Virtual Networks

Virtual RAN gets a boost from Samsung demo using Intel’s Grand Rapids/Xeon Series 6 SoC

Samsung is the fifth largest worldwide RAN equipment vendor, behind Huawei, Ericsson, Nokia and ZTE. This week, the South Korean conglomerate claimed to have reached a virtual RAN (vRAN) milestone with the completion of a commercial phone call using Granite Rapids – Intel’s Xeon 6700P-B SoC processor series. The call took place on the network of a large, undisclosed U.S. network operator, but apparently Verizon. Samsung said, “this builds upon the company’s previous achievement in 2024, when it completed the industry-first end-to-end call in a lab environment with Intel Xeon 6 SoC.”

Samsung’s cloud-native vRAN with Intel’s latest Xeon SoC ran on a single commercial off-the-shelf (COTS) server from Hewlett Packard Enterprise with a cloud platform from Wind River. This milestone, coming only a few months after the first wave of Intel Xeon 6 SoC was made commercially available, presents an innovative pathway for single-server vRAN deployments for next-generation networks.

The commercial readiness of vRAN technology promises to give network operators the ability to run RAN and AI workloads on fewer, more powerful servers.

Samsung wrote: “As operators accelerate their transition to software-driven, flexible architectures while seeking more sustainable infrastructure, the ability to run RAN and AI workloads on fewer, more powerful servers becomes critical, On a single server of Samsung’s AI-powered vRAN with enhanced processors, operators can consolidate software-driven network elements such as mobile core, radio access, transport and security, which traditionally required multiple servers, significantly simplifying the management of complex site configuration.”

Image Credit: Samsung

“This breakthrough represents a major leap forward in network virtualization and efficiency. It confirms the real-world readiness of this latest technology under live network conditions, demonstrating that single-server vRAN deployments can meet the stringent performance and reliability standards required by leading carriers,” said June Moon, Executive Vice President, Head of R&D, Networks Business at Samsung Electronics. “We are not only deploying more sustainable, cost-effective networks, but also laying the foundation to fully utilize AI capabilities more easily and prepare for 6G with our end-to-end software-driven network solutions.”

Samsung’s vRAN leverages the latest Intel Xeon 6 SoC with Intel Advanced Matrix Extensions (Intel AMX), Intel vRAN Boost and up to 72 cores, delivering significant improvements in AI processing, memory bandwidth and energy efficiency compared to the previous generation.

“With Intel Xeon 6 SoC, featuring higher core counts and built-in acceleration for AI and vRAN, operators get the compute foundation for AI native, future ready networks,” said Cristina Rodriguez, VP and GM, Network & Edge, Intel. “This collaborative achievement with Samsung, HPE and Wind River enables greater consolidation of RAN and AI workloads, lowering power and total cost while speeding innovation.”

Samsung has been leading the deployment of vRAN solutions with major network operators worldwide and has achieved many industry breakthroughs, including the industry’s first call on a commercial network and large-scale deployments utilizing Intel Xeon processors with Intel vRAN Boost. The company continues to push the boundaries of network virtualization, working closely with ecosystem partners like Intel to deliver solutions that help operators build networks that are more efficient and sustainable.

“This successful first call is an important milestone for the industry,” said Daryl Schoolar, Analyst and Director at Recon Analytics. “By demonstrating multiple network functions running on next-generation processing technology, Samsung is showing what future networks look like — more cloud-native, more scalable and significantly more efficient. This achievement moves the industry beyond theoretical performance gains and into practical, deployable innovation that operators around the world can leverage to modernize their networks, accelerate automation and better support AI-driven use cases.”

“With Samsung’s vRAN and Intel’s Xeon 6 SoC running on a single server, Samsung expects enhanced cost savings for operators,” said a Samsung spokesperson via email to Light Reading, when asked what cost impact Granite Rapids would have. “The ability to consolidate multiple network functions including RAN, core, transport and security onto a single, high-performance COTS server reduces hardware footprint, simplifies site design and lowers power consumption.”

