Broadband Access revenues

Dell’Oro: PONs boost Broadband Access; Total Telecom & Enterprise Network Equipment Markets

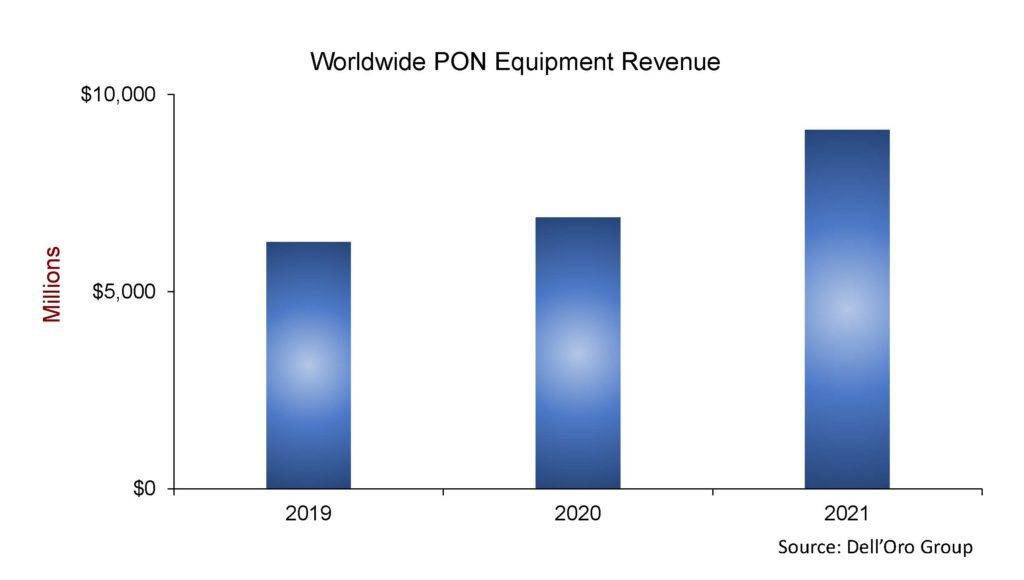

According to a newly published report by Dell’Oro Group, total global revenue for the Broadband Access equipment market increased to $16.3B in 2021, up 12 percent year-over-year (Y/Y). Growth came once again from spending on both PON infrastructure and fixed wireless CPE.

“2021 was a record year for PON (Passive Optical Network) equipment spending, with some of the highest growth coming from the North American market, where expansion projects and fiber overbuilds are picking up considerably,” said Jeff Heynen, Vice President, Broadband Access and Home Networking at Dell’Oro Group. “These fiber expansion projects show no signs of slowing heading into 2022.”

Additional highlights from the 4Q 2021 Broadband Access and Home Networking quarterly report:

- Total cable access concentrator revenue increased 4 percent Y/Y to just over $1B. Steady growth in Distributed Access Architecture (DAA) deployments helps offset declines in traditional CCAP licenses.

- Total PON ONT unit shipments reached a record 140 M units for the year, bucking the supply chain constraints that have dogged the cable CPE market.

………………………………………………………………………………………………………..

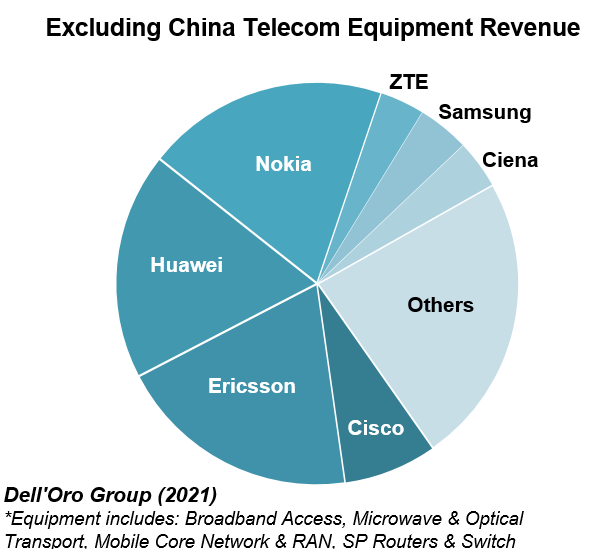

Separately, Dell’Oro just completed the 4Q2021 reports for all the Telecom Infrastructure programs covered, including Broadband Access, Microwave & Optical Transport, Mobile Core Network (MCN), Radio Access Network (RAN), and SP Router & Switch. The data contained in these reports suggests that total year-over-year (Y/Y) revenue growth slowed in the fourth quarter to 2%, however, this was not enough to derail full-year trends.

