5G Network and Smartphone Update: AT&T Verizon and Qualcomm

AT&T is sticking to its “end of the year” 5G commercial deployment schedule, but no smartphones or tablets will be available at that time. AT&T plans to have 5G available in parts of 12 markets up by the end of the year. AT&T Communications CEO John Donovan. said AT&T’s 5G is expected to move into 19 cities (so far) in 2019. AT&T has told Light Reading that it has 5G sites live in Dallas and Waco, Texas now. But the operator has not yet launched its commercial 5G service.

The only confirmed 5G device announced for AT&T’s mobile 5G network is the Netgear Nighthawk 5G Mobile Hotspot, which AT&T calls a “puck.”

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/13592246/Nighthawk_5G_Hotspot_crop.jpg)

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/11914977/IMG_20180802_150637.jpg)

…………………………………………………………………………………………………………………………………………………………………………

“We believe the early 5G opportunities are going to be in enterprise,” Donovan said. He noted that AT&T’s work with Samsung Corp. on“robotic manufacturing” and augmented reality with Magic Leap Inc. will be future 5G enterprise offerings. 5G smartphones will be available in 2019, according to Donovan.

According to The Verge, Verizon will technically have a phone when it launches its mobile 5G offering in early 2019. If you buy the existing, Verizon-exclusive Moto Z3 which is advertised as “5G ready.” Verizon says its first 5G device will be a magnetic, modular 5G Moto Mod attachment you can snap onto that phone to add speedy 5G NR (3GPP Release 15) connectivity.

AT&T and Verizon both say they’re exclusively rolling out millimeter wave (mmWave) radios, which inherently provide far more bandwidth and capacity than today’s networks. But at 39GHz and 28GHz, those millimeter wave signals also don’t travel as far or penetrate buildings as easily as conventional cellular. That means you’ll probably drop down to LTE speeds when you transition indoors, and in order to cover the same area as today’s LTE cell towers, carriers will need to provide many more smaller cell sites. AT&T says it’s focusing on outdoor cells first, but is also looking at indoor ones for public venues like stadiums and concert halls.

……………………………………………………………………………………………………………………………………………………………………………

Qualcomm president Cristiano Amon expects the first real wave of 5G smartphones to arrive in Q2 2019 at the earliest. ”We are working, so as early as the second quarter of 2019, you’ll have smartphones being launched across the United States, across Europe, across South Korea, Australia. Some early in the quarter, some later in the quarter… they’re all going to be Android flagship devices,” says Amon. “You go to CES [in January], you’ll start to see a lot of phone announcements; you go to MWC [in February], you’ll see a lot of actual phone launches.”

Author’s Note: Don’t expect a 5G smartphone from Apple till 2020 at the earliest. The company is closely tracking the REAL 5G standard- ITU-R IMT 2020 which won’t be completed till year end 2020. Companion IMT 2020 standards from ITU-T won’t be finalized till 2021 or later.

………………………………………………………………………………………………………………………………………………………………………………………………

“We need to build a crescendo,” says Amon. “You’re not going to change your phone unless the battery life is higher, the form factor is attractive, and you need companies that can actually deliver the performance,” he added.

“Today you stream music everywhere. You don’t download music anymore; even if you have low coverage, you have enough quality to stream music. 5G will do that for video,” Amon says, before moving on to fancier, further-out predictions like unlimited storage and on-demand processing power from the cloud that can, he imagines, virtually cram the power of a Magic Leap-like augmented reality headset into a normal pair of glasses.”

The Verge says that Qualcomm will announce a new Snapdragon processor at its third annual Snapdragon Technology Summit next week in Maui. It is targeted at 5G NR smartphones. A “Snapdragon 1000” processor for a new wave of always-connected Windows laptops will also be introduced at the summit.

5G Trials in Singapore, Guam and Hong Kong

Nokia and StarHub complete “5G” New Radio pilot in Singapore

Singapore network operator StarHub and Nokia have conducted what they claim was the first outdoor live network demonstration of “5G” New Radio (NR) on the 3.5GHz frequency band in the Asian city-state.

The companies said two use cases were demonstrated to staff, industry partners and enterprise customers over ‘live’ Nokia 5G cells and core network technology at StarHub’s headquarters in Singapore.

The first use case demonstration for industrial applications replicated a manufacturing environment, demonstrating how businesses can use 5G-enabled video analytics to enhance efficiency and reduce production errors.

The use case for consumers demonstrated how sports fans can use a 5G-enabled virtual reality headsets to have immersive video experience of “live” sports events.

The trial was conducted in a 5G non-standalone network architecture, with Nokia 5G radio technology interworking with StarHub’s 4G core network.

Nokia deployed AirScale Radio Access technology with 5G NR 3GPP-compliant software and the Nokia AirFrame data center solution.

“As 5G inches closer, we are intensifying trials to identify new business opportunities and chart our network transformation roadmap to meet the demands of our customers,” said Chong Siew Loong, chief technology officer of StarHub.

“This successful pilot with Nokia showcases the readiness and possibilities of 5G to enhance consumer services and boost efficiencies for enterprises. It aligns with StarHub’s goal to support and accelerate Smart Nation initiatives in Singapore.”

https://www.telecomasia.net/content/starhub-nokia-trial-5g-35ghz-band

………………………………………………………………………………………

NTT Docomo to establish 5G test lab in Guam

The facility, Docomo’s first overseas verification center, will allow Docomo’s Program partners to connect devices and services free of charge to the lab’s 5G base and mobile stations and related equipment.

The test environment will subsequently be extended to outdoor locations to allow verification testing in real-world outdoor environments.

The facility’s location in Guam will allow for testing according to US-market technical and regulatory conditions.

With the initiative, Docomo aims to allow for prompt, flexible and accurate verification of equipment, systems and technologies for applications such as drones and autonomous vehicles.

Docomo’s 5G Open Partner Program is designed to provide global businesses and organizations with the latest 5G information, test environments and opportunities for partner workshops. The partner program currently has more than 1,900 members.

Docomo already operates 5G open labs in Seoul, South Korea and Osaka, Japan. The telco plans to open a third domestic lab in Okinawa, Japan next month.

………………………………………………………………………………………….