Vodafone is one Samsung customer that now expects to benefit from the availability of Granite Rapids. In November, Paco Pignatelli, Vodafone’s head of open RAN, told Light Reading that the new Intel platform offers “much better capacity and efficiency” than its predecessors. That was several weeks after the telco had announced plans to deploy Samsung’s virtual RAN technology in Germany and other European markets, starting in 2026.

…………………………………………………………………………………………………………………………………….

vRAN Market Assessment:

Virtual RAN still accounts for a very small share of the entire market. In 2023, data from Omdia put its market share at just 3% of the total RAN market which generates If vRAN is considered as part of the subsector for baseband RAN, its share was about 10% that year, implying baseband represents about 30% of the total expenditure on RAN products.

Hardware still dominates the RAN equipment business, but there is a rapid shift toward Commercial Off-The-Shelf (COTS) servers, particularly those using Intel’s Xeon 6 processors. Regional Dominance: North America and Asia-Pacific are expected to remain the largest markets in 2026, together accounting for over 70% of global vRAN revenue

- Dell’Oro Group:

- 2026 Stability: Predicts overall RAN revenues will remain “mostly stable” in 2026, but identifies AI-RAN, Cloud RAN, and Open RAN as favorable growth segments within that flat topline.

- Market Share: Expects vRAN to account for 5% to 10% of the total RAN market by 2026.

- Private Wireless: Forecasts that private wireless campus network RAN revenue will surpass USD 1 billion in 2026.

- Omdia:

- Growth Surge: Anticipates a doubling of vRAN’s market share by 2028. Specifically, it expects Open vRAN to reach a 16% share of the total RAN market in 2026, up from 7% in 2022.

- Automation Focus: Forecasts the Service Management and Orchestration (SMO) category to grow at a massive 99% CAGR through 2030 as operators align with O-RAN architectures.

- Research and Markets:

- Estimates the global Open RAN market size will reach between USD 5.0 billion and USD 10.0 billion by 2026, driven by aggressive greenfield deployments.

…………………………………………………………………………………………………………………………

References:

https://www.lightreading.com/5g/intel-and-samsung-add-to-pressure-on-purpose-built-5g

vRAN market disappoints – just like OpenRAN and mobile 5G

RAN silicon rethink – from purpose built products & ASICs to general purpose processors or GPUs for vRAN & AI RAN

LightCounting: Open RAN/vRAN market is pausing and regrouping

Dell’Oro: Private 5G ecosystem is evolving; vRAN gaining momentum; skepticism increasing

Heavy Reading: How network operators will deploy Open RAN and cloud native vRAN

vRAN market disappoints – just like OpenRAN and mobile 5G

Most wireless network operators are not convinced virtual RAN (vRAN) [1.] is worth the effort to deploy. Omdia, an analyst company owned by Informa, put vRAN’s share of the total market for RAN baseband products at just 10% in 2023. It is growing slowly, with 20% market share forecast by 2028, but it far from being the default RAN architectural choice.

Among the highly touted benefits of virtualization is the ability for RAN developers to exploit the much bigger economies of scale found in the mainstream IT market. “General-purpose technology will eventually have so much investment in it that it will outpace custom silicon,” said Sachin Katti, the general manager of Intel’s network and edge group, during a previous Light Reading interview.

Note 1. The key feature of vRAN is the virtualization of RAN functions, allowing operators to perform baseband operations on standard servers instead of dedicated hardware. The Asia Pacific region is currently leading in vRAN adoption due to rapid 5G deployment in countries like China, South Korea, and Japan. Samsung has established a strong presence as a supplier of vRAN equipment and software.

The whole market for RAN products generated revenues of just $40 billion in 2023. Intel alone made $54.2 billion in sales that same year. Yet Huawei, Ericsson and Nokia, the big players in RAN base station technology, have continued to miniaturize and advance their custom chips. Nokia boasts 5-nanometer chips in its latest products and last year lured Derek Urbaniak, a highly regarded semiconductor expert, from Ericsson in a sign it wants to play an even bigger role in custom chip development.

Ericsson collaborates closely with Intel on virtual RAN, and yet it has repeatedly insisted its application-specific integrated circuits (ASICs) perform better than Intel’s CPUs in 5G. One year ago, Michael Begley, Ericsson’s head of RAN compute, told Light Reading that “purpose-built hardware will continue to be the most energy-efficient and compact hardware for radio site deployments going forward.”

Intel previously suffered delays when moving to smaller designs and there is gloominess about its prospects as note in several IEEE Techblog posts like this one and this one. Intel suffered a $17 billion loss for the quarter ending in September, after reporting a small $300 million profit a year before. Sales fell 6% year-over-year, to $13.3 billion, over this same period.

Unfortunately, for telcos eyeing virtualization, Intel is all they really have. Its dominance of the small market for virtual RAN has not been weakened in the last couple of years, leaving operators with no viable alternatives. This was made apparent in a recent blog post by Ericsson, which listed Intel as the only commercial-grade chip solution for virtual RAN. AMD was at the “active engagement” stage, said Ericsson last November. Processors based on the blueprints of ARM, a UK-based chip designer that licenses its designs, were not even mentioned.

The same economies-of-scale case for virtual RAN is now being made about Nvidia and its graphical processing units (GPUs), which Nvidia boss Jensen Huang seems eager to pitch as a kind of general-purpose AI successor to more humdrum CPUs. If the RAN market is too small, and its developers must ride in the slipstream of a much bigger market, Nvidia and its burgeoning ecosystem may seem a safer bet than Intel. And the GPU maker already has a RAN pitch, including a lineup of Arm-based CPUs to host some of the RAN software.

Semiconductor-related economies of scale, should not be the sole benefit of a virtual RAN. “With a lot of the work that’s been done around orchestration, you can deploy new software to hundreds of sites in a couple of hours in a way that was not feasible before,” said Alok Shah of Samsung Electronics. Architecturally, virtualization should allow an operator to host its RAN on the same cloud-computing infrastructure used for other telco and IT workloads. With a purpose-built RAN, an operator would be using multiple infrastructure platforms.

In telecom markets without much fiber or fronthaul infrastructure there is unlikely to be much centralization of RAN compute. This necessitates the deployment of servers at mast sites, where it is hard to see them being used for anything but the RAN. Even if a company wanted to host other applications at a mobile site, the processing power of Sapphire Rapids, the latest Intel generation, is fully consumed by the functions of the virtual distributed unit (vDU), according to Shah. “I would say the vDU function is kind of swallowing up the whole server,” he said.

Indeed, for all the talk of total cost of ownership (TCO) savings, some deployments of Sapphire Rapids have even had to feature two servers at a site to support a full 5G service, according to Paul Miller, the chief technology officer of Wind River, which provides the cloud-computing platform for Samsung’s virtual RAN in Verizon’s network. Miller expects that to change with Granite Rapids, the forthcoming successor technology to Sapphire Rapids. “It’s going to be a bit of a sea change for the network from a TCO perspective – that you may be able to get things that took two servers previously, like low-band and mid-band 5G, onto a single server,” he said.

Samsung’s Shah is hopeful Granite Rapids will even free up compute capacity for other types of applications. “We’ll have to see how that plays out, but the opportunity is there, I think, in the future, as we get to that next generation of compute.” In the absence of many alternative processor platforms, especially for telcos rejecting the inline virtual RAN approach, Intel will be under pressure to make sure the journey for Granite Rapids is less turbulent than it sounds.

