Month: April 2019

SK Telecom’s (pre standard) 5G is live in Seoul. Network Coverage Map Available

Following SK Telecom’s announcement on launching 5G smartphone service on April 3rd, there are continued interests around 5G service available in S Korea and details on actual coverage around the nation.

Therefore, on April 12, 2019, SK Telecom has introduced its 5G network coverage map to further enhance customer convenience through transparent communication. With this 5G coverage map, customers can now check the 5G service availability in Korea at www.sktcoverage.com. SK Telecom’s 5G coverage map shows that the company’s 5G network currently covers most areas of Seoul. The size of Seoul is 233.7 square miles, which is close to that of Chicago (234 square miles), Illinois.

The company has switched on its mobile 5G network on December 1, 2018, in selective areas of 13 cities including Seoul and six metropolitan cities, and has expanded its network coverage to main areas of 85 cities nationwide prior to launching its 5G smartphone service. The 5G network coverage map will be continuously updated as the company builds up more 5G base stations throughout the nation. In particular, it is expanding in-building coverage centered around 120 department stores, shopping malls and airports throughout the nation, and will expand 5G network coverage to nationwide subways, national parks and festival sites in the second half of 2019. We sincerely hope that this information will be useful for your future 5G-related reports.

……………………………………………………………………………………………………………………………………………………………………………………………………

SK Telecom has also introduced four different plans for its commercial 5G offering.

The ‘Slim’plan offers 8 GB of data (1 Mbps speeds after the data cap is reached) at KRW 55,000 ($48) per month and the ‘5GX Standard’ plan comes with 150 GB of data (5 Mbps speeds after data cap) at KRW 75,000 ($66) per month.

Customers who subscribe to ‘5GX Prime’ (200 GB of data for $84 per month) or ‘5GX Platinum’ (300 GB of data for $110 per month) plans through the end of June 2019 will be able to use unlimited data without speed restrictions at KRW 89,000 ($78) and KRW 125,000 ($110) per month, respectively. Unlimited data will be provided on that promotional basis through the end of December, according to the operator.

The telco said it plans to update its price plans after analyzing the data usage patterns of subscribers of unlimited plans.

SK Telecom announced that it has secured around 8,000 different content in diverse areas including video games, ultra-high definition, augmented reality, virtual reality and communications.

Rival operator KT recently confirmed it has already deployed 15,000 5G base stations in Seoul and will install a total of 30,000 5G base stations across the country by April 5.

The carrier said that its 5G commercial offering will be available in 85 major cities nationwide by the end of 2019.

Meanwhile, LG Uplus said it has already deployed a total of 18,000 5G base stations in Seoul and surrounding areas as well as some metropolitan cities. The carrier announced plans to install 50,000 base stations within the first half of the year.

Comment & Analysis: Intel exits 5G modem chip business, but “5G is still a strategic priority”(?)

Just a few hours after the Qualcomm-Apple legal settlement was announced on April 16th, Intel Corporation said in a press release that it would exit the 5G smartphone modem business. The company plans to complete an assessment of the opportunities for 4G and 5G modems in PCs, internet of things devices and other data-centric devices. Intel will also continue to invest in its 5G network infrastructure business.

Intel will continue to meet current customer commitments for its existing 4G-LTE smartphone modem product line, but does not expect to launch 5G modem products in the smartphone space, including those originally planned for launches in 2020.

“We are very excited about the opportunity in 5G and the ‘cloudification’ of the network, but in the smartphone modem business it has become apparent that there is no clear path to profitability and positive returns,” said Intel CEO Bob Swan. “5G continues to be a strategic priority across Intel (?), and our team has developed a valuable portfolio of wireless products and intellectual property. We are assessing our options to realize the value we have created, including the opportunities in a wide variety of data-centric platforms and devices in a 5G world.”

Intel said in the above referenced press release (also see References below) that it expects to provide additional details of its 5G strategy in its upcoming first-quarter 2019 earnings report and conference call, scheduled for April 25th.

A 5G Intel logo was displayed at the Mobile World Congress on February 26, 2019 in Barcelona.

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

Comment and Analysis:

In 2018, as Apple’s legal battle with Qualcomm heated up, Intel became Apple’s sole supplier for 4G-LTE wireless chips in the iPhone. Intel additionally was working to develop 5G chips for Apple to use in future versions of the iPhone. The company regularly participates in both 3GPP and ITU-R WP5D meetings directed at IMT 2020 (the ONLY 5G wireless/radio interface technology standard). However, recent reports have indicated that Intel was “missing deadlines” for the pre-standard 5G chip that was slated to go into the 2020 model of the iPhone. Note that Apple also participates in the ITU-R WP5D IMT 2020 standardization meetings.