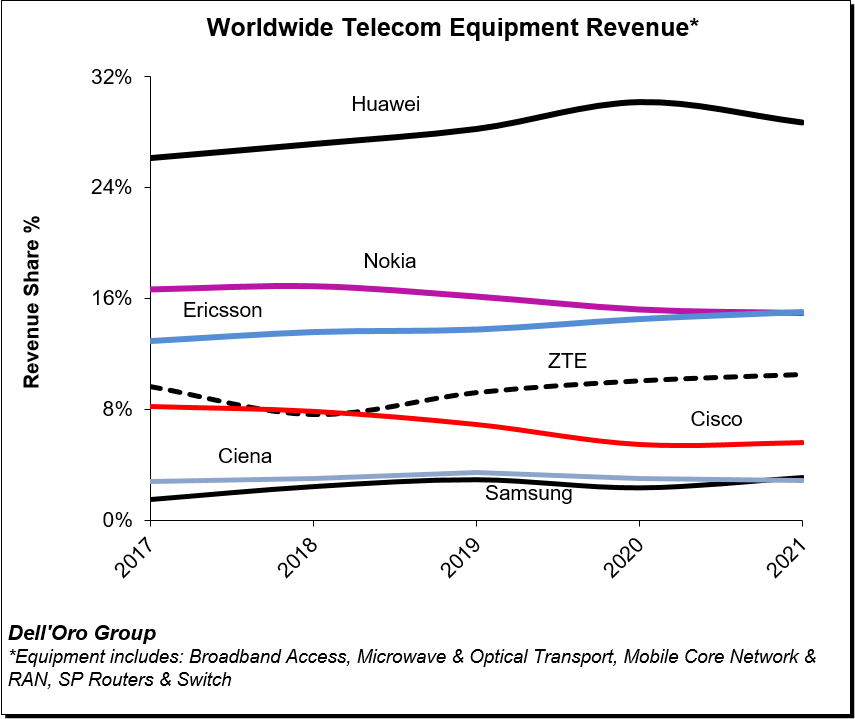

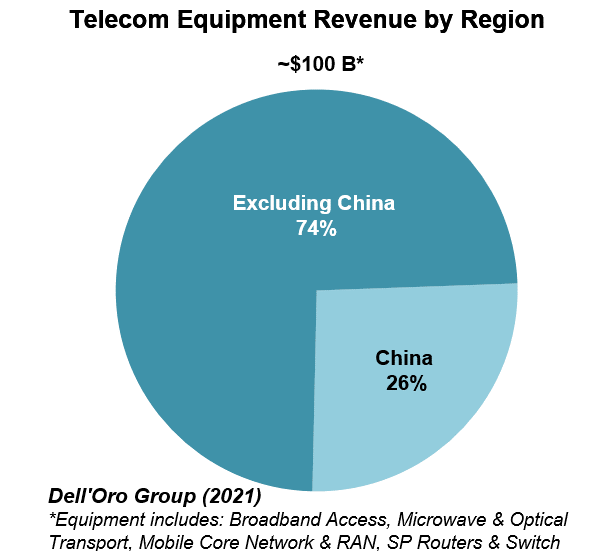

The market research firm estimates suggest the overall telecom equipment market advanced 7% in 2021, recording a fourth consecutive year of growth, underpinned by surging wireless revenues and healthy demand for wireline-related equipment spurred on by double-digit growth both in RAN and Broadband Access. Total worldwide telecom equipment revenues approached $100 B, up more than 20% since 2017.

In addition to challenging comparisons, we attribute the weaker momentum in the fourth quarter to external factors including COVID-19 restrictions and supply chain disruptions.

The analysis contained in these reports suggests the collective global share of the leading suppliers remained relatively stable between 2020 and 2021, with the top seven vendors comprising around 80% of the total market.

Despite U.S. sanctions, Huawei continued to lead the global market, underscoring its grip on the Chinese market, depth of its telecom portfolio, and resiliency with existing footprints. Initial readings suggest the playing field is more even outside of China, with Ericsson and Nokia essentially tied at 20% and Huawei accounting for around 18% of the market.

The relative growth rates have been revised upward for 2022 to reflect new supply chain and capex data. Still, global telecom equipment growth is expected to moderate from 7% in 2021 to 4% in 2022.

