Author: Alan Weissberger

China’s CBN to use 700MHz for 5G network but needs a telco partner

China’s Ministry of Industry and Information Technology (MIIT) announced that it has repurposed the country’s frequency use plan for 700MHz spectrum in order to accelerate the development of 5G technology and to promote the effective use of spectrum resources.

Under the new plan, MIIT will abandon the current usage – 702MHz-to-798MHz for TV and radio and broadcasting – in favor of 703MHz-743MHz/758MHz-798MHz for FDD mobile communication systems. In its notification, the MIIT ruled that mobile systems operating in this band must not interfere with broadcasting or other services operating in the same or adjacent frequency bands. Further, to avoid interference, frequency migration, site relocation and equipment mediation of existing legal radio stations must be carried out. The costs of that will charged to the user(s) of the 700MHz mobile spectrum.

The spectrum in question is currently held by radio and TV broadcaster China Broadcasting Network (CBN), which is also known as China Radio and Television. It plans to use the airwaves in conjunction with its 4.9GHz spectrum to provide a suite of interactive TV services in the short term, and mobile communication (4G and 5G?) plus IoT services in the future.

CBN was a surprise new entrant to mobile when the MIIT issued 5G licenses in June 2019. The company, owned by the National Radio and Television Administration (NRTA), was set up just five years ago. It had total revenues last year of RMB78 billion (US$10.9 billion) — around a third of China Unicom’s and a fifth of China Telecom’s.

CBN began its first wireless network trial last October– a standalone 5G pilot network in central Shanghai, announced last week by the Shanghai city government.

According to broadcast industry website DVBCN, CBN is planning to build pilot networks in 15 or so major cities, such as Beijing, Tianjin and Nanjing.

May 21, 2020 Update:

China Broadcasting Network Corporation (CBN) and China Mobile said they would jointly build and share a 5G network and also collaborate in content and platform sharing.

For China Mobile and CBN, joint network investment and construction at a 1:1 ratio is just one part of their arrangement, which will continue until 2031.

They will jointly own and share the capacity, but China Mobile has committed to wholesaling capacity on its 2.6GHz 5G network to its smaller partner. In areas where the 700MHz band is not yet commercially available, it will open up its 2G and 4G networks.

China Mobile’s statement said while the two partners would retain their own brands, they would explore further joint efforts in areas such as products, operations and content and even in “channels and customer services.”

For China Mobile, which already has 260MHz of 5G spectrum in the 2.6GHz and 4.9GHz bands, the partnership adds to its spectrum inventory and in particular access to precious low-band frequencies.

https://www1.hkexnews.hk/listedco/listconews/sehk/2020/0520/2020052000370.pdf

………………………………………………………………………………………………………………………………………….

As in Shanghai, these will be standalone 5G networks in the 4.9GHz band. The company expects to deploy 200 basestations in each city at an estimated total cost of RMB2-3 billion ($279-419 million).

Table 1. China 5G spectrum allocation

| Operator | Assigned spectrum | Total | Shared spectrum |

| China Mobile | 2515-2675MHz | 160MHz | |

| China Mobile | 4800-4900MHz | 100MHz | |

| China Telecom | 3400-3500MHz | 100MHz | 3300-3400MHz (indoor) |

| China Unicom | 3500-3600MHz | 100MHz | 3300-3400 MHz (indoor) |

| China Broadcast Network | 703-798MHz | 80MHz | 3300-3400 MHz (indoor) |

| China Broadcast Network | 4.9GHz (trial) | TBD | |

| Source: MIIT | |||

Local China news outlet C114 writes that the new network operator (CBN) still needs to clear the spectrum and migrate existing radio and TV services to other frequencies, the cost of which was estimated to run to more than CNY10 billion (USD1.41 billion).

CBN, with income of around $11 billion from cable TV services, lacks the financial scale to build a national network and compete against three big telco incumbents.

CBN has business partners such as Alibaba and financial group Citic, but a partnership with a telco (like China Mobile) is needed to build out the network. The new network rollout cost is estimated to be at least 60 billion yuan (US$8.5 billion).

CBN may be able to reduce that expense through cooperation with cellular providers, though, with a senior China Mobile official quoted as saying that the two providers had communicated ‘to discuss the possibility of co-construction.’

………………………………………………………………………………………………………….

References:

https://www.lightreading.com/5g/china-releases-700mhz-for-5g/d/d-id/758667?

FCC to vote April 23rd to open up 1200 MHz of 6 GHz spectrum for WiFi

“The FCC is aiming to increase the supply of Wi-Fi spectrum with our boldest initiative yet,” Pai said today, “making the entire 6GHz band available for unlicensed use. By doing this, we would effectively increase the amount of spectrum available for Wi-Fi almost by a factor of five.”

The FCC noted that Pai’s draft order initially contemplates two classes of wireless transmissions making use of the 6 GHz band: indoor, low-power operations could use any frequency range within the 1,200 MHz spectrum, while standard power transmissions will be able to access 850 MHz of spectrum, while keeping away from previously permitted 6 GHz users.

Collectively, the 6 GHz channels add over two times more capacity to the FCC’s existing 480 MHz allocation of 5GHz spectrum. They will also give WiFi routers the flexibility to choose between a greater range of additional frequencies. Apart from decongesting existing network environments, including dense housing where multiple users and devices are competing for limited 2.4GHz or 5GHz spectrum, the 6 GHz frequencies might be used for high data rate applications, without the need to rely on shorter-distance millimeter wave spectrum. The FCC said today that it will seek public comments on allowing “very low-power devices” to access the full 1,200MHz of spectrum for “high-performance, wearable, augmented-reality and virtual-reality devices.”

“From Wi-Fi routers to home appliances, Americans’ everyday use of devices that connect to the Internet over unlicensed spectrum has exploded,” said FCC Chairman Pai. “That trend will only continue. Cisco projects that nearly 60% of global mobile data traffic will be off-loaded to WiFi by 2022. To accommodate that increase in Wi-Fi demand, the FCC is aiming to increase the supply of Wi-Fi spectrum with our boldest initiative yet: making the entire 6 GHz band available for unlicensed use. By doing this, we would effectively increase the amount of spectrum available for Wi-Fi almost by a factor of five. This would be a huge benefit to consumers and innovators across the nation. It would be another step toward increasing the capacity of our country’s networks. And it would help advance even further our leadership in next generation wireless technologies, including 5G.”

…………………………………………………………………………………………….

Expert Opinions:

Wi-Fi advocates say the bands currently used for Wi-Fi – the 2.4 and 5 GHz – do not offer enough to meet projected demands. They also say that the 6 GHz band offers super-wide channels, which are needed to carry traffic from a bunch of devices simultaneously, as well as to increase speed. Companies like Amazon, Facebook and Apple are eyeing the band for new devices, including wearables and wireless AR/VR headsets.

”Consumer advocates commend the FCC for its pathbreaking spectrum-sharing order,” said Michael Calabrese, director of the Wireless Future Project at New America’s Open Technology Institute, in a statement. “Opening the entire 6 GHz band for low-power, gigabit-fast Wi-Fi in every home, school, and enterprise will accelerate the availability and affordability of next-generation applications and services nationwide. Even the fastest fiber broadband internet service is useless for consumers without the Wi-Fi spectrum needed to connect all of our laptops, tablets, and smartphones.”

The Wi-Fi Alliance praised today’s FCC announcement while underscoring the growing importance of Wi-Fi. “Ensuring necessary unlicensed spectrum access is critical for Wi-Fi,” it said, “which now more than ever keeps us connected, supports our communications infrastructure, and delivers major economic benefits.”