Fast Company reported earlier this month that “in order to deliver big numbers of those modems in time for a September 2020 iPhone launch, Intel needs to deliver sample parts to Apple by early summer of this year, and then deliver a finished modem design in early 2020.” That design would likely be based on 3GPP Release 15 NR, as Release 16 wont be completed till the spring of 2020.

If Intel had failed to provide Apple with (pre-standard) 5G chips in a timely manner, that would have put Apple in an untenable position. The iPhone’s competitors would be able to offer 5G capabilities using Qualcomm chips, while Qualcomm could have denied Apple access to 5G chips as long as the patent battle continued. That’s over now, as Apple will surely use Qualcomm 5G chips in its future iPhones, iPads and other products.

More importantly, it appears that Apple was Intel’s ONLY volume customer for 4G-LTE chips so the company felt it would be a huge struggle to attract new customers for its planned 5G silicon. Moreover, it was widely reported that Intel was selling 4G-LTE chips to Apple at a LOSS as seems to be corroborated by CEO Bob Swan’s statement above: “It has become apparent that there is no clear path to profitability and positive returns in the smartphone modem business.”

With Intel’s exit, there appears to be ONLY TWO 5G merchant semiconductor companies- Qualcomm and MediaTek. Huawei and Samsung are developing their own 5G silicon for use in their smartphones and base stations, but they are NOT likely to be sold on the open market to competitors.

Finally, we don’t know how 5G can be a “strategic priority” at Intel when they have consistently failed to profit from the network equipment business after making billions of dollars of acquisitions in the late 1990s and early 2000s (e.g. WiMax, optical networking, Dialogic, etc). While Intel silicon is inside most IBM compatible PCs, they are NOT in hardly any smartphones or tablets, portable gaming machines, or other cellular connected equipment. Hence, we wonder how the 5G strategic priority will evolve into profitable products.

The only “strategic priority” area we can come up with is Intel’s processors inside new wireless connected autonomous systems (e.g. remote controlled drones, industrial robots, self driving cars or other vehicles, etc) that uses Qualcomm 5G silicon. Wireless Autonomous Systems (WAS’s), which Intel Labs has been researching, will surely require ultra low latency and high reliability. Those capabilities are NOT in 3GPP Release 15 NR, but will be included in 3GPP Release 16 and the first IMT 2020 RIT standards that won’t be finished till the end of 2020. That implies the first 5G WAS’s products won’t be available till mid 2021 at the earliest.

……………………………………………………………………………………………………………………………………………………………………………………………………………….

References:

PRESS RELEASE: Intel exits 5G chip business

FTTH Council Asia Pacific Conference: Singapore is APAC’s top Smart Fiber City

Singapore is the top Smart Fiber City in Asia-Pacific (APAC region), according to a new ranking released at the FTTH Council Asia Pacific Conference in Wuhan, China.

The inaugural Smart Fiber Cities ranking list Singapore as the region’s Champion, due to the city’s 93% FTTH/B coverage, 100% 4G coverage and its over 10,000 Wi-Fi hotspots. For the regional rankings, FTTH Council Asia-Pacific evaluated cities with high FTTH/B coverage based on the innovative and useful solutions that have been developed to take advantage of this infrastructure.

Cities were raked in two categories – champs and challengers.

- Champs have almost complete fiber coverage city-wide and have reached maturity in smart projects that have been deployed. They also generally have a comprehensive smart city framework in place and smart projects already in operation.

- Challengers meanwhile are actively deploying fiber infrastructure to meet their smart city ambitions, but their fiber-based smart services are usually limited to specific domains.

Behind Singapore in the Champs category are Tokyo in Japan and Seoul in South Korea with roughly 90% FTTH coverage, followed by Hong Kong, Busan in South Korea, and Melbourne in Australia.

Chinese cities took the first three spaces in the Challenger category, with Shanghai on top with round 90% FTTH/Building coverage, followed by Hangzhou and Wuhan. Runners up included Malaysia’s Selangor, Jakarta in Indonesia, Bhubaneswar in India and Ho Chi Minh in VIetnam.

“The research into Smart Fiber Cities shows that we are just at the beginning of these developments. Across APAC, we see many mature projects in areas such as e-government and security, with 5G-based applications in, for example, transport and disaster management coming up,” FTTH Council Asia-Pacific president Venkatesan Babu said.

The ranking promotes the specific concept of a ‘Smart Fiber City’ as the FTTH Council believes that only a Smart City enabled by Fiber can be a genuine Smart City.

