Uncategorized

T-Mobile US achieves speeds over 3 Gbps using 5G Carrier Aggregation on its 5G SA network

T-Mobile US said it was able to aggregate three channels of mid-band 5G spectrum, reaching speeds over 3 Gbps on its standalone 5G network. It’s the first time the test has ever been done with a commercial device, here the Samsung Galaxy S22 powered by Snapdragon 8 Gen 1 Mobile Platform with Snapdragon X65 Modem-RF System), on a live production network, the company said.

5G Carrier Aggregation (New Radio or NR CA) allows T-Mobile to combine multiple 5G channels (or carriers) to deliver greater speed and performance. In this test, the carrier merged three 5G channels – two channels of 2.5 GHz Ultra Capacity 5G and one channel of 1900 MHz spectrum – creating an effective 210 MHz 5G channel.

The achievement is only possible with standalone 5G architecture (SA) and is just the latest in a series of important SA 5G milestones for T-Mobile. The carrier said it was the first in the world to launch a nationwide SA 5G network nearly two years ago. The carrier began lighting up Voice over 5G (VoNR) this month so that all services can run on 5G. By removing the need for an underlying LTE network and 4G core, 5G will be able to reach its true future potential with incredibly fast speeds, real-time responsiveness and massive connectivity, the company mentioned.

NR CA is live in parts of T-Mobile’s network today, combining two 2.5 GHz 5G channels for greater speeds, performance and capacity. Customers with the Samsung Galaxy S22 will be among the first to experience a third 1900 MHz 5G channel later this year. This functionality will expand across the carrier’s network and to additional devices in the near future.

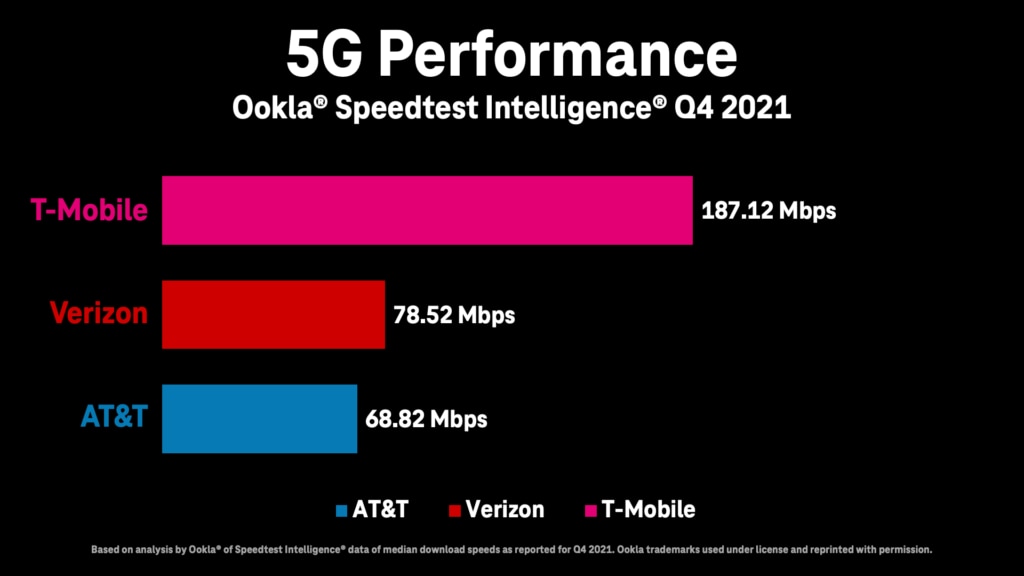

T-Mobile US was the first in the world to launch a nationwide SA 5G network nearly two years ago and has been driving toward a true 5G-only experience for customers ever since. Just this month the Un-carrier began deploying Voice over 5G (VoNR) so ALLvoice services can run on 5G. By removing the need for an underlying 4G LTE network and 4G core, 5G will be able to reach its true future potential with incredibly fast speeds, real-time responsiveness and massive connectivity. The carrier’s 5G network covers 315 million people across 1.8 million square miles. 225 million people nationwide are covered with super-fast Ultra Capacity 5G, and T-Mobile expects to cover 260 million in 2022 and 300 million next year. It also has the fastest 5G network, according to Ookla speed tests in Q4 2021:

Note that neither Verizon or AT&T have deployed 5G SA core networks with no future dates specified.

References:

AT&T CFO sees inflation as main threat, but profits and margins to expand in 2nd half 2022

At the Credit Suisse Communications Conference on Tuesday, AT&T CFO Pascal Desroches said Tuesday that inflation is the issue he is most concerned about, and one that he expects to continue “for the foreseeable future. It’s hard for me to envision that that’s not going to impact the consumer negatively,” Desroches said. “And that we and some others will see some pressure,” he added.

AT&T has already raised prices on some mobile service plans in order to combat the impacts of inflation. The CFO’s comments were made mere weeks after the telecom giant increased the pricing for certain older single-line individual plans by $6 per month or $12 a month for family plans.

Yet Desroches said the company may review its pricing again. AT&T is seeing the impacts of inflation across labor, supplies, energy and transport. Nonetheless, AT&T is expecting to see profit margins expand during the course of the second half of the year, as well as improved profit trends, Desroches added.

Desroches reiterated that AT&T has taken a disciplined approach to growth and investment and made the following points:

- The company continues to grow customer relationships in its strategic focus areas of 5G and fiber. Desroches said the company continues to see healthy consumer demand even with continued expectations that 2022 postpaid wireless industry demand is unlikely to replicate 2021 levels. AT&T continues to successfully attract high-value customers with its consistent, simple go-to-market strategy.

- Desroches remains comfortable that the company can deliver improving postpaid phone ARPU trends in 2022. He noted that postpaid phone ARPU could in fact edge up sequentially in the second quarter.

- Desroches also reiterated expectations for gradual improvement in year-over-year mobility EBITDA trends through the course of 2022. Following a more pronounced impact in the second quarter, the revenue and EBITDA impacts of the previously announced 3G network shutdown and the absence of approximately $100 million in CAF II and FirstNet related reimbursements are expected to be more than mitigated in the back half of year by organic service revenue growth and the lapping of 3G shutdown costs comparisons in the second half of 2021.

- AT&T’s fiber build progress continues with expectations to achieve 30+ million customer locations by 2025. Desroches noted that AT&T is acquiring new customers and seeing strong penetration rates thanks to a straightforward go-to-market approach.

- Desroches shared that the company continues to work with state and local government municipalities across the country to provide affordable broadband connectivity to low-income customers through the Affordable Connectivity Program. Over time, the company believes these efforts can help provide internet for all Americans and expand the total addressable market for broadband access. Additionally, Desroches indicated that any federal funding in support of the company’s fiber buildout would be deployed to expand its network to additional customer locations, representing potential upside above AT&T’s existing guidance.

- AT&T continues to work through its business wireline portfolio rationalization process and focus its efforts on core transport and connectivity solutions. Desroches noted that the company has yet to see a recovery in government sector demand trends which impacted the business during the first quarter.

- With regard to the macroeconomic environment, Desroches said that the company considered a higher-than-typical level of inflation when setting 2022 budget. The company’s recent pricing increases were a response to higher-than-expected inflation trends. Additionally, the company has opportunities to address the impacts of inflation with its ongoing cost savings initiative, which is expected to reach a run rate of $4+ billion by the end of this year.

- Desroches stated the company feels good about its financial flexibility, does not plan to issue any debt in the near-term and remains focused on its goal of achieving a net debt-to-adjusted EBITDA ratio in the 2.5x range by the end of 2023.

References:

https://about.att.com/story/2022/pascal-desroches-webcast-summary-june-14.html

https://www.barrons.com/articles/att-prices-inflation-51655220258

New broadcast TV standard ATSC 3.0 “Next Gen TV” to cover 82% of U.S. households by end of 2022

Pearl TV, a consortium of U.S. broadcasters operating more than 820 TV stations, said that it is making progress with hardware and software that wants to accelerate the rollout and adoption of ATSC 3.0, the new broadcast TV signaling standard that’s been branded as “NextGen TV.” ATSC 3.0 has been in the works for many years, but only now seems to be gaining a wide following.

Pearl TV has collaborated with Taiwan wireless telecom semiconductor company MediaTek on a reference design for smart TVs and other devices that support the new standard. On the software front, the consortium has formally introduced RUN3TV, a web-based platform that enables broadcasters to deliver interactive and on-demand apps and services over ATSC 3.0.

The new IP-based standard – which supports 4K video, enhanced audio and interactive apps – are expected to take center stage. Pearl TV’s members include Cox Media Group, the E.W. Scripps Company, Graham Media Group, Hearst Television, Nexstar Media Group, Gray Television, Sinclair Broadcast Group and Tegna.

Sinclair Broadcast Group and USSI Global said they will partner to offer the nation’s first commercial datacasting service using the NextGen Broadcast standard (ATSC 3.0). The pilot program will deliver local content, advertising, and data files to the rapidly growing Electric Vehicle Charging station market.

The ATSC 3.0 reference design – billed as the “FastTrack to NextGen TV” platform – includes a TV system-on-chip (SoC), ATSC 3.0 demodulators and a software stack. It will be pre-certified for compliance with the Consumer Technology Association’s (CTA’s) NextGen TV logo requirements, A3SA security (which uses IP-based encryption protocols, device certificates and rights management technology) and the RUN3TV application platform.

It’s hoped that the ATSC 3.0 reference design will open up the market for lower-cost ASTC 3.0-based TVs and drive more volume into the NextGen TV ecosystem. MediaTek already provides TV SoCs to about 90% of all TV brands, according to Pearl TV and MediaTek. The program stems from a partnership between them announced in January 2022. CTA expects NextGen TV sales to double this year, rise by 75% in 2023 and then double again in 2024.

About 70 TV models from Samsung, Sony and LG Electronics support ASTC 3.0 today, with Hisense on deck to build sets that utilize the new standard. More than 100 TV models are expected to support ATSC 3.0 by later this year, Anne Schelle, managing director of Pearl TV, recently told Light Reading.

The official launch of RUN3TV brings to market a web platform that supports interactive apps delivered via ATSC 3.0, such as targeted advertising, weather widgets, live sports scores, TV-based commerce and enhanced emergency alerts. It is arriving on the scene as the deployment of the new standard reaches about 60 markets.

Pearl TV is launching the RUN3TV platform through a subsidiary, ATSC 3.0 Framework Alliance LLC, with development partners that include Kineton, MadHive, IBM Weather, Freewheel (the Comcast-owned ad-tech company) and Google. Gray Television.

The E.W. Scripps Company, Graham Media, Tegna, Hearst and Howard University’s WHUT are among the platform’s early adopters.

“With NextGen TV and RUN3TV, broadcasters can now bring the OTA environment into the digital world,” Schelle said in a statement.

The reference design and interactive platform are coming together amid an ongoing expansion of ATSC 3.0. It’s expected that NextGen TV will cover about 82% of all U.S. households by the end of 2022. Large markets set for launches later this year include Boston, New York, Philadelphia, Chicago and Miami.

References:

Cincinnati Bell rebrands as Altafiber after takeover by Macquarie Infrastructure

Consistent with the strong fiber build-out megatrend, Cincinnati Bell [1.] said it will now be doing business in Ohio, Kentucky and Indiana under the new Altafiber brand. With its takeover by Macquarie Infrastructure now complete, the company will continue to put attention on expanding its geographic reach and investing into its broadband network. Cincinnati Bell will transition to the Altafiber brand over the next 6-9 months. The change will not impact Hawaiian Telcom and the IT services business, branded as CBTS.

Note 1. Cincinnati Bell was founded in 1873 as the City and Suburban Telegraph Association and later called the Cincinnati and Suburban Bell Telephone Company starting in 1903.

