TC3 Update on CORD (Central Office Re-architected as a Data center)

Introduction:

Timon Sloane of the Open Networking Foundation (ONF) provided an update on project CORD on November 1st at the Telecom Council’s Carrier Connections (TC3) summit in Mt View, CA. The session was titled:

Spotlight on CORD: Transforming Operator Networks and Business Models

After the presentation, Sandhya Narayan of Verizon and Tom Tofigh of AT&T came up to the stage to answer a few audience member questions (there was no real panel session).

The basic premise of CORD is to re-architect a telco/MSO central office to have the same or similar architecture of a cloud resident data center. Not only the central office, but also remote networking equipment in the field (like an Optical Line Termination unit or OLT) are decomposed and disaggregated such that all but the most primitive functions are executed by open source software running on a compute server. The only hardware is the Physical layer transmission system which could be optical fiber, copper, or cellular/mobile.

Author’s Note: Mr. Sloane didn’t mention that ONF became involved in project CORD when it merged with ON.Labs earlier this year. At that time, the ONOS and CORD open source projects became ONF priorities. The Linux Foundation still lists CORD as one of their open source projects, but it appears the heavy lifting is being done by the new ONF as per this press release.

………………………………………………………………………………………………………………

Backgrounder:

A reference implementation of CORD combines commodity servers, white-box switches, and disaggregated access technologies with open source software to provide an extensible service delivery platform. This gives network operators (telcos and MSOs) the means to configure, control, and extend CORD to meet their operational and business objectives. The reference implementation is sufficiently complete to support field trials.

Illustration above is from the OpenCord website

……………………………………………………………………………………………………………………….

Highlights of Timon Sloane’s CORD Presentation at TC3:

- ONF has transformed over the last year to be a network operator led consortium.

- SDN, Open Flow, ONOS, and CORD are all important ONF projects.

- “70% of world wide network operators are planning to deploy CORD,” according to IHS-Markit senior analyst Michael Howard (who was in the audience- see his question to Verizon below).

- 80% of carrier spending is in the network edge (which includes the line terminating equipment and central office accessed).

- The central office (CO) is the most important network infrastructure for service providers (AKA telcos, carriers and network operators, MSO or cablecos, etc).

- The CO is the service provider’s gateway to customers.

- End to end user experience is controlled by the ingress and egress COs (local and remote) accessed.

- Transforming the outdated CO is a great opportunity for service providers. The challenge is to turn the CO into a cloud like data center.

- CORD mission is the enable the “edge cloud.” –>Note that mission differs from the OpenCord website which states:

“Our mission is to bring datacenter economies and cloud agility to service providers for their residential, enterprise, and mobile customers using an open reference implementation of CORD with an active participation of the community. The reference implementation of CORD will be built from commodity servers, white-box switches, disaggregated access technologies (e.g., vOLT, vBBU, vDOCSIS), and open source software (e.g., OpenStack, ONOS, XOS).”

- A CORD like CO infrastructure is built using commodity hardware, open source software, and white boxes (e.g. switch/routers and compute servers).

- The agility of a cloud service provider depends on software platforms that enable rapid creation of new services- in a “cloud-like” way. Network service providers need to adopt this same model.

- White boxes provide subscriber connections with control functions virtualized in cloud resident compute servers.

- A PON Optical Line Termination Unit (OLT) was the first candidate chosen for CORD. It’s at the “leaf of the cloud,” according to Timon.

- 3 markets for CORD are: Mobile (M-), Enterprise (E-), and Residential (R-). There is also the Multi-Service edge which is a new concept.

- CORD is projected to be a $300B market (source not stated).

- CORD provides opportunities for: application vendors (VNFs, network services, edge services, mobile edge computing, etc), white box suppliers (compute servers, switches, and storage), systems integrators (educate, design, deploy, support customers, etc).

- CORD Build Event was held November 7-9, 2017 in San Jose, CA. It explored CORD’s mission, market traction, use cases, and technical overview as per this schedule.

Service Providers active in CORD project:

- AT&T: R-Cord (PON and g.fast), Multi-service edge-CORD, vOLTHA (Virtual OLT Hardware Abstraction)

- Verizon: M-Cord

- Sprint: M-Cord

- Comcast: R-Cord

- Century Link: R-Cord

- Google: Multi-access CORD

Author’s Note: NTT (Japan) and Telefonica (Spain) have deployed CORD and presented their use cases at the CORD Build event. Deutsche Telekom, China Unicom, and Turk Telecom are active in the ONF and may have plans to deploy CORD?

……………………………………………………………

Q&A Session:

- This author questioned the partitioning of CORD tasks and responsibility between ONF and Linux Foundation. No clear answer was given. Perhaps in a follow up comment?

- AT&T is bringing use cases into ONF for reference platform deployments.

- CORD is a reference architecture with systems integrators needed to put the pieces together (commodity hardware, white boxes, open source software modules).

- Michael Howard asked Verizon to provide commercial deployment status- number, location, use cases, etc. Verizon said they can’t talk about commercial deployments at this time.

- Biggest challenge for CORD: Dis-aggregating purpose built, vendor specific hardware that exist in COs today. Many COs are router/switch centric, but they have to be opened up if CORD is to gain market traction.

- Future tasks for project CORD include: virtualized Radio Access Network (RAN), open radio (perhaps “new radio” from 3GPP release 15?), systems integration, and inclusion of micro-services (which were discussed at the very next TC3 session).

Addendum from Marc Cohn, formerly with the Linux Foundation:

Here’s an attempt to clarify the CORD project responsibilities:

- CORD is an open reference architecture. In that sense, CORD is similar to the ETSI NFV Architectural Framework, ONF SDN Architecture, and MEF LifeCycle Services Orchestration (LSO) reference architectures.

- As it is a reference architecture, it is not an implementation, and is maintained by the Open Networking Foundation (ONF), which merged with ON.LAB towards the end of 2016.

- OpenCORD is a Linux Foundation project announced in the summer of 2016. It is focused on an open source implementation of the CORD architecture. OpenCord was derived from the work undertaken by ON.LAB, prior to the merger with ONF in 2016.

- For technical details, visit the OpenCORD Wiki

- Part of the confusion is that if one visits the Linux Foundation projects page, CORD is listed, but the link is to the OpenCord website.

Fog Computing Definition, Architecture, Market and Use Cases

Introduction to Fog Computing, Architecture and Networks:

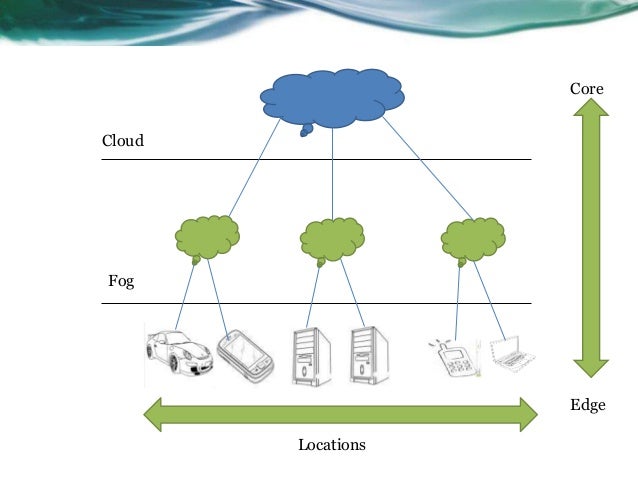

Fog computing is an extension of cloud computing which deploys data storage, computing and communications resources, control and management data analytics closer to the endpoints. It is especially important for the Internet of Things (IoT) continuum, where low latency and low cost are needed.

Fog computing architecture is the arrangement of physical and logical network elements, hardware, and software to implement a useful IoT network. Key architectural decisions involve the physical and geographical positioning of fog nodes, their arrangement in a hierarchy, the numbers, types, topology, protocols, and data bandwidth capacities of the links between fog nodes, things, and the cloud, the hartware and software design of individual fog nodes, and how a complete IoT network is orchestrated and managed. In order to optimize the architecture of a fog network, one must first understand the critical requirements of the general use cases that will take advantage of fog and specific software application(s) that will run on them. Then these requirements must be mapped onto a partitioned network of appropriately designed fog nodes. Certain clusters of requirements are difficult to implement on networks built with heavy reliance on the cloud (intelligence at the top) or intelligent things (intelligence at the bottom), and are particularly influential in the decision to move to fog-based architectures.

From a systematic perspective, fog networks provide a distributed computing system with a hierarchical topology. Fog networks aim at meeting stringent latency requirements, reducing power consumption of end devices, providing real-time data processing and control with localized computing resources, and decreasing the burden of backhaul traffic to centralized data centers. And of course, excellent network security, reliability and availability must be inherent in fog networks.

Fog computing network architecture

Illustration courtesy of August 2017 IEEE Communications Magazine article: “Architectural Imperatives for Fog Computing: Use Cases, Requirements, and Architectural Techniques for Fog-Enabled IoT Networks” (IEEE Xplore or IEEE Communications magazine subscription required to view on line)

………………………………………………………………………………………………………………………..

Fog Computing Market:

The fog computing market opportunity will exceed $18 billion worldwide by the year 2022, according to a new report by 451 Research. Commissioned by the OpenFog Consortium, the Size and Impact of Fog Computing Market projects that the largest markets for fog computing will be, in order, energy/utilities, transportation, healthcare and the industrial sectors.

“Through our extensive research, it’s clear that fog computing is on a growth trajectory to play a crucial role in IoT, 5G and other advanced distributed and connected systems,” said Christian Renaud, research director, Internet of Things, 451 Research, and lead author of the report. “It’s not only a technology path to ensure the optimal performance of the cloud-to-things continuum, but it’s also the fuel that will drive new business value.”

Key findings from the report were presented during an opening keynote on October 30th at the Fog World Congress conference. In addition to projecting an $18 billion fog market and identifying the top industry-specific market opportunities, the report also identified:

- Key market transitions fueling the growth include investments in energy infrastructure modernization, demographic shifts and regulatory mandates in transportation and healthcare.

- Hardware will have the largest percentage of overall fog revenue (51.6%), followed by fog applications (19.9%) and then services (15.7%). By 2022, spend will shift to apps and services, as fog functionality is incorporated into existing hardware.

- Cloud spend is expected to increase 147% to $6.4 billion by 2022.

“This is a seminal moment that not only validates the magnitude of fog, but also provides us with a first-row seat to the opportunities ahead,” said Helder Antunes, chairman of the OpenFog Consortium and Senior Director, Cisco. “Within the OpenFog community, we’ve understood the significance of fog—but with its growth rate of nearly 500 percent over the next five years—consider it a secret no more.”

The fog market report includes the sizing and impact of fog in the following verticals: agriculture, datacenters, energy and utilities, health, industrial, military, retail, smart buildings, smart cities, smart homes, transportation, and wearables.

Fog computing is the system-level architecture that brings computing, storage, control, and networking functions closer to the data-producing sources along the cloud-to-thing continuum. Applicable across industry sectors, fog computing effectively addresses issues related to security, cognition, agility, latency and efficiency.

Download the full report at www.openfogconsortium.org/growth.

………………………………………………………………………………………………………………

Fog Use Cases:

According to the Open Fog Consortium, fog architectures offer several unique advantages over other approaches, which include, but are not limited to:

Security: Additional security to ensure safe, trusted transactions

Cognition: awareness of client-centric objectives to enable autonomy

Agility: rapid innovation and affordable scaling under a common infrastructure

Latency: real-time processing and cyber-physical system control

Efficiency: dynamic pooling of local unused resources from participating end-user devices

New use cases created by the OpenFog Consortium were also released that showcase how fog works in industry. These use cases provide fog technologists with detailed views of how fog is deployed in autonomous driving, energy, healthcare and smart buildings.

The August 2017 IEEE Communications magazine article lists various IoT vertical markets and example fog use cases for each one:

It also delineates several application examples and allowable latency for each one:

IEEE to Standardize Fog Network Architecture based on Open Fog Consortium Reference Model

The OpenFog Consortium has announced that its OpenFog Reference Architecture will serve as the basis for a new working group formed by the IEEE Standards Association (IEEE-SA) to accelerate the creation and adoption of industry standards for fog computing and networking. This and other future standards on Fog computing and networking will serve as a significant catalyst to propel the digital revolution occurring as a result of advanced Internet of Things (IoT), 5G and embedded artificial intelligence (AI) applications.

Fog computing and networking is an advanced distributed architecture that brings computing, storage, control, and networking functions closer to the data-producing sources along the cloud-to-thing continuum. Applicable across industry sectors, fog computing effectively addresses issues related to security, cognition, agility, latency and efficiency (SCALE).

The inaugural meeting of the IEEE ComSoc Standards Working Group on Fog Computing and Networking Architecture Framework- Project P1934 [1] is scheduled for November 2017, with its work expected to be complete by April 2018. Additional details were presented at two Fog World Congress sessions I attended on October 31st and November 1st in Santa Clara, CA (see below).

Note 1. IEEE P1934 proposed standard: OpenFog Reference Architecture for Fog Computing:

-Working Group: Fog Computing Architecture Framework

-Working Group Chair: John Zao – [email protected]

-Working Group Vice-Chair: Tao Zhang – [email protected]

-Sponsoring Society and Committee: IEEE Communications Society/Standards Development Board (COM/SDB)

-Sponsor Chair: Mehmet Ulema – [email protected]

http://standards.ieee.org/develop/wg/FOG.html

………………………………………………………………………………………………………………………………………………….

The OpenFog Reference Architecture is a universal technical framework designed to enable the data-intensive requirements of IoT, 5G and AI applications. It is a structural and functional prescription of an open, inter-operable, horizontal system architecture for distributing computing, storage, control and networking functions closer to the users along a cloud-to-thing continuum. The framework encompasses various approaches to disperse information technology (IT), communication technology (CT) and operational technology (OT) services through an information messaging infrastructure as well as legacy and emerging multi-access networking technologies.

“This represents a giant step forward for fog computing and for the industry, which will soon have the specifications for use in developing industrial strength fog-based hardware, software and services,” said John Zao, Chair, IEEE Standards Working Group on Fog Computing and Networking Architecture Framework (and Associate Professor at Taiwan Chiao-Tung University). “The objective from the beginning was that the Open Fog Reference Architecture would serve as the high-level basis for industry standards, and the IEEE is looking forward to the collaboration in this effort.”

“The standards work produced by this new working group will be crucial in the continued growth of fog computing innovation and things-to-cloud systems,” said Dr. Mehmet Ulema, Director, Standards Development, IEEE Communications Society, and Professor at Manhattan College, New York. “This also is an outstanding example of the strategic alliance between IEEE and OpenFog to co-create and co-promote fog networking concepts and architectures.”

“The mandate for fog computing is growing stronger, driven by the recognition that traditional architectures can’t deliver on the operational challenges for today’s advanced digital applications,” said Helder Antunes, chairman of the OpenFog Consortium and Senior Director at Cisco. “On behalf of the members of the OpenFog technical community, I’m pleased to see the recognized value of the OpenFog Reference Architecture and IEEE’s commitment to fog computing and networking via the formation of this new working group.”

…………………………………………………………………………………………

IEEE ComSoc Rapid Reaction Standards Activities – RRSA

On November 1st at the Open Fog World Congress, IEEE ComSoc Standards Chair Alex Gelman, PhD explained the RRSA mechanism to define new IEEE ComSoc standards for Fog computing/networking and other projects related to communications technologies. Special targets for IEEE standardization are emerging technologies

Methodology:

- Invite industry practitioners that have ideas for specific standardization projects or for areas of standardization

- Identify relevant leading experts in the target field, e.g. Industrial and academic researchers

- Leverage IEEE ComSoc Technical Committees

- Issue a call for participation, solicit project proposals and/or position statements

- Select participants based on proposals/positions statements submissions

- Selected proposals are typically selected that can be clustered in 1-3 groups

- 1 day face to face meeting to come to agreement on a proposed new standard

- If approved, culminates in a PAR – Project Authorization Request

Some observations made during OpenFog RRSA:

- Scholarly nature of Fog Technologies

- Fog/Edge technologies are still, at least in part, in conceptual phase

- It is critical to engage Industrial and academic researchers in discussion and standardization

- Multiplicity of standards

- Notable complimentary efforts, e.g. MEC

- The bad news about standards is that there are many to choose from

- The good news about standards is that there are many to choose from

- “Legislating” any particular technology will impede innovation

- Properly architecting standards is key to harmonization of efforts

- Early cooperation with IEEE and external standards groups is highly desirable for harmonization

- Proper modularity of standards is critical for future Interoperability, Interworking, or Coexistence mechanisms

- Viable Standardization Strategy

- Harmonize IEEE standardization method with OpenFog entity-based membership is a good idea

- Deploy adoption and standard development methods as appropriate

- Position OpenFog Standardization among IEEE Strategic projects for 5G and Beyond

Related IEEE Standards Projects:

- IEEE P1934 “Open Fog Reference Architecture for Fog Computing”

- IEEE P2413™: Draft Standard for an Architectural Framework for the Internet of Things

…………………………………………………………………………………………………………………………………………………………..

Future Fog Computing and Networking Standards:

During a November 1st late afternoon discussion on Fog/IEEE standards, Professor Zao said that in the future, the Open Fog Consortium would work with IEEE and other standards bodies/entities on other Fog computing standards. This author suggested that future Fog networking standards follow the CCITT (now ITU-T) model adopted for ISDN in the early to mid 1980’s: define the reference architecture, functional groupings and reference points between functional groupings. Then standardize the interfaces, protocols and message sets based on pointers to existing standards (where applicable) or new standards. Several attendees agreed with that approach with the goal of being able to certify compliance to exposed Fog networking interfaces.

References:

IEEE Standards Association: http://standards.ieee.org/

IEEE Standards for 5G and Beyond: https://5g.ieee.org/standards

IEEE IoT Initiative: https://iot.ieee.org/

IEEE SDN/NFV Initiative: https://sdn.ieee.org/

IEEE 5G Initiative: https://5g.ieee.org/

…………………………………………….

2017 Telecom Council’s TC3 Summit: SPIFFY Award Winners + Start-up Success Stories

2017 SPIFFY Awards:

Seven pioneering start-up companies were recognized by the Service Provider Innovation Forum (SPIF) at the 10th Annual SPIFFY Awards held Wednesday evening November 1st at TC3 Summit.

Since 2001, the Telecom Council has worked to identify and recognize companies who represent a broad range of cutting-edge telecom products and services. From there, dozens of young companies are presented each month to the Service Provider Innovation Forum (SPIF), ComTech Forum, IoT Forum, and Investor Forum.

SPIF members, who represent cutting-edge telcos from over 50 countries and who serve over 3B subscribers, selected seven companies from hundreds of presenting communication startup companies and 30 SPIFFY nominees as best-in-class in their respective categories. Each winner, who is set apart for their dedication, technical vision, and interest from the global service provider community, is a company to watch in the telecommunication industry.

The winners below represent the best and brightest in their respective categories:

- The Graham Bell Award for Best Communication Solutions – Sightcall : a cloud API that enables any business to add rich communications (e.g. video), accessible with a single touch, in the context of their application.

- Edison Award for Most Innovative Startup – DataRPM: cognitive preventive maintenance platform.

- San Andreas Award for Most Disruptive Technology – Veniam: networking solution for future autonomous vehicles; mobile WiFi done right.

- Core Award for Best Fixed Telecom Opportunity – Datera: storage and data management for service providers, private cloud, digital business via “Datera elastic data fabric software.”

- Zephyr Award for Best Mobile Opportunity – AtheerAir: augmented reality solutions for industrial enterprises.

- Ground Breaker Award for Engineering Excellence – Cinova: virtual reality streaming at practical bit rates using Cinova’s cloud server technology.

- Prodigy Award for the Most Successful SPIF Alumni – Plex: streaming media server and apps to stream video, audio and photo collections on any device.

This year’s entrepreneurs had a chance to vote on the operators as well, to give a shout out to those telcos who were supportive, approachable, and helpful to young and growing telecom companies. The entreprenneurs chose Verizon.

- Fred & Ginger Award for the Most Supportive Carrier – Verizon.

The SPIFFY nominees attended the awards ceremony along with 50 global fixed and wireless communications companies and over 300 industry professionals. Photos of the event can be found on Telecom Council’s blog and Instagram pages. Note that none of this year’s SPIFFY award winners, with the possible exception of Veniam, actually provide a connectivity (PHY, MAC/Data Link layer) solution.

……………………………………………………………………………………………………………………………………….

Author’s Notes on three impressive start-ups that presented at TC3 on November 1st (only day I attended 2017 TC3):

1. In a session titled “Closing the Rural Broadband Gap,” Skyler Ditchfield, CEO of GeoLinks, provided an overview of his company’s success in providing high-speed broadband to schools and libraries using fixed wireless technologies, specifically microwave radio operating in several frequency bands. The company’s flagship service is ClearFiber™, which offers customers fixed wireless broadband service on the most resilient and scalable networkSkyler described the advantages of their 100% in house approach to engineering, design, land procurement, construction and data connectivity. GeoLinks approach offers gigabit plus speeds at a fraction of the cost of fiber with lower latency and rapid deployment across the country.

A broadband fixed wireless installation on Santa Catalina island was particularly impressive. Speeds on the island (which GeoLinks says is 41 miles offshore) are typically 300 Mbps, and the ultra-fast broadband connection provides support for essential communications services, tourism services, and commerce. GeoLinks successfully deployed Mimosa Network´s fiber-fast broadband solutions to bring high-speed Internet access to the island community for the first time in its history. Connecting the island to the mainland at high speeds was very challenging. GeoLinks ultimately selected Mimosa for the last mile of the installation, deploying Mimosa A5 access and C5 client devices throughout the harbor town of Avalon.

Another ClearFiber™ successful deployment was at Robbins Elementary school in California. It involved 19 miles of fixed broadband wireless transport to provide the school with broadband Internet access.

Skyler said that next year, GeoLinks planned to deliver fixed wireless transport at 10G b/sec over 6 to 8 miles in the 5Ghz unlicensed band- either point to point OR point to multi-point. The company is considering 6GHz, 11GHz, 18Ghz and 20Ghz FCC licensed bands. He said it would be important for GeoLinks to get licensed spectrum for point to multi-point transmission.

More on GeoLinks value proposition here and here. And a recent blog post about Skyler Ditchfield who told the TC3 audience he grew up fascinated by communications technologies. This author was very impressed with Skyler and GeoLinks!

2. In a panel on “Startup Success Stories,” Nitin Motgi, founder and CEO of Cask (a “big data” software company) talked about how long it took to seal a deal with telcos. It’s longer than you might think! In one case, Nitin said it was 18 months from the time an unnamed telco agreed to purchase Cask’s solution (based on a proof of concept demo) till the contract was actually signed and sealed. Nitin referred to the process of selling to telcos as “whale hunting.” However, he said that if you succeed it’s worth it because of the telco’s scale of business.

3. Tracknet Co-Founder and CEO Hardy Schmidbauer presented a 5 minute “fast pitch” to the Telecom Council Service Provider Forum. He talked about his company’s highly scalable LPWAN/ IoT network solutions: “TrackNet provides LoRaWAN IoT solutions for consumers and industry, focusing on ease of use and scalability to enable a “new era” of exponentially growing LPWAN deployments.” The company is a contributing member of the LoRa Alliance and the TrackNet team has been instrumental in specifying, building, and establishing LoRaWAN and the LoRa Alliance for more than five years. The founding Tracknet team includes veterans from IBM and Semtech who were instrumental in the development of LoRa and LoRaWAN.

With “Tabs,” Tracknet combines a WiFi connected IoT home and tracker system with LoRaWAN network coverage built from indoor Tabs hubs.

………………………………………………………………………………………………………………………………………….

About the Telecom Council: The Telecom Council of Silicon Valley connects the companies who are building communication networks, with the people and ideas that are creating them – by putting those companies, research, ideas, capital and human expertise from across the globe together in the same room. Last year, The Telecom Council connected over 2,000 executives from 750 telecom companies and 60 fixed and wireless carriers across 40 meeting topics. By joining, speaking, sponsoring, or simply participating in a meeting, there are many ways telecom companies of any size can leverage the Telecom Council network. For more information visit: https://www.telecomcouncil.com.

Reference:

…………………………………………………………………………………………………………………………………………………………

Forward Reference:

A follow up TC3 blog post will provide an update on project CORD (Central Office Re-architected as a Data Center) from the perspective of the Open Network Foundation (ONF) with panelists from AT&T and Verizon.

Australia’s ACMA Targets 3.6-GHz for “5G” Mobile Broadband

Australian telecoms regulator ACMA has announced plans to reallocate spectrum in the 3.6-GHz band for 5G purposes.

The five-year spectrum outlook released today by ACMA details how Australia’s telecom regulator will adjust spectrum usage of 50MHz of the 900MHz band for 4G mobile broadband, switching from the roughly 8MHz paired chunks of spectrum that worked best with 2G to sets of matched 5MHz pairs more efficient for 4G networks. This won’t happen until mid-2021 to give telcos enough time to roll out appropriate hardware, and also takes into account the as-yet-unallocated 850MHz ‘expansion’ band, where two 15MHz portions sit unused.

However, it’s 3.6GHz that’s most interesting, because that massive 125MHz portion of spectrum could be huge for 5G mobile connectivity or even fixed wireless broadband across Australia. 3.6GHz is “being looked at internationally as a pioneer band for 5G mobile broadband”, according to ACMA chair Nerida O’Loughlin, and ACMA wants Australia to be positioned well to take advantage of any early developments. Telstra sits on the 5G steering council, and both Vodafone and Optus have already done significant testing with network partners.

The Australia telecom regulator also plans to re-allocate the 2G spectrum being freed by the switch off of 2G services for more modern mobile services. In order to achieve these goals the regulator is following a new five-year spectrum roadmap, which was published last week.

The outlook includes details of planned spectrum allocations including possible auction scenarios, as well as a proposed approach to the development of annual spectrum work programs.

‘The 3.6 GHz band is being looked at internationally as a pioneer band for 5G mobile broadband. We want to make sure Australia is well placed to realize the benefits 5G has to offer,” ACMA chairwoman Nerida O’Loughlin said.

‘Now that 2G services have been or are being switched off, the ACMA is also keen to re-farm the 900 MHz GSM band and optimise its utility for newer generation mobile broadband services, such as 4G. We propose to do this over a number of years to avoid disruption of existing services. We also plan to make available additional spectrum already planned for reallocation to mobile broadband in the 850-MHz band.”

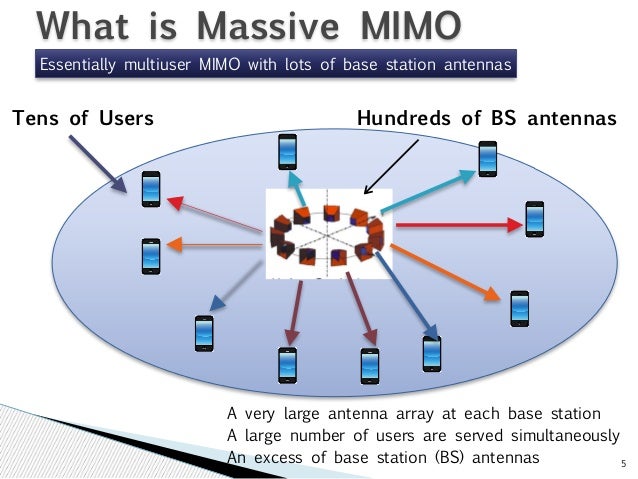

Verizon, Ericsson Team Up for Massive MIMO Deployment

Verizon and Ericsson have deployed frequency division duplexing (FDD) Massive Multiple Input-Multiple Output (MIMO) technology on the Verizon’s wireless network in Irvine, Calif., a step forward in implementing “5G” wireless communications. Ericsson provided 16 transceiver radios and 96 antenna elements in an array for the deployment.

The two companies say the Massive MIMO deployment will improve spectral and energy efficiency, increasing network capacity for current devices in the market. Other network enhancements are expected to provide higher and more consistent speeds for using apps and uploading and downloading files, clearing the pathway for “5G” deployment.

The massive MIMO deployment is running on a 20 MHz block of AWS spectrum. Four-way transmit has been widely deployed throughout the Verizon network and has contributed to significant 4G LTE advancements, according to the announcement. The high number of transmitters from the Massive MIMO provides more possible signal paths. It also enables beamforming, which directs the beam from the cell site directly to where the customer is, dramatically cutting down on interference. Reduced interference results in higher and more consistent speeds for customers.

Note: Massive MIMO is a candidate feature for IMT 2020 (standardized 5G). Please see last references for authoritative status of IMT 2020.

……………………………………………………………………………………………………….

“While continuing to drive 5G development, the deployment of Massive MIMO offers very tangible benefits for our customers today. As we innovate, we learn and continue to lay the groundwork and set the standards for 5G technology,” said Nicola Palmer, Verizon Wireless chief network officer, in a prepared statement. “Our collaboration with Ericsson on this new deployment continues to drive industry-wide innovation and advancements.”

“We have a tremendous excitement around 5G, and today we made a great announcement to our commitment of driving the 5G ecosystem,” Verizon SVP Atish Gude said

Niklas Heuveldop, Ericsson head of market area North America said: “Massive MIMO is a key technology enabler for 5G, but already today, 4G LTE service providers and end users can benefit from the superior capacity and network performance this technology enables. The current trial is an important step in the collaboration we have with Verizon to prepare their network for 5G.”

Ericsson is active with massive MIMO deployments on other carrier networks, including Sprint, who announced a deployment last month.

References:

ABI Research: MIMO starting to realize its full potential in LTE Advanced networks

On the Path to 5G, Verizon, Ericsson Team Up for Massive MIMO Deployment

http://www.zdnet.com/article/verizon-and-ericsson-deploy-massive-mimo-on-irvine-lte-network/

IEEE ComSoc Webinar: 5G: Converging Towards IMT-2020 Submission

LoRaWAN and Sigfox lead LPWANs; Interoperability via Compression

Backgrounder:

The Low Power Wide Area Network (LPWAN) market is focused on IoT WAN connectivity for devices (endpoints) that consume low power, send/receive short messages at low speeds, and have low duty cycles. There are two categories of LPWANs:

1] Cellular (e.g. NB-IoT and LTE Category M1) WANs using licensed spectrum.

2] Wireless WANs operating in unlicensed frequency bands.

While cellular may be the ultimate winner, Sigfox and LoRAWAN currently have a lot more market traction and are growing very fast. Other non-cellular LPWANs (Ingenu, Weightless SIG, etc.) are also getting some attention, but if there are too many commercially available LPWANs the market will be segmented and fractured.

Overview of LoRaWAN and Sigfox network:

Let’s look at the two most popular unlicensed band LPWANs:

1. LoRaWAN:

- LoRaWAN is specified by the LoRa Alliance which includes 47 network operators.

- The LoRa Alliance states on its website: “LoRaWAN™ is the open global standard for secure, carrier-grade IoT LPWA connectivity. With a certification program to guarantee interoperability and the technical flexibility to address the multiple IoT applications be they static or mobile we believe that LoRaWAN can give all THINGS a global voice.”

- For the Physical layer (PHY), LoRa uses a modulation scheme called chirp spread spectrum (CSS) and a radio both developed and sold or licensed by Semtech Corporation.

- About two years ago, Semtech licensed its technology to Microchip and NXP (like ARM, Semtech now licenses to other semiconductor companies). As a result, the core LoRa hardware (PHY layer) is no longer provided by a single global chip manufacturer.

- LoRaWAN defines the media access control (MAC) sublayer of the Data Link layer, which is maintained by the LoRa Alliance. This distinction between LoRa and LoRaWAN is important because other companies (such as Link Labs) use a proprietary MAC sublayer on top of a LoRa chip to create a better performing, hybrid design (called Symphony Link by Link Labs).

- Many of the LoRa Alliance companies building products are focusing on software defined enhancement and use the LoRaWAN defined MAC.

- LoRaWAN will most likely be best used for “discrete” applications like smart buildings or campuses, where mobile network connectivity is not needed.

……………………………………………………………………………………………………………………….

2. Sigfox:

- Sigfox has designed its technology and network to meet the requirements of mass IoT applications; long device battery life-cycle, low device cost, low connectivity fee, high network capacity, and long range.

- Sigfox has the lowest cost radio modules(<$3, compared to ~$10 for LoRa, and $12 for NB-IoT).

- A recent announcement from Sigfox noted the addition of a new service called “Admiral Ivory,” that makes possible to connect devices with hardware components costing as little as $0.20.

- An overview of Sigfox’s network technology is described here. It consists of: Ultra Narrow Band radio modulation, a light weight protocol, small frame size/payload, and a star network architecture.

- The Sigfox network is currently deployed in 36 countries, 17 of which already have national coverage.

- In February, Sigfox reached an agreement with mobile network operator Telefonica to integrate Sigfox’s low-powered connectivity into the Telefonica’s managed connectivity platform. By complementing Telefónica’s cellular connectivity offerings, with Sigfox’s LPWAN connectivity solution, customers can choose the most appropriate type of connectivity or combine them, implementing use cases and creating new service opportunities that otherwise may not have been possible.

- Additionally, Telefónica´s managed connectivity platform will integrate Sigfox’s cloud, which gives the company the ability to develop its own end-to-end IoT solutions, based on Sigfox’s connectivity solution and including device integration, as well as data collection and management.

- While Sigfox is a proprietary IoT network architecture, the company has provided their intellectual property library free of charge and royalty-free to semiconductor companies which have implemented chipsets with dedicated Sigfox interfaces or multi-mode capabilities. The list of chipsets/modules supporting Sigfox (+ multimode) includes: Pycom (+ WiFi, BLE=BlueTooth Low Energy), Texas Instruments (+ BLE), STMicroelectronics (+ BLE), Microchip/Atmel, Analog Devices (+ BLE), NXP, OnSemiconductor (SiP), SiLabs, M2Com, GCT Semiconductor (+ BLE, CatM1, NB-IoT, EC-GSM, GPS), Innocom, and Wisol.

- The current Sigfox ecosystem is composed of several chipset vendors, device makers, platform providers and solution providers.

- Here’s a graphic from the Sigfox website on their expanding network footprint:

…………………………………………………………………………………………………….

Sigfox’s LPWAN Interoperability using Internet Compression Technology:

In a phone conversation with Sigfox standardization expert Juan Carlos Zuniga last week, I learned that Sigfox plans to achieve LPWAN interoperability at the Application layer, rather than building multi-mode base stations with different radio access networks. Here’s a glimpse on how that might happen:

At the IETF 98 Bits-n-Bites event, March 30th in Chicago, Sigfox demonstrated IoT interoperability with internet compression technology. which enables LPWAN applications to run transparently over different IoT radio access network (RAN) technologies.

To achieve this milestone and enable IP applications to communicate over its network, Sigfox and Acklio implemented Static Context Header Compression (SCHC) -a compression scheme being standardized by the IETF IPv6 over LPWAN working group*, which Juan Carlos participates in. SCHC allows reducing IPv6/UDP/CoAP headers to just a few bytes, which can then be transported over LPWAN network small frame size for low-power, low-cost IoT applications.

…………………………………………………………………………………………………….

* The focus of the IPv6 over LPWAN working group is on enabling IPv6 connectivity over four different Low-Power Wide-Area (LPWA) technologies: Sigfox, LoRa WAN, WI-SUN and NB-IOT (from 3GPP).

…………………………………………………………………………………………………….

The demonstration platform was based on an Acklio compression protocol stack running on Sigfox-enabled devices and cloud-based applications over the live Sigfox network in Chicago. Two scenarios were demonstrated: 1] CoAP requests to legacy IP LPWAN devices, and 2] CoAP interoperability over the live Sigfox and cellular networks in Chicago with IP enabled endpoint devices.

“We are thrilled with this latest milestone in our quest to support and promote interoperability in the IoT,” said Juan-Carlos Zúñiga, senior standardization expert at Sigfox and co-chair of the IETF IntArea working group. “It is critical that the industry rallies together to adopt open internet standards to unlock the true potential of the IoT.”

Compression based technology for LPWAN application interoperability builds on Sigfox’s commitment to supporting the development of IoT interoperability as an active member of standards development organizations including the IETF, ETSI and IEEE 802. And the number of chip companies providing Sigfox network interfaces (see above list) is equally impressive.

References:

https://www.iotforall.com/a-primer-for-loralorawan/

………………………………………………………………………………………………………..

Juan Carlos will be following up with a blog post on LPWAN application layer interoperability as well as a more detailed description of the IETF work on LPWANs.

Wi-Fi hotspots in Cuba Create Strong Demand for Internet Access

by Alexandre Meneghini, Sarah Marsh of Reuters

The introduction of Wi-Fi hotspots in Cuban public spaces two years ago has transformed the Communist-run island that had been mostly offline. Nearly half the population of 11 million connected at least once last year.

That has whet Cubans’ appetite for better and cheaper access to the internet.

“A lot has changed,” said Maribel Sosa, 54, after standing for an hour with her daughter at the corner of a park in Havana, video chatting with her family in the United States, laughing and gesticulating at her phone’s screen.

She recalled how she used to queue all night to use a public telephone to speak with her brother for a few minutes after he emigrated to Florida in the 1980s.

Given the relative expense of connecting to the internet, Cubans use it mostly to stay in touch with relatives and friends. Although prices have dropped, the $1.50 hourly tariff represents 5 percent of the average monthly state salary of $30.

“A lot more could change still,” said Sosa. “Why shouldn’t we be able to have internet at home?”

A tiny share of homes has had broadband access until now, subject to government permission granted to some professionals such as academics and journalists.

The state telecoms monopoly has vowed to hook up the whole island and connected several hundred Havana homes late last year as a pilot project. In September, it said it would roll that service out nationwide by the end of 2017.

Cubans say previous promises for such access have not been fulfilled, so their expectations are not high. They also say the cost is prohibitive, with the cheapest monthly subscription priced at $15.

Cubans use their mobile devices to connect to the Internet via WiFi Hotspot near their street.

…………………………………………………………………………………………………..

Havana says it has been slow to develop network infrastructure because of high costs, attributed partly to the U.S. trade embargo. Critics say the government fears losing control.

Cubans who can afford it flock to Internet cafes and 432 outdoor hotspots where they brave ants, mosquitoes and the elements.

Here they laugh, cry, shout, and whisper. Black market vendors weave in and out among them, trying to hawk pre-paid scratchcards allowing Wi-Fi access. The ping of incoming messages and ring of calls fill the air.

“There’s absolutely no privacy here,” said Daniel Hernandez, 26, a tourist guide, after video chatting with his girlfriend in Britain.

“When I have sensitive things to talk about, I try shutting myself into my car and talking quietly.”

The quality of connections is often good only at specific spots, he said, and when fewer users are connected. Otherwise, the screen tends to freeze mid-chat.

Hernandez said he also uses the internet to search for news. In Cuba, the state has the monopoly on print and broadcast media.

A few meters further on, Rene Almeida, 62, sat in his taxi checking email. He said he felt lucky that his two children had moved to the United States where communications are better than ever. It was only in 2008 that the government first allowed Cubans to own cell phones.

He, too, complained of the lack of privacy and the expense.

“It’s better than nothing,” he said. “But it should improve. It will.”

…………………………………………………………………………………………………

References:

https://techblog.comsoc.org/2017/08/18/whats-the-real-status-of-internet-access-in-cuba/

Preview of Fog World Congress: October 30th to November 1st, Santa Clara, CA

The Fog World Congress (FWC), to be held October 30th to November 1st in Santa Clara, CA, provides an innovative forum for industry and academia in the field of fog computing and networking to define terms, discuss critical issues, formulate strategies and organize collaborative efforts to address the challenges. Also, to share and showcase research results and industry developments.

FWC is co-sponsored by IEEE ComSoc and the OpenFog Consortium. It is is the first conference that brings industry and research together to explore the technologies, challenges, industry deployments and opportunities in fog computing and networking.

Don’t miss the fog tutorial sessions which aim to clarify misconceptions and bring the communities up to speed on the latest research, technical developments and industry implementations of fog. FWC Research sessions will cover a comprehensive range of topics. There will also be sessions designed to debate controversial issues such as why and where fog will be necessary, what will happen in a future world without fog, how could fog disrupt the industry.

Here are a few features sessions:

- Fog Computing & Networking: The Multi-Billion Dollar opportunity before us

- Driving through the Fog: Transforming Transportation through Autonomous vehicles

- From vision to practice: Implementing Fog in Real World environments

- Fog & Edge: A panel discussion

- Fog over Denver: Building fog-centricity in a Smart City from the ground up

- Fog Tank: Venture Capitalists take on the Fog startups

- 50 Fog Design & Implementation Tips in 50 Minutes

- Fog at Sea: Marine Use Cases For Fog Technology

- NFV and 5G in a Fog computing environment

- Security Issues, Approaches and Practices in the IoT-Fog Computing Era: A panel discussion

View the 5 track conference program here.

Finally, register here.

For general information about the conference, including registration, please email: [email protected]

About the Open Fog Consortium:

The OpenFog Consortium bridges the continuum between Cloud and Things in order to solve the bandwidth, latency and communications challenges associated with IoT, 5G and artificial intelligence. Its work is centered around creating an open fog computing architecture for efficient and reliable networks and intelligent endpoints combined with identifiable, secure, and privacy-friendly information flows between clouds, endpoints, and services based on open standard technologies. While not a standards organization, OpenFog drives requirements for fog computing and networking to IEEE. The global nonprofit was founded in November 2015 and today represents the leading researchers and innovators in fog computing.

For more information, visit www.openfogconsortium.org; Twitter @openfog; and LinkedIn /company/openfog-consortium.

Reference:

https://techblog.comsoc.org/2017/07/20/att-latency-sensitive-next-gen-apps-need-edge-computing/

Gartner’s Advice to use Multi-Vendor Network Architectures Contradicts Industry Trends, e.g. SD-WANs, NFV

Editor’s Note: Why Single Vendor Solutions Dominate New Networking Technologies

There are no accredited standards for exposed interfaces or APIs* in SD-WANs, NFV “virtual appliances,” Virtual Network Functions (VNFs), and access to various cloud networking platforms (each cloud service provider has their own connectivity options and APIs). Those so called “open networking” technologies are in reality closed, single vendor solutions. How could there be anything else if there are no standards for multi-vendor interoperability within a given network?

In other words, “open” is the new paradigm for “closed” with vendor lock-in a given.

* The exception is Open Flow API between Control and Data planes-from ONF.

Yet Gartner Group argues in a new white paper (available free to clients or to non clients for $195), that IT end users should always adopt multi-vendor network architectures. This author strongly agrees, but that’s not the trend in today’s networking industry, especially for the red hot “SD-WANs” where over two dozen vendors are proposing their unique solution in light of no standards for interoperability or really anything else for that matter within a single SD-WAN.

Yes, we know Metro Ethernet Forum (MEF) has started working on SD-WAN policy and security orchestration across multiple provider SD WAN implementations. They’ve also written a white paper “Understanding SD-WAN Managed Services,” which defines SD-WAN fundamental characteristics and service components. However, neither MEF or any other fora/standards body we know of is specifying functionality, interfaces for interoperability within a single SD-WAN.

…………………………………………………………………………………………………….

Here are a few excerpts from the Gartner white paper is titled:

Divide Your Network and Conquer the Best Price and Functionality

“IT leaders should never rely on a single vendor for the architecture and products of their network, as it can lead to vendor lock-in, higher acquisition costs and technical constraints that limit agility. They should segment their network into logical blocks and evaluate multiple vendors for each.”

Key Challenges:

-

Vendors tend to promote end-to-end network architectures that lock clients with their solutions because they are focused on their business goals, rather than enterprise requirements.

-

Enterprises that make strategic network investments by embracing vendors’ architectures without first mapping their requirements often end up with solutions that are overhyped, over-engineered and more expensive.

-

Enterprises that do not create and actively maintain a competitive environment can overpay by as much as 50% for the same equipment from the same vendor. Savings can be even greater when comparing to other vendors with a functionally equivalent solution.

Recommendations:

IT and Operations leaders focused on network planning should:

- Divide the network into foundational building blocks, defining how they interwork with each other, to enable multiple vendor options for each block.

- Remove proprietary components from the network, replacing them with industry standard elements as they are available, to facilitate new vendors to make competitive proposals.

- Get a technical solution that meets needs at the lowest market purchase price by competitively bidding on each building block.

- Ensure that operations can deal with multiple vendors by planning for network management solutions and processes that can cope with a multivendor environment.

Introduction

Network technologies have matured in the last 20 years and are a routine component of every IT infrastructure. No vendor can claim a unique “core competency” nor “best-of-breed” capabilities in every area of the network, so there is no reason to treat the network as a monolithic infrastructure entrusted to a single supplier. However, we regularly speak to clients that still give credit to the myth of the single-vendor network. They believe that having only one networking vendor provides the following advantages:

- There is no need to spend time designing a solution, as you simply get what leading vendors recommend.

-

Products from the same vendor are designed to work seamlessly together, with limited or no integration challenges.

-

The procurement process is simplified with only one vendor, and there’s no need to deal with time-consuming, vendor-neutral RFPs.

-

A higher volume of purchases with one vendor would result in a better discount.

-

You only have a single vendor to hold accountable in case you run into problems, and one that will respond quickly given the loyalty and volume of purchases.

However, these perceived advantages are largely a myth, as much as open networking and complete vendor freedom is a myth. The harsh reality that we frequently hear from clients that followed this single-vendor strategy includes:

- Holistic designs recommended by vendors are not necessarily the best. They are often over-engineered, include products that are not aligned with enterprise needs and are ultimately more expensive to buy and maintain.

- Diverse product lines from the same vendor share the brand, but they are rarely designed to work together from the start, since they often come from independent BUs or acquisitions, making them difficult to integrate.

- A higher volume of purchases does not automatically translate into better discounts. For most vendors, their best discounts are reserved for competitive situations and will generally offer savings of 15% to 50% when compared with the best-negotiated sole-source deals.

- Having to deal with just one vendor for technical issues is simpler, but does not necessarily translate in shorter time to repair and better overall network availability, which is the real goal.

Clients that pursue a multivendor strategy report that time spent on RFPs and evaluation of different vendors is not a waste, because it increases teams’ skills, motivates them to stay abreast of market innovations, prevents suboptimal decisions and pays off — technically and financially.

Divide the Network Into Foundational Building Blocks to Enable Multiple Vendor Options for Each Block

Network planners and architects must break the network infrastructure into smaller, manageable blocks to plan, design and deploy a “fit-for-purpose” infrastructure that addresses the defined usage scenarios and control costs (Figure 1 shows typical building blocks).

*Security is not addressed in this document. Note: There is no hierarchy associated with block positioning in this picture.

*Security is not addressed in this document. Note: There is no hierarchy associated with block positioning in this picture.

Source: Gartner (October 2017)

……………………………………………………………………………………….

The key objectives of this activity are to:

- Identify network blocks that have logical and well-defined boundaries.

- Document and standardize as much as possible the interfaces between the various building blocks, to allow choice and enable use of multiple vendors.

This building block approach is useful because not all network segments have the same properties. In some segments little differentiation exists among suppliers, and there is a high degree of substitution within a building block, so enterprises can seek operational and cost advantages. For example, wired LAN switching solutions for branch offices are largely commoditized, and the difference between vendors is hard to discern in the most common use cases.

In other cases, such as in the data center networking market, there is more differentiation among vendors, and the segmentation approach ensures that enterprise architectural decisions align with IT infrastructure strategies and business requirements.

There are no hard-and-fast industry rules on where the boundaries between blocks must be drawn. Each enterprise has to split network infrastructure in a way that makes sense for them. The most common approach is segmentation around functional areas, such as data center leaf and spine switches, WAN edge, WAN connectivity, LAN core and LAN access. Each segment could further be split. For example, LAN access includes wired and wireless, while WAN edge might include WAN optimization and network security services. Another complementary segmentation boundary can be the geographical place, as a large organization with subsidiaries in multiple locations could select different vendors on a regional or country basis for some blocks. Disaggregation is creating another possible segmentation, since hardware and software can be awarded to different vendors for some solutions like white-box Ethernet switching.

Defining building blocks also protects organizations from the “vendor creep” trap. As vendors acquire small companies and startups in adjacent markets, they often encourage enterprises to add these new products or capabilities to the “standardized” solution. If the enterprise defines its foundational requirements, it can easily determine whether the new functionality truly solves a business need, and whether any additional cost is warranted.

Remove Proprietary Components From the Network to Facilitate New Vendors to Make Competitive Proposals

Employment of proprietary protocols and features inside the network limits the ability to segment the network into discrete blocks and makes this activity more difficult.

Within building blocks, it is acceptable to use proprietary technologies, as long as enterprises compare vendors against their business requirements (to avoid over-engineering) and the solution provides a real and indispensable functional advantage. It is important to express the business functionality as a requirement and not to tie requirements to specific proprietary technologies.

Between building blocks, it is critical to avoid proprietary features and use standards, since proprietary protocols favor using certain vendors and disfavor others, leading to loss of purchasing power. Sometimes it’s necessary to employ a proprietary protocol, for example:

-

To obtain functionality that uniquely meets a critical business need. If so, then it’s critical that these protocols be reviewed regularly and are not automatically propagated into new buying criteria over the long term.

-

In the early stages of market development, before standards have caught up to innovation. However, once standards exist, or the technology has started to move down the commodity curve, it is imperative that network architects and planners migrate to standards-based solutions (as long as business requirements aren’t compromised). Examples of industry standards that replace previous proprietary solutions are Power over Ethernet Plus (PoE+) and Virtual Router Redundancy Protocol (VRRP) (see Note 1).

In these cases it is essential to document and motivate the exception, so that it can be periodically reviewed. Proprietary technologies should always be avoided in the interface between the network and other components of IT infrastructure (for example, proprietary trunking to connect servers to the data center network).

Get a Technical Solution That Meets Needs at the Lowest Market Purchase Price by Competitively Bidding on Each Building Block

Dividing the network provides a clear definition of what is really needed within each building block, which in turns enables a fit-for-purpose approach and a competitive bidding process.

–>The goal is not to bid on the best technical solution for each block, but on one that is good enough to meet requirements.

This enables real competition across vendors and provides maximum price leverage, since all value-adds to the common denominator can be evaluated separately and matched with the cost difference.

By introducing competition in this thoughtful manner, Gartner has seen clients typically achieve sustained savings of between 10% and 30% and of as much as 300% on specific components like optical transceivers.

Discern the Relationships Between Networking Vendors and Network Management Vendors

You may also find that networking vendors have some level of leverage with certain other vendors specialized in network management. Therefore, it is valuable to understand the arrangement of any partner agreement and whether this can be leveraged to your organization’s benefit.

………………………………………………………………

Editor’s Closing Comment:

The advice provided above by Gartner Group seems very reasonable and mitigates risk of using only a single vendor for a network or sub-network. If so, how can any network operator or enterprise networking customer justify the single vendor SD-WAN solutions that are proliferating today?

Readers are invited to comment in the box below the article (can be anonymous) or contact the author directly ([email protected]).

……………………………………………………………………………..

References:

https://www.firemon.com/resources/collateral/avoid-these-bottom-ten-networking-worst-practices/

https://www.gartner.com/doc/3783150/market-trends-csps-approach-sdwan