Cisco

NTT and Cisco launch IoT as a Managed Service for Enterprise Customers

NTT and Cisco have teamed up to launch a suite of repeatable IoT solutions that can be sold as a managed service. The partnership brings together NTT’s edge infrastructure, managed services, and IT systems integration expertise and Cisco’s IoT capabilities. Together, they promise to offer IoT services that encompass real-time data insights, enhanced security, improved decision-making, and reduced operational costs through predictive maintenance, asset tracking, and supply chain management.

NTT and Cisco are targeting opportunities in the manufacturing, transportation, healthcare and utility sectors, where they claim there is growing demand for edge computing and IoT solutions. The team has already begun working with Belgian public water distribution utility, Compagnie Intercommunale Liégeoise des Eaux (CISE). CISE has deployed thousands of LoRaWAN sensors on its infrastructure, giving it the visibility it needs to improve efficiency in the areas of water quality, consumption, distribution, and maintenance. It’s being delivered as a managed service by NTT and Cisco.

“We are accelerating our IoT business initiatives to deliver a powerful portfolio of repeatable services that can be tailored to meet customer demand for these kinds of solutions,” said Devin Yaung, SVP of group enterprise IoT products and services at NTT, in a statement. “We’re doubling down on NTT’s IoT capabilities to meet customer demand,” said Yaung. “What we’re doing is pulling together our collective knowledge and skillsets, and putting the full power of NTT behind it, to better service our customers and the increasing need to outfit or retrofit their organisations with the connectivity and visibility they need to improve day-to-day business operations.”

“We are excited to work together to help transition our customers to this IoT-as-a-service model so they can quickly realise the business benefits across industries and around the globe,” added Samuel Pasquier, VP of product management, industrial IoT networking, at Cisco.

According to IoT Analytics, global enterprise IoT spending is expected to grow 19% to $238 billion in 2023, up from $201 billion in 2022. By 2027, it could reach as high as $483 billion.

References:

https://iot-analytics.com/iot-market-size/?utm_source=IoT+Analytics+Master+People+List

Dell’Oro: SD-WAN market grew 45% YoY; Frost & Sullivan: Fortinet wins SD-WAN leadership award

According to a recently published report by Dell’Oro Group, the worldwide SD-WAN market grew 45% in the third quarter of 2021 compared to the prior year. Cisco maintained the top position for the revenue share for the quarter and was followed by Fortinet and VMware in the second and third spots.

“Enterprises are upgrading network infrastructures at accelerated rates compared to pre-pandemic times, and our research finds that the SD-WAN market is growing at strong double-digit rates in all regions of the world,” said Shin Umeda, Vice President at Dell’Oro Group. “Because SD-WAN is software-based technology, the global supply chain disruptions have had less of an effect compared to hardware-based networking products,” added Umeda.

Additional highlights from the 3Q 2021 SD-WAN Report:

- The SD-WAN market continues to consolidate around a small number of vendors with the top six vendors accounting for 69 percent market share in 3Q 2021.

- Cisco’s quarterly SD-WAN revenue nearly doubled in 3Q 2021 with especially strong growth in the North America region.

- The market for hardware-based Access Routers grew quarterly revenues for the first time in almost two years.

The Dell’Oro Group SD-WAN & Enterprise Router Quarterly Report offers complete, in-depth coverage of the SD-WAN and Enterprise Router markets for future current and historical periods. The report includes qualitative analysis and detailed statistics for manufacture revenue by regions, customer types, and use cases, average selling prices, and unit and port shipments. To purchase these reports, please contact us by email at [email protected].

Dell’Oro Group is a market research firm that specializes in strategic competitive analysis in the telecommunications, networks, and data center IT markets. Our firm provides in-depth quantitative data and qualitative analysis to facilitate critical, fact-based business decisions. For more information, contact Dell’Oro Group at +1.650.622.9400 or visit www.delloro.com.

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………

Separately, Frost & Sullivan recently analyzed the global SD-WAN vendor market, and recognized Fortinet with the 2021 Global SD-WAN Vendor Product Leadership Award for transforming and securing the WAN. Fortinet’s Security-driven Networking approach to SD-WAN enables a wide range of use cases including secure and optimized connections to cloud-based applications. The company’s Secure SD-WAN solution integrates SD-WAN capabilities, advanced routing functions, next-generation firewall (NGFW), and zero trust network access (ZTNA) proxy on a single appliance or a single virtual machine (VM) to deliver secure networking capability. The solution can be deployed in a virtual or physical format on-premise or as a VM in the cloud, with a throughput of 20 Gbps, the highest available in the industry.

Fortinet’s Secure SD-WAN solution, powered by the industry’s first SOC4 SD-WAN ASIC [1.] for accelerated performance, features an unrestricted WAN bandwidth consumption model on appliances that is unique in the industry. Cloud adoption continues to grow, but enterprises have generally struggled to implement and maintain a secure, high-performing WAN that allows for efficient access to cloud-based applications across their user base. With the rise in remote working and with distributed users accessing cloud-hosted applications, the enterprise perimeter is no longer limited to users within the company site. Fortinet’s solution securely connects users to cloud-based applications delivering consistent policies off- and on-network.

Note 1. On Apr 9, 2019 John Maddison, EVP of product and solutions, Fortinet said:

“The WAN edge is now a part of digital attack surfaces, but the edge of your network must never be a bottleneck. For branch offices, the ability to provide best-of-breed WAN Edge — including SD-WAN, WAN optimization, security and orchestration — with optimal performance and security is critical to enable the digital experience. Fortinet’s SoC4 SD-WAN ASIC allows organizations to realize security-driven networking whether they have 100 or 10,000 branch offices.”

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………….

Roopa Honnachari, VP of Research, Network Services & Edge, explained that “Fortinet has been a long-time leader in the network security market, which has enabled them to deliver a solution that tightly knits advanced security features with SD-WAN. Though Fortinet is best known as a security company, they have shown their strength and innovation in networking as one of the top SD-WAN solutions on the market capable of supporting enterprise digital transformation.”

To break the perception that it is a security vendor that also does SD-WAN and to eliminate the risk of not appealing to enterprise infrastructure or network decision makers, the company has consciously focused on highlighting its routing and networking capabilities in marketing activities and proofs of concept.”

With its focus on SD-WAN with integrated advanced security and ability to deliver multiple functions in a single hardware appliance or VM, Fortinet has experienced significant growth in the last three years. The company sells 100% through channel partners, including large telcos, such as AT&T, Verizon, British Telecom, Masergy, GTT, KDDI, Orange, and Windstream, that are looking to add secure SD-WAN to their portfolios. As a result, Fortinet has nearly doubled its revenue.

Honnachari added that “Fortinet has emerged as a formidable competitor in the enterprise secure networking space. While the company has always served as a leading competitor in the network security space, the transformation to adding SD-WAN, NGFW, ZTNA access proxy, and advanced routing capabilities on a single operating system and managed by a single console is highly commendable.”

Gartner’s Magic Quadrant for WAN Edge Infrastructure

Cisco is a leader in this Magic Quadrant. It has two branded offerings: Cisco SD-WAN powered by Viptela and Cisco SD-WAN powered by Meraki. Both include hardware and software appliances, and associated orchestration and management. Cisco also provides optional additional security via the Cisco Umbrella Security Internet Gateway (SIG) platform. Cisco is based in California, U.S., and has more than 40,000 WAN edge customers. The vendor operates globally and addresses customers of all sizes, in all verticals. We expect the vendor to continue to invest in this market, particularly in the areas of improved self-healing capabilities, new consumption-based pricing models and integrated security to enable a single-vendor SASE offering.

Fortinet is a leader in this Magic Quadrant. Its offering is the FortiGate Secure SD-WAN product, which includes physical, virtual appliances and cloud-based services managed with FortiManager orchestrator. Fortinet is based in Sunnyvale, California, U.S., and Gartner estimates that it has more than 34,000 WAN edge customers with more than 10,000 SD-WAN customers. FortiOS v.7.0 combines ZTNA to its broad WAN and network security functionalities to deliver a capable SASE offering. It has a wide global presence, addressing customers across multiple verticals and sizes. We expect the vendor to continue investing in SASE, artificial intelligence for IT operations (AIOps) and 5G functionality.

VMware is a leader in this Magic Quadrant. Its offering is branded as VMware SD-WAN, and is part of VMware SASE. The offering includes edge appliances (hardware and software), gateways — VMware points of presence (POPs) offering various services — and an orchestrator and its Edge Network Intelligence. VMware provides additional optional security via VMware Cloud Web Security and VMware Secure Access. Based in California, U.S., it has more than 14,000 SD-WAN customers. The vendor operates globally and addresses customers of all sizes, and in all verticals. Gartner expects the vendor to continue investments in this market, including enhancing options for remote workers and building out its SASE offering.

………………………………………………………………………………………………………………………

Each year, Frost & Sullivan presents this award to the company that has developed a product with innovative features and functionality that is gaining rapid market acceptance. The award recognizes the quality of the solution and the customer value enhancements it enables.

About Frost & Sullivan:

For six decades, Frost & Sullivan has been world-renowned for its role in helping investors, corporate leaders, and governments navigate economic changes and identify disruptive technologies, Mega Trends, new business models, and companies to action, resulting in a continuous flow of growth opportunities to drive future success. Contact us: Start the discussion. Contact us: Start the discussion.

Contact: Bianca Torres

P: 1.210.477.8418

E: [email protected]

References:

https://www.gartner.com/doc/reprints?id=1-27EGPR7B&ct=210909&st=sb

Telenor Deploys 5G xHaul Transport Network from Cisco and NEC; xHaul & ITU-T G.8300 Explained

NEC Corp. and Cisco have been selected by Telenor to deploy 5G xHaul transport networks in Norway and Denmark. 5G-xHaul proposes a converged optical and wireless network solution able to flexibly connect Small Cells to the core network.

In April this year, NEC and Cisco entered a Global System Integrator Agreement (GSIA) to expand their partnership for accelerating the deployment of innovative 5G IP transport network solutions worldwide. This project is a flagship initiative in which the two companies take full advantage of the GSIA and collaborate to deliver state-of-the-art networks to the customer.

NEC and Telenor have a well-established history of working together, and this project is an extension of a global frame agreement signed in 2016 for Telenor’s 4G IP / Multi-Protocol Label Switching (MPLS) network in Scandinavia, to deliver next-generation networks to the operator.

For this specific project, Cisco will supply its NCS 540 series as the cell site router and NEC will provide value added services built on its expertise both in the IT and network domain to implement an architecture that enables flexible and highly scalable end-to-end IP/MPLS networks with bandwidth that can support the high-capacity and low-latency communication required by 5G.

“As a One-stop Network Integrator, NEC takes a customer-first approach, providing optimal solutions that match individual requirements based on our best-of-breed ecosystem, consisting of NEC’s own products and those from industry-leading partners such as Cisco. We are excited to contribute to the advancement of Telenor’s 5G network evolution,” said Mayuko Tatewaki, General Manager, Service Provider Solutions Division, NEC Corporation.

“At Cisco, we continue to look for ways we can shape the future of the internet by providing unparalleled value to our customers and our partners,” said Shaun McCarthy, Vice President of Worldwide Sales, Mass Infrastructure Group, Cisco. “Through our partnership with NEC, we can help Telenor connect more people in Norway and Denmark and provide the automation and orchestration necessary to meet future demands on the network.”

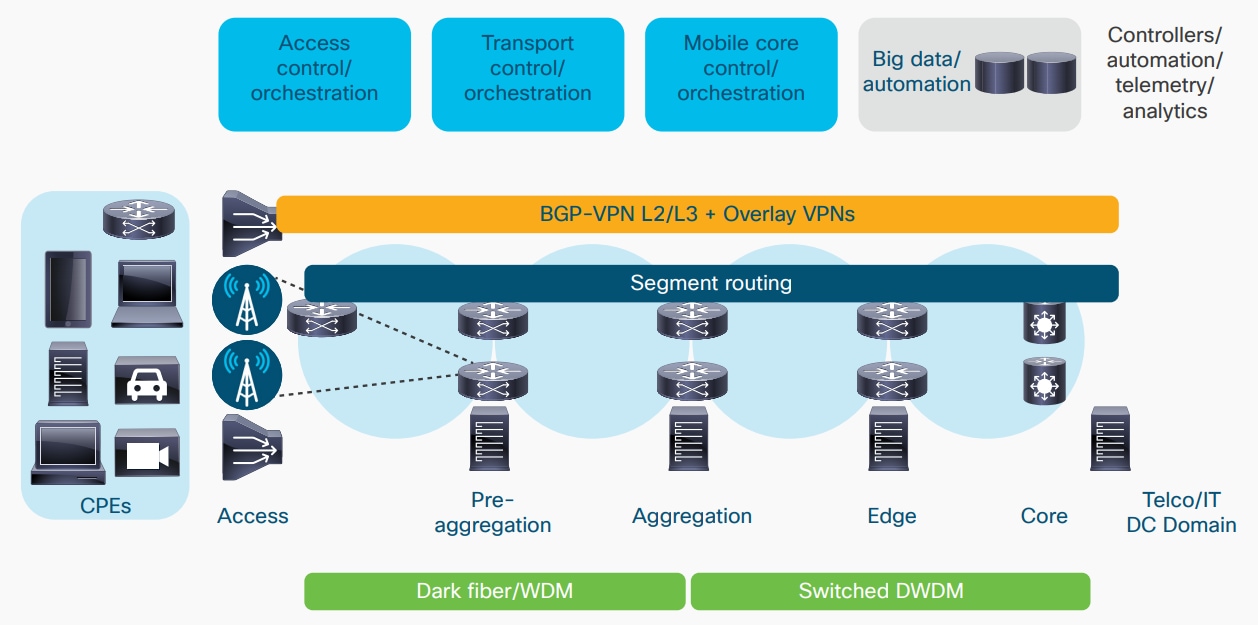

Cisco believes that a converged, end-to-end packet infrastructure, beginning in the access layer and stretching via the network data center all the way to the core, based upon segment routing and packet-based QoS, provides the underlying xHaul transport network (see Figure below). This provides the most flexibility of application placement, the best scalability, the most robust reliability, and the leanest operational costs. On top of this, we layer VPN services, either based on BGP-based VPNs or business software-defined WAN (SD-WAN) technologies, to provide the means to support a multi-service environment capable of supporting strict SLAs.

Overall Architecture for 5G xHaul:

Editor’s Note:

ITU-T G.8300 recommendation “Characteristics of transport networks to support IMT-2020/5G” defines the requirements for the Physical layer transport network support for the 5G fronthaul, midhaul and backhaul networks. The digital clients are the digital streams to/from the 5G entities (e.g., RU, DU, CU, 5GC/NGC) and other digital clients carried in the access, aggregation and core transport networks. The requirements and characteristics are documented for each of the fronthaul, midhaul and backhaul networks as defined in this recommendation.

The factors addressed include:

• Relationship of 5G network architecture to transport network architecture

• Operations, administration, and maintenance (OAM) requirements

• Timing performance and time/synchronization distribution architecture

• Survivability mechanisms

………………………………………………………………………………………………………………………………

NEC and Telenor have worked together before, with this announcement representing an extension of a previous global frame agreement signed in 2016 for Telenor’s 4G IP/Multi-Protocol Label Switching (MPLS) network in Scandinavia. As part of the agreement, the system integrated helped Telenor prepare, enable and perform the migration of services in a turnkey arrangement.

Going forward, NEC and Cisco will continue making collaborative efforts to further enhance their joint solution portfolio and to optimize regional activities for advancing the digital transformation of customers across the globe.

References:

https://newsroom.cisco.com/press-release-content?type=webcontent&articleId=2203825

http://Telenor Deploys 5G xHaul Transport Network from Cisco and NEC

https://www.nec.com/en/press/201603/global_20160331_01.html

Broadcom, Cisco and Facebook Launch TIP Group for open source software on 6 GHz Wi-Fi

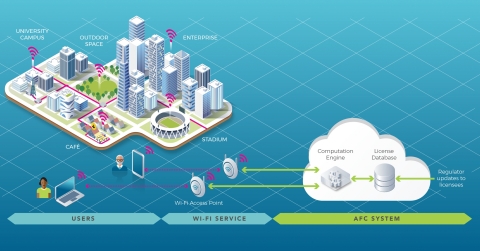

The purpose of this new TIP project group is to develop a common reference open source software for an AFC system. The AFC will be used by unlicensed devices in the newly available 6 GHz band to operate outdoor and increased range indoor while ensuring incumbent services are protected.

The US, EU, Canada, and Brazil, among others, have approved or are finalizing the approval of 6 GHz unlicensed spectrum use, opening up a huge bandwidth for Wi-Fi services.

By 2025, the Wi-Fi Alliance estimates that the 6 GHz Wi-Fi will deliver USD 527.5 billion in incremental economic benefits to the global economy [1]. Standard outdoor power operations will be a key part of the value proposition of 6 GHz Wi-Fi and is critical for enabling more affordable wireless broadband for consumer access.

The FCC is the first regulator to enable its use under an AFC, ISED Canada authorized standard power with AFC in May 2021, with others expected to follow. The AFC will enhance Wi-Fi to provide a consistent wireless broadband user experience in stadiums, homes, enterprises, schools, and hospitals.

“The 6 GHz Wi-Fi momentum is unmistakable. In the year following the historic FCC ruling to open up the band for unlicensed access, we already have an entire ecosystem of Wi-Fi 6E devices delivering gigabit speeds indoors. As we work towards closing the digital divide and further realizing the value of the 6 GHz band, AFC-enabled standard power Wi-Fi operation becomes critical. As Wi-Fi 7 comes along, AFC will turbocharge the user experience by enabling over 60 times more power for reliable, low latency, and multi-gigabit wireless broadband both indoors and outdoors. With this vision in mind, Broadcom is excited to join hands with Cisco and Facebook to create the TIP Open AFC Software Group aimed at enabling a cost effective and scalable AFC system,” said Vijay Nagarajan, Vice President of Marketing, Wireless Communications & Connectivity Division, Broadcom.

“The creation of the TIP Open AFC Software Group represents the immense momentum behind unlicensed spectrum and the potential it holds to deliver innovation,” said Rakesh Thaker, VP of Wireless Engineering, Cisco. “Many of the applications and use cases we’re just beginning to dream up with the introduction of Wi-Fi 6 and the 6 GHz spectrum will rely on standard power, greater range and reliability. This software group will play an important role in ensuring those applications can become reality, while also protecting important incumbent services. We’re thrilled to join Broadcom and Facebook on this effort, and to share a vision with TIP of providing high-quality, reliable connectivity for all.”

Facebook developed a proof of concept Open AFC system, which will protect 6 GHz incumbent operations and enable faster adoption of standard power operations in the 6 GHz band. This prototype system will be contributed to the TIP community through today’s launch of the Open AFC Software Group, with the goal of enabling the proliferation of standard power devices in the United States to start, with other markets to follow.

Broadcom and Cisco have committed to driving the industry forward in developing Open AFC to ensure that the code continues to be developed to meet the needs of the industry and regulators, such that an AFC operator could take the code and build upon it for rapid certification.

The vast majority of Wi-Fi use is indoors, but there are situations where people will want to use Wi-Fi outdoors. The use of AFC provides the flexibility for outdoor deployments in open air stadiums and similar venues.

“Bringing AFC technology to the TIP Open AFC Software Group is a huge milestone for the unlicensed spectrum community,” said Dan Rabinovitsj, vice president for Facebook Connectivity. “We are excited to see the contributions and innovations by Open AFC and we look forward to celebrating the widespread adoption of the 6 GHz band, which will rapidly accelerate the performance and bandwidth of Wi-Fi networks around the world”.

David Hutton, Chief Engineer of TIP, said: “The industry is coming together to support 6 GHz for unlicensed use for Wi-Fi and TIP will be providing the forum to contribute to make this happen, supporting regulatory efforts by ensuring that AFC systems are developed under a common code base that is available to all industry stakeholders.”

Closing Comment:

We wonder why this new WiFi 6GHz group is in TIP rather than the WiFi Alliance. From the WiFi Alliance Certified 6:

“Wi-Fi Alliance is leading the development of specifications and test plans that can help ensure that standard power Wi-Fi devices operate in 6 GHz spectrum under favorable conditions, avoiding interference with incumbent devices.”

In this author’s opinion, there are way too many alliances/ fora/ consortiums that produce specifications that are to be used with existing standards. In this case (IEEE 802.11ax) there is potential overlap amongst amongst groups, which leads to inconsistent implementations that inhibit interoperability.

References:

NEC and Cisco in Global Systems Integrator Agreement for 5G IP Transport

NEC Corp and Cisco today announced they have entered into a Global System Integrator Agreement (GSIA) to expand their partnership for accelerating the deployment of innovative 5G IP transport network solutions worldwide.

[Will any other protocol besides IP operate over 5G data plane?]

Under the agreement, the companies will jointly drive new business opportunities for 5G. NEC group companies will work closely with Cisco to complement NEC’s ecosystem with optimized IP metro/access transport and edge cloud computing solutions. Cisco will support NEC’s customer engagements by offering best-in-class products, proposals and execution support.

The new agreement underlines NEC’s successful track record as a Cisco Gold Partner over two decades, and its proven engineering capabilities to provide Cisco products to its global customer base across multiple regions.

“We believe 5G is fueling the internet for the future, and accelerating our customers’ digital transformations,” said Jonathan Davidson, Senior Vice President and General Manager, Mass-Scale Infrastructure Group, Cisco. “Together with NEC, we are creating a powerful force to drive the critical changes needed in networking infrastructure to carry the internet into the next decade.”

“Collaboration across the network solution ecosystem is essential for continued success in meeting diversified customer requirements and establishing a win-win relationship,” said Mayuko Tatewaki, General Manager, Service Provider Solutions Division, NEC Corporation. “This powerful partnership strengthens our global competitiveness as a network integrator that drives the customer journey with innovative solutions.”

NEC and Cisco say they will make collaborative efforts to further enhance their joint solution portfolio and to optimize regional activities for advancing the digital transformation of customers across the globe. Indeed, NEC has a long history of working with Cisco stretching back more than two decades. This includes the two working together on 4G LTE equipment that combined NEC’s RAN and backhaul assets with Cisco’s network equipment.

The two firms last year bolstered efforts in ensuring the security of their networking equipment. This involved using NEC’s blockchain technologies and Cisco’s fraud detection technologies to confirm the authenticity of network equipment used for security and critical industrial infrastructure before it was shipped to a customer, during the construction of those networks, and during operation.

NEC also participated in Rakuten Mobile’s 4G-LTE network deployment in Japan. NEC has so far gained the most from that deployment as it’s been tapped to provide a standalone (SA) 5G core network based on the specification it wrote with Rakuten Mobile.

NEC recently established an Global Open RAN Center of Excellence in the UK, which aims “to accelerate the global adoption of Open RAN and to further strengthen its structure for accelerating the global deployment of 5G.”

The company also developed (with Samsung) and demonstrated an O-RAN Alliance compliant 5G base station baseband unit (5G-CU/DU) on NTT DOCOMO’s commercial 5G network.

Source: NEC Corp.

………………………………………………………………………………………………………………………………….

Cisco was initially part of Rakuten Mobile’s 4G-LTE deployment, but has been conspicuously absent from the Japanese carrier’s more recent 5G plans. Cisco has been steadily bolstering its 5G focus with updates to its routing and networking equipment. This includes updates earlier this year to its router portfolio, and scoring a deal late last year with AT&T to assist with disaggregated IP routing technology for an edge routing platform.

Cisco has also been working with Japanese carrier KDDI on its 5G and network virtualization efforts. This included a proof-of-concept (PoC) last year that demonstrated cloud-native software with Cisco’s Ultra Packet Core platform.

Nonetheless, Cisco continues to lag behind the more established telecom vendors in providing 5G equipment. They don’t make cellular base stations which limits their offerings to routers with 5G interfaces.

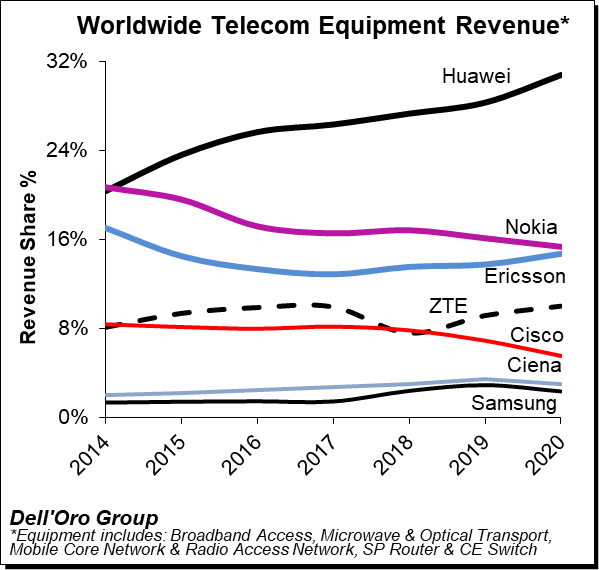

A recent Dell’Oro Group report placed Cisco a distant No. 5 among overall telecom equipment vendors, with its market share having shrunk by 1% from 2019 to 2020 to only 6%.

| Top 7 Suppliers | Year 2019 | Year 2020 |

| Huawei | 28% | 31% |

| Nokia | 16% | 15% |

| Ericsson | 14% | 15% |

| ZTE | 9% | 10% |

| Cisco | 7% | 6% |

| Ciena | 3% | 3% |

| Samsung | 3% | 2% |

Source: Dell’Oro Group

………………………………………………………………………………………….

References:

https://www.nec.com/en/press/202104/global_20210408_01.html

https://www.sdxcentral.com/articles/news/cisco-nabs-nec-to-expand-5g-reach/2021/04/

https://www.delloro.com/key-takeaways-total-telecom-equipment-market-2020/

Cisco Plus: Network as a Service includes computing and storage too

Cisco Systems is extending the concept of software-as-a-service (SaaS) technology with the introduction of Cisco Plus, which is a network-as-a-service (NaaS) offering focused on cybersecurity and hybrid cloud services. The new service offering can also provide computing-as-a-service and data-storage-as-a-service.

- Cisco announcing plans to lead the industry with new Network-as-a-Service (NaaS) solutions to deliver simpler IT and flexible procurement for customers looking for greater speed, agility and scale

- Cisco also reveals plans to help customers build a SASE foundation today (with Cisco SD-WAN and security) with as-a-service offer coming soon

- Cisco Plus offers include flexible consumption for data center networking, compute and storage now, and commits to delivering the majority of its portfolio as-a-service over time

“I believe every organization would benefit from simplifying powerful technology,” said Todd Nightingale, Senior Vice President and General Manager, Enterprise Networking and Cloud, Cisco. “Network-as-a-service is a great option for businesses wanting to shift to a cloud operating model without a heavy lift. Cisco is leading the industry in its approach with Cisco Plus. Together with our partners, we intend to offer the majority of our technology portfolio in the simplest, most flexible way: cloud-driven, cloud-delivered, cloud-managed and as-a-service.”

“Network-as-a-service delivery is a great option for businesses wanting to shift to a cloud operating model that makes its easy and simple to buy and consume the necessary components to improve and grow their businesses,” said James Mobley, senior vice president and general manager of Cisco’s Network Services Business Unit.

Cisco Plus NaaS solutions will provide:

- Seamless and secure onramps to applications and cloud providers

- Flexible delivery models, including pay-per-use or pay-as-you-grow options

- End-to-end visibility from the client to the application to the ISP

- Unified policy engine to ensure the right users have access

- Security across everything, not bolted on as another point solution

- Real-time analytics providing AI/ML-driven insights for cost and performance tracking

- API extensibility across the technology stack

- Partners layering additional value and delivering their services faster

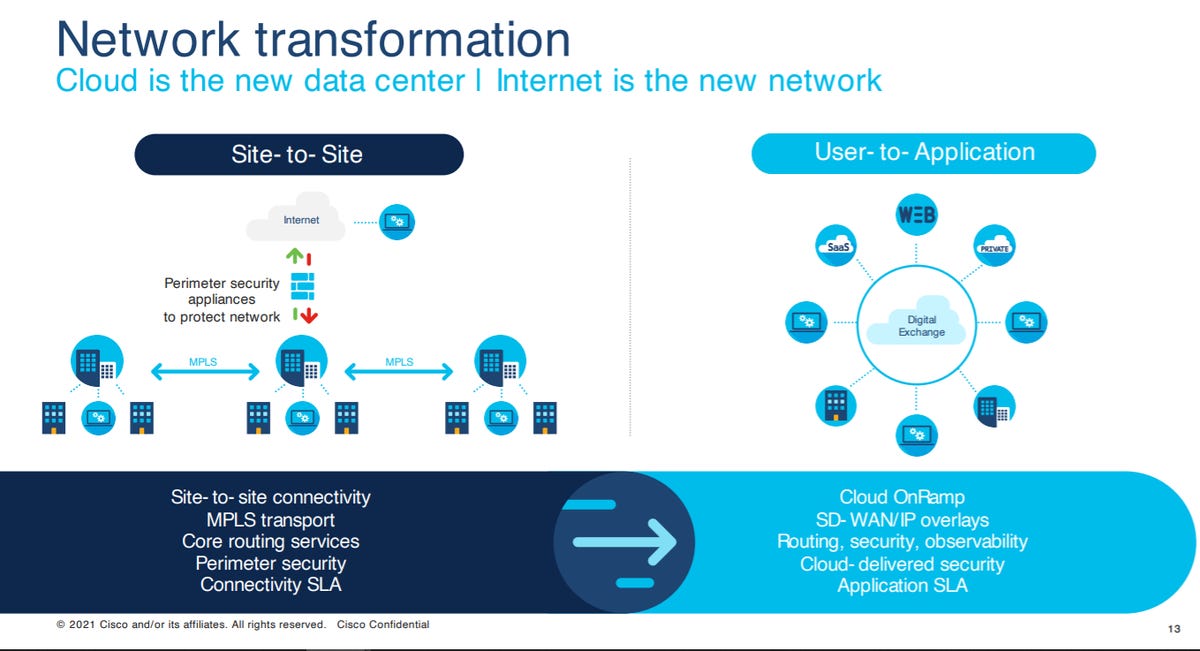

The NaaS rollout will first focus on a cloud-based solution as-a-service for secure access service edge (SASE). The Cisco SASE offer currently available enables customers to easily leverage future services with investment protection. Cisco is planning limited release NaaS solutions later this calendar year that will unify networking, security and visibility services across access, WAN and cloud domains.

While Cisco plans in the next few years to introduce what will likely be many service options under Cisco Plus, for now it is introducing two flavors. The first, Cisco Plus Hybrid Cloud, includes the company’s data-center compute, networking, and storage portfolio in addition to third-party software and storage components all controlled by the company’s Intersight cloud management package. Customers can choose the level of services they want for planning, design and installation Mobley said.

Cisco Plus Hybrid Cloud, which will be available mid-year, offers pay-as-you-go with delivery of orders within 14 days, Mobley said.

“As enterprises recommit to their digital transformation strategies, they are increasingly looking for more cloud-like, flexible consumption models for procuring and managing their IT, cloud and network infrastructure. These “as-a-service” deployment options provide much needed flexibility and scalability, along with a simplification of network deployments and ongoing operations. Cisco’s transition to as-a-service via Cisco Plus shows the company is committed to meeting customer needs for predictable costs, cloud-like agility, first-class security, and more.

“With Cisco Plus, it’s taking NaaS and its hybrid cloud offerings to the next level by including hardware and the full portfolio into this as-a-service offer, that provides cloud-like simplicity and flexibility of consumption on one end, and on the other, it provides a rich set of intelligent operational enhancements that go a long way to deliver enhanced IT experiences and outcomes. This has also been made possible by increased embedded intelligence now available in network and IT hardware and software, coupled with advanced telemetry options in many of these platforms.”

— Rohit Mehra, Vice President of Network Infrastructure, IDC.

“With Cisco Plus, we couldn’t be more excited that Cisco is diving deeper into the as-a-service era, helping us in our transformation to deliver IT as a service to our customers. In this way, we are better equipped to help our customers simplify their IT operations, and free up resources to invest in innovation of their core business.” — Jeffrey den Oudsten, CTO Office Solutions Director, Conscia Nederland

“There’s always been a push and pull in how to operationalize and finance IT infrastructure. Cisco Plus is the matching pair to a cloud operating model. Delivering Cisco Plus across the majority of Cisco’s portfolio helps us at Insight to further deliver the transformation to a cloud operating model our clients want. With Cisco Plus, organizations can not only operate their infrastructure as a cloud, but also consume it in a similar fashion, enabling a true hybrid, multi-cloud.” — Juan Orlandini, Chief Architect Cloud + Data Center Transformation, Insight

“At Presidio, we have seen this shift coming for a long time. Our customers are very clear: They want to consume reliable, best of breed infrastructure with consumption-based financial models. And with the launch of Cisco Plus, Presidio and Cisco in partnership are doing just that.” — Raphael Meyerowitz, Engineering VP, Office of the CTO, Data Center, Presidio

The second Cisco Plus service, which did not have an availability timeframe, will feature the company’s secure access services edge (SASE) components, such as Cisco’s SD-WAN and cloud-based Umbrella security software.

Security-as-a-service models offer many advantages for organizations including offloading the maintenance of hundreds or thousands of firewalls and other security appliances, said Neil Anderson, senior director of network solutions at World Wide Technology, a technology and supply-chain services provider.

“With SASE, enterprises can consume that from the cloud and let someone else take care of the toil, which frees up their security team to focus on threat vectors and prevention,” he said.

While the strategy behind delivering network components as a cloud-based service has been around for a few years, it is not a widely used enterprise-customer strategy. Cisco’s entry into NaaS is likely to change that notion significantly.

“Cisco has been on this journey for a few years now—starting with providing subscription-based offers for many of its software solutions—while working on simplifying and enriching the licensing and consumption experience,” Mehra said. “Customers understand and have embraced cloud-like IT-consumption models that are typically subscription-based and provide scalability and other on-demand capabilities,” Mehra said.

Terms such as NaaS are still largely new in an enterprise context to most IT practitioners, although they do understand that operational simplicity and flexibility will be crucial to their success in digital transformation, Mehra said.

While NaaS might be relatively new to some customers, others are already utilizing it, other experts said. For remote-access, customers are more than ready, and it’s starting to go mainstream, Anderson said.

“For connectivity to the cloud edge, it’s coming very soon, and the adoption of SASE models for security will accelerate the demand for NaaS services,” he said. “NaaS in the campus will probably take a bit longer, but we see that coming. Some customer segments, like retail, are probably ready today, while others like global financials will take longer to adopt.”

Networking is no longer just about connecting things within private networks because there is a world of networking to and between clouds to account for, Anderson said. “For example, with private WANs, I typically networked my sites to my other sites like a private data center. Now, I need to network my sites to cloud services, and I may be doing so with public-internet services,” Anderson said.

NaaS for the campus network is another use case on the horizon, he said. “To build campus networks in the past, we had access, distribution, and core layers, and the core spanned my campus and sometimes private data center. It was designed to aggregate traffic from users into my private data center,” Anderson said. “Today, much of the traffic is heading to the cloud—Office 365 is the tipping point for many organizations—so building a core network may not be necessary. I see a new architecture emerging where the goal is to tie each site, including each building of a campus, to the internet directly to connect users to cloud and enable traffic to [reach] the cloud sooner, ultimately improving the user experience.”

Naas is by no means a slam dunk, and there will be challenges for enterprises that use it. “For medium to large organizations with significant investments in existing remote, branch, campus and data-center networking network-security infrastructure, migrating to NaaS will be difficult and time consuming. Multi-vendor environments will further complicate the matter,” stated principal analyst at Doyle Research, Lee Doyle.

Widespread adoption of enterprise NaaS will occur slowly over the next five to 10 years Doyle stated. The best fits for adoption now are greenfield sites, temporary locations, and small branch offices. NaaS offerings will also be attractive to network remote, home and mobile workers who need secure, reliable application performance. Enterprise networks with the requirement to move traffic at high speeds on-site would be more difficult to deliver as a service, Doyle stated.

Key challenges, besides understanding of what NaaS will help deliver, face IT practitioners who are the potential customers as well as vendors and service providers, Mehra said.

“On the customer aspects, what we’ll need to watch will be the changing role of IT and how it can optimally consume these technologies as a service while retaining overall control of its IT environment,” Mehra said. “On the provider side, visibility across issues such as operational flexibility and simplicity will be one area to consider, while another will be the direction the industry takes on what metered-service options it makes available for its clients.”

The challenges depend on the industry and security requirements, WWT’s Anderson said. “If the organization is in a heavily regulated industry like financial, healthcare, or federal [government], one challenge will be trusting the integrated security needed,” Anderson said. “For example, there would be fewer challenges to enable everyone to connect to the internet, akin to a giant hotspot, but to adopt more of a zero-trust model, where you may need to securely isolate sessions and devices from one another, will require building trust in some integrated security technologies.”

“What Cisco is doing is very interesting because what NaaS is out there has been limited to mostly the WAN world but once you start targeting the enterprise that’s where the challenges are because customers still have to move bits and everything can’t be in the cloud,” Doyle said. “Instead of being in the first inning of a game we are really just now defining the rules of the game, so there’s a long way to go.”

References:

https://www.zdnet.com/article/cisco-launches-cisco-plus-a-step-toward-network-as-a-service/

Dell’ Oro: Huawei still top telecom equipment supplier; optical transport market +1% in 2020

Huawei has increased its lead as the#1 global telecoms network equipment vendor, boosting its revenue share by a three percentage points last year, according to Dell’Oro Group. Nokia lost one percentage point of revenue share year-on-year, as did Cisco, the latter falling to 6%. Ericsson gained one percentage point to match Nokia at 15% of the market and ZTE also saw a 1% uptick to 10% of the global telecom market. (Please refer to chart below).

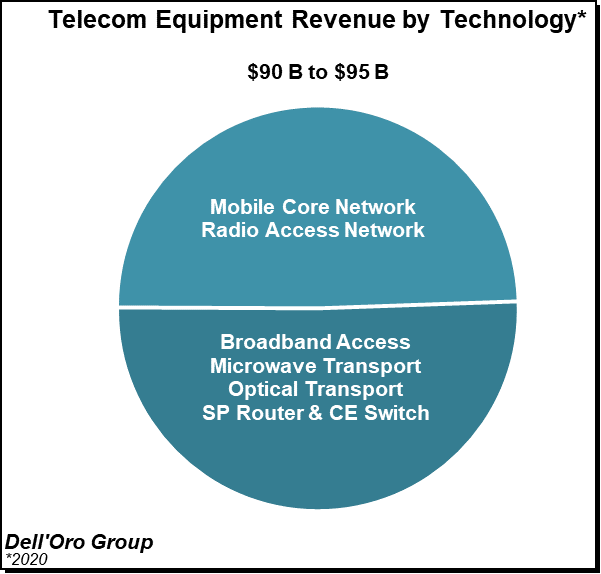

Dell’Oro Group’s preliminary estimates suggest the overall telecom equipment market – Broadband Access, Microwave & Optical Transport, Mobile Core & Radio Access Network, SP Router & Carrier Ethernet Switch (CES) – advanced 7% year-over-year (Y/Y) for the full year 2020, growing at the fastest pace since 2011.

The telecom and networking market research firm suggests revenue rankings remained stable between 2019 and 2020, with Huawei, Nokia, Ericsson, ZTE, Cisco, Ciena, and Samsung ranked as the top seven suppliers, accounting for 80% to 85% of the total market. At the same time, revenue shares continued to be impacted by the state of the 5G rollouts in highly concentrated markets. While both Ericsson and Nokia improved their RAN positions outside of China, initial estimates suggest Huawei’s global telecom equipment market share, including China, improved by two to three percentage points for the full year 2020.

Dell’Oro now estimates the following revenue shares for the top seven suppliers:

| Top 7 Suppliers | Year 2019 | Year 2020 |

| Huawei | 28% | 31% |

| Nokia | 16% | 15% |

| Ericsson | 14% | 15% |

| ZTE | 9% | 10% |

| Cisco | 7% | 6% |

| Ciena | 3% | 3% |

| Samsung | 3% | 2% |

Additional key takeaways from the 4Q2020 reporting period:

- Preliminary estimates suggest that the positive momentum that has characterized the overall telecom market since 1Q-2020 extended into the fourth quarter, underpinned by strong growth in multiple wireless segments, including RAN and Mobile Core Networks, and modest growth in Broadband Access and CES.

- Helping to drive this output acceleration for the full year 2020 is faster growth in Mobile Core Networks and RAN, both of which increased above expectations.

- Covid-19 related supply chain disruptions that impacted some of the telco segments in the early part of the year had for the most part been alleviated towards the end of the year.

- Not surprisingly, network traffic surges resulting from shifting usage patterns impacted the telecom equipment market differently, resulting in strong demand for capacity upgrades with some technologies/regions while the pandemic did not lead to significant incremental capacity in other cases.

- With investments in China outpacing the overall market, we estimate Huawei and ZTE collectively gained around 3 to 4 percentage points of revenue share between 2019 and 2020, together comprising more than 40% of the global telecom equipment market.

- Even with the higher baseline, the Dell’Oro analyst team remains optimistic about 2021 and projects the overall telecom equipment market to advance 3% to 5%.

Dell’Oro Group telecommunication infrastructure research programs consist of the following: Broadband Access, Microwave Transmission & Mobile Backhaul, Mobile Core Networks, Mobile Radio Access Network, Optical Transport, and Service Provider (SP) Router & Carrier Ethernet Switch.

…………………………………………………………………………………………….

Last week, Dell’Oro Group reported that the optical transport equipment revenue increased 1% in 2020 reaching $16 billion. In this period, all regions grew with the exception of North America and Latin America.

“Between concerns on starting new optical builds during the start of the pandemic and aggressive plans on 5G deployments that required a larger share of a service provider’s capital budget, the spending on optical transport dramatically slowed by the end of 2020,” said Jimmy Yu, Vice President at Dell’Oro Group.

“It was a really dramatic drop in optical equipment purchases in the fourth quarter. While we anticipated a slowdown near the end of the year due to concerns around COVID-19, we were surprised by a 29 percent year-over-year decline in WDM purchases in North America as well as a 12 percent decline in China. That said, there was good growth in the other parts of the world, especially Japan,” continued Yu.

| Optical Transport Equipment Market | |

| Regions | Growth Rate in 2020 |

| North America | -6% |

| Europe, Middle East and Africa | 2% |

| China | 1% |

| Asia Pacific excluding China | 13% |

| Caribbean and Latin America | -14% |

| Worldwide | 1% |

The Dell’Oro Group Optical Transport Quarterly Report offers complete, in-depth coverage of the market with tables covering manufacturers’ revenue, average selling prices, unit shipments (by speed including 100 Gbps, 200 Gbps, 400 Gbps, and 800 Gbps). The report tracks DWDM long haul, WDM metro, multiservice multiplexers (SONET/SDH), optical switch, optical packet platforms, data center interconnect (metro and long haul), and disaggregated WDM. To purchase this report, please email [email protected].

References:

Cisco Systems: Huge pivot from hardware to software, security and services; Sales & Earnings forecast disappoints

Historical Review:

From its beginnings as a start-up multi-protocol router company, through the early 2000s, Cisco thrived as a major supplier of hardware to build corporate and internet networks, both to telecom firms, large enterprise companies, universities, and government agencies (like the European Commission).

Having acquired many Ethernet switch start-ups, most notably Crescendo Communications and Grand Junction Networks, Cisco became the undisputed leader in Ethernet switching. But that dominance faded with the rise of cloud computing and “white box” switches the big Internet companies bought for their cloud resident data centers. Also, the competition from Arista Networks, co-founded by brilliant hardware architect Andy Bechtolsheim, depressed sales to cloud computing companies like Microsoft and Amazon.

Much of Cisco’s revenue growth has come from acquisitions. Cisco recently acquired ThousandEyes, a networking intelligence company, for about $1 billion. Cisco bought WAN companies Stratacom and Cerent for $4B in 1996 and $6.9B in 1999, respectively. Cisco acquired software maker AppDynamics for $3.7 billion in 2017. Later that year, it bought BroadSoft for $1.9 billion.

Most of Cisco’s recent acquisitions have been software-related. In July 2019, Cisco acquired Duo Security for $2.35 billion, marking its biggest cybersecurity acquisition since its purchase of Sourcefire in 2013. Acquiring Duo Security bolstered Cisco in an emerging category called zero trust cybersecurity.

Not to be outdone by VMware, HP Enterprise and other large corporate acquirers Cisco purchased SD-WAN companies Meraki in 2012 and Viptela in 2017. In 2019, Cisco agreed to buy Acacia Communications, a maker of 400G optical components, for $2.6 billion in cash. That deal has not closed. Earlier it bought optics device maker Luxtera for $660 million.

CFO Kramer told Reuters that Cisco will continue to acquire smaller companies to help boost revenue and that its $2.84 billion acquisition of Acacia Communications Inc remains on track. The deal was slated to close before the end of Cisco’s fiscal 2020 last month, but the company said it is still awaiting approval from Chinese regulators.

Cisco CEO Chuck Robbins

…………………………………………………………………………………………………………………………………….

Revenues Drop; Earnings Forecast Disappoints:

In its 4th fiscal quarter (May to July 2020), Cisco revenues fell 9% year-on-year to just $12.2 billion as enterprise customers slashed spending on network “infrastructure platforms.” Earnings declined 4% to 80 cents a share from a year earlier. For the current quarter, Cisco expects sales to fall between 9% and 11% in the current quarter. A 10% revenue drop would be at the midpoint of its forecast to about $11.84 billion. Wall Street analysts had expected $12.25 billion in revenue.

According to a filing with the Securities and Exchange Commission (SEC), sales of “infrastructure platforms” tumbled 16% during the quarter, to about $6.6 billion, compared with the year-earlier period. “This is the product area most impacted by the COVID environment,” said Kelly Kramer, Cisco’s chief financial officer who is retiring. “We saw declines across switching, routing, data center and wireless, driven primarily by the weakness we saw in the commercial and enterprise markets,” Kelly added.

Cisco’s applications unit, its second largest product segment, sells everything from unified communications products to “Internet of Things” software. It recorded a 9% drop in sales, to $1.4 billion in the last quarter.

That’s no surprise. As companies shift business workloads to cloud computing services like AWS, AZURE and Google Cloud they spend much less on internal computer networks (aka Enterprise Networks). In addition, Cisco has lost share in several large markets, though it aims to rebound in cybersecurity.

Indeed, Cisco’s only real 4th fiscal quarter growth came at its comparatively small security business, where sales were up 10%, to $814 million. Cisco’s huge services unit were flat YoY, generating $3.3 billion in revenues.

CFO Kramer elaborated:

“Applications (segment) was down 5% driven by a decline in unified communication and TP endpoints. We did see growth in conferencing as we saw strong uptake with the COVID-19 environment. We also saw strong double-digit growth in AppDynamics and IoT software. Security was up 6% with strong performance in unified threat management, identity and access and advanced threats. Our cloud security portfolio performed well with strong double-digit growth and continued momentum with our Duo and Umbrella offerings. Service revenue was up 5% driven by software and solution support. We continue to transform our business delivering more software offerings and driving more subscriptions. Software subscriptions were 74% of total software revenue, up 9 points year-over-year.

In terms of orders in Q3, total product orders were down 5%. During the quarter, there was a slowdown in April as we saw the impact of the COVID-19 environment continue. Looking at our geographies, the Americas was flat, EMEA was down 4%, and APJC was down 22%. Total emerging markets were down 21% with the BRICS plus Mexico down 29%. In our customer segments, public sector was up 1% while enterprise was down 4%, commercial was down 11%, and service provider was down 3%. Remaining performance obligations or RPO at the end of Q3 were $25.5 billion, up 11%. The portion related to product was up 25%.”

“Management does not see the Covid-19 disruption as having improved since May,” Barclays analyst Tim Long said in a note to clients. He added that Cisco’s fiscal fourth quarter saw “Data center particularly weak from reduced demand. Applications again below expectations as growth in Webex (video conferencing) volume still to be fully monetized, and outweighed by weakness in the larger campus communications business.”

“Cisco earnings were disappointing on several levels, primarily on the news of a large restructuring and elimination of jobs as well as the forecast for a revenue decline, which shows the company is not meeting its growth forecasts,” said Scott Raynovich, founder and chief analyst of Futuriom, in an email Wednesday afternoon to FierceTelecom. “The share price looks like it will fall on Thursday based on the fact that investors were too optimistic that cloud infrastructure expansion could support Cisco’s business. The fact is that Cisco has never been a major player in the cloud, and this quarter may be proving out that point.”

Transition/Pivot to Software, Services and Security:

It’s a work in progress and not at all easy for a large company to accomplish. In its fiscal 4th quarter, approximately 31% of revenues came from pure software vs. 51% of sales generated by software and services in the last fiscal year. Of its software revenues, 78% now come from subscriptions, easily beating a company target of 66%. However, the company wants to transition faster.

“We will accelerate the transition of the majority of our portfolio to be delivered as a service,” according to CEO Chuck Robbins who said on the earnings call:

“We believe the transition in our own business model through our shift to more software and subscription-based offerings is paying off. We saw continued strong adoption of our SaaS-based offerings and now have 74% of our software that is subscription versus 65% a year ago. We also believe we remain well-positioned over the long-term to serve our customers and create differentiated value aligned to cloud, 5G, Wi-Fi 6 and 400 gig. Our business model, diversified portfolio, and ability to continue to invest in key growth priorities gives us a strong foundation to build even stronger customer relationships. As we prepare for the future, we will closely partner with our customers to modernize their infrastructure, secure their remote workforce and their data through our innovative solutions that will serve as the foundation for their digital organizations.”

“I think this pandemic is basically just giving us the air cover to accelerate the transition of R&D expense into cloud security, cloud collab, away from the on-prem aspects of the portfolio. Clearly, we’ve got a lot of technology that we’re working on today to help our customers over the next three, four, five years in this multi-cloud world that they’re going to live in, and you’ll see more of that come out over the next couple of years.”

Related to security, Robbins said:

“Moving on to security, which is always at the heart of everything we do. In Q3, we saw solid growth reflecting increased demand for our robust solutions to secure the rapid growth in remote workers and their devices. Being the largest enterprise security company in the world, we are uniquely positioned to safeguard our customers wherever they work. We have the most comprehensive and integrated end-to-end portfolio in the industry across the network, cloud, applications, and endpoints.”

“As I mentioned earlier, we provided extended free licenses for key security technologies that are designed to protect remote workers including Cisco Umbrella, Zero Trust Security from Duo, industry-leading secure network access from Cisco AnyConnect and endpoint protection from our AMP technology. We are also supporting our customers on their multi-cloud journey by enabling them to secure direct Internet access, cloud application usage, and roaming users. We are only two quarters into our Secure Internet Gateway transition and we are already seeing strong adoption from existing and new customers. Building on the investments we made in innovation partnerships and acquisitions, we also introduced SecureX. This is the industry’s broadest cloud-based security platform connecting the breadth of our portfolio and our customer security infrastructure by providing unified visibility, automation, and simplified security across applications, the network endpoints and the cloud.”

SD-WAN Opportunity:

Robbins outlined the company’s SD-WAN strategy during the earnings call:

“We continue to execute on our secure cloud scale SD-WAN strategy by investing in innovation and partnerships to help enterprises accelerate their multi-cloud strategies. As an example, we are now integrating with our Umbrella secure Internet gateway to give our customers flexibility to use best of breed cloud security with our industry-leading SD-WAN solution. Our partnerships across web scale providers like AWS, Azure and our most recent announcement with Google Cloud allow us to offer a truly multi-cloud network fabric. As bandwidth and SaaS application demand increases, we are enabling our customers to securely connect branches and interconnect to different cloud providers to enable consistent application performance and user experience.”

With SD-WAN, companies have less need for costly private data networks leased from telecom companies. Cisco competes with VMware, startup Aryaka, Fortinet and CloudGenix in the SDN market. Palo Alto Networks recently bought CloudGenix.

Will 5G/WiFi 6 Drive Demand for Routers and 5G Core Products?

“In our view, headwinds have mostly played out, and we see smoother sailing ahead with easier comps and better growth cycles that are related to new product cycles,” Bank of America analyst Tal Liani said in a note. “5G could drive demand for routers, especially access and aggregation routers, 400G switching could drive demand for data center switching to recover, and Wi-Fi 6 (IEEE 802.11ax) could drive up another upgrade cycle.”

CEO Robbins on 5G growth:

“So I think what we see happening with 5G is a little bit mixed, but generally there is a tendency for our customers to want to sort of put their foot on the accelerator. I think you heard some of our customers that are looking for permits and with regional governments around the United States and other places that they are not sure they’re going to be able to get that done (permits to mount small cells on public infrastructure) during this pandemic. You got other customers who are saying that they actually are not having a problem, but it’s — so we think generally there is going to be an acceleration, particularly as our service provider customers also realize that some element of this work from home scenario will not go away and so we’re going to be continuing in the future to work in these very hybrid worlds where we’re going to have even a much broader distribution of where their users will be working from and I think that’s the reason that they want to continue to accelerate the deployments and the strategies around 5G.”

CEO Robbins on WiFi 6 mixed customer feedback:

“I’d say in Wi-Fi 6, I don’t see any big significant shift. I’d say on the cloud, I’ve had mixed feedback from customers. I think that in general, it’s probably a tailwind to cloud, but there are some customers that believe they have a cloud strategy and this doesn’t — they don’t understand why this would change how they go about it, but it will, as it relates to our strategy. We are going to continue to accelerate those technologies that help our customers use the cloud more effectively. We are going to — as our customers, some of our customers are going to need opex offers in the future given capex restraints. So we’re working on a balance of our portfolio to be delivered in both op capex models to give customers the flexibility that they need and we’re definitely going to continue to accelerate the development and work around our security portfolio as it relates to remote work and cloud connectivity because we think that’s only going to accelerate as well.”

Cost Cutting including Layoffs Coming:

Cisco’s restructuring plan started in the current quarter and is expected to recognize a related one-time charge of about $900 million. CEO Robbins plans to cut costs and shrink the payroll. “Over the next few quarters, we will be taking out over $1 billion on an annualized basis to reduce our cost structure,” he said on the earnings call. CFO Kramer said operating costs would fall by around $800 million, about 4.4% of the annual total.

Costs have already been reduced substantially. In the 4th fiscal quarter opex fell 9%, to about $4.4 billion. Yet with those cuts, operating profit dropped 11%, to $3.3 billion. It was only due to lower tax payments via the 2017 GOP tax bill (which benefited companies at the expense of the middle class) that net profit rose 19%, to roughly $2.6 billion.

While older Cisco workers were getting buy-out deals to retire, headcount at the firm has grown for the past four years, rising from 71,833 employees in 2015 to 75,900 last year. That latter number will surely decline in the months ahead. Note that Cisco does not provide details of staff numbers or layoffs in quarterly earnings updates.

CEO Robbins did not disclose any details about possible job cuts. According to Reuters: “Cisco’s restructuring, which includes a voluntary early retirement program and layoffs, will begin this quarter, the company said, adding that it expected to recognize a related one-time charge of about $900 million.”

…………………………………………………………………………………………………………………………………….

References:

Cisco’s Annual Internet Report (2018–2023) forecasts huge growth for IoT and M2M; tepid growth for Mobile

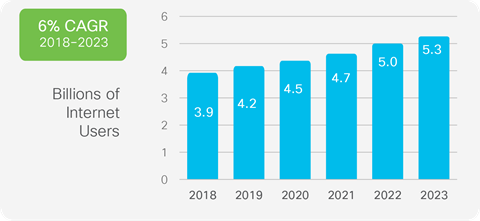

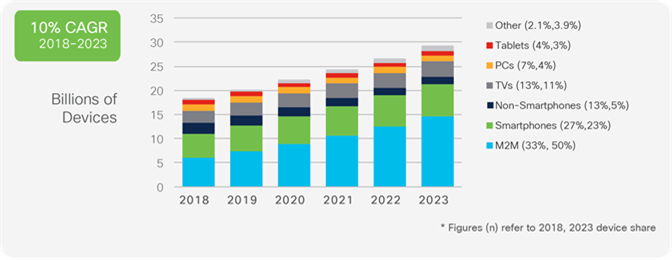

According to Cisco’s newly renamed Annual Internet Report [1.], networked devices around the globe will total 29.3 billion in 2023, outnumbering humans by more than three to one. The number of overall connected devices: 29.3 billion networked devices by 2023, compared to 18.4 billion in 2018.

The report also anticipates that the internet of things (IoT) will spread to 50% of all networked devices through machine-to-machine (M2M) technology and that the internet will reach 5.3 billion people, compared to 3.9 billion in 2018.

“There is a lot of growth that still can happen from a user perspective,” said Shruti Jain, senior analyst with Cisco. “Machine-to-machine is going to grow phenomenally,” she added.

Note 1. Cisco’s Annual Internet Report was formerly titled Visual Networking Index or VNI)

………………………………………………………………………………………………….

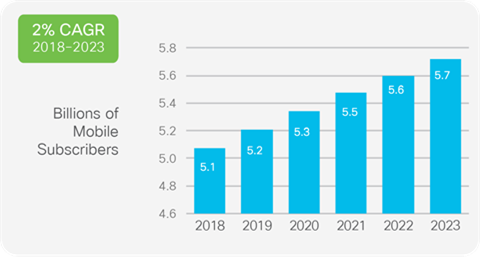

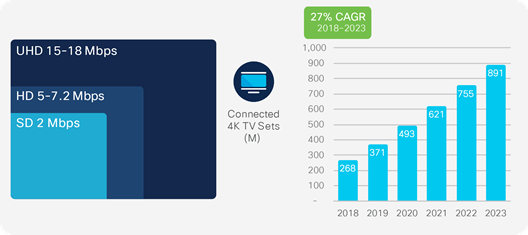

Cisco said that about 70% of the global population will have mobile-network-based connectivity by 2023, with the total number of mobile subscribers growing from 66% of the population in 2018 to 71% of the population (5.7 billion) by 2023. Of those, about 10% will be 5G connections by the end of the forecast period, with the number of global mobile devices rising from 8.8 billion in 2018 to 13.1 billion, with 1.4 billion of those being 5G-capable.

5G speeds are anticipated to be 13-times faster than the average mobile connection speed: 575 Mbps by 2023. Ms. Jain noted that as mobile network speeds approach those of wireline networks, it opens up new possibilities for mobile applications.

“Soon, those speeds are going to get very close to WiFi and [wired] broadband speeds, and be able to support a lot of new applications and experiences,” she said.

…………………………………………………………………………………………………………….

Other key findings from the 2020 Cisco AIR:

-The number of devices per person will continue to rise, from 2.4 networked devices per-capita in 2018 to 3.6 devices by 2023.

-The number of public WiFi hot spots will increase fourfold by 2023, to nearly 628 million.

-Almost 300 million mobile applications will be downloaded by 2023, with the most popular ones being social media, gaming and business applications.

-Power users’ impact is dwindling. Cisco found that globally, the top 1% of mobile data users accounted for 5% of mobile data in 2019. That has dropped significantly since 2010, when the top 1% of mobile users accounted for 52% of mobile data usage.

………………………………………………………………………………………………………

Summary: Multi-domain innovation and integration redefines the Internet

Throughout the forecast period (2018 – 2023), network operators and IT teams will be focused on interconnecting all the different domains in their diverse infrastructures – access, campus/branch, IoT/OT, wide-area, data center, co-los, cloud providers, service providers, and security. By integrating these formerly distinct and siloed domains, IT can reduce complexity, increase agility, and improve security. The future of the Internet will establish new connectivity requirements and service assurance levels for users, personal devices and IoT nodes, all applications (consumer and business), via any network access type (fixed broadband, Wi-Fi, and cellular) with dynamic security. Through our research and analysis, we anticipate innovation and growth in the following strategic areas.

Applications: Across virtually every business sector, there is an increased demand for new or enhanced applications that improve customer experiences. The Internet of Things (IoT), Artificial Intelligence (AI), Machine Learning (ML) and business analytics are changing how developers build smart applications to simplify customer transactions and deliver new business insights. Businesses and service organizations need to understand evolving demands and deliver exceptional customer experiences by leveraging technology.

Infrastructure transformation: The rapid growth of data and devices is outpacing many IT teams’ capabilities and manual approaches won’t allow them to keep up. Increased IT automation, centrally and remotely managed, is essential for businesses to keep pace in the digital world. Service providers and enterprises are exploring software-defined everything, as well as intent-driven and context-powered infrastructures that are designed to support future application needs and flexibility.

Security: Cybersecurity is a top priority for all who rely on the Internet for business and personal online activities. Protect every surface, detect fast and remediate confidently. Protecting digital assets and content encompasses an ever-expanding digital landscape. Organizations need the actionable insights and scalable solutions to secure employees’ devices, IoT connections, infrastructure and proprietary data.

Empowering employees and teams: To achieve business agility and prepare employees for the future, empowering global work forces with the right tools is a must. Automation, collaboration and mobility are essential for managing IT complexity and new customer expectations and demands. Business teams, partners and groups in all types of organizations need to collaborate seamlessly across all application mediums that are relevant to various roles and responsibilities. Employees and teams need accurate and actionable data to solve problems and create new growth strategies.

…………………………………………………………………………………………..

For more information:

Several interactive tools are available to help you create custom highlights and forecast charts by region, by country, by application, and by end-user segment (refer to the Cisco Annual Internet Report Highlights tool). Inquiries can be directed to [email protected].

……………………………………………………………………………………………………..

References:

Cisco’s ‘Internet of the Future’ Strategy with Silicon One Architecture

Executive Summary:

- Cisco shared further details behind its ‘Internet for the Future’ technology strategy based on development investments in Silicon+Optics+Software.

- Cisco Silicon OneTM, a first-ever single, unified silicon architecture that can serve anywhere in the network and be used in any form factor.

- New Cisco 8000 Series, the first platform built with Silicon One and new IOS XR7 operating system.

- Cisco 8000 Series set to reduce cost of building and operating mass scale networks to run digital applications and services such as 5G, video and cloud.

- New flexible business model options that enable customers to consume new innovation in new ways that best fit their business needs.

- AT&T, Century Link, Comcast, Facebook, Microsoft and The Walt Disney Studios share insights on joint innovation and the needs of the next Internet

Cisco announced its “Internet of the Future” strategy at a December 11th event in San Francisco, CA. The highlight of the announcement was Cisco’s Silicon One chip, which is a unified silicon architecture that can work anywhere in the network and be used in any form factor. Silicon One, along with Cisco’s new IOS XR7 operating system, is powering Cisco’s new 800 series routers that were designed for hyperscale web operators and large service providers to power applications and services, such as 5G core network, video streaming and 400GE transport.

“Innovation requires focused investment, the right team and a culture that values imagination,” said Cisco Chairman and CEO Chuck Robbins, in a press release. “We are dedicated to transforming the industry to build a new internet for the 5G era. Our latest solutions in silicon, optics and software represent the continued innovation we’re driving that helps our customers stay ahead of the curve and create new, ground-breaking experiences for their customers and end users for decades to come.”

The next-generation of internet infrastructure combines Cisco’s new silicon architecture with its next-generation of optics. Cisco says its strategy will change the economics behind how the internet will be built to support the demands of future, digital applications and will enable customers to operate their businesses with simpler, more cost-effective networks.

Cisco’s strategy is based on development and investments in three key technology areas: silicon, optics and software.

“Pushing the boundaries of innovation to the next level — far beyond what we experience today — is critical for the future and we believe silicon, optics and software are the technology levers that will deliver this outcome,” said David Goeckeler, executive vice president and general manager of the Networking and Security Business at Cisco.

“Cisco’s technology strategy is not about the next-generation of a single product area. We have spent the past several years investing in whole categories of independent technologies that we believe will converge in the future — and ultimately will allow us to solve the hardest problems on the verge of eroding the advancement of digital innovation. This strategy is delivering the most ambitious development project the company has ever achieved.”

Silicon One will be the foundation of Cisco’s routing portfolio going forward, with expected near-term performance availability up to 25 Terabits per second (Tbps). Cisco says it is the industry’s first networking chip designed to be universally adaptable across service provider and web-scale markets. Designed for both fixed and modular platforms, it can manage the most challenging requirements in a way that’s never been done before. The first Cisco Silicon One ‘Q100’ model surpasses the 10 Tbps routing milestone for network bandwidth without sacrificing programmability, buffering, power efficiency, scale or feature flexibility.

Traditionally, multiple types of silicon with different capabilities are used across a network and even within a single device. Developing new features and testing can be lengthy and expensive. Unified and programmable silicon will allow for network operators to greatly reduce costs of operations and reduce time-to-value for new services.

The new Cisco 8000 series is the first platform built with Cisco Silicon One Q100. It is engineered to help service providers and web-scale companies reduce the costs of building and operating mass-scale networks for the 5G, AI and IOT era. Key features include:

- Optimized for 400 Gbps and beyond, starting at 10.8 Tbps in just a single rack unit

- Powered by the new, cloud-enhanced Cisco IOS XR7 networking operating system software, designed to simplify operations and lower operational costs

- Offers enhanced cybersecurity with integrated trust technology for real-time insights into the trustworthiness of your critical infrastructure

- Service providers gain more bandwidth scale and programmability to deliver Tbps in even the most power and space constrained network locations

Cisco is also supporting Microsoft-developed SONiC (Software for Open Networking in the Cloud) OCP software in its 800 series routers.

Global Customer Deployments and Trials:

Cisco is working with a group of pioneering customers on deployments and trials of the Cisco 8000 Series. STC, the leading telecom services provider in the Middle East, Northern Africa region, marks the first customer deploying the new technology. Ongoing trials include Comcast and NTT Communications among others.

Testimonials:

“We look forward to working with Cisco as it enters the high-end routing silicon space, collaborating to help meet the next generation of network demands for higher speeds and greater capacity,” said Amin Vahdat, fellow and vice president of Systems Infrastructure, Google Cloud.

“Facebook has been a strong advocate for network disaggregation and open ecosystems, launching key industry initiatives such as the Open Compute Project and the Telecom Infrastructure Project to transform the networking industry,” said Najam Ahmad, vice president, Network Engineering at Facebook. “Cisco’s new Silicon One architecture is aligned with this vision, and we believe this model offers network operators diverse and flexible options through a disaggregated approach.”

“It’s aggregation through disaggregation,” said Scott Raynovich, founder and chief analyst of Futuriom. “Cisco clearly thinks the way to compete in web scale is to deliver its own optical platform with a vertically oriented system and a new, disaggregated OS — which also means it can protect profit margins by owning its own components. The cloud so far is being built on disaggregation — so it will be interesting to see how the market receives this.”

“Cisco is changing the economics of powering the Internet, innovating across hardware, software, optics and silicon to help its customers better manage the operational costs to function on a larger scale for the next phase of the Internet,” said Ray Mota, CEO and principal analyst at ACG Research. “As we move to 2020, the timing of delivering operational efficiency will be vital.”

…………………………………………………………………………………………………………..

Optics for 400G and Beyond:

Building a new internet that can support future digital innovation will depend on continued breakthroughs in silicon and optics technologies. Cisco is unique in the industry with advanced intellectual property in both areas.

As port rates increase from 100G to 400G and beyond, optics become an increasingly larger portion of the cost to build and operate internet infrastructure. Cisco is investing organically to assure our customers that as router and switch port rates continue to increase, optics will be designed to meet the industry’s stringent reliability and quality standards.

Through the company’s qualification program, Cisco will test its optics to comply with industry standards and operate in Cisco – and non-Cisco hosts. With this program, customers can utilize Cisco optics in applications where non-Cisco hosts have been deployed and have confidence that the optics will meet the reliability and quality standards that they have come to expect from Cisco.

In addition, as silicon and silicon photonics advance, functions that were traditionally delivered in separate chassis-based solutions will soon be available in pluggable form factors. This transition has significant potential benefits for network operators in terms of operational simplicity. Cisco is investing in silicon photonics technologies to effect architectural transitions in data center networks and service provider networks that will drive down cost, reduce power and space, and simplify network operations.

……………………………………………………………………………………………..

Cisco rival Juniper Networks announced a major reboot to its MX routing platform last year, which included new silicon—which gives Juniper’s MX routers a 50% increase in efficiency—more programmability and more chassis options, but Juniper isn’t able to match the breadth of Cisco’s Internet of the Future platform.

References:

https://newsroom.cisco.com/press-release-content?type=webcontent&articleId=2039386

https://www.fiercetelecom.com/telecom/cisco-makes-a-bold-play-silicon-space-bows-new-router-series