DOCOMO PACIFIC

A wholly-owned subsidiary of Japan telecommunications giant, NTT DOCOMO, DOCOMO PACIFIC was originally a merger of Guamcell Communications and HafaTel prior to acquisition in December 2006 by NTT DOCOMO. This acquisition allowed NTT DOCOMO the opportunity to share its world-leading technology with the region as evidenced by significant investments and upgrades in DOCOMO PACIFIC. In October 2008, DOCOMO PACIFIC was first on Guam to introduce the fastest and only 3.5G network. In November 2011, DOCOMO PACIFIC launched 4G HSPA+ service on Guam followed by the launch of advanced 4G LTE service in October 2012.

On 22 May 2013, DOCOMO PACIFIC officially merged with MCV Broadband and is now Guam and the CNMI’s leading provider of telecommunications and entertainment services. With combined offerings to include the latest mobile services, television, internet and telephone services in the region, DOCOMO PACIFIC continues to enhance the diversified range of services available to its customers.

https://www.telecomasia.net/content/docomo-establish-5g-test-lab-guam

https://www.docomopacific.com/about-us

…………………………………………………………………………………..

3HK completes Hong Kong’s first outdoor 5G trial

3 Hong Kong has revealed it has completed of 5G outdoor network trials in the 3.5-GHz and 28-GHz spectrum bands.

The company said it believes it was the first mobile operator in Hong Kong to complete a live outdoor 5G trial broadcast. The test was conducted at a trial cell site in Causeway Bay.

3 Hong Kong received an indoor 5G test permit for the 3.5-GHz band in August 2017, and completed a number of initial trials by the end of that year. In May, the company secured a temporary permit to conduct 5G trials in the 26-GHz and 28-GHz millimeter wave bands.

Another temporary permit for outdoor and indoor trials in the 3.5-GHz band was granted in June, and the company achieved 2Gbps network speeds during an earlier trial using 100MHz of spectrum in this band.

3 Hong Kong said the test results indicate that 3.5-GHz band coverage – when used in conjunction with Massive MIMO, can be comparable to the coverage afforded over LTE using the 1800-MHz band.

The design of 5G networks will use a combination of mid-band spectrum such as 3.5-GHz for a wider coverage area, and millimeter wave spectrum for high speeds

“3 Hong Kong took the initiative to carry out end-to-end trials in various 5G bands in preparation for a new era of mobile communications,” commented Kenny Koo, CEO of 3 Hong Kong’s parent company Hutchison Telecommunications Hong Kong Holdings.

“We welcome the government’s decision to allow various of its premises to accommodate 5G base stations, and we hope the application and approval processes can be simplified and accelerated to help Hong Kong’s 5G development.”

First published in Computerworld Hong Kong

AIS Fibre is first to deploy Nokia’s in-home meshed Wi-Fi solution

Thailand’s AIS Fibre has become the first network operator globally to commercially launch services based on Nokia’s in-home meshed Wi-Fi solution. The fixed line broadband operator will offer customers Nokia CPE designed to provide a seamless Wi-Fi broadband experience across every corner of the home. IEEE Techblog covered whole-home Wi-Fi service in this blog post.

AIS Fibre customers in Thailand will be eligible to receive the Nokia WiFi Beacon 3 duo-pack for a special price which, once installed, should establish a whole-home meshed Wi-Fi network that significantly enhances ultra-broadband coverage and performance.

Many homes suffer from poor Wi-Fi performance. Speeds and reliability can be impacted by the number of connected devices and by interference from appliances like microwaves or Wi-Fi networks from neighbours. In addition, coverage is often inadequate due to dead zones from indoor walls. Solving these issues can be difficult, often requiring several access points to be installed.

Nokia’s meshed Wi-Fi solution is designed to address common issues impacting Wi-Fi performance in the home, such as interference from household appliances or neighboring Wi-Fi networks, as well as dead zones from indoor walls. It automatically connects to the strongest channel to provide the best possible performance. The beacons also include embedded software and analytic functions to automatically self-heal and optimize Wi-Fi networks.

“In speaking with service providers from all over the world it’s clear that Wi-Fi is a major challenge because, most don’t provide or manage the Wi-Fi network in the home that customers rely on for broadband access,” Diffraction Analysts chief research officer Benoit Felten said. “To deliver a great end-to-end service, operators need to ensure a consistent broadband experience can be achieved in the home and Nokia is helping make that happen,” Felton added.

AIS Fibre customers with a true meshed Wi-Fi experience that is easy to install and delivers the whole-home coverage and performance needed to support ultra-broadband services.

Under the agreement, AIS will offer the beacons to customers at a special price. The solution is designed to be set up in minutes and generate a heat map to help users identify and manage dead zones.

Nokia says their product “enhances in-home Wi-Fi solution for service providers to provide a faster, better, smarter network experience:”

- Expanded portfolio of Nokia residential devices and gateways now support intelligent mesh Wi-Fi capabilities

- New software and analytics provide self-healing, self-learning, self-care functions that optimize Wi-Fi networks and maximize performance

- Nokia enables service providers and users to quickly identify and resolve Wi-Fi network issues with new online portal and mobile application

References:

https://networks.nokia.com/solutions/nokia-wifi/the-solution

https://www.telecomasia.net/content/ais-fibre-launches-nokias-meshed-wi-fi-solution

http://www.nationmultimedia.com/detail/Corporate/30359542

https://techblog.comsoc.org/2018/11/07/consumers-want-whole-home-wi-fi-service-from-isps/

Cignal AI Raises Forecast for Asia Optical Hardware Market while NA declined for 8th consecutive quarter

|

|

|

Optical Vendor Summary Reports

A new feature of the Optical Hardware Report this quarter are Optical Vendor Summary Reports which examine in depth the most recent quarterly results and items of interest about vendors in the optical market. Reports this quarter cover ADVA, Ciena, Fujitsu, Huawei, Infinera/Coriant and Nokia.

About the Optical Hardware Report

The Cignal AI Optical Hardware Report is published quarterly and includes market share and forecasts for optical transport hardware used in optical networks worldwide. The analysis includes an Excel database as well as PDF and PowerPoint summaries. Subscribers to the Optical Hardware Report also have access to Cignal AI’s real-time news briefs on current market events, Active Insight.

The report examines revenue for metro WDM, long-haul WDM and submarine (SLTE) equipment in six global regions and includes detailed port shipments by speed. Vendors in the report include Adtran, ADVA, Ciena, Cisco, Coriant, ECI, Ekinops, Fiberhome, Fujitsu, Huawei, Infinera, Juniper Networks, Mitsubishi Electric, MRV, NEC, Nokia, Padtec, Tejas, Xtera and ZTE.

Full report details, as well as articles and presentations, are available on the Cignal AI website.