While many Alliance members offered positive comments on the FCC news, Qualcomm CEO Steve Mollenkopf’s stood out as especially expansive regarding the 6 GHz spectrum’s potential.

“In February,we demonstrated a full suite of Wi-Fi 6E products ready to start using this large new swath of spectrum. We are also optimizing other exciting new technologies for this large swath of spectrum, including the next version of 5G and next generation Wi-Fi.”

A Qualcomm spokesperson noted that 5G NR-U will be optimized to take advantage of the “massive amount of spectrum” in the 6 GHz band.

As expected, the proposed re-allocation of spectrum is being opposed by broadcasters, utilities and other companies that currently use the airwaves in question, known as the 6 gigahertz band, for beaming video signals or monitoring electric grids.

T-Mobile US Inc. and other telecommunications wireless carriers would also lose out. They had hoped to win exclusive rights to some of the airwaves as they build out cellular 5G networks.

……………………………………………………………………………………………..

Conclusions:

FCC approval isn’t guaranteed as a result of the April 23rd vote, but it’s likely, as three of the five commissioners — including Pai — tend to vote in lock step. The Wi-Fi Alliance has said that 6GHz-compatible WiFi 6 devices will be ready to go relatively quickly after approval is finalized.

“Once all the rules are in place, products can move relatively quickly,” Blair Levin, an analyst at New Street Research, wrote in a note to his firm’s clients this week about the expected FCC move.

…………………………………………………………………………………………………….

Addendum – FCC Commissioner O’Rielly released the following statement on April 1st:

I am grateful that Chairman Pai has circulated an item to allow sharing between unlicensed services and incumbent providers in the 6 GHz band. Having worked for most of my professional career on unlicensed service issues and having taken on the lead advocate role for 6 GHz, I am extremely pleased that we have finally reached this point. It’s been a long and winding road.

Today’s item effectively concludes some of the substantive debates and will end some extraneous noise surrounding our approach. While I look forward to reading the specifics, it appears very consistent with my emphatic support for protecting incumbent users while permitting varied unlicensed services within the band.

Specifically, higher powered unlicensed services will be allowed in the band using a slimmed-down automated frequency coordination (AFC) regime, while low power indoor (LPI) use, which probably could use a closer review and improvements to its technical rules over the next couple weeks, will be allowed throughout the band without an AFC.

Although it initially settles on certain lower power limits for LPI use, the further notice will explore increasing these limits, as well as setting workable power limits and more specifics to effectuate very lower powered (VLP) unlicensed devices. “Over the last few years, I have heard from entrepreneurs and innovators discussing how dramatic the impact would be of unleashing such a large unlicensed allocation with seven 160 megahertz channels. I can’t wait to see, and use, the new services and ideas brought forward because of our work here.

Today’s action to permit all 1200 megahertz of the band to be used for unlicensed services means that proposals to license portions of the band were not accepted. I fully support this outcome, but I also remain fully committed to identifying other mid-bands for licensed services. Simply put, U.S. wireless providers must have more mid-band spectrum to meet consumer demand, and I will fight to refill the spectrum pipeline for future licensed wireless services.

This effort is absolutely vital to preserving U.S. leadership in wireless technology and to alleviate the demands being placed on existing networks. I firmly believe that the most likely candidate bands for this purpose are Federal spectrum allocations, such as the 3.1 to 3.55 GHz band, that can be converted to commercial use.

I look forward to discussing this draft with interested parties in the coming weeks, and I will go out on a limb to predict a unanimous vote from my colleagues.

https://docs.fcc.gov/public/attachments/DOC-363454A1.pdf

……………………………………………………………………………………………………………………………………………..

April 23, 2020 UPDATE:

FCC to open up 6 GHz band for unlicensed use – boon for WiFi 6

References:

https://www.fcc.gov/document/chairman-pai-proposes-new-6-ghz-band-rules-unleash-unlicensed-use

FCC sets 6GHz Wi-Fi vote for April 23, opening door to Wi-Fi 6E

https://www.wsj.com/articles/fcc-moves-to-boost-wi-fi-speed-11585763721

https://www.fiercewireless.com/regulatory/fcc-sets-all-1-200-mhz-motion-for-6-ghz-unlicensed

The New T-Mobile (with Sprint): Merging incompatible 3G networks and integrated 5G

At long last, T-Mobile closed its $23 billion acquisition of Sprint today (April 1, 2020) after a two-year effort to merge the two companies. The New T-Mobile also replaced long-time uncarrier CEO (cowboy) John Legere with his hand-picked successor Mike Sievert. T-Mobile now takes its place as an equal among the three major wireless carriers in the US.

The deal was the subject of protracted legal actions, opposition by 11 state attorney generals, lobbying before the FCC and the Justice Department, and other actions as consumer groups tried to find a way to block it.

The merger required Sprint to divest itself of Boost Mobile and the remains of Virgin Mobile, and it required a number of commitments by T-Mobile not to raise prices for three years, and to provide widespread wireless broadband. T-Mobile also had to help Dish Networks become a competitive wireless company as a way to quell fears that the merger would leave the U.S. with only three wireless telcos instead of four.

“During this extraordinary time, it has become abundantly clear how vital a strong and reliable network is to the world we live in. The New T-Mobile’s commitment to delivering a transformative broad and deep nationwide 5G network is more important and more needed than ever and what we are building is mission-critical for consumers,” said Mike Sievert, president and CEO of T-Mobile. “With this powerful network, the New T-Mobile will deliver real choice and value to wireless and home broadband customers and double down on all the things customers have always loved about the Un-carrier. T-Mobile has been changing wireless for good — and now we are going to do it on a whole new level!”

Sievert continued, “All of us at T-Mobile owe John an incredible thank you for everything he’s done to get this company to where we are today. He has changed what it means to be a CEO. Everything that T-Mobile has accomplished is the result of his vision for what a different kind of wireless provider could be. John IS what the Un-carrier is all about: advocating for customers at every turn, forcing us to think differently and always driving for more. He has always pushed the boundaries of what’s possible and pushed us to do the same. His leadership has made us what we are today, and we will take that into the future. Thank you, John, for everything you’ve done for wireless consumers and for our beloved employees!

I also want to thank Marcelo Claure and the entire Sprint leadership team for their hard work to get us to this huge day! We did it!… and I’m looking forward to welcoming Sprint employees into Team Magenta, and to working with you now as a member of our Board of Directors.”

This quantum leap forward can only be achieved by using T-Mobile and Sprint’s combined low-, mid- and high-spectrum bands — and only the New T-Mobile will have the resources to do it quickly.

- The network will have 14 times more capacity in the next six years than T-Mobile alone has today, enabling the New T-Mobile to leapfrog the competition in network capability and experience.

- Customers will have access to average 5G speeds up to eight times faster than current LTE in just a few years and 15 times faster over the next six years.

- Within six years, the New T-Mobile will provide 5G to 99% of the U.S. population and average 5G speeds in excess of 100 Mbps to 90% of the U.S. population.

- New T-Mobile’s business plan is built on covering 90% of rural Americans with average 5G speeds of 50 Mbps, up to two times faster than broadband on average.

“The network is at the core of everything we do as a business, and it’s critically important for keeping customers connected to each other, their communities and the world,” said Neville Ray, president of Technology at T-Mobile. “The supercharged 5G network that we’ll build as a combined company will be a huge step forward, transforming wireless, fueling innovation and delivering new experiences for customers all across the country that we can’t even imagine today.”

Impact on Users:

For users, the merger will initially be a non-event. Sprint is now a subsidiary of T-Mobile and will operate as a separate company. The transition will occur in stages, and while T-Mobile isn’t commenting on that, a highly placed source at T-Mobile said on background that customers of both companies will find that they have access to the other’s network in areas where they need better coverage.

However, many Sprint 3G devices (CDMA) can work on the T-Mobile’s 3G network (GSM), especially for voice calls or if 4G LTE mobile data access is not available. T-Mobile plans to use the model it used when it acquired MetroPCS, which was also an incompatible network. In that merger, T-Mobile replaced incompatible handsets as the old network was decommissioned.

…………………………………………………………………………………………………..

Pundits Weigh In:

Keith Pennachio, EVP and chief strategy officer at SQUAN, a network infrastructure company serving both T-Mobile and Sprint, said that he expects to see growth in network infrastructure. “We’ll see network consolidation, networks convergence for some sites and for moving traffic,” he said.

“I expect T-Mobile to take advantage of spectrum assets where T-Mobile didn’t have assets previously,” Pennachio said. “What you’ll start to see in markets where Sprint had a decent footprint, T-Mobile may opt to supplant some equipment to their own.” This will mean that in areas where T-Mobile didn’t have a great signal, the company will use Sprint’s sites and frequencies to improve things.

As the merger progresses, T-Mobile will update the programming on some cell sites so that Sprint customers with compatible phones will be able to use them. T-Mobile will also begin using Sprint’s 2.5 GHz mid-band spectrum to build out its network.

“I think they’re going to be very busy integrating the business, the networks and the employees,” said Brandon Parris of Morrison & Foerster, “and start in earnest their upgrades and their focus on 5G.” Parris led the team that advised Sprint and and its owner Softbank on the merger with T-Mobile.

“Whenever you have two huge industry giants it takes time,” Parris explained, “but they will go through the process of making sure the technology is integrated, and then adding 5G. You have to integrate everything from office space to compensation arrangements. It’s huge undertaking.”

………………………………………………………………………………………………

Deploying 5G:

According to a FAQ press release, “the new T–Mobile will build a transformative nationwide 5G network that will drive innovation and connect every American. With T–Mobile’s low-band, Sprint’s mid-band, and other spectrum, the highest capacity nationwide network in U.S. history will be built—400MHz+ on average nationwide.”

T-Mobile is starting its 5G buildout “almost immediately”

T-Mobile has long said that the primary driver for its merger with Sprint is its desire to combine its 600MHz spectrum with Sprint’s 2.5GHz spectrum for a 5G network. Indeed, in its press release Wednesday the New T-Mobile promised its forthcoming network would have 14 times more capacity in the next six years than T-Mobile alone has today. The operator added that it expects to provide average 5G speeds above 100Mbit/s to 90% of the US population within the next six years.

In comments to CNBC, incoming CEO Sievert said the operator is going to start on the construction of the network “almost immediately.” He said the company would use equipment from its existing suppliers Nokia and Ericsson to build “the world’s best 5G network.”

A key factor in in the integration of the two networks, will be the speed at which T-Mobile can begin rolling out its use of Sprint’s mid-band spectrum, which is critical to its 5G success.

While T-Mobile already has nationwide 5G with its 600 MHz low-band frequencies that feature much longer range than can exist in higher bands, the low bands have lower speeds. Mid-band spectrum is considered a perfect compromise between the speeds in the millimeter wave bands and the lower speeds in the low bands.

“With its lead in customer care and cost of service, T-Mobile is well positioned to bring that winning culture to its new family members, both the employees of Sprint as well as its customers,” said Ian Greenblatt, TMT head at J. D. Power. “The only 5G nationwide network is notable (despite being 600MHz only – it’s still faster than the fastest 4G-LTE) and will be even more capable with the addition of Sprint’s mid-band spectra.”

CTO Neville Ray told CNET that the operator would turn on its new 5G network first in Philadelphia, and that other cities would go live “rapidly” in the coming weeks.

Conclusions:

According to Pennachio, T-Mobile’s culture will play a critical role in the success of the merged companies. “The culture of T-Mobile is very different,” he said. “Now it creates this third competitor that’s strong from a spectrum but with a culture that’s more in line with technology companies.”

T-Mobile’s “in your face” culture, which has been compared with that at many Silicon Valley startups, could play a significant role in how the company impacts the wireless business.

………………………………………………………………………………………………..

References:

https://www.t-mobile.com/news/t-mobile-sprint-one-company

https://www.t-mobile.com/support/account/t-mobile-sprint-merger-faqs

https://www.lightreading.com/5g/the-eight-new-things-we-learned-about-new-t-mobile/d/d-id/758625?

Europe and U.S. to delay 5G deployments; China to accelerate 5G

Up until the COVID-19 pandemic hit the world hard in late February, 5G seemed a priority for most wireless network operators. Now, with across the board cutbacks everywhere, it will be much further down the must do list for 2020.

In the absence of any new 5G applications or completion of 3GPP 5G Phase 2 and ITU-R IMT 2020, 5G was not expected to ramp this year, despite ridiculous hype and false claims (especially ultra low latency which has not yet been specified let alone standardized yet).

Now the new technology faces an unprecedented slow down to launch and expand pilot deployments. Why? It’s because of the stay at home/shelter in place orders all over the world. Non essential business’ are closed and manufacturing plants have been idled. Also, why do you need a mobile network if you’re at home 95% of the time?

One reason to deploy 5G is to off load data (especially video) traffic on congested 4G-LTE networks. But just like the physical roads and highways, those 4G networks have experienced less traffic since the virus took hold. People confined to their homes need wired broadband and Wi-Fi, NOT 4G and 5G mobile access.

“5G deployment in Europe will certainly be delayed,” said Eric Xu, one of Huawei’s rotating CEOs, during a Huawei (private company) results presentation today. Xu also told reporters the delays could last until “the time when the pandemic is brought under control.”

Huawei’s Eric Xu said the current crisis would “certainly” delay 5G rollouts

………………………………………………………………………………………………………..

Answering questions about its annual report, published on Tuesday, Huawei vice-president Victor Zhang said there would “definitely” be an impact but it would likely be worse in Europe than in the UK.

A few data points from European telcos in the aftermath of COVID-19:

- On March 20, the UK’s BT reported a 5% drop in mobile data traffic, compared with normal levels.

- Today, Belgian incumbent Proximus said capital expenditure would go down this year to offset the impact of COVID-19 on profits.

- A growing number of European countries are delaying 5G spectrum auctions, as restrictions related to the Covid-19 pandemic make it difficult to maintain planning. The EU’s deadline of June for the release of the 700 MHz band for 5G will be missed by several countries, including Spain and Austria.

- In Portugal, MEO, NOS and Vodafone Portugal now face a further wait for frequency rights in the 700MHz, 900MHz, 1800MHz, 2.1GHz, 2.6GHz and 3.6GHz bands

- German company United Internet’s CEO, Ralph Dommermuth, said that the construction of subsidiary 1&1 Drillisch’s 5G network would experience delays due to current measures adopted in the country to prevent a further spread of the COVID-19 pandemic in Germany, local paper Handelsblatt reported.

- In Sweden, which has controversially avoided a total lockdown, telecom incumbent carrier Telia has now cut dividends as it prepares for a hit.

Huawei’s statements imply the U.S. will also face a delay in 5G rollouts. It has overtaken Italy as the country with the highest number of coronavirus infections, and its response to the outbreak has been lackluster and confusing at best, horrendous at worst.

As a mobile-only network equipment vendor, Ericsson looks the most exposed to a 5G slow down. More than 50% of its business is generated in Europe and the Americas, where the rate of COVID-19 infections is rising.

Although less reliant on the 5G wireless base station business than Ericsson, Nokia could also be in trouble due to the slowdown in 5G deployments. Approximately 30% of its sales came from North America last year, and another 28% from Europe.

…………………………………………………………………………………………….

“After the pandemic was brought under control, China has accelerated its 5G deployments,” according to Huawei’s Xu.

China has accelerated its own 5G deployment after the number of cases of Covid-19 subsided, according to Xu, but in other countries, it would depend “on several factors”, including whether telecoms companies had the budget and resources to “win back the time” lost.

Indeed, China Mobile this week awarded 5G contracts worth $5.2 billion with approximately 90% of the contracts going to Huawei and ZTE. Ericsson won contracts worth RMB4.2 billion ($593 million) and small local vendor CICT will net RMB965 million ($136 million). Nokia reportedly bid, but failed to win any of the contracts from China Mobile.

This centralized procurement involves 28 China provinces, autonomous regions and municipalities directly under the central government. According to C114, the total demand is 232,143 5G base stations. At the end of February, the number of 5G base stations owned China Mobile has exceeded 80,000.

References:

https://www.bbc.com/news/technology-52108172

https://www.lightreading.com/5g/covid-19-will-help-china-to-extend-its-5g-lead/d/d-id/758596?

https://www.lightreading.com/5g/5g-auctions-delayed-across-europe-due-to-covid-19/d/d-id/758606?

…………………………………………………………………………………………………

9 April 2020 Update:

5G is looking like a casualty of COVID-19

All 5G companies had accomplished was the design of a technology that provides faster connections and additional capacity on smartphone networks. A few have already been launched, and South Korea, the most advanced market, already has millions of subscribers. Yet local news reports suggest many have been underwhelmed by the 5G experience. For service providers, it has had minimal impact on sales while marketing and rollout costs have made a huge dent in profits.

This will discourage 5G investment in countries under COVID-19 lockdown. As customers downgrade to cheaper services and dump TV sports packages rerunning last year’s highlights, many operators will cut spending. Concerned about exposing field workers to unnecessary health risks, they will prioritize the maintenance of networks already used by the majority. Moreover, people confined to their broadband-equipped homes for most of the day have little use for mobile data networks. Any additional investment is likely to go into fiber-optic equipment.

5G launches will also be delayed in European markets that have postponed auctions of the spectrum needed to support services. Austria, the Czech Republic, France, Portugal and Spain are all now reported to have delayed auctions. Without spectrum, 5G will obviously not fly.

Fear mongering stories linking 5G to illness could also hinder rollout. Countries such as Belgium and Switzerland have imposed limits on the use of 5G antennas amid lingering concern that radiofrequency emissions are carcinogenic. The World Health Organization says mobile frequencies are too low to be dangerous, but activists are unconvinced.

In the UK, operators now have to contend with the ludicrous suggestion that 5G networks transmit COVID-19. After misinformed tweets by celebrities including Amanda Holden, a British actress and reality-TV regular, 5G masts were burnt in the cities of Belfast, Birmingham and Liverpool.

China, meanwhile, remains determined to erect more than half a million 5G base stations by the end of this year. Claiming to have beaten COVID-19, it has lifted restrictions on the movement of people and reopened its factories. For the equipment makers building those 5G networks, this investment program could be essential medicine. Just last month, China Mobile, the country’s largest operator, awarded 5G contracts worth $5.2 billion. Unfortunately, with almost 90% of the work going to domestic suppliers Huawei and ZTE, Western vendors will not be able to count on China for a boost.

https://www.lightreading.com/5g/5g-is-looking-like-a-casualty-of-covid-19/a/d-id/758804?

SK Telecom is 5G market leader after one year of 5G service in Korea

SK Telecom today announced its 5G milestones achieved over the past year since launching the world’s first 5G service on April 3, 2019, along with its plans going forward.

According to the (South) Korean Ministry of Science and ICT released in January 2020, SK Telecom has established itself as the leader in the 5G market with around 2.22 million subscribers and 44.7% market share. With its strong performance in 5G, SK Telecom continues to maintain the unrivaled market leadership it secured since launching the 2G service in (South) Korea.

…………………………………………………………………………………………………………

SK Telecom has increased customers’ 5G experience and acceptance by creating around 70 5G Clusters* in key commercial districts and densely populated areas throughout the nation. To date, around 1 million customers visited 5G Clusters to experience differentiated 5G services including ‘Jump AR Zoo’ and ‘5G LoL Park.’

*5G Clusters are built with more base stations than other 5G coverage areas to offer optimal 5G environment for services like AR and VR.

……………………………………………………………………………………………………

Highlights:

- Since launching the world’s first 5G service on April 3, 2019, the company continues to maintain its leadership in the Korean mobile market backed by 44.7% 5G market share

- Over the past year, the company expanded its business to new areas by leveraging its strength in 5G

- SK Telecom also pronounced its plans to offer the best 5G services through hyper-collaboration

- Its plans include delivering new customer experience through mobile cloud gaming services, mixed reality contents and quantum-safe mobile devices; expanding enterprise business such as 5G MEC-based cloud business and 5G smart factory; and strengthening its 5G network by building more 5G Clusters and expanding 5G network coverage

According to SK Telecom’s analysis on 5G subscribers, people in their 30s and 40s are taking up 53% of the company’s total 5G subscriber base, which is significantly higher than the proportion of people in their 30s and 40s in total LTE subscriber base, which currently stands at 32%.

The total amount of data consumption of SK Telecom’s 5G subscribers reached 62,000 TB on average per month over the past three months (Dec. 2019 ~ Feb. 2020). During the same period, the average monthly data usage of subscribers who switched devices from LTE to 5G has increased about twofold from 14.5 GB (LTE) to 28.5 GB (5G) per person.

SK Telecom’s 5G subscribers are found to be using media services, which generally require greater speeds and bandwidths, much more actively than LTE subscribers. As of February 2020, 5G subscribers are using 7 times more VR services, 3.6 times more video steaming services and 2.7 times more game apps than LTE subscribers.

Moreover, armed with its strong capabilities in 5G, SK Telecom has successfully expanded into new business areas. The company is cooperating with Microsoft and Amazon Web Services in the area of cloud, and has ventured into the U.S. next-generation broadcasting (ATSC 3.0) market with Sinclair Broadcast Group.

SK Telecom also shared its experience and knowhow in 5G with other mobile operators across the globe including Deutsche Telekom, Taiwan Mobile and IT&E.

Going forward, SK Telecom aims to earn the title of the world’s best 5G service provider through hyper-collaboration with strong global companies. At CES 2020, SK Telecom’s President and CEO Park Jung-ho suggested “Hyper-Collaboration” with diverse Korean ICT companies to achieve innovations in areas including artificial intelligence.

For consumers, SK Telecom will focus on providing differentiated 5G services that innovate user experience through borderless collaboration with diverse ICT companies including cloud service providers, device manufacturers and telecommunications companies.

SK Telecom will continue to work closely with Microsoft to prepare mobile cloud streaming games and will also open ‘Jump Studio,’ a mixed-reality content production facility.

SK Telecom and Microsoft are currently providing 92 different games through Project xCloud. Cloud gaming service is being highlighted as the ‘game changer’ that will shift the paradigm in the gaming industry by enabling users to play high quality, premium games anywhere, anytime by accessing the cloud server.

Jump Studio will provide solutions that enable the creation of 3D content like holograms by combining the technological strengths of augmented and virtual reality technologies. SK Telecom expects Jump Studio to accelerate the popularization of realistic media by significantly reducing time and cost for content creation.

SK Telecom plans to release mobile device applied with global leading quantum cryptography technologies and provide advanced security solutions to 5G users.

In B2B, SK Telecom announced its vision of expanding the enterprise business in full scale by marking 2020 as the first year of its B2B business. To this end, the company will work closely with companies of diverse industries to serve as a catalyst for industrial innovations in Korea.

SK Telecom plans to build 5G MEC (Mobile Edge Computing) Centers in 12 different locations across Korea to lead a cloud-driven industrial revolution. To this end, the company is preparing to launch nationwide 5G edge cloud service by joining hands with global leading cloud companies such as Amazon Web Services and Microsoft.

5G edge cloud, once commercialized, will provide ultra-low latency connectivity for services like unmanned delivery robots and telemedicine, thereby bringing unprecedented changes to all industries including manufacturing, distribution and healthcare.

Moreover, SK Telecom plans to deploy a private 5G network at SK Hynix’s semiconductor manufacturing facility to realize 5G smart factory that can lead to a supercycle in the semiconductor industry. The company is planning to add cutting-edge ICT including AI video analytics and AR technology to its 5G network.

SK Telecom is also cooperating with Korea Hydro & Nuclear Power (KHNP) to realize 5G smart power plant. It will first upgrade real-time drone monitoring system for dams, remote water level monitoring system, and situation sharing system by applying private 5G network and quantum cryptography technologies to KHNP’s hydro-electric/ pumped storage power plant.

Furthermore, the company will continue to work closely with Seoul Metropolitan Government to accelerate the C-ITS (Cooperative Intelligent Transportation System) project by applying Road Learner, which consists of 5G ADAS (Advanced Driver Assistance System) and Live HD Map Update solution. 5G ADAS and Live HD Map Update solution are key technologies for autonomous driving as 5G ADAS improves driving safety through features including lane departure warning and forward collision avoidance, and Live HD Map Update solution reflects road situations to HD maps in real time.

In 2020, SK Telecom will bring the total number of its 5G Clusters to 240 and expand 5G coverage to neighborhoods (‘dong’) of 85 cities nationwide by working closely with telecommunications equipment manufacturers.

The company will also secure indoor coverage for a total of 2,000 buildings, including not just airports, department stores and large shopping malls but also small-to medium-sized buildings, by applying its sophisticated 5G in-building solutions.

“SK Telecom was able to secure new business opportunities ahead of others by achieving the world’s first 5G commercialization,” said Ryu Young-sang, Vice President and Head of MNO Business of SK Telecom. “We are confident that the 5G business models to be launched this year will drive the company’s growth over the next decade.”

………………………………………………………………………………………………………….

About SK Telecom:

SK Telecom is Korea’s leading ICT company, driving innovations in the areas of mobile communications, media, security, commerce and mobility. Armed with cutting-edge ICT including AI and 5G, the company is ushering in a new level of convergence to deliver unprecedented value to customers. As the global 5G pioneer, SK Telecom is committed to realizing the full potential of 5G through ground-breaking services that can improve people’s lives, transform businesses, and lead to a better society.

SK Telecom boasts unrivaled leadership in the Korean mobile market with over 30 million subscribers, which account for nearly 50 percent of the market. The company now has 47 ICT subsidiaries and annual revenues approaching KRW 17.8 trillion.

For more information, please contact [email protected] or [email protected].

Media Contact

Yong-jae Lee

SK Telecom Co., Ltd.

(822) 6100 3838

………………………………………………………………………………………………….

Local carriers SK Telecom, KT and LG Uplus had initially launched limited 5G commercial services in December 2018 as part of an agreement with the ICT ministry to launch simultaneously to avoid excessive competition. SK Telecom, KT and LG Uplus initially offered the 5G service in limited areas in Seoul.

Highlights of Heavy Reading’s 5G Network Operator Survey

5G Deployment Timelines & Services (from Heavy Reading’s 5G report), Author: Gabriel Brown, Principal Analyst, Mobile Networks & 5G, Heavy Reading

Key Findings:

• On a 2-year view, 41% of respondents said “faster end user speeds” is the primary driver for 5G, up from 33% in Heavy Reading’s 2019 survey. Over a 5-year view, the ability to “address new markets & services” climbs to first place in the ranking, with 42%. Operators appear to see 5G technology investment as focused on evolving their current service strategies in the near term and becoming more ambitious in the medium term.

• Heavy Reading asked when operators think more than 25% of their subscriber base will have a 5G device. 50% of respondents expect this to be the case by the end of 2022, up slightly from 45% in our 2019 survey. This looks like a bullish view at first glance, but it is in line with Omdia’s independent estimate of 28% 5G penetration in the U.S. during the same timeframe.

• Over a 3-year view, operators expect some differences between their 4G and 5G service portfolios, but not major ones. 43% said their company will offer a “very similar services portfolio” while a comparable 45% believe their portfolio will offer “mostly common services, with some 5G-only services.” Only 8% expect to offer “many 5G-only services.”

As was the case in the 2019 survey, Heavy Reading asked respondents to identify the primary drivers for 5G deployment over 2- and 5-year time horizons.

On a 2-year view, the large st group (41%) said “faster end user speeds” is the primary driver for 5G, up from 33% in 2019. “Addressing new markets and services” comes second with 28%. “System capacity and efficiency” (16%) and “competitive reasons” (16%) bring up the rear, both with reduced support relative to our 2019 survey.

These results fit with how operators tended to market 5G in 2019 – namely, on downlink speed and gigabit performance claims.

Over a 5-year view, the ability to “address new markets and services” climbs to first place in the ranking at 42%, significantly above all other scores. Operators clearly see 5G investment as focused on how advanced technology capabilities can be translated into compelling services over

the medium term.

“ULTRA-RELIABLE LOW LATENCY COMMUNICATION (URLLC) SERVICES ARE ONE OF THE DEFINING FEATURES OF 5G. URLLC REQUIREMENTS WERE INFLUENTIAL IN THE DESIGN OF THE 5G SYSTEM AND AIR INTERFACE.”

Editor’s Note:

It remains to be seen if URLLC capabilities will be finalized in 3GPP Release 16 (June 2020) and included in the first ITU IMT-2020 standard.

…………………………………………………………………………………………………..

…………………………………………………………………………………………………………….

In terms of 5G devices, 50% of respondents expect 25% or more of their subscriber base to have a 5G-compatible handset by the end of 2022. At first glance, this looks like a bullish view, and it is up slightly from Heavy Reading’s 2019 survey. This positive view on 5G adoption perhaps reflects better knowledge of, and greater confidence in, 5G device and chipset development timelines. It also possibly echoes analyst upgrades to 5G device estimates made by research firms across the board in 2019 and widely reported in the media.

For example, the result is in line with Omdia’s independently produced estimate of 28% 5G penetration in the U.S. during the same timeframe. A critical factor is handset replacement cycles for smartphones, which have lengthened in most developed markets in the past few years. In some markets – like China and South Korea – there is evidence that 5G can drive an acceleration in handset upgrades. But this is not a universal phenomenon; for instance, there is not yet good evidence of this in Europe and the U.S.

This may be because first-generation 5G devices tend to come with compromises (e.g., on power consumption, cost, and bugs). Looking into 2020 and 2021, newer handset models at high- and mid-tier prices will become available in volume. For example, a 5G iPhone – rumored for late 2020 – will be important, particularly in the U.S., where iPhone market share is high. As established earlier, over a 5-year view, operators see 5G addressing new markets and driving advanced services (Fig 7). sought insight into the differences between 5G and 4G service portfolios over a 3-year view.

A fair summary would be that operators expect some differences, but not major ones. A large 43% said their company will offer a “very similar services portfolio” for 4G and 5G users, while a comparable 45% believe their portfolio will offer “mostly common services, with some 5G-only services.” Only 8% expect to offer “many 5G-only services.”

In part, this result may reflect that 5G deployed in non-standalone (NSA) mode makes existing 4G services faster rather than fundamentally different. As discussed later, it may be that a transition to standalone (SA) is a prerequisite for service innovation.

Telecom data traffic in Cuba grows 10% due to COVID-19; Free access to EnZona e-commerce platform

Cuba state owned telecom company ETECSA president Mayra Arevich posted on her Twitter account @MayraArevich on Thursday:

“The traffic growth for (last) three days is more than 10% of additional volume on our networks”

The ETECSA official also urged not to use large volumes of data on the mobile network so that the traffic capacity can be shared among all, after noting that navigation requires seven times more resources than voice calls.

“To think as a country is to maintain the stability of our systems to guarantee services to our population. We advise you not to use large volumes of data on the mobile network, so that the traffic capacity can be shared among all,” said the executive president of the state enterprise, Mayra Arevich, quoted by the official Cubadebate site.

These (voice calls) guarantee the fundamental communications with the emergency services and our health system,’ Arevich wrote in another tweet quoted Friday by Cuba’s Granma newspaper after social media were flooded with requests for the telephone company to lower rates.

ETECSA guarantees voice/data network stability at this time of constant surveillance on the coronavirus pandemic, with which more than 465,000 people have already been infected in 200 countries, she said.

Cuba Communications Minister Jorge Luis Perdomo said this Thursday that the measures to fight coronavirus were conceived with integrity.

On Friday, Mayra Arevich Marín tweeted: “Starting today, March 27, 2020, you can access the #EnZona platform, an e-commerce application, which together with #Transfermóvil are the forefront of computerization in our society, free of charge.”

Nikkei Asian Review: Apple to delay 5G iPhone, but no opportunity lost

Apple will likely delay the launch of its first 5G iPhones, originally scheduled for September, as the coronavirus pandemic threatens global demand and disrupts the company’s product development schedule, sources familiar with the matter have told the Nikkei Asian Review.

The company has held internal discussions on the possibility of delaying the launch by months, said people familiar with the matter, while supply chain sources say practical hurdles could push back the release till 2021.

“Supply chain constraint aside, Apple is concerned that the current situation would significantly lower consumer appetite to upgrade their phones, which could lead to a tame reception of the first 5G iPhone,” said a source with direct knowledge of the discussion. “They need the first 5G iPhone to be a hit.”

Nikkei said that Apple had set an aggressive target for the release of a 5G iPhone for this September, instructing mobile suppliers to prepare to make up to 100 million units of the new devices for 2020 and designing four different models of the handsets.

Apple is closely monitoring the coronavirus outbreaks in the U.S. and Europe, its two largest markets that together account for more than half of its sales, and assessing whether a delay is necessary, the sources told Nikkei.

All of the employees at Apple’s headquarters are working from home indefinitely, as the company is subject to the Santa Clara County and the California state-wide “shelter in place” order, which requires all workers at non-essential businesses to stay at home (and tele-work if possible). The exact timetable for the 5G iPhone launch might not be finalized till that order is lifted, one of the sources said (and that could be sometime in June according to KCBS radio commentators).

“Apple will make a final decision around May at the latest, given the fluid situation globally,” another person told Nikkei.

The engineering development of the 5G iPhone has also been affected by travel curbs introduced in the U.S., China and elsewhere to combat the coronavirus, two people with knowledge of Apple’s schedule said. The company was supposed to work with suppliers to develop a more concrete prototype for the new phones from early March, but it had to delay such close collaboration, which requires hands-on testing, indefinitely.

Suppliers have not been officially notified of a possible change in the production timeline, and Apple is even urging many of them to make up for time lost due to coronavirus-related disruptions.

“We are not giving it up yet. We are doing whatever we can to sort the issue out,” a person with direct knowledge of the matter told Nikkei.

“The discussion is still at an early stage, and the fall launch is not completely off the table,” one of the sources with direct knowledge of the issue said. “But the 5G iPhone could be postponed to 2021 in the worst-case scenario.”

Suppliers agree that given where the company is in the engineering process, the possibility of a delay is looming. Some component suppliers, moreover, have told Nikkei that they have been instructed to defer their mass production schedule for about two to three months.

“We have been notified to start shipping in big volumes to meet Apple’s new product launch by the end of August, instead of like in previous years, when it would be sometime in June,” said a supplier of components related to printed circuit boards. “The change was made very recently, and that could imply that the mass production of the phone could also be delayed for months.”

The worst-case scenario, delaying the launch until 2021, would do more than just disrupt Apple’s roadmap for product releases.

The decision of the world’s most profitable smartphone company involves hundreds of global suppliers in the U.S., Europe, Japan, South Korea and China, Apple’s biggest manufacturing hub. Millions of production line jobs could be affected in the world’s second-largest economy during the peak production season for iPhones in the second half of the year.

“It’s a very tough decision for Apple to make,” as the ripple effect would be very big, another source familiar with the discussion told Nikkei.

“If any big tech company like Apple delay its plan for important new products … the issue could be even bigger than whether the supply chain could meet its schedule. It implies that they really see end demand weakening and the whole economy not recovering soon,” Joey Yen, an analyst with research company IDC, told Nikkei. “As of now we are still hoping everything can gradually recover to normal by the end of this year but for now the scenario is moving toward the pessimistic side, that the global economy could be significantly impacted.”

…………………………………………………………………………………………………..

Opinion:

We don’t think Apple delaying launch of a 5G iPhone will cause them to lose any significant revenue, as 5G roll-outs and upgrades will be delayed due to the coronavirus.

Moreover, 3GPP Release 16 and 17 have been delayed as we reported yesterday. We expect IMT 2020, scheduled for completion late this year, will also be delayed till mid 2021 as ITU-R WP 5D face to face meetings will be cancelled.

References:

3GPP delays Release 16 and 17 Freeze by 3 months; IMT 2020 impact unclear

3GPP delays Release 16 and 17 Freeze by 3 months; IMT 2020 impact unclear

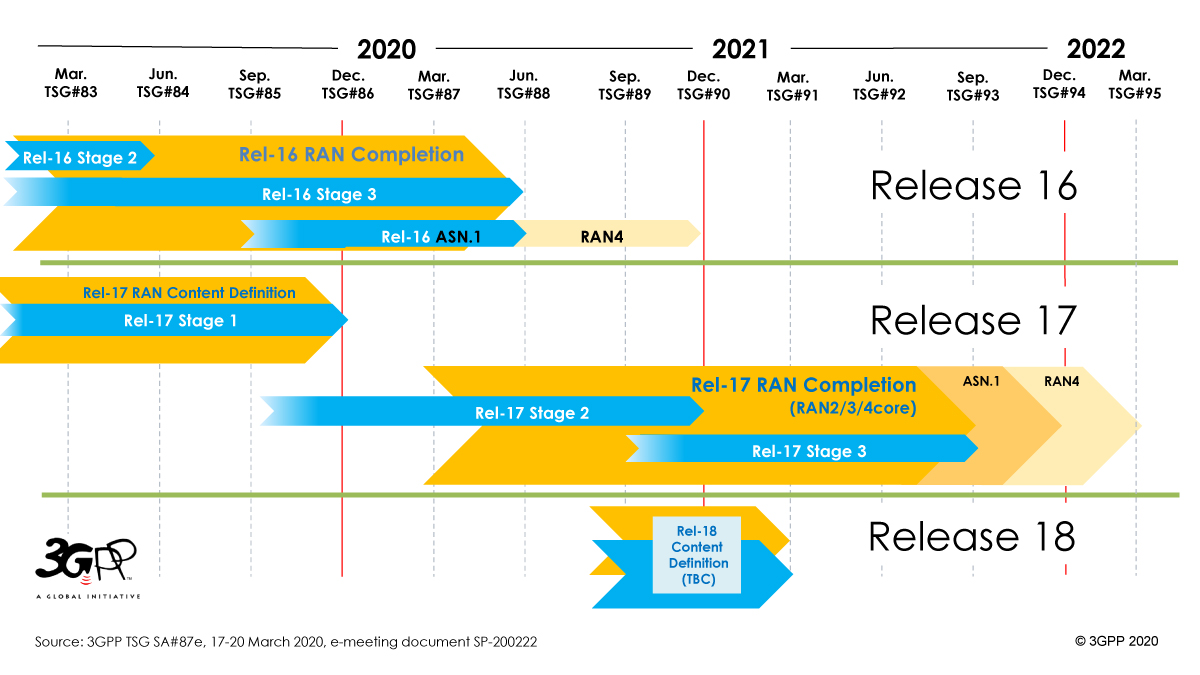

3GPP stated on its website that the timeline for the completion of two of their upcoming releases that include 5G specifications will be delayed.

A shift of the Release 16 timeline was approved at the 3GPP March 20th TSG#87 plenary e-meetings.

- Rel-16 Stage 3 freeze now June 2020 (shifted by 3 months)

- Rel-16 ASN.1 and OpenAPI specification freeze will also be complete in June 2020 (stays as planned)

Freezing stage 3 of a 3GPP release essentially means no further functions can be added to the spec. ASN.1 refers to abstract syntax notation object identifiers maintained by ETSI.

3GPP SA Plenary Chairman Georg Mayer wrote in an email to this author:

“Whilst 3GPP shifted the R16 stage 3 freeze by three months, we kept the code freeze in June.

It is from my perspective incorrect to say that we shifted R16 by three months. Just the stage 3 freeze and the code freeze are now coinciding. This was also clearly stated in the approved discussion papers in all groups. Those are the source of information people should go to when they look for guidance.”

3GPP RAN Chairman Belasz Bertenyi wrote in an email to this author:

“The Release-16 ASN.1 and OpenAPI code freeze timeline is kept unchanged, and is still targeting June 2020.”

…………………………………………………………………………….

New 3GPP Release Timeline:

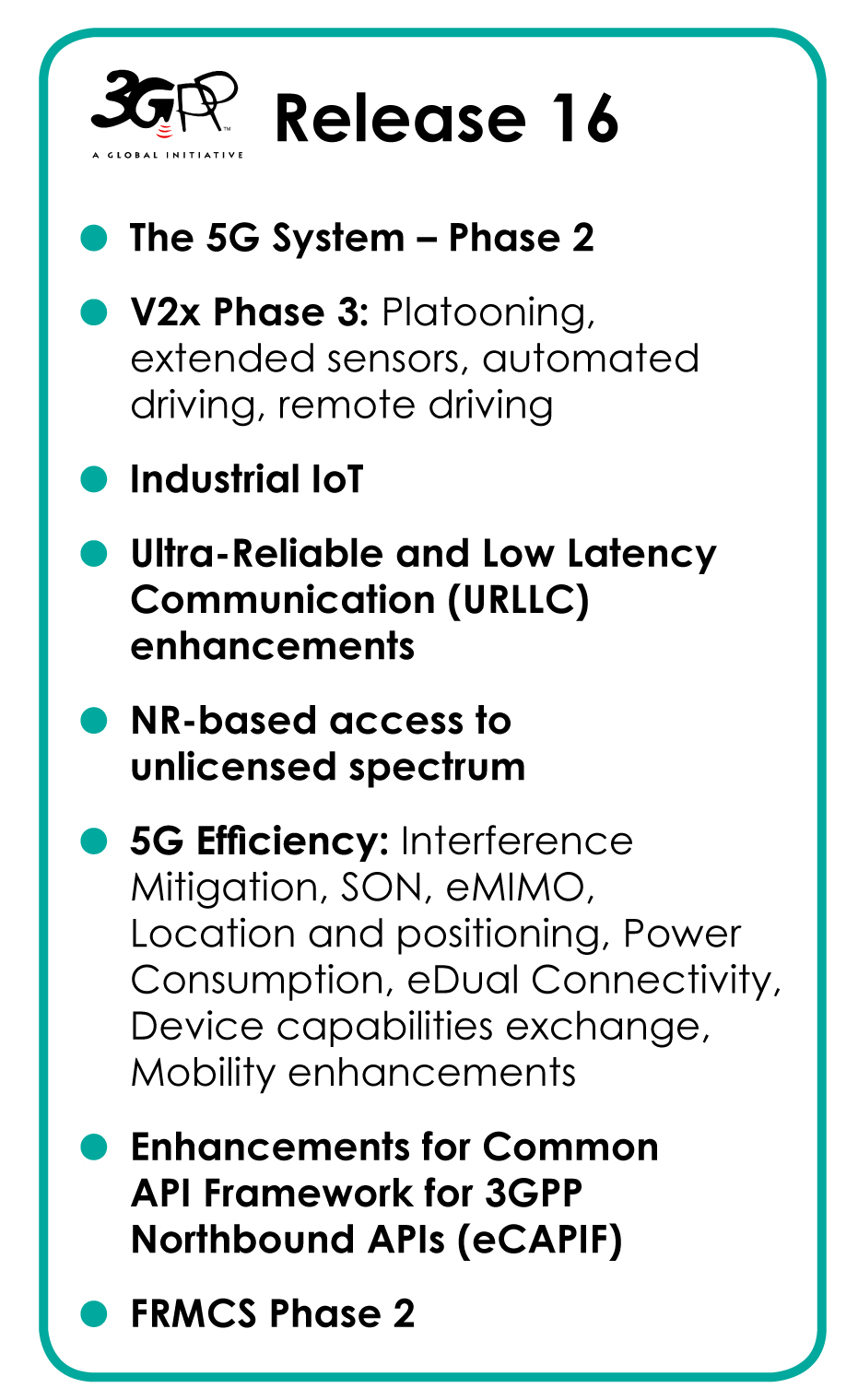

The “Release 16 Description: Summary of Rel-16 Work Items” (TR21.916) is now in production, with the Work Plan manager adding summary notes about each of the Features that it will bring, to the 3GPP system. As the Release approaches its Freeze date and completion (June 2020) – TR21.916 will start to expand and fill with useful detail about the main purpose and state of each feature.

The schedule for Release 17 is to be shifted by three months, such that the freezing of stage 3 will take place in September 2021. [Release 17 is to include further 5G system enhancements such as 5G wearables and faster network performance.] The specification freeze for Release 17 ASN.1 and OpenAPI is now scheduled for December 2021.

……………………………………………………………………………………………

The move had been expected after 3GPP announced it would cancel its face-to-face meetings in February and March due to concerns about the spreading coronavirus.

While 3GPP’s face-to-face meetings have been canceled through May, the organization has scheduled online meetings to continue its work despite the pandemic and will hopefully be able to keep their specifications on schedule going forward.

However, the impact of 3GPP’s Release 16 delay will surely push back the roll-out of true 5G deployments. It remains to be seen if the much touted but not yet completed Enhancement of Ultra-Reliable (UR) Low Latency Communications (URLLC) in 3GPP Release 16 will be submitted to ITU-R WP5D at their June 2020 meeting for inclusion in the IMT 2020 RIT/SRIT standard.

This author suspects ITU-R WP 5D leaders are looking at how to adjust their meeting plans in light of the global pandemic. Their next meeting is scheduled for June 23 to July 1, 2020 in Geneva.

Balasz says that “whatever the IMT 2020 schedule, 3GPP is continuously committed to make sure its IMT 2020 submissions will arrive in time and with high specification quality.”

………………………………………………………………………………………….

Reference:

https://www.3gpp.org/specifications/releases

…………………………………………………………………………………………..

15 April 2020 Update:

VERY IMPORTANT to note that unless it’s delayed till 2021, ITU-R IMT 2020 standard will NOT specify ultra low latency/ultra high reliability cause those capabilities are in 3GPP Rel 16 which won’t be frozen till July 3rd when their next meeting ends. ITU-R WP5D meeting ends July 1st. Hence, it will not be possible for 3GPP to submit 5G portions of Rel 16 till after WP5D’s July 1st meeting which will be too late to be included in the 1st version of IMT 2020 scheduled for late November 2020. The alternative is for WP 5D to delay their IMT 2020 completion schedule at their June-July 2020 meeting so we’ll watch that 5D meeting very closely to keep readers informed.

Background on Release 16:

- See the full Release 16 Description – TR21.916 (Available at Release freeze)

- RAN Rel-16 progress and Rel-17 potential work areas (July 18, 2019)

- Early progress on Rel-16 bands for 5G (April 2, 2019)

- “Working towards full 5G in Rel-16″…See a webinar presentation (July 3, 2018)

- Preparing the ground for IMT-2020

- SA1 completes its study into 5G requirements

Details of the features and work items under each 3GPP Release are kept in the corresponding, on-line, list of features and study items.

5G Patent Wars: Are Nokia’s 3,000 “5G” Patent Declarations Legit?

A Nokia press release today, Nokia announces over 3,000 5G patent declarations, the company declared more than 3,000 patent families to the European Telecommunications Standards Institute (ETSI) which were said to be “essential for the 5G standard.”

We wonder what 5G standard is that as IMT 2020 has not yet been completed? Neither has 3GPP Release 16 (5G phase 2) which when combined with Release 16 (5G Phase 1) will be the REAL (but unofficial) 5G standard.

Nokia wrote in the aforementioned press release:

With the latest declarations, the portfolio of Nokia cellular standard essential patents (SEPs) [1] declared to one or more of the 2G, 3G, 4G and 5G standards spans more than 3,400 patent families, of which more than 3,000 are relevant to 5G standards. This SEP portfolio has more than doubled in size over the past five years, with Nokia having a leading market share. Nokia Bell Labs produces the majority of these SEPs, and Nokia Technologies business manages and licenses this patent portfolio, with more than 200 licensees, including most major smartphone vendors and many automotive brands.

NOTE 1. HOW ARE SEPs DETERMINED IF A STANDARD LIKE 5G HAS NOT YET BEEN COMPLETED?

…………………………………………………………………………………………………….

Marcus Weldon, Nokia Chief Technology Officer and President of Nokia Bell Labs, said: “Nokia has defined many of the fundamental technologies used in virtually all mobile devices and digital systems and networks, and these inventions are critical to the new Industrial Internet of Things era. We standardize these inventions to allow widespread utilization and adoption. The benefits of 5G are initially in massive amounts of new capacity for consumers, but as the new technology and network architecture develops, it will enable new applications for enterprises and industrial businesses, with end-to-end 5G networks forming the critical fabric for the Fourth Industrial Revolution, with Nokia Bell Labs once again at the heart of this revolution.”

Jenni Lukander, President of Nokia Technologies, said: “I am thrilled that our R&D efforts are creating new opportunities for the consumer and industrial technology ecosystem, as the 5G era gathers momentum. As an inventor for the long-term, Nokia is able to innovate for a 5G future because of the fair reward we earn through licensing the standardized technologies created from our extensive R&D investments. This virtuous cycle creates vast new potential in 5G technologies, and I am excited for the possibilities ahead.”

Resource:

5G standards and research leadership (Nokia)

…………………………………………………………………………………………………

Comment and Analysis:

We previously reported that Samsung had licensed some of Nokia’s “5G” patents in this blog post.

Nokia’s so called “milestone” was positioned as a major step forward from the previous one six months ago declaring 2,000 patents. The clear intention was to create the impression that Nokia’s 5G R&D efforts have improved by 50% in the last six months, but it’s very difficult to verify that claim since it contains so many unknowns.

Is all that blah, blah, blah just PR or the truth? Let’s examine this 5G Patent War issue in some detail.

………………………………………………………………………………………………….

In a December 11, 2019 letter to the WSJ, Jenny Beth Martin wrote:

Nothing could be further from the truth. Qualcomm today is the undisputed leader in the 5G space for the simple reason that no other companies can keep up with the San Diego-based innovator. Qualcomm holds a staggering 140,000 patents and patent applications for 5G technologies.

………………………………………………………………………………………………………..

On March 12, 2020, Huawei was the clear leader in a European Patent Office (EPO) report titled Digital technologies take top spot in European patent applications. For the first time in more than a decade, the EPO said that digital technologies have taken the lead in patent applications filed. According to the EPO Patent Index 2019, the surge in the fields of digital communications (+19.6%) and computer technology (+10.2%) is fuelling the sustained growth in patent filings.

Statista says Huawei is leading in 5G patents. With more than 3,000 patent applications filed and more than 1,200 of these granted, Chinese manufacturer Huawei took first place in a ranking complied by IPlytics and the Technical University of Berlin.

Scott Bicheno of telecoms.com says about half of Huawei’s 5G patent applications seem to have been filed in China, and those account for half of all such applications made in China. While there’s nothing intrinsically wrong with that, it’s worth noting that Samsung and LG, which are in the top three 5G patent applicants alongside Qualcomm, have hardly filed any applications in South Korea. It’s almost as if the barrier to entry for patent filing in China is lower.

………………………………………………………………………………………………..

This author is also very skeptical about 5G patents, in light of the REALITY that many of the key 5G attributes, e.g. ultra high reliability, ultra low latency, 5G packet core, etc have not been completed yet by 3GPP.

So how can those and many other important features of “not yet completed” 5G standards be patented at this time?

Also, 5G builds on 4G-LTE so some of the so called “5G” patents might be more related to the latter.

…………………………………………………………………………………………………………

In a blog post from October 2019 titled Why you shouldn’t believe everything you read about 5G patents, Christina Petersson, CIPO and Head of IPR & Licensing at Ericsson, argues that when you apply certain essentiality filters, Ericsson is number one when it comes to 5G patents.

The patent intelligence division of the law firm of Bird & Bird, twoBirds Pattern, examined news articles and studies around 5G standard essential patents (SEPs) and found that the people writing about patents often get it wrong concerning which companies own the largest 5G SEP portfolios. They found that studies, in addition to being premature at this stage, are often over-simplistic or flawed, and that seemingly small corrections produce dramatically different results.

…………………………………………………………………………………………………..

Bicheno concludes:

That this patent war is being waged in Europe probably isn’t a coincidence either, as that is the primary battleground in the geopolitical battle of wills between the US and China. Every time a European country refuses to ban Huawei that represents a win for the Chinese state and its belt-and-road strategy of economic imperialism.

The fact remains, however, that nearly all of the patent announcements being chucked out there are largely meaningless given the lack of qualification and context attached to them. Most patent applications made now won’t be processed for around four years, and it’s only then that we’ll know who the 5G technology leader is. Until then the industry would be well advised to take any such claims with a big pinch of salt. We certainly will.

It’s quite clear that heavy cross-licensing, patent litigation, and patent pooling generate billions of dollars of legal liability and 5G will spark new and unpreceded patent wars that will dwarf previous ones.

………………………………………………………………………………………………..

References:

https://telecoms.com/503274/5g-patent-chest-beating-is-an-unhelpful-distraction/

https://www.wsj.com/articles/qualcomm-5g-security-and-patent-wars-11576096074

https://www.iplytics.com/wp-content/uploads/2020/02/5G-patent-study_TU-Berlin_IPlytics-2020.pdf

Photo courtesy of SK Telecom

Photo courtesy of SK Telecom