Dell’ Oro: Huawei still top telecom equipment supplier; optical transport market +1% in 2020

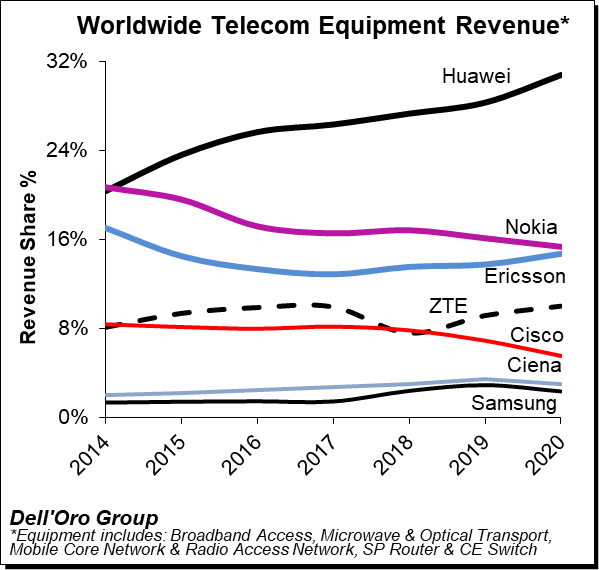

Huawei has increased its lead as the#1 global telecoms network equipment vendor, boosting its revenue share by a three percentage points last year, according to Dell’Oro Group. Nokia lost one percentage point of revenue share year-on-year, as did Cisco, the latter falling to 6%. Ericsson gained one percentage point to match Nokia at 15% of the market and ZTE also saw a 1% uptick to 10% of the global telecom market. (Please refer to chart below).

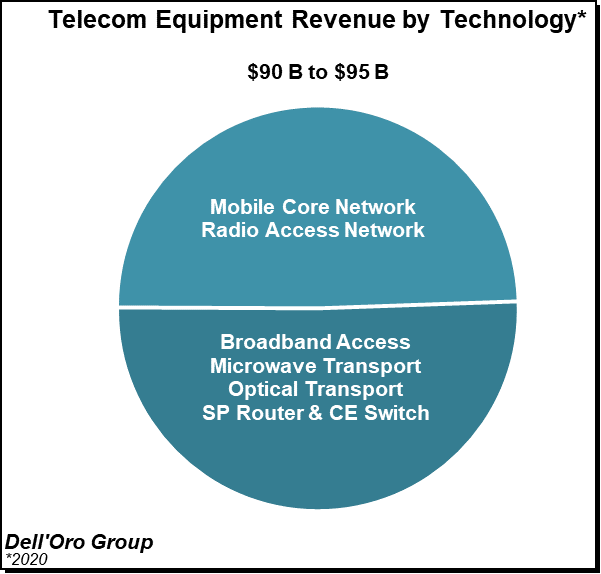

Dell’Oro Group’s preliminary estimates suggest the overall telecom equipment market – Broadband Access, Microwave & Optical Transport, Mobile Core & Radio Access Network, SP Router & Carrier Ethernet Switch (CES) – advanced 7% year-over-year (Y/Y) for the full year 2020, growing at the fastest pace since 2011.

The telecom and networking market research firm suggests revenue rankings remained stable between 2019 and 2020, with Huawei, Nokia, Ericsson, ZTE, Cisco, Ciena, and Samsung ranked as the top seven suppliers, accounting for 80% to 85% of the total market. At the same time, revenue shares continued to be impacted by the state of the 5G rollouts in highly concentrated markets. While both Ericsson and Nokia improved their RAN positions outside of China, initial estimates suggest Huawei’s global telecom equipment market share, including China, improved by two to three percentage points for the full year 2020.

Dell’Oro now estimates the following revenue shares for the top seven suppliers:

| Top 7 Suppliers | Year 2019 | Year 2020 |

| Huawei | 28% | 31% |

| Nokia | 16% | 15% |

| Ericsson | 14% | 15% |

| ZTE | 9% | 10% |

| Cisco | 7% | 6% |

| Ciena | 3% | 3% |

| Samsung | 3% | 2% |

Additional key takeaways from the 4Q2020 reporting period:

- Preliminary estimates suggest that the positive momentum that has characterized the overall telecom market since 1Q-2020 extended into the fourth quarter, underpinned by strong growth in multiple wireless segments, including RAN and Mobile Core Networks, and modest growth in Broadband Access and CES.

- Helping to drive this output acceleration for the full year 2020 is faster growth in Mobile Core Networks and RAN, both of which increased above expectations.

- Covid-19 related supply chain disruptions that impacted some of the telco segments in the early part of the year had for the most part been alleviated towards the end of the year.

- Not surprisingly, network traffic surges resulting from shifting usage patterns impacted the telecom equipment market differently, resulting in strong demand for capacity upgrades with some technologies/regions while the pandemic did not lead to significant incremental capacity in other cases.

- With investments in China outpacing the overall market, we estimate Huawei and ZTE collectively gained around 3 to 4 percentage points of revenue share between 2019 and 2020, together comprising more than 40% of the global telecom equipment market.

- Even with the higher baseline, the Dell’Oro analyst team remains optimistic about 2021 and projects the overall telecom equipment market to advance 3% to 5%.

Dell’Oro Group telecommunication infrastructure research programs consist of the following: Broadband Access, Microwave Transmission & Mobile Backhaul, Mobile Core Networks, Mobile Radio Access Network, Optical Transport, and Service Provider (SP) Router & Carrier Ethernet Switch.

…………………………………………………………………………………………….

Last week, Dell’Oro Group reported that the optical transport equipment revenue increased 1% in 2020 reaching $16 billion. In this period, all regions grew with the exception of North America and Latin America.

“Between concerns on starting new optical builds during the start of the pandemic and aggressive plans on 5G deployments that required a larger share of a service provider’s capital budget, the spending on optical transport dramatically slowed by the end of 2020,” said Jimmy Yu, Vice President at Dell’Oro Group.

“It was a really dramatic drop in optical equipment purchases in the fourth quarter. While we anticipated a slowdown near the end of the year due to concerns around COVID-19, we were surprised by a 29 percent year-over-year decline in WDM purchases in North America as well as a 12 percent decline in China. That said, there was good growth in the other parts of the world, especially Japan,” continued Yu.

| Optical Transport Equipment Market | |

| Regions | Growth Rate in 2020 |

| North America | -6% |

| Europe, Middle East and Africa | 2% |

| China | 1% |

| Asia Pacific excluding China | 13% |

| Caribbean and Latin America | -14% |

| Worldwide | 1% |

The Dell’Oro Group Optical Transport Quarterly Report offers complete, in-depth coverage of the market with tables covering manufacturers’ revenue, average selling prices, unit shipments (by speed including 100 Gbps, 200 Gbps, 400 Gbps, and 800 Gbps). The report tracks DWDM long haul, WDM metro, multiservice multiplexers (SONET/SDH), optical switch, optical packet platforms, data center interconnect (metro and long haul), and disaggregated WDM. To purchase this report, please email [email protected].

References:

4 thoughts on “Dell’ Oro: Huawei still top telecom equipment supplier; optical transport market +1% in 2020”

Comments are closed.

Very informative summary of the telecom equipment industry. It’s interesting to note that Huawei, Ericsson and ZTE are the only major equipment companies which can claim a growing market share.

Basant, Thanks a lot for your comment. I was recently asked who would make money on 5G. I could only name a few companies- 3 of which you named- Huawei, Ericsson and ZTE. The others are Qualcomm and possibly companies working on energy efficient 5G (like InterDigital- a technology licensing company).

June 16 2021 Update from LightReading:

Last year, Ericsson issued a blunt warning to Europe. Without faster progress, it risked falling behind Asia and North America on 5G rollout and the launch of new services that need 5G connectivity.

The Swedish equipment vendor says these fears have now been realized. According to data that Ericsson has shared exclusively with Light Reading, Europe this year finds itself at a worrying disadvantage to market leaders on the availability and performance of the new-generation mobile technology.

“It is not a [question of] risk today. Europe is lagging behind and at the heart of this is the deployment strategy associated with 5G midband,” says Christian Leon, who leads Ericsson’s networks and managed services units for Europe and Latin America.

Despite a wave of 5G launches in the last two years, Europe’s failure to invest in technologies compatible with midband spectrum – usually in or around the 3.5GHz frequency range – means less than 10% of people in the European Union and UK are today covered by a 5G midband network, according to Ericsson’s latest estimates.

That compares with 5G midband coverage of more than 90% in South Korea and 46% in Switzerland, one of Europe’s few high-flyers, reckons Ericsson. It also means the region is badly trailing countries including Australia, China and the US on midband availability.

Ericsson’s thesis is that European operators have tended to rely heavily on dynamic spectrum sharing (DSS) – which has allowed them to use existing and lower-band frequencies for both 4G and 5G services – without introducing midband technology. The consequence of that has been much poorer connectivity than consumers enjoy elsewhere.

Data that Ericsson has partially sourced from Ookla, which monitors network performance internationally, shows that 5G users in the UK, Germany, Spain, France and Italy can expect median 5G downlink speeds of not more than 150 Mbit/s. Connection speeds are twice as fast in China and more than 400 Mbit/s in South Korea, according to the data.

While lowband signals travel over long distances and are good for indoor coverage, higher ranges come with more spectrum and support faster connections.

“Europe has done pretty well at licensing midband and operators have stood up networks, but in nearly all cases they have not done a broad midband coverage deployment,” says Gabriel Brown, a principal analyst with Heavy Reading (a sister company to Light Reading).

One problem is that Europe’s operators do not have the same density of sites as their peers in China and South Korea, concedes Leon. China today has about 1.9 million 4G sites, of which 776,000 have been upgraded to 5G, while South Korea has 290,000 4G sites and 166,250 that can support 5G services.

Those figures indicate South Korea has about 57 sites for every 10,000 people, while China has nearly 14. The equivalent figure for Germany would be 8.7, Deloitte calculated in a 2018 report, and France’s 4G footprint of about 47,000 sites equates to a comparable ratio of just seven.

Putting Europe on the same footing as South Korea would require a huge investment that operators could not justify unless sales grew rapidly. So far, the rollout of 5G technology has not led to a substantial increase in revenues in any part of the world.

“I don’t see a big push to densify networks in Europe and what operators are hoping is that technology will solve it for them with massive MIMO,” says Heavy Reading’s Brown. “What we will see is strategic investment in certain areas and hotspots. They will incrementally densify.”

In December, Michael Trabbia, the chief technology officer of France’s Orange, told Light Reading that he hoped to avoid much 5G “densification” through the use of “more efficient technology.” Orange is basing its 5G strategy largely on deployment in the 3.4GHz to 3.8GHz bands of massive MIMO, an advanced antenna system, and it has made limited use of DSS outside Poland, Light Reading has learned.

Improvements for Orange might also come from beamforming, a technique that focuses the mobile signal on user devices, rather like a flashlight on a distant object, although Leon doubts this would really improve coverage and says beamforming is more about delivering a capacity boost.

Orange, BT and Telefónica all declined to comment on the data that Ericsson shared.

Deutsche Telekom supplied the following statement: “Our ambition is to create the best network experience for our customers wherever they are. That means to boost capacity with 5G in addition to 4G/LTE in rural areas, for example with DSS, and to bring high speed in areas where it’s really needed (e.g. more speed in dense or urban areas with more than 1Gbit/s download with 3.6GHz, ultra-low latency to the business customers or highly reliable campus networks for critical businesses).

“5G is more than an app benchmark measurement showcase, and speaking only about speed is far away from customer centricity. For us it’s the evolutionary next step to save the best customer experience in Germany, for private and for business customers.”

Innovation outside Europe

As Europe’s largest vendor of 5G products, Ericsson clearly has a vested interest in calling for greater investment. Nevertheless, the concern for regional authorities and even operators is that Europe could miss out as applications that genuinely need a 5G network start to appear.

The data gathered by Ericsson shows that China and South Korea, as well as Saudi Arabia and the United Arab Emirates (UAE), are now in a far better position to support applications based on immersive augmented reality and 360-degree virtual reality.

European countries not as capable of delivering 5G experiences

https://www.lightreading.com/5g/ericsson-says-fears-about-europes-5g-lag-have-come-true/d/d-id/770228?

Based on an article in today’s NY Times, it’s highly unlikely that Huawei can build a complete semiconductor supply chain, especially manufacturing very advanced semiconductor chips for its smartphones, base stations, fiber optics and other equipment.

A fairly new semiconductor manufacturing machine, made by ASML Holding in Veldhoven, Netherlands is the SHOW STOPPER! Its system uses a different kind of light to define ultra-small circuitry on chips, packing more performance into the small slices of silicon. The tool, which took decades to develop and was introduced for high-volume manufacturing in 2017, costs more than $150 million.

This complex machine is widely acknowledged as necessary for making the most advanced chips, an ability with geopolitical implications. The Trump administration successfully lobbied the Dutch government to block shipments of such a machine to China in 2019, and the Biden administration has shown no signs of reversing that stance.

Manufacturers can’t produce leading-edge chips without the system, and “it is only made by the Dutch firm ASML,” said Will Hunt, a research analyst at Georgetown University’s Center for Security and Emerging Technology, which has concluded that it would take China at least a decade to build its own similar equipment. “From China’s perspective, that is a frustrating thing.”

ASML’s machine has effectively turned into a choke point in the supply chain for chips, which act as the brains of computers and other digital devices.

A study this spring by Boston Consulting Group and the Semiconductor Industry Association estimated that creating a self-sufficient chip supply chain would take at least $1 trillion and sharply increase prices for chips and products made with them. That goal is “completely unrealistic” for anybody, said Willy Shih, a management professor at Harvard Business School who studies supply chains. ASML’s technology “is a great example of why you have global trade.”

Since ASML introduced its commercial EUV model in 2017, customers have bought about 100 of them. Buyers include Samsung and TSMC, the biggest service producing chips designed by other companies. TSMC uses the tool to make the processors designed by Apple for its latest iPhones. Intel and IBM have said EUV is crucial to their plans.

“It’s definitely the most complicated machine humans have built,” said Darío Gil, a senior vice president at IBM.

Dutch restrictions on exporting such machines to China, which have been enforced since 2019, haven’t had much financial impact on ASML since it has a backlog of orders from other countries. But about 15 percent of the company’s sales come from selling older systems in China.

https://www.nytimes.com/2021/07/04/technology/tech-cold-war-chips.html