Ericsson: Global 5G subs to reach 1.5 billion by 2024; mobile broadband subs growing 15% YoY

Global 5G subscriptions are set to reach 1.5 billion by the end of 2024, when the technology will be available to more than 40 percent of the world’s population, according to the latest of Ericsson’s semi-annual mobility report. North America and northeast Asia are expected to lead the 5G uptake, with US service providers already beginning to offer 5G services this year or in 2019, rising to 55 percent of mobile subscriptions by the end of 2024. In northeast Asia, the corresponding forecast figure is over 43 percent. That would make 5G the fastest-growing generation of cellular technology to ever be rolled out globally.

The first commercial 5G subscriptions in Europe are expected next year, with the technology set to account for some 30 percent of mobile subscriptions in the region by end of 2024, said the report. Total mobile subscriptions are forecast to rise to 8.9 billion at the end of 2024, up from 5 billion at the end of this year.

Global mobile data traffic, meanwhile, grew 79 percent year-on-year in Q3 2018, the highest rate since 2013. Increased data-traffic-per-smartphone in northeast Asia, above all China, pushed the global figure notably higher, said Ericsson, adding that the region now has the second highest data traffic per smartphone at 7.3GB per month. North America still has the highest data traffic per smartphone, set to reach 8.6GB per month by the end of this year.

“As 5G now hits the market, its coverage build-out and uptake in subscriptions are projected to be faster than for previous generations. At the same time, cellular IoT continues to grow strongly. What we are seeing is the start of fundamental changes that will impact not just the consumer market but many industries,” said Fredrik Jejdling, Ericsson executive vice president and head of business area networks.

…………………………………………………………………………………………………………………………………………………………

Ericsson states that the total number of mobile subscriptions was around 7.9 billion in Q3 2018, with 120 million new subscriptions added during the quarter. The number of mobile subscriptions grew at 3 percent year-on-year and currently totals 7.9 billion. China had the most net additions during the quarter (+37 million), followed by India (+31 million) and Indonesia (+13 million). The high subscription growth in China continues from Q1 and Q2, and is likely the result of intense competition among communications service providers.

The number of mobile broadband subscriptions is growing at 15 percent year-on-year, increasing by 240 million in Q3 2018. The total is now 5.7 billion.

References:

https://www.ericsson.com/en/mobility-report/reports/november-2018

https://www.telecompaper.com/news/global-5g-subs-to-reach-15-billion-by-2024-ericsson–1270919

Verizon’s “5G” FWA Progess in Sacramento vs Huawei’s Home Broadband System

Verizon’s “5G” FWA Progresses in Sacramento, CA:

Sacramento Chief Innovation Officer Louis Stewart said in an interview with Government Technology that the California state capital became one of the first four cities nationally to debut Verizon’s (proprietary) “5G” fixed wireless access (FWA) network, along with Los Angeles, Houston and Indianapolis on October 1st. The purpose of this and other FWA broadband networks is to deliver residential triple play services.

More “5G” offerings should arrive in Sacramento during 2019:

• Sacramento is on schedule to be one of the nation’s first 11 cities that will have the infrastructure needed to underpin “5G” and a connected future. That includes: in-ground fiber to link light poles and traffic signals and materials to support free Wi-Fi via kiosks in 27 parks. Much of this should arrive in early 2019, the innovation officer said, calling the digital kiosks “not on hold indefinitely,” implying “the conversation is still happening.”

• Emilie Cameron, public affairs and communications director for Downtown Sacramento Partnership (DSP), the nonprofit that manages the assessment for the property-based improvement district, said the city reached out to the group in late 2017 with “high-level” information about the Verizon partnership. But she described the conversation as “conceptual.” She described the response to the kiosks as generally positive but agreed district members are interested to learn where the devices will be located, what they’ll look like and what content and services will be offered. “You don’t want anything to be in conflict with the streetscape,” Cameron said.

• Stewart said a great deal of coordination must happen to enable deployment of infrastructure and services in 2019, which he described as “a fairly heavy lift.” Sacramento, the innovation executive said, wants to ensure the project is “done right” for the community whether in the parks or in the downtown corridor, to enable “the right user experience.” Much content development for the kiosks’ digital displays remains to be completed, he said, but officials are currently in the “ideation phase.”

“If the future that everybody’s looking at is how do you build, ultimately, a connected city, kiosks fit into that, whether it be providing additional connectivity to connect the cars and autonomous cars as they essentially geolocate, driving down the streets. They could provide other smart city solutions, be they charging stations or power down the road, in some kind of way,” Stewart said.

……………………………………………………………………………………………………………………………………………………………………….

Huawei’s 5G Home Broadband System:

Huawei and U.K. carrier Three showcased a 5G home broadband demonstration using Three’s 100 megahertz of C-Band spectrum last week at the Huawei’s Global Mobile Broadband Forum in London, which IEEE Techblog has been reporting on this week and last.

The demonstration leveraged Huawei’s latest 5G-based home broadband routers to allow forum attendees to experience ultra-high-speed 5G broadband services such as cloud gaming and 4K video streaming, Huawei said. The world’s #1 network equipment vendor highlighted that the 5G broadband service will deliver a maximum download speed of 2 Gbps, with an average of 1 Gbps for a single user.

Huawei and Three U.K. carried out a pre-commercial network test of this technology earlier this year. The two companies plan to carry out further 5G service tests in the U.K. in the coming months, which are expected to be released to the public in densely-populated urban areas and train stations, paving the way for the full commercial use of 5G networks in 2019.

“The 5G trials we carried out today demonstrate the opportunity this technology brings to the home broadband market. Huawei will continue to work with Three UK to bring customers more market-leading commercial applications of 5G,” said Yang Chaobin, President of Huawei 5G Product Line.

“Huawei is the only true 5G supplier right now,” said Neil McRae, chief architect at British Telecom. “Others need to catch up. I’ve been to Shenzhen recently and there’s nowhere else in the world where you can see” the kind of 5G technology developments that Huawei has achieved. Other suppliers need to learn from Huawei. Others are held back by old telco issues,” McRae added.

In the UK, Three, EE and BT have all said they’re launching a 5G network in some form in 2019 (that’s 1 year before IMT 2020 standard will be completed and with no standards for virtual RAN, Cloud RAN, network slicing, scheduling, OA&M, etc). EE has announced which cities will be first to get its 5G service.

………………………………………………………………………………………………………………………………………………………….

Analysis:

Some pundits say that 5G FWA networks have the potential to complement fiber to the home (FTTx) deployments by providing an alternative “last-mile” solution consumer and business services. In both urban and suburban regions, the ability to deploy 5G FWA will help reduce costs for operators and increase accessibility of high speed broadband for residential FWA customers. 5G FWA networking equipment also requires a much smaller footprint than traditional mobile networks, reducing requirements for government approvals of new tower locations.

Market research firm Ovum has this assessment of Huawei’s “5G” FWA strategy:

Huawei has gradually built its WTTx fixed wireless access (FWA) business into a key component of its wireless broadband portfolio. At the Huawei Global Analyst Summit earlier this month, the vendor reported significant successes for WTTx and high expectations for its future development. Although still small in scale relative to mobile broadband services, the FWA market is experiencing rapid growth, even outpacing FTTx and copper for new subscription additions in many world markets, according to Huawei’s figures. WTTx is central to Huawei’s wireless broadband strategy.

Even though other large network equipment vendors including Nokia and Ericsson provide their own fixed wireless broadband solutions, Huawei is arguably more aggressive in its public backing of FWA. Huawei’s work with WiMAX has given it more experience with fixed wireless and it has existing FWA operator relationships it can leverage. Huawei’s FWA strategy also differs from that of competitors such as Nokia in that it places WTTx as part of its mobile products line rather than part of its fixed broadband offering.

Huawei already claims a substantial installed base for its WTTx fixed wireless offering, with 200 WTTx commercial networks in service and 50 million households connected as of end-2017. The vendor says 82 operators launched WTTx for home broadband in 2017 alone, and it expects to see a surge in demand over the next two years.

The future growth of FWA will depend on a number of factors, including the ability to deliver efficient and sustainable home broadband services to underserved and unconnected communities more economically than fiber alternatives. Huawei has identified the following four major deployment models where it believes WTTx can provide a fiber-like experience to complement fixed broadband:

-

As a home fixed broadband service for mobile operators to deliver triple-play services

-

As a complement to wireline broadband services for converged operators

-

As a DSL upgrade for wholesale broadband providers

-

As a 5G-oriented fixed wireless broadband service.

Along with a maturing WTTx ecosystem, a number of factors support the expansion of fixed wireless services. On the network side, spare cell capacity arising from the uneven traffic distribution associated with smartphones can be used more efficiently by operators introducing FWA services. On the equipment side, advances in self-install CPE, along with performance and efficiency gains from the incorporation of multiple receiver and antenna technologies and the use of massive MIMO and 256QAM at the eNodeB, is helping to deliver a high-capacity equivalent to evolved LTE. This will support the evolution toward 5G FWA.

Even so, the business case for FWA is likely to be challenging, particularly in emerging markets where population densities and ARPU are low. Huawei believes governments and regulators can promote the benefits of universal network coverage by providing more practical encouragement and financial stimulus to local mobile operators. It offers a business operation and management platform as part of its WTTx pre-sales service suite, which helps operators evaluate the potential opportunity for a fixed wireless solution based on aspects such as network capacity trends and coverage gaps in existing FTTx and wireline networks.

Ultimately, the success of fixed wireless broadband will depend on the scope it provides for operators to monetize services.

Huawei’s “All Bands Go to 5G” Strategy Explained; Partnership with China Telecom Described

Huawei unveiled its “All Bands Go to 5G” strategy for the evolution towards a 5G wireless network at its Global Mobile Broadband Forum 2018 in London last week. This strategy provides suggestions for future development of the wireless network in three key aspects: simplified site, simplified network, and automation.

Huawei Launches the Evolution Strategy for 5G-oriented Wireless Target Network

……………………………………………………………………………………………………………………………………………………………………………

I. Global commercial use of 5G networks has now entered the fast lane.

Massive wireless connectivity has become an inevitable trend. Data traffic on global mobile broadband (MBB) networks has increased rapidly. By 1st half of 2018, the data of usage (DOU) for a number of global operators has exceeded 10 GB, and that in certain Middle East regions has even reached 70 GB. Releasing data traffic helps to promote a positive MBB business cycle in the global wireless industry and ushers in a new era of traffic operation.

By October 2018, new fixed wireless access (FWA) services have been put into commercial use on about 230 networks. About 75 million families can now enjoy the benefits of FWA-based home broadband (HBB) services. In the future, the larger bandwidth capability of 5G will provide fiber-like HBB user experience and enable diverse home entertainment applications such as 4K/8K UHD video and AR/VR. At the same time, new IoT connections are becoming a new source of potential growth for operators. LTE NB-IoT is undergoing rapid development and has seen 58 commercial networks around the world, with industry applications providing millions of connections such as smart gas, water, white goods, firefighting, and electric vehicle tracking. 5G technologies will offer more reliable connection capabilities with shorter latency. Massive wireless connectivity has become an inevitable trend.

The development of the global 5G industry is accelerating in 2018. According to the 5G spectrum report published by GSA in November 2018, the UK, Spain, Latvia, Korea, and Ireland have officially released spectrum resources dedicated for 5G by August 2018. In addition, 35 countries have scheduled related plans. The 5G industry supply chain is steadily growing more and more mature.

Huawei claims to have released 5G commercial CPEs in 2018 (???), and multiple 5G smartphones will be launched in 2019. According to the report released by GSMA, 182 global operators are conducting tests on 5G technologies and 74 operators have announced plans for 5G commercial deployment. Global commercial use of 5G networks has now entered the fast lane, according to Huawei (but not this author).

5G development will enable more commercial application scenarios and promote the continuous development of a digital society. Under such circumstances, Huawei has proposed a new eMBB (enhanced Mobile Broad Band) industry vision for Cloud X featuring smart terminals, broad pipes, and cloud applications. For example, Huawei has shifted the most complex processes of rendering, real-time computing, and service content to the cloud. Thanks to transmission data streams using large bandwidth and ultra-low latency on the 5G network, as well as encoding and decoding technologies that match the cloud and terminals, applications such as Cloud AR/VR can be deployed anywhere anytime, according to the company.