Risks are broadly balanced. In addition to the direct and indirect impact of the war in Ukraine and the broader implications across Europe and the world, the industry is still contending with COVID-19 restrictions and supply chain disruptions. At the same time, wireless capex is expected to surge in the U.S. this year.

…………………………………………………………………………………………………..

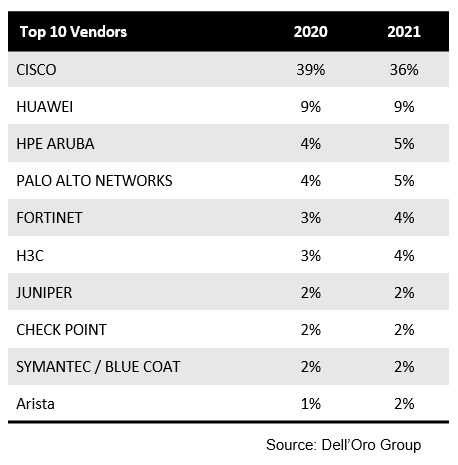

Top 10 Enterprise Network Equipment Vendors:

References:

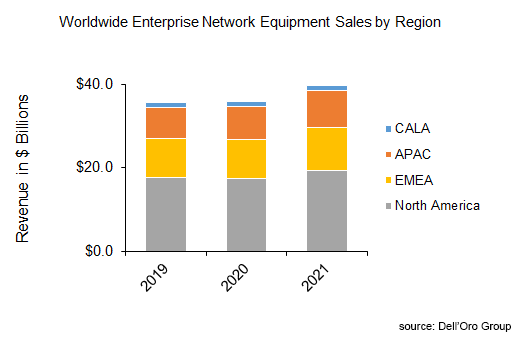

Key Takeaways—2021 Total Enterprise Network Equipment Market

MoffettNathanson: Robust broadband and FWA growth, but are we witnessing a fiber bubble?

According to a new comprehensive, market research report from MoffettNathanson (written by our colleague Craig Moffett), Q4 2021 broadband growth, at +3.3%, “remains relatively robust,” and above pre-pandemic levels of about +2.8%.

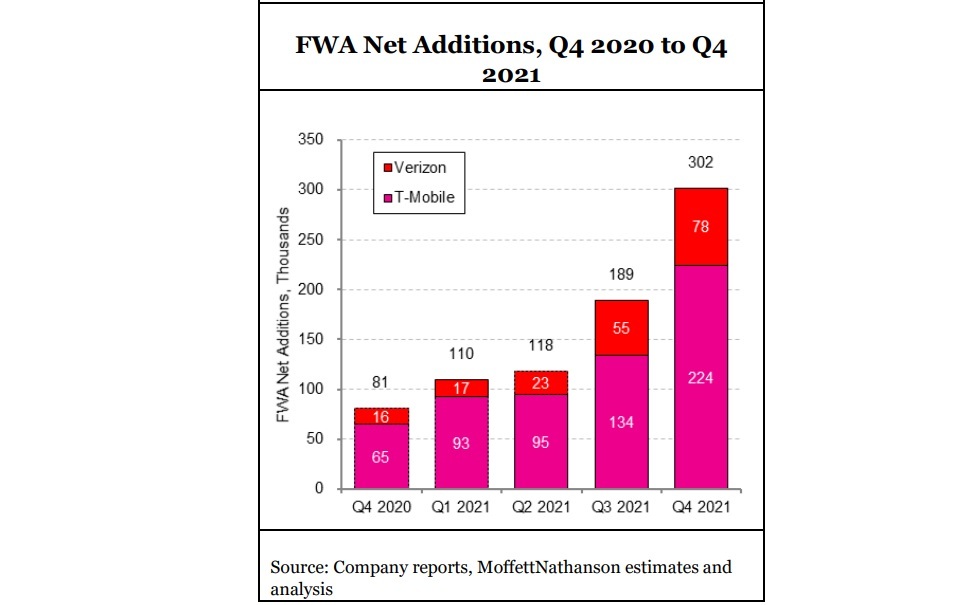

Meanwhile, the U.S. fixed wireless access (FWA market) captured ~ 38% share of broadband industry net adds in the fourth quarter of 2021. Approximately half of Verizon’s FWA customers are coming from commercial accounts, T-Mobile has indicated that about half its FWA customers are coming from former cable Internet subscribers. FWA’s strong Q4 showing left cable’s flow share at just 66%, about the same as cable’s share of installed US broadband households. “In other words, Cable likely neither gained nor lost share during the quarter, and instead merely treaded water,” Moffett noted. FWA “has gone from low-level background noise to suddenly a major force, with Verizon and T-Mobile alone capturing more than 300K FWA subscribers in the fourth quarter,” Craig noted. However, he isn’t sure that wireless network operators will allocate enough total bandwidth capacity for FWA to fully scale.

In 2020, a year that witnessed a surge in broadband subs as millions worked and schooled from home, the growth rate spiked to 5%. Here’s a snapshot of the broadband subscriber metrics per sector for Q4 2021:

Table 1:

| Sector | Q4 2021 Gain/Loss | Q4 2020 Gain/Loss | Year-on-Year Growth % | Total |

| Cable | +464,000 | +899,000 | +3.8% | 79.43 million |

| Telco | -26,000 | +21,000 | -0.4% | 33.51 million |

| FWA* | +302,000 | +81,000 | +463.9% | 869,000 |

| Satellite | -35,000 | -35,000 | -6.6% | 1.66 million |

| Total Wireline | +437,000 | +920,000 | +2.8% | 112.95 million |

| Total Broadband | +704,000 | +966,000 | +3.3% | 115.48 million |

| * Verizon and T-Mobile only (Source: MoffettNathanson) |

||||

U.S. broadband ended 2021 with a penetration of 84% among all occupied households. According to US Census Bureau data, new household formation, a vital growth driver for broadband, added just 104,000 to the occupied housing stock in Q4 2021, versus +427,000 in the year-ago period. Moffett said the “inescapable conclusion” is that growth rates will continue to slow, and that over time virtually all growth will have to stem from new household formation.

Factoring in competition and other elements impacting the broadband market, MoffettNathanson also adjusted its subscriber forecasts for several cable operators and telcos out to 2026. Here’s how those adjustments, which do not include any potential incremental growth from participation in government subsidy programs, look like for 2022:

- Comcast: Adding 948,000 subs, versus prior forecast of +1.25 million

- Charter: Adding 958,000 subs, versus prior forecast of +1.22 million

- Cable One: Adding 39,000, versus prior forecast of +48,000

- Verizon: Adding 241,000, versus prior forecast of +302,000

- AT&T: Adding 136,000, versus prior forecast of +60,000

Are we witnessing a fiber bubble?

“The market’s embrace of long-dated fiber projects rests on four critical assumptions. First, that the cost-per-home to deploy fiber will remain low. Second, that fiber’s eventual penetration rates will be high. Third, that these penetration gains can be achieved even at relatively high ARPUs. And fourth, that the capital to fund these projects remains cheap and plentiful.

None of these assumptions are clear cut. For example, there is an obvious risk that all the jostling for fiber deployment labor and equipment will push labor and construction costs higher. More pointedly, we think there is a sorely underappreciated risk that the pool of attractive deployment geographies – sufficiently dense communities, preferably with aerial infrastructure – will be exhausted long before promised buildouts have been completed.

Revenue assumptions, too, demand scrutiny. Cable operators are increasingly relying on bundled discounts of broadband-plus-wireless to protect their market share. What if the strategy works, even a little bit? And curiously, the market’s infatuation with fiber overbuilds comes at a time when cable investors are growing increasingly cautious about the impact of fixed wireless. Won’t fixed wireless dent the prospects of new overbuilds just as much (or more) as those of the incumbents.”

Moffet estimates that about 30% of the U.S. population has been overbuilt by fiber over the past 20 years, and that the number is poised to rise as high as 60% over the next five years. But the big question is whether there’s enough labor and equipment to support this magnitude of expansion. “Our skepticism about the prospects for all of the fiber plans currently on the drawing board is not born of doubt that there is enough labor to build it all so much as it is that the cost of building will be driven higher by excess demand,” Moffett explained. “There are already widespread reports of labor shortages and attendant higher labor costs,” he added.

“The outlook for broadband growth for all the companies in our coverage, particularly the cable operators, is more uncertain than at any time in memory. IMarket share trends are also more uncertain that they have been in the past. Cable continues to take share from the telcos, but fixed wireless, as a new entrant, is now taking share from all players. Share shifts between the TelCos and cable operators are suppressed by low move rates, likely due in part to supply chain disruptions in the housing market. This is likely dampening cable growth rates. In at least some markets, returns will likely be well below the cost of capital,” Moffett forecasts.

References:

U.S. Broadband: Are We Witnessing a Fiber Bubble? MoffetNathanson research note (clients and accredited journalists)

Dell’Oro: PON ONT spending +15% Year over Year

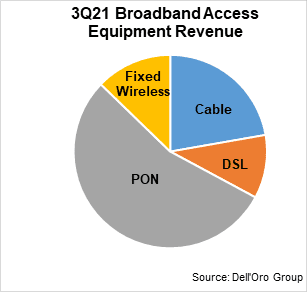

According to a newly published report by Dell’Oro Group, total global revenue for the Broadband Access equipment market increased to $3.9 B in 3Q 2021, up 7% year-over-year (Y/Y). Growth came from spending on both PON infrastructure and fixed wireless CPE. Please see chart below.

“5G fixed wireless deployments joined fiber as the primary drivers for spending this quarter,” noted Jeff Heynen, Vice President, Broadband Access and Home Networking at Dell’Oro Group. “Despite supply chain constraints and increased costs, operators continue to focus on expanding broadband connectivity,” explained Heynen.

Additional highlights from the 3Q 2021 Broadband Access and Home Networking quarterly report:

- Total cable access concentrator revenue decreased 27 percent Y/Y to $257 M. There was a clear mix shift this quarter to remote PHY and remote MACPHY devices, both of which saw Y/Y revenue increases.

- Total PON ONT unit shipments reached 32 M units, marking the fourth quarter in row-unit shipments have exceeded 30 M globally.

- Component shortages are clearly impacting cable CPE and home networking device sales, with unit shipments down markedly Y/Y.

The Dell’Oro Group Broadband Access and Home Networking Quarterly Report provides a complete overview of the Broadband Access market with tables covering manufacturers’ revenue, average selling prices, and port/unit shipments for Cable, DSL, and PON equipment. Covered equipment includes Converged Cable Access Platforms (CCAP) and Distributed Access Architectures (DAA); Digital Subscriber Line Access Multiplexers ([DSLAMs] by technology ADSL/ADSL2+, G.SHDSL, VDSL, VDSL Profile 35b, and G.FAST); PON Optical Line Terminals (OLTs), Cable, DSL, and PON CPE (Customer Premises Equipment); and SOHO WLAN Equipment, including Mesh Routers. For more information about the report, please contact [email protected].

Separately, Dell’Oro reports that the worldwide Campus Switch market revenue reached a record level in 3Q 2021. Growth was mostly propelled by 1 Gbps, which reached a record level in shipments during the quarter, while Ethernet NBase-T ports were down Y/Y.

“We have been predicting the demand in the market to remain strong, but what surprised us is the level of shipments and revenues that vendors were able to achieve during the quarter, despite ongoing supply challenges,” said Sameh Boujelbene, Senior Director at Dell’Oro Group. “It appears, however, that these supply challenges are impacting the newer technologies more than the older ones, due to a less diversified ecosystem, and in some cases, a less mature supply chain,” added Boujelbene.

Additional highlights from the 3Q 2021 Ethernet Switch – Campus Report:

- Extreme, HPE, and Juniper each gained more than one point of revenue share in Europe, Middle East and Africa (EMEA)

- H3C outperformed the market and captured the revenue leading position in China

- Power-over-Ethernet (PoE) ports up strong double-digits and comprised 30 percent of the total ports

The Dell’Oro Group Ethernet Switch – Campus Quarterly Report offers a detailed view of Ethernet switches built and optimized for deployment outside the data center, to connect users and things to the Local Area Networks. The report contains in-depth market and vendor-level information on manufacturers’ revenue, ports shipped and average selling prices for both Modular and Fixed, and Fixed Managed and Unmanaged Ethernet Switches (100 Mbps, 1, 2.5, 5, 10, 25, 40, 50, 100 Gbps), Power-over-Ethernet, plus regional breakouts as well as split by customer size (Enterprise vs. SMB) and vertical segments. To purchase these reports, please contact us by email at [email protected].

About Dell’Oro Group

Dell’Oro Group is a market research firm that specializes in strategic competitive analysis in the telecommunications, networks, and data center IT markets. Our firm provides in-depth quantitative data and qualitative analysis to facilitate critical, fact-based business decisions. For more information, contact Dell’Oro Group at +1.650.622.9400 or visit www.delloro.com.

References: