AT&T CEO Talks up 5G: Deploying small cells, China/Huawei – Security or Critical U.S. Infrastructure Risk?

AT&T CEO Randall Stephenson said China still lags behind the U.S. in the 5G race (for dubious reasons- see comment in box below this article), but slow cell site permitting processes in the U.S. and heavy Chinese investment, coupled with Huawei’s 5G dominance, could change the situation. Also, European carriers that use Huawei equipment in 4G networks are unable to switch suppliers for 5G networks because “Huawei is not allowing interoperability to 5G-— meaning if you are 4G, you are stuck with Huawei for 5G,” said Stephenson during an interview with Carlisle Group co-founder David Rubenstein at the Economic Club in Washington DC.

“When the Europeans say we got a problem — that’s their problem. They really don’t have an option to go to somebody else…To me, the biggest risk is not that the Chinese government might listen in on our phone conversations or mine our data some how if we use their equipment. That’s not the issue,” he said.

AT&T’s CEO is very optimistic about 5G technology, claiming it “will be the most transformative of all the Gs … you can’t conceive all the services that 5G implies.”

But in a 5G world millions of “things” will be connected and located within a square mile. To make that possible, AT&T will deploy hundreds of thousands of small cell sites throughout the U.S. They will be placed on light poles, sides of buildings, roof tops and other structures.

According to the AT&T CEO, 5G is a more efficient technology, delivering a better smartphone user experience, but it won’t be cheaper than 4G. AT&T has not “worked out what or pricing arithmetic looks like,” Stephenson said.

Regarding 5G replacing smartphone screens with Internet video enabled smart eye glasses, Stephenson said:

We carry around these devices and they’re bigger than they should be, because there’s a lot of computing in here, there’s a lot of storage in here. When you get to 5G, all that computing, all that storage goes away — it’s back in the network. These form factors, some would say they shrink.

I say they go away. It is conceivable that we’re going to be moving into a world without screens, a world where this [points to his eye glasses] is your screen. You don’t need any more of a form factor than this, once the computing and storage requirements move out and into the network. And guys like you [waving to the TV cameras in the back] can think very differently about how you deliver your content to your customers. It becomes a delivery without screens. It’s just a totally different experience. …

AT&T is right at the very center of all this because, if you ask yourself: Five years from now, in this room, will you be consuming more or less global bandwidth. More? Who thinks more? Will you be consuming more or less premium entertainment? More? Well, I like where we are on both of those.

You can watch and listen to Stephenson’s 52 1/2 minute talk here.

References:

https://www.cnn.com/2019/03/20/business/att-randall-stephenson-5g/index.html

……………………………………………………………………………………………………………………………………………………………………….

AT&T says its leading wireless and fiber network, including investments in new technology such as 5G, will provide the network bandwidth required as customers increase engagement with premium video and emerging 4K and virtual reality content.

AT&T is now a software company: “Software is increasingly at the heart of everything we do. Whether a patent or an open source project, software is the future of AT&T. Software is our thing,” AT&T’s Mazin Gilbert wrote in a blog post.

China Telecom to accelerate 5G deployment; 100% Fiber network coverage; Gigabit fiber broadband deployment

According to its latest financial report published today, China Telecom has big plans for 5G. The report states in part:

New technologies represented by 5G and AI are integrating and evolving, enabling them to support supply-side structural reform, which will lead to a rapid expansion of potential value for digital economy. As the next generation infrastructure, 5G network will become ever more intertwined with applications and telecom operators will play an increasingly pivotal role in the information communications industry. The Company (China Telecom) will actively explore commercial applications of various new technologies, accelerate the development of operation mechanisms that are adapted for 5G, and capitalize on its advantages to promote ecological services ahead

of time.Recently, China Telecom was awarded the 3.5GHz band to conduct nationwide 5G network trials. Leveraging the advantages of the 5G mainstream frequency band and insisting on open cooperation, the Company will accelerate 5G deployment proactively and pragmatically. Persisting in a market-oriented and demand-driven approach, the Company will appropriately manage the momentum, propel the development of non-standalone (NSA) and standalone (SA) concurrently, and progressively expand the scale of network trials and the pilot project of 2B/2C applications.

In a presentation on its 2018 financial results, China Telecom noted these 5G milestones:

1. Technology:

• Published industry’s first 5G Technology White Paper

• Launched industry’s first 5G+AI handset standard

• Pioneered to accomplish 4G-5G interoperability on SA network architecture

• Pioneered to interoperate 5G SA (Stand Alone) on equipment from different vendors

2. Extensive Application Trials:

• Internet of Vehicles (IoV): 5G-based remote-controlled driving in Xiong’an and passed test

• Media convergence: Ultra-high definition 5G 4K, VR live broadcasting of gala show

• Smart city: 5G full coverage along a 28km road in city area, performing data traffic management for ultra-high definition 5G+, cloud VR and 5G smart transport

• Energy Internet: Trial on IoT electricity distribution leveraging 5G network slicing (?), performing 5G precision control on electricity distribution and usage

3. Network Capability- Prepare for flexible and agile 5G deployment with:

• Prompt assessment and modification of existing network

• Acceleration of network cloudification and intelligent upgrade

• 100MHz spectrum at 3.5GHz band, which has the world’s most developed industry chain for 5G trial

……………………………………………………………………………………………………………………………………………………….

China Telecom plans to accelerate 5G development pragmatically:

• Persistence in SA as the goal and direction, to expediate industry chain maturity and conduct scale trials in SA/NSA which is concurrently in a very early stage

• Adjust investment plan and expand trial subject to technology maturity, licensing, market competition and results of scale trial

• Actively explore network co-building and co-sharing to reduce network construction and maintenance cost

Open co-operation initiatives include:

• Promote key 5G technology researches, actively participate in formulating 5G international standards and foster end-to-end development of industry supply chains

• Collaborate with customers and business partners for innovations, enrich products and applications

• Work with industry to commence trials on smart city, autonomous driving, industrial Internet, entertainment, medical service, education, etc.

The Company has modified its R&D system to enhance the R&D capability of key technologies of strategic, pioneering and fundamental importance, such as 5G, network capability, AI, etc.

……………………………………………………………………………………………………………………………………………………………………………………………………………………

In its SEC Form 6-K the company wrote:

- Focusing on user experience, business scale expansion and value management, the Company pushed forward the construction and intelligent upgrade of its network to build up comprehensive network advantages.

- Leveraging big data analysis, we deployed dynamic capacity expansion of 4G network with precision, and further optimized in-depth coverage at key locations.

- The number of 4G base stations reached 1.38 million, effectively supporting the upgrade to VoLTE high definition voice, as well as the continuous growth of large data traffic business.

- Our fiber network now fully covers all cities and towns in the service area of the Company, enabling a leading customer experience. By leading the deployment of Gigabit fiber broadband, we established a new edge in broadband network.

- We continued to enhance our NB-IoT network, and built a whole-range speed rate IoT structure, which combines high, medium and low speeds, supporting further expansion in vertical industries.

- By pushing forward cloud-network integration at full throttle, we continued to optimize our nationwide deployment of cloud resources and backbone network coverage, resulting in the establishment of a cloud-led network.

- By introducing new technologies such as Software-Defined Networking (SDN) and Network Functions Virtualization (NFV), the Company accelerated the re-constitution of its networks, and rolled out scale promotion of intelligent self-selecting bandwidth network products for government and enterprise customers as well as home gateway products based on SDN technology, which allows our network products to be activated within minutes.

- We also launched a VoLTE virtual IP Multimedia Subsystem (vIMS) core network with software and hardware decoupling, facilitating the progress of cloudification and virtualization. This significantly strengthened our competitiveness and differentiation in the cloud market, while laying a foundation for 5G network cloudification in the future.

- The Company proactively contributed to the formulation of international standards for 5G technologies and conducted large-scale 5G network trial runs in a number of locations.

- We achieved some preliminary progress in areas such as 5G voice call, 4G/5G interoperability, and interoperability between (pre-standard 5G) equipment, among others.

- By supporting the Ultra HD Live broadcast for CCTV’s 2019 Spring Festival Evening Gala with “5G+4K” and “5G+VR” solutions, we took an important step towards the successful accomplishment of enhanced mobile broadband (eMBB) application scenarios.

- The Company also actively explored applications for other vertical industries, such as 5G autonomous driving bus, smart water treatment and mobile remote medical service.