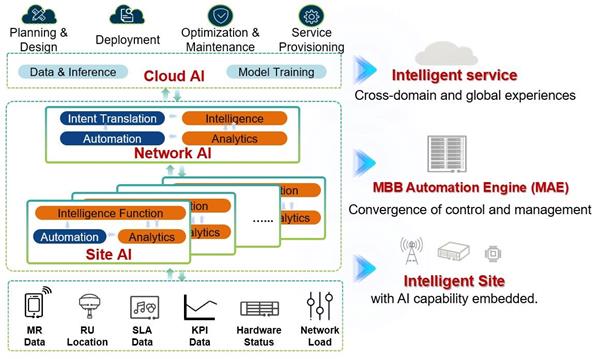

Huawei believes that AI technologies can be adopted in the communication industry. AI-based automation of network planning, deployment, optimization, and service provisioning will enable network O&M to be simplified, unleash network potential, and make networks more intelligent.

II. “LTE Evolution+5G NR” is gaining industry’s consensus for 5G wireless networks.

In the 5G era, wireless spectrum evolution is divided into two phases:

Phase 1: Sub-3 GHz spectrum resources evolve to LTE and 5G non stand alone (based on 3GPP release 15 NR) high frequency bands are introduced.

Phase 2: Sub-3 GHz spectrum resources evolve to 5G NR. “LTE Evo+NR” is realized on the target network.

Therefore, target network evolution in the 5G era can be summarized as “LTE Evolution+5G NR.” In the process of achieving this goal, the global wireless network faces the following challenges:

1. OPEX increases year by year. From 2005 to 2017, global operators’ OPEX/revenue percentage is increased from 62% to 75%. In the future, the coexistence of 2G, 3G, 4G, and 5G will increase the complexity of network O&M. In particular, site TCO is high. Site deployment still faces several issues such as difficult site acquisition, high engineering costs, and high site rentals.

2. 4G-LTE basic services fall back to 2G or 3G. Generally, insufficient 4G network coverage causes VoLTE services to fall back to 2G or 3G, deteriorating voice experience. NB-IoT/eMTC services also require better 4G network coverage. As a result, it is difficult for operators to shut down 2G and 3G networks.

–>The coexistence of four RAN technologies leads to more complex network operation and presents difficulties in reducing OPEX.

III. 5G-oriented simplified networks are built to effectively meet challenges and promote 5G business success.

Peter Zhou, CMO of Huawei Wireless Network Product Line, illustrated the evolution strategy for 5G-oriented wireless target network. This strategy aims to help operators resolve the preceding challenges and commercialize 5G. The evolution strategy includes three key aspects: simplified site, simplified network, and automation.

Simplified site enables full outdoor base stations and facilitates site acquisition, deployment, and TCO saving.

Along with the development of Moore’s Law, the 7 nm technology has enjoyed widespread commercial adoption throughout the chip manufacturing industry, and BBUs are becoming more and more integrated. In recent years, lithium battery technology has seen rapid development, and the energy density of lithium batteries is far more superior to that of lead-acid batteries. The development of new technologies makes full outdoor wireless base stations a reality. Peter Zhou pointed out, “Using componentized outdoor BBUs, blade power modules, and blade batteries, full outdoor macro base stations can be deployed on poles without shelters or cabinets. This greatly reduces the upgrade cost of existing sites, decreases the difficulty and cost of obtaining new sites, and helps operators reduce TCO by 30% and above.”

Antenna reconstruction is required for 5G deployment on the C-band. Currently, 70% urban sites cannot deploy new antennas due to insufficient antenna space. In order to resolve this problem, Huawei proposes the “1+1” antenna solution. That is, one multi-band antenna is used to support all sub-3 GHz bands, and one Massive MIMO AAU is used to support C-band NR. In total, two antennas are able to support all operator’s frequency bands. This solution greatly simplifies site space, reduces site OPEX, and realizes 5G NR deployment with insufficient antenna space.

Simplified network realizes the construction of an LTE full-service foundation network and ensures “Zero Fallback” for three basic services.

In the 5G era, the coexistence of multiple RAN technologies (2G/3G/4G/5G) results in complex networks and high O&M costs. Therefore, basic voice, IoT, and data services need to be migrated to the LTE network so that the LTE network becomes the bearer network for basic services and 2G and 3G networks enter the life cycle development phase. Huawei’s Peter Zhou emphasized that, “The LTE network needs to be built as a full-service foundation network to achieve ‘Zero Fallback’ for basic services such as voice, IoT, and data. Therefore, LTE must be planned based on the coverage of basic services rather than the traditional population coverage.”

“Simplified site, simplified network, and automation help operators reduce TCO, simplify the network architecture, reduce operation costs, and fully unleash the network potential. This lays a solid foundation for the successful commercial use of 5G networks and helps the industry to identify the goal and direction for future network evolution. Huawei also wishes to work more closely with industry partners to innovate continuously, build a 5G business ecosystem, and finally achieve a better connected digital society.”

……………………………………………………………………………………………………………………………………………….

Separately, China Telecom announced it had partnered with Huawei for investment in 5G innovation and has begun researching how to commercialize 5G technology. Both parties intend to leverage their advantages to develop the 5G service innovation base, build an industry ecosystem alliance, and research the usage scenarios and business models of 5G services. Huawei Wireless X Labs in Shenzhen, simulates 5G technologies and usage scenarios, and works with upstream and downstream industry partners to jointly develop industry standards and plans. China Telecom leverages the resources of 5G trial networks and existing industry customers to develop new 5G applications, driving the development of the entire 5G industry and improving China Telecom’s influence in the 5G field.

Application Models

Based on the first of six 5G trial network, China Telecom Shenzhen is exploring 5G application models. During the 5G Unmanned Aerial Vehicle (UAV) flight test and inspection demonstration, remote control personnel experienced VR capabilities and remote HD video transmission over a low-latency 5G network. Both the maiden test flight and inspection were completed successfully, demonstrating the ability of 5G to support UAV applications. This means that aerial photography, unattended inspection, logistics transportation, security identification, and other industrial applications will be driven by the rapid development of 5G in the telecom sector, creating a strong foundation for China Telecom to explore new vertical industries. In tests on Gbps-level experience buses, 5G provided an average speed of more than 1 Gbps and a peak rate of 3 Gbps, allowing passengers to experience mobile 4K IPTV, 16-channel HD video streams, and VR applications while traveling. This paves the way for China Telecom’s plans of 5G and IPTV convergence.

To achieve its goal of connecting 50 5G sites by the end of 2018 while constructing its transport network, China Telecom Shenzhen upgraded its existing IP RAN to deploy and verify 5G technologies, enabling the co-existence of both 4G and 5G. In addition, the operator gained valuable engineering experience and developed scenario-based solutions for subsequent 5G construction.

Addressing 5G challenges for the smooth evolution of live networks

While bringing a wide variety of services, 5G also brings challenges in terms of bandwidth, latency, connections, and the slicing of transport networks. GNodeBs, however, deliver five to ten times more bandwidth than eNodeBs. 5G services such as Internet of Vehicles (IoV) require the latency to be one-tenth of what they are with 4G. In terms of connections, the cloudification of wireless and core networks brings full-mesh connections, requiring flexible scheduling on the transport network. In addition, 5G’s differentiated services require network slicing, with a focus on isolation and the automated management of network slices on transport networks. To cope with these challenges, China Telecom Shenzhen assessed the existing IP RAN, opting to upgrade and expand core and aggregation devices and replace specific access devices for 5G transport. To quickly deploy 5G services and fully reuse the existing network, China Telecom Shenzhen implemented the smooth evolution solution for the transport network in pilot areas.

Network upgrade for co-existence of 4G and 5G

The co-deployment of eNodeB and gNodeB is the optimal choice for transport networks, and China Telecom Shenzhen verified different co-existence solutions. Access ring devices can be upgraded and expanded to satisfy the requirements of 50GE ring networking and allow 4G and 5G services to share the same access ring. When access devices need to be replaced, China Telecom Shenzhen can establish a new 5G access ring, which can share the core and aggregation layer to achieve unified service bearing.

E2E large capacity to meet HD video transmission requirements

As China Telecom continues to explore 5G services, the convergence of 5G and IPTV has become its focus. To meet the requirements of 4K IPTV video transmission using 5G, the transport network must have large bandwidth transmission capabilities. China Telecom Shenzhen upgraded the access layer from an eNodeB GE ring to a 50GE ring, and upgraded the core and aggregation layer from a 10GE network to a 100GE network, allowing high-bandwidth connections between base stations and the core network.

References:

https://techblog.comsoc.org/2018/11/06/gsma-5g-spectrum-guide-vs-wrc-2019/

OpenSignal: Cellular networks getting faster than Wi-Fi; but not in U.S.

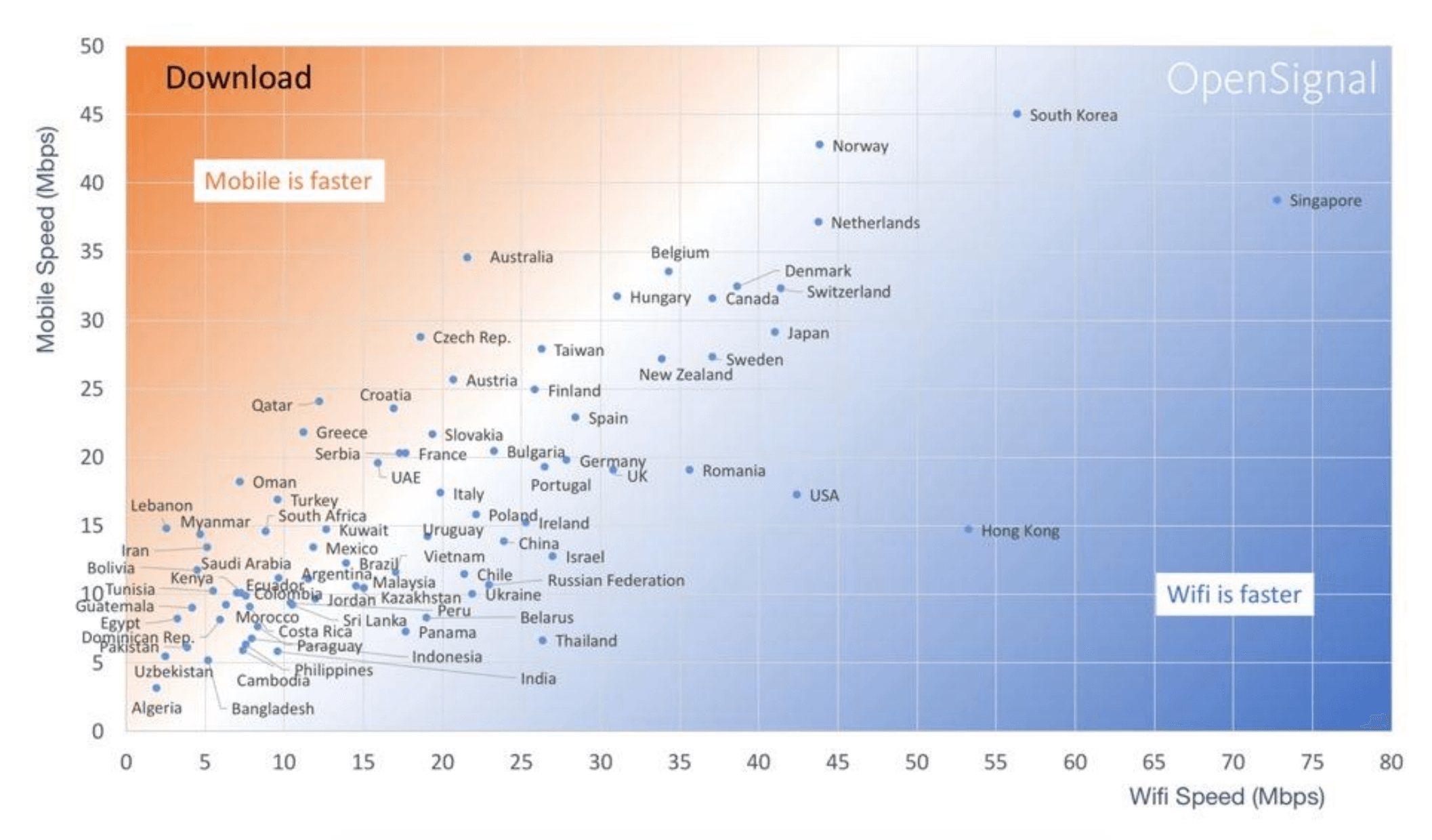

According to a new report by OpenSignal, cellular network speeds have gotten faster and often greater than average Wi-Fi speeds. In 33 countries, smartphone users now experience faster average download speeds using a mobile (cellular) network than using Wi-Fi. The upshot is that cellular networks (some type of LTE) are no longer inferior to Wi-Fi in every country and the mobile industry must change a number of design decisions as a result.

Australia smartphone users experienced the biggest advantage with average download speeds 13 Mbps faster on mobile networks than on Wi-Fi. The mobile network advantage for a few other countries: France (+2.5 Mbps); Qatar (+11.8 Mbps); Turkey (+7.3 Mbps); Mexico (+1.5 Mbps) and South Africa (+5.7 Mbps).