“The investment in fiber, our geographic expansion, and our partnership with Macquarie mark a clear inflection point for the company. And it’s all incredibly exciting and positive for our employees and for the communities and customers that we serve,” said Leigh Fox, President and CEO of altafiber.

“The word ‘alta’ is rooted in a word that means elevated, and that’s what altafiber is doing: We’re providing an elevated connection through fiber and raising the standard of service to our customers and the communities,” the company said. Cincinnati Bell said the new Altafiber brand and mission statement embodies the company’s tagline, “Connecting What Matters,” while capturing its transformation into a fiber optic based carrier positioned to support customers over the next 150 years.

As the leading supplier of fibre services in Greater Cincinnati, Altafiber has invested over USD 1 billion into the fiber optic network and now offers Fiber-to-the-Premises (FTTP) connectivity to 60 percent of all locations in the area. The idea is to provide the services to all of the addresses in the area over the next fibre years.

Altafiber will also bring fiber beyond its traditional operating area through partnerships with Greene County in Ohio, and City of Greendale, Indiana. Altafiber has established a regional headquarter in the Dayton market, including a retail store and business office in the city.

Fox noted that the he company’s commitment to the community, its customers, and leadership continues:

• Commitment to the community. altafiber and its employees will continue to support community initiatives – particularly those that provide increased access to education, employment, and healthcare opportunities – and increase investments into sustainability, safety, and diversity and inclusion initiatives.

•Commitment to customers. altafiber will continue to provide customers with the same great service they have come to expect from the company.

• Leadership. The current executive team will continue to lead the company. altafiber will also honor its legacy through the recently launched “Bell Charitable Foundation,” an exciting new platform for corporate giving that will allow the company to more strategically support

organizations that are focused on Economic, Environmental, Social, Technology, and Health & Wellbeing initiatives.

“We are proud of the Cincinnati Bell name, and it will always be a part of our history,” said Fox. “We are still the local hometown company, with 2,000 employees across Greater Cincinnati who are dedicated to connecting our customers with what matters most through technology for the next 150 years,” Fox said.

About altafiber:

Cincinnati Bell is now doing business as “altafiber” in Ohio, Kentucky, and Indiana. The Company delivers integrated communications solutions to residential and business customers over its fiber-optic network including high-speed internet, video, voice and data. The Company also provides service in Hawai’i under the brand Hawaiian Telcom. In addition, the Company’s enterprise customers across the United States and Canada rely on CBTS and OnX, wholly-owned subsidiaries, for efficient, scalable office communications systems and end-to-end IT solutions.

References:

https://info.cincinnatibell.com/altafiber

https://www.telecompaper.com/news/cincinnati-bell-rebrands-to-altafiber–1416259

TIP OpenRAN Release 2 Roadmap Published along with Release Schedule

The Telecom Infra Project (TIP) OpenRAN Project Group [1.] has just published its Release 2 Roadmap after conducting a thorough industry review with input from both the supply and the demand sides – including some of the world’s largest network operators. T-Mobile USA, Orange, Bharti Airtel, and Vodafone were authors and contributors.

Note 1. TIP’s OpenRAN Project Group (OpenRAN PG) is focused on scaling up productization of Open RAN technology driven by an ecosystem of technology suppliers, including hardware and software vendors, along with system integrators and service providers. The overarching goal of the OpenRAN PG is to streamline the industry’s efforts on OpenRAN development and to accelerate OpenRAN adoption.

