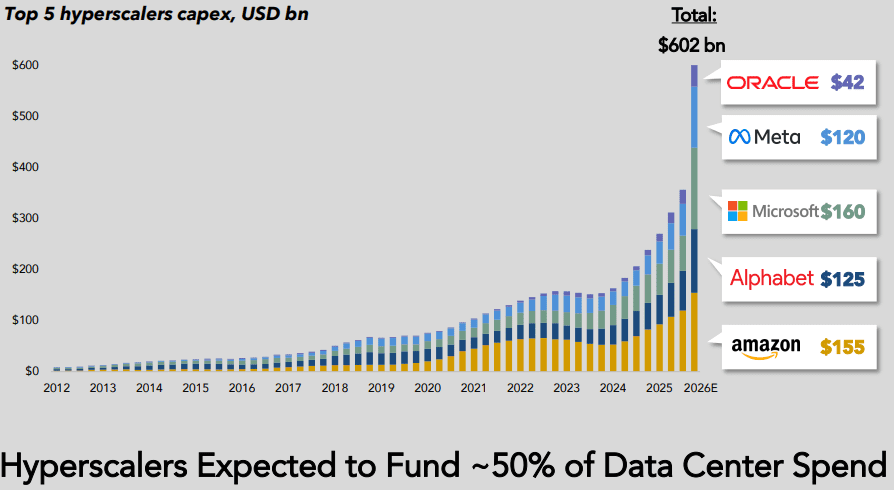

Hyperscaler capex > $600 bn in 2026 a 36% increase over 2025 while global spending on cloud infrastructure services skyrockets

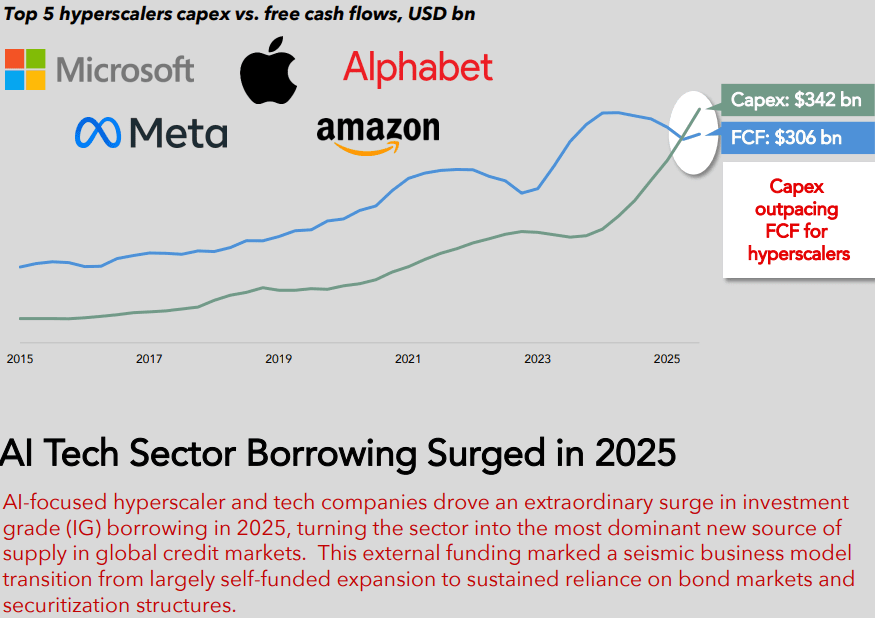

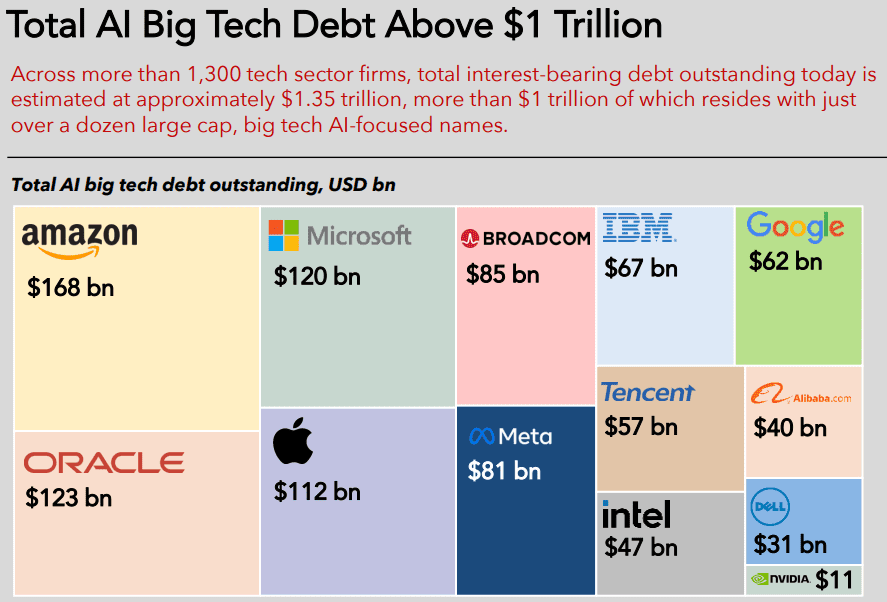

Hyperscaler capex for the “big five” (Amazon, Alphabet/Google, Microsoft, Meta/Facebook, Oracle) is now widely forecast to exceed $600 bn in 2026, a 36% increase over 2025. Roughly 75%, or $450 bn, of that spend is directly tied to AI infrastructure (i.e., servers, GPUs, datacenters, equipment), rather than traditional cloud. Hyperscalers are increasingly leaning on debt markets to bridge the gap between rapidly rising AI capex budgets and internal free cash flow, transforming historically cash-funded business models into ones utilizing leverage, albeit with still very strong balance sheets. Aggregate capex for “the big five”, after buybacks and dividends are included, are now above projected cash flows, thereby necessitating external funding needs.

……………………………………………………………………………………………………………………………………………………………………………………………………………………..

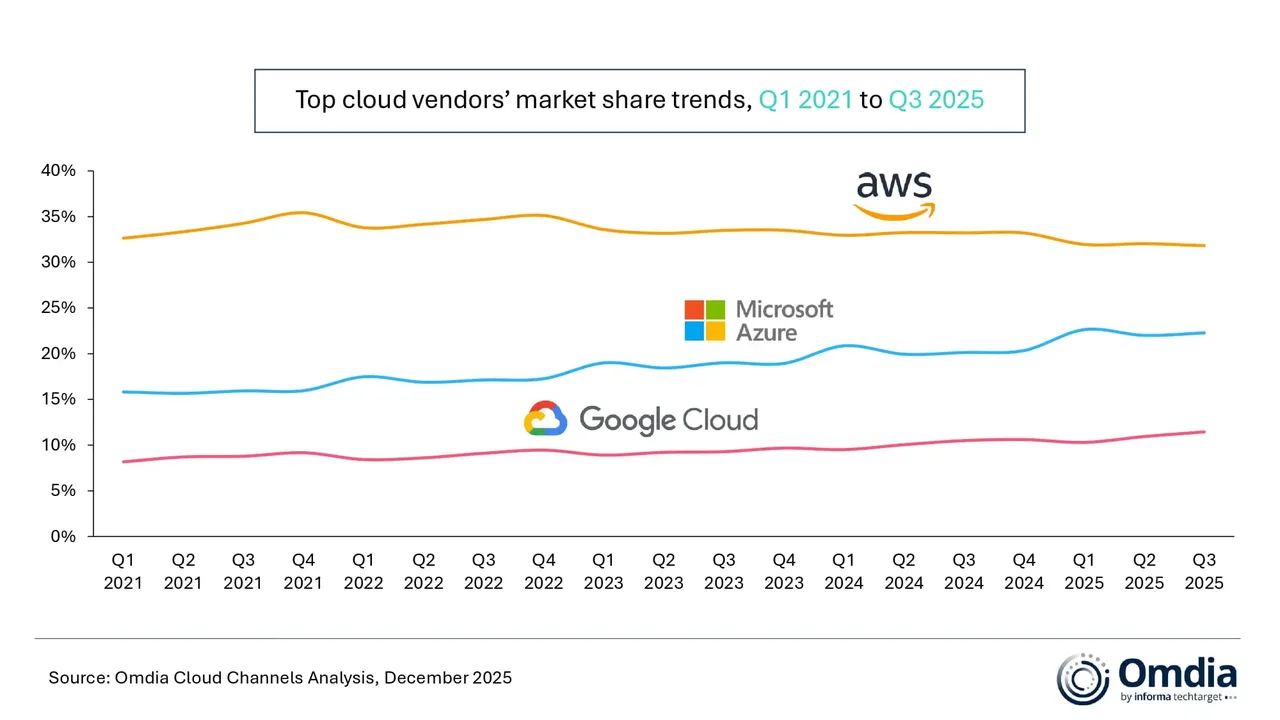

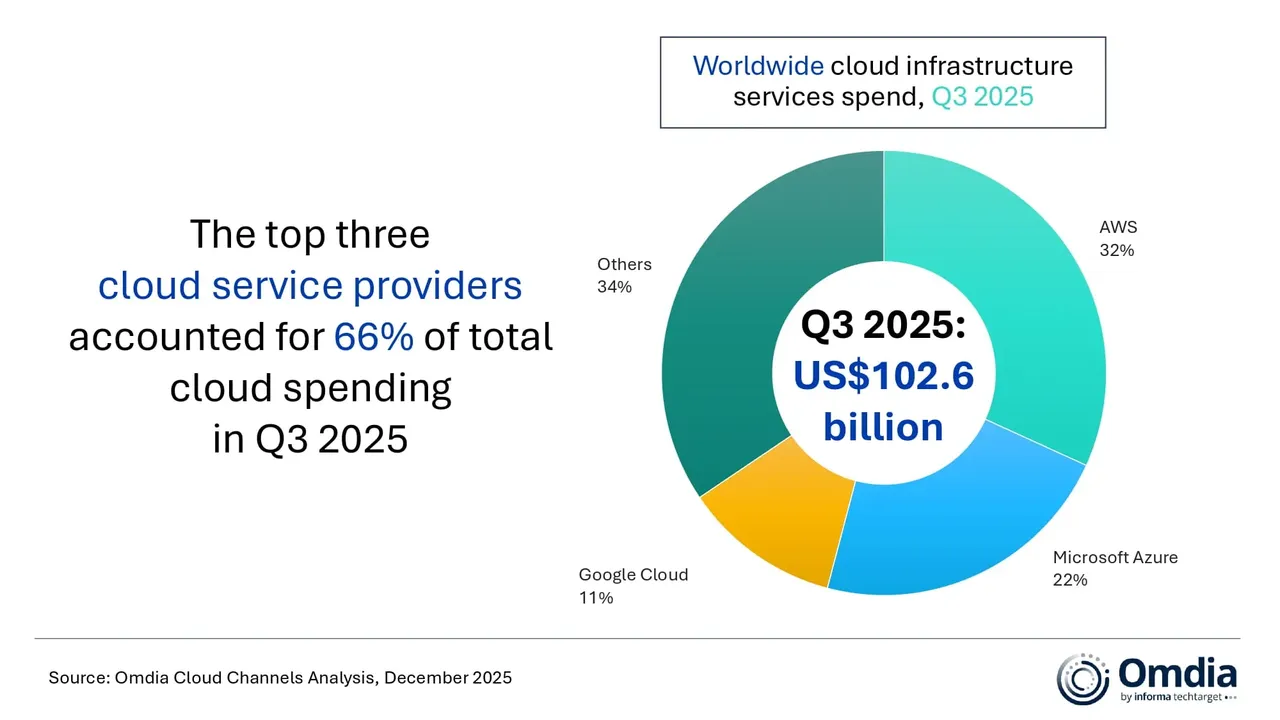

According to market research from Omdia (owned by Informa) global spending on cloud infrastructure services reached $102.6 billion in Q3 2025 — a 25% year-on-year increase. It was the fifth consecutive quarter in which cloud spending growth remained above 20%. Omdia says it “reflects a significant shift in the technology landscape as enterprise demand for AI moves beyond early experimentation toward scaled production deployment.” AWS, Microsoft Azure, and Google Cloud – maintained their market rankings from the previous quarter, and collectively accounted for 66% of global cloud infrastructure spending. Together, the three firms had 29% year-on-year growth in their cloud spending.

Hyperscaler AI strategies are shifting from a focus on incremental model performance to platform-driven, production-ready approaches. Enterprises are now evaluating AI platforms based not solely on model capabilities, but also on their support for multi-model strategies and agent-based applications. This evolution is accelerating hyperscalers’ move toward platform-level AI capabilities. According to the report, Amazon Web Services (AWS), Microsoft Azure, and Google Cloud are integrating proprietary foundation models with a growing range of third-party and open-weight models to meet these new demands.

“Collaboration across the ecosystem remains critical,” said Rachel Brindley, Senior Director at Omdia. “Multi-model support is increasingly viewed as a production requirement rather than a feature, as enterprises seek resilience, cost control, and deployment flexibility across generative AI workloads.”

Facing challenges with practical application, major cloud providers are boosting resources for AI agent lifecycle management, including creation and operationalization, as enterprise-level deployment proves more intricate than anticipated.

Yi Zhang, Senior Analyst at Omdia, said, “Many enterprises still lack standardized building blocks that can support business continuity, customer experience, and compliance at the same time, which is slowing the real-world deployment of AI agents. This is where hyperscalers are increasingly stepping in, using platform-led approaches to make it easier for enterprises to build and run agents in production environments.”

This past October, Omdia released a report forecasting that growth of cloud adoption among communications service providers (CSPs) will double this year. It also forecasted a compound annual growth rate (CAGR) of 7.3% to 2030, resulting in the telco cloud market being worth $24.8 billion.

………………………………………………………………………………………………………………………………………………………………………………………………………………………..

Editor’s Note: Does anyone remember the stupendous increase in fiber optic spending from 1998-2001 till that bubble burst? Caveat Emptor!

………………………………………………………………………………………………………………………………………………………………………………………………………………………..

References:

https://www.telecoms.com/public-cloud/global-cloud-infrastructure-spend-up-25-in-q3

https://www.telecoms.com/public-cloud/telco-investment-in-cloud-infrastructure-is-accelerating-omdia

AI infrastructure spending boom: a path towards AGI or speculative bubble?

Expose: AI is more than a bubble; it’s a data center debt bomb

Can the debt fueling the new wave of AI infrastructure buildouts ever be repaid?

AI spending boom accelerates: Big tech to invest an aggregate of $400 billion in 2025; much more in 2026!

Gartner: AI spending >$2 trillion in 2026 driven by hyperscalers data center investments

AI spending is surging; companies accelerate AI adoption, but job cuts loom large

Will billions of dollars big tech is spending on Gen AI data centers produce a decent ROI?

Big tech spending on AI data centers and infrastructure vs the fiber optic buildout during the dot-com boom (& bust)

Canalys & Gartner: AI investments drive growth in cloud infrastructure spending

Sovereign AI infrastructure for telecom companies: implementation and challenges

AI Echo Chamber: “Upstream AI” companies huge spending fuels profit growth for “Downstream AI” firms

Custom AI Chips: Powering the next wave of Intelligent Computing

KobeissiLetter tweet – US technology CapEx spend has been massive:

In 2025, tech CapEx as a % of GDP nearly matched the COMBINED scale of the largest capital projects of the 20th century. This comes as Big Tech CapEx rose to ~1.9% of GDP last year. By comparison, nationwide broadband development at the beginning of the century made up ~1.2% of GDP.

The rapid expansion of electricity in 1949, the Apollo Moon Landing project, and the Interstate Highway system in the 1960s each represented ~0.6% of GDP. The Manhattan Project to develop the first atomic weapons in the 1940s totaled ~0.4% of GDP.

https://x.com/KobeissiLetter/status/2009429665421885480

In 2025, investment in tech equipment and software had reached 4.4% of GDP, nearly as high as at the peak of the dotcom bubble (Chart 1). The five hyperscalers – Amazon, Google, Meta, Microsoft, and Oracle – had plans to add about $2 trillion of AI-related assets to their balance sheets by 2030. Given that AI assets typically depreciate at a rate of around 20% per year, this implied that the hyperscalers were facing an annual depreciation expense of $400 billion – more than their combined profits in 2025.

These capex plans still do not capture the full extent of the AI build-out. OpenAI alone had intended to spend $1.4 trillion on data centers, alongside the billions that Anthropic and xAI planned to undertake, and the additional billions in AI-related assets targeted by the emerging “neoclouds” – CoreWeave, Nebius, IREN, Lambda, and Crusoe.

https://www.bcaresearch.com/sites/default/files/2026-01/GIS_SO_2025_12_11_Sample_Report.pdf

Yann LeCun left his role as Meta’s chief AI scientist in late 2025, arguing that the capabilities of LLMs were limited. In his estimation, LLMs were great at regurgitating old knowledge but not so great at coming up with new knowledge. Supporting LeCun’s perspective, a study by METR found that experienced programmers who had access to AI took 19% longer to finish their tasks than those who did not