In sharp contrast to the above, U.S. Wi-Fi is still 25Mbps faster than mobile networks on average. Same is true for Hong Kong, South Korea, and Singapore.

Hong Kong’s mobile networks deliver average speeds that are 38.6Mbps lower than that experienced over Wi-Fi. Hong Kong’s mobile users experience an average speed over Wi-Fi of nearly 55Mbps, compared to just 15Mbps for its mobile network.

In China by contrast, average Wi-Fi speeds were recorded at 23.9Mbps, compared to overall mobile download speeds of 13.8Mbps.

Of the Asia-Pacific countries studied, only Japan, South Korea and Singapore recorded faster Wi-Fi compared to mobile speeds, and the difference between the two was a lot closer in each market. South Korea recorded the fastest average mobile speeds of around 45Mbps, compared to 56Mbps for Wi-Fi, while Singapore had the fastest Wi-Fi speeds of 73Mbps, compared to around 39Mbps over Wi-Fi.

OpenSignal states that telecom operators in markets where there is little difference between mobile and Wi-Fi speeds are using fixed wireless networks effectively to support their cellular networks. They also experience greater mobile network consumption as consumers in the market have little incentive to switch networks.

With 5G coming in various flavors, cellular networking speeds are bound to get faster and better. However the next generation of Wi-Fi – IEEE 802.11ax or Wi-Fi 6 is designed for cellular data offloading to a fixed broadband wireless network. Hence, both technologies are meant to be complementary.

Another interesting observation from the study is a mobile device’s tendency to favor Wi-Fi over cellular, even if the Wi-Fi connection is not as good (that’s my experience with a Samsung smart phone). With the exception of smart phones made by Huawei, most cellular devices will automatically switch from cellular networks to Wi-Fi without performing a speed test. Huawei phones will switch from a slow Wi-Fi link to a faster cellular connection where appropriate. We think the entire mobile phone industry should do this type of speed test and wireless network switching in both directions (Wi-Fi to cellular and cellular to Wi-Fi).

References:

https://www.theregister.co.uk/2018/11/23/mobile_v_wifi_speed_report/

https://www.techspot.com/news/77559-opensignal-mobile-networks-getting-faster-than-wi-fi.html

https://www.cw.com.hk/it-hk/hong-kong-mobile-networks-significantly-slower-than-wi-fi

Huawei has 22 commercial 5G contracts; U.S. government warns allies about the company

1. Huawei has signed 22 commercial contracts for 5G as operators prepare for the commercial launch of the new technology.

The company’s executive director and president of carrier business group Ryan Ding made the announcement during a keynote speech at the Global Mobile Broadband Forum (MBBF) in London.

During his speech, Ding noted that a number of operators are expediting 5G commercial deployment in order to secure the first mover advantage. Major countries representing a third of the global population are among the first adopters of the technology.

“So far, we have signed 22 commercial contracts for 5G, and we are working with over 50 carriers on 5G commercial tests,” Ding said.

“Through heavy investment and continuous innovation, we are committed to helping carriers deploy 5G networks easily, rapidly, and cost-effectively. And we are ready to work with all stakeholders to drive robust development of the 5G industry.”

Ding spoke of the technical capabilities of Huawei’s 4G/5G kit, such as an uplink and downlink decoupling that can achieve co-coverage of 4G and 5G using C-band spectrum, and the ability to offer end-to-end solutions meant it was an ideal partner for operators.Ding added that the first 5G smartphones will be available next year, and phone makers are expected to launch budget 5G phones priced at around $100 soon after the commercial roll-out of 5G networks.

He also mentioned the relatively small size and lightweight of Huawei’s wireless networking equipment. This will appeal to operators struggling to add more equipment to mobile sites, especially in urban areas

“Every new generation of network comes with new challenges, and this applies to 5G commercial deployment, too,” said Ding. “We take complexity and deliver simplicity. That means we will provide innovative solutions to address challenges in 5G commercialization. Our close collaboration with carriers will help them find the easy way to 5G.

“Huawei has earned customer recognition for our leading 5G end-to-end capabilities and innovative products and solutions. So far, we have signed 22 commercial contracts for 5G, and we are working with over 50 carriers on 5G commercial tests. Through heavy investment and continuous innovation, we are committed to helping carriers deploy 5G networks easily, rapidly, and cost-effectively. And we are ready to work with all stakeholders to drive robust development of the 5G industry.”

The 5G contracts could also be viewed as a vote of confidence in Huawei. It has effectively been frozen out of the U.S. and Australian markets due to national security fears, specifically that the use of its equipment risks the possibility of Chinese government backdoors.

–>The effort to ban Huawei is further described in 2. below.

………………………………………………………………………………………………………………….

2. U.S. Asks Allies to Drop Huawei – worried about potential Chinese meddling in 5G networks, but foreign carriers may balk

WSJ article front page lead story on 23 November 2018

The U.S. government has initiated an extraordinary outreach campaign to foreign allies, trying to persuade wireless and internet service providers in these countries to avoid telecommunications equipment from China’s Huawei Technologies Co., according to people familiar with the situation.

American officials have briefed their government counterparts and telecom executives in friendly countries where Huawei equipment is already in wide use, including Germany, Italy and Japan, about what they see as cybersecurity risks, these people said. The U.S. is also considering increasing financial aid for telecommunications development in countries that shun Chinese-made equipment, some of these people say.

One U.S. concern centers on the use of Chinese telecom equipment in countries that host American military bases, according to people familiar with the matter. The Defense Department has its own satellites and telecom network for especially sensitive communications, but most traffic at many military installations travels through commercial networks.

Officials familiar with the current effort say concerns about telecom-network vulnerabilities predate the Trump era and reflect longstanding national-security worries.

The overseas push comes as wireless and internet providers around the world prepare to buy new hardware for 5G, the coming generation of mobile technology. 5G promises superfast connections that enable self-driving cars and the “Internet of Things,” in which factories and such everyday objects as heart monitors and sneakers are internet-connected.

U.S. officials say they worry about the prospect of Chinese telecom-equipment makers spying on or disabling connections to an exponentially growing universe of things, including components of manufacturing plants.

“We engage with countries around the world about our concerns regarding cyberthreats in telecommunications infrastructure,” a U.S. official said. “As they’re looking to move to 5G, we remind them of those concerns. There are additional complexities to 5G networks that make them more vulnerable to cyberattacks.”