………………………………………………………………………………………………………………………………………………………………………………

China Telecom’s CAPEX is expected to increase 4% this year, to roughly RMB78 billion ($11.6 billion), after dropping 7.9% in 2018. That will include a 21% increase in spending on “information and application services,” to about RMB10.5 billion ($1.56 billion), as China Telecom prepares for its 5G future.

…………………………………………………………………………………………………………………………………………………………………………………….

In a paper published last August, consulting company Deloitte said China had outspent the US on 5G-supporting infrastructure by around $24 billion since 2015. Last year, the 1.9 million mobile sites across China worked out at 14.1 for every 10,000 people. With just 200,000 sites, the US had an equivalent ratio of just 4.7, according to Deloitte. Catching up with China in 5G may be “near impossible” for the Americans, Deloitte said in its report which we summarized for the IEEE Techblog.

In a recent Lightreading.com blog post, Iain Morris wrote:

With its huge population and model of state capitalism, China could be a fertile testing ground for new 5G applications. China Telecom alone had a staggering 303 million mobile customers at the end of last year — an increase of 53 million on the number in 2017 — including 242 million on 4G networks. Revenues were up 3%, to RMB377.1 billion ($56.2 billion), thanks to customer growth, and net profit rose 14%, to RMB21.2 billion ($3.16 billion).

Seeking advantage in AI, China’s government will undoubtedly look for support to a such a large, financially stable organization, with its vast reserves of customer data and stake in 5G. Demographics and democracy make the task much harder for US authorities worried about falling behind in the new technology arms race. Amid recent political talk of building a nationalized 5G network, the US operators may be under government pressure on a generation of mobile technology like never before.

Editor’s Note: Mr. Morris strongly asserts that China Telecom said it will be a leader in delivering 5G low latency (which will be specified in 3GPP release 16- due to be completed in 2020 and later in ITU-R IMT 2020 for ultra low latency.high reliability use case). He wrote, “China Telecom said it will be “industry leading” in latency, a signaling delay that could become a new battleground for 5G competitive advantage.” However, we have NOT found that reference to latency in any of China Telecom’s reports (see highlights above) and presentation made today (March 19, 2019).

The 5G-IMT2020 radio access network latency objectives, which Ericsson and others often say will faciliate many new applications, are specified in ITU-R M.2410-0: https://www.itu.int/dms_pub/itu-r/opb/rep/R-REP-M.2410-2017-PDF-E.pdf

The minimum requirements for user plane latency are: 4 ms for eMBB and 1 ms for URLLC assuming unloaded conditions (i.e. a single user) for small IP packets (e.g. 0 byte payload + IP header), for both downlink and uplink.

………………………………………………………………………………………………………..

There is no spec or even target for cloud network latency related to carrying 5G packets. In fact, the cloud network might not be used at all for real time control of 5G applications such as V2V or IoT

FCC to open spectrum above 95 GHz for new technologies

The Federal Communications Commission (FCC) has adopted rules to clear spectrum in the 95 GHz to 3 TeraHz frequencies for experimental use in order to ecnourage technological breakthroughs in communications. It might even set the stage for 6G and beyond. The FCC will issue experimental licenses for up to 10 years and open 21.2 GHz of spectrum in that range for testing unlicensed devices.

FCC Chairman Ajit Pai invited NYU Wireless Professor Ted Rappaport, who was instrumental in conducting ground-breaking millimeter wave research, to present his institution’s findings thus far on the opportunities afforded by the spectrum bands above 95 GHz, where “science fiction will become reality,” Rappaport told the commission.

The applications that become possible at these higher frequencies are kind of mind-blowing, he said. With so much bandwidth and wider bandwidth channels, you can start having data rates that approach the bandwidth needed to provide wireless cognition, where the computations of the human brain at those data rates could actually be sent on the fly over wireless. As such, you could have drones or robotics receive in real time the kind of perception and cognition that the human brain could do.

The conventional wisdom is that as you go higher in frequency, you get more loss. “That’s only if you use an omnidirectional antenna, the old way of doing cellular 10 and 20 years ago. When you start using directional antennas, what happens is, you actually do better as you go higher in frequency for a given power level and a given antenna physical size,” Rappaport said.

The FCC’s Spectrum Horizons First Report and Order creates a new category of experimental licenses for use of frequencies between 95 GHz and 3 THz. These licenses will give innovators the flexibility to conduct experiments lasting up to 10 years, and to more easily market equipment during the experimental period, according to the FCC.

The item also makes a total of 21.2 gigahertz of spectrum available for use by unlicensed devices. The Commission selected bands with propagation characteristics that will permit large numbers of unlicensed devices to use the spectrum, while limiting the potential for interference to existing governmental and scientific operations in the above-95 GHz bands, such as space research and atmospheric sensing.

The First Report and Order provides unprecedented opportunities for new experimental and unlicensed use in the frequencies above 95 GHz and will help ensure that the United States stays at the forefront of wireless innovation. Moreover, study of these uses could ultimately lead to further rulemaking actions and additional licensing opportunities within the Spectrum Horizons bands.

“Today, we take big steps towards making productive use of this spectrum,” Pai said in his statement. “We allocate a massive 21 gigahertz for unlicensed use and we create a new category of experimental licenses. This will give innovators strong incentives to develop new technologies using these airwaves while also protecting existing uses.”

References:

https://www.fiercewireless.com/wireless/fcc-moves-to-open-spectrum-above-95-ghz-for-new-technologies

https://venturebeat.com/2019/03/15/fcc-opens-95ghz-to-3thz-spectrum-for-6g-7g-or-whatever-is-next/

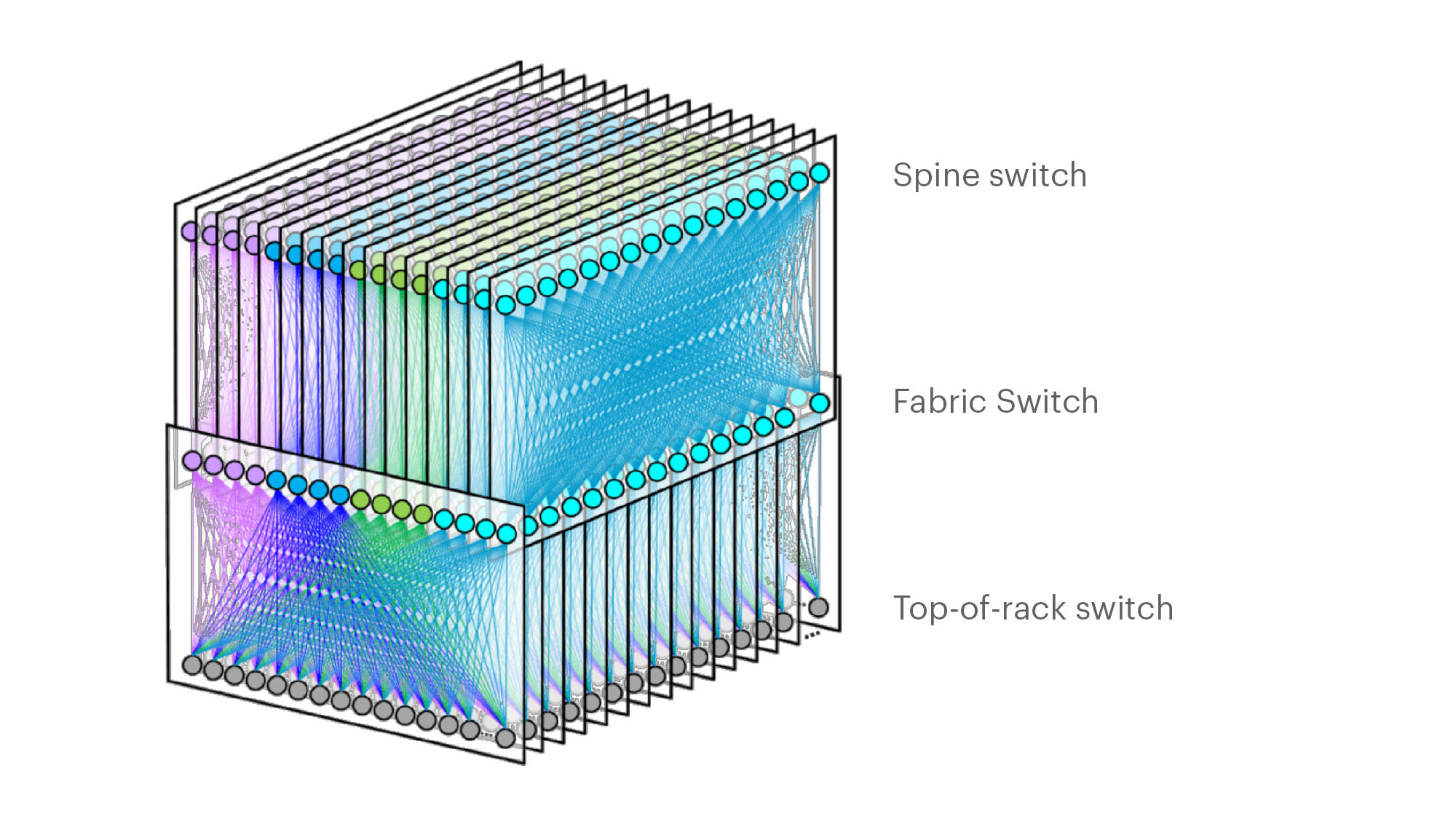

Facebook’s F16 achieves 400G effective intra DC speeds using 100GE fabric switches and 100G optics, Other Hyperscalers?

