OpenRAN

Progress in 5G private networks and Open RAN

Harry Baldock of Total Telecom writes, “The month of November was one of quiet progress for 5G, with more momentum steadily being gained for long-term trends towards private network deployments and open RAN innovation.”

Private 5G networks could be viable connectivity options for major industries like manufacturing and shipping, giving them not only access to the latest technologies to enhance efficiency, but also the flexibility to structure their network however they please.

In Europe, the German telecom regulator announced in November that it has awarded 88 licences for private 5G networks this year and expects more to come. For example, Nokia recently installed a private 5G network in Nuremburg for industrial IoT specialist MYNXG. In France, electronics manufacturer Lacroix is working with with Orange and Ericsson to create a 5G factory, and in the UK BT is installing a 5G network into Belfast Harbour, while Huawei is creating a private 5G testbed in Cambridge.

There has also been significant movement in the U.S., with General Motor’s new Factory ZERO installing a private 5G network from Verizon to manufacture the next generation of electric vehicles.

However, it should be remembered that despite its promise, private 5G networks are also still very much in their infancy, with a survey from STL Partners showing that the majority of enterprises still rely primarily on Wi-Fi and ethernet or fixed broadband for their connectivity needs.

Meanwhile, Open RAN has been gaining momentum for some months now as we reported yesterday in this IEEE Techblog post. In November, Dish and Qualcomm announced that they are set to work together on the U.S.’s first Open RAN-compliant (which spec?) 5G network. Similarly, in the UK, Vodafone’s August pilot for Open RAN, that took place in Wales, is being scaled up to 2,600 Open RAN sites in Wales and England, potentially using them to replace Huawei gear.

Meanwhile, companies like Mavenir continue to rapidly develop open RAN solutions, recently boasting of supporting 2G–5G for its open RAN packet core, thanks to a recent acquisition of ip.access.

Baldock concludes, “it seems fair to say that Open RAN is here to stay and is no longer something of a novelty. While many issues remain around things like standardization (e.g. no liaison with either ITU, ETSI or 3GPP) the movement is beginning to see increasing interest from operators and policymakers alike.”

…………………………………………………………………………………………………………………………………….

References:

https://techblog.comsoc.org/2020/12/04/omdia-and-delloro-group-increase-open-ran-forecasts/

German Telecom Regulator awards 5G private network licenses in the 3.7GHz to 3.8GHz band

Omdia and Dell’Oro Group increase Open RAN forecasts

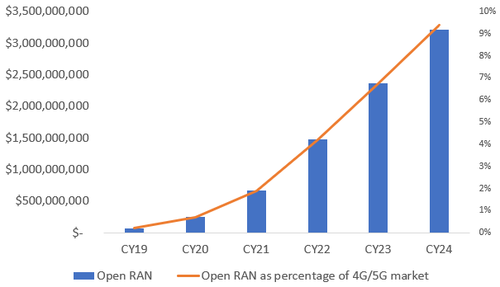

In an updated forecast out this month, Informa owned Omdia predicts that Open RAN is likely to generate about $3.2 billion in annual revenues by 2024. That would make it about 9.4% of the total 4G and 5G cellular market.

That forecast implies a massive increase on last year’s sales of just $70 million (see Dell’Oro forecast below), and Omdia’s Open RAN numbers have been raised significantly in the last few months. Previously, it was expecting Open RAN to generate about $2.1 billion in revenues in 2024.

Telco buy-in and support is critical, according to Daryl Schoolar, practice leader at Omdia responsible for the firm’s Open RAN forecasts. “Mobile operators remain the real driving force behind the development of open virtual RAN,” he says. “I see this as a positive sign for the market versus other technology and network developments I have seen during my career that were driven by vendors and ultimately went nowhere. The bigger market opportunity is with brownfield deployments, but this takes more time to accomplish as operators have to integrate open RAN with their legacy network systems and make sure those legacy networks and services are not adversely impacted,” Schoolar added.

Here are some of the network operators that have committed to OpenRAN:

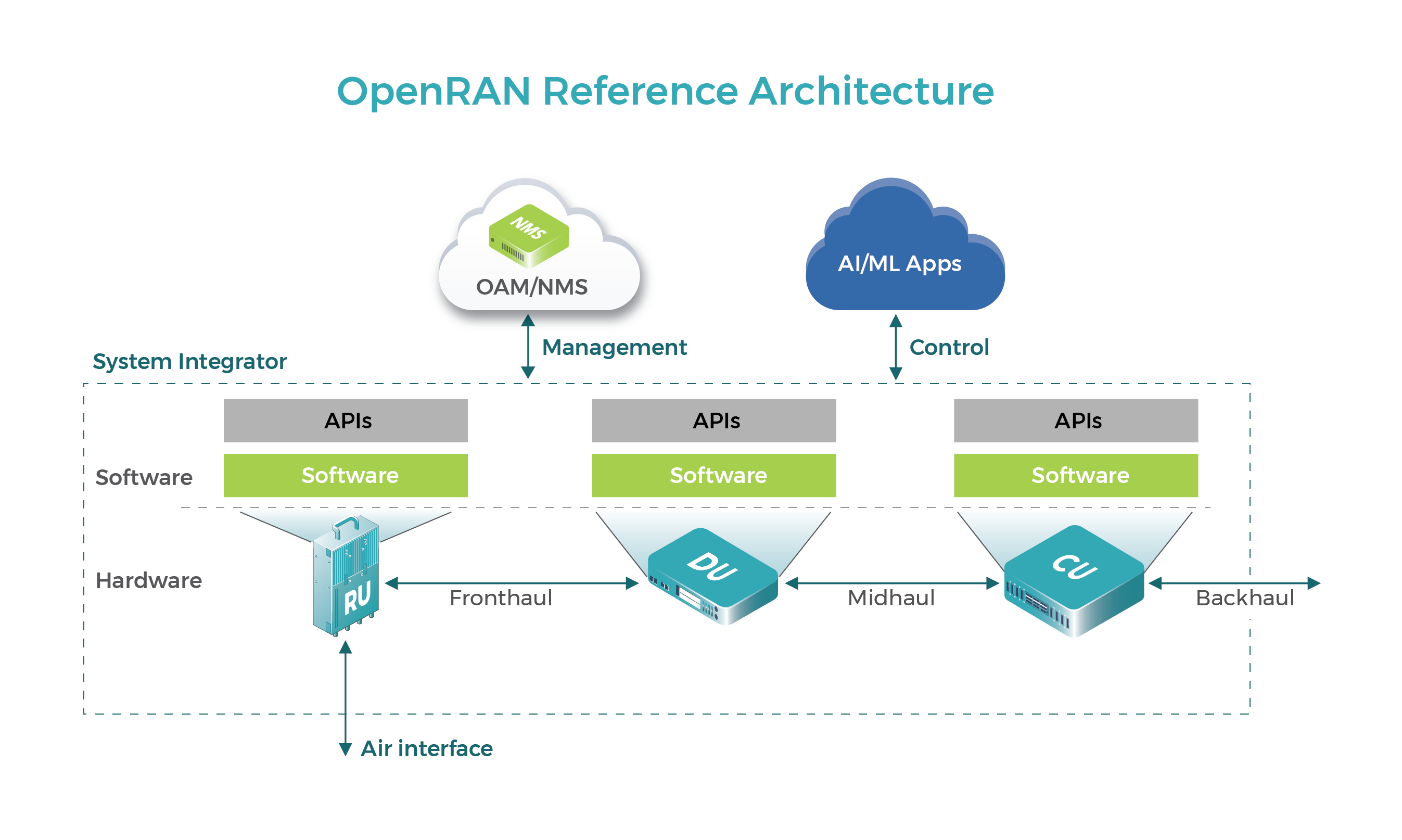

- Japan’s Rakuten, which already operates a 4G and 5G network based on open RAN. While customer numbers remain low, its early success has undoubtedly encouraged others.

- Telefónica and Rakuten have announced a partnership to accelerate the development of Open RAN technology for 5G access and core networks, and the associated operations support systems (OSS). They will jointly test, develop and procure Open RAN systems.

- Dish Network, is another greenfield builder that is using open RAN technology to roll out a fourth mobile network in the US. which is primarily focused on business customers.

- Orange sees a role for Open RAN vendors to provide more “plug and play” indoor coverage for businesses through 2021 and 2022. Open RAN could also play a part in the macro network, although that is more likely to come from 2023, and still requires work.

Dell’Oro Group (see forecast below) says: “Dish is running into delays in the US market, Rakuten is moving forward at a rapid pace in Japan deploying a variety of both sub 6 GHz and mmWave RAN systems. In addition, some of the Japanese telecom equipment vendors (e.g. NEC) are reporting that the lion share of their radio shipments are already O-RAN compatible.”

Open RAN progress:

Source: Omdia

……………………………………………………………………………………………………………………

Omdia notes that Open RAN is a potential dilemma for the big telco equipment vendors like Ericsson and Nokia (which intends to supply Open RAN products). The risk is that it decreases their market share for traditional cellular gear, as wireless network providers opt for Open RAN products developed by alternative suppliers. Yet open RAN might also bring opportunities in new markets for the old guard. “Either way, vendors cannot ignore this market trend,” says Omdia.

Gabriel Brown, a principal analyst at Heavy Reading, a sister company to Omdia and Light Reading, says he is positive about Open RAN but warns against expectations of liftoff next year. “The right timeline to view it on is a four-to-five-year timeline,” he said in a discussion with Light Reading this week. “I think next year continues to be primarily trials, scaling the trials … and some operators moving into production networks, but I don’t think it’s the year when it all takes off.”

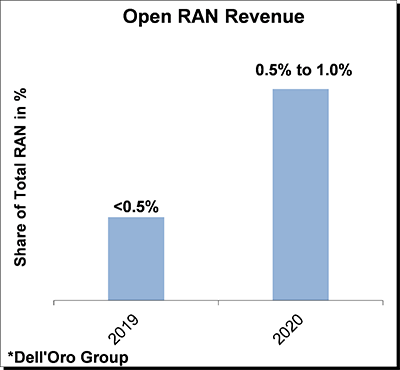

Separately, Dell’Oro Group’s latest Open RAN forecast, projects that Open RAN baseband and radio investments—including hardware, software, and firmware excluding services—will more than double in 2020 with cumulative investments on track to surpass $5B over the forecast period.

Open and Virtual RAN continues to gain momentum, bolstered by Ericsson now formalizing its support with its Cloud-RAN announcement. The uptake remains mixed. In this blog we will discuss three key takeaways for the 3Q20 quarter including:

1) The primary objective of Open RAN is to address market concentration and vendor lock-in;

2) Open RAN revenues are trending ahead of schedule;

3) Not all Open RAN is disruptive.

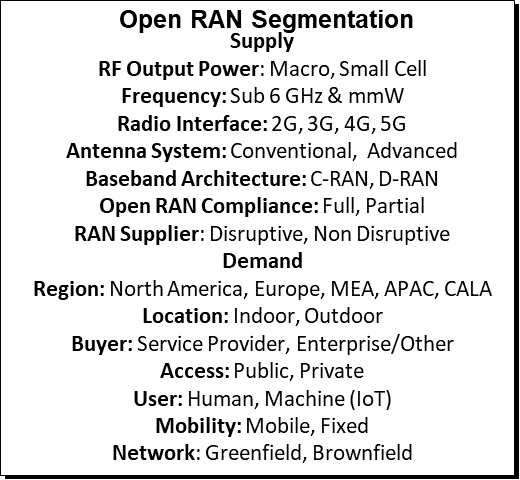

Source: Dell’Oro Group

Dell”Oro says that the more favorable Open RAN outlook to a confluence of factors including:

- Verification from live networks the technology is working in some settings;

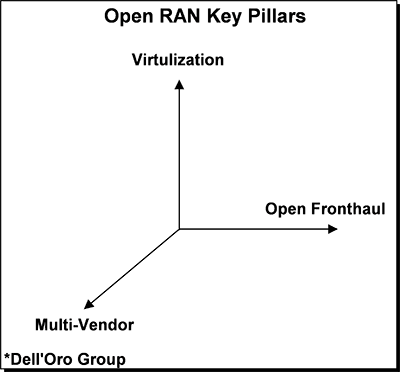

- Three of the five incumbent RAN suppliers are planning to support various forms of Open RAN – “Partial Open RAN” (open and virtual but not multi-vendor) are at this juncture captured in the Open RAN estimates meaning we require the first two pillars but we are excluding the third multi-vendor requirement as a necessity to reflect the Open RAN movement;

- The geopolitical uncertainty has escalated significantly in the past six months, with multiple operators reassessing and/or reviewing their reliance on Huawei’s RAN portfolio, resulting in an improved entry point for the Open RAN suppliers;

- Progress with full virtualization is firming up, with multiple suppliers announcing the commercial availability of V-RAN, consisting of both vCU and vDU;

- Operators are increasingly optimistic the technology will move beyond the rural settings for brownfield deployments;

- Policies to stimulate Open RAN are on the rise.

Source: Dell’Oro Group

“We estimate total open RAN revenues are tracking ahead of schedule,” wrote Stefan Pongratz of Dell’Oro Group, noting the market research firm recently raised its 2020 open RAN revenue forecast to $300,000 from $200,000. “On the other hand, the lion share of any ‘security’ related RAN swaps are still going to the traditional RAN players, suggesting the technology for basic radio systems remains on track but the smaller players also need to ramp up investments rapidly to get ready for prime time and secure larger brownfield wins.”

…………………………………………………………………………………………………………….

References:

https://www.lightreading.com/open-ran/open-ran-will-be-$32b-market-in-2024-says-omdia/d/d-id/765889?

https://omdia.tech.informa.com/OM011039/Open-RAN-commercial-progress-in-2020 (must be an Omdia client to access)

https://www.delloro.com/open-ran-results-mixed-in-3q20/

Bank of America: OpenRAN primer with global 5G implications

Written by Multiple Bank of America Research Analysts

Introduction:

OpenRAN turns base stations using proprietary hardware into software running on common off-the-shelf hardware. Tal Liani views this trend as a continuation of ongoing forces in the broader IT and hardware markets – a shift to virtualized hardware, merchant silicon and general software disruption of proprietary hardware markets.

With 78% of the cellular base station/ RAN market controlled by Huawei, Ericsson and Nokia, OpenRAN represents an opportunity for software-only vendors like Altiostar, Parallel Wireless and Mavenir to offer traditional as well as new carriers such as Rakuten and DISH the technology to build cost effective networks with no legacy equipment consideration. OpenRAN is ideally deployed in a virtualized or cloud-based architecture, offering a high degree of automation as well as enabling vendor mixing/matching to reduce costs of innovation and increase efficiencies.

$35bn RAN market set for new competition, disruption:

Radio Access Networks (RANs) represent the largest category of hardware technology, estimated at just under $35bn in 2020. The market is highly concentrated, with 78% controlled by Huawei, Ericsson, and Nokia. OpenRAN is disrupting the market, enabling vendor mixing and matching, greater competition, and introducing new entrants via standardization, separation of software and hardware, and by turning certain elements into independent applications.

Early days for OpenRAN, likely limited impact in near-term:

OpenRAN is still in its early days, representing ~1% of the total RAN market in 2020 and ~6% projected by 2024. These estimates are preliminary though, and like any other disruptive technology, deployments could gain momentum as they are adopted by key carriers. To date, the biggest OpenRAN advocates are new carriers, like Rakuten and DISH, which are utilizing the technology to build cost effective networks having no legacy equipment considerations. Tier-1 carriers are taking a more measured approach with legacy architectures/vendors still offering better economics. Yet, at the same time, most leading carriers are testing OpenRAN and some already deploy it on a small scale. For example, Verizon‘s 5G upgrade is partially done with Ericsson‘s proprietary approach and partially with Samsung‘s OpenRAN solution. We also see interest from European carriers, with OpenRAN providing an efficient way to replace Huawei equipment.

Importance of semis, commodity hardware on the rise:

On the vendor side, OpenRAN represents new opportunities for software-only vendors like Altiostar, Parallel Wireless, and Mavenir, hardware providers like Fujitsu and leading semi vendors like Intel and Qualcomm. Nokia and Ericsson partially support OpenRAN, given its disruptive nature, focusing instead on proprietary software-based solutions, like virtualized (vRAN) or Cloud RAN. However, as momentum grows, we expect all leading vendors to support OpenRAN, similar to trends seen in Switching and Routing. We expect the legacy Radio vendors to offset the negative implications of OpenRAN via a growing focus on software, applications and expansion into adjacent markets.

Open Radio Access Networks, or OpenRAN, is an emerging trend that is set to shake up the roughly $40bn 4G/5G infrastructure market. We view this trend as a continuation of ongoing forces in the broader IT and Telecom Hardware markets, such as the shift to virtualized software, whitebox hardware, merchant silicon, and general software disruption of the proprietary hardware markets. We have witnessed similar efforts to open and standardize other networking markets such as Ethernet Switching and IP Routing, however, the complexity, performance demands, and tight vendor controls in the Mobile Infrastructure market have left the Radio Access Networks proprietary thus far. 5G deployments represent an entry point and a catalyst for OpenRAN, and our deep dive aims to explore the potential opportunities and disruption across vendors and sectors that service the RAN market.

Our note is organized into 5 main sections: 1) drivers of OpenRAN deployments vs the challenges, 2) introduction to the Radio Access Market, which describes the technical components, leading vendors, and market dynamics of the traditional RAN market, 3) an OpenRAN 101 section that outlines the architectural changes, new vendors, and growth forecasts, 4) the impact of OpenRAN, and opportunities related to adjacent areas of technology, such as semiconductors, and lastly 5) OpenRAN traction by geographic region.

Ultimately, we see three key takeaways for investors: 1) we flag that OpenRAN and Virtualized/Cloud RAN are separate trends that are coming together to form the attractiveness of Open and Virtualized RAN (vRAN), 2) it remains early for OpenRAN, which is expected to represent less than 1% of RAN spending in 2020 and grow to only 6% of the total market by 2024, and 3) OpenRAN creates opportunities for legacy and new vendors, in our view. We quantify the disruptive potential on page 33, and compare the OpenRAN phenomenon to what happened in the virtualized Evolved Pack Core (EPC) market. We also view OpenRAN as an enabling technology for global carriers to replace Huawei in certain areas, either through growing share of Nokia and Ericsson, or via the introduction of new vendors.

|

Figure 1: OpenRAN vs Virtual RAN and evolution to Open vRAN |

|

|

|

Source: BofA Global Research, Omdia |

A key benefit of OpenRAN is new innovation in the radio access market, with newer software companies such as Altiostar pushing incumbent vendors to begin disaggregating their software from hardware and support industry groups dedicated to developing OpenRAN technology, such as the O-RAN Alliance. OpenRAN itself also encourages innovation via its open interfaces, and the enablement of third party vendors to add new solutions. OpenRAN is ideally deployed in a virtualized and cloud-based architecture, offering a high degree of automation, increasing efficiencies and reducing costs. Currently, OpenRAN development is supported by a wide range of semiconductor, hardware, testing, systems integration, and software companies, helping foster innovation in each domain and cooperation toward a more ‘hyperscale-like‘ network. As we have seen in other areas of cloud networking and technology, open ecosystems often foster greater innovation.

|

Figure 2: Comparison of Traditional RAN versus OpenRAN |

|

|

| Source: World Wide Technology |

Less vendor lock-in to create more competition:

Another key driver for OpenRAN interest is the ability to avoid vendor lock-in. Following years of vendor consolidation in the Mobile Infrastructure market, there are only four leading equipment provider choices: Huawei, Nokia, Ericsson, and ZTE to a lesser extent. On top of limited choice, it is notoriously difficult to switch vendors, requiring expensive and labor-intensive equipment swaps from the radio head to the baseband data center infrastructure. In some cases, the equipment swap cost burden falls on the carrier and in some cases vendors provide such services as part of the sales/services strategies. Ultimately, the lack of choice and difficulty in switching vendors create a market rife with equipment vendor lock-in.

