and Nokia, have successfully tested a system based on a Broadband Forum specification which will make it quicker and easier to deliver faster fixed broadband services to new and existing customers across Europe.

In a world first, the companies applied a new open architecture to the Broadband Network Gateway (BNG) – a critical component for connecting multiple users to the Internet – to enable it to work using separate software and hardware from multiple vendors. This is an important step in opening up the current single-supplier, monolithic broadband gateways to greater technological innovation from a more diverse supply chain.

Called Disaggregated BNG, the technology will change the way broadband networks are built. Using the global TR-459 standard devised by the Broadband Forum, the test allowed the core control functions of the gateway, such as authenticating a user and increasing bandwidth to support streaming services, to be separated and managed efficiently in the cloud whilst ensuring multi-vendor interoperability. Vodafone can then separately upgrade, scale and deploy new features and add more capacity, enabling greater agility and faster time to market when making enhancements across its pan-European broadband network.

Johan Wibergh, Chief Technology Officer for Vodafone, said: “We are already driving a more diverse and open mobile ecosystem with Open RAN, and now we are targeting fixed broadband. As an industry, and with government support, we owe it to people with no or slow internet access to quicken the rollout of new capabilities on fast, fixed broadband.”

Disaggregated BNG will also lower development costs for existing and new ecosystem partners and allow deeper integration with 5G.

Broadband Forum specification – multi-vendor interoperability

The test used Control and User Plane Separation technologies defined by both the Broadband Forum and the global mobile standard 3GPP, which means there will be more opportunity for converged fixed and mobile service delivery. It was conducted between test labs in Belgium (Nokia), Ireland (Casa Systems), India (Cisco) and the United States (Benu Networks).

The Broadband Forum TR-459 specification describes how a traditionally monolithic function is split into two main components – the Control Plane and the User or the Data plane. The Control Plane is the brain of the system and is responsible for managing the interactions with the customer home router, authenticating the user and determining the services and policies that should be applied. The User or Data Plane is then responsible for forwarding the users’ traffic to the correct services and enforcing any required policies such as Quality of Service (QoS).

Standardization of Control and User Plane Separation (CUPS) enables the Control Plane from one vendor to control the User Plane from a different vendor.

Partner quotes:

“We applaud Vodafone for taking a strong industry leadership role by driving standards-based interoperability between vendors,” said Ajay Manuja, CTO and VP of Engineering at Benu Networks. “Benu has specifically designed our cloud-native, disaggregated SD-Edge platform to be an open system for BNG and 5G convergence, supporting over 25 million broadband-connected homes and businesses.”

“Our goal is to simplify network transformation and make it easy for service providers to be more agile and innovative,” said Jerry Guo, CEO of Casa Systems. “Working with Vodafone, we were able to prove the interoperability and scalability of our standards-based disaggregated BNG solution that allows operators to break away from legacy infrastructures and deploy new services to their customers faster.”

“Cisco is committed to driving solutions to expand broadband penetration worldwide.” said Andy Schutz, Product Management Senior Director for Cisco. “We believe the work being done in the Broadband Forum is fundamental to these efforts, especially in the area of creating greater flexibility and choice of control and user planes from different vendors leveraging the TR-459 standard.”

“As a leading BNG vendor, Nokia is pleased to demonstrate support for a wide range of BNG deployment models including Broadband Forum’s disaggregated BNG architecture,” said Vach Kompella, VP and GM of Nokia’s IP Networks Business Division. “Nokia envisions a significant evolution in BNG architecture with the introduction of CUPS in fixed, wireless and 5G fixed wireless applications which will allow rapid feature introduction, optimal user plane placement and selection, as well as improved operations.”

……………………………………………………………………………………………………………………………

Ken Ko, managing director of Broadband Forum, told Fierce Telecom the BNG has traditionally been a “monolithic piece of equipment,” meaning operators might have to purchase a second BNG if they want to scale up or add capacity. This in turn could leave them with control plane capacity they don’t need but paid for anyway.

But with a disaggregated BNG, operators can deploy the control and user planes in a new way, centralizing the former and distributing the latter to reap myriad benefits, he said. For instance, the user plane can be deployed closer to the customer, delivering improved performance for users and giving the operator the option to scale in more flexible increments.

Additionally, by centralizing the control plane, operators not only gain scale benefits, but can also eliminate the need to set up a control plane for each individual BNG that’s rolled out. Ko pointed to improved resilience and streamlined orchestration as two other benefits of the disaggregated BNG.

For its part, Vodafone argued disaggregated BNGs would also enable “greater technological innovation from a more diverse supply chain” by lowering development costs for new and existing ecosystem players. It also highlighted the potential for deeper integration with 5G since the same control and user plane separation technology is also defined by 3GPP specifications.

Ko said the test “is a really important milestone,” adding “just the fact that we’ve got all of these players working together on this test shows that we’re getting to real deployable solutions.”

Vodafone Group

Media Relations

[email protected]

Investor Relations

[email protected]

References:

https://www.vodafone.com/news/press-release/world-first-multi-vendor-test-new-broadband-standard

https://www.fiercetelecom.com/tech/vodafone-trials-disaggregated-broadband-gateway-nokia-cisco