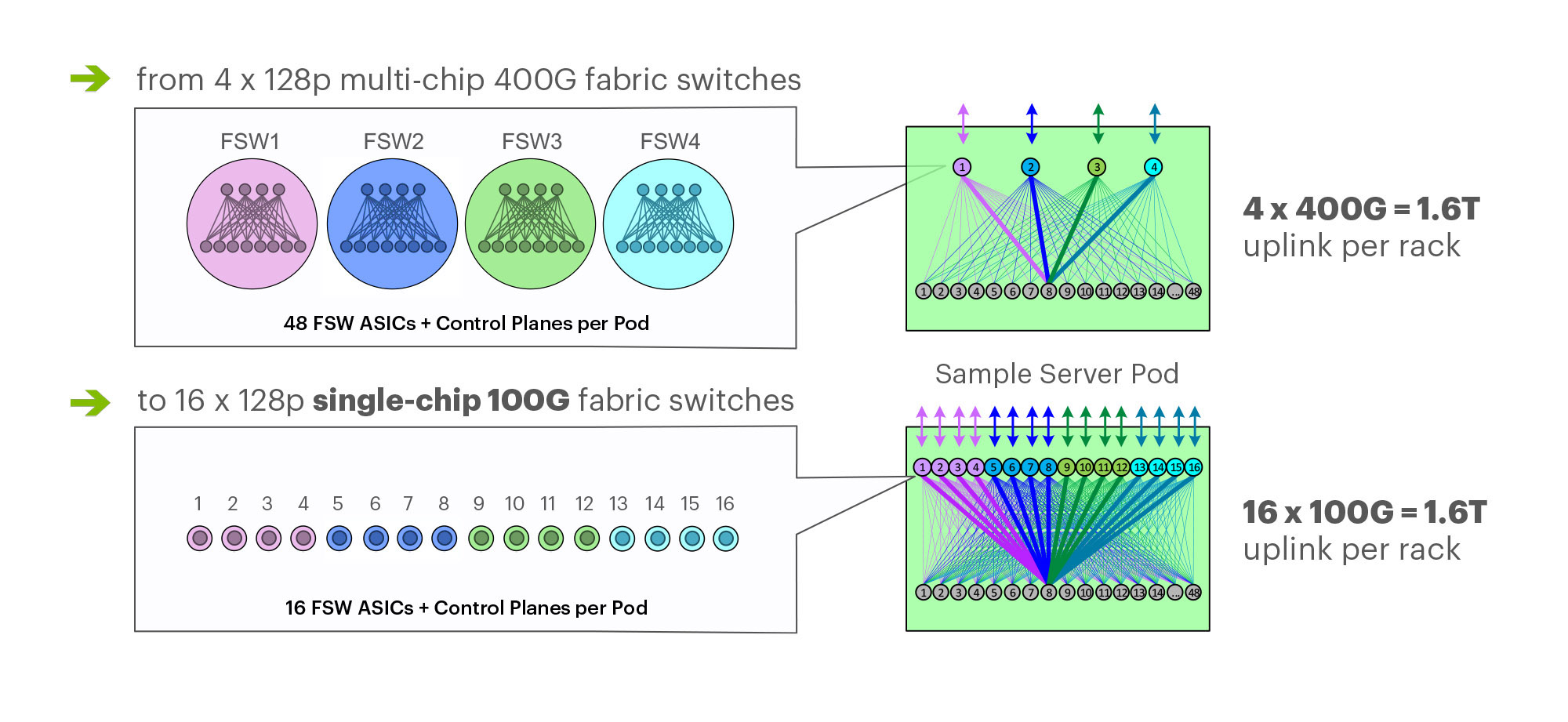

On March 14th at the 2019 OCP Summit, Omar Baldonado of Facebook (FB) announced a next-generation intra -data center (DC) fabric/topology called the F16. It has 4x the capacity of their previous DC fabric design using the same Ethernet switch ASIC and 100GE optics. FB engineers developed the F16 using mature, readily available 100G 100G CWDM4-OCP optics (contributed by FB to OCP in early 2017), which in essence gives their data centers the same desired 4x aggregate capacity increase as 400G optical link speeds, but using 100G optics and 100GE switching.

F16 is based on the same Broadcom ASIC that was the candidate for a 4x-faster 400G fabric design – Tomahawk 3 (TH3). But FB uses it differently: Instead of four multichip-based planes with 400G link speeds (radix-32 building blocks), FB uses the Broadcom TH3 ASIC to create 16 single-chip-based planes with 100G link speeds (optimal radix-128 blocks). Note that 400G optical components are not easy to buy inexpensively at Facebook’s large volumes. 400G ASICs and optics would also consume a lot more power, and power is a precious resource within any data center building. Therefore, FB built the F16 fabric out of 16 128-port 100G switches, achieving the same bandwidth as four 128-port 400G switches would.

Below are some of the primary features of the F16 (also see two illustrations below):

-Each rack is connected to 16 separate planes. With FB Wedge 100S as the top-of-rack (TOR) switch, there is 1.6T uplink bandwidth capacity and 1.6T down to the servers.

-The planes above the rack comprise sixteen 128-port 100G fabric switches (as opposed to four 128-port 400G fabric switches).

-As a new uniform building block for all infrastructure tiers of fabric, FB created a 128-port 100G fabric switch, called Minipack – a flexible, single ASIC design that uses half the power and half the space of Backpack.

-Furthermore, a single-chip system allows for easier management and operations.

Facebook F16 data center network topology

Facebook F16 data center network topology

………………………………………………………………………………………………………………………………………………………………………………………………..

Multichip 400G b/sec pod fabric switch topology vs. FBs single chip (Broadcom ASIC) F16 at 100G b/sec

…………………………………………………………………………………………………………………………………………………………………………………………………..

In addition to Minipack (built by Edgecore Networks), FB also jointly developed Arista Networks’ 7368X4 switch. FB is contributing both Minipack and the Arista 7368X4 to OCP. Both switches run FBOSS – the software that binds together all FB data centers. Of course the Arista 7368X4 will also run that company’s EOS network operating system.

F16 was said to be more scalable and simpler to operate and evolve, so FB says their DCs are better equipped to handle increased intra-DC throughput for the next few years, the company said in a blog post. “We deploy early and often,” Baldonado said during his OCP 2019 session (video below). “The FB teams came together to rethink the DC network, hardware and software. The components of the new DC are F16 and HGRID as the network topology, Minipak as the new modular switch, and FBOSS software which unifies them.”

This author was very impressed with Baldonado’s presentation- excellent content and flawless delivery of the information with insights and motivation for FBs DC design methodology and testing!

References:

https://code.fb.com/data-center-engineering/f16-minipack/

………………………………………………………………………………………………………………………………….

Other Hyperscale Cloud Providers move to 400GE in their DCs?

Large hyperscale cloud providers initially championed 400 Gigabit Ethernet because of their endless thirst for networking bandwidth. Like so many other technologies that start at the highest end with the most demanding customers, the technology will eventually find its way into regular enterprise data centers. However, we’ve not seen any public announcement that it’s been deployed yet, despite its potential and promise!