The briefings are aimed at dissuading governments and telecom executives from using Huawei network components in both government and commercially operated networks. A core focus of the briefings is Beijing’s ability to force Chinese corporations to comply with government requests from government authorities, a U.S. official said.

The talking points also emphasize how wireless and internet networks in a few years could be more susceptible to cyberattacks or espionage, people familiar with the briefings said. Today’s cellular-tower equipment, for instance, is largely isolated from the “core” systems that transfer much of a network’s voice and data traffic. But in the 5G networks telecom carriers are preparing to install, cellular-tower hardware will take over some tasks from the core—and that hardware could potentially be used to disrupt the core via cyberattacks. For that reason, U.S. officials worry that Huawei or ZTE cellular-tower equipment could compromise swaths of a telecom network.

Huawei is the world’s No. 2 smartphone maker behind Samsung Electronics Co. It is the global leader for telecom equipment, such as the hardware that goes into cellular towers, internet networks and other infrastructure that enables modern communication.

Huawei has long said it is an employee-owned company and isn’t beholden to any government, and has never used its equipment to spy on or sabotage other countries. It said its equipment is as safe as that of Western competitors, such as Finland’s Nokia Corp. and Sweden’s Ericsson , because all manufacturers share common supply lines.

In a statement Friday, Huawei said it has its customers’ trust and was “surprised by the behaviors of the U.S. government” detailed in this article. “If a government’s behavior extends beyond its jurisdiction, such activity should not be encouraged,” it said.

The Trump administration and Congress this year initiated a multipronged push to tighten up restrictions on Huawei and other Chinese telecom-equipment manufacturers, including ZTE Corp. The Federal Communications Commission, for instance, moved to restrict federal subsidies to some carriers if they buy Chinese gear.

Even without U.S. business, Huawei dominates the world’s telecom-equipment market. Last year, the company held a 22% share globally, according to research firm IHS Markit Ltd. Nokia had 13%, Ericsson had 11% and ZTE was in fourth at 10%. Dell’Oro Group says Huawei has a 38% revenue market share in Asia Pacific, a 30% share in Europe, but only a 2% share in North America.

Some other members of the “Five Eyes,” a five-member intelligence pact among English-speaking countries that includes the U.S., have also publicly challenged Huawei. The Australian government in August banned Huawei and ZTE from its 5G networks. In October, U.K. authorities said they were reviewing the makeup of its telecom-equipment market, a move industry leaders said was clearly aimed at Huawei.

Still, there is a big hitch to U.S. efforts to curb Huawei overseas: The company is already popular among carriers in allied countries, including some of America’s closest military partners. Some major carriers in these places say Huawei offers the most products and often customizes them to fit a carrier’s needs. They also cite lower costs and high quality.

In an effort to narrow that advantage in some countries, Washington is considering ways to increase funding from various U.S. government sources to subsidize the purchase and use of non-Chinese equipment, according to people familiar with the matter. Countries buying Chinese telecommunications equipment would be ineligible for such subsidies.

In the past year, U.S. officials, including representatives from the National Security Council and Commerce, Defense and State departments, worked together to produce briefing notes about why they believe Chinese telecom equipment poses national-security risks, people familiar with the matter said. One U.S. government official said they focused on Huawei but also included ZTE, a Chinese rival with a much smaller business outside China. A ZTE representative declined to comment on the U.S. effort.

Washington has circulated the notes to national-security officials as well as to embassies, with the idea that they can deliver the message to foreign officials and telecom executives, some of the people said.

A spokesman for the Commerce Department said it would “remain vigilant against any threat to U.S. national security.” Spokesmen for the National Security Council and the State Department declined to comment. The Defense Department didn’t return a request for comment.

U.S. officials have briefed counterparts in Germany, which has signaled a new wariness toward Huawei, according to people familiar with the matter. Huawei this month opened a lab in Germany similar to one it already operates in Britain, where Huawei products are inspected for security flaws. The U.K. government said in July it found shortcomings in the process.

Germany’s Federal Office for Information Security declined to comment.

American officials have also briefed Japanese officials about Huawei, people familiar with the matter said. A Japanese government official said “we share various information with the U.S.,” but declined to comment on specifics. Japanese officials in August said they were studying restrictions on Huawei.

Telstra completes “5G” data call using Qualcomm chipset

Telstra says it has successfully conducted a live “5G” data call using a commercial chipset on the telco’s wireless network. Australia’s largest network operator made a 3GPP Release 15 (not 5G according to 3GPP) compliant data call using its 3.5GHz spectrum, Ericsson’s latest 5G network software and Qualcomm’s commercial 5G Snapdragon chipset in a form factor device.

The operator also said it turned on two 5G-enabled base stations in the state of Tasmania. In August it switched on its first 5G-compatible cell sites to enable testing of pre-commercial devices, with aims to deploy more than 200 sites across Australia by the year-end. Telstra plans a commercial 5G launch in 2019 and is engaged in various trials at its 5G Innovation Centre in Australia’s Gold Coast (see pic below), which it opened in February. That Centre, supported by Ericsson, has since been home to several world and Australian firsts including the world’s first precinct of 5G-enabled WiFi hotspots, Australia’s first 5G Connected Car, the world’s first end-to-end 5G non-standalone data call on a commercial mobile network, and the launch of over 50 5G-enabled sites around the country.

Although the form factor device used for the so called “5G” test is larger than most mobile handsets, it bears a far closer resemblance to a commercially available smartphone than the 200kg, fridge-like prototype 5G device that Telstra was employing for tests just a few months ago.

“Today’s announcement is a significant milestone as it signals that commercial 5G devices are getting closer and closer,” he added.

“Field testing in our real-world mobile network with this chipset over our commercial spectrum moves the verification well and truly from the lab into the street,” Seneviratne said. “The team will continue testing over the coming months to improve data rates and overall performance in readiness for device availability.”

Telstra’s chief executive, Andy Penn, has said that he expects the transition from 4G to 5G to be even swifter than the migration from 3G to 4G.

In July this year Telstra said that it had successfully conducted a 5G data call over its network using Intel’s 5G Mobile Trial Platform. In August the company announced that it had started progressively declaring its mobile sites ‘5G-ready’ — a move that rival telco Optus dismissed as a marketing stunt.

The Australian Communication and Media Authority is currently auctioning off spectrum in the 3.6GHz band, which will play a key role in early 5G services.

References:

https://www.computerworld.com.au/article/649902/telstra-gets-ready-put-5g-your-pocket/