Optical Network Equipment Market

Highlights of 2017 Telecom Infrastructure Project (TIP) Summit

Executive Summary:

The Telecom Infra Project (TIP) is gaining a lot of awareness and market traction, judging by last week’s very well attended TIP Summit at the Santa Clara Convention Center. The number of telecom network operators presented was very impressive, especially considering that none were from the U.S. with the exception of AT&T, which presented on behalf of the Open Compute Project (OCP) Networking Group. It was announced at the summit that the OCP Networking group had formed an alliance with TIP.

The network operators that presented or were panelists included representatives from: Deutsche Telekom AG, Telefonica, BT, MTN Group (Africa), Bharti Airtel LTD (India), Reliance Jio (India), Vodafone, Turkcell (Turkey), Orange, SK Telecom, TIM Brasil, etc. Telecom Italia, NTT, and others were present too. Cable Labs – the R&D arm of the MSOs/cablecos – was represented in a panel where they announced a new TIP Community Lab (details below).

Facebook co-founded TIP along with Intel, Nokia, Deutsche Telekom, and SK Telecom at the 2016 Mobile World Congress event. Like the OCP (also started by Facebook), its mission is to dis-aggregate network hardware into modules and define open source software building blocks. As its name implies, TIP’s focus is telecom infrastructure specific in its work to develop and deploy new networking technologies. TIP members include more than 500 companies, including telcos, Internet companies, vendors, consulting firms and system integrators. Membership seems to have grown exponentially in the last year.

During his opening keynote speech, Axel Clauberg, VP of technology and innovation at Deutsche Telekom and chairman of the TIP Board of Directors, announced that three more operators had joined the TIP Board: BT, Telefonica, and Vodafone.

“TIP is truly operator-focused,” Clauberg said. “It’s called Telecom Infrastructure Project, and I really count on the operators to continue contributing to TIP and to take us to new heights.” That includes testing and deploying the new software and hardware contributed to TIP, he added.

“My big goal for next year is to get into the deployment stage,” Clauberg said. “We are working on deployable technology. [In 2018] I want to be measured on whether we are successfully entering that stage.”

Jay Parikh, head of engineering and infrastructure at Facebook, echoed that TIP’s end goal is deployments, whether it is developing new technologies, or supporting the ecosystem that will allow them to scale.

“It is still very early. Those of you who have been in the telco industry for a long time know that it does not move lightning fast. But we’re going to try and change that,” Parikh said.

…………………………………………………………………………………………………………………….

TIP divides its work into three areas — access, backhaul, and core & management — and each of the project groups falls under one of those three areas. Several new project groups were announced at the summit:

- Artificial Intelligence and applied Machine Learning (AI/ML): will focus on using machine learning and automation to help carriers keep pace with the growth in network size, traffic volume, and service complexity. It will also work to accelerate deployment of new over-the-top services, autonomous vehicles, drones, and augmented reality/virtual reality.

- End-to-End Network Slicing (E2E-NS): aims to create multiple networks that share the same physical infrastructure. That would allow operators to dedicate a portion of their network to a certain functionality and should make it easier for them to deploy 5G-enabled applications.

- openRAN: will develop RAN technologies based on General Purpose Processing Platforms (GPPP) and disaggregated software.

The other projects/working groups are the following:

- Edge Computing: This group is addressing system integration requirements with innovative, cost-effective and efficient end-to-end solutions that serve rural and urban regions in optimal and profitable ways.

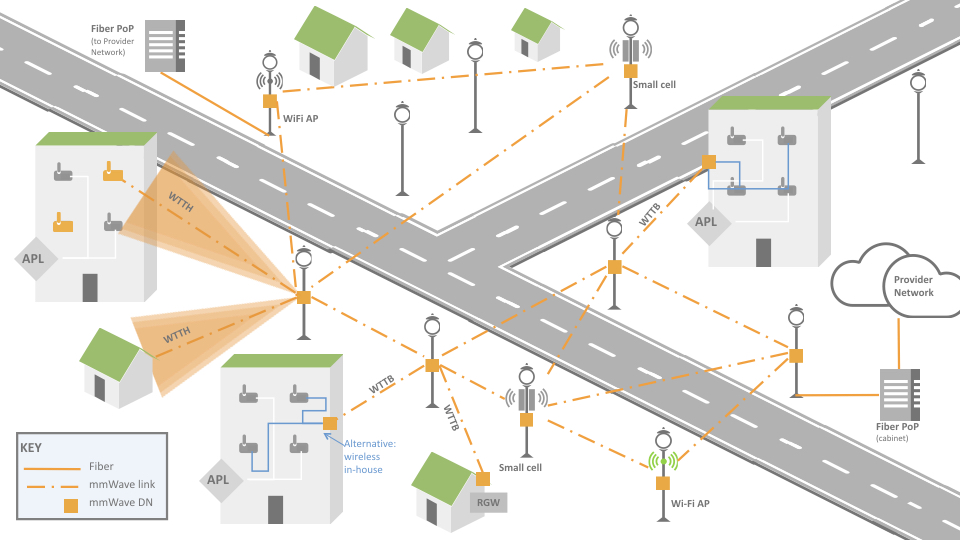

- This group is pioneering a 60GHz wireless networking system to deliver gigabits of capacity in dense, urban environments more quickly, easily and at a lower cost than deploying fiber. A contribution was made to IEEE 802.11ay task force this year on use cases for mmW backhaul.

Above illustration courtesy of TIP mmW Networks Group

- Open Optical Packet Transport: This project group will define Dense Wavelength Division Multiplexing (DWDM) open packet transport architecture that triggers new innovation and avoids implementation lock-ins. Open DWDM systems include open line system & control, transponder & network management and packet-switch and router technologies.

- The Working Group is focused on enabling carriers to more efficiently deliver new services and applications by using mobile edge computing (MEC) to turn the RAN network edge (mobile, fixed, licensed and unlicensed spectrum) into an open media and service hub.

- The project is pioneering a virtualized RAN (VRAN) solution comprised of low-cost remote radio units that can be managed and dynamically reconfigured by a centralized infrastructure over non-ideal transport.

- project group will develop an open RAN architecture by defining open interfaces between internal components and focusing on the lab activity with various companies for multi-vendor interoperability. The goal is to broaden the mobile ecosystem of related technology companies to drive a faster pace of innovation.

A complete description, with pointers/hyperlinks to respective project/work group charters is in the TIP Company Member Application here.

TEACs – Innovation Centers for TIP:

Also of note was the announcement of several new TEACs – TIP Ecosystem Acceleration Centers, where start-ups and investors can work together with incumbent network operators to progress their respective agendas for telecom infrastructure.

The TIP website comments on the mission of the TEACs:

“By bringing together the key actors – established operators, cutting-edge startups, and global & local investors – TEACs establish the necessary foundation to foster collaboration, accelerate trials, and bring deployable infrastructure solutions to the telecom industry.”

TEACs are located in London (BT), Paris (Orange), and Seoul (SK Telecom). .

TIP Community Labs:

TIP Community Labs are physical spaces that enable collaboration between member companies in a TIP project group to develop telecom infrastructure solutions. While the labs are dedicated to TIP projects and host TIP project teams, the space and basic equipment are sponsored by individual TIP member companies hosting the space. The labs are located in: Seoul, South Korea (sponsored by SK Telecom); Bonn, Germany (sponsored by Deutsche Telekom); Menlo Park, California, USA (sponsored by Facebook). Coming Soon Rio de Janiero, Brazil – to be sponsored by TIM Brasil. At this summit, Cable Labs announced it will soon open a TIP Community Lab in Louisville, CO.

…………………………………………………………………………………………………………………………..

Selected Quotes:

AT&T’s Tom Anschutz (a very respected colleague) said during his November 9th – 1pm keynote presentation:

“Network functions need to be disaggregated and ‘cloudified.’ We need to decompose monolithic, vertically integrated systems into building blocks; create abstraction layers that hide complexity. Design code and hardware as independent modules that don’t bring down the entire IT system/telecom network if they fail.”

Other noteworthy quotes:

“We’re going to build these use-case demonstrations,” said Mansoor Hanif, director of converged networks and innovation at BT. “If you’re going to do something as difficult and complex as network slicing, you might as well do it right.”

“This is the opening of a system that runs radio as a software on top of general purpose processes and interworks with independent radio,” said Santiago Tenorio, head of networks at Vodafone Group. The project will work to reduce the costs associated with building mobile networks and make it easier for smaller vendors to enter the market. “By opening the system will we get a lower cost base? Definitely yes,” absolutely yes,” Tenorio added.

“Opening up closed, black-box systems enables innovation at every level, so that customers can meet the challenges facing their networks faster and more efficiently,” said Josh Leslie, CEO of Cumulus Networks. “We’re excited to work with the TIP community to bring open systems to networks beyond the data center.” [See reference press release from Cumulus below].

“Open approaches are key to achieving TIP’s mission of disaggregating the traditional network deployment approach,” said Hans-Juergen Schmidtke, Co-Chair of the TIP Open Optical Packet Transport project group. “Our collaboration with Cumulus Networks to enable Cumulus Linux on Voyager (open packet DWDM architecture framework and white box transponder design) is an important contribution that will help accelerate the ecosystem’s adoption of Voyager.”

……………………………………………………………………………………………………………………………

Closing Comments: Request for Reader Inputs!

- What’s really interesting is that there are no U.S. telco members of TIP. Bell Canada is the only North American telecom carrier among its 500 members. Equinix and Cable Labs are the only quasi- network operator members in the U.S.

- Rather than write a voluminous report which few would read, we invite readers to contact the author or post a comment on areas of interest after reviewing the 2017 TIPS Summit agenda.

References:

https://www.devex.com/news/telecom-industry-tries-new-tactics-to-connect-the-unconnected-91492

TC3 Update on CORD (Central Office Re-architected as a Data center)

Introduction:

Timon Sloane of the Open Networking Foundation (ONF) provided an update on project CORD on November 1st at the Telecom Council’s Carrier Connections (TC3) summit in Mt View, CA. The session was titled:

Spotlight on CORD: Transforming Operator Networks and Business Models

After the presentation, Sandhya Narayan of Verizon and Tom Tofigh of AT&T came up to the stage to answer a few audience member questions (there was no real panel session).

The basic premise of CORD is to re-architect a telco/MSO central office to have the same or similar architecture of a cloud resident data center. Not only the central office, but also remote networking equipment in the field (like an Optical Line Termination unit or OLT) are decomposed and disaggregated such that all but the most primitive functions are executed by open source software running on a compute server. The only hardware is the Physical layer transmission system which could be optical fiber, copper, or cellular/mobile.

Author’s Note: Mr. Sloane didn’t mention that ONF became involved in project CORD when it merged with ON.Labs earlier this year. At that time, the ONOS and CORD open source projects became ONF priorities. The Linux Foundation still lists CORD as one of their open source projects, but it appears the heavy lifting is being done by the new ONF as per this press release.

………………………………………………………………………………………………………………

Backgrounder:

A reference implementation of CORD combines commodity servers, white-box switches, and disaggregated access technologies with open source software to provide an extensible service delivery platform. This gives network operators (telcos and MSOs) the means to configure, control, and extend CORD to meet their operational and business objectives. The reference implementation is sufficiently complete to support field trials.

Illustration above is from the OpenCord website

……………………………………………………………………………………………………………………….

Highlights of Timon Sloane’s CORD Presentation at TC3:

- ONF has transformed over the last year to be a network operator led consortium.

- SDN, Open Flow, ONOS, and CORD are all important ONF projects.

- “70% of world wide network operators are planning to deploy CORD,” according to IHS-Markit senior analyst Michael Howard (who was in the audience- see his question to Verizon below).

- 80% of carrier spending is in the network edge (which includes the line terminating equipment and central office accessed).

- The central office (CO) is the most important network infrastructure for service providers (AKA telcos, carriers and network operators, MSO or cablecos, etc).

- The CO is the service provider’s gateway to customers.

- End to end user experience is controlled by the ingress and egress COs (local and remote) accessed.

- Transforming the outdated CO is a great opportunity for service providers. The challenge is to turn the CO into a cloud like data center.

- CORD mission is the enable the “edge cloud.” –>Note that mission differs from the OpenCord website which states:

“Our mission is to bring datacenter economies and cloud agility to service providers for their residential, enterprise, and mobile customers using an open reference implementation of CORD with an active participation of the community. The reference implementation of CORD will be built from commodity servers, white-box switches, disaggregated access technologies (e.g., vOLT, vBBU, vDOCSIS), and open source software (e.g., OpenStack, ONOS, XOS).”

- A CORD like CO infrastructure is built using commodity hardware, open source software, and white boxes (e.g. switch/routers and compute servers).

- The agility of a cloud service provider depends on software platforms that enable rapid creation of new services- in a “cloud-like” way. Network service providers need to adopt this same model.

- White boxes provide subscriber connections with control functions virtualized in cloud resident compute servers.

- A PON Optical Line Termination Unit (OLT) was the first candidate chosen for CORD. It’s at the “leaf of the cloud,” according to Timon.

- 3 markets for CORD are: Mobile (M-), Enterprise (E-), and Residential (R-). There is also the Multi-Service edge which is a new concept.

- CORD is projected to be a $300B market (source not stated).

- CORD provides opportunities for: application vendors (VNFs, network services, edge services, mobile edge computing, etc), white box suppliers (compute servers, switches, and storage), systems integrators (educate, design, deploy, support customers, etc).

- CORD Build Event was held November 7-9, 2017 in San Jose, CA. It explored CORD’s mission, market traction, use cases, and technical overview as per this schedule.

Service Providers active in CORD project:

- AT&T: R-Cord (PON and g.fast), Multi-service edge-CORD, vOLTHA (Virtual OLT Hardware Abstraction)

- Verizon: M-Cord

- Sprint: M-Cord

- Comcast: R-Cord

- Century Link: R-Cord

- Google: Multi-access CORD

Author’s Note: NTT (Japan) and Telefonica (Spain) have deployed CORD and presented their use cases at the CORD Build event. Deutsche Telekom, China Unicom, and Turk Telecom are active in the ONF and may have plans to deploy CORD?

……………………………………………………………

Q&A Session:

- This author questioned the partitioning of CORD tasks and responsibility between ONF and Linux Foundation. No clear answer was given. Perhaps in a follow up comment?

- AT&T is bringing use cases into ONF for reference platform deployments.

- CORD is a reference architecture with systems integrators needed to put the pieces together (commodity hardware, white boxes, open source software modules).

- Michael Howard asked Verizon to provide commercial deployment status- number, location, use cases, etc. Verizon said they can’t talk about commercial deployments at this time.

- Biggest challenge for CORD: Dis-aggregating purpose built, vendor specific hardware that exist in COs today. Many COs are router/switch centric, but they have to be opened up if CORD is to gain market traction.

- Future tasks for project CORD include: virtualized Radio Access Network (RAN), open radio (perhaps “new radio” from 3GPP release 15?), systems integration, and inclusion of micro-services (which were discussed at the very next TC3 session).

Addendum from Marc Cohn, formerly with the Linux Foundation:

Here’s an attempt to clarify the CORD project responsibilities:

- CORD is an open reference architecture. In that sense, CORD is similar to the ETSI NFV Architectural Framework, ONF SDN Architecture, and MEF LifeCycle Services Orchestration (LSO) reference architectures.

- As it is a reference architecture, it is not an implementation, and is maintained by the Open Networking Foundation (ONF), which merged with ON.LAB towards the end of 2016.

- OpenCORD is a Linux Foundation project announced in the summer of 2016. It is focused on an open source implementation of the CORD architecture. OpenCord was derived from the work undertaken by ON.LAB, prior to the merger with ONF in 2016.

- For technical details, visit the OpenCORD Wiki

- Part of the confusion is that if one visits the Linux Foundation projects page, CORD is listed, but the link is to the OpenCord website.

CignalAI: Cloud/Colo Spending Unexpectedly Drops in 1st Half 2017

by Andrew Schmitt, CignalAI

|

|

|

Top Optical Network Equipment Vendors: Data Center Interconnect & Overall Market

Executive Summary:

Market research firms Dell’Oro and Heavy Reading disagree on who are the top optical network equipment vendors, especially for data center interconnect (DCI). Obviously, the mega cloud computing/Internet service providers (Google, Amazon, Baidu, Facebook, etc) together account for the overwhelming market for DCI equipment purchased. None of them disclose who their DWDM vendors are. It’s well known that most of those mega cloud/Internet players design their own IT equipment (e.g. compute servers, Ethernet switches, Routers, etc), but they don’t design or build DWDM transport gear.

Dell’Oro Group DCI Market Analysis:

Ciena, Cisco and Infinera together command 85% of the disaggregated wavelength-division multiplexing field for DCI optical network equipment market segment, Dell’Oro Group estimates.

……………………………………………………………………………………………………..

–>This is a big surprise to this author as neither Nokia (via Alcatel-Lucent), Huawei (#1 overall optical network vendor) or ZTE are top tier according to Dell’Oro. See two graphs below (“Other Voices” section), courtesy of Heavy Reading and IHS-Markit.

……………………………………………………………………………………………………..

Dell’Oro Group estimated that disaggregated WDM systems reached an annualized revenue run rate of $400 million, growing 225% year-over-year. This is partly because these systems are finding utility in the booming DCI market segment.

Jimmy Yu, VP at Dell’Oro Group, said that while the disaggregation concept is not new, service provider adoption in the data center segment is.

“In most—if not all—purchases, we found that these new systems were being employed in DCI across both metro and long haul spans,” Yu said in a press release. “So far, the largest consumers have been internet content providers that appreciate the platform for its simplicity, capacity, and power savings.”

Yu added that “based on second quarter results, where disaggregated WDM systems represented nearly one-third of the optical DCI equipment purchases made, we have to say that Disaggregated WDM systems are truly hitting the sweet spot for DCI.”

As wireline operators look to diversify their revenue mix, the DCI market has a compelling growth path driven by the consumption and distribution of various data forms over the public internet and private networks.

Outside of DCI, the overall WDM market, which consists of WDM Metro and DWDM Long Haul, grew only 2% year-over-year in the second quarter, says Dell’Oro. The research firm noted that growth was driven by strength in the Asia Pacific region, especially China and India.

The share of 100G WDM wavelength shipments going to DCI was 14% in the quarter, according to Dell’Oro.

About the Report:

The Dell’Oro Group Optical Transport Quarterly Report offers complete, in-depth coverage of the market with tables covering manufacturers’ revenue, average selling prices, unit shipments (by speed including 40 Gbps, 100 Gbps, and >100 Gbps). The report tracks DWDM long haul terrestrial, WDM metro, multiservice multiplexers (SONET/SDH), optical switch, optical packet platforms, and data center interconnect (metro and long haul). To purchase this report, call Matt Dear at +1.650.622.9400 x223 or email [email protected].

………………………………………………………………………………………………………………

Other Voices on Optical Network Equipment Market:

1. Cignal AI:

Huawei and ZTE saw record shipments of 100-Gbps coherent ports in China during the second quarter of 2017 as well as strong sales in general throughout the region, reports Cignal AI. So what accounts for sour grapes from optical component houses? Inventory corrections at Chinese systems vendors, particularly Huawei, according to the market research firm.

“Demand for optical hardware in China is not slowing down, and equipment vendors are universally providing positive guidance for North America during the second half of the year,” said Andrew Schmitt, lead analyst for Cignal AI. “Operators around the world are shifting spending from long-haul to metro WDM, though this shift is materializing into gains for only a few vendors.”

Optical revenue in China is up 13 percent for the first half of 2017 as compared to the same period in 2016. The weak demand reported by component makers is a result of an ongoing inventory correction (primarily at Huawei), rather than a signal of weak end market demand.

2. IHS-Markit:

Huawei ranked first overall in combined market presence and market leadership in the recent Optical Network Hardware Vendor Scorecard released by IHS Markit. Huawei received this assessment for its comprehensive performance on multiple benchmarks including reputation for innovation, market share momentum, and global market share.

There are over a dozen vendors around the globe that make and sell optical network equipment. The 10 vendors profiled in this Scorecard–ADVA, Ciena, Cisco, Coriant, ECI, Fujitsu, Huawei, Infinera, Nokia, and ZTE–were selected because they are the top revenue producers of optical hardware.

The Scorecard used concrete data and metrics, including market share, financials and direct feedback from buyers on innovation, product reliability, service and support to evaluate 2016 market performance and future momentum of the top 10 optical network equipment vendors.

IHS Markit optical network hardware vendor scorecard (Source: IHS Markit Optical Network Hardware Vendor Scorecard)

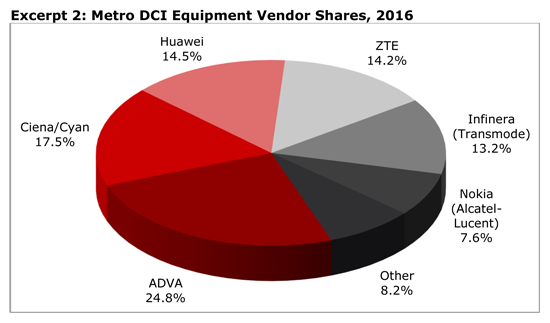

3. Heavy Reading:

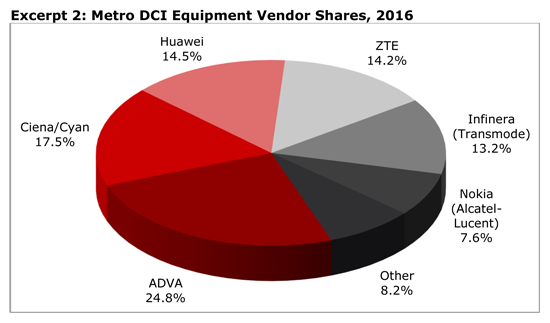

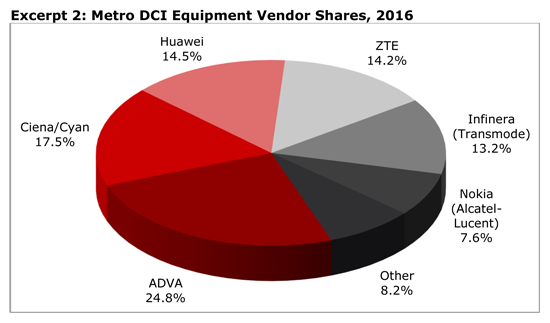

Market share estimates are based on DCI revenue contribution by Heavy Reading’s definition (not disclosed in the teaser briefing). Most vendors do not currently break out from their broader metro WDM revenue the portion accounted for by metro DCI deployments. A few companies did provide Heavy Reading with some general guidance on their revenue from metro DCI. The pie chart figure below shows Heavy Reading’s metro DCI equipment vendor share estimates for 2016.

Note that Adva has the top vendor market share and Cisco is not represented in the figure.

Source: Heavy Reading

References:

https://cignal.ai/2017/08/2q17-optical-hardware-results/

http://www.huawei.com/en/news/2017/8/Huawei-Optical-Network-IHS-Leader

http://www.heavyreading.com/details.asp?sku_id=3503&skuitem_itemid=1728

Top Optical Network Equipment Vendors: Data Center Interconnect & Overall Market

Executive Summary:

Market research firms Dell’Oro and Heavy Reading disagree on who are the top optical network equipment vendors, especially for data center interconnect (DCI). Obviously, the mega cloud computing/Internet service providers (Google, Amazon, Baidu, Facebook, etc) together account for the overwhelming market for DCI equipment purchased. None of them disclose who their DWDM vendors are. It’s well known that most of those mega cloud/Internet players design their own IT equipment (e.g. compute servers, Ethernet switches, Routers, etc), but they don’t design or build DWDM transport gear.

Dell’Oro Group DCI Market Analysis:

Ciena, Cisco and Infinera together command 85% of the disaggregated wavelength-division multiplexing field for DCI optical network equipment market segment, Dell’Oro Group estimates.

……………………………………………………………………………………………………..

–>This is a big surprise to this author as neither Nokia (via Alcatel-Lucent), Huawei (#1 overall optical network vendor) or ZTE are top tier according to Dell’Oro. See two graphs below (“Other Voices” section), courtesy of Heavy Reading and IHS-Markit.

……………………………………………………………………………………………………..

Dell’Oro Group estimated that disaggregated WDM systems reached an annualized revenue run rate of $400 million, growing 225% year-over-year. This is partly because these systems are finding utility in the booming DCI market segment.

Jimmy Yu, VP at Dell’Oro Group, said that while the disaggregation concept is not new, service provider adoption in the data center segment is.

“In most—if not all—purchases, we found that these new systems were being employed in DCI across both metro and long haul spans,” Yu said in a press release. “So far, the largest consumers have been internet content providers that appreciate the platform for its simplicity, capacity, and power savings.”

Yu added that “based on second quarter results, where disaggregated WDM systems represented nearly one-third of the optical DCI equipment purchases made, we have to say that Disaggregated WDM systems are truly hitting the sweet spot for DCI.”

As wireline operators look to diversify their revenue mix, the DCI market has a compelling growth path driven by the consumption and distribution of various data forms over the public internet and private networks.

Outside of DCI, the overall WDM market, which consists of WDM Metro and DWDM Long Haul, grew only 2% year-over-year in the second quarter, says Dell’Oro. The research firm noted that growth was driven by strength in the Asia Pacific region, especially China and India.

The share of 100G WDM wavelength shipments going to DCI was 14% in the quarter, according to Dell’Oro.

About the Report:

The Dell’Oro Group Optical Transport Quarterly Report offers complete, in-depth coverage of the market with tables covering manufacturers’ revenue, average selling prices, unit shipments (by speed including 40 Gbps, 100 Gbps, and >100 Gbps). The report tracks DWDM long haul terrestrial, WDM metro, multiservice multiplexers (SONET/SDH), optical switch, optical packet platforms, and data center interconnect (metro and long haul). To purchase this report, call Matt Dear at +1.650.622.9400 x223 or email [email protected].

………………………………………………………………………………………………………………

Other Voices on Optical Network Equipment Market:

1. Cignal AI:

Huawei and ZTE saw record shipments of 100-Gbps coherent ports in China during the second quarter of 2017 as well as strong sales in general throughout the region, reports Cignal AI. So what accounts for sour grapes from optical component houses? Inventory corrections at Chinese systems vendors, particularly Huawei, according to the market research firm.

“Demand for optical hardware in China is not slowing down, and equipment vendors are universally providing positive guidance for North America during the second half of the year,” said Andrew Schmitt, lead analyst for Cignal AI. “Operators around the world are shifting spending from long-haul to metro WDM, though this shift is materializing into gains for only a few vendors.”

Optical revenue in China is up 13 percent for the first half of 2017 as compared to the same period in 2016. The weak demand reported by component makers is a result of an ongoing inventory correction (primarily at Huawei), rather than a signal of weak end market demand.

2. IHS-Markit:

Huawei ranked first overall in combined market presence and market leadership in the recent Optical Network Hardware Vendor Scorecard released by IHS Markit. Huawei received this assessment for its comprehensive performance on multiple benchmarks including reputation for innovation, market share momentum, and global market share.

There are over a dozen vendors around the globe that make and sell optical network equipment. The 10 vendors profiled in this Scorecard–ADVA, Ciena, Cisco, Coriant, ECI, Fujitsu, Huawei, Infinera, Nokia, and ZTE–were selected because they are the top revenue producers of optical hardware.

The Scorecard used concrete data and metrics, including market share, financials and direct feedback from buyers on innovation, product reliability, service and support to evaluate 2016 market performance and future momentum of the top 10 optical network equipment vendors.

IHS Markit optical network hardware vendor scorecard (Source: IHS Markit Optical Network Hardware Vendor Scorecard)

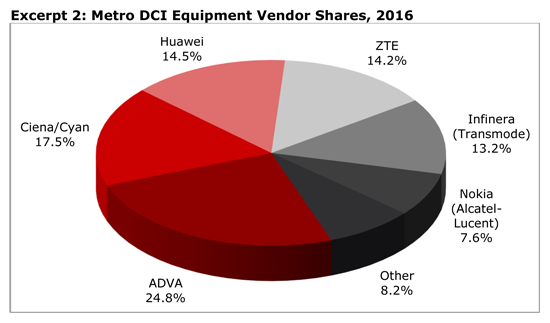

3. Heavy Reading:

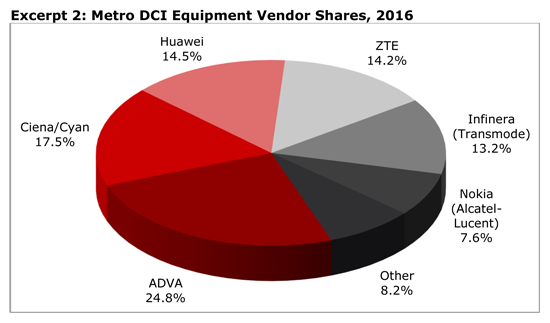

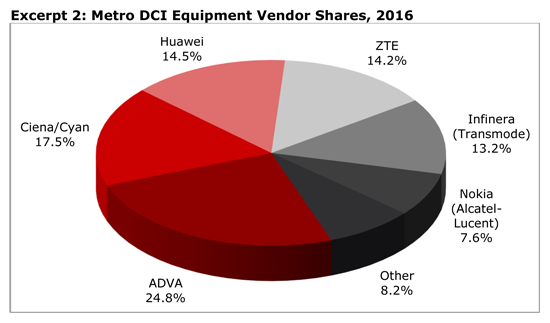

Market share estimates are based on DCI revenue contribution by Heavy Reading’s definition (not disclosed in the teaser briefing). Most vendors do not currently break out from their broader metro WDM revenue the portion accounted for by metro DCI deployments. A few companies did provide Heavy Reading with some general guidance on their revenue from metro DCI. The pie chart figure below shows Heavy Reading’s metro DCI equipment vendor share estimates for 2016.

Note that Adva has the top vendor market share and Cisco is not represented in the figure.

Source: Heavy Reading

References:

https://cignal.ai/2017/08/2q17-optical-hardware-results/

http://www.huawei.com/en/news/2017/8/Huawei-Optical-Network-IHS-Leader

http://www.heavyreading.com/details.asp?sku_id=3503&skuitem_itemid=1728