Swapping out Huawei represents a major catalyst:

As the market has consolidated, political pressures versus Chinese vendors‘ role in 5G (see note on Huawei pressure and risk) further limit vendor choice to only 2-3 firms in some regions. Therefore, global pushback against Huawei/ZTE may be one of the largest drivers of OpenRAN adoption, pulling forward the timing of operator decisions on RAN architectures. Huawei has gained significant share in the $38bn market over the last seven years, now representing 34% of the total market, and government support for removing the vendor from networks has grown in recent months. The UK government recently instituted a policy banning UK carriers from buying new Huawei equipment beginning in 2021, and all Huawei equipment must be removed from UK networks by 2027. Other regions of Europe such as Belgium, Poland, and Sweden have also recently shied away from Huawei.

Importantly, replacing Huawei brings large costs, both from losing Huawei as a competitor (Huawei known for its attractive price/performance) and equipment swaps. As a result, the US government is beginning to take steps to help developing countries within Africa and the Middle East fund the costly replacement of Huawei/traditional equipment. Specifically, the US Agency for International Development is spearheading the effort, while the US State Department continues to pressure US allies to displace Huawei and ZTE equipment from their networks. In our view, the replacement of Chinese RAN technology could open up a $35bn market to both incumbent and new vendors, and the replacement of network vendors‘ architectures offers an attractive opportunity for carries to re-architect the Access network utilizing modernization and virtualization, which are both drivers for OpenRAN. The US government has also explored investing in OpenRAN technologies to help US software/hardware/semi vendors play more of a role in cellular networks.

Open RAN Cost Savings:

Opening the interfaces between the baseband unit (BBU) and remote radio unit (RRU) helps increase competition, lowers the switching costs, and likely saves carrier capex to some degree. However, we believe the real benefits related to the OpenRAN vision come to fruition when the architecture becomes virtualized or cloud OpenRAN (often referred to as Open vRAN). In Open vRAN, carriers first save on equipment capex as the baseband unit software runs on commodity off the shelf (COTS) hardware (i.e., x86 servers) rather than proprietary integrated hardware. Software can be purchased from new vendors and the equipment can be provided by vendors such as Quanta Computer. High degree of competition for the RRU component and the hardware commoditization for the BBU component could result in potential capex savings of 40-50%. Installation and integration services can also potentially be brought in house or outsourced to a longer list of competitors, adding RAN installation savings that are typically part of capex (see Exhibit 3).

The second area of carrier total cost of ownership (TCO) savings is related to the maintenance and operating expense. By copying the efficient cloud models of hyperscalers and centralizing/standardizing the foundation of the RAN, carriers stand to run more efficient data center operations. The software-defined approach also adds to network agility and automation. Through better agility and automation, carriers save on the management, maintenance, and upgrades for the network. Early reports suggest potential 31% operating expense savings as a result (see Exhibit 4).

|

|

|

OpenRAN Industry groups:

1. Telecom Infra Project (TIP):

TIP was formed in February 2016, with Facebook playing a central role. Major vendor Nokia is also part of the group. Japanese members include NTT, KDDI, SoftBank, Rakuten Mobile, NEC and Fujitsu. TIP‘s goal is to create mobile networks using open and disaggregated solutions. The scope of the group‘s work extends from OpenRAN to include the backhaul portion of the network, core network architecture and other areas.

TIP and O-RAN Alliance announced a liaison agreement in February 2020. Under the agreement, the groups will share information, reference respective specifications and collaborate on testing.

2. O-RAN Alliance:

O-RAN Alliance was formed in February 2018 through a merger between x-RAN Forum and C-RAN Alliance. Japanese members include NTT DoCoMo, KDDI, SoftBank, Fujitsu and NEC. In May 2020, O-RAN Alliance and GSMA, an industry body representing MNOs, agreed to collaborate on opening up 5G networks.

Major vendors Ericsson and Nokia are also part of the O-RAN Alliance. However, they appear to be taking a slightly different stance on OpenRAN. In February 2019, some members of O-RAN Alliance announced new open fronthaul specifications and related testing. Nokia is mentioned in the announcement, but Ericsson is absent. Nokia believes open standards are a viable option for RU-DU, but is doubtful about the effectiveness for the CU-DU interface.

The O-RAN Alliance is focused on efforts to standardize technologies. NTT DoCoMo is expected to play a key role in the standardization process. In September 2019, DoCoMo announced it had achieved interoperability with equipment from different vendors in a 4G/5G demo project. Vendors in the demo were Nokia, Fujitsu and NEC. As widely reported, Fujitsu has teamed up with Ericsson and NEC is collaborating with Samsung in OpenRAN technology.

Altiostar and NEC demonstrate front haul at India’s first O-RAN Alliance plugfest hosted by Bharti Airtel

Altiostar and NEC today said that they participated in the first plugfest event in the India region for the O-RAN ALLIANCE. Hosted by Bharti Airtel (“Airtel”), India’s largest integrated telecommunications services provider, the goal of the O-RAN Plugfest was to test and demonstrate the growing maturity of the O-RAN ecosystem.

Bharti Airtel plugfest was in partnership with telecom players like Altiostar, Altran, ASOCS, Mavenir, NEC, Sterlite Technologies (STL), VVDN, among others to demonstrate emerging technologies such as 5G.

“We are committed to evolving our network through an open architecture and are delighted to partner with the O-RAN community. This offers a great opportunity to Indian organizations with innovative hardware, software, and services capabilities to build a “’ Make in India – O-RAN solution’ – for Indian and global markets.” said Randeep Sekhon, CTO, Bharti Airtel.

The Indian telco is currently working with various US and Japanese vendors like Altiostar and NEC to develop OpenRAN based 5G telecom equipment, ETTelecom exclusively reported recently.

Airtel revealed that it is engaging with “Disruptive Telecom Equipment Vendors” to develop innovative solutions customized to Airtel’s requirements based on OpenRAN technology. “As a TSDSI Member, Airtel has proposed a new study Item on “Adoption of O-RAN Specification by TSDSI and contribution towards the development of India.

Specific use cases within the TSDSI Network Study Group (SG-N). Airtel will be submitting contributions in the form of a Study Report on O-RAN in SGN, and will also be collaborating with industry partners on the subject,” the telco had said.

“Testing and integration are crucial for developing a commercially available open RAN ecosystem and that’s why the O-RAN Alliance provides its member companies with an efficient global plugfest framework, which complements the O-RAN specification effort as well as the O-RAN Software Community,” said Andre Fuetsch, Chairman of the O-RAN Alliance and Chief Technology Officer of AT&T.

The telco has been a member of the O-RAN Alliance since its establishment in 2018. The first India edition of O-RAN Plugfest is part of Airtel’s commitment to building an open technology ecosystem, including O-RAN-based deployments, said the telco in an official statement.

It was also the first operator in India to commercially deploy a virtual RAN solution based on disaggregated and open architecture defined by the O-RAN Alliance.

Airtel, Altiostar and NEC teamed up for this project to demonstrate the world’s first interoperability testing and integration of massive MIMO radio units (O-RU) and virtualized distributed units (O-DU) running on commercial-off-the-shelf (COTS) servers. The project featured a commercial end-to-end Open Fronthaul interface based on O-RAN specifications. This demonstration was comprised of control, user, synchronization and management plane protocols, including 3GPP RCT and performance cases.

The purpose and scope of this demonstration was to show O-RAN option 7.2x split integration between a virtualized O-DU from Altiostar and an NR O-RU (i.e. 5G radio unit) from NEC. The demonstration also showed how this integrated setup can be used in an end-to-end EN-DC network setup (i.e. 5G non standalone architecture).

Going forward, Altiostar and NEC will continue to jointly drive new levels of openness in radio access networks (RAN) and across next-generation 5G networks.

“Today’s 4G and 5G radio access networks are undergoing a profound transformation, as the wireless industry is shifting to an open and cloud-native architecture that is being driven by vendors such as Altiostar and NEC, who are at the forefront of providing software and radio solutions based on O-RAN standards,” said Anil Sawkar, Vice President of Engineering and Operations at Altiostar. “Dozens of greenfield and brownfield wireless operators worldwide are trialling and deploying O-RAN networks as they realize the benefits of this new approach, including reduced costs, increased automation, and faster time to market with services.”

“Providing open innovations that conform to industry standards in the radio access network is critical to accelerating our customers’ journey towards Open RAN deployment and provisioning of more flexible and efficient networks that meet the requirements of cutting edge 5G use cases,” said Kazuhiko Harasaki, Deputy General Manager, Service Provider Solutions Division, NEC Corporation. “It is NEC’s honor to contribute to interoperability verification initiatives in India towards Open RAN innovation.”

Airtel has been a member of the O-RAN ALLIANCE since its inception in 2018. Airtel was the first operator in India to commercially deploy a virtual RAN solution based on a disaggregated and open architecture defined by O-RAN. “We are delighted to partner with the global O-RAN community. Our engagement with Altiostar and NEC for demonstrating O-RAN O-DU and O-RU, 5G RCT and E2E performance is another step forward towards building 5G systems with open network architecture,” said Randeep Sekhon, CTO at Bharti Airtel.

…………………………………………………………………………………………………………………………………………………………………………………………

About Altiostar:

Based outside Boston, Altiostar provides 4G and 5G open virtualized RAN (Open vRAN) software that supports open interfaces and virtualizes the baseband unit to build a disaggregated multi-vendor, web-scale, cloud-native mobile network. Operators can add intelligence, quickly adapt the network for different services and automate operations to rapidly scale the network and reduce Total Cost of Ownership (TCO). Altiostar collaborates with a growing ecosystem of partners to support a diverse Open RAN supply chain. The Altiostar Open vRAN solution based on O-RAN standards has been deployed globally, including the world’s first cloud-native commercial-scale mobile network with Rakuten Mobile in Japan. For more information, visit www.altiostar.com.