Some large changes in IT and OT are driving the need to consider 400 GbE infrastructure:

- Servers are more packed in than ever. Whether it is hyper-converged, blade, modular or even just dense rack servers, the density is increasing. And every server features dual 10 Gb network interface cards or even 25 Gb.

- Network storage is moving away from Fibre Channel and toward Ethernet, increasing the demand for high-bandwidth Ethernet capabilities.

- The increase in private cloud applications and virtual desktop infrastructure puts additional demands on networks as more compute is happening at the server level instead of at the distributed endpoints.

- IoT and massive data accumulation at the edge are increasing bandwidth requirements for the network.

400 GbE can be split via a multiplexer into smaller increments with the most popular options being 2 x 200 Gb, 4 x 100 Gb or 8 x 50 Gb. At the aggregation layer, these new higher-speed connections begin to increase in bandwidth per port, we will see a reduction in port density and more simplified cabling requirements.

Yet despite these advantages, none of the U.S. based hyperscalers have announced they have deployed 400GE within their DC networks as a backbone or to connect leaf-spine fabrics. We suspect they all are using 400G for Data Center Interconnect, but don’t know what optics are used or if it’s Ethernet or OTN framing and OAM.

…………………………………………………………………………………………………………………………………………………………………….

In February, Google said it plans to spend $13 billion in 2019 to expand its data center and office footprint in the U.S. The investments include expanding the company’s presence in 14 states. The dollar figure surpasses the $9 billion the company spent on such facilities in the U.S. last year.

In the blog post, CEO Sundar Pichai wrote that Google will build new data centers or expand existing facilities in Nebraska, Nevada, Ohio, Oklahoma, South Carolina, Tennessee, Texas, and Virginia. The company will establish or expand offices in California (the Westside Pavillion and the Spruce Goose Hangar), Chicago, Massachusetts, New York (the Google Hudson Square campus), Texas, Virginia, Washington, and Wisconsin. Pichai predicts the activity will create more than 10,000 new construction jobs in Nebraska, Nevada, Ohio, Texas, Oklahoma, South Carolina, and Virginia. The expansion plans will put Google facilities in 24 states, including data centers in 13 communities. Yet there is no mention of what data networking technology or speed the company will use in its expanded DCs.

I believe Google is still designing all their own IT hardware (compute servers, storage equipment, switch/routers, Data Center Interconnect gear other than the PHY layer transponders). They announced design of many AI processor chips that presumably go into their IT equipment which they use internally but don’t sell to anyone else. So they don’t appear to be using any OCP specified open source hardware. That’s in harmony with Amazon AWS, but in contrast to Microsoft Azure which actively participates in OCP with its open sourced SONIC now running on over 68 different hardware platforms.

It’s no secret that Google has built its own Internet infrastructure since 2004 from commodity components, resulting in nimble, software-defined data centers. The resulting hierarchical mesh design is standard across all its data centers. The hardware is dominated by Google-designed custom servers and Jupiter, the switch Google introduced in 2012. With its economies of scale, Google contracts directly with manufactures to get the best deals.Google’s servers and networking software run a hardened version of the Linux open source operating system. Individual programs have been written in-house.

Huawei to build Public Cloud Data Centers using OCP Open Rack and its own IT Equipment; Google Cloud and OCP?

Huawei:

On March 14th at the OCP 2019 Summit in San Jose, CA, Huawei Technologies (the world’s number one telecom/network equipment supplier) announced plans to adopt OCP Open Rack in its new public cloud data centers worldwide. The move is designed to enhance the environmental sustainability of Huawei’s new public cloud data centers by using less energy for servers, while driving operational efficiency by reducing the time it takes to install and maintain racks of IT equipment. In addition to Huawei’s adoption of Open Rack in its cloud data centers, the company is also expanding its work with the OCP Community to extend the design of the standard and further improve time-to-market, and high serviceability and reduce TCO. In an answer to this author’s question, Jinshui Liu CTO, IT Hardware Domain said the company would make its own OCP compliant compute servers and storage equipment (in addition to network switches) that would be used in its public cloud data centers. All that IT equipment will ALSO sold to its customers building cloud resident data centers.

The Open Rack initiative introduced by the Open Compute Project (OCP) in 2013, seeks to redefine the data center rack and is one of the most promising developments in the scale computing environment. It is the first rack standard that is designed for data centers, integrating the rack into the data center infrastructure. Open Rack integrating the rack into the data center infrastructure as part of the Open Compute Project’s “grid to gates” philosophy, a holistic design process that considers the interdependence of everything from the power grid to the gates in the chips on each motherboard.

“Huawei’s engineering and business leaders recognized the efficiency and flexibility that Open Rack offers, and the support that is available from a global supplier base. Providing cloud services to a global customer base creates certain challenges. The flexibility of the Open Rack specification and the ability to adapt for liquid cooling allows Huawei to service new geographies. Huawei’s decision to choose Open Rack is a great endorsement!” stated Bill Carter, Chief Technology Officer for the Open Compute Project Foundation.

OCP specified Open Rack v2:

Last year Huawei became an OCP Platinum Member. This year, Huawei continues investment in and commitment to OCP and the open source community. Huawei’s active involvement within the OCP Community includes on-going participation and contributions for various OCP projects such as Rack and Power, System Management and Server projects with underlying contributions to the upcoming specs for OCP accelerator Module, Advanced Cooling Solutions and OpenRMC.

“Huawei’s strategic investment and commitment to OCP is a win-win,” said Mr. Kenneth Zhang, General Manager of FusionServer, Huawei Intelligent Computing Business Department. “Combining Huawei’s extensive experience in Telco and Cloud deployments together with the knowledge of the vast OCP community will help Huawei to provide cutting edge, flexible and open solutions to its global customers. In turn, Huawei can leverage its market leadership and global data center infrastructure to help introduce OCP to new geographies and new market segments worldwide.”

During a keynote address at OCP Global Summit, Huawei shared more information about its Open Rack adoption plans as well as overall OCP strategy. Huawei also showcased some of the building blocks of these solutions in its booth, including OCP-based compute module, Huawei Kunpeng 920 ARM CPU, Huawei Ascend 310 AI processor and other Huawei intelligent Compute products.

Huawei’s Booth at OCP 2019 Summit

………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………….

In summary, Huawei has developed an optimized rack scale design that will become the foundation of its cloud and IT infrastructure roll out. This extends the company’s product portfolio from telecom/networking to cloud computing and storage as well as an ODM for compute and storage equipment. Hence, Huawei will now compete with Microsoft Azure as well as China CSPs Alibaba, Baidu and Tencent in using OCP compliant IT equipment in their cloud resident data centers,. Unlike the other aforementioned OCP Platinum members, Huawei will design and build its own IT equipment (the other CSPs buy OCP equipment from ODMs).

There are now 124 OCP certified products available with over 60 more in the pipeline. Most of the OCP ODMs are in Taiwan.

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………….

Google:

While Google has been an OCP Platinum member since 2015, they maintained a very low profile at this year’s OCP Summit, so it’s not clear how much OCP compliant equipment they use in Google Cloud or in any of their cloud resident data centers. Google did present 2 tech sessions at the conference:

“Google’s 48V Rack Adaptation and Onboard Power Technology Update” at the OCP 2019 Summit early Friday morning March 15th. Google said that significant progress has been made in three specific applications:

1. Multi-phase 48V-to-12V voltage regulators adopting the latest hybrid switched-capacitor-buck topologies for traditional 12V workloads such as PCIEs and OTS servers;

2. Very high efficiency high density fixed ratio bus converters for 2-stage 48V-to-PoL power conversions;

3. High frequency high density voltage regulators for extremely power hungry AI accelerators.

Google and ONF provided an update on Stratum — a next generation, thin switch OS that provides silicon and hardware independence, which was first introduced at the 2018 OCP Summit. Stratum was said to enable the next generation of SDN. It adds new SDN-ready interfaces from the P4 and OpenConfig communities to ONL (Open Network Linux) that enable programmable switching chips (ASICs, FPGAs, etc.) and traditional switching ASICs alike. The talk described how the open source community has generalized Google’s seed OVP contribution for additional whitebox targets, and demonstrate Stratum on a fabric of OCP devices controlled by an open source control plane.

I believe Google is still designing all their own IT hardware (compute servers, storage equipment, switch/routers, Data Center Interconnect gear other than the PHY layer transponders). They announced design of many AI processor chips that presumably go into their IT equipment which they use internally but don’t sell to anyone else (just like Amazon AWS).

Google Cloud Next 2019 conference will be April 9-11, 2019 at the Moscone Center in San Francisco, CA.

References:

https://www.huawei.com/en/press-events/news/2019/3/huawei-ocp-open-rack-public-cloud-datacenters

Verizon and AT&T want to virtualize the 5G Network Core and use Mobile Edge Computing

Verizon:

As we reported earlier this week, Verizon announced the first deployment of it’s mobile 5G network with Chicago and Minneapolis going live on April 11. The nation’s largest mobile network operator says the service will be available in “select areas” in those markets, and it plans to bring an additional 30 markets online later this year.

Verizon engineers have been preparing for 5G by migrating network core and edge processing functions from the physical world to the virtual world for about three years now, said Adam Koeppe, SVP of network planning at Verizon. “Today, in the (proprietary) 5G network that we’ve already launched in our four 5G Home markets (FWA), those software functions that are used for the core of the 5G network are 100 percent virtual. Unlike LTE where you had to start physical and move to virtual, they’re native 5G network functions, those all start as virtual,” said Koeppe.

Similar to other carriers’ 5G roadmaps, Verizon’s initial pre-standard 5G deployments are based on 3GPP Release 15 NR NSA (non-standalone) architecture. It’s using parts of the 4G network core (EPC) and signaling with a 5G radio access network for the data plane. “All those functions in that path for 5G are virtual regardless of whether they’re 4G core that you’re using to support 5G or native to 5G functions,” Koeppe said.

“We’re trying to get the processing capabilities required on a network session as close to the consumer as possible, and the reason for that is one of the promises and realities of 5G is that you have the ability to have much lower network latency,” he said. Multi-access edge compute equipment (MEC) and network slicing are key components of that effort. “You have to make fundamental architectural changes to how your core works if you want to provide very low-latency services.”

Verizon currently manages different network use cases manually, by identifying the class of service for each device running on its wireless network. Network slicing and virtualization would change that significantly, and software plays a critical role, Koeppe said. “All the network functions that are providing that service need to be virtualized, because I can’t autonomously spin up physical capacity. That has to be done by a person. But if it’s virtual capacity I can spin that up from a machine through orchestration and machine learning.”

When you have 15 to 20 different use cases, “you have a very sophisticated network that is all virtualized and all programmable. Some of that you physically just can’t do with LTE today. Much of those 5G use cases will rely on that type of programmability of your network and you can’t do that without having a virtualized network function,” Koeppe added.

Verizon wants to put the capabilities of its 5G network and the MEC network into the hands of innovators who can drive use cases beyond what’s possible with 4G today, according to Koeppe. “These are radically different network capabilities, a lot goes in to ensuring that the hardware and the software works well together. And that’s the phase we’re in right now with our deployment.”

…………………………………………………………………………………………………………………………………………………………………………………………………………………………..

ITU-T Standards status of network softwarization:

Question 21 of ITU-T SG13 is studying network softwarization including: network slicing, SDN, and orchestration which are highly expected to contribute to IMT-2020. Question 21 met during the SG13 meeting, from 4 to 14 March 2019 at Victoria Falls, Zimbabwe under the chairmanship of co-Rapporteur Ms.Yushuang Hu (China Mobile, China) and Mr. Kazunori TANIKAWA (NEC, Japan).

On March 14, 2019, ITU-T SG13 has consented to two new Recommendations:

- ITU-T Y.IMT2020-ML-Arch “Architectural framework for machine learning in future networks including IMT-2020” (Ref. SG13-TD355/WP1)

- ITU-T Y.3115 (formerly Y.NetSoft-SSSDN). It describes SDN control interfaces for network slicing, which especially focuses on the control of front haul networks such as PON.

…………………………………………………………………………………………………………………………………………………………………………………………………………………………..

AT&T:

AT&T is on a similar path with virtualized network functions and MEF. According to Light Reading, AT&T has virtualized 65% of its core network during the past five years, and is on track to meet its goal of virtualizing 75% of its network functions by the end of 2020.

“We see the cloud fragmenting again and certain workloads being pushed out to the edge — at customer [premises] and in the network — with more heavy-duty storage, and the back end being in the centralized cloud,” Roman Pacewicz, AT&T Business’s chief product officer, told Light Reading during an interview conducted at MWC 2019 in Barcelona.

“Nowhere is [virtualization] more important than in our rollout of 5G,” Pacewicz says. “If we didn’t have a network edge cloud environment that takes the mobile core out to the edge of the network, those deployments would be complicated and longer. The whole strategy of virtualization and cloudification of the network (see IEEE Techblog posts on ITU-T SG13 recommendations related to IMT 2020) becomes more important in upgrading the infrastructure to 5G, because everything is virtualized and software-enabled.”

A new generation of services enabled by 5G will require low latency, and therefore require compute and storage resources close to the edge of the network, Pacewicz says. That’s where MEC comes in to play a huge role in 5G (as well as real time critical IoT applications). We previously reported that AT&T has a joint project with Microsoft to deliver Microsoft Azure cloud services from the AT&T network edge. The goal is reduced latency and increased network resiliency. For applications such as AI, mixed reality and augmented reality, latency needs to be no greater than 20 milliseconds and that requires data to be processed closer to the edge of the network and closer to the end user, Pacewicz says.

A retailer with 8,000–10,000 stores can’t have dedicated compute at every site, but needs low latency to create new types of experience and networks need 2 millisecond latency for safe interactions between robots and human beings, Pacewicz claims.

–>Of course latency includes the mobile access network, mobile packet core, and edge network. We are a very long way from achieving 20 milliseconds one way latency let alone round trip!

AT&T is teaming with Israeli startup Vorpa on projects to monitor the location of drones around sensitive locations such as aircraft and airports, alert authorities if they’re flying in restricted areas, and identify the location of a drone’s controller. Those types of applications require low latency enabled by mobile edge computing, Pacewicz says. He concluded the Light Reading interview by highlighting SD-WAN is a key part of making the network more intelligent and flexible to accommodate 5G applications by optimizing traffic routing, particularly as edge devices don’t just consume data, but also generate lots of data.

–>While the SD-WAN market is growing, there are no standard definitions, interfaces or any specs for UNI or NNI interoperability.

AT&T’s CFO John Stephens said that several trends are conspiring to potentially lower AT&T’s CAPEX. He cited the company’s move to network functions virtualization (NFV) and software-defined networking (SDN), which are technologies intended to replacing expensive, proprietary vendor hardware/equipment with less expensive, software-powered equivalents that run on commodity compute servers, white boxes and bare metal switches. Stephens said that more than half of AT&T’s network functions have been virtualized, and that the company remains on track to reach its goal of virtualizing fully 75% of its network functions by 2020. “All of this leads to an efficiency opportunity on a going forward basis,” he said.

References:

https://www.lightreading.com/cloud/atandts-pacewicz-we-see-the-cloud-fragmenting-again/d/d-id/750150

ITU-T SG13 Non Radio Hot Topics and Recommendations related to IMT 2020/5G

GSMA to ITU-D: Addressing Barriers to Mobile Network Coverage in the Developing World

by Ms. Lauren Dawes, GSMA-UK [email protected]

Abstract:

- While mobile broadband (3G or 4G) coverage in the developed world is ubiquitous, 800 million people are still not covered by mobile broadband networks. In rural areas the cost of building and operating mobile infrastructure can be twice as expensive compared to urban areas, with revenues up to 10 times smaller.

- In addition, 3.2 billion people live in areas covered by mobile broadband networks but are not using mobile internet services. A large scale consumer survey conducted by the GSMA revealed that affordability was the greatest barrier to using mobile internet services.

- Both the private sector and public sector have important roles to play in improving the business case for mobile network coverage expansion.

- By providing precise and granular data on mobile coverage, GSMA Mobile Coverage Maps can help operators determine the costs of providing mobile broadband services in uncovered areas and support the development of mobile networks.

- For example, GSMA Coverage maps can help mobile operators assess the relevance of infrastructure sharing deals. Indeed, infrastructure sharing can help to lower the risk and costs of investments in network expansion. Regulators should seize this opportunity and ensure all forms of voluntary infrastructure sharing between operators are permitted.

- GSMA Coverage Maps can also help other stakeholders – including governments, NGOs, and private companies that rely on mobile connectivity – to strategically target their activity, by helping them identify the locations with existing coverage.

- In this context, policy-makers are encouraged to adopt policies that will support mobile operators’ efforts to provide affordable mobile internet services. This includes:

- Removing sector specific taxes which have an impact on the price of mobile devices and the costs of providing mobile internet services;

- Adopting pro-investment supply side policies in areas such as spectrum policy and planning;

- Providing open and non-discriminatory access to state-owned public infrastructures.

…………………………………………………………………………………………………………………………………………………………………………………………………………………………

Discussion:

Mobile is now the most common – and often the only way – that many people around the world access the internet, with 3.6 billion now subscribing to mobile internet services. However, while mobile broadband (3G or 4G) coverage in the developed world is ubiquitous, 800 million people are still not covered by mobile broadband networks. In rural areas the cost of building and operating mobile infrastructure can be twice as expensive compared to urban areas, with revenues up to 10 times smaller. As a result, mobile operators who expand their networks to rural areas often find that they lose money or take a long time to produce a return on investment. While seeking to grow their coverage (and hence their subscriber base) they can struggle to identify locations that could be economically viable.

In addition, 3.2 billion people live in areas covered by mobile broadband networks but are not using mobile internet services – thus indicating that whilst coverage is a necessary criteria, it alone cannot address the problem of digital inclusion. A large scale consumer survey conducted by the GSMA[1] revealed that affordability was the greatest barrier to using mobile internet services, for people who were aware of mobile internet. In almost all the sample countries, the greatest barriers to mobile internet use are access to, and the cost of, internet-enabled handsets and data. These barriers are clearly interlinked, representing the importance of the overall cost of mobile internet access. The analysis also indicates that, although cost is an important consideration for both women and men in many of the surveyed countries, this barrier disproportionately affects women. For example, in Dominican Republic, 53% of female mobile users who do not use mobile internet, but are aware of it, cited handset cost as a key barrier to mobile internet use compared to 37% of men. In a similar sample in Kenya, 43% of women and 31% of men stated that not having access to an internet-enabled mobile phone was a major barrier to using mobile internet.

Both the private sector and public sector have important roles to play in improving the business case for mobile network coverage expansion.

Precise and granular data is key to help mobile operators, governments and others to determine the costs of providing mobile broadband services in uncovered areas and support the development of sustainable networks. In this context, the GSMA developed Mobile Coverage Maps[2]: a tool to help operators and others estimate the precise location and size of uncovered populations. These maps will allow users to:

- Gain an accurate and complete picture of the mobile coverage in a given country by each generation of mobile technology (2G, 3G and 4G)

- Estimate the population living in uncovered or underserved settlements with a very high level of granularity (e.g. small cities, villages or farms)

- Search for uncovered settlements based on population size.

GSMA Mobile Coverage Maps are therefore a key tool to help operators improve the efficiency of their investments. For example, GSMA Coverage maps can help mobile operators assess the need for infrastructure sharing deals. Indeed, infrastructure sharing can help to lower the risk and costs of investments in network expansion. Regulators should seize this opportunity and ensure all forms of voluntary infrastructure sharing between operators are permitted. This is especially the case since the costs savings of such commercial arrangements can be significant, reducing capital investment and on-going operating costs by between 50% and 80% -depending on market structure and the sharing model – which can be reinvested in network expansion[3]. This helps to close the ‘coverage gap’ and encourage operators to venture into rural areas they might otherwise have not wanted or could not afford to go to.

GSMA Mobile Coverage Maps can also help other stakeholders – including governments, NGOs, and private companies that rely on mobile connectivity – to strategically target their activity, by helping them identify the locations with existing coverage.

In this context, it is critical for policy makers to adopt economic policies that will support mobile operators’ efforts to provide affordable services.

- Mobile is the main gateway to the internet for consumers in many parts of the world today, particularly in developing countries. Despite this, governments in many of these countries are increasingly imposing – in addition to general taxes – sector-specific taxes on consumers of mobile services and devices and on mobile operators. This poses a significant risk to the growth of the services among citizens, limiting the widely acknowledged social and economic benefits associated with mobile technology. This latest report from GSMA Intelligence https://www.gsmaintelligence.com/research/?file=8f36cd1c58c0d619d9f165261a57f4a9&download examines mobile sector taxation over time and its impact on affordability and connectivity. The report highlights the taxes applied to mobile services and how certain taxes can raise the affordability barrier and reduce the ability of citizens to take part in digital society. It also explores the impact of uncertain tax regimes on operators’ ability to continue investing in new networks. The report shows how sector-specific taxes can create inefficiency, inequity and complexity, and hinder achievement of the UN Broadband Commission’s target for affordable broadband for all by 2025.

- Effective pro-investment supply side policies should also be adopted in areas such as spectrum policy and planning to encourage long term investment in the sector and result in more affordable mobile internet services being made available to all.

- Providing open and non-discriminatory access to state-owned public infrastructures such as public buildings, roads, railways and utility service ducts can also significantly reduce the costs of network roll-out and can be key to providing the site access and necessary backhaul capacity so critical to operator investments.

[1] The analysis is based on findings from quantitative face-to-face surveys with women and men in 23 low- and middle-income countries across Asia, Africa and Latin America. Source: Gender Gap Report 2018. GSMA (2019). Available here: https://www.gsma.com/mobilefordevelopment/wp-content/uploads/2018/04/GSMA_The_Mobile_Gender_Gap_Report_2018_32pp_WEBv7.pdf

[2] GSMA Mobile Coverage Maps use data collected directly from mobile operators and overlay it with the High Resolution Settlement Layer, a dataset developed by Facebook Connectivity Lab and the Center for International Earth Science Information Network (CIESIN) at Columbia University. This data estimates human population distribution at a hyperlocal level, based on census data and high-resolution satellite imagery. We have further enriched this data by adding socioeconomic indicators and key buildings such as schools, hospitals, and medical centres. The Mobile Coverage Maps are accessible here: www.mobilecoveragemaps.com

[3] Unlocking rural coverage: Enablers for commercially sustainable mobile network expansion. GSMA (2016). Available here: https://www.gsma.com/mobilefordevelopment/wp-content/uploads/2016/07/Unlocking-Rural-Coverage-enablers-for-commercially-sustainable-mobile-network-expansion_English.pdf

Verizon Announces Mobile 5G for April 11, 2019 in Chicago and Minneapolis

Verizon plans to deploy its mobile 5G “ultra wideband” network in Chicago and Minneapolis on April 11th, the company said in a statement on Wednesday. Verizon CTO Kyle Malady said that the company is only starting in Chicago and Minneapolis, with only parts of the cities getting 5G coverage initially. The #1 US carrier plans to have more than 30 U.S. markets running 5G connections by the end of the year.

Preorders for the Verizon-exclusive 5G Moto mod – the first 5G-upgradeable smartphone – begin March 14, with a $50 special offer

Verizon’s 5G service plan comes with unlimited data, available for just $10 a month (with the first three months free) with any Verizon unlimited plan, including Verizon Go Unlimited, Beyond Unlimited or Above Unlimited plans

Customers that order a 5G Moto mod on March 14 get a FREE Moto z3 when they activate a new line of service on a Verizon device payment plan5G Ultra Wideband technology uses new radio technology and new device hardware to deliver advanced capabilities to consumers and businesses.When customers move outside Verizon’s 5G Ultra Wideband coverage area, the 5G moto mod automatically and seamlessly hands off the signal to Verizon’s 4G LTE network, the nation’s best and most reliable 4G LTE network.Verizon’s 5G Ultra Wideband service will continue to improve as Verizon expands capabilities and coverage areas.Editor’s Note: Moto phones are made by Mototola Mobility which is owned by Lenovo“Continuing our track record of 5G ‘firsts,’ we are thrilled to bring the first 5G-upgradeable smartphone exclusively to Verizon customers,” said Verizon’s chief technology officer, Kyle Malady.

“Not all 5G networks are the same. Verizon’s 5G Ultra Wideband network is built by the company with the nation’s best and most reliable 4G LTE network. It will change the way we live, work, learn and play, starting in Chicago and Minneapolis and rapidly expanding to more than 30 U.S. markets this year.”“At Motorola we proudly deliver innovations, like the 5G Moto mod and Moto z3, that change how people connect with each other and use technology in daily life,” said Rudi Kalil, vice president and general manager, North America at Motorola.

“We’re very excited that the transformative 5G Moto mod developed at our HQ in Chicago will soon be used by our own community, in addition to Minneapolis, to bring our bright 5G future to life.”Verizon said that its 5G offering will come with unlimited data that will cost $10 a month with any Verizon unlimited plan. That’s on top of what unlimited customers are paying already. The first three months of Verizon’s 5G unlimited data will be free to customers. Verizon also announced that it will be exclusively offering the 5G Moto Mod for pre-order starting on Mar. 14. The Moto Mod is an add-on for the Moto Z3 smartphone that effectively turns it into a 5G phone. Verizon said that the Moto Z3 and Moto Mod combination will turn it into the world’s first 5G phone.

Dan Hays, an adviser at PricewaterhouseCoopers’ consulting firm, said $10 a month is right in line with what its research shows customers are willing to pay for premium wireless connections. Hays said he believes most people aren’t willing to change the device they’re currently using to another brand or model just because it has 5G.Comment: Just like all the other fake mobile 5G offerings, Verizon’s Ultra Wideband uses 3GPP NR NSA which means it relies on LTE signaling/control plane as well as LTE’s Evolved Packet Core (EPC). Further, there isn’t a phone available yet to US customers that can operate independently on any of the announced pre-IMT 2020 standard 5G networks. In February 2019, Samsung announced its first ever 5G smartphone – the Galaxy S10 5G. The device will be available to Verizon customers during the second quarter of this year. It will be available from other wireless carriers later this summer. While Samsung S10 5G and other pre-standard 5G phones use 3GPP Rel 15 NR for the data plane, they all use LTE signalling for the control plane.

References:

https://www.verizon.com/about/news/verizon-5g-mobility-service-and-motorola-5g-smartphone-are-here

https://www.verizonwireless.com/5g/

https://www.verizon.com/about/news/verizon-issues-built-5g-challenge

http://fortune.com/2019/02/21/verizon-5g-mobile-wireless-30-cities/

ITU-T SG13 Non Radio Hot Topics and Recommendations related to IMT 2020/5G

IMT 2020 Related Hot Topics for ITU-T SG13:

DISCLAIMER: A few of the referenced hyperlinks point to documents that can only be opened by users with an ITU TIES account. However, most of the hyperlinks point to public documents which can be downloaded free of charge.

SOURCE: ITU-T SG13 4-14 March 2019 meeting in Victoria Falls, Zimbabwe with UPDATES from later 2019 SG13 meetings.

1. Intelligence for network automation, augmentation and amplification

- Identify the standardization needs for intelligence in 5G systems and the telecommunications sector.

- Automatic detection and resolution of anomalies and other incidents of inefficiency, as well as predictive maintenance will reduce the operational expenditure of network operators and service providers

- Address the architecture, interfaces, functional entities, service scenarios and protocols required for intelligence retrieval and actuation, and the performance bench marking and certification of AI techniques

Related Work items:

–>PLEASE SEE 20 AUG 2019 UPDATE BELOW |

2. Realizing 5G/ IMT-2020 vision

- Unified access-independent network management

- Standardization roadmap on IMT-2020

- ICN (Information Centric Networks) with scalability, mobility and security

- Open-source software and standards for 5G

- Software-based networking functions to optimize a per-session based performance

- Emerging fronthaul and midhaul technologies to support the 5G deployment

- Large-bandwidth backhaul and fronthaul solutions

- Concrete strategies for the migration from 4G to 5G systems.

- End-to-end network orchestration, control and management

- Service-based network architecture

- Open service management APIs for the Internet of Things

- Electromagnetic field (EMF) studies around 5G beam-forming capabilities

- Interoperability of services supporting public safety.

Related Work items:

- Y.NGNe-O-arch: Functional architecture of orchestration in NGNe

- Y.IMT2020-qos-fa: QoS functional architecture for IMT-2020 networks

- Y.IMT2020-qos-req: QoS functional requirements for IMT-2020 networks

- Y.qos-ml-arch: Architecture of machine learning based QoS assurance for IMT-2020 networks

- Y.IMT2020.qos-mon: IMT-2020 network QoS monitoring architectural framework

- Y.IMT2020-CEF: Network capability exposure function in IMT-2020 networks

- Y.3MO: Requirements and Architectural Framework of Multi-layer, Multi-Domain, Multi-Technology Orchestration

- Y.IMT2020-ADPP: Advanced Data Plane Programmability for IMT-2020 (renamed- see below)

- Y.NetSoft-SSSDN: High level architectural model of network slice support for IMT-2020 – Part: SDN (renamed- see below)

…………………………………………………………………………………………………………………………………………………….

IMT 2020 non radio recommendations developed by ITU-T SG13:

- Y.3112: Framework for the support of network slicing in the IMT-2020 network (Revised)

- Draft Recommendation ITU-T Y.IMT2020-NSAA-reqts: “Requirements for network slicing with AI-assisted analysis in IMT-2020 networks”

- Draft Recommendation ITU-T Y.IMT2020-CEF: “Network capability exposure function in the IMT-2020 networks”

- Draft Recommendation ITU-T Y.qos-ec-vr-req: ” QoS requirements and architecture for virtual reality delivery using edge computing in IMT-2020″

- Draft Recommendation ITU-T Y.3072 (formerly Y.ICN-ReqN): “Requirements and Capabilities of Name Mapping and Resolution for Information Centric Networking in IMT-2020”

- Draft Recommendation ITU-T Y.3151 (formerly Y.NetSoft-SSSDN): “High level architectural model of network slice support for IMT-2020 – part: SDN”

- Draft Recommendation ITU-T Y.3152(formerly Y.IMT2020-ADPP): “Advanced Data Plane Programmability for IMT-2020”

- Draft Recommendation ITU-T Y.3172 (formerly Y.IMT2020-ML-Arch): “Architectural framework for machine learning in future networks including IMT-2020

- Draft Recommendation ITU-T Y.3106 (formerly Y.IMT2020-qos-req): “QoS functional requirements for the IMT-2020 network”

Editor’s Note:

A summary of SG13 work program provides the timing of each work item, e.g. handbook, technical reports, supplements and recommendation.

…………………………………………………………………………………………………………………………………………….

ITU-T SG13/WP1 work related to IMT-2020:

| Question | (Co-) Rapporteur

(Associate Rapporteur) |

Title |

| Q6/13 | Taesang CHOI (Korea) | Quality of service (QoS) aspects including IMT-2020 networks |

| Guosheng ZHU (China) | ||

| Q20/13 | Nam Seok KO (Korea) | IMT-2020: Network requirements and functional architecture |

| Marco CARUGI (Huawei, China) | ||

| Q21/13 | Kazunori TANIKAWA (Japan)

Yushuang HU (China) |

Network softwarization including software-defined networking, network slicing and orchestration |

| Sangwoo KANG (Korea) | ||

| Q22/13 | Jiguang CAO (China)

Ved P. KAFLE (Japan) |

Upcoming network technologies for IMT-2020 and Future Networks |

| Q23/13 | Jeong Yun KIM (Korea)

Nauxiang Shi (China) |

Fixed-Mobile Convergence including IMT-2020 |

Question 21 of ITU-T SG13 is studying network softwarization including: network slicing, SDN, and orchestration which are highly expected to contribute to IMT-2020. Question 21/SG13 met from 4 to 14 March 2019 at Victoria Falls, Zimbabwe under the chairmanship of co-Rapporteur Ms.Yushuang Hu (China Mobile, China) and Mr. Kazunori TANIKAWA (NEC, Japan). On March 14, 2019, ITU-T SG13 consented to two new Recommendations:

- ITU-T Y.IMT2020-ML-Arch “Architectural framework for machine learning in future networks including IMT-2020” (Ref. SG13-TD355/WP1)

- ITU-T Y.3115 (formerly Y.NetSoft-SSSDN). It describes SDN control interfaces for network slicing, which especially focuses on the control of front haul networks such as PON.

………………………………………………………………………………………………………………………………………………

20 August 2019 Update: New ITU standard has established a basis for the cost-effective integration of Machine Learning into 5G and future networks.

The standard – ITU Y.3172 – describes an architectural framework for networks to accommodate current as well as future use cases of Machine Learning. “Machine Learning will change the way we operate and optimize networks,” said Slawomir Stanczak, Chairman of the ITU-T Focus Group on ‘Machine Learning for Future Networks including 5G’. ITU Y.3172 is under the responsibility of the Focus Group’s parent group, ITU-T Study Group 13 (Future networks and cloud).

“Every company in the networking business is investigating the introduction of Machine Learning, with a view to optimizing network operations, increasing energy efficiency and curtailing the costs of operating a network. This ITU Y.3172 architectural framework provides a common point of reference to improve industry’s orientation when it comes to the introduction of Machine Learning into mobile networks.”

Machine Learning holds great promise to enhance network management and orchestration. Drawing insight from network-generated data, Machine Learning can yield predictions to support the optimization of network operations and maintenance. This optimization is becoming increasingly challenging, and increasingly important, as networks gain in complexity to support the coexistence of a diverse range of information and communication technology (ICT) services.

Network operators aim to fuel Machine Learning models with data correlated from multiple technologies and levels of the network. They are calling for deployment mechanisms able to ‘future-proof’ their investments in Machine Learning. And they are in need of interfaces to transfer data and trained Machine Learning models across Machine Learning functionalities at multiple levels of the network.

The ITU Y.3172 architectural framework is designed to meet these requirements. The standard includes a unique focus on the future.

“ITU Y.3172 provides for the declarative specification of Machine Learning applications, making it the first mechanism to meet industry’s need for a standard method of including future use cases,” says Vishnu Ram, the lead editor of the standard.

“This is the first time that a Study Group has approved a Focus Group deliverable as an ITU standard before the conclusion of the Focus Group’s lifetime,” says Leo Lehmann, Chairman of ITU-T Study Group 13. This represents an important achievement in ITU’s work to expedite the transition from exploratory studies to the agreement of new ITU standards.

ITU-T Focus Groups are open to all interested parties. These groups accelerate ITU studies in fields of growing strategic relevance to ITU membership, delivering base documents to inform related standardization work in membership-driven ITU-T Study Groups.

“I would like to commend the many experts participating in both the Focus Group and ITU-T Study Group 13,” says Lehmann. “This early approval required a considerable amount of planning and extremely close collaboration, which could only have been achieved with dual participation and common interest.”

The standard offers a common vocabulary and nomenclature for Machine Learning functionalities and their relationships with ICT networks, providing for ‘Machine Learning Overlays’ to underlying technology-specific networks such as 5G networks. It describes a ‘loosely coupled’ integration of Machine Learning and 5G functionalities, minimizing their interdependencies to account for their parallel evolution.

The components of the architectural framework include ‘Machine Learning Pipelines’ – sets of logical nodes combined to form a Machine Learning application – as well as a ‘Machine Learning Function Orchestrator’ to manage and orchestrate the nodes of these pipelines.

‘Machine Learning Sandboxes’ are another key component of the framework, offering isolated environments hosting separate Machine learning pipelines to train, test and evaluate Machine Learning applications before deploying them in a live network.

“This combination of an architectural framework for Machine Learning and this declarative language to specify new use cases will give network operators complete power over the extension of Machine Learning to new use cases, the deployment and management of Machine Learning in the network, and the correlation of data from sources at multiple levels of the network,” says Ram.

The ITU Y.3172 architectural framework is the first of a nascent series of ITU standards addressing Machine Learning’s contribution to networking.

“A range of ITU standards under development will complement and complete the architectural framework described by ITU Y.3172,” says Ram. “Collectively these standards will provide a full toolkit to build Machine Learning into our networks.”

Two draft ITU standards will propose mechanisms for data handling and specify the design of the ‘Machine Learning Function Orchestrator.’ “If data is the blood flowing through the heart that is Machine Learning, this function orchestrator can be considered the brain,” Ram added.

Another ITU standard will support the assessment of intelligence levels across different parts of the network.

“Different parts of the network will be supplied by different vendors,” says Ram. “We are developing a standard way for different parties to look the intelligence level of the network, helping operators to evaluate vendors and regulatory authorities to evaluate the network.”

The series of ITU standards will be completed by a standard supporting the interoperability of Machine Learning marketplaces, marketplaces hosting repositories of Machine Learning models.

“The standard would assist potential adopters both in selecting a Machine Learning model capable of addressing their specific needs and in integrating the model into the network,” says Ram.

NOTE: To join the group’s mailing list, request access to documents and sign-up to a working group on the homepage of the ITU Focus Group on Machine Learning for Future Networks including 5G.

……………………………………………………………………………………………………………………………

December 2019 update:

Y.3106 Quality of service functional requirements for the IMT-2020 network standard was posted on December 2019 at the ITU website and is available for free download here.

………………………………………………………………………………………………………………………………………………

Status and timing of SG13 work: https://www.itu.int/itu-t/workprog/wp_search.aspx?sg=13

……………………………………………………………………………………………………………………………

Related: The following ITU-T Technical Report was developed by ITU-T SG15:

Technical Report (GSTR-TN5G) on “Transport network support of IMT-2020/5G”

……………………………………………………………………………………………………………………………

Previous Techblog post on this topic:

New ITU-T Standards for IMT 2020 (5G) + 3GPP Core Network Systems Architecture

Forward Reference (April 2020 IEEE Techblog post):

New ITU-T SG13 Recommendations related to IMT 2020 and Quantum Key Distribution

SD-WAN revenue hits $359 million in Q4 2018; Data Center Networking Highlights

By Josh Bancroft, senior analyst, DC and enterprise SDN, Networked Services, IHS Markit.

Highlights

Software-defined networking (SD-WAN) software revenue, including appliance and control and management software, rose 26 percent quarter over quarter to reach $359 million in the fourth quarter (Q4) of 2018. VMware led SD-WAN market revenue share with 20 percent, followed by Cisco at 14 percent and Aryaka at 12 percent, according to the “Data Center Network Equipment Market Tracker” from IHS Markit.

Editor’s Notes:

- VMware and Cisco acquired SD-WAN start-ups Velocloud and Viptela, respectively in 2018 which enabled them to lead this market.

- There are many types of SD-WANs, none of which are based on standards. Here’s an article describing the different SD-WAN “flavors”

……………………………………………………………………………………………………………………………………………………………………………………………………………………..

In the fourth quarter, vendors began to reap the rewards of partnering with multiple managed-service providers, systems integrators and telcos. Revenue deal sizes have been rising, and the number of enterprise sites deploying SD-WAN continues to grow.

For the foreseeable future, both direct and channel sales will continue to drive SD-WAN market growth. In the IHS Markit “Edge Connectivity Strategies North American Enterprise” survey in February 2019, respondents showed a clear bias for consuming SD-WAN with self-managed on-site hardware and software, or as a standalone managed service bundled with connectivity. However, by 2019 they expect to shift to managed services bundled with other network functions virtualization (NFV) services and connectivity.

“Telcos want to utilize the high speeds and network-slicing capability of 5G, along with the application-traffic steering capability of SD-WAN, to support the industrial internet of things and other new edge applications,” said Josh Bancroft, senior research analyst at IHS Markit. “The telcos view SD-WAN as a key way to ensure various traffic types are automatically steered to the appropriate links. It can also guarantee IoT traffic is prioritized over 5G, and other applications are automatically routed over broadband.”

“If they haven’t done so already, SD-WAN vendors should consider adding IoT-specific features to their offering, such as application identification, prioritization and protocol translation functionality on SD-WAN appliances,” Bancroft said.

Following are some additional data center network market highlights:

- Application delivery controller revenue declined 4 percent quarter over quarter and 7 percent year over year in Q4 2018, reaching $438 million.

- Virtual ADC appliances comprised 35 percent of ADC revenue in Q4 2018.

- F5 revenue declined by 8 percent, quarter over quarter, in Q4 2018, but the company still garnered 47 percent of ADC market share. Citrix followed F5 with 27 percent, and A10 came in third with 8 percent.

Data Center Network Equipment Market Tracker

With forecasts through 2023, this IHS Markit report provides quarterly worldwide and regional market size, vendor market share, analysis and trends for data center Ethernet switches by category and market, application delivery controllers by category, and software-defined WAN (SD-WAN) appliances and control and management software. Vendors tracked include A10, ALE, Arista, Array Networks, Aryaka, Barracuda, Cisco, Citrix, CloudGenix, CradlePoint, Cato, Dell, F5, FatPipe, Fortinet, HPE, Huawei, Hughes, InfoVista, Juniper, KEMP, Nokia (Nuage), Radware, Riverbed, Silver Peak, Talari, TELoIP, VMware, Versa, ZTE and others.

…………………………………………………………………………………………………………………………………………………………………………………………………………………………..