“We have great expectation for the large numbers of pilots in areas such as healthcare, smart grids and autonomous traffic. We look forward to closely follow new developments in the coming years.”

FTTH APAC 2019: 5G Smart Cities Enabled by Fiber will take place on 15-17 April 2019, Hilton Wuhan Optics Valley Hotel, Wuhan, China

For more information on the FTTH Conference APAC, please visit http://bit.ly/2uT4mPd.

About FTTH Council Asia-Pacific

The FTTH Council Asia-Pacific is a non-profit organization established in 2005 in Singapore. The organization is building on the success of its sister organizations in the US and Europe to educate the industry and the general public on the opportunities and benefits of FTTH solutions. FTTH Council Asia-Pacific members represent all areas of broadband industries, including telecommunications, computing, networking, system integration, engineering and content-provider companies, as well as traditional telecommunications service providers, utilities and municipalities.

To find out more about the work of the FTTH Council Asia-Pacific, please visit http://www.ftthcouncilap.org.

PR Contact:

Rusafie Alam

Associate Manager

FTTH Council Asia-Pacific

Mobile : +880-171-7087708

Email: [email protected]

Cignal AI: Record Spending on Cloud Operator Optical Networks Drives Growth in 2018

|

|

|

CRU: Fiber deployments in China to slow, but will increase worldwide by 2% this year

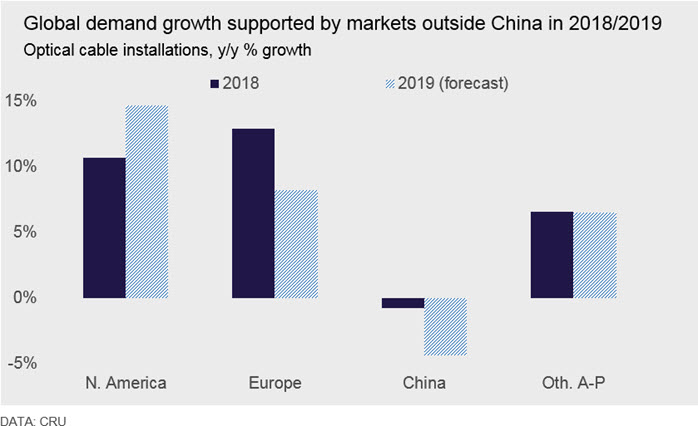

For the second year in a row, deployments of fiber-optic cable in China should decline year-on-year, according to CRU. And, for the second year in a row, deployments elsewhere in the world should offset this decline and lead to overall growth – just not as much in 2019 as in 2018, predicts the market research firm.

In recent years, China has accounted for more than half the world’s total annual demand for optical cable. China’s telecom network operators have installed fiber in the full range of telecom applications – inter-city, intra-city, FTTx, and mobile cellular systems. And as in other countries, China also has companies and government authorities installing fiber systems to support the electric power grid, railways, highways, pipelines, airports, WiFi hotspots, data centers, and many other applications.

Fiber deployments in China declined 1% in 2018, according to CRU. However, fiber-optic cable roll outs grew 10% everywhere else, leading total deployments to rise from 492 million fiber-km in 2017 to more than 500 million fiber-km in 2018.

Fiber cable installations in China should decline even further in 2019, CRU predicts. The country’s three main service providers have largely finished their 4G mobile and fiber to the home (FTTH) roll outs, the market research firm asserts, while 5G requirements for now are limited to a relatively small number of metro markets with large field trials. The transition period in China is not unusual. With the exception of a few carriers in Japan, South Korea, the US, and a few other countries, full-scale 5G construction is not expected until 2020 or later. What’s different about China is that the country’s carriers completed vast 4G and FTTH projects in a relatively small number of years, causing unusually high levels of fiber demand during those years. With China’s FTTH networks now having passed over 90% of homes, and with more than 80% subscribing it has become increasingly clear that China’s FTTx and 4G markets have become saturated with fiber and that demand from both sectors will be softer this year.

As was the case last year, fiber deployments everywhere else should continue to increase – but this time just by single digits. For this reason, CRU expects the overall market to grow by 2%, half of last year’s rate. With a few exceptions in such markets as Japan, South Korea, and the U.S., carriers won’t substantially increase fiber deployments for 5G backhaul until 2020 or later, CRU forecasts.

Should such delays cause a further slowing in fiber deployment growth, the end of a fiber deployment boom could be at hand. CRU notes that fiber installations enjoyed a 14% compound annual growth rate (CAGR) between 1997 and 2017. This led to annual fiber deployment totals to rise from 37 million fiber-km in 1997 to 2017’s 492 million fiber-km. CRU also notes that it took operators nearly 30 years, from the late 1970s to 2008, to deploy 1 billion fiber-km. Network operators deployed half that total last year alone!

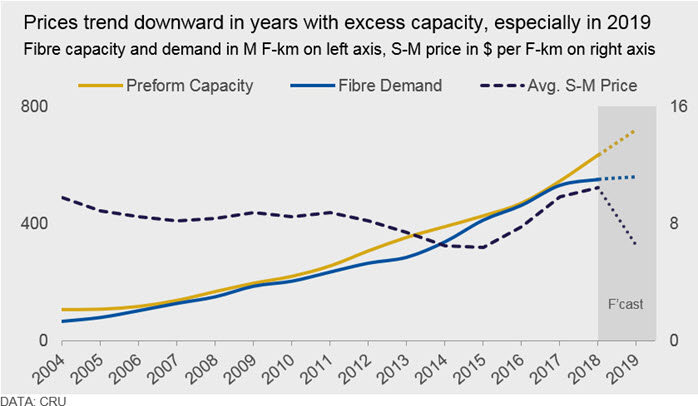

Since the start of 2019, there have been reports that fiber prices have fallen more precipitously. In early March, CRU assessed bare fibre prices had fallen further, back to pre-shortage levels – similar to, or lower than prices reported in 2015. That’s depicted in this chart from CRU:

5G will be a key variable in fiber demand for many advanced telecom markets, including China over the coming years. The reason is that 5G construction will need fiber to link a much denser array of cell sites than in 4G networks. 5G networks will also support communications between many devices other than smart phones, tablets, and computers. Examples include automobiles, trucks, cargo containers, point-of-sale terminals, vending machines, smart-grid equipment, smart-cities and smart building equipment, and many other types of devices. These systems will rely on connections to new data centers, which also will drive demand for fiber.

Despite the recent softness, CRU forecasts China will account for approximately 50% of the growth in total global optical cable demand between 2018 and 2023 and will remain a key driver of demand mid-term.

CRU Report Author: Michael Finch Head of Wire and Cable

References:

AT&T Exec Talks Smart Cities: Private LTE, LTE-M, NB-IoT, and 5G

AT&T’s Mike Zeto discussed the teleco and media company’s smart cities strategy as part of its 5G and IoT roll-out, saying in an interview AT&T will go beyond providing connectivity and focus on building “end-to-end solutions” for localities and enterprises. “The only way these cities are going to be move forward is with public-private partnerships,” Zeto said.

AT&T talks cities: “We wouldn’t do it if it didn’t make sense, but it’s not about money”

Trump and FCC plan to accelerate 5G rollout in U.S.; FCC fund to connect rural areas

In a press conference today in the White House’s Roosevelt Room, President Trump laid out a number of initiatives focused on helping accelerate the U.S. role in the 5G race.

“This is, to me, the future,” Trump said, opening the press conference flanked by FCC Chairman Ajit Pai, Ivanka Trump and a room full of communications representatives in cowboy and hard hats.

“It’s all about 5G now,” Trump told the audience. “We were 4G and everyone was saying we had to get 4G, and then they said before that, ‘we have to get 3G,’ and now we have to get 5G. And 5G’s a big deal and that’s going to be there for a while. And at some point we’ll be talking about number six (6G).”

“5G will be as much as 100 times faster than the current 4G cellular networks. The race to 5G is on and America must win, It’s a race our great companies are now involved in,” Trump added.

Trump said a secure 5G network will transform how everyone communicates and create astonishing new opportunities in America. “It will make American farms more productive, American manufacturing more competitive and American health care better and more accessible,” he said.

The apparently off-script moment echoed Trump’s recent call on Twitter for the U.S. to get 6G technology “as soon as possible.” There’s something to be said for the spirit, perhaps, but it’s probably a little soon to be jumping the gun on a technology that doesn’t really exist just yet.

Trump used the opportunity to downplay earlier rumors that the government might be building its own 5G network, instead promoting a free-market method, while taking a shot at the government’s capabilities. “In the United States, our approach is private sector-driven and private sector-led,” he added. “The government doesn’t have to spend lots of money.”

“We cannot allowed any other country to out compete the United States in this power industry of the future,” Trump said. It’s important to note that China and the U.S. are fiercely competing in 5G adding to the tensions among the #1 and #2 global economies.

In recent months both the administration and the FCC have been discussing ways to make America more competitive in the race to the soon-to-be-ubiquitous cellular technology. Earlier today, the FCC announced plans to hold the largest spectrum auction in U.S. history, offering up the bands to wireless carriers. The planned auction is set to commence on December 10th. As much as 3.4 gigahertz of “millimeter-wave” spectrum could be sold by the FCC to wireless carriers such as AT&T and Verizon in the spectrum sale, according to Pai.

“Forward-thinking spectrum policy, modern infrastructure policy, and market-based network regulation form the heart of our strategy for realizing the promise of the 5G future.” – FCC Chairman Pai

………………………………………………………………………………………………………………………………………………………………………..

The focus is understandable, of course (AJW: really???). 5G’s value will go far beyond faster smartphones, providing connections for a wide range of IoT and smart technologies and potentially helping power things like robotics and autonomous vehicles. The technology will undeniably be a key economic driver, touching as of yet unseen portions of the U.S. workforce.

“To accelerate and incentivize these investments, my administration is freeing up as much wireless spectrum as needed,” Trump added, echoing Pai’s plans.

Earlier today Pai and the FCC also proposed a $20.4 billion fund design to help connect rural areas. The chairman said the commission believes the fund could connect as many as four million small businesses and residences to high-speed Internet over the course of the next decade. The “Rural Digital Opportunity Fund” could launch later this year, after a period of public notice and comment.

The focus is understandable, of course. 5G’s value will go far beyond faster smartphones, providing connections for a wide range of IoT and smart technologies and potentially helping power things like robotics and autonomous vehicles. The technology will undeniably be a key economic driver, touching as of yet unseen portions of the U.S. workforce.

…………………………………………………………………………………………………………………………………………………

References:

https://www.foxbusiness.com/politics/trump-says-securing-5g-will-create-astonishing-us-opportunities

IHS Markit: 5G Market Set to Boom, but clarity needed; Japanese Telcos: $14.4B in 5G spending

IHS Markit: 5G Market Set to Boom, but clarity needed

As global 5G capabilities expand, alignment of what 5G is, what end users should expect and how it should be measured will be critical to adoption

As the first commercial deployments of (pre-standard) 5G start to appear, the stage is set for consumers finally to find out what the powerful next-generation mobile standard promises can bring: an ambitious and far-reaching technological advance that transforms virtually all aspects of human activity—how we experience life, conduct business, create goods, and build societies. In its latest complimentary white paper, “The Promise and Potential of 5G,” business information provider IHS Markit explores the opportunities and challenges surrounding the upcoming global rollout of new 5G wireless networks.

Without question, 5G is helping set the stage for incredible change, but it remains a confusing landscape, with varied and sometimes conflicting interpretations of what 5G is and what to expect from it. This confusion is impacting not just consumers but also complicating the industry’s ability to measure itself against a standard set of 5G expectations and requirements.

To optimize short-term and long-term 5G adoption, it is imperative that clarity regarding what 5G is and when each capability will be available is established for both consumers and the ecosystem. To that end, IHS Markit follows the official 3GPP definition of 5G [1]but also believes that this description needs to be understood within the context of everyday experience and concepts.

[1.] ITU considers 5G to be based on its forthcoming IMT 2020 recommendations. Those are the only official standards for 5G.

https://news.itu.int/5g-fifth-generation-mobile-technologies/

…………………………………………………………………………………………………………………………………………………………………………………………….

According to the previously referenced IHS Markit 5G white paper, 5G will improve existing services and enable new use cases, such as driverless cars, immersive entertainment, zero-delay virtual reality, uninterrupted video and no-latency gaming. On the industrial front, 5G will be key to expanding and realizing the full promise of the internet of things (IoT), with the technology’s impact to be felt in smart homes, smart cities and smart industries.

“The marketplace implicitly understands 5G represents an unprecedented growth opportunity, with the initial smartphone rollout set to generate record shipment volumes,” said Francis Sideco, vice president, technology at IHS Markit. “However, fewer people understand the iterative nature of major technology rollouts such as the one we are going through now with 5G—a process involving multiple major updates that will add new capabilities in the coming years. With each of these updates having the potential to significantly disrupt the market’s competitive dynamics, it’s critical for companies to clearly understand the implications of each rollout or risk falling behind the competition.”

Following initial sales of 37 million first-generation 5G smartphones this year, with initial shipments only now commencing, worldwide shipments will surge to 120 million devices in 2020, IHS Markit forecasts. This rollout will be the fastest ever for a new wireless generation, generating six times more unit shipments than previous record-holder LTE, over a similar timeframe. Benefitting from strong industry momentum and alignment, global 5G smartphone shipments will continue to rise in the coming years, reaching over 525 million devices in 2023. “Despite strong growth, the level of success among individual competitors in the smartphone and infrastructure market will hinge on their ability to shift their business strategies in parallel with the evolution of 5G,” Sideco said.

New 5G technical standards (i.e. IMT 2020 from ITU) will eventually enable the creation of applications that could open new opportunities, inform new business models and transform everyday life for multiple industries and billions of users throughout the world. However, many of these capabilities won’t be available in initial 5G rollouts, but instead will arrive in subsequent releases of the standard to be implemented over the next few years. Each of the releases will deliver new challenges and opportunities not only for the wireless industry but also every industry for which the new use cases are envisioned. To fully realize the potential of these opportunities, competitors will need to understand and capitalize on new capabilities even before they are fully introduced.

The 5G standard’s next release is already on the horizon, with the expected introduction of Release 16 in late 2019. The upcoming release will deliver highly desirable enhancements, including far greater reliability and peak data rates of 20 gigabits-per-second (Gbps) downlink and 10 Gbps uplink. “This next phase of implementation and rollout will trigger a race among mobile network operators to meet and take advantage of these performance enhancements,” Sideco said. “The winners of this race are likely to gain a competitive advantage as they gear up for the next wave of growth.”

Future revisions will spur similar competitive battles, as 5G adds major new capabilities and expands into other markets beyond mobile communications, such as mission-critical applications and massive internet of things (IoT) deployments. “For companies throughout the technology supply chain—from network operators, to smartphone brands, to industrial and automotive device manufacturers and electronics suppliers—it will become increasingly important to understand the changes brought by each phase of the 5G deployment and to be ready to capitalize on the latest capabilities to gain a competitive advantage,” Sideco said.

To learn more about managing the complexities of the 5G era, download the free white paper, “The Promise and Potential of 5G.”

…………………………………………………………………………………………………………………………………………………………………………………………………….

In other 5G related news today….

Japan’s carriers plan $14.4bn spending blitz for nationwide 5G:

The Ministry of Internal Affairs and Communications has approved the allocation of spectrum after determining that the companies’ applications met the conditions of the allocation, the Nikkei Asian Review reported. Japan’s telecom ministry has allocated 5G mobile spectrum to incumbent operators NTT Docomo, KDDI, and Softbank, as well as local e-commerce giant Rakuten.

The four companies plan to invest heavily in 5G, spending a combined 1.6 trillion yen ($14.4 billion) over the next five years. Docomo is planning the largest spend, with goals to invest at least 795 billion yen in 5G over this time.

Japan’s mobile operators have set aside $14 billion to invest in 5G networks over five years. (Photo by Ken Kobayashi)

…………………………………………………………………………………………………………………………………………………………………………………………………………………….

The four Japanese wireless carriers plan to commence commercial 5G services in 2020, with KDDI and SoftBank planning to commence advertising for its services in March. Rakuten Mobile, Japan’s upcoming newest market entrant, plans to commence 4G services in October 2019 and 5G services in June 2020.

The conditions for the allocation of spectrum included commitments to commence services in every prefecture of the nation within two years, and set up 5G base stations in at least half the country within five years.

According to the report, Docomo and KDDI are each targeting more than 90% 5G population coverage by the end of the five years, while SoftBank is targeting 64% coverage while Rakuten is aiming for 56%.

The Japanese government wants industry to build out 5G infrastructure widely, from big metropolitan areas to rural regions. It expects the technology, which offers speeds up to 100 times as fast as 4G, to enable self-driving buses and telemedicine, and to help Japan combat its worker shortage.

The conditions required for receiving 5G spectrum included starting services in every prefecture within two years. The communications ministry also divided Japan into 4,500 blocks, requiring operators to set up base stations in at least half of them within five years. Docomo and KDDI each plan to achieve coverage of more than 90% in that time. SoftBank and Rakuten set less ambitious goals, at 64% and 56%, respectively. The requirement will force mobile operators to balance making heavy investments with attaining profits.

IDTechEx: China’s 5G investments may be slowing, but it’s still the 5G market to watch

China is certain to be one of the world’s largest 5G markets and has been spending heavily to gain an early lead in 5G adoption, yet there are signs that 5G momentum is slowing down in the market. That was one of the conclusions of a new report from IDTechEx Research on the 5G technology market forecast for the next 10 years.

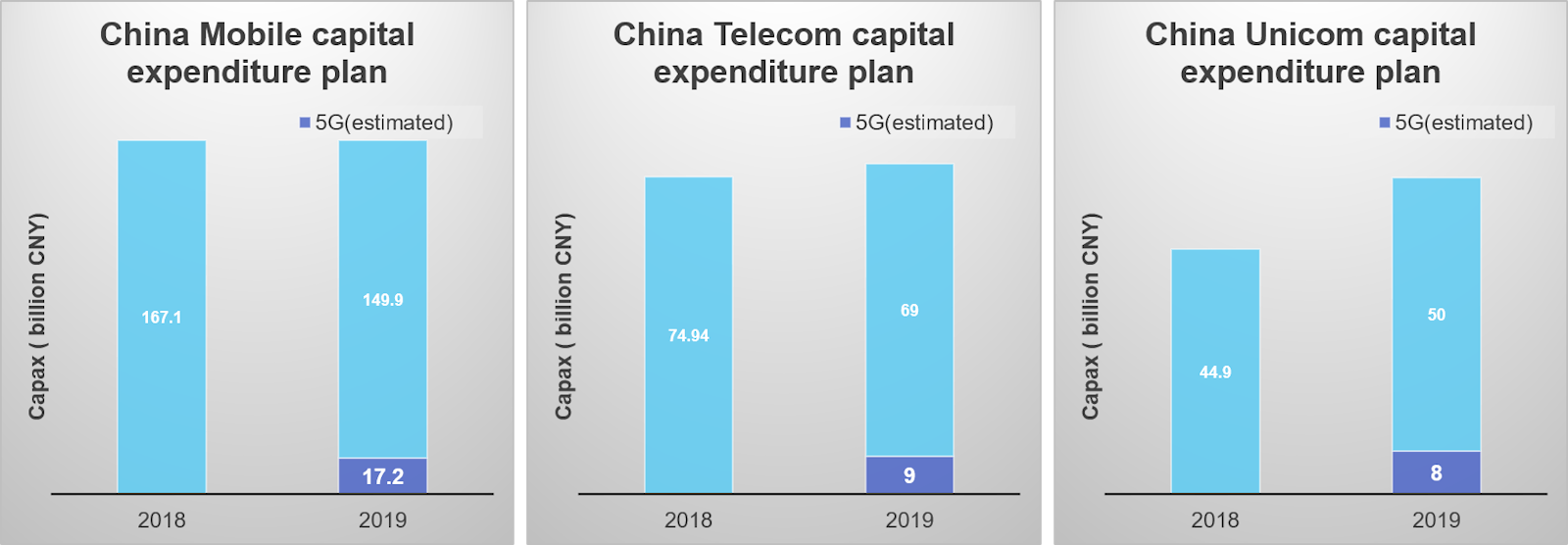

The report found that China’s big three operators China Mobile, China Telecom and China Unicom have all announced 5G capex budgets that are lower than expected.

China Unicom plans to spend between 6 billion yuan ($893.3 million) and 8 billion yuan on 5G in 2019, while China Telecom has allocated 9 billion yuan. While market leader China Mobile has not disclosed its projected 5G spending, the report forecasts that its spending will be in the region of 17 billion yuan. The total 5G capex budget allocated in China (34 billion yuan) for 2019 is therefore significantly lower than the projected 50 billion to 100 billion yuan.

Factors behind the lower than expected spending include: greater activity to upgrade 3G networks to 4G, falling per-subscriber revenue and the uncertainty over whether 5G investments will generate returns, the market research firm said. The CEO from Huawei, the top one telecom infrastructure supplier and number two smartphone provider in the world, has publicly expressed a similar concern on the payback from 5G.

Based on slower than expected 5G deployment schedules, the total contribution of 5G for the telecoms sector could be reduced from the projected $200 billion by 2029 to $160 billion. Network operators are forecast to invest around $200 billion to $350 billion for 5G development from 2020 to 2030.

Source: IDTechEx Research

……………………………………………………………………………………………………………………………………………………………………………………………………………………….

IDTechEx Research predicts that by 2030 the direct 5G revenue in China will be 6.3 trillion CNY (about $930 bn) and the Compound Annual Growth Rate (CAGR) in the coming ten years will be 29%. 5G will create 8 million jobs and contribute around 5.8% GDP growth in China by 2030. The indirect revenue generated by 5G will be 10.6 trillion CNY (about $1,579 bn), with CAGR of 24%. Among them, the direct revenue for telecoms will be over $200 bn by 2029.

As the current 5G deployment plan is slower than expected, these numbers might be overestimated. The new IDTechEx Research report 5G Technology, Market and Forecast 2019-2029 forecasts a moderated revenue of $160 bn for telecoms in China by 2029. Nonetheless, China is still the main market to watch. It is likely that the telecoms in China will invest at least $200-350 bn from 2020-2030 for 5G development, with the key focus on automotive, industry, healthcare and energy.

References:

https://www.idtechex.com/research/articles/is-5g-slowing-down-in-china-00016958.asp

More information can be found from 5G Technology, Market and Forecast 2019-2029 – contact [email protected] or visit www.IDTechEx.com/5g.

China Broadcasting Network Corp. to launch mobile network; already provides cable TV, Internet and Telecom services in China

As China state-owned telecom carriers (Unicom, China Mobile, China Telecom) prepeare for launch of 5G services, Beijing is supporting the creation of a new full-service telco by upgrading the nation’s cable network giant, China Broadcasting Network Corp. This is evident from the flurry of initiatives from the state-owned cable TV network operator to enhance its infrastructure and emerge as a stronger entity that can join the Big Three telecom firms in their own game.

Last month, China Broadcasting, an entity set up to run the nation’s cable TV system before being awarded, in 2016, a license to operate internet and telecom services, announced strategic partnerships with CITIC Group and Alibaba Group to help speed up efforts for network upgrades.

Under the cooperation agreements, China Broadcasting, which was founded by what is currently known as the National Radio and Television Administration (NRTA), will receive assistance from CITIC and Alibaba “for integrated development and upgrading of the nation’s cable TV networks as well as related product development and management,” state news agency Xinhua reported.

China aims to make its national cable TV networks smarter and create new generation radio and TV technology infrastructure by integrating cable TV networks and letting 4K, 5G, IPv6, big data, artificial intelligence and quantum communications technologies play their roles, Nie Chenxi, the head of the NRTA, said at the signing ceremony.

China Broadcasting’s plans comes as the traditional cable TV business faces a tough challenge in the era of internet TV and streaming services, throwing up the need for operators to upgrade themselves and expand their services via two-way interactive high speed broadband infrastructure.

Currently, telecom operators like China Telecom and China Mobile are offering fiber-to-the-home or fiber-to-the-building broadband networks to provide dedicated bandwidth for each broadband line, while cable network can only adopt a share-bandwidth approach. That has made it difficult for cable networks to compete with the fiber broadband operators.

China has seen cable TV subscribers falling in number after hitting a peak in 2016. Last year, subscribers were estimated at 223 million, down 8.75 percent from a year ago. The industry has seen its profitability get constrained and profit margins decline amid the weak subscriber figures. Meanwhile, IPTV and OTT video platforms had around 150 million users in 2018.

As the industry gets reshaped, CITIC is emerging as a key player in the reform of China’s cable network. The group, as a matter of fact, is not new to telecom network deployment. It owns CITIC Guoan network in Beijing, which is expanding its cable network operation across the nation. The conglomerate is also exploring new business models by teaming up with local cable operators to operate smart community service platforms for citizens.

Such experience puts CITIC in a good position to help integrate China’s state-owned nationwide cable network into a single valuable backbone network to deliver high definition content to TV as well as mobile devices.

CITIC Group can also help ease the financial burden of the government on network capital expenditure. Though there isn’t an equity deal, CITIC’s partnership with China Broadcasting can help the latter catch up with the three big state-owned telecom carriers through a market-driven approach.

In November last year, mainland media quoted Chinese authorities as saying that they have allowed China Broadcasting to build 5G networks, a move that will allow the market to transform into a four-player battleground. China Daily cited sources close to the Ministry of Industry and Information Technology as saying that China Broadcasting, which was formed in 2014 by combining several regional cable TV operators, was officially applying for a 5G license. That will help boost competition in the industry that has long been dominated by three players — China Mobile, China Unicom and China Telecom.

In China, traditional cable TV service has been facing keen competition from online media services such as IPTV, OTT video as well as Internet video. Telecom operators are using fiber broadband to provide IPTV services to their broadband users, while OTT players like Youku and Tencent also dominate the screen time of Chinese users.

Amid this situation, cable TV network operators need to invest not only on the content but also the network technology to provide triple or even quad play in the market to catch up with the telecom carriers.

China Broadcasting is preparing to launch a mobile network using the 700MHz spectrum band. The spectrum is currently being used for domestic analogue television broadcasting. Now, China Broadcasting and CITIC have formed a joint venture, China Broadcasting Network Mobile, to operate a mobile business on 700Mhz band. The joint venture is expected to receive a mobile license from the Chinese government so that they can build a network across the nation to challenge the dominance of the Big Three operators.

As the low-band 700MHz spectrum can have better network coverage compared with other frequency bands, the joint venture will be in a good position to provide better coverage for high speed mobile internet using 5G technology. Once the 5G war kicks off, apart from China Broadcasting, CITIC Group could also effectively become a major player in the China telecom market.

References:

http://www.ejinsight.com/20190409-china-cable-network-reform-what-it-means-for-telecom-industry/

https://en.wikipedia.org/wiki/Telecommunications_industry_in_China

http://english.cctv.com/2016/05/06/VIDElPgPCFpnb3m4hk1XC3Gq160506.shtml