About NEC Corporation:

NEC Corporation has established itself as a leader in the integration of IT and network technologies while promoting the brand statement of “Orchestrating a brighter world.” NEC enables businesses and communities to adapt to rapid changes taking place in both society and the market as it provides for the social values of safety, security, fairness and efficiency to promote a more sustainable world where everyone has the chance to reach their full potential. For more information, visit NEC at http://www.nec.com.

About Airtel:

Headquartered in India, Airtel is a global telecommunications company with operations in 18 countries across South Asia and Africa. The company ranks amongst the top three mobile operators globally and its mobile network covers a population of over two billion people. Airtel is India’s largest integrated telecom provider and the second largest mobile operator in Africa. At the end of September 2020, Airtel had approx. 440 mn customers across its operations.

Airtel’s portfolio includes high speed 4G/4.5G mobile broadband, Airtel Xstream Fiber that promises speeds up to 1Gbps, converged digital TV solutions through the Airtel Xstream 4K Hybrid Box, digital payments through Airtel Payments Bank as well as an integrated suite of services across connectivity, collaboration, cloud and security that serves over one million businesses.

Airtel’s OTT services include Airtel Thanks app for self-care, Airtel Xstream app for video, Wynk Music for entertainment and Airtel BlueJeans for video conferencing. In addition, Airtel has forged strategic partnerships with hundreds of companies across the world to enable the Airtel platform to deliver an array of consumer and enterprise services.

References:

Vodafone says Open RAN ready for prime time as Huawei is phased out in the UK

Vodafone has made a major commitment to use Open RAN at about 2,600 mobile base stations currently served by Huawei. That’s about 35% of the Chinese telecom equipment vendor’s installed base within Vodafone’s network, according to a spokesperson for the UK service provider after it was reported by the Financial Times (subscription required).

Approximately 2,600 sites in rural Wales and the south west of England will be switched to OpenRAN by the government-imposed deadline, a process that will commence in 2022. Vodafone wants to be viewed as a trailblazer for OpenRAN, which increasingly looks like the most likely source of telecoms vendor diversity in the wake of Huawei’s blacklisting by the U.S., UK and other countries.

“This commitment can get Open RAN ready for prime time,” Scott Petty, chief technology officer at Vodafone UK, told the Financial Times. He added that although open RAN was still a nascent technology more suited to rural coverage than dense urban areas, including such a large chunk of its network would create an opportunity for it to push into the mainstream. Spanish telecom operator Telefónica is also exploring greater use of open RAN systems for future upgrades.

Vodafone’s plan represents a boost for the UK government, after a task force launched to help strip Huawei equipment out of the country’s 5G networks by 2027 identified open RAN as a potential growth opportunity for the UK. It could also support a government ambition to rebuild a foothold in the telecoms equipment market if growing Open RAN use is used to justify research and development subsidies and companies in the field based themselves in Britain.

“The UK could regain a foothold which it hasn’t had since the break-up of Marconi,” said Mr Petty, referring to the collapsed British telco. Recommended Huawei Technologies Huawei develops plan for chip plant to help beat US sanctions US companies Mavenir, Parallel Wireless and Altiostar have emerged as open RAN specialists in recent years, hoping to compete with larger companies, while hardware vendors like Samsung, NEC and Fujitsu are hoping to win market share as Huawei kit is removed. The move to ban Huawei, the world’s biggest telecoms equipment maker, from 5G networks has meant networks have turned to Ericsson and Nokia to fill the void.

BT has signed deals with both the Ericsson and Nokia to replace Huawei base stations over time, putting the cost of complying with the government phase out at £500m. Ian Livingston, the former BT chief executive and trade minister heading up the government’s telecoms task force, told MPs last week that the push to foster Open RAN would grant telecoms companies a greater choice of vendors in the wake of the Huawei ban and avoid a bottleneck in the supply chain. Using Open RAN is a more costly exercise which has led to some calls within the industry for more financial support. Mr Petty said this need not be in the form of direct subsidies to use the equipment but could be directed at speeding up the development of chips and software to compete with established companies such as Huawei.

Vodafone’s pledge to use emerging open RAN tech for at least 2,600 masts and rooftops is the largest confirmed promise made by a European carrier © Alamy Stock Photo

…………………………………………………………………………………………………………………………………………………………………………………………………………………….

Analysis & Opinion:

Vodafone is likely interested in Open RAN because that could boost supplier diversity in a market where there are currently few viable alternatives to the giant kit vendors. Trials in various geographies have already been carried out with Mavenir and Parallel Wireless, two U.S. developers of Open RAN software. Many telecom operators have complained that today’s systems force them to rely on one company for all the RAN technologies at a particular site. Thanks to other “virtualization” schemes, they would be able to run open RAN software on commoditized, general-purpose equipment.

Vodafone hasn’t named any of the vendors that will help it with this initiative. Telecoms.com was told that it’s committing a fair bit to OpenRAN R&D and that it definitely sees a significant role for the technology across its entire radio estate. It seems the UK government has actually been of some help in this matter too, with the creation of a taskforce charged with improving vendor diversity considered a step in the right direction.

Vodafone seems to be trying to set the agenda when it comes to emerging technology trends. For years it promoted NB-IoT, but it’s been silent on that LPWAN (for IoT) lately. OpenRAN suffers from the classic paradox of new technologies in that companies are reluctant to invest much in being first movers. Vodafone is putting its money where its mouth is regarding OpenRAN and it will be watched closely by other operators looking for reassurance before deploying this untested technology.

Vodafone is under pressure to comply with a government deadline for the removal of all Huawei’s 5G products by the end of 2027. This would be fairly straightforward with mainstream technologies from Ericsson and Nokia. Using open RAN as a substitute, even across only 35% of these sites in rural areas, may be tough.

The payoff for Open RAN is a much larger choice of telecom equipment and software vendors. That might even include UK firms, which have not featured in the network equipment sector since the days of Marconi, eventually bought by Ericsson in 2006. Lime Microsystems, based in the UK town of Guildford, is one player that might benefit. It is already supplying 4G equipment to a Vodafone site in Wales that was supposed to be used during this year’s Royal Welsh Show, an agricultural event canceled in 2020 because of the coronavirus pandemic.

Japan’s Rakuten Mobile and U.S. based Dish Network have already made significant open RAN commitments. Yet both of those companies are building their networks from scratch as greenfield wireless carriers. With today’s update, Vodafone is taking a bigger step into the unknown than any other brownfield telco in a developed market has taken, including Telefonica.

………………………………………………………………………………………………………………………………………………………………………………………….

References:

https://www.ft.com/content/a872a299-2f49-45b3-b3ff-9200f6ce8247

https://www.lightreading.com/vodafone-uk-to-swap-big-part-of-huawei-for-open-ran/d/d-id/765104?

Vodafone and NEC Europe trial Open RAN technology with voice call

Vodafone and NEC Europe Ltd., a wholly owned subsidiary of NEC Corporation, in partnership with Altiostar, have jointly announced the first successful voice call made on an open virtual Radio Access Network (Open RAN) on Vodafone’s network in the Netherlands.

Open RAN technology holds promise and potential for next-generation wireless infrastructure. It’s being driven by innovation and open specifications from various consortiums (O-RAN, TIP Open RAN, and ONF). Today’s announcement demonstrates Vodafone’s strong commitment to sustaining its technological leadership, by bringing in such technological advances.

During the course of this trial, Vodafone and NEC intend to integrate solutions of leading Open RAN technology vendors, such as Altiostar [1.] and various other radio vendors, including NEC’s own 5G radio products, using commercial off the shelf (COTS) hardware from third parties, enabling Vodafone to transform its network to a software-based one suiting multiple deployment scenarios.

Note 1. It’s somewhat surprising that Altiostar was the only OpenRAN software vendor to be mentioned. Altiostar is part-owned by Rakuten and must therefore be near the front of the queue for its OpenRAN vendors. Rakuten has said it would make its Open RAN platform technology available to other operators. If successful, NEC and Altiostar will be involved in more deals as OpenRAN gathers momentum. Separately, there is the Rakuten-NEC 5G Core network (based on 3GPP 5G core “vision” specs) that Rakuten also wants to sell to global network operators.

…………………………………………………………………………………………………………………………………………………………………………………………

Image Credit: Rakuten Mobile

“We are proud to embark on this journey together with Vodafone that will transform mobile network economics, while deploying technology with greater flexibility, greater efficiencies, and more agility,” said Yogarajah Gopikrishna, GM at NEC Europe. “By integrating best of breed solutions, NEC, as an experienced Open RAN System Integrator, is committed to bring transformative change to the telecommunications space leveraging our long history and experience in mobile network solutions.”

“We are delighted to work together with NEC towards the first live Open RAN site,” said Ruud Koeyvoets, Vodafone Mobile Networks’ Director. “The introduction of the technology enables us to introduce new suppliers, such as Altiostar, giving us greater flexibility when rolling out our mobile network. We’re proud to be pioneering the development of Open RAN and will be monitoring the performance of this pilot.”

…………………………………………………………………………………………………………………………………………

About Vodafone

VodafoneZiggo is a leading Dutch company that provides fixed, mobile and integrated communication and entertainment services to consumers and businesses. As of June 30, 2020 we have more than 5 million mobile, nearly 4 million TV, nearly 3.4 million fixed broadband internet and 2.4 million fixed telephony subscriptions. VodafoneZiggo is a joint venture by Liberty Global, the largest international TV and broadband internet company, and Vodafone Group, one of the world’s largest telecommunication companies.

About NEC Europe Ltd.

NEC Europe Ltd. is a wholly owned subsidiary of NEC Corporation, a leader in the integration of IT network technologies that benefit businesses and people around the world. NEC Europe Ltd. is building upon its heritage and reputation for innovation and quality by providing its expertise, solutions and services to a broad range of customers, from telecom operators to enterprises and the public sector. For additional information, please visit the NEC Europe Ltd. home page at:

http://uk.nec.com/

References:

https://www.nec.com/en/press/202010/global_20201019_04.html

Why It’s IMPORTANT: Telefonica, Rakuten MOU on Open RAN, 5G Core Network and OSS

ABI Research: Open RAN radio units to exceed $47 billion by 2026

ABI Research expects the total CAPEX spent on Open RAN radio units (RUs) for public outdoor networks, including both macro and small cells will reach US$40.7 billion in 2026. Cumulative unit shipments will reach 9.9 million during the same year. Meanwhile, the total revenue of Open RAN radios for indoor enterprise networks will reach as much as US$6.7 billion in 2026, with cumulative unit shipments expected to reach 29.4 million. The Open Radio Access Network (Open RAN) market is rapidly expanding and is expected to exceed the traditional RAN market for the first time around 2027-2028.

“The Open RAN opportunity invites various stakeholders to bring their best in class technologies and hardware/software components to contribute to building a flexible, secure, agile, and multi-vendor interoperable network solution,” said Jiancao Hou, Senior Analyst at ABI Research. “In addition, trade wars and the global pandemic of COVID-19 have resulted in tremendous restrictions on the telecom supply chain and disrupt the evolution of new technologies. These effects will accelerate the development of Open RAN and open networks.”

Rakuten Mobile, a greenfield network operator in Japan, set a prime example to deploy this new approach. Moreover, many other operators are also quite active in the field, namely Dish Network in the U.S., Vodafone, Telefonica, Deutsche Telekom, Orange, and Turkcell in the EU and other geological regions. The Open RAN supply chain is also expanding with Altiostar, Mavenir, and Parallel Wireless leading the charge while new entrants are announced every week.

“ABI Research expects greenfield installations, as well as private enterprise networks and public consumer networks, in rural/uncovered areas to drive the deployment of Open RAN throughout the entire forecast period,” Hou points out. Open RAN can introduce many advantages to the enterprise market, including infrastructure reconfigurability, network sustainability, and deployment cost efficiency. On the other hand, these small and easily manageable network use cases will likely lower the entry barrier for Open RAN. Simultaneously they help network operators and their ecosystem partners clearly understand the approach and suppliers’ maturity level, therefore paving the way for a broader market. Besides, “ABI Research sees new entrants will lead the early deployment for Open RAN, but they will be increasingly challenged by tier-one vendors and system integrators for both public cellular implementations and enterprise deployment,” Hou concludes.

These findings are from ABI Research’s Open RAN market data report. This report is part of the company’s 5G & Mobile Network Infrastructure research service, which includes research, data, and analyst insights. Market Data spreadsheets are composed of in-depth data, market share analysis, and highly segmented, service-specific forecasts to provide detailed insight where opportunities lie.

Earlier this week, the Telecom Infra Project (TIP) saw fit to recap its recent achievements regarding OpenRAN; read more about them here.

Image Credit: Telecom Infra Project

…………………………………………………………………………………………………………………………………………………………………………………………

About ABI Research

ABI Research provides strategic guidance to visionaries, delivering actionable intelligence on the transformative technologies that are dramatically reshaping industries, economies, and workforces across the world. ABI Research’s global team of analysts publish groundbreaking studies often years ahead of other technology advisory firms, empowering our clients to stay ahead of their markets and their competitors.

References:

https://www.abiresearch.com/press/open-ran-radio-units-soar-more-us47-billion-2026/

Why It’s IMPORTANT: Telefonica, Rakuten MOU on Open RAN, 5G Core Network and OSS

Rakuten Mobile, Inc., and Telefónica, S.A. announced today the signing of a Memorandum of Understanding (MoU) to cooperate on a shared vision to advance OpenRAN, 5G Core and OSS (operations support systems).

“We’re excited to collaborate with Telefónica on this shared vision of advancing OpenRAN,” said Tareq Amin, Representative Director, Executive Vice President and CTO of Rakuten Mobile. “I envision our partnership to also co-explore further development around the Rakuten Communications Platform that will enable operators around the world to take advantage of cost-effective cloud-native mobile network architecture that is secure and reliable.” (Emphasis added)

Amin emphasised the partnership is not just about opening the interfaces: “It’s about the future possibilities when these networks become fully autonomous. What makes a difference is automation, as it enables much needed operational savings. We’re going to spend a lot of energy around joint development of automation, especially what we call OSS transformation to move away from legacy systems.”

Enrique Blanco, Chief Technology & Information Officer (CTIO) at Telefónica, said: “Telefónica strongly believes that networks are evolving towards end-to-end virtualization through an open architecture, and OpenRAN is a key piece of the whole picture. Beyond the flexibility and simplicity that OpenRAN will provide, it will change the supplier ecosystem and revolutionise the current 5G industry in the medium and long term. At the same time, open and virtualized networks will lead to a new telco operating model. Telefonica and Rakuten Mobile have signed this MoU to work towards evaluating and demonstrating the capability and feasibility of OpenRAN architectures and make them a reality.”

“This is a massive opportunity for all of us. This is an inclusive approach and how we can guarantee we are building the network for the future,” Blanco added. In addition to defining the interfaces, the companies are exploring procurement of hardware and software, Blanco said.

Under the terms of the MoU, Rakuten Mobile and Telefónica plan to collaborate on the following:

- To research and conduct lab tests and trials to support OpenRAN architectures, including the role of the AI (Artificial Intelligence) in the RAN Networks.

- To jointly develop proposals for optimal 5G RAN architecture and OpenRAN models as part of industry efforts to achieve quicker time to market, new price-points, and the benefits of software-centric RAN.

- To collaborate in building an open and cost-effective 5G ecosystem, based on open interfaces, that will help accelerate the maturity of 5G with global roaming.

- To develop a joint procurement scheme of OpenRAN Hardware and Software that will help increase volumes and reach economies of scale, including CUs, DUs, RRUs, and other necessary network equipment and/or software components.

In addition, the companies will also jointly work on 4G/5G Core and OSS technology utilized by Rakuten Mobile in Japan and its Rakuten Communications Platform.

“Vendor selection typically takes a long time in the telecoms industry compared with the web-scale companies. Maybe together with Telefonica the discussions with vendors might change a bit and require us to create new business models.”

Telefonica plans to introduce open RAN in three phases, with pilots starting this year, initial rollouts in 2021 and mass deployments in 2022. “I’m extremely convinced we’ll hit these targets, but we are trying to be conservative,” Blanco said. From 2022 to 2025, up to half of Telefonica’s 5G deployments will use open RAN, he added.

Why this MOU is IMPORTANT:

- As there are no ITU recommendations or 3GPP specs detailing how to implement a 5G Core/5G SA network, the Rakuten-NEC 5G core could become a defacto standard. As we’ve stated many times, the 3GPP specs on 5G Core are network architecture specs that leave the various implementation choices to the implementer. And 3GPP is not even sending their 5G non-radio specs to ITU-T for consideration as future recommendations.

- Meanwhile, Rakuten and NEC have created a 5G “cloud native” core spec (proprietary of course) built on containers, which NEC (and likely other vendors) will implement in Rakuten’s 5G network. Rakuten and NEC plan to offer there 5G Core as a product to other 5G network operators.

- The Rakuten Communications Platform for Open RAN could similarly be sold to other carriers that want to deploy an Open RAN 4G/5G network. The catch here is that any legacy wireless carrier wanting to do so would have to support two incompatible sets of cellular infrastructure to serve its customers: 1] The traditional “closed box base stations” (from Huawei, Ericsson, Nokia, Samsung, ZTE, etc) in cell towers AND 2] The new Open RAN, multi-vendor base stations using totally different hardware/software platforms which requires a significant amount of systems integration and tech support/trouble resolution. Rakuten’s platform could, at the very least, simplify systems integration and avoid “finger pointing” when troubleshooting a failure or degraded service.

- Both the Rakuten-NEC 5G Core and Rakuten Communications Platform for Open RAN could be terrific products to sell to greenfield carriers (with no existing wireless infrastructure). Apparently, that’s too late for Dish Network and Reliance Jio, which claim they’re building their own “open 5G” network. Meanwhile, India based Tech Mahindra claims it can build a complete 5G network now, which they would surely sell to would be 5G network providers, utilities, and government agencies around the world.

- The OSS co-operation amongst these two carriers is significant, because (once again) there are no standards for 5G SA OSS’s such that the deliverable output of cooperation here could become a defacto standard.

- Co-operative work on automation of network functions and operations will also be vitally important. Otherwise, that too will be proprietary to the wireless network provider which would require different software for the SAME functions for different carriers. The work will probably start with these 2800 series 3GPP specs: TS 28.554 Management and orchestration; 5G end to end Key Performance Indicators (KPI); TS 28.555 Management and orchestration; Network policy management for 5G mobile networks; Stage 1 TS 28.556 Management and orchestration; Network policy management for 5G mobile networks; Stage 2 and stage 3. There are similar ITU-T SG 13 high level Recommendations on these subjects.

Image Credit: STL Partners

………………………………………………………………………………………………………………………………………………………………………………

About Rakuten Mobile

Rakuten Mobile, Inc. is a Rakuten Group company responsible for mobile communications, including mobile network operator (MNO) and mobile virtual network operator (MVNO) businesses, as well as ICT and energy. Through continuous innovation and the deployment of advanced technology, Rakuten Mobile aims to redefine expectations in the mobile communications industry in order to provide appealing and convenient services that respond to diverse customer needs.

About Telefónica

Telefónica is one of the largest telecommunications service providers in the world. The company offers fixed and mobile connectivity as well as a wide range of digital services for residential and business customers. With 342 million customers, Telefónica operates in Europe and Latin America. Telefónica is a 100% listed company and its shares are traded on the Spanish Stock Market and on those in New York and Lima.

Telefonica was a co-founder of the Open RAN Policy Coalition, and previously partnered with five companies including Altiostar and Intel to foster the approach.

For more information about Telefónica: www.telefonica.com

References:

https://stlpartners.com/research/5g-bridging-hype-reality-and-future-promises/

Analysis of Open Network Foundation new 5G SD-RAN™ Project

Executive Summary:

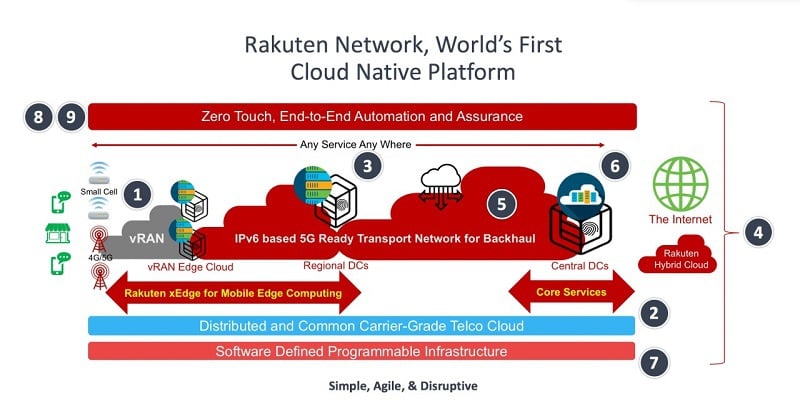

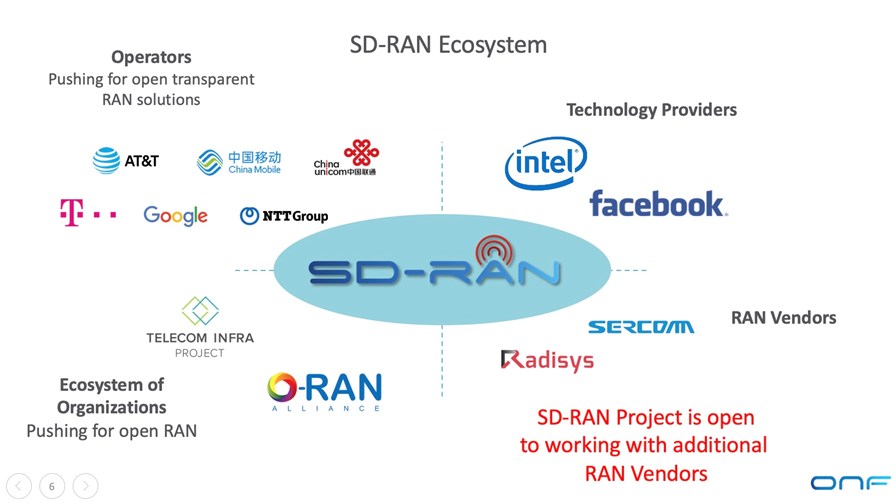

In a move that will help promote multi-vendor interoperability, the Open Networking Foundation (ONF) today announced the formation of the SD-RAN project (Software Defined Radio Access Network) to pursue the creation of open source software platforms and multi-vendor solutions for mobile 4G and 5G RAN deployments. Initially, the project will focus on building an open source Near Real-Time RAN Intelligent Controller (nRT-RIC) compatible with the O-RAN architecture.

The new SD-RAN project is backed by a consortium of leading operators and aligned technology companies and organizations that together are committed to creating a truly open RAN ecosystem. Founding members include AT&T, China Mobile, China Unicom, Deutsche Telekom, Facebook, Google, Intel, NTT, Radisys and Sercomm. All the project members will be actively contributing, and this includes the operators contributing use cases and trialing the results, according to the ONF. However, the larger cellular base station vendors that are ONF members, Nokia, Samsung, ZTE, Fujitsu, NEC were silent on their participation in this SD-RAN project.

There may be some confusion caused by ONF’s SD-RAN project as it is the third Open RAN consortium. The O-RAN Alliance and TIP Open RAN project are working on open source hardware and open interfaces for disaggregated RAN equipment, like a 4G/5G combo base station.

In a brief video chat yesterday, Timon Sloane, VP of Ecosystem and Marketing for ONF told me that this new ONF SD-RAN project would be in close contact with the other two Open RAN consortiums and distinguished itself from them by producing OPEN SOURCE SOFTWARE for disaggregated RAN equipment—something he said the O-RAN Alliance and TIP Open RAN project were NOT doing.

That should go a long way in dispelling that confusion, but it nonetheless presents a challenge on how three consortiums can effectively work together to produce meaningful open source software code (ONF) and hardware (O-RAN Alliance and TIP) specifications with joint compliance testing to ensure multi-vendor interoperability.

Sloane told Matt Kapko of SDXCentral: “The operators really are pushing for separation of hardware and software and for enabling new innovations to come in in software without it being tightly coupled to the hardware that they purchase. And xApps are where the functionality of the RAN is to be housed, and so in order to do this in a meaningful way you have to be able to do meaningful functions in these xApps,” Sloane said.

However, no mention was made in the ONF press release of a liaison with either 3GPP or ITU-R WP5D which are producing the standards and specs for 5G and have already done so for 4G-LTE. Neither of the aforementioned O-RAN consortiums have liaisons with those entities either.

There are other complications with Open RAN (independent of SD-RAN), such as U.S. government’s attempt to cripple Huawei and other China telecom equipment vendors, need for a parallel wireless infrastructure, legacy vs greenfield carriers. These are addressed in Comment and Analysis section below.

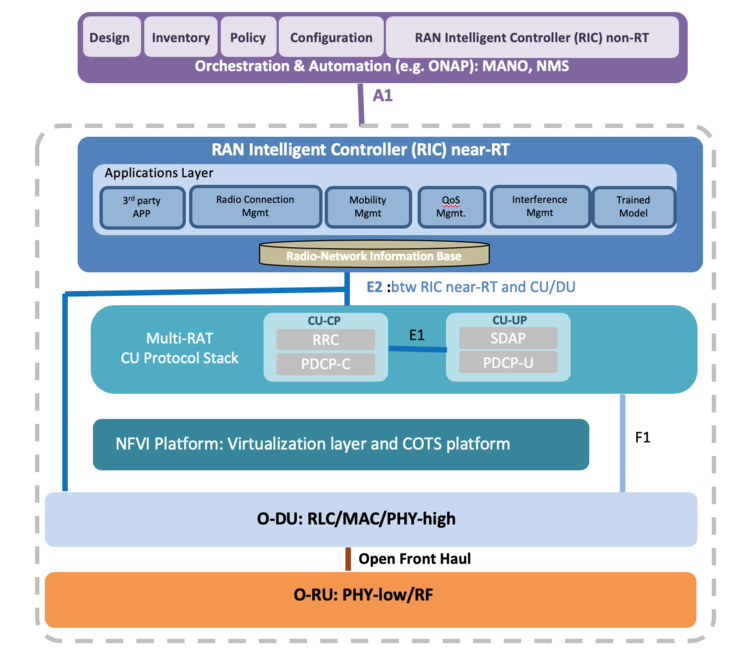

µONOS-RIC:

Central to the project is the development of an open source near-real time RIC called µONOS-RIC (pronounced “micro-ONOS-RIC”).

µONOS is a microservices-based SDN controller created by the refactoring and enhancement of ONOS, the leading SDN controller for operators in production tier-1 networks worldwide. µONOS-RIC is built on µONOS, and hence features a cloud-native design supporting active-active clustering for scalability, performance and high availability along with the real-time capabilities needed for intelligent RAN control.

µONOS-RIC is designed to control an array of multi-vendor open RAN equipment consistent with the O-RAN ALLIANCE architecture. In particular, the O-RAN ALLIANCE E2 interface is used to interface between µONOS-RIC and vendor supplied RAN RU/DU/CU RAN components.

xApps running on top of the µONOS-RIC are responsible for functionality that traditionally has been implemented in vendor-proprietary implementations. A primary goal of the SD-RAN project (and, not coincidentally, for the operators who founded the O-RAN consortium) is to enable an external intelligent controller to control the RAN so that operators have both visibility and control over their RAN networks, thus giving operators ownership and control over how spectrum is utilized and optimized along with the tools to deliver an optimal experience for users and applications.

……………………………………………………………………………………………………………………………………………………………………………………………………

Relationship to O-RAN Alliance, O-RAN Software Community and TIP:

The participating members of the SD-RAN project plan to implement, prototype and trial an advanced architecture that enables intelligent RIC xApps to control a broad spectrum of SON and RRM functionality that historically has been implemented as vendor-proprietary features on bespoke base station equipment and platforms. SD-RAN’s focus and goals are complementary to various efforts across the industry, including work taking place within the O-RAN ALLIANCE, the O-RAN Software Community and the TIP OpenRAN Project Group.

SD-RAN will follow O-RAN specifications as they are developed and will also make use of components of existing open source to facilitate interoperability. As the project pioneers new functionality, all extensions and learnings that come from building the system will be contributed back to O-RAN ALLIANCE, with the intent that these extensions can inform and advance the O-RAN specifications.

The SD-RAN work inside the ONF community will take place in parallel with work being contributed to the O-RAN Software Community. The intent is for interoperable implementations to come out of both efforts, so that a mix of open source and vendor proprietary components can be demonstrated and ultimately deployed.

Timing and Availability:

The SD-RAN project already has a working skeleton prototype of the µONOS-RIC controller above a RAN emulation platform through the E2 interface. This implementation is demonstrating handover and load balancing at scale, supporting over 100 base stations and 100,000 user devices with less than 50ms handover latency (less than 10ms latency for 99% of all handovers).

The SD-RAN community is advancing towards a field trial by early 2021, working with RAN vendors to integrate carrier-grade RU/DU/CU components while in parallel implementing xApps to demonstrate SON and RRM functionality. Interested parties are encouraged to contact ONF for additional information.

Quotes Supporting the SD-RAN Project:

“AT&T strongly supports the development of specifications and components that can help drive openness and innovation in the RAN ecosystem. The O-RAN ALLIANCE’s specifications are enabling the ecosystem, with a range of companies and organizations creating both open source and proprietary implementations that are bringing the open specifications to life. The ONF SD-RAN project, along with the O-RAN OSC, will expand the ecosystem with an nRT-RIC that can support xApps and help demonstrate their interoperability. This project will help accelerate the transition to an open RAN future.”

Andre Fuetsch, President and Chief Technology Officer, AT&T Labs

“China Mobile co-founded O-RAN in order to promote both the opening of the RAN ecosystem for multi-vendor solutions and the realization of RAN with native intelligence for performance and cost improvement. An open nRT-RIC with support for open xApps that go beyond policy-based control and SON to also enhance Radio Resource Management (RRM) will make it possible for operators to optimize resource utilization and application performance. We are excited to see the development of an open nRT-RIC and xApps in the SD-RAN project led by ONF, and expect this work to help advance the state-of-art for open and intelligent RAN.”

Dr. Chih-Lin I, Chief Scientist, Wireless Technologies, China Mobile

“China Unicom has been a long-term partner with ONF. We continue to see the benefits of the ONF’s work and the impact it has on our industry. The SD-RAN project is now applying the ONF’s proven strategy for disaggregating and creating open source implementations to the 5G RAN space in order to foster innovation and ecosystem transformation. We are excited by this work, and are committed to trialing a solution as it becomes available.”

Dr. Xiongyan Tang, Network Technology Research Institute, China Unicom

“Deutsche Telekom is a huge believer in applying disaggregation and open source principles for our next-generation networks. DT has ONF’s mobile core platform (OMEC) in production and we are taking ONF’s broadband access (SEBA/VOLTHA) platform to production towards the end of 2020. This journey has shown us the tremendous value that is created when we can build solutions based on interoperable multi-vendor components intermixed with open source components. ONF’s SD-RAN project is leveraging these same principles to help accelerate innovation in the RAN domain, and we are excited to be an active collaborator in this journey.”

Dr. Alex Jinsung Choi, SVP Strategy & Technology Innovation, Deutsche Telekom

“Connectivity is an integral part of Facebook’s focus to bring people closer together. We work closely with partners to develop programs and technologies that make connectivity more affordable and accessible. Through our collaboration with ONF on their SD-RAN project, we look forward to engaging with the community to improve connectivity experiences for many people around the world.”

Aaron Bernstein, Facebook’s Director of Connectivity Ecosystem Programs

“Google is an advocate for SDN, disaggregation and open source, and we are excited to see these principles now being applied to the RAN domain. ONF’s SD-RAN project’s ambition to create an open source RIC can help invigorate innovation across the mobile domain.”

Ankur Jain, Distinguished Engineer, Google

“Intel is an active participant of the ONF’s SD-RAN project to advance the development of open RAN implementations on high volume servers. ONF has been leading the industry with advanced open source implementations in the areas of disaggregated Mobile Core, e.g. the Open Mobile Evolved Core (OMEC), and we look forward to continuing to innovate by applying proven principles of disaggregation, open source and AI/ML to the next stepping stone in this journey – the RAN. SD-RAN will be optimized to leverage powerful performance, AI/ML, and security enhancements, which are essential for 5G and available in Intel® Xeon® Scalable Processors, network adapters and switching technologies, including Data-Plane Development Kit (DPDK) and Intel® Software Guard Extensions (Intel SGX).”

Pranav Mehta, Vice President of Systems and Software Research, Intel Labs

“NTT sees great value in transforming the RAN domain in order to foster innovation and multi-vendor interoperability. We are excited to be part of the SD-RAN ecosystem, and look forward to working with the community to develop open source components that can be intermixed with vendor proprietary elements using standard O-RAN interfaces.”

Dai Kashiwa, Evangelist, Director of NTT Communications

“Radisys is excited to be a founding member of the SD-RAN project, and we are committed to integrating our RAN software implementation (CU & DU) with O-RAN interfaces to the µONOS-RIC controller and xApps being developed by the SD-RAN project community. This effort has the potential to accelerate the adoption of O-RAN based RIC implementation and xApps, and we are committed to working with this community to advance the open RAN agenda.”

Arun Bhikshesvaran, CEO, Radisys

“As a leading manufacturer of small cell RAN equipment and an avid supporter of the open RAN movement, Sercomm is excited to collaborate with the SD-RAN community to open E2 interfaces and migrate some of our near-real-time functionalities from the RAN equipment into xApps running the μONOS-RIC controller. This is a nascent yet dynamic area full of potential, and we are committed to working with the SD-RAN ecosystem to build solutions ready for trials and deployment.”

Ben Lin, CTO and Co-Founder, Sercomm

“TIP’s OpenRAN solutions are an important element of our work to accelerate innovation across all elements of the network including Access, Transport, Core and Services. We are excited about the collaboration between our RIA subgroup and ONF’s SD-RAN project to accelerate RAN disaggregation and adoption of open interfaces. Through this collaboration we will enable the OpenRAN ecosystem to leverage the strengths of data science and AI/ML technologies to set new industry benchmarks on performance, efficiency and total cost of ownership.”

Attilio Zani, Executive Director for Telecom Infra Project (TIP)

…………………………………………………………………………………………………………………………………………………………………………………………………

Comment and Analysis of Open RAN Market:

Disclaimer: Like all IEEE Techblog posts, opinions, comment and analysis are ALWAYS by the authors and do NOT EVER represent an opinion or position by IEEE or the IEEE Communications Society. This should be obvious to all in the 11 1/2 years of this author’s contribution to the IEEE Techblog and its predecessor- ComSoc Community blogs.

…………………………………………………………………………………………………………………………………………………………………………

Besides NOT having a liaison with either 3GPP or ITU-R, the following Open RAN issues may limit its market potential. These are NOT specific to the ONF SD-RAN project, but generic to Open RAN deployments.

- U.S. officials promoting Open RAN as a way to decrease the dominance of Huawei, the world’s biggest vendor of mobile equipment by market share and also to thwart the rise of other vendors like ZTE and China Information and Communication Technology Group (CICT) which recently won a small part of s China Mobile contract. Obviously, China’s government will fight back and NOT allow any version of Open RAN to be deployed in China (likely to be the world’s biggest 5G market by far)! That despite China Mobile and China Unicom’s expressed interest in Open RAN (see Quotes above). Remember, that the three big China carriers (China Mobile, China Telecom, China Unicom) are all state owned.

- Dual infrastructure: If a legacy wireless carrier deploys Open RAN, existing wireless infrastructure equipment (base stations, small cells, cell tower equipment, backhaul, etc) must remain in place to support its customers. Open RAN gear (with new fronthaul and backhaul) won’t have wide coverage area for many years. Therefore, current customers can’t simply be switched over from legacy wireless infrastructure to Open RAN gear. That means that a separate separate and distinct WIRELESS INFRASTRUCTURE NETWORK must be built and physically installed for Open RAN gear. Yet no one seems to talk or write about that! Why not?

- Open RAN is really only for greenfield carriers with NO EMBEDDED WIRELESS INFRASTRUCTURE. Rakuten and Dish Network are two such carriers ideally suited to Open RAN. That despite a lot of noise from AT&T and Deutsche Telekom about Open RAN trials. All the supporting quotes from legacy carriers are indicative of their interest in open source software AND hardware: to break the stranglehold the huge wireless equipment vendors have on cellular infrastructure and its relatively high costs of their proprietary network equipment and element management systems.

- Open RAN should definitely lower initial deployment costs (CAPEX), but may result in INCREASED maintenance cost (OPEX) due to the difficulty of ensuring multi-vendor interoperability, systems integration and MOST IMPORTANTLY tech support with fault detection and rapid restoration of service.

Conclusions:

Considering all of the above, one may conclude that traditional cellular infrastructure, based on vendor specific equipment and proprietary interfaces, will remain in place for many years to come. As a result, Open RAN becomes a decent market for greenfield carriers and a small market (trial or pilot networks) for legacy carriers, which become brownfield carriers after Open RAN is commercially available to provide their cellular services.

Given a smaller than commonly believed market for Open RAN, this author believes the SD-RAN project is a very good idea. That’s because it will make open source software available for Open RAN equipment, something that neither the O-RAN Alliance of TIP Open RAN project are doing. Of course, having more vendors producing Open RAN white boxes and software does add to the systems integration and tech support that only large (tier 1) telcos (like AT&T, Deutsche Telekom, NTT and cloud companies (like Google, Facebook, Microsoft) have the staff to support.

In a follow up phone conversation today, Timon Sloane told me that network operators want a fully functional and powerful RAN Intelligent Controller (RIC) to gain visibility and control over their RANs, but that has yet to be realized. To date, such controllers have been proprietary, rather than open source software.

The ONF µONOS-RIC is a key software module to realize that vision, Timon said. It is very much like a (near) real time operating system for an Open RAN. If successful, it will go a long way to promote multi-vendor interoperability for Open RAN deployments. Success and good luck ONF!

………………………………………………………………………………………………………………………………………………………………………….

References:

https://www.prnewswire.com/news-releases/onf-announces-new-5g-sd-ran-project-301117481.html

https://www.sdxcentral.com/articles/news/onf-picks-up-where-o-ran-alliance-falls-short/2020/08/

Mavenir and Altiostar Collaborate to Deliver OpenRAN Radios for U.S. Market; Parallel Wireless CEO Opinion

Mavenir and Altiostar are among a number of networking software start-ups focusing on delivering Open RAN solutions to wireless network operators . Both companies specialize in cloud telecoms software – so one would expect them to be competing with each other. However, they have decided to collaborate to deliver a wide portfolio of radios based on OpenRAN principles for the US market.

Both companies will be supporting the development of radios through third party OEM’s that will be based on O-RAN open interfaces and will address the frequencies of Tier-1 and Regional/Rural operators in the US.

Analysis:

The two companies will NOT design or build the radios themselves, which is not within the scope of networking software startups. In essence, they will be using O-RAN compliant radios built by (mostly Asian) OEMs/ODMs- many of which are members of the O-RAN Alliance. One has to wonder, however, why such an agreement is necessary? Why aren’t O-RAN compliant interface specifications complete and well enough accepted to ensure multi-vendor interoperability?

The joint press release answers those questions:

“Very few companies are participating in the current (OpenRAN) supply chain and mostly offering proprietary radio solutions lacking open interfaces that are not interoperable with other network elements. In addition, the requirement to procure products from trusted vendors in the US market is also causing operators to reconsider supplier options. OpenRAN radios provide new possibilities for operators to implement a secure, cost effective and best of breed solution as networks move to 5G and beyond.”

Parallel Wireless CEO Steve Papa commented to Light Reading that Open RAN (aka O-RAN) “will only be as good as the radios that are available,” he said. “If Ericsson and Nokia are struggling to be competitive with Huawei’s radios, we should not expect O-RAN to magically solve this problem by using the same semiconductors available to Ericsson and Nokia at present.”

Papa blames a lack of U.S. semiconductor innovation for Huawei’s lead in radios. He has repeatedly urged U.S. authorities to pump an extra $1 billion into radio semiconductor research. He has even suggested using the $1 billion the US recently fined Ericsson for corruption, a remark that is unlikely to win him many friends in Stockholm.

………………………………………………………………………………………………………………………………………………..

As part of this effort, it is also planned to have these radios available to support the Secure and Trusted Communications Networks Act that was signed into law on March 12, 2020.

Public Law No: 116-124 (03/12/2020)

Secure and Trusted Communications Networks Act of 2019

This bill establishes (1) a mechanism to prevent communications equipment or services that pose a national security risk from entering U.S. networks, and (2) a program to remove any such equipment or services currently used in U.S. networks.

Specifically, the bill prohibits the use of certain federal funds to obtain communications equipment or services from a company that poses a national security risk to U.S. communications networks. The Federal Communications Commission (FCC) must publish and maintain a list of such equipment or services.

Each communications provider must submit an annual report to the FCC regarding whether it has purchased, rented, leased, or otherwise obtained any prohibited equipment and, if so, provide a detailed justification for such action.

The bill also establishes the Secure and Trusted Communications Networks Reimbursement Program to supply small communications providers (i.e., providers with 2 million or fewer customers) with funds to offset the cost of removing prohibited equipment or services from their networks and replacing it with more secure communications equipment or services.

In addition, the National Telecommunications and Information Administration must establish a program to share information regarding supply chain security risks with trusted communications providers and suppliers.

For a short video describing O-RAN’s progress, see www.o-ran.org/videos

……………………………………………………………………………………………………………………………………………

“Altiostar has been at the forefront of the OpenRAN movement that is now being embraced by mobile operators around the world,” said Ashraf Dahod, CEO of Altiostar Networks. “Our collaboration with Mavenir on OpenRAN radios will ensure operators in the US have a truly open end-to-end infrastructure that will be cost effective and allows them to grow their business.”

“We are collaborating with Altiostar to realize the full promise of OpenRAN. Our Radios will have O-RAN compliant interfaces and will interwork with other vendors’ solutions,” said Pardeep Kohli, President and CEO of Mavenir. “I encourage other companies in the OpenRAN Policy Coalition to open their radios and ensure a broad supply of radios with open interfaces that are interoperable with third party equipment.”

Mavenir and Altiostar have committed to work together to develop a full set of FCC banded radios to be available starting June 2020, with a complete set of radios in the market by Q1 2021. The parties are also committed to making these OpenRAN radios available to be sourced by all OpenRAN vendors and system integrators, widening the OpenRAN supply chain in the US market to meet the frequency band needs of Tier-1 and Regional/Rural operators.

Mavenir and Altiostar have been pioneers of OpenRAN, including founding board members of the Open RAN Policy Coalition, as well as part of the Telecom Infra Project (TIP) and O-RAN Alliance.

Members of the Open RAN Policy Coalition include Airspan, Altiostar, AT&T, AWS, Cisco, CommScope, Dell, DISH Network, Facebook, Fujitsu, Google, IBM, Intel, Juniper Networks, Mavenir, Microsoft, NEC Corporation, NewEdge Signal Solutions, Nokia, NTT, Oracle, Parallel Wireless, Qualcomm, Rakuten Mobile, Samsung Electronics America, Telefónica, US Cellular, US Ignite, Verizon, VMWare, Vodafone, World Wide Technology, and XCOM-Labs.

Other software start-ups that are pursuing Open RAN include Parallel Wireless, Robin io., WiSig Networks, and several others. This author has talked with principals of Robin.io and WiSig who have been invited to write guest articles about their work for the IEEE Techblog.

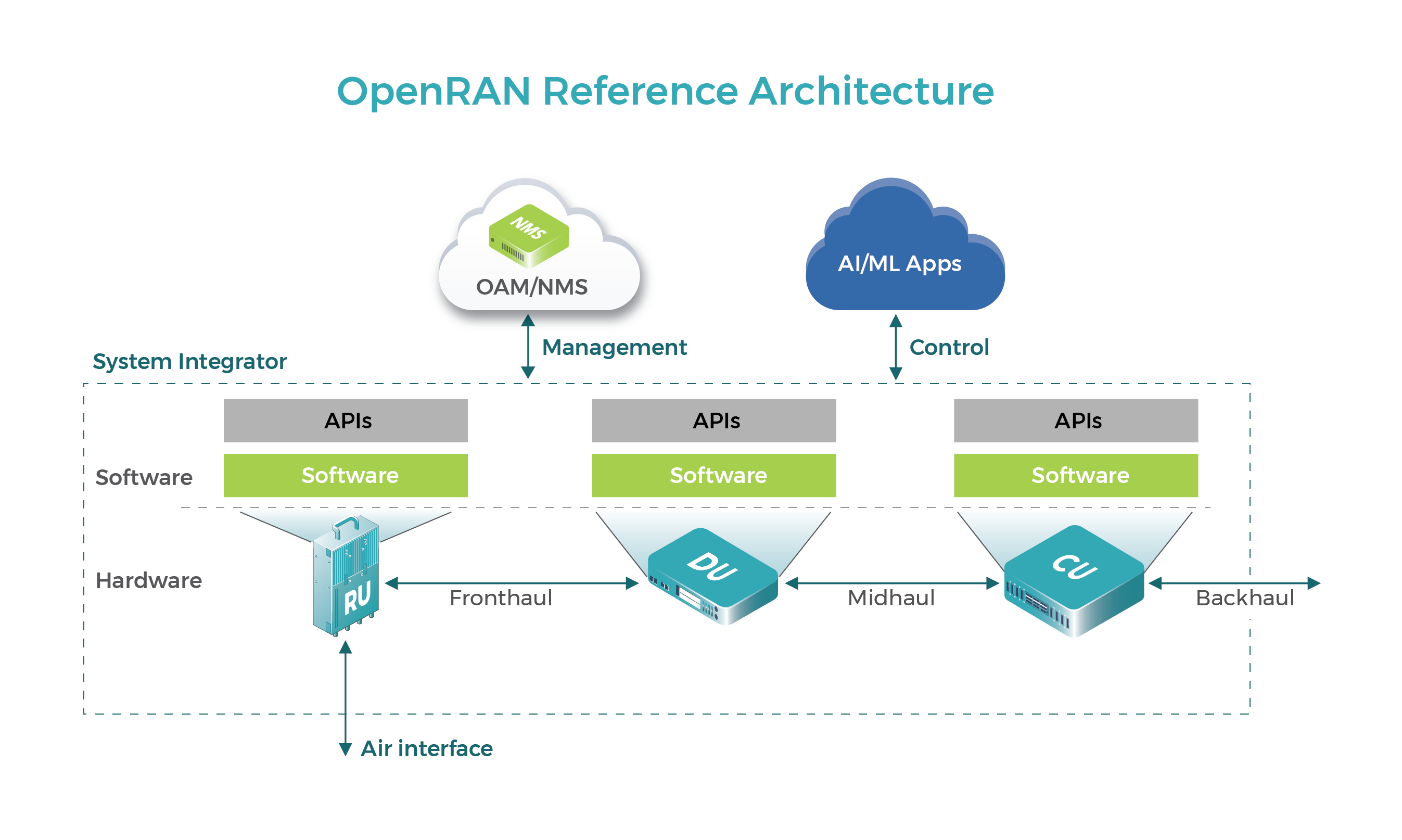

Below is the O-RAN reference architecture model:

…………………………………………………………………………………………………………………………………..

About Mavenir:

Mavenir is the industry’s only end-to-end, cloud-native Network Software and Solutions/Systems Integration Provider for 4G and 5G, focused on accelerating software network transformation for Communications Service Providers (CSPs). Mavenir offers a comprehensive end-to-end product portfolio across every layer of the network infrastructure stack. From 5G application/service layers to packet core and RAN, Mavenir leads the way in evolved, cloud-native networking solutions enabling innovative and secure experiences for end users. Leveraging innovations in IMS (VoLTE, VoWiFi, Advanced Messaging (RCS)), Private Networks as well as vEPC, 5G Core and OpenRAN vRAN, Mavenir accelerates network transformation for more than 250+ CSP customers in over 140 countries, which serve over 50% of the world’s subscribers.

Mavenir embraces disruptive, innovative technology architectures and business models that drive service agility, flexibility, and velocity. With solutions that propel NFV evolution to achieve web-scale economics, Mavenir offers solutions to help CSPs with cost reduction, revenue generation, and revenue protection. www.mavenir.com

About Altiostar:

Altiostar provides a 4G and 5G open virtualized RAN software solution that supports open interfaces and disaggregates the hardware from the software to build a multi-vendor web-scale network. This solution supports indoor and outdoor massive MIMO, as well as macro and small cells, enabling interference management, carrier aggregation and dual connectivity to improve the efficiency of the network. It also enhances the Quality of Experience for the end user, while providing broadband speeds. Operators can add intelligence, quickly adapt the software for different services and automate operations to rapidly scale the network and reduce Total Cost of Ownership (TCO). The Altiostar open vRAN solution has been deployed globally, including the world’s first cloud native-mobile network with Rakuten in Japan. www.altiostar.com

……………………………………………………………………………………………………………..

References:

Ultra Oxymoron: GSMA teams up with O-RAN Alliance without liaison with 3GPP or ITU