Dark fiber market

Neos Networks and Giganet partner to deliver FTTP to millions of UK homes

Dark Fiber network operator Neos Networks has announced a new partnership with Giganet, aiming to support the ISP’s burgeoning FTTP rollout with backhaul and data centre services.

Giganet currently offers customers access to its gigabit services through a variety of network providers, including Openreach and CityFibre, reaching millions of homes across the UK. In fact, earlier this year, Giganet announced that they had extended their partnership with CityFibre, thereby making their services available to customers across the entirety of CityFibre’s UK network.

However, last year Giganet announced they would also be rolling out their own FTTP network directly, investing £250 million to cover underserved areas of Hampshire, Dorset, Wiltshire, and West Sussex.

In total, the company hopes to reach 300,000 premises with full fibre over the next four years, with its core network and first four exchange rings set to be live by the end of 2022.

As this new network grows, it will need additional backhaul capacity and support – something that Neos, with its 550 unbundled exchange network, is well positioned to provide.

“Neos Networks rose to the challenge of providing us with resilient and high capacity backhaul circuits across a wide range of exchanges as well as our core data centres,” explained Matthew Skipsey, Chief Technology Officer at Giganet. “Using Neos Networks, we have been able to secure connectivity to our points of presence faster than expected, initially enabling each of our first four regional rings with resilient 100Gb/s backhaul. This means our south coast roll-out is progressing at pace.”

This network expansion project will see Neos support Giganet to deliver a more than tenfold capacity increase.

“Both Neos Networks and Giganet have adopted a collaborative approach to this relationship. This has resulted not only in solutions being delivered faster than ever, as the Giganet network grows, it also gives us the ability to transition connectivity between points of presence without any disruption,” explained Sarah Mills, Chief Revenue Officer at Neos Networks. “There is no doubt that by working in partnership with alternative network providers, like Giganet, UK residents will benefit from a better, faster, and more resilient connectivity.”

Matthew Skipsey added: “The ready availability of high-quality resilient connections to our points of presence, undoubtedly enabled us to quickly roll-out hyperfast, full broadband to a marketplace hungry for improved connectivity.”

References:

https://totaltele.com/giganet-teams-up-with-neos-networks-to-support-new-fibre-rollout/

Grand View Research: Dark Fiber Networks – Market Size, Share & Trends Analysis

Executive Summary

The global dark (unlit) fiber network [1.] market size is estimated to reach $11.22 billion by 2027, according to the new report by Grand View Research, Inc. That market is anticipated to expand at a 12% compound annual growth rate (CAGR) during the forecast period.

Note 1. In fiber-optic communications, fiber optic cables that are not yet put in service by a provider or carrier, are termed as dark or unlit fiber. Network communications and telecom usually use the network. In regular fiber networks, information is sent through the cables in light pulses. Whereas, dark fiber networks are known to be ‘dark’ as no light or data is transmitted from it.

……………………………………………………………………………………………………………

Dark Fiber Market Positioning

The dark fiber market has emerged as a sustainable solution for various organizations that are focusing on enhanced communication and network management. Continuously increasing penetration of internet services, over the period, has paved the way for the high demand for internet bandwidth. This demand is expected to remain rampant over the forecast period. This is the most significant factor driving the market growth. The market is strongly supported by companies with high reliance on internet connectivity. These networks are highly beneficial for organizations with a high volume of data flow in their operation. These benefits include reduced network latency, scalability, reliability, and enhanced security.

Dark fiber networks can be installed and set-up using point-to-multipoint or point-to-point configurations. Dense Wavelength Division Multiplexing (DWDM) is an essential factor for the improvement and development of dark fiber networks. DWDM occurs when many data signals are transmitted using the same optical fiber at the same time. Although these signals are transmitted around the same time, they are transmitted at separate and unique wavelengths to keep these data signals separate. The significant benefits of DWDM include an increase in bandwidth of the optical fiber, high-quality internet performance, lightning-fast internet, and secure and powerful network.

Dark fiber networks are not just used for business purposes but can be installed beneath land and oceans. Some of the interesting uses cases of dark fiber include earthquake research and to monitor permafrost. Some of the disadvantages include high initial cost and loss of time in setting up your infrastructure and high repairing and maintenance costs. Similarly, large dark fiber networks are currently available at metropolitan cities only and yet to at small cities and towns.

Key suggestions from the report:

- The significant benefits of DWDM include an increase in bandwidth of the optical fiber, high-quality internet performance, lightning-fast internet, and secure and powerful network

- Telecommunication is anticipated to present promising growth prospects due to growing adoption of the 5G technology in communication and data transmission services

- Medical and military and aerospace application segments are poised to witness significant growth, attributed to increasing adoption of optic technology devices

- Asia Pacific is expected to witness the fastest growth owing to technological advancements and large-scale adoption of the technology in IT and telecommunication and administrative sector

………………………………………………………………………………………………………………………………….

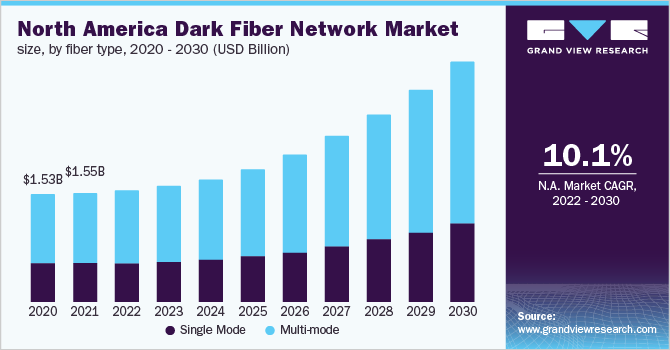

Fiber Type Insights

In 2019, the multimode segment led the market in terms of revenue and held around 60% of the total market share. It is also expected to continue leading the market over the forecast period. This type is best suited for short transmission distances. It is mainly used in video surveillance and Local-area Network (LAN) systems. Single-mode fiber, on the other hand, is best suited for longer transmission distances. It is mainly used in multi-channel television broadcast systems and long-distance telephony. Single mode segment is anticipated to witness considerable growth over the projected period. This product type is used for long distance installations ranging from 2 meters to 10,000 meters. It offers lower power loss in comparison to multimode. However, it is costlier than multimode fibers.

Network Type Insights

Long-haul fiver systems remained the mainstay of the market in 2019, capturing 69.7% revenue share. The segment continues to gather pace due to their capacity to connect over large distances at low signal intensity. Such long-haul terrestrial networks are widely applied in undersea cabling across long oceanic distance, thus attracting the participation of several organizations in terms of investments. For instance, in May 2018, Vodafone Group deployed 200G long-haul network-largest in the world-across 88 cities in India, covering over 43,000 km of network.

Long-haul network is driven by continuously growing investments, development of smart cities, and strong competitive dynamics in the market. However, the broadening availability of metro network fibers at relatively cost-effective price is gradually swinging the momentum towards the segment over the next few years.

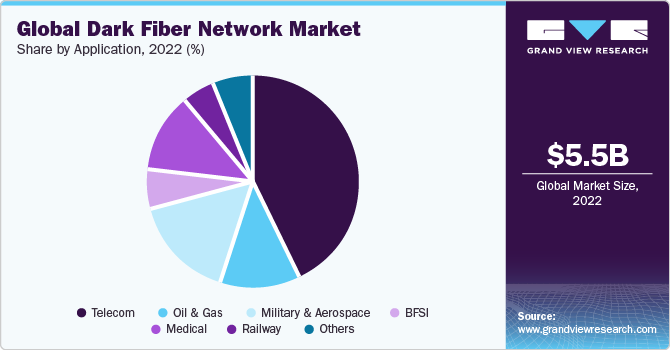

Application Insights

In terms of revenue, telecommunication segment dominated the market with a share of 43.3% in 2019 and is anticipated to retain its dominance in terms of market size by 2027. Telecommunication is anticipated to present promising growth prospects due to growing adoption of the 5G technology in communication and data transmission services. Dark fiber enables high-speed data transfer services in both small and long-range communications. Furthermore, increasing cloud-based applications, audio-video services, and Video-on-Demand (VoD) services stimulate the demand.

Medical and military and aerospace application segments are poised to witness significant growth, attributed to increasing adoption of optic technology devices. Stringent regulations and standards imposed by the regulatory authorities and medical associations are further fueling the market to flourish in the medical sector, eventually driving the overall growth.

Regional Insights

In 2019, North America led held largest market share in terms of revenue with around 30%. Asia Pacific is spearheading revenue growth owing to technological advancements and large-scale adoption of the technology in IT and telecommunication and administrative sector. High penetration of the technology in manufacturing sector and expanding IT and telecom sector across Asia Pacific are strengthening the regional market hold. Moreover, increasing application of fiber networks in medical sector is catapulting growth across countries, such as China, Japan, and India, thus propelling the overall demand at a significant pace.

Governments of developed countries such as U.S., U.K., Germany, China, and Japan are heavily investing in security infrastructure at country levels. Awareness is growing among the rapidly developing economies that aim to strengthen their hold at the global level. This is eventually necessitating the funding for technologies, majorly across the fiber networks that would enhance the telecommunication sector infrastructure with better security measures.

Dark Fiber Networks Market Report Scope

| Report Attribute | Details |

| Market size value in 2020 | USD 5.09 billion |

| Revenue forecast in 2027 | USD 11.22 billion |

| Growth Rate | CAGR of 12.0% from 2020 to 2027 |

| Base year for estimation | 2019 |

| Historical data | 2016 – 2018 |

| Forecast period | 2020 – 2027 |

| Quantitative units | Revenue in USD million and CAGR from 2020 to 2027 |

| Report coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments covered | Fiber type, network type, application, region |

| Regional scope | North America; Europe; Asia Pacific; South America; Middle East & Africa |

| Country scope | U.S.; Canada; Mexico; U.K.; Germany; France; Japan; China; India; Australia; Brazil |

| Key companies profiled | AT&T Intellectual Property; Colt Technology Services Group Limited; Comcast; Consolidated Communications; GTT Communications, Inc.; Level 3 Communications, Inc. (CenturyLink, Inc.); NTT Communications Corporation; Verizon Communications, Inc.; Windstream Communications; Zayo Group, LLC |

| Customization scope | Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope |

| Pricing and purchase options | Avail customized purchase options to meet your exact research needs. Explore purchase options |

…………………………………………………………………………………………………………………………………………..

Grand View Research has segmented the global dark fiber network market based on fiber type, network type, application, and region:

- Dark Fiber Network Fiber Type Outlook (Revenue, USD Million, 2016 – 2027)

- Single Mode

- Multi-mode

- Dark Fiber Network Type Outlook (Revenue, USD Million, 2016 – 2027)

- Metro

- Long-haul

- Dark Fiber Network Application Outlook (Revenue, USD Million, 2016 – 2027)

- Telecom

- Oil & Gas

- Military & Aerospace

- BFSI

- Medical

- Railway

- Others

- Dark Fiber Network Regional Outlook (Revenue, USD Million, 2016 – 2027)

- North America

- U.S.

- Canada

- Mexico

- Europe

- France

- Germany

- U.K.

- Asia Pacific

- China

- India

- Japan

- Australia

- South America

- Brazil

- Middle East & Africa

- North America

- List of Key Players in the Dark Fiber Network Market

- AT&T Intellectual Property

- Colt Technology Services Group Limited

- Comcast, Consolidated Communications

- GTT Communications, Inc.

- Level 3 Communications, Inc. (CenturyLink, Inc.)

- NTT Communications Corporation

- Verizon Communications, Inc.

- Windstream Communications

- Zayo Group, LLC

………………………………………………………………………………………………………………………….

References:

https://www.grandviewresearch.com/industry-analysis/dark-fiber-networks-market