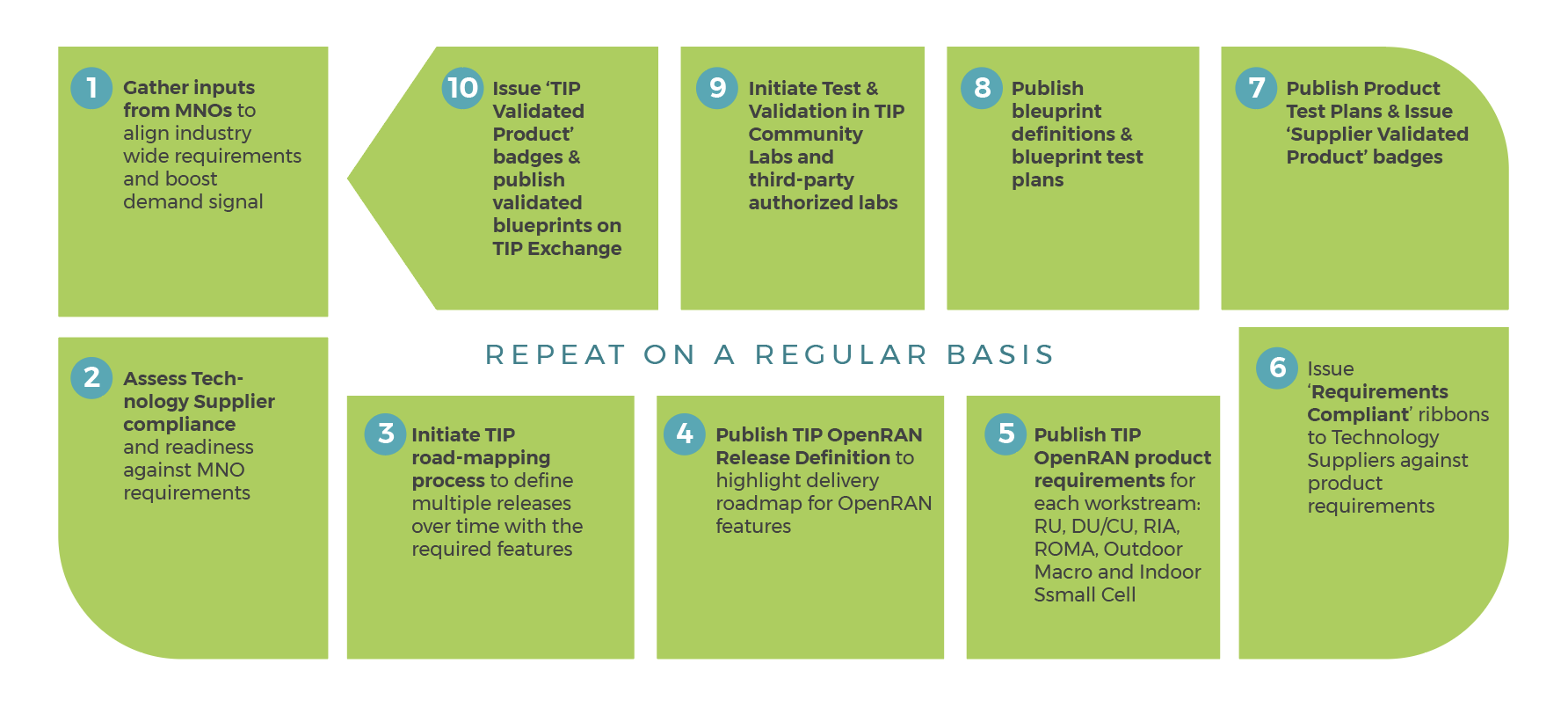

The OpenRAN PG activities include, but are not limited to:

- Gathering and consolidation of prioritized technology requirements for MNOs.

- Identification and engagement with vendors that will deliver the various hardware and software components for OpenRAN solutions that meet harmonized MNO requirements.

- Publishing an OpenRAN Release Definition document mapping the prioritized features to a roadmap of releases.

- Creation of the resulting harmonized OpenRAN Product Requirements documents and definition of Product Test Plans utilized in the Test & Validation framework within TIP.

- Definition of OpenRAN Product Blueprint documents and Blueprint Test Plans utilizing the Test and Validation framework within TIP.

……………………………………………………………………………………………………………………………………………………………………..

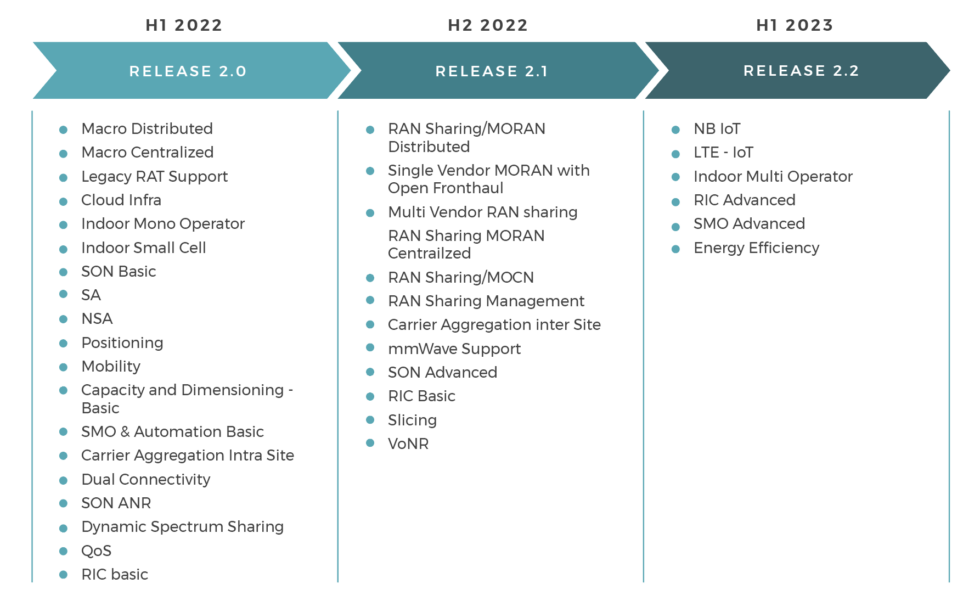

The Roadmap document provides a foundational framework for ecosystem alignment – harmonizing the prioritized network operator requirements, including the five European Open RAN MoU signatories, with vendor’s product readiness. You can read the full document here.

Last June, TIP published the ‘Open RAN Technical Priorities Document’ – a comprehensive list of technical requirements that the signatories of the Open RAN MoU Group (Deutsche Telekom, Orange, Telefónica, TIM and Vodafone) considered priorities for Open RAN architecture. Building on that work, the TIP OpenRAN Project Group invited community participants to provide feedback, resulting in over 40 ecosystem responses.

The Roadmap release approach (shown below) enables the execution of the Project Group activities more efficiently, while also providing a path to commercialization via TIP’s Test and Validation framework, delivering on product requirements, blueprint definitions and associated test plans.

TIP Open RAN Roadmap Release Schedule:

The TIP OpenRAN Project Group will continue to advance the requirements gathering and road-mapping process with a regular cadence. As part of the framework, the requirement contribution window will open for MNOs for subsequent minor releases R2.1, R2.2, and so on. The requirements input from MNOs will be harmonized into requirements documents and assessed for compliance and readiness with the technology suppliers.

The TIP OpenRAN Project Group is focused on scaling up productization of OpenRAN technology driven by an ecosystem of technology suppliers, system integrators and service providers. The Project Group aims to streamline the industry’s efforts on OpenRAN development and accelerates OpenRAN adoption.

In addition to publishing the overall roadmap, TIP is also publishing Release 2 roadmaps and Technical Requirements Documents 2.0 for the RU, DU/CU, RIA and ROMA OpenRAN PG subgroups. These will form the basis for issuing ribbons and badges to vendor products – once they have progressed through TIP’s Test and Validation framework – with their subsequent listing on TIP Exchange.

References:

TIP OpenRAN project: New 5G Private Networks and ROMA subgroups

TIP OpenRAN and O-RAN Alliance liaison and collaboration for Open Radio Access Networks

Vodafone-Oracle latest deal between 5G telco and “cloud native” service provider

UK network operator Vodafone has signed a deal with enterprise software maker Oracle to implement its cloud native network policy management platform into its 5G core network. This is consistent with the trend of cloud service providers (like Amazon, Microsoft and Google) to ink contracts with wireless network operators for their cloud native 5G SA core network, thus taking over all the intelligent functions, features and services that 5G can (theoretically) provide. In general, alliances between cloud giants and wireless telcos are increasing at a rapid rate.