Another challenge is the mobile backhaul, which is expected to limit the growth of the vRAN industry. Backhaul connectivity ia central s widely used in wireless networks to transfer a signal from a remote cell site to the core network (typically the edge of the Internet). The two main methods of mobile backhaul implementations are fiber-based and wireless point-to-point backhaul.

The pace of data delivery suffers in tiny cell networks with poor mobile network connectivity. Data management is becoming more and more important as tiny cells are employed for network connectivity. Increased data traffic across small cells, which raises questions about data security, is mostly to blame for poor data management. vRAN solutions promise improved network resiliency and utilization, faster network routing, and better-optimized network architecture to meet the diverse 5G requirements of enterprise customers.

References:

https://www.lightreading.com/5g/virtual-ran-still-seems-to-be-not-worth-the-effort

https://www.ericsson.com/en/blog/north-america/2024/open-ran-progress-report

https://www.sdxcentral.com/5g/ran/definitions/vran/

LightCounting: Open RAN/vRAN market is pausing and regrouping

Dell’Oro: Private 5G ecosystem is evolving; vRAN gaining momentum; skepticism increasing

Huawei CTO Says No to Open RAN and Virtualized RAN

Heavy Reading: How network operators will deploy Open RAN and cloud native vRAN

Global Cloud VPN Market Report: Rising Demand for Cloud-based Security Services

The Global Cloud Virtual Private Network (VPN) Market Size, Share, Trends, Product Type (Services and Software), Connectivity Type (Site-To-Site and Remote Access), Company Size, End-user, and Region – Forecast to 2030 report has been published by ResearchAndMarkets.com.

The global cloud Virtual Private Network (VPN) market is expected to experience rapid growth in the coming years, with an estimated market size of USD 40.78 Billion by 2030 and a projected revenue compound annual growth rate (CAGR) of 21.6%.

This growth can be attributed to various factors, including the increased demand for cloud VPN technologies in security products and services, the rising adoption of secure remote access, and the growing acceptance of private clouds.

Cloud VPNs are becoming increasingly popular among businesses due to their ability to provide high security without sacrificing usability. They are cost-effective and easy to set up, and provide secure, encrypted web browsing capabilities. Compared to traditional VPNs, the new generation of cloud-based VPNs offers more flexibility, cost efficiency, and security features. This makes them ideal for businesses that regularly share sensitive or confidential information over private networks.

Cloud VPNs protect against both internal and external threats, and offer faster access to applications, ensuring smooth business operations. Major tech companies are investing in cloud VPN-based services, which is contributing significantly to market revenue growth. For example, GoodAccess recently secured a $1 million seed funding round to expand its cloud-based VPN services. Similarly, HMD Global, the manufacturer of Nokia smartphones, has partnered with ExpressVPN to offer secure digital connections on mobile devices using 3G, 4G, and 5G networks.

Market Dynamics

The market for cloud VPN services is expected to grow due to the increased adoption of secure remote access and the widespread acceptance of private clouds. Leading cloud VPN service providers are focusing on replacing traditional VPNs with cloud VPNs to meet the growing demand for more secure and sophisticated technologies that support privacy protection in a reliable and streamlined manner. Businesses that have already adopted cloud services have seen significant improvements in process efficiency, time to market, and IT spending reduction.

Cloud computing investment is expected to reach $160 billion worldwide by 2020, nearly twice what it was in 2017, and cloud solutions are expected to account for 80% of all IT investments by 2019. Cloud VPNs enable secure connections between offices located anywhere in the world over an open network and can connect any number of branch offices with the main office, supply chain, and partners. The VPN technology also enables user-to-office connections, making remote working simple.

The revenue growth in this industry is driven by an increase in product launches by leading tech companies that target secure remote access and widespread acceptance of cloud computing. For instance, Google has released BeyondCorp Remote Access, a zero-trust remote-access service that allows remote teams to access their companies’ internal web-based services without the use of a VPN.

The use of VPNs is restrained by stringent government regulations, which limit the growth potential of the market. Governments worldwide have implemented severe restrictions and regulations against using VPNs to prevent criminal use and increase the visibility of online activity. Cybercriminals can use VPNs to conceal their illegal activity and maintain their anonymity. New regulations mandate that all VPN service providers keep customer data for at least five years.

For example, India has approved a law requiring all VPN service providers to retain user data, including names, email addresses, phone numbers, and IP addresses, for at least five years. These regulations are focused on strict VPN regulations, and the national order mandates the collection of specific, substantial customer data even after users delete their accounts or cancel their subscriptions. These regulations apply not only to VPN providers but also to cloud service providers, data centers, and cryptocurrency exchanges.

Product Type Insights

The global Cloud Virtual Private Network (VPN) market is divided into two product types: software and services. In 2021, services dominated the market, with Managed Security Service Providers (MSSPs), Virtual Private Network as a Service (VPNaaS), and cloud-based remote access being some of the frequently used services. The need for managed cloud VPN-as-a-service solutions has risen as businesses require secure and remote connections to their corporate network through the Internet.

Additionally, cloud-based services have gained popularity among businesses as they offer cost-effectiveness. On the other hand, the software segment is predicted to experience rapid growth during the forecast period. Many businesses have realized that using a VPN provides an extra layer of protection and privacy for their remote workers. Cloud-based VPN software allows users to access systems through an internet-based software deployment approach. This eliminates the need for businesses to maintain physical servers or infrastructure.

Connectivity Type Insights

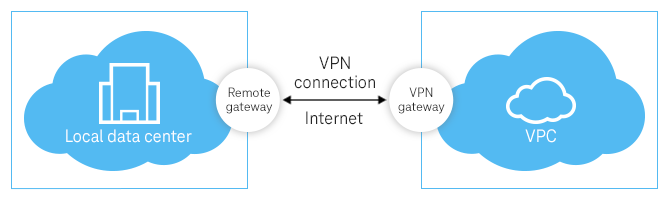

The global Cloud Virtual Private Network (VPN) market is also segmented based on connectivity type: site-to-site and remote access. Site-to-site VPNs held the largest revenue share in 2021 due to their secure IPsec protocols that encrypt communication transmitted through the VPN tunnel. They are used to establish encrypted links between VPN gateways located at different geographical sites, which require secure inter-site communication.

The site-to-site VPN tunnel also prevents any attempts to intercept traffic from the outside. Recent innovations in site-to-site VPN services, such as IPSec VPN connections through Direct Connect, are driving revenue growth of this segment. On the other hand, remote access VPNs are predicted to grow at a steady rate during the forecast period. The coronavirus pandemic has led to the increased popularity of remote access VPNs, allowing remote employees to connect safely to company networks. Cloud-based solutions are preferred to control costs, and major tech companies are launching innovative remote VPN solutions to drive revenue growth of this segment.

End-User Insights

Based on end-users, the telecom and IT sector held the largest revenue share in 2021. New demands for fast and secure VPN networks by the telecom industry have led to the growth of cloud VPNs. Operators and vendors in the telecom industry are adopting cloud-native technologies, while public cloud and IT companies have been using them for some time. Cloud-based VPNs have experienced tremendous growth over the past five years, leading to a rise in global spending on cloud computing. Cloud VPNs offer virtual private branch exchange capabilities, improving employee accessibility while maintaining cost management.

Regional Insights

In terms of regional analysis, the Cloud Virtual Private Network (VPN) market in North America has dominated the global market in 2021 with the highest revenue share. This can be attributed to the increasing partnerships between major companies and government agencies to address data protection and privacy issues. Furthermore, the presence of leading market players in the region has been a driving factor for market growth. For example, Google, a subsidiary of Alphabet Inc., has announced its plans to launch a VPN service for its users that will be bundled with certain Google One subscription levels. The VPN service has been introduced in the United States in 2020 for Android users through the Google One app, with plans to expand to other nations and operating systems such as iOS, Windows, and Mac.

Europe is anticipated to experience steady revenue growth during the forecast period. According to NordLayer’s Global Remote Work Index, Germany is the top country for remote work followed by Denmark, the USA, Spain, Lithuania, the Netherlands, Sweden, Estonia, Singapore, and France. Consequently, there has been a rising demand for privacy protection, and businesses are choosing cloud-based solutions to provide their remote access to Virtual Private Networks to efficiently manage costs. Major IT companies are releasing their own advanced remote VPN solutions, which is driving revenue growth in the region. For instance, Deutsche Telekom has launched a cloud VPN service for small and medium-sized organizations in Croatia, Hungary, and Slovakia, providing easy access to highly secure and scalable internet services. The cloud VPN option includes cloud-managed IT solutions, firewalls, online protection, and remote access through encrypted VPNs. Additionally, Cisco and Deutsche Telekom are collaborating on this project.

About ResearchAndMarkets.com:

ResearchAndMarkets.com is the world’s leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

References:

Samsung and KDDI complete SLA network slicing field trial on 5G SA network in Japan

Samsung Electronics and KDDI announced the successful demonstration of Service Level Agreements (SLA) assurance network slicing in a field trial conducted in Tokyo, Japan. For the first time in the industry, the companies proved their capabilities to generate multiple network slices using a RAN Intelligent Controller (RIC) on a live commercial 5G Standalone (SA) network. The RIC, provided by Samsung in this field trial, is a software-based component of the Open RAN architecture that optimizes the radio resources of the RAN to improve the overall network quality.

Network slicing (which requires a 5G SA core network) enables multiple virtual networks to be created within a single physical network infrastructure, where each slice is dedicated for a specific application or service — serving different purposes. For instance, 5G SA network operators can create a low latency slice for automated vehicles, an IoT slice for smart factories and a high bandwidth slice for live video streaming — all within the same network. This means that a single 5G SA network can support a broad mix of use cases simultaneously, accelerating the delivery of new services and meeting the tailored demands of various enterprises and consumers.

“Network slicing will help us activate a wide range of services that require high performance and low latency, benefitting both consumers and businesses,” said Toshikazu Yokai, Managing Executive Officer, General Manager of Mobile Network Technical Development Division at KDDI. “Working with Samsung, we continue to deliver the most innovative technologies to enhance customer experiences.”

Through this field trial conducted in Q4 of 2022, KDDI and Samsung proved their capabilities of SLA assurance to generate multiple network slices that meet SLA requirements, guaranteeing specific performance parameters — such as low latency and high throughput — for each application. Samsung also proved the technical feasibility of multiple user equipment (UE)-based network slices with quality assurance using the RIC, which performs advanced control of RAN as defined by the O-RAN Alliance.

“Network slicing will open up countless opportunities, by allowing KDDI to offer tailor-made, high-performance connectivity, along with new capabilities and services, to its customers,” Junehee Lee, Executive Vice President, Head of Global Sales & Marketing, Networks Business at Samsung Electronics. “This demonstration is another meaningful step forward in our efforts to advance technological innovation and enrich network services. We’re excited to have accomplished this together with KDDI and look forward to continued collaboration.”

For more than a decade, the two companies have been working together, hitting major 5G networks milestones that include: KDDI’s selection of Samsung as a 5G network solutions provider, end-to-end 5G network slicing demonstration in the lab, 5G network rollout on 700MHz and the deployment of 5G vRAN on KDDI’s commercial network.

Samsung has pioneered the successful delivery of 5G end-to-end solutions including chipsets, radios and core. Through ongoing research and development, Samsung drives the industry to advance 5G networks with its market-leading product portfolio from virtualized RAN and Core to private network solutions and AI-powered automation tools. The company is currently providing network solutions to mobile operators that deliver connectivity to hundreds of millions of users around the world.

References: