Fujitsu

NEC exits 4G/5G base station market underscoring Japan’s weak mobile infrastructure ecosystem

Japanese telecom vendor NEC has decided to cease development of 4G and 5G radio access base stations, effectively exiting a segment now overwhelmingly controlled by only five vendors (Huawei, Ericsson, Nokia, ZTE and Samsung). Huawei, Ericsson, and Nokia collectively hold ~80% of the worldwide 4G/5G base station market, while NEC and Fujitsu together hold under 1.5% global market share. That leaves Japan’s network equipment vendors structurally disadvantaged on both scale and pricing power. The move underscores structural weaknesses in Japan’s mobile infrastructure ecosystem, particularly its inability to reach scale in a highly globalized, capex‑intensive market.

Fujitsu spun off its communications-related business, including base stations, into a new subsidiary this July. Kyocera, which had planned to enter the 5G base station market in 2027, has also abandoned development of 5G base stations. NTT DoComo, Japan’s largest mobile network operator by subscriber count and market share, previously prioritized procurement from such Japanese companies such as NEC and Fujitsu but changed tack in 2024 and stepped up purchases from Ericsson, Nokia and other foreign companies.

A wireless base station on the roof of a building in Tokyo. (Photo obtained by Nikkei)

……………………………………………………………………………………………………………………………………………………………………

Key points:

-

NEC will halt new development of 4G and 5G base stations for smartphones and other endpoint devices, while stepping back from a market where its share had already fallen to a marginal level.

-

The decision is widely viewed as a market‑driven outcome, reflecting persistent losses in a business that never achieved the scale or cost structure required to compete with leading global RAN vendors.

-

Contemporary mobile infrastructure is a globalized and capital‑intensive industry, where survival hinges on high volumes to amortize R&D, silicon, software, manufacturing, and go‑to‑market costs across multiple product generations.

-

NEC will continue R&D for 6G and “Beyond 5G” systems, aligning with Japan’s national Beyond 5G Promotion Strategy, which targets commercialization of next‑generation services around 2030.

-

The company is concentrating research talent in areas such as open and virtualized RAN (v-RAN, Near‑RT RIC, AI-driven network optimization, and integrated terrestrial–non‑terrestrial networks, which are all positioned as building blocks for 6G.

-

However, Japan’s relatively shallow 5G deployment and weak installed base constrain its ability to test dense high‑frequency networks, a prerequisite for 6G architectures that will rely on ultra‑short‑range spectrum and far denser site grids.

-

Japan’s research and IP position in 6G remains modest, with domestic players accounting for roughly 10 percent of global 6G‑related patent filings in recent surveys, trailing several major competitors.

-

Limitations in technology reserves and standards participation raise questions about whether policy roadmaps alone can close the gap without corresponding gains in commercial scale and deployment experience.

-

Japan, along with Australia, Canada, the UK, and the US, has formed the Global Coalition on Telecommunications (GCOT), which is focusing on AI, security, and next‑generation standards, and is widely interpreted as a vehicle to counter China’s growing influence in telecom infrastructure.

-

Attempts to architect future high‑speed networks primarily around geopolitical blocs risk fragmenting markets, inflating development and compliance costs, and undermining interoperability—factors that historically have worked against technically superior but commercially isolated platforms in 4G and 5G.

-

Japan lacks a sufficiently large, unified domestic mobile market to independently sustain globally competitive RAN vendors and generate the economies of scale seen in China, Europe, or the US‑centric ecosystem.

-

Political alignment and industrial policy can provide funding and coordination, but they cannot substitute for large‑scale commercial demand, broad ecosystem participation, and sustained competitiveness across cost, performance, and time‑to‑market

References:

https://www.globaltimes.cn/page/202512/1351697.shtml

Japan to support telecom infrastructure in South Pacific using Open RAN technology

Japan telecoms are launching satellite-to-phone services

SNS Telecom & IT: Private 5G Market Nears Mainstream With $5 Billion Surge

Telecom sessions at Nvidia’s 2025 AI developers GTC: March 17–21 in San Jose, CA

SK Telecom, DOCOMO, NTT and Nokia develop 6G AI-native air interface

Nikkei Asia: Huawei demands royalties from Japanese companies

AT&T to deploy Fujitsu and Mavenir radio’s in crowded urban areas

AT&T announced today that it has signed new agreements with Fujitsu and Mavenir to develop radios specifically for crowded urban areas in its Open RAN deployment using Ericsson hardware and software. The goal is to improve network performance and coverage in cities with lots of mobile data traffic.

These radios will be open C-band radios (TDD 4T4R) and dual band radios (B25/B66 FDD 4T4R) which can be attached to existing utility and light poles. They can often be hidden, making them virtually unseen from street level. We are continuing to look for opportunities to bring additional third-party radios into the network when needed.

All open radios will be managed by Ericsson’s Intelligent Automation Platform (EIAP) via open management interfaces. EIAP is Ericsson’s open network management and service orchestration platform. It supports replacing the old legacy equipment and installing the new radios without missing a beat.

When Open RAN architectures are combined with innovative applications called ‘rApps’ from either the operator or third parties, they can greatly improve the customer experience. This is achieved through better network performance, wider coverage, cost efficiency, and fosters innovation. ‘rAPPs’ are expected to play a critical role in managing and sustaining third party radio innovation opportunities.

AT&T is moving 70% of its 5G network traffic to flow across Open RAN hardware by late 2026 – our customers can relax and enjoy a better wireless experience.

…………………………………………………………………………………………………..

Mavenir has been selling open RAN software for years, but it entered the 5G radio sector in 2022 with its OpenBeam brand. Mavenir’s radios for AT&T will be managed by Ericsson’s Intelligent Automation Platform (EIAP).

AT&T said it would only use Mavenir radios in “crowded urban areas,” which are typically covered by small cell radios rather than massive macro cell sites. The operator did not say how many Mavenir radios it would use nor when it might start deploying those radios.

“Maybe the initial thinking is it’s small cells, but there’s a bigger strategy at play here,” AT&T’s Jeff McElfresh said during a media event on Tuesday. McElfresh explained that small cells could play an important role inside AT&T’s network as network traffic increases. After all, small cells are viewed as a way to increase overall wireless network capacity in the absence of additional spectrum.

Mavenir’s other 5G radio customers include Paradise Mobile and Triangle Communications.

Aramco Digital, the tech-focused subsidiary of oil giant Saudi Aramco, is poised to invest $1 billion into Mavenir for a significant minority stake in the business.

That cash is needed. S&P Global recently warned that Mavenir is close to default or restructuring because it has insufficient funds to cover looming debt obligations.

References:

https://about.att.com/blogs/2024/open-ran-new-collaborations.html

https://www.lightreading.com/open-ran/at-t-to-deploy-radios-from-mavenir

NTT advert in WSJ: Why O-RAN Will Change Everything; AT&T selects Ericsson for its O-RAN

KDDI claims world’s first 5G Standalone (SA) Open RAN site using Samsung vRAN and Fujitsu radio units

Japan’s KDDI is claiming to have turned on the world’s first commercial 5G Standalone (SA) Open Radio Access Network (Open RAN) site, using equipment and software from Samsung Electronics and Fujitsu. KDDI used O-RAN Alliance compliant [1.] technology, including Samsung’s 5G virtualized CU (vCU) and virtualized DU (vDU) as well as Fujitsu’s radio units (MMU: Massive MIMO Units).

Note 1. O-RAN Alliance specifications are being used for RAN module interfaces that support interoperation between different Open RAN vendors’ equipment.

The first network site went live in Kawasaki, Kanagawa today. KDDI, together with its two partners, will deploy this Open RAN network in some parts of Japan and continue its deployment and development, embracing openness and virtualization in KDDI’s commercial network. Note that both Rakuten-Japan and Dish Network/Amazon AWS have promised 5G SA Open RAN but neither company seems close to deploying it.

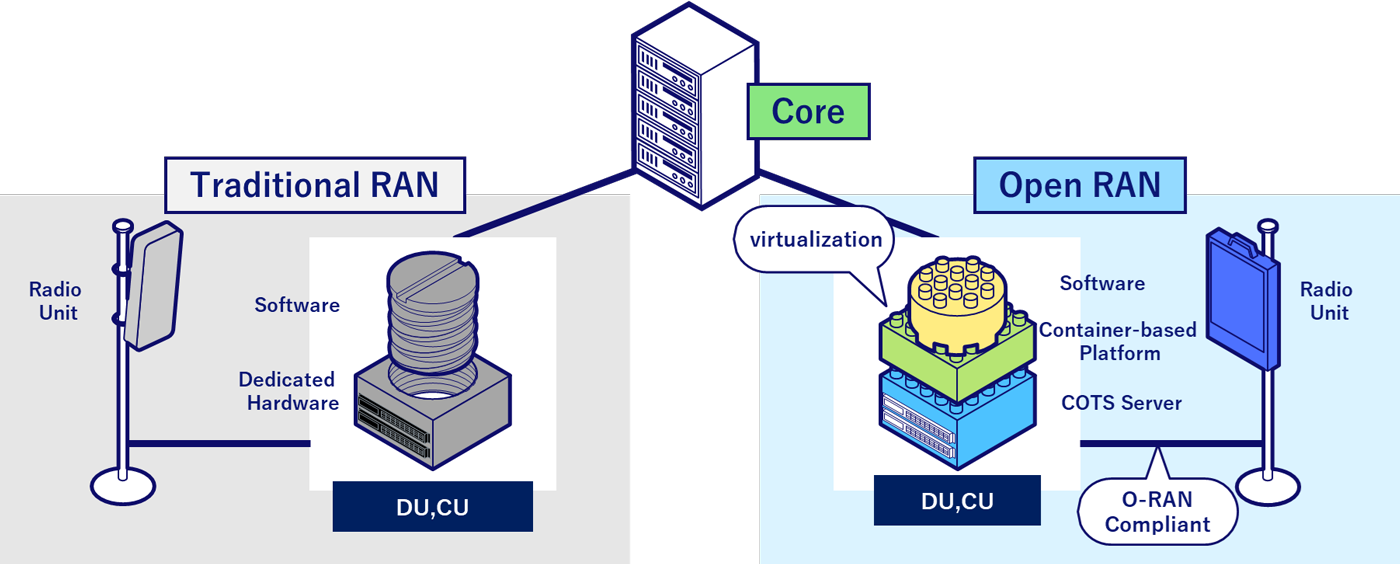

Virtualization and O-RAN technology replaces dedicated hardware with software elements that can run on commercial off-the-shelf (COTS) servers. This brings flexibility and agility to KDDI’s network, allowing the operator to offer enhanced mobile services to its users. KDDI says this architecture will deliver reliability, while accelerating deployment of Open RAN throughout Japan, including in rural areas. Meanwhile, 5G SA will deliver superior performance, higher speeds and lower latency and make possible advanced services/applications, such as network slicing, automation, service chaining and Multi-access Edge Computing (MEC).

Traditional RAN vs. Open RAN Configuration. Source: KDDI

Characteristics of this site:

This Open RAN site leverages fully-virtualized RAN software, provided by Samsung, that runs on commercial off-the-shelf (COTS) servers. Furthermore, by pursuing an open network approach between radio units and baseband unit, KDDI used Samsung’s baseband and Fujitsu’s Massive MIMO Units, which are connected with an open interface.

- Fully-virtualized 5G RAN software can be swiftly deployed using existing hardware infrastructure, which brings greater flexibility in deployment. New 5G SA technologies―such as network slicing, Multi-access Edge Computing (MEC) and others―powered by 5G vRAN, will deliver superior performance, higher speeds and lower latency, allowing KDDI users to experience a range of new next-generation services and immersive applications.

- Using an open interface between radio units and baseband unit, Open RAN not only ensures security and reliability but also enables operators to implement best-of-breed solutions from different partners and build an optimal network infrastructure for maximized performance.

- The virtualized network allows the use of general-purpose hardware (COTS servers) across the country, which will greatly increase deployment efficiencies. Additionally, by leveraging system automation, fully-virtualized RAN software can reduce deployment time, enabling swift nationwide expansion, including rural areas.

Comments from Kazuyuki Yoshimura, Chief Technology Officer, KDDI Corporation:

“Together with Samsung and Fujitsu, we are excited to successfully develop and turn on the world’s first commercial 5G SA Open RAN site powered by vRAN. Taking a big step, we look forward to continue leading network innovation and advancing our network capabilities, towards our vision of delivering cutting-edge 5G services to our customers.”

Comments from Woojune Kim, Executive Vice President, Head of Global Sales & Marketing, Networks Business at Samsung Electronics:

“Leveraging our industry-leading 5G capabilities, we are excited to mark another milestone with KDDI and Fujitsu. Samsung stands out for its leadership in 5G vRAN and Open RAN with wide-scale commercial deployment experiences across the globe. While KDDI and Samsung are at the forefront of network innovation, we look forward to expanding our collaboration towards 5G SA, to bring compelling 5G services to users.”

Note: Samsung released its first 5G vRAN portfolio in early 2021 following its blockbuster RAN deal with Verizon, which was the first operator to commercially deploy the new equipment. Samsung also gained a foothold in Vodafone’s plan to deploy 2,500 open RAN sites in the southwest of England and most of Wales. Samsung’s open RAN compliant vRAN hardware and software were previously deployed in 5G NSA commercial networks in Japan and Britain, but this is the first 5G SA deployment. We wonder if it is “cloud native?” Hah, hah, hah!

Comments from Shingo Mizuno, Corporate Executive Officer and Vice Head of System Platform Business (In charge of Network Business), Fujitsu Limited:

“The Open RAN-based ecosystem offers many exciting possibilities and this latest milestone with KDDI and Samsung demonstrates the innovative potential of next-generation mobile services with Massive MIMO Units. Fujitsu will continue to enhance this ecosystem, with the goal of providing advanced mobile services and contributing to the sustainable growth of our society.”

The companies will continue to strengthen virtualized and Open RAN leadership in this space, bringing additional value to customers and enterprises with 5G SA.

……………………………………………………………………………………………………………………………………………………………………………………………………………..

Addendum: As of December 31, 2021 there were only 21 known 5G SA eMBB networks commercially deployed.

|

5G SA eMBB Network Commercial Deployments |

|

|

Rain (South Africa) |

Launched in 2020 |

|

China Mobile |

|

|

China Telecom |

|

|

China Unicom |

|

|

T-Mobile (USA) AIS (Thailand) True (Thailand) |

|

|

China Mobile Hong Kong |

|

|

Vodafone (Germany) |

Launched in 2021 |

|

STC (Kuwait) |

|

|

Telefónica O2 (Germany) |

|

|

SingTel (Singapore) |

|

|

KT (Korea) |

|

|

M1 (Singapore) |

|

|

Vodafone (UK) |

|

|

Smart (Philippines) |

|

|

SoftBank (Japan) |

|

|

Rogers (Canada) |

|

|

Taiwan Mobile |

|

|

Telia (Finland) |

|

|

TPG Telecom (Australia) |

|

SOURCE: Dave Bolan, Dell’Oro Group.

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………….

References:

https://news.kddi.com/kddi/corporate/english/newsrelease/2022/02/18/5896.html

Samsung Electronics wins $6.6B wireless network equipment order from Verizon; Galaxy Book Flex 5G

Mobile Core Network (MCN) growth to slow due to slow roll-out of 5G SA networks