The cloud platform is based on the ability to dynamically prioritize low-latency applications to edge data networks, while optimizing network policies based on data analytics. With Oracle’s cloud native network policy management solution as part of its 5G core, Vodafone says they will be able to make more intelligent policy decisions and quickly test and deploy new services.

“Moving to ‘cloud native’ is a culture shift as much as it is a technology shift for a telecom company like Vodafone,” said Andrea Dona, chief network officer, Vodafone UK. “Our partners must demonstrate flexibility and agility, as well as aligning to our vision of how technology will augment and support tomorrow’s digital society,” she added.

Converged policy management is comprised of the 5G Core Policy Control Function (PCF) and the Policy and Charging Rules Function (PCRF). The solution helps to dynamically prioritizes low-latency applications to edge data networks, while continuously optimizing network policies based on data analytics. For example, based on the data, the solution can help Vodafone customers get the network offering that best suits their needs, be it connecting smart devices, utilizing live streaming, or enabling AR/VR gaming. As such, Vodafone can provide a seamless experience across 4G and 5G networks while simultaneously delivering a smooth integration of new 5G services. The solution will be deployed by Oracle Communications consulting.

“5G undoubtedly opens the door for endless new ways to engage with our world, but intelligent policy management is the entryway to capitalize on these opportunities,” said Andrew Morawski, senior vice president and general manager, Oracle Communications, Networks. “Our 5G and cloud capabilities are helping Vodafone to build a future-proof network that is automated, easier to scale, simpler to operate, and more cost-effective.”

Aligned with the Cloud Native Computing Foundation (CNCF) [1.], Oracle’s cloud native 5G core control plane features network functions, including the policy control, that help operators automate and scale to meet the expected growth in 5G subscribers and connected devices. Learn more about how Oracle is powering the future of 5G.

Note 1. Cloud Native Computing Foundation (CNCF) serves as the vendor-neutral home for many of the fastest-growing open source projects, including Kubernetes, Prometheus, and Envoy. CNCF) hosts critical components of the global technology infrastructure. CNCF brings together the world’s top developers, end users, and vendors and runs the largest open source developer conferences. CNCF is part of the nonprofit Linux Foundation.

Oracle also has similar relationships with Italian carrier TIM, Indian carrier Bharti Airtel, and other international telecommunications companies. The company currently has 37 cloud computing regions in 20 countries. It is trying to compete with Amazon AWS, Microsoft Azure, and Google Cloud in the cloud infrastructure and platform as a service markets, along with its telecom cloud ambitions.

……………………………………………………………………………………………………………………………………………………………………………………………………………………………………………….

Just last week Oracle struck a global cloud deal with Spanish telecoms group Telefónica, where the two firms will jointly offer platform-as-a-service (PaaS) and applications to enterprises and public sector organizations. As cloud computing continues to become more embedded in the telecoms sector, and the wider world besides, we can expect to see many more partnerships of this type in the future.

Telefónica will also become the host partner for the Oracle Cloud Madrid Region. It is Oracle’s first cloud region in Spain, and will offer enterprises and public sector bodies there a secure and reliable connection to its range of services. It will also help businesses address their in-country data residency and compliance requirements, Oracle said.

“With Oracle Cloud Infrastructure, we are complementing Telefónica’s robust cloud services offering with a cloud platform that has seen strong growth over the last year as customers all over the world use it to run their most mission-critical workloads,” said Albert Triola, country leader, Oracle Spain.

Source: Gartner

………………………………………………………………………………………………………………………….

References:

https://telecoms.com/513455/vodafone-recruits-oracle-cloud-platform-to-bolster-5g-core/

https://www.oracle.com/industries/communications/

Why are alliances between operators and cloud giants multiplying?

Oracle and Telefónica Tech Partner to Offer Global Cloud Services

New partnership targets future global wireless-connectivity services combining satellites and HAPS

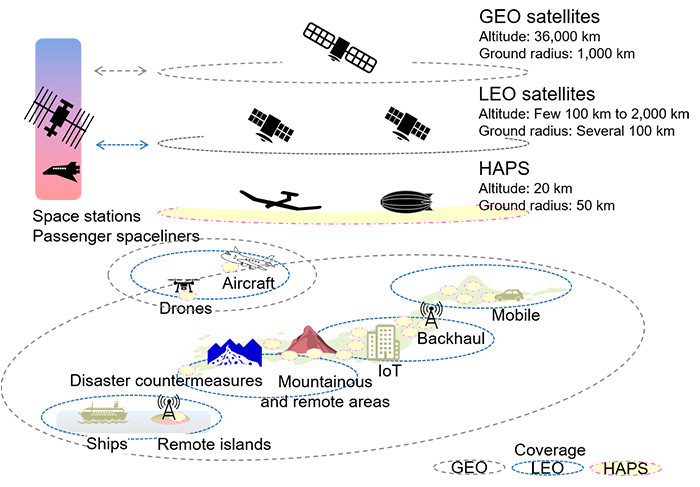

NTT, its mobile subsidiary DoCoMo, aircraft maker Airbus, and Japanese satcoms Sky Perfect JSAT Corporation are partnering to conduct a feasibility study on high altitude platform stations (HAPS). Deployed at altitudes of around 20 kilometers, they are essentially flying base stations that can provide coverage to a radius of around 50 kilometers.

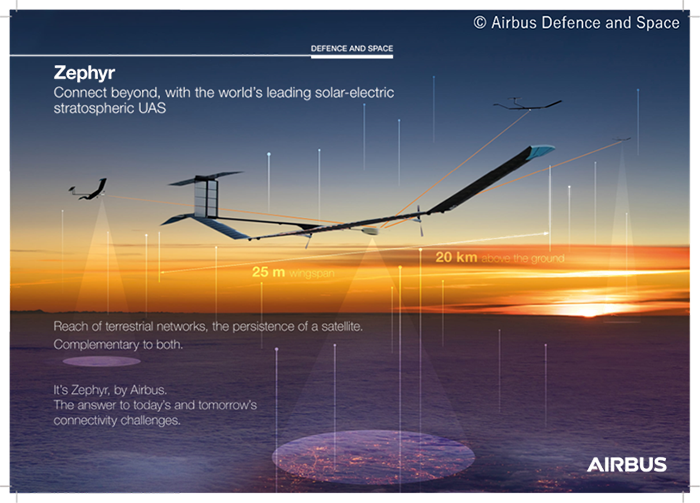

Launched with a memorandum of understanding (MOU), the study will attempt to identify the early deployment requirements of a HAPS-based network. The collaboration will investigate the use of the Airbus Zephyr, the leading solar-powered, stratospheric unmanned aerial system (UAS), and the wireless communication networks of NTT, DOCOMO and SKY Perfect JSAT in order to test HAPS connectivity, identify practical applications, develop required technologies and ultimately launch space-based wireless broadband services.

Illustration of Airbus “Zephyr” HAPS aircraft:

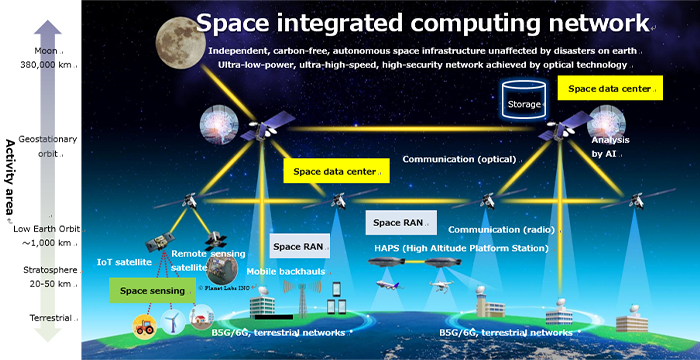

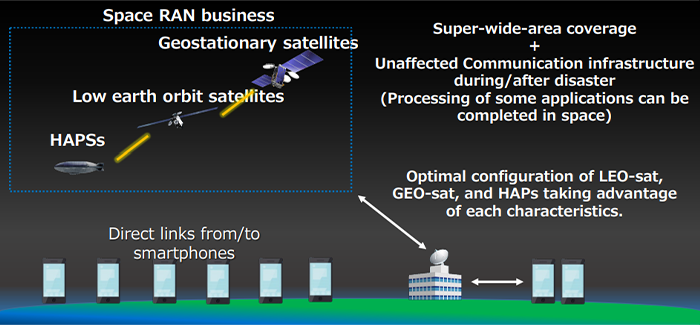

In the global push to further advance 5G and eventually introduce 6G, initiatives are under way to expand coverage worldwide, including in the oceans and in the air. Such initiatives will include HAPS, which fly in the stratosphere about 20 km above the earth, and non-terrestrial network (NTN) technologies using geostationary-orbit (GEO) satellites and low Earth-orbit (LEO) satellites.

HAPS networks are deemed to be a relatively easy solution for air and sea connectivity and an effective platform for deploying disaster countermeasures and many industrial applications. The provision of space-based radio access network services using NTN technologies, collectively called Space RAN (radio access network), is expected to support worldwide mobile communications with ultra-wide coverage and improved disaster resistance as well enhanced 5G and 6G. In addition,

HAPS platforms can also interconnect to the nearest terrestrial network gateway and extend the reach of existing mobile services directly to end-user devices, providing service options including as rural, emergency and maritime connectivity.

With the signing of the MOU, the four companies will discuss and identify possible future developments necessary to unlock future HAPS-based connectivity services, lobby for standardization and institutionalization of HAPS operations, and explore business models for commercializing HAPS services.

Specific themes will include the applicability of HAPS for mobile connectivity on the ground and base station backhaul,1 the performance of various frequency bands in HAPS systems, the technological considerations for linking HAPS with satellites and ground base stations, and the establishment of a cooperative system to test a network combining NTN technology, satellites and HAPS.

As separately announced on November 15, 2021, DOCOMO and Airbus have successfully conducted a propagation test between the ground and a “Zephyr S” HAPS aircraft in the stratosphere, demonstrating the possibility of providing stable communication with such a configuration.

…………………………………………………………………………………………………………….

Nick Wood of Telecoms.com wrote:

If the group achieves its stated objectives, it will have succeeded where a few other big names have failed.

Google, which has a long and rich history of dabbling, had a go at HAPS in 2011. Project Loon as it was called, consisted of a fleet of stratospheric balloons with base stations dangling beneath them. It was spun out of Google’s ‘X’ lab into a standalone company in 2018 and launched its first commercial service in partnership with Telkom Kenya in 2020. However, Project Loon couldn’t drive the costs down low enough to turn it into a viable long-term business, and the whole enterprise ceased operations around this time last year. Alongside Project Loon, Google also flirted with drone-based connectivity. This one was called Project Titan, and it fared even worse than Loon. Test flights began in 2015, but amid rumours of funding issues and technical difficulties, the whole thing was canned in early 2016.

Meta (previously known as Facebook) also had a crack at HAPS. As part of its effort to connect the unconnected and sell their data to advertisers, in 2016 it showed off Aquila: a portable fleet of unmanned, solar-powered drones that would deliver service to rural areas. It gave up on the idea two years later after reaching the not-so-startling conclusion that it wasn’t particularly good at building aircraft.

Despite these high-profile failures, the aviation and telecoms industries are clearly not ready to give up on HAPS just yet. They even launched their own lobby group in February 2020, the HAPS Alliance. Last month it announced the successful test flight of Sunglider, an unmanned, solar-powered aircraft equipped with an LTE base station. Funnily enough, Airbus, DoCoMo and Sky Perfect JSAT are all members of the HAPS Alliance, which aims to create an ecosystem around the technology that will turn it into a sustainable business.

DoCoMo et al are undoubtedly aware of the unproven business case for this technology, and so spreading the risk across several experts – rather than going it alone like Google and Facebook – is probably better than the HAPS-hazard approach taken by those giants of Silicon Valley.

References:

https://www.nttdocomo.co.jp/english/info/media_center/pr/2022/0117_00.html

https://www.nttdocomo.co.jp/english/info/media_center/pr/2021/1115_00.html

NTT hopes to succeed where Google Loon and Facebook Aquila failed

Ericsson and HERE partner for custom mine mapping technology using private mobile networks and location tracking

The Ericsson and HERE partnership, announced during CES 2022, will combine private mobile networks from Ericsson with HERE’s location technology, providing real-time customizable maps of mining projects.

The mining industry is in rapid modernization phase, with smart mining operations projected to increase threefold until 20251. A key driver of this transformation is the access to private cellular networks, enabling safer, more productive, and more sustainable mining operations, through reliable and low latency connectivity. Ericsson’s high-performance 5G private networks are purpose-built for mining operations. A business can deploy an on-premise cellular network for its exclusive use. For mining this includes facilities in very remote areas and underground tunnels, both of which are not typically within public cellular range.

The combination of Ericsson connectivity and HERE location services deliver true smart mining capabilities, from mapping private terrain, to pinpointing and navigating assets in real-time. By using location data to build continuously updated private maps on the HERE location platform, mining companies can create a canvas to improve operational efficiency and safety. The living map can then be used to search or track, and deploy routing powered by HERE, as well as custom-built applications and services.

“We are partnering with HERE because of the breadth of their location services – ranging from mapping to routing, positioning and asset tracking. Combining our advanced private network solutions with HERE services will give mining firms a head start on their digitalization journey,” said Thomas Norén, Head of Dedicated Network and Vice-President at Ericsson.

“We look forward to increasing the productivity and safety of the mining industry by bringing location services to Ericsson’s customers. With our private mapping capabilities, we enable mining companies to unleash the power of their location data in many important use cases,” said Gino Ferru, General Manager EMEAR and Senior Vice-President at HERE Technologies.

In summary:

- HERE is now part of Ericsson’s industry 4.0 partner ecosystem providing location services in combination with private cellular networks for mining operations.

- HERE map making enables mining companies to build custom maps of open pit mining operations.

- Mapping of mining sites helps increase safety, efficiency and sustainability by enabling asset tracking, fleet telematics and analytics.

Photo of a Mine with Staircase

…………………………………………………………………………………………………………………………………………………………………………………………………………….

The partnership becomes part of Ericsson’s growing Industry 4.0 ecosystem, which includes HERE alongside numerous additional technology partners, such as Cisco, Cradlepoint, Dell, and HPE. The value of automation, mapping, and other Industry 4.0 applications making use of the latest connectivity technology cannot be understated. An Ericsson report on ‘Connected Mining’ in December 2020 suggested that 5G private networks could see return on investment at mining operations reach 200% within 10 years, with smart mining operations themselves expected to triple by 2025.

About HERE Technologies:

HERE, the leading location data and technology platform, moves people, businesses and cities forward by harnessing the power of location. By leveraging our open platform, we empower our customers to achieve better outcomes – from helping a city manage its infrastructure or a business optimize its assets to guiding drivers to their destination safely. To learn more about HERE, please visit https://www.here.com and https://360.here.com.

About Ericsson:

Ericsson enables communications service providers to capture the full value of connectivity. The company’s portfolio spans Networks, Digital Services, Managed Services, and Emerging Business and is designed to help our customers go digital, increase efficiency and find new revenue streams. Ericsson’s investments in innovation have delivered the benefits of telephony and mobile broadband to billions of people around the world. The Ericsson stock is listed on Nasdaq Stockholm and on Nasdaq New York. www.ericsson.com

References:

https://www.totaltele.com/512092/Ericsson-and-HERE-partner-for-custom-mine-mapping-tech

Broadband accounts for 98% of households with home Internet service; 85% of all households have broadband access

Of the 87% of homes in the U.S. that are connected to the Internet via fixed access (mostly wireline), 98% have broadband access. Of those with high-speed internet, 60% find their service provider (ISP) very satisfactory, while only 7% are not satisfied. Those figures represent significant growth compared to the 83% who had broadband in 2016 and 69% in 2006.

The findings are based on a survey of 2,000 U.S. households from a new Leichtman Research Group (LRG) study, Broadband Internet in the U.S. 2021.

This is LRG’s 19th annual study on this topic.

Other related findings include:

- 63% of broadband subscribers rate the speed of their Internet connection 8-10 (with 10 being excellent), while 7% rate it 1-3 (with 1 being poor)

- 45% of broadband subscribers do not know the download speed of their service – compared to 59% in 2016

- 69% reporting Internet speeds of 100+ Mbps are very satisfied with their service, compared to 53% with speeds <50 Mbps, and 58% that don’t know their speed

- 60% of adults with an Internet service at home watch video online daily – compared to 50% in 2019, 41% in 2016, and 5% in 2006

- 87% of households use at least one laptop or desktop computer – 95% of this group get an Internet service at home

- 68% of those that do not use a laptop or desktop computer are not online at home – accounting for 67% of all that do not have an Internet service at home

Also, on-line (OTT) video viewing is a daily activity for six out of ten adults who have internet service, compared to 50% in 2019, 41% in 2016, and 5% in 2006. Another 87% of households use at least one laptop or desktop computer – 95% of this group get an ISP at home. Separately, 68% of those that do not use a laptop or desktop computer are not online at home – accounting for 67% of all that do not have an ISP at home.

“The percentage of households getting an internet service at home is now higher than in any previous year,” Bruce Leichtman, principal analyst for Leichtman Research Group, said in a statement. “Broadband subscribers generally remain satisfied with their service, with 60% reporting that they are very satisfied, compared to 57% in 2016,” he added.

Broadband Internet in the U.S. 2021 is based on a survey of 2,000 adults age 18+ from throughout the U.S. The random sample of respondents was distributed and weighted to best

reflect the demographic and geographic make-up of the U.S. The survey, conducted in November-December 2021, included a sample of 820 via telephone (including landline and

cell phone calls) used to track the presence of Internet services in the home, and an additional sample of 1,200 with an Internet service at home via an online sample. The phone sample

has a statistical margin of error of +/- 3.4%. The combined phone and online samples of those with an Internet service at home has a margin of error of +/- 2.3%. The online sample

solely used for some questions has a margin of error of +/- 2.8%.

About Leichtman Research Group:

Leichtman Research Group, Inc. (LRG) specializes in research and analysis on the broadband, media and entertainment industries. LRG combines ongoing consumer research studies with

industry tracking and analysis, to provide companies with a richer understanding of current market conditions, and the adoption and impact of new products and services. For more information

about LRG, please call (603) 397-5400 or visit www.LeichtmanResearch.com.

References:

Sequans clever CBRS module for Green-GO Digital’s Beltpack Sports

Paris, France based Sequans Communications, a leading provider of cellular IoT chips and modules for massive and broadband IoT, announced that Green-GO Digital is using its Cassiopeia CB410L CBRS module to connect its new Beltpack Sports wireless intercom communications device.

Cassiopeia CB410L Module Highlights:

- All-in-one standalone module

- Small 32 x 29 mm leadless chip carrier (LCC) package

- CBRS networks in USA on LTE band 48

- MNO networks worldwide on LTE bands 42/43

- FCC

- 3GPP Release 10

- Easy integration into IoT, M2M and broadband applications

- Drivers compatible with Linux, Android,Google Chrome, MAC OS, Windows and a wide range of embedded and realtime OSes

- Comprehensive set of interfaces

CB610L and CB410L are used to add LTE connectivity to electronics devices for industrial Internet of Things (IoT), Machine-to-Machine (M2M) and broadband consumer applications. The LCC package allows for a cost-efficient platform and simple PCB design. The modules support a wide variety of interfaces, including USB 2.0 device and UARTs.

…………………………………………………………………………………..

The Green-GO Beltpack Sports is designed to facilitate coach to coach communications in professional sports teams. It is connected by LTE technology and designed specifically to run on CBRS (citizens broadband radio service), a new block of spectrum allocated by the FCC to enable private LTE networks on a shared spectrum basis. CBRS provides enterprises in many sectors, including sports, government, education, industry, and agriculture, with an affordable way to set up private networks for their organizations without subscribing to commercial wireless service.

“It’s exciting to see our technology connecting the new Green-GO device now being used in the world of professional sports,” said Bertrand Debray, EVP of Sequans’ Broadband IoT division. “The Green-GO Beltpack is designed with features that facilitate ease of use on the playing field, and it shows how well a private LTE network using CBRS spectrum can meet the communications needs of enterprises like pro sports teams.”

“We selected Sequans’ technology to connect the Green-GO Beltpack Sports because Sequans is an expert in cellular IoT connectivity with particular expertise in solutions for 3.5 GHz, the frequency of CBRS, said Joost van Eenbergen, Principal and Founder of ELC Lighting BV, manufacturer of Green-GO! Digital Intercom. “Sequans’ IoT module is proven reliable in LTE devices and networks all over the world, and it has all the capabilities we required for design into the Beltpack, including small size, low power consumption for long battery life, and most important, reliability.”

The Green-GO CBRS/LTE Beltpack Sports has features designed specifically for use outdoors, including a backlit display for easier viewing in sunlight, weather-tight buttons for protection from rain and for use with gloves. Its four big buttons can be used all as talk buttons or as a combination of talk and call.

The Beltpack can be easily combined with a wired system by using a Green-GO Bridge. There is no need for a separate interface to connect the Beltpack to an existing wired network. By simply plugging in the bridge and cloning the configuration to the Beltpacks, the wireless device is fully integrated. Each Green-Go Beltpack connects to a port on a bridge as a remote user, providing the same user interface and audio quality of a wired beltpack, with the security and reliable connectivity of LTE.

“As the exclusive US distributor of Green-GO! Digital Intercom, we are excited to introduce this revolutionary product through our network of authorized dealers,” said Jim Casey, President of Nova Lume LLC. “Having worked with the premier professional sports league in the US for almost two years to implement this product across all 32 teams in time for the 2021 season, while dealing with the pandemic restrictions, was a remarkable accomplishment and prepared us to provide this solution to a wide range of use cases needing secure, reliable, wireless intercom.”

Sequans Cassiopeia CB410L/CB610L Modules:

Sequans’ Cassiopeia CBRS modules are available in two versions:

1) Cassiopeia CB410L with LTE Category 4 throughput, and

2) Cassiopeia CB610L with LTE Category 6 throughput.

Both modules are standalone all-in-one solutions delivering robust LTE network connectivity. The module design benefits from Sequans’ long and extensive experience in 3.5 GHz solutions. The module supports CBRS networks in the USA on LTE band 48 and MNO networks worldwide on LTE bands 42/43.

The Sequans Cassiopeia CBRS modules feature unique LCC (leadless chip carrier) packaging and a compact size, and they are OnGo certified.

The new Green-GO Digital Wireless Beltpack Sports will be on display at CES 2022 in Sequans meeting room at the Venetian at CES TECH WEST. For more information or to schedule a meeting at CES, please email [email protected].

About Sequans:

Sequans Communications S.A. is a leading developer and supplier of cellular IoT connectivity solutions, providing chips and modules for 5G/4G massive and broadband IoT. For 5G/4G massive IoT applications, Sequans provides a comprehensive product portfolio based on its flagship Monarch LTE-M/NB-IoT and Calliope Cat 1 chip platforms, featuring industry-leading low power consumption, a large set of integrated functionalities, and global deployment capability. For 5G/4G broadband IoT applications, Sequans offers a product portfolio based on its Cassiopeia Cat 4/Cat 6 4G and high-end Taurus 5G chip platforms, optimized for low-cost residential, enterprise, and industrial applications. Founded in 2003, Sequans is based in Paris, France with additional offices in the United States, United Kingdom, Israel, Hong Kong, Singapore, Finland, Taiwan, South Korea, and China.

References: